UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2007

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-11921

E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 94-2844166 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

135 East 57th Street, New York, New York 10022

(Address of Principal Executive Offices and Zip Code)

(646) 521-4300

(Registrant’s Telephone Number, including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer xAccelerated filer ¨Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of November 5, 2007, there were 423,754,324 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended September 30, 2007

TABLE OF CONTENTS

Unless otherwise indicated, references to “the Company,” “We,” “Us,” “Our” and “E*TRADE” mean E*TRADE Financial Corporation or its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank (“Bank”), ClearStation, Equity Edge, Equity Resource, OptionsLink and the Converging Arrows logo are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries.

2

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

This information is set forth immediately following Item 3, “Quantitative and Qualitative Disclosures about Market Risk.”

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements involving risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expect,” “may,” “anticipate,” “intend,” “plan” and similar expressions. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Factors that could contribute to our actual results differing from any forward-looking statements include those discussed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. Important factors that may cause actual results to differ materially from any forward-looking statements are set forth in our 2006 Form 10-K filed with the Securities and Exchange Commission (“SEC”) under the heading “Risk Factors.”

We further caution that there may be risks associated with owning our securities other than those discussed in such filings.

GLOSSARY OF TERMS

In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined in the “Glossary of Terms,” which is located at the end of Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

OVERVIEW

Strategy

Our strategy centers on strengthening and growing our retail business and leveraging that growth in our institutional business. We strive to further develop our retail business by acquiring, retaining and expanding our relationships with global retail customers. We offer our retail and institutional customers a suite of trading, investing, banking and lending products. We plan to grow these relationships organically by using technology to deliver an attractive combination of product, service and price to the value-driven mass affluent customer. We also intend to grow, where appropriate, through targeted acquisitions which leverage our existing business platform and through further expansion into certain international markets.

On September 17, 2007, we announced a plan to further align our balance sheet and business operations with our retail growth opportunity. This strategy includes accelerating plans to shift the composition of the balance sheet toward retail assets and liabilities, largely one- to four-family originated mortgage loans and customer cash, and away from institutional assets and liabilities, mainly securities, purchased mortgage loans and wholesale borrowings. In addition, we announced plans to simplify and streamline the business by exiting and/or restructuring certain non-core operations. In lending, we are exiting our wholesale mortgage origination channel, and repositioning the lending business to focus on direct retail originations. In institutional, we are taking steps to restructure the institutional equity business to allow us to focus on areas that complement order flow generated by our retail customers. We believe these changes in strategy better align our business with our core asset, the retail customer.

3

Key Factors Affecting Financial Performance

Our financial performance is affected by a number of factors outside of our control, including:

| | • | | customer demand for financial products and services; |

| | • | | competitors’ pricing on financial products and services; |

| | • | | the weakness or strength of the residential real estate and credit markets; |

| | • | | market demand and liquidity in the mortgage- and asset-backed securities markets; |

| | • | | the impact of rating agency actions on asset-backed securities; |

| | • | | interest rates and the shape of the interest rate yield curve; and |

| | • | | the performance, volume and volatility of the equity and capital markets. |

In addition to the items noted above, our success in the future will depend upon, among other things:

| | • | | continuing our success in the acquisition, growth and retention of customers; |

| | • | | deepening customer acceptance of our trading, investing, banking and lending products; |

| | • | | our ability to assess and manage credit risk; |

| | • | | disciplined expense control and improved operational efficiency; and |

| | • | | transition of the balance sheet toward retail-driven assets and liabilities. |

Management monitors a number of metrics in evaluating the Company’s performance. The most significant of these are shown in the table and discussed in the text below:

| | | | | | | | | | | | | | | | | | | | | | |

| | | As of or For the Three Months Ended September 30, | | | | | | As of or For the Nine Months Ended September 30, | | | | |

| | | Variance | | | | Variance | |

| | | 2007 | | | 2006 | | | 2007 vs.

2006 | | | 2007 | | | 2006 | | | 2007 vs.

2006 | |

Customer Activity Metrics: | | | | | | | | | | | | | | | | | | | | | | |

Retail client assets (dollars in billions) | | $ | 218.0 | | | $ | 184.8 | | | 18 | % | | $ | 218.0 | | | $ | 184.8 | | | 18 | % |

Customer cash and deposits (dollars in billions) | | $ | 39.6 | | | $ | 31.6 | | | 25 | % | | $ | 39.6 | | | $ | 31.6 | | | 25 | % |

U.S. daily average revenue trades | | | 161,459 | | | | 116,459 | | | 39 | % | | | 148,139 | | | | 139,382 | | | 6 | % |

International daily average revenue trades | | | 32,926 | | | | 18,671 | | | 76 | % | | | 29,748 | | | | 21,207 | | | 40 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total daily average revenue trades | | | 194,385 | | | | 135,130 | | | 44 | % | | | 177,887 | | | | 160,589 | | | 11 | % |

Average commission per trade | | $ | 11.71 | | | $ | 11.95 | | | (2) | % | | $ | 11.87 | | | $ | 12.10 | | | (2) | % |

| | | | | | |

Company Financial Metrics: | | | | | | | | | | | | | | | | | | | | | | |

Net revenue growth(1) | | | (45) | % | | | 39 | % | | (84) | % | | | (9) | % | | | 46 | % | | (55) | % |

Enterprise net interest spread (basis points) | | | 265 | | | | 286 | | | (7) | % | | | 269 | | | | 288 | | | (7) | % |

Enterprise interest-earning assets (average in billions) | | $ | 60.0 | | | $ | 46.4 | | | 29 | % | | $ | 56.9 | | | $ | 44.0 | | | 29 | % |

Non-performing loans as a % of gross loans receivable | | | 0.84 | % | | | 0.24 | % | | 0.60 | % | | | 0.84 | % | | | 0.24 | % | | 0.60 | % |

Operating margin (%) | | | (18) | % | | | 38 | % | | (56) | % | | | 29 | % | | | 41 | % | | (12) | % |

Compensation and benefits as a % of revenue | | | 37 | % | | | 19 | % | | 18 | % | | | 22 | % | | | 20 | % | | 2 | % |

(1) | | Net revenue growth is the difference between the current and prior comparable period total net revenue divided by the prior comparable period total net revenue. |

4

Customer Activity Metrics

| | • | | Retail client assets are an indicator of the value of our relationship with the customer. An increase in retail client assets generally indicates that the use of our products and services by existing and new customers is expanding. Changes in this metric are also driven by changes in the valuations of our customers’ underlying securities. |

| | • | | Customer cash and deposits are an indicator of a deepening engagement with our customers and are a key driver of net operating interest income. |

| | • | | Daily average revenue trades (“DARTs”) are the predominant driver of commission revenue from our retail customers. |

| | • | | Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing. As a result, this metric is impacted by both the mix between our retail domestic and international businesses and the mix between active traders, mass affluent and main street customers. |

Company Financial Metrics

| | • | | Net revenue growth is an indicator of our overall financial well-being and our ability to execute on our strategy. When coupled with operating margin, the two provide information about the general success of our business. The negative revenue growth during the period was due to lower revenue in our institutional segment, due to increased provision for loan losses and write downs in our asset-backed securities portfolio. The revenue growth in our retail segment, which we believe is the primary indicator of the success of our strategy, was 21% and 9% for the three and nine months ended September 30, 2007, respectively. |

| | • | | Enterprise net interest spread is a broad indicator of our ability to generate net operating interest income. |

| | • | | Enterprise interest-earning assets, in conjunction with our enterprise net interest spread, are indicators of our ability to generate net operating interest income. |

| | • | | Total nonperforming loans receivable as a percentage of gross loans receivable is an indicator of the performance of our total loan portfolio. |

| | • | | Operating margin is an indicator of the profitability of our operations. The negative operating margin during the period was due to a significant loss in our institutional segment, which was driven by an increase in our provision for loan losses and write downs in our asset-backed securities portfolio. The operating margin in our retail segment was 47% and 44% for the three and nine months ended September 30, 2007, respectively. |

| | • | | Compensation and benefits as a percentage of revenue is an indicator of our productivity. This ratio coupled with operating margin is an indicator of our efficiency. The increase in this metric during the period was driven primarily by the reduction in institutional revenue noted above, not by a reduction in our overall productivity. |

Significant Events in the Third Quarter of 2007

Announced a Plan to Better Align Balance Sheet and Operations with Retail Growth Opportunity

We announced a plan to further align our balance sheet and business operations with our retail growth opportunity. The new strategy will shift the balance sheet toward retail assets and liabilities and includes exiting certain non-core operations. We believe these changes in strategy better align our business with our core asset, the retail customer.

