FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2007

Commission File Number: 001-14404

Telefónica del Perú S.A.A.

(Translation of registrant’s name into English)

Avenida Arequipa 1155

Santa Beatriz, Lima, Perú

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):N/A

Telefónica del Perú

TABLE OF CONTENTS

Item 1

Lima, February 8, 2007

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Dear Sirs:

In compliance with Article 28 of the Stock Market Law, approved by Supreme Decree N° 093-2002-EF, and CONASEV Resolution N° 107-2002-EF/94.10, enclosed to the present we submit a copy of the Public Deed of the merger project between Telefónica del Perú S.A.A. and Telefónica Empresas Perú S.A.A. duly executed in the presence of the Public Notary of Lima, Doctor Jaime Murguía as deposition of its inscription in the registry certificate of both companies. At the same time, we include the balances at closing and opening of the fusion of the referred companies. Finally we comply with indicating that having prospered the registry inscription of said fusion, the procedure for the exclusion of the shares of Telefónica Empresas Perú S.A.A. from the Public Registry of the Stock Market will continue. Finally we indicate that the exchange of provisional shares performed acquires the quality of final in merit to the indicated registry inscription.

We remain at your service for any additional information that can be required.

Sincerely,

Julia María Morales Valentín

Stock Exchange Representative

Telefónica del Perú S.A.A.

Item 2

Lima, February 13, 2007

PUBLIC REGISTRY OF THE STOCK MARKET

NATIONAL SUPERVISORY COMMISSION

ON COMPANIES AND SECURITIES (CONASEV)

Dear Sirs:

According to Article 28 of the Peruvian Capital Markets Law and regarding the Rules related to Key Events, Private Information and other Communications approved by CONASEV Resolution No. 107-2002-EF/94.10, Telefónica del Perú S.A.A. informs you that yesterday, the Board of Directors adopted the following decisions which are considered key events:

| | • | | Presentation of the consolidated and non-consolidated financial statements of the company for the fourth quarter of 2006 and annual preliminary – which will be duly registered through the MVNet system today. Find enclosed the management report of the financial statements consolidated as to the fourth quarter of 2006. |

| | • | | Delegated faculties in the Executive President, the Chief Executive Officer, the General Secretary and the Central Manager of Finances so that any of them may determine the date, place and hour of execution of the Special Class B Shareholders’ Meeting and of Annual Shareholders’ Meeting, for Shareholders in first, second or third citation; establish the dates of respective registration; determine the agendas that will be treated in both meetings; arrange, according to law, the publication of the notices of respective assembly; formulate the motions and, in general, adopt the measures that turn out to be necessary or convenient for its normal development. |

Sincerely,

Julia María Morales Valentín

Stock Exchange Representative

Telefónica del Perú S.A.A.

Item 3

Quarterly Results

Telefónica del Perú S.A.A. and Subsidiaries

October - December 2006

Significant Events

A summary containing the most significant events since September 2006 is presented below:

Merger between Telefónica del Perú S.A.A and Telefónica Perú Holding S.A.C. (TPH)

| 1. | The Board of Directors’ meeting held on October 18, 2006, approved the following: |

| | • | | Approve the merger project between Telefónica del Perú S.A.A. and Telefónica Perú Holding S.A.C. |

| 2. | The following resolutions were approved at the General Shareholders’ Meeting held on November 16, 2006: |

| | • | | The merger project between Telefónica del Perú S.A.A and Telefónica Perú Holding S.A.C, through which Telefónica Perú Holding S.A.C. would be fully incorporated by Telefónica del Perú S.A.A. |

| | • | | A reduction of the capital stock of Telefónica del Perú in an amount equivalent to the total nominal value of the shares received from Telefónica Perú Holding and issued by Telefónica del Perú, as a result of the merger. |

| | • | | As a result of the merger the capital stock of Telefónica del Perú was increased by S/. 1,425,068,614.44 to S/. 2,727,843, 113.60, while the nominal value of the shares was increased from S/. 0.77 to S/. 1.52. |

3. | On January 25th of 2007 the board of directors established the reduction of the nominal value of Telefónica shares from S/. 1.60 to S/. 1,52 for an amount of S/ 136,392,155.68 of its capital stock to offset the loss generated in retained earnings as a result of the merger. |

Appointments and resignations

1. | On November 23rd the board of directors accepted the resignation of Mr. Antonio Carlos Valente da Silva as chairman of the board of directors of Telefónica del Perú S.A.A , and appointed Mr. José Javier Manzanares Gutiérrez as new chairman of the board. Also the board appointed Mr. Luis Bernardo Silva as Vice-president of human resources and Luis Fernández Jiménez as Vice-president of planning and network engineering. |

| 2. | On December 12, 2006 the Board of Directors accepted the resignation of Mr. Carlos Graham Sardi as Residential Vice-president of Telefónica del Perú S.A.A., due to his new appointment as general manager of Telefónica Multimedia S.A.C. The board appointed Mr. Cesar Andrade Nicoli in his place. |

