FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2005

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Telefónica del Perú

TABLE OF CONTENTS

Item 1

TRANSLATION

Lima, January 19, 2005

Messers.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

According to the article 28 of the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs that on the Board of Directors held today the following decisions were adopted:

| | • | | Acceptance of the resignation of Mr. Vicente Murcia Navarro, Spanish, identified with carne de extranjería No. N-85232, as Gerente Central de Red and assigned Mr. Manuel Plaza Martín, Spanish, identified with carne de extranjería No. N-85231 in such position. |

| | • | | Acceptance of the payment to be made on the capital stock of its subsidiary Telefonica Servicios Integrados S.A.C. as of S/. 4 000, 000. |

Finally, we inform you the today has been installed the Appointments, Retributions and Good Management Committee which assigned Mr. Afonso Ferrari Herrero as its President.

Sincerely yours,

Julia Maria Morales Valentín

Representative to the Stock Exchange

Item 2

TRANSLATION

January 21, 2005

Messers.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

According to the article 28 of the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the result of the of 31ST Issue, of the Second Program of Telefónica del Peru’s Commercial Papers made on January 20th, 2005:

| | | | |

| Serial | | : | | A |

| | |

| Amount | | : | | S/. 35 000 000 |

| | |

| Date of Auction: | | : | | January 20, 2005 |

| | |

| Date of Issue | | : | | January 21, 2005 |

| | |

| Date of Redemption | | : | | January 16, 2006 |

| | |

| Maturity | | : | | 360 days |

| | |

| Yield | | : | | 4.4222% |

| | |

| Price | | : | | 95.7651% nominal value |

At the same time, we inform that within the 31st issue there is a remaining balance of S/. 85 000 000,00 (eighty five million Nuevos Soles).

Sincerely yours,

Julia María Morales Valentín

Stock Exchange Representantive

Item 3

TRANSLATION

February 9, 2005

Messers.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

CONASEV

Lima.-

Re: Key Events

Dear Sirs,

Pursuant to the Peruvian Capital Markets Law and regarding Key Events, Private Information and Other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs that on February 9th, 2005, the Board of Directors adopted the following decisions which are considered key events:

| | • | | Presentation of the consolidated and non-consolidated financial statements of the forth quarter of the year 2004 as well as the preliminary annual accounts (which will be duly registered through the MVNet system), and ordered its register with the Comisión Nacional Supervisora de Empresas y Valores – CONASEV -, the Lima Stock Exchange and other stock market institutions that may be concerned. |

Enclosed please find the Managing Report regarding the consolidated financial statements.

| | • | | Delegation of faculties to the President, Chief Executive Officer and the Legal Council so that any one of them, can fix the date, place and time of the Annual Shareholders Meeting, on first, second and third call; fix the respective dates of register; fix the agenda of such meeting; order pursuant to law the publication of the respective notices, state the motions and, in general, adopt the necessary measures for the normal development of the meeting. |

On the other hand, we inform you that today the General Shareholders Meeting of Antena 3 Producciones S.A. decided the modification of the social denomination to Media Networks Perú S.A.C. Enclosed herewith the information of the Group.

Sincerely yours,

Julia María Morales Valentín

Stock Exchange Representantive

Item 4

Quarterly Results

Telefónica del Perú S.A.A. and subsidiaries

October – December 2004

1

Significant Events

A summary containing the most significant events since October 2004 is presented below:

| | 1. | Board of Directors approvals: |

October 20, 2004 Board:

| | • | | Approved the individual and consolidated financial statements of the company corresponding to the third quarter of 2004 and decided for their filing with the Comisión Nacional Supervisora de Empresas y Valores, the Lima Stock Exchange and other relevant institutions of the stock market. |

| | • | | Accepted the motions presented by the President of the Board on September 30, following the execution of the faculties granted to him, motions that were presented to the General Shareholders’ Meeting on November 8. |

November 24, 2004:

| | • | | Reformulated the Executive Committee of the Board, which will be composed now by Antonio Carlos Valente, whom will preside it, Javier Nadal, Juan Revilla, José María Alvarez-Pallete and José Antonio Colomer. |

