- VRSN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

VeriSign (VRSN) DEF 14ADefinitive proxy

Filed: 14 Apr 09, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement. | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | ||

x Definitive Proxy Statement. | ||||

¨ Definitive Additional Materials. | ||||

¨ Soliciting Material Pursuant to §240.14a-12. |

VeriSign, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

VeriSign, Inc.

487 East Middlefield Road

Mountain View, California 94043-4047

April 14, 2009

To Our Stockholders:

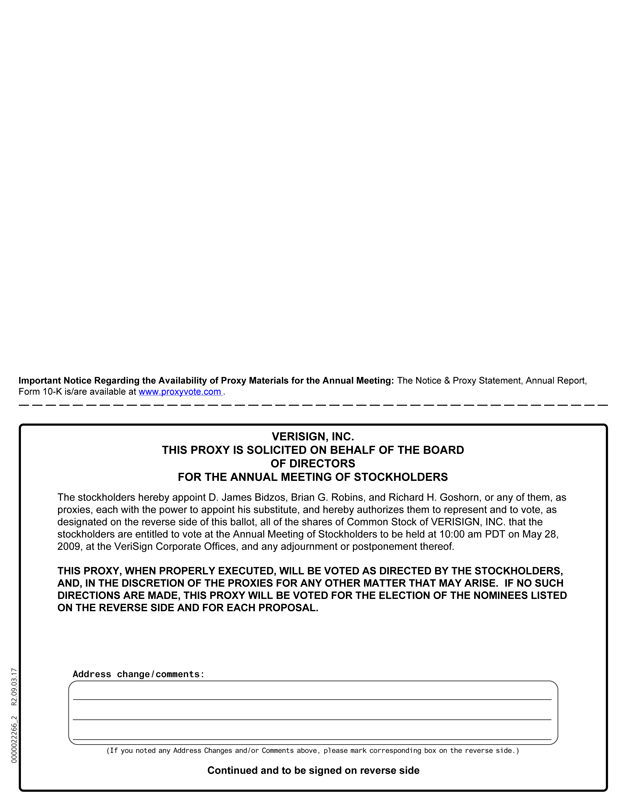

You are cordially invited to attend the 2009 Annual Meeting of Stockholders of VeriSign, Inc. (“VeriSign”) to be held at our corporate offices located at 487 East Middlefield Road, Mountain View, California 94043-4047 on Thursday, May 28, 2009 at 10:00 a.m., Pacific Time (the “Meeting”).

The matters expected to be acted upon at the Meeting are described in detail in the followingNotice of the 2009 Annual Meeting of Stockholders and Proxy Statement.

We have implemented a U.S. Securities and Exchange Commission rule that requires companies to furnish their proxy materials over the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2008 (the “Annual Report”). The Notice of Internet Availability of Proxy Materials contains instructions on how to access those documents over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how each stockholder can receive a paper copy of our proxy materials, including this notice and proxy statement, our Annual Report and a form of proxy card or voting instruction card. We believe that this new process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

It is important that you use this opportunity to take part in the affairs of VeriSign by voting on the business to come before this meeting. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE THE PROXY ELECTRONICALLY OR BY PHONE AS DESCRIBED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS AND UNDER “INTERNET AND TELEPHONE VOTING” IN THE ATTACHED PROXY STATEMENT, OR ALTERNATIVELY, IF RECEIVING PAPER COPIES OF PROXY MATERIALS, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. Returning or completing the Proxy does not deprive you of your right to attend the Meeting and to vote your shares in person.

We look forward to seeing you at our 2009 Annual Meeting of Stockholders.

Sincerely, |

/s/ D. James Bidzos |

| D. James Bidzos |

| Executive Chairman of the Board and Chief Executive Officer on an interim basis |

VERISIGN, INC.

487 East Middlefield Road

Mountain View, California 94043-4047

Notice of the 2009 Annual Meeting of Stockholders

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2009 Annual Meeting of Stockholders of VeriSign, Inc. will be held at our corporate offices located at 487 East Middlefield Road, Mountain View, California 94043-4047 on Thursday, May 28, 2009 at 10:00 a.m., Pacific Time. The 2009 Annual Meeting of Stockholders is being held for the following purposes:

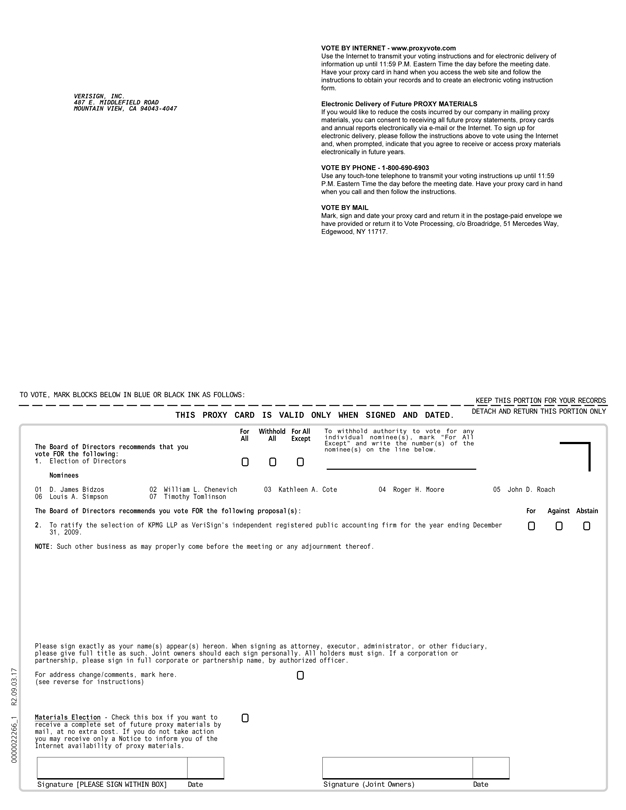

1. To elect seven directors of VeriSign, each to serve until the next annual meeting, or until a successor has been elected and qualified or until the director’s earlier resignation or removal.

2. To ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2009.

3. To transact such other business as may properly come before the 2009 Annual Meeting of Stockholders or any adjournment thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only stockholders of record at the close of business on March 31, 2009 are entitled to notice of and to vote at the 2009 Annual Meeting of Stockholders or any adjournment thereof.

By Order of the Board of Directors, |

/s/ Richard H. Goshorn |

Richard H. Goshorn |

Secretary |

Mountain View, California

April 14, 2009

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE THE PROXY ELECTRONICALLY OR BY PHONE AS DESCRIBED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS AND UNDER “INTERNET AND TELEPHONE VOTING” IN THE ATTACHED PROXY STATEMENT, OR ALTERNATIVELY, IF RECEIVING PAPER COPIES OF PROXY MATERIALS, COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING.

| Page | ||

| 1 | ||

| 4 | ||

| 4 | ||

| 7 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 12 | ||

| 13 | ||

Security Ownership of Certain Beneficial Owners and Management | 14 | |

| 14 | ||

| 15 | ||

| 16 | ||

| 16 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 35 | ||

Policies and Procedures With Respect to Transactions With Related Persons | 36 | |

| 38 | ||

Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm | 40 | |

| 41 | ||

| 41 | ||

| 42 | ||

Stockholder Proposals for the 2010 Annual Meeting of Stockholders | 42 | |

| 42 | ||

| 43 | ||

Appendix A—Charter of the Audit Committee of the Board of Directors | A-1 |

VERISIGN, INC.

