FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May, 2005

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Telefónica del Perú

TABLE OF CONTENTS

| | |

Item

| | |

| 1. | | First quarter results for Telefónica del Perú and Subsidiaries: January—March 2005. |

| |

| 2. | | Translation of a letter to CONASEV, dated April 20, 2005, regarding the resolutions of the Board of Directors. |

| |

| 3. | | Consolidated Income Statements of Telefónica del Perú and Subsidiaries. |

| |

| 4. | | Translation of a letter to CONASEV, dated April 22, 2005, regarding the redemption of the 8th Issue of the Second Program of Telefónica Corporate Bonds, Serial B. |

| |

| 5. | | Translation of a letter to CONASEV, dated April 20, 2005, regarding the result of the 7th Issue, Serial A of the Third Program of Telefónica del Perú’s Corporate Bonds. |

Item 1

Quarterly Results

Telefónica del Perú S.A.A. and subsidiaries

January – March 2005

1

Item 1

Significant Events

A summary containing the most significant events since January 2005 is presented below:

| | 1. | The Board of Directors took the following resolutions: |

On its session held on January 19, 2005:

| | • | | Approved the increase in capital stock of its fully owned subsidiary Telefónica Servicios Integrados. |

| | • | | Installed the Committee of Appointments and Retributions and Corporate Governance and appointed Mr. Alfonso Ferrari as its President. |

| | • | | Accepted the resignation presented by Mr. Vicente Murcia to the position of Central Manager of Networks and appointed Mr. Manuel Plaza as his replacement. |

On its session held on February 9, 2005:

| | • | | Approved the individual and consolidated financial statements of the Company corresponding to the fourth quarter of 2004 and the preliminary annual accounts and decided for their filing with the Comisión Nacional Supervisora de Empresas y Valores, the Lima Stock Exchange and corresponding institutions of the stock market. |

| | • | | Granted the President, the Chief Executive Officer and the General Secretary with powers so that any of them determine the conditions for the carrying out of the General Shareholders’ Meeting. |

| | 2. | Resolutions taken by the General Shareholders’ Meeting on March 28: |

| | • | | Approved the management performance and the audited financial statements, individual and consolidated, for the fiscal year 2004. |

| | • | | Modified the dividend policy of the Company, so that it can distribute the full amount of the net earnings of each fiscal year less the workers’ participation, taxes and corresponding legal reserve, if any, as dividends. The dividends may be paid as interim or final for each fiscal year. |

| | • | | Approved that net earnings, less the aforementioned subtractions, to be destined to accumulate earnings for its later application. Granted powers to the Board of Directors, so that if considered convenient and after evaluating the financial situation of the Company, would: (i) declare a dividend payment to be charged to the partial or full amount of said earnings; and (ii) declare a provisional dividend corresponding to the fiscal year 2005 to be charged to the final dividend, to be approved in the General Shareholders’ Meeting of 2006. |

| | • | | Approved a program of equity reduction in order to return benefits to the shareholders and granted the powers to the Board of Directors so that, if applicable, it would establish the terms and conditions for the process. |

| | • | | Granted the Board of Directors with powers to appoint the external auditors for the fiscal year 2005. |

2

Item 1

TELEFÓNICA DEL PERÚ S.A.A. AND SUBSIDIARIES

Management discussion and analysis of the consolidated results

for the first quarter ended on March 31, 2005

It is recommended that the reading of this report be made along with the corresponding financial statements and their notes that have been presented simultaneously, since they form an integral part of this document and contain complementary information.

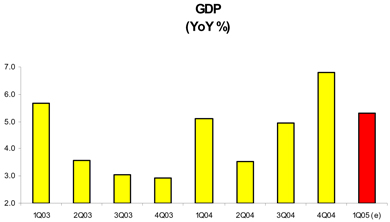

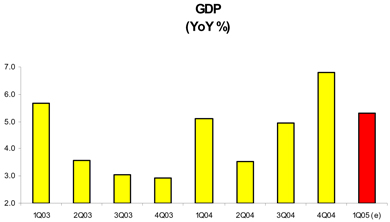

Economic Environment

The Gross Domestic Product during 1Q05 could have grown about 5.0% according to the analysts’ consensus. Therefore, the growth rate could have slowed down compared to the last quarter of 2004, when the economy grew 6.8% (the highest record in 19 quarters). As in previous months, between January and March of the current year, the most dynamic sectors were the non-primary ones, like manufacturing. The following months, could be positive considering that the consumer’s and corporate confidence continue to ascend. In that sense, the projection for the GDP growth for the current year could be revised upwards, which according to the local and international analysts’ consensus lies around 4.3%.

