UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 SCHEDULE 14A INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION |

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a‑12 |

| U.S. Global Investors Funds |

| (Name of Registrant as Specified in Its Charter) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| |

(1) Title of each class of securities to which transaction applies: |

| | |

| |

(2) Aggregate number of securities to which transaction applies: |

| | |

| |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| |

(4) Proposed maximum aggregate value of transaction: |

| | |

| |

(5) Total fee paid: |

| | |

| | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

(1) Amount previously paid: |

| | |

| |

(2) Form, Schedule or Registration Statement No.: |

| | |

| |

(3) Filing Party: |

| | |

| |

(4) Date Filed: |

| | |

| U.S. GLOBAL INVESTORS FUNDS November 12, 2015 Dear Shareholder: We are writing to cordially invite you to a Special Meeting of Shareholders to take place on December 9, 2015, at 9 a.m. Central time, at the offices of U.S. Global Investors, Inc. located at 7900 Callaghan Road, San Antonio, Texas 78229. The Meeting has been proposed to ask for your vote on an important proposal relating to the U.S. Global Investors Funds. The proposal language can be found on the Meeting Notice and is detailed within the Proxy Statement. In addition, we have included a Summary of the Proposal which describes the proposal and its effects on you as a shareholder. After careful consideration, the Board of Trustees of the U.S. Global Investors Funds recommends that you vote FOR the proposal. We need your instructions and urge you to review the enclosed materials thoroughly. Once you have determined how you would like to vote, please vote promptly by utilizing our three convenient voting options. Vote by telephone, record your voting instructions through the Internet, or simply complete the enclosed proxy card and return it to us in the postage paid return envelope provided. Specifics regarding each of these voting options can be found on the enclosed voting instruction form. We realize that you, like most people, lead a busy life and might be tempted to put this Proxy Statement aside for another day. Please don’t. Your prompt return of the enclosed proxy card (or your voting by telephone or through the Internet) may save the necessity and expense of further solicitations. Your vote is important to us. We appreciate the time and consideration we expect you will give this important matter. If you have questions about the proposal, please call AST Fund Solutions, our proxy solicitor, at 1-877-536-1559, or contact your financial adviser. Thank you for your continued support of U.S. Global Investors Funds. Sincerely yours, Frank E. Holmes

Chief Executive Officer and Trustee

U.S. Global Investors Funds |

This page intentionally left blank.

U.S. GLOBAL INVESTORS FUNDS

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

This is the formal agenda for the Special Meeting of Shareholders (the “Meeting”) of each fund (each a “Fund” and collectively the “Funds”) of U.S. Global Investors Funds (the “Trust”). It tells you what proposal you will be voting on and the time and place of the Meeting, in the event you choose to attend in person.

To the Shareholders of the Funds:

The Meeting will be held at 7900 Callaghan Road, San Antonio, Texas 78229, on December 9, 2015, 9 a.m. Central time, to consider the following proposal (the “Proposal”):

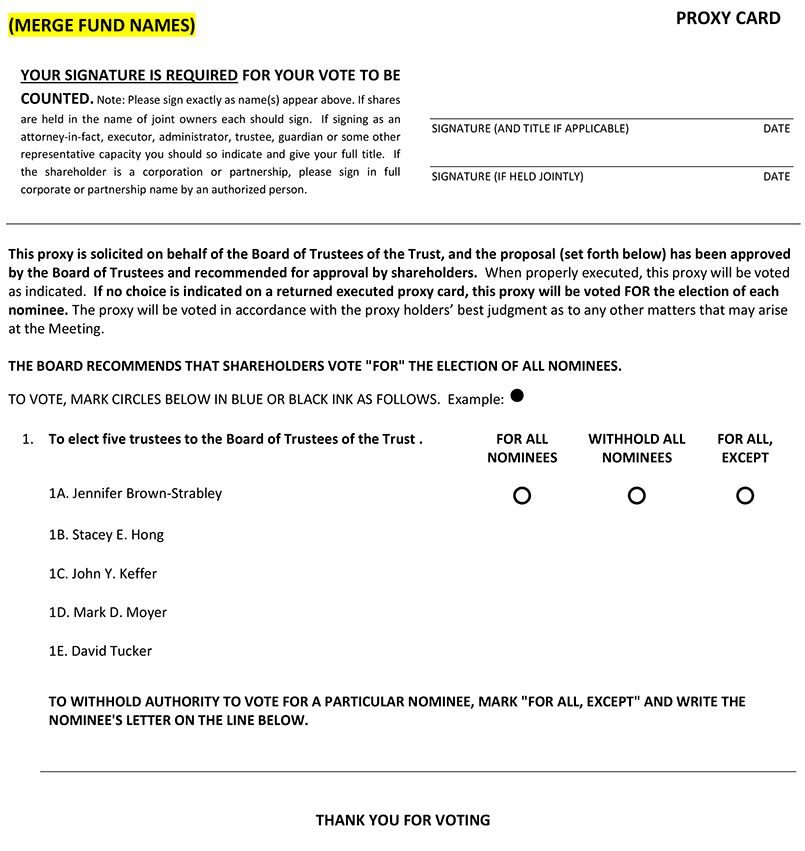

| | 1. | To elect five trustees to the Board of Trustees of the Trust, as discussed under the heading “Proposal – Election of Trustees” in the attached Proxy Statement. |

After careful consideration, the Board of Trustees of the Trust recommends that you vote FOR the Proposal.

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

Holders of record of shares of the Funds at the close of business on October 30, 2015, are entitled to notice of, and to vote at, this Meeting and at any adjournments or postponements thereof.

In the event that a quorum is present but sufficient votes in favor of the Proposal have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any adjournment of the Meeting for the further solicitation of proxies as to any Proposal will require the affirmative vote of a majority of the shares present in person or by proxy at the session of the Meeting to be adjourned. The persons named as proxies will vote those proxies they are entitled to vote in their discretion as to any such adjournment.

| | U.S. GLOBAL INVESTORS FUNDS |

| | By order of the Trustees, |

| | |

| | Susan B. McGee |

| | Secretary |

November 12, 2015

WE URGE YOU TO MARK, SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD IN THE POSTAGE PAID ENVELOPE PROVIDED OR RECORD YOUR VOTING INSTRUCTIONS BY TELEPHONE OR THROUGH THE INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

This page intentionally left blank.