Agreements with the government

On December 22, 2006, talks between the Peruvian government and Telefónica del Perú S.A.A., to promote the development of telecommunication public services were completed. The following are the main agreements:

| | • | | Reduce the average tariff of several telephone plans to benefit 1.5 million households by 22%. |

| | • | | Create per second tariff plans, with no fixed charge per call. |

| | • | | Extend the operating life of pre-paid cards. |

| | • | | Execute a deregulation process within the long distance market. |

| | • | | Implement new tariffs of public telephony, and increase the average minutes of use per sol. |

| | • | | Develop an expansion plan of 685 thousand new residential lines, aiming to serve the low-income population. |

| | • | | Implement technological innovation within the commitment of the Telefónica Group to invest US$1,000 million over a 4-year period. |

Telefónica del Perú S.A.A. and Subsidiaries

Discussion and analysis of the consolidated results for the fiscal year 2006

It is recommended the reading of this report along with the corresponding financial statements and their notes, presented at the same time, since they form integral part of this document and contain complementary information.

Economic Environment

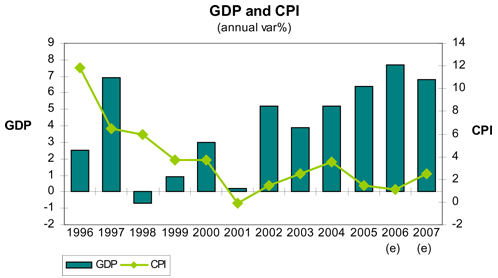

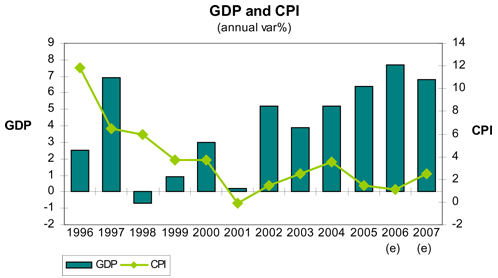

By the end of 2006, the indicators of the Peruvian economy continued to show positive results in terms of Gross Domestic Product (GDP), inflation (Consumer Price Index) and external and fiscal accounts. Other indicators came out strong particularly the foreign exchange rate and the stock market indexes.

The estimate of the Central Bank (BCR) for the economic growth of 2006 is at 7.7%, much higher than the forecasts from the 2007-2009 Multianual Macroeconomic Framework (MMM) of August (6.6%) and from analysts, who had estimated a growth below 7%. The growth of the GDP, was driven by a dynamic internal demand, which by the end of the year would have recorded an increase of 9.9% due to higher public and private investments. Furthermore, during 2006, the expansion of the non-primary sectors would have been higher than the expansion from primary sectors, highlighting the construction and commerce segments, whereas employment rose at the same level of the GDP’s growth.

The inflation rate for the year 2006 rose by 1.14%, below the range established by the BCR and the MEF of (1.5% - 3.5%). The temporary factors that explain the lack of inflationary pressure throughout 2006 are the price decrease from fuel, public services and food.

The balance of trade during 2006 would have recorded a new historical peak of US$ 8.5 billion, forecasting a surplus of 2.2% of GDP in the current account. Given the dynamism of the economic activity and the high export prices, the government recorded an outstanding increase in tax revenues in 2006, which chiefly explains a primary budget surplus of 1.5% of the GDP.

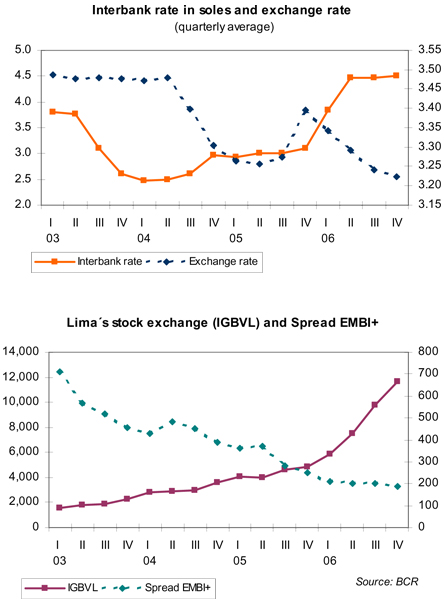

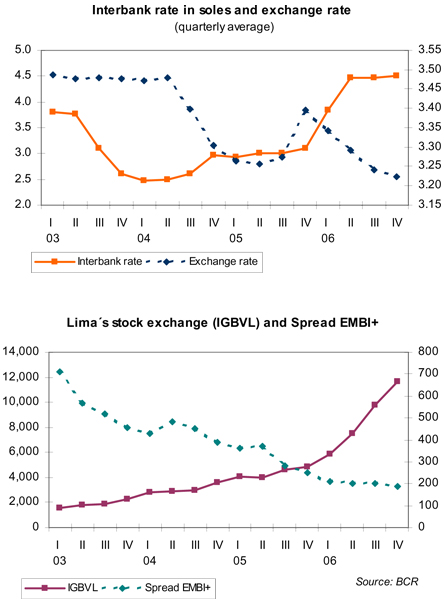

During 2006, the new sol appreciated 6.5% due to the strength of the external and fiscal accounts. From December 2005 to December 2006, the foreign exchange rate kept its downward trend throughout the year going from S/. 3.43 to S/. 3.20 per dollar. In this context, the BCR had to purchase US$3,945 billion of foreign currency during the year, thus, Net International Reserves went up to US$17,275 billion, 23% higher than the reserves recorded in 2005.

