UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01800

U.S. GLOBAL INVESTORS FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 – June 30, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

USGI Global Luxury Goods Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI Global Luxury Goods Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $77 | 1.51% |

| Total Net Assets | $48,462,732 |

| # of Portfolio Holdings | 56 |

| Portfolio Turnover Rate | 79% |

| Management Fee (Net of fees waived) | $152,936 |

Top Ten Holdings

(% of investments)

| Cie Financiere Richemont SA | 6.57% |

| Hermes International SCA | 5.68% |

| Amazon.com, Inc. | 4.78% |

| KKR & Co., Inc. | 4.44% |

| Industria de Diseno Textil SA | 4.25% |

| UBS Group AG | 4.14% |

| LVMH Moet Hennessy Louis Vuitton SE, ADR | 4.05% |

| Constellation Brands, Inc., Class A | 3.68% |

| Apollo Global Management, Inc. | 3.65% |

| Lululemon Athletica, Inc. | 3.42% |

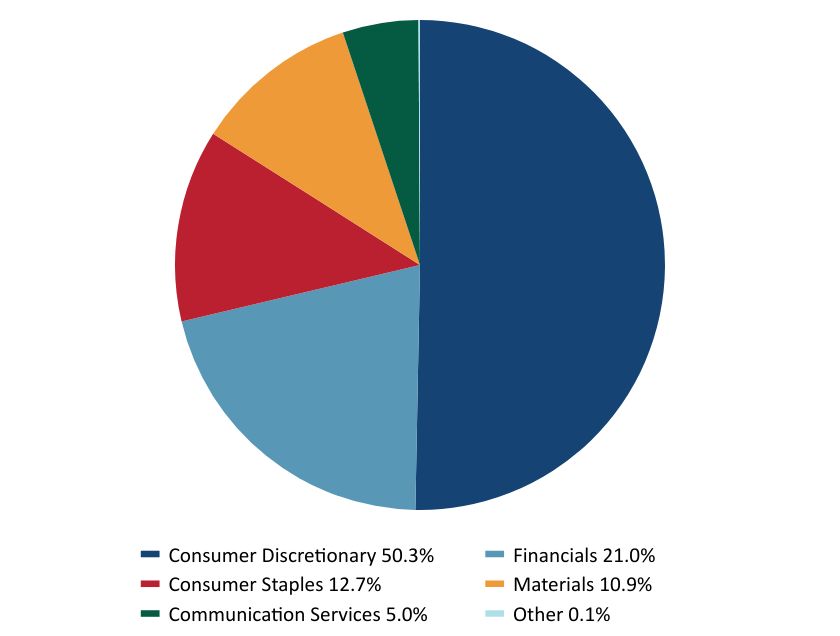

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Consumer Discretionary | 50.3% |

| Financials | 21.0% |

| Consumer Staples | 12.7% |

| Materials | 10.9% |

| Communication Services | 5.0% |

| Other | 0.1% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

USGI Global Luxury Goods Fund

Semi-Annual Shareholder Report - June 30, 2024

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI Global Resources Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $73 | 1.48% |

| Total Net Assets | $41,729,829 |

| # of Portfolio Holdings | 139 |

| Portfolio Turnover Rate | 45% |

| Management Fee (Net of fees waived) | $88,288 |

Top Ten Holdings

(% of investments)

| Abaxx Technologies, Inc. | 7.19% |

| Ivanhoe Mines, Ltd. | 6.18% |

| Filo Corp. | 5.27% |

| Cheniere Energy, Inc. | 3.14% |

| Kimbell Royalty Partners LP | 2.16% |

| Linde PLC | 2.10% |

| OceanaGold Corp. | 1.93% |

| Viper Energy, Inc. | 1.80% |

| NG Energy International Corp. | 1.79% |

| K92 Mining, Inc. | 1.73% |

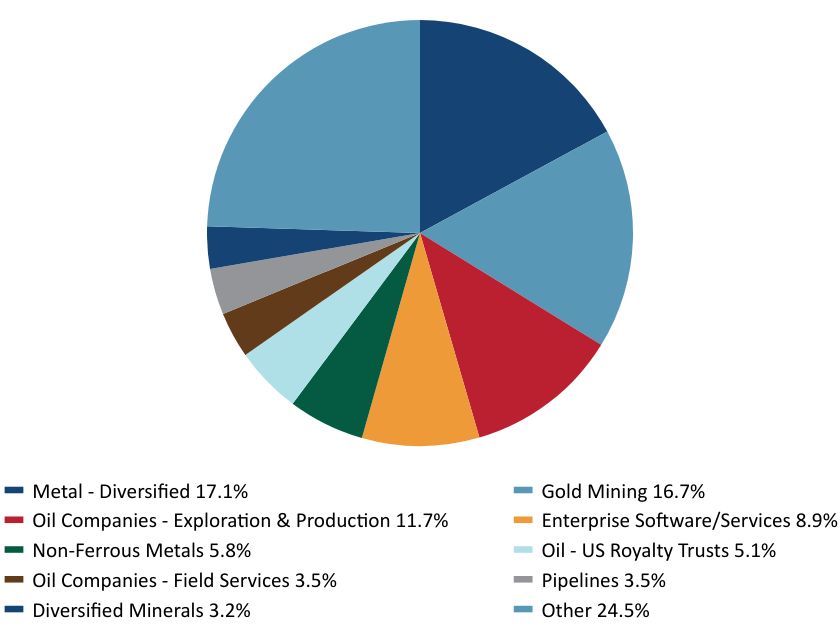

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Metal - Diversified | 17.1% |

| Gold Mining | 16.7% |

| Oil Companies - Exploration & Production | 11.7% |

| Enterprise Software/Services | 8.9% |

| Non-Ferrous Metals | 5.8% |

| Oil - US Royalty Trusts | 5.1% |

| Oil Companies - Field Services | 3.5% |

| Pipelines | 3.5% |

| Diversified Minerals | 3.2% |

| Other | 24.5% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

U.S. Global Investors Funds

Semi-Annual Shareholder Report - June 30, 2024

Gold and Precious Metals Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI Gold and Precious Metals Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $92 | 1.73% |

| Total Net Assets | $101,512,583 |

| # of Portfolio Holdings | 71 |

| Portfolio Turnover Rate | 29% |

| Management Fee Paid | $434,999 |

Top Ten Holdings

(% of investments)

| K92 Mining, Inc. | 9.62% |

| Aya Gold & Silver, Inc. | 6.84% |

| Vox Royalty Corp. | 4.09% |

| Alamos Gold, Inc. | 3.86% |

| OceanaGold Corp. | 3.39% |

| Equinox Gold Corp. | 2.83% |

| Mineros SA | 2.67% |

| Karora Resources, Inc. | 2.57% |

| Emerald Resources NL | 2.31% |

| Ivanhoe Mines, Ltd. | 2.23% |

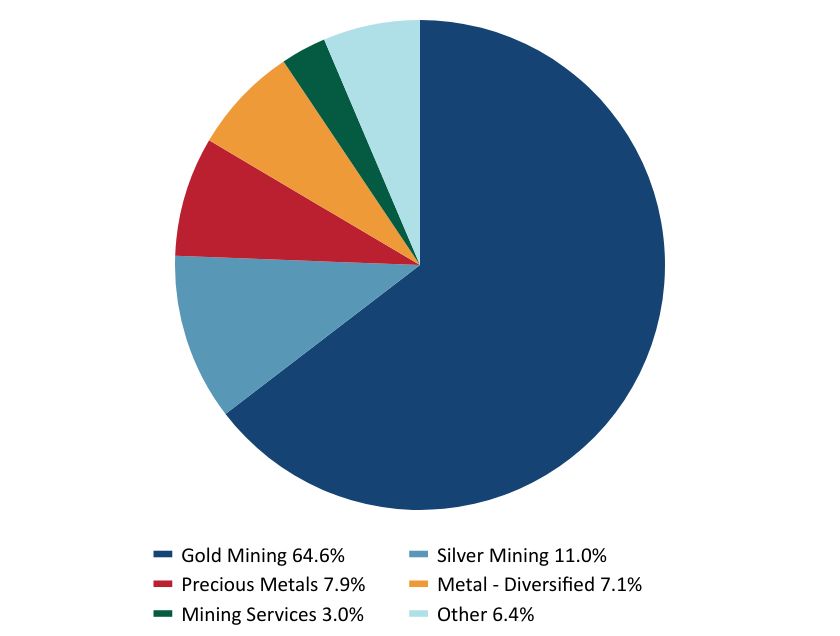

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Gold Mining | 64.6% |

| Silver Mining | 11.0% |

| Precious Metals | 7.9% |

| Metal - Diversified | 7.1% |

| Mining Services | 3.0% |

| Other | 6.4% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

U.S. Global Investors Funds

Gold and Precious Metals Fund

Semi-Annual Shareholder Report - June 30, 2024

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI Near-Term Tax Free Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $22 | 0.45% |

