Exhibit 99.1

January 24, 2008 (All data and ratings are as of 12/31/07) Supplemental Portfolio Disclosure This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-lookingstatements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and wedisclaim any duty to update any forward-looking statements. E*TRADE

Safe Harbor Statement In this presentation the Company will be sharing certain projections or other forward-looking statements regarding future events or its future performance. E*TRADE Financial cautions you that certain factors, including risks and uncertainties referred to in the 10-K’s, 10-Q’s and other reports it periodically files with the Securities and Exchange Commission, could cause the Company’s actual results to differ materially from those indicated by its projections or forward-looking statements. This presentation presents information as of December 31, 2007. Please note that E*TRADE Financial disclaims any duty to update any forward-looking statements made in the presentation. In this presentation, E*TRADE Financial may also discuss some non-GAAP financial measures in talking about its performance. These measures will be reconciled to GAAP either during the course of the call or in the Company’s press release, which can be found on its website at www.etrade.com. This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements. 2

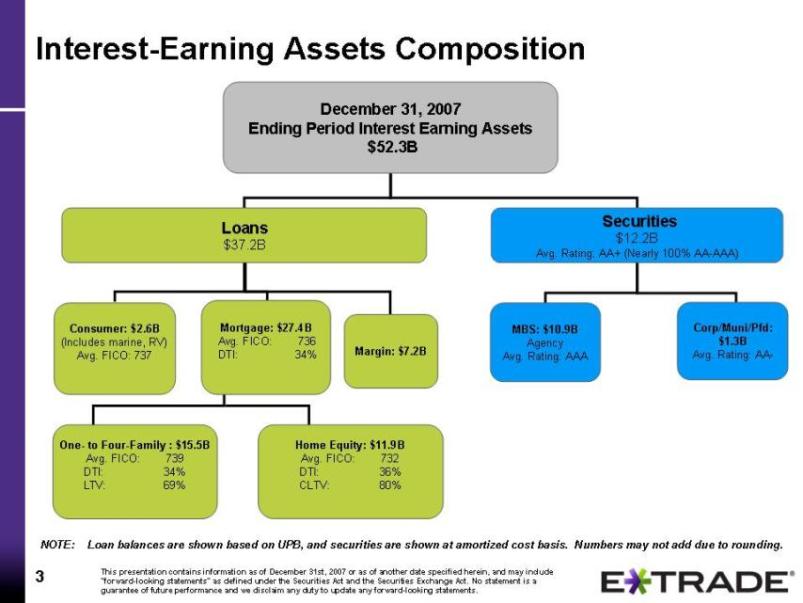

Interest-Earning Assets Composition NOTE: Loan balances are shown based on UPB, and securities are shown at amortized cost basis. Numbers may not add due to rounding. This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements. December 31, 2007 Ending Period Interest Earning Assets $52.3B Loans $37.2B Securities $12.2B Avg. Rating: AA+ (Nearly 100% AA-AAA) Consumer: $2.6B (Includes marine, RV) Avg. FICO: 737 Mortgage: $27.4B Avg. FICO: 736 DTI: 34% Margin: $7.2B MBS: $10.9B Agency Avg. Rating: AAA Corp/Muni/Pfd: $1.3B Avg. Rating: AAOne- to Four-Family : $15.5B Avg. FICO: 739 DTI: 34% LTV: 69% Home Equity: $11.9B Avg. FICO: 732 DTI: 36% CLTV: 80%