5

Ranked #1 Premium Broker bySmartMoney Magazine

SmartMoney Magazine recognized the Company as the #1 “premium broker” in its 2007 broker survey.SmartMoney noted the Company for its improved service, new global trading capabilities, intuitive trade tools and easy search capabilities and numerous banking products.

International Expansion

We continued our expansion into international markets with the launch of operations in Singapore. Singapore offers investors direct access to the U.S. stock markets through the E*TRADE retail trading platform.

Summary Financial Results

Income Statement Highlights for the Three and Nine Months Ended September 30, 2007 (dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months

Ended September 30, | | | | | | Nine Months Ended September 30, | | | | |

| | | Variance | | | | Variance | |

| | | 2007 | | | 2006 | | | 2007 vs. 2006 | | | 2007 | | | 2006 | | | 2007 vs. 2006 | |

Total net revenue | | $ | 321.2 | | | $ | 581.8 | | | (45 | )% | | $ | 1,629.8 | | | $ | 1,791.5 | | | (9 | )% |

Net operating interest income | | $ | 418.0 | | | $ | 355.1 | | | 18 | % | | $ | 1,222.8 | | | $ | 1,024.5 | | | 19 | % |

Provision for loan losses | | $ | (186.5 | ) | | $ | (12.5 | ) | | 1387 | % | | $ | (237.8 | ) | | $ | (33.0 | ) | | 620 | % |

Net operating interest income after provision for loan losses | | $ | 231.5 | | | $ | 342.6 | | | (32 | )% | | $ | 985.0 | | | $ | 991.5 | | | (1 | )% |

Commission revenue | | $ | 188.4 | | | $ | 133.6 | | | 41 | % | | $ | 517.2 | | | $ | 476.8 | | | 8 | % |

Fees and service charges revenue | | $ | 64.8 | | | $ | 58.3 | | | 11 | % | | $ | 189.7 | | | $ | 174.0 | | | 9 | % |

Operating margin | | $ | (59.4 | ) | | $ | 223.2 | | | (127 | )% | | $ | 472.6 | | | $ | 727.7 | | | (35 | )% |

Net income (loss) | | $ | (58.4 | ) | | $ | 153.2 | | | (138 | )% | | $ | 270.1 | | | $ | 452.2 | | | (40 | )% |

Diluted net earnings (loss) per share | | $ | (0.14 | ) | | $ | 0.35 | | | (140 | )% | | $ | 0.62 | | | $ | 1.03 | | | (40 | )% |

Operating margin (%) | | | (18 | )% | | | 38 | % | | (56 | )% | | | 29 | % | | | 41 | % | | (12 | )% |

The operating environment during the third quarter of 2007 was extremely challenging. Losses caused by instability in the residential real estate and credit markets more than offset the considerable growth in our retail segment. Total net revenue for the three months ended September 30, 2007 decreased 45% compared to the same period in the prior year due primarily to an increase to our provision for loan losses of $174.0 million and write downs in our asset-backed securities portfolio of $197.6 million. Net income (loss) declined by 138% from the same quarter in the prior year to a loss of $58.4 million for the third quarter of 2007.

The retail segment delivered strong organic growth and overall results during third quarter of 2007. Total retail segment income increased 55% to $224.2 million for the three months ended September 30, 2007 compared to the same period in the prior year. This growth was primarily driven by an increase in DARTs and customer cash and deposits, which both increased significantly compared to the same periods in the prior year. DARTs increased 44% to 194,385 and customer cash and deposits ended the period at $39.6 billion, up 25% from the prior year.

6

Balance Sheet Highlights (dollars in billions)

| | | | | | | | | | | |

| | | September 30, 2007 | | | December 31, 2006 | | | Variance | |

| | | | | 2007 vs. 2006 | |

Total assets | | $ | 64.2 | | | $ | 53.7 | | | 19 | % |

Total enterprise interest-earning assets | | $ | 59.9 | | | $ | 49.5 | | | 21 | % |

Loans, net and margin receivables as a percentage of enterprise interest-earning assets(1) | | | 67 | % | | | 68 | % | | (1 | )% |

Retail deposits and customer payables as a percentage of enterprise interest-bearing liabilities(1) | | | 62 | % | | | 64 | % | | (2 | )% |

(1) | | Loans, net and margin receivables as a percentage of enterprise interest-earning assets and retail deposits and customer payables as a percentage of enterprise interest-bearing liabilities include balances not recorded on the balance sheet, such as margin and customer cash and deposits held by third parties. |

The increase in total assets was attributable primarily to an increase of $6.0 billion in loans receivable, net. The increase in loans receivable, net was due principally to growth in our one- to four-family loan portfolio during the first and second quarters of 2007. We plan to hold total assets at current levels or slightly lower, for the foreseeable future. Our eventual goal is to increase the asset and liability ratios in the table above to approximately 80% to 85%. On the asset side, we plan to increase our one- to four-family real estate loans and margin loans, while allowing our home equity loan and securities portfolios to decline. On the liability side, we plan to increase customer cash and deposits, while allowing wholesale borrowings to decline. We believe this transition to a more retail focused balance sheet will better align our business with our core asset, the retail customer.

EARNINGS OVERVIEW

Net income (loss) decreased 138% to a loss of $58.4 million and 40% to income of $270.1 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The loss for the three months ended September 30, 2007 was due principally to an increase in our provision for loan losses to $186.5 million and write downs of $197.6 million in our asset-backed securities portfolio. These losses in our institutional segment more than offset the increase in net income in our retail segment of $79.2 million to $224.2 million and $87.9 million to $599.8 million for the three and nine months ended September 30, 2007, respectively.

We report corporate interest income and corporate interest expense separately from operating interest income and operating interest expense. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Our operating interest income and operating interest expense is generated from the operations of the Company and is a broad indicator of our success in our banking, lending and balance sheet management businesses. Our corporate debt, which is the primary source of our corporate interest expense, has been used primarily to finance acquisitions, such as Harrisdirect and BrownCo, and generally has not been downstreamed to any of our operating subsidiaries.

Similarly, we report gain (loss) on sales of investments, net separately from gain (loss) on loans and securities, net. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Gain (loss) on loans and securities, net are the result of activities in our operations, namely our lending and balance sheet management businesses, including impairment on our available-for sale mortgage-backed and investment securities portfolio. Gain (loss) on sales of investments, net relates to historical equity investments of the Company at the corporate level and are not related to the ongoing business of our operating subsidiaries.

7

The following sections describe in detail the changes in key operating factors and other changes and events that have affected our consolidated net revenue, expense excluding interest, other income (expense) and income tax expense (benefit).