Regarding prices, the inflation rate registered in 1Q05 was 0.51%. With this result, the accumulated inflation for the last 12 months dropped from 4.61% in July to 1.88%, approaching to the lower target range of the Central Bank (1.5% - 3.5%) faster than expected. It is estimated that this indicator will remain within the target range of the Central Bank over the next months. On the other hand, the Wholesale Price Index (WPI) accumulated an increase of 0.34% during the first quarter of the year and 2.34% within the last twelve months (an important decrease compared to last July when it was 6.94%)

The exchange rate finished March at levels of S/. 3.263 per dollar, which represented a depreciation of 0.1%, compared to the end of February. This was the first monthly depreciation since last June. Nevertheless, during the first quarter, the local currency recorded an appreciation of 0.6% which jumped to 5.8% for the last 12 months. The strength of the external accounts (commercial surplus and current account almost balanced) as well as the gradual process of de-dollarization and the global trend of the dollar to depreciate itself were the main factors that explained this appreciatory trend during the last year. During the quarter, the Central Bank subdued the appreciation pressures of the local currency through its interventions on the exchange market and accumulated purchases for

US$1,149 million, 68% higher than the amount bought in a similar period of the previous year. As a result of these purchases, the Net National Reserves jumped to a record level of US$13,555 million by the end of March, equivalent to 16 months of imports.

On the other hand, the country risk dropped to historical low levels (below 200 basic points) at the beginning of March. However, fears that the FED could raise the interest rates in a more accelerated way, resulted in an increase in the risk for Latin America, trend in which Peru tagged along. In March, the country risk registered an average of 228 basic points, slightly lower than the average for December-February: 238 basic points.

3

Item 1

On the fiscal side, during the first quarter tax collections from SUNAT recorded a 11% increase in real terms compared to the same period of 2004, despite the fact that the Extraordinary Solidary Tax was eliminated (annual cost of 0.2% of the GDP) in December. Similarly the non-financial expense of the Central Government could have increased at a similar rate during that period. For 2005, the analysts’ consensus expects and expansive fiscal policy. Thus, the higher expenses (salary increases, new social program Pro Perú, among others) would be financed with the income from the Regularization of the Income Tax.

Operating revenues

During 1Q05 the operating revenues have been strongly affected by theregulatory environment –application of the new productivity factor (10.07%), new Conditions of Usage and tariff imputation proof for DLD—and acompetitive environmentmore aggressive and complex. In local telephony, the main competitors are Telmex and Americatel, with a segmentation strategy mainly oriented to corporate sector (both small and medium enterprises), while in the businesses of long distance and public telephony, the competition, with strong price reductions, has focused on the marketing of prepaid cards, mainly for long distance calls. The main competitors in the prepaid cards market are Americatel, IDT and Telmex. In public telephony, besides the competition of prepaid cards, there was an important growth of the plant in service of other operators.

Operating revenues for 1Q05 reached S/. 881 million, a 0.8% reduction regarding 1Q04, mainly due to the lower revenues from the businesses of Local Telephony (-4.7%), Long Distance (-6.5%), Business Communications (-18.2%) and Public and Rural Telephony (-1.1%), which were not compensated by the increase in revenues for the businesses of Internet (36.3%) and Cable Television (0.2%).

The revenues forLocal Telephonyreached S/. 338 million in 1Q05, presenting a 4.7% reduction compared with 1Q05. Even the increase in lines in service, the local measured service revenues were affected by the productivity factor applied to the rate for call connection (average reduction of 28% in December 2004 and 50% in March 2005), as well as the reduction of the billed local traffic. At the end of 1Q05 the plant in service reached 2.1 million lines a 10% annual growth rate. This shows the efforts developed by the company to increase penetration in low income segments by offering prepaid and consumption limit products.

The revenues forPublic and Rural Telephony reached S/. 201 million in 1Q05, representing a 1.1% reduction regarding the 1Q04. On one hand, there was a 12% increase in lines in service and, on the other hand, there was a larger substitution on behalf of the mobile telephony and an increase in the fixed telephony plant. Additionally, there were lower DLD traffic revenues due to the migration from the use of coins toward prepaid cards.

