FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

July 12, 2004

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Exact name of registrant as specified in its charter)

Telefonica of Peru

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether the registrant by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Telefónica del Perú S.A.A.

TABLE OF CONTENTS

| | |

Item

| | |

| 1. | | Translation of a letter to CONASEV dated April 12, 2004 regarding the redemption of Series F of the 27th Issue of the Second Program of Commercial Paper. |

| |

| 2. | | Translation of a letter to CONASEV dated April 14, 2004 regarding the issuance of the Second Issue of the Third Program of Corporate Bonds. |

| |

| 3. | | Translation of a letter to CONASEV dated April 16, 2004 regarding the redemption of Series H of the 26th Issue of the Second Program of Commercial Paper. |

| |

| 4. | | Translation of a letter to CONASEV dated April 20, 2004 regarding the Amendment of the “Regulations for the Communication of Information to the Markets”. |

| |

| 5. | | Translation of a letter to CONASEV dated April 21, 2004 regarding the meeting of the Board of Directors on April 21, 2004. |

| |

| 6. | | First Quarter Results for 2004. |

| |

| 7. | | Translation of a letter to CONASEV dated May 3, 2004 regarding the resignation of Mr. Eduardo Airaldi as Alternate Director and Managing Director. |

| |

| 8. | | Translation of a letter to CONASEV dated May 19, 2004 regarding the designation of Mr. Gabriel Frías García as Chief Executive Officer of Telefónica del Perú S.A.A. |

| |

| 9. | | Translation of a letter to CONASEV dated June 14, 2004 regarding the report concerning the extension request of the concessions contract. |

| |

| 10. | | Translation of a letter to CONASEV dated June 17, 2004 regarding the resolutions adopted at a meeting of the Board of Directors of Telefónica del Perú on June 16, 2004. |

Item 1.

TRANSLATION

GCF-220-A1-106-04

Lima, April 12, 2004

Messrs.

Comisión Nacional Supervisora

De Empresas y Valores – CONASEV

Lima.-

Dear Sirs,

According to Article 28 of the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the redemption of the Series F of the 27th Issue of the Second Program of Commercial Papers, under the following characteristics:

| | | | | | | | | | | |

Issue

| | Series

| | Term

| | Date of Issue

| | Date of Maturity

| | Nominal Value

|

27th | | F | | 360 | | 04.14.03 | | 04.08.04 | | S/. | 40,000,000 |

Sincerely yours,

Julia María Morales Valentín

Stock Exchange Representative

1

Item 2.

TRANSLATION

April 14, 2004

Messrs.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

According to Article 28 of the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the terms and conditions of the Second Issue of the Third Program of Corporate Bonds of Telefónica del Perú, according to the advertisement published this morning, which is enclosed herewith.1

Best regards,

Julia María Morales Valentín

Stock Exchange Representative

| 1 | English translation not included. |

2

Item 3.

TRANSLATION

GCF-220-A1-109-04

Lima, April 16, 2004

Messrs.

Comisión Nacional Supervisora

De Empresas y Valores – CONASEV

Lima.-

Dear Sirs,

According to Article 28 of the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the redemption of the Series H of the 27th Issue of the Second Program of Commercial Papers, under the following characteristics:

| | | | | | | | | | | |

Issue

| | Series

| | Term

| | Date of Issue

| | Date of

Maturity

| | Nominal Value

|

26th | | H | | 360 | | 04.22.03 | | 04.16.04 | | US$ | 3,125,000 |

Sincerely yours,

Julia María Morales Valentín

Stock Exchange Representative

3

Item 4.

The General Management of Telefónica del Perú S.A.A.

Whereas, in compliance with the provisions contained in CONASEV Resolution No. 107-2002-EF/94.10, the Board of Directors of Telefónica del Perú S.A.A. approved the Regulations for the Communication of Information to the Markets, which regulates the procedure to prepare and disclose important facts, other communications, confidential information and other information to be submitted from time to time to the institutions representing the markets where the Company’s shares are listed, in order to guarantee that the company’s relevant information is disclosed to them in a clear, accurate, transparent and timely manner.

Whereas, in such meeting, the Board of Directors delegated authority to the General Management so that it may individually extend, complement or modify such regulations, in whole or in part, and establish, through self-regulation, the materiality criteria to be used in the determination of important facts, so as to disclose the information that is useful and relevant to the investor.

Whereas, in the exercise of such delegation of authority, the general management has established the materiality criteria that will govern the communication of information to the market, and has also specified the scope of the sixth paragraph of Section 3.4.2.2.

In view of the foregoing, the General Management resolves:

1. To modify the “Regulations for the Communication of Information to the Markets”, the restated text of which is made part hereof.

2. In compliance with the provisions set forth in Resolution No. 107-2002-94/EF.10, the Stock Market Representative shall be in charge of informing the National Supervisory Commission for Companies and Securities (Conasev) of the modifications approved by virtue hereof.

Lima, April 20, 2004

General Management

4

TELEFÓNICA DEL PERÚ S.A.A.

Regulations for the Communication of Information to the Markets

Lima, April 2004

5

REGULATIONS FOR THE COMMUNICATION OF

INFORMATION TO THE MARKET

These regulations are aimed at establishing the necessary provisions for the preparation and registration of Important Facts, Other Communications, Confidential Information and other information to be submitted from time to time to the institutions representing the markets where the Company’s shares are listed, in order to guarantee that the company’s relevant information is disclosed to them in a clear, accurate, transparent and timely manner.

The provisions contained herein are of mandatory compliance for the directors, managers and other officers of Telefónica del Perú S.A.A. (hereinafter, the Company).

| | 1.3. | General Principles of Important Facts and Other Communications |

1.3.1. In accordance with the provisions contained in the Stock Market Law and in the Regulations of Important Facts, Classified Information and Other Communications, approved by CONASEV Resolution No. 107-2002.EF/94.10 (the Regulations), the Company will immediately disclose to the National Supervisory Commission for Companies and Securities (CONASEV), the Lima Stock Exchange and other institutions representing the markers where its securities are listed, the Important Facts, Other Communications and periodic information to be furnished to them.

1.3.2. The contents of the communications must be clear, accurate and sufficient so as not to lead to confusion or deceit.

1.3.3. The Company must submit all the information on Important Facts and Other Communications through the means to be established for this purpose, and complying with all requirements regarding time, form and means required by the Stock Market Law, the Regulations and other applicable rules.

1.3.4. Pursuant to the provisions contained in the Regulations, Important Facts and other Communications must be informed no later than within the business day following the adoption of the resolution, decision or occurrence of the relevant fact, on or before 17:00 hours.

1.3.5. The Company will furnish Important Facts and Other Communications to CONASEV and the Lima Stock Exchange before any other means to which it may disclose said information.

