UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

Amendment No. 1

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from _____________________ to ____________________

Commission file number 001-32702

ALMADEN MINERALS LTD.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1333 Johnston Street, #210, Vancouver, British Columbia V6H 3R9

(Address of principal executive offices)

Korm Trieu, ktrieu@almadenminerals.com, 1333 Johnston Street, #210, Vancouver, BC V6H 3R9

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

| Securities registered or to be registered pursuant to Section 12(b) of the Act. |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| | | |

| Common shares without Par Value | AAU | NYSE American |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common shares as of the close of the period covered by the annual report.

137,221,408

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ | | Emerging Growth Company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐1

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐1

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

1 Checkboxes are blank pending adoption of the underlying rules.

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Under the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), Almaden is classified as an "Emerging Growth Company". The Company will continue to be deemed an emerging growth company until the earliest on the last day of our fiscal year during which (i) annual gross revenue exceeds $1.07 billion or (ii) the Company issues more than $1.0 billion in non-convertible debt in a three-year period. Almaden will lose its status as an emerging growth company on the last day of its fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement. The Company will also lose its status as an emerging growth company if at any time it is deemed to be a large accelerated filer.

As an emerging growth company, Almaden is exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), which requires a public company’s auditor to attest to, and report on, management’s assessment of its internal controls. The Company is also exempt from Sections 14A(a) and (b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

Almaden has elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows the Company to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, Almaden’s financial statements may not be comparable to companies that comply with public company effective dates.

Explanatory Note

Almaden Minerals Inc. (“we”, “our”, “us”, the “Company” and “Almaden”) is filing this Amendment No. 1 on Form 20-F/A (this “Amendment”) to our Annual Report on Form 20-F for the fiscal year ended December 31, 2022 (the “Original Filing”), filed with the Securities and Exchange Commission (the “SEC”) on April 27, 2023, in response to comments received from the SEC. We are filing this Amendment to revise Item 4. Information on the Company and Exhibit 14.2 S-K 1300 Technical Report Summary of the Ixtaca Gold-Silver Project as previously filed on April 28, 2022.

This Amended Annual Report as of the filing date of the Form 20-F (the “Filing Date”) does not reflect events that may have occurred subsequent to the Filing Date and does not modify or update our disclosures in the Original Filing.

Item 4. Information on the Company

D. Property, Plants and Equipment

Company’s Principal Property

The Tuligtic Project, which hosts the Company’s Ixtaca discovery, is the only project material to the Company. The Tuligtic Project property (the “Tuligtic Property” or the “Property”) is located in Puebla State, Mexico at 618,800m east and 2,176,100m north (UTM NAD83 Zone 14 coordinates).

The Tuligtic Property/Ixtaca Project – Mexico

Location and Access

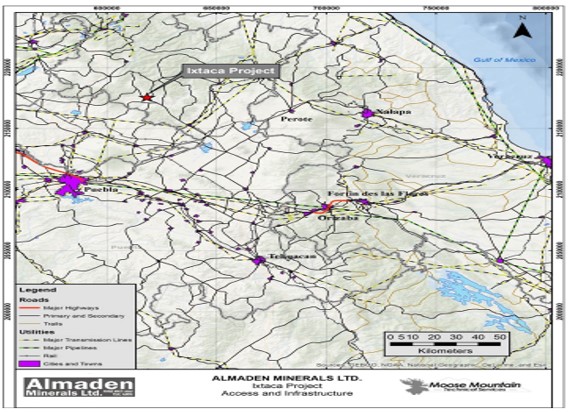

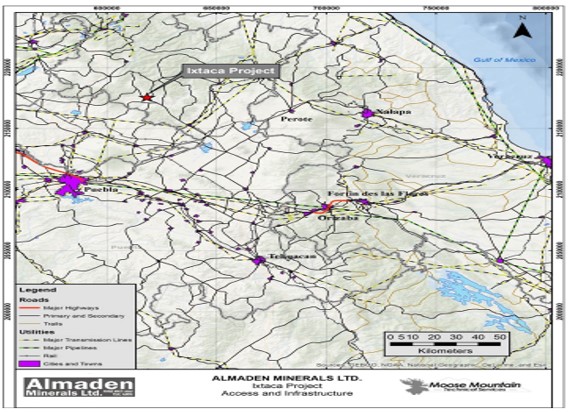

The Ixtaca deposit, the epithermal gold-silver target within the Tuligtic Property, is located 8 km northwest of the town of San Francisco Ixtacamaxtitlán, the county seat of the municipality of Ixtacamaxtitlán, Puebla State. The Ixtaca Project is accessible by driving 40 km east along Highway 119 from Apizaco, an industrial center located approximately 50 km north of Puebla City by two-lane Highway, and then north approximately 2 km along a paved road to the town of Santa Maria. The trip from Apizaco to site can be driven in approximately 1.5 hours. There is also access to the Tuligtic Property using gravel roads from the northeast via Tezhuitan and Cuyoaco, from the south via Libres and from the northwest via Chignahuapan. The Xicohtencatl Industrial complex lies 30 km southwest by paved road from the Ixtaca Project, and houses agricultural, chemical, biomedical and industrial manufacturing facilities and is serviced by rail. Puebla, the fourth largest city in Mexico has a population in excess of 4 million people, and includes one of the largest Volkswagen automotive plants outside Germany.

The Topography on the Tuligtic Property is generally moderate to steep hills with incised stream drainages. Elevation ranges from 2,300 meters (m) above sea level in the south to 2,800 m in the north. Vegetation is dominantly cactus and pines and the general area is also somewhat cultivated with subsistence vegetables, bean and corn crops. The Ixtaca Zone (as defined below) exploration area has been previously cleared and logged. The region has a temperate climate with mean monthly temperatures ranging from 16°C in June to 12°C in January. The area experiences approximately 714 mm of precipitation annually with the majority falling during the rainy season, between June and September. Annual evapotranspiration is estimated to be 774 mm. Exploration can be conducted year-round within the Tuligtic Property; however, road building and drilling operations may be impacted by weather to some degree during the rainy season. Electricity is available on the Tuligtic Property from the national electricity grid that services nearby towns such as Santa Maria and Zacatepec. The surface rights locally are privately owned and Almaden has negotiated voluntary surface land use agreements with surface landowners within the exploration area prior to beginning activities. To date Almaden has secured through purchase agreements over 1,139 hectares, from numerous independent owners.

Claims and Title

The Tuligtic Property was staked by Almaden in 2001, following the identification of surficial clay deposits that were interpreted to represent high-level epithermal alteration. The Property originally consisted of approximately 14,000 hectares (the “Original Concessions”), as shown below:

| Claim Name | Claim Number | Area (hectares) | Valid Until Date |

| Cerro Grande | 219469 | 11,202 | March 5, 2053 |

| Cerro Grande 2 | 233434 | 3,028 | February 23, 2059 |

| Total | | 14,230 | |

On February 17, 2022, the Company announced that the SCJN reached a decision in respect of the Mineral Title Lawsuit involving the Company’s mineral claims (for background see Item 8. Financial Information, sub-heading “Legal Proceedings”). On April 27, 2022, the Company announced that the SCJN published its final decision regarding the Mineral Title Lawsuit.

