UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

Wintrust Financial Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ý | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

WINTRUST FINANCIAL CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 26, 2022

To the Shareholders of Wintrust Financial Corporation:

You are cordially invited to attend the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Wintrust Financial Corporation (the “Company”) to be held at our offices located at 9700 West Higgins Road, 2nd Floor, Rosemont, Illinois 60018 on Thursday, May 26, 2022, at 9:00 a.m. Central Time, for the following purposes:

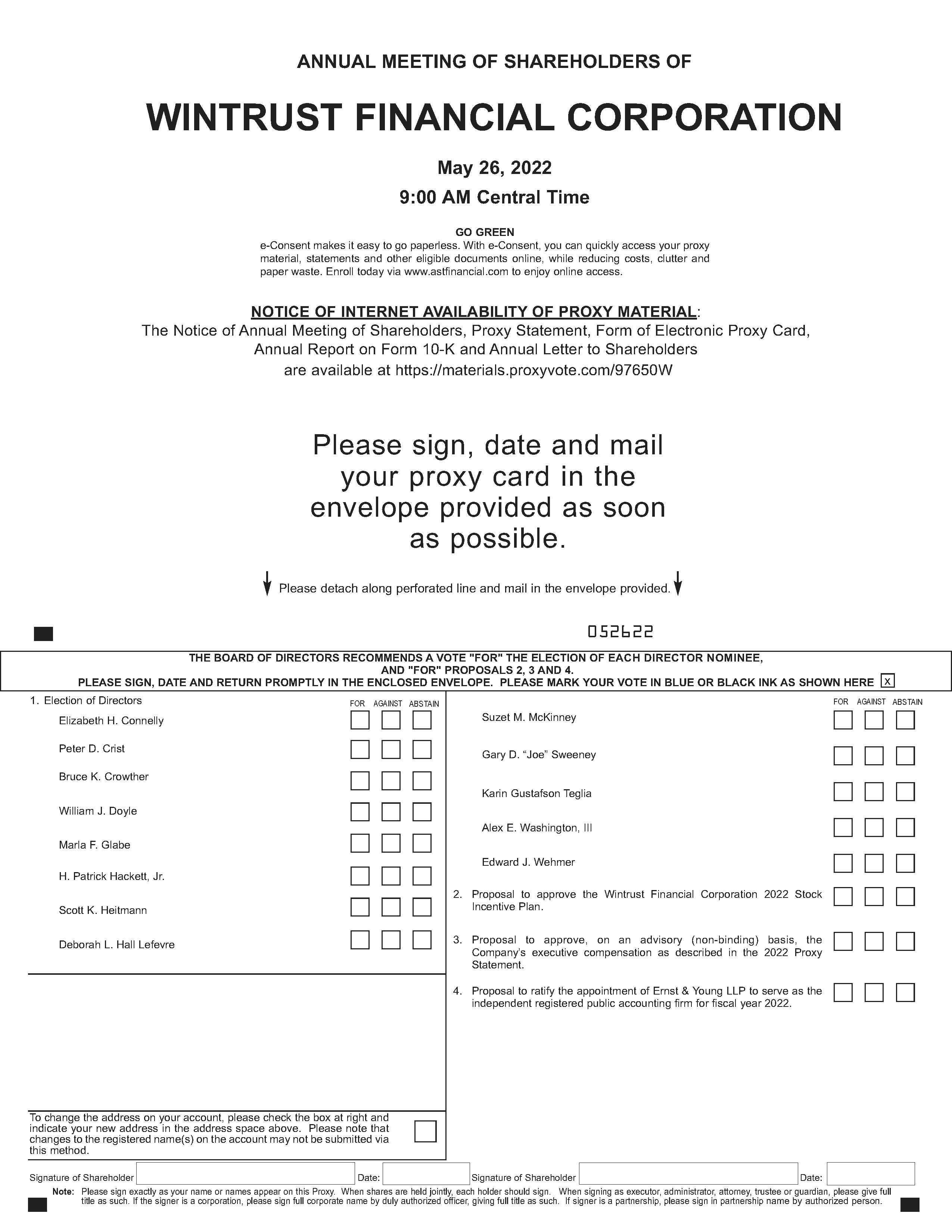

1.To elect the 13 nominees for director named in this Proxy Statement to hold office until the 2023 Annual Meeting of Shareholders or until a successor has been elected and qualified;

2.To consider a proposal to approve the Company’s 2022 Stock Incentive Plan;

3.To approve, on an advisory (non-binding) basis, the Company’s executive compensation as described in this Proxy Statement;

4.To ratify the appointment of Ernst & Young LLP to serve as the independent registered public accounting firm for fiscal year 2022; and

5.To transact such other business as may properly come before the meeting and any adjournment thereof.

The record date for determining shareholders entitled to notice of, and to vote at, the Annual Meeting was the close of business on March 31, 2022. We encourage you to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, prompt voting will be appreciated.

By order of the Board of Directors,

Kathleen M. Boege

Corporate Secretary

April 7, 2022

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, IT IS IMPORTANT THAT YOU VOTE BY ONE OF THE METHODS NOTED IN THE ATTACHED PROXY STATEMENT.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 26, 2022: This Notice of the Annual Meeting, Proxy Statement and the 2021 Annual Report on Form 10-K are Available at: https://materials.proxyvote.com/97650W

TABLE OF CONTENTS

WINTRUST FINANCIAL CORPORATION

9700 West Higgins Road, Suite 800

Rosemont, Illinois 60018

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, MAY 26, 2022

These proxy materials are furnished in connection with the solicitation by the Board of Directors (the “Board” with individual members of the Board each being referred to herein as a “Director”) of Wintrust Financial Corporation, an Illinois corporation (“Wintrust” or the “Company”), of proxies to be used at the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) and at any adjournment of such meeting. In accordance with rules and regulations of the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each shareholder of record, we furnish proxy materials, which include this Proxy Statement (this “Proxy Statement”) and the accompanying proxy card, Notice of Annual Meeting, and Annual Report on Form 10-K for fiscal year ended December 31, 2021, to our shareholders by making such materials available on the Internet unless otherwise instructed by the shareholder. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice, which is first being mailed to shareholders on or about April 14, 2022.

ABOUT THE MEETING

When and where is the Annual Meeting?

The Annual Meeting will be held on Thursday, May 26, 2022 at 9:00 a.m. Central Time at the Company’s headquarters at 9700 West Higgins Road, 2nd Floor, Rosemont, Illinois 60018.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the matters described in the Notice of Annual Meeting that accompanies this Proxy Statement, including the election of the 13 nominees for Director named in this Proxy Statement, a proposal to approve the Company’s 2022 Stock Incentive Plan (“2022 Plan”), a proposal approving (on an advisory basis) the Company’s executive compensation as described in this Proxy Statement, and the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022.

Who may vote at the Annual Meeting?

Only record holders of our Common Stock, no par value per share (“Common Stock”), as of the close of business on March 31, 2022 (the “Record Date”), will be entitled to vote at the meeting. On the Record Date, the Company had outstanding approximately 57,253,214 shares of Common Stock. Each outstanding share of the Common Stock entitles the holder to one vote.

May shareholders ask questions at the Annual Meeting?

Yes. Shareholders will have the ability to submit questions during the Annual Meeting. Such questions must be confined to matters properly before the Annual Meeting and of general Company relevance.

What constitutes a quorum?

The Annual Meeting will be held only if a quorum is present. A quorum will be present if a majority of the shares of the Common Stock issued and outstanding on the Record Date are represented, online or by proxy, at the Annual Meeting. Shares represented by properly completed proxy cards marked “abstain” or returned without voting instructions are counted as present for the purpose of determining whether a quorum is present at the Annual Meeting. Also, if shares are held by brokers who submit a proxy but are prohibited from exercising discretionary authority for beneficial owners who have not given voting instructions on certain matters (“broker non-votes”), those shares will be counted as present for the purpose of determining whether a quorum is present at the Annual Meeting.