In line with the regional trend, the country risk, measured through the EMBI+ Perú, fell from 185 b.p. in 2005 to 131 b.p. by year end. Likewise the EMBI + Perú averaged 159 b.p. a 41 b.p. fall when compared to 2005. In 2006, the local currency yield curve lowered its slope as investors captured the value from the long end of the curve (5 years on), reflecting investors’ improved confidence in the Peruvian economy. Long local rates dropped by to 200 basic points during the year. This behavior was influenced by investor’s confidence in the local economy and reflected by the decrease of the sovereign risk and the lower depreciation expectations of the local currency. As well, the main shares in the Lima Stock Exchange, particularly within the mining sector continued their upward trend, recording the highest profitability in the world of the stock exchanges for 2006.

Competitive Environment

During the year of 2006, Telefónica faced a stronger competitive environment in the different business in which the Company operates, due to competitors business moves as well as to the substitution effect of other technologies such as mobile telephony. It is worth noting, that the main competitors of local telephony – Telmex and Americatel – continue with their strategy of focusing on the corporate business sector with the use of wireless technology.

The long distance business has kept its high level of competitiveness with numerous players like Sitel, IDT, Convergia and IMPSAT, which add to Telmex and Americatel prepaid cards. Telefónica del Perú could not match strong price cuts –implemented by some competitors -, due to the application of the tariff imputation proof (minimum prices in the domestic long distance market). Nevertheless, this practice has not prevented Telefónica to maintain its leadership in this market. In September 2006, a new operator (1910 S.A.) entered the long distance market by offering multidial services and long distance plans.

A greater degree of competition has been observed in public telephony, both in formal and informal ways – through “locutorios” -. The proliferation of informal “locutorios” continues to impact the business of Public Telephony and Long Distance.

Also the business of TV by subscription continues to grow significantly due to the strong growth in Cable TV, but also due to the launch of satellite television which started in 4Q06. It is worth noting that Direct TV is a competitor of TV by subscription.

Finally, the internet business remains strong as the migration of clients from narrowband into broadband services, reflects in the significant increase of customers in 2006.

Operating revenues1

The Company continues to develop its commercial based on market penetration through the offering of services that allow the company to attend specific needs of each market segment, as well as through campaigns to keep customers loyalty, which has enabled the company to keep client growth among the main services that it offers. (basic telephony, broadband and TV by subscription). Thus, by the end of the 4Q06, the total number of accesses showed an important annual growth of 6.4% in fixed telephony, allowing the access of 151 thousand new customers in this service), 37.5% in broadband, as a consequence of the strong growth in clients of Speedy (132 thousand of new subscribers), 20.5% in subscribers of TV by subscription with the incorporation of new alternatives such as satellite technology for those clients who live in remote places, and 4.9% in public and rural telephony, despite the increase of illegal installations which has resulted in a significant number of lines disconnected.

Theoperating revenues in 2006 totaled S/. 4,499 billion, an increase of 7.3% over 2005, mainly explained by the addition of the revenues of Telefónica Empresas S.A.A. (TEmpresas) to Telefónica del Perú starting November of 2005. Excluding of this additions the increase in revenues would be reduced to 3.9%. As well the 4Q06 operating revenues 4Q06 added to S/. 1,143 billion, a 2.5% increase when compared to same period of the previous year (1.0% increase excluding TEmpresas effect).

1 | Starting November 2005 Telefónica del Perú financial statements incorporate the results of Telefónica Empresas S.A.A. reflecting the purchase of 97.86% of the stock of Telefónica Empresas in October of 2005. The merger of afore-mentioned companies was effective on May 2006. In addition, on December 30th 2006, the merger between Telefónica del Perú S.A.A. and Telefónica Perú Holding S.A.C. was implemented. For comparison purposes the financial statements of Telefónica del Perú S.A.A. have been restructured as if the merger had occurred on the 1st of January of 2005. |

As for the performance of the businesses, the revenues fromLocal Telephony for the fiscal year 2006 rose by 0.5% over 2005, reaching S/. 1,655 billion. This increase was mainly explained by higher revenues from high value added services and monthly fees - which moved up 6.5% y-o-y for the plant in service, reaching 2.4 million of accesses – that offset the negative effects caused by the implementation of the productivity factor and drop in revenues from fixed to fixed traffic. Lower revenues from local service and fixed-to mobile traffic resulted in a reduction of market share for classic lines from 38% in 2005 to 37% in 2006 due to the implementation of the productivity factor of 10.07% and to the substitution for mobile-to-mobile traffic. Revenues in 4Q06 rose by 2.2% over 4Q05 reaching S/. 420 million. This increase is mainly explained by the aforementioned reasons.