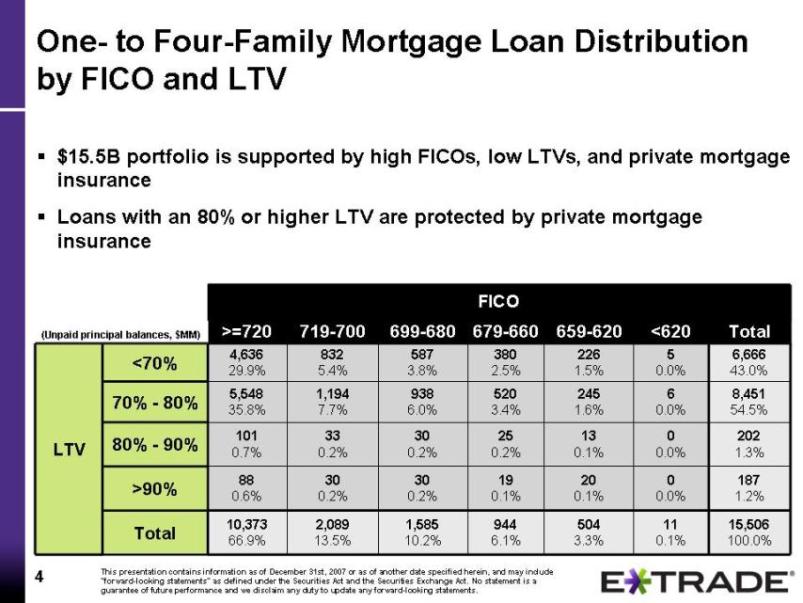

One- to Four-Family Mortgage Loan Distribution by FICO and LTV * Averages based upon 2006 engagement trends $15.5B portfolio is supported by high FICOs, low LTVs, and private mortgage insurance Loans with an 80% or higher LTV are protected by private mortgage insurance FICO 11 0.1% 0 0.0% 0 0.0% 6 0.0% 5 0.0% <620 504 3.3% 20 0.1% 13 0.1% 245 1.6% 226 1.5% 659-620 944 6.1% 19 0.1% 25 0.2% 520 3.4% 380 2.5% 679-660 10,373 66.9% 88 0.6% 101 0.7% 5,548 35.8% 4,636 29.9% >=720 187 1.2% 30 0.2% 30 >90% 0.2% 1,585 10.2% 30 0.2% 938 6.0% 587 3.8% 699-680 LTV (Unpaid principal balances, $MM) 719-700 Total <70% 832 5.4% 6,666 43.0% 70% - 80% 1,194 7.7% 8,451 54.5% 80% - 90% 33 0.2% 202 1.3% Total 2,089 13.5% 15,506 100.0% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

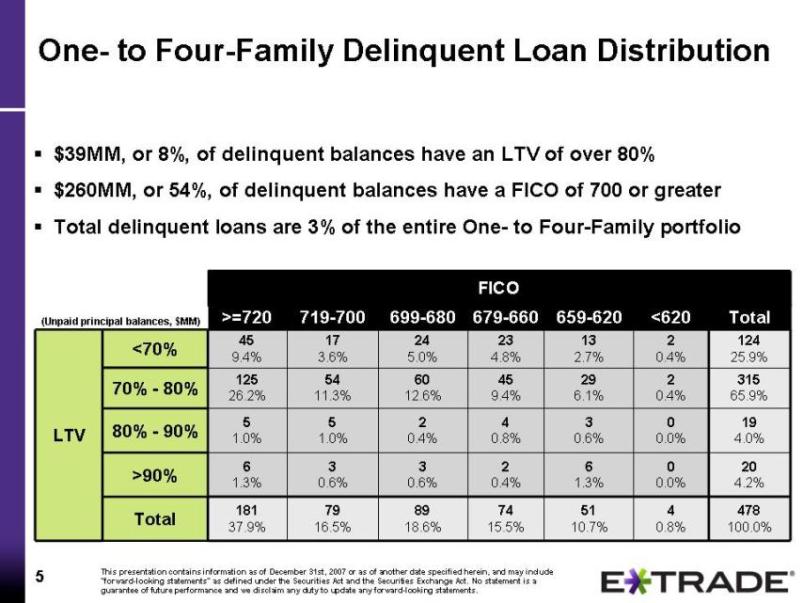

One- to Four-Family Delinquent Loan Distribution * Averages based upon 2006 engagement trends $39MM, or 8%, of delinquent balances have an LTV of over 80% $260MM, or 54%, of delinquent balances have a FICO of 700 or greater Total delinquent loans are 3% of the entire One- to Four-Family portfolio FICO 4 0.8% 0 0.0% 0 0.0% 2 0.4% 2 0.4% <620 51 10.7% 6 1.3% 3 0.6% 29 6.1% 13 2.7% 659-620 74 15.5% 2 0.4% 4 0.8% 45 9.4% 23 4.8% 679-660 181 37.9% 6 1.3% 5 1.0% 125 26.2% 45 9.4% >=720 20 4.2% 3 0.6% 3 >90% 0.6% 89 18.6% 2 0.4% 60 12.6% 24 5.0% 699-680 LTV (Unpaid principal balances, $MM) 719-700 Total <70% 17 3.6% 124 25.9% 70% - 80% 54 11.3% 315 65.9% 80% - 90% 5 1.0% 19 4.0% Total 79 16.5% 478 100.0% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

