Exhibit 99.2

© 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. E*TRADE FINANCIAL Corporation Year-end 2007 Investor Conference Call January 24, 2008

2 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Safe Harbor Statement Included in this presentation the Company will be sharing certain projections or other forward-looking statements regarding future events or its future performance. E*TRADE Financial cautions you that certain factors, including risks and uncertainties referred to in the 10-K’s, 10-Q’s and other reports it periodically files with the Securities and Exchange Commission, could cause the Company’s actual results to differ materially from those indicated by its projections or forward-looking statements. This presentation presents information as of January 24, 2008. Please note that E*TRADE Financial disclaims any duty to update any forwardlooking statements made in this presentation. In this presentation, E*TRADE Financial may also discuss some non-GAAP financial measures in talking about its performance. These measures will be reconciled to GAAP either during the course of the call or in the Company’s press release, which can be found on its website at www.etrade.com.

3 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Agenda Overview Q407 & FY2007 review 2008 turnaround plan summary 2008 outlook

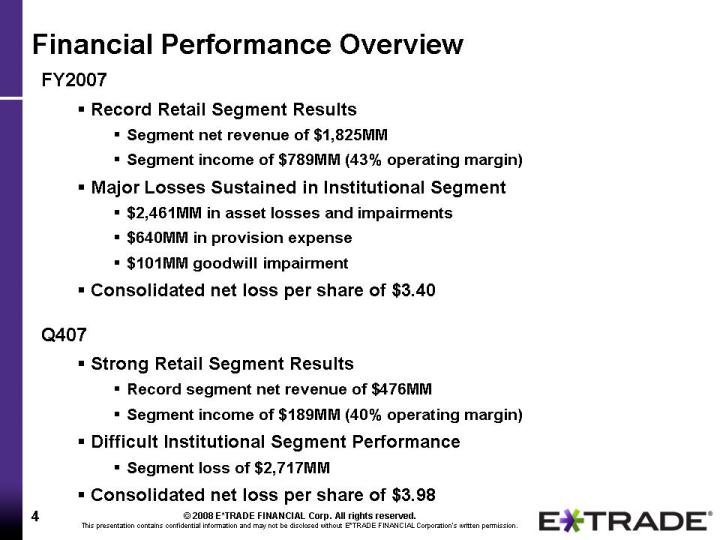

4 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Financial Performance Overview FY2007 Record Retail Segment Results Segment net revenue of $1,825MM Segment income of $789MM (43% operating margin) Major Losses Sustained in Institutional Segment $2,461MM in asset losses and impairments $640MM in provision expense $101MM goodwill impairment Consolidated net loss per share of $3.40 Q407 Strong Retail Segment Results Record segment net revenue of $476MM Segment income of $189MM (40% operating margin) Difficult Institutional Segment Performance Segment loss of $2,717MM Consolidated net loss per share of $3.98

