Exhibit 99.2

Investor Presentation May 3, 2023 +

+ Disclaimer 2 No Offer or Solicitation This communication relates to the proposed merger (the “proposed transaction”) between Option Care Health, Inc . (“Option Care Health”) and Amedisys, Inc . (“Amedisys”) . This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Additional Information and Where to Find It In connection with the proposed transaction, Option Care Health and Amedisys will file relevant materials with the United States Securities and Exchange Commission (the “SEC”), including an Option Care Health registration statement on Form S - 4 that will include a joint proxy statement of Option Care Health and Amedisys that also constitutes a prospectus of Option Care Health, and a definitive joint proxy statement/prospectus will be mailed to stockholders of Option Care Health and Amedisys . INVESTORS AND SECURITY HOLDERS OF OPTION CARE HEALTH AND Amedisys ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Option Care Health or Amedisys through the website maintained by the SEC at http : //www . sec . gov . Copies of the documents filed with the SEC by Option Care Health will be available free of charge on Option Care Health’s internet website at https : //investors . optioncarehealth . com or by contacting Option Care Health’s investor relations department at investor . relations@optioncare . com . Copies of the documents filed with the SEC by Amedisys will be available free of charge on Amedisys’ internet website at https : //investors . amedisys . com or by contacting Amedisys’ investor relations department at IR@amedisys . com . Certain Information Regarding Participants Option Care Health, Amedisys and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction . Information about the directors and executive officers of Option Care Health is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 7 , 2023 . Information about the directors and executive officers of Amedisys is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 27 , 2023 . Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available . You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at http : //www . sec . gov and from the investor relations departments at Option Care Health or Amedisys as described above . Cautionary Statement Regarding Forward - Looking Statements This communication may contain “forward - looking statements” within the meaning of the safe harbor provisions of the U . S . Private Securities Litigation Reform Act of 1995 . Forward - looking statements can be identified by words such as : “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” “may,” “should,” “will” and similar references to future periods . Examples of forward - looking statements include projections as to the anticipated benefits of the proposed transaction as well as statements regarding the impact of the proposed transaction on Option Care Health’s and Amedisys’ business and future financial and operating results, the amount and timing of synergies from the proposed transaction and the closing date for the proposed transaction . Forward - looking statements are neither historical facts nor assurances of future performance . Instead, they are based only on management’s current beliefs, expectations and assumptions regarding the future of Option Care Health’s and Amedisys’ business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Option Care Health’s and Amedisys’ control . Option Care Health’s, Amedisys’ and the combined company’s actual results and financial condition may differ materially from those indicated in the forward - looking statements as a result of various factors . These factors include, among other things, ( 1 ) the termination of or occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement or the inability to complete the proposed transaction on the anticipated terms and timetable, ( 2 ) the inability to complete the proposed transaction due to the failure to obtain approval of the stockholders of Option Care Health or Amedisys or to satisfy any other condition to closing in a timely manner or at all, or the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated, ( 3 ) the ability to recognize the anticipated benefits of the proposed transaction, which may be affected by, among other things, the ability of the combined company to maintain relationships with its patients, payers and providers and retain its management and key employees, ( 4 ) the ability of the combined company to achieve the synergies contemplated by the proposed transaction or such synergies taking longer to realize than expected, ( 5 ) costs related to the proposed transaction, ( 6 ) the ability of the combined company to execute successfully its strategic plans, ( 7 ) the ability of the combined company to promptly and effectively integrate the Option Care Health and Amedisys businesses and ( 8 ) the diversion of management’s time and attention from ordinary course business operations to completion of the proposed transaction and integration matters . The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere . Additional information concerning risks, uncertainties and assumptions can be found in Option Care Health’s and Amedisys’ respective filings with the SEC, including the risk factors discussed in Option Care Health’s and Amedisys’ most recent Annual Reports on Form 10 - K, as updated by their Quarterly Reports on Form 10 - Q and future filings with the SEC . It should also be noted that prospective financial information for the combined businesses of Option Care Health and Amedisys is based on management’s estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S - X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein . This prospective financial information should not be relied upon as being necessarily indicative of future results . The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Accordingly, there can be no assurance that the prospective financial information is indicative of the future performance of the combined company or that actual results will not differ materially from those presented in the prospective financial information . Inclusion of the prospective financial information in this communication should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of Amedisys and Option Care Health . Any forward - looking statement made in this communication is based only on information currently available to Option Care Health and Amedisys and speaks only as of the date on which it is made . Option Care Health and Amedisys undertake no obligation to publicly update any forward - looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise . You are cautioned not to rely on Option Care Health’s and Amedisys’ forward - looking statements . Note Regarding Use of Non - GAAP Financial Measures In addition to the financial measures presented in accordance with U . S . generally accepted accounting principles (“GAAP”), this communication includes certain non - GAAP financial measures, such as Adjusted EBITDA . Option Care Health and Amedisys believe Adjusted EBITDA provides useful supplemental information regarding the performance of their business operations and facilitates comparisons to their historical operating results . Adjusted EBITDA should not be used in isolation or as a substitute or alternative to net income, operating income or any other performance measure derived in accordance with GAAP, or as a substitute or alternative to cash flow from operating activities or a measure of liquidity . In addition, Option Care Health’s and Amedisys’ definition of Adjusted EBITDA may not be comparable to similarly titled non - GAAP financial measures reported by other companies . For a definition of Adjusted EBITDA and a full reconciliation of Adjusted EBITDA to the most comparable GAAP financial measure, please see Option Care Health's Current Report on Form 8 - K filed with the SEC on February 23 , 2023 and Amedisys' Current Report on Form 8 - K filed with the SEC on February 15 , 2023 . Adjusted EBITDA for Amedisys as disclosed herein adds back stock - based compensation of $ 17 million for full year 2022 . This communication also includes certain financial measures for the combined company . These measures are provided for illustrative purposes, are based on an arithmetic sum of the relevant historical financial measures of Option Care Health and Amedisys and do not reflect pro forma adjustments . These measures do not reflect what the combined company’s financial condition or results of operations would have been had the proposed transaction occurred on or prior to the dates indicated . The combined company’s actual financial position and results of operations may differ significantly from the amounts reflected herein due to a variety of factors .