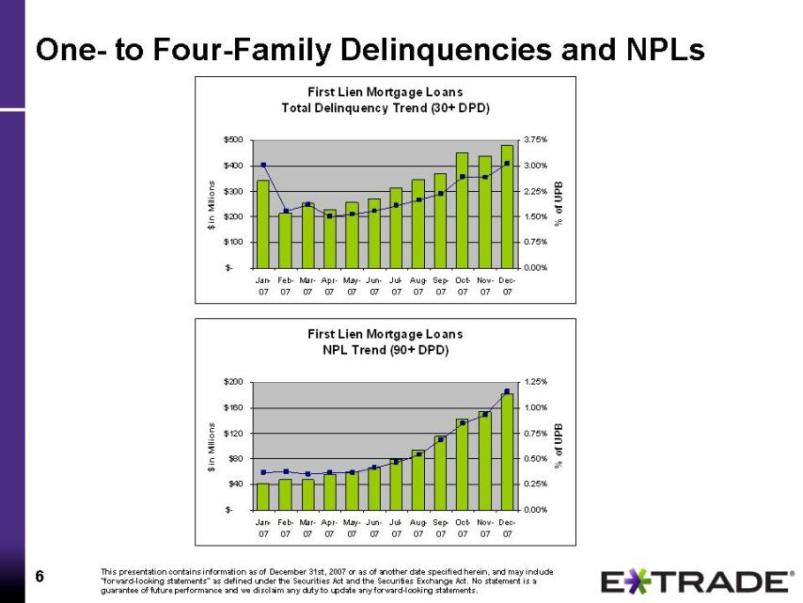

One- to Four-Family Delinquencies and NPLs * Averages based upon 2006 engagement trends First Lien Mortgage Loans Total Delinquency Trend (30+ DPD) $- $100 $200 $300 $400 $500 Jan- 07 Feb- 07 Mar- 07 Apr- 07 May- 07 Jun- 07 Jul- 07 Aug- 07 Sep- 07 Oct- 07 Nov- 07 Dec- 07 $ in Millions 0.00% 0.75% 1.50% 2.25% 3.00% 3.75% % of UPB First Lien Mortgage Loans NPL Trend (90+ DPD) $- $40 $80 $120 $160 $200 Jan- 07 Feb- 07 Mar- 07 Apr- 07 May- 07 Jun- 07 Jul- 07 Aug- 07 Sep- 07 Oct- 07 Nov- 07 Dec- 07 $ in Millions 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% % of UPB This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