| Total Net Assets | $25,030,270 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 17% |

| Management Fee (Net of fees waived) | $(51,026) |

Top Ten Area Concentrations

(% of net assets)

| Pennsylvania | 8.83% |

| Texas | 8.38% |

| Minnesota | 6.59% |

| New Mexico | 4.64% |

| Michigan | 4.46% |

| Colorado | 3.48% |

| California | 3.41% |

| Massachusetts | 3.24% |

| Missouri | 2.89% |

| Florida | 2.84% |

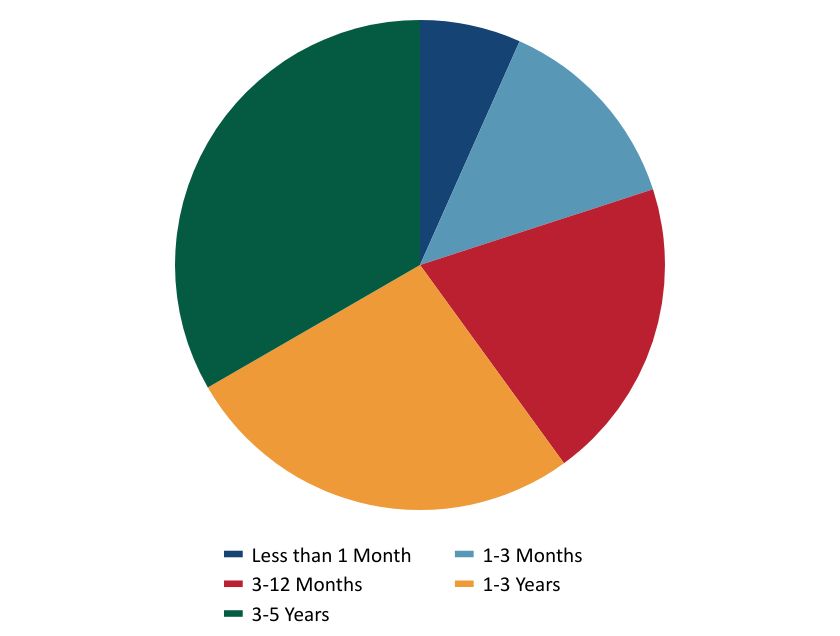

Maturity Weightings

(% total investments)

| Value | Value | Value | Value | Value | Value |

|---|

| Less than 1 Month | 1,535,651 | | 6.9% | |

| 1-3 Months | 3,053,408 | | 13.6% | |

| 3-12 Months | 6,001,611 | | 27.2% | |

| 1-3 Years | 9,434,056 | | 42.2% | |

| 3-5 Years | 2,238,524 | | 10.1% | |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

U.S. Global Investors Funds

Semi-Annual Shareholder Report - June 30, 2024

U.S. Government Securities Ultra-Short Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI U.S. Government Securities Ultra-Short Bond Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $23 | 0.45% |

| Total Net Assets | $30,072,414 |

| # of Portfolio Holdings | 12 |

| Portfolio Turnover Rate | 33% |

| Management Fee (Net of fees waived) | $(39,483) |

Top Ten Holdings

(% of investments)

| U.S. Treasury Bill | 13.22% |

| Federal Home Loan Mortgage Corp. | 13.11% |

| Federal Home Loan Mortgage Corp., MTN | 12.97% |

| Federal Home Loan Bank | 8.84% |

| Federal Farm Credit Bank | 8.82% |

| U.S. Treasury Bill | 8.76% |

| Federal Farm Credit Bank | 8.66% |

| U.S. Treasury Note/Bond | 6.57% |

| Federal Home Loan Bank | 6.09% |

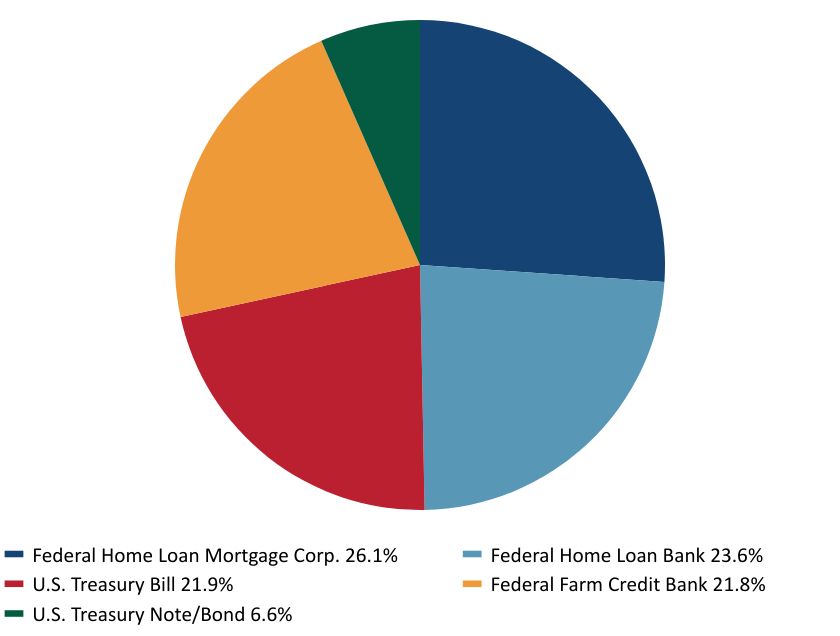

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Federal Home Loan Mortgage Corp. | 26.1% |

| Federal Home Loan Bank | 23.6% |

| U.S. Treasury Bill | 21.9% |

| Federal Farm Credit Bank | 21.8% |

| U.S. Treasury Note/Bond | 6.6% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

U.S. Global Investors Funds

U.S. Government Securities Ultra-Short Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

USGI World Precious Minerals Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the USGI World Precious Minerals Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at www.usfunds.com/invest-with-us/prospectus-2/. You can also request this information by contacting us at (800) 873-8637.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $76 | 1.48% |

| Total Net Assets | $41,616,658 |

| # of Portfolio Holdings | 167 |

| Portfolio Turnover Rate | 14% |

| Management Fee (Net of fees waived) | $68,905 |

Top Ten Holdings

(% of investments)