Revenue

The components of net revenue and the resulting variances are as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Variance | | | Nine Months Ended September 30, | | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | | 2006 | | | Amount | | | % | | | 2007 | | | 2006 | | | Amount | | | % | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating interest income | | $ | 951,836 | | | $ | 731,429 | | | $ | 220,407 | | | 30 | % | | $ | 2,687,403 | | | $ | 1,986,096 | | | $ | 701,307 | | | 35 | % |

Operating interest expense | | | (533,804 | ) | | | (376,293 | ) | | | (157,511 | ) | | 42 | % | | | (1,464,621 | ) | | | (961,569 | ) | | | (503,052 | ) | | 52 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating interest income | | | 418,032 | | | | 355,136 | | | | 62,896 | | | 18 | % | | | 1,222,782 | | | | 1,024,527 | | | | 198,255 | | | 19 | % |

Provision for loan losses | | | (186,536 | ) | | | (12,547 | ) | | | (173,989 | ) | | 1387 | % | | | (237,767 | ) | | | (33,014 | ) | | | (204,753 | ) | | 620 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating interest income after provision for loan losses | | | 231,496 | | | | 342,589 | | | | (111,093 | ) | | (32 | )% | | | 985,015 | | | | 991,513 | | | | (6,498 | ) | | (1 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commission | | | 188,403 | | | | 133,606 | | | | 54,797 | | | 41 | % | | | 517,164 | | | | 476,771 | | | | 40,393 | | | 8 | % |

Fees and service charges | | | 64,802 | | | | 58,330 | | | | 6,472 | | | 11 | % | | | 189,746 | | | | 174,001 | | | | 15,745 | | | 9 | % |

Principal transactions | | | 20,889 | | | | 22,697 | | | | (1,808 | ) | | (8 | )% | | | 78,739 | | | | 84,979 | | | | (6,240 | ) | | (7 | )% |

Gain (loss) on loans and securities, net | | | (197,057 | ) | | | 16,003 | | | | (213,060 | ) | | * | | | | (174,354 | ) | | | 38,738 | | | | (213,092 | ) | | * | |

Other revenue | | | 12,699 | | | | 8,541 | | | | 4,158 | | | 49 | % | | | 33,469 | | | | 25,471 | | | | 7,998 | | | 31 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest income | | | 89,736 | | | | 239,177 | | | | (149,441 | ) | | (62 | )% | | | 644,764 | | | | 799,960 | | | | (155,196 | ) | | (19 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total net revenue | | $ | 321,232 | | | $ | 581,766 | | | $ | (260,534 | ) | | (45 | )% | | $ | 1,629,779 | | | $ | 1,791,473 | | | $ | (161,694 | ) | | (9 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Total net revenue declined by 45% and 9% to $321.2 million and $1.6 billion for the three and nine months ended September 30, 2007, respectively when compared to the same periods in 2006. This decline was driven by an increase in the provision for loan losses of $174.0 million and $204.8 million for the three and nine months ended September 30, 2007, respectively, as well as write downs in our asset-backed securities portfolio of $197.6 million and $185.5 million for the three and nine months ended September 30, 2007, respectively.

Net Operating Interest Income

Net operating interest income increased 18% to $418.0 million and 19% to $1.2 billion for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. Net operating interest income is earned primarily through holding credit balances, which includes margin, real estate and consumer loans, and by holding customer cash and deposits, which are a low cost source of funding. The increase in net operating interest income was due primarily to the increase in enterprise interest-earning assets. Average loans, net as a percentage of average enterprise interest-earning assets increased 5% to 54% and 6% to 54% for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006.

8

The following table presents enterprise average balance sheet data and enterprise income and expense data for our operations, as well as the related net interest spread, yields and rates and has been prepared on the basis required by the SEC’s Industry Guide 3, “Statistical Disclosure by Bank Holding Companies” (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | |

| | | 2007 | | | 2006 | |

| | | Average

Balance | | | Operating

Interest

Inc./Exp. | | | Average

Yield/

Cost | | | Average

Balance | | Operating Interest

Inc./Exp. | | Average

Yield/

Cost | |

Enterprise interest-earning assets: | | | | | | | | | | | | | | | | | | | | |

Loans, net(1) | | $ | 32,445,828 | | | $ | 528,193 | | | 6.51 | % | | $ | 22,955,022 | | $ | 364,744 | | 6.36 | % |

Margin receivables | | | 7,605,184 | | | | 138,290 | | | 7.21 | % | | | 6,645,017 | | | 123,855 | | 7.39 | % |

Mortgage-backed and related available-for-sale securities | | | 12,811,113 | | | | 169,603 | | | 5.30 | % | | | 12,068,052 | | | 159,199 | | 5.28 | % |

Available-for-sale investment securities | | | 5,097,480 | | | | 83,595 | | | 6.56 | % | | | 3,220,054 | | | 51,885 | | 6.44 | % |

Trading securities | | | 118,195 | | | | 3,052 | | | 10.33 | % | | | 114,806 | | | 2,600 | | 9.06 | % |

Cash and cash equivalents(2) | | | 1,266,614 | | | | 13,102 | | | 4.10 | % | | | 974,738 | | | 11,272 | | 4.59 | % |

Stock borrow and other | | | 698,251 | | | | 14,528 | | | 8.25 | % | | | 422,010 | | | 8,690 | | 8.17 | % |

| | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-earning assets | | | 60,042,665 | | | | 950,363 | | | 6.33 | % | | | 46,399,699 | | | 722,245 | | 6.22 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-operating interest-earning assets(3) | | | 4,436,069 | | | | | | | | | | | 4,250,365 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 64,478,734 | | | | | | | | | | $ | 50,650,064 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Enterprise interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

Retail deposits | | $ | 27,764,658 | | | | 216,426 | | | 3.09 | % | | $ | 20,992,962 | | | 141,035 | | 2.67 | % |

Brokered certificates of deposit | | | 418,123 | | | | 5,154 | | | 4.89 | % | | | 618,681 | | | 7,453 | | 4.78 | % |

Customer payables | | | 6,678,370 | | | | 23,614 | | | 1.40 | % | | | 5,794,586 | | | 18,326 | | 1.25 | % |

Repurchase agreements and other borrowings | | | 12,582,907 | | | | 165,925 | | | 5.16 | % | | | 11,586,260 | | | 150,837 | | 5.09 | % |

Federal Home Loan Bank (“FHLB”) advances | | | 8,650,546 | | | | 115,531 | | | 5.23 | % | | | 3,583,663 | | | 43,950 | | 4.80 | % |

Stock loan and other | | | 1,048,037 | | | | 6,539 | | | 2.48 | % | | | 1,283,026 | | | 11,617 | | 3.59 | % |

| | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-bearing liabilities | | | 57,142,641 | | | | 533,189 | | | 3.68 | % | | | 43,859,178 | | | 373,218 | | 3.36 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-operating interest-bearing liabilities(4) | | | 3,015,641 | | | | | | | | | | | 2,872,657 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 60,158,282 | | | | | | | | | | | 46,731,835 | | | | | | |

Total shareholders’ equity | | | 4,320,452 | | | | | | | | | | | 3,918,229 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 64,478,734 | | | | | | | | | | $ | 50,650,064 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread | | $ | 2,900,024 | | | $ | 417,174 | | | 2.65 | % | | $ | 2,540,521 | | $ | 349,027 | | 2.86 | % |

| | | | | | | | | | | | | | | | | | | | |

Enterprise net interest margin (net yield on enterprise interest-earning assets) | | | | | | | | | | 2.78 | % | | | | | | | | 3.01 | % |

Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities | | | | | | | | | | 105.08 | % | | | | | | | | 105.79 | % |

Return on average: | | | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | | (0.36 | )% | | | | | | | | 1.21 | % |

Total shareholders’ equity | | | | | | | | | | (5.41 | )% | | | | | | | | 15.65 | % |

Average equity to average total assets | | | | | | | | | | 6.70 | % | | | | | | | | 7.74 | % |

| | | | | | | | | | | | | | | | | | | | |

|

| Reconciliation from enterprise net interest income to net operating interest income (dollars in thousands): | |

| | | | | |

| | | Three Months Ended September 30, | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | | | | | |

Enterprise net interest income(5) | | $ | 417,174 | | | $ | 349,027 | | | | | | | | | | | | | |

Taxable equivalent interest adjustment | | | (8,523 | ) | | | (5,246 | ) | | | | | | | | | | | | |

Customer cash held by third parties and other(6) | | | 9,381 | | | | 11,355 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 418,032 | | | $ | 355,136 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) | | Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