Summary of the Proposal

November 12, 2015

Although we recommend that you read the complete Proxy Statement, for your convenience we have provided a brief overview of the proposal to be voted on at the Special Meeting of Shareholders (the “Meeting”).

What is the purpose of the Meeting?

You are being asked to vote on the election of new trustees (the “Nominees”) for U.S. Global Investors Funds (the “Trust” or the “Funds”). This action is intended to result in the Trust becoming part of the family of funds that receives administrative, fund accounting, and/or transfer agency services from Atlantic Fund Services (“Atlantic”). The primary reason behind this initiative is to transition the Funds to the Forum family of funds (the “Forum Complex”) so that they may realize operational economies of scale. The Board of Trustees of the Trust has unanimously recommended that shareholders approve the election of the proposed Nominees (the “Proposal”).

How will the Funds become members of the Forum Complex?

Shareholders of the Trust are being asked to elect a new slate of trustees to the Board of Trustees (the “Board”) for the Trust. The nominees for Board membership are the people who serve as board members for certain other investment companies in the Forum Complex. If elected, U.S. Global Investors, Inc., the investment adviser to the Funds (“U.S. Global” or the “Adviser”) and Atlantic have indicated to the current Board their intention to recommend to the new Board the appointment of the same officers to the Trust as certain of the other funds in the Forum Complex, and the approval of agreements between the Trust and Atlantic whereby Atlantic will, over time, provide administrative, fund accounting, and transfer agency services to the Funds, and a revised administration agreement between the Trust and U.S. Global whereby U.S. Global will provide fewer administrative services to the Trust than it currently provides and at a reduced fee level. There is no assurance, however, that the new Board will take such actions.

Is there going to be a change in the investment strategies used by the Funds?

No. U.S. Global will continue to be responsible for the day-to-day investment management of the Funds and will maintain the same investment strategies.

Will the expenses of each Fund remain the same?

Although there will be no change to the investment advisory fee currently charged to each Fund, management submitted data to the Board showing potential overall cost savings due to economies of scale available by becoming a part of the Forum Complex. However, there is no guarantee that such projected cost savings will be realized. In addition, U.S. Global represented to the Board that each Fund’s current voluntary expense cap will remain in place, although the Adviser reserves the right to terminate each Fund’s voluntary expense cap at any time.

i

What are the costs of the Proposal and who is paying for them?

The costs to implement the Proposal include: (i) the preparation, printing, and mailing of the enclosed proxy card and proxy statement, and all other costs incurred in connection with the solicitation of proxies for the Funds; (ii) trustee and legal fees in connection with the Board meetings at which the Proposal was considered and approved; and (iii) ongoing insurance coverage over the next six years for the Trust and the current Board of Trustees (which is commonly referred to as “tail insurance”). All costs will be split equally between U.S. Global and the Trust, with the Trust’s portion exclusive of each Fund’s expense cap. The total costs are estimated to be approximately $660,000 and could be higher or lower, with the estimated cumulative net asset value impact per Fund ranging from $0.0005 to $0.0193 per share.

How does the Trust’s Board of Trustees suggest that I vote on the proposal?

After careful consideration, the Board of Trustees unanimously recommends that you vote “FOR” the approval of the Proposal.

Will my vote make a difference?

Your vote is needed to ensure that the proposal can be approved. Additionally, your immediate response will help save on the costs of any future solicitations for these shareholder votes. We encourage all shareholders to participate in the governance of their Fund.

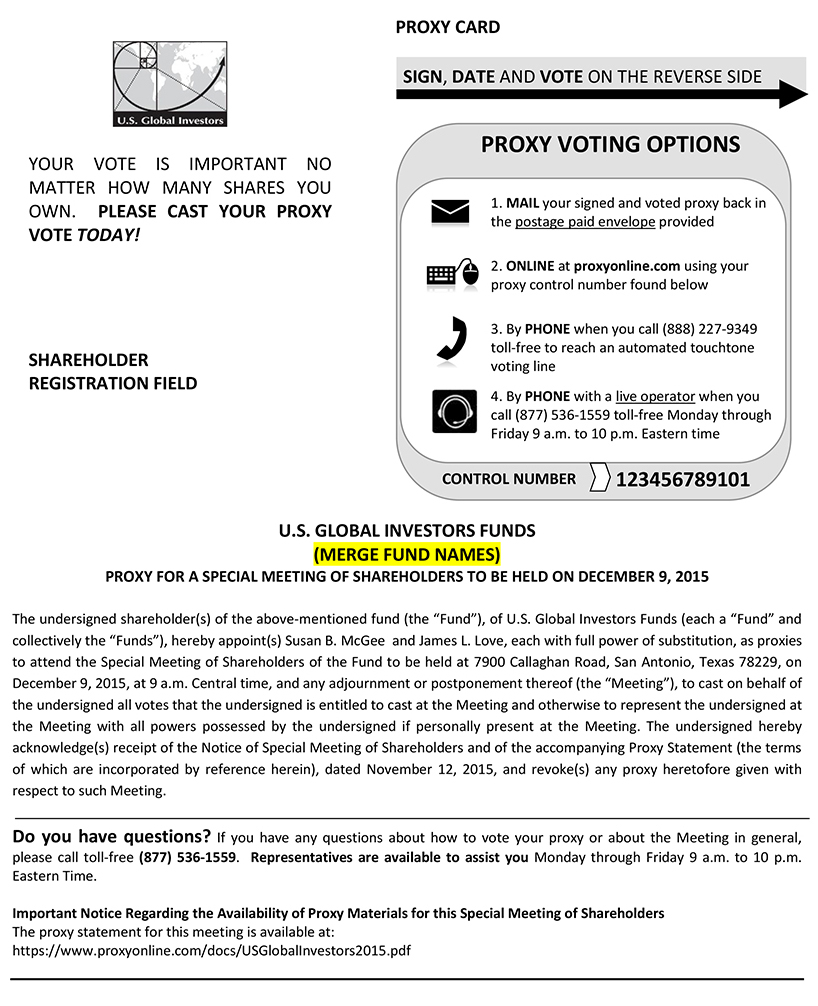

How can I vote?

You can vote your shares by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number on the proxy card or by computer by going to the Internet address provided on the proxy card and following the instructions, using your proxy card as a guide.