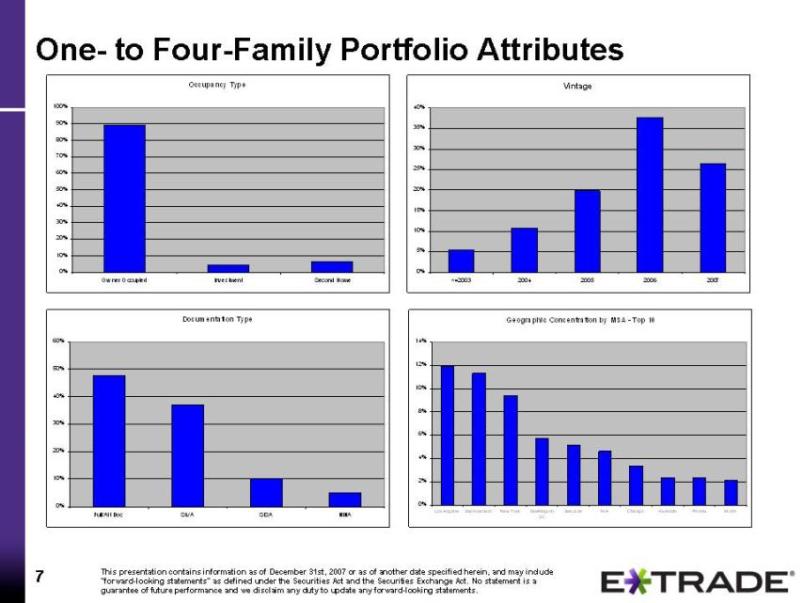

One- to Four-Family Portfolio Attributes Occupancy Type 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Ow ner Occupied Investment Second Home Vintage 0% 5% 10% 15% 20% 25% 30% 35% 40% <=2003 2004 2005 2006 2007 Documentation Type 0% 10% 20% 30% 40% 50% 60% Full/Alt Doc SIVA SISA NINA Geographic Concentration by MSA - Top 10 0% 2% 4% 6% 8% 10% 12% 14% Los Angeles San Francisco New York Washington DC San Jose N/A Chicago Riverside Phoenix Miami This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

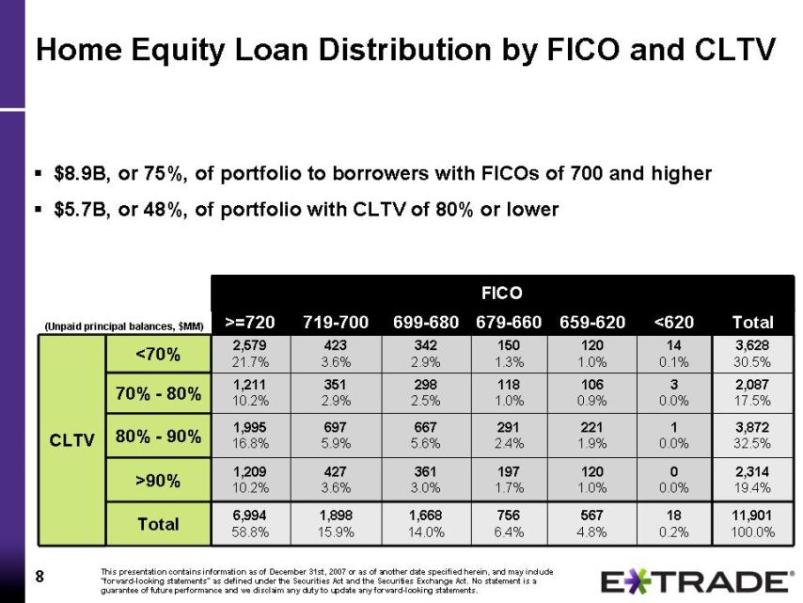

Home Equity Loan Distribution by FICO and CLTV $8.9B, or 75%, of portfolio to borrowers with FICOs of 700 and higher $5.7B, or 48%, of portfolio with CLTV of 80% or lower FICO 18 0.2% 0 0.0% 1 0.0% 3 0.0% 14 0.1% <620 567 4.8% 120 1.0% 221 1.9% 106 0.9% 120 1.0% 659-620 756 6.4% 197 1.7% 291 2.4% 118 1.0% 150 1.3% 679-660 6,994 58.8% 1,209 10.2% 1,995 16.8% 1,211 10.2% 2,579 21.7% >=720 2,314 19.4% 361 3.0% 427 >90% 3.6% 1,668 14.0% 667 5.6% 298 2.5% 342 2.9% 699-680 CLTV (Unpaid principal balances, $MM) 719-700 Total <70% 423 3.6% 3,628 30.5% 70% - 80% 351 2.9% 2,087 17.5% 80% - 90% 697 5.9% 3,872 32.5% Total 1,898 15.9% 11,901 100.0% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