(2) | | Includes segregated cash balances. |

(3) | | Non-operating interest-earning assets consist of property and equipment, net, goodwill, other intangibles, net and other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

(4) | | Non-operating interest-bearing liabilities consist of corporate debt, accounts payable, accrued and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

(5) | | Enterprise net interest income is taxable equivalent basis net operating interest income excluding corporate interest income and corporate interest expense, stock conduit interest income and expense and interest earned on customer cash held by third parties. Management believes this non-GAAP measure is useful to analysts and investors as it is a measure of the net operating interest income generated by our operations. |

(6) | | Includes interest earned on average customer assets of $4.1 billion and $3.6 billion for the three months ended September 30, 2007 and 2006, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. Other consists of net operating interest income earned on average stock conduit assets of $26.5 million for the three months ended September 30, 2006. There were no stock conduit assets for the three months ended September 30, 2007. |

9

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | |

| | | Average

Balance | | | Operating

Interest

Inc./Exp. | | | Average

Yield/

Cost | | | Average

Balance | | Operating Interest

Inc./Exp. | | Average

Yield/

Cost | |

Enterprise interest-earning assets: | | | | | | | | | | | | | | | | | | | | |

Loans, net(1) | | $ | 30,541,679 | | | $ | 1,477,109 | | | 6.45 | % | | $ | 20,994,403 | | $ | 949,513 | | 6.03 | % |

Margin receivables | | | 7,135,135 | | | | 389,611 | | | 7.30 | % | | | 6,702,436 | | | 352,149 | | 7.02 | % |

Mortgage-backed and related available-for-sale securities | | | 12,629,026 | | | | 500,071 | | | 5.28 | % | | | 11,451,932 | | | 432,077 | | 5.03 | % |

Available-for-sale investment securities | | | 4,504,831 | | | | 220,224 | | | 6.52 | % | | | 2,931,914 | | | 136,561 | | 6.21 | % |

Trading securities | | | 117,364 | | | | 9,495 | | | 10.79 | % | | | 131,885 | | | 8,194 | | 8.28 | % |

Cash and cash equivalents(2) | | | 1,289,564 | | | | 44,040 | | | 4.57 | % | | | 1,259,239 | | | 40,592 | | 4.31 | % |

Stock borrow and other | | | 674,245 | | | | 39,267 | | | 7.79 | % | | | 481,809 | | | 25,215 | | 7.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-earning assets | | | 56,891,844 | | | | 2,679,817 | | | 6.28 | % | | | 43,953,618 | | | 1,944,301 | | 5.90 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-operating interest-earning assets(3) | | | 4,489,061 | | | | | | | | | | | 4,615,662 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 61,380,905 | | | | | | | | | | $ | 48,569,280 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Enterprise interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

Retail deposits | | $ | 26,424,575 | | | | 593,836 | | | 3.00 | % | | $ | 19,664,315 | | | 346,602 | | 2.36 | % |

Brokered certificates of deposit | | | 436,265 | | | | 16,033 | | | 4.91 | % | | | 539,508 | | | 18,262 | | 4.53 | % |

Customer payables | | | 6,632,786 | | | | 66,872 | | | 1.35 | % | | | 6,319,950 | | | 51,656 | | 1.09 | % |

Repurchase agreements and other borrowings | | | 12,761,556 | | | | 500,293 | | | 5.17 | % | | | 10,680,195 | | | 391,460 | | 4.83 | % |

Federal Home Loan Bank (“FHLB”) advances | | | 6,612,725 | | | | 257,183 | | | 5.13 | % | | | 3,161,930 | | | 108,696 | | 4.53 | % |

Stock loan and other | | | 1,196,013 | | | | 27,435 | | | 3.07 | % | | | 1,031,071 | | | 24,301 | | 3.15 | % |

| | | | | | | | | | | | | | | | | | | | |

Total enterprise interest-bearing liabilities | | | 54,063,920 | | | | 1,461,652 | | | 3.59 | % | | | 41,396,969 | | | 940,977 | | 3.02 | % |

| | | | | | | | | | | | | | | | | | | | |

Non-operating interest-bearing liabilities(4) | | | 3,001,160 | | | | | | | | | | | 3,464,003 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 57,065,080 | | | | | | | | | | | 44,860,972 | | | | | | |

Total shareholders’ equity | | | 4,315,825 | | | | | | | | | | | 3,708,308 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 61,380,905 | | | | | | | | | | $ | 48,569,280 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread | | $ | 2,827,924 | | | $ | 1,218,165 | | | 2.69 | % | | $ | 2,556,649 | | $ | 1,003,324 | | 2.88 | % |

| | | | | | | | | | | | | | | | | | | | |

Enterprise net interest margin (net yield on enterprise interest-earning assets) | | | | | | | | | | 2.85 | % | | | | | | | | 3.04 | % |

Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities | | | | | | | | | | 105.23 | % | | | | | | | | 106.18 | % |

Return on average: | | | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | | 0.59 | % | | | | | | | | 1.24 | % |

Total shareholders’ equity | | | | | | | | | | 8.34 | % | | | | | | | | 16.26 | % |

Average equity to average total assets | | | | | | | | | | 7.03 | % | | | | | | | | 7.64 | % |

|

Reconciliation from enterprise net interest income to net operating interest income (dollars in thousands): | |

| | | | | |

| | | Nine Months Ended September 30, | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | | | | | |

Enterprise net interest income(5) | | $ | 1,218,165 | | | $ | 1,003,324 | | | | | | | | | | | | | |

Taxable equivalent interest adjustment | | | (23,330 | ) | | | (12,944 | ) | | | | | | | | | | | | |

Customer cash held by third parties and other(6) | | | 27,947 | | | | 34,147 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 1,222,782 | | | $ | 1,024,527 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) | | Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

(2) | | Includes segregated cash balances. |

(3) | | Non-operating interest-earning assets consist of property and equipment, net, goodwill, other intangibles, net and other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

(4) | | Non-operating interest-bearing liabilities consist of corporate debt, accounts payable, accrued and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

(5) | | Enterprise net interest income is taxable equivalent basis net operating interest income excluding corporate interest income and corporate interest expense, stock conduit interest income and expense and interest earned on customer cash held by third parties. Management believes this non-GAAP measure is useful to analysts and investors as it is a measure of the net operating interest income generated by our operations. |

(6) | | Includes interest earned on average customer assets of $4.0 billion and $3.5 billion for the nine months ended September 30, 2007 and 2006, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. Other consists of net operating interest income earned on average stock conduit assets of $1.6 million and $401.4 million for the nine months ended September 30, 2007 and 2006, respectively. |

10

Average enterprise interest-earning assets increased 29% to $60.0 billion and $56.9 billion for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. Average loans, net grew 41% to $32.4 billion and 45% to $30.5 billion for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. Average loans, net grew as a result of our focus on growing real estate loan products in the first and second quarters of 2007. We plan to increase our one-to four-family real estate loans and margin loans, while allowing our home equity loan and securities portfolios to decline. We expect this will keep total average enterprise interest-earnings assets approximately at or below current levels.

Average enterprise interest-bearing liabilities increased 30% to $57.1 billion and 31% to $54.1 billion for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in average enterprise interest-bearing liabilities was primarily in retail deposits. Average retail deposits increased 32% to $27.8 billion and 34% to $26.4 billion for the three and nine months ended September 30, 2007, respectively, compared to the same period in 2006. Increases in average retail deposits were driven by growth in the Complete Savings Account. We expect average retail deposits to continue to grow and replace repurchase agreements and FHLB advances as they mature.

Enterprise net interest spread decreased by 21 basis points to 2.65% and 19 basis points to 2.69% for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This decrease was primarily the result of a challenging interest rate environment throughout the past 12 months as well as growth in our Complete Savings Account. We expect this decline to subside, as we focus on reducing our wholesale borrowings, which have a higher cost of borrowing when compared to deposits.