December 15, 2004:

| | • | | Approved the new structure of the Company: |

| | i. | Dissolution of the Central Management of Regulation and Strategic Planning; |

| | ii. | The Management of Communication will become a Central Management and been appointed for such position Mr. Carlos Oviedo; |

| | iii. | Dissolution of the Head of the Presidency’s Cabinet position under Mario Coronado responsibility., to be appointed Manager of Corporate Marketing and Corporate Social Responsibility; |

| | iv. | Modification to the functional dependency of the Management of Purchases, which will now depend from the Central Management of Control. |

| | 2. | Appointments and Resignations: |

| | • | | The resignation of Mr. Javier Nadal to the position of President of the Board was accepted, Mr. Nada will continue as member of the Board of Telefónica del Perú S.A.A.. |

| | • | | The resignation of Mr. Eduardo Caride to the position of Director of the Board was accepted and Mr. Antonio Carlos Valente was appointed as his replacement. Mr. Valente was also appointed as President of the Board. |

| | • | | The resignation of Mr. Antonio Villa to the position of Chief Financial Officer was accepted and Mr. Fermín Álvarez was appointed as his replacement. |

| | • | | The resignation of Mr. Jorge Melo-Vega to the positions of Central Manager of Regulation and Strategic Planning and Alternate Director of the Board was accepted. |

| | 3. | General Shareholders’ Meeting on November 08: |

| | • | | Approved the capitalization of the accumulated monetary correction as of December 31, 2002, increasing the capital in the amount of S/. 1,173,603,880.30, totalizing S/. 2,895,568,297.30. Said capital increase will be effective through a higher face value of the shares from S/. 1.00 to S/. 1.68154943778957, keeping unchanged the number of shares representative of the equity as well as the participation of the shareholders. |

| | • | | Approved the equity reduction of S/. 743,112,776.05, which will be effective with the reduction of the face value of the shares in S/. 0.43154943789573 per share, being S/. 1.25 the ended face value, keeping unchanged the number of shares representative of the equity. The amount of the equity reduction will be used to reimburse the contributions of the shareholders, pro rata to their participation in the capital stock, in the amount of S/. |

2

| | | 0.435968977782321 per share. The date of registration and modification of the face value of the shares of Telefónica del Perú S.A.A. was set on December 30, 2004, as well as the date of registration for the reimbursement of the contributions to the shareholders, which will be effective on December 31, 2004. |

| | • | As a consequence of the resolutions taken, the General Shareholders’ Meeting approved the modification of the article 5 of the Company’s Bylaws with regards to the amount of the equity. |

| | 4. | On November 24, rating agency Moody’s downgraded the rating of the certificates issued by Telefónica del Perú Grantor Trust in December 1998 from Baa3 to Ba2, and kept them under review. The balance of such certificates at the time totaled US$ 35.3 million and corresponds to a securitization operation of the accounts receivable of the international long distance business. The downgrade in the rating of the certificates was conducted on the equity of the trusteeship and not on the corporate rating of Telefónica del Perú, which was upward revised from BB- to BB by Fitch Ratings on November 19, 2004. |

| | 5. | On December 01, 2004, Telefónica del Perú S.A.A. acquired from Antena 3 de Televisión S.A. and Antena 3 Perú S.A. shares representative corresponding the 99,9% of Antena 3 Producciones S.A equity (US$ 3,8 million). Therefore, Antena 3 Producciones S.A. is incorporated in the Telefónica Economic Group. |

3

Item 4

TELEFÓNICA DEL PERÚ S.A.A. AND SUBSIDIARIES

Management discussion and analysis of the consolidated results

for the fourth quarter and twelve months ended on December 31, 2004

I It is recommended that the reading of this report be made along with the corresponding financial statements and their notes that have been presented simultaneously, since they form an integral part of this document and contain complementary information.

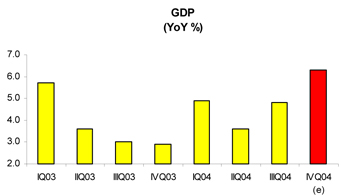

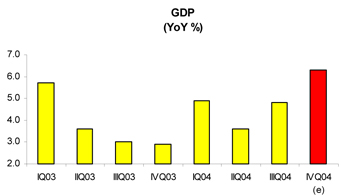

Economic Environment

The Gross Domestic Product (GDP) during 4Q04 could have grown around 6%. Thus, the GDP increase could have been around 5% in 2004, accumulating 14 consecutive of quarters growth. As in previous quarters, exports were the most active component due to the favorable international environment. Worth mentioning among exports are the higher revenues from traditional products (mining, fish flour) and non-traditional (textile, agribusiness). On a sector basis, the performance of the non-primary sectors is outstanding, specially manufacturing. Among the primary sectors, the most dynamics were fishing and hydrocarbon, since the beginning of the Camisea gas project last June.

