FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July, 2006

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):N/A

Telefónica del Perú

TABLE OF CONTENTS

| | |

| Item | | |

| 1. | | Translation of a letter to CONASEV, dated July 13, 2006, regarding the detail account of the key events registered on July 6, 2006, as well as the adjustments to the capital stock approved this year. |

| |

| 2. | | Translation of a letter to CONASEV, dated July 19, 2006, regarding the reduction of capital stock. |

| |

| 3. | | Quarterly Results (April-June 2006) of Telefónica del Perú S.A.A. and subsidiaries. |

| |

| 4. | | Translation of a letter to CONASEV, dated July 20, 2006, regarding the Rules related to Key Events. |

Item 1

Lima, July 13, 2006

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Dear Sirs,

Through the following, Telefónica del Perú S.A.A. informs you in detail the key events registered on July 6, 2006, as well as the adjustments to capital stock approved this year by its General Shareholders’ Meeting and Board of Directors, which were duly registered with the Public Registration of the Stock Market.

| | (i) | On March 24, 2006, the General Shareholders’ Meeting approved the amortization of 17,456,037 Class B shares from the own issued shares account, which were purchased in compliance with the agreement presented in the General Shareholders’ Meeting on March 26th, 2004. As a result of such amortization, the capital stock was reduced in S/. 17,456,037.00, that is from S/. 1,721,964,417.00 to S/. 1,704,508,380.00, represented by 1,704,508,380 shares of a nominal value of S/. 1.00 each. |

| | (ii) | On April 24, 2006, the General Shareholders’ Meeting approved the merger project by which Telefónica del Perú S.A.A. merged with Telefónica Empresas Perú S.A.A. As a result of such transaction, the capital stock of Telefónica del Perú S.A.A. was increased in S/. 930,270.00, this is from S/. 1,704,508,380.00 to S/. 1,705,438,650.00, which was materialized through the issue of 930,270 shares. Therefore, the capital stock was established as S/. 1,705,438,650.00, represented by the same number of shares of a nominal value of S/. 1.00 each. |

| | (iii) | In exercise of the faculties granted by the General Shareholders’ Meeting, the Board of Directors on June 5 approved the reduction of capital stock in an amount of S/. 594,758,268.01. Considering that the amount of capital stock reduction will be used for the refund of the contribution of the shareholders, it was necessary to comply with the terms established by law to make such reduction effective. In that sense, it has been established July 26, 2006 as the date for the exchange of the nominal value of the share. It is important to remark that this reduction of capital stock will be executed after the increase approved by the General Shareholders’ Meeting on July 6, 2006 referred on (v) below. |

| | (iv) | Within the merger process indicated above, some shareholders of Telefónica del Perú S.A.A. and of Telefónica Empresas Perú S.A.A. exercised their right of separation pursuant to law. Such right was exercised concerning 536,704 shares, which were acquired by the Company and |

amortized by a decision adopted by the board of directors on June 20, 2006. As a consequence of such amortization of shares, which was executed immediately, the capital stock was reduced from S/. 1,705,438,650.00 to S/. 1,704,901,946.00, represented by the same number of shares of nominal value of S/. 1.00 each. Such capital stock is the result of the merger project by absorption of Telefónica Empresas Peru S.A.A., net of the number of shares of the ones exercised their right of separation.

| | (v) | On July 6, 2006 the General Shareholders’ Meeting approved the capitalization of the result from exposure to inflation accrued as of December 31, 2004 and, consequently, the increase of capital stock in S/. 202,630,820.43. Considering that the amortization of shares detailed in the (iv) above was executed before the reduction of capital stock referred (iii) above, capital stock will be increased from S/. 1,704,901,946.00 to S/. 1,907,532,766.43. The increase of capital stock will be executed on July 25, 2006, before the reduction of capital stock agreed by the Board of Directors on June 5, 2006 and indicate in (iii) above. |

Therefore, on July 25, 2006 the capital stock of Telefónica del Perú S.A.A. :

| | a. | will be increased from S/. 1,704,901,946.00 to S/. 1,907,532,766.43, that is in S/. 202,630,820.43, which will be done through the increase of the nominal value of the share in S/. 0.1188518911045930, this is from S/. 1.00 to S/. 1.1188518911045930, keeping the 1,704,901,946 issued shares; and, |

| | b. | in the same act but immediately after, the capital stock will be reduced in S/. 594,758,268.01, as indicated in (iii) above, this is from S/. 1,907,532,766.43 to S/. 1,312,774,498.42, which will be materialized through the decrease of the nominal value of the share in S/. 0.3488518911045930, this is from S/. 1.1188518911045930 to S/. 0.77. |

After the execution of all the transactions previously indicated, the capital stock of Telefónica del Perú S.A.A. will be of S/. 1,312,774,498.42 and will be represented by 1,704,901,946 shares of a nominal value of S/. 0.77 each.

Finally, it is important to remark that, according to law, we will send you the copies of the public deeds of such operations, duly registered within the following days after the register in the Company’s card.

Sincerely yours,

Julia María Morales Valentín

Telefónica del Perú S.A.A.