| TriStar Gold, Inc. | 11.13% |

| K92 Mining, Inc. | 6.92% |

| Nano One Materials Corp. | 6.64% |

| Dolly Varden Silver Corp. | 3.75% |

| Arizona Metals Corp. | 3.48% |

| Vizsla Silver Corp. | 3.40% |

| Ivanhoe Mines, Ltd. | 3.10% |

| Radisson Mining Resources, Inc. | 2.68% |

| First Nordic Metals Corp. | 2.60% |

| Asante Gold Corp. | 2.55% |

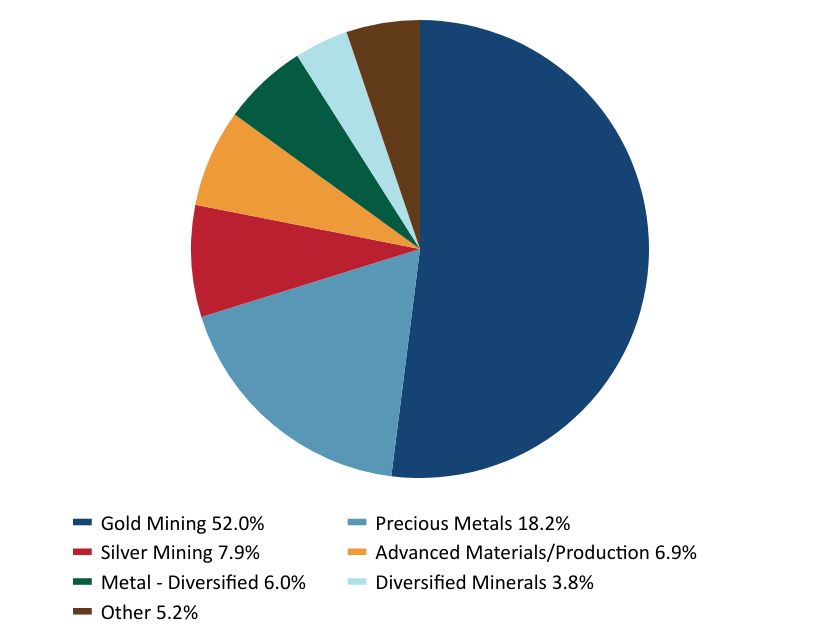

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Gold Mining | 52.0% |

| Precious Metals | 18.2% |

| Silver Mining | 7.9% |

| Advanced Materials/Production | 6.9% |

| Metal - Diversified | 6.0% |

| Diversified Minerals | 3.8% |

| Other | 5.2% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit www.usfunds.com/invest-with-us/prospectus-2/. The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group).

U.S. Global Investors Funds

USGI World Precious Minerals Fund

Semi-Annual Shareholder Report - June 30, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

U.S.

Global

Investors

Funds

Semi-Annual

Financials

and

Other

Information

Semi-Annual

Financials

and

Other

Information

Portfolios

of

Investments

5

Notes

to

Portfolios

of

Investments

29

Statements

of

Assets

and

Liabilities

40

Statements

of

Operations

42

Statements

of

Changes

in

Net

Assets

44

Notes

to

Financial

Statements

48

Financial

Highlights

61

Other

Information

67

Apex

Fund

Services

3

Canal

Plaza,

Suite

600

Portland,

ME

04101

U.S.

Global

Investors

Funds

Investor

Class

U.S.

Government

Securities

Ultra-Short

Bond

Fund

UGSDX

Near-Term

Tax

Free

Fund

NEARX

Global

Luxury

Goods

Fund

USLUX

Global

Resources

Fund

PSPFX

World

Precious

Minerals

Fund

UNWPX

Gold

and

Precious

Metals

Fund

USERX

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

U.S.

Government

Securities

Ultra-Short

Bond

Fund

United

States

Government

and

Agency

Obligations

75.26%

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

Federal

Farm

Credit

Bank

16.36%

Fixed

Rates:

0.47

11/18/24

$

2,000,000

$

1,959,939

2.35

12/05/25

1,000,000

963,960

5.34

05/28/26

2,000,000

1,997,072

4,920,971

Federal

Home

Loan

Bank

17.79%

Fixed

Rates:

4.63

12/13/24

1,000,000

996,414

5.35

12/30/24

2,000,000

2,000,908

2.63

09/12/25

1,000,000

972,825

1.11

10/28/26

1,500,000

1,378,359

5,348,506

Federal

Home

Loan

Mortgage

Corp.

19.63%

Fixed

Rates:

2.40

03/28/25

3,000,000

2,935,750

4.05

08/28/25

3,000,000

2,967,690

5,903,440

U.S.

Treasury

Bill

16.54%

◊

Yield

to

Maturity:

5.13

07/18/24

3,000,000

2,992,555

5.19

09/05/24

2,000,000

1,980,909

4,973,464

U.S.

Treasury

Note/Bond

4.94%

Fixed

Rates:

4.25

12/31/25

1,500,000

1,485,850

Investments,

at

value

75.26%

22,632,231

(cost

$22,674,080

)

Other

assets

and

liabilities,

net

24.74%

7,440,183

Net

Assets

100.00%

$

30,072,414

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Municipal

Bonds

88.95%

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

Alabama

1.94%

Alabama

Community

College

System,

Alabama,

Refunding,

RB

BAM

4.00

11/01/24

$

185,000

$

185,049

Alabaster

Board

of

Education,

Alabama,

Prefunding,

Special

Tax

Bond

AGM

5.00

09/01/44

300,000

300,604

485,653

Arizona

1.61%

City

of

Mesa

AZ,

Arizona,

Refunding,

GO

Limited

4.00

07/01/25

400,000

403,384

California

3.41%

City

of

Milpitas

CA

Wastewater

Revenue,

California,

Refunding,

RB

5.00

11/01/24

350,000

351,856

East

Side

Union

High

School

District,

California,

GO

Unlimited

AGM

5.00

08/01/24

200,000

200,213

State

of

California,

California,

Refunding,

GO

Unlimited

5.00

08/01/24

300,000

300,378

852,447

Colorado

3.48%

City

of

Glendale

CO,

Colorado,

Refunding,

COP

AGM

5.00

12/01/25

510,000

517,152

Colorado

Health

Facilities

Authority,

Colorado,

Refunding,

RB

5.00

10/01/25

350,000

355,079

872,231

Connecticut

1.62%

State

of

Connecticut,

Connecticut,

Refunding,

GO

Unlimited

5.00

05/15/27

200,000

206,028

Town

of

Simsbury

CT,

Connecticut,

Refunding,

GO

Unlimited

5.00

08/01/24

200,000

200,265

406,293

Florida

2.84%

Port

St

Lucie

Community

Redevelopment

Agency,

Florida,

Refunding,

Tax

Allocation

Bond

5.00

01/01/25

705,000

710,345

Georgia

1.22%

Grady

County

School

District,

Georgia,

GO

Unlimited

5.00

10/01/25

300,000

306,123

Hawaii

0.73%

State

of

Hawaii,

Hawaii,

Refunding,

GO

Unlimited

5.00

10/01/27

175,000

181,573

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Municipal

Bonds (cont’d)

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

Illinois

1.21%

Cook

County

Township

High

School

District

No.

225,

Illinois,

Refunding,

GO

Unlimited

5.00

12/01/24

$

300,000

$

301,712

Indiana

1.79%

County

of

Warrick

IN

Redevelopment

District,

Indiana,

Refunding,

Tax

Allocation

Bond

4.00

08/01/25

170,000

170,932

Northwestern

School

Corp.,

Indiana,

GO

Limited

5.00

01/15/26

150,000

153,083

South

Henry

Multi

School

Building

Corp.,

Indiana,

RB

5.00

07/15/24

125,000

125,047

449,062

Iowa

1.17%

Iowa

Finance

Authority,

Iowa,

Refunding,

RB

5.00

02/15/25

290,000

291,898

Kansas

1.87%

City

of

Lawrence

KS,

Kansas,

GO

Unlimited

3.25

09/01/27

170,000

166,816

Sedgwick

County

Unified

School

District

No.

262

Valley

Center,

Kansas,

Refunding,

GO

Unlimited

4.00

09/01/25

300,000

300,355

467,171

Kentucky

2.82%

Campbellsville

Independent

School

District

Finance

Corp.,

Kentucky,

RB

4.00

08/01/25

165,000

165,712

City

of

Ashland

KY,

Kentucky,

Refunding,

GO

Unlimited

AGM

5.00

01/01/25

300,000

302,096

Kentucky

Bond

Development

Corp.,

Kentucky,

Refunding,

RB

5.00

05/01/25

235,000

237,553

705,361

Louisiana

1.17%

Louisiana

Housing

Corp.,

Louisiana,

RB

FHLMC

2.15

12/01/24

295,000

292,353

Massachusetts

3.24%

Massachusetts

Development

Finance

Agency,

Massachusetts,

Refunding,

RB

4.00

04/01/25

250,000

251,180

Massachusetts

Port

Authority,

Massachusetts,

Refunding,

RB

5.00

07/01/24

560,000

560,000

811,180

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Municipal

Bonds (cont’d)

