SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14(a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §.240.14a-12

FLEXIINTERNATIONAL SOFTWARE, INC. |

|

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

FlexiInternational Software, Inc.

Two Enterprise Drive

Shelton, Connecticut 06484

_______________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, MAY 14, 2004

_______________

To the Stockholders of FlexiInternational Software:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of FlexiInternational Software, Inc. (the “Company”) will be held on Friday, May 14, 2004, at the offices of the Company located at 3541 Bonita Bay Boulevard, Suite 200, Bonita Springs, Florida 34134, at 10:00 a.m., Florida time, to consider and act upon the following matters:

1. To elect one Class I Director to serve for the ensuing three years;

2. To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on Friday, April 2, 2004 will be entitled to notice of, and to vote at, the Annual Meeting of Stockholders or any adjournment thereof. A list of the Company’s stockholders will be open for examination ten days prior to the meeting by any stockholder at the executive offices of the Company, Two Enterprise Drive, Shelton, Connecticut 06484 and will be available at the meeting.

A copy of the Company’s Annual Report to Stockholders for the year ended December 31, 2003 and Proxy Statement, which contains financial statements and other information of interest to stockholders, accompanies this Notice.

All stockholders are cordially invited to attend the Annual Meeting of Stockholders.

By Order of the Board of Directors,

Stefan R. Bothe

Secretary

Shelton, Connecticut

April 12, 2004

YOUR VOTE IS IMPORTANT WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS, PLEASE VOTE BY PROXY VIA TELEPHONE OR INTERNET, IF AVAILABLE TO YOU, OR MAIL IN ACCORDANCE WITH THE VOTING INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY MAIL, YOU SHOULD COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES. |

|

FlexiInternational Software, Inc.

Two Enterprise Drive

Shelton, Connecticut 06484

_______________

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, MAY 14, 2004

_______________

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”) of FlexiInternational Software, Inc. (the “Company”), for use at the 2004 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, May 14, 2004, and at any adjournments of that meeting. All proxies will be voted in accordance with the stockholders’ instructions and, if no choice is specified, the proxies will be voted in favor of the election of Stefan R. Bothe as a director of the Company. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of a written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy.

These proxy solicitation materials will be mailed on or about April 12, 2004 to all stockholders entitled to vote at the Annual Meeting. A copy of the Company’s 2003 Annual Report to Stockholders accompanies and is attached to this Proxy Statement.

The Company will, upon written request of any stockholder, furnish without charge a copy of its Annual Report on Form 10-K for the year ended December 31, 2003 as filed with the Securities and Exchange Commission. Please address all such requests to the Company, attention of Stefan R. Bothe, Chief Executive Officer, FlexiInternational Software, Inc., Two Enterprise Drive, Shelton, Connecticut 06484. Exhibits will be provided upon written request, at no charge.

Quorum Requirement

At the close of business on April 2, 2004, the record date for the determination of stockholders entitled to vote at the Annual Meeting (the “Record Date”), there were outstanding and entitled to vote an aggregate of 17,797,519 shares of Common Stock, par value $0.01 per share (the “Common Stock”). Holders of Common Stock are entitled to one vote per share.

Under the Company’s Amended and Restated By-laws (the “By-laws”), the holders of a majority of the number of votes represented by shares of Common Stock issued, outstanding and entitled to vote on any matter shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock present in person or represented by proxy (including shares which abstain or do not vote for any reason) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

Votes Required

The affirmative vote of the holders of a plurality of the votes cast by the stockholders entitled to vote at the Annual Meeting is required for the election of directors. If any other matters properly come before the Annual Meeting, the affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required for approval at the Annual Meeting.

Shares which abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the votes cast or shares voting on a matter.

Beneficial Ownership of Common Stock

The following table sets forth the beneficial ownership of the Company’s Common Stock as of December 31, 2003, by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares of Common Stock, (ii) each director of the Company, (iii) each executive officer of the Company named in the Summary Compensation Table set forth under the caption “Executive Compensation” below and (iv) all directors and current executive officers of the Company as a group. Unless otherwise specified below, the address for each of the parties is c/o FlexiInternational Software, Inc., Two Enterprise Drive, Shelton, Connecticut 06484.

Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned (1) | Percentage of Common Stock Outstanding (2) |

| | |

WR Hambrecht & Co., LLC and affiliates (3)............................................ | 3,343,550 | 18.8% |

Stefan R. Bothe (4)........................................................................................ | 1,570,218 | 8.8 |

Jennifer V. Cheng (5)..................................................................................... | 642,500 | 3.6 |

Robert A. Degan (6)...................................................................................... | 23,250 | * |

John K. P. Stone III (6).................................................................................. | 12,750 | * |

Dmitry G. Trudov (6)..................................................................................... | 69,089 | * |

Maureen Okerstrom (7)................................................................................. | 18,000 | * |

| | |

All directors and current executive officers as a group (6 persons) (8) ...................................................................... | 2,335,807 | 13.1 |

| | |

__________

* Less than 1%

(1) The inclusion in this table of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. Unless otherwise indicated, to the knowledge of the Company based upon information provided by such persons, each person listed above has sole voting and investment power (or shares such power with his or her spouse) with respect to the shares listed. For purposes of this table, each person is deemed to beneficially own any shares subject to stock options, warrants or other securities convertible into Common Stock, which are currently exercisable (or convertible) or become exercisable or convertible within 60 days after December 31, 2003.

(2) As of December 31, 2003, on which date there were a total of 17,784,185 shares of Common Stock outstanding.

(3) The beneficial ownership WR Hambrecht & Co., LLC is as reported on its Schedule 13D filed with the Commission on December 24, 2003. Consists of 3,343,550 shares with respect to which WR Hambrecht & Co., LLC and Mr. Hambrecht, a member of WR Hambrecht & Co., LLC, respectively, share voting and dispositive power and 616,962 shares owned by Mr. Hambrecht. Mr. Hambrecht disclaims beneficial ownership of all shares held by WR Hambrecht & Co., LLC except to the extent of his proportional ownership interest therein. The address for WR Hambrecht & Co., LLC, as reported on its most recent Schedule 13D, is 539 Bryant Street, Suite 100, San Francisco, California 94107.

(4) Includes 376,190 shares subject to options exercisable within 60 days after December 31, 2003. Excludes 642,500 shares beneficially owned by Jennifer V. Cheng, Mr. Bothe’s spouse, with respect to which Mr. Bothe disclaims beneficial ownership.

(5) Includes 96,250 shares subject to options exercisable within 60 days after December 31, 2003 and 5,000 shares held by Cheng Associates, a limited partnership of which Ms. Cheng is the general partner. Excludes 1,570,218 shares beneficially held by Stefan R. Bothe, Ms. Cheng’s spouse, with respect to which Ms. Cheng disclaims beneficial ownership.

(6) Consists of shares subject to options exercisable within 60 days after December 31, 2003.

(7) Includes 16,500 shares subject to options exercisable within 60 days after December 31, 2003.

(8) Includes an aggregate of 405,756 shares held by current executive officers and directors subject to options exercisable within 60 days after December 31, 2003.

PROPOSAL I

ELECTION OF DIRECTORS

The Company has a classified Board of Directors consisting of three classes, with members of each class holding office for three-year terms. In July 2003, the directors elected John K. P. Stone, III to serve as a Class II Director serving until the next election of Class II directors at the 2005 Annual Meeting. Currently, there is one Class I director, whose term expires at the 2004 annual meeting, two Class II directors, whose terms expire at the 2005 annual meeting, and one Class III director, whose term expires at the 2006 annual meeting of stockholders.

The persons named in the enclosed proxy will vote to elect Stefan R. Bothe as a Class I Director to serve for the ensuing three years, unless authority to vote for Mr. Bothe is withheld by marking the proxy to that effect. Mr. Bothe has indicated his willingness to serve, if elected. In the event the nominee is unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors. The Board of Directors has no reason to believe that the nominee will be unable or unwilling to serve if elected.

Directors and Nominee

Set forth below, for each director of the Company (including the nominee for Class I Director), is each director’s respective name, age, positions with the Company, principal occupation, business experience during the past five years, the names of other publicly held corporations of which such person is a director and the year in which such person first became a director of the Company. Other than Mr. Stefan R. Bothe and Ms. Jennifer V. Cheng, who are husband and wife, there are no family relationships among any of the directors and executive officers of the Company.

Class I Director (Term expires at 2004 Annual Meeting; nominee for election)

Stefan R. Bothe, age 55, has served as Chairman of the Board of Directors and Chief Executive Officer of the Company since March 1993 and Acting Chief Financial Officer since August 2001. From November 1991 to February 1993, Mr. Bothe was President and Chief Executive Officer of DSI Group N.V., a Dutch-based international software company. From 1989 to 1991, Mr. Bothe was President and Chief Executive Officer of GEAC Computer Corporation Limited (“GEAC”), a software company. Prior to joining GEAC, Mr. Bothe was President of the Application Products Division of Computer Associates International, Inc. (“Computer Associates”), one of the largest software companies in the industry. While at Computer Associates, Mr. Bothe held numerous senior management positions, including President of the International Division, President of the Appli cations Product Division, President of the Micro Products Division and Senior Vice President of Marketing.