The final decision of the SCJN determines that the Mexican mineral title law is constitutional, but that before issuing Almaden’s mineral titles, Economia should have provided for a consultation procedure with relevant indigenous communities. The decision orders Economia to declare Almaden’s mineral titles ineffective (“insubsistentes”) and to then issue them to Almaden following Economia’s compliance with a series of steps necessary to meet its obligation to carry out the necessary procedures to consult with indigenous communities.

The final SCJN decision (i) expands indigenous consultation requirements; (ii) provides details regarding the procedure for indigenous consultation prior to the grant of mineral claims; and (iii) clarifies that the Company’s applications were submitted pursuant to the legal framework in force at the time. The Company understands that its Mineral Rights are safeguarded while the mining authorities comply with conditions and requirements contained in the SCJN decision.

On July 4, 2022, the Company reported that Economia was officially notified of the final decision of the SCJN relating to the Mineral Title Lawsuit, and in turn notified Almaden that the Company’s mineral titles relating to the Ixtaca Project were “ineffective”. The Company understands this to mean that the mineral title reverted to application status, and that these applications preserve the mineral rights for Almaden but do not allow the Company to engage in exploration until such time as Economia completes the steps required in the court-ordered indigenous consultation in the area covered by the mineral title applications.

On February 22, 2023, the Company reported that Economia had made a submission to the District Court, which is implementing the SCJN decision, to deny the two mineral title applications which were first made by Almaden in 2002 and 2008, and which in turn led to the grant of mineral titles in 2003 and 2009, respectively (see the “Original Concessions”, above). In its District Court submission, Economia states that it reviewed the original claim applications on file and resolved, despite acting to the contrary in 2003 and 2009, that the applications contain technical faults which preclude the grant of the mineral claims (the “Economia Submission”). Economia is therefore seeking to deny the grant of the mineral claims prior to engaging in the indigenous consultation ordered by the SCJN. These mineral claims underpin the Ixtaca deposit which was discovered by Almaden in 2010, and were reduced to application status because of the February, 2022 decision of the SCJN. Almaden believes that this action by Economia is inconsistent with the Mexican Mining Law, the SCJN decision, and international law. The Company submitted arguments challenging the Economia Submission to the District Court, but on April 13, 2023, the Company reported that the District Court ruled in favour of the Economia Submission. The Company is appealing this ruling to a higher court, and additional legal action is being considered. In the meantime, Almaden has been advised that so long as these appeals are continuing, Almaden’s mineral title applications from 2002 and 2008 remain in place thus preserving the mineral rights.

The Company had also, in November, 2022 during the time that the Company’s rights to the area of the Ixtaca project were protected by its original title applications, submitted amended title applications which substantially reduced the area being requested. To date the General Directorate of Mines within Economia has not responded to these amended mineral title applications, and they were not considered by the District Court in its decision regarding the Economia Submission.

Further information on the Amparo is provided in Item 8 below under the heading “Legal Proceedings”.

Almaden’s interest with respect to the Tuligtic Property is held by Minera Gorrion S.A. de C.V., a subsidiary of Almaden, through the holding company, Puebla Holdings Inc., and is subject to a 2% NSR in favour of Almadex.

To maintain a claim in good standing in Mexico, the holder is required to meet annual exploration or exploitation expenditure requirements. Given that the Original Concessions have reverted to application status, the Company has been advised that currently there are no taxes or expenditure requirements relating to them.

Geological Setting of the Tuligtic Project and Ixtaca Zone

The Ixtaca Project is situated within the Trans Mexican Volcanic Belt (TMVB), a Tertiary to recent intrusive volcanic arc extending approximately east-west across Mexico from coast to coast and ranging in width from 10 to 300km. The TMVB is the most recent episode of a long lasting magmatic activity which, since the Jurassic, produced a series of partially overlapping arcs as a result of the eastward subduction of the Farallon plate beneath western Mexico (Ferrari, 2011). The basement rocks of the eastern half of the TMVB are Precambrian terranes, including biotite orthogneiss and granulite affected by granitic intrusions, grouped into the Oaxaquia microcontinent (Ferrari et al., 2011; Fuentes-Peralta and Calderon, 2008). These are overlain by the Paleozoic Mixteco terrane, consisting of a metamorphic sequence known as the Acatlan complex and a fan delta sedimentary sequence known as the Matzitzi formation. Another sedimentary complex is found on top of the Mixteco terrane, represented by various paleogeographic elements such as the Mesozoic basins of Tlaxiaco, Zongolica, Zapotitlan, and Tampico-Misantla (Fuentes-Peralta and Calderon, 2008). The subducting plates associated with the TMVB are relatively young, with the Rivera plate dated at 10Ma (million years) and the Cocos plate at 11 to 17Ma.

.

The stratigraphy of the Tuligtic area can be divided into two main sequences: a Mesozoic sedimentary rock sequence related to the Zongolica basin and a sequence of late Tertiary igneous extrusive rocks belonging to the TMVB (Fuentes-Peralta & Calderon, 2008; Tritlla et al., 2004). The sedimentary sequence is locally intruded by plutonic rocks genetically related to the TMVB. The sedimentary complex at Tuligtic corresponds to the Upper Tamaulipas formation (Reyes-Cortes 1997). This formation, Late Jurassic to Early Cretaceous in age, is regionally described (Reyes-Cortes, 1997) as a sequence of grey-to-white limestone, slightly argillaceous, containing bands and nodules of black chert. The drilling conducted by Almaden allows for more detailed characterisation of the Upper Tamaulipas Formation carbonate units in the Tuligtic area. The sequence on the Project consists of clastic calcareous rocks. The limestone unit variably bedded, generally light grey but locally dark grey to black, with local chert rich sections graded into what have been named transition units and shale (also black shale). The transition units are brown calcareous siltstones and grainstones. These rocks are not significant in the succession but mark the transition from limestone to underlying calcareous shale. Typical of the transition units are coarser grain sizes. The lower calcareous “shale” units exhibit pronounced laminated bedding and is typically dark grey to black in colour, although there are green coloured beds as well. The shale units appear to have been subjected to widespread calc-silicate alteration.

Both the shale and transition units have very limited surface exposure and may be recessive. The entire carbonate package of rocks has been intensely deformed by the Laramide orogeny, showing complex thrusting and chevron folding in the hinge zones of a series of thrust-related east verging anticlines in the Ixtaca area (Tritlla et al., 2004; Coller, 2011). The calcareous shale units appear to occupy the cores of the anticlines while the thick bedded limestone units occupy the cores of major synclines identified in the Ixtaca zone.

The Tamaulipas Formation carbonate rocks are intruded in the mid-Miocene by a series of magmatic rocks. The compositions are very variable, consisting of hornblende-biotite-bearing tonalites, quartz-plagioclase-hornblende diorites, and, locally, aphanitic diabase dykes (Carrasco-Nunez et al., 1997). In the central part of the Tuligtic Property porphyry mineralization is hosted by and associated with a hornblende-biotite-quartz phyric granodiorite body. The contact between the granodiorite and the limestone is marked by the development of a prograde skarn.

In the Ixtaca deposit epithermal area of the Project, the limestone basement units are crosscut by intermediate dykes that are often intensely altered. In the vicinity of the Ixtaca zone these dykes are well mineralized especially at their contacts with limestone country rock. Petrography has shown that epithermal alteration in the dykes, marked by illite, adularia, quartz and pyrite overprints earlier calc-silicate endoskarn mineralogies (Leitch, 2011). Two main orientations are identified for dykes in the Ixtaca area; 060 degrees (parallel to the Main Ixtaca and Ixtaca North zones) and 330 degrees (parallel to the Chemalaco Zone).