If I send in my voting instructions now as requested, can I change my vote later?

Yes, you may change your vote, including proxies given by telephone or over the Internet, at any time before the special meeting by sending a written revocation to the Secretary of the U.S. Global Investors Funds at 7900 Callaghan Road, San Antonio, Texas 78229.

Who should I call about additional information relating to this Proxy Statement?

For additional information, please call AST Fund Solutions, the Funds’ proxy solicitor, at 1-877-536-1559, or contact your financial adviser.

ii

U.S. GLOBAL INVESTORS FUNDS

7900 Callaghan Road

San Antonio, Texas 78229

PROXY STATEMENT

November 12, 2015

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees of U.S. Global Investors Funds (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of the following series of U.S. Global Investors Funds (each a “Fund” and collectively the “Funds”):

All American Equity Fund | China Region Fund |

Emerging Europe Fund | Global Resources Fund |

Gold and Precious Metals Fund | Holmes Macro Trends Fund |

Near-Term Tax Free Fund | U.S. Government Securities Ultra-Short Bond Fund |

World Precious Minerals Fund | |

The Meeting is to be held at 7900 Callaghan Road, San Antonio, Texas 78229, on December 9, 2015, at 9 a.m. Central time.

This Proxy Statement, along with the Notice of a Special Meeting of Shareholders and the proxy card, is being mailed to shareholders on or about November 12, 2015. It explains concisely what you should know before voting on the proposal described in this Proxy Statement (the “Proposal”). Please read it carefully and keep it for future reference.

The Meeting is being held to consider the following Proposal and such other matters as may properly come before the Meeting or any adjournments thereof:

| | 1. | To elect five trustees to the Board of Trustees of the Trust. |

After careful consideration, the Board of Trustees of the Trust recommends that you vote FOR the proposal.

Shareholders of record at the close of business on October 30, 2015, are entitled to notice of, and to vote at, the Meeting.

PROPOSAL – Election of Trustees

You are being asked to elect a new slate of trustees to the Board of Trustees (the “Board”) for the Trust. This action is intended to result in the Trust becoming part of the family of funds that receives administrative, fund accounting, and/or transfer agency services from Atlantic Fund Services (“Atlantic”). The primary reason behind this initiative is to transition the Funds to the Forum family of funds (the “Forum Complex”) so that they may realize operational economies of scale.

The Trust’s current trustees, none of whom will continue to serve after the Meeting, have nominated and proposed the election at the Meeting of the following five nominees (the “Nominees”): Jennifer Brown-Strabley, Stacey E. Hong, John Y. Keffer, Mark D. Moyer, and David Tucker (the “Proposal”). None of the Nominees currently serves as a trustee of the Trust. The Board unanimously recommends that you vote “For” the approval of the Proposal.

Why are the Trust’s current trustees recommending approval of the Proposal?

Earlier this year on multiple occasions, U.S. Global Investors, Inc. (“U.S. Global” or the “Adviser”), the investment adviser and an administrator of the Funds, discussed with the Board the possibility of having the Funds join a series trust sponsored by a third-party service provider so that the Funds could realize operational economies of scale not currently available to the Funds given the small level of assets in the Trust. As a result of these discussions, U.S. Global, in the early summer, began a due diligence process, identifying four potential service providers from whom it solicited information and proposals.

After completing its due diligence with the four potential service providers, U.S. Global provided detailed information to the Board about the proposals. U.S. Global recommended that the Board select Atlantic’s proposal for a variety of reasons set forth in the materials, including, among other things, the ability to reduce the ongoing expenses of the Funds while avoiding costly termination fees from the Fund’s existing service providers due to Atlantic’s flexibility with respect to the structure of the Proposal. These materials were provided to the Board in advance of its regularly scheduled quarterly meeting on September 15, 2015.

Mr. Keffer, the founder and Chairman of Atlantic, and Mr. Hong, the President of Atlantic, attended the Board meeting in San Antonio on September 15. Mr. Keffer and Mr. Hong delivered a presentation based on materials that Atlantic provided to the Board. During the meeting, the Board had an opportunity to ask questions about Atlantic, the Forum Complex, the Nominees, and the Proposal.

Subsequent to the September 15 meeting, counsel, on behalf of the independent trustees, requested further detailed information about the Proposal and the Nominees. U.S. Global and Atlantic provided the requested materials to the trustees in advance of meetings of the Board and its Nominating and Governance Committee scheduled for September 30, 2015. During the meetings on September 30, the Board had an opportunity to discuss the materials with U.S. Global. In addition, the independent trustees met in executive session with independent counsel. After the meeting, the independent trustees sought further information from U.S. Global and requested that another meeting be scheduled with Mr. Keffer.

The Board met again on October 5, 2015, with Mr. Keffer. Also during the Board meeting on October 5, the Board discussed issues related to the costs of the Proposal and the allocation of those costs. The independent trustees met in executive session with independent counsel. After the executive session, the Board’s Nominating and Governance Committee met to recommend the nomination of the Nominees to the Board. Subsequent to the Nominating and Governance Committee meeting, the full Board of Trustees met to approve the submission of the Proposal to shareholders.

Who are the Nominees?

The Nominees serve as board members for certain other investment companies in the Forum Complex. If elected, U.S. Global and Atlantic have indicated to the current Board their intention to recommend to the new Board the appointment of the same officers to the Trust as other funds in the Forum Complex, and the approval of agreements between the Trust and Atlantic whereby Atlantic, over time, will provide administrative, fund accounting, and transfer agency services to the Funds, and a revised administration agreement between the Trust and U.S. Global whereby U.S. Global will provide fewer administrative services to the Trust than it currently provides, and at a reduced fee level. There is no assurance, however, that the new Board will take such actions.

The term of office of each person elected as a trustee will be until the next meeting held for the purpose of electing trustees and until such person’s successor is elected and qualified (or until such trustee’s earlier retirement, resignation, death, or removal). The Nominees have agreed to serve as trustees if elected. If any of the Nominees should be unavailable for election at the time of the Meeting (which is not presently anticipated), the persons named as proxies may vote for another person in their discretion.

