Exhibit 99.1

Wintrust Financial Corporation

727 North Bank Lane, Lake Forest, Illinois 60045

News Release

| | |

FOR IMMEDIATE RELEASE | | January 18, 2012 |

FOR MORE INFORMATION CONTACT:

Edward J. Wehmer, President & Chief Executive Officer

David A. Dykstra, Senior Executive Vice President & Chief Operating Officer

(847) 615-4096

Web site address: www.wintrust.com

WINTRUST FINANCIAL CORPORATION REPORTS FOURTH QUARTER 2011 NET INCOME OF $19.2

MILLION, AN INCREASE OF 35% AND RECORD FULL YEAR 2011 NET INCOME OF $77.6 MILLION

LAKE FOREST, ILLINOIS – Wintrust Financial Corporation (“Wintrust” or “the Company”) (Nasdaq WTFC) announced net income of $19.2 million or $0.41 per diluted common share for the fourth quarter of 2011 compared to net income of $14.2 million or ($0.06) per diluted common share for the fourth quarter of 2010. The Company recorded net income of $77.6 million or $1.67 per diluted common share for the full year of 2011 compared to net income of $63.3 million or $1.02 per diluted common share for the full year of 2010.

The Company’s total assets of $15.9 billion at December 31, 2011 increased $1.9 billion from December 31, 2010. Total deposits as of December 31, 2011 were $12.3 billion, an increase of $1.5 billion from December 31, 2010. Noninterest bearing deposits increased by $584 million or 49% since December 31, 2010, while NOW, wealth management, money market and savings deposits increased $914 million or 19% during the same time period. Total time certificates of deposit remained essentially unchanged at December 31, 2011 compared to December 31, 2010. Total loans, including loans held for sale but excluding covered loans, were $10.8 billion as of December 31, 2011, an increase of $871 million over December 31, 2010.

Edward J. Wehmer, President and Chief Executive Officer, commented, “Our reported fourth quarter net income of $19.2 million caps a record year of earnings for the Company. Full year net income for 2011 of $77.6 million represents our highest reported net income in the history of Wintrust. The fourth quarter of 2011 was highlighted by solid loan growth, an increase in net interest margin and net interest income, growth of pre-tax adjusted earnings, continued improvement in credit quality, and continued favorable shifting in the mix of the deposit funding base.

Total loans outstanding at December 31, 2011, excluding covered loans but including loans held for sale, increased $356 million from September 30, 2011. This growth was primarily comprised of $210 million of commercial and commercial real-estate and $107 million of mortgage loans held for sale. Funding of this loan

growth was provided by using existing liquidity at each of our banking affiliates as total deposits outstanding remained the same as September 30, 2011. While our overall level of deposits remained the same as the prior quarter, our mix of deposits improved due to both a more desirable mix of deposits from our core customers and to the replacement of approximately $70 million of matured certificates of deposits related to FDIC-assisted acquired banks with non-maturity deposit products. In the fourth quarter, the $371 million growth in non-maturity core deposits slightly more than offset the $370 million decline in certificates of deposits during the period. This movement has helped improve the Company’s deposit mix as certificates of deposit at December 31, 2011 make up only 40% of total deposits, down from 45% at December 31, 2010. Additionally, non-interest bearing demand deposits now comprise 15% of total deposits, up from 11% at December 31, 2010.

As a result of the solid loan growth and improved net interest margin, net interest income increased in the fourth quarter by $6 million over the third quarter of 2011. The Company’s net interest margin improved to 3.45% for the fourth quarter of 2011, compared to 3.37% in the previous quarter. Net interest income and net interest margin for the full year of 2011 were $461 million and 3.42%, respectively, compared to $416 million and 3.37% for the full year of 2010. The growth in net interest income in the fourth quarter of 2011 contributed to continued improvement in pre-tax adjusted earnings, one of our main internal measurements of profitability.”

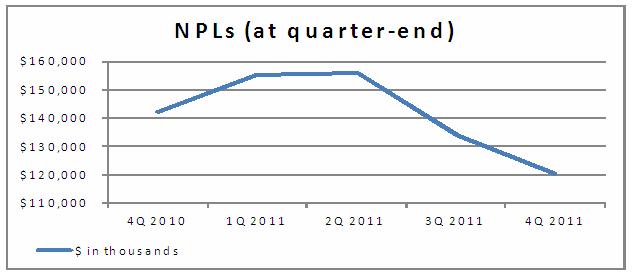

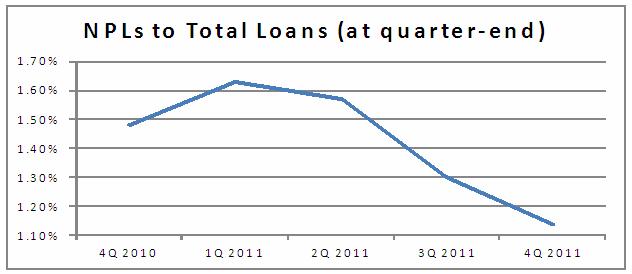

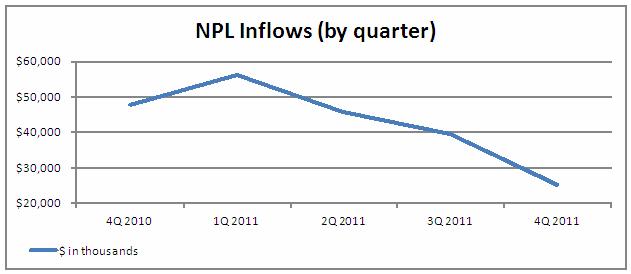

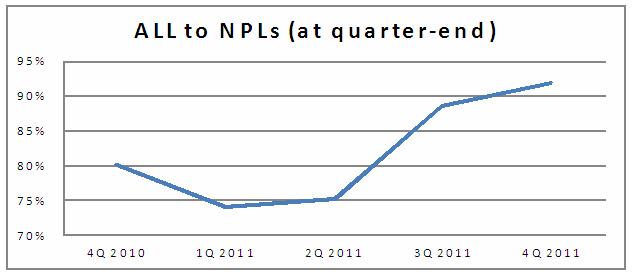

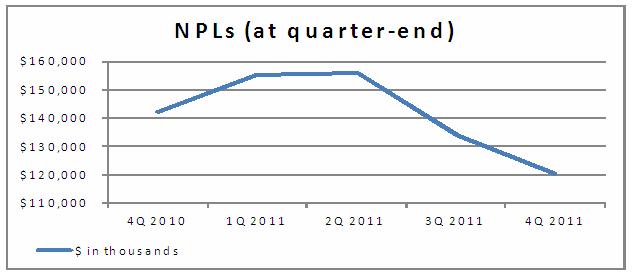

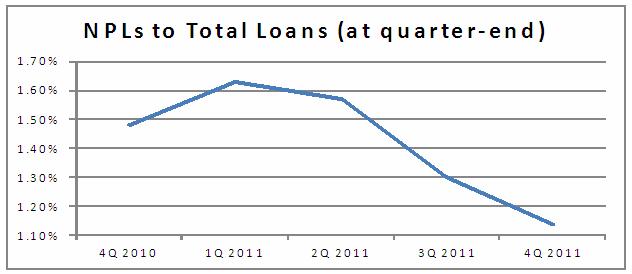

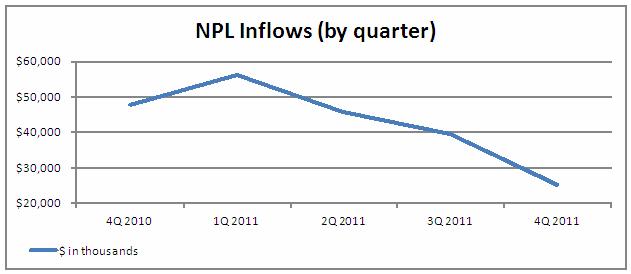

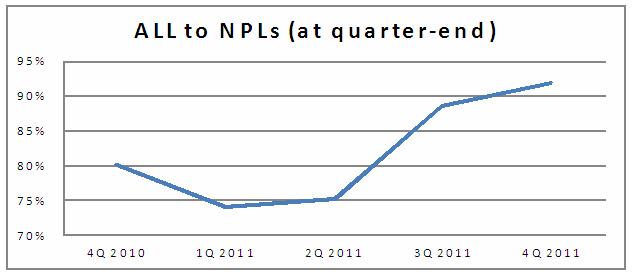

Commenting on credit quality, Mr. Wehmer noted, “The Company’s credit quality metrics improved during the quarter as non-performing loans as a percent of total loans decreased to 1.14%, the lowest level reported since the end of the fourth quarter of 2007. Total non-performing loans decreased to $120 million at December 31, 2011, down from $142 million at December 31, 2010 and down from $134 million at September 30, 2011. Non-performing loan inflows during the fourth quarter of 2011 declined to $25 million, the lowest amount in the past eight quarters, down from $48 million in the fourth quarter of 2010 and $40 million in the third quarter of 2011. Total allowance for loan losses as a percentage of non-performing loans rose to 92% at December 31, 2011, the highest level since September 30, 2007.

Total non-performing assets, which includes other real estate owned, declined to $207 million, down from $213 million at December 31, 2010 and $231 million at September 30, 2011. During the fourth quarter of 2011, excluding the provision for covered loan losses, the Company recorded a provision for loan losses of $17 million, net charge-offs of $25 million and other real-estate owned operating charges of $9 million.”

2

Turning to 2012, Mr. Wehmer noted, “We expect loan growth to continue in 2012 which should allow the Company to expand the franchise organically as our loan pipelines remain strong. This should allow us to return to an asset-driven business model similar to our pre ‘Rope-A-Dope’ days prior to 2006. We also expect 2012 to be a very active year industry-wide for acquisition opportunities for both FDIC-assisted and unassisted banks as well as individual branches and lines of business.”

