SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Ainos, Inc. |

| (Name of Issuer) |

Common Stock, $0.01 par value |

| (Title of Class of Securities) |

00902F 105 |

| (CUSIP Number) |

Chun-Hsien Tsai Chief Executive Officer Ainos, Inc. 14F., No. 61, Sec. 4, New Taipei Boulevard, Xinzhuang District New Taipei City 242, Taiwan F5 886-37-581999 |

(Name, address and telephone number of person authorized to receive notices and communications) |

December 6, 2021 |

| (Date of event which requires filing of this statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 2 of 7 Pages |

| 1 | NAME OF REPORTING PERSONS Ainos, Inc | |||

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ | |||

| 3 | SEC USE ONLY | |||

| 4 | SOURCE OF FUNDS OO | |||

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐ | |||

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Cayman Islands | |||

NUMBER OF | 7 | SOLE VOTING POWER | 93,715,000 | |

SHARES BENEFICIALLY | 8 | SHARED VOTING POWER | 0 | |

OWNED BY EACH | 9 | SOLE DISPOSITIVE POWER | 93,715,000 | |

REPORTING PERSON WITH | 10 | SHARED DISPOSITIVE POWER | 0 | |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 93,715,000 | |||

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ | |||

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 65.79% | |||

| 14 | TYPE OF REPORTING PERSON CO | |||

The percentage ownership is based upon 142,442,215 shares of common stock issued and outstanding as of December 6, 2021, as certified by the Issuer to the Reporting Person on December 9, 2021.

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 3 of 7 Pages |

Item 1. Security and Issuer

This statement relates to the shares of common stock (“Common Stock”) of Ainos, Inc., a Texas corporation (the “Issuer”), the principal executive offices of which are located at 8880 Rio San Diego Drive, Suite 800, San Diego, CA 92108.

Item 2. Identity and Background

(a-b) This statement is filed by Ainos, Inc., a Cayman Islands corporation (“Ainos KY” or the “Reporting Person”). The principal business address of Ainos KY is 14F., No. 61, Sec. 4, New Taipei Boulevard, Xinzhuang District, New Taipei City 242, Taiwan F5.

(c) The principal business of Ainos KY is developing and manufacturing biosensors and diagnostic point-of-care testing rapid test kits that include diagnostics for COVID-19 (SARS CoV2 Antigen Rapid Test), pneumonia, vaginal infection, and helicobacter pylori (H. pylori) bacterial infection.

(d) During the last five years, neither the Reporting Person nor, to the best of its knowledge, any of the entities or individuals named in Schedule A, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, neither the Reporting Person nor, to the best of its knowledge, any of the entities or individuals named in Schedule A, has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The name, citizenship, present principal occupation or employment and business address of each director and executive officer of Ainos KY are set forth in Schedule A attached hereto (such persons included in Schedule A are referred to herein as the “Additional Persons”).

Item 3. Source and Amount of Funds or Other Consideration

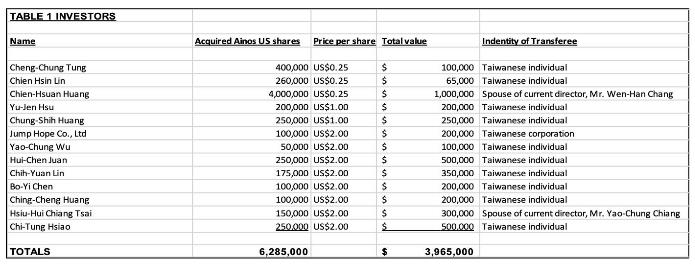

Reference is made to the Stock Purchase Agreements, dated as of December 1, 2021 (the “Agreements”), by and among Ainos KY and those certain twelve individual investors and one company identified in the following Table 1 (the “Table 1 Investors”). Under the Agreements, Ainos KY sold 6,285,000 shares of the Issuer’s Common Stock (the “Shares”) for an aggregate purchase price of $3,965,000.

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 4 of 7 Pages |

Ainos KY filed a Form 4 with the Securities and Exchange Commission (“SEC”) on December 9, 2021 reporting its sale of 6,285,000 Shares to the Table 1 Investors. Mr. Wen-Han Chang, a director of the Issuer, filed a Form 4 with the SEC on December 9, 2021 relating to the acquisition of 4,000,000 Shares by his spouse, Chien-Hsuan Huang. Additionally, Mr. Yao-Chung Chiang, a director of the Issuer, filed a Form 4 with the SEC on December 9, 2021 relating to the acquisition of 150,000 Shares by his spouse, Hsiu-Hui Chiang Tsai.

