SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July, 2005

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ Nox

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ Nox

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes¨ Nox

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Telefónica del Perú

TABLE OF CONTENTS

Item 1

Quarterly Results

Telefónica del Perú S.A.A. and subsidiaries

April – June 2005

Significant Events

A summary containing the most significant events since April 2005 is presented below:

| 1. | The Board of Directors took the following resolutions: |

On its session held on April 21, 2005:

| | • | | Approved the individual and consolidated financial statements of the Company corresponding to the first quarter of 2005 and decided for their filing with the Comisión Nacional Supervisora de Empresas y Valores (CONASEV), the Lima Stock Exchange (BVL) and corresponding institutions of the stock market. |

On its session held on May 25, 2005:

| | • | | Using the powers that were granted to it by the General Shareholders’ Meeting on its session held on March 28, 2005, the Board of Directors approved the reduction of the capital stock from S/. 2,152,455,521.25 to S/. 1,377,571,533.88, which represents S/. 774,883,987.65. This reduction will be accomplished by the reduction of the nominal value of each share from S/. 1.25 to S/. 0.80, keeping the same number of representative shares of the capital stock of the Company. The total amount of the reduction of the capital stock will be used to return the contributions of the shareholders, “pro rata” of their participation in the capital stock, in the ratio of S/. 0.454608494004588 per share – without considering the 17,456,037 shares of the Company purchased as per the agreement of the General Shareholders’ Meeting held on March 26, 2004. It is worth noting that July 20, 2005 has been set as the registry and modification date for the nominal value of the shares, as well as the registry date for the return of the contributions, which will be effective on July 26, 2005. Return of contributions will be paid in U.S. Dollars. |

| | • | | Approved the modification of the article of the Company’s bylaws that refers to the amount of the capital stock, on the previously mentioned terms. |

| | • | | Approved the execution of a restricted and private offering through the issuance of notes denominated “Pagarés de Telefónica del Perú” for an outstanding amount of up to US$400 million and granted certain executives of the Company with powers to establish the characteristics for the issuance of such notes. |

| 2. | Resolutions taken by the Extraordinary General Shareholders’ Meeting of the A-1 class on June 30: |

| | • | | Appointed Mr. Eduardo Navarro, as alternate director to the director Mr. Fernando José de Almansa. |

TELEFÓNICA DEL PERÚ S.A.A. AND SUBSIDIARIES

Management discussion and analysis of the consolidated results

for the second quarter ended on June 30, 2005

It is recommended the reading of this report along with the corresponding financial statements and their notes, presented at the same time, since they form integral part of this document and contain complementary information.

Economic Environment

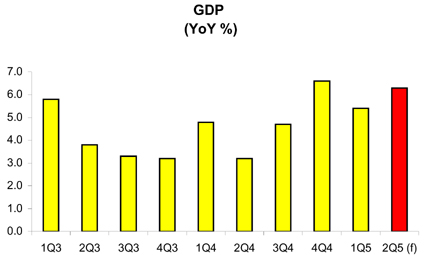

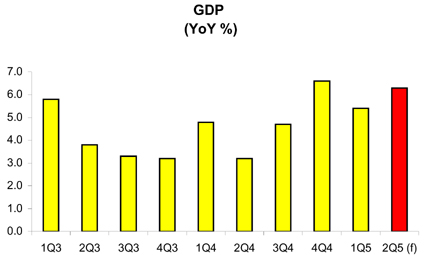

During the 2Q05 the Gross Domestic Product (GDP) could have grown 6.0%. This high record is partially influenced by the 3.2% growth in the 2Q04, the lowest of that year. Asides from the statistical effects, the drivers responsible for the economic growth are: exports (traditional and non-traditional), investments in different sectors (mining, construction, industry, among others) and public expenditures. Furthermore, the almost 50 months of consecutive growth have favorably impacted the confidence of both consumers and businessmen. This scenario occurs in the midst of a low inflation environment, an stronger local currency and strengthened external and fiscal accounts. For the following months, the domestic expenditure could be accelerated, partially influenced by a larger fiscal expansion (recent budget increase of 0.5% of the GDP). Therefore, according to analyst consensus, it is probable that the GDP growth for 2005 would be 5.0%, or even higher, figure above the one that analysts predicted at the beginning of the year. Nevertheless, despite the encouraging macroeconomic indicators, the strikes and social protests have been increasing throughout the country during the last months, becoming an item of concern.