+ Today’s Participants 3 John Rademacher Chief Executive Officer Richard Ashworth President and Chief Executive Officer Scott Ginn Acting Chief Operating Officer and Chief Financial Officer Nick Muscato Chief Strategy Officer Mike Shapiro Chief Financial Officer

+ Key Transaction Terms 4 Transaction Structure and Exchange Ratio • Option Care to issue shares to Amedisys in an all - stock transaction valued at $3.6B, including assumption of net debt • 3.0213 shares of Option Care to be exchanged for each share of Amedisys — Implies a 26% premium to Amedisys’ stock price on May 2nd Ownership • Option Care Health shareholders: 64.5% • Amedisys shareholders: 35.5% Synergies • Approximately $75M 1 in anticipated annual incremental EBITDA from run - rate revenue and net cost synergies by year three following transaction close Management • Chief Executive Officer: John Rademacher • Chief Financial Officer: Mike Shapiro • Executive team comprised of best talent from both organizations Board • 10 member Board to be comprised of 7 directors from Option Care Health’s Board and 3 directors from Amedisys' Board Name • Retain Option Care Health corporate name, common shares to be traded on NASDAQ under ticker symbol OPCH Leverage • Combined Net Leverage of ~2.0x 2 Timing / Conditions • Subject to approval by Option Care Health and Amedisys stockholders and other customary closing conditions, including receipt of applicable regulatory approvals • Transaction expected to close in second half of 2023 1 Includes anticipated $50M of net run - rate cost synergies and $25M of EBITDA impact from revenue synergies. 2 Calculated as net debt divided by Adjusted EBITDA on a combined basis for the year ended December 31, 2022. Adjusted EBITDA i s a non - GAAP measure. Please see Note Regarding Use of Non - GAAP Financial Measures on slide 2.