The inflation rate registered in 4Q04 was 0.25%, a similar rate compared to the previous quarter. With this result, the accumulated inflation for the last 12 months dropped from 4.03% in September to 3.48% in December. Therefore, the consumer price index closed the year 2004 with the highest value of the last 4 years, but within the objective range of the Central Bank (1.5%-2.5%). During the year, several inflationary pressures were present due to important demand shocks: the drought that affected the prices of agricultural products and the increase in the international oil price. The appreciation of the Peruvian currency helped the achievement of the inflationary targets in 2004.

During 4Q04, the local currency continued its appreciation trend by 1.8%. The exchange rate year end was S/. 3.283 per dollar, which represented a 5.2% appreciation. The strength of the external accounts (commercial surplus and current account almost balanced) along with the gradual process of de-dollarization and the global trend of the dollar to depreciate itself were the main factors that explained this appreciatory trend. The Central Bank stepped up purchase of US currency about US$ 1,000 million just in the 4Q04 and accumulated purchases of US$ 2,340 million during the year (this amount is about the total value of the commercial surplus in 2004). According to some analysts, without these purchases the appreciation of the Nuevo Sol could have been higher. The purchases of the Central Bank increased the Net National Reserves to a record level of US$ 12,631 million (15 months of imports) by the end of 2004.

In November, rating agency Fitch upgraded the rating for the long-term sovereign debt in foreign currency from BB- to BB, which now stands within two levels of investment grade. The change was sustained on the decreasing trend of the fiscal deficit and the economic growth. In June, Standard & Poor’s (S&P) upgraded the Peruvian sovereign rating by one level to BB. Both rating agencies assign the category of “stable” to the outlook of the Peruvian Economy. Favored by the regional trend and the good news coming from Fitch and S&P, the country risk spread achieved low historical levels in December.

4

Item 4

Operating revenues

During 2004, the operating revenues have been strongly affected by theregulatory environment changes which increased the productivity factor and established new Conditions of Usage and acompetitive environmentmore aggressive and complex. In local telephony, the main competitors are Telmex and Americatel, with a segmentation strategy mainly oriented to corporate sector (both small and medium enterprises), while in the businesses of long distance and public telephony, the competition, with strong price reductions, has focused on the marketing of prepaid cards, mainly for long distance calls. The main competitors in the prepaid cards market are Americatel, IDT and Telmex, among others. In public telephony, besides the competition of prepaid cards, there was an important growth of the plant in service of other operators.

Operating revenues for 4Q04 reached S/. 869 million, showing a 4.6% reduction regarding 4T03, mainly due to the lower revenues from the businesses of Local Telephony (-6.2%), Public and Rural Telephony (-9.0%), Long Distance (-10.5%) and Cable Television (-4.2%), which were not compensated by the increase in revenues of Business Communications (14.0%).

Meanwhile,operating revenues for 12M04 reached S/. 3,459 million, 4.3% lower than the ones recorded in the 12M03, due to lower revenues in Local Telephony (-7.6%), Long Distance (-15.7%) and Public and Rural Telephony (-8.0%), partially offset by higher revenues in Business Communications (30.8%), Cable TV (0.9%) and Other Operating Revenues (2.4%)

Revenues forLocal Telephonytotaled S/. 371 million in 4Q04, presenting a 6.2% reduction compared with 4Q03. Despite the fact that the plant in service grew 9.4%, revenues fell mainly because of the application of the new productivity factor (10.07% per annum is the new factor since September 1st. ) and by the new Conditions of Usage established by Osiptel which impacted on the revenues of monthly fee and local measured service from May 2004 on. On the other hand, revenues for 12M04 showed a 7.6% reduction compared to 12M03, totaling S/. 1,485 million. Additionally to the aforementioned reasons, this reduction is also explained by the reduction of Internet billed traffic due to the increase of Broadband clients and the trend of fixed-to-mobile traffic substitution. By the end of 2004, the plant in service reached 2,025,534 lines which reflects the efforts developed by the Company to increase the penetration in lower-income population segments with the availability of prepaid or consumption limit services. Therefore, during the year, more than 400 thousand new clients accessed to these services.

The revenues forPublic and Rural Telephony totaled S/. 165 million in 4Q04, representing a 9.0% reduction regarding 4Q03, while in 12M04 totaled S/. 677 million, 8.0% lower than those of 12M03. This behavior is mainly explained by the reduction in the revenues from domestic long distance – resulting from the increasing migration from the use of coins toward cards and the expansion of the prepaid fixed telephony -, as well as the reduction in the average local traffic per public telephone as a consequence of the increase of the plant of mobile telephony. Moreover, the revenues were negatively impacted by the change established by the regulator for calls to rural telephones since January.