How do I submit my vote?

If you are a shareholder of record, you can vote by:

•attending the Annual Meeting and voting by ballot during the Annual Meeting;

•using your telephone, according to the instructions on the Notice or proxy card;

•visiting www.voteproxy.com and then following the instructions on the screen; or

•signing, dating and mailing in your proxy card which may be obtained by calling 888-proxyna (888-776-9962) or by emailing info@astfinancial.com.

The deadline for voting by telephone or on the Internet is 11:59 p.m. Eastern Time on May 25, 2022. Proxy cards submitted by mail must be received by the close of business on May 25, 2022.

How do I vote if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a valid legal proxy issued in your name from the institution that holds your shares and bring that proxy to the Annual Meeting.

Can I change or revoke my vote after I return my proxy card?

Yes. If you are a shareholder of record, you may change your vote by:

•returning a later-dated proxy card;

•entering a new vote by telephone or on the Internet (prior to 11:59 p.m. Eastern Time on May 25, 2022);

•voting in person by ballot during the Annual Meeting; or

•delivering written notice of revocation to the Company’s Corporate Secretary by mail at 9700 West Higgins Road, Suite 800, Rosemont, Illinois 60018.

If you vote by phone or Internet, you may change your vote if you do so prior to 11:59 p.m. Eastern Time on May 25, 2022. Any later-dated proxy card or revocation sent by mail must be received by the close of business on May 25, 2022. If you hold your shares through an institution, that institution will instruct you as to how your vote may be changed.

Who will count the votes?

The Company’s Inspector of Election, American Stock Transfer & Trust Company, LLC, will count the votes.

Will my vote be kept confidential?

Yes. As a matter of policy, shareholder proxies, ballots and tabulations that identify individual shareholders are kept secret and are available only to the Company, its tabulator and inspectors of election, who are required to acknowledge their obligation to keep your votes confidential.

Who pays to prepare, mail and solicit the proxies?

The Company pays all of the costs of preparing, mailing and soliciting proxies. The Company asks brokers, banks, voting trustees and other nominees and fiduciaries to forward proxy materials to the beneficial owners and to obtain authority to execute proxies. The Company will reimburse the brokers, banks, voting trustees and other nominees and fiduciaries upon request. In addition to solicitation by mail, telephone, facsimile, Internet or personal contact by its officers and employees, the Company has retained the services of Morrow Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford, Connecticut 06902, to solicit proxies for a fee of $7,000 plus expenses.

What are the Board’s recommendations as to how I should vote on each proposal?

The Board recommends a vote:

•FOR the election of each of the 13 Director nominees named in this Proxy Statement;

•FOR the proposal to approve the Company’s 2022 Stock Incentive Plan;

•FOR the approval, on an advisory (non-binding) basis, of the Company’s executive compensation as described in this Proxy Statement; and

•FOR the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022.

How will my shares be voted if I sign, date and return my proxy card?

If you sign, date and return your proxy card and indicate how you would like your shares voted, your shares will be voted as you have instructed. If you sign, date and return your proxy card but do not indicate how you would like your shares voted, your proxy will be voted:

•FOR the election of each of the 13 Director nominees named in this Proxy Statement;

•FOR the proposal to approve the Company’s 2022 Stock Incentive Plan;

•FOR the approval, on an advisory (non-binding) basis, of the Company’s executive compensation as described in this Proxy Statement; and

•FOR the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022.

With respect to any other business that may properly come before the meeting, or any adjournment of the meeting, that is submitted to a vote of the shareholders, including whether or not to adjourn the meeting, your shares will be voted in accordance with the best judgment of the persons voting the proxies.

How will broker non-votes be treated?

A broker non-vote occurs when a broker who holds its customer’s shares in street name submits proxies for such shares, but indicates that it does not have authority to vote on a particular matter. Generally, this occurs when brokers have not received any instructions from their customers. In these cases, the brokers, as the holders of record, are permitted to vote on “routine” matters only, but not on other matters. In this Proxy Statement, brokers who have not received instructions from their customers would only be permitted to vote on:

•the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022.

Brokers who have not received instructions from their customers would not be permitted to vote on the remaining proposals to be presented at the Annual Meeting, which are considered “non-routine” matters. Broker non-votes will have no impact on the voting results with regard to such proposals.

We will treat broker non-votes as present to determine whether or not we have a quorum at the Annual Meeting, but they will not be treated as entitled to vote on the “non-routine” matters described above, for which the broker indicates it does not have discretionary authority.

How will abstentions be treated?

For purposes of determining whether or not we have a quorum at the Annual Meeting, if you vote to abstain, your shares will be counted as present at the Annual Meeting.

If you abstain from voting for one or more of the nominees for Director, this will have the same effect as a vote against such nominee. If you abstain from voting on the proposal to approve the Company’s 2022 Stock Incentive Plan, the advisory

(non-binding) proposal approving the Company’s executive compensation as described in this Proxy Statement, or on the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2022, your abstention will have the same effect as a vote against the proposal or proposals on which you abstain from voting.

What if other matters come up during the Annual Meeting?

If any matters other than those referred to in the Notice of Annual Meeting properly come before the Annual Meeting, the individuals named in the proxy card will vote the proxies held by them in accordance with their best judgment. The Company is not aware of any business other than the items referred to in the Notice of Annual Meeting that may be considered at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, prompt voting will be appreciated. Registered shareholders can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services are provided on the proxy card. Of course, you may still vote your shares by submitting the proxy card. A proxy card may be obtained as instructed above under “How do I submit by vote?” If you chose to vote by mail, we ask that you complete, sign, date and return the proxy card promptly in the postage-paid envelope.

BOARD OF DIRECTORS, COMMITTEES AND GOVERNANCE

Board of Directors

Overview

The Board provides oversight with respect to our overall performance, strategic direction and key corporate policies. It approves major initiatives, advises on key financial and business objectives, and monitors progress with respect to these matters. Members of the Board are kept informed of our business by various reports and documents provided to them on a regular basis, including operating and financial reports made at Board and committee meetings by the Chief Executive Officer (“CEO”) and other officers. The Board has seven standing committees. The principal responsibilities of the standing committees are described under the applicable committee headings below. Additionally, the independent Directors meet in regularly scheduled executive sessions, with and without management present, at each meeting of the Board and its committees.

Corporate Governance Practices

We believe that a culture of strong corporate governance is a critical component of our success. Our Board continually evaluates corporate governance developments and strives to adopt “best practices” including:

•Annual election of Directors.

•Independent Chairman of the Board.

•Independent Board. Our Board is comprised of all independent Directors, except our CEO.

•Majority vote standard for election of our Directors.

•Independent Board committees. Each of our committees (other than the Executive Committee) is made up entirely of independent Directors. Each standing committee operates under a written charter that has been approved by the respective committee, the Nominating and Corporate Governance Committee (the “Nominating Committee”) and the Board.

•Regular executive sessions of independent Directors. At each meeting of the Board and each of its Committees, the Directors meet without management present in regularly scheduled executive sessions of independent Directors.

•Regular Board self-evaluation process. The Board and each committee evaluate their respective performance on an annual basis.

•Regular Board education and training. Each Director is required to complete annually a robust suite of online training modules administered by the Company, including courses focused on financial institution compliance and regulatory frameworks. In addition to the completion of comprehensive Director onboarding sessions, each Director

is encouraged to participate in training sessions provided by third parties to public company directors, focusing on corporate governance matters as well as subjects relevant to the committees on which a particular Director serves.

•Service by the majority of our Directors on the boards of our subsidiary banks or other operating subsidiaries. We believe this dual service gives our Directors a robust view into our operations and performance.