In closing, Mr. Wehmer added, “We have ended 2011 well positioned to take advantage of these growth opportunities. We will continue to be disciplined in our approach to growth. Given proper execution of our objectives, Wintrust can be the financial institution of choice to allow any customer, as we say, to ‘HAVE IT ALL’.”

3

The graphs below depict changes in the level of non-performing loans, excluding covered loans, over the last five quarters. The following metrics, for the last five quarters, are diagrammed below: total non-performing loans, non-performing loans as a percent of total loans, non-performing loan inflows and allowance for loan losses as a percent of total non-performing loans.

4

5

Wintrust’s key operating measures and growth rates for the fourth quarter of 2011, as compared to the sequential and linked quarters are shown in the table below:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % or (4)

basis point (bp)

change

from

3rd Quarter

2011 | | | % or

basis point (bp)

change

from

4th Quarter

2010 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Three Months Ended | | | |

| | | December 31,

2011 | | | September 30,

2011 | | | December 31,

2010 | | | |

Net income | | $ | 19,221 | | | $ | 30,202 | | | $ | 14,205 | | | | (36 | )% | | | 35 | % |

Net income per common share – diluted | | $ | 0.41 | | | $ | 0.65 | | | $ | (0.06 | ) | | | (37 | )% | | | 783 | % |

| | | | | |

Pre-tax adjusted earnings(2) | | $ | 61,341 | | | $ | 60,936 | | | $ | 57,675 | | | | 1 | % | | | 6 | % |

Net revenue(1) | | $ | 169,559 | | | $ | 185,657 | | | $ | 157,138 | | | | (9 | )% | | | 8 | % |

Net interest income | | $ | 124,647 | | | $ | 118,410 | | | $ | 112,677 | | | | 5 | % | | | 11 | % |

| | | | | |

Net interest margin (2) | | | 3.45 | % | | | 3.37 | % | | | 3.46 | % | | | 8 | bp | | | (1 | )bp |

Net overhead ratio (3) | | | 1.83 | % | | | 1.00 | % | | | 1.73 | % | | | 83 | bp | | | 10 | bp |

Return on average assets | | | 0.48 | % | | | 0.77 | % | | | 0.40 | % | | | (29 | )bp | | | 8 | bp |

Return on average common equity | | | 4.87 | % | | | 7.94 | % | | | (0.66 | )% | | | (307 | )bp | | | 553 | bp |

| | | | | |

At end of period | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 15,893,808 | | | $ | 15,914,804 | | | $ | 13,980,156 | | | | (1 | )% | | | 14 | % |

Total loans, excluding loans held-for-sale, excluding covered loans | | $ | 10,521,377 | | | $ | 10,272,711 | | | $ | 9,599,886 | | | | 10 | % | | | 10 | % |

Total loans, including loans held-for-sale, excluding covered loans | | $ | 10,841,901 | | | $ | 10,485,747 | | | $ | 9,971,333 | | | | 14 | % | | | 9 | % |

Total deposits | | $ | 12,307,267 | | | $ | 12,306,008 | | | $ | 10,803,673 | | | | — | % | | | 14 | % |

Total shareholders’ equity | | $ | 1,543,533 | | | $ | 1,528,187 | | | $ | 1,436,549 | | | | 4 | % | | | 7 | % |

| (1) | Net revenue is net interest income plus non-interest income. |

| (2) | See “Supplemental Financial Measures/Ratios” for additional information on this performance measure/ratio. |

| (3) | The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency. |

| (4) | Period-end balance sheet percentage changes are annualized. |

Certain returns, yields, performance ratios, or quarterly growth rates are “annualized” in this presentation to represent an annual time period. This is done for analytical purposes to better discern for decision-making purposes underlying performance trends when compared to full-year or year-over-year amounts. For example, a 5% growth rate for a quarter would represent an annualized 20% growth rate. Additional supplemental financial information showing quarterly trends can be found on the Company’s web site atwww.wintrust.com by choosing “Financial Reports” under the “Investor Relations” heading, and then choosing “Supplemental Financial Info.”

6

Items Impacting Comparative Financial Results: Acquisitions and Capital

Acquisitions

On September 30, 2011, the Company completed its acquisition of Elgin State Bancorp, Inc. (“ESBI”). ESBI was the parent company of Elgin State Bank, which operated three banking locations in Elgin, Illinois. As part of the transaction, Elgin State Bank merged into the Company’s wholly-owned subsidiary bank, St. Charles Bank & Trust Company (“St. Charles”), and the three acquired banking locations are operating as branches of St. Charles under the brand name Elgin State Bank. Elgin State Bank had approximately $262 million in assets and $240 million in deposits as of the acquisition date, prior to purchase accounting adjustments. The Company recorded goodwill of $5.0 million on the acquisition.

On July 8, 2011, the Company announced that its wholly-owned subsidiary bank, Northbrook Bank & Trust Company (“Northbrook”), acquired certain assets and liabilities and the banking operations of First Chicago Bank & Trust (“First Chicago”) in an FDIC-assisted transaction. First Chicago operated seven locations in Illinois: three in Chicago and one each in Bloomingdale, Itasca, Norridge and Park Ridge.

On July 1, 2011, the Company completed its acquisition of Great Lakes Advisors, Inc. (“Great Lakes Advisors”), a Chicago-based investment manager with approximately $2.4 billion in assets under management. The Company recorded goodwill of $15.7 million on the acquisition. Great Lakes Advisors merged with Wintrust’s existing asset management business, Wintrust Capital Management, LLC and operates as “Great Lakes Advisors, LLC, a Wintrust Wealth Management Company”. Wintrust Wealth Management, which includes Great Lakes Advisors, Wayne Hummer Investments and the Chicago Trust Company, has $13.8 billion assets under administration at December 31, 2011.

On April 13, 2011, the Company announced the acquisition of certain assets and the assumption of certain liabilities of the mortgage banking business of River City Mortgage, LLC (“River City”) of Bloomington, Minnesota. With offices in Minnesota, Nebraska and North Dakota, River City originated nearly $500 million in mortgage loans in 2010.

On March 25, 2011, the Company announced that its wholly-owned subsidiary bank, Advantage National Bank Group (“Advantage”) acquired certain assets and liabilities and the banking operations of The Bank of Commerce (“TBOC”) in an FDIC-assisted transaction. TBOC operated one location in Wood Dale, Illinois. Advantage subsequently changed its name to Schaumburg Bank and Trust Company, N.A. (“Schaumburg”).

7

On February 4, 2011, the Company announced that its wholly-owned subsidiary bank, Northbrook, acquired certain assets and liabilities and the banking operations of Community First Bank-Chicago (“CFBC”) in an FDIC-assisted transaction. CFBC operated one location in Chicago, Illinois.

On February 3, 2011, the Company announced the acquisition of certain assets and the assumption of certain liabilities of the mortgage banking business of Woodfield Planning Corporation (“Woodfield”) of Rolling Meadows, Illinois. With offices in Rolling Meadows, Illinois and Crystal Lake, Illinois, Woodfield originated approximately $180 million in mortgage loans in 2010.

On August 17, 2010, the Company announced that its wholly-owned subsidiary bank, Wheaton Bank & Trust Company (“Wheaton”) signed a Branch Purchase and Assumption Agreement whereby it agreed to acquire a branch of an unaffiliated bank located in Naperville, Illinois. The transaction closed on October 22, 2010 and the acquired operations are operating as Naperville Bank & Trust. Through this transaction, Wheaton acquired approximately $23 million of deposits, approximately $11 million of performing loans, the property, bank facility and various other assets.

On August 6, 2010, the Company announced that its wholly-owned subsidiary bank, Northbrook, in an FDIC-assisted transaction, had acquired certain assets and liabilities and the banking operations of Ravenswood Bank (“Ravenswood”). Ravenswood operated one location in Chicago, Illinois and one in Mount Prospect, Illinois.

On April 23, 2010, the Company announced that Northbrook and Wheaton, in two FDIC-assisted transactions, had acquired certain assets and liabilities and the banking operations of Lincoln Park Savings Bank (“Lincoln Park”) and Wheatland Bank (“Wheatland”), respectively. Lincoln Park operated four locations in Chicago, Illinois. Wheatland had one location in Naperville, Illinois.

Summary of FDIC-assisted Transactions

| | • | | Northbrook assumed approximately $887 million of the outstanding deposits and approximately $959 million of assets of First Chicago on July 8, 2011, prior to purchase accounting adjustments. A bargain purchase gain of $27.4 million was recognized on this transaction. |

| | • | | Schaumburg assumed approximately $161 million of the outstanding deposits and approximately $163 million of assets of TBOC on March 25, 2011, prior to purchase accounting adjustments. A bargain purchase gain of $8.6 million was recognized on this transaction. |

8

| | • | | Northbrook assumed approximately $50 million of the outstanding deposits and approximately $51 million of assets of CFBC on February 4, 2011, prior to purchase accounting adjustments. A bargain purchase gain of $2.0 million was recognized on this transaction. |

| | • | | Northbrook assumed approximately $120 million of the outstanding deposits and approximately $188 million of assets of Ravenswood on August 6, 2010, prior to purchase accounting adjustments. A bargain purchase gain of $6.8 million was recognized on this transaction. |

| | • | | Northbrook assumed approximately $160 million of the outstanding deposits and approximately $170 million of assets of Lincoln Park on April 23, 2010, prior to purchase accounting adjustments. A bargain purchase gain of $4.2 million was recognized on this transaction. |

| | • | | Wheaton assumed approximately $400 million of the outstanding deposits and approximately $370 million of assets of Wheatland on April 23, 2010, prior to purchase accounting adjustments. A bargain purchase gain of $22.3 million was recognized on this transaction. |

Loans comprise the majority of the assets acquired in the FDIC-assisted transactions and are subject to loss sharing agreements with the FDIC where the FDIC has agreed to reimburse the Company for 80% of losses incurred on the purchased loans. Additionally, the loss share agreements with the FDIC require the Company to reimburse the FDIC in the event that actual losses on covered assets are lower than the original loss estimates agreed upon with the FDIC with respect to such assets in the loss share agreements. We refer to the loans subject to these loss-sharing agreements as “covered loans.” We use the term “covered assets” to refer to the total of covered loans, covered OREO and certain other covered assets. The agreements with the FDIC require that the Company follow certain servicing procedures or risk losing FDIC reimbursement of losses related to covered assets.