Long Distance revenues during 1Q05 dropped 6.5% compared to 1Q04, totaling S/. 76 million, explained by the lower DLD traffic

(-3%) and the lower average ILD tariff (-28%). It is worth noting that those markets continue to present a highly competitive environment, mainly in the pre-paid cards market. Additionally, the new parameters from OSIPTEL to the tariff imputation proof for DLD pressure to the Company to increase its DLD cards tariffs reducing its traffic and losing market share. These effects were partially offset by the better commercial management within the period, the higher incoming ILD traffic, as well as the lower accounting rates applied to other operators.

The revenues forInternetreached S/. 85 million in 1Q05, a 36.3% increase compared to 1Q04. The Company continues developing the internet market through important levels of investment. In this sense, it is worth noting the significant increase in the number of lines, which at the end of the quarter reached 235 thousand, 118.8% higher than in 1Q04. This increase was mainly due to the broadband (ADSL), because of the attention given to this technology, increasing its presence through new products, more benefits to the users (free increase of speed) and clients promotions.

The revenues forBusiness Communicationsreached S/. 20 million in 1Q05, 18.2% lower than in 1Q04. This was mainly explained by the reduction of revenues from Digired in 30.1% due to the lower average plant (-9.1%) affected by the migration through IP-VPN product.

4

Item 1

Cable Television revenues reached S/. 76 million in, a 0.2% increase with respect to 1Q04 . This result is a reflection of the 8.6% increase in the average billable plant, which was offset by the depreciation of the dollar compared to the Nuevo Sol.

Operating expenses

In light of the negative evolution of the revenues, the Company is committed to reduce its cost base and to look for increasing efficiency. The operating expenses totaled S/. 683 million in 1Q05, which represents a 4.8% decrease in relation to the S/. 717 million of 1Q04. This decline is explained by lower expenses of S/. 14 million in provisions for bad debt, as a result of the increase of the prepaid plant and the better collection management, and lower personnel expenses of S/. 4 million as a result of the reduction in the average headcount (5.5%) as a result of the early retirement plan executed between October 2004 and March 2005. In addition we recorded S/. 63 million lower expenses due to Management fee.

EBITDA and Operating Result

The EBITDA (Earnings before interest, taxes, depreciation and amortization) reached S/. 479 million, a 14.0% increase compared to 1Q04, as a result of lower expenses that compensate the lower revenues. The operating result increase S/. 27 million in 1Q05 compared to 1Q04, going from S/. 172 million in 1Q04 to S/. 199 million in 1Q05, which represents an increase of 15.7%.

Non-operating Result

The non operating result was mainly affected by the inflation adjustment (REI) which during 1Q04 had a positive effect of S/. 81 million. However, after a change in the accounting policy in the country, starting on January 1, 2005 the inflation adjustment is no longer applied. Furthermore, the increase in extraordinary expenses by S/. 41 million affected the result. Conversely, the financial expenses dropped 13.3% compared to 1Q04, as a result of the accounting reclassifications in the 1Q05. As such 1Q05 recorded a non operating loss of S/. 93 million compared to S/. 23 million gained in 1Q04.

Net result

The net earning dropped from S/. 108 million in the 1Q04 to S/. 20 million in the 1Q05, mainly as a result of the change in the accounting policy regarding inflation.

Consolidated Balance Sheet

The liquidity levels of the Company – measured by the current assets over current liabilities ratio – increased from 0.44 in the 4Q04 to 0.55 in the 1Q05, mainly as a result of the higher cash levels and other receivables, and the reduction in the indebtedness of the company in the short-term and of other accounts payable by the Company.

During the 1Q05, there was a slight increase of the “debt over debt plus equity” ratio, going from 38.5% in the 4Q04 to 39.6% in the 1Q05. Additionally, an improvement of the “interest coverage” ratio was recorded – EBITDA over net financial results-, going from 12.7 in the 1Q04 to 17.6 in the 1Q05, as a result of the lower financial expenses during the quarter.

5

Item 2

Lima, April 20, 2005

Messers.