•Limitation on other outside board service. We limit our Directors to serve on no more than four other public company boards.

•Retirement Age. We have a policy that we will not nominate a candidate for Director if he or she has attained the age of 76 before the election.

•Robust code of ethics. Our corporate code of ethics applies to all of our employees, including our Directors and executive officers. We also have an additional code of ethics applicable to our senior financial officers.

•Robust role for the Board in risk oversight. Our Board and its committees play an active and ongoing role in the management of the risks of our business.

•Stock ownership guidelines for Directors and named executive officers. Our Directors and named executive officers each must maintain a significant ownership of our Common Stock in order to increase alignment of their interests with those of our shareholders.

•Prohibition on hedging, short selling and pledging. Our Directors and employees are prohibited from engaging in selling short our Common Stock, engaging in hedging or offsetting transactions regarding our Common Stock, including the use of puts, calls, swaps, collars or other derivative securities designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Company. Similarly, our Directors and insiders are prohibited from pledging our Common Stock.

•No shareholder rights plan (poison pill).

Meetings

The Board met five times in 2021. Each member of the Board attended more than 90% of the total number of meetings of the Board and the committees on which he or she served. We encourage, but do not require, our Board members to attend annual meetings of shareholders. All of our Board members then in office attended our virtual 2021 Annual Meeting of Shareholders.

Board Leadership Structure

The Board has a non-executive Chairman. This position is independent from management. The Chairman leads the Board meetings as well as meetings of the independent Directors. The CEO is a member of the Board and participates in its meetings. The Board believes that this leadership structure is appropriate for the Company at this time because it allows for independent oversight of management, increases management accountability and encourages an objective evaluation of management’s performance relative to compensation. In addition, the Board recognizes that acting as Chairman of the Board is a particularly time-intensive responsibility. Separating these roles allows the CEO to focus solely on his duties, which the Board believes better serves the Company. Separation of the roles of Chairman and CEO also promotes risk management, enhances the independence of the Board from management, and mitigates potential conflicts of interest between the Board and management. In order to ensure continuity of leadership, the Company has a policy set forth in its Corporate Governance Guidelines providing that each non-executive Chairman may serve for a term of not more than nine (9) consecutive years, subject to the requirement that he or she be re-elected as Chairman annually by the Board. The Nominating Committee has proposed, and the Board has agreed, that pending his re-election, H. Patrick Hackett, Jr. will continue to serve as non-executive Chairman of the Board following the Annual Meeting.

The Board’s Role in Risk Oversight

Our Board has an active and ongoing role in the management of the risks of our business. This role has two fundamental elements: (1) ensuring that management of the Company has implemented an appropriate system to manage risks by

identifying, assessing, mitigating, monitoring and communicating about risks; and (2) providing effective risk oversight through the Board and its committees.

The Board believes the first element of its risk oversight role is fulfilled through the Company’s extensive risk assessment and management program designed to identify, monitor, report and control the Company’s risks, which are broken down into various categories deemed relevant to the Company and its business operations. The Enterprise Risk Management Program is administered by the Company’s Executive Vice President — Chief Risk Officer, who provides reports to the Board, the Audit Committee and the Risk Management Committee on a regular basis and other committees of the Board as needed.

The second element of the Board’s oversight role is fulfilled primarily by the full Board regularly receiving written and oral reports from management on the status of various categories of Company risk, including cybersecurity risks and COVID-19 risks, and on the Company’s overall risks as well as any material changes or developments in risk profiles or experiences. The Board also periodically receives reports regarding regulatory priorities and reviews regulatory examination reports of the Company to remain informed on issues and observations raised by regulatory authorities regarding the risk categories of the Company.

In addition to the full Board’s direct oversight, the Board’s committees provide oversight of various risks created by the Company’s operations. The Audit Committee provides oversight of financial, regulatory, operational and legal risks, in particular. The Risk Management Committee monitors, among other things, overall enterprise risk management, credit, interest rate, liquidity and market risks. The Finance Committee provides oversight of risks related to strategic transactions and reviews risks associated with the Company’s capital planning strategy and liquidity. The Information Technology & Information Security Committee (“IT/IS Committee”) provides oversight of risks related to the Company’s information technology and information security strategy, infrastructure, systems, business continuity planning and disaster recovery plans and testing. The IT/IS Committee and the Audit Committee coordinate regarding oversight of the Company’s information security programs. The Nominating Committee provides risk oversight relating to the Company’s board and governance, as well as in relation to the Company’s environmental and social responsibility efforts and progress. The Compensation Committee provides oversight of risks related to the Company’s compensation of its employees. In addition, the Audit Committee, Finance Committee and Risk Management Committee have each undertaken to monitor relevant portions of the risks relating to the capital stress testing process. The Board receives a comprehensive quarterly report from each committee chair regarding matters considered by each respective Board committee, including environmental and social risk oversight as well as cybersecurity.

Codes of Ethics

The Board has adopted our Corporate Code of Ethics applicable to all Directors, officers and employees, and our Senior Financial Officer Code of Ethics (together with the Corporate Code of Ethics, the “Codes”) each of which is available on the Company’s website at www.wintrust.com by choosing “Investor Relations” and then choosing “Corporate Governance.” To assist in enforcement of the Codes, we maintain Wintrust’s Ethicspoint, a toll-free hotline and Internet-based service through which confidential complaints may be made by employees regarding actual or alleged illegal or fraudulent activity; questionable accounting, internal controls or auditing matters; conflicts of interest, dishonest or unethical conduct; disclosures in the Company’s reports filed with the SEC, bank regulatory filings and other public disclosures that are not full, fair, accurate, timely or understandable; violations of our Codes; and/or any other violations of laws, rules or regulations. Any complaints submitted through this process are presented to the Audit Committee on a regular, periodic basis or more frequently as needed. The Company will post on its website any amendments to, or waivers from, the Codes as they apply to its Directors and executive officers to the extent required by the rules of the SEC or the Nasdaq stock market (“Nasdaq”).

Shareholder Communications

Any shareholder or other interested parties who desire to contact the non-employee Directors or the other members of our Board may do so by writing to: Wintrust Financial Corporation, Board of Directors, c/o the Corporate Secretary, Wintrust Financial Corporation, 9700 West Higgins Road, Suite 800, Rosemont, Illinois 60018. Copies of written communications received at this address will be provided to the Board, the applicable committee chair or the non-employee Directors as a group unless such communications are considered, in consultation with the non-employee Directors, to be improper for submission to the intended recipient(s). All communications will be forwarded to the Chair of the Nominating Committee unless the communication is specifically addressed to another member of the Board, in which case, the communication will be forwarded to that Director. Shareholders also may obtain a copy of any of the documents posted to the website free of

charge by calling (847) 939-9000 and requesting a copy. Information contained on Wintrust’s website is not deemed to be a part of this Proxy Statement and is not incorporated herein by reference.

Committee Membership

The following table summarizes the current membership of the Board and each of its committees as of the date of this Proxy Statement:

| | | | | | | | | | | | | | | | | | | | | | | |

| Board of Directors | Nominating and Corporate Governance Committee | Audit Committee | Compensation Committee | Risk Management Committee | Finance Committee | Information Technology/

Information Security Committee | Executive Committee |

| Elizabeth H. Connelly | | | | | | | |

| Peter D. Crist | Chair | | Member | | Member | | Member |

| Bruce K. Crowther | Member | | Chair | | Member | | Member |

| William J. Doyle | Member | | Member | | Member | | |

| Marla F. Glabe | | Member | | Member | | Member | |

| H. Patrick Hackett, Jr. (Chair) | Member | | | | Member | | Chair |

| Scott K. Heitmann | | Member | | Chair | | Member | Member |

| Deborah L. Hall Lefevre | | | | | | Chair | Member |

| Suzet M. McKinney | | Member | | Member | | | |

Gary D. “Joe” Sweeney | | Member | Member | Member | | | |

| Karin Gustafson Teglia | | Chair | | Member | | Member | Member |

| Alex E. Washington, III | Member | | | | Chair | Member | Member |

| Edward J. Wehmer | | | | | | | Member |

The Board adopted the charter of each of the Nominating Committee, the Audit Committee, the Compensation Committee, the Risk Management Committee, the Finance Committee, the IT/IS Committee and the Executive Committee, copies of which are available at www.wintrust.com by choosing “Investor Relations” and then choosing “Corporate Governance.” Our Corporate Governance Guidelines are also available on the Company’s website under the same heading.