Regarding prices, the inflation rate registered in the 2Q05 was 0.51%. With this result, the accumulated inflation through June was 1.03%, lower than the rate of previous years. Furthermore, the inflation for the last 12 months dropped to 1.49%, below the lower target range of the Central Bank for the whole year (1.5% - 3.5%). The recovery of the global offer of some imported goods (wheat, corn, soy) and the absence of droughts, which affected the local agricultural production in 2004, reduced the inflationary pressures. Recently, the Central Bank revised downwards its projection for the 2005 inflation rate from 2.3% to 2.2%. For 2006, the expected inflation rate is 2.4%, which comfortably fits within the Central Bank target range. According to the Central Bank, it is even possible to reach a lower rate, especially for 2005.

On the other hand, the exchange rate finished June at levels of S/. 3.255 per dollar, which represented an appreciation of 0.2%, compared to the previous quarter. During the last 12 months, the exchange rate appreciated 6.2%. The strength of the external accounts and the gradual process of de-dollarization are the main factors that explain the pressures that resulted in an stronger Nuevo Sol. As in previous periods, the intervention of the Central Bank in the foreign exchange market could have avoided a larger appreciation of the local currency. During the second quarter, it bought US$970 million and accumulated purchases of US$2,118 million during the first half, amount that is close to all the purchases in 2004 (US$2,342 million). Fueled by

these purchases, the Net International Reserves rose to US$13,818 million, equivalent to 15 months of imports. During the next months, the pressures for further appreciation of the local currency could be partially dwindled due to the political uncertainty generated by the April 2006 elections and the current spread of the FED interest rate over the one of the Central Bank.

The country risk spread finished June at 206 basic points, and during some days in that month, it dropped to historical low levels (191 basic points) and very close to corresponding spread of Mexico, country with investment grade sovereign debt (BBB rating). It is important to notice that on July 11, Standard & Poor´s modified its view over Peruvian sovereign debt from stable to positive. On the other hand, in mid-June, the Club of Paris officially accepted Peru’s offer for a debt pre-payment. It was later decided that the operation would be for up to US$1,552 million and to carry out until August 15, 2005. The pre-payment of the principal amounts, with maturities from August 2005 to December 2009, will imply lower payments of about US$350 million for the Government in annual amortizations until 2009. The pre-payment will be mainly financed by recent and successful issuances of debt in the local (S/.2 550 million) and international (US$750 million) capital markets.

Operating revenues

During the 1H05, operating revenues were still strongly affected byregulatory decisions.First, due to the application of the new productivity factor of 10.07%, the charge for network access for additional local calls in lines without restrictions on use was eliminated starting on June 1. Additionally, the new conditions of usage approved in 2004 and the application of tariff imputation tests in DLD had a material impact on operating revenues. The second key factor was thecompetitive environmentwhich is becoming more aggressive and complex every time, and mainly focused on the Local Telephony, Public Telephony and Long Distance businesses. The impact of both factors on the operating revenues was partially offset by the significant effort by the Company in the deployment of fixed telephony lines, which has permitted a 10% yoy growth of the plant in service. Additionally, the Company continued focusing in the development of broadband, thereby reaching more than 276 thousand users by the end of this quarter with a 104.7% yoy increase, and in the expansion of cable television with a 10.5% yoy growth of measured local traffic of 10.5%.

In local telephony, the main competitors are Telmex and Americatel, with an strategy mainly oriented to the corporate sector. Furthermore, this business has been affected by the substitution of fixed-fixed traffic to mobile-mobile traffic due to the growth of the mobile telephony plant. In the LD and public telephony businesses, the competition –Americatel, IDT and Telmex-, focused in selling pre-paid cards for LD calls, with an strategy oriented to lower prices. In public telephony, besides the competition in pre-paid cards, there was an important growth in the plant of other operators.

Operating revenues for the 2Q05 reached S/. 836 million, showing a reduction of 1.5% regarding the 2Q04, mainly due to lower revenues from the Local Telephony (-10.8%) and Business Communications (-16.7%) businesses, which were not offset by the increase in revenues from the businesses of Internet (29.5%), Public and Rural Telephony (1.6%) and Others (4.6%).