Class II Directors (Terms expire at 2005 Annual Meeting)

Jennifer V. Cheng, age 54, has served as a Director of the Company since the Company’s inception in 1990. She was also the Company’s President from its inception through February 1999. Since June 1999, Ms. Cheng has been President of International Boutiques.com LLC, a start-up Internet retail company. In addition, since 1984, Ms. Cheng has been a General Partner of Cheng Associates, an investment partnership specializing in investments in emerging growth companies, including technology companies. Prior to forming Cheng Associates, Ms. Cheng served with several major financial organizations, including Morgan Stanley & Co., Inc., as an emerging growth Stock Analyst, Mutual Life Insurance Company of New York, as Director of Equity Investments, and Donaldson, Lufkin & Jenrette Securities Corporation, as a Research Analyst.

John K. P. Stone, III, age 71, has served as a Director of the Company since July 2003, when he was elected by the Board for a term expiring at the 2005 Annual Meeting. Mr. Stone has served as Senior Vice President and General Counsel of PolyMedica Corporation since June 2002. Prior to joining PolyMedica, Mr. Stone was a senior partner at Hale and Dorr, LLP, a leading Boston-based law firm, where his corporate practice focused on emerging companies primarily in the high technology and medical fields. Mr. Stone is also a director of PolyMedica Corporation.

Class III Director (Term expires at 2006 Annual Meeting)

Robert A. Degan, age 65, has served as a Director of the Company since March 2000. Mr. Degan has been a private investor since January 2000. From November 1998 to December 1999, Mr. Degan served as General Manager of the Enhanced Services & Migration Unit (formerly, Summa Four, Inc.) of Cisco Systems, Inc. From January 1997 to October 1998, Mr. Degan was Chairman, President and Chief Executive Officer of Summa Four, Inc., a developer of open platforms for telecommunications providers. From August 1996 to December 1996, Mr. Degan was Executive Vice President of the Communications Product Group (formerly, Tylink Corporation) of Sync Research. From March 1991 to August 1996, Mr. Degan was President, Chief Executive Officer and a Director of Tylink Corporation, a supplier of digital access products to users of high-speed digital networks. Mr. Degan is also a Director of Gensym Corporation, Overland Data, Inc. and Caminosoft Corp.

Board of Director and Committee Meetings

The Board of Directors met five times during the fiscal year ended December 31, 2003. Each of the Company’s directors attended at least 50% of the total number of meetings of the Board of Directors held during fiscal 2003 and at least 50% of the total number of meetings held during such period by all committees on which he or she then served. All directors attended 100% of the meetings except for Mr. Stone who was unable to attend the October 2003 Board and Audit Committee Meetings.

It is the Company’s policy that, absent unusual and unforeseen circumstances, all of the directors are expected to attend the annual meetings of stockholders. All of the directors then serving attended the Company’s 2003 Annual Meeting of Stockholders.

The Company has a standing Audit Committee of the Board of Directors which, among other things, recommends independent auditors, reviews with the independent auditors the Company’s internal accounting control policies and procedures and the results and scope of the audit and provides the opportunity for direct contact between the Company’s independent auditors and the Board of Directors. The Audit Committee met five times during the fiscal year ended December 31, 2003. The Audit Committee consisted of Mr. Degan from January 2003 to July 2003 and Messrs. Stone and Degan for the remainder of 2003 and for 2004, each of whom is a nonemployee director. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which was attached to Proxy Statement for 2002 Annual Meeting.

The Company has a standing Compensation Committee of the Board of Directors which, among other things, reviews and makes recommendations concerning salaries, bonuses and incentive compensation for employees of, and consultants to, the Company and administers and grants stock options pursuant to the Company’s stock option plans. The Compensation Committee met two times during the fiscal year ended December 31, 2003. The Compensation Committee consisted of Mr. Degan from January 2003 to July 2003 and Messrs. Stone and Degan for the remainder of 2003 and for 2004, each of whom is a nonemployee director.

The Company does not have a standing Nominating Committee of the Board of Directors. The functions of selecting nominees is performed by the full Board of Directors with each member participating in the consideration of director nominees. The Board believes that this approach is appropriate in light of the limited number of members of the Board and the importance of having a broad consensus on decisions as significant to the Company as the selection of nominees for election as directors.