Nominating and Corporate Governance Committee

The Board has established the Nominating Committee which is responsible for the following, among other responsibilities:

•determining criteria for the selection and qualification of the members of the Board and reviewing with the Board the appropriate skills and characteristics required of the Board members in the context of the current composition of the Board;

•identifying, evaluating and recommending candidates to fill positions on the Board;

•seeking out possible candidates and otherwise aid in attracting highly qualified candidates to serve on the Board and coordinating with the CEO to the extent the Nominating Committee deems appropriate;

•evaluating, at least annually, the independence of each member of the Board and establishing procedures for the regular ongoing reporting by Directors of any developments that may be deemed to affect their independence status or qualification to serve as a Director;

•considering any resignation submitted by a Director who has experienced a significant change to his or her personal circumstances;

•reviewing the corporate governance guidelines and code of ethics and recommending modifications thereto to the Board;

•advising the Board with respect to the size, composition and individual members of the various committees of the Board and the functions of the Board and its committees;

•establishing and implementing self-evaluation procedures for the Board and its committees;

•assessing and reviewing with management the overall effectiveness of the organization of the Board and the conduct of its business and making appropriate recommendations to the Board with regard thereto;

•reviewing shareholder proposals submitted for business to be conducted at an annual meeting;

•in consultation with the Audit Committee, reviewing related-party transactions;

•reviewing annually Director compensation and recommending modifications thereto to the Board;

•reviewing insurance policies and indemnification arrangements applicable to the Directors and executive officers and recommending modifications thereto to the Board;

•considering from time to time the overall relationship of the Board and management;

•overseeing the Company’s workforce strategy, including management development, diversity and inclusion initiatives;

•overseeing the Company’s environmental and social responsibility efforts and progress;

•reviewing and assessing annually the adequacy of the Executive Committee Charter and, if appropriate, recommending changes to the Board for approval; and

•reviewing and assessing annually the adequacy of the Nominating Committee Charter and, if appropriate, recommending changes to the Board for approval.

The Board has determined that each member of the Nominating Committee has no material relationship with the Company and is otherwise independent under the applicable Nasdaq listing standards. During 2021, the Nominating Committee met five times.

Nomination of Directors

The Nominating Committee seeks nominees from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. In doing so, the Nominating Committee considers a wide range of factors in evaluating the suitability of director candidates, including a general understanding of finance and other disciplines relevant to the success of a publicly-traded company in today’s business environment, understanding of our business, education and professional background. The following personal characteristics are considered minimum qualifications for Board membership under the Corporate Governance Guidelines approved by the Board: integrity and accountability, the ability to provide informed judgments on a wide range of issues, financial literacy, a good reputation in the business community, a talent for networking and referring business to the Company, a history of achievements that reflects high standards for themselves and others, and willingness to raise tough questions in a manner that encourages open discussion. Under the Corporate Governance Guidelines adopted by the Board, Directors are expected to own Common Stock having a value of at least four times the annual retainer fee, which is $140,000 for fiscal year 2022, within four years of becoming a Director, and to limit board service at other companies to no more than four other public company boards.

The Nominating Committee believes in an expansive definition of diversity that includes differences of experience, education and talents, among other things. While the Nominating Committee does not have a formal policy in this regard, the diversity of the Board is a consideration in evaluating candidates for the Board, among others, as set forth in our Corporate Governance Guidelines.

The Nominating Committee also evaluates the performance of Directors and assesses the effectiveness of committees and the Board as a whole. The effectiveness of the nomination process is evaluated by the Board each year as part of its self-evaluation process and by the Nominating Committee as it evaluates and identifies director candidates.

The Nominating Committee does not have any single method for identifying director candidates but will consider candidates suggested by a wide range of sources. Elizabeth H. Connelly, who is standing for reelection to the Board for the first time at the Annual Meeting following her appointment to the Board in January, 2022, was originally recommended as a candidate for Director by several non-management Directors of the Company, in light of her qualifications, including years of experience in the banking industry.

The Nominating Committee will consider director candidates recommended by our shareholders and will apply the same standards in considering director candidates recommended by shareholders as it applies to other candidates. Once the Nominating Committee receives a recommendation from a shareholder, it may request additional information from the candidate about the candidate’s independence, qualifications and other information that would assist the Nominating Committee in evaluating the candidate, as well as certain information that must be disclosed about the candidate in the Company’s proxy statement, if nominated.

Shareholders may also directly nominate a candidate for Director pursuant to the advance notice provisions of the Company’s By-laws. Nominations must be received in writing at the principal executive offices of the Company and addressed to Wintrust Financial Corporation, Nominating and Corporate Governance Committee, c/o Corporate Secretary, 9700 West Higgins Road, Suite 800, Rosemont, Illinois 60018 and otherwise satisfy the requirements set forth in the Company’s By-laws.

Audit Committee

The Board has established an Audit Committee for the purpose of overseeing our accounting and financial reporting processes and the audits of our financial statements and evaluating and monitoring the risk profile of the Company. In addition, the Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to the following, in addition to other responsibilities:

•being directly responsible for the appointment, termination, compensation and oversight of the work of the independent auditors, including an assessment of the qualifications and independence of the independent auditors;

•reviewing the adequacy and effectiveness of the Company’s disclosure controls and procedures and management reports thereon;

•discussing with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC;

•overseeing the Company’s internal audit function;

•reviewing with management and the independent auditors, the financial statements, footnotes and related disclosures to be included in the Company’s Annual Report on Form 10-K and quarterly reports on Form 10-Q;

•reviewing results of quarterly interim financial statements and the financial disclosure in the Company’s earnings press releases, registration statements, or current reports;

•in consultation with the Nominating Committee, reviewing related-party transactions;

•reviewing the status of the Company’s Information Security Program, including updates to risk assessments, results of audit testing and details of any security breaches or violations, as well as any changes to the program;

•monitoring and discussing with management and the internal auditors, as it deems appropriate, the Company’s risk assessment and risk management policies;

•reviewing the status and results of regulatory examinations;

•reviewing compliance with the Codes and insider trading policy; and

•reviewing and assessing annually the adequacy of the Audit Committee Charter and, if appropriate, recommending changes to the Board for approval.

The Audit Committee has established a policy to pre-approve all audit and non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services

and other services. Pre-approval is generally provided for up to one year. Once pre-approved, the services and pre-approved amounts are monitored against actual charges incurred and modified if appropriate.

To serve on the Audit Committee, Directors must meet financial competency standards and heightened independence standards set forth by the SEC and Nasdaq. In particular, each Audit Committee member:

•must be financially literate;

•must not have received any consulting, advisory, or other compensatory fees from the Company (other than in his or her capacity as a Director);

•must not be the Company’s affiliate or the affiliate of any of the Company’s subsidiaries; and

•must not serve on the audit committee of more than two other public companies, unless the Board determines that such simultaneous service would not impair the ability of such Director to effectively serve on the Audit Committee.

Furthermore, at least one member of the Audit Committee must be an “audit committee financial expert” as defined by SEC rules.

The Board has determined that each member of the Audit Committee has no material relationship with the Company and each is otherwise independent under the applicable Nasdaq listing standards and meets the financial competency and heightened independence standards set forth above. The Board has determined that each of Mses. Glabe and Teglia, Dr. McKinney, and Messrs. Heitmann and Sweeney qualify as audit committee financial experts. During 2021, the Audit Committee met five times.

