2013 - We Are Wintrust.

WE ARE WINTRUST. We are nearly 3,500 community and commercial bankers, home loan officers, financial advisors and specialty lenders focused solely on our customers and the communities where they live. We operate under many brands reflecting the many communities we serve, but we all have the same mission: To provide best-in-class financial services to all of our customers, be the local alternative to the big banks, and to improve the communities which we call home.

We are Chicago’s Bank, a leading bank in Illinois and Wisconsin, and strive to be the top community bank in each of our local communities. This is some of what we do:

Asset allocation | Creative financial solutions for almost any need | Investment selection | Robust Treasury Management platform | FREE checking accounts | MaxSafe cash accounts with $3.75 million in FDIC insurance | Wealth transfer strategies | 529 college savings plans | Balanced portfolios | Proprietary, discretionary asset management | Equity, fixed income and municipal strategies | Payroll services | Bank at any of more than 120 locations | Bill pay service | Merchant card programs | Foreign Exchange services | Online banking | Comprehensive Financial Review | Retirement income distribution planning | i-BusinessCapture | Mobile banking | Risk management | Remote deposit capture | Business succession planning | Commercial insurance premium financing | Employee retirement benefit plans | Pension fund management | 1031 Exchanges | Trust administration and tax filing | Estate planning and settlement | Guardianship services | Charitable and special needs trusts | Mortgages | Home equity loans | Personal lines of credit | Commercial & Industrial (C&I) lending | i-BusinessClearing | Interest rate management through swaps, etc. | Residential real estate financing | Specialty financing | Small business lending (including SBA loans) | Commercial real estate lending for apartments, offices and industrial property | i-BusinessBanking | Home equity lines of credit | Creative solutions including cross-collateralization and bridge loan structures | Loans and lines against concentrated and restricted stock | Credit Cards | Structured investment products | Margin trading | In-house and third party solutions | Cash or risk mitigation strategies | Insurance planning | Specialized financial divisions to support: Building Management Companies, Condominium & Homeowner Associations, Franchisees, Health Care Companies, Insurance Agents & Brokers, Life Insurance Premium Financing, Mortgage Companies (Warehouse Lending), Municipalities, School Districts, & Non-Profits, Physicians, Dentists & Medical Personnel, Temporary Staffing & Security Companies

|

| | | | |

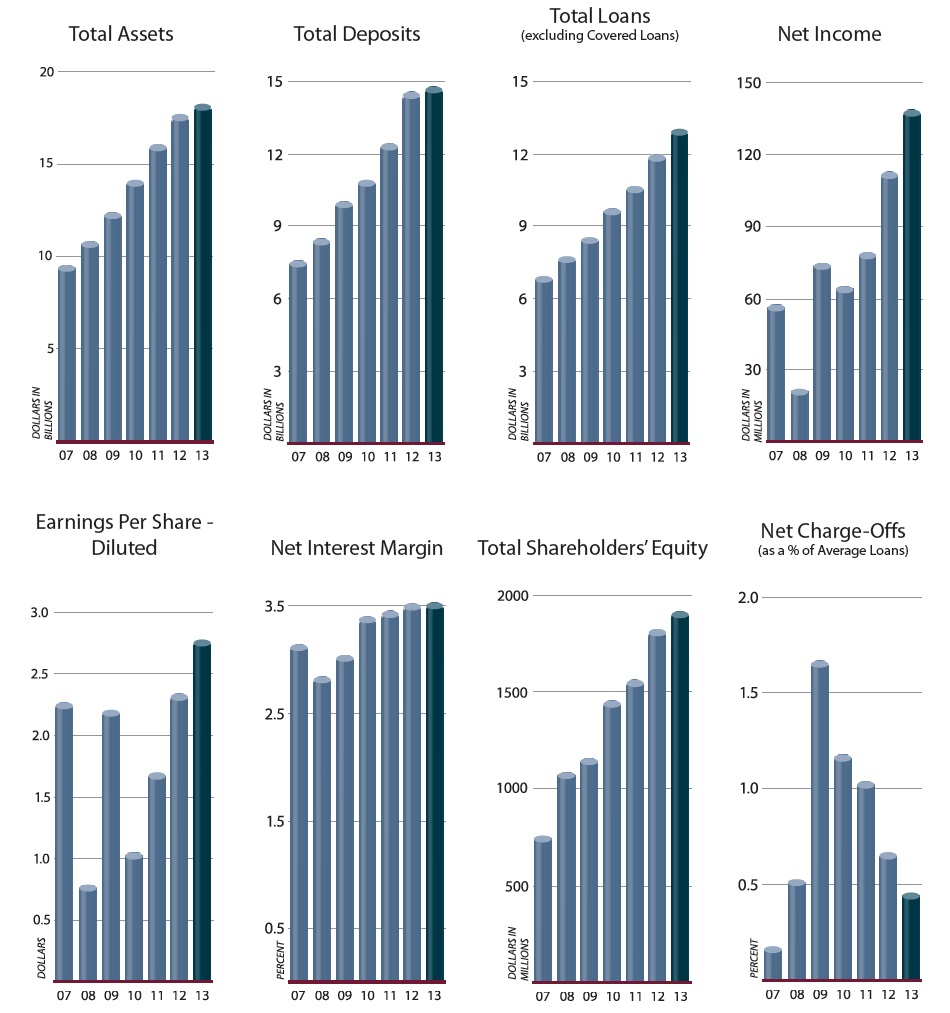

| Selected Financial Trends |

|

| | |

| 2 | | Wintrust Financial Corporation |

|

| | | | |

| Selected Financial Highlights |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, |

| (Dollars in thousands, except per share data) | | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| Selected Financial Condition Data (at end of year): | | | | | | | | | | |