An erosional unconformity surface has been formed subsequent to the intrusion of the porphyry mineralization-associated granodiorites. This paleo topographical surface locally approximates the current topography. Although not well exposed the unconformity is marked by depression localised accumulations of basal conglomerate comprised of intrusive and sedimentary boulders.

Two styles of alteration and mineralization have been identified in the area: (1) copper-molybdenum porphyry style alteration and mineralization hosted by diorite and quartz-diorite intrusions; (2) silver-gold low-sulphidation epithermal quartz-bladed calcite veins hosted primarily by carbonate rocks and spatially associated with overlying volcanic hosted texturally destructive clay alteration and replacement silicification.

Outcropping porphyry-style alteration and mineralization is observed in the bottoms of several drainages where the altered intrusive complex is exposed in erosional windows beneath post mineral unconsolidated ash deposits. Multiple late and post mineral intrusive phases have been identified crossing an early intensely altered and quartz-veined medium-grained feldspar phyric diorite named the Principal Porphyry. Other intrusive types include late and post mineral mafic dykes and an inter-mineral feldspar-quartz phyric diorite. Late mineral mafic dykes are fine grained and altered to chlorite with accessory pyrite. Calc-silicate (garnet-clinopyroxene) altered limestone occurs in proximity to the intrusive contacts and is crosscut by late quartz-pyrite veins. Early biotite alteration of the principal porphyry consists of biotite-orthoclase flooding of the groundmass. Quartz veins associated with early alteration have irregular boundaries and are interpreted to be representative of A-style porphyry veins. These are followed by molybdenite veins which are associated with the same wall rock alteration. Chalcopyrite appears late in the early alteration sequence. Late alteration is characterized by intense zones of muscovite-illite-pyrite overprinting earlier quartz-K-feldspar-pyrite ± chalcopyrite veining and replacing earlier hydrothermal orthoclase and biotite. Stockwork quartz-pyrite crosscuts the A-style veins and is associated with muscovite-illite alteration of biotite. The quartz-sericite alteration can be texturally destructive resulting in white friable quartz veined and pyrite rich rock. Pyrite is observed replacing chalcopyrite and in some instances chalcopyrite remains only as inclusions within late stage pyrite grains.

Epithermal mineralization on the Tuligtic Property is considered to have no genetic relationship to the porphyry alteration and mineralization described above. The epithermal system is well preserved and there is evidence of a paleosurface as steam heated kaolinite and replacement silica alteration occur at higher elevations where the upper part of the Coyoltepec pyroclastic deposit is preserved.

The Upper Tamaulipas formation carbonates (limestone and shale units), the dykes that crosscut it and the upper Coyoltepec volcanic subunit (variously referred to as volcanics, tuff or ash) are the host rocks to the epithermal system at Ixtaca. The epithermal alteration occurs over a roughly 5 by 5 kilometre area and occurs as intense kaolinite-alunite alteration and silicification in volcanic rocks. This alteration is interpreted to represent the upper portion of a well preserved epithermal system. The bulk of the mineralisation occurs in the carbonate (limestone and shale) as colloform banded epithermal vein zones. Unlike many epithermal vein systems in Mexico, the bulk of the veining in the Ixtaca zone has low base metal contents and gold and silver occur as electrum and other sulphides. SEM work has demonstrated that silver does not occur with galena or tetrahedrite in any significant way. In the main limestone unit (80% of recoverable metal in the FS) the silver to gold ratio of the mineralisation is roughly estimated to average ~65:1 while in the shale it is roughly estimated to be slightly higher at ~75:1.

History of Past Work

To the Company’s knowledge, no modern exploration has been conducted on the Ixtaca Project prior to Almaden’s acquisition of claims during 2001 and there is no record of previous mining; as such, this is a maiden discovery.

During January 2003, Almaden completed a program of geologic mapping, rock, stream silt sampling and induced polarization (IP) geophysical surveys at the Tuligtic Property (then known as the “Santa Maria Prospect”). The exploration identified both a porphyry copper and an epithermal gold target within an approximately 5 x 5km area of intensely altered rock. At the porphyry copper target, stockwork quartz-pyrite veins associated with minor copper mineralization overprint earlier potassic alteration within a multi-phase intrusive body. A single north-south oriented IP survey line identified a greater than 2km long elevated chargeability response coincident with the exposed altered and mineralized intrusive system. Volcanic rocks exposed 1km to the south of the mineralized intrusive display replacement silicification and sinter indicative of the upper parts of an epithermal system (the “Ixtaca Zone”). Quartz-calcite veins returning anomalous values in gold and silver and textural evidence of boiling have been identified within limestone roughly 100m below the sinter. The sinter and overlying volcanic rocks are anomalous in mercury, arsenic, and antimony.

Additional IP surveys and soil sampling were conducted in January and February 2005, further defining the porphyry copper target as an area of high chargeability and elevated copper, molybdenum, silver and gold in soil. A total of eight (8) east-west oriented lines, 3km in length, spaced at intervals of 200m have been completed over mineralized intrusive rocks intermittently exposed within gullies cutting through the overlying unmineralized ash deposits.

The Tuligtic Property was optioned to Pinnacle Mines Ltd. in 2006 and the option agreement was terminated in 2007 without completing significant exploration.

The Property was subsequently optioned to Antofagasta Minerals S.A. (Antofagasta) on March 23, 2009. During 2009 and 2010 Antofagasta, under Almaden operation, carried out IP geophysical surveys and a diamond drill program targeting the copper porphyry prospect. Three additional IP survey lines were completed, and in conjunction with the previous nine (9) IP lines, a 2 x 2.5km chargeability high anomaly, open to the west and south, was defined. The 2009 drilling consisted of 2,973m within seven (7) holes that largely intersected skarn type mineralization.

On February 16, 2010, Almaden announced that Antofagasta terminated its option to earn an interest in the Property.

In July 2010, Almaden initiated a preliminary diamond drilling program to test epithermal alteration within the Tuligtic Property, resulting in the discovery of the Ixtaca Zone. The target was based on exploration data gathered by Almaden since 2001 including high gold and silver in soil and a chargeability and resistivity high anomaly (derived from an IP geophysical survey conducted by Almaden) topographically beneath Cerro Caolin, a prominent clay and silica altered hill. This alteration, barren in gold and silver, was interpreted by Almaden to represent the top of an epithermal system which required drill testing to depth. The first hole, TU-10-001 intersected 302.42 metres of 1.01g/t gold and 48g/t silver and multiple high grade intervals including 44.35 metres of 2.77g/t gold and 117.7g/t silver.

As at December 31, 2022, the net book value of the Ixtaca Project was $63,115,076 (December 31, 2021 - $61,431,639).

Present Condition of Project

Geology and Mineral Resources

The veining of Ixtaca epithermal system displays characteristics representative of low and intermediate sulphidation deposits. These include typical mill feed and gangue mineralogy (electrum Ag-sulphides, sphalerite, galena, adularia, quartz and carbonates), mineralization dominantly in open space veins (colloform banding, cavity filling).

At the base of the overlying clay altered volcanics disseminated gold-silver mineralisation occurs in association with pyrite and minor veining. Locally this mineralisation can be high grade but largely associated with lower Ag:Au ratios roughly estimated to average 20:1.