Stockholder Nominations

The Board of Directors will consider any recommendation by a stockholder of a candidate for nomination as a director. If a stockholder wants to recommend a candidate for election as a director, the stockholder may submit the name of the proposed nominee in writing delivered or mailed by first class United States mail, post prepaid, to the Secretary, and received not less than 60 days nor more than 90 days prior to such meeting; provided, however, that if less than 70 days’ notice or prior public disclosure of the date of the meeting is given to stockholders, such nomination shall have been mailed or delivered to the Secretary not later than the close of business on the 10th day following the date on which the notice of the meeting was mailed or such public disclosure was made, whichever occurs first. Such notice shall set forth (a) as to each proposed nominee (i) the name, age, business address and, if known, residence address of each such nominee, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares of stock of the corporation which are beneficially owned by each such nominee, and (iv) any other information concerning the nominee that must be disclosed as to nominees in proxy solicitations pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such person’s written consent to be named as a nominee and to serve as a director if elected); and (b) as to the stockholder giving the notice (i) the name and address, as they appear on the corporation’s books, of such stockholder and (ii) the class and number of shares of the corporation which are benefi cially owned by such stockholder. The corporation may require any proposed nominee to furnish such other information as may reasonably be required by the corporation to determine the eligibility of such proposed nominee to serve as a director of the corporation.

Copies of any recommendations received in accordance with these procedures will be distributed to each of the Company’s directors. One or more of the Company’s directors may contact the proposed candidate to request additional information.

The Company will not, however, be obligated to notify a stockholder who has recommended a candidate for election as a director of the reasons for any action the Board may take with respect to such nomination.

Stockholder Communications

The Board welcomes questions, comments and observations from stockholders concerning the policies and operation of the Board and about the general business and operation of the Company.

Any stockholder wishing to communicate with the Board or with any specified director should address his or her communication to the Board of Directors or to the particular director(s) and send it to the Company’s principal office. Stockholder communications to the Board or to specified director(s) will be initially reviewed by the Company’s Chief Executive Officer. Communications that the Chief Executive Officer determines relate to the Company’s ordinary course of business will be responded to by him or his designee. Communications that the Chief Executive Officer determines do not relate to the Company’s ordinary course of business or that he otherwise believes are appropriate for review by the directors will be forwarded to each of the directors. Actions, if any, to be taken in response to any stockholder communication will be in the discretion of the Board of Directors.

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company served as a director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity any of whose executive officers served as a director of or member of the Compensation Committee of the Board of Directors of the Company.

Compensation of Directors

Under the Company’s 1997 Director Stock Option Plan (the “Director Plan”), each nonemployee director receives an option to purchase 7,500 shares of Common Stock at the close of business on the date on which such nonemployee director is initially elected to the Board of Directors, and each continuing nonemployee director receives an option to purchase 5,250 shares of Common Stock on the date of each annual meeting of stockholders after his or her election. The exercise price of all options granted under the Director Plan is the last reported sale price per share of the Common Stock on the OTC Bulletin Board Service on the date of grant. The Director Plan provides that all options are fully vested on the date of grant.

In addition, effective as of January 1, 2000, members of the Board of Directors who are not employees of the Company are paid a retainer of $12,000 per year, payable in equal quarterly installments. The Company also reimburses nonemployee directors for their out-of-pocket expenses in connection with their attendance at Board of Directors and committee meetings.

On the date of the Company’s Annual Meeting, Ms. Cheng, Mr. Degan and Mr. Stone (assuming he is elected to the Board of Directors) will each receive a fully vested and immediately exercisable option to purchase 5,250 shares of Common Stock at an exercise price per share equal to the last reported sale price per share of the Common Stock on the OTC Bulletin Board Service on such meeting date.

EXECUTIVE COMPENSATION

Summary Compensation

The following table sets forth the total compensation paid or accrued for the three fiscal years ended December 31, 2003, 2002 and 2001 for the Company’s (i) Chief Executive Officer, (ii) the Company’s two other executive officers who served as an executive officer of the Company as of the end of 2003 and whose individual total salary and bonus exceeded $100,000 during such fiscal year.