| Total assets | | $ | 18,097,783 |

| | $ | 17,519,613 |

| | $ | 15,893,808 |

| | $ | 13,980,156 |

| | $ | 12,215,620 |

|

| Total loans, excluding covered loans | | 12,896,602 |

| | 11,828,943 |

| | 10,521,377 |

| | 9,599,886 |

| | 8,411,771 |

|

| Total deposits | | 14,668,789 |

| | 14,428,544 |

| | 12,307,267 |

| | 10,803,673 |

| | 9,917,074 |

|

| Junior subordinated debentures | | 249,493 |

| | 249,493 |

| | 249,493 |

| | 249,493 |

| | 249,493 |

|

| Total shareholders’ equity | | 1,900,589 |

| | 1,804,705 |

| | 1,543,533 |

| | 1,436,549 |

| | 1,138,639 |

|

| Selected Statements of Income Data: | | | | | | | | | | |

| Net interest income | | $ | 550,627 |

| | $ | 519,516 |

| | $ | 461,377 |

| | $ | 415,836 |

| | $ | 311,876 |

|

Net revenue (1) | | 773,024 |

| | 745,608 |

| | 651,075 |

| | 607,996 |

| | 629,523 |

|

Pre-tax adjusted earnings (2) | | 275,999 |

| | 274,873 |

| | 221,547 |

| | 196,078 |

| | 122,665 |

|

| Net income | | 137,210 |

| | 111,196 |

| | 77,575 |

| | 63,329 |

| | 73,069 |

|

| Net income per common share – Basic | | 3.33 |

| | 2.81 |

| | 2.08 |

| | 1.08 |

| | 2.23 |

|

| Net income per common share – Diluted | | 2.75 |

| | 2.31 |

| | 1.67 |

| | 1.02 |

| | 2.18 |

|

| Selected Financial Ratios and Other Data: | | | | | | | | | | |

| Performance Ratios: | | | | | | | | | | |

Net interest margin (2) | | 3.50 | % | | 3.49 | % | | 3.42 | % | | 3.37 | % | | 3.01 | % |

| Non-interest income to average assets | | 1.27 |

| | 1.37 |

| | 1.27 |

| | 1.42 |

| | 2.78 |

|

| Non-interest expense to average assets | | 2.88 |

| | 2.96 |

| | 2.82 |

| | 2.82 |

| | 3.01 |

|

Net overhead ratio (2) (3) | | 1.60 |

| | 1.59 |

| | 1.55 |

| | 1.40 |

| | 0.23 |

|

Net overhead ratio - pre-tax adjusted earnings (2) (3) | | 1.57 |

| | 1.48 |

| | 1.61 |

| | 1.62 |

| | 1.66 |

|

Efficiency ratio (2) (4) | | 64.57 |

| | 65.85 |

| | 64.58 |

| | 63.77 |

| | 54.44 |

|

Efficiency ratio - pre-tax adjusted earnings (2) (4) | | 64.01 |

| | 62.38 |

| | 63.67 |

| | 64.70 |

| | 72.25 |

|

| Return on average assets | | 0.79 |

| | 0.67 |

| | 0.52 |

| | 0.47 |

| | 0.64 |

|

Return on average common equity (2) | | 7.56 |

| | 6.60 |

| | 5.12 |

| | 3.01 |

| | 6.70 |

|

Return on average tangible common equity (2) | | 9.93 |

| | 8.70 |

| | 6.70 |

| | 4.36 |

| | 10.86 |

|

| Average total assets | | $ | 17,468,249 |

| | $ | 16,529,617 |

| | $ | 14,920,160 |

| | $ | 13,556,612 |

| | $ | 11,415,322 |

|

| Average total shareholders’ equity | | 1,856,706 |

| | 1,696,276 |

| | 1,484,720 |

| | 1,352,135 |

| | 1,081,792 |

|

| Average loans to average deposits ratio (excluding covered loans) | | 88.9 | % | | 87.8 | % | | 88.3 | % | | 91.1 | % | | 90.5 | % |

