Earnings Release Presentation Q1 2021 Wintrust Financial Corporation

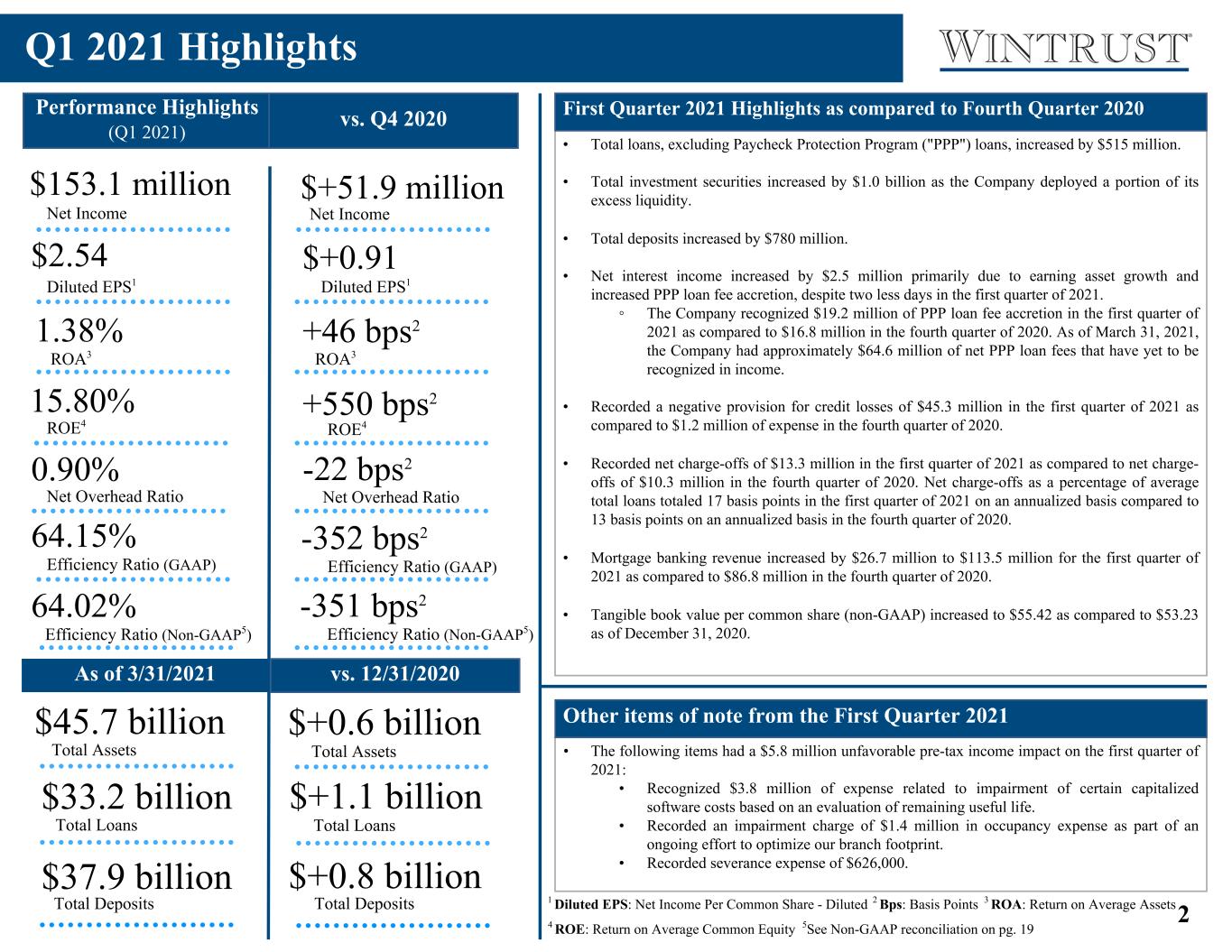

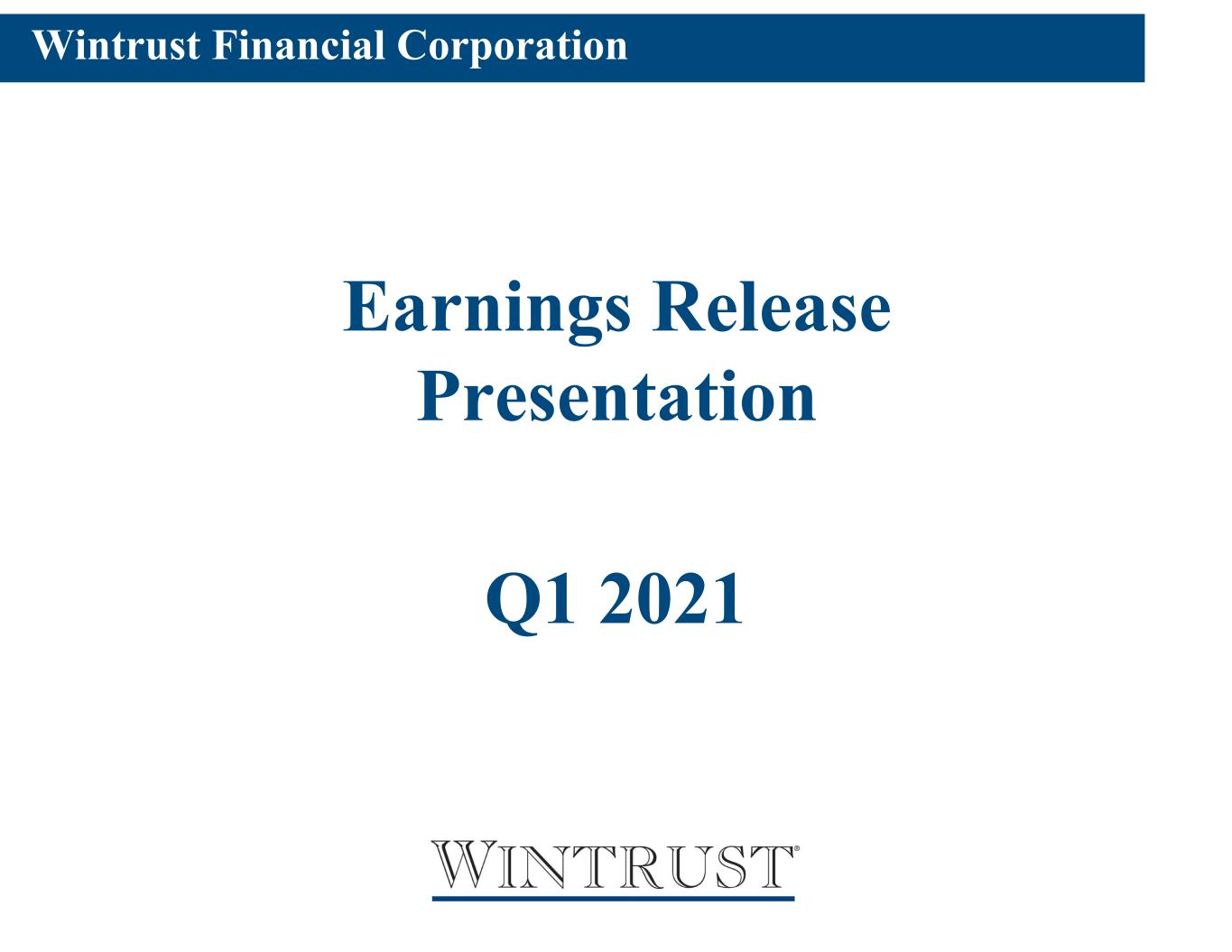

2 ROA3 • Total loans, excluding Paycheck Protection Program ("PPP") loans, increased by $515 million. • Total investment securities increased by $1.0 billion as the Company deployed a portion of its excess liquidity. • Total deposits increased by $780 million. • Net interest income increased by $2.5 million primarily due to earning asset growth and increased PPP loan fee accretion, despite two less days in the first quarter of 2021. ◦ The Company recognized $19.2 million of PPP loan fee accretion in the first quarter of 2021 as compared to $16.8 million in the fourth quarter of 2020. As of March 31, 2021, the Company had approximately $64.6 million of net PPP loan fees that have yet to be recognized in income. • Recorded a negative provision for credit losses of $45.3 million in the first quarter of 2021 as compared to $1.2 million of expense in the fourth quarter of 2020. • Recorded net charge-offs of $13.3 million in the first quarter of 2021 as compared to net charge- offs of $10.3 million in the fourth quarter of 2020. Net charge-offs as a percentage of average total loans totaled 17 basis points in the first quarter of 2021 on an annualized basis compared to 13 basis points on an annualized basis in the fourth quarter of 2020. • Mortgage banking revenue increased by $26.7 million to $113.5 million for the first quarter of 2021 as compared to $86.8 million in the fourth quarter of 2020. • Tangible book value per common share (non-GAAP) increased to $55.42 as compared to $53.23 as of December 31, 2020. • The following items had a $5.8 million unfavorable pre-tax income impact on the first quarter of 2021: • Recognized $3.8 million of expense related to impairment of certain capitalized software costs based on an evaluation of remaining useful life. • Recorded an impairment charge of $1.4 million in occupancy expense as part of an ongoing effort to optimize our branch footprint. • Recorded severance expense of $626,000. $33.2 billion $2.54 Q1 2021 Highlights Other items of note from the First Quarter 2021 Performance Highlights (Q1 2021) $153.1 million Net Income Diluted EPS1 1.38% ROA3 15.80% ROE4 $45.7 billion Total Assets Total Loans $37.9 billion Total Deposits $+0.6 billion Total Assets $+1.1 billion $+0.8 billion Total Loans Total Deposits $+51.9 million Net Income $+0.91 Diluted EPS1 +46 bps2 +550 bps2 ROE4 0.90% 64.02% Net Overhead Ratio Efficiency Ratio (Non-GAAP5) -351 bps2 Efficiency Ratio (Non-GAAP5) -22 bps2 Net Overhead Ratio First Quarter 2021 Highlights as compared to Fourth Quarter 2020vs. Q4 2020 As of 3/31/2021 vs. 12/31/2020 64.15% Efficiency Ratio (GAAP) -352 bps2 Efficiency Ratio (GAAP) 4 ROE: Return on Average Common Equity 1 Diluted EPS: Net Income Per Common Share - Diluted 3 ROA: Return on Average Assets 5See Non-GAAP reconciliation on pg. 19 2 Bps: Basis Points