Summary Compensation Table

| | Annual Compensation (2) | Long-Term

Compensation

Awards | |

Name and Principal Position (1) | Fiscal Year | Salary ($) | Bonus ($) | Securities

Underlying

Options (#) (3) | All Other Compensation ($) |

| | | | | |

Stefan R. Bothe.................................................................... | 2003 | 219,000 | 94,100 | 200,000 | 17,880(8) |

Chairman and Chief Executive Officer | 2002 | 200,000 | - | - | 12,000(4) |

| 2001 | 200,000 | 106,666(5) | 100,000 | 12,272(6) |

| | | | | |

Dmitry G. Trudov............................................................... | 2003 | 100,000 | 10,000 | 20,000 | 3,300(7) |

Chief Technology Officer | 2002 | 100,000 | - | 20,000 | - |

| 2001 | 91,875 | 7,208 | 10,000 | 2,973(7) |

| | | | | |

Maureen M. Okerstrom....................................................... | 2003 | 157,099 | - | 25,000 | 825(7) |

Vice President, Sales USA | 2002 | 69,160 | - | 50,000 | - |

| | | | | |

__________

(1) Lists the principal position with the Company as of December 31, 2003.

(2) In accordance with the rules of the Securities and Exchange Commission, other compensation in the form of perquisites and other personal benefits have been omitted in those instances where such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total of annual salary and bonus for the Named Executive Officer for the fiscal year.

(3) Represents the number of shares covered by options to purchase shares of the Company’s Common Stock granted during the fiscal year listed.

(4) Represents Company paid car allowance of $12,000.

(5) Mr. Bothe was paid a scheduled executive bonus through July 2001, at which time his bonus was discontinued as part of an executive compensation reduction program implemented by the Company’s Board of Directors.

(6) Represents Company paid car allowance of $7,000 and Company contributions under the 401(k) plan of $5,272.

(7) Represents Company contributions under the 401(k) plan.

(8) Represents Company paid car allowance of $12,000 and Company contributions under the 401(k) plan of $5,880.

Option Grants

The following table sets forth information regarding option grants and exercises during the fiscal year ended December 31, 2003 to or by the Named Executive Officers and the number and value of the unexercised options held by such persons on December 31, 2003.

Option Grants in Last Fiscal Year

| | | | | Potential Realizable |

| Individual Grants | Value at Assumed |

| | Percent of Total | Exercise | | Annual Rates of Stock |

| Number of Securities | Options Granted | Price | | Price Appreciation for |

| Underlying Options | To Employees in | Per | Expiration | Option Term (3) |

Name | Granted (1) | Fiscal Year | Share (2) | Date | 5% | 10% |

Stefan R. Bothe.................... | 200,000 | 54.2 | 0.05 | 01/30/13 | 6,290 | 15,939 |

Dmitry G. Trudov................. | 20,000 | 5.4 | 0.05 | 01/30/13 | 630 | 1,593 |

Maureen Okerstrom............. | 25,000 | 6.8 | 0.05 | 01/30/13 | 787 | 1,992 |

| | | | | | |

| | | | | | |

(1) Each option represents a right to purchase one share of the Company’s Common Stock. Each option vests in three equal annual installments and has a term of 10 years.

(2) The exercise price per share of each option was equal to the fair market value per share of Common Stock on the date of grant as reported on the OTC Bulletin Board.

(3) Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercises of the option or the sale of the underlying shares. The actual gains, if any, on the exercises of stock options will depend on the future performance of the Common Stock, the option holder’s continued employment through the option period and the date on which the options are exercised.

Option Year End Values

The following table sets forth, for each of the Named Executive Officers, the number of shares acquired upon the exercise of options during the fiscal year ended December 31, 2003, the aggregate dollar value realized upon such exercise and the number and value of unexercised options held by each such Named Executive Officer on December 31, 2003.

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| | | Number of Securities | Value of Unexercised |

| Shares | | Underlying Unexercised | In-the-Money |

| Acquired | | Options at Fiscal | Options at |

| on | Value | Year-End | Fiscal Year-End |

Name | Exercise | Realized | Exercisable | Unexercisable | Exercisable | Unexercisable |

Stefan R. Bothe............................ | — | — | 328,570 | 171,430 | 128,570 | 171,430 |

Dmitry G. Trudov......................... | — | — | 52,422 | 36,666 | 13,334 | 36,666 |

Maureen M. Okerstrom............... | — | — | 16,667 | 58,333 | 16,667 | 58,333 |

| | | | | | |

| | | | | | |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Overview

The Audit Committee of the Company’s Board of Directors was established in September 1997 and acts under a written charter first adopted and approved in February 2002. This charter was attached to Proxy Statement for the 2002 Annual Meeting. The Audit Committee of the Company’s Board of Directors currently is composed of two independent, nonemployee members, Mr. Degan and Mr. Stone. Mr. Degan and Mr. Stone are independent directors, as defined by the rules of the Nasdaq Stock Market.