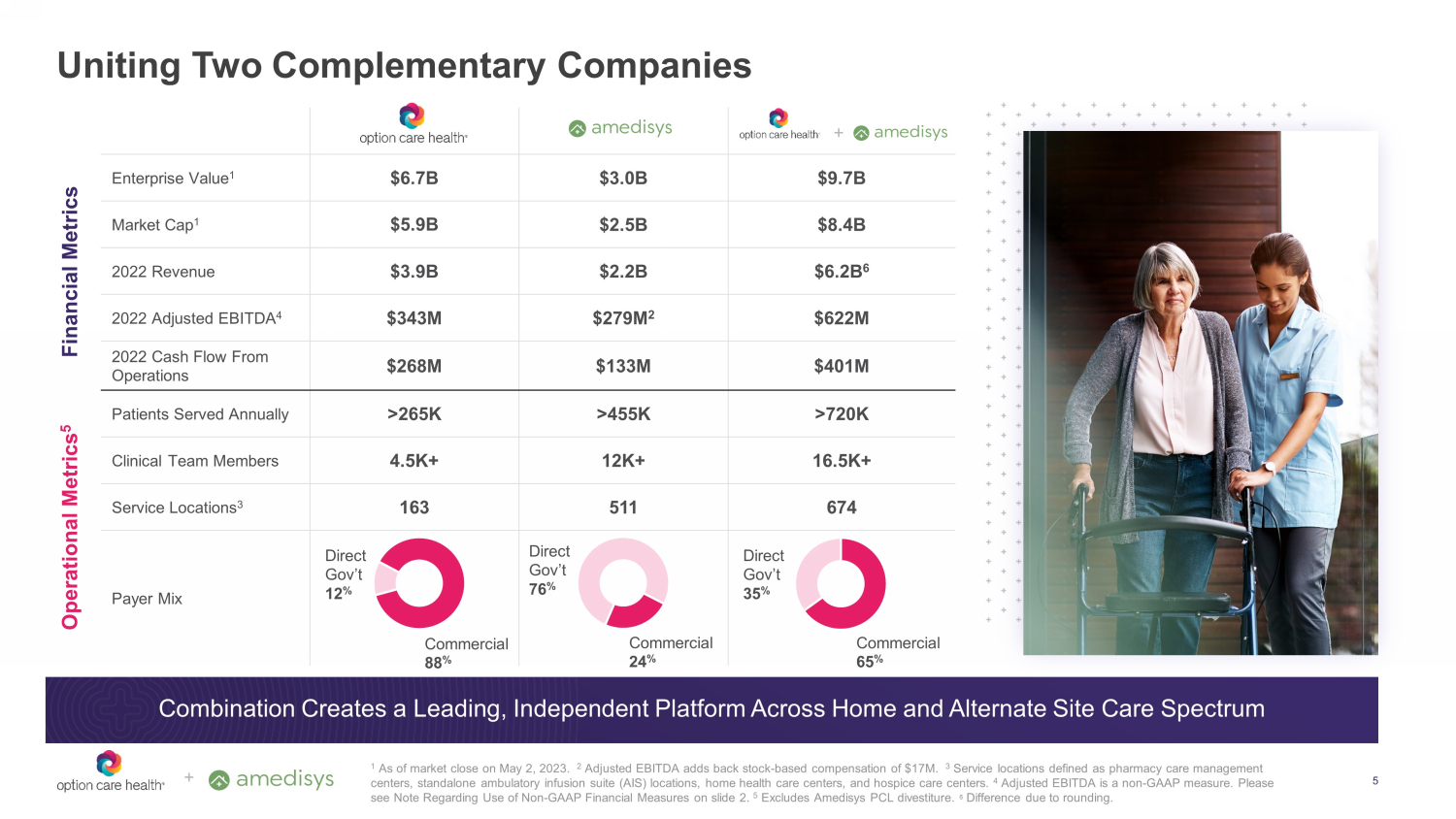

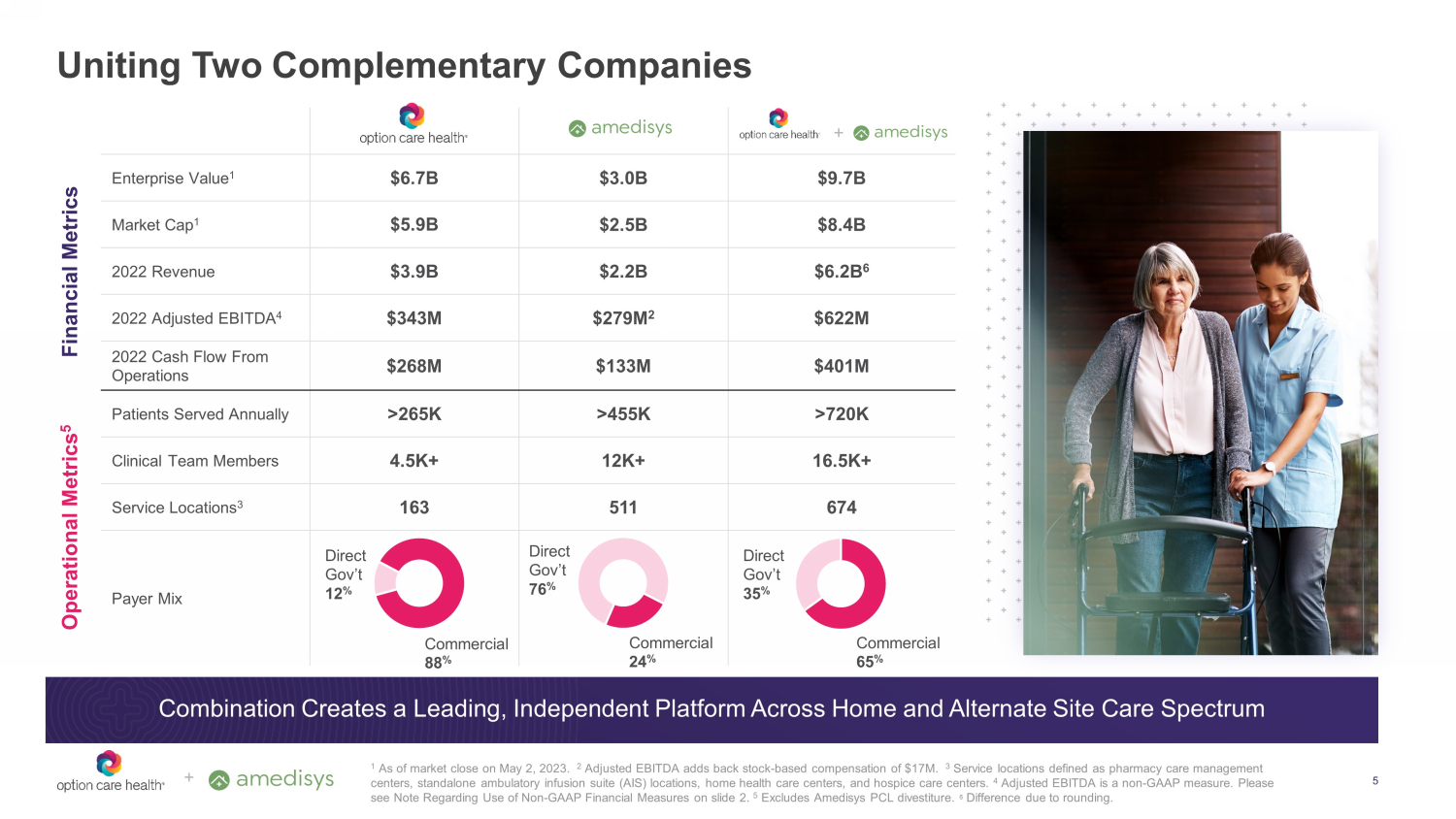

+ Enterprise Value 1 $6.7B $3.0B $9.7B Market Cap 1 $5.9B $2.5B $8.4B 2022 Revenue $3.9B $2.2B $6.2B 6 2022 Adjusted EBITDA 4 $343M $279M 2 $622M 2022 Cash Flow From Operations $268M $133M $401M Patients Served Annually >265K >455K 5 >720K Clinical Team Members 4.5K+ 12K+ 16.5K+ Service Locations 3 163 511 674 Payer Mix Uniting Two Complementary Companies 5 Combination Creates a Leading , Independent Platform Across Home and Alternate Site Care Spectrum Operational Metrics 5 Financial Metrics Direct Gov’t 12 % Commercial 88 % 1 As of market close on May 2, 2023. 2 Adjusted EBITDA adds back stock - based compensation of $17M. 3 Service locations defined as pharmacy care management centers, standalone ambulatory infusion suite (AIS) locations, home health care centers, and hospice care centers. 4 Adjusted EBITDA is a non - GAAP measure. Please see Note Regarding Use of Non - GAAP Financial Measures on slide 2. 5 Excludes Amedisys PCL divestiture. 6 Difference due to rounding. + Direct Gov’t 76 % Commercial 24 % Direct Gov’t 35 % Commercial 65 %

+ Compelling Strategic Rationale 6 Comprehensive Capabilities Across Care Continuum Expands Access to Care and Enhances Growth Delivers Significant Benefits to Patients by Broadening Stakeholder Relationships Scaled and Unparalleled Clinician Team Across Broad Professional Specialties and National Platform Enables Intelligent Insights to Enhance Outcomes and Reduce Cost of Care Builds on Track Records of Delivering High Quality Care and Patient Satisfaction Transform healthcare through innovative platform that improves outcomes, expands access to care, reduces cost and delivers hope and dignity to patients and their families