6

For purposes of these regulations, the following terms shall be considered:

Are considered to be:

2.1.1. Actions, decisions, facts and agreements that may affect the Company and its business, as well as the companies that make up its Economic Group.

2.1.2. Information directly affecting or that may significantly affect the determination of the price, the offer or trading of the securities registered with the Stock Exchange Public Registry.

2.1.3. Important Facts include ongoing negotiations of the Company, their value and offers made.

2.1.4. In general, the information required so that investors may make a judgment on the implicit risk of the Company, its financial situation and the results of the operation and securities issued.

2.1.5. Pursuant to the provisions contained in the Stock Market Law, the importance of a fact is measured by the influence that it may have upon a sensible investor to change its decision to invest or not in the Company’s securities. To this end, the following objective parameters have been established that will allow identifying when a certain fact is material to the Company and, therefore, should be registered as an important fact:

| | • | Any financing operation or granting of loans or guaranties in favor of third parties, involving an amount greater than or equal to 5% of the Company’s paid-in capital; |

| | • | Purchase or sale of assets in an amount greater than or equal to 5% of the total value of the Company’s assets; |

| | • | Changes in the Company’s consolidated equity greater than 5% thereof ; |

| | • | Contingencies arising from firm judgments rendered in judicial, extrajudicial or administrative actions, sanctioning proceedings and others that may affect the Company or its Economic Group, the amount of which, considered individually, exceeds 5% of the Company’s equity; and, |

| | • | Work stoppages, shift reductions as long as they entail a reduction of 25% of the standards existing in the Company. |

7

2.1.6. Without limiting the foregoing, the following are considered to be important facts, regardless of the amount that may be involved:

| | • | Suspension or exclusion of the Company’s securities in the organized markets where they are listed; |

| | • | Issuance, withdrawal, amortization, redemption and early redemption of the Company’s securities; |

| | • | Postponement of compliance with the obligations arising from the issue of debt instruments, whether it is the principal or interest, as well as any extension of the payment of preferential rights or benefits; |

| | • | Participation in ADR Programs, as well as the listing or delisting of ADRs or GDRs in foreign stock market supervisory mechanisms and in stock exchanges where they are traded; |

| | • | Total or partial amendment to the Company Bylaws; |

| | • | Increase or reduction of the share capital; |

| | • | Amortization or redemption of shares and modification of their par value; |

| | • | Merger and/or spin off of the Company or any form of corporate reorganization in which it participates; |

| | • | Submittal and modification of the list and information on the legal entities that make up its Economic Group; |

| | • | Application of profits and distribution of Company dividends; |

| | • | Approval of or change of remuneration plans for directors based on the Company’s shares; |

| | • | Approval of the Company’s individual and consolidated annual financial information and its individual and consolidated quarterly financial statements; |

| | • | Approval of the Company’s Annual Report and filing of Form 20-F with the SEC; |

| | • | Regulations governing the operation or conduct of the Shareholders’ Meeting and of Special Shareholders’ Meetings and of the Company’s Board of Directors; |

| | • | Modification of the Regulations for the Communication of Information to the Markets and designation of new Stock Market Representative; |

8

| | • | Resignations and appointments of Board Members, General Manager, Central Managers or equivalent positions in the current corporate structure of the Company and of its Economic Group; modification of the Company’s corporate structure starting at the level of Central Manager or its equivalent; |

| | ��� | Designation or change of the Company’s liquidator or of the representative of bond holders; |

| | • | Designation or resignation of the Company’s external auditor; |

| | • | Whenever more than two-thirds of the total obligations of the company are past due and unpaid for a period of over thirty days and/or when it has accumulated losses after deducting reserves, the amount of which exceeds two-thirds of the paid-in capital; |

| | • | Plans or programs for the purchase or sale of shares issued by the Company or its Economic Group; |

| | • | Knowledge of agreements or covenants entered into by the shareholders of the Company the purpose of which is to jointly exercise voting rights; |

| | • | Revision of the Company’s corporate debt ratings, as well as of its prospects by risk classifying agencies; |

| | • | The summoning of a Shareholders’ Meeting and/or a Special Shareholders’ Meeting of the Company and the resolutions adopted by said bodies relating to any of the topics referred to in the foregoing points; and |

| | • | Changes in accounting estimates, in accounting policies and the correction of the substantial errors referred to in International Accounting Standard No. 8 “Net Loss or Profit of the Year, Substantial Errors and Changes in Accounting Policies” which significantly alter the estimates of results, of revenues or expenses, and informing the estimated effect thereof. |

These are understood to be press releases, statements made to the press, presentations given to analysts and investors, among others, in which information is given related to the general evolution of the Company or of its Economic Group.

| | 2.3. | Confidential Information |

Pursuant to the provisions contained in the Stock Market Law and in the Regulations, an important fact – including the negotiations underway – may be confidential, when it is considered that the premature disclosure thereof may damage the company. To this end, such information must be designated confidential pursuant to Section 3.6 hereof.

9

| | 3.1. | Regarding the Stock Market Representative |

3.1.1. The Board of Directors of the Company must designate the Stock Market Representative, which must notify Conasev, the Lima Stock Exchange and the other relevant institutions as an Important Fact. Pursuant to the provisions contained in these Regulations, the removal of the Stock Market Representative, as well as the identity of whoever may replace him, must be communicated to the market as an Important Fact.

3.1.2. The Stock Market Representative will be the only one authorized to advise Conasev and the Lima Stock Exchange about the information as Important Facts, Other Communications and Confidential Information. In the event of the absence or impediment of the Stock Market Representative, his functions will be assumed by the General Manager, the Chairman or Vice-Chairman of the Board, the participation of any one of them being sufficient to evidence the absence or impediment of the others.

3.1.3. The General Secretary must accredit the Stock Market Representative, the General Manager, the Chairman or Vice Chairman of the Board before Conasev and the Lima Stock Exchange, for which purpose it must submit prior to any notice thereof to the market, the form approved by the former, duly signed by said officers.

| | 3.2. | Procedure for the preparation and registration of Important Facts |

3.2.1. The responsible party in the General Management or in the area that is aware of information that may be considered to be an Important Fact in accordance with the definition contained in point 2.1 above and in Annex No. 1 of Conasev Resolution No. 107-2002-EF/94.15, must advise the Legal Representative thereof immediately following the occurrence of the event or adoption of the respective resolution.

3.2.2. The information must be immediately delivered to the Stock Market Representative on the day of its occurrence.

3.2.3. Without prejudice to the provisions set forth in Section 3.2.1 above, the parties required to inform the Stock Market Representative of the existence of a decision or fact that should be advised are, particularly, the Chairman of the Board, the General Manager and the highest-ranking officers that make up the General Secretary, the Central Finance Management, Central Management of Regulation and Strategic Planning, Human Resources Management, Control Central Management, Internal Control Central Management, Investor Relations Central Management, or their respective equivalents in the Company’s corporate structure from time to time.