Representative to the Stock Exchange

Item 2

Lima, July 19, 2006

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Dear Sirs,

As, it was duly informed, the Board of Directors of Telefónica del Perú S.A.A. on June 5, 2006 approved the reduction of capital stock in an amount of S/. 594,758,268.01, which will be used to refund the shareholders’ contribution in prorate to their participation in the capital stock as S/. 0.3488518911045930 per share. Given that according to the decisions adopted by the Board of Directors, the refund of the contribution will be carried out in Dollars of the United States of America. We inform you that the exchange rate sale published today by the Superintendencia de Banca y Seguros is of S/. 3.242, and therefore, the refund of contributions will be of US$ 0.107603914591176 per share.

Sincerely yours,

Julia María Morales Valentín

Telefónica del Perú S.A.A.

Representative to the Stock Exchange

Item 3

Quarterly Results

Telefónica del Perú S.A.A. and subsidiaries

April – June 2006

1

Significant Events

A summary containing the most significant events since April 2006 is presented below:

| | 1. | Boards of Directors’ Meeting |

Session of April 20, 2006

| | • | | Approved the individual and consolidated financial statements of the Company corresponding to the first quarter of 2006 and decided for their filing with the Comisión Nacional Supervisora de Empresas y Valores (CONASEV), the Lima Stock Exchange (BVL) and corresponding institutions of the stock market. |

| | 2. | Deliberations of the General Shareholders’ Meeting held on April 24: |

| | • | | Approved the merger project of Telefónica Empresas Perú S.A.A. into Telefónica del Perú S.A.A., that will entail the extinguishing of the legal representation of the first one. It also approved the modification of Articles 5 and 6 of the Company’s bylaws. |

| | • | | Approved the distribution and exchange of shares established in the Project. According to it, the shareholders of Telefónica Empresas will receive 2.32541920389 Class B shares of Telefónica del Perú by each share of Telefónica Empresas that they hold at the registry date. |

| | • | | Approved capital stock increase at Telefónica del Perú in the amount of S/. 930,270 that is, from S/. 1,704,508,380 to S/. 1,705,438,650 |

| | 3. | Boards of Directors’ Meeting |

Session of June 05, 2006

| | • | | Call for a General Shareholders’ Meeting to be held on July 06, 2006, to discuss capital stock increase due to the capitalization of the monetary correction accumulated as of December 31, 2004, in the amount of S/. 202,630,820.43; the board also granted powers to modify the first paragraph of Article 5 of the Company’s bylaws. |

| | • | | As part of the capital stock reduction program approved by the General Shareholders’ Meeting on its session held on March 24, 2006, it approved the reduction of capital stock in the amount of S/. 594,758,268.01. This amount will be allocated to reimburse the shareholders’ contributions pro-rata of their participations in the capital stock. Such capital reduction will take place through a decrease in the nominal value of the shares. |

| | 4. | Boards of Directors’ Meeting |

Session of June 20, 2006

| | • | | Approved the amortization of 536,704 Class B shares of Telefónica del Perú S.A.A., which corresponded to the shareholders that exercised their right of withdrawal, according to law. As a consequence, it approved the reduction of capital stock in S/. 536,704.00, that is from S/. 1,705,538,650.00 to S/. 1,704,901,946.00, as well as the modification of the first paragraph of article 5 of the Company’s bylaws. |

| | 5. | Deliberations of the General Shareholders’ Meeting held on July 6: |

| | • | | Approved the capitalization of results for inflation expose on December 31, 2006, by consequence, capital stock increased in the amount of S/. 202,630,820.43 that is, from S/. 1,704,901,946.00 to S/. 1,907,532,766.43. |

| | • | | Approved that such capital grow will take place through a increase in the nominal value of the shares, keeping the same number of shares and don’t change the participation of the shareholders in the capital stock. |

2

| | • | | Approved to grant powers to the Board of Directors of Telefónica del Perú to modify the first paragraph of Article 5 of the Company’s bylaws. |

| | 6. | Appointments and resignations: |

| | • | | On June 20, 2006, the resignation of Mr. Álvaro Badiola to the position of Vice-President of Management Control was accepted. Mr. Badiola was promoted by the Group to a position in Telefónica Internacional S.A. Mr. Juan Parra, a Chilean national, identified with passport # 7986115-4, was appointed as his replacement. |

3

TELEFÓNICA DEL PERÚ S.A.A. AND SUBSIDIARIES

Management discussion and analysis of the consolidated results

for the second quarter ended on June 30, 2006

It is recommended the reading of this report along with the corresponding financial statements and their notes, presented at the same time, since they form integral part of this document and contain complementary information.

Economic Environment

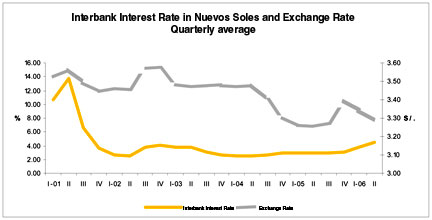

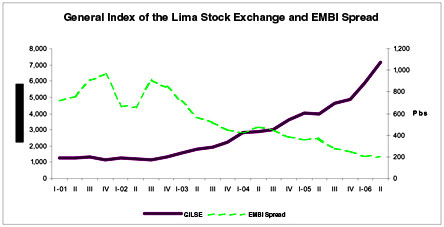

The Peruvian economy continues to show solid indicators in terms of Gross Domestic Product (GDP), inflation (Consumer Price Index) and external and fiscal accounts. Moreover, after the elections, the financial variables showed stability and even strength, particularly the foreign exchange rate and the stock market indexes.