Long Distance revenues during 4Q04 dropped 10.5% compared to 4Q03, totaling S/. 80 million, while revenues for 12M04 reached S/. 318 million, 15.7% lower than in 12M03. This evolution is basically explained by a highly competitive environment with strong tariff reductions mainly in the prepaid cards market. Therefore, the total traffic of long distance minutes increased 12,7% during the year 2004, while the participation of prepaid cards (Hola Perú and 147) increased to 45.9% of recorded traffic, 13.6 percentage points higher than the previous year, which was detrimental do the long distance direct calls.

Revenues forBusiness Communicationsshowed a 14.0% increase, going from S/. 80 million in 4Q03 to S/. 91 million in 4Q04, while they totaled S/. 312 million in 12M04, 30.8% higher than those registered in 12M03. The higher revenues are mainly explained by the growth shown by the Broadband market where ADSL lines increased from 66,403 in 12M03 to 185,516 in 12M04, a 179.4% increased.

It is worth noting that the Company continues with the expansion of the broadband (ADSL and Cablenet) nationwide, which represents strong investments; therefore, the total number of lines in service showed a significant growth, going from 91 thousand in 12M03 to 205 thousand in 12M04, a 126.5% increased.

5

Item 4

Cable Television revenues totaled S/. 85 million in 4Q04, which represents a 4.2% decrease compared to 4Q03, and totaled S/. 339 million in 12M04, a 0.9% increase compared to 12M03. The number of subscriptions totaled 389,174 as of December 31, 2004, a 7.2% year-over-year increase.

Operating expenses

In light of the negative evolution of the revenues, the Company is committed to reduce its cost base and to look for increasing efficiency. Therefore, operating expenses totaled S/. 569 million in 4Q04, which represents a 21.1% decrease in relation to the S/. 721 million of 4Q03, mainly due to the reduction of the Management Fee in S/. 78 million. Additionally, there have been lower expenses of S/. 60 million in provisions for bad debt – mainly due to the increase of the prepaid plant -, S/. 26 million in general and administrative expenses.

The accumulated operating expenses for 12M04 dropped S/. 321 million, a drop of 10.9% compared to 12M03, totaling S/. 2,610 million.

Additionally, it is worth noting the reduction of S/. 40 million in personnel expenses, a 9,5% reduction, due to the reduction in the headcount of Telefónica del Perú S.A.A in light of the Voluntary Early Retirement Program announced in October, which will continue until March 31, 2005. Thus, the number of employees dropped by 5% going from 3316 in 4Q03 to 3153 employees in 4Q04.

EBITDA

The EBITDA (Earnings before interest, taxes, depreciation and amortization) reached S/. 568 million, a 26.5% increased compared to 4Q03, as a result of lower management fee expenses and provisions. Excluding both effects, the EBITDA would dropped by 4,1% which means that lower revenues could not be offset by lower expenses in 4Q04.

Likewise, the accumulated EBITDA increased by 7.7% in 12M04 compared to 12M03. Excluding the lower management fee and provisions expenses, the EBITDA would have dropped by 5,3%.

Non-operating Result

The non-operating loss increased S/. 167 million, going from a loss of S/. 133 million in 4Q03 to a loss of S/. 301 million in 4Q04. This evolution is mainly explained by the introduction of the Voluntary Early Retirement Program which totaled S/. 82 million, as well as the expenses recorded with the collections or attempts to collect from certain municipalities through seizures, among other contingencies. Additionally, there was the negative effect of the monetary correction (REI) that amounted to S/. 26 million in 4Q04 compared to the gain of S/. 18 million in 4Q03. These results were partially offset by the net financial expenses which showed a decrease of S/. 9 million.

In 12M04, the non-operating result increased S/. 82 million regarding 12M03, going from a loss of S/. 401 million in 12M03 to a loss of S/. 319 million in 12M04 due to the higher level of REI registered during the year and the lower financial expenses.

Net result

The net loss increased from S/. 38 million in 4Q03 to S/. 222 million in 4Q04 as a result of the higher non-operating loss. The net profit grew from S/. 23 million in 12M03 to S/. 51 million in 12M04, mainly explained by the lower expenses related with the Management Fee, and the positive effect of the monetary correction (REI).

