River Valley Bancorp

430 Clifty Drive

P.O. Box 1590

Madison, Indiana 47250-0590

(812) 273-4949

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On April 19, 2006

Notice is hereby given that the Annual Meeting of Shareholders of River Valley Bancorp (the “Holding Company”) will be held at 430 Clifty Drive, Madison, Indiana, on Wednesday, April 19, 2006, at 3:00 p.m., Eastern Standard Time.

The Annual Meeting will be held for the following purposes:

| | 1. | Election of Directors. Election of two directors of the Holding Company for terms expiring in 2009. |

| | 2. | Other Business. Such other matters as may properly come before the meeting or any adjournment thereof. |

Shareholders of record at the close of business on February 24, 2006, are entitled to vote at the meeting or any adjournment thereof.

We urge you to read the enclosed Proxy Statement carefully so that you may be informed about the business to come before the meeting, or any adjournment thereof. At your earliest convenience, please sign and return the accompanying proxy in the postage-paid envelope furnished for that purpose.

A copy of our Annual Report for the fiscal year ended December 31, 2005, is enclosed. The Annual Report is not a part of the proxy soliciting material enclosed with this letter.

By Order of the Board of Directors

Matthew P. Forrester, President

Madison, Indiana

March 15, 2006

IT IS IMPORTANT THAT THE PROXIES BE RETURNED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE SIGN, DATE AND COMPLETE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

River Valley Bancorp

430 Clifty Drive

P.O. Box 1590

Madison, Indiana 47250-0590

(812) 273-4949

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

April 19, 2006

This Proxy Statement is being furnished to the holders of common stock, without par value (the “Common Stock”), of River Valley Bancorp (the “Holding Company”), an Indiana corporation, in connection with the solicitation of proxies by the Board of Directors of the Holding Company to be voted at the Annual Meeting of Shareholders to be held at 3:00 p.m., Eastern Standard Time, on April 19, 2006, at 430 Clifty Drive, Madison, Indiana, and at any adjournment of such meeting. The principal asset of the Holding Company consists of 100% of the issued and outstanding shares of common stock, $.01 par value per share, of River Valley Financial Bank (the “Bank”). This Proxy Statement is expected to be mailed to the shareholders of the Holding Company on or about March 15, 2006.

The proxy solicited hereby, if properly signed and returned to the Holding Company and not revoked prior to its use, will be voted in accordance with the instructions contained therein. If no contrary instructions are given, each proxy received will be voted for each of the matters described below and, upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies.

Any shareholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing with the Secretary of the Holding Company written notice thereof (Lonnie D. Collins, 430 Clifty Drive, P.O. Box 1590, Madison, Indiana 47250-0590), (ii) submitting a duly executed proxy bearing a later date, or (iii) by appearing at the Annual Meeting and giving the Secretary notice of his or her intention to vote in person. Proxies solicited hereby may be exercised only at the Annual Meeting and any adjournment thereof and will not be used for any other meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Only shareholders of record at the close of business on February 24, 2006 (“Voting Record Date”), will be entitled to vote at the Annual Meeting. On the Voting Record Date, there were 1,592,877 shares of the Common Stock issued and outstanding, and the Holding Company had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting on all matters properly presented at the Annual Meeting. The holders of over 50% of the outstanding shares of Common Stock as of the Voting Record Date must be present in person or by proxy at the Annual Meeting to constitute a quorum. In determining whether a quorum is present, shareholders who abstain, cast broker non-votes, or withhold authority to vote on one or more director nominees will be deemed present at the Annual Meeting.

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of February 24, 2006, by each person who is known by the Holding Company to own beneficially 5% or more of the Common Stock. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares.

Name and Address of Beneficial Owner(1) | | Number of Shares of Common Stock Beneficially Owned (1) | | Percent of Class | |

River Valley Financial Bank, as Trustee | | | 147,733(2 | ) | | 9.3 | % |

| 430 Clifty Drive | | | | | | | |

| Madison, IN 47250 | | | | | | | |

Jeffrey L. Gendell | | | 140,599(3 | ) | | 8.8 | % |

| Tontine Financial Partners, L.P. | | | | | | | |

| Tontine Management, L.L.C. | | | | | | | |

| 55 Railroad Avenue, 3rd Floor | | | | | | | |

| Greenwich, CT 06830 | | | | | | | |

Thomas M. and Mary E. Davee | | | 117,800(4 | ) | | 7.4 | % |

| 215 West Main Street | | | | | | | |

| Madison, IN 47250 | | | | | | | |

Wellington Management Company, LLP | | | 90,000(5 | ) | | 5.6 | % |

| First Financial Fund, Inc. | | | | | | | |

| 75 State Street | | | | | | | |

| Boston, MA 02109 | | | | | | | |

| (1) | The information in this chart is based on Schedule 13D and 13G Report(s) filed by the above-listed person(s) with the Securities and Exchange Commission (the “SEC”) containing information concerning shares held by them. It does not reflect any changes in those shareholdings which may have occurred since the date of such filings. |

| (2) | These shares are held by the Trustee of the River Valley Bancorp Employee Stock Ownership Plan and Trust (the “ESOP”). The Employees participating in the ESOP are entitled to instruct the Trustee how to vote shares held in their accounts under the ESOP. Unallocated shares held in a suspense account under the ESOP are required under the ESOP terms to be voted by the Trustee in the same proportion as allocated shares are voted. |