To date two main vein orientations have been identified in the Ixtaca deposit:

| · | 060 trending sheeted veins hosted by limestone; |

| · | 330 trending veins hosted by shale; |

The bulk of the resource and over 80% of the mill feed is hosted by the limestone in the Main Ixtaca and Ixtaca North zones as swarms of sheeted and anastomosing high grade banded epithermal veins. There is no disseminated mineralisation within the host rock to the vein swarms, which is barren and unaltered limestone. To the northeast of the limestone hosted mineralisation, the Chemalaco zone, a 330 striking and west dipping vein zone hosted by shale, also forms part of the deeper resource.

Rock Creek Mill

Almaden entered into an option agreement to acquire the Rock Creek Mill in October 2015. The Rock Creek Mill is a completed mill that was located outside of Nome, Alaska and which only operated for several months before its owner suspended its mining operation in 2008. The mill has been kept in excellent condition on care and maintenance.

The Rock Creek Mill was built to process 7,000 tonnes per day. It includes a three-stage crushing plant, gravity circuit, ball mill, floatation cells and leaching facilities. Also included in the option agreement are conveyors, metallurgical and chemical fire assay laboratories, a water treatment plant, full electrical circuitry and generators, and spare parts.

Almaden exercised its right and option under the option agreement and has purchased the Rock Creek Mill and related assets for a total of US$6,500,000, subject to adjustment under certain circumstances.

In addition to the cash payments, Almaden also issued to the optionor 407,997 Almaden common shares valued at $273,358 upon receipt of regulatory approval, which were issued on November 25, 2016.

During the year ended December 31, 2018, Almaden obtained ownership and title to the mill equipment, which remains located in Nome, Alaska.

The Rock Creek Mill has been incorporated into the Ixtaca economic studies.

Amended Preliminary Economic Assessment

On January 22, 2016, Almaden’s independent consultants prepared a Technical Report titled "Preliminary Economic Assessment of the Ixtaca Project”, which provided further detail to its December 9, 2015 press release summarizing the results of integrating the optioned Rock Creek Mill and a smaller, higher grade, payback focused pit on potential mine economics. An amended technical report was completed on April 13, 2016 (the “Amended PEA”); however the amendments were not material changes and the Report’s data, inputs, interpretation, conclusions and results all remained unchanged. This report was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the mining property disclosure rules specified in Subpart 1300 of Regulation S-K under the United States Securities Act of 1933 (“Subpart 1300”) promulgated by the SEC.

The Amended PEA followed the historical PEAs released in 2014 and 2015 (“Historical PEAs”) which evaluated larger throughput development alternatives. The primary reasons for providing an update to the Historical PEAs were to show the impact of significantly reduced initial capital cost on project economics and, given the significant decrease in precious metals prices, to demonstrate the viability of a mine plan which focused on the near surface high grade limestone hosted portions of the Ixtaca Zone deposit.

This mine plan was a smaller higher grade scenario than those described in Almaden’s Historical PEA studies. In addition, the Amended PEA incorporated the optioned Rock Creek mill as well as results from various engineering studies related to the project which had been conducted since the Historical PEAs were completed. The Amended PEA incorporated:

| · | The same resource model as the Historical PEAs; |

| · | The Rock Creek Mill, which was optioned by the Company in October 2015, with average throughput of 7,500 tonnes per day; |

| · | A smaller, near surface and payback focussed pit; |

| · | A mine production schedule which targets higher grades earlier; |

| · | Optimised waste placement and tailings management facilities; |

| · | A 2% NSR now held by Almadex. |

Pre-Feasibility Study (“PFS”)

Upon completion of the Amended PEA, Almaden began the work required for a Pre-Feasibility Study on the Ixtaca Project. During 2016, Almaden completed the necessary geotechnical, geomechanical, and hydrologic field programs, and also optimized site layout through updated waste placement and facilities locations. A new metallurgical program was also completed on the limestone domain, which represents approximately 82% of the total gold equivalent ounces produced over the life of the mine in the PFS. This report was also prepared in accordance with NI 43-101, the standards for which differ from the mining property disclosure rules specified in Subpart 1300 promulgated by the SEC.

The completed PFS is dated May 17, 2017 and included an updated resource model. The mine production schedule also included the optioned Rock Creek Mill while targeting higher grades earlier, using smaller, payback focused starter pits.

Feasibility Study (“Study”)

Upon completion of the PFS, Almaden began the work required for a Feasibility Study on the Ixtaca Project. The Study and resulting mine plan incorporate significant changes from the PFS including filtered (dry stack) tailings, ore sorting, increased throughput and an improved mine schedule. Collectively the changes result in a reduced project footprint and improved economics.

Almaden engaged a team of consultants led by Moose Mountain Technical Services (“MMTS”) to undertake this Study. As of the date of the Study and of the date hereof, the aforementioned Named Experts or, as applicable, Designated Professionals, to the best of the Company's knowledge, after reasonable inquiry, beneficially own, directly or indirectly, less than 1% of the Common Shares of the Company or any of the Company’s associates or affiliates, and none of them have any registered or beneficial ownership, direct or indirect, of property of the Company or any of the Company’s associates or affiliates.

The completed Study is dated January 24, 2019, and an update to the FS is dated October 3, 2019. The Study was prepared in accordance with NI 43-101, the standards for which differ from the mining property disclosure rules specified in Subpart 1300 promulgated by the SEC. A technical report summary which summarises the Study in a manner intended to be in accordance with Subpart 1300 of Regulation S-K (the “TRS”) has been filed as an exhibit to this Annual Report. The TRS is a review and summary of the previous technical work carried out up to the date of the Study. No significant technical work has been conducted subsequent to this Study and all exploration, legal, permitting and other project updates subsequent to the Study are provided elsewhere in this 20F. The Study was filed as a Feasibility Study under 43-101 standards. However, since Subpart 1300 standards are different than 43-101 standards, such as a lower range for cost estimates and contingencies, the Study likely would not meet Subpart 1300 requirements for a Feasibility-level study.

TRS HIGHLIGHTS

(All values shown in this section discussing the TRS are in $US unless noted otherwise. Base case uses $1275/oz gold and $17/oz silver prices. Gold and silver equivalency calculations assume 75:1 ratio).

| · | Average annual production of 108,500 ounces gold and 7.06 million ounces silver (203,000 gold equivalent ounces, or 15.2 million silver equivalent ounces) over first 6 years; |

| | · | After-tax internal rate of return (“IRR”) of 42% and after-tax payback period of 1.9 years; |

| | · | After-tax net present value (“NPV”) of $310 million at a 5% discount rate; |

| | · | Initial Capital of $174 million; |

| | · | Conventional open pit mining with a Proven and Probable Mineral Reserve of 1.39 million ounces of gold and 85.2 million ounces of silver; |

| | · | Pre-concentration uses ore sorting to produce a total of 48 million tonnes of mill feed averaging 0.77 g/t gold and 47.9 g/t silver (2.03 g/t gold equivalent over first 6 years, 1.41 g/t gold equivalent over life of mine); |

| · | Average life-of-mine (“LOM”) annual production of 90,800 ounces gold and 6.14 million ounces silver (173,000 gold equivalent ounces, or 12.9 million silver equivalent ounces); |

| | · | Operating cost $716 per gold equivalent ounce, or $9.55 per silver equivalent ounce; |

| | · | All-in Sustaining Costs (“AISC”), including operating costs, sustaining capital, expansion capital, private and public royalties, refining and transport of $850 per gold equivalent ounce, or $11.30 per silver equivalent ounce; |

| | · | Elimination of tailings dam by using filtered tailings significantly reduces the project footprint and water usage |