6

Item 4

Consolidated Balance Sheet

The liquidity levels of the Company – measured by the current assets over current liabilities ratio – decreased from 0.81 in 3Q04 to 0.44 in 4Q04, as a consequence of the lower cash levels and the increase in the short-term debt and other accounts payable by the Company.

During 4Q04, there was an increase of the “debt over debt plus equity” ratio, going from 28.8% in 3Q04 to 38.5% in 4Q04, because of the effect of both the increase of debt levels and the reduction of the equity. Additionally, an improvement in the “interest coverage” ratio – EBITDA over net interests – was recorded, which increased from 14.6 in 4Q03 to 26.5 in 4Q04, as a result of a 30.0% reduction in the net financial expenses. Moreover, year over year, an increase in the “interest coverage” ratio was recorded, going from 15.3 in 12M03 to 19.0 in 12M04. On the other hand, the “debt coverage” ratio – debt over EBITDA – was 0.9 in 12M04 compared to the 1.1 recorded in 12M03.

7

TABLE 1

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS IN ADJUSTED SOLES (000) AS OF SEPTEMBER 30, 20041/

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4Q03

| | | 4Q04

| | | Abs. Var.

4Q04-4Q03

| | | % Var.

4Q04-4Q03

| | | 12M03

| | | 12M04

| | | Var. Abs.

12M04-12M03

| | | Var. %

12M04-12M03

| |

| | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | |

Local Telephone Service | | 394,919 | | | 43.3 | | | 370,553 | | | 42.6 | | | (24,366 | ) | | (6.2 | ) | | 1,607,148 | | | 44.4 | | | 1,485,202 | | | 42.9 | | | (121,946 | ) | | (7.6 | ) |

Long Distance | | 89,212 | | | 9.8 | | | 79,873 | | | 9.2 | | | (9,339 | ) | | (10.5 | ) | | 377,863 | | | 10.4 | | | 318,409 | | | 9.2 | | | (59,454 | ) | | (15.7 | ) |

Public Telephones | | 180,831 | | | 19.8 | | | 164,632 | | | 18.9 | | | (16,199 | ) | | (9.0 | ) | | 736,650 | | | 20.4 | | | 677,378 | | | 19.6 | | | (59,272 | ) | | (8.0 | ) |

Cable TV | | 89,254 | | | 9.8 | | | 85,470 | | | 9.8 | | | (3,784 | ) | | (4.2 | ) | | 335,683 | | | 9.3 | | | 338,582 | | | 9.8 | | | 2,899 | | | 0.9 | |

Business Communications | | 80,121 | | | 8.8 | | | 91,361 | | | 10.5 | | | 11,240 | | | 14.0 | | | 238,253 | | | 6.6 | | | 311,699 | | | 9.0 | | | 73,446 | | | 30.8 | |

Other | | 77,134 | | | 8.5 | | | 77,265 | | | 8.9 | | | 131 | | | 0.2 | | | 320,443 | | | 8.9 | | | 328,025 | | | 9.5 | | | 7,582 | | | 2.4 | |

Total Operating Revenues | | 911,471 | | | 100.0 | | | 869,154 | | | 100.0 | | | (42,317 | ) | | (4.6 | ) | | 3,616,040 | | | 100.0 | | | 3,459,295 | | | 100.0 | | | (156,745 | ) | | (4.3 | ) |

| | | | | | | | | | | | |

Personnel | | 101,677 | | | 11.2 | | | 97,827 | | | 11.3 | | | (3,850 | ) | | (3.8 | ) | | 423,911 | | | 11.7 | | | 383,739 | | | 11.1 | | | (40,172 | ) | | (9.5 | ) |

General and Administrative | | 245,249 | | | 26.9 | | | 219,243 | | | 25.2 | | | (26,006 | ) | | (10.6 | ) | | 997,740 | | | 27.6 | | | 957,824 | | | 27.7 | | | (39,916 | ) | | (4.0 | ) |

Depreciation | | 259,070 | | | 28.4 | | | 268,260 | | | 30.9 | | | 9,190 | | | 3.5 | | | 1,051,720 | | | 29.1 | | | 1,020,765 | | | 29.5 | | | (30,955 | ) | | (2.9 | ) |

Technology Transfer and Management Fees | | 78,061 | | | 8.6 | | | — | | | — | | | (78,061 | ) | | (100.0 | ) | | 309,905 | | | 8.6 | | | 157,843 | | | 4.6 | | | (152,062 | ) | | (49.1 | ) |