3.2.4. The information furnished to the Stock Market Representative must be complete and sufficient, so as to enable it to evaluate and determine the relevance thereof and the need of advising it to the market.

3.2.5. The Stock Market Representative, or whoever is acting as such as established in Section 3.1.2 above, may obtain the opinion or consent of the management or area under whose jurisdiction the operation, agreement, event or decision falls, regarding the information that will be submitted to the market.

10

3.2.6. In order to make sure that the company’s relevant information is known by the Company’s executive principal officers, the Stock Market Representative must deliver a copy of the documentation furnished to the markets to the Chairman of the Board, the General Manager, the Finance Central Manager, the Control Central Manager, the Institutional Relations Central Manager, and others that it deems convenient.

3.2.7. As long as the Company’s securities are listed in the foreign centralized trading mechanisms, it will be necessary to submit the information referred to in these regulations in the language of the respective country, for which purpose the Stock Market Representative must immediately request the corresponding translation to the Investor Relations Area.

3.2.8. In the event of the disclosure of inaccurate or incomplete information regarding an Important Fact, the Stock Market Representative will be in charge of clarifying or denying such information, for which the procedure and requirements in place for this purpose must be observed.

| | 3.3. | Registration Procedure for Other Communications |

| | 3.3.1. | Press releases and statements to the media |

The Institutional Relations Central Management must inform the Stock Market Representative each time the Company discloses press releases or makes statements to the media in connection with the evolution of the business of the company and of its economic group.

When appropriate, the Institutional Relations Central Management will deliver to the Stock Market Representative a copy of the information to be attached to the communication to be filed with CONASEV and the other institutions. The Stock Market Representative must take into account the provisions set forth in Section 3.2.7 above.

| | 3.3.2. | Presentations to analysts or investors |

| | • | The Finance Central Management will inform the Stock Market Representative of meetings with analysts and investors, telephone conferences and other events where it delivers information on the conduct of business of the company and its economic group. |

| | • | The individuals participating in such meetings must refrain from disclosing this type of information if it has not been previously disclosed to the market. |

| | • | When appropriate, the Finance Central Management will deliver to the Stock Market Representative a copy of the information to be attached to the communication to be delivered to CONASEV and to other institutions. The Stock Market Representative must take into account the provisions set forth in Section 3.2.7 above. |

11

| | 3.4.1. | Periodic information on results |

In accordance with the legal requirements in force, the Company will prepare the following information on a periodic basis to be disclosed to the markets:

| | • | Intermediate financial information: The Company will submit, in the form and within the time periods required by the legal rules in force, the intermediate, individual and consolidated information relating to the closing dates at March 31, June 30, September 30 and December 31 of each year. |

| | • | Annual financial information: The Company will submit, in the form and within the time periods required by the legal rules in force, the annual, individual and consolidated information included between the first day and the last day of each financial year. |

The Company will deliver each of these communications of financial results to all the markets where its securities are admitted for trading, in accordance with the requirements and time frames fixed in each case.

| | 3.4.1.1. | General Principles |

| | • | The periodic financial information to be disclosed to the markets must be prepared as established in the Financial Information Regulations approved by Conasev Resolution No. 103-99-EF/94.10, as amended and amplified. |

| | • | The Control Central Management will be in charge of preparing and disclosing the periodic financial information. For its part, the Finance Central Management will be in charge of preparing the Management Report. These Central Managements may obtain the internal certifications that they deem necessary from the different areas of the organization, as well as from the different entities whose results are consolidated in the Company. |

| | • | The intermediate and annual information on its results prepared as established by the law, will be delivered by the Stock Market Representative to Conasev, the Lima Stock Exchange and other applicable representative institutions of the stock market, as an Important Fact, on or before the day following its approval by the applicable corporate body. |

12

| | • | The intermediate and annual information on its results prepared as contemplated in the law will be delivered to Conasev, the Lima Stock Exchange and other representative institutions of the stock market prior to any disclosures that the company may intend to make to the press. In the event the Company prepares relevant, complementary or additional information on its results, it must be delivered to the referred institutions before being disclosed to the public. |

| | 3.4.2. | Annual Reports (Annual Report and Form 20-F) |

The Annual Reports are those that do not exclusively contain financial and economic information but rather general information on the Company and on the evolution of its business, the filing of which is required by law of the markets where its securities are traded.

| | 3.4.2.1. | General Principles |

Annual Reports must be written clearly and with understandable language. The information contained therein must be accurate, correct and complete in all relevant aspects. They must contain all the relevant information on the Company’s business and activities, as required by the respective applicable legislation, so as to reasonably provide a true picture of the financial situation, results of the business in all its significant aspects.

| | 3.4.2.2. | Process for the preparation of Annual Reports |

| | • | In the first annual meeting each fiscal year of the Directive Committee, this body will entrust a Central Manager (hereinafter the Responsible Party) with the preparation of the Annual Report, whose personnel will be in charge of implementing the project, following up and coordinating the preparation process, reviewing and consolidating the information to be included in such Annual Report, under the supervision of the respective Central Manager. |

| | • | For their respective parts, the Finance Central Manager, the Control Central Manager, the Secretary General, the Internal Control Central Manager, the Regulation and Strategic Planning Central Manager and the Institutional Relations Central Manager, must expressly designate an officer of their respective management, who will act as an intermediary in the preparation of such Annual Report, being able to give an opinion regarding the aspects in consultation. The officer so designated shall keep his respective Central Manager updated at all times of the progress of the Annual Report. |

| | • | Within the week after being entrusted with the work, the Responsible Party shall deliver to the corresponding areas the calendar for the preparation of the Annual Report, as well as the details of the information to be submitted. |

13

| | • | The Responsible Party may summon the officers designated by each Central Management area to jointly review and discuss the draft of the Annual Report, and may also request additional information, changes to the information furnished or specific comments with regard to matters that fall under his sphere of duty, to which end he may fix the deadlines he deems convenient. |

| | • | In accordance with the approved work schedule, the Responsible Party will deliver the draft Annual Report for the review of the Chairman of the Board, the General Manager, the Secretary General and the Central Managers, who must deliver their comments and observations within the term fixed for this purposes. Without limiting the foregoing, such officers may have access at all times to the information to be included in the process for the preparation of the Annual Report and make the comments they deem necessary. |

| | • | The General Secretary will make sure that the respective Annual Report reasonably contains the information required to be contained therein by the Peruvian law. |

| | • | For its part, the Directive Committee will be in charge of evaluating the accuracy, relevance and sufficiency of the information included in the Annual Report, and may make recommendations as it deems appropriate. |

| | • | Pursuant to the provisions contained in the legal rules in force, the Responsible Party must sign a liability statement in the sense that the information contained in the Annual Report is complete and accurate and that it reflects, in all significant aspects, the relevant information of the company for the period in reference. For its part, the responsible party may support said statement with the certifications requested from the parties responsible for the respective information. |

| | • | Once the Annual Report has been approved by the respective body, the Stock Market Representative must submit this instrument as an Important Fact, for which purpose it must observe the requirements and deadlines established in the applicable legislation. |

| | 3.5. | Rules regarding action to be taken in the event of rumors or leaking of Confidential Information |