The offer and sale of the Shares pursuant to the Agreements were made in reliance on and pursuant to Regulation S under the Securities Act of 1933, as amended.

Items 4. Purpose of Transaction

The information set forth in Item 3 of this Schedule 13D is hereby incorporated by reference into this Item 4, as applicable.

The disposition of the Shares by Ainos KY was done in the normal course of business to raise working capital for Ainos KY’s principal business.

Except as disclosed herein, the Reporting Person has no plans which relate to or would result in an event described in subparagraphs (a) through (j) of Item 4 of Schedule 13D. However, the Reporting Person may, from time to time, engage in discussions, whether initiated by the Reporting Person or another party, concerning proposals for transactions or other arrangements that may relate to or, if consummated, result in an event described in Item 4 of Schedule 13D. The Reporting Person may review and evaluate its investment in the Issuer at any time, whether in light of the discussions described in the immediately preceding sentence or otherwise, which may give rise to plans or proposals that, if consummated, would result in one or more of the events described in Item 4 of Schedule 13D. Any such discussion or actions may consider various factors, including, without limitation, the Issuer’s business prospects and other developments concerning the Issuer, alternative investment opportunities, general economic conditions, financial and stock market conditions and any other facts and circumstances that may become known to the Reporting Person regarding or related to the matters described in this Schedule 13D.

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 5 of 7 Pages |

Item 5. Interest in Securities of the Issuer.

(a) The aggregate number and percentage of shares of the Issuer’s Common Stock to which this Schedule 13D relates is 93,715,000, constituting 65.79% of the Issuer’s outstanding Common Stock as of December 6, 2021.

(b) The Reporting Person holds sole power to vote and dispose of the shares of the Issuer’s Common Stock.

(c) On November 18, 2021, the Reporting Person entered into an Asset Purchase Agreement (the “APA”) with the Issuer. Pursuant to the APA, the Issuer will acquire certain intellectual property assets and manufacturing, testing, and office equipment for a total purchase price of Twenty-six Million Dollars ($26,000,000 U.S.D.) (the “Purchase Price”). Of the total Purchase Price, the Parties agreed to allocating Twenty-four Million Eight Hundred Eighty-six Thousand and Twenty-three Dollars ($24,886,023 U.S.D.) toward acquisition of the intellectual property assets and One Million One Hundred Thirteen Thousand and Nine Hundred Seventy-seven Dollars ($1,113,977 U.S.D.) toward the purchase of the equipment. The Purchase Price will be paid at closing by the Issuer issuing a Convertible Note (the “Convertible Note”) in favor of the Reporting Person. The terms and conditions of the Convertible Note will be determined by the Parties prior to Closing.

Other than the transactions described herein there have been no other transactions concerning the Common Stock of the Issuer effected during the past sixty (60) days.

(d) No other person is known to the Reporting Person to have the right to receive or the power to direct the receipt of dividends from, or proceeds from the sale of, the Shares.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

The information set forth in Item 4 of this Schedule 13D is hereby incorporated by reference into this Item 6, as applicable.

Other than the foregoing agreements and arrangements, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among Ainos KY or the Additional Persons and any other person with respect to any securities of the Issuer, including, but not limited to transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits.

None.

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 6 of 7 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: December 13, 2021 | By: /s/ Chun-Hsien Tsai__________________ |

| Chairman and CEO of Ainos, Inc., a Cayman Islands corporation | |

CUSIP No. 00902F 105 | SCHEDULE 13D | Page 7 of 7 Pages |

SCHEDULE A

Officers and Directors of Reporting Person

Note 1: The address of each individual is c/o Ainos, Inc., 14F., No. 61, Sec. 4, New Taipei Blvd., Xinzhuang Dist., New Taipei City 242, Taiwan F5, and each individual is a citizen of Taiwan except for Mr. Yukio Sakamoto, who is a citizen of Japan.

Chun-Hsien Tsai is also Chairman, President and CEO of the Issuer. Chun-Jung Tsai is also a director of the Issuer.

| Name | Principal Occupation (and name/address of employerif not one of the entities listed on this Schedule) | Principal Business Address | Interest in Issuer |

| Hsing-Hseng Lin | Director | See Note 1. | None |

| Hung-Szu Tung | Director | See Note 1. | None |

| Chun-Hsien Tsai | Director & CEO | See Note 1. | None |

| Chun-Jung Tsai | Director | See Note 1. | None |

| Yukio Sakamoto | Director | See Note 1. | None |

| Chih-Heng Lu | Director | See Note 1. | None |

| Tsong-Jung Lee | Director | See Note 1. | None |