Capital and Operating Costs

Initial capital cost for the Ixtaca gold-silver project is $174 million and sustaining capital (including expansion capital) is $111 million over the LOM. The estimated expansion capital of $64.5 million will be funded from cashflow in Year 4 for the throughput ramp-up in Year 5. Estimated LOM operating costs are $26.8 per tonne mill feed. The following tables summarize the cost components:

Initial Capital Costs ($ millions)

| Mining | 22.2 |

| Process | 80.2 |

| Onsite Infrastructure | 24.3 |

| Offsite Infrastructure | 7.5 |

| Indirects, EPCM, Contingency and Owner’s Costs | 39.9 |

| Total | 174.2 |

Expansion Capital Costs ($ millions)

| Mining | $1.2 |

| Process | $56.9 |

| Infrastructure | $1.5 |

| Indirects, EPCM, Contingency and Owner’s Costs | $5.0 |

| Total | $64.5 |

LOM Average Operating Costs ($)

| Mining costs | $/tonne milled | $15.2 |

| Processing | $/tonne milled | $10.5 |

| G&A | $/tonne milled | $1.1 |

| Total | $/tonne milled | $26.8 |

Economic Results and Sensitivities

A summary of financial outcomes comparing base case metal prices to alternative metal price conditions are presented below. The TRS base case prices are derived from current common peer usage, while the alternate cases consider the project’s economic outcomes at varying prices witnessed at some point over the three years prior to the Study.

Summary of Ixtaca Economic Sensitivity to Precious Metal Prices (Base Case is Bold)

| Gold Price ($/oz) | 1125 | 1200 | 1275 | 1350 | 1425 |

| Silver Price ($/oz) | 14 | 15.5 | 17 | 18.5 | 20 |

| |

| Pre-Tax NPV 5% ($million) | 229 | 349 | 470 | 591 | 712 |

| Pre-Tax IRR (%) | 35% | 46% | 57% | 67% | 77% |

| Pre-Tax Payback (years) | 2.0 | 1.8 | 1.6 | 1.4 | 1.3 |

| |

| After-Tax NPV 5% ($million) | 151 | 233 | 310 | 388 | 466 |

| After-Tax IRR (%) | 25% | 34% | 42% | 49% | 57% |

| After-Tax Payback (years) | 2.6 | 2.1 | 1.9 | 1.7 | 1.5 |

Mineral Resource Estimate

On January 31, 2013 the Company announced a maiden resource on the Ixtaca Zone, which was followed by a resource update on January 22, 2014 and another on May 17, 2017. Since that time an additional 104 holes have been completed, and this data is also included in the Mineral Resource Estimate which is summarised in the table below. The data available for the resource estimation consisted of 649 drill holes assayed for gold and silver. Wireframes constraining mineralised domains were constructed based on geologic boundaries defined by mineralisation intensity and host rock type. Higher grade zones occur where there is a greater density of epithermal veining. These higher grade domains have good continuity and are cohesive in nature.

Of the total drill holes, 558 intersected the mineralised solids and were used to make the resource estimate. Capping was completed to reduce the effect of outliers within each domain. Uniform down hole 3-meter composites were produced for each domain and used to produce semivariograms for each variable. Grades were interpolated into blocks 10 x 10 x 6 meters in dimension by ordinary kriging. Specific gravities were determined for each domain from drill core. Estimated blocks were classified as either Measured, Indicated or Inferred based on drill hole density and grade continuity.

Table showing the Measured, Indicated and Inferred Mineral Resource Statement (exclusive of Reserves) with the Base Case 0.3 g/t AuEq Cut-Off highlighted. AuEq calculation is based on average prices of $1250/oz gold and $18/oz silver.

Ixtaca Zone Measured, Indicated and Inferred Mineral Resource Statement (exclusive of Reserves)

| | AuEq | Tonnes > Cut-off | Grade>Cut-off | Contained Metal x1000 |

| | Cut-off (g/t) | ('000000) | Au (g/t) | Ag (g/t) | AuEq (g/t) | Au (oz) | Ag (oz) | AuEq (oz) |

| Measured | 0.3 | 11.7 | 0.39 | 16.7 | 0.63 | 148 | 6,317 | 239 |

| Indicated | 0.3 | 40.4 | 0.32 | 16.8 | 0.56 | 412 | 21,870 | 726 |

| Measured + Indicated | 0.3 | 52.2 | 0.34 | 16.8 | 0.58 | 560 | 28,187 | 965 |

| Inferred | 0.3 | 40.4 | 0.32 | 16.8 | 0.56 | 412 | 21,870 | 726 |

| 1. | Ixtaca Mineral Resources Estimate have an effective date of 8 July 2018. |

| 2. | Base Case 0.3 g/t AuEq Cut-Off grade is highlighted. AuEq calculation based on average prices of $1250/oz gold and $18/oz silver. The Base Case cut-off grade includes consideration of the open pit mining method, 90% metallurgical recovery, mining costs of $1.82/t, average processing costs of $11.7, G&A costs of $1.81/t |

| 3. | Mineral Resources are reported exclusive of those Mineral Resources that have been converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 4. | The estimate of Mineral Resources may be materially affected by environmental, permitting, legal or other relevant issues. The Mineral Resources have been classified according to the definitions outlined in the SEC Disclosure by Registrants Engaged in Mining Operations. |

| 5. | All figures were rounded to reflect the relative accuracy of the estimates and may result in summation differences. |

Mineral Reserve Estimate

Mineral Reserves in the table below have been developed by MMTS with an effective date of November 30, 2018, The Mineral Reserves are based on an engineered open pit mine plan.

Mineral Reserves

| | Tonnes | Diluted Average Grades | Contained Metal |

| | (millions) | Au (g/t) | Ag (g/t) | Au - '000 ozs | Ag - '000 ozs |

| Proven | 31.6 | 0.70 | 43.5 | 714 | 44,273 |

| Probable | 41.4 | 0.51 | 30.7 | 673 | 40,887 |

| TOTAL | 73.1 | 0.59 | 36.3 | 1,387 | 85,159 |

| · | Mineral Reserves have an effective date of November 30, 2018. The qualified person responsible for the Mineral Reserves is Jesse Aarsen, P.Eng of Moose Mountain Technical Services. |

| | · | The cut-off grade used for ore/waste determination is NSR>=$14/t |

| | · | All Mineral Reserves in this table are Proven and Probable Mineral Reserves. The Mineral Reserves are not in addition to the Mineral Resources but are a subset thereof. All Mineral Reserves stated above account for mining loss and dilution. |

| | · | Associated metallurgical recoveries (gold and silver, respectively) have been estimated as 90% and 90% for limestone, 50% and 90% for volcanic, 50% and 90% for black shale. |

| | · | Reserves are based on a US$1,300/oz gold price, US$17/oz silver price and an exchange rate of US$1.00:MXP20.00. |

| | · | Reserves are converted from resources through the process of pit optimization, pit design, production schedule and supported by a positive cash flow model. |

| | · | Rounding as required by reporting guidelines may result in summation differences. |

Legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Reserves are provided in this Form 20-F under the heading “Risk Factors”.0

Mine Plan

The Ixtaca gold-silver project is planned as a typical open pit mining operation using contractor mining. Initial production will ramp up to a mill feed rate of 7,650 tonnes per day followed by an expansion to 15,300 tonnes per day from Year 5 onwards.