487 East Middlefield Road

Mountain View, California 94043-4047

FOR THE 2009 ANNUAL MEETING OF STOCKHOLDERS

April 14, 2009

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) of VeriSign, Inc. (“VeriSign” or the “Company”) for use at the 2009 Annual Meeting of Stockholders (the “Meeting”) to be held at our corporate offices located at 487 East Middlefield Road, Mountain View, California 94043-4047 on Thursday, May 28, 2009 at 10:00 a.m., Pacific Time. Only holders of record of our common stock at the close of business on March 31, 2009, which is the record date, will be entitled to vote at the Meeting. At the close of business on the record date, we had 192,763,937 shares of common stock outstanding and entitled to vote. This proxy statement and the accompanying form of proxy (collectively, the “Proxy Statement”) were first made available to stockholders on or about April 14, 2009. Our Annual Report on Form 10-K for the year ended December 31, 2008 (the “Annual Report”) is enclosed with this Proxy Statement for stockholders receiving a paper copy of proxy soliciting materials. The Annual Report and Proxy Statement can both be accessed on the Investor Relations section of our website athttp://investor.verisign.com, or athttp://www.proxyvote.com.

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if the accompanying proxy is executed and returned (and not revoked) prior to the Meeting, the shares of VeriSign common stock represented by the proxy will be voted: (1) FORthe election of each of the seven director candidates nominated by the Board; (2) FORthe ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009 (“fiscal 2009”); and (3) in accordance with the best judgment of the named proxies on any other matters properly brought before the Meeting.

Adoption of Majority Vote Standard in Uncontested Director Elections

VeriSign’s Fifth Amended and Restated Bylaws provide for a majority of votes cast standard in uncontested elections. A majority of the votes cast means that the number of shares voted “for” a director must exceed the number of votes cast “withheld” for that director. In contested elections where the number of nominees exceeds the number of directors to be elected, the vote standard will continue to be a plurality of votes cast. In addition, if a nominee who already serves as a director is not re-elected, the director shall tender his or her resignation, subject to acceptance by the Board. The Corporate Governance and Nominating Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Corporate Governance and Nominating Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. The director who tenders his or her resignation will not participate in the Board’s decision. If the failure of a nominee to be elected at the annual meeting results in a vacancy on the Board, that vacancy can be filled by action of the Board.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the record date.

1

Quorum, Effect of Abstentions and Broker Non-Votes, Vote Required to Approve the Proposals

A majority of the outstanding shares of common stock must be present or represented by proxy at the Meeting in order to have a quorum. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Meeting. A broker non-vote occurs when a bank, broker or other stockholder of record holding shares for a beneficial owner submits a proxy for the meeting, but does not vote on a particular proposal because that holder does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner.

If a quorum is present, a nominee for election to a position on the Board in an uncontested election will be elected as a director if the votes cast “for” the election of the nominee exceed the votes cast as “withheld” for that nominee. The following will not be votes cast and will have no effect on the election of any director nominee: (i) a share whose ballot is marked as abstain; (ii) a share otherwise present at the meeting but for which there is an abstention; and (iii) a share otherwise present at the meeting as to which a shareholder gives no authority or direction. Stockholders may not cumulate votes in the election of directors.

If a quorum is present, approvals of the proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal 2009 and all other matters that properly come before the Meeting require the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote on the subject matter. Abstentions and broker non-votes could prevent approval of such proposals if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the shares of common stock present or represented by proxy and entitled to vote on the subject matter. The inspector of elections appointed for the Meeting will separately tabulate affirmative and withheld votes, abstentions and broker non-votes.

Adjournment of Meeting

In the event that a quorum shall fail to attend the Meeting, either in person or represented by proxy, the chairman may adjourn the Meeting, or alternatively, a stockholder or a person named as a proxy may propose the adjournment of the Meeting. Any such adjournment proposed by a stockholder or person named as a proxy would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy at the Meeting.

Expenses of Soliciting Proxies

VeriSign will pay the expenses of soliciting proxies to be voted at the Meeting. VeriSign has retained The Altman Group to assist with the solicitation of proxies for a fee of $6,500, plus reimbursement of expenses. Following the original mailing of the Notices of Internet Availability of Proxy Materials and paper copies of proxies and other soliciting materials, we and/or our agents may also solicit proxies by mail, telephone, telegraph, or in person. Following the original mailing of Notices of Internet Availability of Proxy Materials and paper copies of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders of our shares forward copies of the proxy and other soliciting materials to persons for whom they hold shares and request authority for the exercise of proxies. In such cases, we will reimburse the record holders for their reasonable expenses if they ask us to do so.

Revocability of Proxies

A stockholder may revoke any proxy that is not irrevocable by attending the Meeting and voting in person or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company.

Internet and Telephone Voting

If you hold shares of record as a registered shareholder, you can simplify your voting process and save the Company expense by voting your shares by telephone at 1-800-690-6903 or on the Internet at

2

www.proxyvote.comtwenty-four hours a day, seven days a week. Telephone and Internet voting are available through 11:59 p.m. Eastern Time the day prior to the Meeting. More information regarding Internet voting is given on the Notice of Internet Availability of Proxy Materials. If you hold shares through a bank or brokerage firm, the bank or brokerage firm will provide you with separate instructions on a form you will receive from them. Many such firms make telephone or Internet voting available, but the specific processes available will depend on those firms’ individual arrangements.

Householding

VeriSign has adopted a procedure called “householding,” which has been approved by the Securities and Exchange Commission (the “SEC”). Under this procedure, VeriSign is delivering only one copy of the Notice of Internet Availability of Proxy Materials or paper copies of the Annual Report and Proxy Statement, as the case may be, to multiple stockholders who share the same address and have the same last name, unless VeriSign has received contrary instructions from an affected stockholder. This procedure reduces VeriSign’s printing costs, mailing costs and fees. Stockholders who participate in householding will continue to receive separate voter control numbers or proxy cards, in accordance with their preferred method of delivery.

VeriSign will deliver promptly upon written or oral request a separate copy of the Notice of Internet Availability of Proxy Materials or Annual Report and the Proxy Statement to any stockholder at a shared address to which a single copy of any of those documents was delivered. To receive a separate copy of any of these documents, you may write or call VeriSign’s Investor Relations Department at VeriSign, Inc., 487 East Middlefield Road, Mountain View, California 94043-4047, Attention: Investor Relations, telephone (800) 922-4917. You may also access VeriSign’s Annual Report and Proxy Statement on the Investor Relations section of VeriSign’s website athttp://investor.verisign.com.

If you are a holder of record and would like to revoke your householding consent and receive a separate copy of the Notice of Internet Availability of Proxy Materials, Annual Report or Proxy Statement in the future, please contact Broadridge Financial Solutions, Inc. (“Broadridge”), either by calling toll free at (800) 542-1061 or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. You will be removed from the householding program within thirty (30) days of receipt of the revocation of your consent.

Any stockholders of record who share the same address and currently receive multiple copies of VeriSign’s Notice of Internet Availability of Proxy Materials, Annual Report or Proxy Statement who wish to receive only one copy of these materials per household in the future, please contact VeriSign’s Investor Relations Department at the address or telephone number listed above to participate in the householding program.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker or other holder of record to request information about householding.

3

ELECTION OF DIRECTORS

Our Fifth Amended and Restated Bylaws authorize eleven directors or such number of directors determined from time to time by a resolution of the Board; there are currently seven directors, as determined by a written resolution of the Board. The terms of the current directors, who are identified below, expire upon the election and qualification of the directors to be elected at the Meeting. The Board has nominated each of the seven current directors for re-election at the Meeting, to serve until the 2010 Annual Meeting of Stockholders and until their respective successors have been elected and qualified. There are currently no vacancies on the Board. Proxies cannot be voted for more than seven persons, which is the number of nominees.

Unless otherwise directed, the persons named in the proxy intend to vote all proxiesFORthe re-election of the nominees, as listed below, each of whom has consented to serve as a director if elected. If, at the time of the Meeting, any of the nominees is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Board, unless the Board chooses to reduce its own size. The Board has no reason to believe any of the nominees will be unable or will decline to serve if elected.

Set forth below is certain information furnished to us by our directors.