| (3) | These shares are held by Tontine Financial Partners, L.P., a Delaware limited partnership. Tontine Management, L.L.C. is its general partner and Mr. Gendell is the managing member of the general partner. These persons share voting and investment power with respect to the shares. |

| (4) | Thomas M. Davee and Mary E. Davee are married and jointly own 116,400 of these shares. They share voting and dispositive power as to such shares. |

| (5) | In a Schedule 13G filed with the SEC, the entities listed above indicate that they may be the beneficial owners of the foregoing shares. Wellington Management Company, LLP (“WMC”) is a Massachusetts limited partnership and a registered investment advisor. First Financial Fund, Inc. is one of its clients, with whom WMC shares investment power. First Financial Fund, Inc., Gateway Center Three, 100 Mulberry Street, 9th Floor, Newark, New Jersey 07102-7503, has sole voting power with respect to these shares. |

PROPOSAL I — ELECTION OF DIRECTORS

The Board of Directors consists of six members. All of the directors except Matthew P. Forrester meet the standards for independence of Board members set forth in the Listing Standards for the National Association of Securities Dealers. The By-Laws provide that the directors are to be divided into three classes as nearly equal in number as possible. The members of each class are to be elected for a term of three years and until their successors are elected and qualified. One class of directors is to be elected annually. Directors must have their principal domicile in either Jefferson County, Indiana or Trimble County, Kentucky, must have had a loan or deposit relationship with the Bank for a continuous period of twelve months prior to their nomination to the Board, and non-employee directors must have served as a member of a civic or community organization based in Jefferson County, Indiana or Trimble County, Kentucky for at least a continuous period of twelve months during the five years prior to their nomination to the Board.

The two nominees for election as a director this year are Robert W. Anger and Matthew P. Forrester, each of whom currently serves as a director whose current term will expire upon completion of the election at the Annual Meeting.

Unless otherwise directed, each proxy executed and returned by a shareholder will be voted for the election of the nominees listed below. If any person named as a nominee should be unable or unwilling to stand for election at the time of the Annual Meeting, the proxy holders will nominate and vote for a replacement nominee recommended by the Board of Directors. At this time, the Board of Directors knows of no reason why the nominees listed below may not be able to serve as directors if elected.

The following table sets forth certain information regarding the nominees for the position of director of the Holding Company, including the number and percent of shares of Common Stock beneficially owned by such persons as of the Voting Record Date. Unless otherwise indicated, each nominee has sole investment and/or voting power with respect to the shares shown as beneficially owned by him. Fred W. Koehler is the cousin of John Muessel, the Bank’s Vice President-Trust Services. Apart from this relationship, no nominee for director or director is related to any other nominee for director, director, or executive officer of the Holding Company by blood, marriage, or adoption, and there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected. The table also sets forth the number of shares of Holding Company Common Stock beneficially owned by all directors and executive officers of the Holding Company as a group.

Name | | Expiration of Term as Director | | Director of the Holding Company Since | | Common Stock Beneficially Owned as of February 24, 2006(1) | | Percentage of Class | |

Director Nominees | | | | | | | | | |

| | | | | | | | | | |

| Robert W. Anger | | | 2009 | | | 1996 | | | 23,344(2 | ) | | 1.5 | % |

| Matthew P. Forrester | | | 2009 | | | 1999 | | | 53,687(3 | ) | | 3.3 | % |

Directors Continuing in Office | | | | | | | | | | | | | |

| Michael J. Hensley | | | 2008 | | | 1996 | | | 18,332(4 | ) | | 1.1 | % |

| Fred W. Koehler | | | 2008 | | | 1996 | | | 59,116(5 | ) | | 3.7 | % |

| Lillian Sue Livers, M.S., R.D. | | | 2008 | | | 2002 | | | 300 | | | .02 | % |

| Charles J. McKay | | | 2007 | | | 2000 | | | 4,000(6 | ) | | .25 | % |

| All directors and executive officers as a group (15 persons) | | | | | | | | | 298,728(7 | ) | | 17.9 | % |

| (1) | Based upon information furnished by the respective director nominees. Under applicable regulations, shares are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares the power to vote or dispose of the shares, whether or not he or she has any economic power with respect to the shares. Includes shares beneficially owned by members of the immediate families of the directors residing in their homes. |

| (2) | Of these shares, 2,046 are held jointly by Mr. Anger and his spouse and 8,812 are subject to stock options granted under the River Valley Bancorp Option Plan (the “Option Plan”). |

| (3) | Of these shares, 9,852 are held jointly by Mr. Forrester and his spouse, 1,210 are held in an IRA for his spouse, 192 are held by him as custodian for his minor children, 22,500 are subject to stock options granted under the Option Plan, and 4,723 were held under the ESOP as of December 31, 2004. |

| (4) | Of these shares, 10,000 are held jointly by Mr. Hensley and his spouse. |

| (5) | Of these shares, 9,902 are subject to stock options granted under the Option Plan. |

| (6) | 1,600 of these shares are held jointly by Mr. McKay and his spouse. |

| (7) | Of these shares, 4,260 are held under the River Valley Bancorp Recognition and Retention Plan and Trust (the “RRP”), 73,618 are subject to stock options granted under the Option Plan, and 42,201 were allocated to such persons under the ESOP as of December 31, 2004. Excludes 7,200 shares subject to stock options granted under the Option Plan which may not be exercised within 60 days following the Voting Record Date. |

Presented below is certain information concerning the director nominees of the Holding Company:

Robert W. Anger (age 68) served as the Bank’s Vice President -- Lending from August, 1995 until his retirement in January, 1999. Prior to that, Mr. Anger served as the Bank’s President and Chief Executive Officer.