Capital Ratios

As of December 31, 2011, the Company’s estimated capital ratios were 13.2% for total risk-based capital, 12.0% for tier 1 risk-based capital and 9.4% for leverage, well above the well capitalized guidelines. Additionally, the Company’s tangible common equity ratio was 7.5% at December 31, 2011.

9

Financial Performance Overview – Fourth quarter of 2011

For the fourth quarter of 2011, net interest income totaled $124.6 million, an increase of $12.0 million as compared to the fourth quarter of 2010 and $6.2 million as compared to the third quarter of 2011. The increases in net interest income on both a linked and sequential quarter basis are the result of balance sheet growth:

| | • | | Average earning assets for the fourth quarter of 2011 increased by $1.4 billion compared to the fourth quarter of 2010. Average earning asset growth over the past 12 months was primarily a result of the $885.1 million increase in average loans, $314.5 million of average covered loan growth from the FDIC-assisted bank acquisitions and a $206.7 million increase in average liquidity management and other earning assets. The $885.1 million increase in average loans was, in turn, comprised of a $408.6 million increase in commercial and industrial loans, a $211.1 million increase in life insurance premium finance loans, a $210.6 million increase in commercial insurance premium finance loans, a $163.5 million increase in commercial real estate loans, and an increase in mortgage warehouse lending of $10.6 million, partially offset by a decrease in mortgages held for sale of $95.3 million and a net decrease in all other loans of $24.0 million. The decrease in all other loans was primarily related to home equity loans. The shift in growth over the past 12 months toward commercial and industrial loans is a reflection of the commercial initiatives the Company has implemented. The average earning asset growth of $1.4 billion over the past 12 months was primarily funded by a $723.9 million increase in the average balances of interest-bearing deposits, an increase in the average balance of net free funds of $413.9 million and an increase in wholesale funding of $268.4 million. |

| | • | | Average earning assets for the fourth quarter of 2011 increased by $402.3 million compared to the third quarter of 2011. Average earning asset growth over the past three months was primarily the result of a $434.0 million increase in average loans and covered loans partially offset by $31.7 million decrease in average liquidity management and other earning assets. Liquidity management assets include available-for-sale securities, interest earning deposits with banks, federal funds sold and securities purchased under resale agreements. Growth in average loans was due to a $163.0 million increase in commercial and industrial loans as a result of the Company’s commercial banking initiative and the Elgin State Bank acquisition. Additionally, increases totaling $228.3 million in mortgages held for sale and mortgage warehouse lending as residential originations increased slightly from prior quarters in the fourth quarter of 2011 as a result of lower mortgage interest rates. The average earning asset growth of $402.3 million over the past three months was primarily funded by an increase in the average balance of net free funds of $288.5 million and a $120.2 million increase in deposits. |

10

The net interest margin for the fourth quarter of 2011 was 3.45% compared to 3.46% in the fourth quarter of 2010 and 3.37% in the third quarter of 2011. The changes in net interest margin on both a linked and sequential quarter basis are the result of:

| | • | | The one basis point decrease in the fourth quarter of 2011 compared to the fourth quarter of 2010 was primarily attributable to the negative impact of both competitive and economic pricing pressures on the commercial and industrial and commercial premium finance portfolios during 2011 and a decrease in accretable discount recognized as interest income on the purchased life insurance premium portfolio as prepayments declined. Offsetting the lower yield on loans was a 38 basis point decline in the cost of interest-bearing deposits over the last 12 months and an increase in yield on the covered loan portfolio. |

| | • | | The eight basis point increase in net interest margin in the fourth quarter of 2011 compared to the third quarter of 2011 resulted from positive repricing of retail interest-bearing deposits, the decline in interest expense due to our new interest rate swap agreements on certain trust preferred debentures and higher yields on our covered loan portfolio that more than offset the very low yield on excess liquidity and the lower yield on the non-covered loan portfolio. Pricing pressures both competitive and economic, have negatively impacted the yield on total loans over the past four quarters. |

Non-interest income totaled $44.9 million in the fourth quarter of 2011, increasing $451,000, or 1%, compared to the fourth quarter of 2010 and decreasing $22.3 million, or 33%, compared to the third quarter of 2011. The increase in the fourth quarter of 2011 compared to the fourth quarter of 2010 was primarily attributable to higher wealth management revenues and fees from covered call options, partially offset by decreases in mortgage banking revenue. The decrease in the fourth quarter of 2011 compared to the third quarter of 2011 is primarily attributable to the bargain purchase gains recorded during the third quarter of 2011 as a result of the First Chicago FDIC-assisted transaction. Mortgage banking revenue decreased $4.7 million when compared to the fourth quarter of 2010 and increased $3.6 million when compared to the third quarter of 2011. The decrease in the current quarter as compared to the fourth quarter of 2010 resulted primarily from a decrease in gains on sales of loans, which was driven by lower origination volumes in the current quarter. Mortgage banking revenue in the past two quarters has been restrained by negative mortgage servicing rights valuation adjustments totaling $1.0 million in the fourth quarter of 2011 and $2.6 million in the third quarter of 2011. Loans sold to the secondary market were $883.0 million in the fourth quarter of 2011 compared to $1.3 billion in the fourth quarter of 2010 and $642 million in the third quarter of 2011 (see “Non-Interest Income” section later in this document for further detail).

11

Non-interest expense totaled $118.8 million in the fourth quarter of 2011, increasing $12.6 million, or 12%, compared to the fourth quarter of 2010 and increasing $12.4 million compared to the third quarter of 2011. The increase compared to the fourth quarter of 2010 was primarily attributable to a $7.7 million increase in salaries and employee benefits. The increase in salaries and employee benefits was attributable to a $4.8 million increase in salaries caused by the addition of employees from the various acquisitions and larger staffing as the Company grows, a $1.2 million increase in bonus and commissions primarily attributable to the Company’s long-term incentive program approved by the Compensation Committee of the Board of Directors in August 2011 and a $1.7 million increase from employee benefits (primarily health plan and payroll taxes related).

Financial Performance Overview – Full Year 2011

The net interest margin for 2011 was 3.42%, compared to 3.37% in 2010. Average earning assets for 2011 increased by $1.1 billion compared to 2010. This average earning asset growth was primarily a result of the $671.9 million increase in average loans, $288.3 million of average covered loan growth from the FDIC-assisted bank acquisitions and a $169.7 million increase in liquidity management and other earning assets. Growth in the commercial and industrial portfolio of $330.8 million, in the life insurance premium finance portfolio of $266.8 million and in the commercial insurance premium finance loan portfolio of $145.4 accounted for the majority of the total average loan growth over the past 12 months. The average earning asset growth of $1.1 billion over the past 12 months was primarily funded by a $602.6 million increase in the average balances of interest-bearing deposits and an increase in the average balance of net free funds of $354.7 million.

Non-interest income totaled $189.7 million in 2011, decreasing $2.5 million, or 1%, compared to 2010. The change was primarily attributable to lower bargain purchase gains recorded during the current period relating to the FDIC-assisted transactions than during the comparable period as well as lower net gains on available-for-sale securities in 2011, partially offset by higher wealth management revenues and fees from covered call options in the current period. The Company recognized $1.8 million of net gains on available-for-sale securities in 2011 compared to a net gain of $9.8 million in 2010. The higher net gains in 2010 were primarily related to the sale of certain collateralized mortgage obligations during that period. Additionally, trading gains of $337,000 were recognized by the Company in 2011 compared to gains of $5.2 million in 2010. Lower trading income in 2011 resulted primarily from realizing larger market value increases in the prior year on certain collateralized mortgage obligations held in

12

trading. Mortgages originated for sale totaled approximately $2.5 billion in 2011 compared to approximately $3.7 billion in 2010. Partially offsetting a $13.2 million decrease in gains on sales of loans and other fees as a result of the lower origination volumes, was a $10.5 million positive impact from lower recourse obligation adjustments as the number of indemnification requests from investors declined, as well as lower loss estimates on future indemnification requests.

Non-interest expense totaled $420.4 million in 2011, increasing $37.9 million, or 10%, compared to 2010. The increase compared to 2010 was primarily attributable to a $22.0 million increase in salaries and employee benefits. The increase in salaries and employee benefits was, in turn, attributable to a $18.2 million increase in salaries related to the addition of employees from the various acquisitions and larger staffing related to organic Company growth, and a $6.2 million increase from employee benefits (primarily related to health plans and payroll taxes), partially offset by a $2.4 million decrease in bonus and commissions attributable to variable pay based revenue. Additionally, OREO related expenses increased $7.0 million, occupancy expense increased $4.3 million as a result of rent expense on additional leased premises and depreciation on owned locations, advertising and marketing expense increased $2.1 million primarily related to rebranding initiatives and professional fees increased $480,000, primarily related to increased legal costs related to non-performing assets and recent acquisitions.

The Company’s effective tax rate increased to 39.4% for 2011, up from 37.2% in 2010. This increase is primarily attributable to increases in state income taxes, including the impact of a 2.2% increase in the Illinois corporate tax rate on 2011 earnings.