Materials and Supplies | | 18,922 | | | 2.1 | | | 20,760 | | | 2.4 | | | 1,838 | | | 9.7 | | | 63,515 | | | 1.8 | | | 69,692 | | | 2.0 | | | 6,177 | | | 9.7 | |

Provisions | | 32,039 | | | 3.5 | | | (27,558 | ) | | (3.2 | ) | | (59,597 | ) | | (186.0 | ) | | 131,632 | | | 3.6 | | | 58,845 | | | 1.7 | | | (72,787 | ) | | (55.3 | ) |

Own Work Capitalized | | (13,772 | ) | | (1.5 | ) | | (9,537 | ) | | (1.1 | ) | | 4,235 | | | (30.8 | ) | | (47,311 | ) | | (1.3 | ) | | (38,293 | ) | | (1.1 | ) | | 9,018 | | | (19.1 | ) |

Total Operating Costs and Expenses | | 721,246 | | | 79.1 | | | 568,995 | | | 65.5 | | | (152,251 | ) | | (21.1 | ) | | 2,931,112 | | | 81.1 | | | 2,610,415 | | | 75.5 | | | (320,697 | ) | | (10.9 | ) |

| | | | | | | | | | | | |

Operating Income | | 190,225 | | | 20.9 | | | 300,159 | | | 34.5 | | | 109,934 | | | 57.8 | | | 684,928 | | | 18.9 | | | 848,880 | | | 24.5 | | | 163,952 | | | 23.9 | |

| | | | | | | | | | | | |

EBITDA | | 449,295 | | | 49.3 | | | 568,419 | | | 65.4 | | | 119,124 | | | 26.5 | | | 1,736,648 | | | 48.0 | | | 1,869,645 | | | 54.0 | | | 132,997 | | | 7.7 | |

| | | | | | | | | | | | |

Other Income (Expenses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Income | | 8,032 | | | 0.9 | | | 9,561 | | | 1.1 | | | 1,529 | | | 19.0 | | | 32,284 | | | 0.9 | | | 24,472 | | | 0.7 | | | (7,812 | ) | | (24.2 | ) |

Interest Expenses | | (38,713 | ) | | (4.2 | ) | | (31,049 | ) | | (3.6 | ) | | 7,664 | | | (19.8 | ) | | (145,570 | ) | | (4.0 | ) | | (123,058 | ) | | (3.6 | ) | | 22,512 | | | (15.5 | ) |

Others Net | | (120,372 | ) | | (13.2 | ) | | (252,942 | ) | | (29.1 | ) | | (132,570 | ) | | 110.1 | | | (295,092 | ) | | (8.2 | ) | | (298,848 | ) | | (8.6 | ) | | (3,756 | ) | | 1.3 | |

Inflation Gain (Loss) | | 17,626 | | | 1.9 | | | (26,235 | ) | | (3.0 | ) | | (43,861 | ) | | (248.8 | ) | | 7,146 | | | 0.2 | | | 78,689 | | | 2.3 | | | 71,543 | | | 1,001.2 | |

Total Other Income (Expenses) | | (133,427 | ) | | (14.6 | ) | | (300,665 | ) | | (34.6 | ) | | (167,238 | ) | | 125.3 | | | (401,231 | ) | | (11.1 | ) | | (318,745 | ) | | (9.2 | ) | | 82,486 | | | (20.6 | ) |

| | | | | | | | | | | | |

Early Retirement Expense | | — | | | — | | | (207 | ) | | (0.0 | ) | | (207 | ) | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | |

Income Before Taxes and Participations | | 56,798 | | | 6.2 | | | (506 | ) | | (0.1 | ) | | (57,304 | ) | | (100.9 | ) | | 283,697 | | | 7.8 | | | 530,135 | | | 15.3 | | | 246,438 | | | 86.9 | |

| | | | | | | | | | | | |

Workers’ Participation | | (25,832 | ) | | (2.8 | ) | | (59,071 | ) | | (6.8 | ) | | (33,239 | ) | | 128.7 | | | (69,868 | ) | | (1.9 | ) | | (128,309 | ) | | (3.7 | ) | | (58,441 | ) | | 83.6 | |

Income Tax | | (69,118 | ) | | (7.6 | ) | | (162,918 | ) | | (18.7 | ) | | (93,800 | ) | | 135.7 | | | (190,807 | ) | | (5.3 | ) | | (350,922 | ) | | (10.1 | ) | | (160,115 | ) | | 83.9 | |

| | | | | | | | | | | | |

Net Income | | (38,152 | ) | | (4.2 | ) | | (222,495 | ) | | (25.6 | ) | | (184,343 | ) | | 483.2 | | | 23,021 | | | 0.6 | | | 50,904 | | | 1.5 | | | 27,883 | | | 121.1 | |

| 1/ | Data is adjusted according to the WPI published by the National Statistics Institute |