Name | Age | Position | ||

Nominees for election as directors for a term expiring in 2010: | ||||

D. James Bidzos | 54 | Executive Chairman of the Board and Chief Executive Officer on an Interim Basis | ||

William L. Chenevich(1)(2) | 65 | Lead Independent Director | ||

Kathleen A. Cote(1)(2) | 60 | Director | ||

Roger H. Moore | 67 | Director | ||

John D. Roach(1)(2) | 65 | Director | ||

Louis A. Simpson(3) | 72 | Director | ||

Timothy Tomlinson(3) | 59 | Director |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Corporate Governance and Nominating Committee. |

| (3) | Member of the Compensation Committee. |

D. James Bidzoshas served as Executive Chairman of the Board and Chief Executive Officer on an interim basis since June 2008 and as President on an interim basis from June 2008 to January 2009. He served as Chairman of the Board of Directors from August 2007 to June 2008 and from April 1995 to December 2001. He served as Vice Chairman of the Board from December 2001 to August 2007. Mr. Bidzos served as Vice Chairman of RSA Security, an Internet identity and access management solution provider, from March 1999 to May 2002 and Executive Vice President from July 1996 to February 1999. Prior thereto, he served as President and Chief Executive Officer of RSA Data Security, Inc. from 1986 to February 1999.

William L. Chenevichhas served as Lead Independent Director since February 2009 and as a director since April 1995. Mr. Chenevich has served as Vice Chairman of Technology and Operations for U.S. Bancorp, a financial holding company, since February 2001. He served as Vice Chairman of Technology and Operations Services of Firstar Corporation, a financial services company, from 1999 until its merger with U.S. Bancorp in February 2001. Prior thereto, he was Group Executive Vice President of VISA International, a financial services company, from 1994 to 1999. Mr. Chenevich holds a B.B.A. degree in Business from the City College of New York and an M.B.A. degree in Management from the City University of New York.

4

Kathleen A. Cotehas served as a director since February 2008. From May 2001 to June 2003, Ms. Cote served as Chief Executive Officer of Worldport Communications Company, a provider of Internet managed services. From September 1998 to May 2001, she served as Founder and President of Seagrass Partners, a consulting firm specializing in providing business, operational and management support for startup and mid-sized companies. Prior thereto, she served as President and Chief Executive Officer of Computervision Corporation, a supplier of desktop and enterprise, client server and web-based product development and data management software and services. Ms. Cote serves as a director of Asure Software Corporation, 3Com Corporation and Western Digital Corporation. Ms. Cote holds an Honorary Doctorate from the University of Massachusetts, an M.B.A. degree from Babson College, and a B.A. degree from the University of Massachusetts, Amherst.

Roger H. Moorehas served as a director since February 2002. Since December 2007, he has served as a consultant assisting VeriSign in the divestiture of its Communications Services business. From June 2007 through November 2007, Mr. Moore served as interim Chief Executive Officer of Arbinet-Thexchange, Inc., a provider of online trading services. He was President and Chief Executive Officer of Illuminet Holdings, Inc. from December 1995 until December 2001 when VeriSign acquired Illuminet Holdings. Prior to Illuminet Holdings, Mr. Moore spent ten years with Nortel Networks in a variety of senior management positions including President of Nortel Japan. Mr. Moore serves as a director of Western Digital Corporation and Consolidated Communications Illinois Holdings, Inc. Mr. Moore holds a B.S. degree in General Science from Virginia Polytechnic Institute and State University.

John D. Roach has served as a director since July 2007. Mr. Roach has served as Chairman of the Board of Directors and Chief Executive Officer of Stonegate International, a private investment and advisory services company, since September 2001. From November 2002 to January 2006, he served as Executive Chairman of Unidare U.S., a subsidiary of Unidare plc, a public Irish financial holding company and supplier of products to the welding, safety and industrial markets. From 1998 to 2001, he served as Founder and Chairman, President and Chief Executive Officer of Builders FirstSource, Inc., a distributor of building products. Prior to that, he was Chairman, President and Chief Executive Officer of Fibreboard Corporation, a building products company, from July 1991 to July 1997 when it was acquired by Owens Corning. Mr. Roach serves as a director of PMI Group, Inc. and URS Corporation. Mr. Roach holds a B.S. degree in Industrial Management from M.I.T. and an M.B.A. degree from Stanford University.

Louis A. Simpson has served as a director since May 2005. Since May 1993, he has served as President and Chief Executive Officer, Capital Operations, of GEICO Corporation, a passenger auto insurer. Mr. Simpson previously served as Vice Chairman of the Board of GEICO from 1985 to 1993. Mr. Simpson serves as a director of Science Applications International Corporation. Mr. Simpson holds a B.A. degree from Ohio Wesleyan University and an M.A. degree in Economics from Princeton University.

Timothy Tomlinsonis Of Counsel with the law firm Greenberg Traurig LLP. Mr. Tomlinson was the founder and a named partner of Tomlinson Zisko LLP, a law firm, from 1983 until its acquisition by Greenberg Traurig LLP in May 2007. Mr. Tomlinson was a member of the Board from 1995 until 2002, and was reappointed to the Board in November 2007. Mr. Tomlinson holds a B.A. degree in Economics, an M.A. degree in History, an M.B.A. and a J.D. degree from Stanford University.

Compensation of Directors

This section provides information regarding the compensation policies for non-employee directors and amounts earned and securities awarded to these directors in 2008. D. James Bidzos, a director, was appointed Executive Chairman, President and Chief Executive Officer on an interim basis of VeriSign on June 30, 2008. As an employee of the Company, Mr. Bidzos no longer participates in the compensation program for non-employee directors. Mr. Bidzos has been compensated as an executive officer of the Company since June 30, 2008 and his compensation both as a non-employee director and an employee is described in “Executive Compensation” elsewhere in this Proxy Statement.

5

Non-Employee Director Retainer Fees and Equity Compensation Information

On August 4, 2008, the Compensation Committee met to consider the equity-based compensation to be paid to non-employee directors. The Compensation Committee reviewed competitive market data prepared by Frederic W. Cook & Co. (“FW Cook”) for the same comparator group used to benchmark executive compensation and certain available information for other boards and reviewed the board compensation practices of these companies. Following this review and consideration of the recommendations made by FW Cook, the Compensation Committee determined that grants equal to $200,000 worth of annual equity awards split evenly between stock options and restricted stock units (“RSUs”) were in the best interest of VeriSign and its stockholders. New directors are granted an equity award equal to the pro rata amount of such annual equity award, the amount of which is determined based on the date of such new director’s appointment or election to the Board, split evenly between stock options and RSUs. After consideration of materials and recommendations from FW Cook, the Compensation Committee approved effective as of May 6, 2008, an increase in the annual retainer for Audit Committee members from $20,000 to $25,000 and an increase in the annual retainer for the Audit Committee Chairman from $10,000 to $15,000.

During 2008, annual retainer fees were as follows:

Annual retainer for non-employee directors | $ | 40,000 | |

Additional annual retainer for Non-Executive Chairman of the Board | $ | 100,000 | |

Additional annual retainer for Audit Committee members | $ | 25,000 | |

Additional annual retainer for Compensation Committee members | $ | 20,000 | |

Additional annual retainer for Corporate Governance and Nominating Committee members | $ | 10,000 | |

Additional annual retainer for Audit Committee Chairperson | $ | 15,000 | |

Additional annual retainer for Compensation Committee Chairperson | $ | 10,000 | |

Additional annual retainer for Corporate Governance and Nominating Committee Chairperson | $ | 5,000 |

Non-employee directors are reimbursed for their expenses in attending meetings.

6

Non-Employee Director Compensation Table for Fiscal 2008

The following table sets forth a summary of compensation information for our non-employee directors as of December 31, 2008.