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

Michigan

4.46%

Great

Lakes

Water

Authority

Water

Supply

System

Revenue,

Michigan,

Refunding,

RB

5.00

07/01/26

$

365,000

$

377,134

Michigan

Finance

Authority,

Michigan,

RB

AGM

5.00

07/01/26

300,000

300,231

Wayne

State

University,

Michigan,

RB

5.00

11/15/27

430,000

438,427

1,115,792

Minnesota

6.59%

City

of

Woodbury

MN,

Minnesota,

GO

Unlimited

3.00

02/01/28

550,000

536,254

County

of

Chisago

MN,

Minnesota,

GO

Unlimited

2.00

02/01/27

1,175,000

1,113,311

1,649,565

Mississippi

0.50%

County

of

Madison

MS,

Mississippi,

GO

Unlimited

4.50

11/01/25

125,000

125,418

Missouri

2.89%

Nixa

Public

Schools,

Missouri,

Refunding,

GO

Unlimited

2.25

03/01/25

530,000

522,336

St

Louis

Land

Clearance

for

Redevelopment

Authority,

Missouri,

RB

4.00

07/15/25

200,000

201,251

723,587

Nebraska

1.21%

Nebraska

Public

Power

District,

Nebraska,

Refunding,

RB

5.00

01/01/25

300,000

302,319

Nevada

1.20%

Clark

County

Water

Reclamation

District,

Nevada,

Refunding,

GO

Limited

5.00

07/01/24

300,000

300,000

New

Jersey

1.73%

Middlesex

County

Improvement

Authority,

New

Jersey,

RB

5.00

07/01/25

425,000

432,370

New

Mexico

4.64%

City

of

Rio

Rancho

NM,

New

Mexico,

GO

Unlimited

5.00

08/01/27

600,000

632,058

Los

Alamos

Public

School

District,

New

Mexico,

GO

Unlimited

5.00

08/01/25

520,000

529,274

1,161,332

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Municipal

Bonds (cont’d)

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

New

York

2.72%

City

of

New

York

NY,

New

York,

Refunding,

GO

Unlimited

5.00

08/01/25

$

250,000

$

254,593

City

of

New

York

NY,

New

York,

Refunding,

GO

Unlimited

5.00

08/01/26

200,000

207,391

Port

Authority

of

New

York

&

New

Jersey,

New

York,

Refunding,

RB

5.00

10/01/25

215,000

218,674

680,658

North

Carolina

2.02%

County

of

Pender

NC,

North

Carolina,

RB

5.00

04/01/25

500,000

505,247

Ohio

1.12%

Kettering

City

School

District,

Ohio,

Refunding,

GO

Unlimited

5.00

12/01/24

280,000

281,552

Oklahoma

0.90%

Grady

County

School

Finance

Authority,

Oklahoma,

RB

5.00

09/01/24

225,000

225,377

Oregon

2.60%

City

of

Ashland

OR,

Oregon,

GO

Limited

2.38

10/01/26

200,000

192,379

City

of

Lincoln

City

OR,

Oregon,

Refunding,

GO

Unlimited

2.50

06/01/28

300,000

283,396

Klamath

Falls

Intercommunity

Hospital

Authority,

Oregon,

Refunding,

RB

4.00

09/01/24

175,000

174,890

650,665

Pennsylvania

8.83%

Commonwealth

of

Pennsylvania,

Pennsylvania,

Refunding,

GO

Unlimited,

First

Series

5.00

08/15/25

310,000

315,834

Commonwealth

of

Pennsylvania,

Pennsylvania,

GO

Unlimited,

Second

Series

5.00

09/15/24

300,000

300,851

Delaware

River

Port

Authority,

Pennsylvania,

Refunding,

RB

5.00

01/01/27

500,000

521,406

Pittsburgh

Water

&

Sewer

Authority,

Pennsylvania,

RB

AGM

5.00

09/01/24

300,000

300,655

Williamsport

Sanitary

Authority,

Pennsylvania,

Refunding,

RB

BAM

5.00

01/01/27

740,000

771,499

2,210,245

South

Carolina

1.32%

City

of

Tega

Cay

SC,

South

Carolina,

Refunding,

GO

Unlimited

2.25

04/01/25

335,000

329,478

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Municipal

Bonds (cont’d)

Coupon

Rate

%

Maturity

Date

Principal

Amount

Value

South

Dakota

0.54%

South

Dakota

Health

&

Educational

Facilities

Authority,

South

Dakota,

Refunding,

RB

5.00

09/01/24

$

135,000

$

135,178

Tennessee

1.00%

Metropolitan

Government

of

Nashville

&

Davidson

County

TN,

Tennessee,

GO

Unlimited

5.00

07/01/24

250,000

250,000

Texas

8.38%

City

of

Austin

TX,

Texas,

Refunding,

GO

Limited

5.00

09/01/24

215,000

215,509

City

of

Denton

TX,

Texas,

GO

Limited

4.00

02/15/26

265,000

268,162

City

of

Denton

TX,

Texas,

Refunding,

GO

Limited

5.00

02/15/27

400,000

417,620

Harris

County

Water

Control

&

Improvement

District

No.

21,

Texas,

GO

Unlimited

BAM

4.00

09/01/24

1,000,000

1,000,092

Lower

Colorado

River

Authority,

Texas,

Refunding,

RB

5.00

05/15/27

195,000

197,190

2,098,573

Utah

1.12%

Jordan

Valley

Water

Conservancy

District,

Utah,

Refunding,

RB

5.00

10/01/24

280,000

281,051

Vermont

1.54%

University

of

Vermont

and

State

Agricultural

College,

Vermont,

Refunding,

RB

5.00

10/01/24

385,000

386,300

Virginia

0.91%

Virginia

Commonwealth

Transportation

Board,

Virginia,

RB

5.00

05/15/25

225,000

228,361

Washington

2.61%

City

of

Seattle

WA

Municipal

Light

&

Power

Revenue,

Washington,

Refunding,

RB

5.00

10/01/24

240,000

240,925

King

County

Fire

Protection

District

No.

45,

Washington,

GO

Unlimited

4.00

12/01/25

260,000

261,765

King

County

Housing

Authority,

Washington,

Refunding,

RB

4.00

06/01/27

150,000

150,706

653,396

Investments,

at

value

88.95%

22,263,250

(cost

$22,465,097

)

Other

assets

and

liabilities,

net

11.05%

2,767,020

Net

Assets

100.00%

$

25,030,270

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks

93.87%

Shares

Value

Apparel

Manufacturers

12.58%

Burberry

Group

PLC

18,800

$

208,776

Christian

Dior

SE

585

425,384

Deckers

Outdoor

Corp.

*

995

963,110

Hermes

International

SCA

1,192

2,753,074

Kering

SA,

ADR

29,200

1,059,376

PRADA

SpA

22,000

163,932

Ralph

Lauren

Corp.

3,000

525,180

6,098,832

Athletic

Footwear

0.78%

NIKE,

Inc.,

Class B

5,000

376,850

Automotive

-

Cars

&

Light

Trucks

8.93%

Bayerische

Motoren

Werke

AG

8,800

832,405

Ferrari

NV

1,850

755,485

Mercedes-Benz

Group

AG,

ADR

52,000

897,000

Porsche

Automobil

Holding

SE,

ADR

87,000

388,890

Volkswagen

AG

12,150

1,455,861

4,329,641

Beverages

-

Wine/Spirits

4.56%

Constellation

Brands,

Inc.,

Class A

6,940

1,785,523

Remy

Cointreau

SA

5,050

424,320

2,209,843

Casino

Hotels

0.96%

Wynn

Resorts,

Ltd.

5,200

465,400

Cosmetics

&

Toiletries

0.22%

The

Estee

Lauder

Cos.,

Inc.

1,000

106,400

Cruise

Lines

5.72%

Carnival

Corp.

*

63,200

1,183,104

Norwegian

Cruise

Line

Holdings,

Ltd.

*

59,000

1,108,610

Royal

Caribbean

Cruises,

Ltd.

*

3,000

478,290

2,770,004

Diversified

Banking

Institution

7.75%

JPMorgan

Chase

&

Co.

2,600

525,876

The

Goldman

Sachs

Group,

Inc.

2,700

1,221,264

UBS

Group

AG

68,000

2,008,720

3,755,860

E-Commerce/Products

4.78%

Amazon.com,

Inc.

*

11,980

2,315,135

Energy

-

Alternate

Sources

0.00%

Pacific

Green

Energy

Corp.