An ore control system is planned to provide field control for the loading equipment to selectively mine ore grade material separately from the waste.

Mining operations will be based on 365 operating days per year with three 8 hour shifts per day.

Processing

The TRS reflects the Rock Creek process plant which has been purchased by Almaden. Run of mine ore will be crushed in a three-stage crushing circuit to -9 mm.

The TRS also incorporates ore sorting, test work for which has shown the ability to separate barren or low grade limestone host rock encountered within the vein swarm from vein and veined material (see Almaden news release of July 16th 2018). Product from the secondary crusher will be screened in to coarse (+20mm), mid-size (12 to 20 mm), and fine (-12mm) fractions. Coarse and mid-size ore will be sorted by an XRT ore sort machine to eject waste rock. Fine ore will bypass the ore sorting and is sent directly to the mill.

Ore sort waste from Limestone and Black Shale is below waste/ore cutoff grade and is placed in the waste rock dump. Ore sort ‘waste’ from the Volcanic unit is low grade ore and will be stockpiled for processing later in the mine life. Ore sorting pre-concentration increases the mill feed gold and silver grades by 32% and 31% respectively compared to run of mine (ROM) grades. The table below shows ROM grades with ore sort waste removed from the ROM, and the resulting mill feed.

Ore Sort Mill Feed grade improvement

| | | ROM | Ore sort | Mill |

| | | Ore | Waste | Feed |

| Limestone | million tonnes | 51.5 | 18.8 | 32.7 |

| Au g/t | 0.572 | 0.24 | 0.763 |

| Ag g/t | 37.5 | 12.0 | 52.2 |

| Black Shale | million tonnes | 12.2 | 6.3 | 5.8 |

| Au g/t | 0.517 | 0.25 | 0.806 |

| Ag g/t | 44.4 | 20.0 | 70.8 |

| Volcanic | million tonnes | 9.4 | - | 9.4 |

| Au g/t | 0.790 | - | 0.790 |

| Ag g/t | 18.6 | - | 18.6 |

| TOTAL | million tonnes | 73.1 | 25.1 | 48.0 |

| Au g/t | 0.591 | 0.24 | 0.773 |

| Ag g/t | 36.3 | 14.0 | 47.9 |

Crushed ore is transported to the grinding circuit by an over land conveyor. Grinding to 75 microns is carried out with ball milling in a closed circuit with cyclones. Cyclone underflow is screened and the screen undersize is treated in semi-batch centrifugal gravity separators to produce a gravity concentrate.

The gravity concentrate will be treated in an intensive leach unit with gold and silver recovered from electrowinning cells.

The cyclone overflow will be treated in a flotation unit to produce a flotation concentrate. After regrinding the flotation concentrate leaching will be carried out in 2 stages. CIL leaching for 24 hours will complete gold extraction, followed by agitated tank leaching to complete silver leaching. A carbon desorption process will recover gold and silver from the CIL loaded carbon, and a Merrill Crowe process will recover gold and silver from pregnant solution from the agitated leach circuit.

Cyanide destruction on leach residue is carried out using the SO2/Air process. Final tailings are thickened and filtered then dry stacked and co-disposed with mine waste rock.

Average process recoveries from mill feed to final product over the life of mine are summarized below for each ore type.

Average Life of Mine Process Recoveries from Mill Feed

| | Gold | Silver |

| Limestone | 88.5% | 86.8% |

| Volcanic | 64.4% | 76.3% |

| Black Shale | 54.5% | 84.7% |

Water and Waste Management

One of Almaden’s top priorities at Ixtaca is water quality and a mine plan that provides a permanent and consistent long-term supply of water for residents. The plan outlined in the TRS has evolved through the open dialogue between the Company and residents over the past number of years and as part of the Social Investment Plan consultation (see section below on “Community”).

Rainfall in the Ixtaca vicinity falls primarily during a relatively short rainy season. With no local water storage facilities, the flash flows of water are currently lost to the communities. Under the TRS, rainwater will be captured during the rainy season in the water storage reservoir and slowly released during the dry season, for use by both the mining operation and local residents.

Extensive geochemical studies have evaluated the potential for acid rock drainage and metal leaching from the waste rock and tailings using globally accepted standardised methods of laboratory testing and in compliance with Mexican regulations. Most of the waste rock at Ixtaca is limestone, and the studies of both waste rock and tailings have consistently shown that there is more than enough neutralising potential present in the waste rock to neutralise any acid generated. Testing to date also indicates low potential for metal leaching. These results along with the excellent access to potential markets in the growing industrial state of Puebla, indicate the potential for rock waste and tailings from the Ixtaca deposit to be secondary resources such as aggregate and cement feedstock. These opportunities were examined in 2019 as part of the Company’s commitment to best sustainable practices.

In consideration of these findings and the hydrologic conditions at Ixtaca, Almaden and its consultants reviewed Best Available Technology and Best Applicable Practice in the design and planning of tailings management at Ixtaca, which resulted in selecting a dry-stack tailings facility which would include co-disposal of waste with filtered tailings, use much less water than traditional slurry facilities, reduce the mine footprint, allow for better dust control, and enable earlier rehabilitation of the tailings and waste disposal areas.

Community Consultations

Almaden has a long history of engagement with communities in the region around the Ixtaca Project. Amongst many other initiatives, the Company has trained and employed drillers and driller helpers from the local area, held ten large-scale community meetings totalling over 4,500 people, taken 500 local adults on tours of operating mines in Mexico, and held monthly technical meetings on a diverse range of aspects relating to the mining industry and the Ixtaca Project. At the end of 2021, the Company convened an outdoor end of year gathering in a large open space and is very appreciative of the ongoing support and optimism from local communities regarding the future of the project and the tremendous value that we can collectively deliver to the local area through project development.

In 2017, Almaden engaged a third-party consultant to lead a community consultation and impact assessment at the Ixtaca Project. In Mexico, only the energy industry requires completion of such an assessment (known in Mexico as a Trámite Evaluación de Impacto Social, or “EVIS”) as part of the permitting process. The purpose of these studies is to identify the people in the area of influence of a project (“Focus Area”), and assess the potential positive and negative consequences of project development to assist in the development of mitigation measures and the formation of social investment plans. To Almaden’s knowledge, this is the first time a formal EVIS has been completed in the minerals industry in Mexico, and as such reflects the Company’s commitment to best national and international standards in Ixtaca project development.

The EVIS and subsequent work on the development of a Social Investment Plan were conducted according to Mexican and international standards such as the Guiding Principles on Business and Human Rights, the Equator Principles, and the OECD Guidelines for Multinational Enterprises and Due Diligence Guidance for Meaningful Stakeholder Engagement in the Extractive Sector.

Fieldwork for the EVIS was conducted by an interdisciplinary group of nine anthropologists, ethnologists and sociologists graduated from various universities, who lived in community homes within the Ixtaca Focus Area during the study to allow for ethnographic immersion and an appreciation for the local customs and way of life. This third-party consultation sought voluntary participation from broad, diverse population groups, with specific attention to approximately one thousand persons in the Focus Area.

This extensive consultation resulted in changes to some elements of the mine design, including the planned construction of a permanent water reservoir to serve the local area long after mine closure, and the shift to dry-stack filtered waste management.