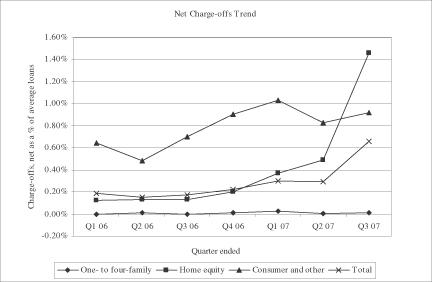

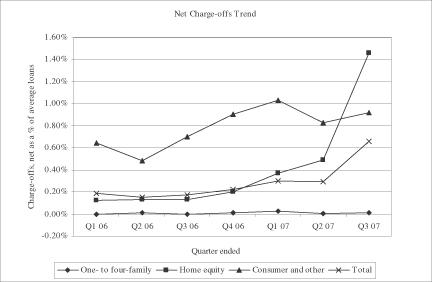

Provision for Loan Losses

Provision for loan losses increased to $186.5 million and to $237.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in the provision for loan losses in the third quarter of 2007 was related primarily to deterioration in the performance of our home equity loan portfolio. We believe this deterioration was caused by several factors, which are described below. First, the combined impact of rising mortgage rates and home price depreciation in key markets contributed to the declining performance of our home equity loan portfolio. Second, concerns that began in the sub-prime mortgage loan market spread to the broader credit markets in the third quarter of 2007 resulting in a significant deterioration in the overall credit markets. This deterioration led to a dramatic tightening of lending standards across the industry, and general liquidity pressure for many mortgage lenders, some of whom ultimately ceased operations as a result. The factors described above dramatically reduced the ability of borrowers to refinance their mortgage loans, specifically their home equity loans, therefore drastically increasing the risk of loss once a loan becomes delinquent. During the third quarter of 2007, we also observed a decline in the percentage of delinquent loans that cure prior to charge-off or foreclosure once they have become delinquent. We attribute this change in behavior to the factors described above, which have significantly limited borrowers’ alternatives to avoid defaulting on their loans. In addition, because of the decline in value of the homes collateralizing our home equity loans, our ability to recover our investment by foreclosing on the underlying properties has diminished as well.

We believe the provision for loan losses will continue at historically high levels in future periods as the instability in the residential real estate and credit markets continues to impact the performance of our portfolio.

Commission

Retail and institutional commission revenue increased 41% to $188.4 million and 8% to $517.2 million for the three and nine months ended September 30, 2007, compared to the same periods in 2006. The primary factors that affect our retail commission revenue are DARTs and average commission per trade, which is impacted by both trade types and the mix between our domestic and international businesses. Each business has a different pricing structure, unique to its customer base and local market practices, and as a result, a change in the relative

11

number of executed trades in these businesses impacts average commission per trade. Each business also has different trade types (e.g. equities, options, fixed income, exchange-traded funds, contract for difference and mutual funds) that can have different commission rates. As a result, changes in the mix of trade types within either of these businesses may impact average commission per trade. Institutional commission revenue is also impacted by negotiated rates, which differ by customer. Our institutional customers are provided with global execution and settlement services as well as worldwide access to research provided by third parties in exchange for commissions based on negotiated rates.

DARTs increased 44% and 11% to 194,385 and 177,887 for the three and nine months ended September 30, 2007, compared to the same periods in 2006. Our U.S. DART volume increased 39% and 6% for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. Our international DARTs grew by 76% and 40% for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006, driven entirely by organic growth. Our international operations continue to be a strong growth contributor within our retail trading business, and we believe that over time they will become a significant component of our entire business. In addition, option-related DARTs further increased as a percentage of our total U.S. DARTs and now represent 17% of U.S. trading volume versus 13% a year ago.

Average commission per trade decreased 2% to $11.71 and $11.87 for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The decrease was primarily a function of the mix of customers. Main Street Investors, who generally have a higher commission per trade, traded less during the period compared to Active Traders and Mass Affluent, who generally have a lower commission per trade.

Fees and Service Charges

During the first quarter of 2007, the Company re-defined the line item “Service charges and fees” by reclassifying certain fee-like revenue items formerly reported in “Other revenue” into the “Service charges and fees” line item, now called “Fees and service charges.” The fee-like revenue streams moved include payment for order flow, foreign currency margin revenue, 12b-1 fees after rebates, fixed income product revenue and management fee revenue.

Fees and service charges increased 11% to $64.8 million and 9% to $189.7 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This increase was due to an increase in our advisor management fees, mutual fund fees, order flow payment and CDO management fees, partially offset by a decrease in account maintenance fees and mortgage servicing fees. We expect our account maintenance fee income to continue to decline over time as we have fewer customers who are subject to the fee; however, we expect our advisory management fee income, which is not currently a significant portion of fees and service charges, to increase over time as we focus on growing this product.

Principal Transactions

Principal transactions decreased 8% to $20.9 million and 7% to $78.7 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The decrease in principal transactions resulted from lower trading volumes as well as a decrease in the average revenue earned per trade. Our principal transactions revenue is influenced by overall trading volumes, the number of stocks for which we act as a market maker, the trading volumes of those specific stocks and the performance of our proprietary trading activities.

12

Gain (Loss) on Loans and Securities, Net

Gain (loss) on loans and securities, net decreased to a loss of $197.1 million and to a loss of $174.4 million for the three and nine months ended September 30, 2007 compared to the same periods in 2006, as shown in the following table (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months

Ended September 30, | | | Variance | | | Nine Months Ended September 30, | | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | | 2006 | | | Amount | | | % | | | 2007 | | | 2006 | | | Amount | | | % | |

Gain on sales of originated loans | | $ | 830 | | | $ | 3,213 | | | $ | (2,383 | ) | | (74) | % | | $ | 4,788 | | | $ | 9,212 | | | $ | (4,424 | ) | | (48) | % |

Loss on sales of loans held-for-sale, net | | | (1,991 | ) | | | (235 | ) | | | (1,756 | ) | | 747 | % | | | (3,678 | ) | | | (1,333 | ) | | | (2,345 | ) | | 176 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gain (loss) on sales of loans, net | | | (1,161 | ) | | | 2,978 | | | | (4,139 | ) | | (139) | % | | | 1,110 | | | | 7,879 | | | | (6,769 | ) | | (86) | % |

Gain on securities and other investments | | | 1,701 | | | | 33,006 | | | | (31,305 | ) | | (95) | % | | | 10,072 | | | | 42,365 | | | | (32,293 | ) | | (76) | % |

Loss on impairment | | | (159,752 | ) | | | (1,504 | ) | | | (158,248 | ) | | * | | | | (162,713 | ) | | | (1,504 | ) | | | (161,209 | ) | | * | |

Loss on trading securities | | | (37,845 | ) | | | (18,477 | ) | | | (19,368 | ) | | 105 | % | | | (22,823 | ) | | | (10,002 | ) | | | (12,821 | ) | | 128 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gain (loss) on securities, net | | | (195,896 | ) | | | 13,025 | | | | (208,921 | ) | | * | | | | (175,464 | ) | | | 30,859 | | | | (206,323 | ) | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gain (loss) on loans and securities, net | | $ | (197,057 | ) | | $ | 16,003 | | | $ | (213,060 | ) | | * | | | $ | (174,354 | ) | | $ | 38,738 | | | $ | (213,092 | ) | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

The decrease in the total gain (loss) on loans and securities, net during the three months ended September 30, 2007 was due primarily to write downs in our asset-backed securities portfolio totaling $197.6 million. These write downs were primarily confined to securities rated below “AA” in what we believe are the two highest risk categories within our asset-backed portfolio: CDOs and securities collateralized by second lien mortgages. We did not sell any of these securities during the period ended September 30, 2007; however, it is our intent to sell them in future periods in order to reduce our exposure to further deterioration in these asset classes. The write downs were due to both an anticipated deterioration in cash flows and our decision to sell these securities. In either case, the securities were required to be written down to fair market value as of September 30, 2007.