| Average loans to average deposits ratio (including covered loans) | | 92.1 |

| | 92.6 |

| | 92.8 |

| | 93.4 |

| | 90.5 |

|

| Common Share Data at end of year: | | | | | | | | | | |

| Market price per common share | | $ | 46.12 |

| | $ | 36.70 |

| | $ | 28.05 |

| | $ | 33.03 |

| | $ | 30.79 |

|

Book value per common share (2) | | $ | 38.47 |

| | $ | 37.78 |

| | $ | 34.23 |

| | $ | 32.73 |

| | $ | 35.27 |

|

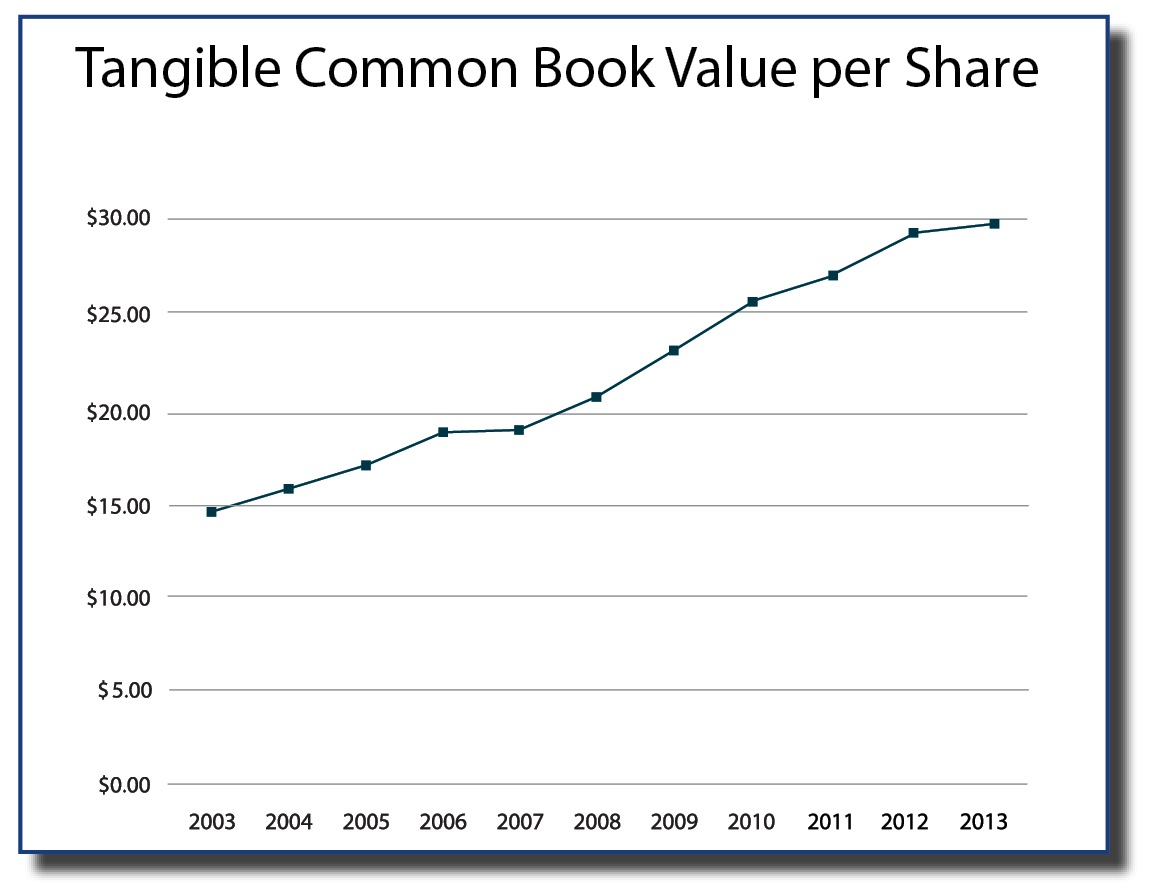

Tangible common book value per share (2) | | $ | 29.93 |

| | $ | 29.28 |

| | $ | 26.72 |

| | $ | 25.80 |

| | $ | 23.22 |

|

| Common shares outstanding | | 46,116,583 |

| | 36,858,355 |

| | 35,978,349 |

| | 34,864,068 |

| | 24,206,819 |

|

Other Data at end of year: (7) | | | | | | | | | | |

| Leverage Ratio | | 10.5 | % | | 10.0 | % | | 9.4 | % | | 10.1 | % | | 9.3 | % |

| Tier 1 Capital to risk-weighted assets | | 12.2 |

| | 12.1 |

| | 11.8 |

| | 12.5 |

| | 11.0 |

|

| Total Capital to risk-weighted assets | | 12.9 |

| | 13.1 |

| | 13.0 |

| | 13.8 |

| | 12.4 |

|

Tangible Common Equity ratio (TCE) (2) (6) | | 7.8 |

| | 7.4 |

| | 7.5 |

| | 8.0 |

| | 4.7 |

|

Tangible Common Equity ratio, assuming full conversion of preferred stock (2) (6) | | 8.5 |

| | 8.4 |

| | 7.8 |

| | 8.3 |

| | 7.1 |

|

Allowance for credit losses (5) | | $ | 97,641 |

| | $ | 121,988 |

| | $ | 123,612 |

| | $ | 118,037 |

| | $ | 101,831 |

|

| Non-performing loans | | 103,334 |

| | 118,083 |

| | 120,084 |

| | 141,958 |

| | 131,804 |

|

Allowance for credit losses(5) to total loans, excluding covered loans | | 0.76 | % | | 1.03 | % | | 1.17 | % | | 1.23 | % | | 1.21 | % |

| Non-performing loans to total loans, excluding covered loans | | 0.80 |

| | 1.00 |

| | 1.14 |

| | 1.48 |

| | 1.57 |

|

| Number of: | | | | | | | | | | |

| Bank subsidiaries | | 15 |

| | 15 |

| | 15 |

| | 15 |

| | 15 |

|

| Non-bank subsidiaries | | 8 |

| | 8 |

| | 7 |

| | 8 |

| | 8 |

|

| Banking offices | | 124 |

| | 111 |

| | 99 |

| | 86 |

| | 78 |

|

| |

| (1) | Net revenue includes net interest income and non-interest income |

| |

| (2) | See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures/Ratios,” for a reconciliation of this performance measure/ratio to GAAP. |

| |

| (3) | The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s total average assets. A lower ratio indicates a higher degree of efficiency. |

| |

| (4) | The efficiency ratio is calculated by dividing total non-interest expense by tax-equivalent net revenue (less securities gains or losses). A lower ratio indicates more efficient revenue generation. |

| |

| (5) | The allowance for credit losses includes both the allowance for loan losses and the allowance for unfunded lending-related commitments, but excluding the allowance for covered loan losses. |

| |

| (6) | Total shareholders’ equity minus preferred stock and total intangible assets divided by total assets minus total intangible assets |

| |

| (7) | Asset quality ratios exclude covered loans. |

|

| | | | |

| To Our Fellow Shareholders |

Welcome to Wintrust Financial Corporation’s 2013 annual report. We thank you for being a shareholder.

First, a quick look at 2013 results.

We always enjoy penning the opening of our letters because we always get to start with the good stuff.

And the best lead of all is our record results for 2013. Your Company saw an increase in net income of 23%, reaching a record $137.2 million!

For us, one of the most important metrics of the value of our Company is Tangible Common Book Value per Share. This metric shows our ability to grow the Company, including our capital, without diminishing the value held by our shareholders. For the 12th consecutive year, our Tangible Common Book Value per Share increased this year, to $29.93. As we grow, acquire, and raise capital, we always keep our focus on adding value to our shareholders. This is your Company, we merely have the privilege of managing it for you.

In the last year, your Company -

| |

| • | Achieved its 17th consecutive year of profitability. |

| |

| • | Topped last year’s net income record, reaching a new high of $137.2 million, an increase of 23% over 2012. |

| |

| • | Reached $18 billion in assets, a 3.3% increase over 2012. |

| |

| • | Increased deposits $240.2 million to $14.7 billion. Non-interest bearing accounts are now 19% of total deposits. |

| |

| �� | Added $1.1 billion in loans, excluding covered loans, an increase of 9% to $12.9 billion. |