Matthew P. Forrester (age 49) became President and Chief Executive Officer of the Holding Company and the Bank in October, 1999; theretofore he served as Senior Vice President, Treasurer and Chief Financial Officer of Home Loan Bank and Home Loan Bancorp in Fort Wayne, Indiana for more than five years.

Lillian Sue Livers, M.S., R.D. (age 56) has served as Director of Nutrition Services, The King’s Daughters’ Hospital and Health Services since 1971.

Michael J. Hensley (age 50) is a partner in the law firm Kemper, Collins & Hensley. Mr. Hensley served as a Compliance Officer, Assistant Trust Officer and the General Counsel to The Madison Bank & Trust Company from 1980 to January, 1989.

Fred W. Koehler (age 65) is retired. He formerly owned and operated Koehler Tire Co., a tire and automotive parts store in Madison, Indiana, and served as the Jefferson County Auditor for eight years.

Charles J. McKay (age 53) is a partner with the accounting firm Scott, Callicotte, & McKay LLC, which is based in Madison, Indiana.

THE DIRECTORS SHALL BE ELECTED UPON RECEIPT OF A PLURALITY OF VOTES CAST AT THE ANNUAL SHAREHOLDERS MEETING. PLURALITY MEANS THAT INDIVIDUALS WHO RECEIVE THE LARGEST NUMBER OF VOTES CAST ARE ELECTED UP TO THE MAXIMUM NUMBER OF DIRECTORS TO BE CHOSEN AT THE MEETING. ABSTENTIONS, BROKER NON-VOTES, AND INSTRUCTIONS ON THE ACCOMPANYING PROXY TO WITHHOLD AUTHORITY TO VOTE FOR ONE OR MORE OF THE NOMINEES WILL RESULT IN THE RESPECTIVE NOMINEE RECEIVING FEWER VOTES. HOWEVER, THE NUMBER OF VOTES OTHERWISE RECEIVED BY THE NOMINEE WILL NOT BE REDUCED BY SUCH ACTION.

The Board of Directors and its Committees

During the fiscal year ended December 31, 2005, the Board of Directors of the Holding Company acted by written consent or held meetings six times. No director attended fewer than 75% of the aggregate total number of meetings during the last fiscal year of the Board of Directors of the Holding Company held while he served as director and of meetings of committees which he served during that fiscal year. The Board of Directors of the Holding Company has an Audit Committee, a Stock Compensation Committee, Compensation Committee and a Governance and Nominating Committee, among its other Board Committees. All committee members are appointed by the Board of Directors.

The Audit Committee, comprised of all directors except Matthew P. Forrester, recommends the appointment of the Holding Company’s independent accountants, and meets with them to outline the scope and review the results of such audit. The Audit Committee met six times during the fiscal year ended December 31, 2005.

The Stock Compensation Committee administers the Option Plan and the River Valley Recognition and Retention Plan and Trust. The members of that Committee are all directors except Matthew P. Forrester. The Stock Compensation Committee met one time during the fiscal year ended December 31, 2005.

The Compensation Committee establishes the compensation of the Holding Company’s executive officers. Its members include all outside directors. All of these members meet the standards for independence for compensation committee members set forth in the Listing Standards of the National Association of Securities Dealers. The Compensation Committee met one time in 2005.

The Governance and Nominating Committee selects the individuals who will run for election to the Holding Company’s Board of Directors each year. Its members for this year’s nominations were Fred W. Koehler, Michael J. Hensley and Charles J. McKay. All of these members meet the standards for independence for nominating committee members set forth in the Listing Standards of the National Association of Securities Dealers. It met one time in 2005. Its charter is attached hereto as Exhibit A.

Although the Governance and Nominating Committee will consider nominees recommended by shareholders, it has not actively solicited recommendations for nominees from shareholders nor has it established procedures for this purpose, as it will address nominations on a case by case basis. When considering a potential candidate for membership on the Holding Company’s Board of Directors, the Governance and Nominating Committee considers issues of diversity; age; skills relevant to the Holding Company’s business; community involvement; professional and business experience; and ethical conduct. The Governance and Nominating Committee will also consider the qualification requirements for Directors in the Holding Company’s By-laws as described on page 2 of this Proxy Statement. The Governance and Nominating Committee does not have specific minimum qualifications that must be met by a Governance and Nominating Committee-recommended candidate other than those prescribed by the By-laws and it has no specific process for identifying such candidates. There are no differences in the manner in which the Governance and Nominating Committee evaluates a candidate that is recommended for nomination for membership on the Holding Company’s Board of Directors by a shareholder. The Governance and Nominating Committee has not received any recommendations from any of the Holding Company’s shareholders in connection with the Annual Meeting.