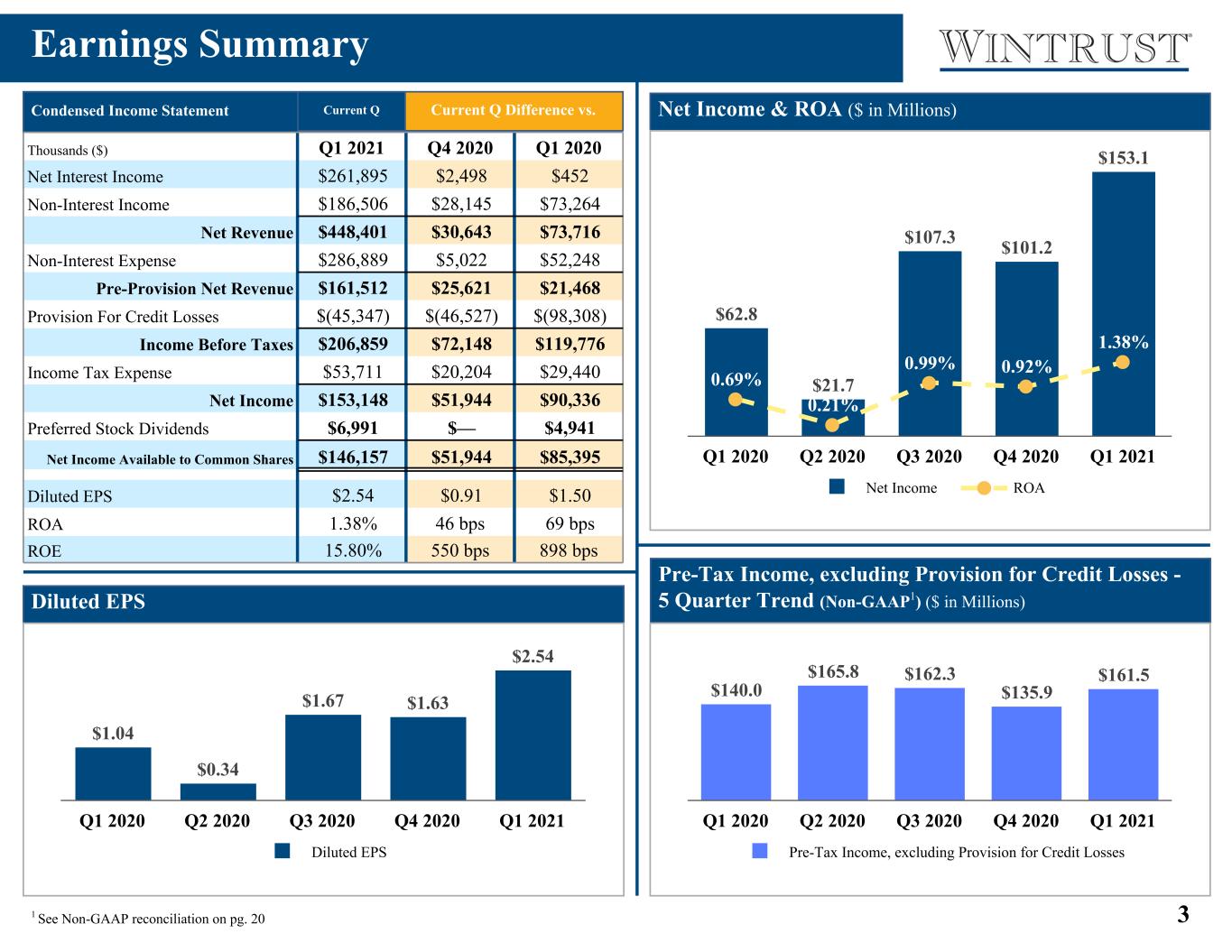

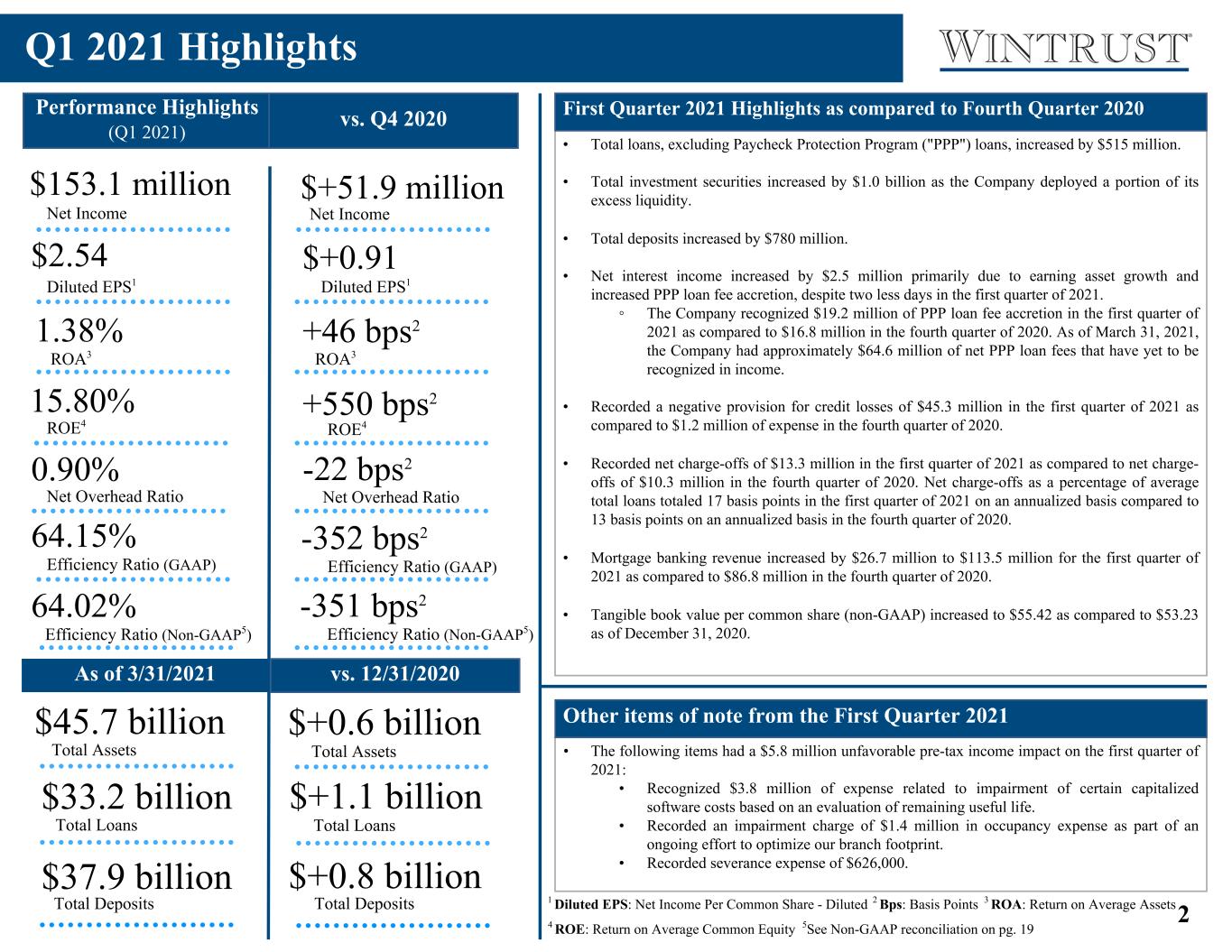

3 Earnings Summary Net Income & ROA ($ in Millions) Diluted EPS Key Observations Condensed Income Statement Current Q Difference vs.Current Q • Pre-Provision Net Revenue increased by $15.5 million compared to the prior quarter and $10.8 million as compared to Q1 2020 • $62.8 $21.7 $107.3 $101.2 $153.1 0.69% 0.21% 0.99% 0.92% 1.38% Net Income ROA Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $1.04 $0.34 $1.67 $1.63 $2.54 Diluted EPS Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Pre-Tax Income, excluding Provision for Credit Losses - 5 Quarter Trend (Non-GAAP1) ($ in Millions) $140.0 $165.8 $162.3 $135.9 $161.5 Pre-Tax Income, excluding Provision for Credit Losses Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 1 See Non-GAAP reconciliation on pg. 20 Thousands ($) Q1 2021 Q4 2020 Q1 2020 Net Interest Income $261,895 $2,498 $452 Non-Interest Income $186,506 $28,145 $73,264 Net Revenue $448,401 $30,643 $73,716 Non-Interest Expense $286,889 $5,022 $52,248 Pre-Provision Net Revenue $161,512 $25,621 $21,468 Provision For Credit Losses $(45,347) $(46,527) $(98,308) Income Before Taxes $206,859 $72,148 $119,776 Income Tax Expense $53,711 $20,204 $29,440 Net Income $153,148 $51,944 $90,336 Preferred Stock Dividends $6,991 $— $4,941 Net Income Available to Common Shares $146,157 $51,944 $85,395 Diluted EPS $2.54 $0.91 $1.50 ROA 1.38% 46 bps 69 bps ROE 15.80% 550 bps 898 bps 2 Preferred dividends were $7.0 million in Q4 2020. Recorded preferred dividends of $10.3 million in Q3 2020 including dividends declared for Q3 2020 as well as a stub period related to the issuance of preferred stock in Q2 2020. 1 Q3 2020 had a $9.0 million state income tax benefit.

4 3.12% 2.73% 2.56% 2.53% 2.53% 3.14% 2.74% 2.57% 2.54% 2.54% 4.13% 3.44% 3.12% 3.02% 2.96% 0.35% 0.28% 0.24% 0.22% 0.21% 1.34% 0.98% 0.79% 0.70% 0.63% Net Interest Margin (GAAP) Net Interest Margin, Fully Taxable-Equivalent (Non-GAAP ) Earning Assets Yield Net Free Funds Contribution Rate on Interest Bearing Liabilities Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Net Interest Margin • Q1 2021 net interest income totaled $261.9 million. ◦ An increase of $2.5 million as compared to Q4 2020 and an increase of $452,000 as compared to Q1 2020. • Net interest margin (Non-GAAP1) was unchanged from the prior quarter: ◦ Yield on earning assets down 6 bps. ◦ Interest bearing liability rate down 7 bps. ◦ Net free funds down 1 bp. Net Interest Margin, Fully Taxable-Equivalent (Non-GAAP1) Key Observations Net Interest Margin (Quarterly Trends) 2.54% (0.06)% 0.07% (0.01)% 2.54% Q4 202 0 Ear ning Ass et Y ield Inte rest Bea ring Lia bilit y R ate Net Fre e Fu nds Q1 202 1 1 See Non-GAAP reconciliation on pg. 19 1 2.54% (0.06)% 0.07% (0.01)% 2.54% Q4 202 0 Ear ning Ass et Y ield Inte rest Bea ring Lia bilit y R ate Net Fre e Fu nds Q1 202 1 • Q1 2021 net interest income totaled $261.9 million. ◦ A decrease of $2.5 million as compared to Q4 2020 and a decrease of $0.5 million as compared to Q1 2020. • Net interest margin (Non-GAAP1) decreased by 0 bps from the prior quarter: ◦ Earning assets yield down 6 bps. ◦ Interest bearing liability rate down 7 bps. ◦ Net free funds down 1 bps.

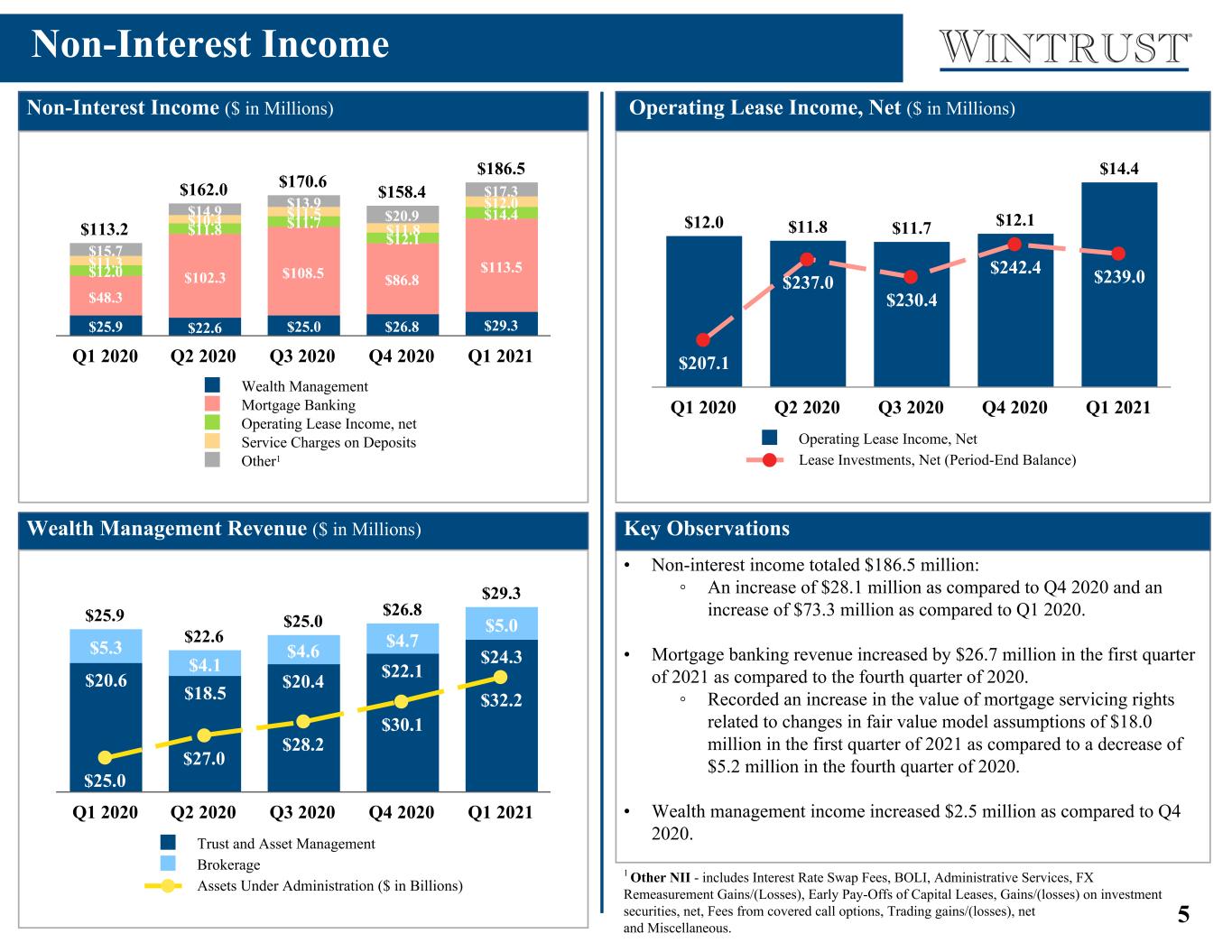

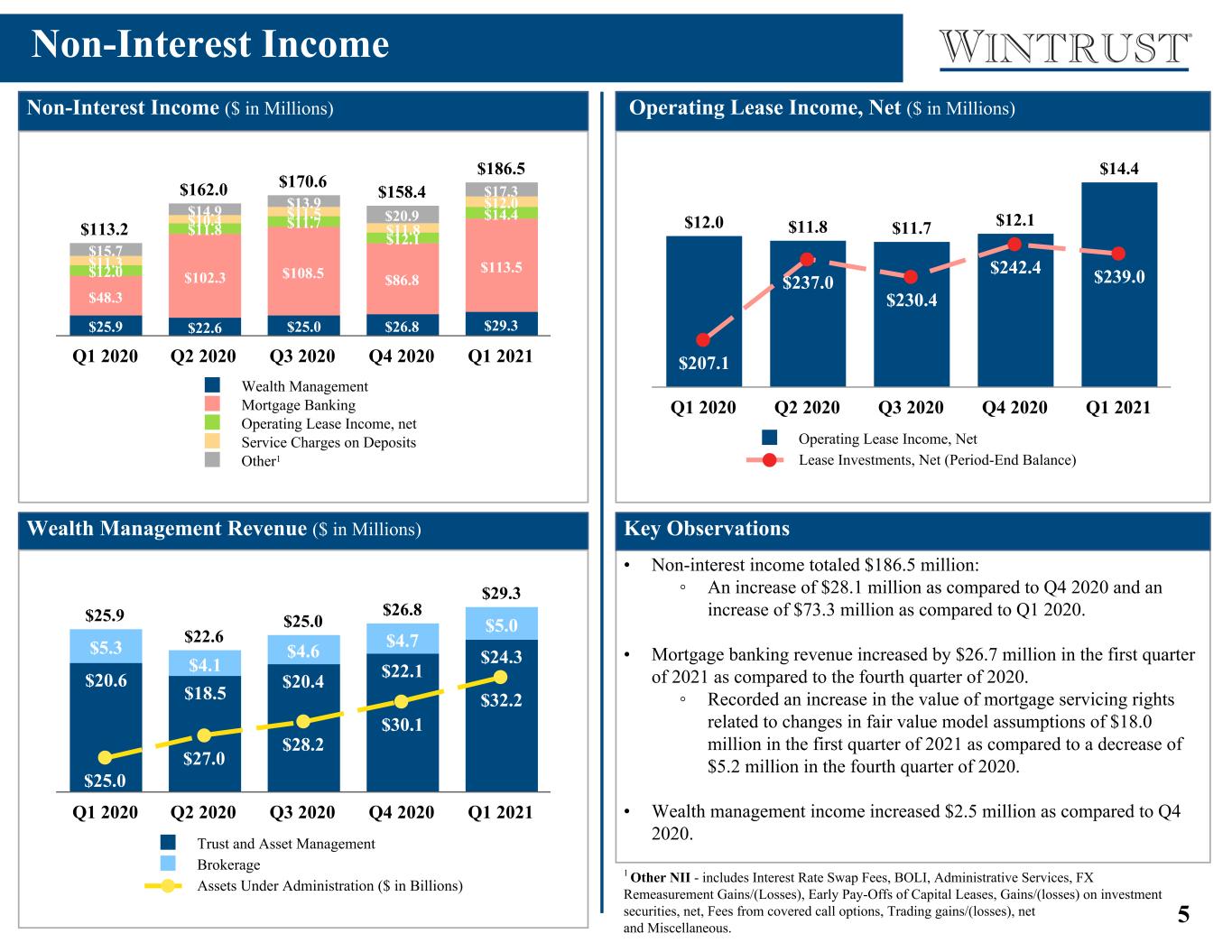

5 Non-Interest Income ($ in Millions) $113.2 $162.0 $170.6 $158.4 $186.5 $25.9 $22.6 $25.0 $26.8 $29.3 $48.3 $102.3 $108.5 $86.8 $113.5$12.0 $11.8 $11.7 $12.1 $14.4 $11.3 $10.4 $11.5 $11.8 $12.0 $15.7 $14.9 $13.9 $20.9 $17.3 Wealth Management Mortgage Banking Operating Lease Income, net Service Charges on Deposits Other Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Non-Interest Income Wealth Management Revenue ($ in Millions) • Non-interest income totaled $186.5 million: ◦ An increase of $28.1 million as compared to Q4 2020 and an increase of $73.3 million as compared to Q1 2020. • Mortgage banking revenue increased by $26.7 million in the first quarter of 2021 as compared to the fourth quarter of 2020. ◦ Recorded an increase in the value of mortgage servicing rights related to changes in fair value model assumptions of $18.0 million in the first quarter of 2021 as compared to a decrease of $5.2 million in the fourth quarter of 2020. • Wealth management income increased $2.5 million as compared to Q4 2020. Key Observations 1 Other NII - includes Interest Rate Swap Fees, BOLI, Administrative Services, FX Remeasurement Gains/(Losses), Early Pay-Offs of Capital Leases, Gains/(losses) on investment securities, net, Fees from covered call options, Trading gains/(losses), net and Miscellaneous. 1 $25.9 $22.6 $25.0 $26.8 $29.3 $20.6 $18.5 $20.4 $22.1 $24.3$5.3 $4.1 $4.6 $4.7 $5.0 $25.0 $27.0 $28.2 $30.1 $32.2 Trust and Asset Management Brokerage Assets Under Administration ($ in Billions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Operating Lease Income, Net ($ in Millions) $12.0 $11.8 $11.7 $12.1 $14.4 $207.1 $237.0 $230.4 $242.4 $239.0 Operating Lease Income, Net Lease Investments, Net (Period-End Balance) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 • primarily due to increased trust and asset management fees and brokerage commissions