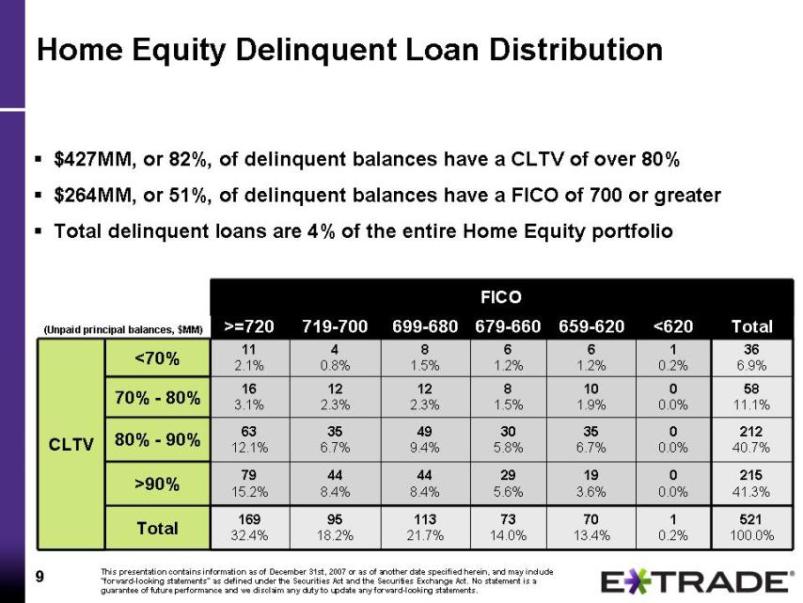

Home Equity Delinquent Loan Distribution * Averages based upon 2006 engagement trends $427MM, or 82%, of delinquent balances have a CLTV of over 80% $264MM, or 51%, of delinquent balances have a FICO of 700 or greater Total delinquent loans are 4% of the entire Home Equity portfolio FICO 1 0.2% 0 0.0% 0 0.0% 0 0.0% 1 0.2% <620 70 13.4% 19 3.6% 35 6.7% 10 1.9% 6 1.2% 659-620 73 14.0% 29 5.6% 30 5.8% 8 1.5% 6 1.2% 679-660 169 32.4% 79 15.2% 63 12.1% 16 3.1% 11 2.1% >=720 215 41.3% 44 8.4% 44 >90% 8.4% 113 21.7% 49 9.4% 12 2.3% 8 1.5% 699-680 CLTV (Unpaid principal balances, $MM) 719-700 Total <70% 4 0.8% 36 6.9% 70% - 80% 12 2.3% 58 11.1% 80% - 90% 35 6.7% 212 40.7% Total 95 18.2% 521 100.0% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

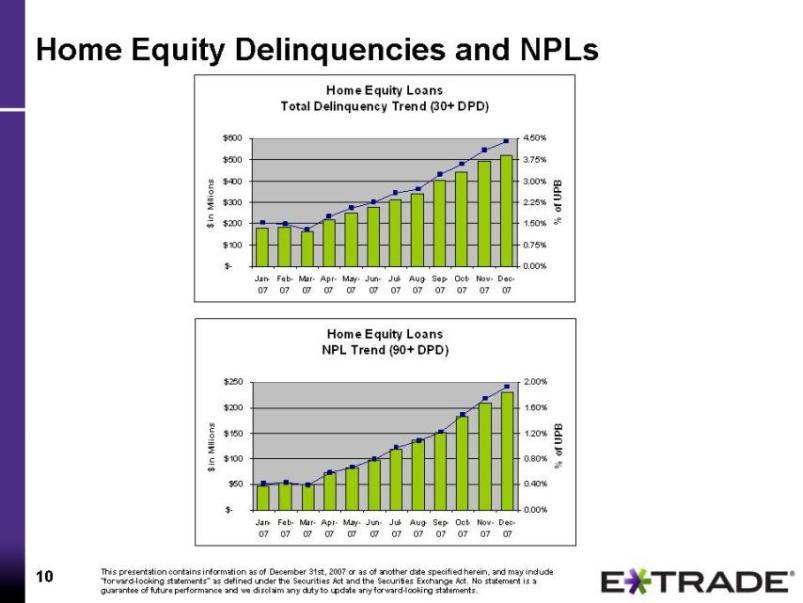

Home Equity Delinquencies and NPLs * Averages based upon 2006 engagement trends Home Equity Loans Total Delinquency Trend (30+ DPD) $- $100 $200 $300 $400 $500 $600 Jan- 07 Feb- 07 Mar- 07 Apr- 07 May- 07 Jun- 07 Jul- 07 Aug- 07 Sep- 07 Oct- 07 Nov- 07 Dec- 07 $ in Millions 0.00% 0.75% 1.50% 2.25% 3.00% 3.75% 4.50% % of UPB Home Equity Loans NPL Trend (90+ DPD) $- $50 $100 $150 $200 $250 Jan- 07 Feb- 07 Mar- 07 Apr- 07 May- 07 Jun- 07 Jul- 07 Aug- 07 Sep- 07 Oct- 07 Nov- 07 Dec- 07 $ in Millions 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% % of UPB This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