During the confidential phase of the information submitted as such to Conasev, the Company must oversee the evolution of its securities traded in the market, and the news issued that may affect them. In the event of an abnormal evolution of the trading

14

volume or of the traded values and if there are rational indications that such evolution is occurring as a result of information that has leaked, the Company will release an Important Fact, which will clearly and precisely disclose the status of the current event.

| | 3.6. | Confidential Information |

| | 3.6.1. | Classification of Confidential Information |

| | • | The Parties Responsible for the Managements or areas that may be aware of information that could be considered confidential, must directly report it to the Chairman of the Board, who will submit it for the evaluation of the Board of Directors. |

| | • | If the information is eligible to be considered confidential, the Chairman of the Board will call a Board Meeting on the same date on which the information is received in order to classify it as such. This meeting may be held or the respective resolution may be adopted in the manner set forth in the Company Bylaws or in the Business Corporations’ Law. |

| | • | In order for a given fact to qualify as Confidential Information, it must have been approved with the favorable vote of 3/4 of the Board Members. |

| | 3.6.2. | Communication of Confidential Information |

| | • | The information must by submitted to the Presidency of CONASEV, within the term set forth for the communication of Important Facts, requesting that it be kept confidential. |

| | • | The application must contain: |

| | • | The justification to keep the information confidential |

| | • | The list of people and their titles who know such confidential information. |

| | • | The time period during which such confidentiality is requested. |

| | • | A Copy of the Resolution of Board of Directors or of the corresponding corporate Body where the respective classification was approved, duly certified by the General Management. |

| | • | During the confidential phase, all the acts, decisions, agreements or negotiations underway relating to the fact registered as Confidential Information will have the same status and must be submitted using the same procedures. |

15

| | 3.6.3. | Management of Confidential Information |

| | • | The Stock Market Representative must keep a record listing the names of the individuals who have access to certain confidential information and will be responsible for expressly warning them of such status and that it is privileged information. |

| | • | The Stock Market Representative must require a confidentiality commitment from those people outside the company who are familiar with the confidential information. |

| | • | The physical information classified as Confidential, must be kept by the Stock Market Representative, who will order that it be kept in a special file. |

| | • | Furthermore, electronic files must be stored with the same confidentiality criteria. |

| | 3.6.4. | Dissemination of Confidential Information |

Confidential Information must be disseminated as an Important Fact within the time frames and in the manner contemplated in the Regulations, in the following cases:

| | • | If the President’s Office of CONASEV notifies the Company in the sense that the information registered as Confidential does not satisfy the characteristics applicable to such information. |

| | • | If the confidential nature of the relevant information has ceased, the Stock Market Representative must then furnish it. |

These regulations will go into effect as from the date of their approval by the Company’s Board of Directors.

Pursuant to the Regulations, these rules must be advised to Conasev and to the Lima Stock Exchange, as well as any modification thereof, within two business days after it has occurred.

16

Item 5.

TRANSLATION

Lima, April 21, 2004

Messers.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

Pursuant to the Peruvian Capital Markets Law and CONASEV Resolution No. 107-2002-EF/94.10 related to Key Events, Private Information and Other Communications, we hereby inform you that on April 21st, 2004, the Board of Directors adopted the following decisions which are considered key events:

| | • | Approved the consolidated and non-consolidated financial statements of the first quarter of the year 2004 and ordered to submit them to the Comisión Nacional Supervisora de Empresas y Valores – CONASEV -, the Lima Stock Exchange and other stock market institutions that may be concerned. This information is registered through the System Mvnet and find enclosed the Managing Report regarding the consolidated results. |

| | • | Approved a partial modification of the Company’s organization in the following terms: the Customer Service Management, which was part of the Residential Management, will now form part of the Resources Management; and the latter will modify its name to Resources and Customer Service Management. |

Sincerely yours,

Julia Maria Morales Valentín

Representative to the Stock Exchange

17

Item 6.

Quarterly Results

Telefónica del Perú S.A.A. and subsidiaries

January – March 2004

18

Significant Events

A summary containing the most significant events that have occurred since January 2004 is presented below:

| | 1. | The Board of Directors, at a meeting held on February 11, 2004, approved the individual and consolidated financial statements of the Company corresponding to the fourth quarter of 2003 and decided for their filing with the Comisión Nacional Supervisora de Empresas y Valores (CONASEV), the Lima Stock Exchange and other relevant institutions of the stock market. |

| | 2. | Appointments and resignations: |

| | • | On January 21, the resignation of Mr. Bernardo Santos to the position of Central Manager of Internal Audit was accepted. As his replacement Mr. Manuel Lara, a Spanish national, was appointed. |

| | • | On February 24, Mr. Werner Schuler was appointed as Chief Executive Officer of Telefónica Multimedia S.A.C., to replace Michael Duncan. |

| | 3. | Delisting of Telefónica del Perú’s ADRs: |

| | • | On February 27, the Securities and Exchange Commission (SEC) ordered that the request of Telefónica del Perú S.A.A. for the delisting and cancellation of registry of its American Depositary Shares (ADS) of the New York Exchange (NYSE) be granted starting on March 1, 2004 at market open. |

| | • | On March 4, the Company requested to the Lima Stock Exchange the exclusion of ADSs from said institution, considering the cancellation of the ADSs Depositary Program and the delisting of those shares from the NYSE. On April 1, CONASEV ruled in favor of the delisting of ADSs representatives of Telefónica del Perú S.A.A. class B shares from the Securities Registry of the Lima Stock Exchange and determined their exclusion of the Public Registry of the Stock Market. |

| | • | The Company informed its ADR holders that they could request JP Morgan Chase Bank to exchange their respective ADS for Telefónica del Perú S.A.A. class B shares, underlying them, considering that one ADS is equivalent to 10 class B shares. As an alternative to that option, ADS holders will receive the amount corresponding to the value of said class B shares, resulting from the sale that JP Morgan will conduct in the Lima Stock Exchange starting on April 13, 2004. The exclusion of the ADS trade in the Lima Stock Exchange is not detrimental to the shareholders, as the underlying securities to them, the class B shares of Telefónica del Perú S.A.A., are listed and will continue to be traded in the Lima Stock Exchange. |