We expect conditions in the residential real estate and credit markets to remain uncertain for the foreseeable future. Due to the inherent leverage within our asset-backed securities, even a slight deterioration in the performance of the underlying loans could result in a significant deterioration in the performance of our asset-backed securities. Therefore, continued deterioration in market conditions would likely cause additional write downs in our securities portfolio, primarily in our asset-backed portfolio.

Subsequent to September 30, 2007, we observed a significant decline in the fair value of our asset-backed securities portfolio, specifically our asset-backed CDO and second-lien securities. Our total exposure to asset-backed CDO and second-lien securities at September 30, 2007 was approximately $450 million in amortized cost.

The declines in fair value followed a series of rating agency downgrades of securities in this sector and occurred after the end of the third quarter. We believe there will likely be additional downgrades by the rating agencies of securities in this sector. Overall, approximately $208 million of our asset-backed securities were downgraded during the month of October and through November 7, 2007, including approximately $50 million of “AAA” rated asset-backed CDOs that were downgraded to below investment grade.

We expect these declines will result in significant write downs to these securities during the fourth quarter; however, we cannot predict the amount for the fourth quarter as the write downs will depend on future market developments, including potential additional downgrades, and the estimated fair values of these securities on December 31, 2007.

In addition to our asset-backed CDO and second lien portfolio, we hold approximately $2.6 billion in amortized cost in other asset-backed securities, mainly securities backed by prime residential first-lien mortgages. These securities have also declined in fair value subsequent to September 30, 2007; however, the decline has not been as significant.

13

Other Revenue

Other revenue increased 49% to $12.7 million and 31% to $33.5 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in other revenue was due to an increase in fees earned in connection with distribution of shares during initial public offerings and software consulting fees from our Corporate Services business.

Expense Excluding Interest

The components of expense excluding interest and the resulting variances are as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Variance | | | Nine Months Ended September 30, | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | 2006 | | Amount | | | % | | | 2007 | | 2006 | | Amount | | | % | |

Compensation and benefits | | $ | 117,538 | | $ | 110,705 | | $ | 6,833 | | | 6 | % | | $ | 360,399 | | $ | 352,334 | | $ | 8,065 | | | 2 | % |

Clearing and servicing | | | 78,784 | | | 62,500 | | | 16,284 | | | 26 | % | | | 220,213 | | | 189,926 | | | 30,287 | | | 16 | % |

Advertising and market development | | | 26,508 | | | 23,914 | | | 2,594 | | | 11 | % | | | 108,038 | | | 89,115 | | | 18,923 | | | 21 | % |

Communications | | | 27,525 | | | 25,576 | | | 1,949 | | | 8 | % | | | 79,502 | | | 84,818 | | | (5,316 | ) | | (6) | % |

Professional services | | | 21,014 | | | 20,741 | | | 273 | | | 1 | % | | | 71,161 | | | 71,715 | | | (554 | ) | | (1) | % |

Depreciation and amortization | | | 22,205 | | | 18,565 | | | 3,640 | | | 20 | % | | | 61,663 | | | 56,181 | | | 5,482 | | | 10 | % |

Occupancy and equipment | | | 22,848 | | | 22,150 | | | 698 | | | 3 | % | | | 69,247 | | | 63,082 | | | 6,165 | | | 10 | % |

Amortization of other intangibles | | | 10,485 | | | 12,087 | | | (1,602 | ) | | (13) | % | | | 30,940 | | | 35,391 | | | (4,451 | ) | | (13) | % |

Facility restructuring and other exit activities | | | 5,871 | | | 16,684 | | | (10,813 | ) | | (65) | % | | | 5,104 | | | 19,315 | | | (14,211 | ) | | (74) | % |

Other | | | 47,824 | | | 45,675 | | | 2,149 | | | 5 | % | | | 150,925 | | | 101,888 | | | 49,037 | | | 48 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total expense excluding interest | | $ | 380,602 | | $ | 358,597 | | $ | 22,005 | | | 6 | % | | $ | 1,157,192 | | $ | 1,063,765 | | $ | 93,427 | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Expense excluding interest increased 6% to $380.6 million and 9% to $1.2 billion for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in expense excluding interest was driven primarily by an increase in clearing and servicing expense for the three months ended September 30, 2007 and an increase in other expense for the nine months ended September 30, 2007.

Compensation and Benefits

Compensation and benefits increased 6% to $117.5 million and 2% to $360.4 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The slight increase for the three months ended September 30, 2007 compared to the same period in 2006 resulted primarily from lower incentive based compensation in the prior year.

Clearing and Servicing

Clearing and servicing expense increased 26% to $78.8 million and 16% to $220.2 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This increase is due primarily to higher loan balances during the period, which resulted in higher servicing costs and increased trading activity, which resulted in higher clearing expenses.

Advertising and Market Development

Advertising and market development expense increased 11% to $26.5 million and 21% to $108.0 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This planned increase is a result of expanded efforts to promote our products and services to the value-driven mass affluent customer.

14

Facility Restructuring and Other Exit Activities

Facility restructuring and other exit activities expense decreased 65% to $5.9 million and 74% to $5.1 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. In the third quarter of 2006, we relocated several functions out of the state of California and our facility restructuring and other exit activities expense in that period consisted of severance and facilities costs that resulted from the relocation. In the third quarter of 2007, we began to exit the wholesale mortgage lending business as well as restructure the international institutional brokerage business.

Other

Other expense increased 5% to $47.8 million and 48% to $150.9 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase for the nine months ended September 30, 2007 is due primarily to higher expense for certain legal and regulatory matters.

Other Income (Expense)

Other income (expense) decreased to an expense of $37.1 million and to an expense of $65.8 million for the three and nine months ended September 30, 2007, compared to the same periods in 2006, as shown in the following table (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Variance | | | Nine Months Ended September 30, | | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | | 2006 | | | Amount | | | % | | | 2007 | | | 2006 | | | Amount | | | % | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate interest income | | $ | 1,018 | | | $ | 1,942 | | | $ | (924 | ) | | (48 | )% | | $ | 3,724 | | | $ | 6,091 | | | $ | (2,367 | ) | | (39 | )% |

Corporate interest expense | | | (37,365 | ) | | | (37,964 | ) | | | 599 | | | (2 | )% | | | (113,022 | ) | | | (114,586 | ) | | | 1,564 | | | (1 | )% |

Gain (loss) on sales of investments, net | | | (18 | ) | | | 26,991 | | | | (27,009 | ) | | * | | | | 37,005 | | | | 59,897 | | | | (22,892 | ) | | (38 | )% |

Loss on early extinguishment of debt | | | (37 | ) | | | — | | | | (37 | ) | | * | | | | (6 | ) | | | (703 | ) | | | 697 | | | * | |

Equity in income (loss) of investments and venture funds | | | (741 | ) | | | 2,519 | | | | (3,260 | ) | | * | | | | 6,514 | | | | 1,701 | | | | 4,813 | | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | $ | (37,143 | ) | | $ | (6,512 | ) | | $ | (30,631 | ) | | * | | | $ | (65,785 | ) | | $ | (47,600 | ) | | $ | (18,185 | ) | | * | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Total other income (expense) for the three and nine months ended September 30, 2007 primarily consisted of corporate interest expense resulting from the senior notes and mandatory convertible notes issued by the Company. During the nine months ended September 30, 2007, we sold our investments in E*TRADE Australia and E*TRADE Korea, which resulted in $37.0 million in gain on sales of investments, net. There was no significant investment activity for the three months ended September 30, 2007.

Income Tax Expense (Benefit)

Income tax expense (benefit) from continuing operations was a benefit of $38.1 million for the three months ended September 30, 2007, compared to an expense of $66.4 million for the same period in 2006. Income tax expense from continuing operations decreased 40.6% to $136.7 million during the nine months ended September 30, 2007, compared to the same period in 2006. The decrease in income tax expense for the nine months ended September 30, 2007 compared to the same period in prior year was related to the decrease in pre-tax income over the comparable period. Our effective tax rates for the nine months ended September 30, 2007 and 2006 were 33.6% and 33.8%, respectively.