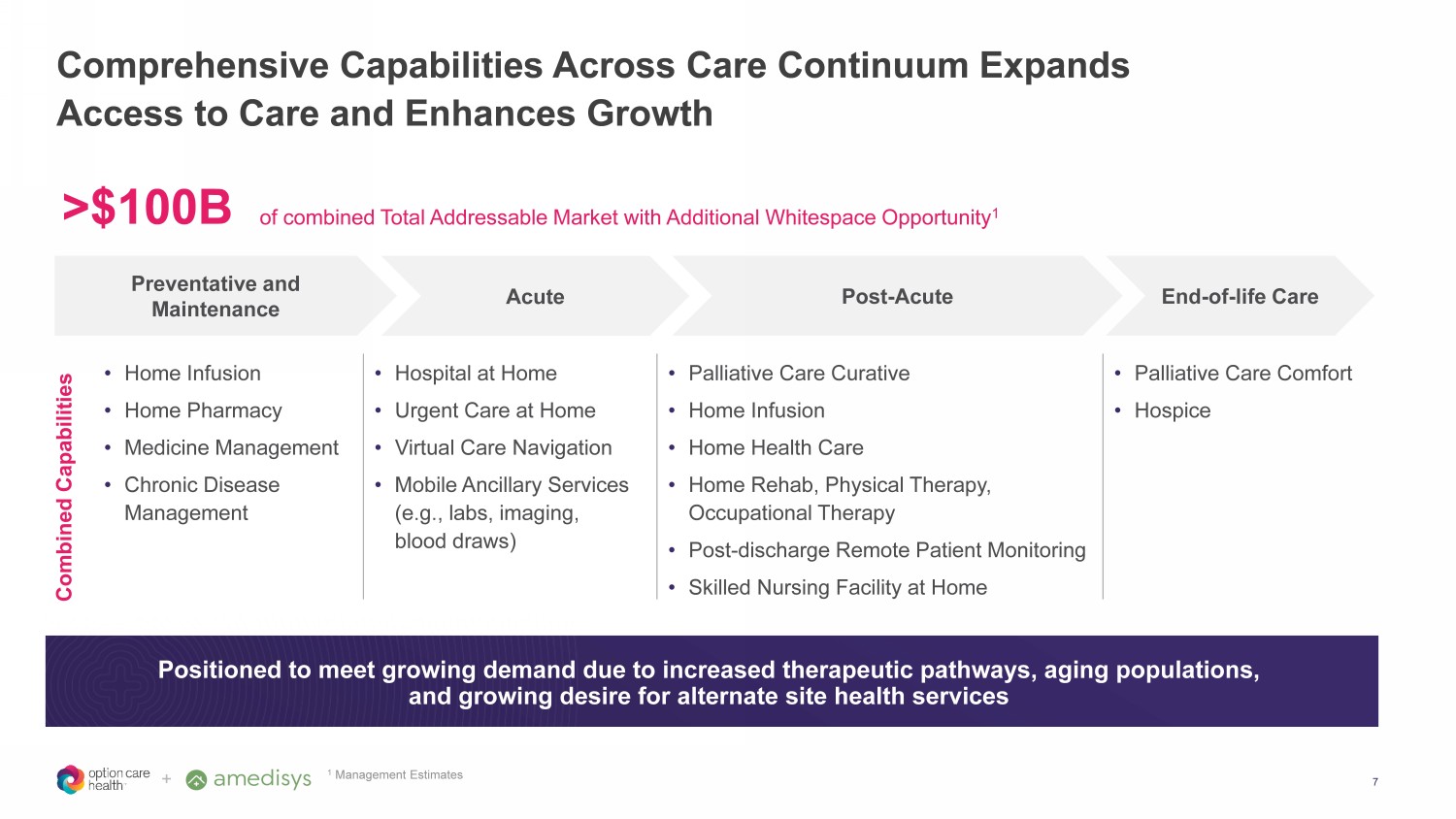

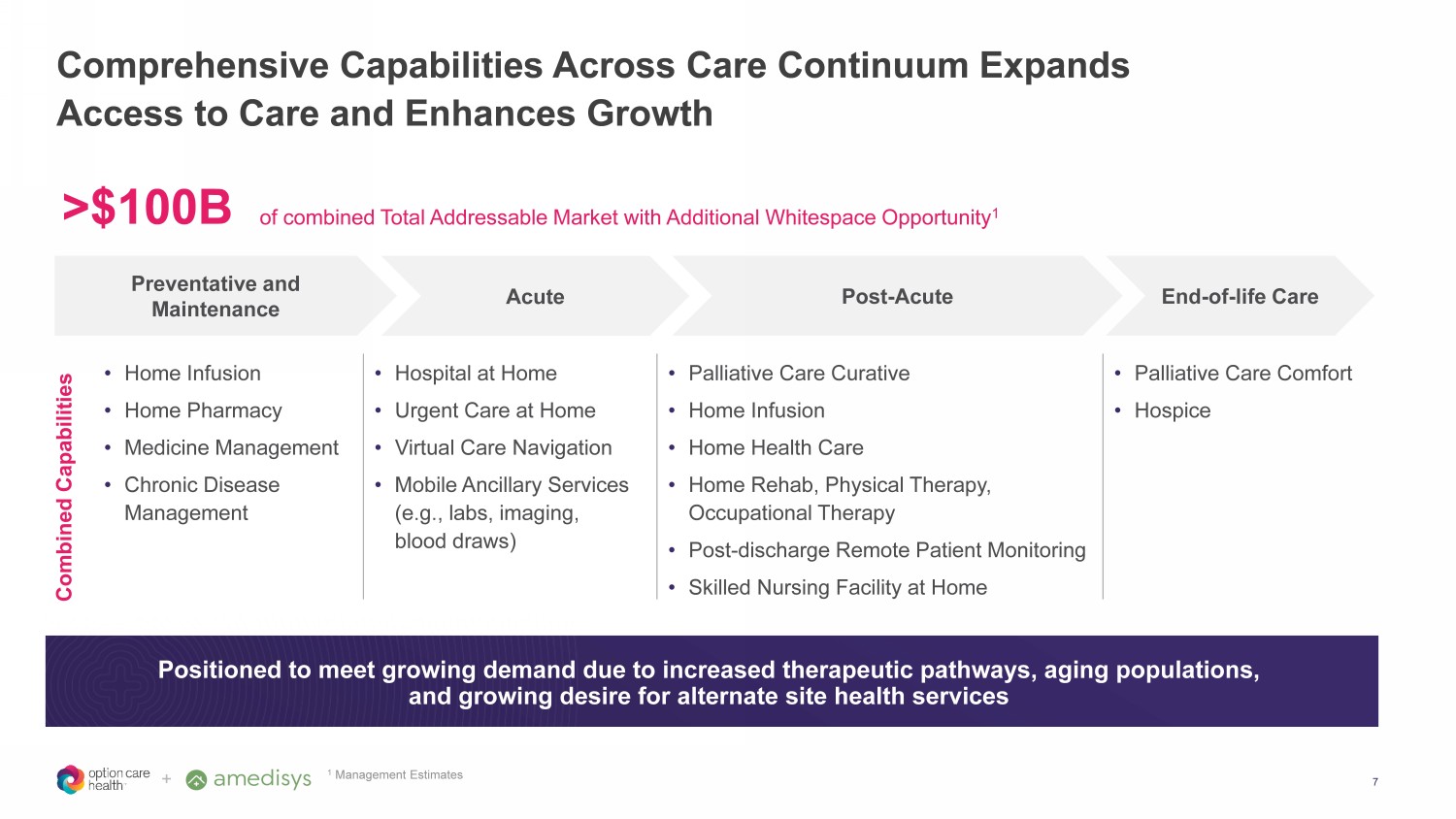

+ Comprehensive Capabilities Across Care Continuum Expands Access to Care and Enhances Growth Preventative and Maintenance Acute Post - Acute End - of - life Care Positioned to meet growing demand due to increased therapeutic pathways, aging populations, and growing desire for alternate site health services • Home Infusion • Home Pharmacy • Medicine Management • Chronic Disease Management • Hospital at Home • Urgent Care at Home • Virtual Care Navigation • Mobile Ancillary Services (e.g., labs, imaging, blood draws) • Palliative Care Curative • Home Infusion • Home Health Care • Home Rehab, Physical Therapy , Occupational Therapy • Post - discharge Remote Patient Monitoring • Skilled Nursing Facility at Home • Palliative Care Comfort • Hospice >$100B 7 Combined Capabilities 1 Management Estimates of combined Total Addressable Market with Additional Whitespace Opportunity 1