19

| | 4. | On March 26, the Mandatory General Shareholders’ Meeting took the following resolutions: |

| | • | Approved the managerial performance and the financial results for the 2003 fiscal year, which are expressed in the annual report and the financial statements, individual and consolidated, for the 2003 fiscal year – presented to the Public Registry of the Stock Market of February 26, 2004. |

| | • | Approved that the full amount of Telefónica del Perú S.A.A. net profit – after employees’ participation, corresponding taxes and legal reserve deduction – be allocated to the entry of retained earnings for a later use. It also granted the Board of Directors the appropriate powers, if considered appropriate after the evaluation of the financial situation of the Company, to determine a provisional dividend to be charged against the definitive dividend that the General Shareholders’ Meeting could approve for the 2004 fiscal year. |

| | • | Approved to maintain in 2004 fiscal year as directors’ remuneration the level set by the General Shareholders’ Meeting on March 9, 1998 which will be paid to the directors that do not hold any executive position in any of the Telefónica Group companies, with the exception of the Chairman of the Board and the Chief Executive Officer. |

| | • | Delegated to the Board of Directors the designation of external auditors for the 2004 fiscal year. |

| | • | Extended until March 26, 2008 the authorization to issue obligations of the Company. As a consequence, the Company will be able to issue bonds in an amount of up to US$ 680 million in circulation, and short-term instruments up to US$ 300 million, considering that at any given moment, the principal of the debt contracted in light of the issuance of such securities may not exceed, in total, US$ 900 million, or its equivalent in local currency. |

| | • | Approved that the Company purchase shares of its own issuance in an amount not higher than 10% of the subscribed capital, which can be kept in treasury for a maximum period of two years. In that sense, authorized the Board of Directors, which is vested with broad powers, to determine the convenience, opportunity, amount and remaining aspects related with the possible purchase and disposal of shares of its own issuance. |

| | • | Approved simple reorganization of the Company in favor of its subsidiary Telefónica Multimedia S.A.C., in which Telefónica del Perú S.A.A. spun-off and transferred to Telefónica Multimedia S.A.C. the equity composed of the assets or liabilities related to the cable television business line and vested broad powers to the Board of Directors to determine and value the assets or liabilities that will compose such equity. |

20

TELEFÓNICA DEL PERÚ S.A.A. AND SUBSIDIARIES

Management discussion and analysis of the consolidated results

for the first quarter ended March 31, 2004

It is recommended that the reading of this report be made along with the corresponding financial statements and their notes that have been presented simultaneously, since they form an integral part of this document and contain complementary information.

Economic Environment

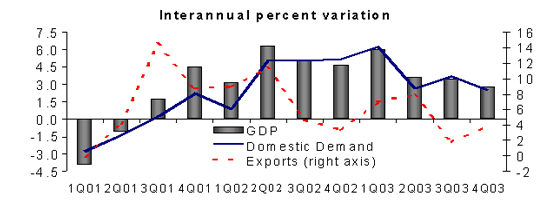

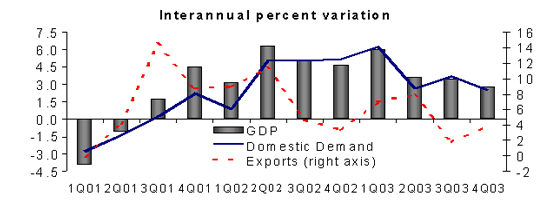

During 1Q04, the Gross Domestic Product (GDP) may have grown around 3.4%, which would be the lowest expected rate of the year. This growth could have been mainly explained by the good performance of the exports, especially mining and textiles. In effect, the increase in the main commodities prices (gold, cooper and zinc) and the maturity of the investments made in the textile sector because of the sound prospects regarding the Free Trade Agreement (FTA) with the United States could allow a significant growth in exports.

Nevertheless, in annualized terms as of March 2004, the GDP could have reported a growth of just 3.3%, lower than the 4.0% reported as of December 2003, which would confirm the deceleration of the economic activity. The performance of the economic activity during the first quarter could be supported by the increase in exports (7%) while consumption and private investment (2.7% and 3.2%, respectively) could remain stagnant due to the impact of the politic crisis events. In disaggregated terms, it is worth noting the highlighted acceleration of the growth rate of the primary sectors, especially mining, as well as an increase in the non-primary sectors, particularly the construction sector.

The inflation rate acceleration reported in 1Q04 (2.1%) reflects the shocks of external and domestic demand: (i) among the external ones, primarily, the increases in international prices of wheat, soybean oil and oil (which affect the prices of bread, edible oil and fuel) and (ii) among the domestic shocks are the problems related to bad weather conditions in the mountain region

21

which have reduced the production and increased the prices of some domestic food items (potato, pea, rice and sugar). On the other hand, prices mostly tied to the domestic demand (underlying, the index that excludes products with highly volatile prices) grew 1.6% during the quarter.

The 1Q04 fiscal accounts could show signs of an important recovery. This is due to the tax collecting policies present since mid 2002. In effect, current revenues could grow 8% during 1Q04, mainly explained by the improvement in the collection of the IGV (increase of one percentage point), the ISC, the IR and due to the recent introduction of the Banking Transaction Tax (ITF). These results in tax collection could allow the financing of non-financial expenses that could have grown 4.5% during the quarter. However, the differences in the growth sources are of concern, because while public expenditures have focused on permanent areas (salaries and pensions), it is unclear whether the growth source of the revenues is of the same nature.

The exchange rate appreciation pressures seem to be reinforced in the market. It is increasingly clearer that economic fundamentals of the exchange rate are defining such behavior, as confirmed by the last data of the trade balance, which in twelve months (as of February) has surpassed US$ 1,000 million in surplus. In that sense, after the exchange rate correction, suffered following the bubble in February, it has remained relatively stable in March reaching, at the end of 1Q04, levels of S/. 3.461 per dollar., regardless of the Central Bank policy of US dollars purchase (more than US$ 700 million during the quarter).

Operating revenues

The highlight in 1Q04 is the entrance of Telmex in the Peruvian market as a result of the acquisition of AT&T Latin America. Its arrival will mainly impact the markets of fixed telephony, long distance and data transmission, increasing the competition among operators of these services.

Operating revenues for 1Q04 totaled S/. 871 million, showing a 4.5% reduction regarding the 1Q03, mainly due to the lower revenues from Local Telephony (8.1%), Long Distance (19.8%) and Public and Rural Telephony (2.6%) and Other Operating Revenues (7.0%). These reductions were partially offset by the increases in revenues for Business Communications (40.0%), Cable Television (5.9%).

Revenues forLocal Telephonytotaled S/. 377 million in 1Q04, presenting a 8.1% reduction compared with 1Q03. This variation is mainly explained by lower revenues of the local measured service, affected by the reduction in billed traffic, due to the introduction of the new tariff plans since March 2003, the application of the productivity factor, as well as the significant increase in the plant of closed lines (limit consumption lines), which represent more than 50% of the plant in service by the end of the first quarter.