| |

| • | Increased net interest margin to 3.50%. |

| |

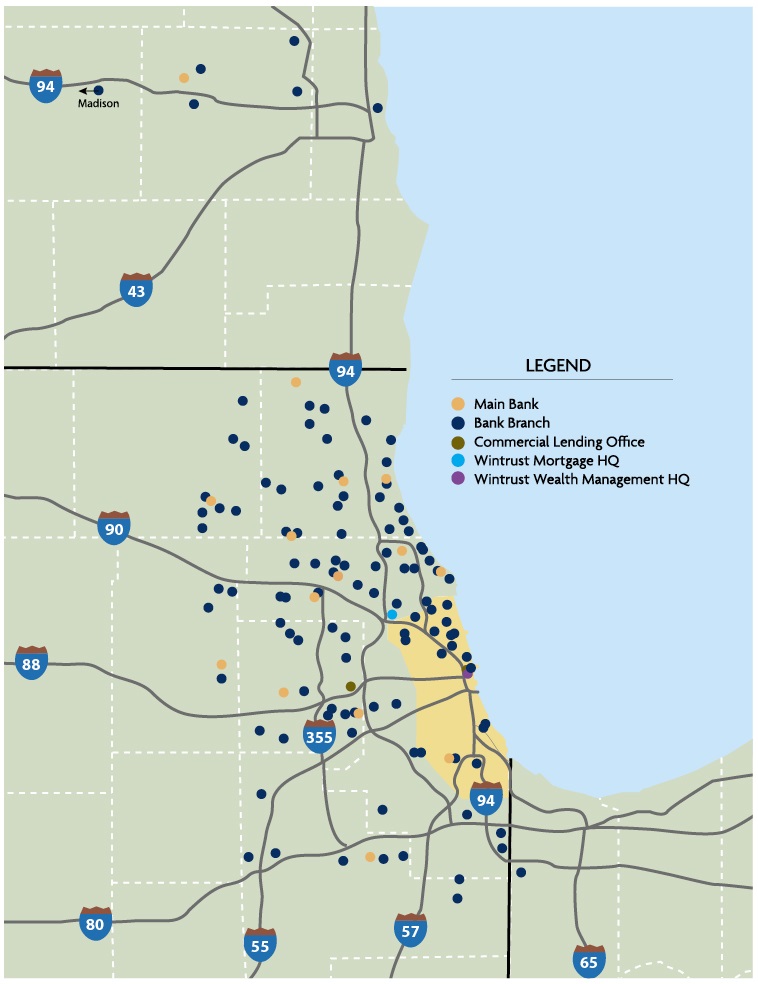

| • | Acquired two banks, adding 12 locations, and opened another seven locations. We now have 124 banking offices (127, if you include our commercial loan offices). |

| |

| • | Acquired certain assets and liabilities of a California-based mortgage operation. |

| |

| • | Decreased non-interest expenses as a percentage of average assets from 2.96% to 2.88%. |

| |

| • | Kept its overhead ratio consistent at 1.60%. We’re as efficient as many of our peers, multiple bank charter structure or not. |

| |

| • | Continued to improve its already exceptional credit quality, excluding covered loans, reducing the provision for credit losses by $26 million, net charge-offs by $19 million and non-performing assets by $27 million. |

As you can see, we had a great year and the Company’s Board of Directors decided in early 2014 to increase our dividend. Subject to ongoing Board of Director approval, future dividend payments will be made on a quarterly basis.

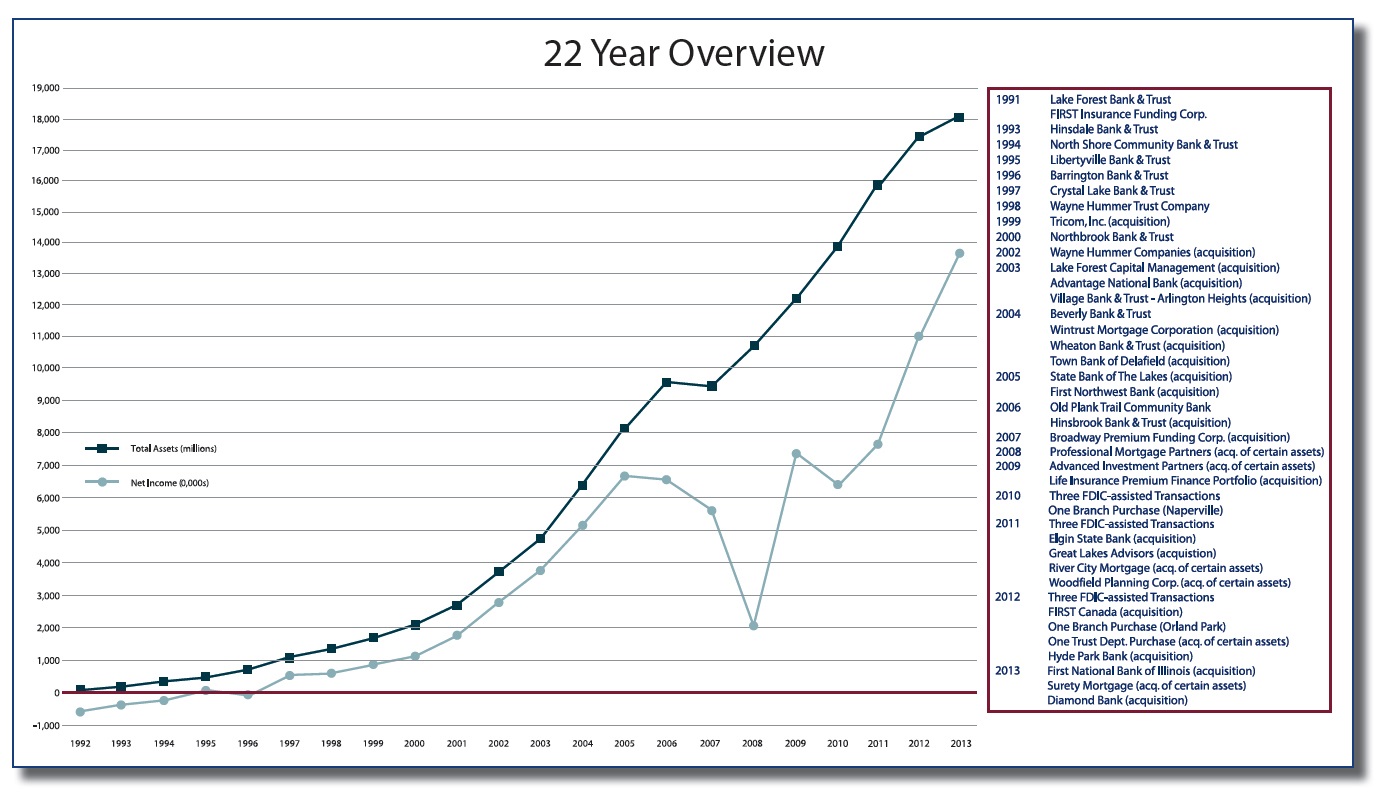

Overall, in 2013, Wintrust achieved consistent growth and record profitability while realizing a compound average growth rate of 11.2% in assets over the last five years. But we know we can do better.