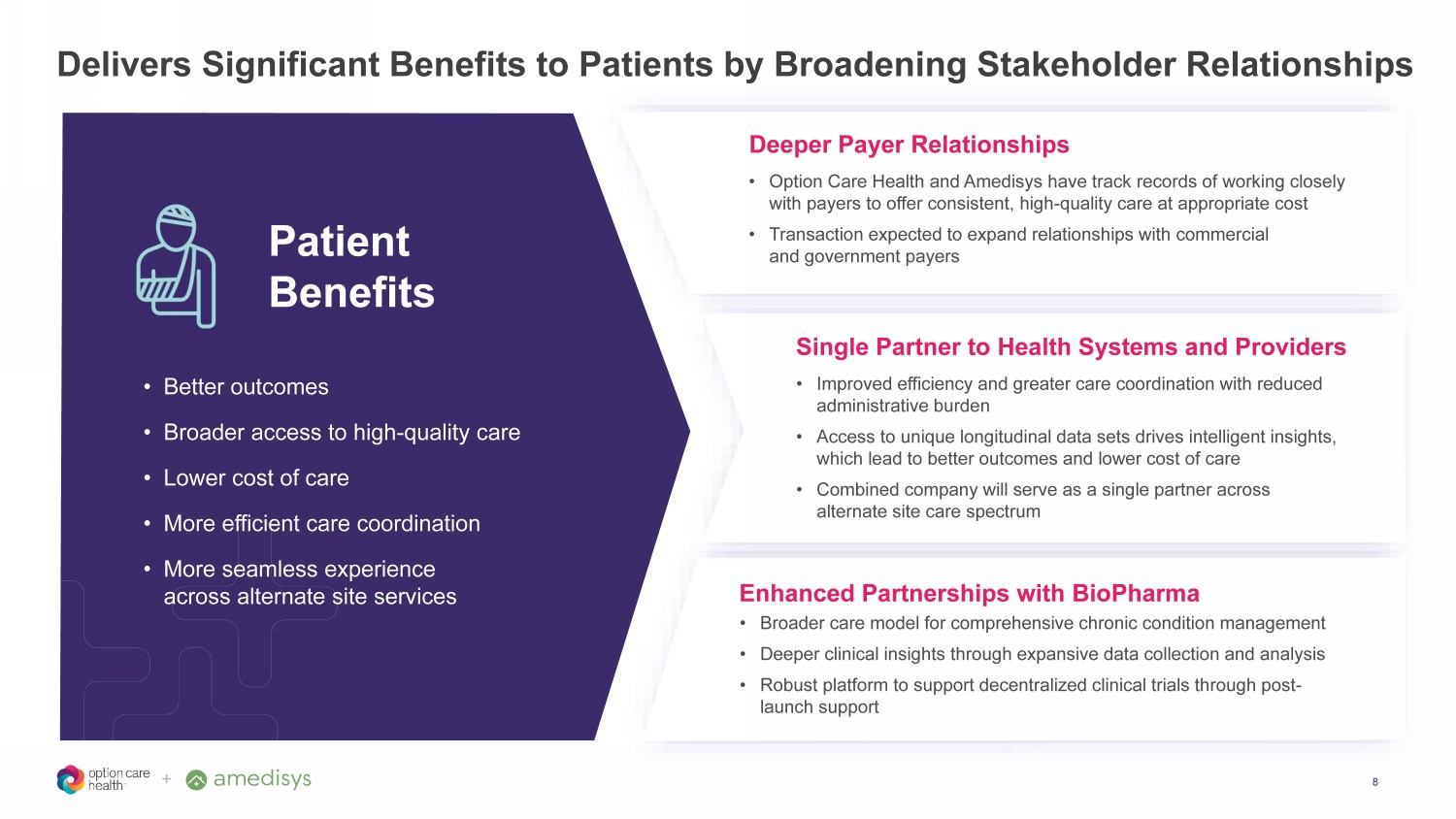

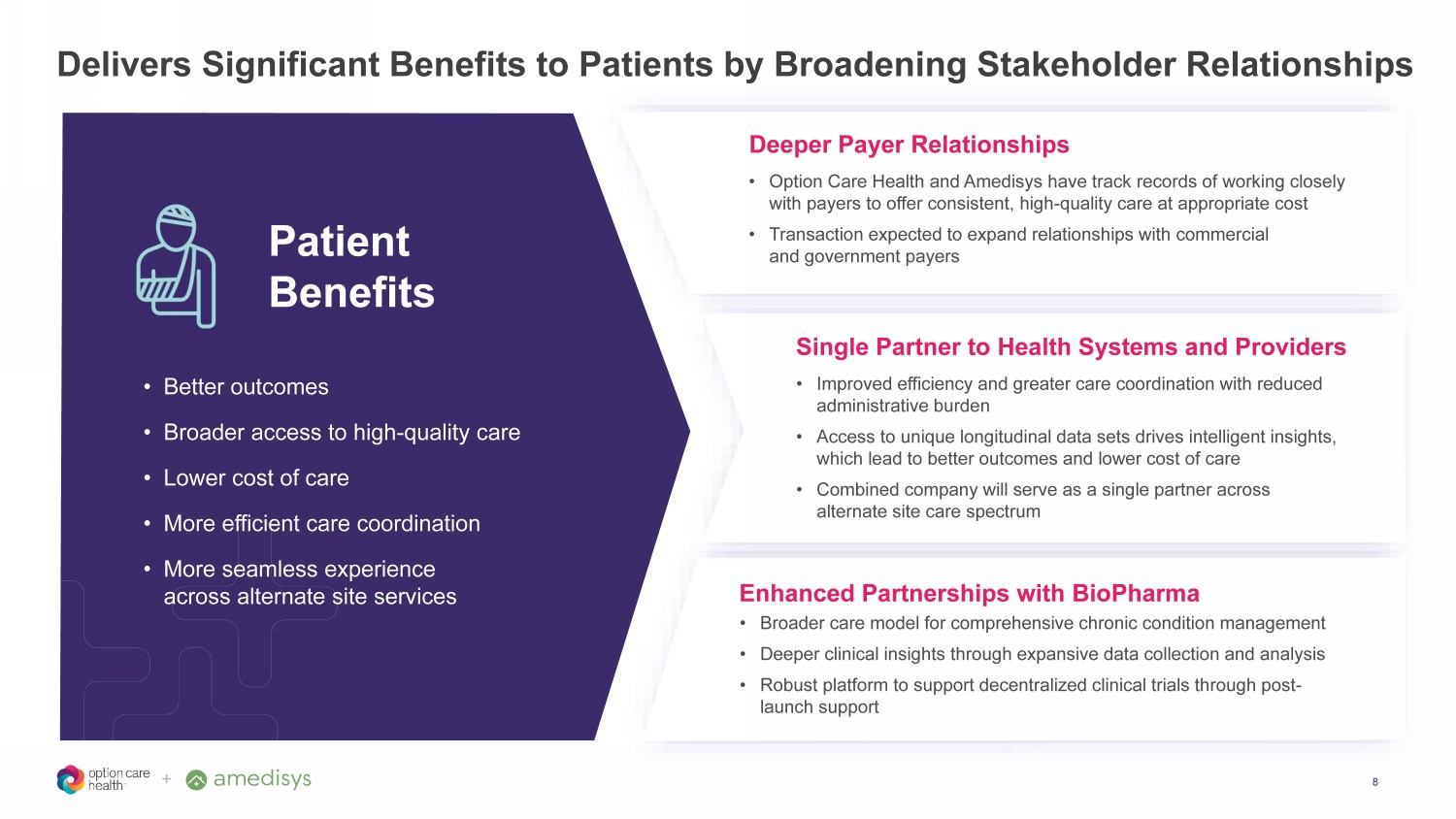

+ Delivers Significant Benefits to Patients by Broadening Stakeholder Relationships 8 • Better outcomes • Broader access to high - quality care • Lower cost of care • More efficient care coordination • More seamless experience across alternate site services • Improved efficiency and greater care coordination with reduced administrative burden • Access to unique longitudinal data sets drives intelligent insights, which lead to better outcomes and lower cost of care • Combined company will serve as a single partner across alternate site care spectrum Patient Benefits Single Partner to Health Systems and Providers • Option Care Health and Amedisys have track records of working closely with payers to offer consistent, high - quality care at appropriate cost • Transaction expected to expand relationships with commercial and government payers Deeper Payer Relationships Enhanced Partnerships with BioPharma • Broader care model for comprehensive chronic condition management • Deeper clinical insights through expansive data collection and analysis • Robust platform to support decentralized clinical trials through post - launch support