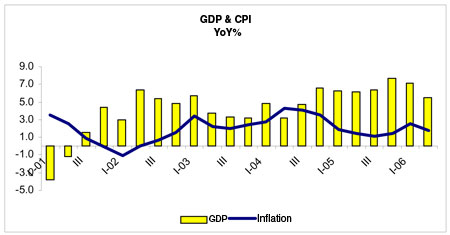

In the 2Q06, it is estimated that the economy could have grown 5.5%. The Ministry of Economy and Finance (MEF) estimates a growth of 6%, while the International Monetary Fund estimates a growth of 5.5%, in line with estimate of the local analysts. Lately, the non-primary sectors, specially construction and services, are the ones that are growing the most. Regarding inflation, since the 1Q05, the inflation rate of the last 12 months fluctuates between 1.1% and 2.5%, which is the lower range of the annual target established by the Central Bank (BCR). There are no major risks for a substantial increase in the inflation rate, which led the BCR to maintain its reference interest rate in 4.5%.

Furthermore, the fiscal and external accounts continue to show strength. Tax collection due to the IGV (Peruvian Value Added Tax) and income tax keep growing at rates higher than 20%, which implies a fiscal deficit for the year lower than 1% of the GDP. On the other hand, the surplus of the commercial balance, fueled by the increase in the price of commodities, surpasses US$ 6,000 million, close to US$ 900 million higher than the one of 2005.

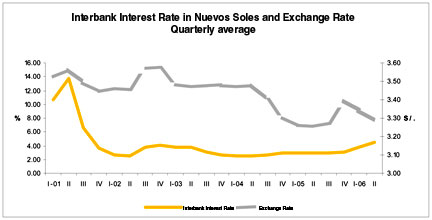

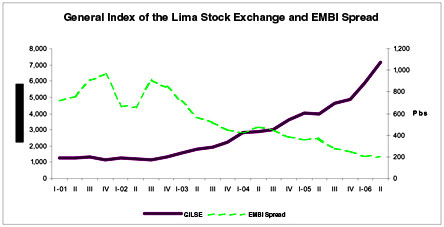

Furthermore, the Nuevo Sol continued to strengthen, a midst a lower political noise and a higher seasonal demand for the local currency, and despite the continuous and significant purchases of dollars by the BCR. Recently, the exchange rate dropped below S/. 3.24, the lowest level since January 1999. Additionally, share prices of the main companies in the Lima Stock Exchange, particularly the mining and banking sectors, continued to rise. Finally, the interest rates increased slightly, in line with the international rates, whereas the country risk – measured by the EMBI – fell after then second round of the elections, somehow isolated from the volatility within the region.

4

Competitive Environment

During the first half of 2006, the competitive pressure in the different businesses in which the Company operates continued, mainly by the substitution effect from other technologies like mobile telephony. Furthermore, the presence of other companies in the market is increasing in the businesses of Local Telephony, Public Telephony and Long Distance. It is worth noting the impact caused by the strong increase of the number of subscribers in mobile telephony, which resulted in a decrease in traffic of fixed-to-fixed and fixed-to-mobile minutes. Moreover, the increasing proliferation of informal phone booths is significantly impacting the businesses of Public Telephony and Long Distance. Conversely, the main competitors in local telephony – Telmex and Americatel – continue with their strategy of mainly focusing on the corporate business sector.

On the other hand, the long distance business shows high competition with several players both in the direct dial-up as well as the sale of prepaid cards. The application by the Regulator of the tariff imputation proof (minimum prices in domestic long distance) did not allow Telefónica del Perú to match the lower prices of the competition, which resulted in a traffic drop and the consequent reduction in the market share. On the other hand and in the case of public telephony, the competition – mainly Telmex – had an important growth in its plant.

5

Operating revenues1

Theoperating revenues in the 2Q06 totaled S/. 1,115 million, 11.4% above the ones registered in the 2Q05, mainly as a result of registering the revenues from Telefónica Empresas S.A.A. starting November 2005. If we excluded the effect of Telefónica Empresas the increase in revenues would be reduced to 6.9%

Therefore, higher revenues are recorded in the businesses of Data and Information Technology (270.1%), Internet (45.7%), Cable TV (21.5%), Local Telephony (2.9%) and Others (3.0%), which offset the drop in revenues registered in the businesses of Long Distance (6.5%) and Public and Rural Telephony (3.7%).

For 1H06 the operating revenues totaled S/. 2,238 million, which represents an increase of 8.9% compared to the 1H05, as a result of higher revenues mainly in the businesses of Data and Information Technology (243.9%), Internet (43.9%) and Cable TV (20.4%), which offset the lower revenues registered in the businesses of Local Telephony (1.9%), Long Distance (4.6%), Public and Rural Telephony (1.0%) and Others (0.2%). If we excluded the effect of Telefónica Empresas the increase in revenues would be reduced to 4.6%

Furthermore, it is worth noting that the Company has developed a vast organizational effort to increase market penetration through the offering of services, in order to accomodate the specific needs of each market segment, as well as customer loyalty campaigns, which resulted in a significant increase in the number of clients of the main services it offers (basic telephony lines, broadband and cable TV). Therefore, by the end of the 2Q06, the total number of accesses showed an important annual growth of 8.2% in fixed telephony lines, 40.9% in broadband accesses, 17.5% in cable TV subscribers and 7.4% in public and rural telephony lines.