The Nominees are identified in the table on the following pages. The table provides information as to the Nominees’ principal business occupations held during the last five years and certain other information. The address for all Nominees is c/o Atlantic Fund Services, Three Canal Plaza, Suite 600, Portland, Maine 04101. Stacey E. Hong and John Y. Keffer are considered interested Nominees due to their affiliation with Atlantic. The other Nominees are considered to be non-interested (or independent) because they are not interested persons of the Trust or U.S. Global as defined in Section 2(a)(19) of the Investment Company Act of 1940.

NAME

AND AGE | POSITION HELD WITH TRUST | TERM OF OFFICE AND LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF PORTFOLIOS IN THE TRUST TO BE OVERSEEN BY TRUSTEE | OTHER DIRECTORSHIPS HELD BY TRUSTEE |

NON-INTERESTED NOMINEES |

David Tucker Born: 1958 | Nominee | N/A | Director, Blue Sky Experience (a charitable endeavor), since 2008; Senior Vice President & General Counsel, American Century Companies from 1998-2008. | 9 | Trustee, Forum Funds; Trustee, Forum Funds II; Trustee, Forum ETF Trust |

Mark D. Moyer Born: 1959 | Nominee | N/A | Chief Financial Officer, Institute of International Education from 2008-2011; Chief Financial Officer, Ziff Davis Media Inc. from 2005-2008; Adjunct Professor of Accounting, Fairfield University from 2009-2012. | 9 | Trustee, Forum Funds II; Trustee, Forum ETF Trust; Trustee, Outlook Funds Trust |

Jennifer Brown-Strabley Born: 1964 | Nominee | N/A | Principal, Portland Global Advisors from 1996-2010. | 9 | Trustee, Forum Funds II; Trustee, Forum ETF Trust |

NAME AND AGE | POSITION HELD WITH TRUST | TERM OF OFFICE AND LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF PORTFOLIOS IN THE TRUST TO BE OVERSEEN BY TRUSTEE | OTHER DIRECTORSHIPS HELD BY TRUSTEE |

INTERESTED NOMINEES |

Stacey E. Hong Born: 1966 | Nominee | N/A | President, Atlantic since 2008. | 9 | Trustee, Forum Funds II |

John Y. Keffer* Born: 1942 | Nominee | N/A | Chairman, Atlantic since 2008; President, Forum Investment Advisors LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depositary trust company chartered in the State of Maine) since 1997. | 9 | Trustee, Forum Funds; Trustee, Forum Funds II; Trustee, Forum ETF Trust; Trustee, ALTMFX Trust; Director, Wintergreen Fund, Inc. |

* | Atlantic and Forum Investment Advisors, LLC are subsidiaries of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer. |

In addition to the information set forth in the table above, each Nominee possesses certain relevant qualifications, experience, attributes or skills. The following provides additional information about these qualifications and experience.

David Tucker: Mr. Tucker has extensive experience in the investment management industry, including experience in senior management, legal and compliance roles at two large mutual fund complexes; service on various committees of the Investment Company Institute (“ICI”); and director of ICI Mutual (a mutual insurance company sponsored by the investment company industry), including service as chairman of the underwriting, risk and fraud committees of ICI Mutual’s board of directors. Mr. Tucker actively serves charitable organizations in the metropolitan Kansas City area.

Mark D. Moyer: Mr. Moyer has extensive experience with finance, having served as chief financial officer for an integrated media company and a not-for-profit organization. Mr. Moyer also served as an adjunct professor of accounting at Fairfield University. During his tenure as an executive officer of Ziff Davis Media, Inc., the company

filed for bankruptcy, at which time Mr. Moyer was appointed as the company’s Chief Restructuring Officer. Four months later, the company emerged from bankruptcy with a court-appointed plan, at which time Mr. Moyer’s employment with the company ceased.

Jennifer Brown-Strabley: Ms. Brown-Strabley has extensive experience in the financial services and investment management industry, including institutional sales experience in global fixed-income and in related quantitative research. Ms. Brown-Strabley also has experience in business start-up and operations and as a former principal of a registered investment adviser, for which she continues to provide consulting advice from time to time.

Stacey E. Hong: Mr. Hong has experience in auditing as a certified public accountant, and in the financial services industry as the president of a fund service provider specializing in administration, accounting, and transfer agency services for pooled investment products. Mr. Hong serves as a principal executive officer, and has served as the principal financial officer, for certain investment companies.

John Y. Keffer: Mr. Keffer has extensive experience in the investment management industry, including organizational experience as chairman and chief executive officer of a fund service provider; and multiple years of service as a trustee. Mr. Keffer also served as a trustee of Monarch Funds from 2003 to 2009 and Core Trust from 1995 to 2006 and continues to serve as an interested trustee of Forum Funds, Forum ETF Trust and ALTMFX Trust and an independent director of Wintergreen Fund, Inc., another open-end management investment company.

Who are expected to become the officers of the Trust if the Nominees are elected?

If the Nominees are elected to the Board, the current officers of the Trust are expected to resign immediately after the Meeting and U.S. Global and Atlantic have indicated to the current Board their intention to recommend appointment of the following new officers of the Trust (listed in the table below). There is no assurance, however, that the new Board will take such action.

Name and Year

of Birth | Position(s)

with the Trust | Principal Occupation(s)

During Past 5 Years |

Jessica Chase Born: 1970 | President; Principal Executive Officer | Senior Vice President, Atlantic since 2008. |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Senior Vice President, Atlantic since 2008. |

Zachary Tackett Born: 1988 | Vice President; Secretary and Anti-Money Laundering Compliance Officer | Associate Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013. |

Timothy Bowden Born: 1969 | Vice President | Manager, Atlantic since 2008. |

Michael J. McKeen Born: 1971 | Vice President | Senior Vice President, Atlantic since 2008. |

Name and Year

of Birth | Position(s)

with the Trust | Principal Occupation(s)

During Past 5 Years |

Geoffrey Ney Born: 1975 | Vice President | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. |

Todd Proulx Born: 1978 | Vice President | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. |

Carlyn Edgar Born: 1963 | Chief Compliance Officer | Senior Vice President, Atlantic since 2008. |

The mailing address of each of the individuals identified above is Atlantic Fund Services, Three Canal Plaza, Suite 600, Portland, Maine 04101.