Financial Performance Overview – Credit Quality

Non-performing loans, excluding covered loans, totaled $120.1 million, or 1.14% of total loans, at December 31, 2011, compared to $142.1 million, or 1.48% of total loans, at December 31, 2010 and $134.0 million, or 1.30% of total loans, at September 30, 2011. OREO, excluding covered OREO, of $86.5 million at December 31, 2011, increased $15.3 million compared to $71.2 million at December 31, 2010, and decreased $10.4 million compared to $96.9 million at September 30, 2011.

The provision for credit losses, excluding the provision for covered loan losses, totaled $16.6 million for the fourth quarter of 2011 compared to $28.8 million in the fourth quarter of 2010 and $28.3 million for the third quarter of 2011. Net charge-offs as a percentage of loans, excluding covered loans, for the fourth quarter of 2011 totaled 93 basis points on an annualized basis compared to 96 basis points on an annualized basis in the fourth quarter of 2010 and 105 basis points on an annualized basis in the third quarter of 2011. Net charge-offs, excluding covered loans, for the full year of 2011 totaled $103.3 million or 102 basis points compared to $109.7 million or 116 basis points in 2010. The provision for credit losses, excluding covered loans, totaled $97.9 million for the full year 2011 compared to $124.7 million for the full year 2010.

13

Excluding the allowance for covered loan losses, the allowance for credit losses at December 31, 2011 totaled $123.6 million, or 1.17% of total loans, compared to $118.0 million, or 1.23% of total loans, at December 31, 2010 and $132.1 million, or 1.29% of total loans, at September 30, 2011.

The lower level of provision for credit losses and the allowance for credit losses, reflect the improvements in credit quality metrics for the fourth quarter of 2011. The graphs on pages four and five highlight the level of total non-performing loans, the improvement seen in the reduced levels of inflows to non-performing loans and the improvement in the allowance for loan loss coverage of non-performing loans.

14

WINTRUST FINANCIAL CORPORATION

Selected Financial Highlights

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

| | | December 31, | | | December 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Selected Financial Condition Data (at end of period): | | | | | | | | | | | | | | | | |

Total assets | | $ | 15,893,808 | | | $ | 13,980,156 | | | | | | | | | |

Total loans, excluding covered loans | | | 10,521,377 | | | | 9,599,886 | | | | | | | | | |

Total deposits | | | 12,307,267 | | | | 10,803,673 | | | | | | | | | |

Junior subordinated debentures | | | 249,493 | | | | 249,493 | | | | | | | | | |

Total shareholders’ equity | | | 1,543,533 | | | | 1,436,549 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Selected Statements of Income Data: | | | | | | | | | | | | | | | | |

Net interest income | | $ | 124,647 | | | $ | 112,677 | | | $ | 461,377 | | | $ | 415,836 | |

Net revenue(1) | | | 169,559 | | | | 157,138 | | | | 651,075 | | | | 607,996 | |

Pre-tax adjusted earnings(2) | | | 61,341 | | | | 57,675 | | | | 225,451 | | | | 199,033 | |

Net income | | | 19,221 | | | | 14,205 | | | | 77,575 | | | | 63,329 | |

Net income per common share – Basic | | $ | 0.51 | | | $ | (0.06 | ) | | $ | 2.08 | | | $ | 1.08 | |

Net income per common share – Diluted | | $ | 0.41 | | | $ | (0.06 | ) | | $ | 1.67 | | | $ | 1.02 | |

| | | | | | | | | | | | | | | | |

Selected Financial Ratios and Other Data: | | | | | | | | | | | | | | | | |

Performance Ratios: | | | | | | | | | | | | | | | | |

Net interest margin(2) | | | 3.45 | % | | | 3.46 | % | | | 3.42 | % | | | 3.37 | % |

Non-interest income to average assets | | | 1.11 | % | | | 1.24 | % | | | 1.27 | % | | | 1.42 | % |

Non-interest expense to average assets | | | 2.94 | % | | | 2.97 | % | | | 2.82 | % | | | 2.82 | % |

Net overhead ratio(3) | | | 1.83 | % | | | 1.73 | % | | | 1.55 | % | | | 1.40 | % |

Efficiency ratio (2) (4) | | | 69.99 | % | | | 67.48 | % | | | 64.58 | % | | | 63.77 | % |

Return on average assets | | | 0.48 | % | | | 0.40 | % | | | 0.52 | % | | | 0.47 | % |

Return on average common equity | | | 4.87 | % | | | (0.66 | )% | | | 5.11 | % | | | 3.01 | % |

Average total assets | | $ | 16,014,209 | | | $ | 14,199,351 | | | $ | 14,920,160 | | | $ | 13,556,612 | |

Average total shareholders’ equity | | | 1,531,936 | | | | 1,442,754 | | | | 1,484,720 | | | | 1,352,135 | |

Average loans to average deposits ratio (excluding covered loans) | | | 86.6 | % | | | 89.0 | % | | | 88.3 | % | | | 91.1 | % |

Average loans to average deposits ratio (including covered loans) | | | 91.9 | % | | | 92.1 | % | | | 92.8 | % | | | 93.4 | % |

| | | | | | | | | | | | | | | | |

Common Share Data at end of period: | | | | | | | | | | | | | | | | |

Market price per common share | | $ | 28.05 | | | $ | 33.03 | | | | | | | | | |

Book value per common share(2) | | $ | 34.23 | | | $ | 32.73 | | | | | | | | | |

Tangible common book value per share(2) | | $ | 26.76 | | | $ | 25.80 | | | | | | | | | |

Common shares outstanding | | | 35,978,349 | | | | 34,864,068 | | | | | | | | | |

Other Data at end of period:(8) | | | | | | | | | | | | | | | | |

Leverage Ratio (5) | | | 9.4 | % | | | 10.1 | % | | | | | | | | |

Tier 1 capital to risk-weighted assets(5) | | | 12.0 | % | | | 12.5 | % | | | | | | | | |

Total capital to risk-weighted assets (5) | | | 13.2 | % | | | 13.8 | % | | | | | | | | |

Tangible common equity ratio (TCE)(2)(7) | | | 7.5 | % | | | 8.0 | % | | | | | | | | |

Allowance for credit losses(6) | | $ | 123,612 | | | $ | 118,037 | | | | | | | | | |

Non-performing loans | | $ | 120,084 | | | $ | 142,132 | | | | | | | | | |

Allowance for credit losses to total loans(6) | | | 1.17 | % | | | 1.23 | % | | | | | | | | |

Non-performing loans to total loans | | | 1.14 | % | | | 1.48 | % | | | | | | | | |

Number of: | | | | | | | | | | | | | | | | |

Bank subsidiaries | | | 15 | | | | 15 | | | | | | | | | |

Non-bank subsidiaries | | | 7 | | | | 8 | | | | | | | | | |

Banking offices | | | 99 | | | | 86 | | | | | | | | | |

| (1) | Net revenue includes net interest income and non-interest income |

| (2) | See “Supplemental Financial Measures/Ratios” for additional information on this performance measure/ratio. |

| (3) | The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s total average assets. A lower ratio indicates a higher degree of efficiency. |

| (4) | The efficiency ratio is calculated by dividing total non-interest expense by tax-equivalent net revenue (less securities gains or losses). A lower ratio indicates more efficient revenue generation. |

| (5) | Capital ratios for current quarter-end are estimated. |

| (6) | The allowance for credit losses includes both the allowance for loan losses and the allowance for unfunded lending-related commitments, but excludes the allowance for covered loan losses. |

| (7) | Total shareholders’ equity minus preferred stock and total intangible assets divided by total assets minus total intangible assets. |

| (8) | Asset quality ratios exclude covered loans. |

15

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CONDITION

| | | | | | | | | | | | |

| | | (Unaudited) | | | (Unaudited) | | | | |

| | | December 31, | | | September 30, | | | December 31, | |

(In thousands) | | 2011 | | | 2011 | | | 2010 | |

Assets | | | | | | | | | | | | |

Cash and due from banks | | $ | 148,012 | | | $ | 147,270 | | | $ | 153,690 | |

Federal funds sold and securities purchased under resale agreements | | | 21,692 | | | | 13,452 | | | | 18,890 | |

Interest-bearing deposits with other banks | | | 749,287 | | | | 1,101,353 | | | | 865,575 | |

Available-for-sale securities, at fair value | | | 1,291,797 | | | | 1,267,682 | | | | 1,496,302 | |

Trading account securities | | | 2,490 | | | | 297 | | | | 4,879 | |

Federal Home Loan Bank and Federal Reserve Bank stock, at cost | | | 100,434 | | | | 99,749 | | | | 82,407 | |

Brokerage customer receivables | | | 27,925 | | | | 27,935 | | | | 24,549 | |

Mortgage loans held-for-sale, at fair value | | | 306,838 | | | | 204,081 | | | | 356,662 | |

Mortgage loans held-for-sale, at lower of cost or market | | | 13,686 | | | | 8,955 | | | | 14,785 | |

Loans, net of unearned income, excluding covered loans | | | 10,521,377 | | | | 10,272,711 | | | | 9,599,886 | |

Covered loans | | | 651,368 | | | | 680,075 | | | | 334,353 | |

| | | | | | | | | | | | |

Total loans | | | 11,172,745 | | | | 10,952,786 | | | | 9,934,239 | |

Less: Allowance for loan losses | | | 110,381 | | | | 118,649 | | | | 113,903 | |

Less: Allowance for covered loan losses | | | 12,977 | | | | 12,496 | | | | — | |

| | | | | | | | | | | | |

Net loans | | | 11,049,387 | | | | 10,821,641 | | | | 9,820,336 | |

Premises and equipment, net | | | 431,512 | | | | 412,478 | | | | 363,696 | |

FDIC indemnification asset | | | 344,251 | | | | 379,306 | | | | 118,182 | |

Accrued interest receivable and other assets | | | 444,912 | | | | 468,711 | | | | 366,438 | |