Regarding the performance of the businesses, the revenues fromLocal Telephonyreached S/. 407 million in the 2Q06, an increase of 2.9% compared to the 2Q05, mainly explained by the y-o-y growth of 8.2% in the plant in service that reached 2.3 million lines, which offset the negative impact of the application of the productivity factor and the drop in traffic. As well, the revenues for the 1H06 showed a decrease of 1.9% compared to the 1H05, reaching S/. 821 million, mainly due to the negative impact of the application of the productivity factor of 10.07% and the drop in traffic, which despite the continuous growth of the plant, is being affected by a shift to the prepaid lines and by mobile to mobile traffic substitution.

Long Distance revenues fell 6.5% in the 2Q06 compared to the 2Q05, totaling S/. 123 million. The drop in revenues form DLD (9.9%), as a result of lower traffic from public telephones (coins and cards), were not offset by the higher revenues from ILD (1.8%), the latter as a result of the higher revenues from Incoming ILD, as well as revenues for outgoing ILD calls coming from mobile operators. The long distance market continues under pressure by a highly competitive environment, mainly in the prepaid card segment and public telephony from an informal nature, rendered through informal phone booths. Additionally, regulatory measures like the tariff imputation proof in DLD established by Osiptel have lowered volume traffic. Revenues in the 1H06 totaled S/. 255 million, 4.6% lower than in the 1H05, due to lower revenues in DLD in 9.0%. Such effect was partially offset by higher revenues in ILD in 6.9%, resulting from higher incoming traffic.

The revenues fromPublic and Rural Telephony reached S/. 190 million in the 2Q06, representing a 3.7% decrease when compared to 2Q05, while in the 1H06 reached S/. 403 million, 1.0% down from the ones of 1H05. The decrease is mainly due to the substitution effect from the mobile telephony and the competitive environment. This decrease took place despite the 7.4% y-o-y growth of the plant in service, as well as the 3.7% increase in the revenues of rural telephony, the latter as a result of the qualification of Telefónica as a Rural Operator.

Cable Television revenues reached S/. 86 million in the 2Q06, which represents a 21.5% increase compared to the 2Q05. Furthermore, the 1H06 showed a 20.4% growth compared to the 1H05, reaching S/. 171 million. This growth is explained by the y-o-y increase of 17.5% in the number of subscribers, reaching 490 thousand by the end of June 2006, as a result of the continuous commercial effort carried out to gain new clients, as well as the execution of a permanent program against illegal installations.

| 1 | On October 21, 2005, Telefónica del Perú S.A.A. acquired 97.86% of the capital stock of Telefónica Empresas S.A.A. The merger is effective from May on, as approved by the General Shareholders’ Meeting held on April 24, 2006. |

6

The revenues forInternetreached S/. 132 million in the 2Q06, an increase of 45.7% compared to the 2Q05. The increase is chiefly explained by the growth of the broadband plant in 40.9%, reaching 389 thousand lines in service through permanent commercial actions aimed to provide the customers with greater benefits. Also, the revenues for the 1H06 reached S/. 254 million, 43.9% higher than in the 1H05.

The revenues forData and Information Technologyreached S/. 81 million in the 2Q06, 270.1% higher than in the 2Q05, and S/. 153 million in the 1H06, 243.9% higher than in the 1H05. This increase is mainly explained by the additional recording of the revenues for these services, after the merger of Telefónica Empresas into the Consolidated Group of Telefónica del Perú.

Operating expenses

The operating expenses in the 2Q06 totaled S/. 894 million, which represents an increase of 4.4% compared to the S/. 857 million registered in the 2Q05. This is chiefly explained by the merger of Telefónica Empresas and the costs associated with the plant expansion. Higher expenses were recorded for: general and administrative expenses in S/. 33 million, personnel expenses in S/. 18 million – due to a higher average headcount in 21.6%-, and materials and supplies in S/. 11 million. These increases were partially offset by the lower expenses recorded for: depreciation and amortization in S/. 16 million, provisions in S/. 11 million, and the lower interconnection expenses in S/. 7 million.

For 1H06 the operating expenses totaled S/. 1,809 million, which represent an increase of 5.6% compared to the 1H05, mainly as a result of higher general and administrative expenses of S/. 37 million, personnel expenses of S/. 36 million, depreciation and amortization expenses of S/. 31 million, materials and supplies expenses of S/. 19 million and management fee expenses of S/. 9 million, which offset the lower expenses in interconnection for S/. 29 million, and the lower expenses recorded for bad debt provisions of S/. 14 million, for the same reasons explained in the previous paragraph.

Operating Result

The operating result for the 2Q06 increased 53.3% compared to the 2Q05, from S/. 144 million to S/. 220 million. Excluding the effect of Telefónica Empresas, the operating result increased 46%.

Likewise, in the 1H06 the operating result increased S/. 86 million compared to the 1H05, as a result of the higher revenues recorded in the businesses of Data and Information Technology and Internet, which compensated the higher operating expenses. Excluding the effect of Telefónica Empresas the operating result increased S/. 60 million.

Non-operating Result

In the 2Q06, the non-operating result went from a loss of S/. 60 million in the 2Q05 to a loss of S/. 76 million in the 2Q06, reflecting a loss of S/. 15 million in foreign exchange in the 2Q06 compared to 2Q05, due to the impact of the generation of de new sol over the year in the net monetary position. Likewise, the net financial expenses show an increase of S/. 10 million as a result of the higher debt level, while other net revenues/expenses decreased S/. 8 million, mainly as a result of the lower registry of contingencies.