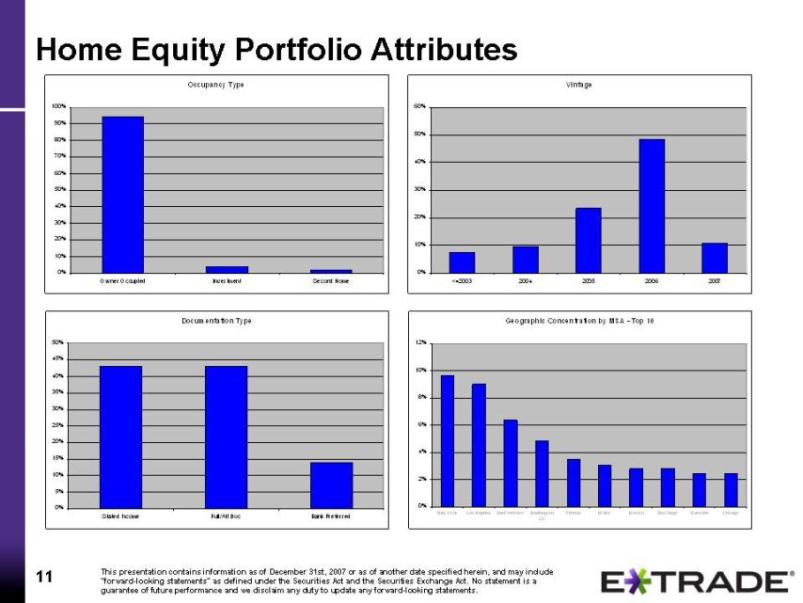

Home Equity Portfolio Attributes Occupancy Type 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Ow ner Occupied Investment Second Home Documentation Type 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Stated Income Full/Alt Doc Bank Preferred Vintage 0% 10% 20% 30% 40% 50% 60% <=2003 2004 2005 2006 2007 Geographic Concentration by MSA - Top 10 0% 2% 4% 6% 8% 10% 12% New York Los Angeles San Francisco Washington DC Phoenix Miami Boston San Diego Riverside Chicago This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