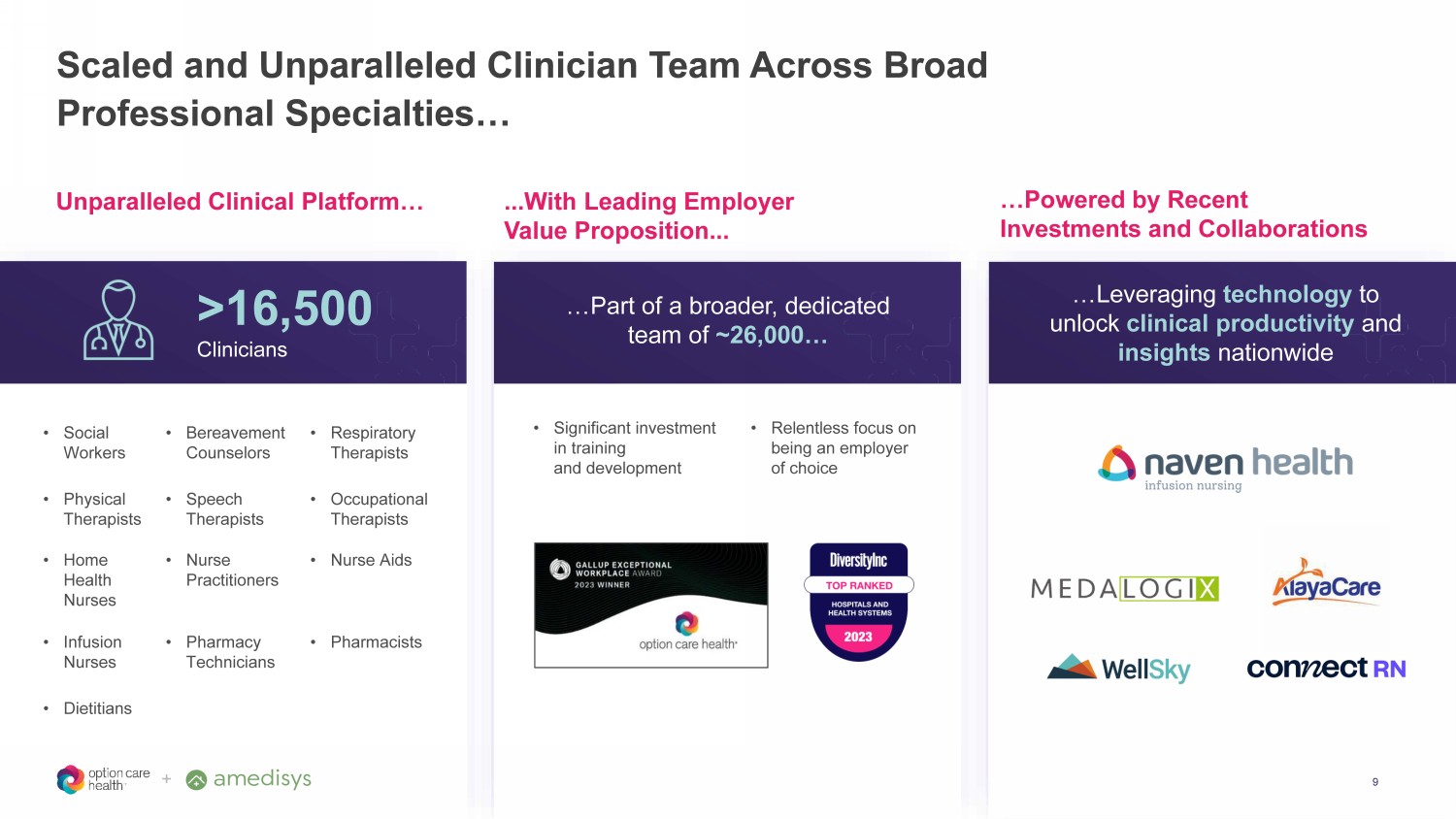

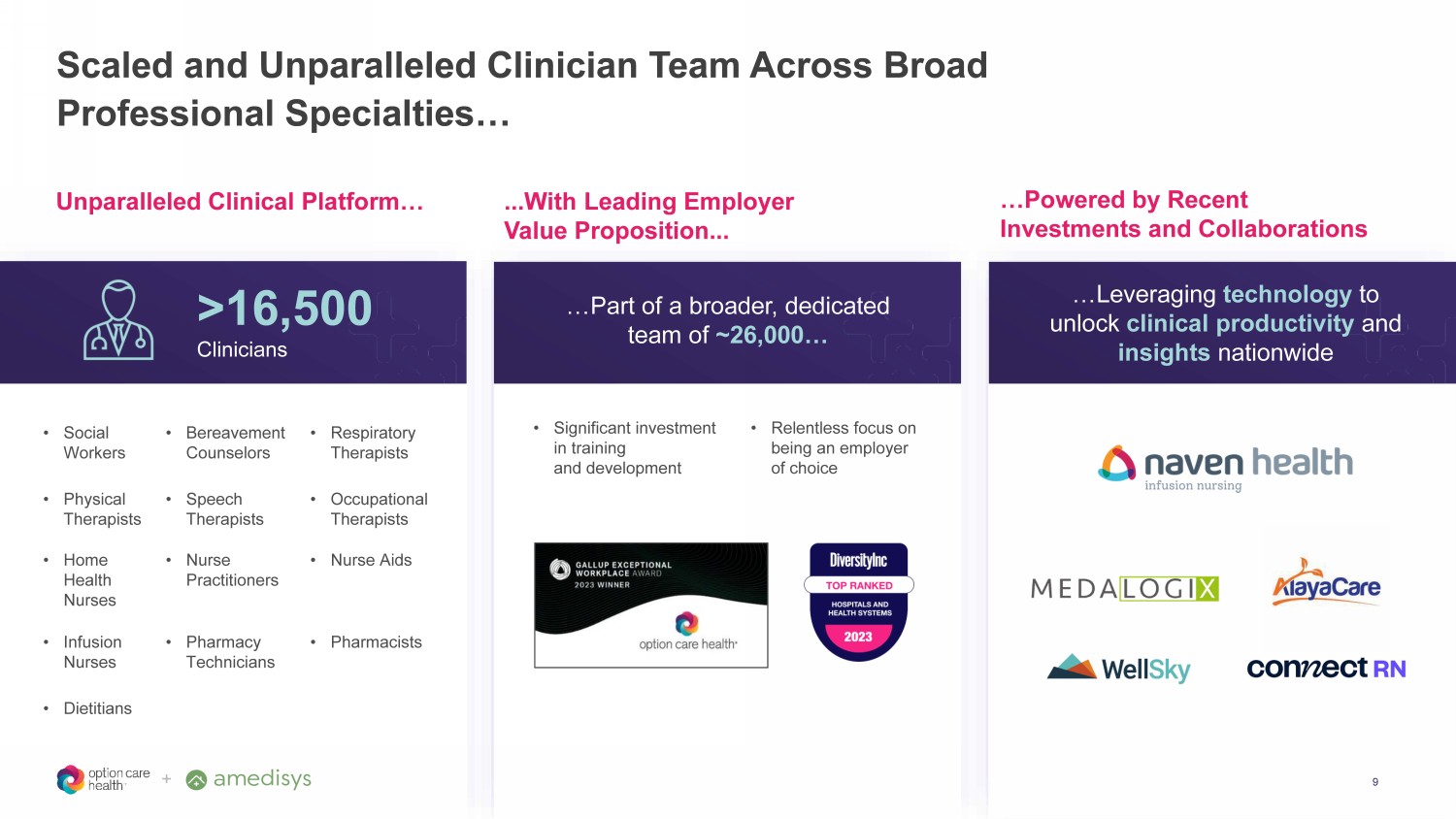

+ Scaled and Unparalleled Clinician Team Across Broad Professional Specialties… • Social Workers • Bereavement Counselors • Respiratory Therapists • Physical Therapists • Speech Therapists • Occupational Therapists • Home Health Nurses • Nurse Practitioners • Nurse Aids • Infusion Nurses • Pharmacy Technicians • Pharmacists • Dietitians >16,500 Clinicians Unparalleled Clinical Platform… …Powered by Recent Investments and Collaborations 9 ...With Leading Employer Value Proposition... + …Part of a broader, dedicated team of ~26,000… …Leveraging technology to unlock clinical productivity and insights nationwide • Significant investment in training and development • Relentless focus on being an employer of choice

+ …and National Platform that Increases Access to High Quality Care 10 Option Care Management Centers Option Care Stand - Alone Infusion Centers Amedisys Hospice Care Centers Amedisys Home Health Care Centers 1 As of YE2022 National Footprint with a Local Focus 1

+ >720K Patients Served with Data Aggregation Enables Intelligent Insights to Enhance Outcomes and Reduced Cost of Care 11 Lower Total Cost of Care Deliver Quality Patient Outcomes Improve Patient Experience Enable Value - Based Care Models and Other Insights for Payers Utilize Data to Streamline Patient Care Pathways BioPharma Collaboration and Clinical Trial Management Capabilities Real - Time Feedback for Care , Coordination, and Optimization Robust Analytics to Provide Enhanced Insight and Decision Support Population Analytics