Likewise, the operating revenues for the 1H05 reached S/. 1,717 million, dropping 1.2% compared to the 1H04, due to lower revenues from the Local Telephony (-7.6%), Business Communications (-18.9%), and LD (-2.8%) businesses, which were partially compensated by the increase in revenues from the businesses of Internet (32.7%) and Public and Rural Telephony (0.8%).

Revenues forLocal Telephonyreached S/. 298 million in the 2Q05, presenting a reduction of 10.8% compared with the 2Q04. Even though there was an important increase in lines in service, the revenues for local measured service were affected by the application of the productivity factor over the charge for network access for additional local calls in lines without restrictions on use (average reduction of 28% in December 2004 and 54% in March 2005) and its elimination starting on June 1, 2005, as well as by the 7% reduction of measured local traffic due to the increasing competition of the mobile business. 1H05 revenues showed a 7.6% reduction compared to the 1H04, reaching S/. 634 million. Nevertheless, by the end of the quarter, the plant in service reached 2.1 million lines, with a 10% yoy growth, which reflects the strong effort developed by the

Company to increase the penetration in low-income segments of the population, through the offer of pre-paid and limited-consumption lines.

Long Distance revenues dropped 0.4% during the 2Q05 compared to the 2Q04, totaling S/. 112 million. This reduction is explained by lower revenues from DLD of 4.9%, as a result of lower traffic and lower average tariffs, but partially compensated by the 11.1% increase in revenues from ILD. This is a highly competitive market, mainly in prepaid cards, which has been affected by the tariff imputation test established by Osiptel. The later has generated a reduction in the volume of minutes and in market share for the Company. On the other hand, the revenues for the 1H05 totaled S/. 230 million, 2.8% lower than in the 1H04, due to the lower revenues for DLD by 6.6%. This effect was partially offset by higher revenues in incoming ILD by 5.2%, resulting from higher traffic and lower payments to foreign carriers.

The revenues forPublic and Rural Telephony reached S/. 147 million in the 2Q05, representing a 1.6% increase regarding the 2Q04, while on the 1H05 reached S/. 305 million, 0.8% higher than in the 1H04. These increases are mainly the result of the 13% yoy growth of the plant in service, which was partially offset by the lower traffic per line due to the increasing substitution by the mobile telephony and the increase in the fixed telephony plant.

Cable Television revenues reached S/. 79 million in the 2Q05, which represents a 0.9% increase compared to the 2Q04. Likewise, in the 1H05 an increase of 0.5% compared to the 1H04 was registered, and revenues reached S/. 155 million. The 1H05 growth is explained by the 10.5% increase of the average billable plant, which was partially offset by the depreciation of the dollar against the Nuevo Sol.

The revenues forBusiness Communicationsreached S/. 21 million in the 2Q05, 16.7% lower than in the 2Q04, and S/. 41 million in the 1H05, 18.9% lower than in the 1H04. These results were mainly explained by the 27.6% reduction of revenues from Digired, due to a migration to the IP-VPN product.

The revenues forInternetreached S/. 92 million in the 2Q05, an increase of 29.5% compared to the 2Q04. This increase is chiefly explained by the 104.7% growth of the Broadband lines, reaching 276 thousand lines in June 2005, due to commercial initiatives aimed to bringing more benefits to customers. Likewise, the revenues for the 1H05 reached S/. 177 million, 32.7% higher than in the 1H04.

Operating expenses

The operating expenses totaled S/. 692 million in the 2Q05, which represents an increase of 0.6% in relation to the S/. 688 million of the 2Q04. There were increases in depreciation and amortization (S/. 50 million) and in general and administrative expenses (S/. 18 million), which were partially offset by a lower management fee of S/. 64 million.

The accumulated expenses of S/. 1,375 million in the 1H05 dropped S/. 30 million or 2.2% compared to the 1H04, mainly because of the reductions in the management fee (S/. 128 million) and in late collection provision (S/. 17 million), due to the pre-paid plant growth and an improved collection system.

Operating Result

On the other hand, the operating result was reduced in 10.4%, going from S/. 160 million in the 2Q04 to S/. 144 million in the 2Q05. The decrease was mainly due to the fall in Local Telephony revenues, though partially compensated by the reduction in management fee.