#*@

100,000

0

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Finance

-

Credit

Card

1.00%

American

Express

Co.

2,100

$

486,255

Finance

-

Mortgage

Loan/Banker

0.00%

Lendified

Holdings,

Inc.

#*@

1,116,560

0

Gold

Mining

8.23%

B2Gold

Corp.

175,000

472,500

Centerra

Gold,

Inc.

19,533

131,357

Dundee

Precious

Metals,

Inc.

72,000

563,664

Franco-Nevada

Corp.

4,600

545,192

New

Gold,

Inc.

*

35,000

68,250

Osisko

Gold

Royalties,

Ltd.

29,500

459,610

Red

5,

Ltd.

*

1,607,112

384,941

Resolute

Mining,

Ltd.

*

342,000

118,930

Royal

Gold,

Inc.

3,250

406,770

Torex

Gold

Resources,

Inc.

*

30,000

464,895

Westgold

Resources,

Ltd.

230,000

370,154

3,986,263

Hotels

&

Motels

4.28%

Accor

SA

22,200

908,402

HUGO

BOSS

AG

6,276

282,190

InterContinental

Hotels

Group

PLC

8,400

882,641

2,073,233

Investment

Management/Advisory

Services

3.65%

Apollo

Global

Management,

Inc.

15,000

1,771,050

Oil

Companies

-

Exploration

&

Production

0.08%

NG

Energy

International

Corp.,

144A

#*∆

50,000

37,279

Precious

Metals

0.49%

Wheaton

Precious

Metals

Corp.

4,500

235,890

Private

Equity

7.58%

Blackstone,

Inc.,

Class A

12,300

1,522,740

KKR

&

Co.,

Inc.

20,450

2,152,158

3,674,898

Real

Estate

Operating/Development

0.00%

Infrastructure

Ventures,

Inc.

#*@+

426,533

0

Retail

-

Apparel/Shoe

11.46%

Brunello

Cucinelli

SpA

3,950

394,234

Industria

de

Diseno

Textil

SA

41,500

2,059,371

JD

Sports

Fashion

PLC

145,000

217,737

Lululemon

Athletica,

Inc.

*

5,550

1,657,785

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Retail

-

Apparel/Shoe

(cont’d)

Moncler

SpA

20,000

$

1,226,879

5,556,006

Retail

-

Jewelry

6.57%

Cie

Financiere

Richemont

SA

20,380

3,185,047

Silver

Mining

0.20%

Fortuna

Silver

Mines,

Inc.

*

20,000

97,800

Textile

-

Apparel

4.05%

LVMH

Moet

Hennessy

Louis

Vuitton

SE,

ADR

12,786

1,960,733

Total

Common

Stocks

45,492,419

(cost

$42,671,885)

Corporate

Non-Convertible

Bond

1.54%

Coupon

Rate

%

Maturity

Date

Principal

Amount

Gold

Mining

1.54%

Aris

Gold

Corp.

7.50

08/26/27

$

623,067

747,680

(cost

$623,000)

Investments,

at

value

95.41%

46,240,099

(cost

$43,294,885

)

Other

assets

and

liabilities,

net

4.59%

2,222,633

Net

Assets

100.00%

$

48,462,732

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks

85.64%

Shares

Value

Advanced

Materials/Production

0.80%

Nano

One

Materials

Corp.

*

325,000

$

332,590

Agricultural

Chemicals

1.47%

CF

Industries

Holdings,

Inc.

5,000

370,600

OCI

NV

10,000

244,233

614,833

Agricultural

Operations

1.15%

Bunge

Global

SA

4,500

480,465

Building

Products

-

Wood

0.93%

Atlas

Engineered

Products,

Ltd.

*

100,000

103,797

Atlas

Engineered

Products,

Ltd.

*

85,000

88,228

Stella-Jones,

Inc.

3,000

195,760

387,785

Chemicals

-

Specialty

1.30%

Daqo

New

Energy

Corp.,

ADR

*

7,500

109,500

Methanex

Corp.

9,000

434,524

544,024

Coal

0.00%

Caribbean

Resources

Corp.

#*@

2,148,176

0

Diamonds/Precious

Stones

0.48%

Barksdale

Resources

Corp.

*

1,955,000

200,066

Diversified

Minerals

2.93%

Arianne

Phosphate,

Inc.

*

600,000

124,995

Atlas

Lithium

Corp.

*

3,000

31,140

BHP

Group,

Ltd.,

ADR

3,500

199,815

Core

Assets

Corp.,

144A

#*∆

600,000

50,437

E3

Lithium,

Ltd.

*

100,000

105,990

IberAmerican

Lithium

Corp.

*@

1,000,000

116,955

Legacy

Lithium

Corp.

#*@

100,000

2,039

Leo

Lithium,

Ltd.

#*@

700,000

202,151

Lithium

Royalty

Corp.

*

821

3,961

NGEX

Minerals,

Ltd.

*

20,000

118,417

NGX,

Ltd.

*

90

8

Nio

Strategic

Metals,

Inc.

*

3,325,000

145,828

Nio

Strategic

Metals,

Inc.,

144A

#*∆

362,069

15,880

Sigma

Lithium

Corp.

*

3,000

36,090

Wolfden

Resources

Corp.

*

1,825,000

66,701

1,220,407

Electric

-

Integrated

0.91%

CPFL

Energia

SA

65,000

381,272

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Energy

-

Alternate

Sources

0.35%

Canadian

Solar,

Inc.

*

10,000

$

147,500

Pacific

Green

Energy

Corp.

#*@~

2,400,000

0

147,500

Enterprise

Software/Services

8.03%

Abaxx

Technologies,

Inc.

*

300,000

2,997,698

Base

Carbon,

Inc.

*

1,000,000

350,864

3,348,562

Food

-

Miscellaneous/Diversified

1.10%

Ingredion,

Inc.

4,000

458,800

Gold

Mining

12.98%

Agnico

Eagle

Mines,

Ltd.

2,500

163,500

Barrick

Gold

Corp.

25,000

417,000

Black

Cat

Syndicate,

Ltd.

*

550,475

111,801

Centerra

Gold,

Inc.

22,539

151,573

Collective

Mining,

Ltd.

*

75,000

174,336

EnviroGold

Global,

Ltd.,

144A

#*∆

75,000

2,467

Firefinch,

Ltd.

#*@

1,000,000

50,833

K92

Mining,

Inc.

*

126,000

723,000

Montage

Gold

Corp.

*

650,000

627,170

New

Gold,

Inc.

*

150,000

292,500

OceanaGold

Corp.

350,000

803,333

Osisko

Gold

Royalties,

Ltd.

10,000

155,800

Ramelius

Resources,

Ltd.

150,000

192,683

Royal

Road

Minerals,

Ltd.

*

5,500,000

402,032

Seabridge

Gold,

Inc.

*

20,000

273,800

Seasif

Exploration,

Inc.

*

2,000,000

21,929

Silver

Tiger

Metals,

Inc.

*

1,000,000

153,503

Torex

Gold

Resources,

Inc.

*

45,000

697,343

5,414,603

Industrial

Gases

2.10%

Linde

PLC

2,000

877,620

Investment

Companies

0.33%

Contango

Holdings

PLC

*

10,502,248

138,866

Metal

-

Copper

1.95%

Arizona

Sonoran

Copper

Co.,

Inc.

*

467,800

434,272

Kutcho

Copper

Corp.

*

1,223,500

147,566

Meridian

Mining

UK

Societas

*

500,000

157,158

Trigon

Metals,

Inc.

*

90,000

73,024

812,020

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Metal

-

Diversified

15.54%

Anglo

American

PLC

3,500

$

110,602

Blackwolf

Copper

and

Gold,

Ltd.

*

208,000

17,485

Electra

Battery

Materials

Corp.,

144A

#*∆

55,555

24,365

Filo

Corp.

*

120,000

2,199,919

Glencore

PLC

40,000

227,611

GoviEx

Uranium,

Inc.,

144A

#*∆

58,000

3,392

Ivanhoe

Electric,

Inc./US

*

16,499

154,761

Ivanhoe

Mines,

Ltd.

*

200,000

2,580,315

Juno

Corp.,

144A

#*@∆

200,000

292,387

Nubian

Resources,

Ltd.