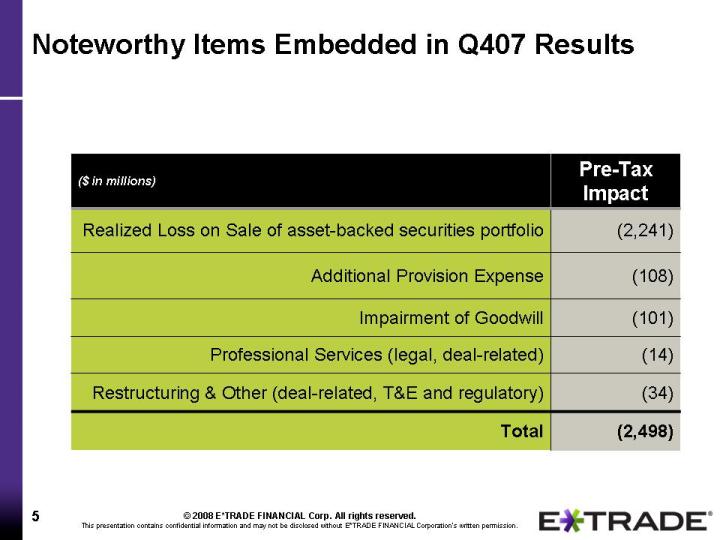

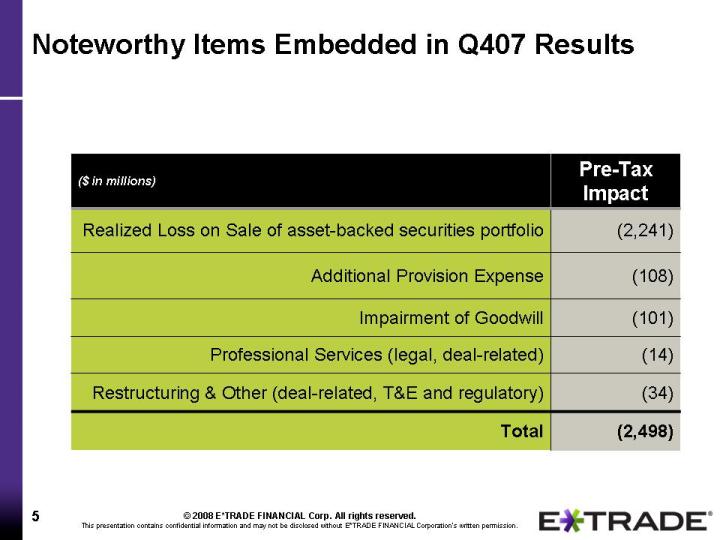

5 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Noteworthy Items Embedded in Q407 Results (101) Impairment of Goodwill (2,498) Total (34) (14) (108) (2,241) Pre-Tax Impact ($ in millions) Restructuring & Other (deal-related, T&E and regulatory) Professional Services (legal, deal-related) Additional Provision Expense Realized Loss on Sale of asset-backed securities portfolio

6 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Citadel Transaction Benefits: Realized loss on ABS portfolio to eliminate earnings volatility and larger potential future write-downs Provided funds to Parent company to enable the Bank to: Replace capital from loss on ABS sale Absorb loan losses Strengthen excess regulatory capital Results: Stabilized customer confidence Provided ability to address home equity portfolio in an orderly fashion