In the 1H05, the operating result raised 3.1% compared to the 1H04, reaching S/. 342 million. The lower management fee partially reduced the impact of the fall in operating revenues, mainly in Local Telephony. If the management fee had no diminished, the operating result would have reduced by 35%.

Non-operating Result

During this period, the non-operating result was mainly impacted by the effect of the monetary correction (or REI), which had a positive effect of S/. 49 million in the 2Q04, while in the 2Q05 is no longer applied, due to the accounting policy changes applied in Perú starting on January 1, 2005. Furthermore, the S/. 13 million higher loss in others net also impacted this result. Conversely, the net financial expenses fell 3.8% compared to the 2Q04. Thus, in the 2Q05, a non-operating loss of S/. 60 million was recorded, compared with the profit of S/. 1 million in the 2Q04.

In the 1H05, the non-operating result was reduced in S/. 177 million compared to the 1H04. As in the quarter, this was mainly caused by the monetary correction explained in the previous paragraph, as well as by a higher loss others net of S/. 54 million in the 1H05 compared to the 1H04.

Net result

The net results dropped 46.5% from S/. 88 million in the 2Q04 to S/. 47 million in the 2Q05. Likewise, the net accumulated result reduced 65.9% from S/. 196 million in the 1H04 to S/. 67 million in the 1H05. In both cases, the fall is explained by the lower operating profitability once excluded the impact of the management fee reduction.

Consolidated Balance Sheet

The liquidity levels of the Company – measured by the current assets over current liabilities ratio – increased from 0.55 in the 1Q05 to 0.71 in the 2Q05, mainly as a consequence of higher cash levels. During the 2Q05, there was a slight increase of the “debt over debt plus equity” ratio, going from 39.6% in the 1Q05 to 43.4% in the 2Q05.

TABLE 1

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS IN ADJUSTED SOLES (000) AS OF JUNE 30, 20051/

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2Q04

| | | 2Q05

| | | Abs. Var. 2Q05-2Q04

| | | % Var. 2Q05-2Q04

| | | 6M04

| | | 6M05

| | | Var. Abs. 6M05-6M04

| | | Var. % 6M05-6M04

| |

| | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | |

Local Telephone Service | | 333,697 | | | 39.3 | | | 297,511 | | | 35.6 | | | (36,186 | ) | | (10.8 | ) | | 686,298 | | | 39.5 | | | 634,445 | | | 36.9 | | | (51,853 | ) | | (7.6 | ) |

Long Distance | | 111,992 | | | 13.2 | | | 111,569 | | | 13.3 | | | (423 | ) | | (0.4 | ) | | 236,573 | | | 13.6 | | | 229,946 | | | 13.4 | | | (6,627 | ) | | (2.8 | ) |

Public Telephones | | 145,030 | | | 17.1 | | | 147,379 | | | 17.6 | | | 2,349 | | | 1.6 | | | 302,759 | | | 17.4 | | | 305,031 | | | 17.8 | | | 2,272 | | | 0.8 | |

Cable TV | | 78,021 | | | 9.2 | | | 78,730 | | | 9.4 | | | 709 | | | 0.9 | | | 153,999 | | | 8.9 | | | 154,838 | | | 9.0 | | | 839 | | | 0.5 | |

Business Communications | | 24,625 | | | 2.9 | | | 20,510 | | | 2.5 | | | (4,115 | ) | | (16.7 | ) | | 50,996 | | | 2.9 | | | 41,333 | | | 2.4 | | | (9,663 | ) | | (18.9 | ) |

Internet | | 70,706 | | | 8.3 | | | 91,562 | | | 11.0 | | | 20,856 | | | 29.5 | | | 133,171 | | | 7.7 | | | 176,731 | | | 10.3 | | | 43,560 | | | 32.7 | |

Other | | 84,667 | | | 10.0 | | | 88,568 | | | 10.6 | | | 3,901 | | | 4.6 | | | 173,675 | | | 10.0 | | | 174,937 | | | 10.2 | | | 1,262 | | | 0.7 | |

Total Operating Revenues | | 848,738 | | | 100.0 | | | 835,829 | | | 100.0 | | | (12,909 | ) | | (1.5 | ) | | 1,737,471 | | | 100.0 | | | 1,717,261 | | | 100.0 | | | (20,210 | ) | | (1.2 | ) |

| | | | | | | | | | | | |

Personnel | | 94,286 | | | 11.1 | | | 96,269 | | | 11.5 | | | 1,983 | | | 2.1 | | | 191,623 | | | 11.0 | | | 190,072 | | | 11.1 | | | (1,551 | ) | | (0.8 | ) |