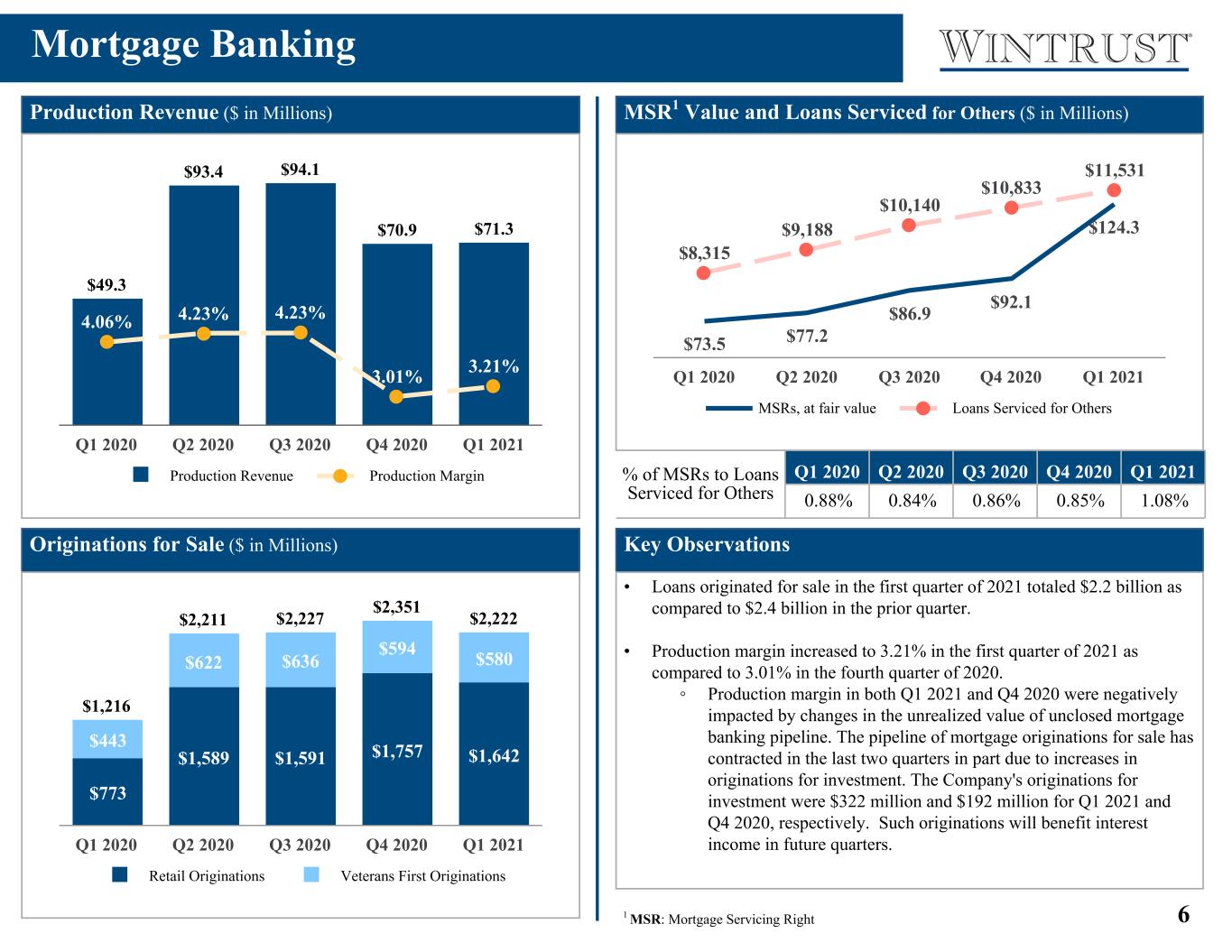

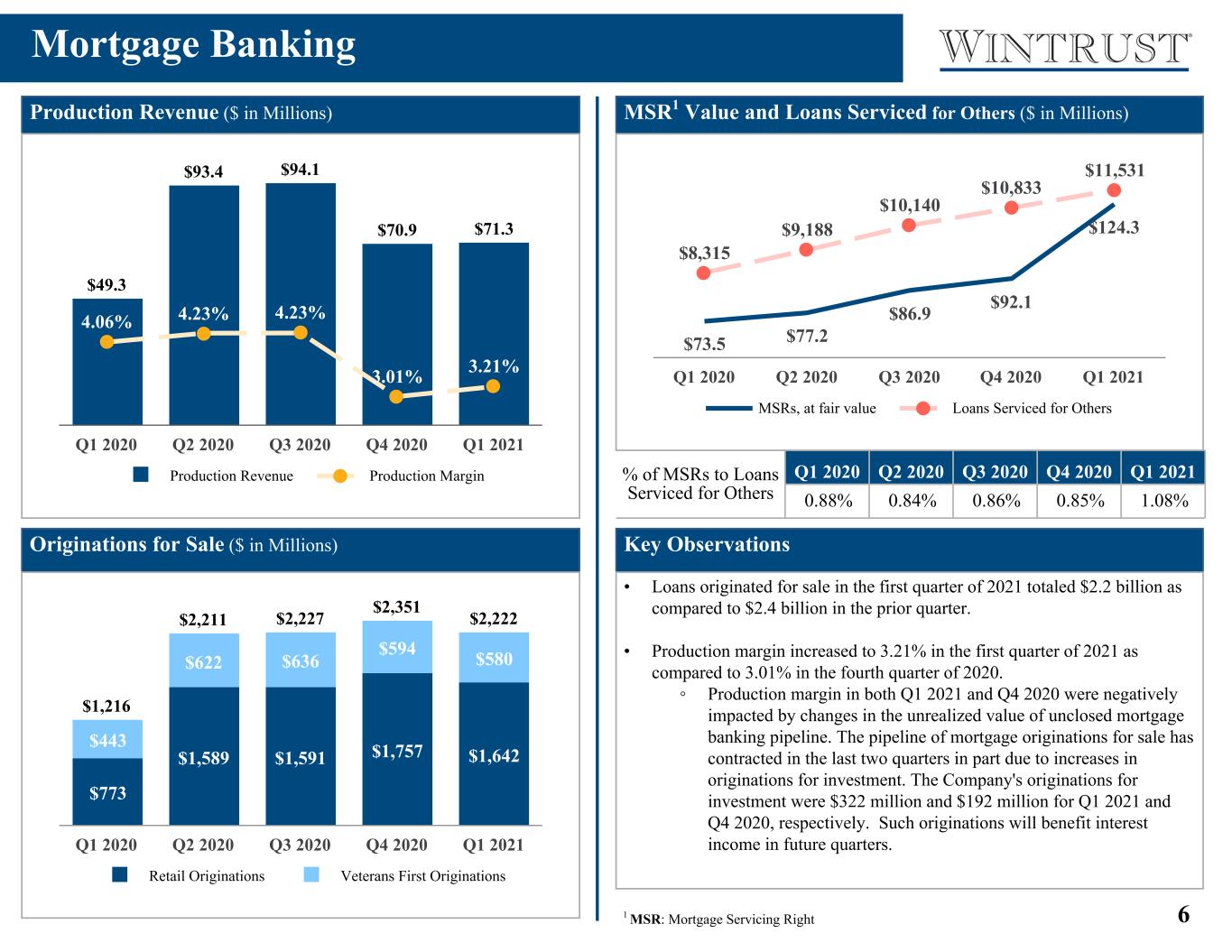

6 $(7.9)$(9.0)$(10.2) $(14.6)$(8.0)$(3.0)$(5.2) $18.0 $48.9 $93.4$94.1$70.9 $71.3 $7.0 $(49.4)$(1.8)$(77.0) $(103.7) $9.4 MSR - Payoffs/Paydowns MSR - Change in Fair Value Model Assumptions Production Revenue Servicing Income & Other MSR Capitalization MSR Hedging Gains (Losses) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Mortgage Banking Production Revenue ($ in Millions) MSR1 Value and Loans Serviced for Others ($ in Millions) Originations for Sale ($ in Millions) Key Observations • Loans originated for sale in the first quarter of 2021 totaled $2.2 billion as compared to $2.4 billion in the prior quarter. • Production margin increased to 3.21% in the first quarter of 2021 as compared to 3.01% in the fourth quarter of 2020. ◦ Production margin in both Q1 2021 and Q4 2020 were negatively impacted by changes in the unrealized value of unclosed mortgage banking pipeline. The pipeline of mortgage originations for sale has contracted in the last two quarters in part due to increases in originations for investment. The Company's originations for investment were $322 million and $192 million for Q1 2021 and Q4 2020, respectively. Such originations will benefit interest income in future quarters. % of MSRs to Loans Serviced for Others Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 0.88% 0.84% 0.86% 0.85% 1.08% 1 MSR: Mortgage Servicing Right LOGIC IN MORTGAGE BANKING REVENUE NEEDS TO BE MODIFIED Mortgage banking production revenue increased by $0.4 million as mortgage originations for sale totaled $2.2 billion in the first quarter of 2021 as compared to $2.4 billion in the fourth quarter of 2020. $49.3 $93.4 $94.1 $70.9 $71.3 4.06% 4.23% 4.23% 3.01% 3.21% Production Revenue Production Margin Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $73.5 $77.2 $86.9 $92.1 $124.3 $8,315 $9,188 $10,140 $10,833 $11,531 MSRs, at fair value Loans Serviced for Others Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $1,216 $2,211 $2,227 $2,351 $2,222 $773 $1,589 $1,591 $1,757 $1,642 $443 $622 $636 $594 $580 Retail Originations Veterans First Originations Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021

7 $234.6 $259.4 $264.2 $281.9 $286.9 $136.8 $154.2 $164.0 $171.1 $180.8 $14.8 $15.8 $17.3 $20.6 $20.9 $17.5 $16.9 $15.8 $19.7 $20.0 $10.9 $7.7 $7.9 $9.9 $8.5 $9.3 $9.3 $9.4 $9.9 $10.8 $6.7 $7.7 $6.5 $6.5 $7.6 $8.4 $10.4 $5.7 $5.7 $6.0 $30.2 $37.4 $37.6 $38.5 $32.3 Salaries and Employee Benefits Equipment Occupancy, net Advertising and Marketing Operating Lease Equipment Professional Fees Data Processing Other Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 1.33% 0.93% 0.87% 1.12% 0.90% 61.67% 60.97% 61.86% 67.53% 64.02% Net Overhead Ratio Efficiency Ratio (Non-GAAP ) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Non-Interest Expense Trending Non-Interest Expense ($ in Millions) Q1 2021 Key Observations • Salaries and employee benefits increase comprised of: ◦ $9.0 million increase in commissions and incentive compensation. ◦ $3.2 million increase in employee benefits expense. ◦ $2.5 million decrease in salaries. Q1 2021 salaries included $626,000 of severance expense. • Advertising and marketing decrease of $1.3 million relates primarily to decreased digital advertising campaigns and printing costs. • All other expenses decrease of $5.3 million relates primarily to a $937,000 reversal of contingent consideration expense related to the previous acquisition of mortgage operations as compared to $6.6 million of expense in the prior quarter. The Company also recognized $3.8 million of expense in Q1 2021 related to impairment of certain capitalized software costs based on an evaluation of remaining useful life. 1 Other NIE - includes amortization of other intangible assets, FDIC insurance, OREO expense, net, Commissions (3rd Party Brokers), Postage and Miscellaneous Non-Interest Expense - Current Quarter vs. Prior Quarter ($ in Millions) $281.9 $9.7 $0.8 $(1.3) $1.1 $(5.3) $286.9 Q4 2020 Salaries and Employee Benefits Operating lease equipment depreciation Advertising and marketing Professional fees All Other Expenses Q1 2021 1 Expense Management Ratios 2 3 2 Net Overhead Ratio - The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period's average total assets. A lower ratio indicates a higher degree of efficiency. 3 See Non-GAAP reconciliation on pg. 19