REGISTRO PÚBLICO DEL MERCADO DE VALORES

Lima.-

Re: Key Events

Dear Sirs,

According to the Peruvian Capital Markets Law and CONASEV Resolution No. 107-2002-EF/94.10 related to Key Events, Private Information and Other Communications, we hereby inform you that today the Board of Directors of Telefónica del Perú S.A.A adopted the following agreements:

| | • | | Formulated its individual and consolidated financial statements for the first quarter of the year 2005, which would be registered today, in a single document through MVNet´s System and arranged its presentation to CONASEV, Lima´s Stock Exchange and the other institutions of the stock market, that may correspond. Attached to this communication you will find the mentioned consolidated results. |

| | • | | Named “Medina, Zaldívar, Paredes y Asociados Sociedad Civil” (member of Ernst and Young international firm) as an external auditor for the period of 2005. |

Sincerely yours,

Julia María Morales Valentín

Telefónica del Perú S.A.A.

Representative to the Stock Exchange

Item 3

TABLE 1

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS 1/

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | |

| | | 4Q03

| | | 4Q04

| | | Abs. Var.

4Q04-4Q03

| | | % Var.

4Q04-4Q03

| |

| | | | | | %

| | | | | | %

| | | | | | %

| |

Local Telephone Service | | 354,661 | | | 39.9 | | | 337,920 | | | 38.3 | | | (16,741 | ) | | (4.7 | ) |

Long Distance | | 81,418 | | | 9.2 | | | 76,160 | | | 8.6 | | | (5,258 | ) | | (6.5 | ) |

Public Telephones | | 202,838 | | | 22.8 | | | 200,668 | | | 22.8 | | | (2,170 | ) | | (1.1 | ) |

Cable TV | | 75,991 | | | 8.5 | | | 76,108 | | | 8.6 | | | 117 | | | 0.2 | |

Business Communications | | 24,479 | | | 2.8 | | | 20,024 | | | 2.3 | | | (4,455 | ) | | (18.2 | ) |

Other | | 87,039 | | | 9.8 | | | 85,383 | | | 9.7 | | | (1,656 | ) | | (1.9 | ) |

Total Operating Revenues | | 888,891 | | | 100.0 | | | 881,432 | | | 100.0 | | | (7,459 | ) | | (0.8 | ) |

| | | | | | |

Personnel | | 97,353 | | | 11.0 | | | 93,803 | | | 10.6 | | | (3,550 | ) | | (3.6 | ) |

General and Administrative | | 261,391 | | | 29.4 | | | 273,784 | | | 31.1 | | | 12,393 | | | 4.7 | |

Depreciation | | 248,604 | | | 28.0 | | | 280,480 | | | 31.8 | | | 31,876 | | | 12.8 | |

Technology Transfer and Management Fees | | 73,743 | | | 8.3 | | | 10,415 | | | 1.2 | | | (63,328 | ) | | (85.9 | ) |

Materials and Supplies | | 15,129 | | | 1.7 | | | 16,145 | | | 1.8 | | | 1,016 | | | 6.7 | |

Provisions | | 30,799 | | | 3.5 | | | 17,272 | | | 2.0 | | | (13,527 | ) | | (43.9 | ) |

Own Work Capitalized | | (9,835 | ) | | (1.1 | ) | | (9,098 | ) | | (1.0 | ) | | 737 | | | (7.5 | ) |

Total Operating Costs and Expenses | | 717,184 | | | 80.7 | | | 682,801 | | | 77.5 | | | (34,383 | ) | | (4.8 | ) |

| | | | | | |

Operating Income | | 171,707 | | | 19.3 | | | 198,631 | | | 22.5 | | | 26,924 | | | 15.7 | |

| | | | | | |

EBITDA | | 420,311 | | | 47.3 | | | 479,111 | | | 54.4 | | | 58,800 | | | 14.0 | |

| | | | | | |

Other Income (Expenses) | | | | | | | | | | | | | | | | | | |

Interest Income | | 12,658 | | | 1.4 | | | 12,446 | | | 1.4 | | | (212 | ) | | (1.7 | ) |

Interest Expenses | | (45,818 | ) | | (5.2 | ) | | (39,718 | ) | | (4.5 | ) | | 6,100 | | | (13.3 | ) |

Others Net | | (25,183 | ) | | (2.8 | ) | | (66,041 | ) | | (7.5 | ) | | (40,858 | ) | | 162.2 | |

Inflation Gain (Loss) | | 81,132 | | | 9.1 | | | — | | | — | | | (81,132 | ) | | (100.0 | ) |