In the 1H06, the non-operating result improved S/. 16 million compared to the 1H05, chiefly as a consequence of a significant reduction of S/. 60 million in other net revenues/expenses (essentially by lower adjustments for contingencies), which offset the higher net financial expenses that rose S/. 26 million, as in the quarter. This was the result of the higher debt level and an increased loss of S/. 19 million in foreign exchange when compared to the 1H05, due to the same reasons stated in the previous paragraph.

7

Net result

The net result reached S/. 75 million in the 2Q06, compared to the S/. 47 million in the 2Q05. An increase of 121.1% is recorded, from S/. 67 million in the 1H05 to S/. 147 million in the 1H06. This increase is mainly explained by the better operating result, product of the merger of Telefónica Empresas, as well as the better non-operating result.

Consolidated Balance Sheet

The liquidity levels of the Company – measured by the current assets over current liabilities ratio – reached 0.66 in the 2Q06, slightly higher than the 0.64 recorded in the 1Q06, mainly as a consequence of the higher cash levels. Regarding the capacity for debt payment, the financial coverage ratio (debt – cash and cash equivalents / operating result + depreciation and amortization) slightly decreased from 0.95 in the 1Q06 to 0.93 in the 2Q06. Furthermore, the investments executed for the extension of the services reached S/. 184.3 million in the 2Q06.

8

TABLE 1

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES1/.

CONSOLIDATED INCOME STATEMENT (S/. 000)

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2Q05 | | | 2Q06 | | | Var. Abs.

2Q06-2Q05 | | | Var. %

2Q06-2Q05 | | | 6M05 | | | 6M06 | | | Abs.Var.

6M06-6M05 | | | Var. %

6M06-6M05 | |

| | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | |

Total Operating Revenues | | 1,000,683 | | | 100.0 | | | 1,114,789 | | | 100.0 | | | 114,106 | | | 11.4 | | | 2,055,602 | | | 100.0 | | | 2,237,876 | | | 100.0 | | | 182,274 | | | 8.9 | |

Local Telephone Service | | 395,275 | | | 39.5 | | | 406,542 | | | 36.5 | | | 11,267 | | | 2.9 | | | 836,789 | | | 40.7 | | | 820,906 | | | 36.7 | | | (15,883 | ) | | (1.9 | ) |

Long Distance | | 131,922 | | | 13.2 | | | 123,299 | | | 11.1 | | | (8,623 | ) | | (6.5 | ) | | 267,354 | | | 13.0 | | | 254,985 | | | 11.4 | | | (12,369 | ) | | (4.6 | ) |

Public Telephones | | 197,810 | | | 19.8 | | | 190,420 | | | 17.1 | | | (7,390 | ) | | (3.7 | ) | | 407,105 | | | 19.8 | | | 403,146 | | | 18.0 | | | (3,959 | ) | | (1.0 | ) |

Cable TV | | 70,824 | | | 7.1 | | | 86,064 | | | 7.7 | | | 15,240 | | | 21.5 | | | 141,857 | | | 6.9 | | | 170,806 | | | 7.6 | | | 28,949 | | | 20.4 | |

Data & Information Technology | | 22,017 | | | 2.2 | | | 81,480 | | | 7.3 | | | 59,463 | | | 270.1 | | | 44,381 | | | 2.2 | | | 152,627 | | | 6.8 | | | 108,246 | | | 243.9 | |

Internet | | 90,470 | | | 9.0 | | | 131,849 | | | 11.8 | | | 41,379 | | | 45.7 | | | 176,717 | | | 8.6 | | | 254,285 | | | 11.4 | | | 77,568 | | | 43.9 | |

Other | | 92,365 | | | 9.2 | | | 95,135 | | | 8.5 | | | 2,770 | | | 3.0 | | | 181,399 | | | 8.8 | | | 181,121 | | | 8.1 | | | (278 | ) | | (0.2 | ) |

| | | | | | | | | | | | |

Total Operating Costs & Expenses | | 856,991 | | | 85.6 | | | 894,496 | | | 80.2 | | | 37,505 | | | 4.4 | | | 1,713,279 | | | 83.3 | | | 1,809,111 | | | 80.8 | | | 95,832 | | | 5.6 | |

Interconnection Expenses | | 161,443 | | | 16.1 | | | 154,943 | | | 13.9 | | | (6,500 | ) | | (4.0 | ) | | 331,521 | | | 16.1 | | | 302,596 | | | 13.5 | | | (28,925 | ) | | (8.7 | ) |

Personnel | | 96,269 | | | 9.6 | | | 114,677 | | | 10.3 | | | 18,408 | | | 19.1 | | | 190,072 | | | 9.2 | | | 225,930 | | | 10.1 | | | 35,858 | | | 18.9 | |

General and Administrative | | 260,040 | | | 26.0 | | | 292,926 | | | 26.3 | | | 32,886 | | | 12.6 | | | 537,233 | | | 26.1 | | | 574,427 | | | 25.7 | | | 37,194 | | | 6.9 | |

Depreciation and Amortization | | 294,901 | | | 29.5 | | | 278,803 | | | 25.0 | | | (16,098 | ) | | (5.5 | ) | | 575,381 | | | 28.0 | | | 606,033 | | | 27.1 | | | 30,652 | | | 5.3 | |