8

TABLE 2

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET IN ADJUSTED SOLES (000) AS OF SEPTEMBER 30, 2004 (1)

(End of Period Figures)

| | | | | | | | | | | | | | | |

| ASSETS | | 4QT04

| | | 3Q04

| | | 2Q04

| | | 1Q04

| | | 4Q03

| |

| | | | | | | | | | | | | | | | |

CURRENT ASSETS | | | | | | | | | | | | | | | |

Cash and cash equivalents | | 63,332 | | | 352,221 | | | 255,251 | | | 123,853 | | | 52,457 | |

Negociable securities | | 37,325 | | | 45,388 | | | 39,512 | | | 53,559 | | | 48,622 | |

Accounts and notes receivable - net | | 569,592 | | | 547,559 | | | 576,373 | | | 624,589 | | | 664,226 | |

Other accounts receivable | | 188,230 | | | 214,044 | | | 223,639 | | | 230,737 | | | 373,937 | |

Materials and supplies | | 37,558 | | | 37,487 | | | 37,176 | | | 35,575 | | | 29,370 | |

Prepaid taxes and expenses | | 41,307 | | | 48,029 | | | 47,470 | | | 39,454 | | | 71,376 | |

Total current assets | | 1,032,549 | | | 1,329,255 | | | 1,263,948 | | | 1,192,294 | | | 1,324,515 | |

| | | | | |

LONG-TERM INVESTMENTS | | 0 | | | 8,593 | | | 7,962 | | | 7,126 | | | 6,266 | |

| | | | | |

PROPERTY, PLANT AND EQUIPMENT | | 15,473,120 | | | 15,195,811 | | | 15,073,072 | | | 15,067,236 | | | 15,020,794 | |

| | | | | |

Accumulated depreciation | | (9,579,437 | ) | | (9,342,531 | ) | | (9,111,535 | ) | | (8,890,955 | ) | | (8,660,939 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Write-off Provision | | (79,192 | ) | | (65,355 | ) | | (65,355 | ) | | (65,355 | ) | | (65,355 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 5,814,491 | | | 5,787,925 | | | 5,896,182 | | | 6,110,926 | | | 6,294,500 | |

| | | | | |

OTHER ASSETS, net | | 225,141 | | | 225,141 | | | 245,176 | | | 215,905 | | | 236,321 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL ASSETS | | 7,081,378 | | | 7,350,914 | | | 7,413,268 | | | 7,526,251 | | | 7,861,602 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | 4Q04

| | | 3Q04

| | | 2Q04

| | | 1Q04

| | | 4Q03

| |

| | | | | | | | | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | | | | | | | | |

Overdrafts | | 5,347 | | | 368 | | | 5,911 | | | 4,213 | | | 23,087 | |

Accounts payable and accrued liabilities | | 478,260 | | | 355,479 | | | 364,366 | | | 425,234 | | | 477,535 | |

Other accounts payable | | 1,051,875 | | | 775,682 | | | 817,244 | | | 768,086 | | | 910,632 | |

Provision for severance indemnities | | 4,120 | | | 2,374 | | | 3,000 | | | 3,077 | | | 2,779 | |

Bank Loans | | 201,500 | | | 110,000 | | | 120,114 | | | 212,249 | | | 148,538 | |

Current maturities of long-term debt | | 90,211 | | | 120,395 | | | 122,280 | | | 85,455 | | | 89,702 | |

Current maturities of bonds | | 398,496 | | | 234,519 | | | 244,237 | | | 162,252 | | | 27,541 | |

Commercial Papers | | 95,000 | | | 51,500 | | | 50,788 | | | 114,862 | | | 265,254 | |

Total current liabilities | | 2,324,809 | | | 1,650,317 | | | 1,727,940 | | | 1,775,428 | | | 1,945,068 | |

| | | | | |

LONG-TERM DEBT | | 335,144 | | | 235,276 | | | 252,010 | | | 310,461 | | | 329,736 | |

| | | | | |

BONDS | | 582,522 | | | 746,561 | | | 746,976 | | | 783,994 | | | 952,724 | |

| | | | | |

GUARANTY DEPOSITS | | 102,475 | | | 104,203 | | | 102,398 | | | 105,576 | | | 109,333 | |

| | | | | |

DEFERRED EARNINGS | | 1,009,042 | | | 918,020 | | | 937,395 | | | 985,860 | | | 1,061,405 | |

| | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

Capital stock | | 2,355,086 | | | 3,098,199 | | | 3,098,199 | | | 3,098,199 | | | 3,098,199 | |