Community Banks are the center of our universe.

When we started 22 years ago, our goal was to create an organization that built and supported community banks across the area. We wanted them to be genuine alternatives to the big banks. For that to be true, we built (and continue to build) a diverse network that ensures our customers want for nothing. Everything our Company does is designed to support our community banks.

Since our start, we’ve operated with a simple philosophy: same or better products and delivery systems as the big banks

|

| | |

| 4 | | Wintrust Financial Corporation |

paired with unmatched customer service. One of the ideas behind our founding was that people want a bank or financial company that knows them, their family, their company and their financial needs. This philosophy drives us to always go above and beyond and to deliver the best customer service possible.

To enable our community bankers to concentrate on local needs, we provide centralized support in areas that could detract from their community banking mission. Investing in technology and centralizing some functions allows our banks to deliver outstanding customer service. Security, human resources, finance, compliance, marketing and other support functions are centralized at the holding company and view the banks as their clients, not just other departments to support.

Those elements of our business that touch customers stay at the local bank level. The retail deposit products (savings, checking, CDs, etc.) offered by our banks are local to their markets. Our retail bankers understand their local markets and design products accordingly. Our systems allow this level of hyper-local flexibility so that each bank can remain as competitive and responsive to community needs as possible.

When our retail bankers or customers need specific expertise, we turn to our non-bank companies. Our Wintrust Mortgage team is a great example. It is hard to believe that what started as several small, decentralized mortgage operations is now one of the largest mortgage originators in the region with operations from coast to coast. Generating nearly $4 billion in loans in 2013, Wintrust Mortgage is there to make sure our banks have competitive mortgage offerings while staying on top of the increased complexity, risk and regulation in the industry. In addition to traditional mortgage loan offices, Wintrust Mortgage built a network of community bank-based loan officers that act as extensions of our banks. In order to ensure that all of our mortgage banking operations comply with the new regulations that took effect in January 2014, we built a centralized loan servicing unit. This unit services all mortgage loans originated and held by our banks, but with the same skill and flexibility that you’d expect to see from a decentralized operation.

Our Wintrust Wealth Management team also exemplifies our combination of local service backed by deep centralized expertise. A team of financial advisors, trust officers and portfolio managers work with and within each local bank to design financial plans to best meet the needs of each customer. Each of these individuals is backed by an organization with more than $18 billion in assets under administration (up from

$15 billion at the end of 2012) that grew revenue by $10 million in 2013 to more than $63 million. Centrally, Wintrust Wealth Management provides research, builds products and makes recommendations that benefit the entire system.

Retail product offerings can and need to be local. However, truly competitive commercial and business offerings require more expertise. So, we built it.

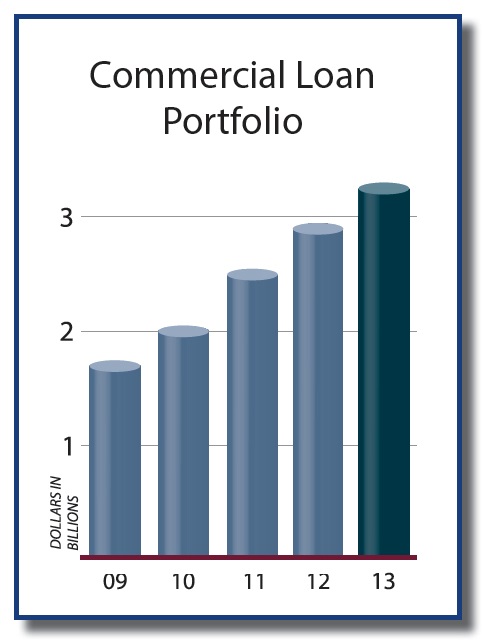

Our commercial banking initiative, started in 2010, is a compilation of local delivery with centralized efficiencies. The premise is simple and similar to our mortgage and wealth management operations: find great commercial bankers, deploy them around the system, coordinate for market coverage, find experts and build the systems that support everyone.

The Wintrust Commercial Bankers across our footprint rely on centralized teams that handle asset-based lending, SBA loans, interest rate swaps, international services, and treasury management implementation. We also created specialized teams that handle the needs of non-profits and local governments and rolled out a new leasing division, called Wintrust Capital, in December 2013.

All of this is supported by a strong credit team and a managed asset division that address any problem loans that may arise.

We also support the banks by investing in niche businesses that generate high quality earning assets. The First Insurance Funding companies (FIRST US, FIRST Canada and FIRST Life) are by far our largest. TRICOM Funding, Community Advantage, Mortgage Warehouse Lending and, more recently, Wintrust Capital all contribute to our banks’ balance sheet diversification on the asset side.

From a funding perspective, our banks have many deposit products to help maintain liquidity, as well as mitigate the increased funding costs and margin reductions that usually come along for the ride when banks need to turn to wholesale funding products to manage liquidity needs. For example, our MaxSafe portfolio, including Wealth Management’s Insured Bank Deposits (IBD) program, totals more than $2.3 billion at a weighted average cost of only 16 basis points.

With all of the support our banks receive, it’s no wonder why they continue to be successful and provide a banking experience that is second to none in the markets we serve.

So, how did our community banks do in 2013?

First, let’s take a look at the sheer growth of our community banks in the last five years. We’ve gone from 79 locations in 2008 to 124 at the end of 2013, an increase of 45. We firmly believe that we can only be Chicago’s bank if we cover all of Chicago. This means the entire area, including the city, as well as Wisconsin and Northwest Indiana.

In 2013, we purchased two more banks which added 12 locations. First National Bank of Illinois brought us eight new locations, seven new markets and a new state, Indiana. We added locations which filled in the south side of our market from Dyer, Indiana to Plainfield, Illinois. The acquisition of Diamond Bank gave us additional locations in Chicago and Schaumburg and allowed us to enter a new market in Elmhurst.

We don’t rely on acquisitions alone to grow. Our banks opened new locations and added five completely new markets for us: Chicago’s Pullman and Logan Square neighborhoods, Milwaukee, Oak Lawn, and Round Lake Beach, and strengthened our presence in Geneva and Elk Grove Village.

All of these new locations, along with continued growth at our existing branches, boosted our number of retail customer households to more than 149,000, an increase of 14% over 2012. That number doesn’t include the tremendous impact of our bankers continuing to strengthen current customer relationships. As more of our customers used more of our products and services, our bankers witnessed increases in on-line banking and mobile banking usage of 24% and 112%.