In March 2020, the Company announced that it has partnered with a local community group focused on irrigation development, and together with them coordinated with the Federal Government water authority (“CONAGUA”), to co-fund a new water reservoir in Zacatepec, a community located close to the Ixtaca mine development area. Next steps will involve adding new pipelines, tanks, and other structures to enhance the irrigation potential in support of local agricultural production.

This reservoir is one of the projects identified which could bring immediate benefits to the local area even prior to Ixtaca development. The Company looks forward to advancing further elements of the community Social Investment Plan as mine permitting and construction advance.

The Company has now commenced a HRIA at the Ixtaca project. The HRIA will be conducted in accordance with best international practice and in observance of the latest developments in international human rights legislation and precedents. It will seek to predict, identify, characterize, and assess the impacts the project may have on these matters and will propose strategies which amplify the positive impacts and mitigate or compensate for any negative ones.

Economic Contributions

The TRS anticipates that approximately 600 direct jobs will be created during the peak of construction, and 420 jobs will be generated during operations. Assuming base case metal prices, under this TRS Ixtaca is anticipated to generate approximately US$130 million in Federal taxes, US$50 million in State taxes and US$30 million in Municipal taxes.

Closure and Reclamation

Mine waste areas will be reclaimed and re-vegetated at the end of mining activity. At closure, all buildings will be removed and remaining facilities, except for the water storage dam (WSD), will be reclaimed and re-vegetated. The WSD and the availability of this water to the local communities will remain after closure.

Opportunities

Several opportunities excluded from the base case economics have been identified in the TRS.

| · | Results from the ore sorting tests identified several opportunities to increase the ore sort efficiency and could result in a further increase in mill feed grades. These opportunities will be investigated with future test work. |

| · | Gold extraction recoveries in the minor black shale unit are currently impeded by the presence of carbonaceous material. Recent test work including carbon pre-flotation and ultra-fine gravity separation has demonstrated that the carbon can be liberated and removed with a significant improvement in gold recovery. This test work is ongoing and is expected to improve the black shale gold recovery. |

| · | Test work carried out on Ixtaca limestone waste rock samples concluded that Ixtaca limestone waste rock is suitable for many types of concrete use and other applications such as shotcrete, subgrade, asphalt aggregate or railroad ballast with little effort and processing. Concrete produced with tests on Ixtaca limestone aggregate performed very well, achieving the 28-day design compressive strength of 30 MPa already at 7 days, and more than 40 MPa at 28 and 56 days. |

| | | |

| | | Ixtaca is connected by 60 km of paved road to the industrial city Apizaco, 120 km of paved road to the state capital of Puebla, and 170 km of paved road to Mexico City. |

| | | |

| | | The sale of limestone ore sort rejects (a waste product) as an aggregate presents a very significant potential source of revenue to the Project at no additional capital or operating cost to the Project. There is also potential to sell some of the waste rock as an aggregate. |

| · | Fine aggregate from crushing and grinding operations is also expected to perform in a similar way to the coarse aggregate. Chemical analysis of the fine aggregate indicates that it is also suitable as a raw material for the production of lime cement or Portland cement if properly processed and blended with suitable silica aluminates. |

Next Engineering and Development Steps

In December 2020, the Company announced that it received notification from the Mexican federal permitting authority, SEMARNAT, that the Company’s initial MIA, a required permit in order to proceed to construction and operation of the Ixtaca Project, did not receive approval. The Company originally submitted the MIA in early 2019.

The reasons cited by SEMARNAT for not approving the MIA include insufficient technical information regarding the impacts of the Ixtaca Project on the environment, local and regional area. Although not formally vested with authority on indigenous matters under a specific local body of law, SEMARNAT also expressed its opinion that indigenous persons are present in the area affected by the Ixtaca Project and indicated that this needs to be addressed in the context of obligations assumed by Mexico under ILO Convention 169 regarding the human right to free, prior, informed consultation of indigenous communities.

The Company intends to proceed with the completion of the HRIA during 2023. Almaden has now substantially completed a revised MIA permit application which incorporates additional data available to the Company as well as data gathered in further field studies. The Company expects to submit the MIA application once the HRIA document is completed and if and when the indigenous consultation is finalized. In the normal course, MIA permits may take up to one year for review by SEMARNAT after submission.

Qualified Persons, Sample Preparation, Analyses, Quality Control and Assurance

The independent qualified person responsible for the TRS is Jesse Aarsen, P.Eng., of Moose Mountain Technical Services. A copy of the TRS, and Mr. Aarson’s consent, are included as exhibits to this Annual Report.

The analyses used in the preparation of the mineral resource statement were carried out at ALS Chemex Laboratories of North Vancouver (“ALS”) using industry standard analytical techniques. All strongly altered or epithermal-mineralized intervals of core have been sampled. Almaden employs a maximum sample length of 2 to 3m in unmineralized lithologies, and a maximum sample length of 1m in mineralized lithologies. During the years 2010 and 2011, Almaden employed a minimum sample length of 20cm. The minimum sample length was increased to 50cm from 2012 onwards to ensure the availability of sufficient material for replicate analysis. Drill core is half-sawn using industry standard diamond core saws. After cutting, half the core is placed in a new plastic sample bag and half is placed back in the core box. Sample numbers are written on the outside of the sample bags and a numbered tag placed inside the bag. Sample bags are sealed using a plastic cable tie. Sample numbers are checked against the numbers on the core box and the sample book.

ALS sends its own trucks to the Ixtaca Project to take custody of the samples at the Santa Maria core facility and transports them to its sample preparation facility in Guadalajara or Zacatecas, Mexico. Prepared sample pulps are then forwarded by ALS personnel to the ALS North Vancouver, British Columbia laboratory, which is ISO/IEC 17025:2017 and ISO 9001: 2015 certified, for analysis.

For gold, samples are first analysed by fire assay and atomic absorption spectroscopy (“AAS”). Samples that return values greater than 10 g/t gold using this technique are then re-analysed by fire assay but with a gravimetric finish. Silver is first analysed by Inductively Coupled Plasma - Atomic Emission Spectroscopy (“ICP-AES”). Samples that return values greater than 100 g/t silver by ICP-AES are then re analysed by HF-HNO3-HCLO4 digestion with HCL leach and ICP-AES finish. Of these samples those that return silver values greater than 1,500 g/t are further analysed by fire assay with a gravimetric finish. Blanks, field duplicates and certified standards were inserted into the sample stream as part of Almaden’s quality assurance and control program. In addition to the in-house QAQC measures employed by Almaden, Kris Raffle, P.Geo. of APEX Geoscience Ltd., completed an independent review of blank, field duplicate and certified standard analyses. All QAQC values falling outside the limits of expected variability were flagged and followed through to ensure completion of appropriate reanalyses. No discrepancies were noted within the drill hole database, and all QAQC failures were dealt with and handled with appropriate reanalyses.

Current Work

In December 2020, the Company announced that its initial MIA was not approved by Mexican authorities. The Company substantially completed a revised MIA permit application which incorporates additional data available to the Company as well as data gathered in further field studies. The Company expects to submit the MIA application once the HRIA document and the indigenous consultation are finalized. In the normal course, MIA permits may take up to one year for review by SEMARNAT after submission.