General and Administrative | | 238,480 | | | 28.1 | | | 256,629 | | | 30.7 | | | 18,149 | | | 7.6 | | | 499,823 | | | 28.8 | | | 530,413 | | | 30.9 | | | 30,590 | | | 6.1 | |

Depreciation | | 245,206 | | | 28.9 | | | 294,901 | | | 35.3 | | | 49,695 | | | 20.3 | | | 493,764 | | | 28.4 | | | 575,381 | | | 33.5 | | | 81,617 | | | 16.5 | |

Technology Transfer and Management Fees | | 74,193 | | | 8.7 | | | 9,887 | | | 1.2 | | | (64,306 | ) | | (86.7 | ) | | 147,923 | | | 8.5 | | | 20,302 | | | 1.2 | | | (127,621 | ) | | (86.3 | ) |

Materials and Supplies | | 17,310 | | | 2.0 | | | 18,746 | | | 2.2 | | | 1,436 | | | 8.3 | | | 32,436 | | | 1.9 | | | 34,891 | | | 2.0 | | | 2,455 | | | 7.6 | |

Provisions | | 28,329 | | | 3.3 | | | 24,627 | | | 2.9 | | | (3,702 | ) | | (13.1 | ) | | 59,123 | | | 3.4 | | | 41,899 | | | 2.4 | | | (17,224 | ) | | (29.1 | ) |

Own Work Capitalized | | (9,501 | ) | | (1.1 | ) | | (8,922 | ) | | (1.1 | ) | | 579 | | | (6.1 | ) | | (19,335 | ) | | (1.1 | ) | | (18,020 | ) | | (1.0 | ) | | 1,315 | | | (6.8 | ) |

Total Operating Costs and Expenses | | 688,303 | | | 81.1 | | | 692,137 | | | 82.8 | | | 3,834 | | | 0.6 | | | 1,405,357 | | | 80.9 | | | 1,374,938 | | | 80.1 | | | (30,419 | ) | | (2.2 | ) |

| | | | | | | | | | | | |

Operating Income | | 160,435 | | | 18.9 | | | 143,692 | | | 17.2 | | | (16,743 | ) | | (10.4 | ) | | 332,114 | | | 19.1 | | | 342,323 | | | 19.9 | | | 10,209 | | | 3.1 | |

| | | | | | | | | | | | |

Other Income (Expenses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Income | | 9,216 | | | 1.1 | | | 10,139 | | | 1.2 | | | 923 | | | 10.0 | | | 21,873 | | | 1.3 | | | 22,585 | | | 1.3 | | | 712 | | | 3.3 | |

Interest Expenses | | (40,247 | ) | | (4.7 | ) | | (39,998 | ) | | (4.8 | ) | | 249 | | | (0.6 | ) | | (86,060 | ) | | (5.0 | ) | | (79,716 | ) | | (4.6 | ) | | 6,344 | | | (7.4 | ) |

Others Net | | (16,576 | ) | | (2.0 | ) | | (29,760 | ) | | (3.6 | ) | | (13,184 | ) | | 79.5 | | | (41,756 | ) | | (2.4 | ) | | (95,801 | ) | | (5.6 | ) | | (54,045 | ) | | 129.4 | |

Inflation Gain (Loss) | | 48,921 | | | 5.8 | | | — | | | — | | | (48,921 | ) | | (100.0 | ) | | 130,043 | | | 7.5 | | | — | | | — | | | (130,043 | ) | | (100.0 | ) |