Article III, Section 12 of the Holding Company’s By-Laws provides that shareholders entitled to vote for the election of directors may name nominees for election to the Board of Directors but there are certain requirements that must be satisfied in order to do so. Among other things, written notice of a proposed nomination must be received by the Secretary of the Holding Company not less than 120 days prior to the Annual Meeting; provided, however, that in the event that less than 130 days’ notice or public disclosure of the date of the meeting is given or made to shareholders (which notice or public disclosure includes the date of the Annual Meeting specified in the Holding Company’s By-Laws if the Annual Meeting is held on such date), notice must be received not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made.

The Holding Company has adopted a policy for its shareholders to send written communications to the Holding Company’s directors. Under this policy, shareholders may send written communications in a letter by first-class mail addressed to any director at the Holding Company’s main office. The Holding Company has also adopted a policy that strongly encourages its directors to attend each Annual Meeting of shareholders. All of the Holding Company’s seven directors attended the Annual Meeting of shareholders on April 20, 2005.

Management Remuneration and Related Transactions

Remuneration of Named Executive Officer

During the fiscal year ended December 31, 2005, no cash compensation was paid directly by the Holding Company to any of its executive officers. Each of such officers was compensated by the Bank.

The following tables set forth information as to annual, long term and other compensation for services in all capacities paid to the President and Chief Executive Officer of the Holding Company (the “Named Executive Officer”) for the last three fiscal years. There were no other executive officers of the Holding Company who earned over $100,000 in salary and bonuses during the fiscal year ended December 31, 2005.

Summary Compensation Table

| | | | | Annual Compensation | | Long Term Compensation Awards | | | |

Name and Principal Position | | Fiscal Year | | Salary ($)(1) | | Bonus | | Other Annual Compen sation(2) | | Restricted Stock Awards($) | | Securities Underlying Options(#) | | All Other Compen- sation($)(3) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Matthew P. Forrester, | | | 2005 | | $ | 153,373 | | $ | 5,500 | | | — | | | — | | | — | | $ | 4,553 | |

| President and Chief | | | 2004 | | $ | 152,689 | | $ | 2,803 | | | — | | | — | | | — | | $ | 4,462 | |

| Executive Officer | | | 2003 | | $ | 145,225 | | $ | 4,671 | | | — | | | — | | | — | | $ | 4,030 | |

| (1) | Includes directors fees. |

| (2) | The Named Executive Officer received certain perquisites, but, except as otherwise noted, the incremental cost of providing such perquisites did not exceed the lesser of $50,000 or 10% of his salary and bonus. |

| (3) | Constitutes matching contributions made by the Bank to the Holding Company’s 401(k) Plan. |

Stock Options

The following table includes information relating to option exercises by the named Executive Officer during fiscal 2005 and the number of shares covered by stock options held by Matthew P. Forrester as of December 31, 2005. Also reported are the values for “in-the-money” options (options whose exercise price is lower than the market value of the shares at fiscal year end) which represent the spread between the exercise price of any such existing stock options and the fiscal year-end market price of the stock.

Option Values as of 12/31/05 |

| | | | Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-the-Money Options at Fiscal Year End (1) |

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable | Unexercisable(2) | Exercisable | Unexercisable(2) |

| Matthew P. Forrester | 2,500 | $34,200(3) | 22,500 | 0 | $279,725 | — |

| (1) | Amounts reflecting gains on outstanding options are based on the closing price for the shares on December 29, 2005, which was $19.05 per share. |

| (2) | The shares represented could not be acquired by the Named Executive Officer as of December 31, 2005. |

No stock options were granted to the Named Executive Officer during the fiscal year ended December 31, 2005.

Employment Contracts

The Bank has entered into an employment agreement with Matthew P. Forrester, the Bank’s President and Chief Executive Officer. The agreement is for a three-year term and extends annually for an additional one-year term to maintain its three-year term if the Bank’s Board of Directors determines to so extend it. Under the agreement, the employee receives an initial annual salary equal to his current

salary, subject to increases approved by the Board of Directors. The agreement also provides, among other things, for the employee’s participation in other bonus and fringe benefit plans available to other employees. The employee may terminate his employment upon ninety (90) days’ prior written notice to the Bank. The Bank may discharge the employee for just cause (as defined in the agreement) at any time or in certain events specified by applicable law or regulations. If the Bank terminates the employee’s employment for other than just cause or the employee is constructively discharged and such termination does not occur within twelve months after a change in control of the Bank or the Holding Company, the agreement provides for the employee’s receipt of a lump-sum or periodic payment of an amount equal to the sum of (A) his base salary through the end of the then-current term, plus (B) his base salary for an additional twelve-month period, plus (C) in the employee’s sole discretion and in lieu of continued participation in his employer’s fringe benefit plans, cash in an amount equal to the cost of obtaining all health, life, disability and other benefits in which the employee would otherwise be eligible to participate. In the event the Bank terminates the employee’s employment for other than just cause or the employee is constructively discharged within twelve months following a change in control of the Bank or the Holding Company, the agreement provides for the employee’s receipt of a lump-sum payment of an amount equal to the difference between (A) the product of 2.99 times his “base amount” (as defined in Section 280G(b)(3) of the Internal Revenue Code of 1986, as amended (“Code”)) and (B) the sum of any other parachute payments, as determined under Section 280G(b)(2) of the Code. If the payments provided for under the agreement, together with any other payments made to the employee by the Bank, are determined to be payments in violation of the “golden parachute” rules of the Code, such payments will be reduced to the largest amount which would not cause the Bank to lose a tax deduction for such payments under those rules. As of the date hereof, the cash compensation that would be paid to Mr. Forrester under the agreement if such agreement were terminated after a change in control of the Bank would be $450,000. The Holding Company has guaranteed the obligations of the Bank under this employment agreement.