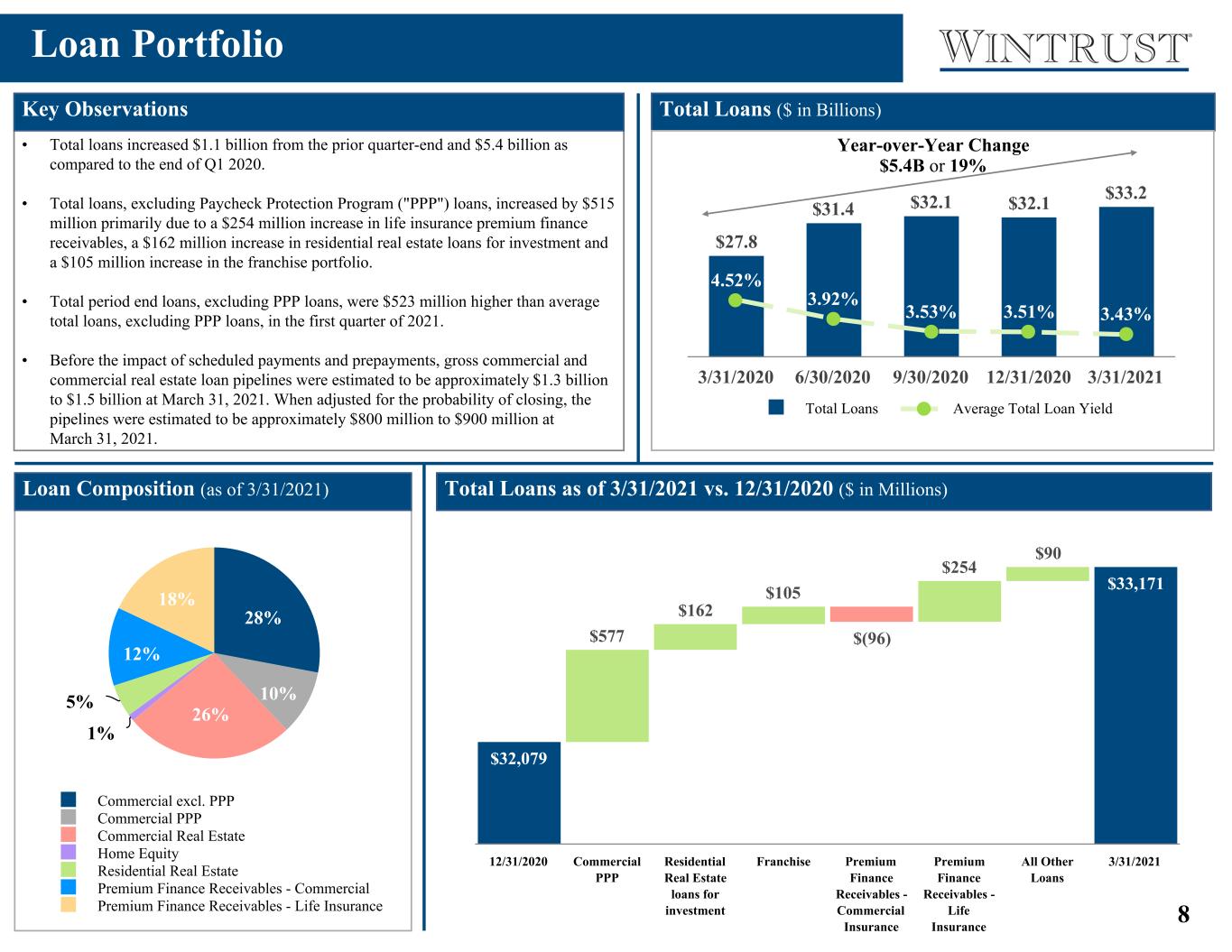

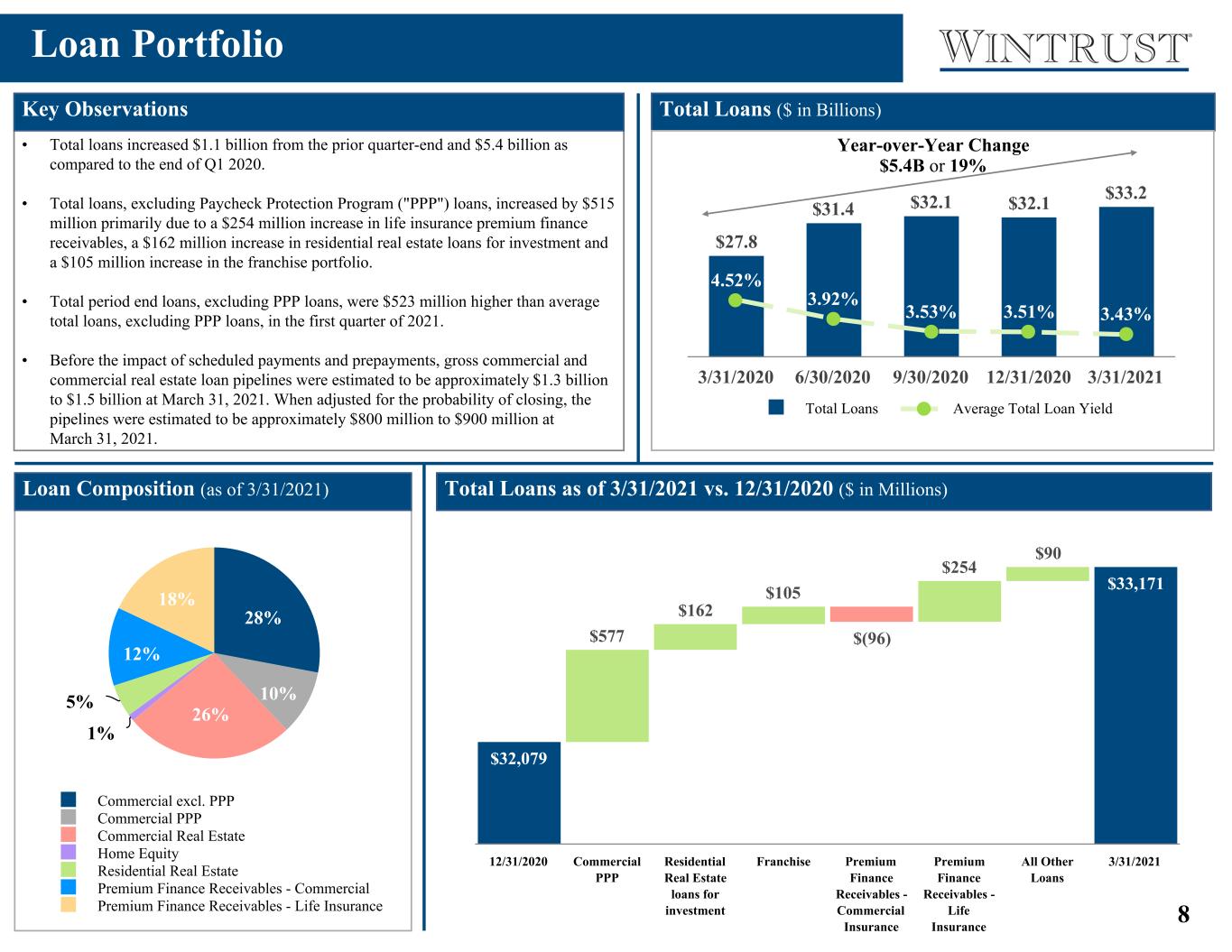

8 • Total loans increased $1.1 billion from the prior quarter-end and $5.4 billion as compared to the end of Q1 2020. • Total loans, excluding Paycheck Protection Program ("PPP") loans, increased by $515 million primarily due to a $254 million increase in life insurance premium finance receivables, a $162 million increase in residential real estate loans for investment and a $105 million increase in the franchise portfolio. • Total period end loans, excluding PPP loans, were $523 million higher than average total loans, excluding PPP loans, in the first quarter of 2021. • Before the impact of scheduled payments and prepayments, gross commercial and commercial real estate loan pipelines were estimated to be approximately $1.3 billion to $1.5 billion at March 31, 2021. When adjusted for the probability of closing, the pipelines were estimated to be approximately $800 million to $900 million at March 31, 2021. $32,079 $577 $162 $105 $(96) $254 $90 $33,171 12/31/2020 Commercial PPP Residential Real Estate loans for investment Franchise Premium Finance Receivables - Commercial Insurance Premium Finance Receivables - Life Insurance All Other Loans 3/31/2021 Loan Portfolio Total Loans ($ in Billions) Total Loans as of 3/31/2021 vs. 12/31/2020 ($ in Millions) Key Observations $27.8 $31.4 $32.1 $32.1 $33.2 4.52% 3.92% 3.53% 3.51% 3.43% Total Loans Average Total Loan Yield 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 28% 10% 26% 1% 5% 12% 18% Commercial excl. PPP Commercial PPP Commercial Real Estate Home Equity Residential Real Estate Premium Finance Receivables - Commercial Premium Finance Receivables - Life Insurance Year-over-Year Change $5.4B or 19% Loan Composition (as of 3/31/2021)

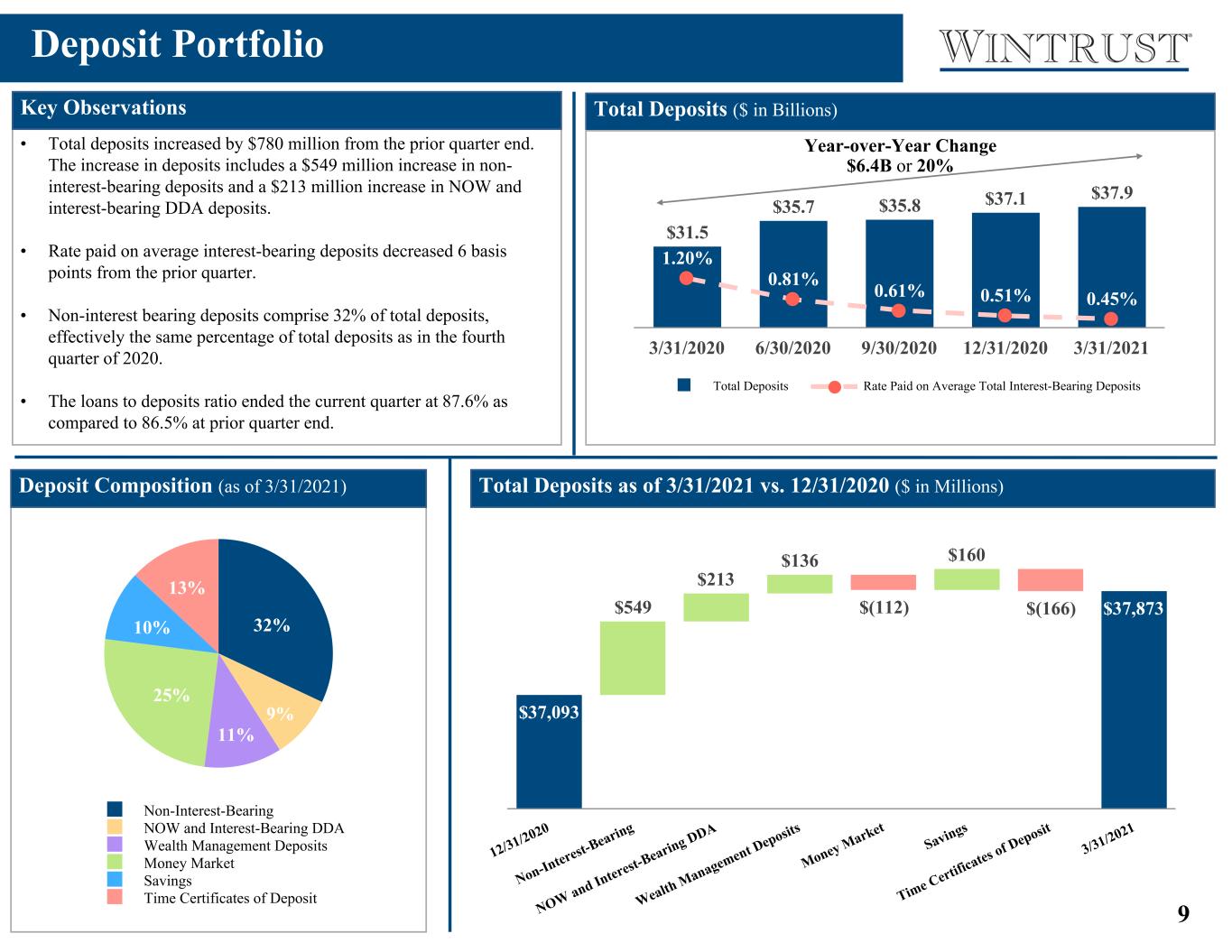

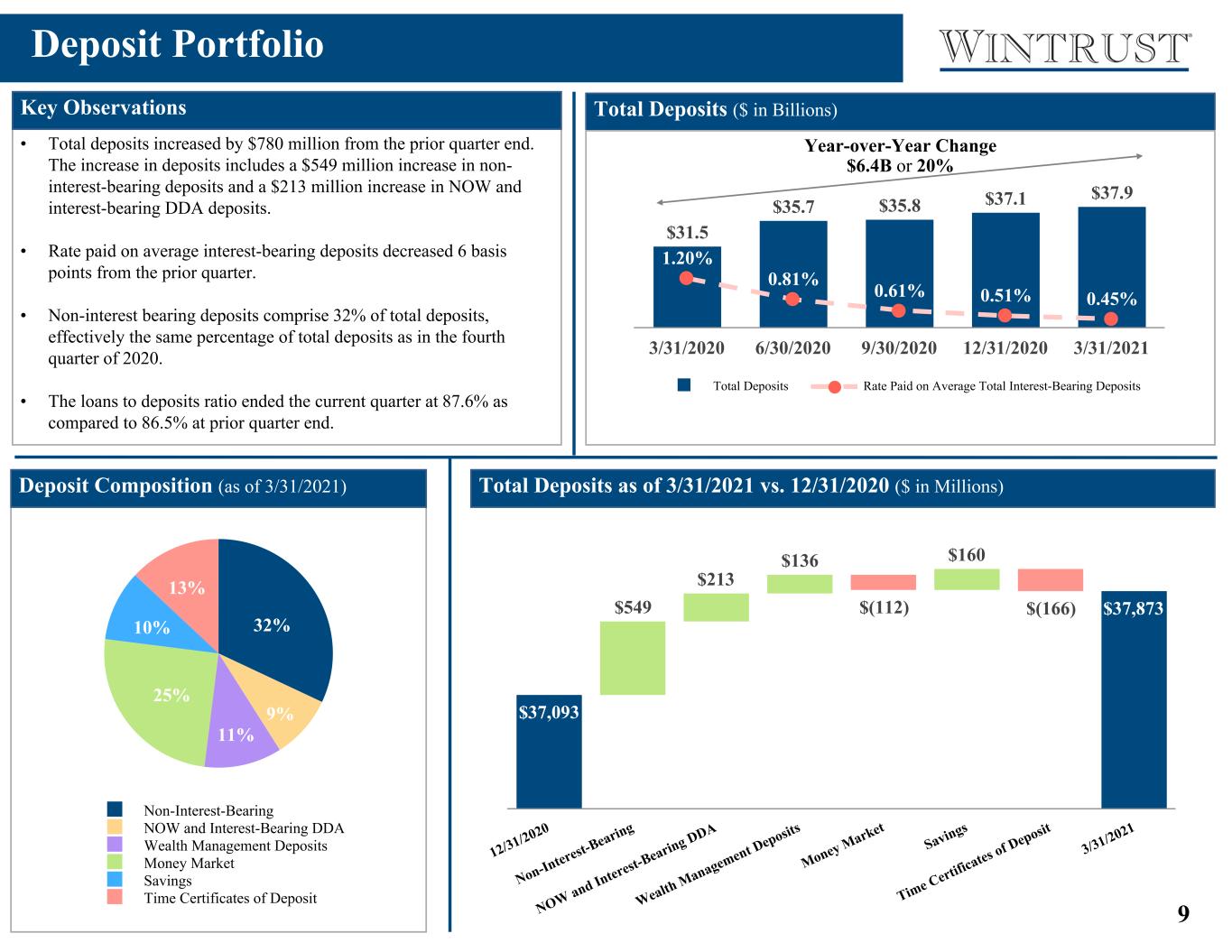

9 • Total deposits increased by $780 million from the prior quarter end. The increase in deposits includes a $549 million increase in non- interest-bearing deposits and a $213 million increase in NOW and interest-bearing DDA deposits. • Rate paid on average interest-bearing deposits decreased 6 basis points from the prior quarter. • Non-interest bearing deposits comprise 32% of total deposits, effectively the same percentage of total deposits as in the fourth quarter of 2020. • The loans to deposits ratio ended the current quarter at 87.6% as compared to 86.5% at prior quarter end. $37,093 $549 $213 $136 $(112) $160 $(166) $37,873 12/3 1/20 20 Non -Int eres t-Be arin g NO W a nd I nter est- Bea ring DD A We alth Ma nag eme nt D epo sits Mo ney Ma rke t Sav ings Tim e C erti fica tes of D epo sit 3/31 /202 1 Deposit Portfolio Total Deposits ($ in Billions) Total Deposits as of 3/31/2021 vs. 12/31/2020 ($ in Millions)Deposit Composition (as of 3/31/2021) Key Observations $31.5 $35.7 $35.8 $37.1 $37.9 1.20% 0.81% 0.61% 0.51% 0.45% Total Deposits Rate Paid on Average Total Interest-Bearing Deposits 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 32% 9% 11% 25% 10% 13% Non-Interest-Bearing NOW and Interest-Bearing DDA Wealth Management Deposits Money Market Savings Time Certificates of Deposit Year-over-Year Change $6.4B or 20%