15

SEGMENT RESULTS REVIEW

Retail

Retail segment income increased 55% to $224.2 million and 17% to $599.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006, as shown in the following table (dollars in thousands, except for key metrics):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Variance | | | Nine Months Ended September 30, | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | 2006 | | Amount | | | % | | | 2007 | | 2006 | | Amount | | | % | |

Retail segment income: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 258,846 | | $ | 221,059 | | $ | 37,787 | | | 17 | % | | $ | 736,831 | | $ | 655,685 | | $ | 81,146 | | | 12 | % |

Commission | | | 142,291 | | | 100,902 | | | 41,389 | | | 41 | % | | | 393,779 | | | 364,333 | | | 29,446 | | | 8 | % |

Fees and service charges | | | 62,019 | | | 51,244 | | | 10,775 | | | 21 | % | | | 174,201 | | | 156,640 | | | 17,561 | | | 11 | % |

Gain on loans and securities, net | | | 1,148 | | | 10,608 | | | (9,460 | ) | | (89) | % | | | 13,410 | | | 28,293 | | | (14,883 | ) | | (53) | % |

Other revenue | | | 9,824 | | | 8,488 | | | 1,336 | | | 16 | % | | | 30,748 | | | 28,690 | | | 2,058 | | | 7 | % |

Net segment revenue | | | 474,128 | | | 392,301 | | | 81,827 | | | 21 | % | | | 1,348,969 | | | 1,233,641 | | | 115,328 | | | 9 | % |

Total segment expense | | | 249,901 | | | 247,227 | | | 2,674 | | | 1 | % | | | 749,121 | | | 721,742 | | | 27,379 | | | 4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total retail segment income | | $ | 224,227 | | $ | 145,074 | | $ | 79,153 | | | 55 | % | | $ | 599,848 | | $ | 511,899 | | $ | 87,949 | | | 17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retail client assets (dollars in billions) | | $ | 218.0 | | $ | 184.8 | | $ | 33.2 | | | 18 | % | | $ | 218.0 | | $ | 184.8 | | $ | 33.2 | | | 18 | % |

Customer cash and deposits (dollars in billions) | | $ | 39.6 | | $ | 31.6 | | $ | 8.0 | | | 25 | % | | $ | 39.6 | | $ | 31.6 | | $ | 8.0 | | | 25 | % |

U.S. DARTs | | | 161,459 | | | 116,459 | | | 45,000 | | | 39 | % | | | 148,139 | | | 139,382 | | | 8,757 | | | 6 | % |

International DARTs | | | 32,926 | | | 18,671 | | | 14,255 | | | 76 | % | | | 29,748 | | | 21,207 | | | 8,541 | | | 40 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

DARTs | | | 194,385 | | | 135,130 | | | 59,255 | | | 44 | % | | | 177,887 | | | 160,589 | | | 17,298 | | | 11 | % |

Average commission per trade | | $ | 11.71 | | $ | 11.95 | | $ | (0.24 | ) | | (2) | % | | $ | 11.87 | | $ | 12.10 | | $ | (0.23 | ) | | (2) | % |

Average margin debt (dollars in billions) | | $ | 7.71 | | $ | 6.66 | | $ | 1.05 | | | 16 | % | | $ | 7.25 | | $ | 6.76 | | $ | 0.49 | | | 7 | % |

Our retail segment generates revenue from trading, investing, banking and lending relationships with retail customers. These relationships essentially drive five sources of revenue: net operating interest income; commission; fees and service charges; gain on loans and securities, net; and other revenue. Other revenue includes results from our stock plan administration products and services, as we ultimately service retail customers through these corporate relationships. Our geographically dispersed retail accounts grew 6% from September 30, 2006 to September 30, 2007. We believe this growth is a result of the investments we have made in marketing, operations and service. As of September 30, 2007, we had approximately 3.7 million active investing and trading accounts and 1.0 million active deposit and lending accounts. Our retail trading and investing products contributed 62% and our deposit products contributed 21% of total net revenue for the nine months ended September 30, 2007. All other products contributed less than 10% of total net revenue for the nine months ended September 30, 2007.

The increase in retail segment income for the three and nine months ended September 30, 2007 compared to the same periods in 2006 was due to an increase in commission revenue, fees and service charges revenue and net operating income, slightly offset by a decrease in gains on sales of loans and securities, net.

16

Retail net operating interest income increased 17% to $258.8 million and 12% to $736.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This increase was driven by growth in customer cash and deposits, which generally translate into a lower cost of funds. The growth in customer cash and deposits was largely the result of the growth in the Complete Savings Account.

Retail commission revenue increased 41% and 8% to $142.3 million and $393.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in commission revenue was primarily the result of increased trading volumes in the overall domestic equity market and in our international commissions where DARTs increased 40% from 21,207 to 29,748 for the nine months ended September 30, 2007 compared to the same period in 2006. Retail commission revenue represented 76% of total commission revenue for the three and nine months ended September 30, 2007 and 2006, respectively.

Retail segment expense increased 1% to $249.9 million and 4% to $749.1 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. This slight increase related to our targeted growth in marketing spend as we expanded efforts to promote our products and services to the value-driven mass affluent customer.

Institutional

Institutional segment income (loss) was a loss of $283.6 million and $127.3 million for the three and nine months ended September 30, 2007, respectively, as shown in the following table (dollars in thousands, except for key metrics):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Variance | | | Nine Months Ended September 30, | | | Variance | |

| | | 2007 vs. 2006 | | | | 2007 vs. 2006 | |

| | | 2007 | | | 2006 | | | Amount | | | % | | | 2007 | | | 2006 | | | Amount | | | % | |

Institutional segment income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 159,186 | | | $ | 134,077 | | | $ | 25,109 | | | 19 | % | | $ | 485,951 | | | $ | 368,842 | | | $ | 117,109 | | | 32 | % |

Provision for loan losses | | | (186,536 | ) | | | (12,547 | ) | | | (173,989 | ) | | 1387 | % | | | (237,767 | ) | | | (33,014 | ) | | | (204,753 | ) | | 620 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating interest income (loss) after provision for loan losses | | | (27,350 | ) | | | 121,530 | | | | (148,880 | ) | | (123) | % | | | 248,184 | | | | 335,828 | | | | (87,644 | ) | | (26) | % |

Commission | | | 46,112 | | | | 32,704 | | | | 13,408 | | | 41 | % | | | 123,385 | | | | 112,438 | | | | 10,947 | | | 10 | % |

Fees and service charges | | | 5,370 | | | | 7,708 | | | | (2,338 | ) | | (30) | % | | | 22,768 | | | | 22,035 | | | | 733 | | | 3 | % |

Principal transactions | | | 20,889 | | | | 22,697 | | | | (1,808 | ) | | (8) | % | | | 78,739 | | | | 84,979 | | | | (6,240 | ) | | (7) | % |

Gain (loss) on loans and securities, net | | | (198,205 | ) | | | 5,395 | | | | (203,600 | ) | | * | | | | (187,764 | ) | | | 10,445 | | | | (198,209 | ) | | * | |

Other revenue | | | 3,019 | | | | 183 | | | | 2,836 | | | 1550 | % | | | 3,151 | | | | 346 | | | | 2,805 | | | 811 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net segment revenue | | | (150,165 | ) | | | 190,217 | | | | (340,382 | ) | | (179) | % | | | 288,463 | | | | 566,071 | | | | (277,608 | ) | | (49) | % |

Total segment expense | | | 133,432 | | | | 112,122 | | | | 21,310 | | | 19 | % | | | 415,724 | | | | 350,262 | | | | 65,462 | | | 19 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total institutional segment income (loss) | | $ | (283,597 | ) | | $ | 78,095 | | | $ | (361,692 | ) | | (463) | % | | $ | (127,261 | ) | | $ | 215,809 | | | $ | (343,070 | ) | | (159) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nonperforming loans as a % of total gross loans receivable | | | 0.84 | % | | | 0.24 | % | | | * | | | 0.60 | % | | | 0.84 | % | | | 0.24 | % | | | * | | | 0.60 | % |

Average revenue capture per 1,000 equity shares | | $ | 0.415 | | | $ | 0.382 | | | $ | 0.033 | | | 9 | % | | $ | 0.472 | | | $ | 0.339 | | | $ | 0.133 | | | 39 | % |

| * | | Percentage not meaningful |

17

Our institutional segment generates net income (loss) from balance sheet management activities, market-making and global execution and settlement services. Balance sheet management activities include purchasing loan receivables from the retail segment as well as third parties, and leveraging these loans and retail customer cash and deposit relationships to generate additional net operating interest income. Retail trading order flow is leveraged by the institutional segment to generate additional revenue for the Company.