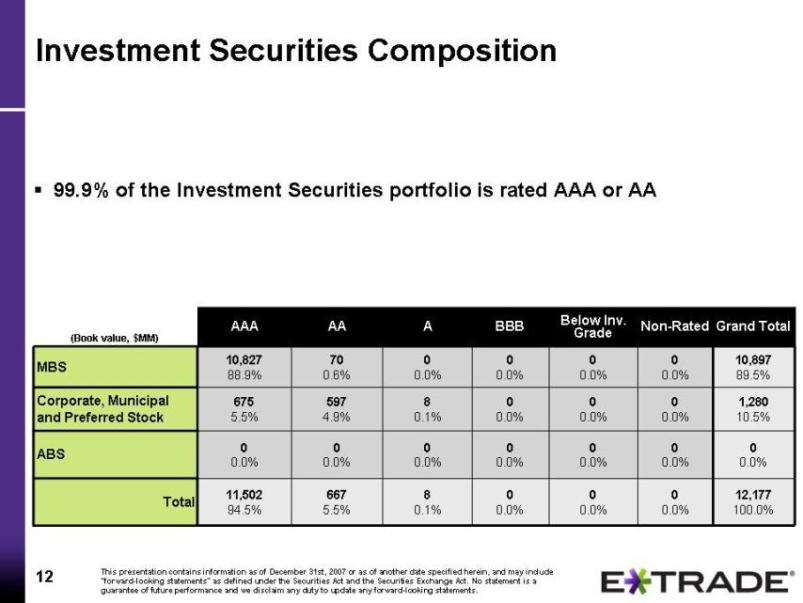

Investment Securities Composition 99.9% of the Investment Securities portfolio is rated AAA or AA 0 0.0% 0 0.0% 0 0.0% 0 0.0% Non-Rated 0 0.0% 0 0.0% 0 0.0% 0 0.0% Below Inv. Grade 0 0.0% 0 0.0% 0 0.0% 0 0.0% BBB 11,502 94.5% 0 0.0% 675 5.5% 10,827 88.9% AAA 8 0.1% 0 0.0% 8 0.1% 0 0.0% A (Book value, $MM) AA Grand Total MBS 70 0.6% 10,897 89.5% Corporate, Municipal and Preferred Stock 597 4.9% 1,280 10.5% ABS 0 0.0% 0 0.0% Total 667 5.5% 12,177 100.0% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

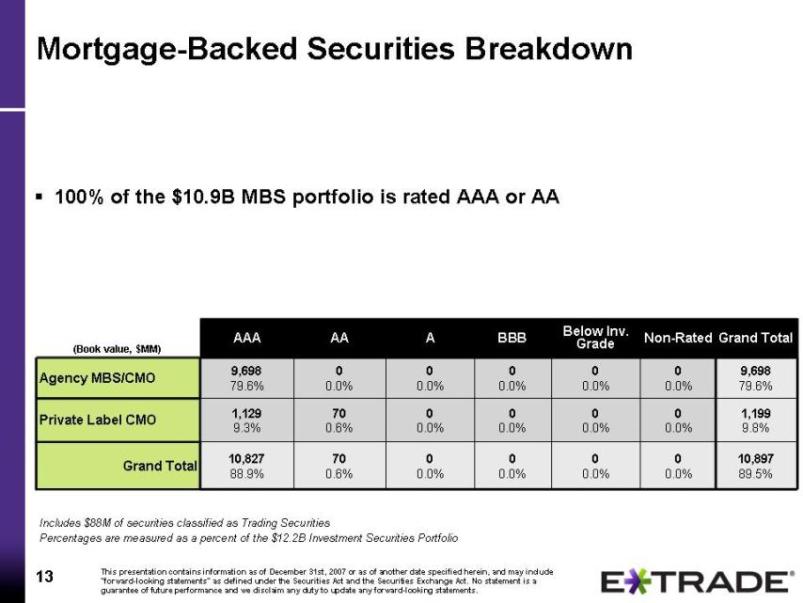

Mortgage-Backed Securities Breakdown 100% of the $10.9B MBS portfolio is rated AAA or AA Percentages are measured as a percent of the $12.2B Investment Securities Portfolio Includes $88M of securities classified as Trading Securities 0 0.0% 0 0.0% 0 0.0% Non-Rated 0 0.0% 0 0.0% 0 0.0% Below Inv. Grade 0 0.0% 0 0.0% 0 0.0% BBB 10,827 88.9% 1,129 9.3% 9,698 79.6% AAA 0 0.0% 0 0.0% 0 0.0% A (Book value, $MM) AA Grand Total Agency MBS/CMO 0 0.0% 9,698 79.6% Private Label CMO 70 0.6% 1,199 9.8% Grand Total 70 0.6% 10,897 89.5% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