*

250,000

11,421

Orsu

Metals

Corp.,

144A

#*@∆

14,761

0

Sovereign

Metals,

Ltd.

*

600,000

245,916

Torq

Resources,

Inc.

*

1,000,000

62,132

Vox

Royalty

Corp.

200,000

554,000

6,484,306

Metal

-

Iron

0.00%

Consolidated

Growth

Holdings,

Ltd.

#*@

19,859,173

0

Mining

Services

0.65%

Cordoba

Minerals

Corp.

*

58,823

19,779

Defense

Metals

Corp.

*

1,800,000

249,991

269,770

Natural

Resource

Technology

0.30%

I-Pulse,

Inc.,

144A

#*@+∆

15,971

126,171

Non-Ferrous

Metals

5.28%

Cameco

Corp.

10,000

492,000

Denison

Mines

Corp.

*

230,000

457,700

Encore

Energy

Corp.

*

150,000

588,794

EV

Nickel,

Inc.

*

225,000

106,904

InZinc

Mining,

Ltd.

*

2,000,000

40,203

NexGen

Energy,

Ltd.

*

25,000

174,500

Peninsula

Energy,

Ltd.

*

1,400,000

98,391

Peninsula

Energy,

Ltd.

*

500,000

35,139

Sterling

Group

Ventures,

Inc.,

144A

#*@∆

500,000

0

Ur-Energy,

Inc.

*

150,000

210,000

2,203,631

Oil

-

US

Royalty

Trusts

4.59%

Deterra

Royalties,

Ltd.

100,000

265,350

Kimbell

Royalty

Partners

LP

55,000

899,800

Viper

Energy,

Inc.

20,000

750,600

1,915,750

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Oil

Companies

-

Exploration

&

Production

9.38%

Canadian

Natural

Resources,

Ltd.

6,000

$

213,600

ConocoPhillips

1,500

171,570

EOG

Resources,

Inc.

2,500

314,675

LNG

Energy

Group

Corp.

*

1,100,000

201,016

Marathon

Oil

Corp.

17,500

501,725

New

Stratus

Energy,

Inc.

*

1,000,000

409,342

NG

Energy

International

Corp.

*

1,000,000

745,587

NG

Energy

International

Corp.,

144A

#*∆

200,000

149,117

Occidental

Petroleum

Corp.

10,000

630,300

Permian

Resources

Corp.

15,000

242,250

Range

Resources

Corp.

10,000

335,300

3,914,482

Oil

Companies

-

Field

Services

3.15%

Halliburton

Co.

10,000

337,800

Liberty

Energy,

Inc.

7,500

156,675

Schlumberger

NV

6,000

283,080

Select

Water

Solutions,

Inc.,

Class A

50,000

535,000

1,312,555

Oil

Companies

-

Integrated

1.50%

BP

PLC,

ADR

10,000

361,000

TotalEnergies

SE,

ADR

4,000

266,720

627,720

Oil

Refining

&

Marketing

1.25%

Marathon

Petroleum

Corp.

3,000

520,440

Paper

&

Related

Products

1.15%

Sylvamo

Corp.

7,000

480,200

Pipelines

3.14%

Cheniere

Energy,

Inc.

7,500

1,311,225

Precious

Metals

1.01%

Brixton

Metals

Corp.

*

2,000,000

138,884

Coeur

Mining,

Inc.

*

50,000

281,000

419,884

Real

Estate

Operating/Development

0.84%

Infrastructure

Ventures,

Inc.

#*@+

7,443,544

0

Revival

Gold,

Inc.

*

1,690,682

352,213

352,213

Retail

-

Jewelry

0.16%

Mene,

Inc.

*

750,000

68,528

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Common

Stocks (cont’d)

Shares

Value

Silver

Mining

0.89%

Vizsla

Royalties

Corp.

#*@

66,666

$

16,081

Vizsla

Silver

Corp.

*

200,000

353,788

369,869

Total

Common

Stocks

35,736,157

(cost

$76,467,120)

Corporate

Convertible

Bond

1.21%

Coupon

Rate

%

Maturity

Date

Principal

Amount

Investment

Companies

1.21%

Contango

Holdings

PLC,

144A

#@∆

0.00

09/30/24

$

400,000

505,640

(cost

$508,120)

Corporate

Non-Convertible

Bonds

3.38%

Gold

Mining

2.19%

Aris

Gold

Corp.

7.50

08/26/27

763,287

915,944

Oil

Companies

-

Exploration

&

Production

1.19%

NG

Energy

International

Corp.

#

8.00

05/20/27

750,000

494,774

Total

Corporate

Non-Convertible

Bonds

1,410,718

(cost

$1,350,399)

Right

0.00%

Shares

Agricultural

Operations

0.00%

Wide

Open

Agriculture,

Ltd.

#*@

750,000

0

(cost

$231,813)

Exchange

Traded

Fund

0.10%

Direxion

Daily

S&P

Oil

&

Gas

Exp.

&

Prod.

Bear

2X

Shares

ETF

4,400

42,108

(cost

$41,182)

Warrants

0.43%

Exercise

Price

Exp.

Date

Diamonds/Precious

Stones

0.00%

Barksdale

Resources

Corp.,

144A

#*@∆

$

0.60

01/09/27

177,500

0

Diversified

Minerals

0.00%

Core

Assets

Corp.,

144A

#*@∆

0.47

02/17/25

300,000

0

Desert

Mountain

Energy

Corp.,

144A

#*@∆

2.70

03/24/25

300,000

0

Group

6

Metals,

Ltd.

#*@

0.28

01/13/25

400,000

0

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Warrants (cont’d)

Exercise

Price

Exp.

Date

Shares

Value

Diversified

Minerals

(cont’d)

IberAmerican

Lithium

Corp.,

144A

#*∆

$

0.40

09/01/26

500,000

$

0

Lithium

Ion

Energy,

Ltd.,

144A

#*@∆

0.70

04/24/25

225,000

0

Volt

Lithium

Corp.,

144A

#*@∆

0.33

08/04/25

500,000

0

0

Gold

Mining

0.00%

Iris

Metals,

Ltd.

#*@

1.50

05/16/25

325,000

0

Investment

Companies

0.00%

Contango

Holdings

PLC,

144A

#*@∆

0.09

11/07/25

4,583,333

0

Metal

-

Copper

0.00%

Trigon

Metals,

Inc.,

144A

#*@∆

1.50

07/12/26

125,000

0

Metal

-

Diversified

0.00%

Electra

Battery

Materials

Corp.,

144A

#*@∆

1.74

08/11/25

250,000

0

Torq

Resources,

Inc.,

144A

#*@∆

0.30

01/04/27

1,000,000

0

0

Mining

Services

0.31%

Aris

Mining

Corp.

*

2.75

07/29/25

480,000

129,820

Non-Ferrous

Metals

0.00%

Peninsula

Energy,

Ltd.

#*@

0.10

03/31/25

700,000

2,335

Oil

Companies

-

Exploration

&

Production

0.07%

LNG

Energy

Group,

144A

#*@∆

0.60

05/05/26

1,000,000

0

NG

Energy

International

Corp.

*

1.40

05/20/27

300,000

29,604

29,604

Real

Estate

Operating/Development

0.00%

Revival

Gold,

Inc.,

144A

#*@∆

0.72

05/16/26

250,000

0

Revival

Gold,

Inc.,

144A

#*@∆

0.45

05/02/27

137,500

0

0

Silver

Mining

0.05%

Vizsla

Royalties

Corp.

#*@

0.05

12/31/25

66,666

0

Vizsla

Silver

Corp.,

144A

#*@∆

2.00

11/15/24

62,500

19,188

19,188

Total

Warrants

180,947

(cost

$21,535

)

Investments,

at

value

90.76%

37,875,570

(cost

$78,620,169

)

Other

assets

and

liabilities,

net

9.24%

3,854,259

Net

Assets

100.00%

$

41,729,829

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Common

Stocks

93.47%

Shares

Value

Advanced

Materials/Production

6.64%

Nano

One

Materials

Corp.

*

2,700,000

$

2,763,057

Coal

0.00%

Caribbean

Resources

Corp.