Compensation Committee

The Board has established a Compensation Committee which is responsible for the following, among other responsibilities:

•establishing, in consultation with senior management, the Company’s overall compensation philosophy and overseeing the development and implementation of compensation programs and policies;

•reviewing and approving corporate goals and objectives relevant to the compensation of the CEO and other senior management, evaluating the performance of the CEO and other senior management in light of those goals and objectives, and, either as a committee or together with the other independent members of the Board, setting the CEO’s and other senior management’s compensation levels based on this evaluation;

•reviewing and approving in advance employment agreements, salary levels, salary increases and bonuses for executive and senior officers of the Company and, if appropriate, senior officers of its subsidiaries, including salaries and awards to newly-hired executives and senior officers of the Company;

•reviewing the Company’s compensation programs to assess the extent to which such practices encourage risk-taking (including compliance with the Company’s Volcker Rule Compliance Policy) or earnings manipulation, and taking any appropriate remedial actions;

•administering the Company’s stock incentive and employee stock purchase programs;

•reviewing and recommending for Board approval additional executive compensation and employee benefit programs;

•reviewing with the CEO senior management promotions and employment of senior management candidates;

•conferring with the CEO and other senior management regarding succession planning for senior executive officers and making any such recommendations to the Board;

•reviewing and approving changes to be made to severance programs and forms of employment agreements and change-in-control agreements;

•pre-approving all services provided by any independent compensation consultant retained to participate in the evaluation of executive compensation, other than services performed in connection with non-employee Director compensation;

•reviewing the results of any advisory shareholder votes on executive compensation (say-on-pay votes), and considering whether to recommend adjustments to the Company’s executive compensation policies and practices as a result of such votes;

•recommending for approval by the Board how frequently the Company should conduct advisory shareholder votes on executive compensation, taking into account the results of any prior shareholder votes regarding the frequency of such votes;

•developing and implementing policies with respect to the recovery or “clawback” of any excess compensation, including stock options, paid to any of the Company’s executive officers based on erroneous data;

•reviewing and assessing annually the adequacy of the Compensation Committee Charter and, if appropriate, recommending changes to the Board for approval; and

•preparing the proxy statement Compensation Committee report for inclusion in the proxy statement, in accordance with SEC rules.

The Board has determined that each member of the Compensation Committee has no material relationship with the Company and each is otherwise independent under the applicable Nasdaq listing standards. During 2021, the Compensation Committee met six times. The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2021, there were no compensation committee interlocks or insider participation.

Risk Management Committee

The Board has established a Risk Management Committee which is responsible for the following, among other responsibilities:

•reviewing and approving the Enterprise Risk Management Policy;

•reviewing and approving the Risk Appetite Statement;

•reviewing summary reports regarding the Company’s risk profile relative to the Risk Appetite Statement and associated metrics and risk tolerances;

•reviewing the Company’s independent loan review plan and loan review results;

•reviewing measures taken by the Company to identify, measure, monitor, manage and report its risks in the areas of credit, liquidity, interest rates and other market risks, operational risk, vendors, and financial models;

•reviewing measures taken by the Company to identify, measure, monitor, manage and report its risks in the areas of information technology and information security, and reviewing the terms and conditions of the Company’s cybersecurity insurance coverage, in cooperation with the IT/IS Committee;

•reviewing measures taken by the Company to identify, measure, monitor, manage and report its risks in the areas of legal and regulatory compliance, in cooperation with the Audit Committee of the Board;

•reviewing the Company’s capital position including the Company’s annual capital planning and stress testing processes and results, in cooperation with the Finance Committee of the Board;

•reviewing and approving additional policies as may be assigned to the Committee pursuant to the Company’s Enterprise Risk Management Policy, subject to the Board’s reservation of its authority to review and approve any such policies;

•reviewing the status and results of regulatory examinations, any significant issues arising out of such examinations and related responses from management or the Board with respect to their impact on risk management practices;

•meeting periodically with the Chief Risk Officer in separate executive sessions and discussing, among other items, the corporate risk management function’s independent responsibilities, budget and staffing;

•coordinating with other committees of the Board and management committees as appropriate concerning risk management issues within the other committees’ respective areas of responsibility;

•reviewing reports on special or emerging risk topics as deemed appropriate; and

•reviewing and assessing annually the adequacy of the Risk Management Committee Charter and, if appropriate, recommending changes to the Risk Management Committee Charter to the Board for approval.

The Board has determined that each member of the Risk Management Committee has no material relationship with the Company and each is otherwise independent under the applicable Nasdaq listing standards. During 2021, the Risk Management Committee met four times.

Finance Committee

The Board has established a Finance Committee to provide guidance to management regarding strategic opportunities and related financing transactions. In addition, the Finance Committee assists the Board in fulfilling its responsibilities with respect to the following, among other responsibilities:

•reviewing the capital plan and cash position of the Company, and providing advice and guidance on the sources and uses of capital and expected returns on capital deployed;

•reviewing and approving key strategic initiatives to determine if they are aligned with the Risk Appetite Statement;

•reviewing and approving capital policies including the Capital Plan, the Capital Adequacy and Planning Policy and the Capital Contingency Plan;

•reviewing and approving results of capital and earnings business plan, annual budget and forecasts;

•reviewing and approving components of the capital stress testing process including stress test results;

•reviewing holding company/intercompany capital actions, linking to current and forecasted capital levels;

•reviewing and approving action plans to remediate gaps identified in the capital management process;

•reviewing the Company’s financial policies, capital structure, strategy for obtaining financial resources, tax-planning strategies and use of cash flow;

•reviewing and making recommendations with respect to any share repurchase programs and dividend policy;

•reviewing proposed mergers, acquisitions, joint ventures and divestitures involving the Company and its subsidiaries;

•reviewing and making recommendations with respect to private equity and other strategic investments;

•reviewing and making recommendations with respect to issuing equity and debt securities;

•providing advice to management with respect to the financial aspects of transactions by subsidiaries of the Company that require a vote by the Company, as a shareholder of such subsidiaries; and

•reviewing and assessing annually the adequacy of the Finance Committee Charter and, if appropriate, recommending changes to the Board for approval.

The Board has determined that each member of the Finance Committee has no material relationship with the Company and each is otherwise independent under the applicable Nasdaq listing standards. During 2021, the Finance Committee met four times.

Information Technology/Information Security Committee

The Board has established an IT/IS Committee to provide guidance to management regarding information technology and information security. In addition, the IT/IS Committee assists the Board in fulfilling its responsibilities with respect to the following, among other responsibilities:

•reviewing and approving the Company’s information technology strategic plan and planning process;

•assessing the likelihood, frequency and severity of cyber attacks and data breaches;

•reviewing outside audit reports regarding the Company’s cybersecurity practices;

•reviewing and approving the development and implementation of the Company’s information technology and information security programs and policies in context of the Company’s risk profile;

•reviewing the scope and effectiveness of the Company’s material information technology and information security infrastructure, including strategies for the design, development, implementation and maintenance of new technologies and systems;

•reviewing the strategies and measures taken by the Company to identify, assess, monitor, control and mitigate its risks in the areas of information technology and information security;

•reviewing and approving the data management strategy for the Company;

•overseeing any independent third-party assessments of the Company’s information technology and information security programs and policies and data management strategy;

•reviewing the effectiveness of business continuity/disaster recovery following cyber attacks, including adequate insurance coverage and incident response plans and testing; and

•reviewing annually the adequacy of the IT/IS Committee Charter and, if appropriate, recommending changes to the charter to the Board for approval.

The Board has determined that each member of the IT/IS Committee has no material relationship with the Company and each is otherwise independent under the applicable Nasdaq listing standards. During 2021, the IT/IS Committee met four times.