Long Distance revenues in 2006 totaled S/. 515 million, a 1.0% increase over 2005. This growth is explained by higher revenues from international long distance (ILD: +17.6%), as a result of higher traffic and prepaid cards, which offset the lower revenues from Local Long Distance (LLD: -5.8%). This market continues under pressure from a high competitive environment, mainly the prepaid card segment and public telephony from informal nature, through “locutorios”. In addition, regulatory measures like the tariff imputation proof in LLD established by Osiptel, have prevented the Company to decreases its tariffs to the same level of its competitors resulting in lower traffic. 4Q06 revenues climbed 4.2% over the 4Q05, totaling S/. 134 million. This increase is explained by higher revenues (27.3%), mainly from ILD outgoing traffic (fixed and mobile traffic). This increase offset lower revenues from LLD which dropped by 7.0%, as a result of lower traffic from public telephony and prepaid cards.

As forPublic and Rural Telephonyrevenues reached S/. 751 million in 2006, a 7.6% decrease over 2005. The reduction is mainly due to the substitution effect from the mobile telephony, the increase in informal “locutorios” and to a lesser extent to the competitive environment. This decrease occurs despite the 4.9% y-o-y climb of the plant in service, and 25.6% y-o-y increase in revenues of rural telephony in 2006 and 12.9% in the 4Q06.

In 2006, revenues fromSubscription TV business was 17.7% up y-o-y, recording S/. 356 million. This increase is mainly due to a larger plant in service of traditional cable (531 thousand accesses by year end) which climbed by 14.9% y-o-y, and the new satellite television (26 thousand accesses by year end) as a result of a continuous commercial effort carried out to capture new clients, as well as the execution of a permanent program against illegal installations. Thus, revenues for the 4Q06 totaled S/. 95 million, 13.7% higher over 4Q05.

The revenues fromInternet reached S/. 549 million in 2006, 39.8% up y-o-y. This increase is chiefly explained by 37.5% growth in the broadband plant, reaching 468 thousand accesses in service through permanent commercial actions aimed to provide the customers with greater benefits. On the other hand, revenues for the 4Q06 totaled S/. 152 million, a 36.5% increase over 4Q05.

The revenues forData and Information Technologyreached S/. 308 million in 2006 and S/. 85 million in the 4Q06, reflecting a strong growth over the year 2005. This increase is mainly due to the added revenues from Telefónica Empresas since November 2005 after its merger with the Telefónica del Perú Group.

Operating Expenses

The accumulated operating expenses in 2006 totaled S/. 3,802 million, a 6.2% increase over 2005, or S/. 223 million. Higher expenses were recorded due to higher: general and administrative expenses of S/. 72 million, personnel expenses of S/. 62 million – due to higher average headcount of 13.8%, depreciation and amortization of S/. 37 million, materials and supplies of S/. 28 million – affected by the significant growth in cable’s theft that has generated higher expenses due to replacement costs-.

The operating expenses in the 4Q06 added up to S/. 1,028 million, which represented an increase of 11.2% over the S/. 925 million reached in the 4Q05. This is mainly explained by higher expenses recorded from amortization and depreciation of S/. 40 million, interconnection and carrier settlements of S/. 35 million, bad debt provisions of S/. 19 million, general and administrative expenses of S/. 13 million and personnel expenses of S/. 10 million.

Operating Results

The operating result in 2006 rose by 13.4% over 2005, as a result of higher revenues from Data and Information Technology businesses due to the addition of income from Telefónica Empresas S.A.A., as well as other businesses such as: internet, television, wireline and long distance. This increase has compensated lower revenues from public telephony and higher operating expenses related to commercial management and extraordinary events such as cable’s steal. Thus, the operating results in the 4Q06 decrease by 39.8% y-o-y, as result of higher expenses.

Non-operating Results

In 2006, the non-operating results showed a higher loss in an amount of S/. 34 million over 2005, due to the negative effect of the foreign exchange balance of S/. 43 million over 2005, as well as a higher net financial expenses of S/. 41 million, result of higher debt level. These results were offset by a lower loss in other net revenues and expenses of S/. 51 million over 2005 (as a result of higher revenues from investment disposal, due to the sale of TUMSAC and other real estate).

The non-operating loss climbed from S/. 59 million in 4Q05 to S/. 80 million in 4Q06, due to the negative effect of the foreign exchange balance of S/. 9 million over the 4Q05, as well as the net financial expenses recorded that show an increase of S/. 9 million, explained in the previous paragraph.

Net Result

The accumulated net result increased slightly from S/. 176 million in 2005 to S/. 178 million in 2006. In the 4Q06 the company recorded a loss of S/. 17 million, over S/. 86 million registered in 4Q05, as a result of a lower operating result.

Consolidated Balance Sheet

The current assets registered S/. 1,327 billion, which represented an increase of S/. 91 million with respect to 3Q06. Also current liabilities closed at S/. 2,190 billion, a reduction of S/. 187 million. As such, the liquidity level of the Company in the 4Q06 – measured by the current assets over current liabilities ratio – reached 0.61 in the 4Q06, slightly higher than the 0.52 recorded in the 4Q06.