Revenues forPublic and Rural Telephony totaled S/. 182 million in 1Q04, representing a 2.6% reduction regarding 1Q03, mainly due to the lower revenues in Domestic Long Distance from public telephones – resulting from lower DLD traffic due to tariff pressure of the market that originated an important migration from the coin usage to the use of prepaid cards both from TdP and other operators -, as well as the increase in competition in public telephony.

22

Long Distance revenues during 1Q04 dropped 19.8% compared to 1Q03, totaling S/. 81 million, mainly due to lower tariffs in DLD and ILD, as a result of promotional campaigns as well as higher payments to carriers. Such effects were partially offset by increased revenues from the sale of Hola Perú cards and the minute packaged plans.

Regarding the prepaid cards market, TDP maintains the market leadership position followed by IDT and Americatel. Also, Limatel an Full Line left the market and associated themselves with Sitel for the access, keeping the sale of cards.

The revenues forBusiness Communicationstotaled S/. 65 million in 1Q04, a 40.0% increase compared to 1Q03.

It is worth noting the significant growth in the Broad Band market that totaled 107 thousand lines by the end of the quarter, which represents a 146.3% increase compared with 1Q03.

Cable Television revenues totaled S/. 82 million, which represents a 5.9% increase compared to 1Q03, explained by an increased revenues in Cable TV monthly fee (4.1%) due to the 9.6% growth of the average billable plant. It is worth noting that since January of this year the Economic Service was offered in the city of Trujillo, being the first province to have this service.

Other Operating Revenues dropped 7.0% in 1Q04 compared to 1Q03, totaling S/. 84 million, mainly due to the lower net interconnection margin.

Operating expenses

Operating expenses totaled S/. 703 million, a 5.2% decrease in relation to the S/. 742 million of 1Q03, due to the lower expenses in depreciation, which drops S/. 20 million, personnel expenses, down S/. 11 million, and provisions, which falls S/. 4 million – according to the lower revenues from the businesses.

EBITDA and Operating Result

As a consequence of the lower revenues recorded in 1Q04, EBITDA (Earning before interest, tax, depreciation and amortization) totaled S/. 412 million, 5.1% lower than the one reached in 1Q03; likewise, EBITDA margin dropped slightly from 47.6% in 1Q03 to 47.3% in 1Q04. As well, the operating result fell S/. 3 million in 1Q04 compared to 1Q03, which represents a 1.5% decrease.

Non-operating Result

During 1Q04, the Company recorded a S/. 22 million non-operating profit compared to a S/. 66 million loss in 1Q03, explained by the positive effect of the monetary correction (REI) that amounted to S/. 77 million in 1Q04 compared to the S/. 27 million in 1Q03 – a 0.09% appreciation of the Nuevo Sol in the 1Q04 and a 2.8% WPI variation in the same period – and by the significant reduction of the extraordinary revenues and expenses in S/. 40 million, mainly due to lower adjustments for contingencies during 1Q04. In addition, the financial expenses were lower by 4% when compared to 1Q03 due to the decline of the Company debt level. Part of this profit was offset by the lower financial revenues in S/. 3 million.

23

Net result

The net profit increased from S/. 33 million in 1Q03 to S/. 106 million in 1Q04, mainly explained by the of S/. 88 million improvement of the non-operating profit.

Consolidated Balance Sheet

The liquidity levels of the Company – measured by the current assets over current liabilities ratio – decreased from 0.64 in 4Q03 to 0.63 in 1Q04. This decrease is mainly explained by the reduction in the other accounts receivable in 1Q04.

The financial debt in 1Q04 was reduced by S/. 160 million compared to 4Q03, reporting debt, at the end of 1Q04, of S/. 1,640 million. The lower leverage rate was reflected in a decrease of the “debt over debt plus equity” ratio, from 34.7% in 4Q03 to 31.9% in 1Q04. On the other hand, the “interest coverage” ratio – EBITDA over net interest expense – dropped from 15.4% in 1Q03 to 13.9% in 1Q04, while the “debt coverage” ratio – debt over EBITDA –stayed at 1.0 times in 1Q04, close to the level in 1Q03.

24

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS IN ADJUSTED SOLES (000) AS OF MARCH 31, 20041/

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | |

| | | 1Q03

| | | 1Q04

| | | Abs. Var.

1Q04-1Q03

| | | % Var.

1Q04-1Q03

| |

| | | | | | % | | | | | | % | | | | | | % | |

Local Telephone Service | | 409,896 | | | 44.9 | | | 376,542 | | | 43.2 | | | (33,354 | ) | | (8.1 | ) |

Long Distance | | 101,250 | | | 11.1 | | | 81,154 | | | 9.3 | | | (20,096 | ) | | (19.8 | ) |

Public Telephones | | 187,185 | | | 20.5 | | | 182,235 | | | 20.9 | | | (4,950 | ) | | (2.6 | ) |

Cable TV | | 77,498 | | | 8.5 | | | 82,049 | | | 9.4 | | | 4,551 | | | 5.9 | |

Business Communications | | 46,785 | | | 5.1 | | | 65,481 | | | 7.5 | | | 18,696 | | | 40.0 | |

Other | | 90,288 | | | 9.9 | | | 84,001 | | | 9.6 | | | (6,287 | ) | | (7.0 | ) |

Total Operating Revenues | | 912,902 | | | 100.0 | | | 871,462 | | | 100.0 | | | (41,440 | ) | | (4.5 | ) |

| | | | | | |

Personnel | | 106,035 | | | 11.6 | | | 95,444 | | | 11.0 | | | (10,591 | ) | | (10.0 | ) |

General and Administrative | | 255,693 | | | 28.0 | | | 256,267 | | | 29.4 | | | 574 | | | 0.2 | |

Depreciation | | 263,331 | | | 28.8 | | | 243,729 | | | 28.0 | | | (19,602 | ) | | (7.4 | ) |

Technology Transfer and Management Fees | | 78,677 | | | 8.6 | | | 72,297 | | | 8.3 | | | (6,380 | ) | | (8.1 | ) |

Materials and Supplies | | 14,851 | | | 1.6 | | | 14,832 | | | 1.7 | | | (19 | ) | | (0.1 | ) |

Provisions | | 34,195 | | | 3.7 | | | 30,195 | | | 3.5 | | | (4,000 | ) | | (11.7 | ) |

Own Work Capitalized | | (10,853 | ) | | (1.2 | ) | | (9,642 | ) | | (1.1 | ) | | 1,211 | | | (11.2 | ) |