Upcoming / Outlook

Almaden has access to sufficient funding to conduct its anticipated work program for the next fiscal year at the Ixtaca Project. The Company intends to proceed with the completion of the HRIA during 2023 and expects to submit the MIA application once the HRIA document is completed and if and when the indigenous consultation is finalized.

PART III

Item 19. Exhibits

A. The financial statements and notes thereto as required under Item 18 are attached hereto and found immediately following the text of this Annual Report.

Audited Financial Statements

Independent registered Public Accounting Firm reports on the consolidated financial statements, dated March 24, 2023

Consolidated statements of financial position at December 31, 2022 and 2021

Consolidated statements of comprehensive loss for the years ended December 31, 2022, 2021 and 2020

Consolidated statements of changes in equity for the years ended December 31, 2022, 2021 and 2020

Consolidated statements of cash flows for the years ended December 31, 2022, 2021 and 2020

Summary of significant accounting policies and other explanatory information

B. Index to Exhibits

| | |

| 1. | Certificate of Amalgamation |

| | Amalgamation Agreement |

| | - Incorporated by reference to the Company’s Form Annual Report on Form 20-F for the year ended December 31, 2001, as filed with the Commission on May 17, 2002. |

| | |

| 1.1 | Articles |

| | - Incorporated by reference to the Company’s Form Annual Report on Form 20-F for the year ended December 31, 2005, as filed with the Commission on March 30, 2006. |

| | |

| 2. | Instruments defining the rights of holders of equity or debt securities being registered |

| | - Refer to Exhibit No. 1. |

| | |

| 3. | Voting trust agreements. The Voting Trust Agreement dated December 17, 2009 between Ernesto Echavarria, as grantor, and Messrs Duane and Morgan Poliquin, as voting trustees. - Incorporated by reference to the Company’s Form 20-F for the year ended December 31, 2013 and filed with the Commission on March 31, 2014. |

| | |

| 4.1 | Arrangement Agreement dated May 11, 2015 in connection with the Company’s statutory Plan of Arrangement with Almadex and filed with the Commission on March 31, 2016. |

| | |

| 4.2 | Administrative Services Agreement between the Company and Almadex Minerals Limited dated May 15, 2015 and filed with the Commission on March 31, 2016. |

| | |

| 4.3 | First Amending Agreement to the May 15, 2015 Administrative Services Agreement between the Company and Almadex Minerals Limited dated December 16, 2015 and filed with the Commission on March 31, 2016. |

| | |

| 4.4 | Executive Employment Contract between the Company and Duane Poliquin dated effective January 1, 2016 and filed with the Commission on March 31, 2016. |

| | |

| 4.5 | Amending Agreement dated April 1, 2016 to the Executive Compensation Contract with Morgan Poliquin dated January 29, 2013 and filed with the Commission on March 30, 2017. |

| | |

| 4.6 | Amending Agreement dated April 1, 2016 to the Executive Employment Contract with Duane Poliquin dated January 1, 2016 and filed with the Commission on March 30, 2017. |

| | |

| 4.7 | Amending agreement to the Executive Compensation Contract with Morgan Poliquin dated January 1, 2019 and filed with the Commission on March 15, 2019. |

| 4.8 | Amending agreement to the Executive Compensation Contract with Duane Poliquin dated January 1, 2019 and filed with the Commission on March 15, 2019. |

| | |

| 4.9 | Administrative Services Agreement between the Company and Almadex Minerals Ltd. (formerly 1154229 B.C. Ltd.) dated March 29, 2018 and filed with the Commission on March 15, 2019. |

| | |

| 4.10 | Gold Loan Agreement between the Company and Almadex Minerals Ltd. dated effective May 14th, 2019 and filed with the commission on March 27, 2020. |

| | |

| 4.11 | Short Form Base Shelf Prospectus and filed with the commission on February 25, 2021 |

| | |

| 4.12 | Form of Placement Agency Agreement dated March 16, 2021 - Incorporated by reference to the Form 6-K and filed with the Commission on March 16, 2021 |

| | |

| 4.13 | Form of Securities Purchase Agreement - Incorporated by reference to the Form 6-K and filed with the Commission on March 16, 2021 |

| | |

| 4.14** | Salary Deferral and Amendment Agreement and filed with the Commission on April 27, 2023 |

| | |

| 5. | List of foreign patents – N/A |

| | |

| 6. | Calculation of earnings per share – N/A |

| | |

| 7. | Explanation of calculation of ratios – N/A |

| | |

| 8.** | List of subsidiaries and filed with the Commission on April 27, 2023 |

| | |

| 9. | Statement pursuant to the instruction to Item 8.A.4, regarding the financial statement filed in registration |

| | Statements for initial public offerings of securities – N/A |

| | |

| 10. | Any notice required by Rule 104 of Regulation BTR – N/A |

| | |

| 11 | Audit Committee Charter |

| | |

| 11.1 | Nominating and Corporate Governance Committee-Duties and Responsibility |

| | |

| 11.2 | Compensation Committee-Responsibilities and Duties |

| | |

| 11.3 | Code of Business Ethics |

| | |

| 11.4 | Code of Business Conduct and Ethics for Directors |

| | |

| 11.5 | Communications Policy |

| | |

| 11.6 | Securities Trading Policy |

| | |

| 11.7 | Whistleblower Policy |

| | |

| 11.8 | Privacy Policy |

| | - Incorporated by reference to the Company’s Annual Report on Form 20-F for the year ended December 31, 2005, as filed with the Commission on March 30, 2006. |

| | |

| 11.9 | Shareholder Rights Plan dated April 13, 2011, as amended and reconfirmed at the 2017 Annual General Meeting and as reconfirmed at the 2020 Annual General Meeting. - Incorporated by reference to the Form 6-K filed with the Commission on April 15, 2011. |

| | |

| 11.10 | Amended Advance Notice Policy dated January 28, 2013, as amended May 1, 2015 as filed with the Commission on March 29, 2018. |

| | |

| 11.11 | Amended Majority Voting Policy – adopted by the Board of Directors on May 7, 2013, as amended effective May 15, 2017 as filed with the Commission on March 29, 2018. |

| | |

| 12.1 * | Certification of CEO Pursuant to Securities Exchange Act, Rules 13a-14 and 15d-14 as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

| 12.2 * | Certification of CFO Pursuant to Securities Exchange Act, Rules 13a-14 and 15d-14 as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

| 13.1 * | Certification of CEO Pursuant to the Sarbanes-Oxley Act, 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| | |

| 13.2 * | Certification of CFO Pursuant to the Sarbanes-Oxley Act, 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| | |

| 14.1 * | Consent of Jesse Aarsen |

| | |

| 14.2 * | Amended S-K 1300 Technical Report Summary of the Ixtaca Gold-Silver Project |

| | |

| 101.INS** | Inline XBRL Instance Document |

| 101.SCH** | Inline XBRL Taxonomy Extension Schema Documents |

| 101.CAL** | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF** | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB** | Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE** | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104** | Cover Page Interactive Data File (embedded within Inline XBRL document) |

| ** | Previously filed with the Commission on April 27, 2023. |

SIGNATURE

The Registrant hereby certifies that it meets all of the requirements for filing this Amendment No.1 to the Annual Report on Form 20-F/A and that it has duly caused and authorized the undersigned to sign this Amendment No. 1 on its behalf.

Almaden Minerals Ltd.

Registrant

| Dated: September 27, 2023 | By /s/Morgan Poliquin |

| | Morgan Poliquin, CEO |

21