Also in 4Q06 the net assets reach S/. 4,648 billion , a reduction of S/. 167 million over the 3Q06 due to higher depreciation.

Finally, total debt dropped slightly from 2,632 billion in 3Q06 to S/. 2,575 billion in 4Q06, due to bonds amortization. Finally the net equity in 3Q06 dropped slightly by S/. 18 million to S/. 3,061 billion in 4Q06.

TABLE 1

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES1/

CONSOLIDATED INCOME STATEMENT IN NUEVOS SOLES (000) AS OF DECEMBER 31, 2006

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4Q05 | | | 4Q06 | | | Abs. Var.

4Q06-4Q05 | | | % Var.

4Q06-4Q05 | | | 12M05 | | | 12M06 | | | Var. Abs.

12M06-12M05 | | | Var. % 12M06-12M05 | |

| | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | | | | | | % | |

Total Operating Revenues | | 1,115,181 | | | 100.0 | | | 1,142,612 | | | 100.0 | | | 27,431 | | | 2.5 | | | 4,192,932 | | | 100.0 | | | 4,498,611 | | | 100.0 | | | 305,679 | | | 7.3 | |

Local Telephone Service | | 410,459 | | | 36.8 | | | 419,583 | | | 36.7 | | | 9,124 | | | 2.2 | | | 1,646,729 | | | 39.3 | | | 1,655,056 | | | 36.8 | | | 8,327 | | | 0.5 | |

Long Distance | | 129,085 | | | 11.6 | | | 134,474 | | | 11.8 | | | 5,389 | | | 4.2 | | | 509,399 | | | 12.1 | | | 514,626 | | | 11.4 | | | 5,227 | | | 1.0 | |

Public and Rural Telephones | | 203,332 | | | 18.2 | | | 160,357 | | | 14.0 | | | (42,975 | ) | | (21.1 | ) | | 813,227 | | | 19.4 | | | 751,183 | | | 16.7 | | | (62,044 | ) | | (7.6 | ) |

Subscription TV | | 83,640 | | | 7.5 | | | 95,058 | | | 8.3 | | | 11,418 | | | 13.7 | | | 302,261 | | | 7.2 | | | 355,874 | | | 7.9 | | | 53,613 | | | 17.7 | |

Data & Information Technology | | 22,521 | | | 2.0 | | | 84,538 | | | 7.4 | | | 62,017 | | | 275.4 | | | 87,884 | | | 2.1 | | | 307,915 | | | 6.8 | | | 220,031 | | | 250.4 | |

Internet | | 111,564 | | | 10.0 | | | 152,304 | | | 13.3 | | | 40,740 | | | 36.5 | | | 392,927 | | | 9.4 | | | 549,354 | | | 12.2 | | | 156,427 | | | 39.8 | |

Other | | 154,580 | | | 13.9 | | | 96,298 | | | 8.4 | | | (58,282 | ) | | (37.7 | ) | | 440,505 | | | 10.5 | | | 364,603 | | | 8.1 | | | (75,902 | ) | | (17.2 | ) |

Total Operating Costs and Expenses | | 924,686 | | | 82.9 | | | 1,028,028 | | | 90.0 | | | 103,342 | | | 11.2 | | | 3,578,600 | | | 85.3 | | | 3,801,660 | | | 84.5 | | | 223,060 | | | 6.2 | |

Interconnection Expenses | | 169,783 | | | 15.2 | | | 205,227 | | | 18.0 | | | 35,444 | | | 20.9 | | | 659,270 | | | 15.7 | | | 668,802 | | | 14.9 | | | 9,532 | | | 1.4 | |

Personnel | | 107,264 | | | 9.6 | | | 117,057 | | | 10.2 | | | 9,793 | | | 9.1 | | | 392,947 | | | 9.4 | | | 455,030 | | | 10.1 | | | 62,083 | | | 15.8 | |

General and Administrative | | 272,376 | | | 24.4 | | | 285,249 | | | 25.0 | | | 12,873 | | | 4.7 | | | 1,066,096 | | | 25.4 | | | 1,137,621 | | | 25.3 | | | 71,525 | | | 6.7 | |

Depreciation and Amortization | | 331,769 | | | 29.8 | | | 371,518 | | | 32.5 | | | 39,749 | | | 12.0 | | | 1,305,741 | | | 31.1 | | | 1,342,911 | | | 29.9 | | | 37,170 | | | 2.8 | |

Management Fee | | 15,112 | | | 1.4 | | | 8,079 | | | 0.7 | | | (7,033 | ) | | (46.5 | ) | | 45,336 | | | 1.1 | | | 51,953 | | | 1.2 | | | 6,617 | | | 14.6 | |

Materials and Supplies | | 38,938 | | | 3.5 | | | 36,228 | | | 3.2 | | | (2,710 | ) | | (7.0 | ) | | 96,065 | | | 2.3 | | | 124,393 | | | 2.8 | | | 28,328 | | | 29.5 | |