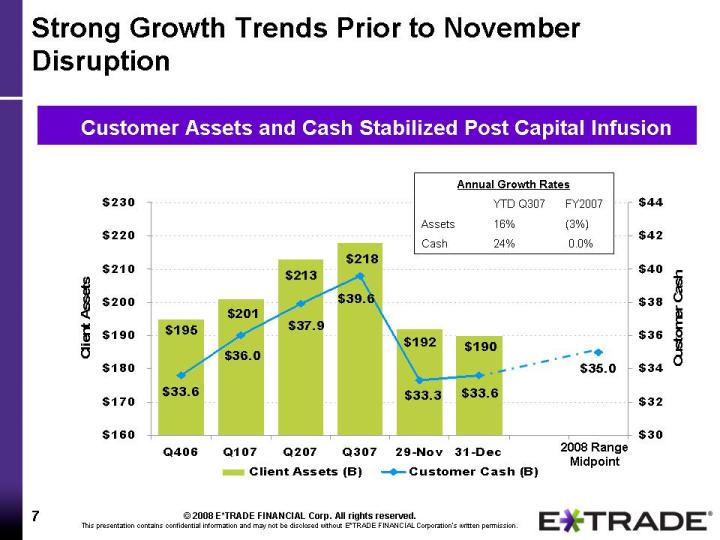

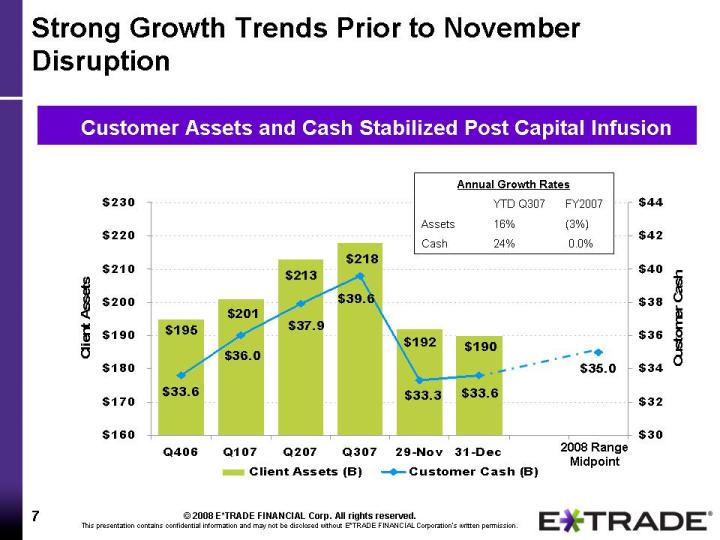

7 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Strong Growth Trends Prior to November Disruption $192 $218 $201 $195 $213 $190 $35.0 $33.6 $33.3 $37.9 $33.6 $36.0 $39.6 $160 $170 $180 $190 $200 $210 $220 $230 Q406 Q107 Q207 Q307 29-Nov 31-Dec Client Assets $30 $32 $34 $36 $38 $40 $42 $44 Customer Cash Client Assets (B) Customer Cash (B) Customer Assets and Cash Stabilized Post Capital Infusion 2008 Range Midpoint Annual Growth Rates YTD Q307 FY2007 Assets 16% (3%) Cash 24% 0.0%

8 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Primary Goals of 2008 Turnaround Plan Reduce concerns of Bank balance sheet Reduce leverage of Parent company Reduce non-core expenses to fund investments RESTORE CONFIDENCE and RETURN TO GROWTH