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2003 and discussed these financial statements with the Company’s management. Management represented to the Audit Committee that the Company’s financial statements had been prepared in accordance with generally accepted accounting principles. The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Kingery, Crouse & Hohl, P.A., the Company’s independent auditors. SAS 61 requires the Company’s independent auditors to discuss with the Company’s Audit Committee, among other things, the following:

· methods to account for significant unusual transactions;

· the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

· the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and

· disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements.

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditors’ professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. In addition, the Audit Committee discussed with the independent auditors their independence from the Company.

Based on its discussions with management and the independent auditors and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

By the Audit Committee of the Board of Directors of the Company,

Robert A. Degan

John K. P. Stone, III

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Overview

The Company established a Compensation Committee of the Board of Directors in September 1997, and this committee currently consists of Mr. Stone and Mr. Degan. The Compensation Committee was responsible for determining salaries and incentive compensation for the fiscal year ended December 31, 2003 for employees of the Company, including its Chief Executive Officer and other executive officers, and for granting options under and administering the Company’s stock plans.

The Company’s compensation program is designed to achieve the following objectives:

• provide compensation that attracts, motivates and retains the best talent and highest caliber people to serve the Company’s customers and achieve its strategic objectives;

• recognize and reward individual performance and responsibility; and

• align management’s interest with the interests of the stockholders and the success of the Company through long-term equity incentives.

Compensation Program

General. The Company’s executive compensation program consists of base salary, annual incentive compensation, long-term equity incentives in the form of stock options and certain benefits, such as life and medical insurance and a 401(k) savings plan, which are generally available to all employees of the Company. The Compensation Committee believes that its executive compensation program provides an overall level of compensation that is competitive in the accounting software industry and comparable to those of other companies of similar size and complexity.

Base Salary. Base salary is generally set within the range of salaries of executive officers with comparable qualifications, experience and responsibilities at other companies in the same or similar businesses and of comparable size and success. Salary is determined within this range by the Company’s financial performance and the individual’s performance based on predetermined non-financial objectives. Non-financial objectives include an individual’s contribution to the Company as a whole, including his or her ability to motivate others, develop the skills necessary to grow as the Company matures, recognize and pursue new business opportunities and initiate programs to enhance the Company’s growth and success.

Cash Incentives. Cash incentive compensation is designed to tie compensation to performance by the Company and by the individual. The Compensation Committee considers a number of factors in determining whether incentive awards should be paid, including achievement by the Company of approved budgets, new product introductions, progress in development of new products and operating income and cash flow goals. The Compensation Committee also considers the achievement by the executives of their assigned objectives. In considering individual performance, as contrasted to Company performance, the Compensation Committee relies more on subjective evaluations of performance than on quantitative data or objective criteria.

Long-Term Incentive Compensation. During the fiscal year ended December 31, 2003, long-term incentives were provided in the form of options under the Company’s 1997 Stock Incentive Plan. The objectives of these plans are to align executive and stockholder long-term interests by creating a strong and direct link between executive compensation and stockholder return and to enable executives to develop and maintain a significant, long-term stock ownership position in the Company’s Common Stock.

1997 Stock Incentive Plan. Stock options are generally granted at an option price equal to the fair market value of the Common Stock on the date of grant. In selecting executives eligible to receive option grants and determining the amount and frequency of such grants, the Compensation Committee evaluates a variety of factors, including:

• the job level of the executive;

• option grants awarded by competitors to executives at comparable job levels;

• past, current and prospective service rendered by the executive; and

• the current equity holding of the executive in the Company.

During fiscal 2003, the Compensation Committee approved option grants for an aggregate of 245,000 shares of Common Stock to the Named Executive Officers.

1997 Employee Stock Purchase Plan. The 1997 Employee Stock Purchase Plan was available to virtually all employees, including executive officers, and allowed participants to purchase shares at a discount of 15 percent from the fair market value at the beginning or end of the applicable purchase period. This plan was discontinued in January 2002.

Compensation of Chief Executive Officer

The Compensation Committee determined the salary for the fiscal year ended December 31, 2003 for the Company’s Chief Executive Officer, Mr. Bothe, based on subjective and objective factors, including the Company’s operating results for the year 2002. Using these criteria, the Compensation Committee raised Mr. Bothe’s base salary for the fiscal year ended December 31, 2003 to $219,000. The Compensation Committee believes that Mr. Bothe’s total compensation for the fiscal year ended December 31, 2003 was appropriate in light of the Company’s performance and circumstances in its market place. The Compensation Committee intends to assess Mr. Bothe’s compensation from time to time to assure that it appropriately reflects Mr. Bothe’s performance and that it remains competitive within the accounting software industry.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), generally disallows a tax deduction to publicly traded corporations for compensation over one million dollars paid to a corporation’s chief executive officer and its four other most highly compensated executive officers. Qualifying “performance-based” compensation is not subject to the deduction limit if certain requirements are met. Although the Compensation Committee is considering the limitations on the deductibility of executive compensation imposed by Section 162(m) in designing the Company’s executive compensation, the Compensation Committee believes that it is unlikely that such limitation will affect the deductibility of the compensation to be paid to the Company’s executive officers in the near term. The Compensation Committee will, however, continue to monitor the impact of Section 162(m) on the Company.