A similar contract has been entered into with three other executive officers of the Holding Company. The cash compensation which would be paid under these contracts if the affected employees were terminated after a change of control of the Holding Company without cause by the Bank, or for cause by the employees, would be $610,000.

Compensation of Directors

Directors of the Holding Company are paid directors’ fees of $500 for each meeting attended.

All directors of the Bank are entitled to receive monthly director fees in the amount of $1,000 for their services. Jerry Allen also receives $1,000 per month as a Director Emeritus of the Bank. Directors of the Bank also receive fees in the amount of $250 for each special meeting of the Board. Outside directors attending Loan Committee meetings are paid $50 for each such meeting. The Bank also has an Appointed Community Advisory Board consisting of five members of the Clark County, Indiana, area. Those members meet quarterly and are paid $250 per meeting attended. Total fees paid to or deferred by directors, former advisory directors, community advisory members, and Mr. Allen for the year ended December 31, 2005, were $153,600.

The Bank’s directors and directors emeritus may, pursuant to deferred compensation agreements, defer payment of some or all of such monthly directors’ fees or salary for a maximum period of five years. Upon reaching the retirement age specified in their respective joinder agreements, directors who participate in the deferred compensation plan receive fixed monthly payments for a specific period ranging from 60 to 180 months, depending on the specific director’s election in his joinder agreement, but may also elect to receive their benefits in a lump sum in the event of financial hardship. The agreements also provide for death and disability benefits, and benefits upon a change in control of the Bank.

The Bank has purchased paid-up life insurance on the lives of directors and directors emeritus participating in the deferred compensation plan to fund benefits payable thereunder. The insurance is provided by General American, Mass Mutual, ING, New York Life, Pacific Mutual and Transamerica. At December 31, 2005, the cash surrender value of the policies was carried on the books of the Bank at approximately $5,523,290. The Bank expensed $1,688 in connection with these agreements for the year ended December 31, 2005.

The following table includes information relating to option exercises by the Holding Company’s outside directors during fiscal 2005, and the value realized in connection with those option exercises.

Name | | Shares Acquired on Exercise (#) | | Value Realized ($) | |

| | | | | | | | |

| Robert W. Anger | | | 1,500 | | | $19,040 | |

| Lonnie D. Collins | | | 5,522 | | | $61,350 | |

No stock options were granted to the outside directors during the fiscal year ended December 31, 2005.

Pension Plan

The Bank’s employees hired prior to September 1, 2005, are participants in the Bank’s Pension Plan. Separate actuarial valuations are not made for individual employer members of the Pension Plan. An employee’s pension benefits are 100% vested after five years of service.

The Pension Plan provides for monthly or lump sum retirement benefits determined as a percentage of the employee’s average salary times his years of service. Salary includes base annual salary as of each January 1, exclusive of overtime, bonuses, fees and other special payments. Early retirement, disability, and death benefits are also payable under the Pension Plan, depending upon the participant’s age and years of service. The Bank recorded expenses totaling $191,044 for the Pension Plan during the fiscal year ended December 31, 2005.

The estimated base annual retirement benefits presented on a straight-line basis payable at normal retirement age (65) under the Pension Plan to persons in specified salary and years of service classifications are as follows (benefits noted in the table are not subject to any offset).

| | | Years of Service | |

Career Average Compensation | | 15 | | 20 | | 25 | | 30 | | 35 | |

| | | | | | | | | | | | |

| $120,000 | | | 22,500 | | | 30,000 | | | 37,500 | | | 45,000 | | | 52,500 | |

| 140,000 | | | 26,250 | | | 35,000 | | | 43,750 | | | 52,500 | | | 61,250 | |

| 160,000 | | | 30,000 | | | 40,000 | | | 50,000 | | | 60,000 | | | 70,000 | |

| 180,000 | | | 33,750 | | | 45,000 | | | 56,250 | | | 67,500 | | | 78,750 | |

| 200,000 | | | 37,500 | | | 50,000 | | | 62,500 | | | 75,000 | | | 87,500 | |

| 220,000 | | | 41,250 | | | 55,000 | | | 68,750 | | | 82,500 | | | 96,250 | |

Benefits are currently subject to maximum Code limitations of $175,000 per year. The years of service credited under the Pension Plan as of December 31, 2005, to the Named Executive Officer are as follows:

| | Name of Executive Officer | | Years of Service | |

| | Matthew P. Forrester | | 20 | |

Joint Report of the Compensation Committee and the Stock Compensation Committee

The Compensation Committee of the Holding Company’s Board of Directors was comprised during fiscal 2005 of all directors of the Holding Company except Matthew P. Forrester. The Committee reviews payroll costs, establishes policies and objectives relating to compensation, and approves the salaries of all employees, including executive officers. All decisions by the Compensation Committee relating to salaries of the Holding Company’s executive officers are approved by the full Board of Directors of the Holding Company. In fiscal 2005, there were no modifications to Compensation Committee actions and recommendations made by the full Board of Directors. In approving the salaries of executive officers, the Committee has access to and reviews compensation data for comparable financial institutions in the Midwest. Moreover, from time to time the Compensation Committee reviews information provided to it by independent compensation consultants in making its decisions.