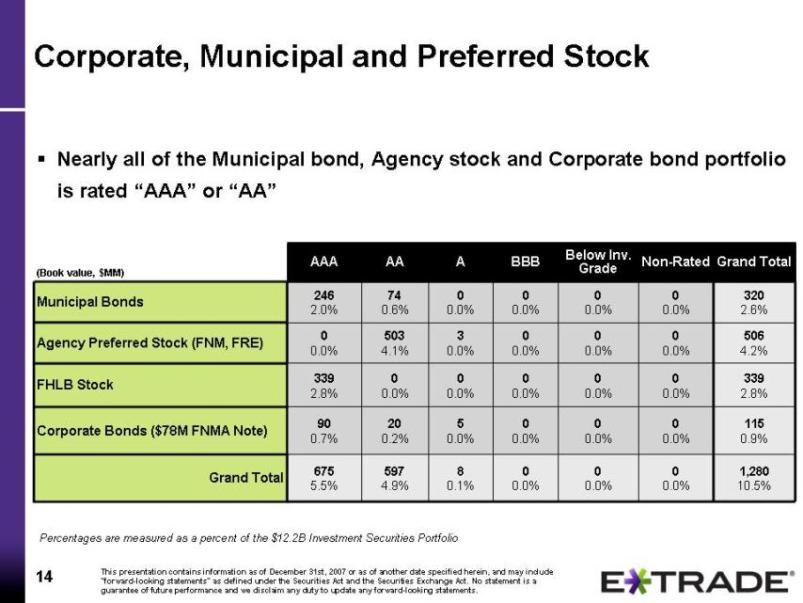

Corporate, Municipal and Preferred Stock Nearly all of the Municipal bond, Agency stock and Corporate bond portfolio is rated “AAA” or “AA” Percentages are measured as a percent of the $12.2B Investment Securities Portfolio 320 2.6% 0 0.0% 0 0.0% 0 0.0% 0 0.0% 74 0.6% 246 Municipal Bonds 2.0% 0 0.0% 0 0.0% 0 0.0% 0 0.0% Non-Rated 0 0.0% 0 0.0% 0 0.0% 0 0.0% Below Inv. Grade 0 0.0% 0 0.0% 0 0.0% 0 0.0% BBB 675 5.5% 90 0.7% 339 2.8% 0 0.0% AAA 8 0.1% 5 0.0% 0 0.0% 3 0.0% A (Book value, $MM) AA Grand Total Agency Preferred Stock (FNM, FRE) 503 4.1% 506 4.2% FHLB Stock 0 0.0% 339 2.8% Corporate Bonds ($78M FNMA Note) 20 0.2% 115 0.9% Grand Total 597 4.9% 1,280 10.5% This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

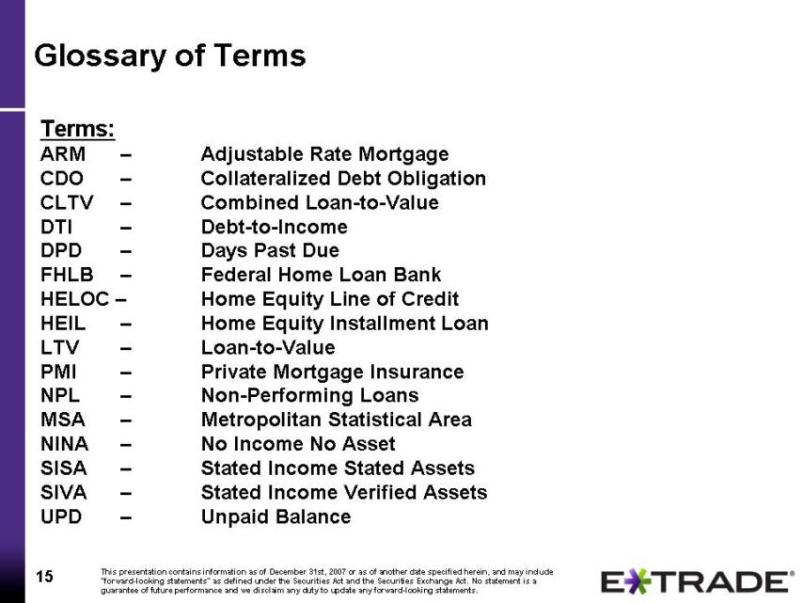

Terms: ARM – Adjustable Rate Mortgage CDO – Collateralized Debt Obligation CLTV– Combined Loan-to-Value DTI – Debt-to-Income DPD – Days Past Due FHLB – Federal Home Loan Bank HELOC – Home Equity Line of Credit HEIL – Home Equity Installment Loan LTV – Loan-to-Value PMI – Private Mortgage Insurance NPL – Non-Performing Loans MSA – Metropolitan Statistical Area NINA – No Income No Asset SISA – Stated Income Stated Assets SIVA – Stated Income Verified Assets UPD – Unpaid Balance Glossary of Terms This presentation contains information as of December 31st, 2007 or as of another date specified herein, and may include "forward-looking statements" as defined under the Securities Act and the Securities Exchange Act. No statement is a guarantee of future performance and we disclaim any duty to update any forward-looking statements.

E*TRADE