As we cover the growth of our community banks, we do want to make a quick point on our continued mission of best-in-class retail delivery and customer service. With all of the talk about commercial banking, technology and specialty services, conversations about retail banking can often get lost.

Our retail community bankers are the keepers of our culture and the backbone of our organization. They are the local face of our banks and deliver every day on the promises that we make to our customers. For us, it has always been customers first. Our retail bankers lead the way.

Remembering who we are and where we came from is a major reason why we continue to embrace our multi-charter

|

| | |

| 6 | | Wintrust Financial Corporation |

structure.We are successful because of the way we started--as a family of community banks, not just a mid-sized Midwestern bank.

Even with a strong focus on service, we can stack our efficiency and overhead ratios up against most banks in our peer group. Our overhead and efficiency ratios ended 2013 at 1.60% and 64.57%, respectively, well within the range of our peers, and with an eye on constantly improving. If you look solely at the performance of our banks, removing the costs associated with the mortgage and wealth management operations, net overhead and efficiency ratios are even more impressive.

All of our bankers have embraced the goal of being first or second in hyper-local deposit market share within the next few years. Thirty-six of our branches are there now. This attention to local markets ensures that we continue on our march to be Chicago’s bank.

A key part of our expansion is continuing to serve the needs of the entire community. We take pride in serving communities in our area. Doing so involves more than free checking accounts, savings accounts, small dollar and credit rebuilding loans. We believe that financial education is a vital part of our responsibility as a community bank. In 2013, our bankers hosted more than 550 Money Smart classes, first-time home buyer seminars, and other educational sessions for more than 5,000 people. In addition, Path2Own, the home buyer coaching program started by Wintrust Mortgage last year has enjoyed success.

Why the focus? Simple-this is what community banks do and we are community bankers. It is impossible to be a community bank and not serve the needs of the entire community. We can’t be Chicago’s bank without serving all of Chicago.

Small businesses are the cornerstone of every community and we’re increasingly focused on meeting those unique needs. In the last few years, we’ve added new products like specialized deposit offerings, technology, and smaller loan programs, like the Easy Access loan and overdraft protection lines, that can help improve the cash flow and financial situations of most small businesses.

We now count more than 20,000 small businesses as our customers, an increase of about 20% over 2012.

The Wintrust SBA Lending team continues to support our small business effort. In the two short years since we began this effort, we are now one of the top SBA lenders in the Chicago area and the state of Illinois. In fact, Village Bank & Trust, which houses our SBA lending team, won 2013 Small Lender of the Year from the Small Business Administration.

In addition, our banks, often together with our partners, provide small businesses with the opportunity to participate in training, seminars and networking to help make their businesses more successful.

And Commercial Banking?

In a previous shareholder letter, we referred to Wintrust Commercial Banking as our heavy lift vehicle. Since starting the commercial initiative in 2010, we’re well on our way to being Chicago’s bank for business. With over 65 middle market bankers in 14 locations across the Wintrust footprint, and expanding in the Wisconsin and Indiana markets, we booked more than $1.7 billion in new commercial loan commitments in 2013.

Commercial bankers focus on providing our customers a full range of services and routinely refer business to other teams within Wintrust, including treasury management, 401(k) plan administration, personal wealth management, and mortgage.

Like every other facet of our business, we continue to build expertise in key areas to deepen our commercial offerings. Asset-based lending and commercial real estate are long time specialties. Government, non-profit and leasing are newer ones. All exist to give our commercial bankers the tools they need to best take care of our customers. Because of our approach, structure and product diversity, our pipelines remain strong.

We are careful, however, that our growth never comes at the expense of our underwriting standards. We built a conservative credit culture that helped us successfully weather the last credit cycle and we maintain that culture today. Banks are paid to take educated risks, not to gamble.

How about Wintrust Mortgage?

What started as an investment in mortgage expertise for our banks has grown into a truly national mortgage operation with 94 offices in 14 states, including Texas, California and across the Midwest. Wintrust Mortgage is one of the top originators in the Midwest and is becoming one of the top originators in the country.

Our national reach allows us to limit the impact of housing fluctuations or seasonality associated with any one region. Combined with an infrastructure that allows for staff and capacity fluctuations with volume, Wintrust Mortgage has grown into a great contributor for the Company.

Our two largest mortgage related acquisitions in recent years, Minnesota-based River City Mortgage in 2011 and southern California’s Surety Financial Services in 2013, are perfect examples of the benefits of our regional diversification strategy. In addition, our mortgage acquisitions are structured mostly on an earn-out basis with minimal up front acquisition costs to us.

The former River City folks remain heavily focused on purchase business with very little refinance volume and have continued their strong production since joining Wintrust.

The Surety Financial folks joined us late in the year, but have the potential to increase our volume more than just marginally. Our focus on picking organizations with a good cultural fit makes acquisition integration less complicated. These are entrepreneurial organizations that fit well within our structure.

Our depth of products, access to markets, strong compliance system and culture make us an attractive partner to smaller mortgage companies looking to sell. We expect more acquisition opportunities in the mortgage business in the future.

Mortgage customers represent a substantial cross-sell opportunity for our banks and our wealth management operations. The mortgage team also brings educational, operational and product resources to our banks and customers.

We are continuing to build our business of financing new home purchases. In 2012, 39% of our volume was related to new purchases (compared to 29% for the industry). This pattern continued in 2013 when 57% of our volume was for new home purchases (compared to 37% for the industry). We’ve rolled out a series of new bank-held portfolio mortgage products, primarily Jumbo and ARM products, that further position us to take advantage of any potential growth in the purchase market.

As in other areas of the Company, our mortgage business is focused on providing the "extras" to our prospects and customers.

And Wintrust Wealth Management?

Our Wealth Management team had an absolutely outstanding year. We increased assets under management by 21%, from $15 billion to $18 billion, and increased revenue by 20%, from $53 million to $63 million. As you may know, there are four key components to our efforts:

| |

| • | Wayne Hummer Investments: our traditional broker/dealer. |

| |

| • | The Chicago Trust Company: houses our trust operations. |

| |

| • | Great Lakes Advisors: the institutional and personal asset manager. |

| |

| • | Wintrust Wealth Services: our Private Client team. |

All of these groups work together, with each other and with the banks, our commercial bankers and mortgage loan officers to build custom financial solutions for families, business owners, non-profits and communities.