10 Liquidity • We continue to maintain excess liquidity and believe that deploying such liquidity could potentially increase our net interest margin. • Period end investment securities were $743 million higher than average investment securities in the first quarter of 2021. Key Observations Total Average Interest-Bearing Deposits with Banks and Cash Equivalents as a Percentage of Total Average Earning Assets ($ in Billions) $1.4 $3.2 $3.4 $4.4 $4.21.38% 0.16% 0.14% 0.12% 0.11% Average Balance Yield Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Interest-Bearing Deposits with Banks and Cash Equivalents Equivalents $33.7 $38.7 $39.8 $40.7 $41.9 $1.4 $3.2 $3.4 $4.4 $4.2 4.2% 8.4% 8.6% 10.8% 10.1% Total Average Earning Assets Total Average Interest-Bearing Deposits with Banks and Cash Equivalents Total Average Interest-Bearing Deposits with Banks and Cash Equivalents as a % of Total Average Earning Assets Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Investment Securities Quarterly Average Balance versus End of Period Balance ($ in Billions) $4.8 $4.3 $3.8 $3.5 $3.9 $4.5 $4.0 $3.6 $3.7 $4.7 Investment Securities Quarterly Average Balance Investment Securities End of Period Balance Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021

11 7.0% 8.5% 10.5% 4.50% 6.00% 8.00% 2.50% 2.50% 2.50% 9.0% 10.1% 12.6% Minimum Requirement Product Conservation Buffer WTFC Capital Q1 2021 Key Observations Strong Capital Levels • Tangible book value per common share increased $2.19 from the prior quarter-end and increased $5.24 or 10.4% from Q1 2020. • Common Equity Tier 1 Capital ratio increased due to strong earnings in Q1 2021. • Q1 2021 dividend of $0.31 per common share up 11% from Q1 2020. 2 See Non-GAAP reconciliation on pg. 20 Capital Adequacy Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Common equity tier 1 capital ratio1 8.9% 8.8% 9.0% 8.8% 9.0% Tier 1 capital ratio1 9.3% 10.1% 10.2% 10.0% 10.1% Total capital ratio1 11.9% 12.8% 12.9% 12.6% 12.6% Tier 1 leverage ratio1 8.5% 8.1% 8.2% 8.1% 8.2% Tangible book value per common share (Non-GAAP2) $50.18 $50.23 $51.70 $53.23 $55.42 Estimated Excess Capital Above Conservation Buffer ($ in Millions)Common equity tier 1 capital1 Tier 1 capital ratio1 Total capital ratio1 $706 $580 $741 1 Ratios for Q1 2021 are estimated

12 PPP Loans Originated in 2020 and 2021 Paycheck Protection Program Customer Impact Key Observations • CECL Day 1 transition adjustment • Includes ACL for loans and leases, off- balance sheet credit exposures and debt securities Day 1 Adjustment Our bankers didn't wait to hear from nonprofit partners. They picked up the phone to make sure they had all the PPP information to get submissions in.<$150k 14,000+ Businesses Supported Note: data provided as of April 16, 2021 $4.8B+ In Loans for Local Businesses Loan Breakdown by Size 160,000+ Local Jobs Impacted Approximately $60,000 We made sure that the businesses that were most in need had our support. That meant focusing on local small businesses. MEDIAN LOAN SIZE "When you bank with a banker who knows you, you can call a direct line. You can ask for them by name. And, when you really need help, they'll pick up, because they actually know you. That's what happened for so many of our clients when COVID-19 hit and they were looking for support with Payment Protection Program loans. We were happy to pick up the phone." $150k - $1M >$1M 600+ Non-Profits 71% 27% 2% 1,500+ 12,000+

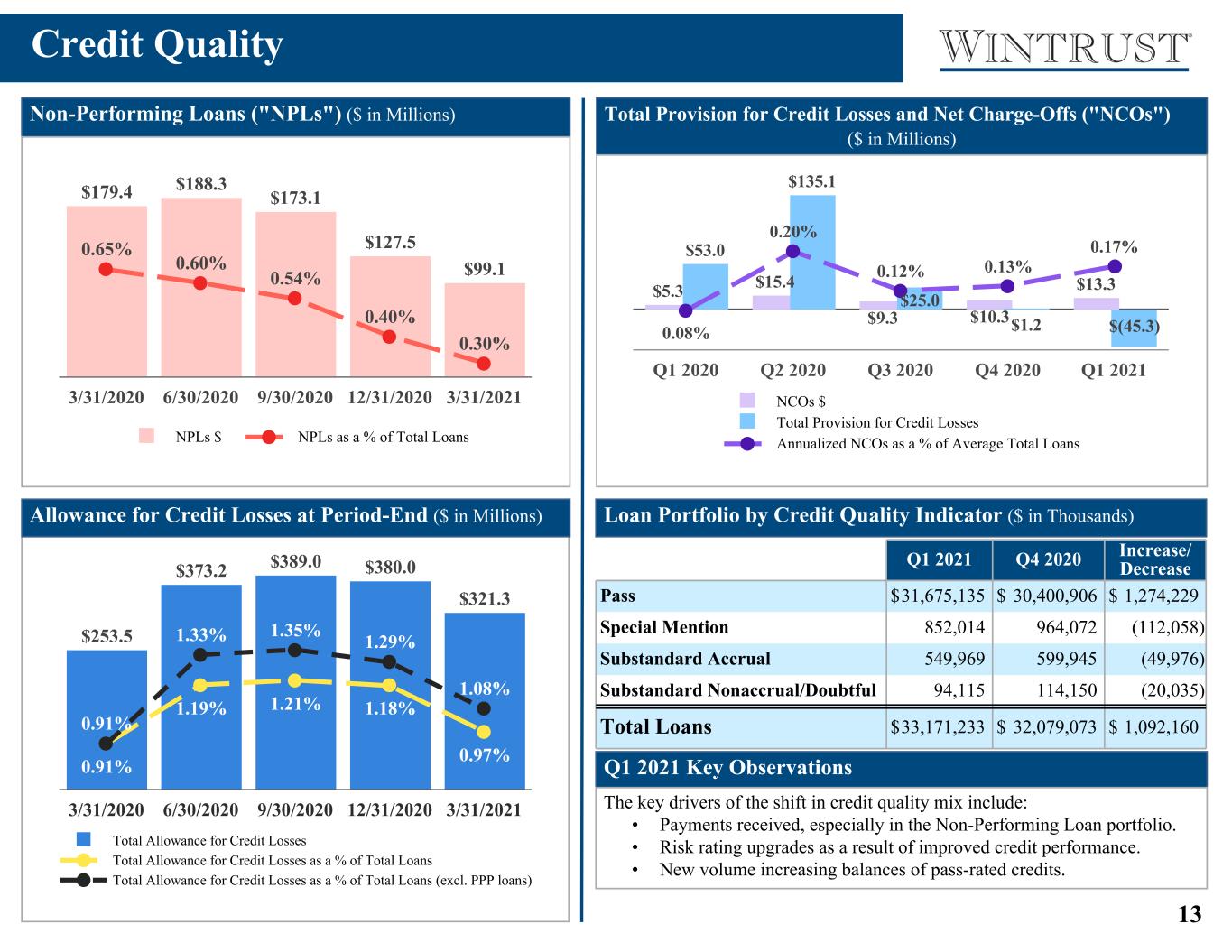

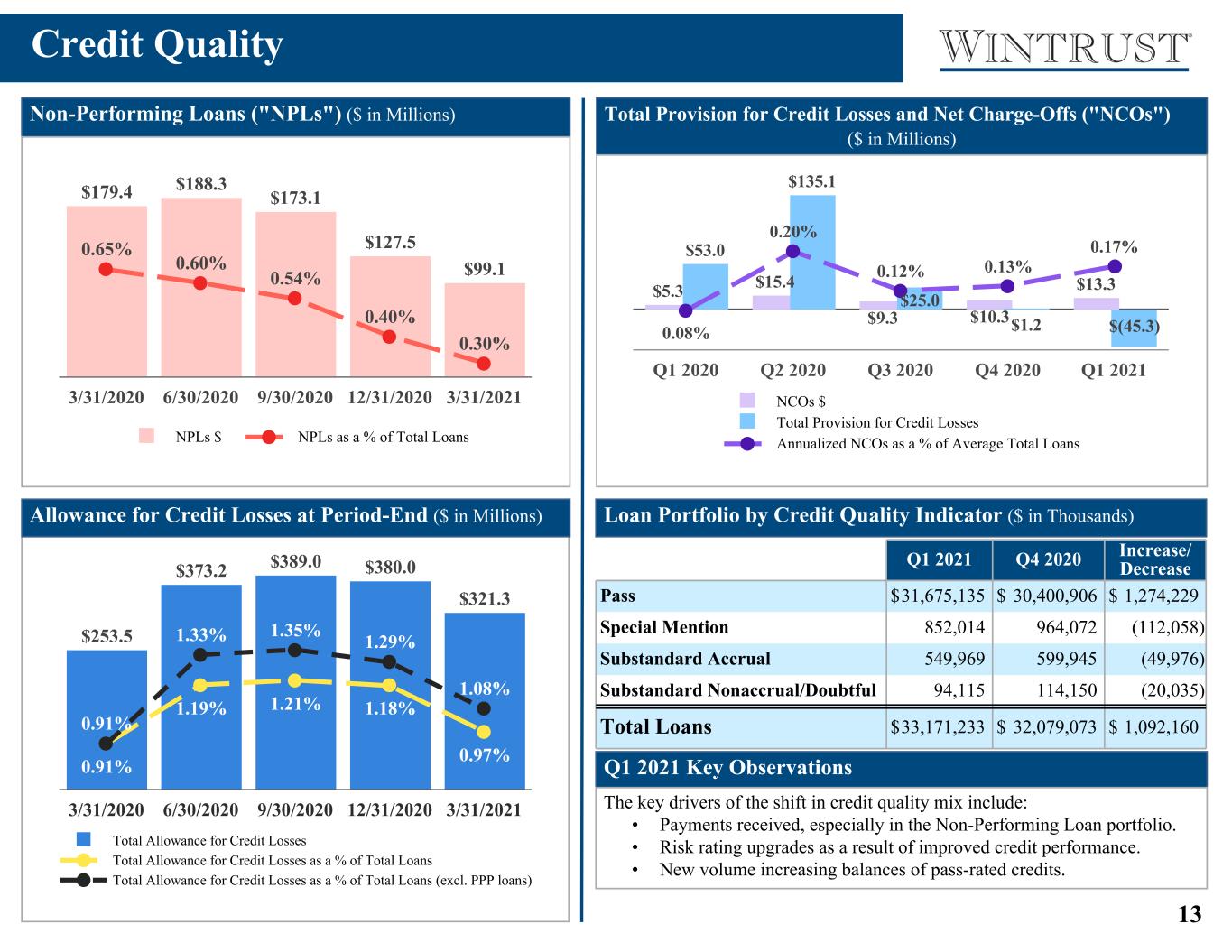

13 $253.5 $373.2 $389.0 $380.0 $321.3 0.91% 1.19% 1.21% 1.18% 0.97% 0.91% 1.33% 1.35% 1.29% 1.08% Total Allowance for Credit Losses Total Allowance for Credit Losses as a % of Total Loans Total Allowance for Credit Losses as a % of Total Loans (excl. PPP loans) 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 Credit Quality • The Company estimates an increase to the allowance for credit losses of approximately 30% to 50% at adoption related to its loan portfolios and related lending commitments. Approximately 80% of the estimated increase is related to: ◦ Additions to existing reserves for unfunded lending-related commitments due to the consideration under CECL of expected utilization by the Company's borrowers over the life of such commitments. ◦ Establishment of reserves for acquired loans which previously considered credit discounts. The Company estimates an insignificant impact at adoption of measuring an allowance for credit losses for other in-scope assets (e.g. held-to-maturity debt securities). Allowance for Credit Losses at Period-End ($ in Millions) Non-Performing Loans ("NPLs") ($ in Millions) Total Provision for Credit Losses and Net Charge-Offs ("NCOs") ($ in Millions) Loan Portfolio by Credit Quality Indicator ($ in Thousands) $179.4 $188.3 $173.1 $127.5 $99.1 0.65% 0.60% 0.54% 0.40% 0.30% NPLs $ NPLs as a % of Total Loans 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 $5.3 $15.4 $9.3 $10.3 $13.3 $53.0 $135.1 $25.0 $1.2 $(45.3)0.08% 0.20% 0.12% 0.13% 0.17% NCOs $ Total Provision for Credit Losses Annualized NCOs as a % of Average Total Loans Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $53.0 $135.1 $25.0 $1.2 $(45.3) 9.98% 11.41% 37.10% Total Provision for Credit Losses Net Charge-Offs as a % of the Provision for Credit Losses 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 $7.8 $53 $135.1 $0 $0 $— $— $— $— $—$7.8 $53.0 $135.1 10.0% 11.4% 37.1% 876.0% Provision for credit losses - PCD Provision for credit losses - non PCD Net charge-offs as a percentage of the provision for credit losses Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Incurred Loss Method CECL Incurred Loss Method CECL Q1 2021 Q4 2020 Increase/Decrease Pass $ 31,675,135 $ 30,400,906 $ 1,274,229 Special Mention 852,014 964,072 (112,058) Substandard Accrual 549,969 599,945 (49,976) Substandard Nonaccrual/Doubtful 94,115 114,150 (20,035) Total Loans $ 33,171,233 $ 32,079,073 $ 1,092,160 Q1 2021 Key Observations The key drivers of the shift in credit quality mix include: • Payments received, especially in the Non-Performing Loan portfolio. • Risk rating upgrades as a result of improved credit performance. • New volume increasing balances of pass-rated credits.