Provisions | | (8,213 | ) | | (0.7 | ) | | 10,541 | | | 0.9 | | | 18,754 | | | (228.3 | ) | | 40,431 | | | 1.0 | | | 42,504 | | | 0.9 | | | 2,073 | | | 5.1 | |

Own Work Capitalized | | (2,343 | ) | | (0.2 | ) | | (5,871 | ) | | (0.5 | ) | | (3,528 | ) | | 150.6 | | | (27,286 | ) | | (0.7 | ) | | (21,554 | ) | | (0.5 | ) | | 5,732 | | | (21.0 | ) |

Operating Income | | 190,495 | | | 17.1 | | | 114,584 | | | 10.0 | | | (75,911 | ) | | (39.8 | ) | | 614,332 | | | 14.7 | | | 696,951 | | | 15.5 | | | 82,619 | | | 13.4 | |

Other Income (Expenses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Income | | 12,120 | | | 1.1 | | | 6,676 | | | 0.6 | | | (5,444 | ) | | (44.9 | ) | | 24,937 | | | 0.6 | | | 29,055 | | | 0.6 | | | 4,118 | | | 16.5 | |

Interest Expenses | | (46,952 | ) | | (4.2 | ) | | (50,087 | ) | | (4.4 | ) | | (3,135 | ) | | 6.7 | | | (147,063 | ) | | (3.5 | ) | | (192,413 | ) | | (4.3 | ) | | (45,350 | ) | | 30.8 | |

Others Net | | (26,899 | ) | | (2.4 | ) | | (31,003 | ) | | (2.7 | ) | | (4,104 | ) | | 15.3 | | | (125,288 | ) | | (3.0 | ) | | (74,641 | ) | | (1.7 | ) | | 50,647 | | | (40.4 | ) |

Net Currency Exchange (Loss) | | 2,994 | | | 0.3 | | | (5,517 | ) | | (0.5 | ) | | (8,511 | ) | | N.A | | | 11,652 | | | 0.3 | | | (31,552 | ) | | (0.7 | ) | | (43,204 | ) | | N.A | |

Non Operating Results | | (58,737 | ) | | (5.3 | ) | | (79,931 | ) | | (7.0 | ) | | (21,194 | ) | | 36.1 | | | (235,762 | ) | | (5.6 | ) | | (269,551 | ) | | (6.0 | ) | | (33,789 | ) | | 14.3 | |

Income Before Taxes and Participations | | 131,758 | | | 11.8 | | | 34,653 | | | 3.0 | | | (97,105 | ) | | (73.7 | ) | | 378,570 | | | 9.0 | | | 427,400 | | | 9.5 | | | 48,830 | | | 12.9 | |

Workers’ Participation | | (12,322 | ) | | (1.1 | ) | | (13,514 | ) | | (1.2 | ) | | (1,192 | ) | | 9.7 | | | (52,751 | ) | | (1.3 | ) | | (65,559 | ) | | (1.5 | ) | | (12,808 | ) | | 24.3 | |

Income Tax | | (33,654 | ) | | (3.0 | ) | | (38,118 | ) | | (3.3 | ) | | (4,464 | ) | | 13.3 | | | (149,515 | ) | | (3.6 | ) | | (183,834 | ) | | (4.1 | ) | | (34,319 | ) | | 23.0 | |

Net Income | | 85,782 | | | 7.7 | | | (16,979 | ) | | (1.5 | ) | | (102,761 | ) | | N.A | | | 176,304 | | | 4.2 | | | 178,007 | | | 4.0 | | | 1,703 | | | 1.0 | |

| 1/ | Starting November 2005 Telefónica del Perú financial statements incorporate the results of Telefónica Empresas S.A.A. reflecting the purchase of 97.86% of the stock of Telefónica Empresas in October of 2005. The merger of aforementioned companies was effective on May 2006. In addition, on December 30th 2006, the merger between Telefónica del Perú S.A.A. and Telefónica Perú Holding S.A.C. was implemented. For comparison purposes the financial statements of Telefónica del Perú S.A.A. have been restructured as if the merger had occurred on the 1st of January of 2005. |

Starting January 1, 2005 and in accordance with the Consejo Normativo de Contabilidad N°031-2004, the financial statement will not be adjusted for inflation, for accounting matters, and therefore the REI record is not shown.

TABLE 2

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES1/

CONSOLIDATED BALANCE SHEET IN NUEVOS SOLES (000) AS OF DECEMBER 31, 2006

(Prepared In Accordance With Peruvian GAAP)

| | | | | | | | | | | | | | | |

| | | 4Q06 | | | 3Q06 | | | 2Q06 | | | 1Q06 | | | 4Q05 | |

ASSETS | | | | | | | | | | | | | | | |

CURRENT ASSETS | | | | | | | | | | | | | | | |

Cash and Banks | | 131,080 | | | 316,860 | | | 733,199 | | | 464,007 | | | 636,019 | |

Negociable securities | | — | | | 34,963 | | | 10,984 | | | 48,170 | | | 38,327 | |

Accounts receivable - net | | 660,577 | | | 701,453 | | | 670,744 | | | 651,315 | | | 698,615 | |