Trade date securities receivable | | | 634,047 | | | | 637,112 | | | | — | |

Goodwill | | | 305,468 | | | | 302,369 | | | | 281,190 | |

Other intangible assets | | | 22,070 | | | | 22,413 | | | | 12,575 | |

| | | | | | | | | | | | |

Total assets | | $ | 15,893,808 | | | $ | 15,914,804 | | | $ | 13,980,156 | |

| | | | | | | | | | | | |

| | | |

Liabilities and Shareholders’ Equity | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | |

Non-interest bearing | | $ | 1,785,433 | | | $ | 1,631,709 | | | $ | 1,201,194 | |

Interest bearing | | | 10,521,834 | | | | 10,674,299 | | | | 9,602,479 | |

| | | | | | | | | | | | |

Total deposits | | | 12,307,267 | | | | 12,306,008 | | | | 10,803,673 | |

| | | |

Notes payable | | | 52,822 | | | | 3,004 | | | | 1,000 | |

Federal Home Loan Bank advances | | | 474,481 | | | | 474,570 | | | | 423,500 | |

Other borrowings | | | 443,753 | | | | 448,082 | | | | 260,620 | |

Secured borrowings - owed to securitization investors | | | 600,000 | | | | 600,000 | | | | 600,000 | |

Subordinated notes | | | 35,000 | | | | 40,000 | | | | 50,000 | |

Junior subordinated debentures | | | 249,493 | | | | 249,493 | | | | 249,493 | |

Trade date securities payable | | | 47 | | | | 73,874 | | | | — | |

Accrued interest payable and other liabilities | | | 187,412 | | | | 191,586 | | | | 155,321 | |

| | | | | | | | | | | | |

Total liabilities | | | 14,350,275 | | | | 14,386,617 | | | | 12,543,607 | |

| | | | | | | | | | | | |

| | | |

Shareholders’ Equity: | | | | | | | | | | | | |

Preferred stock | | | 49,768 | | | | 49,736 | | | | 49,640 | |

Common stock | | | 35,982 | | | | 35,926 | | | | 34,864 | |

Surplus | | | 1,001,316 | | | | 997,854 | | | | 965,203 | |

Treasury stock | | | (112 | ) | | | (68 | ) | | | — | |

Retained earnings | | | 459,457 | | | | 441,268 | | | | 392,354 | |

Accumulated other comprehensive (loss) income | | | (2,878 | ) | | | 3,471 | | | | (5,512 | ) |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 1,543,533 | | | | 1,528,187 | | | | 1,436,549 | |

| | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 15,893,808 | | | $ | 15,914,804 | | | $ | 13,980,156 | |

| | | | | | | | | | | | |

16

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Years Ended | |

| | | December 31, | | | December 31, | |

(In thousands, except per share data) | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Interest income | | | | | | | | | | | | | | | | |

Interest and fees on loans | | $ | 143,514 | | | $ | 144,652 | | | $ | 552,938 | | | $ | 547,896 | |

Interest bearing deposits with banks | | | 696 | | | | 1,342 | | | | 3,419 | | | | 5,170 | |

Federal funds sold and securities purchased under resale agreements | | | 33 | | | | 39 | | | | 116 | | | | 157 | |

Securities | | | 12,574 | | | | 7,236 | | | | 46,219 | | | | 36,904 | |

Trading account securities | | | 6 | | | | 11 | | | | 44 | | | | 394 | |

Federal Home Loan Bank and Federal Reserve Bank stock | | | 591 | | | | 512 | | | | 2,297 | | | | 1,931 | |

Brokerage customer receivables | | | 203 | | | | 170 | | | | 760 | | | | 655 | |

| | | | | | | | | | | | | | | | |

Total interest income | | | 157,617 | | | | 153,962 | | | | 605,793 | | | | 593,107 | |

| | | | | | | | | | | | | | | | |

Interest expense | | | | | | | | | | | | | | | | |

Interest on deposits | | | 19,685 | | | | 27,853 | | | | 87,938 | | | | 123,779 | |

Interest on Federal Home Loan Bank advances | | | 4,186 | | | | 4,038 | | | | 16,320 | | | | 16,520 | |

Interest on notes payable and other borrowings | | | 2,804 | | | | 1,631 | | | | 11,023 | | | | 5,943 | |

Interest on secured borrowings - owed to securitization investors | | | 3,076 | | | | 3,089 | | | | 12,113 | | | | 12,366 | |

Interest on subordinated notes | | | 176 | | | | 233 | | | | 750 | | | | 995 | |

Interest on junior subordinated debentures | | | 3,043 | | | | 4,441 | | | | 16,272 | | | | 17,668 | |

| | | | | | | | | | | | | | | | |

Total interest expense | | | 32,970 | | | | 41,285 | | | | 144,416 | | | | 177,271 | |

| | | | | | | | | | | | | | | | |

Net interest income | | | 124,647 | | | | 112,677 | | | | 461,377 | | | | 415,836 | |

Provision for credit losses | | | 18,817 | | | | 28,795 | | | | 102,638 | | | | 124,664 | |

| | | | | | | | | | | | | | | | |

Net interest income after provision for credit losses | | | 105,830 | | | | 83,882 | | | | 358,739 | | | | 291,172 | |

| | | | | | | | | | | | | | | | |

Non-interest income | | | | | | | | | | | | | | | | |

Wealth management | | | 11,686 | | | | 10,108 | | | | 44,517 | | | | 36,941 | |

Mortgage banking | | | 18,025 | | | | 22,686 | | | | 56,942 | | | | 61,378 | |

Service charges on deposit accounts | | | 3,973 | | | | 3,346 | | | | 14,963 | | | | 13,433 | |

Gains on available-for-sale securities, net | | | 309 | | | | 159 | | | | 1,792 | | | | 9,832 | |

Gain on bargain purchases | | | — | | | | 250 | | | | 37,974 | | | | 44,231 | |

Trading gains | | | 216 | | | | 611 | | | | 337 | | | | 5,165 | |

Other | | | 10,703 | | | | 7,301 | | | | 33,173 | | | | 21,180 | |

| | | | | | | | | | | | | | | | |

Total non-interest income | | | 44,912 | | | | 44,461 | | | | 189,698 | | | | 192,160 | |

| | | | | | | | | | | | | | | | |

Non-interest expense | | | | | | | | | | | | | | | | |

Salaries and employee benefits | | | 66,744 | | | | 59,031 | | | | 237,785 | | | | 215,766 | |

Equipment | | | 5,093 | | | | 4,384 | | | | 18,267 | | | | 16,529 | |

Occupancy, net | | | 7,975 | | | | 5,927 | | | | 28,764 | | | | 24,444 | |

Data processing | | | 4,062 | | | | 4,388 | | | | 14,568 | | | | 15,355 | |

Advertising and marketing | | | 3,207 | | | | 1,881 | | | | 8,380 | | | | 6,315 | |

Professional fees | | | 3,710 | | | | 4,775 | | | | 16,874 | | | | 16,394 | |

Amortization of other intangible assets | | | 1,062 | | | | 719 | | | | 3,425 | | | | 2,739 | |

FDIC insurance | | | 3,244 | | | | 4,572 | | | | 14,143 | | | | 18,028 | |

OREO expenses, net | | | 8,821 | | | | 7,384 | | | | 26,340 | | | | 19,331 | |

Other | | | 14,850 | | | | 13,140 | | | | 51,858 | | | | 47,624 | |

| | | | | | | | | | | | | | | | |

Total non-interest expense | | | 118,768 | | | | 106,201 | | | | 420,404 | | | | 382,525 | |

| | | | | | | | | | | | | | | | |

Income before taxes | | | 31,974 | | | | 22,142 | | | | 128,033 | | | | 100,807 | |

Income tax expense | | | 12,753 | | | | 7,937 | | | | 50,458 | | | | 37,478 | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 19,221 | | | $ | 14,205 | | | $ | 77,575 | | | $ | 63,329 | |

| | | | | | | | | | | | | | | | |

Preferred stock dividends and discount accretion | | $ | 1,032 | | | $ | 16,175 | | | $ | 4,128 | | | $ | 31,004 | |

| | | | | | | | | | | | | | | | |

Net income (loss) applicable to common shares | | $ | 18,189 | | | $ | (1,970 | ) | | $ | 73,447 | | | $ | 32,325 | |

| | | | | | | | | | | | | | | | |

Net income (loss) per common share—Basic | | $ | 0.51 | | | $ | (0.06 | ) | | $ | 2.08 | | | $ | 1.08 | |

| | | | | | | | | | | | | | | | |

Net income (loss) per common share—Diluted | | $ | 0.41 | | | $ | (0.06 | ) | | $ | 1.67 | | | $ | 1.02 | |

| | | | | | | | | | | | | | | | |

Cash dividends declared per common share | | $ | — | | | $ | — | | | $ | 0.18 | | | $ | 0.18 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | 35,958 | | | | 32,015 | | | | 35,355 | | | | 30,057 | |

Dilutive potential common shares | | | 8,480 | | | | — | | | | 8,636 | | | | 1,513 | |

| | | | | | | | | | | | | | | | |

Average common shares and dilutive common shares | | | 44,438 | | | | 32,015 | | | | 43,991 | | | | 31,570 | |

| | | | | | | | | | | | | | | | |

17

SUPPLEMENTAL FINANCIAL MEASURES/RATIOS

The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non-GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. These include taxable-equivalent net interest income (including its individual components), net interest margin (including its individual components), the efficiency ratio, tangible common equity ratio, tangible common book value per share and pre-tax adjusted earnings. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently.