Total Other Income (Expenses) | | 22,789 | | | 2.6 | | | (93,313 | ) | | (10.6 | ) | | (116,102 | ) | | (509.5 | ) |

| | | | | | |

Income Before Taxes and Participations | | 194,496 | | | 21.9 | | | 105,318 | | | 11.9 | | | (89,178 | ) | | (45.9 | ) |

| | | | | | |

Workers' Participation | | (23,607 | ) | | (2.7 | ) | | (21,941 | ) | | (2.5 | ) | | 1,666 | | | (7.1 | ) |

Income Tax | | (63,113 | ) | | (7.1 | ) | | (63,720 | ) | | (7.2 | ) | | (607 | ) | | 1.0 | |

| | | | | | |

Net Income | | 107,776 | | | 12.1 | | | 19,657 | | | 2.2 | | | (88,119 | ) | | (81.8 | ) |

| 1/ | According to the Accounting regulation N° 031-2004, since January 1st, 2005 the inflation adjustment is no longer applied in the accounting financial statements so that REI account has been eliminated. |

In that sense, only the 1Q04 data has been adjusted according to the WPI published by the National Statistics Institute to December 31, 2004.

It is worth noting that since January, 2005 the exchange rate differences are registered in net finance expenses account, according the case. To comparative effects, the 1Q04 exchange rate differences have been reclassified in this line.

Item 3

TABLE 2

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET (1)

(End of Period Figures)

| | | | | | | | | | | | | | | |

| | | 1Q05

| | | 4Q04

| | | 3Q04

| | | 2Q04

| | | 1Q04

| |

ASSETS | | | | | | | | | | | | | | | |

| | | | | |

CURRENT ASSETS | | | | | | | | | | | | | | | |

| | | | | |

Cash and cash equivalents | | 282,242 | | | 63,332 | | | 352,221 | | | 255,251 | | | 123,853 | |

Negotiable securities | | 44,845 | | | 37,325 | | | 45,388 | | | 39,512 | | | 53,559 | |

Accounts and notes receivable - net | | 547,770 | | | 569,592 | | | 547,559 | | | 576,373 | | | 624,589 | |

Other accounts receivable | | 249,492 | | | 188,230 | | | 214,044 | | | 223,639 | | | 230,737 | |

Materials and supplies | | 35,806 | | | 37,558 | | | 37,487 | | | 37,176 | | | 35,575 | |

Prepaid taxes and expenses | | 56,995 | | | 41,307 | | | 48,029 | | | 47,470 | | | 39,454 | |

| | | | | |

Total current assets | | 1,217,150 | | | 1,032,549 | | | 1,329,255 | | | 1,263,948 | | | 1,192,294 | |

| | | | | |

LONG-TERM INVESTMENTS | | 10,035 | | | 9,197 | | | 8,593 | | | 7,962 | | | 7,126 | |

| | | | | |

PROPERTY, PLANT AND EQUIPMENT | | 15,539,435 | | | 15,473,120 | | | 15,195,811 | | | 15,073,072 | | | 15,067,236 | |

| | | | | |

Accumulated depreciation | | (9,836,164 | ) | | (9,579,437 | ) | | (9,342,531 | ) | | (9,111,535 | ) | | (8,890,955 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Write-off Provision | | (79,192 | ) | | (79,192 | ) | | (65,355 | ) | | (65,355 | ) | | (65,355 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 5,624,079 | | | 5,814,491 | | | 5,787,925 | | | 5,896,182 | | | 6,110,926 | |

| | | | | |

OTHER ASSETS, net | | 203,580 | | | 225,141 | | | 225,141 | | | 245,176 | | | 215,905 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL ASSETS | | 7,054,844 | | | 7,081,378 | | | 7,350,914 | | | 7,413,268 | | | 7,526,251 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

| | | | | |

CURRENT LIABILITIES | | | | | | | | | | | | | | | |

| | | | | |

Overdrafts | | 5,239 | | | 5,347 | | | 368.00 | | | 5,911.00 | | | 4,213.00 | |

Accounts payable and accrued liabilities | | 418,214 | | | 478,260 | | | 355,479 | | | 364,366 | | | 425,234 | |

Other accounts payable | | 1,043,349 | | | 1,051,875 | | | 775,682 | | | 817,244 | | | 768,086 | |