Executive Committee

The Board has established an Executive Committee to provide guidance and counsel to the Company’s management team on significant matters and to take action on behalf of the Board between meetings of the Board or when it is not feasible to convene a meeting of the full Board for timely consideration of the actions proposed to be taken. The Executive Committee may exercise all authority of the Board including, without limitation, the approval of acquisition, financing and other business transactions not involving the issuance of Company stock or approval by shareholders, except as otherwise prohibited by law.

The Board has determined that each member of the Executive Committee, except for Mr. Wehmer, has no material relationship with the Company and is otherwise independent under the Nasdaq listing standards. During 2021, the Executive Committee did not meet.

DIRECTOR COMPENSATION

The Company seeks to compensate its non-employee Directors in a manner that attracts and retains qualified candidates to serve on the Board and to compensate such Directors for their service on the Board in an amount that is commensurate with their role and involvement. In setting non-employee Director compensation, the Nominating Committee and the Board consider the significant amount of time the Directors expend in fulfilling their duties as well as the skill level required. During its most recent review of Director compensation, the Nominating Committee reviewed a director compensation review prepared by Meridian Compensation Partners LLC (“Meridian”), the consultant to the Compensation Committee, which included compensation data for non-employee directors from the Company’s then-current peer group. Based on this review of director compensation data (which was based on the most recent proxy statement filed by members of the Company’s peer group), the Nominating Committee recommended, and the Board determined, to increase the annual retainer fee of our Directors to $140,000, effective January 1, 2022.

To strengthen the alignment of interests between Directors and shareholders, the Board maintains a minimum stock ownership guideline for Directors, which requires Directors to own Common Stock (or Common Stock equivalents) having a value of at least four times the then-current annual retainer fee paid to non-employee Directors. For 2022, this resulted in an ownership requirement of $560,000. This minimum stock ownership is required to be met within four years of joining the Board. In the event the annual retainer fee is increased, Directors will have four years to meet the incremental ownership requirement.

As of the Record Date, all of the Company’s non-employee Directors either own sufficient shares to meet the stock ownership guideline or are on target to meet the minimum stock ownership guideline within the prescribed time frame.

Compensation for Non-employee Directors

For their service to the Company, non-employee Directors are entitled to an annual retainer fee (the “Annual Retainer”), attendance fees for committee meetings and certain Board meetings, and a payment for service as a chairman of the Board or of certain committees (other than the Annual Retainer, “Other Director Fees”). Additionally, non-employee Directors who serve as a director of any of the Company’s subsidiaries are entitled to compensation for such service. Directors who are employees of the Company receive no additional compensation for their service on the Board.

Annual Retainer. In 2021, the Company paid an Annual Retainer to non-employee Directors of $115,000. As explained further below, this amount may be paid in cash or in shares of the Company’s Common Stock.

Board Meeting Attendance Fees. The Company does not pay an attendance fee for meetings of the Board; however, in the event the Company holds more than six Board meetings in one year, non-employee Directors will receive per meeting fees of $2,000 for in-person attendance, or $1,500 for telephonic attendance, for each such additional Board meeting the Director attends.

Committee Meeting Attendance Fees. In order to properly reward non-employee Directors who sit on committees for their efforts and contributions, non-employee Directors receive an attendance fee for service on a committee of the Board. Non-employee Directors receive $1,700 per committee meeting attended, except for Audit Committee members, who receive a $2,000 per meeting attendance fee.

Chairmanships. In 2021, each of the Chair of the Audit Committee, the Chair of the Compensation Committee, the Chair of the Finance Committee, the Chair of the IT/IS Committee, the Chair of the Nominating Committee, and the Chair of the Risk Management Committee were entitled to an additional annual fee of $25,000. In 2021, the Company paid the Chairman of the Board an additional annual fee of $60,000.

Subsidiary Directorships. Non-employee Directors who serve on the boards of directors of our subsidiaries are entitled to compensation for such service. No independent member of the Company’s Board serves on more than one subsidiary board other than Ms. Glabe, Dr. McKinney, and Mr. Heitmann.

Directors Deferred Fee and Stock Plan

The 2005 Directors Deferred Fee and Stock Plan (“Director Plan”) is a program that allows non-employee Directors to receive their Director fees in either cash or Common Stock. Under the Director Plan, Directors may also choose to defer the receipt of the Annual Retainer delivered in the form of Common Stock or defer the receipt of Other Director Fees in the form of cash or Common Stock.

A Director will receive all fees in cash unless he or she elects to receive such fees in shares of the Company’s Common Stock. The number of shares of Common Stock to be issued will be determined by dividing the fees earned during a calendar quarter by the fair market value (as defined in the Director Plan) of the Common Stock on the last trading day of the preceding quarter.

Under the Director Plan, a Director may elect to defer receipt of shares of Common Stock received as an Annual Retainer or as Other Director Fees. If a Director elects to defer his or her receipt of fees paid in Common Stock, the Company will maintain on its books deferred stock units (“Units”) representing an obligation to issue shares of Common Stock to the Director. The number of Units credited will be equal to the number of shares that would have been issued but for the deferral election. Additional Units will be credited at the time dividends are paid on the Common Stock. The number of additional Units to be credited each quarter will be computed by dividing the amount of the dividends that would have been received if the Units were outstanding shares by the fair market value of the Common Stock on the last trading day of the preceding quarter. Because Units represent a right to receive Common Stock in the future, and not actual shares, there are no voting rights associated with them. In the event of an adjustment in the Company’s capitalization or a merger or other transaction that results in a conversion of the Common Stock, corresponding adjustments will be made to the Units. The Director will be a general unsecured creditor of the Company for purposes of the Common Stock to be paid in the future. The shares of Common Stock represented by the Units will be issued to the Director in accordance with the deferral election of the Director.

The Director Plan also permits deferral of Other Director Fees in cash. If a Director elects to defer receipt of Other Director Fees in cash, the Company will maintain on its books a deferred compensation account representing an obligation to pay the Director cash in the future. The amount of the Director’s fees will be credited to a Director’s deferred compensation account as of the date such fees otherwise would be payable to the Director. All amounts in such account will accrue interest based on the 91-day Treasury Bill discount rate, adjusted quarterly, until paid. Accrued interest will be credited at the end of the quarter. No funds will actually be set aside for payment to the Director and the Director will be a general unsecured creditor of the Company for the purposes of the amount in his or her deferred compensation account. The amount in the deferred compensation account will be paid to the Director in accordance with the deferral election of the Director.

All deferrals under the Director Plan will be deferred until the 15th of January following the retirement of such Director from the Board and each of its subsidiaries, or, at the election of the Director at the time of deferral, until the first, second, third, fourth or fifth anniversary of such retirement.