By the Compensation Committee of the Board of Directors,

John K. P. Stone, III

Robert A. Degan

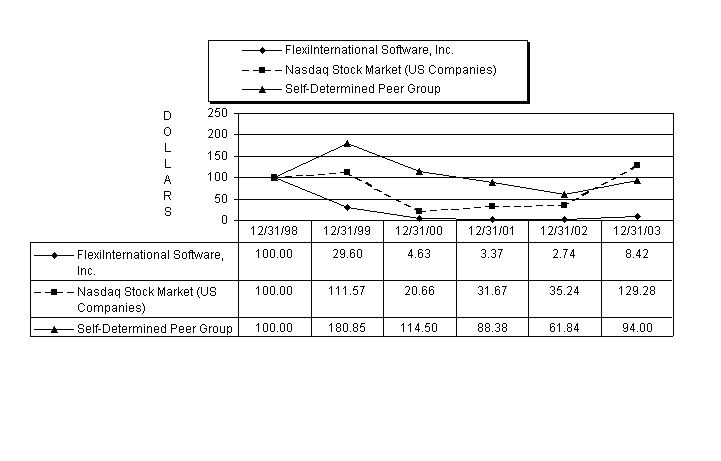

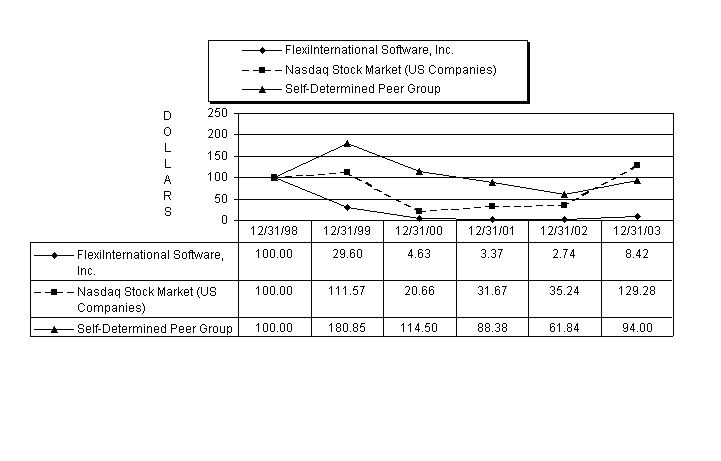

Stock Performance Graph

The following graph compares the cumulative total stockholder return on the Company’s Common Stock for the period from December 31, 1998 through December 31, 2003, with the cumulative total return of (i) the Center for Research in Security Prices (“CRSP”) Total Return Index for the Nasdaq National Market and (ii) a self-determined peer group index over the same period. The self-determined Peer Group Index consists of the Company, American Software Inc., AXS-ONE Inc. (f/k/a Computron Software, Inc.), Epicor Software Corp., Mapics Inc. and QAD Inc. This comparison assumes the investment of $100 on December 31, 1998 in the Company’s Common Stock, the Nasdaq National Market Index and the Peer Group Index and assumes dividends, if any, are reinvested.

Changes in Independent Auditors

On June 27, 2003, with the approval of the Audit Committee and the concurrence of the Board of Directors, the Company engaged Kingery, Crouse & Hohl, P.A. as its independent auditors and dismissed its former independent auditors, Hill, Barth & King (HBK), effective as of that date. Hill, Barth & King informed the Company that it would not register with the Public Company Accounting Oversight Board as required by the Sarbanes-Oxley Act and thus would no longer be able to provide audit services to public company registrants. Prior to the engagement, there were no consultations between Kingery, Crouse & Hohl and the Company regarding the treatment of accounting, auditing or financial reporting issues.