NON-EMPLOYEE DIRECTOR COMPENSATION FOR FISCAL 2008

Non-Employee Director Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Option Awards(2) | All Other Compensation | Total | |||||||||||

William L. Chenevich(3) | $ | 83,077 | $ | 146,779 | $ | 174,794 | $ | — | $ | 404,650 | ||||||

Kathleen A. Cote(4) | 64,835 | 90,464 | 96,775 | — | 252,074 | |||||||||||

Michelle Guthrie(5) | 15,000 | 2,149 | 10,820 | — | 27,969 | |||||||||||

Scott G. Kriens(6) | 20,604 | 34,831 | 65,029 | — | 120,464 | |||||||||||

Roger H. Moore(7) | 40,000 | 146,779 | 191,014 | 300,000 | (8) | 677,793 | ||||||||||

John D. Roach(9) | 69,808 | 119,389 | 120,384 | — | 309,581 | |||||||||||

Louis A. Simpson(10) | 70,000 | 146,779 | 216,507 | — | 433,286 | |||||||||||

Timothy Tomlinson(11) | 60,000 | 163,536 | 158,343 | — | 381,879 | |||||||||||

| (1) | Amounts shown represent retainer fees earned by each director. |

| (2) | Stock Awards consist solely of RSUs. Amounts shown represent compensation expense recognized in fiscal 2008 for financial statement reporting purposes for the applicable awards granted in fiscal 2008 and in prior years pursuant to the Statement of Financial Accounting Standards No. 123(R) (“FAS 123R”), disregarding the estimate of forfeitures related to service-based vesting conditions. The grant date fair value of each Stock Award granted to each non-employee director on August 4, 2008 was $99,971. The grant date fair value of the Stock Award granted on February 20, 2008 to Ms. Cote upon joining the Board was $49,979. The grant date fair value for each Option Award granted to each non-employee director on August 4, 2008 was $107,996. The grant date fair value for the Option Award granted on February 20, 2008 to Ms. Cote upon joining the Board was $53,049. The assumptions used to calculate the value of awards for fiscal 2008 are set forth in Note 13, “Employee Benefits and Stock-Based Compensation,” of our Notes to Consolidated Financial Statements in the Annual Report, and the assumptions used to calculate awards in prior years are set forth in the Notes to Consolidated Financial Statements in the Annual Reports on Form 10-K for the corresponding years. |

| (3) | As of December 31, 2008, Mr. Chenevich held 13,612 RSUs and outstanding options to purchase 110,782 shares of the Company’s common stock. |

| (4) | Ms. Cote became a director on February 20, 2008. As of December 31, 2008, Ms. Cote held 4,483 RSUs and outstanding options to purchase 12,430 shares of the Company’s common stock. |

| (5) | Ms. Guthrie resigned as a director on February 20, 2008. Amounts shown under “Stock Awards” and “Option Awards” reflect the reversal of expenses of $11,362 and $5,633, respectively, disclosed previously in the Non-Employee Director Compensation table with respect to equity awards forfeited by Ms. Guthrie upon her resignation as a director. |

| (6) | Mr. Kriens served as a director until May 29, 2008. Mr. Kriens chose not to stand for re-election at our 2008 Annual Meeting of Stockholders on May 29, 2008. Amounts shown under “Stock Awards” reflect the reversal of expenses of $11,362 disclosed previously in the Non-Employee Director Compensation table with respect to equity awards forfeited by Mr. Kriens upon his ceasing to be a director. |

| (7) | As of December 31, 2008, Mr. Moore held 13,612 RSUs and outstanding options to purchase 112,032 shares of the Company’s common stock. |

| (8) | Amount shown represents retainer fee paid to Mr. Moore during fiscal 2008 in connection with his service as a consultant in connection with assisting the Company in its sale of its Communications Services business. |

| (9) | As of December 31, 2008, Mr. Roach held 7,512 RSUs and outstanding options to purchase 19,432 shares of the Company’s common stock. |

| (10) | As of December 31, 2008, Mr. Simpson held 13,612 RSUs and outstanding options to purchase 87,032 shares of the Company’s common stock. |

| (11) | As of December 31, 2008, Mr. Tomlinson held 7,512 RSUs and outstanding options to purchase 19,432 shares of the Company’s common stock. |

Stock options are granted at an exercise price not less than 100% of the fair market value of VeriSign’s common stock on the date of grant and have a term of not greater than seven years from the date of grant. Stock options and RSUs granted to non-employee directors during fiscal 2008 vest in quarterly installments over one year from the date of grant. Directors are permitted to exercise vested stock options for up to three years following the termination of their Board service. The Compensation Committee may authorize grants with different vesting schedules in the future. The vesting of equity awards for all non-employee directors accelerates as to 100% of any unvested equity awards upon certain changes-in-control as set forth in the 2006 Equity Incentive Plan and the 1998 Directors Stock Option Plan.

7

Moore Consulting Arrangement

As previously authorized by the Audit Committee and Compensation Committee, on October 3, 2008, the Company entered into a Consulting Agreement on the following terms with Roger H. Moore, a member of our Board, for the provision of certain consulting services commencing as of December 17, 2007 in connection with the planned disposition of VeriSign’s Communications Services business:

| • | A consulting fee of $30,000 per month to manage the daily operations of the Communications Services business, which was retroactive to December 17, 2007; |

| • | A minimum success fee of $300,000 if the sale of the Communications Services business was consummated before December 31, 2008, payable either: (i) at the closing if the buyer of the Communications Services business did not offer Mr. Moore an acceptable position with the buyer; or (ii) six months after closing if the buyer offered Mr. Moore an acceptable position with the buyer; |

| • | An additional success fee of up to $600,000 based on receipt by VeriSign of proceeds from the sale of the Communications Services business within the valuation range set by investment bankers retained by VeriSign, which additional success fee would be apportioned on a pro rata basis between the low end and high end of the valuation range so set; and |

| • | Other terms and conditions customary for such an agreement. |

On February 23, 2009 and February 24, 2009, the Compensation Committee and Audit Committee, respectively, authorized, and on March 26, 2009 the Company entered into an Amended and Restated Consulting Agreement on the following terms with Mr. Moore for the provision of certain consulting services in connection with the planned disposition of VeriSign’s Communications Services Group:

| • | A consulting fee of $10,000 per month to manage the daily operations of the Communications Services business, which was retroactive to January 1, 2009; |

| • | A minimum success fee of $300,000 if the sale of the Communications Services business is consummated before December 31, 2009, payable either: (i) at the closing if the buyer of the Communications Services business does not offer Mr. Moore an acceptable position with the buyer; or (ii) six months after closing if the buyer offers Mr. Moore an acceptable position with the buyer; |

| • | An additional success fee of up to $300,000 based on receipt by VeriSign of proceeds from the sale of the Communications Services business within the valuation range set by investment bankers retained by VeriSign, which additional success fee will be apportioned on a pro rata basis between the low end and high end of the valuation range so set; and |

| • | Other terms and conditions customary for such an agreement. |

Since January 1, 2008, the Company has paid Mr. Moore $300,000 pursuant to the Consulting Agreement and the Amended and Restated Consulting Agreement.

The Board Recommends a Vote “FOR” the Election of Each of the Nominated Directors.

8

As required under The NASDAQ Stock Market’s listing standards, a majority of the members of our Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with our legal counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of The NASDAQ Stock Market.

Consistent with these considerations, after review of all relevant transactions and relationships between each director, or any of his or her family members, and VeriSign, our executive officers and our independent registered public accounting firm, the Board affirmatively determined on February 24, 2009 that the majority of our Board is comprised of independent directors. Our independent directors are: Mr. Chenevich, Ms. Cote, Mr. Roach, Mr. Simpson, and Mr. Tomlinson. Each director who serves on the Audit Committee, the Compensation Committee or the Corporate Governance and Nominating Committee is an independent director. Mr. Bidzos serves as Executive Chairman and Chief Executive Officer on an interim basis. Mr. Moore serves as a consultant assisting VeriSign in the divestiture of its Communications Services business. Michelle Guthrie served as a director until her resignation on February 20, 2008. Scott G. Kriens served as a director until May 29, 2008. Mr. Kriens chose not to stand for re-election at our 2008 Annual Meeting of Stockholders on May 29, 2008. William A. Roper, Jr., served as a director until his resignation as our President and Chief Executive Officer and a member of our Board on June 30, 2008.