Management reviews yields on certain asset categories and the net interest margin of the Company and its banking subsidiaries on a fully taxable-equivalent (“FTE”) basis. In this non-GAAP presentation, net interest income is adjusted to reflect tax-exempt interest income on an equivalent before-tax basis. This measure ensures comparability of net interest income arising from both taxable and tax-exempt sources. Net interest income on a FTE basis is also used in the calculation of the Company’s efficiency ratio. The efficiency ratio, which is calculated by dividing non-interest expense by total taxable-equivalent net revenue (less securities gains or losses), measures how much it costs to produce one dollar of revenue. Securities gains or losses are excluded from this calculation to better match revenue from daily operations to operational expenses. Management considers the tangible common equity ratio and tangible book value per common share as useful measurements of the Company’s equity. Pre-tax adjusted earnings is a significant metric in assessing the Company’s operating performance. Pre-tax adjusted earnings is adjusted to exclude the provision for credit losses and certain significant items.

18

The following table presents a reconciliation of certain non-GAAP performance measures and ratios used by the Company to evaluate and measure the Company’s performance to the most directly comparable GAAP financial measures for the last 5 quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Years Ended | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | | | December 31, | |

(Dollars and shares in thousands) | | 2011 | | | 2011 | | | 2011 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Calculation of Net Interest Margin and Efficiency Ratio | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(A) Interest Income (GAAP) | | $ | 157,617 | | | $ | 154,951 | | | $ | 145,445 | | | $ | 147,780 | | | $ | 153,962 | | | $ | 605,793 | | | $ | 593,107 | |

Taxable-equivalent adjustment: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Loans | | | 132 | | | | 100 | | | | 110 | | | | 116 | | | | 79 | | | | 458 | | | | 334 | |

- Liquidity management assets | | | 320 | | | | 313 | | | | 296 | | | | 295 | | | | 326 | | | | 1,224 | | | | 1,377 | |

- Other earning assets | | | 2 | | | | 6 | | | | 2 | | | | 3 | | | | — | | | | 12 | | | | 17 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Income—FTE | | $ | 158,071 | | | $ | 155,370 | | | $ | 145,853 | | | $ | 148,194 | | | $ | 154,367 | | | $ | 607,487 | | | $ | 594,835 | |

(B) Interest Expense (GAAP) | | | 32,970 | | | | 36,541 | | | | 36,739 | | | | 38,166 | | | | 41,285 | | | | 144,416 | | | | 177,271 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income—FTE | | $ | 125,101 | | | $ | 118,829 | | | $ | 109,114 | | | $ | 110,028 | | | $ | 113,082 | | | $ | 463,071 | | | $ | 417,564 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(C) Net Interest Income (GAAP) (A minus B) | | $ | 124,647 | | | $ | 118,410 | | | $ | 108,706 | | | $ | 109,614 | | | $ | 112,677 | | | $ | 461,377 | | | $ | 415,836 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(D) Net interest margin (GAAP) | | | 3.44 | % | | | 3.36 | % | | | 3.38 | % | | | 3.46 | % | | | 3.44 | % | | | 3.41 | % | | | 3.35 | % |

Net interest margin—FTE | | | 3.45 | % | | | 3.37 | % | | | 3.40 | % | | | 3.48 | % | | | 3.46 | % | | | 3.42 | % | | | 3.37 | % |

(E) Efficiency ratio (GAAP) | | | 70.17 | % | | | 57.34 | % | | | 67.41 | % | | | 65.23 | % | | | 67.65 | % | | | 64.75 | % | | | 63.95 | % |

Efficiency ratio—FTE | | | 69.99 | % | | | 57.21 | % | | | 67.22 | % | | | 65.05 | % | | | 67.48 | % | | | 64.58 | % | | | 63.77 | % |

| | | | | | | |

Calculation of Tangible Common Equity ratio (at period end) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity | | $ | 1,543,533 | | | $ | 1,528,187 | | | $ | 1,473,386 | | | $ | 1,453,253 | | | $ | 1,436,549 | | | | | | | | | |

Less: Preferred stock | | | (49,768 | ) | | | (49,736 | ) | | | (49,704 | ) | | | (49,672 | ) | | | (49,640 | ) | | | | | | | | |

Less: Intangible assets | | | (327,538 | ) | | | (324,782 | ) | | | (294,833 | ) | | | (293,996 | ) | | | (293,765 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(F) Total tangible common shareholders’ equity | | $ | 1,166,227 | | | $ | 1,153,669 | | | $ | 1,128,849 | | | $ | 1,109,585 | | | $ | 1,093,144 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Total assets | | $ | 15,893,808 | | | $ | 15,914,804 | | | $ | 14,615,897 | | | $ | 14,094,294 | | | $ | 13,980,156 | | | | | | | | | |

Less: Intangible assets | | | (327,538 | ) | | | (324,782 | ) | | | (294,833 | ) | | | (293,996 | ) | | | (293,765 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(G) Total tangible assets | | $ | 15,566,270 | | | $ | 15,590,022 | | | $ | 14,321,064 | | | $ | 13,800,298 | | | $ | 13,686,391 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Tangible common equity ratio (F/G) | | | 7.5 | % | | | 7.4 | % | | | 7.9 | % | | | 8.0 | % | | | 8.0 | % | | | | | | | | |

| | | | | | | |

Calculation of Pre-Tax Adjusted Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before taxes | | $ | 31,974 | | | $ | 50,046 | | | $ | 18,965 | | | $ | 27,048 | | | $ | 22,142 | | | $ | 128,033 | | | $ | 100,807 | |

Add: Provision for credit losses | | | 18,817 | | | | 29,290 | | | | 29,187 | | | | 25,344 | | | | 28,795 | | | | 102,638 | | | | 124,664 | |

Add: OREO expenses, net | | | 8,821 | | | | 5,134 | | | | 6,577 | | | | 5,808 | | | | 7,384 | | | | 26,340 | | | | 19,331 | |

Add: Recourse obligation on loans previously sold | | | 986 | | | | 266 | | | | (916 | ) | | | 103 | | | | 1,365 | | | | 439 | | | | 10,970 | |

Add: Covered loan expense | | | 944 | | | | 336 | | | | 806 | | | | 745 | | | | 342 | | | | 2,831 | | | | 689 | |

Add: Mortgage servicing rights fair value adjustments | | | 1,047 | | | | 2,631 | | | | 1,136 | | | | (141 | ) | | | (834 | ) | | | 4,673 | | | | 2,955 | |

Less: (Gain) loss from investment partnerships | | | (723 | ) | | | 1,439 | | | | 240 | | | | (356 | ) | | | (499 | ) | | | 600 | | | | (1,155 | ) |

Less: Gain on bargain purchases | | | — | | | | (27,390 | ) | | | (746 | ) | | | (9,838 | ) | | | (250 | ) | | | (37,974 | ) | | | (44,231 | ) |

Less: Trading (gains) losses | | | (216 | ) | | | (591 | ) | | | 30 | | | | 440 | | | | (611 | ) | | | (337 | ) | | | (5,165 | ) |

Less: Gains on available-for-sale securities, net | | | (309 | ) | | | (225 | ) | | | (1,152 | ) | | | (106 | ) | | | (159 | ) | | | (1,792 | ) | | | (9,832 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pre-tax adjusted earnings | | $ | 61,341 | | | $ | 60,936 | | | $ | 54,127 | | | $ | 49,047 | | | $ | 57,675 | | | $ | 225,451 | | | $ | 199,033 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Calculation of book value per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity | | $ | 1,543,533 | | | $ | 1,528,187 | | | $ | 1,473,386 | | | $ | 1,453,253 | | | $ | 1,436,549 | | | | | | | | | |

Less: Preferred stock | | | (49,768 | ) | | | (49,736 | ) | | | (49,704 | ) | | | (49,672 | ) | | | (49,640 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(H) Total common equity | | $ | 1,493,765 | | | $ | 1,478,451 | | | $ | 1,423,682 | | | $ | 1,403,581 | | | $ | 1,386,909 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Actual common shares outstanding | | | 35,978 | | | | 35,924 | | | | 34,988 | | | | 34,947 | | | | 34,864 | | | | | | | | | |

Add: TEU conversion shares | | | 7,666 | | | | 7,666 | | | | 7,342 | | | | 6,696 | | | | 7,512 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(I) Common shares used for book value calculation | | | 43,644 | | | | 43,590 | | | | 42,330 | | | | 41,643 | | | | 42,376 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Book value per share (H/I) | | $ | 34.23 | | | $ | 33.92 | | | $ | 33.63 | | | $ | 33.70 | | | $ | 32.73 | | | | | | | | | |

Tangible common book value per share (F/I) | | $ | 26.72 | | | $ | 26.47 | | | $ | 26.67 | | | $ | 26.65 | | | $ | 25.80 | | | | | | | | | |

19

LOANS

Loan Portfolio Mix and Growth Rates

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Growth | |

| | | | | | | | | | | | From(1) | | | From | |

| | | December 31, | | | September 30, | | | December 31, | | | September 30, | | | December 31, | |

(Dollars in thousands) | | 2011 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Balance: | | | | | | | | | | | | | | | | | | | | |

Commercial | | $ | 2,498,313 | | | $ | 2,337,098 | | | $ | 2,049,326 | | | | 27 | % | | | 22 | % |

Commercial real-estate | | | 3,514,261 | | | | 3,465,321 | | | | 3,338,007 | | | | 6 | | | | 5 | |

Home equity | | | 862,345 | | | | 879,180 | | | | 914,412 | | | | (8 | ) | | | (6 | ) |

Residential real-estate | | | 350,289 | | | | 326,207 | | | | 353,336 | | | | 29 | | | | (1 | ) |

Premium finance receivables - commercial | | | 1,412,454 | | | | 1,417,572 | | | | 1,265,500 | | | | (1 | ) | | | 12 | |

Premium finance receivables - life insurance | | | 1,695,225 | | | | 1,671,443 | | | | 1,521,886 | | | | 6 | | | | 11 | |