The current officers of the Trust are as follows:

NAME, ADDRESS, AND AGE | POSITION(S) HELD WITH TRUST | TERM OF OFFICE AND LENGTH OF TIME SERVED* | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS |

Frank E. Holmes 7900 Callaghan Rd San Antonio, TX 78229 (60) | President and Chief Executive Officer Chief Investment Officer | January 1990 to present August 1999 to present | Director, Chief Executive Officer, and Chief Investment Officer of the Adviser. Since October 1989, Mr. Holmes has served and continues to serve in various positions with the Adviser, its subsidiaries, and the investment companies it sponsors. |

Susan B. McGee 7900 Callaghan Rd San Antonio, TX 78229 (56) | Executive Vice President and General Counsel; Secretary | March 1997 to present | President and General Counsel of the Adviser. Since September 1992, Ms. McGee has served and continues to serve in various positions with the Adviser, its subsidiaries, and the investment companies it sponsors. |

Lisa C. Callicotte 7900 Callaghan Rd San Antonio, TX 78229 (41) | Treasurer | July 2013 to present | Chief Financial Officer of the Adviser. Since July 2009, Ms. Callicotte has served and continues to serve in various positions with the Adviser, its subsidiaries, and the investment companies it sponsors. |

James L. Love, Jr. 7900 Callaghan Rd San Antonio, TX 78229 (46) | Chief Compliance Officer | September 2007 to present | Chief Compliance Officer and Deputy General Counsel of the Adviser. Since September 2007, Mr. Love has served and continues to serve in various positions with the Adviser, its subsidiaries, and the investment companies it sponsors. |

Susan K. Filyk 7900 Callaghan Rd San Antonio, TX 78229 (45) | Vice President Marketing | December 2008 to present | Director of Marketing of the Adviser since August 2007. Ms. Filyk has served and continues to serve in various positions with the Adviser, its subsidiaries, and the investment companies it serves. |

* | These dates include service for a predecessor trust. |

Ownership of Fund Securities

Listed below is Nominee ownership of securities in the Funds as of September 30, 2015.

Nominees | Dollar Range of Beneficial Ownership

in the Funds as of September 30, 2015 |

Non-Interested Nominees | |

David Tucker | None |

Mark D. Moyer | None |

Jennifer Brown-Strabley | None |

Interested Nominees | |

Stacey E. Hong | None |

John Y. Keffer | None |

As of September 30, 2015, no trustee, officer, or Nominee owned greater than 1% of the outstanding shares of any Fund except for the All American Equity, Holmes Macro Trends, Near-Term Tax Free, and U.S. Government Securities Ultra-Short Bond Funds. Trustee/officer Frank E. Holmes beneficially owned 21,215.99 shares (approximately 2.88%) of the All American Equity Fund, 27,286.95 shares (approximately 1.28%) of the Holmes Macro Trends Fund, 3,140,781.84 shares (approximately 7.22%) of the Near-Term Tax Free Fund, and 5,654,293.41 shares (approximately 19.94%) of the U.S. Government Securities Ultra-Short Bond Fund. In addition, as of September 30, 2015, the trustees and officers beneficially owned as a group less than 1% of the outstanding shares of each Fund except for the All American Equity, Holmes Macro Trends, Near-Term Tax Free, and U.S. Government Securities Ultra-Short Bond Funds. The trustees and officers of the Trust, as a group, beneficially owned 24,874.05 shares (approximately 3.38%) of the All American Equity Fund, 41,066.13 shares (approximately 1.92%) of the Holmes Macro Trends Fund, 3,208,710.88 shares (approximately 7.38%) of the Near-Term Tax Free Fund, and 5,796,186.95 shares (approximately 20.44%) of the U.S. Government Securities Ultra-Short Bond Fund.

Board Structure

The Trust’s current Board of Trustees manages the business affairs of the Trust. The Board of Trustees has five members: J. Michael Belz, James F. Gaertner, Frank E. Holmes, Clark R. Mandigo, and Joe C. McKinney. Frank E. Holmes is the only interested trustee. J. Michael Belz, a non-interested trustee, is the chairman of the Board of Trustees. The trustees establish policies and review and approve contracts and their continuance. The trustees regularly request and/or receive reports from the Adviser, the Trust’s other service providers and the Trust’s Chief Compliance Officer. The Trust’s day-to-day operations are managed by the Adviser and other service providers. The Board and the committees meet periodically throughout the year to review the Trust’s activities, including, among others, fund performance, valuation matters and compliance with regulatory requirements, and to review contractual arrangements with service providers. The Board has determined that the Trust’s leadership structure is appropriate

given the number, size and nature of the funds in the fund complex. The Agreement and Declaration of Trust provides that each trustee shall serve as a trustee of the Trust during the lifetime of this Trust and until its termination except as such trustee sooner dies, resigns or is removed. In addition, each trustee who is not an “interested person” of the Trust shall be required to retire in accordance with the terms of any retirement policy then in effect that has been approved by a majority vote of all non-interested trustees. The current retirement policy provides that the retirement age for non-interested trustees is 75 years of age. Trustees also elect the officers on an annual basis who serve until their successors are elected and qualified, and select the trustees to serve as Audit Committee members and Nominating and Governance Committee members. The business address of each trustee and officer is 7900 Callaghan Road, San Antonio, Texas 78229.

Consistent with its responsibility for oversight of the Trust and its Funds, the Board, among other things, oversees risk management of each Fund’s investment program and business affairs directly and through the committee structure that it has established. Risks to the Funds include, among others, investment risk, credit risk, liquidity risk, valuation risk and operational risk, as well as the overall business risk relating to the Funds. The Board has adopted, and periodically reviews, policies and procedures designed to address these risks. Under the overall supervision of the Board, the Adviser and other services providers to the Funds also have implemented a variety of processes, procedures and controls to address these risks. Different processes, procedures and controls are employed with respect to different types of risks. These processes include those that are embedded in the conduct of regular business by the Board and in the responsibilities of officers of the Trust and other service providers.

The Board requires senior officers of the Trust, including the President, Treasurer and Chief Compliance Officer (“CCO”), to report to the full Board on a variety of matters at regular and special meetings of the Board and its committees, as applicable, including matters relating to risk management. The Treasurer also reports regularly to the Audit Committee on the Trust’s internal controls and accounting and financial reporting policies and practices. The Audit Committee also receives reports from the Trust’s independent registered public accounting firm on internal control and financial reporting matters. On at least a quarterly basis, the Board meets with the Trust’s CCO, including separate meetings with the non-interested trustees in executive session, to discuss issues related to portfolio compliance and, on at least an annual basis, receives a report from the CCO regarding the effectiveness of the Trust’s compliance program. In addition, the Board receives reports from the Adviser on the investments and securities trading of the Funds, as well as valuation reports and minutes from the Adviser’s valuation committee meetings. The Board also receives reports from the Trust’s primary service providers on a periodic or regular basis, including the Adviser to the Funds as well as the Trust’s custodian, distributor and transfer agent. The Board also requires the Adviser to report to the Board on other matters relating to risk management on a regular and as-needed basis.