The objectives of the Compensation Committee and the Stock Compensation Committee with respect to executive compensation are the following:

| | (1) | provide compensation opportunities comparable to those offered by other similarly situated financial institutions in order to be able to attract and retain talented executives who are critical to the Holding Company’s long-term success; |

| | (2) | reward executive officers based upon their ability to achieve short-term and long-term strategic goals and objectives and to enhance shareholder value; and |

| | (3) | align the interests of the executive officers with the long-term interests of shareholders by granting stock options which will become more valuable to the executives as the value of the Holding Company’s shares increases. |

At present, the Holding Company’s executive compensation program is comprised of base salary and annual incentive bonuses. The Option Plan and the RRP provide long-term incentive bonuses in the form of stock options and awards of Common Stock. Reasonable base salaries are awarded based on salaries paid by comparable financial institutions, particularly in the Midwest, and individual performance. The annual incentive bonuses are tied to the Holding Company’s performance in the areas of growth, profit, quality, and productivity as they relate to earnings per share and return on equity for the current fiscal year, and it is expected that stock options will have a direct relation to the long-term enhancement of shareholder value. In years in which the performance goals of the Holding Company are met or exceeded, executive compensation tends to be higher than in years in which performance is below expectations.

Base Salary. Base salary levels of the Holding Company’s executive officers are intended to be comparable to those offered by similar financial institutions in the Midwest. In determining base salaries, the Compensation Committee also takes into account individual experience and performance.

Mr. Forrester was the Holding Company’s Chief Executive Officer during fiscal 2005. He received a base salary of $152,689 in 2004 and $153,373 in 2005 which is paid by the Bank.

Annual Incentive Bonuses. Under the Holding Company’s Annual Incentive Plan, all qualifying employees of the Holding Company receive a cash bonus for any fiscal year in which the Holding Company achieves certain goals, as established by the Board of Directors, in the areas of growth, profit, quality and productivity as they relate to earnings per share and return on equity. Individual bonuses are equal to a percentage of the employee’s base salary, which percentage varies with the extent to which the Holding Company exceeds these goals for the fiscal year.

The Holding Company believes that this program provides an excellent link between the value created for shareholders and the incentives paid to executives, since executives may not receive bonuses unless the above-mentioned goals are achieved and since the level of those bonuses will increase with greater achievement of those goals.

In 2005, the Company did not achieve its goals. However, Mr. Forrester was awarded a stipend outside of the Plan of $5,500 to bring his salary more in line with peers.

Stock Options. The Option Plan is intended to align executive and shareholder long-term interests by creating a strong and direct link between executive pay and shareholder return, and enabling executives to acquire a significant ownership position in the Holding Company’s Common Stock. Stock options are granted at the prevailing market price and will only have a value to the executives if the stock price increases. The Stock Compensation Committee has determined and will determine the number of option grants to make to executive officers based on the practices of comparable financial institutions as well as the executive’s level of responsibility and contributions to the Holding Company.

Mr. Forrester did not receive any stock option grants in 2004 or 2005.

RRP. The RRP is intended to provide directors and officers with an ownership interest in the Holding Company in a manner designed to encourage them to continue their service with the Holding Company. This gradual vesting of a director’s or officer’s interest in the shares awarded under the RRP is intended to create a long-term incentive for the director or officer to continue his service with the Holding Company. No RRP awards were granted to Mr. Forrester in 2004 or 2005.

Finally, the Committee notes that Section 162(m) of the Code, in certain circumstances, limits to $1 million the deductibility of compensation, including stock-based compensation, paid to top executives by public companies. None of the compensation paid to the Named Executive Officers named in the compensation table on page six for fiscal 2005 exceeded the threshold for deductibility under section 162(m).

The Compensation Committee and the Stock Compensation Committee believe that linking executive compensation to corporate performance results in a better alignment of compensation with corporate goals and the interests of the Holding Company’s shareholders. As performance goals are met or exceeded, most probably resulting in increased value to shareholders, executives are rewarded commensurately. The Committee believes that compensation levels during fiscal 2005 for executives and for the chief executive officer adequately reflect the Holding Company’s compensation goals and policies.

Compensation Committee and Stock Compensation Committee Members

Robert W. Anger

Michael J. Hensley

Fred W. Koehler

Lillian Sue Livers

Charles J. McKay

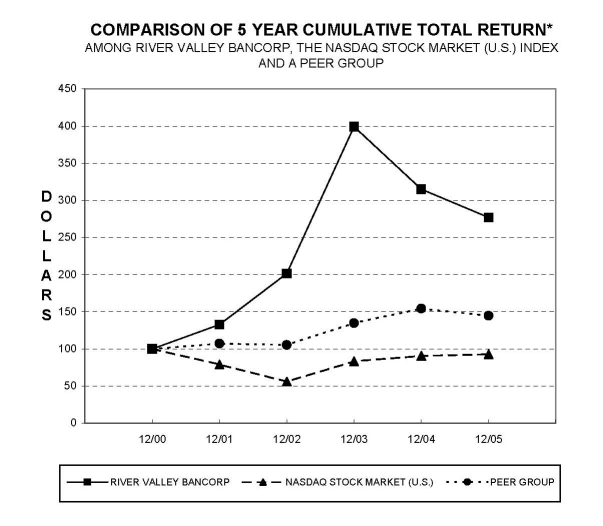

Performance Graph

The following graph shows the performance of the Holding Company’s Common Stock since December 31, 2000, in comparison to the NASDAQ Stock Market (U.S.) Index and a selected peer group index (the “Peer Group Index”). The Peer Group Index was selected on an industry basis and includes American Bancorp, Community Bank Shares of Indiana, First Capital, Inc., First Financial Bancorp, Home Federal Bancorp, Lincoln Bancorp, MainSource Financial Group, Inc., MFB Corp., National City Corp., Peoples Bancorp (Auburn), SY Bancorp, Inc. and Tower Financial Corp.