Afiliatted Company Loans | | 351,340 | | | — | | | — | | | — | | | — | |

Other accounts receivable | | 48,811 | | | 81,671 | | | 85,366 | | | 128,212 | | | 110,012 | |

Materials and supplies | | 48,358 | | | 42,215 | | | 38,479 | | | 41,667 | | | 39,583 | |

Prepaid taxes and expenses and others | | 86,497 | | | 58,944 | | | 53,172 | | | 34,656 | | | 45,068 | |

Total current assets | | 1,326,663 | | | 1,236,106 | | | 1,591,944 | | | 1,368,027 | | | 1,567,624 | |

LONG-TERM INVESTMENTS | | 10,855 | | | 11,011 | | | 10,188 | | | 11,907 | | | 10,703 | |

DEFERRED CHARGES | | 38,817 | | | 31,920 | | | 32,678 | | | 33,438 | | | 10,487 | |

PROPERTY, PLANT AND EQUIPMENT | | 16,416,922 | | | 16,280,182 | | | 16,127,608 | | | 16,025,628 | | | 15,995,439 | |

Accumulated depreciation | | (11,768,833 | ) | | (11,464,758 | ) | | (11,234,004 | ) | | (10,975,249 | ) | | (10,675,496 | ) |

| | | | | | | | | | | | | | | |

| | 4,648,089 | | | 4,815,424 | | | 4,893,604 | | | 5,050,379 | | | 5,319,943 | |

Write-off Provision | | (23,654 | ) | | (18,329 | ) | | (18,363 | ) | | (18,363 | ) | | (30,777 | ) |

| | | | | | | | | | | | | | | |

| | 4,624,435 | | | 4,797,095 | | | 4,875,241 | | | 5,032,016 | | | 5,289,166 | |

OTHER ASSETS, net | | 2,202,733 | | | 2,194,390 | | | 2,248,116 | | | 2,295,254 | | | 2,355,457 | |

| | | | | | | | | | | | | | | |

TOTAL ASSETS | | 8,203,503 | | | 8,270,522 | | | 8,758,167 | | | 8,740,642 | | | 9,233,437 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | 4Q06 | | | 3Q06 | | | 2Q06 | | | 1Q06 | | | 4Q05 | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | | | | | | | | |

Overdrafts | | 11,207 | | | 10,095 | | | 5,658 | | | 8,670 | | | 5,531 | |

Accounts payable | | 581,090 | | | 515,680 | | | 491,083 | | | 451,732 | | | 519,726 | |

Other accounts payable | | 793,964 | | | 759,086 | | | 751,773 | | | 802,696 | | | 1,087,407 | |

Provision for severance indemnities | | 5,605 | | | 12,223 | | | 5,580 | | | 12,305 | | | 5,132 | |

Bank Loans2/ | | 194,013 | | | 186,653 | | | 242,617 | | | 235,737 | | | 241,775 | |

Current portion of long-term debt | | 379,486 | | | 406,823 | | | 407,290 | | | 123,719 | | | 44,983 | |

Current portion of bonds | | 225,073 | | | 487,118 | | | 521,808 | | | 492,479 | | | 392,628 | |

Commercial Papers | | — | | | — | | | — | | | 25,000 | | | 126,900 | |

Total current liabilities | | 2,190,438 | | | 2,377,678 | | | 2,425,809 | | | 2,152,338 | | | 2,424,082 | |

LONG-TERM DEBT2/ | | 403,568 | | | 384,038 | | | 359,689 | | | 541,739 | | | 637,075 | |

BONDS | | 1,372,467 | | | 1,167,005 | | | 1,064,817 | | | 1,111,200 | | | 1,193,707 | |

GUARANTY DEPOSITS AND OTHERS | | 65,724 | | | 65,402 | | | 65,269 | | | 76,793 | | | 83,768 | |

DEFERRED TAXES | | 1,110,327 | | | 1,197,329 | | | 1,261,430 | | | 1,329,747 | | | 1,417,186 | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

Capital stock | | 2,727,843 | | | 2,727,843 | | | 3,322,601 | | | 3,322,208 | | | 3,339,664 | |

Additional Capital | | 4,964 | | | 4,964 | | | 4,964 | | | 3,815 | | | 3,815 | |

Treasury Shares | | — | | | — | | | — | | | — | | | (21,896 | ) |

Legal reserve | | 58,603 | | | 58,603 | | | 58,603 | | | 58,603 | | | 33,275 | |

Freely distributable Reserves | | 249,407 | | | — | | | — | | | — | | | — | |

Other reserves | | (6,889 | ) | | (5,741 | ) | | (3,353 | ) | | (3,313 | ) | | (6,026 | ) |