The current Board of Trustees had four regular meetings and four special meetings during the fiscal year ended December 31, 2014. The Fund has a standing Audit Committee. Members of the Audit Committee are J. Michael Belz, James F. Gaertner, Clark R. Mandigo, and Joe C. McKinney, all of whom are non-interested trustees.

The Audit Committee is responsible for monitoring the Funds’ accounting policies, financial reporting and internal control system; monitoring the work of the Funds’ independent accountants; and providing an open avenue of communication among the independent accountants, Fund management and the Board. The Audit Committee had five meetings during the fiscal year ended December 31, 2014.

The Trust has a standing Nominating and Governance Committee, which is primarily responsible for the identification and recommendation of individuals for Board membership and for overseeing the administration of the Trust’s Governance Guidelines. The members of the Nominating and Governance Committee are J. Michael Belz, James F. Gaertner, Clark R. Mandigo, and Joe C. McKinney, all of whom are non-interested trustees. The Nominating and Governance Committee had two meetings during the fiscal year ended December 31, 2014.

Nominating and Governance Committee meetings were held on September 30, 2015, and October 5, 2015, to consider and nominate trustees (the Nominees and their biographies are listed above) to serve on the Board of the Trust. At the October 5 meeting, the Nominating and Governance Committee recommended the nomination of the Nominees to the Board. Pursuant to the Trust’s Nominating and Governance Committee Charter (which is available at www.usfunds.com), shareholders may submit recommendations for board candidates by sending a resume of the candidate by U.S. mail or courier service to the Secretary of the Trust for the attention of the Chairman of the Nominating and Governance Committee, c/o U.S. Global Investors Funds, 7900 Callaghan Road, San Antonio, Texas 78229. Recommendations by shareholders for Board consideration are reviewed on the same basis as candidates recommended by other sources. The principal criterion for selection of candidates is their ability to carry out the responsibilities of the Board of Trustees. In addition, the Nominating and Governance Committee may consider a wide variety of factors, including but not limited to:

| | ● | The Board of Trustees collectively should represent a broad cross section of backgrounds, functional disciplines and experience. |

| | ● | Candidates should exhibit stature commensurate with the responsibility of representing shareholders. |

| | ● | Candidates should commit to strive for high attendance levels at regular and special meetings, and participate in committee activities as needed. |

| | ● | Candidates should represent the best choices available based upon thorough identification, investigation and recruitment of candidates. |

The Nominating and Governance Committee generally believes that the Board benefits from diversity of background, experience and views among its members, and considers this as a factor in evaluating the composition of the Board, but has not adopted any specific policy in this regard.

To facilitate shareholder communications with the Board (or with any individual trustee), shareholders will be instructed to forward correspondence (including suggestions for Board nominees) by U.S. mail or other courier service to the Trust’s Secretary. Correspondence addressed to the Board shall be forwarded to each trustee, and correspondence addressed to a specific trustee shall be forwarded to that trustee.

If the Nominees are elected to replace the current Board of Trustees, U.S. Global and Atlantic indicated that they expect the new Board will put in place the same governance structure as the Board of Forum Funds II, a group of funds in the Forum Complex for which the Nominees also serve as trustees. However, there is no assurance they will do so. The current governance of Forum Funds II is set forth below.

David Tucker, a non-interested Nominee, serves as independent chair of the Forum Funds II board. The independent chair’s responsibilities include: setting an agenda for each meeting of the board; presiding at all meetings of the board and independent trustees; and serving as a liaison with other trustees, the trust’s officers, other management personnel and counsel to the fund. The independent chair also will perform such other duties as the board may from time to time determine.

Forum Funds II holds four regularly scheduled in-person meetings each year, and holds special meetings, as needed, either in person or by telephone, to address matters arising between regular meetings. The independent trustees of Forum Funds II hold at least one in-person meeting each year during a portion of which management is not present and holds special meetings, as needed, either in person or by telephone.

The Audit Committee of Forum Funds II consists of Ms. Brown-Strabley and Messrs. Tucker and Moyer. The Audit Committee assists the board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the trust, and will be directly responsible for the appointment, termination, compensation and oversight of work of the independent auditors to the trust. In so doing, the Committee reviews the methods, scope and results of the audits and audit fees charged, and reviews the trust’s internal accounting procedures and controls.

The Nominating Committee consists of Ms. Brown-Strabley and Messrs. Tucker and Moyer. The Nominating Committee is charged with the duty of nominating all trustees and committee members and presenting these nominations to the board of Forum Funds II.

The Qualified Legal Compliance Committee (the “QLCC”) of Forum Funds II consists of Ms. Brown-Strabley and Messrs. Tucker, Moyer and Hong. The QLCC evaluates and recommends resolutions to reports from attorneys servicing the trust

regarding evidence of material violations of applicable federal and state law or the breach of fiduciary duties under applicable federal and state law by the trust or an employee or agent of the trust.

Compensation

The following table provides information on compensation paid by U.S. Global Investors Funds to each of the trustees and the CCO for the fiscal year ended December 31, 2014. As shown in the table, the Trust is not responsible for compensation of the interested trustee of the Trust.

| TOTAL 2014 COMPENSATION

FROM U.S. GLOBAL INVESTORS FUNDS* |

NON-INTERESTED TRUSTEES | |

J. Michael Belz, Trustee | $ 61,400 |

James F. Gaertner, Trustee | $ 57,400 |

Clark R. Mandigo, Trustee | $ 54,900 |

Joe C. McKinney, Trustee | $ 59,400 |

INTERESTED TRUSTEE | |

Frank E. Holmes, Trustee, Chief Executive Officer, Chief Investment Officer | $ 0 |

CHIEF COMPLIANCE OFFICER | |

James L. Love, Jr. | $ 142,796 |

* | The U.S. Global Investors Funds do not provide any pension or retirement benefit for the trustees. |

Auditors

KPMG LLP, 60 South Street, Boston, Massachusetts 02111, serves as the independent registered public accounting firm for the Trust. The independent registered public accounting firm audits and reports on the Funds’ annual financial statements, reviews certain regulatory reports and the Funds’ federal income tax returns, and may perform other professional accounting, auditing, tax, and advisory services to the extent approved by the Audit Committee of the Trust. Representatives of KPMG LLP are not expected to be present at the Meeting, but will have the opportunity to make a statement if they wish, and will be available should any matter arise requiring their presence.