Wayne Hummer Investments

This team is the front line of our wealth management group. There are 102 financial advisors, 41 of them in our community banks, 30 in our headquarters and satellite offices, and another 31 in non-affiliated community banks as part of our correspondent network. They offer everything from

|

| | |

| 8 | | Wintrust Financial Corporation |

comprehensive financial reviews for families to management of corporate 401(k) plans for businesses.

The total portfolio administered by Wayne Hummer Financial Advisors now exceeds $10 billion.

The Chicago Trust Company

Slow and steady is the story here. The trust company generally relies on referrals from financial advisors, loan officers, bankers and external centers of influence, like attorneys, accountants and other financial advisors to generate new business.

Those referrals, along with new customers and portfolios from a couple of smaller acquisitions, grew the trust company’s portfolio of assets under management or administration to $3 billion, an increase of 23%.

Great Lakes Advisors

Our institutional and personal asset manager continues along a path of solid growth by developing products and systems to meet the needs of our customers.

GLA has continued its success with public and union pensions and non-profits and has grown to nearly $5 billion in assets under management.

The four Great Lakes mutual funds continue to grow and now count more than $156 million in investments from individual investors, institutions, and defined contribution plans.

We are equally excited about GLA’s new Wintrust Premier Asset Management program. This proprietary program provides key customers with a unique, institutional-quality investment process and best-in-class money managers that continuously apply extensive analysis to investment options and asset allocation models.

The Wintrust Premier Asset Management program uses a rigorous due diligence process to research and select money managers. This process allows the Portfolio Strategy Group to objectively evaluate available managers in each asset category and to select the best-in-class from among the potential candidates.

Furthermore, they seek to combine those best-in-class money managers in optimal ways. By remaining keenly aware of managers’ holdings and investing style, the program avoids overlap and introduction of unintended risk. In doing so, we believe that the Wintrust Premier Asset Management program can generate better results with lower risk.

Wealth Services

Acting as the relationship quarterback, our Wealth Services bankers assist middle market business owners and high-net worth individuals and families, to help them amass, manage, preserve and transfer their wealth. Our professionals focus on a client’s complete financial picture and then work with all of our business units to design customized financial solutions.

Finally, the niches.

In order to remain asset driven and not overreach for loans outside our credit parameters, we develop asset niches. These businesses support our balance sheet and assist in keeping us diversified.

FIRST Insurance Funding

Our original, oldest and still our largest niche lending business, FIRST Insurance Funding is one of the largest premium finance companies in North America, and actually three distinct businesses:

| |

| • | FIRST Property & Casualty, United States |

| |

| • | FIRST Property & Casualty, Canada |

FIRST Property & Casualty, United States

In 2013, the FIRST P&C team originated $4.4 billion in loan volume and ended with $1.9 billion in outstandings, an increase of 9% over 2012.

We expect 2014 to see more growth as the property and casualty insurance premiums which we finance have been slowly increasing and as we continue our sales efforts to add agents and brokers to our list of clients.

FIRST Life Funding

This team had its strongest year yet, bringing in $482.3 million in new loan volume and ending the year with $1.9 billion in outstandings, a 12% increase over 2012.

As one of the few dedicated providers of this financing, we expect to see continued great things from this division.

FIRST Property & Casualty, Canada

Our first international investment two years ago, FIRST Insurance Funding of Canada, has proven to be a great addition to the Wintrust family.

As the second largest premium finance company in Canada, our Canadian team brought in $628.5 million in loan volume and ended the year with $274.8 million in outstandings.

Like our U.S. operation, we’re looking for 2014 to be even stronger.

TRICOM Funding

Tricom was our first acquisition (back in 1999) and its growth over the last several years is nothing short of remarkable. Now a big fish in a small industry, it's grown from a small player to a preeminent provider of financial services to staffing and security firms. In 2013, Tricom saw a 23% increase in outstandings.

We believe that this growth will continue along with the recovery of a vibrant temporary staffing industry.

Community Advantage

Celebrating its fifteenth year in 2014, Community Advantage is one of the few remaining providers in the Midwest of banking services to the Condo/Homeowner Association sector.

For us, its almost like another bank. Community Advantage is now up to $240.6 million in deposits and $90.9 million in loan outstandings.

With good success in Illinois and Wisconsin, Community Advantage has seen recent growth in Minnesota and expects to expand to Missouri and California in coming months.

Leasing

We have actually been in the leasing business for several years. Our original operation, Wintrust Equipment Leasing, buys paper from established leasing companies. This has been a great niche for us and it has grown to more than $109 million.

Late last year, we had an opportunity to start a direct leasing operation, called Wintrust Capital, that did not compete with our current operation or customers. This is a perfect fit for our current commercial banking structure as it gives our bankers another "arrow in their quiver" to provide a complete financial solution to our prospects and customers. We are starting first with referrals from our commercial bankers and will eventually build a national sales team.

A thought about the environment.

Like all of our competitors, we have been working to address an immense regulatory burden that has been broadly applied to the banking industry.

New regulations have required a very expensive "rearrangement of office furniture" with little real benefit to our customers or to Wintrust.

We are continually working to keep the regulations from impacting our service to the customer, but it’s undeniable that compliance with extensive regulation makes our jobs a lot harder behind the scenes and threatens to take our focus away from customer service.

We never wanted to be a big bank, but now we answer to regulators like we are one. We’ve dedicated a lot of time, effort and money into implementing the overwhelming number of new and revised regulations-all of which make it hard for us to be us.

We are complying with all the new regulations. As best we can, we will keep our compliance work behind the scenes and find appropriate ways to make sure the customer has the same experience they have come to expect from us.

Increased regulation is one of the elements behind the decline of community banks nationally. There has only been one new bank charter nationally in the last three years and the number of community banks has dropped by over 40% since June 30, 2007.

With that said, we are focused on the Community Reinvestment Act (CRA). We are continually striving for each of our banks to achieve a high rating. In fact, three of our banks have achieved an "Outstanding" rating while all others are at "Satisfactory," with "Outstanding" in sight.

Although there seem to be new regulations daily, we will take the related challenges head-on and succeed. This is the business we’ve chosen.