#*@

505,453

0

Diamonds/Precious

Stones

0.88%

Barksdale

Resources

Corp.

*

3,570,000

365,338

Diversified

Minerals

3.66%

Ascot

Resources,

Ltd.

*

100,000

40,934

Ascot

Resources,

Ltd.,

144A

#*∆

6,412

2,625

Erdene

Resource

Development

Corp.

*

500,000

148,021

Founders

Metals,

Inc.

*

150,000

202,843

Gossan

Resources,

Ltd.

*

1,250,000

27,411

Indochine

Mining,

Ltd.

#*@

10,000

0

Kenorland

Minerals,

Ltd.

*

225,000

146,376

Kootenay

Resources,

Inc.

*

40,000

3,509

Max

Resource

Corp.

*

2,250,000

98,681

Minaurum

Gold,

Inc.

*

1,500,000

241,219

Serra

Energy

Metals

Corp.

*

2,000,000

29,239

Waraba

Gold,

Ltd.

*~

2,155,000

63,009

Waraba

Gold,

Ltd.,

144A

#*~∆

6,045,000

176,748

Western

Exploration,

Inc.

*

350,000

225,138

Westward

Gold,

Inc.

*

2,000,000

116,955

1,522,708

Energy

-

Alternate

Sources

0.14%

Iondrive,

Ltd.

*

9,806,886

59,900

Financial

Services

0.00%

Tokens.com

Corp.,

144A

#*∆

11,123

1,382

Gold

Mining

47.93%

Abitibi

Metals

Corp.

*

300,000

78,944

Abitibi

Metals

Corp.

*

100,000

26,315

Adamera

Minerals

Corp.

*

547,000

60,975

Adamera

Minerals

Corp.,

144A

#*∆

11,954

1,333

Aero

Energy,

Ltd.

*

50,000

5,299

Allegiant

Gold,

Ltd.

*

500,000

60,305

Alpha

Exploration,

Ltd.

*

500,000

378,276

Amilot

Capital,

Inc.,

144A

#*@∆

410,000

0

Angus

Gold,

Inc.

*

350,000

113,848

Asante

Gold

Corp.

*

1,250,000

1,059,903

Awale

Resources,

Ltd.

*

925,000

338,072

Bellevue

Gold,

Ltd.

*

500,000

595,065

Black

Cat

Syndicate,

Ltd.

*

1,500,000

304,650

Black

Cat

Syndicate,

Ltd.

*

272,400

55,324

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Common

Stocks (cont’d)

Shares

Value

Gold

Mining

(cont’d)

Carolina

Rush

Corp.

*

1,000,000

$

98,681

Cassiar

Gold

Corp.

*

448,000

93,330

Collective

Mining,

Ltd.

*

50,000

116,224

Compass

Gold

Corp.

*

2,000,000

116,955

Faraday

Copper

Corp.,

144A

#*∆

43,500

25,756

Freegold

Ventures,

Ltd.

*

500,000

144,366

G2

Goldfields,

Inc.

*

652,100

676,863

Gold

Bull

Resources

Corp.

*

100,000

38,010

Goldshore

Resources,

Inc.

*

1,400,000

276,306

Heliostar

Metals,

Ltd.

*

1,250,000

251,270

K92

Mining,

Inc.

*

502,000

2,880,523

Karus

Mining,

Inc.

#*@

37,500

60,305

Kesselrun

Resources,

Ltd.

*~

5,000,000

164,468

Kinross

Gold

Corp.

15,000

124,800

Lion

One

Metals,

Ltd.

*

500,000

171,777

Loncor

Gold,

Inc.

*

2,575,000

705,840

Maple

Gold

Mines,

Ltd.

*

1,000,000

62,132

Mawson

Gold,

Ltd.

*

900,000

493,403

McFarlane

Lake

Mining,

Ltd.

*

2,500,000

63,960

Montage

Gold

Corp.

*

400,000

385,951

New

Gold,

Inc.

*

50,000

97,500

NV

Gold

Corp.

*

100,000

23,756

OceanaGold

Corp.

175,000

401,667

Omai

Gold

Mines

Corp.

*

3,000,000

241,219

Onyx

Gold

Corp.

*

200,000

36,548

Osisko

Gold

Royalties,

Ltd.

10,000

155,800

Osisko

Mining,

Inc.

*

125,000

261,321

Radisson

Mining

Resources,

Inc.

*

9,250,000

1,115,639

Radius

Gold,

Inc.,

144A

#*∆

125,000

7,081

Ramelius

Resources,

Ltd.

350,000

449,593

Renegade

Gold,

Inc.

*

650,000

180,549

Reunion

Gold

Corp.

*

500,000

248,529

Roscan

Gold

Corp.

*

1,500,000

82,234

Royal

Road

Minerals,

Ltd.

*

1,500,000

109,645

Sanu

Gold

Corp.

*

585,000

32,071

Sanu

Gold

Corp.,

144A

#*∆

700,000

38,376

Scottie

Resources

Corp.

*

3,250,000

403,859

Seabridge

Gold,

Inc.

*

15,000

205,350

Silver

Tiger

Metals,

Inc.

*

1,000,000

153,503

Skeena

Resources,

Ltd.

*

30,000

160,959

STLLR

Gold,

Inc.

*

92,000

81,371

Storm

Exploration,

Inc.

*

537,500

11,787

Strikepoint

Gold,

Inc.

*

2,750,000

70,356

Sunshine

Metals,

Ltd./Australia

*

12,000,000

102,619

Taurus

Gold,

Ltd.,

144A

#*@∆

2,448,381

0

Tolu

Minerals,

Ltd.

*

600,000

207,695

Tolu

Minerals,

Ltd.

*

317,000

109,732

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Common

Stocks (cont’d)

Shares

Value

Gold

Mining

(cont’d)

Torex

Gold

Resources,

Inc.

*

7,500

$

116,224

TriStar

Gold,

Inc.

*~

28,800,000

4,631,410

Viva

Gold

Corp.

*

500,000

51,168

Westhaven

Gold

Corp.

*

1,000,000

127,919

19,944,709

Metal

-

Copper

0.51%

C3

Metals,

Inc.

*

115,384

21,507

Meridian

Mining

UK

Societas

*

600,000

188,590

210,097

Metal

-

Diversified

5.75%

Aurion

Resources,

Ltd.

*

421,500

184,862

Cartier

Resources,

Inc.

*

750,000

38,376

De

Grey

Mining,

Ltd.

*

250,000

189,674

Ivanhoe

Electric,

Inc./US

*

6,299

59,084

Ivanhoe

Mines,

Ltd.

*

100,000

1,290,157

Juno

Corp.,

144A

#*@∆

200,000

292,387

New

Age

Metals,

Inc.,

144A

#*∆

143,518

4,196

Nubian

Resources,

Ltd.

*

500,000

22,843

Orex

Minerals,

Inc.

*

700,000

143,269

Orsu

Metals

Corp.,

144A

#*@∆

186,922

0

RTG

Mining,

Inc.

*

3,000,000

73,678

Sirios

Resources,

Inc.

*

1,000,000

51,168

Sterling

Metals

Corp.

*

1,000,000

43,858

2,393,552

Mining

Services

0.62%

Cordoba

Minerals

Corp.

*

58,823

19,779

Orexplore

Technologies,

Ltd.

#*@

267,284

3,031

Summa

Silver

Corp.

*

750,000

232,996

255,806

Non-Ferrous

Metals

0.73%

InZinc

Mining,

Ltd.

*

2,000,000

40,203

Solitario

Resources

Corp.

*

300,000

265,500

305,703

Oil

Companies

-

Exploration

&

Production

0.00%

Big

Sky

Energy

Corp.

#*@

2,000,000

0

Optical

Recognition

Equipment

0.00%

Nexoptic

Technology

Corp.,

144A

#*@∆

12,083

132

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Common

Stocks (cont’d)

Shares

Value

Precious

Metals

17.51%

Amani

Gold,

Ltd.

#*@

54,500,000

$

36,357

Arizona

Metals

Corp.

*

1,000,000

1,447,316

Brixton

Metals

Corp.

*

3,000,000

208,326

Canex

Metals,

Inc.