Total Other Income (Expenses) | | 1,314 | | | 0.2 | | | (59,619 | ) | | (7.1 | ) | | (60,933 | ) | | (4,637.2 | ) | | 24,100 | | | 1.4 | | | (152,932 | ) | | (8.9 | ) | | (177,032 | ) | | (734.6 | ) |

| | | | | | | | | | | | |

Income Before Taxes and Participations | | 161,749 | | | 19.1 | | | 84,073 | | | 10.1 | | | (77,676 | ) | | (48.0 | ) | | 356,214 | | | 20.5 | | | 189,391 | | | 11.0 | | | (166,823 | ) | | (46.8 | ) |

| | | | | | | | | | | | |

Workers’ Participation | | (19,968 | ) | | (2.4 | ) | | (10,713 | ) | | (1.3 | ) | | 9,255 | | | (46.3 | ) | | (43,574 | ) | | (2.5 | ) | | (32,654 | ) | | (1.9 | ) | | 10,920 | | | (25.1 | ) |

| | | | | | | | | | | | |

Income Tax | | (54,018 | ) | | (6.4 | ) | | (26,381 | ) | | (3.2 | ) | | 27,637 | | | (51.2 | ) | | (117,120 | ) | | (6.7 | ) | | (90,101 | ) | | (5.2 | ) | | 27,019 | | | (23.1 | ) |

| | | | | | | | | | | | |

Net Income | | 87,763 | | | 10.3 | | | 46,979 | | | 5.6 | | | (40,784 | ) | | (46.5 | ) | | 195,520 | | | 11.3 | | | 66,636 | | | 3.9 | | | (128,884 | ) | | (65.9 | ) |

| 1/ | In order to allow an easier analysis, the income statement of 1Q01 includes reclassifications (without effects in the net income) in some accounts: |

| a. | Since the year 2002 the Tarjeta 147 incomes have been registered separately between the Local Telephone Service and Lond Distance accounts, while they were registered only in the Local Telephone Service in 1Q01. |

| b. | Since the year 2002, the interconection incomes, regarding to the traffic of F2M, M2M and FTF, have not been registered in the Local Telephone Service account besides they are registered in the others account. |

| c. | Since 3Q01 the subsidiaries’s billing have been registered in Others Net account and not in general and administrative expenses |

TABLE 2

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET IN ADJUSTED SOLES (000) AS OF JUNE 30, 2005 (1)

(End of Period Figures)

ASSETS

| | | | | | | | | | | | | | | |

| | | 2Q05

| | | 1Q05

| | | 4Q04

| | | 3Q04

| | | 2Q04

| |

CURRENT ASSETS | | | | | | | | | | | | | | | |

| | | | | |

Cash and cash equivalents | | 768,061 | | | 282,242 | | | 63,332 | | | 352,221 | | | 255,251 | |

Negociable securities | | 41,823 | | | 44,845 | | | 37,325 | | | 45,388 | | | 39,512 | |

Accounts and notes receivable - net | | 591,746 | | | 547,770 | | | 569,592 | | | 547,559 | | | 576,373 | |

Other accounts receivable | | 91,969 | | | 249,492 | | | 188,230 | | | 214,044 | | | 223,639 | |

Materials and supplies | | 39,280 | | | 35,806 | | | 37,558 | | | 37,487 | | | 37,176 | |

Prepaid taxes and expenses | | 56,542 | | | 56,995 | | | 41,307 | | | 48,029 | | | 47,470 | |

| | | | | |

Total current assets | | 1,589,421 | | | 1,217,150 | | | 1,032,549 | | | 1,329,255 | | | 1,263,948 | |

| | | | | |

LONG-TERM INVESTMENTS | | 10,755 | | | 10,035 | | | 9,197 | | | 8,593 | | | 7,962 | |

Deferred Expenses | | 8,699 | | | | | | | | | | | | | |

| | | | | |

PROPERTY, PLANT AND EQUIPMENT | | 15,642,038 | | | 15,539,435 | | | 15,473,120 | | | 15,195,811 | | | 15,073,072 | |

Accumulated depreciation | | (10,109,099 | ) | | (9,836,164 | ) | | (9,579,437 | ) | | (9,342,531 | ) | | (9,111,535 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 5,532,939 | | | 5,703,271 | | | 5,893,683 | | | 5,853,280 | | | 5,961,587 | |

Write-off Provision | | (88,510 | ) | | (79,192 | ) | | (79,192 | ) | | (65,355 | ) | | (65,355 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 5,444,429 | | | 5,624,079 | | | 5,814,491 | | | 5,787,925 | | | 5,896,182 | |

OTHER ASSETS, net | | 209,744 | | | 203,580 | | | 225,141 | | | 225,141 | | | 245,176 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