14 Non-Performing Loan Roll-Forward $127.5 $9.9 $(22.7) $(1.4) $(2.9) $(10.6) $(0.7) $99.1 12/31/2020 New NPLs Pay-offs and Payments Received Transfer to OREO Charge-Offs Net Change in Niche Loans Return to Performing Status 3/31/2021 Non-Performing Loan Balances ($ in Millions) - 3/31/2021 vs. 12/31/2020 Q1 2021 Key Observations • Key driver in the reduction of non-performing loans was payments on loans, driven by the following: ◦ Refinance activity; and ◦ Sales of underlying collateral. • Reductions in non-performing loans were also accomplished through note sales and transfer to OREO. 1 OREO: Other Real Estate Owned 1 2 2 Net Change in Niche Loans: Includes activity for premium finance receivables and indirect consumer loans

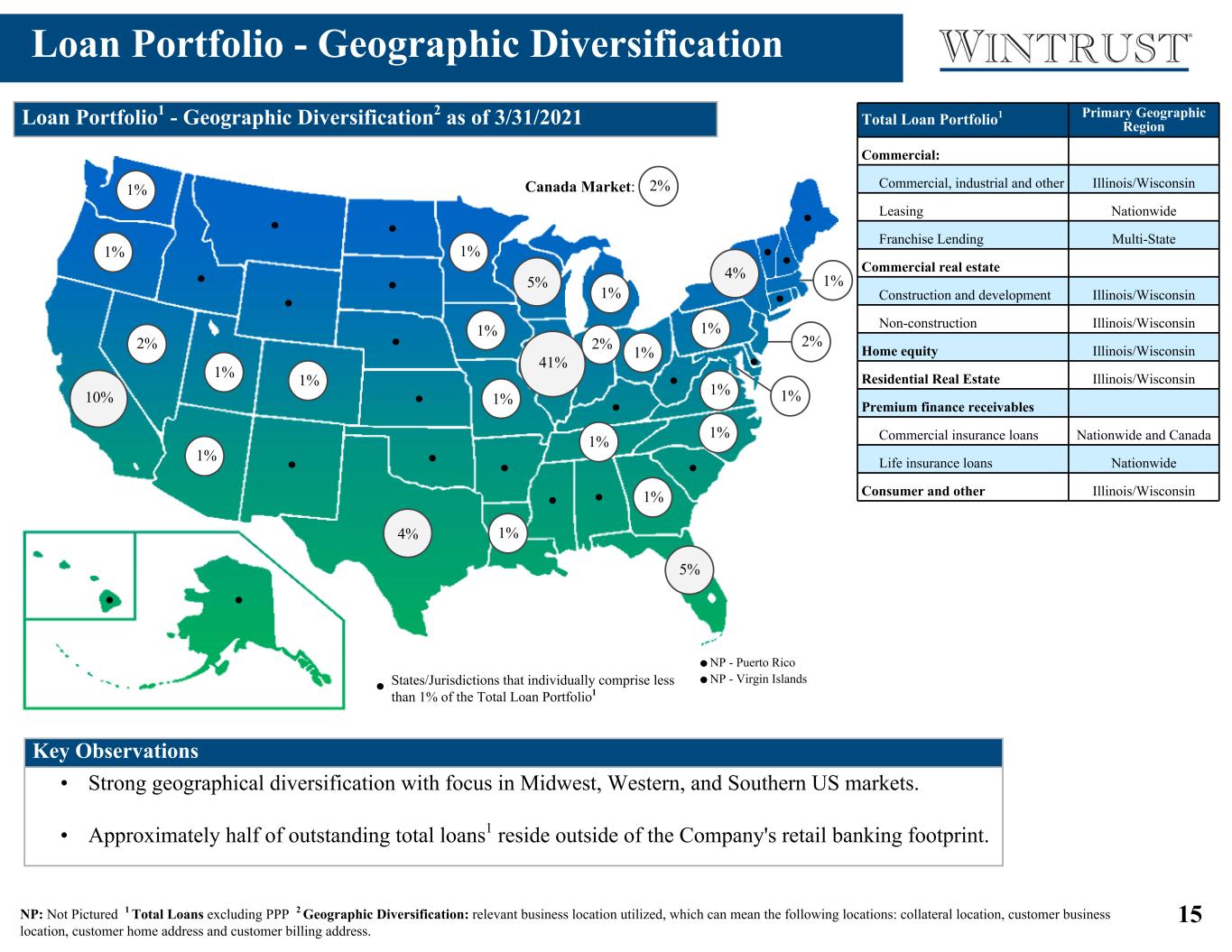

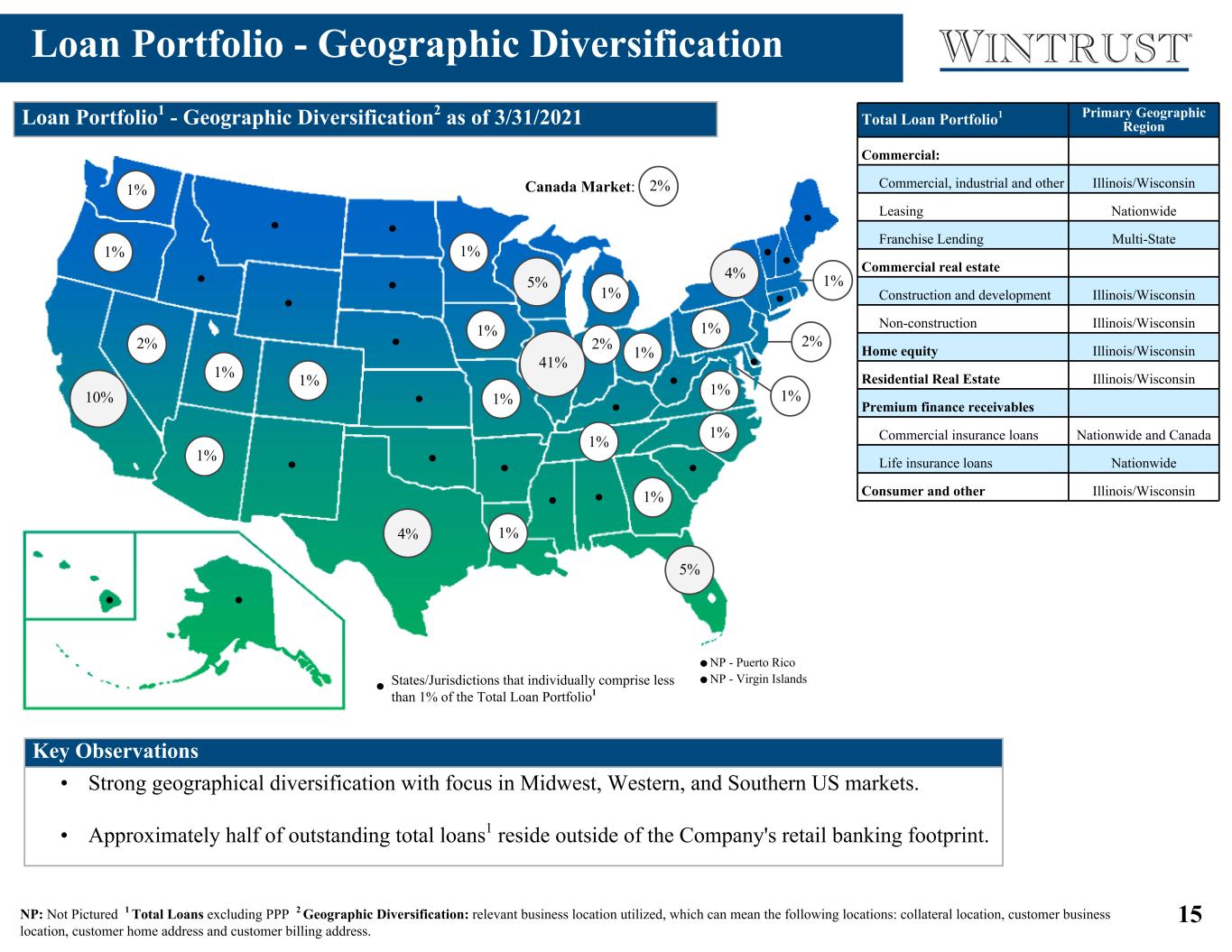

15 Loan Portfolio - Geographic Diversification Canada Market: Loan Portfolio1 - Geographic Diversification2 as of 3/31/2021 Total Loan Portfolio1 Primary Geographic Region Commercial: Commercial, industrial and other Illinois/Wisconsin Leasing Nationwide Franchise Lending Multi-State Commercial real estate Construction and development Illinois/Wisconsin Non-construction Illinois/Wisconsin Home equity Illinois/Wisconsin Residential Real Estate Illinois/Wisconsin Premium finance receivables Commercial insurance loans Nationwide and Canada Life insurance loans Nationwide Consumer and other Illinois/Wisconsin NP: Not Pictured 1 Total Loans excluding PPP 2 Geographic Diversification: relevant business location utilized, which can mean the following locations: collateral location, customer business location, customer home address and customer billing address. Key Observations • Strong geographical diversification with focus in Midwest, Western, and Southern US markets. • Approximately half of outstanding total loans1 reside outside of the Company's retail banking footprint. States/Jurisdictions that individually comprise less than 1% of the Total Loan Portfolio1 2% 10% 5% 41% 2% 2% 4% 1% 4% NP - Puerto Rico NP - Virgin Islands 1% 1% 1% 1% 1% 2% 5% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1%

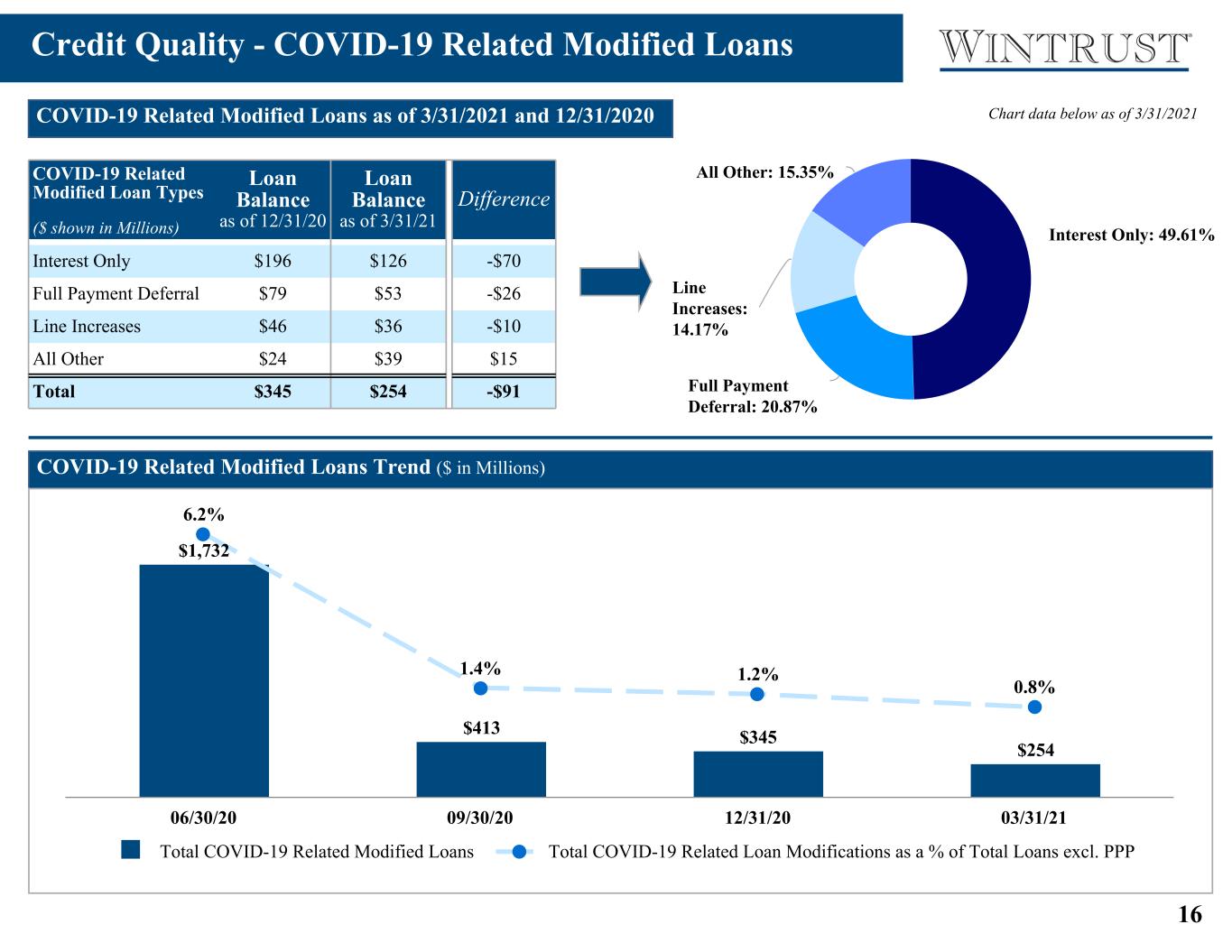

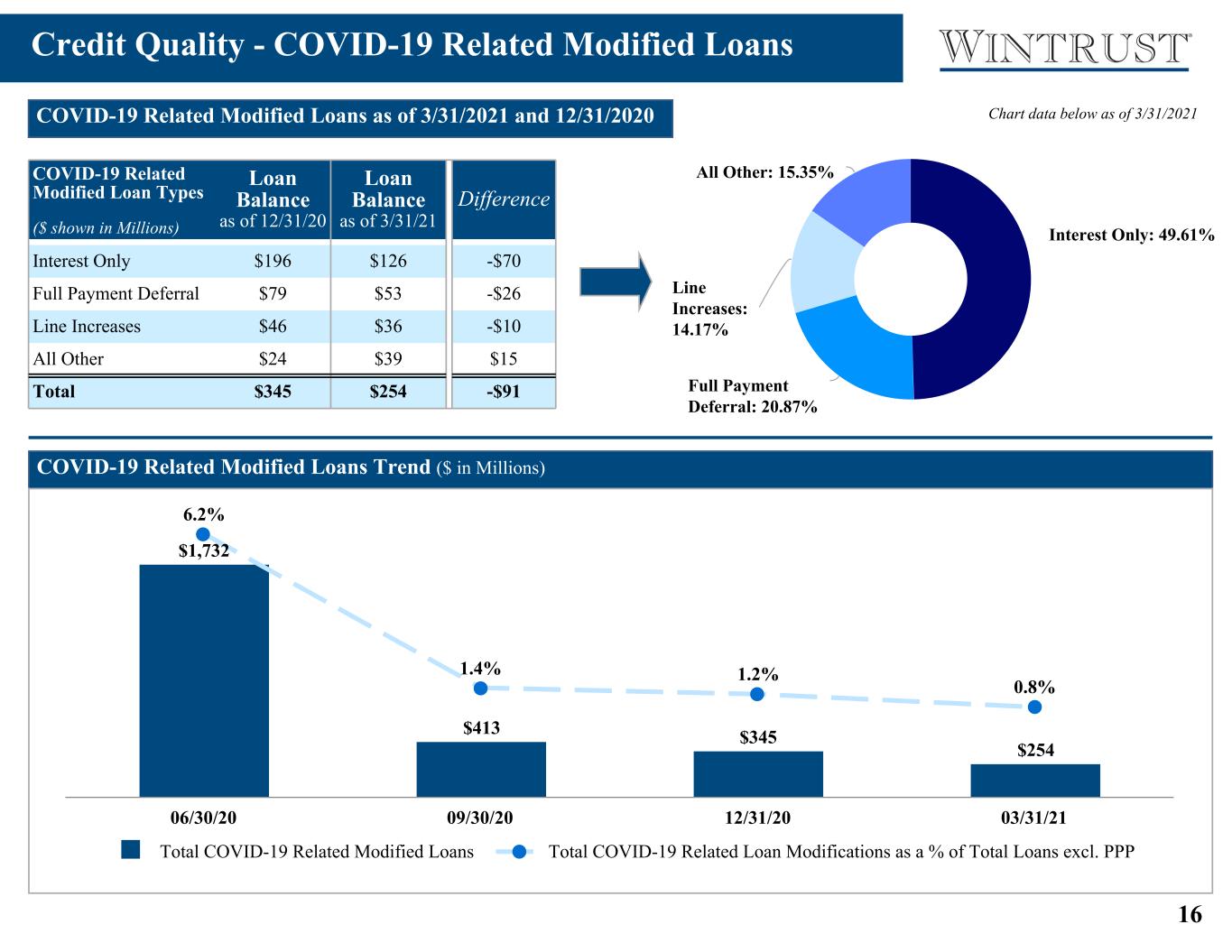

16 Retail: 29.1% Franchise: 70.9% Credit Quality - COVID-19 Related Modified Loans Interest Only: 49.61% Full Payment Deferral: 20.87% Line Increases: 14.17% All Other: 15.35% COVID-19 Related Modified Loans as of 3/31/2021 and 12/31/2020 COVID-19 Related Modified Loan Types ($ shown in Millions) Loan Balance as of 12/31/20 Loan Balance as of 3/31/21 Difference Interest Only $196 $126 -$70 Full Payment Deferral $79 $53 -$26 Line Increases $46 $36 -$10 All Other $24 $39 $15 Total $345 $254 -$91 COVID-19 Related Modified Loans Trend ($ in Millions) • COVID-19 related modified loan balances decreased $1.3 billion or 77.4% in the first quarter of 2021 as compared to the prior quarter. • Full Payment Deferral loans make up 11.2% of COVID-19 related modified loans as of September 30, 2020, down notably from the 39.3% as of June 30, 2020. • Full Payment Deferral COVID-19 related modified loans had the single greatest drop of all the categories at 85.8% in the first quarter of 2021 as compared to the prior quarter. 1 Excludes Premium Finance modifications of $12MM as of June 30, 2020 and $21MM as of September 30, 2020. Chart data below as of 3/31/2021 Commercial Real Estate Retail has COVID-19 related modified loans as a percentage of its portfolio balance of 1.1%. Commercial Real Estate Retail comprises 4,009.7% of the Total Loan Portfolio excluding PPP Loans. $1,732 $413 $345 $254 6.2% 1.4% 1.2% 0.8% Total COVID-19 Related Modified Loans Total COVID-19 Related Loan Modifications as a % of Total Loans excl. PPP 06/30/20 09/30/20 12/31/20 03/31/21 1 Total Loans excludes PPP loans