$100 invested on 12/31/00 in Stock or Index

Including Reinvestment of Dividends

Fiscal Year Ending December 31

Transactions With Certain Related Persons

The Bank has followed a policy of offering to its directors, officers, and employees real estate mortgage loans secured by their principal residence and other loans. These loans are made in the ordinary course of business with the same collateral, interest rates and underwriting criteria as those of comparable transactions prevailing at the time and do not involve more than the normal risk of collectibility or present other unfavorable features.

Audit Committee Report, Charter, and Independence

Audit Committee Report. The Audit Committee reports as follows with respect to the audit of the Holding Company’s financial statements for the fiscal year ended December 31, 2005, included in the Holding Company’s Shareholder Annual Report accompanying this Proxy Statement (“2005 Audited Financial Statements”):

The Committee has reviewed and discussed the Holding Company’s 2005 Audited Financial Statements with the Company’s management.

The Committee has discussed with its independent auditors (BKD, LLP) the matters required to be discussed by Statement on Auditing Standards 61, which include, among other items, matters related to the conduct of the audit of the Holding Company’s financial statements.

The Committee has received written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (which relates to the auditor’s independence from the Holding Company and its related entities) and has discussed with the auditors the auditors’ independence from the Holding Company. The Committee considered whether the provision of services by its independent auditors, other than audit services and reviews of Forms 10-Q, is compatible with maintaining the auditors’ independence.

Based on review and discussions of the Holding Company’s 2005 Audited Financial Statements with management and discussions with the independent auditors, the Audit Committee recommended to the Board of Directors that the Holding Company’s 2005 Audited Financial Statements be included in the Holding Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

This Report is respectfully submitted by the Audit Committee of the Holding Company’s Board of Directors.

Audit Committee Members

Robert W. Anger

Michael J. Hensley

Lillian Sue Livers

Fred W. Koehler

Charles J. McKay

Audit Committee Charter. The Board of Directors has adopted a written charter for the Audit Committee. The Board of Directors reviews and approves changes to the Audit Committee Charter annually.

Independence of Audit Committee Members. The Holding Company’s Audit Committee is comprised of all of the directors except Matthew P. Forrester. Each of these members meets the requirements for independence set forth in the Listing Standards of the National Association of Securities Dealers. In addition, the Board of Directors has determined that Charles J. McKay is a “financial expert” as that term is defined in Item 401(h)(2) of Regulation S-K promulgated under the Securities Exchange Act of 1934.

ACCOUNTANTS

BKD, LLP has served as auditors for the Holding Company since 2000. It is anticipated that a representative of BKD, LLP will be present at the Annual Meeting with the opportunity to make a statement if he or she so desires. He or she will also be available to respond to any appropriate questions shareholders may have. The Audit Committee has not yet completed the process of selecting an independent public accounting firm to audit its books, records and accounts for the fiscal year ended December 31, 2006.

Accountants’ Fees

Audit Fees. The firm of BKD, LLP (“BKD”) served as the Holding Company’s independent public accountants for each of its last two fiscal years ended December 31, 2004 and 2005. The aggregate fees billed by BKD for the audit of the Holding Company’s financial statements included in its annual report on Form 10-KSB and Form 10-K, and for the review of its financial statements included in its quarterly reports

on Form 10-QSB and Form 10-Q for its fiscal years ended December 31, 2004 and 2005, were $68,539 and $69,572, respectively.

Audit-Related Fees. The aggregate fees billed in each of fiscal 2004 and 2005 for assurance and related services by BKD that are reasonably related to the audit or review of the Holding Company’s financial statements and that were not covered in the Audit Fees disclosure above, were $713 and $920, respectively. These services included benefit plan accounting and reporting assistance.

Tax Fees. The aggregate fees billed in each of fiscal 2004 and 2005 for professional services rendered by BKD for tax compliance, tax advice or tax planning were $10,631 and $17,165, respectively.

All Other Fees. In 2004, all other fees were $55,852, and consisted of $39,121 for compliance consulting and $16,731 for loan review. In 2005, these fees were $1,596 and consisted of $496 for compliance consulting and $1,100 for Section 404 assistance.

Audit Committee Pre-Approval. Our Audit Committee formally adopted resolutions pre-approving our engagement of BKD to act as the Holding Company’s independent auditor for the last two fiscal years ended December 31, 2005. The Audit Committee has not adopted pre-approval policies and procedures in accordance with paragraph (c) (7) (i) of Rule 2-01 of Regulation S-X, because it anticipates that in the future the engagement of BKD will be made by the Audit Committee and all non-audit and audit services to be rendered by BKD will be pre-approved by the Audit Committee. The Audit Committee pre-approved any audit-related and tax services provided by BKD in the last two fiscal years. Our independent auditors performed all work described above with their respective full-time, permanent employees.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 (“1934 Act”) requires that the Holding Company’s officers and directors and persons who own more than 10% of the Holding Company’s Common Stock file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Officers, directors and greater than 10% shareholders are required by SEC regulations to furnish the Holding Company with copies of all Section 16(a) forms that they file.