Indirect consumer(2) | | | 64,545 | | | | 62,452 | | | | 51,147 | | | | 13 | | | | 26 | |

Consumer and other | | | 123,945 | | | | 113,438 | | | | 106,272 | | | | 37 | | | | 17 | |

| | | | | | | | | | | | | | | | | | | | |

Total loans, net of unearned income, excluding covered loans | | $ | 10,521,377 | | | $ | 10,272,711 | | | $ | 9,599,886 | | | | 10 | % | | | 10 | % |

Covered loans | | | 651,368 | | | | 680,075 | | | | 334,353 | | | | (17 | ) | | | 95 | |

| | | | | | | | | | | | | | | | | | | | |

Total loans, net of unearned income | | $ | 11,172,745 | | | $ | 10,952,786 | | | $ | 9,934,239 | | | | 8 | % | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Mix: | | | | | | | | | | | | | | | | | | | | |

Commercial | | | 22 | % | | | 21 | % | | | 21 | % | | | | | | | | |

Commercial real-estate | | | 31 | | | | 32 | | | | 34 | | | | | | | | | |

Home equity | | | 8 | | | | 8 | | | | 9 | | | | | | | | | |

Residential real-estate | | | 3 | | | | 3 | | | | 3 | | | | | | | | | |

Premium finance receivables - commercial | | | 13 | | | | 13 | | | | 13 | | | | | | | | | |

Premium finance receivables - life insurance | | | 15 | | | | 15 | | | | 15 | | | | | | | | | |

Indirect consumer(2) | | | 1 | | | | 1 | | | | 1 | | | | | | | | | |

Consumer and other | | | 1 | | | | 1 | | | | 1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total loans, net of unearned income, excluding covered loans | | | 94 | % | | | 94 | % | | | 97 | % | | | | | | | | |

Covered loans | | | 6 | | | | 6 | | | | 3 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total loans, net of unearned income | | | 100 | % | | | 100 | % | | | 100 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (2) | Includes autos, boats, snowmobiles and other indirect consumer loans. |

20

As of December 31, 2011

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | > 90 Days | | | Allowance | |

| | | | | | % of | | | | | | Past Due | | | For Loan | |

| | | | | | Total | | | | | | and Still | | | Losses | |

(Dollars in thousands) | | Balance | | | Balance | | | Nonaccrual | | | Accruing | | | Allocation | |

Commercial: | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | $ | 1,450,451 | | | | 24.2 | % | | $ | 16,154 | | | $ | — | | | $ | 18,787 | |

Franchise | | | 142,775 | | | | 2.4 | | | | 1,792 | | | | — | | | | 1,571 | |

Mortgage warehouse lines of credit | | | 180,450 | | | | 3.0 | | | | — | | | | — | | | | 1,409 | |

Community Advantage - homeowner associations | | | 77,504 | | | | 1.3 | | | | — | | | | — | | | | 194 | |

Aircraft | | | 20,397 | | | | 0.3 | | | | — | | | | — | | | | 110 | |

Asset-based lending | | | 465,737 | | | | 7.7 | | | | 1,072 | | | | — | | | | 7,705 | |

Municipal | | | 78,319 | | | | 1.3 | | | | — | | | | — | | | | 1,136 | |

Leases | | | 72,134 | | | | 1.2 | | | | — | | | | — | | | | 309 | |

Other | | | 2,125 | | | | 0.1 | | | | — | | | | — | | | | 16 | |

Purchased non-covered commercial loans(1) | | | 8,421 | | | | 0.1 | | | | — | | | | 589 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total commercial | | $ | 2,498,313 | | | | 41.6 | % | | $ | 19,018 | | | $ | 589 | | | $ | 31,237 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Commercial Real-Estate: | | | | | | | | | | | | | | | | | | | | |

Residential construction | | $ | 65,811 | | | | 1.1 | % | | $ | 1,993 | | | $ | — | | | $ | 1,804 | |

Commercial construction | | | 169,876 | | | | 2.8 | | | | 2,158 | | | | — | | | | 4,512 | |

Land | | | 178,531 | | | | 3.0 | | | | 31,547 | | | | — | | | | 12,515 | |

Office | | | 554,446 | | | | 9.2 | | | | 10,614 | | | | — | | | | 6,929 | |

Industrial | | | 555,802 | | | | 9.2 | | | | 2,002 | | | | — | | | | 5,314 | |

Retail | | | 536,729 | | | | 8.9 | | | | 5,366 | | | | — | | | | 4,569 | |

Multi-family | | | 314,557 | | | | 5.2 | | | | 4,736 | | | | — | | | | 9,337 | |

Mixed use and other | | | 1,086,654 | | | | 18.1 | | | | 8,092 | | | | — | | | | 11,425 | |

Purchased non-covered commercial real-estate(1) | | | 51,855 | | | | 0.9 | | | | — | | | | 2,198 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total commercial real-estate | | $ | 3,514,261 | | | | 58.4 | % | | $ | 66,508 | | | $ | 2,198 | | | $ | 56,405 | |

| | | | | | | | | | | | | | | | | | | | |

Total commercial and commercial real-estate | | $ | 6,012,574 | | | | 100.0 | % | | $ | 85,526 | | | $ | 2,787 | | | $ | 87,642 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Commercial real-estate - collateral location by state: | | | | | | | | | | | | | | | | | | | | |

Illinois | | $ | 2,913,288 | | | | 82.9 | % | | | | | | | | | | | | |

Wisconsin | | | 335,070 | | | | 9.5 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total primary markets | | $ | 3,248,358 | | | | 92.4 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Florida | | | 57,527 | | | | 1.6 | | | | | | | | | | | | | |

Arizona | | | 39,921 | | | | 1.1 | | | | | | | | | | | | | |

Indiana | | | 43,322 | | | | 1.2 | | | | | | | | | | | | | |

Other (no individual state greater than 0.5%) | | | 125,133 | | | | 3.7 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 3,514,261 | | | | 100.0 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Purchased loans represent loans acquired with evidence of credit quality deterioration since origination, in accordance with ASC 310-30. Loan agings are based upon contractually required payments. |

21

DEPOSITS

Deposit Portfolio Mix and Growth Rates

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Growth | |

| | | | | | | | | | | | From(1) | | | From | |

| | | December 31, | | | September 30, | | | December 31, | | | September 30, | | | December 31, | |

(Dollars in thousands) | | 2011 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Balance: | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing | | $ | 1,785,433 | | | $ | 1,631,709 | | | $ | 1,201,194 | | | | 37 | % | | | 49 | % |

NOW | | | 1,698,778 | | | | 1,633,752 | | | | 1,561,507 | | | | 16 | | | | 9 | |

Wealth Management deposits(2) | | | 788,311 | | | | 730,315 | | | | 658,660 | | | | 32 | | | | 20 | |

Money Market | | | 2,263,253 | | | | 2,190,117 | | | | 1,759,866 | | | | 13 | | | | 29 | |

Savings | | | 888,592 | | | | 867,483 | | | | 744,534 | | | | 10 | | | | 19 | |

Time certificates of deposit | | | 4,882,900 | | | | 5,252,632 | | | | 4,877,912 | | | | (28 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total deposits | | $ | 12,307,267 | | | $ | 12,306,008 | | | $ | 10,803,673 | | | | — | % | | | 14 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Mix: | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing | | | 15 | % | | | 13 | % | | | 11 | % | | | | | | | | |

NOW | | | 14 | | | | 13 | | | | 15 | | | | | | | | | |

Wealth Management deposits(2) | | | 6 | | | | 6 | | | | 6 | | | | | | | | | |

Money Market | | | 18 | | | | 18 | | | | 16 | | | | | | | | | |

Savings | | | 7 | | | | 7 | | | | 7 | | | | | | | | | |

Time certificates of deposit | | | 40 | | | | 43 | | | | 45 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total deposits | | | 100 | % | | | 100 | % | | | 100 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (2) | Represents deposit balances of the Company’s subsidiary banks from brokerage customers of Wayne Hummer Investments, trust and asset management customers of The Chicago Trust Company and brokerage customers from unaffiliated companies which have been placed into deposit accounts of the Banks. |

Deposit Maturity Analysis

As of December 31, 2011

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Weighted- | |

| | | Non- | | | | | | | | | | | | | | | Average | |

| | | Interest | | | Savings | | | | | | | | | | | | Rate of | |

| | | Bearing | | | and | | | | | | Time | | | | | | Maturing Time | |

| | | and | | | Money | | | Wealth | | | Certificates | | | Total | | | Certificates | |

(Dollars in thousands) | | NOW (1) | | | Market(1) | | | Mgt.(1) | | | of Deposit | | | Deposits | | | of Deposit(2) | |

1-3 months | | $ | 3,484,211 | | | $ | 3,151,845 | | | $ | 788,311 | | | $ | 1,031,409 | | | $ | 8,455,776 | | | | 1.02 | % |

4-6 months | | | — | | | | — | | | | — | | | | 878,084 | | | | 878,084 | | | | 1.10 | |

7-9 months | | | — | | | | — | | | | — | | | | 745,054 | | | | 745,054 | | | | 1.28 | |

10-12 months | | | — | | | | — | | | | — | | | | 585,214 | | | | 585,214 | | | | 1.02 | |

13-18 months | | | — | | | | — | | | | — | | | | 615,599 | | | | 615,599 | | | | 1.35 | |

19-24 months | | | — | | | | — | | | | — | | | | 388,425 | | | | 388,425 | | | | 1.45 | |

24+ months | | | — | | | | — | | | | — | | | | 639,115 | | | | 639,115 | | | | 2.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total deposits | | $ | 3,484,211 | | | $ | 3,151,845 | | | $ | 788,311 | | | $ | 4,882,900 | | | $ | 12,307,267 | | | | 1.31 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Balances of non-contractual maturity deposits are shown as maturing in the earliest time frame. These deposits do not have contractual maturities and re-price in varying degrees to changes in interest rates. |

| (2) | Weighted-average rate excludes the impact of purchase accounting fair value adjustments. |