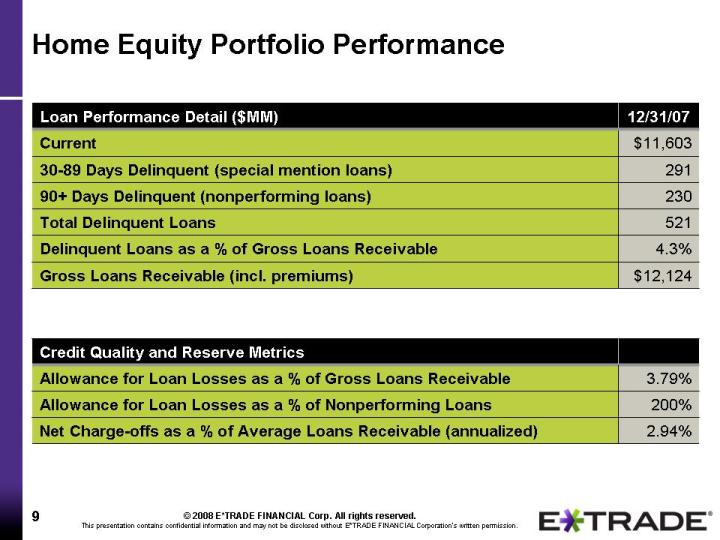

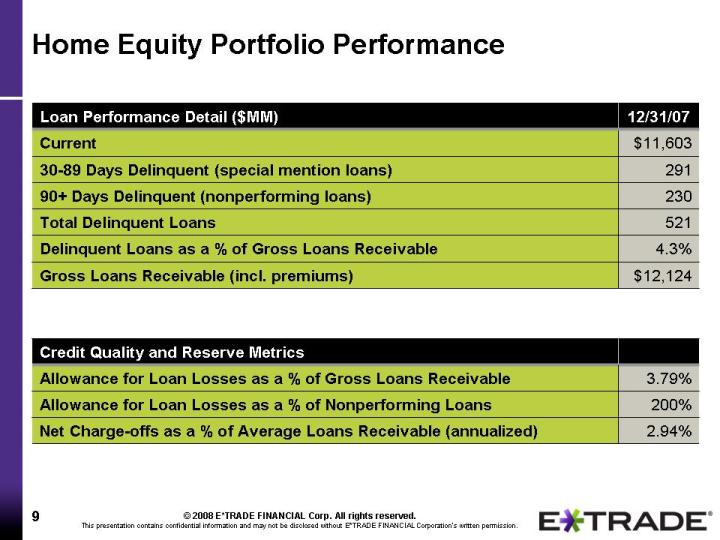

9 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Home Equity Portfolio Performance 4.3% Delinquent Loans as a % of Gross Loans Receivable Credit Quality and Reserve Metrics 200% Allowance for Loan Losses as a % of Nonperforming Loans 3.79% Allowance for Loan Losses as a % of Gross Loans Receivable 2.94% Net Charge-offs as a % of Average Loans Receivable (annualized) $12,124 Gross Loans Receivable (incl. premiums) 521 230 291 $11,603 12/31/07 Loan Performance Detail ($MM) Total Delinquent Loans 90+ Days Delinquent (nonperforming loans) 30-89 Days Delinquent (special mention loans) Current

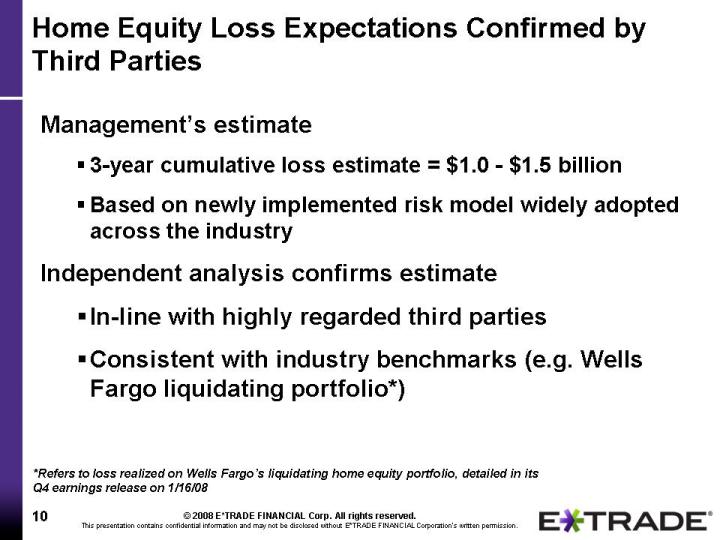

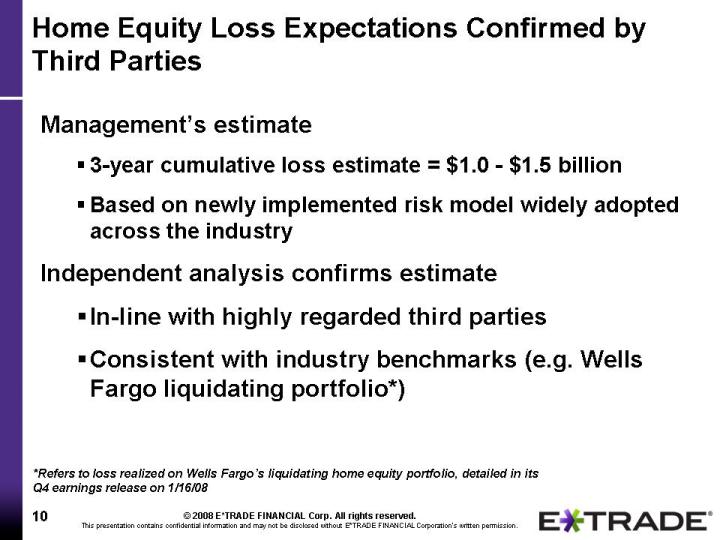

10 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Home Equity Loss Expectations Confirmed by Third Parties Management’s estimate 3-year cumulative loss estimate = $1.0 - $1.5 billion Based on newly implemented risk model widely adopted across the industry Independent analysis confirms estimate In-line with highly regarded third parties Consistent with industry benchmarks (e.g. Wells Fargo liquidating portfolio*) *Refers to loss realized on Wells Fargo’s liquidating home equity portfolio, detailed in its Q4 earnings release on 1/16/08