Based solely on its review of the copies of such forms received by it, and/or written representations from certain reporting persons that no Forms 5 were required for those persons, the Holding Company believes that during the fiscal year ended December 31, 2005, all filing requirements applicable to its officers, directors and greater than 10% beneficial owners with respect to Section 16(a) of the 1934 Act were satisfied in a timely manner, provided, however, that Deanna J. Liter, the Vice President-Data Services, reported an RRP award of 500 shares made on September 20, 2005, about five days late.

SHAREHOLDER PROPOSALS

Any proposal which a shareholder wishes to have presented at the next Annual Meeting of the Holding Company must be received at the main office of the Holding Company for inclusion in the proxy statement no later than 120 days in advance of March 15, 2007. Any such proposal should be sent to the attention of the Secretary of the Holding Company at 430 Clifty Drive, P.O. Box 1590, Madison, Indiana 47250, and will be subject to the requirements of the proxy rules under the Securities Exchange Act of 1934 and, as with any shareholder proposal (regardless of whether included in the Holding Company’s proxy materials), the Holding Company’s articles of incorporation, by-laws and Indiana law.

A shareholder proposal being submitted for presentation at the Annual Meeting but not for inclusion in the Holding Company’s proxy statement and form of proxy, will normally be considered untimely if it is received by the Holding Company later than 120 days prior to the Annual Meeting. If, however, less than 130 days’ notice or prior public disclosure of the date of the next Annual Meeting is given or made to shareholders (which notice or public disclosure of the date of the meeting shall include the date of the

Annual Meeting specified in publicly available By-Laws, if the Annual Meeting is held on such date), such proposal shall be considered untimely if it is received by the Holding Company later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. If the Holding Company receives notice of such proposal after such time, each proxy that the Holding Company receives will confer upon it the discretionary authority to vote on the proposal in the manner the proxies deem appropriate, even though there is no discussion of the proposal in the Holding Company’s proxy statement for the next Annual Meeting.

OTHER MATTERS

Management is not aware of any business to come before the Annual Meeting other than those matters described in the Proxy Statement. However, if any other matters should properly come before the Annual Meeting, it is intended that the proxies solicited hereby will be voted with respect to those other matters in accordance with the judgment of the persons voting the proxies.

The cost of solicitation of proxies will be borne by the Holding Company. The Holding Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to the beneficial owners of the Common Stock. In addition to solicitation by mail, directors, officers, and employees of the Holding Company may solicit proxies personally or by telephone without additional compensation.

Each shareholder is urged to complete, date and sign the proxy and return it promptly in the enclosed envelope.

By Order of the Board of Directors

Matthew P. Forrester

March 15, 2006

Exhibit A

River Valley Bancorp

Governance and Nominating Committee Charter

Purpose

The Governance and Nominating Committee is appointed by the Board of Directors to:

| • | identify individuals qualified to become board members; and |

| • | select, or recommend that the Board select, the director nominees for the next annual meeting of shareholders. |

Committee Membership

The Committee will be composed entirely of directors who satisfy the definition of “independent” under the listing standards of The Nasdaq Stock Market (Nasdaq). The Committee members will be appointed by the Board annually and may be removed by the Board in its discretion. No Committee member shall vote on his or her own nomination to serve on the Board of Directors for an additional term. The Committee shall have the authority to delegate any of its responsibilities to subcommittees as the Committee may deem appropriate, provided the subcommittees are composed entirely of independent directors.

Meetings

The Committee shall meet as often as its members deem necessary to perform the Committee’s responsibilities.

Committee Authority and Responsibilities

The Committee will have the authority, to the extent it deems necessary or appropriate, to retain a search firm to be used to identify director candidates. The Committee shall have sole authority to retain and terminate any such search firm, including sole authority to approve the firm’s fees and other retention terms. The Committee shall also have authority, to the extent it deems necessary or appropriate, to retain other advisors. The Company will provide for appropriate funding, as determined by the Committee, for payment of compensation to any search firm or other advisors employed by the Committee.

The Committee, to the extent it deems necessary or appropriate, will:

| • | Identify individuals qualified to become members of the Board. |

| • | Select, or recommend to the Board, director nominees to be presented for shareholder approval at the annual meeting. |

| • | Recommend to the Board director nominees to fill vacancies on the Board in the interval between annual meetings of the Company’s shareholders. |

| • | Make recommendations to the Board regarding the size and composition of the Board and develop and recommend to the Board criteria (such as, independence, experience relevant to the needs of the Company, leadership qualities, diversity and ability to represent the shareholders) for the selection of individuals to be considered as candidates for election to the Board. |

| • | Make sure director nominees satisfy any director qualification requirements in the Company’s articles of incorporation or bylaws. |

| • | Consider shareholder nominations of directors consistent with the requirements of the Company’s articles of incorporation and bylaws, and recommend to the Board of Directors actions to be taken with respect to such nominations. |