Treasury stock | | (21,896 | ) | | -21,896 | | | 0 | | | 0 | | | 0 | |

Legal reserve | | 372,365 | | | 372,365 | | | 372,365 | | | 372,365 | | | 369,957 | |

Retained earnings | | 21,831 | | | 247,869 | | | 175,985 | | | 94,368 | | | (4,820 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL SHAREHOLDERS’ EQUITY | | 2,727,386 | | | 3,696,537 | | | 3,646,549 | | | 3,564,932 | | | 3,463,336 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 7,081,378 | | | 7,350,914 | | | 7,413,268 | | | 7,526,251 | | | 7,861,602 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| (1) | Data is adjusted according to the WPI published by the National Statistics Institute |

9

TABLE 3

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Statistical Data, End of Period Figures

| | | | | | | | | | | | | | | | |

| | | 4Q03

| | 1Q04

| | 2Q04

| | 3Q04

| | 4Q04

| | Var. Abs.

4Q04-4Q03

| | | 4Q04/

4T03

| |

Fixed-Wire Telephone Service: Local+Long Distance | | | | | | | | | | | | | | | | |

Lines Installed | | 2,145,345 | | 2,178,845 | | 2,197,489 | | 2,260,831 | | 2,307,247 | | 161,902 | | | 7.5 | |

Profits (losses) in Lines in Service, net | | 49,052 | | 33,536 | | 42,988 | | 46,990 | | 50,462 | | 1,410 | | | 2.9 | |

Lines in Service Including Public Telephones (1) | | 1,963,554 | | 1,998,141 | | 2,043,885 | | 2,095,838 | | 2,150,827 | | 187,273 | | | 9.5 | |

| | | | | | | |

Local Traffic - Minutes (000) (2) | | 1,446,274 | | 1,395,796 | | 1,341,295 | | 1,302,021 | | 1,294,169 | | (152,105 | ) | | (10.5 | ) |

Long Distance - Minutes (000) (3) | | 241,167 | | 240,638 | | 239,532 | | 235,797 | | 252,848 | | 11,681 | | | 4.8 | |

| | | | | | | |

Number of Employees (Telefónica del Perú and Subsidiaries) | | 4,920 | | 5,198 | | 5,128 | | 5,227 | | 5,179 | | 259 | | | 5.3 | |

Number of Employees (Telefónica del Perú) | | 3,316 | | 3,335 | | 3,325 | | 3,328 | | 3,153 | | (163 | ) | | (4.9 | ) |

Lines in Service per Employee (Telefónica del Perú) | | 592 | | 599 | | 615 | | 630 | | 682 | | 90 | | | 15.2 | |

Digitalization Rate (%) | | 96 | | 96 | | 96 | | 96 | | 97 | | 0 | | | 0.3 | |

Lines in Service per 100 inhabitants | | 7.2 | | 7.3 | | 7.5 | | 7.6 | | 7.8 | | 1 | | | 8.7 | |

| | | | | | | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (4) | | 115,614 | | 116,694 | | 119,448 | | 124,499 | | 129,353 | | 13,739 | | | 11.9 | |

| | | | | | | |

BROAD BAND | | | | | | | | | | | | | | | | |

Lines in Service (5) | | 90,689 | | 107,246 | | 134,925 | | 166,228 | | 205,425 | | 114,736 | | | 126.5 | |

| | | | | | | |

CABLE TV | | | | | | | | | | | | | | | | |

Subscribers | | 363,088 | | 369,741 | | 373,203 | | 383,260 | | 389,174 | | 26,086 | | | 7.2 | |

| (1) | Excluding Cellular Public Phones, Publifón and rurals |

| (2) | Including traffic F2F billing (voice and internet), F2F anf F2M |

| (3) | Excluding Prepaid cards, including packed minutes plans. |

| (4) | Including Cellular and fixed public phones and Rural fixed and cellular public phones (do not include Publifon). |

| (5) | Including broad band and Cablenet. |

10

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | Telefónica del Perú |

| | |

| Date: February 25, 2005 | | By: | | /s/ Julia María Valentin

|

| | | Name: | | Julia María Valentin |

| | | Title: | | General Counsel |