TOTAL ASSETS | | 7,263,048 | | | 7,054,844 | | | 7,081,378 | | | 7,350,914 | | | 7,413,268 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

| | | | | | | | | | | | | | |

| | | 2Q05

| | | 1Q05

| | | 4Q04

| | | 3Q04

| | | 2Q04

|

CURRENT LIABILITIES | | | | | | | | | | | | | | |

| | | | | |

Overdrafts | | 4,456 | | | 5,239 | | | 5,347 | | | 368 | | | 5,911 |

Accounts payable and accrued liabilities | | 385,536 | | | 418,214 | | | 478,260 | | | 355,479 | | | 364,366 |

Other accounts payable | | 987,881 | | | 1,043,349 | | | 1,051,875 | | | 775,682 | | | 817,244 |

Provision for severance indemnities | | 4,452 | | | 9,912 | | | 4,120 | | | 2,374.00 | | | 3,000 |

Bank Loans | | 304,350 | | | 165,000 | | | 201,500 | | | 110,000 | | | 120,114 |

Current maturities of long-term debt | | 49,439 | | | 89,961 | | | 90,211 | | | 120,395 | | | 122,280 |

Current maturities of bonds | | 163,977 | | | 248,977 | | | 398,496 | | | 234,519 | | | 244,237 |

Commercial Papers | | 328,185 | | | 215,000 | | | 95,000 | | | 51,500 | | | 50,788 |

Total current liabilities | | 2,228,276 | | | 2,195,652 | | | 2,324,809 | | | 1,650,317 | | | 1,727,940 |

| | | | | |

LONG-TERM DEBT | | 468,955 | | | 323,220 | | | 335,144 | | | 235,276 | | | 252,010 |

| | | | | |

BONDS | | 822,824 | | | 749,961 | | | 582,522 | | | 746,561 | | | 746,976 |

| | | | | |

GUARANTEE DEPOSITS | | 105,114 | | | 103,780 | | | 102,475 | | | 104,203 | | | 102,398 |

| | | | | |

DEFERRED INCOME TAX AND WORKER’S PROFIT SHARING | | 843,857 | | | 935,188 | | | 1,009,042 | | | 918,020 | | | 937,395 |

| | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | |

| | | | | |

Capital stock | | 2,355,086 | | | 2,355,086 | | | 2,355,086 | | | 3,098,199 | | | 3,098,199 |

Treasury shares | | (21,896 | ) | | (21,896 | ) | | (21,896 | ) | | (21,895 | ) | | 0 |

Legal reserve | | 377,668 | | | 377,668 | | | 372,365 | | | 372,365 | | | 372,365 |

Retained earnings | | 83,164 | | | 36,185 | | | 21,831 | | | 247,868 | | | 175,985 |

| | |

|

| |

|

| |

|

| |

|

| |

|

TOTAL SHAREHOLDERS’ EQUITY | | 2,794,022 | | | 2,747,043 | | | 2,727,386 | | | 3,696,537 | | | 3,646,549 |

| | |

|

| |

|

| |

|

| |

|

| |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 7,263,048 | | | 7,054,844 | | | 7,081,378 | | | 7,350,914 | | | 7,413,268 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| (1) | Data is adjusted according to the WPI published by the National Statistics Institute. |

TABLE 3

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Statistical Data, End of Period Figures

| | | | | | | | | | | | | | | | |

| | | 1Q04

| | 2Q04

| | 3Q04

| | 4Q04

| | 1Q05

| | Var. Abs. 1Q05-1Q04

| | | 1Q05/ 1Q04

| |

Fixed-Wire Telephone Service: Local+Long Distance | | | | | | | | | | | | | | | | |

Lines Installed | | 2,197,489 | | 2,260,831 | | 2,307,247 | | 2,343,993 | | 2,396,113 | | 198,624 | | | 9.0 | |

Profits (losses) in Lines in Service, net | | 42,988 | | 46,990 | | 50,462 | | 48,380 | | 46,115 | | 3,127 | | | 7.3 | |

Lines in Service Including Public Telephones (1) | | 2,043,885 | | 2,095,838 | | 2,150,827 | | 2,201,167 | | 2,250,663 | | 206,778 | | | 10.1 | |

| | | | | | | |

Local Traffic - Minutes (000) (2) | | 1,341,295 | | 1,302,021 | | 1,294,169 | | 1,260,216 | | 1,247,663 | | (93,632 | ) | | (7.0 | ) |