17 • Restaurants & Food Services make up 4.3% of Total Loans excluding PPP loans and is primarily made up of Quick Service Restaurants ("QSRs"). Outstanding COVID-19 related loan modifications in Restaurants & Food Services modifications decreased to 6.4% as of March 31, 2021 from 8.1% as of December 31, 2020. • Hotels & Accommodation make up 0.6% of Total Loans excluding PPP loans. 14.0% of Hotels & Accommodation had outstanding COVID-19 related modifications as of March 31, 2021. The Hotels & Accommodation portfolio remains under stress due to the pandemic. Key Observations Select High Impact Industries 8.0% Credit Quality - COVID-19 - Select High Impact Industries Key Observations Other Loans 92.0% Total loans of $33.2 billion Total Loan Mix1 as of 9/30/2020: Select High Impact Industries Select High Impact Industries As of 12/31/2020 As of 3/31/2021 As of 12/31/2020 As of 3/31/2021 Industry $ shown in Millions Loan Balance % of Total Loans1 Total Commitment Balance Loan Balance % of Total Loans1 Total Commitment Balance COVID-19 Related Modified Loan Balances Loan Balance % with COVID-19 Related Modifications COVID-19 Related Modified Loan Balances Loan Balance % with COVID-19 Related Modifications Arts Entertainment & Recreation $249 0.8% $344 $236 0.8% $346 $32 12.9% $31 13.1% Dentists, Doctors, & Hospitals $406 1.4% $546 $383 1.3% $532 $0 —% $0 —% Hotels & Accommodation $186 0.6% $186 $186 0.6% $187 $32 17.2% $26 14.0% Nursing Home & Senior Living $237 0.8% $305 $237 0.8% $300 $0 —% $26 11.0% Oil & Gas $22 0.1% $22 $21 0.1% $21 $4 18.2% $4 19.0% Restaurants & Food Services $1,199 4.1% $1,432 $1,295 4.3% $1,545 $97 8.1% $83 6.4% Social Services $96 0.3% $140 $96 0.3% $139 $3 3.1% $3 3.1% Total $2,395 8.2% $2,975 $2,454 8.2% $3,070 $168 7.0% $173 7.0% 1 Total Loans excludes PPP loans

18 $379,969 $(7,391) $(51,270) $321,308 12/31/2020 3/31/2021 • Improving macroeconomic indicators and market conditions. • Additional and ongoing governmental monetary and fiscal support. • Substantial liquidity in the market. • Future expectations regarding current COVID-19 loan modifications. • Low exposure to industries with the highest risk factors. • High touch relationships with commercial and consumer borrowers. • Economic Inputs ◦ Baa Credit Spread ◦ Commercial Real-Estate Price Index ◦ GDP ◦ Dow Jones Total Stock Market Index • Portfolio Characteristics ◦ Risk Ratings ◦ Life of Loan Credit Quality - CECL Allowance for Credit Losses ($ in Thousands) - 3/31/2021 vs. 12/31/2020 Key Observations • CECL Day 1 transition adjustment • Includes ACL for loans and leases, off- balance sheet credit exposures and debt securities • New volume and run-off • Changes in credit quality • Aging of existing portfolio • Shifts in segmentation mix • Changes in specific reserves • Net charge-offs • Changes due to macroeconomic conditions • Model imprecision Day 1 Adjustment Portfolio Changes Economic Factors • Baa Corporate credit spread narrows through Q2 2021 before steadily widening during the 8- Quarter Reasonable and Supportable ("R&S") time period. • Commercial Real Estate Price Index declines through Q4 2021 before appreciating during the remainder of the R&S time period. • Real GDP growth rate stays above potential GDP growth rate of 1.9% in 2021 and 2022. • Dow Jones U.S. Total Stock Market Index generally follows a flat to slightly downward trend during the R&S time period. • Favorable macroeconomic outlook was the primary driver in the Q1 2021 reduction in Allowance for Credit Losses. Macroeconomic Scenario Key Model Inputs Qualitative Considerations