Net operating interest income increased 19% to $159.2 million and 32% to $486.0 million for the three and nine months ended September 30, 2007 compared to the same periods in 2006. The increase in net operating interest income was due primarily to the increase in enterprise interest-earning assets, specifically average loans, net. Average loans, net as a percentage of average enterprise interest-earning assets increased 5% to 54% and 6% to 54% for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006.

Provision for loan losses increased to $186.5 million and to $237.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase in the provision for loan losses was related primarily to deterioration in the performance of our home equity loan portfolio.

Fee and service charges revenue decreased 30% to $5.4 million and increased 3% to $22.8 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The decrease for the three months ended September 30, 2007 is related to a $2.9 million decline in service fee income as a result of lower rates and lower home equity, credit card and CDO management fees.

Institutional commission revenue increased 41% to $46.1 million and 10% to $123.4 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006. The increase was due to higher trading volumes as a result of volatility in global equity markets. Institutional commission revenue represented 24% of total commission revenue for the three and nine months ended September 30, 2007 and 2006, respectively.

Gain (loss) on loans and securities, net decreased to a loss of $198.2 million and $187.8 million for the three and nine months ended September 30, 2007. This decline was due primarily to write downs in the asset-backed securities portfolio totaling $197.6 million for the three months ended September 30, 2007. These write downs were primarily confined to securities rated below “AA” in what we believe are the two highest risk categories within our asset-backed portfolio: CDOs and securities collateralized by second lien mortgages. The write downs were due to both an anticipated deterioration in cash flows and our decision to sell these securities in future periods. In either case, the securities were required to be written down to estimated fair market value as of September 30, 2007.

Total institutional segment expense increased 19% to $133.4 million and 19% to $415.7 million for the three and nine months ended September 30, 2007, respectively, compared to the same periods in 2006 and was due primarily to additional expense recorded for certain legal and regulatory matters.

18

BALANCE SHEET OVERVIEW

The following table sets forth the significant components of our consolidated balance sheet (dollars in thousands):

| | | | | | | | | |

| | | September 30, 2007 | | December 31, 2006 | | Variance | |

| | | | | 2007 vs. 2006 | |

Assets: | | | | | | | | | |

Cash and equivalents(1) | | $ | 1,768,027 | | $ | 1,493,856 | | 18 | % |

Trading securities | | | 120,501 | | | 178,600 | | (33) | % |

Available-for-sale mortgage-backed and investment securities | | | 16,581,257 | | | 13,921,983 | | 19 | % |

Loans held-for-sale | | | 119,357 | | | 283,496 | | (58) | % |

Margin receivables | | | 7,529,971 | | | 6,828,448 | | 10 | % |

Loans receivable, net | | | 32,389,894 | | | 26,372,697 | | 23 | % |

Other assets(2) | | | 5,677,758 | | | 4,660,223 | | 22 | % |

| | | | | | | | | |

Total assets | | $ | 64,186,765 | | $ | 53,739,303 | | 19 | % |

| | | | | | | | | |

Liabilities and shareholders’ equity: | | | | | | | | | |

Deposits | | $ | 29,197,344 | | $ | 24,071,012 | | 21 | % |

Securities sold under agreements to repurchase | | | 10,826,523 | | | 9,792,422 | | 11 | % |

Customer payables | | | 7,002,986 | | | 6,182,672 | | 13 | % |

Other borrowings | | | 9,067,529 | | | 5,323,962 | | 70 | % |

Corporate debt(3) | | | 1,881,112 | | | 1,842,169 | | 2 | % |

Accounts payable, accrued and other liabilities | | | 2,107,288 | | | 2,330,696 | | (10) | % |

| | | | | | | | | |

Total liabilities | | | 60,082,782 | | | 49,542,933 | | 21 | % |

Shareholders’ equity | | | 4,103,983 | | | 4,196,370 | | (2) | % |

| | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 64,186,765 | | $ | 53,739,303 | | 19 | % |

| | | | | | | | | |

(1) | | Includes balance sheet line items cash and equivalents and cash and investments required to be segregated under Federal or other regulations. |

(2) | | Includes balance sheet line items property and equipment, net, goodwill, other intangibles, net and other assets. |

(3) | | Includes balance sheet line items senior notes and mandatory convertible notes. |

During the first quarter of 2007, we re-presented our balance sheet to report margin receivables and customer payables directly on the face of the balance sheet. The remaining components of brokerage receivables and brokerage payables are now reported in the “Other assets” and “Accounts payable, accrued and other liabilities” line items, respectively.

The margin receivables balance is a component of the margin debt balance, which is reported as a key retail metric of $7.6 billion and $7.0 billion at September 30, 2007 and December 31, 2006, respectively. The total margin debt balance is summarized as follows (dollars in thousands):

| | | | | | |

| | | September 30, 2007 | | December 31, 2006 |

Margin receivables | | $ | 7,529,971 | | $ | 6,828,448 |

Margin held by third parties and other | | | 100,319 | | | 174,652 |

| | | | | | |

Margin debt | | $ | 7,630,290 | | $ | 7,003,100 |

| | | | | | |

The increase in total assets was primarily the result of growth in loans receivable, net and available-for-sale mortgage-backed and investment securities. The growth in available-for-sale mortgage-backed and investment securities was driven primarily by growth in mortgage-backed securities. The growth in loans receivable, net was driven primarily by growth in one- to four-family real estate loans. In the future, we plan to hold total assets

19

approximately at current levels or slightly lower. We plan to increase our one- to four-family real estate loans and margin loans, while allowing our home equity loan and securities portfolios to decline.

The increase in total liabilities primarily was attributable to the increase in deposits and securities sold under agreements to repurchase and other borrowings. The $5.1 billion increase in deposits was due primarily to the growth in the Complete Savings Account. The increase in securities sold under agreements to repurchase and other borrowings contributed to the growth of the loans receivable, net. We plan to continue to increase deposits, while allowing securities sold under agreements to repurchase and other borrowings to decline.

Loans Receivable, Net

Loans receivable, net are summarized as follows (dollars in thousands):

| | | | | | | | | | | |

| | | September 30, 2007 | | | December 31, 2006 | | | Variance | |

| | | | | 2007 vs. 2006 | |

One- to four-family | | $ | 16,857,241 | | | $ | 10,870,214 | | | 55 | % |

Home equity | | | 12,422,966 | | | | 11,809,008 | | | 5 | % |

Consumer and other loans: | | | | | | | | | | | |

Recreational vehicle | | | 2,000,818 | | | | 2,292,356 | | | (13) | % |

Marine | | | 552,485 | | | | 651,764 | | | (15) | % |

Commercial | | | 288,841 | | | | 219,008 | | | 32 | % |

Credit card | | | 93,878 | | | | 128,583 | | | (27) | % |

Other | | | 32,906 | | | | 81,239 | | | (59) | % |

Unamortized premiums, net | | | 349,797 | | | | 388,153 | | | (10) | % |

Allowance for loan losses | | | (209,038 | ) | | | (67,628 | ) | | 209 | % |

| | | | | | | | | | | |

Total loans receivable, net | | $ | 32,389,894 | | | $ | 26,372,697 | | | 23 | % |

| | | | | | | | | | | |