Management Fee | | 9,887 | | | 1.0 | | | 14,403 | | | 1.3 | | | 4,516 | | | 45.7 | | | 20,302 | | | 1.0 | | | 29,250 | | | 1.3 | | | 8,948 | | | 44.1 | |

Materials and Supplies | | 18,746 | | | 1.9 | | | 29,622 | | | 2.7 | | | 10,876 | | | 58.0 | | | 34,891 | | | 1.7 | | | 54,102 | | | 2.4 | | | 19,211 | | | 55.1 | |

Provisions | | 24,627 | | | 2.5 | | | 13,552 | | | 1.2 | | | (11,075 | ) | | (45.0 | ) | | 41,899 | | | 2.0 | | | 28,136 | | | 1.3 | | | (13,763 | ) | | (32.8 | ) |

Own Work Capitalized | | (8,922 | ) | | (0.9 | ) | | (4,430 | ) | | (0.4 | ) | | 4,492 | | | (50.3 | ) | | (18,020 | ) | | (0.9 | ) | | (11,363 | ) | | (0.5 | ) | | 6,657 | | | (36.9 | ) |

| | | | | | | | | | | | |

Operating Income | | 143,692 | | | 14.4 | | | 220,293 | | | 19.8 | | | 76,601 | | | 53.3 | | | 342,323 | | | 16.7 | | | 428,765 | | | 19.2 | | | 86,442 | | | 25.3 | |

| | | | | | | | | | | | |

Other Income (Expenses) | | | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Income | | 5,156 | | | 0.5 | | | 8,363 | | | 0.8 | | | 3,207 | | | 62.2 | | | 8,313 | | | 0.4 | | | 14,763 | | | 0.7 | | | 6,450 | | | 77.6 | |

Interest Expenses | | (35,123 | ) | | (3.5 | ) | | (47,874 | ) | | (4.3 | ) | | (12,751 | ) | | 36.3 | | | (63,715 | ) | | (3.1 | ) | | (96,651 | ) | | (4.3 | ) | | (32,936 | ) | | 51.7 | |

Others Net | | (29,760 | ) | | (3.0 | ) | | (21,319 | ) | | (1.9 | ) | | 8,441 | | | (28.4 | ) | | (95,801 | ) | | (4.7 | ) | | (35,208 | ) | | (1.6 | ) | | 60,593 | | | (63.2 | ) |

Net Currency Exchange (Loss) 2/. | | 108 | | | 0.0 | | | (14,991 | ) | | (1.3 | ) | | (15,099 | ) | | (13,980.6 | ) | | (1,729 | ) | | (0.1 | ) | | (20,280 | ) | | (0.9 | ) | | (18,551 | ) | | 1,072.9 | |

| | | | | | | | | | | | |

Non Operating Income | | (59,619 | ) | | (6.0 | ) | | (75,821 | ) | | (6.8 | ) | | (16,202 | ) | | 27.2 | | | (152,932 | ) | | (7.4 | ) | | (137,376 | ) | | (6.1 | ) | | 15,556 | | | (10.2 | ) |

| | | | | | | | | | | | |

Income Before Taxes and Participation | | 84,073 | | | 8.4 | | | 144,472 | | | 13.0 | | | 60,399 | | | 71.8 | | | 189,391 | | | 9.2 | | | 291,389 | | | 13.0 | | | 101,998 | | | 53.9 | |

| | | | | | | | | | | | |

Worker’s Participation | | (10,713 | ) | | (1.1 | ) | | (18,295 | ) | | (1.6 | ) | | (7,582 | ) | | 70.8 | | | (32,654 | ) | | (1.6 | ) | | (38,192 | ) | | (1.7 | ) | | (5,538 | ) | | 17.0 | |

Income Tax | | (26,381 | ) | | (2.6 | ) | | (51,007 | ) | | (4.6 | ) | | (24,626 | ) | | 93.3 | | | (90,101 | ) | | (4.4 | ) | | (105,837 | ) | | (4.7 | ) | | (15,736 | ) | | 17.5 | |

| | | | | | | | | | | | |

Net Income | | 46,979 | | | 4.7 | | | 75,170 | | | 6.7 | | | 28,191 | | | 60.0 | | | 66,636 | | | 3.2 | | | 147,360 | | | 6.6 | | | 80,724 | | | 121.1 | |

| 1/ | Starting November 2005 the financial statements of Telefonica del Perú S.A.A. And Subsidiaries include the results of Telefónica Empresas S.A.A. |

| 2/ | Starting January 1, 2005 and in accordance with the Consejo Normativo de Contabilidad by-law N°031-2004, the financial statements will not be adjusted for inflation for accounting matters. |

TABLE 2

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES1/.