The Board met twelve times and its committees collectively met twenty-one times during 2008. No director during the last fiscal year attended fewer than 75% of the aggregate of (i) the total number of meetings held by the Board and (ii) the total number of meetings held by all committees on which he or she served during fiscal 2008, except for Ms. Guthrie who attended one of the two Board meetings that were held prior to her resignation from the Board. On February 24, 2009, the Board appointed William L. Chenevich as its Lead Independent Director. As the Lead Independent Director, Mr. Chenevich may schedule and conduct separate meetings of the independent directors and perform other similar duties.

Board Members’ Attendance at the Annual Meeting

Although we do not have a formal policy regarding attendance by members of the Board at our annual meeting of stockholders, we encourage directors to attend. Two members of the Board attended our 2008 Annual Meeting of Stockholders.

Corporate Governance and Nominating Committee

The Board has established a Corporate Governance and Nominating Committee to recruit, evaluate, and nominate candidates for appointment or election to serve as members of the Board, recommend nominees for committees of the Board, recommend corporate governance policies and periodically review and assess the adequacy of these policies, and review annually the performance of the Board. The Corporate Governance and Nominating Committee is currently composed of Ms. Cote (Chairperson) and Messrs. Chenevich and Roach, each of whom has been determined by the Board to be an “independent director” under the rules of The NASDAQ Stock Market. The Corporate Governance and Nominating Committee operates pursuant to a written charter. The Corporate Governance and Nominating Committee’s charter is located on our website athttps://investor.verisign.com/documents.cfm. The Corporate Governance and Nominating Committee met four times during fiscal 2008.

9

In carrying out its function to nominate candidates for election to the Board, the Corporate Governance and Nominating Committee considers the performance and qualifications of each potential nominee or candidate, not only for his or her individual strengths but also for his or her contribution to the Board as a group.

The Corporate Governance and Nominating Committee considers candidates for director nominees proposed by directors, the chief executive officer and stockholders. The Corporate Governance and Nominating Committee may also from time to time retain one or more third-party search firms to identify suitable candidates. The Corporate Governance and Nominating Committee has retained an executive search firm to conduct a search for new independent directors for the Board.

If you would like the Corporate Governance and Nominating Committee to consider a prospective candidate, in accordance with our Fifth Amended and Restated Bylaws, please submit the candidate’s name and qualifications to: Richard H. Goshorn, Secretary, VeriSign, Inc., 487 East Middlefield Road, Mountain View, California 94043-4047.

The Corporate Governance and Nominating Committee will consider all candidates identified by the directors, chief executive officer, stockholders, or third-party search firms through the processes described above, and will evaluate each of them, including incumbents and candidates nominated by stockholders, based on the same criteria.

The Board has established an Audit Committee that oversees the accounting and financial reporting processes at the Company, internal control over financial reporting, audits of the Company’s financial statements, the qualifications of the Company’s independent auditor, and the performance of the Company’s internal audit department and the independent auditor. The independent auditor reports directly to the Audit Committee and the Audit Committee is responsible for the appointment (subject to stockholder ratification), compensation and retention of the independent auditor. The Audit Committee also oversees the Company’s processes to manage business and financial risk, and compliance with significant applicable legal and regulatory requirements, and oversees the Company’s ethics and compliance programs. The Audit Committee is currently composed of Messrs. Chenevich (Chairperson) and Roach and Ms. Cote. Each member of the Audit Committee meets the independence criteria of The NASDAQ Stock Market and the SEC. Each Audit Committee member meets The NASDAQ Stock Market’s financial knowledge requirements, and the Board has determined that the Audit Committee has at least one member who has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities as required by Rule 4350(d)(2)(A) of The NASDAQ Stock Market. The Audit Committee operates pursuant to a written charter, which complies with the applicable provisions of the Sarbanes-Oxley Act of 2002 and related rules of the SEC and The NASDAQ Stock Market. A copy of the Audit Committee charter is set forth as Appendix A to this Proxy Statement and is located on our website athttps://investor.verisign.com/documents.cfm. The Audit Committee met ten times during fiscal 2008.

Audit Committee Financial Expert

Our Board has determined that William L. Chenevich, Kathleen A. Cote and John D. Roach are “audit committee financial experts” as such term is defined in Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Messrs. Chenevich and Roach and Ms. Cote meet the independence requirements for audit committee members as defined in the applicable listing standards of The NASDAQ Stock Market.

10

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the Securities and Exchange Commission (“SEC”) or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) except to the extent that VeriSign specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act.

The Audit Committee is composed of three directors who meet the independence and experience requirements of The NASDAQ Stock Market Rules. The Audit Committee operates under a written charter adopted by the board of directors (the “Board”) of VeriSign, Inc. (“VeriSign”). The members of the Audit Committee are Messrs. Chenevich (Chairperson) and Roach, and Ms. Cote. The Audit Committee met ten times during fiscal 2008.

Management is responsible for the preparation, presentation and integrity of VeriSign’s financial statements, accounting and financial reporting principles and internal controls and processes designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with accounting standards and applicable laws and regulations (the “Internal Controls”). The independent registered public accounting firm, KPMG LLP, is responsible for performing an independent audit of VeriSign’s consolidated financial statements in accordance with standards of the Public Accounting Oversight Board (United States) and for issuing a report thereon.

The Audit Committee is responsible for oversight of VeriSign’s financial, accounting and reporting processes and its compliance with legal and regulatory requirements. The Audit Committee is also responsible for the appointment, compensation and oversight of VeriSign’s independent registered public accounting firm, which includes (i) evaluating the independent registered public accounting firm’s qualifications and performance, (ii) reviewing and confirming the independent registered public accounting firm’s independence, (iii) reviewing and approving the planned scope of the annual audit, (iv) overseeing the audit work of the independent registered public accounting firm, (v) reviewing and pre-approving any non-audit services that may be performed by the independent registered public accounting firm, (vi) reviewing with management and the independent registered public accounting firm the adequacy of VeriSign’s Internal Controls, and (vii) reviewing VeriSign’s critical accounting policies, the application of accounting principles and conduct of the internal audit, including the oversight of the resolution of any issues identified by the independent registered public accounting firm.

We have adopted a policy regarding rotation of the audit partners (as defined under SEC rules) responsible for the audit of VeriSign’s financial statements. No audit partner of the independent registered public accounting firm providing audit services to VeriSign shall have served as the lead or coordinating audit partner (having primary responsibility for the audit) or as the audit partner responsible for reviewing the audit for more than five consecutive fiscal years.

During fiscal 2008, the Audit Committee met privately with KPMG LLP to discuss the results of the audit, evaluations by the independent registered public accounting firm of VeriSign’s Internal Controls and quality of VeriSign’s financial reporting.

The Audit Committee has reviewed and discussed the audited financial statements contained in VeriSign’s Annual Report on Form 10-K for the year ended December 31, 2008 with management. This review included a discussion of the accounting principles, reasonableness of significant judgments, and clarity of disclosures in the financial statements. Management represented to the Audit Committee that VeriSign’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and the Audit Committee has reviewed and discussed the consolidated financial statements with management and KPMG LLP.

11

The Audit Committee has discussed with KPMG LLP the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. In addition, KPMG LLP has provided to the Audit Committee the annual written disclosures and letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed the firm’s independence with the firm. The Audit Committee has also considered whether the non-audit services provided by KPMG LLP to VeriSign during 2008 are compatible with maintaining the independent registered public accounting firm’s independence.