2021 Director Compensation Table

The table below summarizes the compensation paid by the Company to non-employee Directors for the fiscal year ended December 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

(a)

Name | (b) Fees Earned or Paid in Cash ($)(1) | (c)

Stock Awards

($) | (d)

Option Awards

($) | (e)

Change in Pension Value and Nonqualified Deferred Compensation Earnings

($) | (f) All Other Compensation ($)(2) | (g)

Total

($) |

| Peter D. Crist | 165,500 | — | — | — | 80,054 | 245,554 |

| Bruce K. Crowther | 162,100 | — | — | — | 49,285 | 211,385 |

| William J. Doyle | 140,500 | — | — | — | 11,052 | 151,552 |

| Marla F. Glabe | 138,600 | — | — | — | 16,479 | 155,079 |

| H. Patrick Hackett, Jr. | 200,500 | — | — | — | 3,611 | 204,111 |

| Scott K. Heitmann | 163,600 | — | — | — | 40,028 | 203,628 |

| Deborah L. Hall Leferve | 146,800 | — | — | — | 6,946 | 153,746 |

Suzet M. McKinney(3) | 74,483 | — | — | — | 6,000 | 80,483 |

Christopher J. Perry(4) | 66,833 | — | — | — | 36,576 | 103,409 |

Ingrid S. Stafford(4) | 60,717 | — | — | — | 35,475 | 96,192 |

| Gary D. “Joe” Sweeney | 142,000 | — | — | — | 12,300 | 154,300 |

| Karin Gustafson Teglia | 163,600 | — | — | — | 18,628 | 182,228 |

| Alex E. Washington, III | 151,683 | — | — | — | 19,841 | 171,524 |

(1)Represents fees for services as non-employee Directors of the Company. During 2021, certain Directors elected to receive fees in Common Stock, in lieu of cash payments, as follows:

| | | | | |

| Name | Fees Earned in Common Stock ($) |

| Peter D. Crist | 165,500 |

| Bruce K. Crowther | 162,100 |

| William J. Doyle | 140,500 |

| Marla F. Glabe | 138,600 |

| Scott K. Heitmann | 56,000 |

| Deborah L. Hall Lefevre | 146,800 |

Christopher J. Perry(4) | 66,833 |

Ingrid S. Stafford(4) | 6,229 |

| Karin Gustafson Teglia | 163,600 |

| Alex E. Washington, III | 151,683 |

As of December 31, 2021, Directors held unissued Units under the Director Plan as follows: Mr. Crist: 60,588 Units; Mr. Crowther: 41,313 Units; Mr. Doyle: 10,169 Units; Ms. Glabe: 2,145 Units; Mr. Hackett: 2,942 Units; Mr. Heitmann: 12,545 Units; Ms. Lefevre: 6,874 Units; Mr. Perry: 30,146 Units; Ms. Stafford: 12,150 Units; Ms. Teglia: 7,526 Units; and Mr. Washington: 4,946 Units.

(2)Includes fees paid in cash and stock, both currently paid and deferred, for services as directors of the Company’s subsidiaries. Also includes dividends earned on fees deferred as described above. Directors with $10,000 or more in “All Other Compensation” for the fiscal year ended December 31, 2021 were: Mr. Crist ($72,604 in dividends earned and $7,450 in fees for service as a director of one of the Company’s subsidiaries); Mr. Crowther ($49,285 in dividends earned); Mr. Doyle ($11,052 in dividends earned); Ms. Glabe ($1,079 in dividends earned and $15,400 in fees for service as a director or member of the executive advisory committee of five of the Company’s subsidiaries or divisions); Mr. Heitmann ($14,828 in dividends earned and $25,200 in fees for service as a director of four of the Company’s subsidiaries); Mr. Perry ($36,576 in dividends earned); Ms. Stafford ($14,875 in dividends earned and $20,600 in fees for service as a director of one of the Company’s subsidiaries); Mr. Sweeney ($12,300 in fees for service as a director of one of the Company’s subsidiaries); Ms. Teglia ($7,478 in dividends earned and $11,150 in fees for service as a director of two of the Company’s subsidiaries); and Mr. Washington ($4,341 in dividends earned and $15,500 in fees for service as a director of two of the Company’s subsidiaries).

(3)Dr. McKinney joined the Board on May 27, 2021.

(4)Mr. Perry and Ms. Stafford retired from the Board on May 27, 2021. Ms. Stafford remains a member of the Board of Directors of Wintrust Bank, National Association, and was elected to the Board of Directors of Great Lakes Advisors, LLC, The Chicago Trust Company, National Association, and Wintrust Investments, LLC on July 27, 2021.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Common Stock as of the Record Date (except as otherwise indicated), with respect to (i) each Director, nominee for Director and each NEO (as defined herein) of the Company; (ii) all Directors and executive officers of the Company as a group and (iii) significant shareholders known to the Company to beneficially own in excess of 5% of the Common Stock. The table below also provides information regarding ownership of restricted stock units and deferred shares held by such persons. Unless otherwise indicated, the listed person has sole voting and dispositive power.

| | | | | | | | | | | | | | | | | | | | |

| Amount of Common Stock Beneficially Owned(1) | Total Percentage Beneficial Ownership(1) | Other Ownership |

Restricted Stock Units(2) | Deferred Shares(3) | Total Ownership(4) | Total Percentage Ownership(4) |

| Directors | | | | | | |

| Elizabeth H. Connelly | — | * | — | — | — | * |

| Peter D. Crist | — | * | — | 61,349 | 61,349 | * |

| Bruce K. Crowther | 644 | * | — | 41,922 | 42,566 | * |

| William J. Doyle | 131 | * | — | 10,649 | 10,780 | * |

| Marla F. Glabe | 15,256 | * | — | 509 | 15,765 | * |

| H. Patrick Hackett, Jr. | 32,084 | * | — | 2,953 | 35,037 | * |

| Scott K. Heitmann | 9,827 | * | — | 12,774 | 22,601 | * |

| Deborah L. Hall Lefevre | — | * | — | 7,373 | 7,373 | * |

| Suzet M. McKinney | — | * | — | — | — | * |

| Gary D. “Joe” Sweeney | 7,223 | * | — | — | 7,223 | * |

| Karin Gustafson Teglia | 2,634 | * | — | 8,116 | 10,750 | * |

| Alex E. Washington, III | 4,617 | * | — | 5,509 | 10,126 | * |

| Edward J. Wehmer** | 102,098 | * | 84,257 | 35,285 | 221,640 | * |

| Named Executive Officers | | | | | | |

| David A. Dykstra | 150,728 | * | 48,105 | — | 198,833 | * |

| Richard B. Murphy | 33,707 | * | 6,490 | — | 40,197 | * |

| Timothy S. Crane | 22,442 | * | 5,908 | — | 28,350 | * |

| David L. Stoehr | 8,753 | * | 4,728 | — | 13,481 | * |

| Total Existing Directors & Executive Officers (20 persons) | 462,867 | * | 159,733 | 186,439 | 809,039 | * |

| Significant Shareholders | | | | | | |

BlackRock, Inc.(5) | 5,596,411 | 9.8% | — | — | 5,596,411 | 9.8% |

The Vanguard Group, Inc.(6) | 5,299,642 | 9.3% | — | — | 5,299,642 | 9.3% |

FMR, LLC(7) | 3,980,470 | 6.982% | — | — | 3,980,470 | 6.982% |

* Less than 1%.

** Mr. Wehmer is also a named executive officer.

(1)Beneficial ownership and percentages are calculated in accordance with SEC Rule 13d-3 promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”) as of the Record Date. Totals include options & warrants exercisable within 60 days of the Record Date, including as follows: Mr. Murphy: 3,778.

(2)Includes vested and unvested restricted stock units representing shares that are not issuable within 60 days of the Record Date. Does not include unvested performance-based restricted stock units. The executive officers do not

have voting power with respect to the shares listed in this column.

(3)Includes deferred Units held in our Director Plan. For Mr. Wehmer, includes deferred performance-based restricted stock units that have vested. For Ms. Glabe, includes 509 shares of Common Stock, respectively, issuable pursuant to Ms. Glabe’s election to receive earned Director fees in the form of Common Stock. None of the shares in this column are issuable within 60 days of the Record Date. Neither the directors nor the executive officers have voting power with respect to the shares listed in this column.

(4)Total includes beneficial ownership of Common Stock as of the Record Date, plus the restricted stock units and deferred shares as indicated in the table.

(5)Based solely on information obtained from a Schedule 13G/A filed by BlackRock, Inc. (“BlackRock”) with the SEC on February 1, 2022 reporting beneficial ownership as of December 31, 2021. According to this report, BlackRock’s business address is 55 East 52nd Street, New York, New York 10055. BlackRock has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. BlackRock has sole voting power with respect to 5,249,017 of these shares and sole dispositive power with respect to 5,596,411 of these shares.