Long Distance - Minutes (000) (3) | | 239,532 | | 235,797 | | 252,848 | | 267,761 | | 286,576 | | 47,044 | | | 19.6 | |

| | | | | | | |

Number of Employees (Telefónica del Perú and Subsidiaries) | | 5,128 | | 5,227 | | 5,179 | | 5,158 | | 5,280 | | 152 | | | 3.0 | |

Number of Employees (Telefónica del Perú) | | 3,325 | | 3,328 | | 3,153 | | 3,144 | | 3,170 | | (155 | ) | | (4.7 | ) |

Lines in Service per Employee (Telefónica del Perú) | | 615 | | 630 | | 682 | | 700 | | 710 | | 95 | | | 15.5 | |

Digitalization Rate (%) | | 96 | | 96 | | 97 | | 97 | | 97 | | 0 | | | 0.3 | |

Lines in Service per 100 inhabitants | | 7.5 | | 7.6 | | 7.8 | | 8.0 | | 8.1 | | 1 | | | 8.0 | |

| | | | | | | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (4) | | 119,448 | | 124,499 | | 129,353 | | 130,980 | | 134,423 | | 14,975 | | | 12.5 | |

| | | | | | | |

BROAD BAND | | | | | | | | | | | | | | | | |

Lines in Service (5) | | 134,925 | | 166,228 | | 205,425 | | 234,660 | | 276,151 | | 141,226 | | | 104.7 | |

| | | | | | | |

CABLE TV | | | | | | | | | | | | | | | | |

Subscribers | | 373,203 | | 383,260 | | 389,174 | | 405,959 | | 417,535 | | 44,332 | | | 11.9 | |

| (1) | Excluding Cellular Public Phones and rurals. |

| (2) | Including traffic F2F billing (voice and internet), F2F anf F2M. |

| (3) | Excluding Prepaid cards, including packed minutes plans. |

| (4) | Including Cellular and fixed public phones and Rural fixed and cellular public phones. |

| (5) | Including broad band and Cablenet. |

Item 2

Lima, July 21, 2005

Messers.

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Present-

Ref. : Key Events

Dear Sirs,

Pursuant to the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and Other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you that yesterday, the Board of Directors adopted the following decissions which are considered key events:

| | • | | Presentation of the consolidated and non-consolidated financial statements of the second quarter of year 2005 (which will be duly registered today through the MVNet system), and ordered its register with the Comisión Nacional Supervisora de Empresas y Valores – CONASEV -, the Lima Stock Exchange and other stock market institutions that may be concerned. Enclosed please find the Managing Report regarding the consolidated financial statements. |

| | • | | Acceptance of the resignation as Gerente Central de Recursos y Servicios al Cliente of Mr. Séneca de la Puente Estremadoyro, identified with D.N.I. No. 06417179. Mr. de la Puente has been assigned by the universal shareholders meeting of Telefónica Gestión de Servicios Compartidos Perú S.A.C. as Chief Executive officer of such company, given the resignation of the Mr. José Luis Escobar González, Spanish, identified with C.E. N° °000048880 (passport N° 23784238F). |

| | • | | Designation of Mr. Dennis Fernando Fernández Armas, identified with D.N.I. No. 15971076, as Gerente Central de Recursos y Servicios al Cliente of Telefónica del Perú S.A.A. given the resignation of Mr. de la Puente. |

Finally, we inform you that, as part of the implementation of practices of good corporate government, today the Audit Committee of Telefónica del Perú S.A.A. approved the “Normativa de Funcionamiento del Canal de Denuncias” through which the employees will be

able to communicate and to deal with before said Committee all the information that they have in relation to possible actions that affect negatively internal of control systems the accounting, the financial information or the audit of accounts of the company or of its economic group such mechanism of accusations will be operating before July 31, 2005.

|

Best regards, |

|

| |

Julia María Morales Valentín |

Stock Exchange Representative |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | |

| | | | | Telefónica del Perú |

| | | |

Date: August 4, 2005 | | | | By: | | /s/ Julia María Morales Valentín |

| | | | | | | | | Name: | | Julia María Morales Valentín |

| | | | | | | | | Title: | | General Counsel of Telefónica del Perú S.A.A. |