Retained earnings | | 27,051 | | | 293,401 | | | 198,338 | | | 147,512 | | | 128,787 | |

| | | | | | | | | | | | | | | |

TOTAL SHAREHOLDERS’ EQUITY | | 3,060,979 | | | 3,079,070 | | | 3,581,153 | | | 3,528,825 | | | 3,477,619 | |

| | | | | | | | | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | 8,203,503 | | | 8,270,522 | | | 8,758,167 | | | 8,740,642 | | | 9,233,437 | |

| | | | | | | | | | | | | | | |

| 1/ | Starting November 2005 Telefónica del Perú financial statements incorporate the results of Telefónica Empresas S.A.A. reflecting the purchase of 97.86% of the stock of Telefónica Empresas in October of 2005. The merger of afore-mentioned companies was effective on May 2006. In addition, on December 30th 2006, the merger between Telefónica del Perú S.A.A. and Telefónica Perú Holding S.A.C. was implemented. For comparison purposes the financial statements of Telefónica del Perú S.A.A. have been restructured as if the merger had occurred on the 1st of January of 2005. |

Starting January 1, 2005 and in accordance with the Consejo Normativo de Contabilidad N°031-2004, the financial statement will not be adjusted for inflation, for accounting matters, and therefore the REI record is not shown.

| 2/ | Includes net position for derivatives |

TABLE 3

TELEFONICA DEL PERU S.A.A. AND SUBSIDIARIES

Statistical Data, End of Period Figures

| | | | | | | | | | | | | | | | |

| | | 4Q05 | | 1Q06 | | 2Q06 | | 3Q06 | | 4Q06 | | Abs. Var

4Q06 - 4Q05 | | | 4Q06/

4Q05 | |

FIXED TELEPHONY | | | | | | | | | | | | | | | | |

Lines Installed | | 2,509,789 | | 2,538,949 | | 2,580,737 | | 2,605,685 | | 2,645,895 | | 136,106 | | | 5.4 | |

Lines in Service (1) | | 2,352,555 | | 2,393,352 | | 2,439,017 | | 2,473,338 | | 2,503,778 | | 151,223 | | | 6.4 | |

Lines in Service per Employee (Telefónica del Perú) (2) | | 682 | | 693 | | 623 | | 629 | | 635 | | (47 | ) | | (6.9 | ) |

Lines in Service per 100 inhabitants (%) | | 8.4 | | 8.5 | | 8.7 | | 8.8 | | 8.8 | | 0.4 | | | 4.8 | |

BASIC TELEPHONY | | | | | | | | | | | | | | | | |

Lines in Service | | 2,216,057 | | 2,253,803 | | 2,294,493 | | 2,330,776 | | 2,360,259 | | 144,202 | | | 6.5 | |

PUBLIC TELEPHONES | | | | | | | | | | | | | | | | |

Lines in Service (3) | | 136,486 | | 139,499 | | 144,339 | | 142,275 | | 143,176 | | 6,690 | | | 4.9 | |

BROADBAND | | | | | | | | | | | | | | | | |

Lines in Service (4) | | 340,436 | | 359,672 | | 389,118 | | 435,444 | | 468,122 | | 127,686 | | | 37.5 | |

SUBSCRIPTION TV | | | | | | | | | | | | | | | | |

Lines in Service (5) | | 462,211 | | 474,710 | | 490,442 | | 507,528 | | 557,166 | | 94,955 | | | 20.5 | |

TRAFFIC | | | | | | | | | | | | | | | | |

Local Traffic - Minutes (000) (6) | | 1,205,026 | | 1,216,188 | | 1,176,153 | | 1,220,611 | | 1,270,330 | | 65,304 | | | 5.4 | |

Long Distance - Minutes (000) (7) | | 329,467 | | 319,281 | | 306,661 | | 338,920 | | 350,691 | | 21,224 | | | 6.4 | |

NUMBER OF EMPLOYEES | | | | | | | | | | | | | | | | |

Telefónica del Perú (2) | | 3,449 | | 3,452 | | 3,917 | | 3,935 | | 3,945 | | 496 | | | 14.4 | |

Telefónica del Perú and Subsidiaries (8) | | 6,163 | | 6,504 | | 6,340 | | 6,518 | | 5,342 | | (821 | ) | | (13.3 | ) |

| (1) | Includes Basic Telephony, Public and Rural Telephones, without Mobiles. |

| (2) | Starting May 2006, includes personnel of Telefónica Empresas due to the merger approved at the General Shareholders’ Meeting held on April 24, 2006. |

| (3) | Includes Fixed and Mobile Public Telephones, Fixed and Mobile Rural Telephone. |

| (4) | Includes Speedy Traditional, Speedy Business, Giga ADSL and Cablenet, and starting 2006 includes acces to Optic Fiber. |

| (5) | Starting 4Q 2006 includes Cable TV and Satellite TV. |

| (6) | Includes F2F billing (voice and internet), F2M and M2F. |

| (7) | Excludes Prepaid cards, includes packet minutes plans. |

| (8) | Starting October 2005, includes personnel of Telefónica Empresas S.A.A. And since September 2006, excludes personnel of TUMSAC, subsidiary sold on October 29. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | Telefónica del Perú |

| | |

| Date: February 19, 2007 | | By: | | /s/ Mariana Brigneti Suito |

| | Name: | | Mariana Brigneti Suito |

| | Title: | | Legal Director of Telefónica del Perú S.A.A. |