*

3,250,000

118,782

Capitan

Silver

Corp.

*

1,100,000

128,650

Denarius

Metals

Corp.

*

150,000

64,691

Dolly

Varden

Silver

Corp.

*

2,074,000

1,561,507

First

Nordic

Metals

Corp.

*

4,550,000

1,080,918

GFG

Resources,

Inc.

*

5,525,000

343,281

GFG

Resources,

Inc.,

144A

#*@∆

500,000

31,066

Gold

Terra

Resource

Corp.

*

3,750,000

205,585

Gold79

Mines,

Ltd.

*

850,000

136,691

GR

Silver

Mining,

Ltd.

*

1,000,000

102,335

Hercules

Metals

Corp.

*

75,000

35,635

Olive

Resource

Capital,

Inc.

*

4,000,000

80,406

Orla

Mining,

Ltd.

*

51,660

198,249

Paramount

Gold

Nevada

Corp.

*

170,000

68,000

Polarx,

Ltd.

*

30,000,000

280,442

Rua

Gold,

Inc.

*

1,500,000

208,326

Silver

Viper

Minerals

Corp.

*

2,000,000

98,681

Silver

Viper

Minerals

Corp.,

144A

#*@∆

1,000,000

49,340

Stillwater

Critical

Minerals

Corp.

*

1,000,000

109,645

Thesis

Gold,

Inc.

*

900,000

394,722

Unico

Silver,

Ltd.

*

1,000,000

100,900

Visionary

Metals

Corp.

*

1,500,000

46,599

Xali

Gold

Corp.,

144A

#*∆

4,875,000

151,447

7,287,897

Real

Estate

Operating/Development

1.13%

Fremont

Gold,

Ltd.

*

400,000

24,853

Mammoth

Resources

Corp.

*~

5,500,000

70,356

Revival

Gold,

Inc.

*

1,798,818

374,740

469,949

Retail

-

Jewelry

0.46%

Mene,

Inc.

*

2,115,000

193,250

Silver

Mining

7.51%

Aya

Gold

&

Silver,

Inc.

*

50,000

496,327

Gatos

Silver,

Inc.

*

15,000

156,600

Gatos

Silver,

Inc.

*

10,000

104,090

Kootenay

Silver,

Inc.

*

478,000

377,355

Metallic

Minerals

Corp.

*

1,000,000

211,980

Reyna

Silver

Corp.

*

360,000

35,525

Southern

Silver

Exploration

Corp.

*

1,500,000

263,148

Vizsla

Royalties

Corp.

#*@

266,666

64,325

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Common

Stocks (cont’d)

Shares

Value

Silver

Mining

(cont’d)

Vizsla

Silver

Corp.

*

800,000

$

1,415,153

3,124,503

Total

Common

Stocks

38,897,983

(cost

$69,798,028)

Corporate

Non-Convertible

Bond

2.22%

Coupon

Rate

%

Maturity

Date

Principal

Amount

Gold

Mining

2.22%

Aris

Gold

Corp.

7.50

08/26/27

$

771,080

925,296

(cost

$771,080)

Exchange

Traded

Fund

0.21%

Shares

ProShares

UltraShort

Gold

ETF

*

4,000

86,676

(cost

$107,899)

Warrants

0.46%

Exercise

Price

Exp.

Date

Diamonds/Precious

Stones

0.00%

Barksdale

Resources

Corp.,

144A

#*@∆

$

0.60

01/09/27

147,500

0

Diversified

Minerals

0.00%

Minaurum

Gold,

Inc.,

144A

#*@∆

0.34

05/02/26

250,000

0

Western

Exploration,

Inc.,

144A

#*@∆

2.15

12/31/49

50,000

0

0

Gold

Mining

0.00%

Cassiar

Gold

Corp.,

144A

#*@∆

0.70

05/04/25

125,000

0

Freegold

Ventures,

Ltd.,

144A

#*@∆

0.52

12/31/49

150,000

0

McFarlane

Lake

Mining,

Ltd.,

144A

#*@∆

0.07

05/01/25

2,500,000

0

Radisson

Mining

Resources,

Inc.,

144A

#*@∆

0.27

11/17/25

375,000

0

STLLR

Gold,

Inc.,

144A

#*@∆

2.19

12/31/27

21,000

0

0

Metal

-

Diversified

0.00%

Sterling

Metals

Corp.,

144A

#*@∆

0.25

04/17/25

1,000,000

0

Mining

Services

0.42%

Aris

Mining

Corp.

*

2.75

07/29/25

645,000

174,446

Oil

Companies

-

Exploration

&

Production

0.00%

Goliath

Resources,

Ltd.,

144A

#*@∆

0.92

05/18/25

112,500

0

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

World

Precious

Minerals

Fund

Warrants (cont’d)

Exercise

Price

Exp.

Date

Shares

Value

Precious

Metals

0.00%

Denarius

Metals

Corp.,

144A

#*@∆

$

0.60

03/02/26

75,000

$

0

GFG

Resources,

Inc.,

144A

#*@∆

0.18

03/20/26

373,077

0

0

Real

Estate

Operating/Development

0.00%

Revival

Gold,

Inc.,

144A

#*@∆

0.45

05/02/27

50,000

0

TDG

Gold

Corp.,

144A

#*@∆

0.42

07/06/26

115,000

0

0

Silver

Mining

0.04%

Kootenay

Silver,

Inc.,

144A

#*@∆

1.68

04/25/26

64,000

0

Southern

Silver

Exploration

Corp.,

144A

#*@∆

0.35

08/14/25

875,000

0

Vizsla

Royalties

Corp.

#*@

0.05

12/31/25

266,666

0

Vizsla

Silver

Corp.,

144A

#*@∆

2.00

11/15/24

62,500

19,188

19,188

Total

Warrants

193,634

(cost

$116,557

)

Investments,

at

value

96.36%

40,103,589

(cost

$70,793,564

)

Other

assets

and

liabilities,

net

3.64%

1,513,069

Net

Assets

100.00%

$

41,616,658

Portfolio

of

Investments

(unaudited)

See

notes

to

portfolios

of

investments

and

notes

to

financial

statements.

Gold

and

Precious

Metals

Fund

Common

Stocks

90.36%

Shares

Value

Distribution/Wholesale

0.48%

A-Mark

Precious

Metals,

Inc.

15,000

$

485,550

Diversified

Minerals

2.13%

Ascot

Resources,

Ltd.

*

400,000

163,737

Calibre

Mining

Corp.

*

750,000

986,806

Leo

Lithium,

Ltd.

#*@

3,500,000

1,010,756

Lithium

Royalty

Corp.

*

679

3,276

2,164,575

Enterprise

Software/Services

0.29%

Abaxx

Technologies,

Inc.

*

30,000

299,770

Gold

Mining

57.55%

Agnico

Eagle

Mines,

Ltd.

20,000

1,308,000

Alamos

Gold,

Inc.

250,000

3,920,000

Anglogold

Ashanti

PLC

65,000

1,633,450

Argonaut

Gold,

Inc.

*

1,000,000

314,316

Barrick

Gold

Corp.

15,000

250,200

Black

Cat

Syndicate,

Ltd.

*

3,400,000

690,540

Catalyst

Metals,

Ltd.

*

2,000,000

1,510,318

Centamin

PLC

425,000

649,481

Centerra

Gold,

Inc.

75,128

505,228

Dundee

Precious

Metals,

Inc.

150,000

1,174,299

Eldorado

Gold

Corp.

*

50,000

739,500

Endeavour

Mining

PLC

60,000

1,267,497

Equinox

Gold

Corp.

*

550,000

2,876,500

Firefinch,

Ltd.

#*@

5,000,000

254,165

Franco-Nevada

Corp.

8,000

948,160

Gold

Resource

Corp.

*

1,000,000

373,500

Harmony

Gold

Mining

Co.,

Ltd.,

ADR

200,000

1,834,000

IAMGOLD

Corp.

*

250,000

937,500

K92

Mining,

Inc.

*

1,702,000

9,766,237

Karora

Resources,

Inc.

*

600,000

2,613,939

Kinross

Gold

Corp.

130,000

1,081,600

Lundin

Gold,

Inc.