Provision for severance indemnities | | 9,912 | | | 4,120 | | | 2,374.00 | | | 3,000 | | | 3,077 | |

Bank Loans | | 165,000 | | | 201,500 | | | 110,000 | | | 120,114 | | | 212,249 | |

Current maturities of long-term debt | | 89,961 | | | 90,211 | | | 120,395 | | | 122,280 | | | 85,455 | |

Current maturities of bonds | | 248,977 | | | 398,496 | | | 234,519 | | | 244,237 | | | 162,252 | |

Commercial Papers | | 215,000 | | | 95,000 | | | 51,500 | | | 50,788 | | | 114,862 | |

Total current liabilities | | 2,195,652 | | | 2,324,809 | | | 1,650,317 | | | 1,727,940 | | | 1,775,428 | |

| | | | | |

LONG TERM DEBT | | 323,220 | | | 335,144 | | | 235,276 | | | 252,010 | | | 310,461 | |

| | | | | |

BONDS | | 749,961 | | | 582,522 | | | 746,561 | | | 746,976 | | | 783,994 | |

| | | | | |

GUARANTY DEPOSITS | | 103,780 | | | 102,475 | | | 104,203 | | | 102,398 | | | 105,576 | |

| | | | | |

DEFERRED EARNINGS | | 935,188 | | | 1,009,042 | | | 918,020 | | | 937,395 | | | 985,860 | |

| | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

Capital stock | | 2,355,086 | | | 2,355,086 | | | 3,098,199 | | | 3,098,199 | | | 3,098,199 | |

Treasury stock | | (21,896 | ) | | | | | | | | | | | | |

Legal reserve | | 377,668 | | | 372,365 | | | 372,365 | | | 372,365 | | | 372,365 | |

Retained earnings | | 36,185 | | | 21,831 | | | 247,868 | | | 175,985 | | | 94,368 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL SHAREHOLDERS’ EQUITY | | 2,747,043 | | | 2,727,386 | | | 3,696,537 | | | 3,646,549 | | | 3,564,932 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 7,054,844 | | | 7,081,378 | | | 7,350,914 | | | 7,413,268 | | | 7,526,251 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| 1/ | According to the Accounting regulation N° 031-2004, since January 1st, 2005 the inflation adjustment is no longer applied in the accounting financial statements so that REI account has been eliminated. |

In that sense, only the 1Q04 data has been adjusted according to the WPI published by the National Statistics Institute to December 31, 2004.

Item 3

TABLE 3

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Statistical Data, End of Period Figures

| | | | | | | | | | | | | | | | |

| | | 1Q04

| | 2Q04

| | 3Q04

| | 4Q04

| | 1Q05

| | Var. Abs.

1Q05-1Q04

| | | 1Q05/

1Q04

| |

Fixed-Wire Telephone Service: Local+Long Distance | | | | | | | | | | | | | | | | |

Lines Installed | | 2,178,845 | | 2,197,489 | | 2,260,831 | | 2,307,247 | | 2,343,993 | | 165,148 | | | 7.6 | |

Profits (losses) in Lines in Service, net | | 33,536 | | 42,988 | | 46,990 | | 50,462 | | 48,380 | | 14,844 | | | 44.3 | |

Lines in Service Including Public Telephones (1) | | 1,998,141 | | 2,043,885 | | 2,095,838 | | 2,150,827 | | 2,201,167 | | 203,026 | | | 10.2 | |

| | | | | | | |

Local Traffic - Minutes (000) (2) | | 1,395,796 | | 1,341,295 | | 1,302,021 | | 1,294,169 | | 1,260,216 | | (135,580 | ) | | (9.7 | ) |

Long Distance - Minutes (000) (3) | | 240,638 | | 239,532 | | 235,797 | | 252,848 | | 267,761 | | 27,123 | | | 11.3 | |

| | | | | | | |

Number of Employees (Telefónica del Perú and Subsidiaries) | | 5,198 | | 5,128 | | 5,227 | | 5,179 | | 5,158 | | (40 | ) | | (0.8 | ) |

Number of Employees (Telefónica del Perú) | | 3,335 | | 3,325 | | 3,328 | | 3,153 | | 3,144 | | (191 | ) | | (5.7 | ) |

Lines in Service per Employee (Telefónica del Perú) | | 599 | | 615 | | 630 | | 682 | | 700 | | 101 | | | 16.9 | |