Based upon discussions of the Audit Committee with management and KPMG LLP, and the Audit Committee’s review of the representations of management and the report of KPMG LLP to the Audit Committee, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in VeriSign’s Annual Report on Form 10-K for the year ended December 31, 2008, for filing with the SEC.

This report is submitted by the Audit Committee

William L. Chenevich (Chairperson)

Kathleen A. Cote

John D. Roach

The Board has established a Compensation Committee to discharge the Board’s responsibilities with respect to all forms of compensation of the Company’s directors and executive officers, to administer the Company’s equity incentive plans, and to produce an annual report on executive compensation for use in the Company’s proxy statement. The Compensation Committee is also responsible for approving and evaluating executive officer compensation arrangements, plans, policies and programs of the Company, and for administering the Company’s equity incentive plans for employees. The Compensation Committee operates pursuant to a written charter. The Compensation Committee’s charter is located on our website athttps://investor.verisign.com/documents.cfm. The Compensation Committee is currently composed of Messrs. Simpson (Chairperson) and Tomlinson, each of whom is an “independent director” under the rules of The NASDAQ Stock Market, and an “outside director” pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Compensation Committee met seven times during fiscal 2008. For further information regarding the role of compensation consultants and management in setting executive compensation, see “Executive Compensation—Compensation Discussion and Analysis.”

Any stockholder who desires to contact the Board may do so electronically by sending an e-mail to the following address: bod@verisign.com. Alternatively, a stockholder may contact the Board by writing to: Board of Directors, VeriSign, Inc., 487 East Middlefield Road, Mountain View, California 94043-4047, Attention: Secretary. Communications received electronically or in writing are distributed to the Chairman of the Board or other members of the Board, as appropriate, depending on the facts and circumstances outlined in the communication received.

On July 6, 2006, a stockholder derivative complaint (Parnes v. Bidzos, et al., and VeriSign) was filed against us in the U.S. District Court for the Northern District of California, as a nominal defendant, and certain of its current and former directors and executive officers related to certain historical stock option grants. The complaint seeks unspecified damages on behalf of us, constructive trust and other equitable relief. Two other derivative actions were filed, one in the U.S. District Court for the Northern District of California (Port Authority

12

v. Bidzos, et al., and VeriSign), and one in the Superior Court of the State of California, Santa Clara County (Port Authority v. Bidzos, et al., and VeriSign) on August 14, 2006. The state court derivative action is stayed pending resolution of the federal actions. The current directors and officers named in this state action are D. James Bidzos, William L. Chenevich, Roger H. Moore and Louis A. Simpson. The Company is named as a nominal defendant in these actions. The federal actions have been consolidated and plaintiffs filed a consolidated complaint on November 20, 2006. The current directors and officers named in this consolidated federal action are D. James Bidzos, William L. Chenevich, Roger H. Moore, Louis A. Simpson and Timothy Tomlinson. Motions to dismiss the consolidated federal court complaint were heard on May 23, 2007. Those motions were granted on September 14, 2007. On November 16, 2007, a second amended shareholder derivative complaint was filed in the federal action wherein we were again named as a nominal defendant. By stipulation and Court order, our obligation to respond to the second amended shareholder derivative complaint has been continued pending informal efforts by the parties to resolve the action.

On May 15, 2007, a putative class action (Mykityshyn v. Bidzos, et al., and VeriSign) was filed in Superior Court for the State of California, Santa Clara County, naming us and certain current and former officers and directors, alleging false representations and disclosure failures regarding certain historical stock option grants. The plaintiff purports to represent all individuals who owned our common stock between April 3, 2002, and August 9, 2006. The complaint seeks rescission of amendments to the 1998 and 2006 Option Plans and the cancellation of shares added to the 1998 Option Plan. The complaint also seeks to enjoin the Company from granting any stock options and from allowing the exercise of any currently outstanding options granted under the 1998 and 2006 Option Plans. The complaint seeks an unspecified amount of compensatory damages, costs and attorneys fees. The identical case was filed in the Superior Court for the State of California, Santa Clara County under a separate name (Pace. v. Bidzos, et al., and VeriSign) on June 19, 2007, and on October 3, 2007 (Mehdian v. Bidzos, et al.). On December 3, 2007, a consolidated complaint was filed in Superior Court for the State of California, Santa Clara County. The current directors and officers named in this consolidated class action are D. James Bidzos, William L. Chenevich, Roger H. Moore, Louis A. Simpson and Timothy Tomlinson. VeriSign and the individual defendants dispute all of these claims. Defendants’ collective pleading challenges to the putative consolidated class action complaint were granted with leave to amend in August 2008. By stipulation and Court order, plaintiff’s obligation to file an amended consolidated class action complaint has been continued pending informal efforts by the parties to resolve the action.

We have adopted a code of ethics that applies to our principal executive officer, principal financial officer and other senior accounting officers. This code of ethics, titled “Code of Ethics for the Chief Executive Officer and Senior Financial Officers,” is posted on our website along with our “Code of Ethics and Business Conduct” that applies to all officers and employees, including the aforementioned officers. The Internet address for our website iswww.verisign.com, and the “Code of Ethics for the Chief Executive Officer and Senior Financial Officers” may be found from our main Web page by clicking first on “About VeriSign” and then on “Corporate Governance” under “Investor Relations,” next on “Codes of Business Conduct” under “Corporate Governance,” and finally on “Code of Ethics for the Chief Executive Officer and Senior Financial Officers.” The “Code of Ethics and Business Conduct” applicable to all officers and employees can similarly be found on the Web page for “Codes of Business Conduct” under the link entitled “Code of Business Conduct.”

We intend to satisfy any disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of the “Code of Ethics for the Chief Executive Officer and Senior Financial Officers” or, to the extent also applicable to the principal executive officer, principal financial officer, or other senior accounting officers, the “Code of Ethics and Business Conduct” by posting such information on our website, on the Web page found by clicking through to “Codes of Business Conduct” as specified above.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of February 28, 2009 by:

| • | each current stockholder who is known to own beneficially more than 5% of our common stock; |

| • | each current director; |

| • | each of the Named Executive Officers (see the “Summary Compensation Table” elsewhere in this Proxy Statement); and |

| • | all current directors and executive officers as a group. |

The percentage ownership is based on 192,691,014 shares of common stock outstanding at February 28, 2009. Shares of common stock that are subject to options currently exercisable or exercisable within 60 days of February 28, 2009 are deemed outstanding for the purpose of computing the percentage ownership of the person holding such options but are not deemed outstanding for computing the percentage ownership of any other person. Unless otherwise indicated in the footnotes following the table, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

| Shares Beneficially Owned | |||||

Name and Address of Beneficial Owner | Number(1) | Percent(1) | |||

Greater Than 5% Stockholders | |||||

T. Rowe Price Associates, Inc.(2) 100 East Pratt Street Baltimore, Maryland 21202 | 28,260,594 | 14.67 | % | ||

FMR LLC(3) 82 Devonshire Street Boston, Massachusetts 02109 | 22,808,780 | 11.84 | % | ||

Delaware Management Holdings(4) 2005 Market Street Philadelphia, Pennsylvania 19103 | 14,993,414 | 7.78 | % | ||

Eton Park Fund, L.P.(5) Eton Park Master Fund, Ltd. 399 Park Avenue, 10th Floor New York, New York 10022 | 11,750,000 | 6.10 | % | ||