CONSOLIDATED BALANCE SHEET (S/. 000)2/.

| | | | | | | | | | | | | | | |

ASSETS | | | | | | | | | | | | | | | |

| | | 2Q06 | | | 1Q06 | | | 4Q05 | | | 3Q05 | | | 2Q05 | |

CURRENT ASSETS | | | | | | | | | | | | | | | |

| | | | | |

Cash and Banks | | 732,870 | | | 463,660 | | | 634,189 | | | 331,241 | | | 768,061 | |

Negotiable securities | | 10,984 | | | 48,170 | | | 38,327 | | | 52,315 | | | 41,823 | |

Accounts receivable - net | | 670,744 | | | 651,315 | | | 698,615 | | | 585,709 | | | 591,746 | |

Other accounts receivable | | 85,366 | | | 128,212 | | | 107202 | | | 93975 | | | 91969 | |

Materials and supplies | | 38,479 | | | 41,667 | | | 39,583 | | | 41,828 | | | 39,280 | |

Prepaid taxes and expenses and others | | 53,172 | | | 37,272 | | | 45,068 | | | 53,244 | | | 56,542 | |

| | | | | |

Total Current Assets | | 1,591,615 | | | 1,370,296 | | | 1,562,984 | | | 1,158,312 | | | 1,589,421 | |

| | | | | |

LONG-TERM INVESTMENTS | | 10,188 | | | 11,907 | | | 10,703 | | | 11,678 | | | 10,755 | |

DEFERRED CHARGES | | 32,678 | | | 33,438 | | | 10,487 | | | 8,266 | | | 8,699 | |

PROPERTY, PLANT AND EQUIPMENT | | 16,127,608 | | | 16,025,628 | | | 15,995,439 | | | 15,790,375 | | | 15,642,038 | |

Accumulated Depreciation | | (11,234,004 | ) | | (10,975,249 | ) | | (10,675,496 | ) | | (10,372,035 | ) | | (10,109,099 | ) |

| | | | | | | | | | | | | | | |

| | 4,893,604 | | | 5,050,379 | | | 5,319,943 | | | 5,418,340 | | | 5,532,939 | |

Write-Off Provision | | (18,363 | ) | | (18,363 | ) | | (30,777 | ) | | (83,085 | ) | | (88,510 | ) |

| | | | | | | | | | | | | | | |

| | 4,875,241 | | | 5,032,016 | | | 5,289,166 | | | 5,335,255 | | | 5,444,429 | |

Other Assets, Net | | 296,609 | | | 306,217 | | | 328,891 | | | 213,974 | | | 209,744 | |

| | | | | | | | | | | | | | | |

TOTAL ASSETS | | 6,806,331 | | | 6,753,874 | | | 7,202,231 | | | 6,727,485 | | | 7,263,048 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | |

| | | 2Q06 | | | 1Q06 | | | 4Q05 | | | 3Q05 | | | 2Q05 | |

CURRENT LIABILITIES | | | | | | | | | | | | | | | |

| | | | | |

Overdrafts | | 5,658 | | | 8,670 | | | 5,531 | | | 4,759 | | | 4,456 | |

Accounts payable | | 488,406 | | | 449,169 | | | 512,924 | | | 421,070 | | | 385,536 | |

Other accounts payable | | 751,773 | | | 802,696 | | | 1,087,407 | | | 1,112,183 | | | 987,881 | |

Provision for severance indemnities | | 5,580 | | | 12,305 | | | 5,132 | | | 9,749 | | | 4,452 | |

Bank Loans3/. | | 242,617 | | | 238,353 | | | 241,775 | | | 225,625 | | | 304,350 | |

Current portion of long-term debt | | 407,290 | | | 123,719 | | | 44,983 | | | 49,623 | | | 49,439 | |

Current portion of bonds | | 521,808 | | | 492,479 | | | 392,628 | | | 278,100 | | | 163,977 | |

Commercial Papers | | — | | | 25,000 | | | 126,900 | | | 282,900 | | | 328,185 | |

| | | | | |

Total Current Liabilities | | 2,423,132 | | | 2,152,391 | | | 2,384,009 | | | 2,228,276 | | | 2,195,652 | |

| | | | | |

LONG-TERM DEBT3/. | | 359,689 | | | 542,314 | | | 637,535 | | | 636,661 | | | 468,955 | |

BONDS | | 1,064,817 | | | 1,111,200 | | | 1,193,707 | | | 710,849 | | | 822,824 | |

GUARANTY DEPOSITS | | 65,269 | | | 76,218 | | | 83,308 | | | 106,929 | | | 105,114 | |

DEFERRED TAXES | | 539,373 | | | 593,804 | | | 667,357 | | | 785,815 | | | 843,857 | |

| | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

| | | | | |

Capital stock | | 1,908,681 | | | 1,907,139 | | | 1,924,595 | | | 1,924,595 | | | 2,355,086 | |

Treasury Shares | | | | | | | | (21,896 | ) | | (21,896 | ) | | (21,896 | ) |

Legal reserve | | 58,603 | | | 58,603 | | | 33,275 | | | 33,275 | | | 377,668 | |

Retained earnings | | 390,120 | | | 315,518 | | | 273,096 | | | 167,248 | | | 83,164 | |

Other reserves | | (3,353 | ) | | (3,313 | ) | | -6,026 | | | | | | | |

| | | | | | | | | | | | | | | |

TOTAL SHAREHOLDERS’ EQUITY | | 2,354,051 | | | 2,277,947 | | | 2,203,044 | | | 2,103,222 | | | 2,794,022 | |

| | | | | | | | | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 6,806,331 | | | 6,753,874 | | | 7,202,231 | | | 6,727,485 | | | 7,263,048 | |

| | | | | | | | | | | | | | | |

| 1/ | Starting November 2005 the financial statements of Telefonica del Perú S.A.A. And Subsidiaries include the results of Telefónica Empresas S.A.A. |

| 2/ | Starting January 1, 2005 and in accordance with the Consejo Normativo de Contabilidad by-law N°031-2004, the financial statements will not be adjusted for inflation for accounting matters. |

| 3/ | Include the passive position of financial derivatives instruments. |

TABLE 3

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Data for each period

| | | | | | | | | | | | | | | | |

| | | 2Q05 | | 3Q05 | | 4Q05 | | 1Q06 | | 2Q06 | | Abs.Var.