Digitalization Rate (%) | | 96 | | 96 | | 96 | | 97 | | 97 | | 0 | | | 0.3 | |

Lines in Service per 100 inhabitants | | 7.3 | | 7.5 | | 7.6 | | 7.8 | | 8.0 | | 1 | | | 9.6 | |

| | | | | | | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (4) | | 116,694 | | 119,448 | | 124,499 | | 129,353 | | 130,980 | | 14,286 | | | 12.2 | |

| | | | | | | |

BROAD BAND | | | | | | | | | | | | | | | | |

Lines in Service (5) | | 107,246 | | 134,925 | | 166,228 | | 205,425 | | 234,660 | | 127,414 | | | 118.8 | |

| | | | | | | |

CABLE TV | | | | | | | | | | | | | | | | |

Subscribers | | 369,741 | | 373,203 | | 383,260 | | 389,174 | | 405,959 | | 36,218 | | | 9.8 | |

| (1) | Excluding Cellular Public Phones and rurals |

| (2) | Including traffic F2F billing (voice and internet), F2F anf F2M |

| (3) | Excluding Prepaid cards, including packed minutes plans. |

| (4) | Including Cellular and fixed public phones and Rural fixed and cellular public phones |

| (5) | Including broad band and Cablenet. |

| | | | |

| | | | Item 4 |

| | |

| | | | | Telefónica del Perú S.A.A. |

| | | | | Secretaría General |

| | | | | Av. Arequipa 1155, piso 6 |

| | | | | Santa Beatriz, Lima |

| | | | | Tel.: 511 210 10 26 |

| | | | | Fax: 511 266 90 21 |

| | | | | jmoralesv@tp.com.pe |

April 22, 2005

Messers.

Comisión Nacional Supervisora

De Empresas y Valores – CONASEV

Lima.

Dear Sirs,

According to the article 28 of the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the redemption of the 8thIssue of the Second Program of Telefonica Corporate Bonds, Serial B, under the following terms:

| | | | | | | | | | |

Issue

| | Serial

| | Term

| | Date of Issue

| | Date of Maturity

| | Nominal Value

|

8th | | B | | 2 years | | 04.22.03 | | 04.22.05 | | S/. 15,000,000.00 |

Sincerely yours,

Julia María Morales Valentín

Stock Exchange Representative

Inscrita en la partida N° 11015766 del Registro de Personas Jurídicas de Lima. RUC 20100017491.Sede Social Av. Arequipa 1155, Lima 1.

Página 1 de 1

Item 5

April 20, 2005

Messrs.

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Lima.-

Ref.-Key Events

Dear Sirs,

According to the article 28 of the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you about the result of the 7th Issue, Serial A of the Third Program of Telefónica del Peru’s Corporate Bonds:

| | |

Amount | | : S/. 70,000,000 |

N° Bonds | | : S/. 14,000 |

Date of Issue | | : April 20, 2005 |

Date of Redemption | | : October 20, 2006 |

Nominal Interest Rate | | : 5.50% |

| |

Schedule of payment | | : |

Coupon 1 | | : 10/20/2005 |

Coupon 2 | | : 04/20/2006 |

Coupon 3 | | : 10/20/2006 |

Find attached the formula required.

Best Regards,

Julia María Morales Valentín

Representative to the Stock Exchange

Item 5

Issuer: Telefónica del Perú S.A.A.

Issue: Third Program of Telefónica del Peru’s Corporate Bonds – 7th Issue.

Lead arranger: BBVA Banco Continental

Placing agent : Continental Bolsa SAB, S.A.

| | | | | | | | | | | | | | | | | | | | | | | |

Serial

| | Interest

Rate

| | | Collocation

Rate ........

| | | Collocation

Price

| | | Amount

| | Collocation

Amount

| | Collocation

Date

| | Date of Issue

| | Date of

Maturity

| | Nominal

Value

| | N° of ....... (Bonds)

|

A | | 5.5000 | % | | 5.5000 | % | | 100 | % | | S/.70,000,000 | | S/.70,000,000 | | 04/19/2005 | | 04/20/2005 | | 10/20/2006 | | S/.5,000 | | 14,000 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | Telefónica del Perú |

| | |

| Date: May 4, 2005 | | By: | | /s/ Mariana Brigneti

|

| | | Name: | | Mariana Brigneti |

| | | Title: | | Manager of Judicial Matters & Matters of Process |