It is also important to make a comment about the current rate environment. It is no secret that the artificially low rate

|

| | |

| 10 | | Wintrust Financial Corporation |

environment makes it difficult for most banks to achieve the net interest margins expected of a successful commercial bank.

What started as an effort to stimulate growth and reduce the impact of the Great Recession is now "too much of a good thing." This near zero interest rate environment has helped to support unprecedented borrowing by the Federal Government. The federal deficits are very high and the national debt is now approaching 100% of GDP. Seemingly, then, the Federal Government can not afford a rise in interest rates, though history tells us that one is coming. The question is when. For now, we assume that we have at least a couple more years of this rate environment and we continue to adjust our balance sheet to prepare for any interest rate increases.

We believe that one result of the extended low rate environment is a return to some of the behavior that got the industry in trouble six years ago. Questionable underwriting and reduced pricing seem to be making a comeback. We will do what we’ve always done--protect your investment in us by sticking to our conservative credit standards and the firm belief that we should always get paid for taking educated risks. Others’ failure to learn from the past will not sway us.

This is who we are.

Many industries that traditionally pride themselves on service seem to have lost that mission. Some, especially bankers, blame the economy, competition or the regulatory environment when they start to skimp on customer service.

For us, the customer is why we are here. We are community bankers.

For those of you who don’t know Dennis Jones, he is one of the original Wintrust bankers. Twenty years ago, he understood what we were building, embraced it and has been one of our key standard bearers ever since.

He helped start and build Hinsdale Bank and, every now and then, when we need to focus on who we are and why we’re here, he is there with an elegant reminder.

Twenty-four hours after we were notified of the massive data breach at Target in late November 2013, Dennis sent the following note to the Hinsdale Bank staff who had spent countless hours personally notifying affected customers. All across our banks, all of our nearly 3,500 employees continue to provide the kind of customer-centric service Dennis describes in his note, and by doing so we remind ourselves why we’re better and why we’re here. Our reaction to this situation is just another outstanding example.

Never Let a Crisis Go to Waste

As I write this e-mail, I find myself heartened and invigorated by numerous members of our staff. We all know that December 19th will be remembered as the "Target" day. I am hanging out here with a number of our fellow employees who are doing an incredible job of strengthening Hinsdale Bank’s ties to our customers.

They have been working on this for over twelve hours, they remain chipper, calm, upbeat, humorous, understanding, careful and care giving. The reaction of our customers to the preemptive actions being taken by our Bank, personal phone calls letting them know of the situation, has been overwhelmingly positive.

About two hours ago one of the "compromised" customers said that this evening’s phone call reminded her of why she "banks with friends." A few minutes ago one of our employees called a cell phone number, asked for the customer, a youthful voice said she would hand the phone to her mother. It turns out the mom is presently in labor and asked if we could hold off "hot carding" her for a few days. We will do that, keep a watchful eye on the account, and, I suspect, have a new Junior Saver in a month or so.

Minutes ago, unable to reach a compromised customer, a staff member noticed in the notes that the customer is in France. We will leave that account open, watching it closely, until we are able to make contact or she returns to the States.

Many more stories like these are being told in our branches this evening and will be repeated tomorrow. Twenty years ago a few of us wanted to start "a different kind of bank." A bank focused on the customer...service oriented...caring and concerned. Those of you working this evening personify that desire. I’m overwhelmed by your unselfish response to this crisis. I cannot thank you enough, but I thank you from the bottom of my heart.

It’s still all about reputation.

Every year, we seem to close much the same way, though we feel it needs repeating.

We’re nothing without our reputation. Our reputation remains strong, across all business lines, with customers, prospects, centers of influence, investors, analysts and even some competitors.

Feedback from our customers, both retail and commercial tell us that we continue to do the right thing: focus on each customer and each community and remember why we’re here and how we got here.

Thank you for being a shareholder. We hope to see you at our Annual Meeting on May 22, 2014 at 10:00 a.m. at our corporate headquarters located at 9700 West Higgins Road in Rosemont, Illinois.

|

| | |

| 12 | | Wintrust Financial Corporation |

The Brands We Market

Our Locations

|

| | |

| 14 | | Wintrust Financial Corporation |

|

| | | | |

| Finding a Wintrust Location |

Wintrust Financial Corporation (Investor Relations)

www.wintrust.com (click on “Contacts & Requests”)

Wintrust Community Banks & Wintrust Commercial Banking

www.wintrust.com/findus

Wintrust Mortgage

www.wintrustmortgage.com (click on “find a location”)

Wintrust Wealth Management: Great Lakes Advisors, The Chicago Trust Company and Wayne Hummer Investments

www.wintrustwealth.com/contact-us (click on “locations”)

FIRST Insurance Funding Corp., including FIRST Canada and FIRST Life Funding

www.firstinsurancefunding.com/contact-us

Tricom, Inc. of Milwaukee

www.tricom.com/about/contact-us

Specialty Services, such as Community Advantage, Wintrust Business Credit, Wintrust Franchise Services, and Wintrust Government Funds

www.wintrust.com (under “Specialized Services”)

|

| |

| Corporate Information | |

Directors

Peter D. Crist (Chairman)

Bruce K. Crowther

Joseph F. Damico

Bert A. Getz, Jr.

H. Patrick Hackett, Jr.

Scott K. Heitmann

Charles H. James III

Albin F. Moschner

Thomas J. Neis

Christopher J. Perry

Ingrid S. Stafford

Sheila G. Talton

Edward J. Wehmer

Public Listing and Market Symbol

The Company’s Common Stock is traded on The NASDAQ Global Select Market® under the symbol WTFC.

The Company’s warrants to purchase common stock are traded on The NASDAQ Global Select Market® under the symbol WTFCW. | Annual Meeting of Shareholders

May 22, 2014

10:00 a.m.

Wintrust Financial Center

9700 West Higgins Road

Rosemont, Illinois 60018

Website Location

The Company maintains a financial relations internet website at the following location: www.wintrust.com

Form 10-K

The Annual Report on Form 10-K to the Securities and Exchange Commission is available on the Internet at the Securities and Exchange Commission’s website. The address for the website is: http://www.sec.gov.

Transfer Agent

IST Shareholder Services

433 South Carlton Avenue

Wheaton, Illinois 60187

Telephone: 800-757-5755

Facsimile: 630-480-0461 |