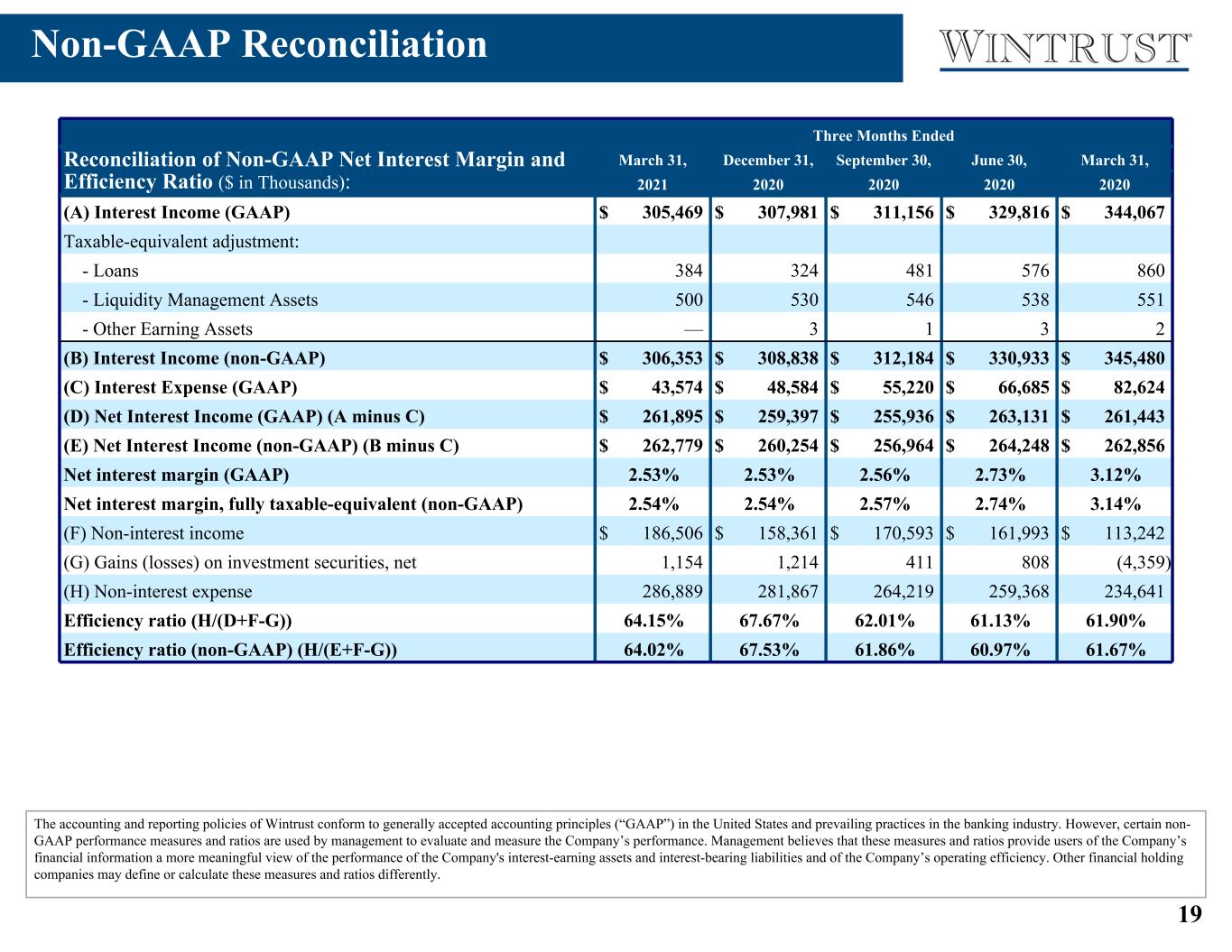

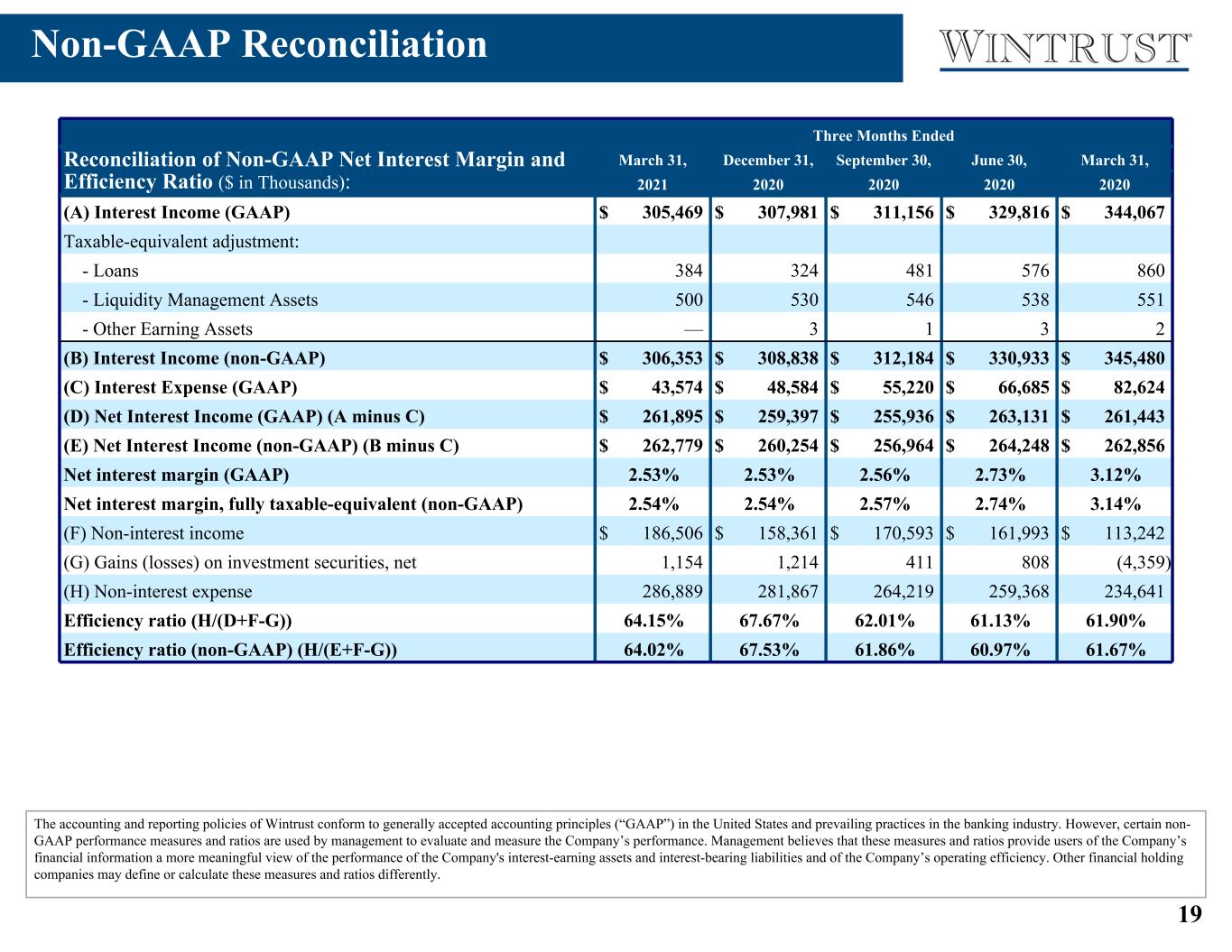

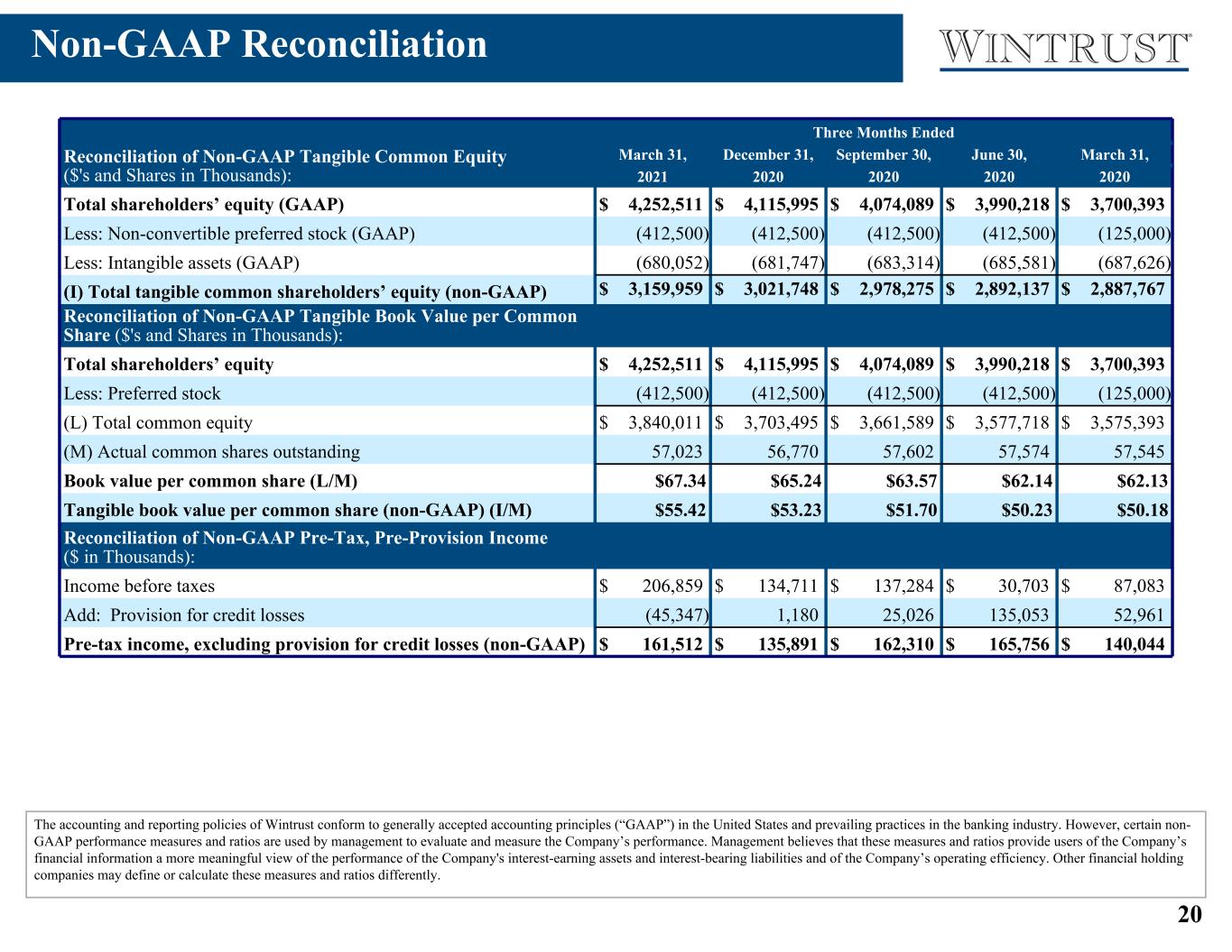

19 Three Months Ended Reconciliation of Non-GAAP Net Interest Margin and Efficiency Ratio ($ in Thousands): March 31, December 31, September 30, June 30, March 31, 2021 2020 2020 2020 2020 (A) Interest Income (GAAP) $ 305,469 $ 307,981 $ 311,156 $ 329,816 $ 344,067 Taxable-equivalent adjustment: - Loans 384 324 481 576 860 - Liquidity Management Assets 500 530 546 538 551 - Other Earning Assets — 3 1 3 2 (B) Interest Income (non-GAAP) $ 306,353 $ 308,838 $ 312,184 $ 330,933 $ 345,480 (C) Interest Expense (GAAP) $ 43,574 $ 48,584 $ 55,220 $ 66,685 $ 82,624 (D) Net Interest Income (GAAP) (A minus C) $ 261,895 $ 259,397 $ 255,936 $ 263,131 $ 261,443 (E) Net Interest Income (non-GAAP) (B minus C) $ 262,779 $ 260,254 $ 256,964 $ 264,248 $ 262,856 Net interest margin (GAAP) 2.53% 2.53% 2.56% 2.73% 3.12% Net interest margin, fully taxable-equivalent (non-GAAP) 2.54% 2.54% 2.57% 2.74% 3.14% (F) Non-interest income $ 186,506 $ 158,361 $ 170,593 $ 161,993 $ 113,242 (G) Gains (losses) on investment securities, net 1,154 1,214 411 808 (4,359) (H) Non-interest expense 286,889 281,867 264,219 259,368 234,641 Efficiency ratio (H/(D+F-G)) 64.15% 67.67% 62.01% 61.13% 61.90% Efficiency ratio (non-GAAP) (H/(E+F-G)) 64.02% 67.53% 61.86% 60.97% 61.67% Non-GAAP Reconciliation The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently.

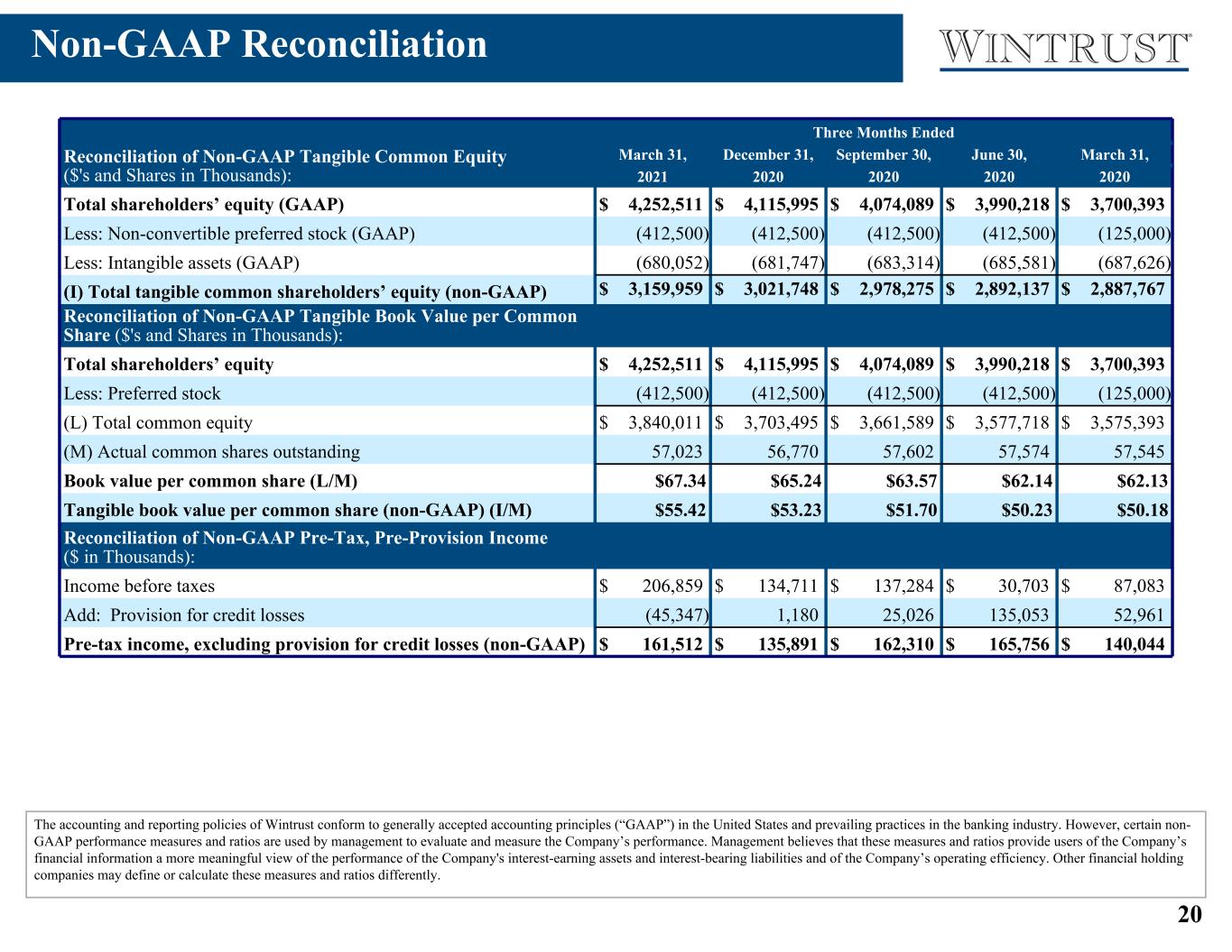

20 Three Months Ended Reconciliation of Non-GAAP Tangible Common Equity ($'s and Shares in Thousands): March 31, December 31, September 30, June 30, March 31, 2021 2020 2020 2020 2020 Total shareholders’ equity (GAAP) $ 4,252,511 $ 4,115,995 $ 4,074,089 $ 3,990,218 $ 3,700,393 Less: Non-convertible preferred stock (GAAP) (412,500) (412,500) (412,500) (412,500) (125,000) Less: Intangible assets (GAAP) (680,052) (681,747) (683,314) (685,581) (687,626) (I) Total tangible common shareholders’ equity (non-GAAP) $ 3,159,959 $ 3,021,748 $ 2,978,275 $ 2,892,137 $ 2,887,767 Reconciliation of Non-GAAP Tangible Book Value per Common Share ($'s and Shares in Thousands): Total shareholders’ equity $ 4,252,511 $ 4,115,995 $ 4,074,089 $ 3,990,218 $ 3,700,393 Less: Preferred stock (412,500) (412,500) (412,500) (412,500) (125,000) (L) Total common equity $ 3,840,011 $ 3,703,495 $ 3,661,589 $ 3,577,718 $ 3,575,393 (M) Actual common shares outstanding 57,023 56,770 57,602 57,574 57,545 Book value per common share (L/M) $67.34 $65.24 $63.57 $62.14 $62.13 Tangible book value per common share (non-GAAP) (I/M) $55.42 $53.23 $51.70 $50.23 $50.18 Non-GAAP Reconciliation The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently. Reconciliation of Non-GAAP Pre-Tax, Pre-Provision Income ($ in Thousands): Income before taxes $ 206,859 $ 134,711 $ 137,284 $ 30,703 $ 87,083 Add: Provision for credit losses (45,347) 1,180 25,026 135,053 52,961 Pre-tax income, excluding provision for credit losses (non-GAAP) $ 161,512 $ 135,891 $ 162,310 $ 165,756 $ 140,044

21 This document contains forward-looking statements within the meaning of federal securities laws. Forward-looking information can be identified through the use of words such as “intend,” “plan,” “project,” “expect,” “anticipate,” “believe,” “estimate,” “contemplate,” “possible,” “will,” “may,” “should,” “would” and “could.” Forward-looking statements and information are not historical facts, are premised on many factors and assumptions, and represent only management’s expectations, estimates and projections regarding future events. Similarly, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict, such as the impacts of the COVID-19 pandemic, and which may include, but are not limited to, those listed below and the Risk Factors discussed under Item 1A of the Company’s 2020 Annual Report on Form 10-K and in any of the Company’s subsequent SEC filings. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of invoking these safe harbor provisions. Such forward-looking statements may be deemed to include, among other things, statements relating to the Company’s future financial performance, the performance of its loan portfolio, the expected amount of future credit reserves and charge-offs, delinquency trends, growth plans, regulatory developments, securities that the Company may offer from time to time, and management’s long-term performance goals, as well as statements relating to the anticipated effects on financial condition and results of operations from expected developments or events, the Company’s business and growth strategies, including future acquisitions of banks, specialty finance or wealth management businesses, internal growth and plans to form additional de novo banks or branch offices. Actual results could differ materially from those addressed in the forward-looking statements as a result of numerous factors, including the following: • the severity, magnitude and duration of the COVID-19 pandemic and the direct and indirect impact of such pandemic, as well as responses to the pandemic by the government, businesses and consumers, on our operations and personnel, commercial activity and demand across our business and our customers’ businesses; • the disruption of global, national, state and local economies associated with the COVID-19 pandemic, which could affect the Company’s liquidity and capital positions, impair the ability of our borrowers to repay outstanding loans, impair collateral values and further increase our allowance for credit losses; • the impact of the COVID-19 pandemic on our financial results, including possible lost revenue and increased expenses (including the cost of capital), as well as possible goodwill impairment charges; • economic conditions that affect the economy, housing prices, the job market and other factors that may adversely affect the Company’s liquidity and the performance of its loan portfolios, particularly in the markets in which it operates; • negative effects suffered by us or our customers resulting from changes in U.S. trade policies; • the extent of defaults and losses on the Company’s loan portfolio, which may require further increases in its allowance for credit losses; • estimates of fair value of certain of the Company’s assets and liabilities, which could change in value significantly from period to period; • the financial success and economic viability of the borrowers of our commercial loans; • commercial real estate market conditions in the Chicago metropolitan area and southern Wisconsin; • the extent of commercial and consumer delinquencies and declines in real estate values, which may require further increases in the Company’s allowance for credit losses; • inaccurate assumptions in our analytical and forecasting models used to manage our loan portfolio; • changes in the level and volatility of interest rates, the capital markets and other market indices (including developments and volatility arising from or related to the COVID-19 pandemic) that may affect, among other things, the Company’s liquidity and the value of its assets and liabilities; • a prolonged period of near zero interest rates or potentially negative interest rates, either broadly or for some types of instruments, which may affect the Company’s net interest income and net interest margin, and which could materially adversely affect the Company’s profitability; • competitive pressures in the financial services business which may affect the pricing of the Company’s loan and deposit products as well as its services (including wealth management services), which may result in loss of market share and reduced income from deposits, loans, advisory fees and income from other products; • failure to identify and complete favorable acquisitions in the future or unexpected difficulties or developments related to the integration of the Company’s recent or future acquisitions; • unexpected difficulties and losses related to FDIC-assisted acquisitions; • harm to the Company’s reputation; • any negative perception of the Company’s financial strength; • ability of the Company to raise additional capital on acceptable terms when needed; • disruption in capital markets, which may lower fair values for the Company’s investment portfolio; Forward-Looking Statements

22 • ability of the Company to use technology to provide products and services that will satisfy customer demands and create efficiencies in operations and to manage risks associated therewith; • failure or breaches of our security systems or infrastructure, or those of third parties; • security breaches, including denial of service attacks, hacking, social engineering attacks, malware intrusion or data corruption attempts and identity theft; • adverse effects on our information technology systems resulting from failures, human error or cyberattacks; • adverse effects of failures by our vendors to provide agreed upon services in the manner and at the cost agreed, particularly our information technology vendors; • increased costs as a result of protecting our customers from the impact of stolen debit card information; • accuracy and completeness of information the Company receives about customers and counterparties to make credit decisions; • ability of the Company to attract and retain senior management experienced in the banking and financial services industries; • environmental liability risk associated with lending activities; • the impact of any claims or legal actions to which the Company is subject, including any effect on our reputation; • losses incurred in connection with repurchases and indemnification payments related to mortgages and increases in reserves associated therewith; • the loss of customers as a result of technological changes allowing consumers to complete their financial transactions without the use of a bank; • the soundness of other financial institutions; • the expenses and delayed returns inherent in opening new branches and de novo banks; • liabilities, potential customer loss or reputational harm related to closings of existing branches; • examinations and challenges by tax authorities, and any unanticipated impact of the Tax Act; • changes in accounting standards, rules and interpretations, and the impact on the Company’s financial statements; • the ability of the Company to receive dividends from its subsidiaries; • uncertainty about the discontinued use of LIBOR and transition to an alternative rate; • a decrease in the Company’s capital ratios, including as a result of declines in the value of its loan portfolios, or otherwise; • legislative or regulatory changes, particularly changes in regulation of financial services companies and/or the products and services offered by financial services companies, including those changes that are in response to the COVID-19 pandemic, including without limitation the CARES Act, the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act, and the rules and regulations that may be promulgated thereunder; • a lowering of our credit rating; • changes in U.S. monetary policy and changes to the Federal Reserve’s balance sheet, including changes in response to the COVID-19 pandemic or otherwise; • regulatory restrictions upon our ability to market our products to consumers and limitations on our ability to profitably operate our mortgage business; • increased costs of compliance, heightened regulatory capital requirements and other risks associated with changes in regulation and the regulatory environment; • the impact of heightened capital requirements; • increases in the Company’s FDIC insurance premiums, or the collection of special assessments by the FDIC; • delinquencies or fraud with respect to the Company’s premium finance business; • credit downgrades among commercial and life insurance providers that could negatively affect the value of collateral securing the Company’s premium finance loans; • the Company’s ability to comply with covenants under its credit facility; and • fluctuations in the stock market, which may have an adverse impact on the Company’s wealth management business and brokerage operation. • ability of the Company to use technology to provide products and services that will satisfy customer demands and create efficiencies in operations and to manage risks associated therewith; Therefore, there can be no assurances that future actual results will correspond to these forward-looking statements. The reader is cautioned not to place undue reliance on any forward- looking statement made by the Company. Any such statement speaks only as of the date the statement was made or as of such date that may be referenced within the statement. The Company undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events after the date of the press release. Persons are advised, however, to consult further disclosures management makes on related subjects in its reports filed with the Securities and Exchange Commission and in its press releases. Forward-Looking Statements