11 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Industry Context on Home Equity Performance 38% 30% % in California <1% 11% Self Originated $1.0B - $1.5B (3-year period) $1.5 732 $11.9 E*TRADE Portfolio $1.0B (2-year period) Cumulative Loss Estimate $0.4 725 $11.9 Wells Fargo Liquidating Portfolio ($ in billions) $ in 1st Lien Position Average FICO Outstanding Principal Balances

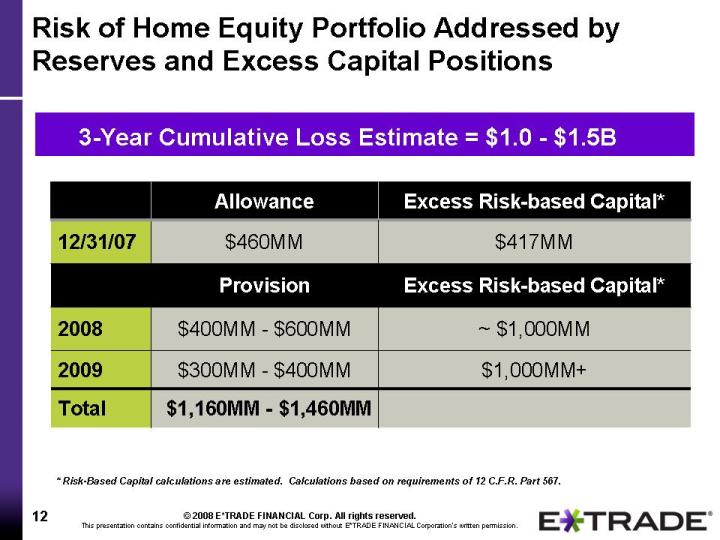

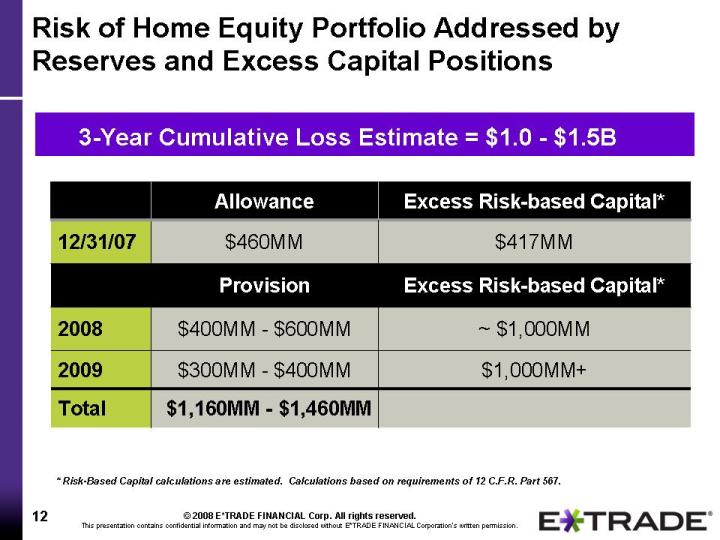

12 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Risk of Home Equity Portfolio Addressed by Reserves and Excess Capital Positions Excess Risk-based Capital* Provision $1,160MM - $1,460MM $300MM - $400MM $400MM - $600MM $460MM Allowance $417MM 12/31/07 $1,000MM+ ~ $1,000MM Excess Risk-based Capital* Total 2009 2008 3-Year Cumulative Loss Estimate = $1.0 - $1.5B * Risk-Based Capital calculations are estimated. Calculations based on requirements of 12 C.F.R. Part 567.