Total Operating Costs and Expenses | | 741,929 | | | 81.3 | | | 703,122 | | | 80.7 | | | (38,807 | ) | | (5.2 | ) |

| | | | | | |

Operating Income | | 170,973 | | | 18.7 | | | 168,340 | | | 19.3 | | | (2,633 | ) | | (1.5 | ) |

| | | | | | |

EBITDA | | 434,304 | | | 47.6 | | | 412,069 | | | 47.3 | | | (22,235 | ) | | (5.1 | ) |

| | | | | | |

Other Income (Expenses) | | | | | | | | | | | | | | | | | | |

Interest Income | | 8,081 | | | 0.9 | | | 5,086 | | | 0.6 | | | (2,995 | ) | | (37.1 | ) |

Interest Expenses | | (36,354 | ) | | (4.0 | ) | | (34,826 | ) | | (4.0 | ) | | 1,528 | | | (4.2 | ) |

Others Net | | (64,759 | ) | | (7.1 | ) | | (24,688 | ) | | (2.8 | ) | | 40,071 | | | (61.9 | ) |

Inflation Gain (Loss) | | 27,280 | | | 3.0 | | | 76,771 | | | 8.8 | | | 49,491 | | | 181.4 | |

Total Other Income (Expenses) | | (65,752 | ) | | (7.2 | ) | | 22,343 | | | 2.6 | | | 88,095 | | | (134.0 | ) |

| | | | | | |

Income Before Taxes and Participations | | 105,221 | | | 11.5 | | | 190,683 | | | 21.9 | | | 85,462 | | | 81.2 | |

| | | | | | |

Workers’ Participation | | (19,380 | ) | | (2.1 | ) | | (23,144 | ) | | (2.7 | ) | | (3,764 | ) | | 19.4 | |

Income Tax | | (53,148 | ) | | (5.8 | ) | | (61,875 | ) | | (7.1 | ) | | (8,727 | ) | | 16.4 | |

| | | | | | |

Net Income | | 32,693 | | | 3.6 | | | 105,664 | | | 12.1 | | | 72,971 | | | 223.2 | |

| 1/ | Data is adjusted according to the WPI published by the National Statistics Institute |

25

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET IN ADJUSTED SOLES (000) AS OF MARCH 31, 2004 (1)

(End of Period Figures)

ASSETS

| | | | | | | | | | | | | | | |

| | | 1T04

| | | 4T03

| | | 3T03

| | | 2T03

| | | 1T03

| |

CURRENT ASSETS | | | | | | | | | | | | | | | |

Cash and cash equivalents | | 121,374 | | | 51,407 | | | 31,124 | | | 103,047 | | | 68,842 | |

Negociable securities | | 52,487 | | | 47,649 | | | 61,001 | | | 53,369 | | | 71,415 | |

Accounts and notes receivable - net | | 621,258 | | | 660,743 | | | 743,629 | | | 702,340 | | | 713,748 | |

Other accounts receivable | | 226,118 | | | 366,451 | | | 239,177 | | | 230,189 | | | 221,077 | |

Materials and supplies | | 34,863 | | | 28,782 | | | 34,870 | | | 34,188 | | | 35,210 | |

Prepaid taxes and expenses | | 38,664 | | | 69,947 | | | 87,303 | | | 66,573 | | | 75,885 | |

| | | | | |

Total current assets | | 1,094,764 | | | 1,224,979 | | | 1,197,104 | | | 1,189,706 | | | 1,186,177 | |

| | | | | |

Accounts receivable - LT wit T. Móviles | | 0 | | | 0 | | | 234,290 | | | 235,253 | | | 234,063 | |

| | | | | |

LONG-TERM INVESTMENTS | | 89,818 | | | 88,975 | | | 73,239 | | | 141,921 | | | 141,769 | |

| | | | | |

PROPERTY, PLANT AND EQUIPMENT | | 14,765,604 | | | 14,720,095 | | | 14,435,908 | | | 14,335,396 | | | 14,276,239 | |

| | | | | |

Accumulated depreciation | | (8,712,954 | ) | | (8,487,544 | ) | | (8,215,195 | ) | | (7,989,809 | ) | | (7,769,317 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Write-off Provision | | (64,060 | ) | | (64,060 | ) | | (64,060 | ) | | (64,060 | ) | | (64,060 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 5,988,590 | | | 6,168,491 | | | 6,156,653 | | | 6,281,527 | | | 6,442,862 | |

| | | | | |

OTHER ASSETS, net | | 211,583 | | | 231,590 | | | 288,414 | | | 320,142 | | | 351,939 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL ASSETS | | 7,384,755 | | | 7,714,035 | | | 7,949,700 | | | 8,168,549 | | | 8,356,810 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | |

| | | | | |

| | | 1T04

| | | 4T03

| | | 3T03

| | | 2T03

| | | 1T03

| |

CURRENT LIABILITIES | | | | | | | | | | | | | | | |

| | | | | |

Overdrafts | | 4,129 | | | 22,625 | | | — | | | — | | | — | |

Accounts payable and accrued liabilities | | 425,894 | | | 477,790 | | | 477,875 | | | 337,474 | | | 470,299 | |

Other accounts payable | | 752,710 | | | 892,402 | | | 924,613 | | | 1,123,221 | | | 974,835 | |

Provision for severance indemnities | | 3,015 | | | 2,723 | | | 0 | | | 350 | | | 1,936 | |

Bank Loans | | 208,000 | | | 145,565 | | | 215,604 | | | 364,610 | | | 382,631 | |

Current maturities of long-term debt | | 83,744 | | | 87,906 | | | 59,824 | | | 60,167 | | | 304,493 | |

Current maturities of bonds | | 159,004 | | | 26,990 | | | 84,357 | | | 205,841 | | | 272,868 | |

Commercial Papers | | 112,563 | | | 259,944 | | | 317,004 | | | 388,591 | | | 350,900 | |

Total current liabilities | | 1,749,059 | | | 1,915,945 | | | 2,079,277 | | | 2,480,254 | | | 2,757,962 | |

| | | | | |

LONG-TERM DEBT | | 304,246 | | | 323,135 | | | 371,432 | | | 382,684 | | | 323,151 | |

| | | | | |

BONDS | | 768,299 | | | 933,651 | | | 883,623 | | | 699,344 | | | 528,005 | |

| | | | | |

GUARANTY DEPOSITS | | 103,461 | | | 107,144 | | | 107,727 | | | 106,140 | | | 103,068 | |

| | | | | |

DEFERRED EARNINGS | | 966,124 | | | 1,040,157 | | | 1,069,855 | | | 1,081,983 | | | 1,065,846 | |

| | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

| | | | | |

Capital stock | | 3,036,176 | | | 3,036,176 | | | 3,036,176 | | | 3,036,176 | | | 3,036,176 | |

Legal reserve | | 364,912 | | | 362,551 | | | 362,551 | | | 362,551 | | | 359,235 | |