22

NET INTEREST INCOME

The following table presents a summary of Wintrust’s average balances, net interest income and related net interest margins, calculated on a fully tax-equivalent basis, for the fourth quarter of 2011 compared to the fourth quarter of 2010 (linked quarters):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended

December 31, 2011 | | | For the Three Months Ended

December 31, 2010 | |

| | | |

(Dollars in thousands) | | Average | | | Interest | | | Rate | | | Average | | | Interest | | | Rate | |

Liquidity management assets (1) (2) (7) | | $ | 3,051,850 | | | $ | 14,215 | | | | 1.85 | % | | $ | 2,844,351 | | | $ | 9,455 | | | | 1.32 | % |

Other earning assets(2) (3) (7) | | | 28,828 | | | | 210 | | | | 2.90 | | | | 29,676 | | | | 183 | | | | 2.45 | |

Loans, net of unearned income (2) (4) (7) | | | 10,662,516 | | | | 128,518 | | | | 4.78 | | | | 9,777,435 | | | | 140,689 | | | | 5.71 | |

Covered loans | | | 652,157 | | | | 15,128 | | | | 9.20 | | | | 337,690 | | | | 4,042 | | | | 4.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total earning assets(7) | | $ | 14,395,351 | | | $ | 158,071 | | | | 4.36 | % | | $ | 12,989,152 | | | $ | 154,369 | | | | 4.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses | | | (137,423 | ) | | | | | | | | | | | (116,447 | ) | | | | | | | | |

Cash and due from banks | | | 130,437 | | | | | | | | | | | | 151,562 | | | | | | | | | |

Other assets | | | 1,625,844 | | | | | | | | | | | | 1,175,084 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 16,014,209 | | | | | | | | | | | $ | 14,199,351 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Interest-bearing deposits | | $ | 10,563,090 | | | $ | 19,685 | | | | 0.74 | % | | $ | 9,839,223 | | | $ | 27,853 | | | | 1.12 | % |

Federal Home Loan Bank advances | | | 474,549 | | | | 4,186 | | | | 3.50 | | | | 415,260 | | | | 4,038 | | | | 3.86 | |

Notes payable and other borrowings | | | 468,139 | | | | 2,804 | | | | 2.38 | | | | 244,044 | | | | 1,631 | | | | 2.65 | |

Secured borrowings—owed to securitization investors | | | 600,000 | | | | 3,076 | | | | 2.03 | | | | 600,000 | | | | 3,089 | | | | 2.04 | |

Subordinated notes | | | 38,370 | | | | 176 | | | | 1.79 | | | | 53,369 | | | | 233 | | | | 1.71 | |

Junior subordinated notes | | | 249,493 | | | | 3,043 | | | | 4.77 | | | | 249,493 | | | | 4,441 | | | | 6.97 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | $ | 12,393,641 | | | $ | 32,970 | | | | 1.05 | % | | $ | 11,401,389 | | | $ | 41,285 | | | | 1.43 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing deposits | | | 1,755,446 | | | | | | | | | | | | 1,148,208 | | | | | | | | | |

Other liabilities | | | 333,186 | | | | | | | | | | | | 207,000 | | | | | | | | | |

Equity | | | 1,531,936 | | | | | | | | | | | | 1,442,754 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 16,014,209 | | | | | | | | | | | $ | 14,199,351 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Interest rate spread(5) (7) | | | | | | | | | | | 3.31 | % | | | | | | | | | | | 3.29 | % |

Net free funds/contribution (6) | | $ | 2,001,710 | | | | | | | | 0.14 | % | | $ | 1,587,763 | | | | | | | | 0.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/Net interest margin (7) | | | | | | $ | 125,101 | | | | 3.45 | % | | | | | | $ | 113,084 | | | | 3.46 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Liquidity management assets include available-for-sale securities, interest earning deposits with banks, federal funds sold and securities purchased under resale agreements. |

| (2) | Interest income on tax-advantaged loans, trading securities and securities reflects a tax-equivalent adjustment based on a marginal federal corporate tax rate of 35%. The total adjustments for the three months ended December 31, 2011 and 2010 were $454,000 and $405,000, respectively. |

| (3) | Other earning assets include brokerage customer receivables and trading account securities. |

| (4) | Loans, net of unearned income, include loans held-for-sale and non-accrual loans. |

| (5) | Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities. |

| (6) | Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities. |

| (7) | See “Supplemental Financial Measures/Ratios” for additional information on this performance ratio. |

The net interest margin decreased by one basis point in the fourth quarter of 2011 compared to the fourth quarter of 2010. This decrease was primarily attributable to a 93 basis point decline in the yield on loans due to the negative impact of both competitive and economic pricing pressures on the commercial, commercial real estate and commercial insurance premium finance portfolios and a decrease in accretable discount recognized as interest income on the purchased life insurance premium portfolio as prepayments declined. Nearly offsetting the lower yield on loans was a 38 basis point decline in the cost of interest-bearing deposits over the last 12 months and an increase in the yield on covered loan portfolio.

The majority of covered loans are accounted for in accordance with ASC 310-30. As such, the yield on these loans at the acquisition date represents a fair value loan yield. In periods subsequent to the quarter of acquisition, the Company has experienced cash collections generally better than estimated for the initial valuation. Overall, expected losses and expected estimated lives have decreased, which has led to generally higher effective yields as estimated cash flows on the pools of loans has improved.

23

The following table presents a summary of Wintrust’s average balances, net interest income and related net interest margins, calculated on a fully tax-equivalent basis, for the fourth quarter of 2011 compared to the third quarter of 2011 (sequential quarters):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended

December 31, 2011 | | | For the Three Months Ended

September 30, 2011 | |

(Dollars in thousands) | | Average | | | Interest | | | Rate | | | Average | | | Interest | | | Rate | |

Liquidity management assets(1) (2) (7) | | $ | 3,051,850 | | | $ | 14,215 | | | | 1.85 | % | | $ | 3,083,508 | | | $ | 14,508 | | | | 1.87 | % |

Other earning assets(2) (3) (7) | | | 28,828 | | | | 210 | | | | 2.90 | | | | 28,834 | | | | 217 | | | | 2.98 | |

Loans, net of unearned income(2) (4) (7) | | | 10,662,516 | | | | 128,518 | | | | 4.78 | | | | 10,200,733 | | | | 127,718 | | | | 4.97 | |

Covered loans | | | 652,157 | | | | 15,128 | | | | 9.20 | | | | 680,003 | | | | 12,926 | | | | 7.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total earning assets(7) | | $ | 14,395,351 | | | $ | 158,071 | | | | 4.36 | % | | $ | 13,993,078 | | | $ | 155,369 | | | | 4.41 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses | | | (137,423 | ) | | | | | | | | | | | (128,848 | ) | | | | | | | | |

Cash and due from banks | | | 130,437 | | | | | | | | | | | | 140,010 | | | | | | | | | |

Other assets | | | 1,625,844 | | | | | | | | | | | | 1,522,187 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 16,014,209 | | | | | | | | | | | $ | 15,526,427 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Interest-bearing deposits | | $ | 10,563,090 | | | $ | 19,685 | | | | 0.74 | % | | $ | 10,442,886 | | | $ | 21,893 | | | | 0.83 | % |

Federal Home Loan Bank advances | | | 474,549 | | | | 4,186 | | | | 3.50 | | | | 486,379 | | | | 4,166 | | | | 3.40 | |

Notes payable and other borrowings | | | 468,139 | | | | 2,804 | | | | 2.38 | | | | 461,141 | | | | 2,874 | | | | 2.47 | |

Secured borrowings - owed to securitization investors | | | 600,000 | | | | 3,076 | | | | 2.03 | | | | 600,000 | | | | 3,003 | | | | 1.99 | |

Subordinated notes | | | 38,370 | | | | 176 | | | | 1.79 | | | | 40,000 | | | | 168 | | | | 1.65 | |

Junior subordinated notes | | | 249,493 | | | | 3,043 | | | | 4.77 | | | | 249,493 | | | | 4,437 | | | | 6.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | $ | 12,393,641 | | | $ | 32,970 | | | | 1.05 | % | | $ | 12,279,899 | | | $ | 36,541 | | | | 1.18 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Non-interest bearing deposits | | | 1,755,446 | | | | | | | | | | | | 1,553,769 | | | | | | | | | |

Other liabilities | | | 333,186 | | | | | | | | | | | | 185,042 | | | | | | | | | |

Equity | | | 1,531,936 | | | | | | | | | | | | 1,507,717 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 16,014,209 | | | | | | | | | | | $ | 15,526,427 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Interest rate spread(5) (7) | | | | | | | | | | | 3.31 | % | | | | | | | | | | | 3.23 | % |

Net free funds/contribution(6) | | $ | 2,001,710 | | | | | | | | 0.14 | % | | $ | 1,713,179 | | | | | | | | 0.14 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/Net interest margin(7) | | | | | | $ | 125,101 | | | | 3.45 | % | | | | | | $ | 118,828 | | | | 3.37 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Liquidity management assets include available-for-sale securities, interest earning deposits with banks, federal funds sold and securities purchased under resale agreements. |

| (2) | Interest income on tax-advantaged loans, trading securities and securities reflects a tax-equivalent adjustment based on a marginal federal corporate tax rate of 35%. The total adjustments for the three months ended December 31, 2011 was $454,000 and for the three months ended September 30, 2011 was $419,000. |

| (3) | Other earning assets include brokerage customer receivables and trading account securities. |

| (4) | Loans, net of unearned income, include loans held-for-sale and non-accrual loans. |

| (5) | Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities. |

| (6) | Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities. |