The aggregate fees billed to the Trust for professional services rendered by the Trust’s principal accountant, KPMG LLP, for the audit of the Trust’s annual financial statements or for services that are normally provided by the accountant in connection with statutory or regulatory filings or engagements were $274,400 and $253,400 for the fiscal years ended December 31, 2014, and 2013, respectively.

The Trust’s Audit Committee is directly responsible for approving the services to be provided by the auditors, including approval in advance of audit and non-audit services at regularly scheduled audit committee meetings. If non-audit services are required between regularly scheduled audit committee meetings, approval may be authorized

by the chairman of the Audit Committee for non-prohibited services for engagements of less than $3,500 with notification to other Audit Committee members at the next scheduled Audit Committee meeting.

The aggregate fees billed by the Trust’s principal accountant for non-audit services rendered to the Trust, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Trust were $72,747 and $128,758 for the fiscal years ended December 31, 2014, and 2013, respectively. These fees related to tax services rendered to the Trust and the issuance of a report on internal controls for an entity controlled by the investment adviser. These non-audit services were considered by the Trust’s Audit Committee in maintaining the principal accountant’s independence.

Recommendation of Trustees

After careful consideration, the Board of Trustees unanimously recommends that you vote “FOR” the election of the Nominees.

ADDITIONAL INFORMATION

Information About Voting and the Special Shareholder Meeting

General. This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees of U.S. Global Investors Funds for use at the Meeting of the Funds. The Meeting will be held at 7900 Callaghan Road, San Antonio, Texas 78229, on December 9, 2015, at 9 a.m. Central time. The Notice of the Special Meeting of Shareholders, the Proxy Statement, and the enclosed form of proxy or voting instruction form are being mailed to shareholders on or about November 12, 2015.

Only shareholders of record of each Fund at the close of business on October 30, 2015 (the “Record Date”) will be entitled to notice of and to vote at the Meeting or any adjournment thereof. Each share is entitled to one vote, with fractional shares voting proportionally.

As of the Record Date, each Fund had the following shares outstanding:

Fund | Number of Shares |

All American Equity Fund | 734,749.860 |

China Region Fund | 2,236,702.954 |

Emerging Europe Fund | 9,019,372.584 |

Global Resources Fund | 21,798,913.635 |

Gold and Precious Metals Fund | 11,912,993.855 |

Holmes Macro Trends Fund | 2,087,940.278 |

Near-Term Tax Free Fund | 43,515,453.041 |

U.S. Government Securities Ultra-Short Bond Fund | 28,368,760.535 |

World Precious Minerals Fund | 20,066,379.882 |

The Trust is aware of the following persons owning of record, or beneficially, more than 5% of the outstanding shares of each Fund as of the Record Date.

FUND | SHAREHOLDERS | PERCENTAGE OWNED | TYPE OF OWNERSHIP |

All American Equity Fund | National Financial Services Corp.(1) | 6.96% | Beneficial |

Holmes Macro Trends Fund | Charles Schwab & Company, Inc.(2) | 6.77% | Beneficial |

Gold and Precious Metals Fund | Charles Schwab & Company, Inc.(2) | 18.59% | Beneficial |

| | National Financial Services Corp.(1) | 12.35% | Beneficial |

World Precious Minerals Fund, Investor Class | Charles Schwab & Company, Inc.(2) | 22.53% | Beneficial |

| | National Financial Services Corp.(1) | 14.57% | Beneficial |

World Precious Minerals Fund, Institutional Class | Charles Schwab & Company, Inc.(2) | 88.04% | Beneficial |

| | NFS LLC FBO Frank J. Nemshick III(3) | 5.75% | Beneficial |

Global Resources Fund, Investor Class | Charles Schwab & Company, Inc.(2) | 24.85% | Beneficial |

| | National Financial Services Corp.(1) | 17.95% | Beneficial |

| | TD Ameritrade, Inc.(4) | 7.36% | Beneficial |

Global Resources Fund, Institutional Class | TD Ameritrade, Inc.(4) | 56.73% | Beneficial |

| | Charles Schwab & Company, Inc.(2) | 42.04% | Beneficial |

Emerging Europe Fund | Charles Schwab & Company, Inc.(2) | 34.18% | Beneficial |

| | National Financial Services Corp.(1) | 22.66% | Beneficial |

| | TD Ameritrade, Inc.(4) | 7.27% | Beneficial |

China Region Fund | Charles Schwab & Company, Inc.(2) | 10.92% | Beneficial |

| | National Financial Services Corp.(1) | 9.33% | Beneficial |

Near-Term Tax Free Fund | TD Ameritrade, Inc.(4) | 19.35% | Beneficial |

| | Charles Schwab & Company, Inc.(2) | 13.95% | Beneficial |

| | National Financial Services Corp.(1) | 11.69% | Beneficial |

| | Merrill Lynch(5) | 5.14% | Beneficial |

U.S. Government Securities Ultra-Short Bond Fund | U.S. Global Investors, Inc. | 19.70% | Record |

(1) | National Financial Services Corp. is located at 499 Washington Blvd, Floor 5, Jersey City, NJ 07310-2010. |

(2) | Charles Schwab & Company, Inc. is located at 211 Main Street, San Francisco, CA 94105-1905. |

(3) | NFS LLC is located at 710 Longview Drive, Middletown, PA 17057-2968. |

(4) | TD Ameritrade, Inc. is located at P.O. Box 2226, Omaha, NE 68103-2226. |

(5) | Merrill Lynch is located at 4800 Deer Lake Drive East, Floor 2, Jacksonville, FL 32246-6484. |

Investment Adviser. U.S. Global Investors, Inc., 7900 Callaghan Road, San Antonio, Texas 78229, furnishes investment advice and manages the Funds’ affairs. The Adviser was organized in 1968 and serves as investment adviser to the U.S. Global Investor Funds, which has approximately $590 million in assets under management as of June 30, 2015.