2Q06 - 2Q05 | | | 2Q06/

2Q05 | |

| TELEFONÍA BÁSICA | | | | | | | | | | | | | | | | |

| Fixed-Wire Telephone Service: Local+Long Distance | | | | | | | | | | | | | | | | |

Lines Installed | | 2,396,113 | | 2,455,347 | | 2,509,789 | | 2,538,949 | | 2,580,737 | | 184,624 | | | 7.7 | |

Net gains (loss) of lines in service | | 46,115 | | 49,558 | | 46,470 | | 37,746 | | 40,690 | | (5,425 | ) | | (11.8 | ) |

Lines in Service, including public phones (1) | | 2,250,663 | | 2,302,585 | | 2,348,139 | | 2,388,836 | | 2,434,290 | | 183,627 | | | 8.2 | |

| | | | | | | |

Local Traffic - Minutes (000) (2) | | 1,247,663 | | 1,236,312 | | 1,205,026 | | 1,216,188 | | 1,176,153 | | (71,509 | ) | | (5.7 | ) |

Long Distance - Minutes (000) (3) | | 286,576 | | 294,434 | | 329,467 | | 319,281 | | 306,661 | | 20,085 | | | 7.0 | |

| | | | | | | |

Number of Employees (Telefónica del Perú and Subsidiaries) (4) | | 5,280 | | 5,371 | | 6,163 | | 6,504 | | 6,340 | | 1,060 | | | 20.1 | |

Number of Employees (Telefónica del Perú) | | 3,170 | | 3,196 | | 3,449 | | 3,452 | | 3,917 | | 747 | | | 23.6 | |

Lines in Service per Employee (Telefónica del Perú) (5) | | 710 | | 720 | | 681 | | 692 | | 621 | | (88.5 | ) | | (12.5 | ) |

Digitalization Rate (%) | | 96.7 | | 96.7 | | 96.8 | | 96.8 | | 97.2 | | 0.5 | | | 0.5 | |

Lines in Service per 100 inhabitants | | 8.1 | | 8.3 | | 8.4 | | 8.5 | | 8.7 | | 0.6 | | | 7.4 | |

| | | | | | | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (6) | | 134,423 | | 137,226 | | 136,486 | | 139,499 | | 144,339 | | 9,916 | | | 7.4 | |

| | | | | | | |

INTERNET | | | | | | | | | | | | | | | | |

Subscribers (7) | | 276,151 | | 310,470 | | 340,436 | | 359,672 | | 389,119 | | 112,968 | | | 40.9 | |

| | | | | | | |

CABLE TV | | | | | | | | | | | | | | | | |

Subscribers | | 417,535 | | 437,172 | | 462,211 | | 474,710 | | 490,442 | | 72,907 | | | 17.5 | |

| (1) | Excluding Cellular Public Phones and rurals |

| (2) | Including traffic F2F billing (voice and internet), F2M and M2F |

| (3) | Excluding Prepaid cards, including packed minutes plans. |

| (4) | Includes personnel of Telefonica Empresas starting November 2005 |

| (5) | Starting November 2005, includes personnel of Telefonica Empresas. |

| (6) | Includes Public Telephones, Cellular and Rural Telephones. |

| (7) | Includes Speedy Traditional , Speedy Business, GIGA ADSL , Cablenet, and starting 2006 includes accesses to Optic Fiber . |

Item 4

Lima, July 20, 2006

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Dear Sirs:

According to Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications, Telefónica del Perú S.A.A. informs you that yesterday its Board of Directors adopted the following decisions which are considered key events:

| | • | | Presentation of the Company’s consolidated and non-consolidated financial statements of the second quarter of 2006 – which will be duly registered today through the MVNet system – and ordered its register with the Comisión Nacional Supervisora de Empresas y Valores – CONASEV – , the Lima Stock Exchange and other stock market institutions that may be concerned. Enclosed please find the Managing Report regarding the consolidated financial statements. |

| | • | | In exercise of the faculties granted by the Annual Shareholders’ Meetings on March 24, 2006, approved the designation of Medina, Zaldívar, Paredes and Asociados Sociedad Civil (member of the international firm Ernst & Young) as external auditor for 2006. |

| | • | | In exercise of the faculties that delegates by the General Shareholders’ Meeting on July 6, 2006, determined the capital figure and approved the modification of Article 5 of the bylaws in the following terms: |

“Article 5.- the capital of the Company is S/. 1,312,774,498.42 (thousand three hundred twelve million seven hundred seventy-four thousand four hundred ninety-eight and 42/100 Nuevos Soles), represented by 1,704,901,946 nominatives shares of S/. 0.77 each, totally issued and paid and divided in three classes as follows:

| | a) | 669,762,378 shares of Class A-1 |

| | b) | 1,034,882,961 shares of Class B |

| | c) | 256,607 shares of Class C |

(...)”

Sincerely,

Julia María Morales Valentín

Stock Market Representative

Telefónica del Perú S.A.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | Telefónica del Perú |

| | |

| Date: July 25, 2006 | | By: | | /s/ Julia María Morales Valentín |

| | Name: | | Julia María Morales Valentín |

| | Title: | | General Counsel of Telefónica del Perú S.A.A. |