Retained earnings | | 92,478 | | | (4,724 | ) | | 39,059 | | | 19,417 | | | 183,367 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL SHAREHOLDERS’ EQUITY | | 3,493,566 | | | 3,394,003 | | | 3,437,786 | | | 3,418,144 | | | 3,578,778 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 7,384,755 | | | 7,714,035 | | | 7,949,700 | | | 8,168,549 | | | 8,356,810 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| (1) | Data is adjusted according to the WPI published by the National Statistics Institute |

26

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Statistical Data, End of Period Figures

| | | | | | | | | | | | | | | | |

| | | 1Q03

| | 2Q03

| | 3Q03

| | 4Q03

| | 1Q04

| | 1Q04-1Q03

| | | 1Q04/

1Q03

| |

Fixed-Wire Telephone Service: Local+Long Distance | | | | | | | | | | | | | | | | |

Lines Installed | | 2,032,817 | | 2,037,097 | | 2,107,791 | | 2,145,345 | | 2,178,845 | | 146,028 | | | 7.2 | |

Profits (losses) in Lines in Service, net | | 16,661 | | 33,991 | | 46,152 | | 49,052 | | 33,536 | | 16,875 | | | 101.3 | |

Lines in Service Including Public Telephones (1) | | 1,828,732 | | 1,866,171 | | 1,915,191 | | 1,963,554 | | 1,998,141 | | 169,409 | | | 9.3 | |

| | | | | | | |

Local Traffic - Minutes (000) (2) | | — | | — | | — | | — | | — | | (237,300 | ) | | — | |

Long Distance - Minutes (000) | | 205,907 | | 226,751 | | 239,200 | | 241,167 | | 240,638 | | 34,731 | | | 16.9 | |

| | | | | | | |

Number of Employees (Telefónica del Perú and Subsidiaries) | | 5,217 | | 5,058 | | 5,004 | | 4,920 | | 5,198 | | (19 | ) | | (0.4 | ) |

Number of Employees (Telefónica del Perú) | | 3,566 | | 3,454 | | 3,413 | | 3,316 | | 3,335 | | (231 | ) | | (6.5 | ) |

Lines in Service per Employee (Telefónica del Perú) | | 513 | | 540 | | 561 | | 592 | | 599 | | 86 | | | 16.8 | |

Digitalization Rate (%) | | 96 | | 96 | | 96 | | 96 | | 96 | | 0 | | | 0.3 | |

Lines in Service per 100 inhabitants | | 6.8 | | 6.9 | | 7.0 | | 7.2 | | 7.3 | | 1 | | | 7.7 | |

| | | | | | | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (3) | | 109,788 | | 113,285 | | 116,159 | | 115,614 | | 116,694 | | 6,906 | | | 6.3 | |

| | | | | | | |

BROAD BAND | | | | | | | | | | | | | | | | |

Lines in Service | | 43,543 | | 54,435 | | 68,197 | | 90,689 | | 107,246 | | 63,703 | | | 146.3 | |

| | | | | | | |

CABLE TV | | | | | | | | | | | | | | | | |

Subscribers | | 340,163 | | 345,016 | | 355,011 | | 363,088 | | 369,741 | | 29,578 | | | 8.7 | |

| (1) | Excluding Cellular Public Phones, Publifón and rurals |

| (2) | Including traffic F2F billing (voice and internet), F2F anf F2M |

| (3) | Excluding Prepaid cards, including packed minutes plans. |

| (4) | Including Cellular Public Phones |

27

Item 7.

TRANSLATION

Lima, May 3, 2004

Messrs.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

Pursuant to Article 28 of the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs that the Board of Directors on April 30, 2004 accepted the resignation of Mr. Eduardo Airaldi Quiñones as Alternate Director and Managing Director of Telefónica del Perú S.A.A.

Sincerely yours,

|

Julia Maria Morales Valentín |

Representative to the Stock Exchange |

28

Item 8.

TRANSLATION

Lima, May 19, 2004

Messrs.

COMISIÓN NACIONAL SUPERVISORA

DE EMPRESAS Y VALORES (CONASEV)

Lima.-

Ref: Key Events

Dear Sirs,

According to the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, we hereby inform you, that at the meeting of the Board of Directors of Telefónica del Perú S.A.A. held today, the Board of Directors has designated as Chief Executive Officer, Mr. Gabriel Frías García of Spanish nationality, identified with passport No. Q032663.

Sincerely yours,

|

Julia María Morales Valentín |

Stock Exchange Representative |

29

Item 9.

TRANSLATION

Lima, June 14, 2004

Messrs.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

According to Article 28 of the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs that in the evening of June 11, 2004, we received the report No. 166-2004-MTC/17.01 sent by the Ministry of Transportation and Communications on which it based its decision of not granting us the possibility to extend the terms of the concession.

Telefónica del Perú S.A.A. will present the necessary evidence within the fifteen calendar days set forth in Section 4.04 of the concession contracts approved by Supreme Decree No. 011-94-TCC.

Sincerely yours,

|

Julia Maria Morales Valentín |

Representative to the Stock Exchange |

30

Item 10.

TRANSLATION

Lima, June 17, 2004

Messrs.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

Pursuant to the Peruvian Capital Markets Law and Key Events, Private Information and Other Communications CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you that on June 16, 2004, the Board of Directors adopted the following resolutions, which are considered key events:

| | • | Approval of the partial modification of the company’s organization in order to create the “Pymes, Negocios y Profesionales” Area and the “Negocios Mayoristas”Area. The Board of Directors appointed as the respective Managing Directors Messrs. Vicente Ricardo Arnaiz Muñoz, identified with DNI 08261087 and Luis Delamer of Argentinean nationality, identified with passport No. 18534989N. |

| | • | In accordance to the Best Corporate Governance Practices, the Board of Directors: |

| | (i) | Formed the Nominating, Compensation and Corporate Governance Committee, and appointed Messrs. Luis Javier Bastida Ibargüen of Spanish nationality, identified with Passport No. R 137722, Enrique Used Aznar of Spanish nationality, identified with passport No. 17793130-P, and Alfonso Ferrari Herrero of Spanish nationality, identified with passport No. 00103821E. The main duties of this Committee will be to ensure the integrity of the selection process of the executive officers of the company and the application of the good corporate governance practices. |

| | (ii) | Approved the “Conduct Standards for the financial officers of the Telefónica Group”, which determines certain behavior patterns that must be followed by the presidents, directors, managers and executives of the financial, capital market, treasury, financing, investor relations, accounting and controllers areas, among others. |

Sincerely yours,

|

Julia Maria Morales Valentín |

Representative to the Stock Exchange |

31

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | TELEFÓNICA DEL PERÚ S.A.A. |

| | |

Date: July 12, 2004 | | By: | | /s/ Julia María Morales Valentín

|

| | | Name: | | Julia María Morales Valentín |

| | | Title: | | General Counsel of Telefónica del Perú S.A.A. |

32