Prior to the engagement of Kingery, Crouse & Hohl, Hill, Barth & King had served as the independent auditors of the Company since December 2001. Hill, Barth & King performed audits of the Company’s financial statements for the years ended December 31, 2001 and 2002. Hill, Barth and King issued an audit report dated February 20, 2002, for the fiscal year 2001, which contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. Hill, Barth and King also issued an audit report dated January 22, 2003, for the fiscal year 2002, which contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. Prior to the engagement, there were no consultations between Hill, Barth & King and the Company regarding the treatment of accounting, auditing or financial reporting issues

Kingery, Crouse & Hohl has been selected as independent auditors for the Company for the year ending December 31, 2004. The Company does not expect that a representative of Kingery, Crouse & Hohl will be at the Annual Meeting.

Audit Fees

The aggregate fees billed by Kingery, Crouse & Hohl for professional services rendered for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2003 were $42,600 including reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q during fiscal 2003.

The aggregate fees billed by Hill, Barth & King for professional services rendered for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q during fiscal 2003 were $2,397.

The aggregate fees billed by Hill, Barth & King for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2002 were $74,763 and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q during fiscal 2002 were $16,792.

The aggregate fees billed by Deloitte & Touche, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte”) for professional services rendered for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q during fiscal 2002 were $7,575.

Audit-Related Fees

Neither Kingery, Crouse & Hohl nor Hill, Barth & King rendered any professional services for assurance and related services relating to financial information systems design and implementation for the fiscal years ended December 31, 2003 or 2002.

Tax Fees

Neither Kingery, Crouse & Hohl nor Hill, Barth & King provided services to the Company for tax compliance, tax advice or tax planning for the fiscal years ended December 31, 2003 or 2002.

All Other Fees

Neither Kingery, Crouse & Hohl nor Hill, Barth & King provided services to the Company other than the services described above under “Audit Fees” for the fiscal years ended December 31, 2003 or 2002. It is the policy of the Audit Committee that all non-audit fees will be approved in advance by the Audit Committee.

OTHER MATTERS

The Board of Directors does not know of any other matters which may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

All costs of solicitation of proxies will be borne by the Company. In addition to solicitations by mail, the Company’s directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names and, as required by regulations, the Company will reimburse them for out-of-pocket expenses incurred on behalf of the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on its review of copies of reports filed by “reporting persons” of the Company under Section 16(a) of the Securities Exchange Act of 1934, as amended (“Section 16(a)”), and written representations from such reporting persons, the Company believes that all filings required to be made by reporting persons of the Company were timely filed for the year ended December 31, 2003 in accordance with Section 16(a) with the exception of one Form 4 for Stefan R. Bothe reporting one transaction, Form 3 for John K. P. Stone, III and Form 3 for Maureen M. Okerstrom.

STOCKHOLDER PROPOSALS FOR THE 2005 ANNUAL MEETING OF STOCKHOLDERS

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for inclusion in the Company’s proxy materials for its 2005 Annual Meeting of Stockholders must be received by the Secretary of the Company at its principal office in Shelton, Connecticut no later than December 13, 2004.

Written notice of proposals of stockholders submitted outside of Rule 14a-8 under the Exchange Act for consideration at the 2005 Annual Meeting of Stockholders must have been received by the Company at its principal office in Shelton, Connecticut on or before February 27, 2005, in order to be considered timely for purposes of Rule 14a-4 under the Exchange Act. The persons designated in the Company’s proxy card will be granted discretionary authority with respect to any stockholder proposal with respect to which the Company does not receive timely notice. If a shareholder proposal is received by the Company in a timely manner, the persons designated in the Company’s proxy card may still exercise discretionary authority under circumstances consistent with the proxy rules of the Securities and Exchange Commission.

In addition, the Company’s By-laws require all stockholder proposals, including nominations of directors, to be timely submitted in advance to the Company at the principal offices of the Company in Shelton, Connecticut. To be timely, the Secretary must receive such notice not less than 60 days nor more than 90 days prior to the 2005 Meeting; provided that, if less than 70 days’ notice or prior public disclosure of the date of the 2005 Annual Meeting is given or made, the notice must be received not later than the close of business on the tenth day following the date on which notice of the date of the meeting was mailed or public disclosure was made, whichever occurs first. Notice of any such proposal must contain the information specified in the Company’s By-laws.

By Order of the Board of Directors,

Stefan R. Bothe

Secretary

April 12, 2004

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE 2004 ANNUAL MEETING. WHETHER OR NOT STOCKHOLDERS PLAN TO ATTEND, STOCKHOLDERS ARE URGED TO VOTE BY PROXY VIA TELEPHONE OR INTERNET, IF AVAILABLE TO YOU, OR MAIL IN ACCORDANCE WITH THE VOTING INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY MAIL, YOU SHOULD COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES. STOCKHOLDERS WHO ATTEND THE ANNUAL MEETING MAY VOTE THEIR SHARES PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES. |

|