13 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Reduce Costs to Fund Growth Investments Reinvest $85MM of savings for growth New marketing campaign Expanded Relationship Manager coverage of high value customers New product and service introduction to continue innovation leadership (home deposit, mobile trading, expanded global trading) Total run-rate expenses decline by $360MM

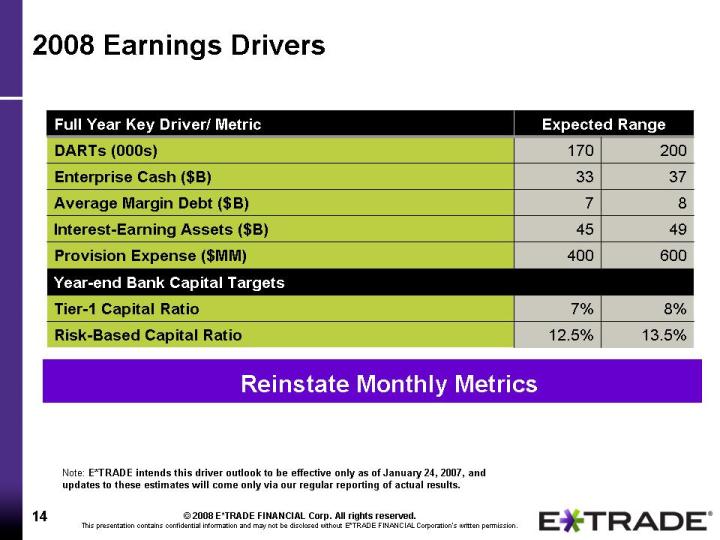

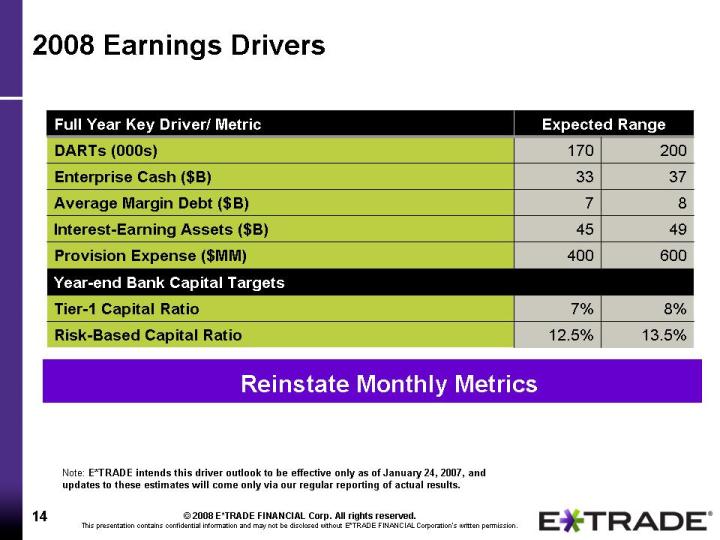

14 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. 2008 Earnings Drivers 8% 7% Tier-1 Capital Ratio 49 45 Interest-Earning Assets ($B) 8 7 Average Margin Debt ($B) 37 33 Enterprise Cash ($B) 200 170 DARTs (000s) 12.5% 400 Expected Range 13.5% 600 Full Year Key Driver/ Metric Risk-Based Capital Ratio Year-end Bank Capital Targets Provision Expense ($MM) Reinstate Monthly Metrics Note: E*TRADE intends this driver outlook to be effective only as of January 24, 2007, and updates to these estimates will come only via our regular reporting of actual results.

15 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Summary Core business is strong Swift actions being taken to reduce financial concerns Significant opportunities to generate capital Restoring confidence = Returning to growth

16 © 2008 E*TRADE FINANCIAL Corp. All rights reserved. This presentation contains confidential information and may not be disclosed without E*TRADE FINANCIAL Corporation’s written permission. Q&A