Directors and Named Executive Officers | |||||

D. James Bidzos(6) | 208,033 | * | |||

William L. Chenevich(7) | 107,973 | * | |||

Kathleen A. Cote(8) | 10,923 | * | |||

Roger H. Moore(9) | 107,015 | * | |||

John D. Roach(10) | 30,954 | * | |||

Louis A. Simpson(11) | 131,880 | * | |||

Timothy Tomlinson(12) | 19,854 | * | |||

Albert E. Clement(13) | 20,337 | * | |||

William A. Roper, Jr.(14) | 79,455 | * | |||

Richard H. Goshorn(15) | 59,018 | * | |||

Russell S. Lewis(16) | 108,037 | * | |||

Brian G. Robins(17) | 54,702 | * | |||

Kevin A. Werner(18) | 41,054 | * | |||

All current directors and executive officers as a group | 885,069 | * | |||

14

| * | Less than 1% of VeriSign’s outstanding common stock. |

| (1) | The percentages are calculated using 192,691,014 outstanding shares of the Company’s common stock on February 28, 2009 as adjusted pursuant to Rule 13d-3(d)(1)(i). Pursuant to Rule 13d-3(d)(1) of the Exchange Act, beneficial ownership information for each person also includes shares subject to options exercisable within 60 days of February 28, 2009, as applicable. |

| (2) | Based on Schedule 13G filed on February 12, 2009 with the SEC by T. Rowe Price Associates, Inc., with respect to beneficial ownership of 28,260,594 shares. T. Rowe Price Associates, Inc. has sole voting power over 7,459,011 of these shares and sole dispositive power over 28,224,194 of these shares. |

| (3) | Based on Schedule 13G filed on February 17, 2009 with the SEC by FMR LLC, with respect to beneficial ownership of 22,808,780 shares. FMR LLC has sole voting power over 185,863 of these shares and sole dispositive power over 22,808,780 of these shares. |

| (4) | Based on Schedule 13G filed on February 6, 2009 with the SEC by Delaware Management Holdings with respect to beneficial ownership of 14,993,414 shares. Delaware Management Holdings and Delaware Management Business Trust each reported that it has sole voting power over 14,935,874 of these shares, shared voting power over 1,640 of these shares and sole dispositive power over 14,993,414 of these shares. Delaware Management Holdings and Delaware Management Business Trust are parties to an Agreement to File Joint Acquisition Statements, dated February 6, 2009. Lincoln National Corp. is the ultimate parent of Delaware Management Business Trust. |

| (5) | Based on Schedule 13G/A filed on February 13, 2009 with the SEC: (i) Eton Park Fund, L.P. (“EP Fund”) directly owns 3,760,000 shares (or 1.95% of the class), over which EP Fund has shared voting power and shared dispositive power; (ii) Eton Park Master Fund, Ltd. (“EP Master Fund”) directly owns 7,990,000 shares (or 4.15% of the class), over which EP Master Fund has shared voting power and shared dispositive power; (iii) Eton Park Associates, L.P. (“EP Associates”), the general partner of EP Fund, has beneficial ownership of 3,760,000 shares (or 1.95% of the class) directly owned by EP Fund, over which EP Associates has shared voting power and shared dispositive power; (iv) Eton Park Capital Management, L.P. (“EP Management”), the investment advisor to EP Master Fund, has beneficial ownership of 7,990,000 shares (or 4.15% of the class) directly owned by EP Master Fund, over which EP Management has shared voting power and shared dispositive power; and (v) Eric M. Mindich (“Mindich”) has beneficial ownership of 11,750,000 shares (or 6.10% of the class) directly owned by EP Fund and EP Master Fund, over which he has shared voting power and shared dispositive power. Eton Park Associates, L.L.C. serves as the general partner of EP Associates. Mr. Mindich is managing member of Eton Park Associates, L.L.C. EP Master Fund is a client of EP Management. Eton Park Capital Management, L.L.C. serves as the general partner of EP Management. Mr. Mindich is the managing member of Eton Park Capital Management, L.L.C. Mr. Mindich disclaims beneficial ownership of the shares reported on Schedule 13G/A other than the portion of such shares which relates to his individual economic interest in each of EP Fund and EP Master Fund. |

| (6) | Includes 107,017 shares subject to options held directly by Mr. Bidzos. Mr. Bidzos is Executive Chairman of the Board and Chief Executive Officer on an interim basis. |

| (7) | Includes 98,959 shares subject to options held directly by Mr. Chenevich. |

| (8) | Includes 7,988 shares subject to options held directly by Ms. Cote. |

| (9) | Includes 97,865 shares subject to options held directly by Mr. Moore. |

| (10) | Includes 14,990 shares subject to options held directly by Mr. Roach. |

| (11) | Includes 72,866 shares subject to options held directly by Mr. Simpson. |

| (12) | Includes 4,864 shares held indirectly by the Tomlinson Family Trust, under which Mr. Tomlinson and his spouse are co-trustees. Includes 14,990 shares subject to options held directly by Mr. Tomlinson. |

| (13) | Mr. Clement is our former Chief Financial Officer. Mr. Clement’s employment with the Company ended on April 4, 2008. |

| (14) | Mr. Roper is our former President and Chief Executive Officer, and was a member of the Board. Mr. Roper resigned from the Company and our Board on June 30, 2008. |

| (15) | Includes 54,734 shares subject to options held directly by Mr. Goshorn. |

| (16) | Includes 94,041 shares subject to options held directly by Mr. Lewis. |

| (17) | Includes 44,758 shares subject to options held directly by Mr. Robins. |

| (18) | Includes 5,000 shares held indirectly by the Werner Family Trust, under which Mr. Werner and his spouse are co-trustees. Includes 33,750 shares subject to options held directly by Mr. Werner. |

| (19) | Includes the shares described in footnotes (6)-(18) and 5,626 shares beneficially held by one additional executive officer. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and officers, and persons who own more than 10% of VeriSign’s common stock to file initial reports of ownership and reports of changes in ownership with the SEC and The NASDAQ Stock Market. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. We file Section 16(a) reports on behalf of our directors and executive officers to report their initial and subsequent changes in beneficial ownership of our common stock.

Based solely on a review of the reports we filed on behalf of our directors and executive officers, or written representations from reporting persons that all reportable transactions were reported, the Company believes that all Section 16(a) filing requirements applicable to our directors and executive officers were complied with for fiscal 2008.

15

Compensation Discussion and Analysis

Summary

2008 continued to be a time of transition for VeriSign. We continued our strategy of focusing on our core businesses, which are Naming Services, SSL Certificate Services, and Identity and Authentication Services (“Core Business Units”), and made progress on our divestiture plan. However, sales of our non-core business units slowed due to the global economic conditions and the corresponding credit crunch. We experienced turnover in our executive ranks. On June 30, 2008, William A. Roper, Jr., our former President and Chief Executive Officer, resigned from the Company and D. James Bidzos was appointed Executive Chairman, President and Chief Executive Officer on an interim basis. Mr. Bidzos served in this capacity until January 14, 2009, when Mark D. McLaughlin was named President and Chief Operating Officer. Mr. McLaughlin previously held a number of key positions at VeriSign from 2000 to 2007. Mr. Bidzos continues to serve as Executive Chairman of the Board of Directors and Chief Executive Officer on an interim basis. Albert E. Clement, VeriSign’s former Chief Financial Officer, left the Company on April 4, 2008, and Brian G. Robins, Senior Vice President, was named acting Chief Financial Officer at that time.

In the sections below, we describe our executive compensation program for 2008, including:

| • | The principles on which our executive compensation program was based. |

| • | The process by which the Compensation Committee established and reviewed the executive compensation program. |

| • | The elements that made up our executive compensation program, as well as detailed information on each individual element. |

For 2008, our Named Executive Officers were:

1. D. James Bidzos, Executive Chairman and Chief Executive Officer on an interim basis;

2. Brian G. Robins, Senior Vice President, acting Chief Financial Officer;

3. Richard H. Goshorn, Senior Vice President, General Counsel and Secretary;

4. Russell S. Lewis, Executive Vice President, Strategy and Technical Operations; and

5. Kevin A. Werner, Senior Vice President, Corporate Development and Strategy.

In addition, the following senior executives who left the Company during 2008 are also considered to be Named Executive Officers for 2008 (all such persons, our “Named Executive Officers”):

1. William A. Roper, Jr., former President, Chief Executive Officer and a member of the Board of Directors; and

2. Albert E. Clement, former Senior Vice President and Chief Financial Officer.

Executive Compensation

Compensation Goals and Philosophy

The goal of our executive compensation program is to create long-term value for our stockholders. In order to achieve this goal, our executive compensation program seeks to attract and retain highly talented executives and to motivate them to achieve our business objectives and contribute to our long-term success.