+ Builds on Track Records of Delivering High Quality Care and Patient Satisfaction 92% 4 Patient Satisfaction 4.49 1 Quality of Patient Care 3.57 2 Patient Satisfaction Consistently above industry average Differentiated Quality Positions Combined Company Well for Value Based Arrangements 99% HIS Composite Score in Hospice Option Care Health has held URAC accreditation since 2017, evidencing commitment to deliver on high standards of care for patients and investments in clinicians and quality oversite programs. PCAB Option Care Health was the first home infusion provider nationally to achieve certification at all our clean room locations from the Pharmacy Compounding Accreditation Board (PCAB), demonstrating our leadership and prioritization of safety and quality in compounding pharmacy operations. 99% Home Health Centers with 4+ Stars Accredited for ongoing quality, growth and compliance OPTION CARE HEALTH AMEDISYS Amedisys holds accreditation at all Home Health and Hospice agencies, demonstrating commitment to patient care and high clinical standards 3 12 1 Maintained the highest Quality of Patient Care star score in the Home Health industry in the Home Health Compare (“HHC”) Apri l 2 023 preview of 4.49 stars, with 99% of care centers at 4+ Stars and 46 care centers rated at 5 stars. 2 Patient Satisfaction star average for January 2023 Home Health industry in the Home Health Compare (“HHC”) release was 3.57, outperforming the industry average by 1%. 3 https://www.amedisys.com/about/why - amedisys/ 4 Jan - Dec 2022 patient satisfaction data, survey of 25,918 patients. Option Care Health holds accreditation at all pharmacy and ambulatory infusion suites, demonstrating commitment to patient care and high clinical standards.