(6)Based solely on information obtained from a Schedule 13G/A filed by The Vanguard Group, Inc. (“Vanguard”) with the SEC on February 10, 2022 reporting beneficial ownership as of December 31, 2021. According to this report, Vanguard’s business address is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. Vanguard has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. Vanguard has shared voting power with respect to 30,168 of these shares, sole dispositive power with respect to 5,220,349 shares and shared dispositive power with respect to 79,293 of these shares.

(7)Based solely on information obtained from a Schedule 13G/A filed by FMR LLC (“FMR”) and Abigail P. Johnson with the SEC on February 9, 2022 reporting beneficial ownership as of December 31, 2021. Ms. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC. According to this report, FMR’s business address is 245 Summer Street, Boston, Massachusetts 02210. FMR has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. FMR has sole voting power with respect to 103,567 of these shares and sole dispositive power with respect to 3,980,470 of these shares. Ms. Johnson has indicated that she also has sole dispositive power with respect to these 3,980,470 shares.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Exchange Act requires the Company’s Directors and executive officers and any person who beneficially owns greater than 10% of the Common Stock to file reports of holdings and transactions in the Common Stock with the SEC.

Based solely on a review of the Section 16(a) reports furnished to use with respect to 2021 and written representations from our Directors and executive officers, we believe that all Section 16(a) filing requirements applicable to each covered person were satisfied during 2021 and during the subsequent period through the date of this Proxy Statement, except that the Company determined that (a) 120 shares of Common Stock withheld on October 24, 2019 to satisfy a tax liability of Mr. Crane incident to his receipt of previously restricted shares of Common Stock inadvertently were not reported when withheld, subsequently corrected on a Form 4 filed with the SEC on February 15, 2022; (b) 3,590 shares of Common Stock sold by Mr. Stoehr on June 8, 2021 inadvertently were not reported when sold, subsequently corrected on a Form 4 filed with the SEC on July 16, 2021; and (c) 2,174 shares of Common Stock sold by Mr. Murphy on October 25, 2021 inadvertently were not reported when sold, subsequently corrected on a Form 4 filed with the SEC on October 28, 2021.

RELATED PARTY TRANSACTIONS

Director Independence

A Director is independent if the Board affirmatively determines that he or she has no material relationship with the Company other than serving as a Director of the Company and he or she otherwise satisfies the independence requirements of the Nasdaq listing standards. A Director is “independent” under the Nasdaq listing standards if the Board affirmatively determines that the Director has no material relationship with us directly or as a partner, shareholder or officer of an organization that has a relationship with us. Direct or indirect ownership of even a significant amount of our stock by a Director who is otherwise independent will not, by itself, bar an independence finding as to such Director.

The Board has reviewed the independence of our current Directors and nominees and found that each of them are independent under the applicable Nasdaq listing standards, except Edward J. Wehmer, who serves as our Founder and CEO. Accordingly, more than 92% of the members of the Board are independent, including the Chairman of the Board.

Related Party Transactions

We or one of our subsidiaries may occasionally enter into transactions with certain “related persons.” Related persons include our executive officers, directors, 5% or more beneficial owners of our Common Stock, immediate family members of these persons and entities in which one of these persons has a direct or indirect material interest. We refer to transactions with these related persons as “related party transactions.” The Audit Committee and the Nominating Committee are jointly responsible for the review and approval of each related party transaction exceeding $120,000. Such committees consider all relevant factors when determining whether to approve a related party transaction including, without limitation, whether the terms of the proposed transaction are at least as favorable to us as those that might be achieved with an unaffiliated third party. Among other relevant factors, the Audit Committee and the Nominating Committee consider the following:

•the size of the transaction and the amount of consideration payable to a related person;

•the nature of the interest of the applicable executive officer, Director or 5% shareholder in the transaction;

•whether the transaction may involve a conflict of interest;

•whether the transaction involves the provision of goods or services to us that are available from unaffiliated third parties; and

•whether the proposed transaction is on terms and made under circumstances that are at least as favorable to us as would be available in comparable transactions with or involving unaffiliated third parties.

Some of the executive officers and Directors of the Company are, and have been during the preceding year, customers of the Company’s banking subsidiaries (the “Banks”), and some of the officers and Directors of the Company are direct or indirect owners of 10% or more of the stock of corporations which are, or have been in the past, customers of the Banks. Extensions of credit by the Company and its banking subsidiaries to “insiders” of the Company and its subsidiaries are also regulated by Regulation O adopted under the Federal Reserve Act and the Federal Deposit Insurance Corporation Improvement Act. It is the Company’s policy that any transactions with persons whom Regulation O defines as “insiders” (i.e., executive officers, Directors, principal shareholders and their related interests) be engaged in the same manner as transactions conducted with all members of the public. As such customers, they have had transactions in the ordinary course of business of the Banks, including borrowings, all of which transactions are or were on substantially the same terms (including interest rates and collateral on loans) as those prevailing at the time for comparable transactions with nonaffiliated persons. In the opinion of management of the Company, none of the transactions involved more than the normal risk of collectability or presented any other unfavorable features. Additionally, in certain cases, a family member of an executive officer or Director of the Company serves as a director of a Bank or is employed in a non-executive role by the Company or an affiliate of the Company on terms that are consistent with their peers and at market compensation levels that are commensurate with their roles. In no case does an immediate family member directly report to a related executive officer or Director. Other than as described above, since January 1, 2021, no transaction was identified as a related party transaction.

CORPORATE SOCIAL RESPONSIBILITY

We know that many of our shareholders expect that we conduct our business in a socially responsible manner through our actions and interactions with our clients, colleagues and within the communities that we serve. Since the Company was founded, we have worked to integrate corporate social responsibility into all of the Company’s activities, and the Board carefully considers corporate social responsibility when it works with management to determine the Company’s strategic priorities and plans to achieve such priorities. We strive to be a good corporate citizen by conducting our business in an environmentally responsible manner, by operating as an employer that is committed to our vibrant and diverse workforce and, through our fifteen chartered community banks, by maintaining strong ties to the communities in which our clients live, work and do business. Although not an exhaustive list, examples of the Company’s activities that reflect our strong commitment to corporate social responsibility include:

Community Service and Partnership

•We collaborate with a wide range of nonprofits and community organizations to strengthen low-to-moderate income neighborhoods through our community outreach programs.

•We provided financial support of approximately $10.2 million to approximately 1,500 nonprofit organizations in 2021, as well as significant in-kind marketing contributions of approximately $1.25 million in value.

•We provide financial education throughout the communities that are served by Wintrust community banks. Our 2021 financial education involved approximately 850 sessions, 10,500 workshop attendees, and 1,500 teaching hours.

•We currently maintain an “Outstanding” rating under the Community Reinvestment Act at fourteen of fifteen of our community bank charters.

Environmental Sustainability

At Wintrust we strive to minimize our environmental impact. Although as a financial services company our energy and water use is relatively small, we nevertheless take pride in promoting natural resource conservation through recycling and water and energy conservation. In our efforts to promote greater environmental responsibility and operate at an increased level of resource efficiency we:

•Endeavor to reduce water consumption at our local bank branches and corporate headquarters, in most cases using low-volume flush valves and motion-activated faucets that help us reduce our water use.

•Enhance air quality in all of our buildings combining improved Minimum Efficiency Reporting Value (MERV) ratings in our air filters and bipolar ionization technology to deliver clean air to our spaces for our customers and employees.

•Construct and remodel our buildings utilizing environmental best practices wherever possible. All new construction of our buildings have LED lighting and high efficiency HVAC systems. Our strategy is to meet and in many cases exceed the guidelines for LEED (Leadership in Energy and Environmental Design) and ENERGY STAR certification, and several of our locations are LEED or ENERGY STAR certified, although we generally forego the expense of formal certification.