Our executive officer compensation program is designed with the following principles in mind:

| • | Performance: a significant portion of each executive officer’s total compensation should depend on the achievement of corporate objectives and the creation of stockholder value. Compensation should be |

16

directly linked to measurable corporate and individual performance, and provide incentives for superior performance that will drive demonstrable business impact. |

| • | Alignment: compensation should closely align the interests of our executive officers with the long-term interests of our stockholders. |

| • | Retention: compensation should be competitive with that offered by other leading high technology companies we view as competitors for the employment of talented executives. |

The Process for Setting Compensation

Role of the Compensation Committee: The Compensation Committee of our Board of Directors is ultimately responsible for the oversight of our compensation and benefit programs, and sets the policies governing compensation of our executive officers and our other employees. As part of this process, the Compensation Committee annually reviews and approves all elements of our executive compensation program (except health and welfare benefits provided to other full-time employees), including the annual incentive bonus program and long-term incentive compensation programs for our non-officer employees.

Compensation decisions are made by the Compensation Committee after reviewing the performance of the Company and each executive’s performance during the year against established goals, current compensation arrangements, market trends, and the compensation history of the executive officer relative to other executives at VeriSign.

Role of Management: The Chief Executive Officer (the “CEO”) annually reviews the performance of each executive officer (other than the CEO whose performance is ordinarily reviewed by the Chairman of the Board and the Compensation Committee) and makes a recommendation regarding the salary, incentive bonus and long-term incentive compensation for each executive officer (other than himself) based on his assessment of the performance of each individual. In 2008, because Mr. Bidzos assumed the CEO duties in mid-year, he did not receive a review. The CEO also takes an active part in the discussions at Compensation Committee meetings at which the compensation of executives who report to him directly, including the Named Executive Officers, is discussed. All decisions regarding the CEO’s compensation are made by the Compensation Committee in executive session, without the CEO present.

Role of Compensation Consultant: Frederic W. Cook & Co. Inc. (“FW Cook”), a recognized compensation consulting firm, serves as the independent consultant to the Compensation Committee to assist it in evaluating and analyzing the Company’s executive compensation program, principles and objectives, as well as the specific compensation and benefit design recommendations presented by the Company’s executive management. FW Cook prepares a report relating to the CEO’s and all other Named Executive Officers’ compensation. The report provides comparative data with peer companies, a tally sheet detailing total target cash compensation, the value of long-term incentive grants, the total annual value of benefits, an estimate of leaving benefits if covered by a change-in-control, a salary history, and an analysis of built in gain on prior equity awards. FW Cook does not perform any other services for us other than its consulting services to the Compensation Committee.

In addition, Human Resources management retained Semler Brossy Consulting Group, an independent compensation consulting firm, to provide analysis, review and recommendation for the Company’s long-term incentive strategy for its broad-based employee population below the Named Executive Officer level.

Benchmarking: We use a benchmarking process to help determine base salary, annual incentive bonus targets and long-term incentive compensation targets for our executive officers. We undertake an annual study of competitive compensation practices for executive officers at certain high technology companies that we view as our peers or as competitors for executive talent.

17

The Compensation Committee considers a number of factors when it establishes its total compensation program, which is comprised of base salary, annual incentive bonus and long-term incentives, for each Named Executive Officer. These factors include the executive’s individual performance in the prior year relative to his peers, the executive’s future potential with us, the scope of the executive’s responsibilities and experience, and total compensation levels as compared to our compensation peer group. Other elements of compensation, including health and welfare benefits and severance and change-in-control payments and benefits are reviewed periodically by the Compensation Committee to ensure that our total compensation is competitive based on data obtained from various sources at the time of the review.

Our compensation peer group is principally made up of publicly-traded companies in the high technology sector which are business competitors and/or with which we compete for executive talent (the “Peer Group”). The Compensation Committee reviews the Peer Group annually and makes adjustments as necessary to ensure it continues to appropriately reflect the competitive market for key talent and includes companies similar to us in scope and complexity.

With the assistance of FW Cook, the Compensation Committee reviewed the Peer Group of companies VeriSign uses to benchmark its executive compensation programs and practices. For 2008, changes were made to the Peer Group that reflect a more geographically balanced group of companies (as compared to the 2007 Peer Group, which was heavily weighted towards Silicon Valley companies) but still appropriately in line with VeriSign’s labor market competition, market capitalization, revenue and number of employees. Companies removed from the Peer Group for 2008 were Adobe Systems, BEA Systems (acquired by Oracle), Business Objects (acquired by SAP), Convergys, Electronic Arts, Juniper Networks and Network Appliance.

The fifteen companies listed below comprise the 2008 compensation Peer Group:

Affiliated Computer Services | Cadence Design Systems | Fiserv | ||

Akamai Technologies | Computer Associates | Intuit | ||

Alliance Data Systems | Citrix Systems | McAfee | ||

Autodesk | Cognizant Tech | Salesforce.com | ||

BMC Software | DST Systems | Total System Services | ||

Range of Revenues and Market Cap for 2008 Peer Group

| Most Recent Four Quarters Revenue ($M) | 12/31/2008 Market Cap ($M) | |||||

75th Percentile | $ | 2,939.9 | $ | 5,267.8 | ||

Median | $ | 2,025.3 | $ | 4,446.6 | ||

25th Percentile | $ | 1,591.7 | $ | 2,911.0 | ||

VeriSign | $ | 962.0 | $ | 3,702.0 | ||

The Compensation Committee also reviewed and considered cash compensation levels from the Radford Executive Survey using a high-technology cut with companies in the $1B—$3B revenue range.

Equity Award Practices

The Compensation Committee approves all equity awards to Section 16 executive officers, which include the Named Executive Officers, including annual award grants and any new hire, promotion and discretionary grants.

18

For all other employees, the Compensation Committee approves an aggregate equity pool and individual grant guidelines. The Committee has delegated the actual award determination for such employees to the Grant Committee established by the Board and comprised of one individual, Mr. D. James Bidzos, Executive Chairman and Chief Executive Officer on an interim basis. The Compensation Committee has determined that any such awards would be granted on the 15th of the month (or the next scheduled trading day if the 15th of the month falls on a non-trading date) following the approval by the Grant Committee.

Beginning with the 2009 fiscal year, the Company changed the timing of the administration of its annual equity award program for executive officers and other employees. The administration and allocation of annual equity awards was changed from August to February to align with the Company’s regular performance management process, which occurs in the first quarter of the fiscal year. During this process, decisions regarding employee performance, salary merit increases and bonus awards are determined. Therefore, moving the timing of the annual equity award process helps support and reinforce our pay for performance objectives. The annual equity award grants are reviewed, approved and granted by the Compensation Committee at its regular meeting during the first quarter of each year, scheduled at least a year in advance.

Elements of Compensation Program

Base Salary: Base salary is the primary fixed component of our compensation program, and is intended to provide a guaranteed level of annual income to our executives. We believe that offering a competitive annual base salary that is not subject to risk for performance is vital in attracting and retaining our executives.

Base salaries of our executive officers are determined annually. Actual base salary levels are established based upon each executive officer’s job responsibilities and experience, individual contributions and future potential. We benchmark against base salary and total compensation levels of executives from our Peer Group to help determine appropriate compensation levels for each executive officer. We also reference other compensation data and surveys relevant to establishing individual or programmatic changes. The Compensation Committee is mindful of the effects changes to base salary can have on other elements of our compensation program such as target bonus amounts and potential severance payments, and carefully considers these factors when setting or changing executive base salaries.