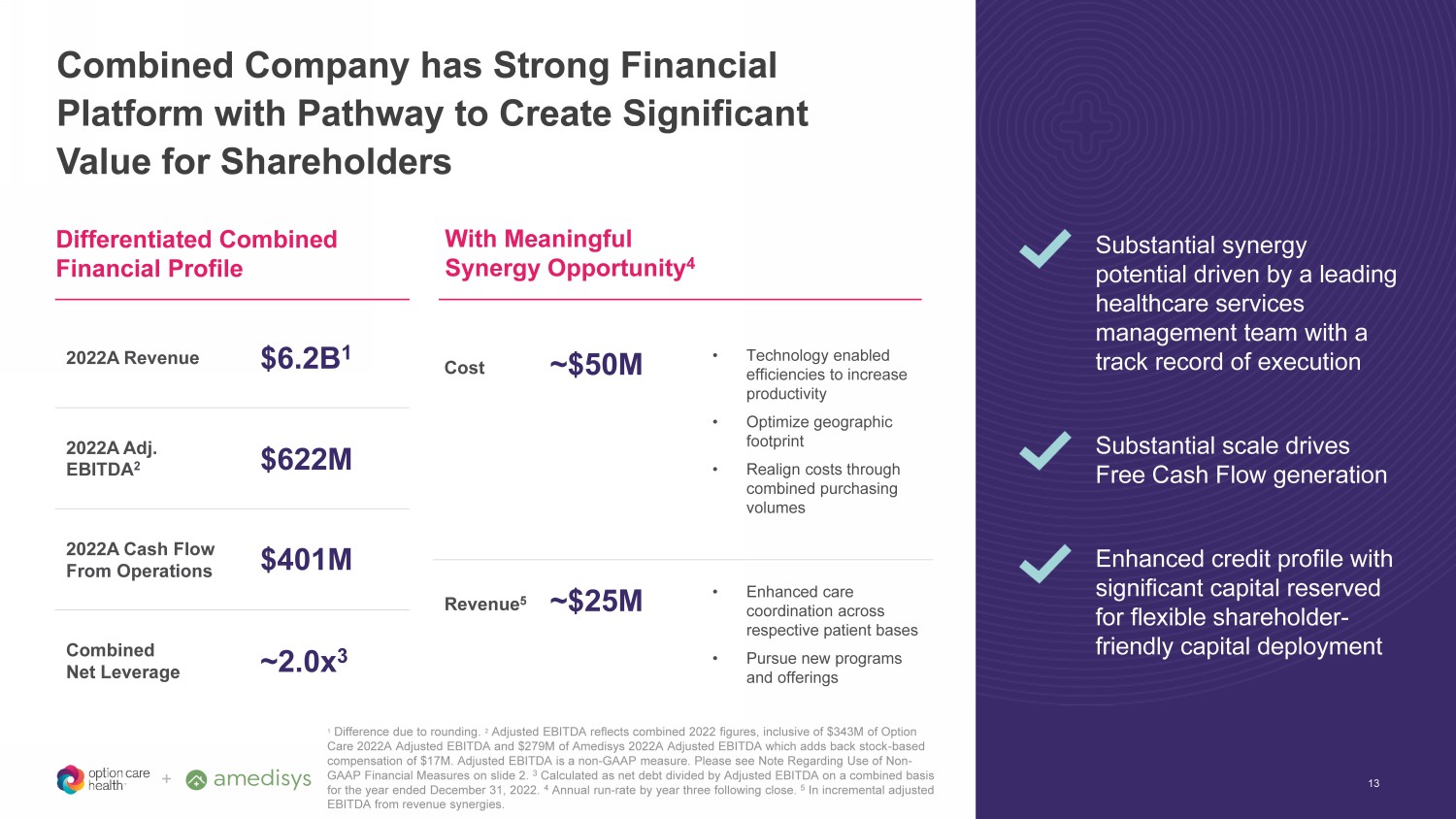

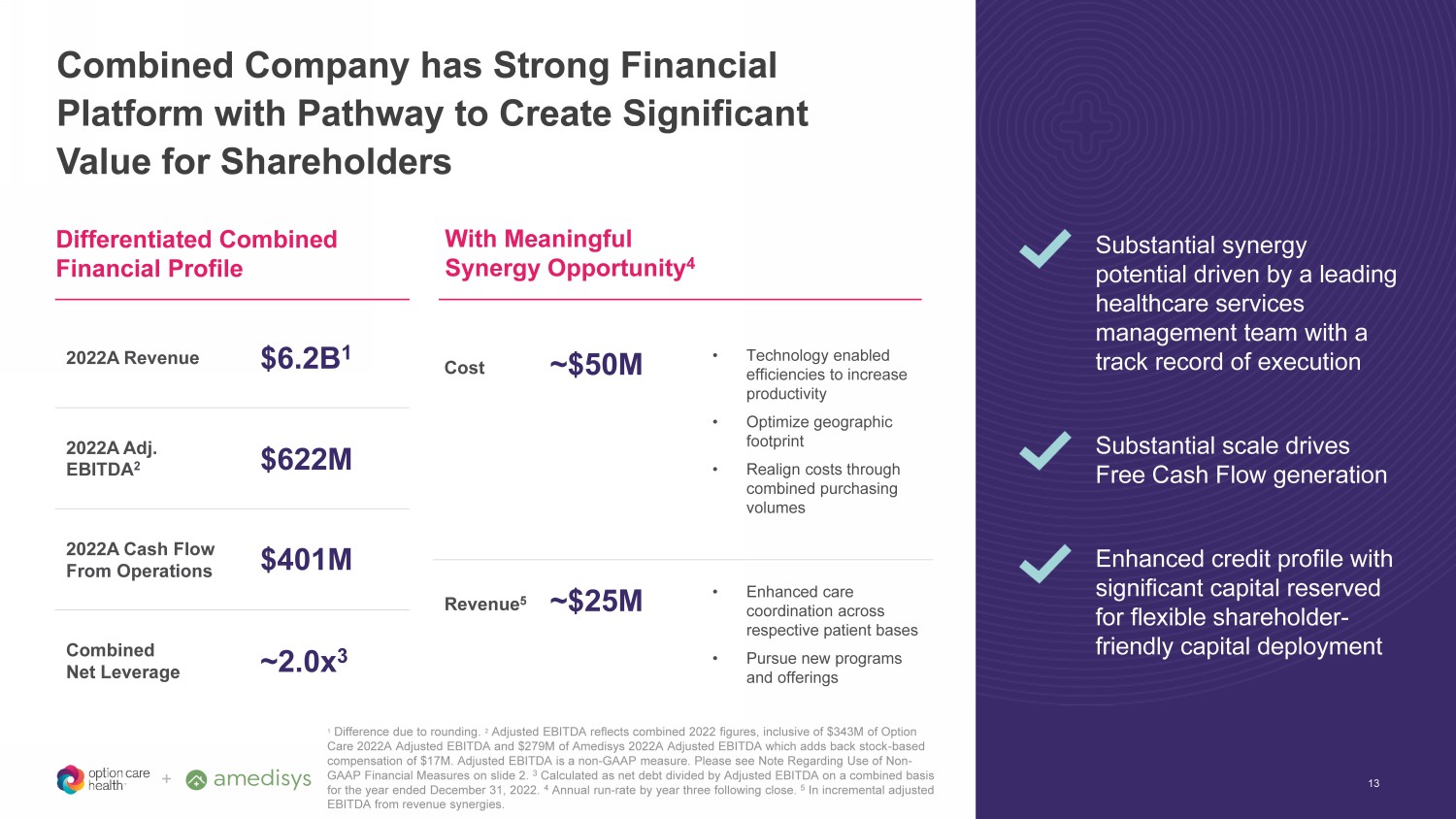

+ Combined Company has Strong Financial Platform with Pathway to Create Significant Value for Shareholders Substantial synergy potential driven by a leading healthcare services management team with a track record of execution Substantial scale drives Free Cash Flow generation Enhanced credit profile with significant capital reserved for flexible shareholder - friendly capital deployment Differentiated Combined Financial Profile With Meaningful Synergy Opportunity 4 2022A Revenue $6.2B 1 2022A Adj. EBITDA 2 $622M 2022A Cash Flow From Operations $401M Combined Net Leverage ~2.0x 3 Cost ~$50M • Technology enabled efficiencies to increase productivity • Optimize geographic footprint • Realign costs through combined purchasing volumes Revenue 5 ~$25M • Enhanced care coordination across respective patient bases • Pursue new programs and offerings 1 Difference due to rounding. 2 Adjusted EBITDA reflects combined 2022 figures, inclusive of $343M of Option Care 2022A Adjusted EBITDA and $279M of Amedisys 2022A Adjusted EBITDA which adds back stock - based compensation of $17M. Adjusted EBITDA is a non - GAAP measure. Please see Note Regarding Use of Non - GAAP Financial Measures on slide 2. 3 Calculated as net debt divided by Adjusted EBITDA on a combined basis for the year ended December 31, 2022. 4 Annual run - rate by year three following close. 5 In incremental adjusted EBITDA from revenue synergies. 13

+ 14 Nick Muscato Chief Strategy Officer (855) 259 - 2046 IR@amedisys.com Mike Shapiro Chief Financial Officer (312) 940 - 2538 investor.relations@optioncare.com