Principal Underwriter. U.S. Global Brokerage, Inc., 7900 Callaghan Road, San Antonio, Texas 78229, is the principal underwriter for the Funds and exclusive agent for the distribution of the Funds’ shares. If the Proposal is approved, U.S. Global and Atlantic have indicated to the current Board that Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101, will be appointed as the principal underwriter for the Funds and exclusive agent for distribution of the Funds’ shares, replacing U.S. Global Brokerage, Inc. There is no assurance, however, that the new Board will take such action.

Administrator. SEI Investments Global Funds Services, One Freedom Valley Drive, Oaks, Pennsylvania 19456, serves as fund accountant and administrator for the Trust. In addition, U.S. Global provides administrative services to the Trust. If the Proposal is approved, U.S. Global and Atlantic have indicated to the current Board that they intend to recommend that Atlantic Fund Services, Three Canal Plaza, Suite 600, Portland, Maine 04101, be appointed as an administrator and fund accountant for the Trust, eventually replacing SEI as fund accountant and administrator. There is no assurance, however, that the new Board will take such action.

Expenses. The costs to implement the Proposal include: (i) the preparation, printing, and mailing of the enclosed proxy card and Proxy Statement, and all other costs incurred in connection with the solicitation of proxies for the Funds; (ii) trustee and legal fees in connection with the Board meetings at which the Proposal was considered and approved; and (iii) ongoing insurance coverage over the next six years for the Trust and the current Board of Trustees (which is commonly referred to as “tail insurance”). All costs will be split equally between U.S. Global and the Trust, with the Trust’s portion exclusive of each Fund’s expense cap. The total costs are estimated to be approximately $660,000 and could be higher or lower, with the estimated cumulative net asset value impact per Fund ranging from $0.0005 to $0.0193 per share. The effect of the cumulative estimated costs by Fund is as follows:

Fund | Estimated Cost | Estimated Per Share Cost |

All American Equity Fund | $14,000 | $0.0193 |

China Region Fund | $19,000 | $0.0085 |

Emerging Europe Fund | $42,500 | $0.0047 |

Global Resources Fund, Investor Class | $74,500 | $0.0035 |

Global Resources Fund, Institutional Class | $1,400 | $0.0024 |

Gold and Precious Metals Fund | $51,500 | $0.0044 |

Holmes Macro Trends Fund | $21,000 | $0.0098 |

Near-Term Tax Free Fund | $21,000 | $0.0005 |

U.S. Government Securities Ultra-Short Bond Fund | $20,000 | $0.0007 |

Fund | Estimated Cost | Estimated Per Share Cost |

World Precious Minerals Fund, Investor Class | $65,000 | $0.0032 |

World Precious Minerals Fund, Institutional Class | $100 | $0.0027 |

Required Vote and Quorum. Approval of the Proposal requires the affirmative vote of the shareholders owning a plurality of the shares of the Trust voting at the Meeting, provided a quorum is present. One-third of the shares of the Trust entitled to vote in person or by proxy shall be a quorum for the transaction of business at the Meeting. Broker non-votes (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee has not voted such shares in its discretion) and abstentions will be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists and will have no effect on the approval of the Proposal. Any proxy card returned with no box marked will be voted for the Proposal. For any other proposals raised at the Meeting, broker non-votes and abstentions will be counted as votes against such proposals.

Revocation of Proxies. Proxies, including proxies given by telephone or over the Internet, may be revoked at any time before they are voted by submitting a subsequent proxy or by a written revocation received by the Secretary of the Funds at 7900 Callaghan Road, San Antonio, Texas 78229.

Proposals of Shareholders. The Funds do not generally hold annual shareholders’ meetings, but will hold special meetings as required or deemed desirable. Because the Funds do not hold regular shareholders’ meetings, the anticipated date of the next shareholders’ meeting (if any) cannot be provided. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholders’ meeting of the Funds should send their written proposals to the Secretary of the Funds at 7900 Callaghan Road, San Antonio, Texas 78229. Proposals must be received in a reasonable time before the Funds begin to print and mail the proxy materials for the meeting. The timely submission of a proposal does not guarantee its inclusion.

Shareholders Sharing the Same Address. As permitted by law, only one copy of this Proxy Statement may be delivered to shareholders residing at the same address, unless such shareholders have notified the Trust of their desire to receive multiple copies of the shareholder reports and proxy statements that the Trust sends. If you would like to receive an additional copy, please contact the Trust by writing to the Trust or by calling 1-800-873-8637. The Trust will then promptly deliver a separate copy of the Proxy Statement to the requesting shareholder residing at an address to which only one copy was mailed. Shareholders wishing to receive separate copies of the Trust’s shareholder reports and proxy statements in the future, and shareholders sharing an address that wish to receive a single copy if they are receiving multiple copies, should also send a request as indicated.

Other Matters to Come Before the Special Meeting. The Board of Trustees is not aware of any matters that will be presented for action at the Meeting other than those set forth herein. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares with respect to any such other matters in accordance with their best judgment in the interest of the Funds.

EACH FUND WILL FURNISH TO ANY SHAREHOLDER, WITHOUT CHARGE, A COPY OF ITS ANNUAL AND SEMI-ANNUAL REPORTS. SHAREHOLDERS CAN REQUEST A COPY BY (1) CALLING 1-800-873-8637 OR (2) WRITING TO THE FUND AT U.S. BANCORP FUND SERVICES, C/O U.S. GLOBAL INVESTORS FUNDS, P.O. BOX 701, MILWAUKEE, WI 53201-0701 OR COPIES ARE AVAILABLE ONLINE AT WWW.USFUNDS.COM. IF SEVERAL SHAREHOLDERS LIVING AT THE SAME ADDRESS RECEIVE ONLY ONE COPY OF THE PROXY MATERIALS, THEY SHOULD CONTACT THE FUNDS TO REQUEST ADDITIONAL SETS.

The Trust’s Board of Trustees recommends that you vote FOR the Proposal.

Please complete, sign and return the enclosed proxy card (or take advantage of available electronic or telephonic voting procedures) promptly. No postage is required if mailed in the United States.

By order of the Board,

Susan B. McGee

Secretary

End of Document