UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2009

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-11921

E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 94-2844166 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

135 East 57th Street, New York, New York 10022

(Address of Principal Executive Offices and Zip Code)

(646) 521-4300

(Registrant’s Telephone Number, including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer x | | | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of May 1, 2009, there were 572,193,965 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended March 31, 2009

TABLE OF CONTENTS

Unless otherwise indicated, references to “the Company,” “We,” “Us,” “Our” and “E*TRADE” mean E*TRADE Financial Corporation or its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, ClearStation, Equity Edge, OptionsLink and the Converging Arrows logo are registered trademarks of E*TRADE Financial Corporation in the United States and in other countries.

2

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

This information is set forth immediately following Item 3, “Quantitative and Qualitative Disclosures about Market Risk.”

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements involving risks and uncertainties. These statements relate to our future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as “expect,” “may,” “anticipate,” “intend,” “plan” and similar expressions. Our actual results could differ materially from those discussed in these forward-looking statements, and we caution that we do not undertake to update these statements. Factors that could contribute to our actual results differing from any forward-looking statements include those discussed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report. The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. Important factors that may cause actual results to differ materially from any forward-looking statements are set forth in our 2008 Form 10-K filed with the Securities and Exchange Commission (“SEC”) under the heading “Risk Factors.”

We further caution that there may be risks associated with owning our securities other than those discussed in such filings.

GLOSSARY OF TERMS

In analyzing and discussing our business, we utilize certain metrics, ratios and other terms that are defined in the “Glossary of Terms,” which is located at the end of Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

OVERVIEW

Strategy

Our core strength is our trading and investing customer franchise. Our strategy centers on eliminating business activities unrelated to this core strength and focusing on the key factors that we believe will best serve our customers, where we are most competitive and where we can earn a return for our shareholders. These key factors include a significant focus on: innovation in trading and investing products and services, growth in new brokerage accounts and continued improvement in customer service. We believe our focus on these key factors combined with our long-term dedication to innovation will lead to continued growth in our core business.

In addition to focusing on our customer franchise, our strategy includes an intense focus on mitigating the risks in our balance sheet caused by the mortgage crisis. We plan to mitigate these risks by minimizing the losses in our loan portfolio while working to generate sufficient levels of capital to offset those losses. We believe that our success or failure in this regard will be the key determinant of our financial health in the near term.

We are also focused on simplifying our organizational structure to improve productivity and reduce our operating expenses. We have streamlined the organizational structure by eliminating overlaps, inefficiencies and outdated functions. We believe these streamlining efforts have reduced our overhead expenses and improved our ability to execute.

3

Key Factors Affecting Financial Performance

Our financial performance is affected by a number of factors outside of our control, including:

| | • | | customer demand for financial products and services; |

| | • | | the weakness or strength of the residential real estate and credit markets; |

| | • | | the performance, volume and volatility of the equity and capital markets; |

| | • | | customer perception of the financial strength of our franchise; |

| | • | | market demand and liquidity in the secondary market for mortgage loans and securities; and |

| | • | | market demand and liquidity in the wholesale borrowings market, including securities sold under agreements to repurchase. |

In addition to the items noted above, our success in the future will depend upon, among other things:

| | • | | continuing our success in the acquisition, growth and retention of customers; |

| | • | | our ability to assess and manage credit risk; |

| | • | | our ability to generate capital sufficient to meet our operating needs, particularly a level sufficient to offset loan losses; |

| | • | | our ability to assess and manage interest rate risk; and |

| | • | | disciplined expense control and improved operational efficiency. |

Management monitors a number of metrics in evaluating the Company’s performance. The most significant of these are shown in the table and discussed in the text below:

| | | | | | | | | | | |

| | | As of or For the

Three Months Ended

March 31, | | | Variance | |

| | | 2009 | | | 2008 | | | 2009 vs. 2008 | |

Customer Activity Metrics: | | | | | | | | | | | |

Customer assets (dollars in billions) | | $ | 110.4 | | | $ | 163.8 | | | (33 | )% |

Net new customer assets (dollars in billions) | | $ | 3.5 | | | $ | 0.3 | | | 1067 | % |

Customer cash and deposits (dollars in billions) | | $ | 34.4 | | | $ | 33.9 | | | 1 | % |

Daily average revenue trades | | | 194,482 | | | | 180,555 | | | 8 | % |

Average commission per trade | | $ | 10.59 | | | $ | 11.05 | | | (4 | )% |

End of period brokerage accounts | | | 2,660,584 | | | | 2,477,892 | | | 7 | % |

| | | |

Company Financial Metrics: | | | | | | | | | | | |

Corporate cash (dollars in millions) | | $ | 406.2 | | | $ | 296.4 | | | 37 | % |

E*TRADE Bank excess risk-based capital (dollars in millions) | | $ | 444.2 | | | $ | 695.3 | | | (36 | )% |

Allowance for loan losses (dollars in millions) | | $ | 1,200.8 | | | $ | 565.9 | | | 112 | % |

Allowance for loan losses as a % of nonperforming loans | | | 91.60 | % | | | 96.84 | % | | (5.24 | )% |

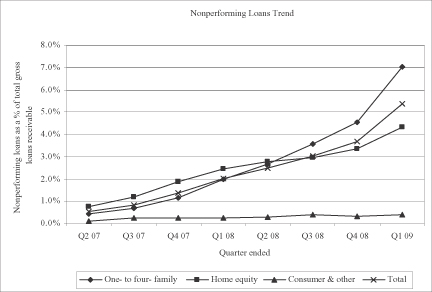

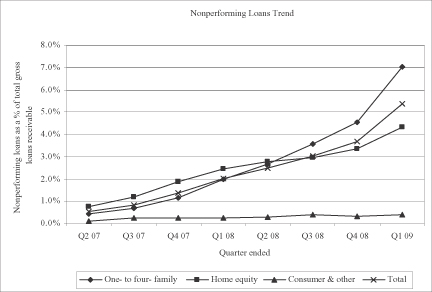

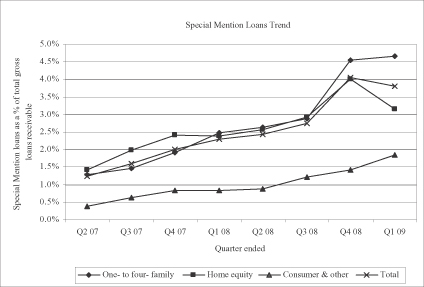

Nonperforming loans receivable as a % of gross loans receivable | | | 5.36 | % | | | 2.02 | % | | 3.34 | % |

Enterprise net interest spread (basis points) | | | 234 | | | | 250 | | | (6 | )% |

Enterprise interest-earning assets (average in billions) | | $ | 44.7 | | | $ | 48.9 | | | (9 | )% |

Customer Activity Metrics

| | • | | Changes in customer assets are an indicator of the value of our relationship with the customer. An increase in customer assets generally indicates that the use of our products and services by existing and new customers is expanding. Changes in this metric are also driven by changes in the valuations of our customers’ underlying securities, which declined substantially during 2008 and the first quarter of 2009. |

4

| | • | | Net new customer assets are total inflows to all new and existing customer accounts less total outflows from all closed and existing customer accounts and are a general indicator of the use of our products and services by existing and new customers. |

| | • | | Customer cash and deposits are an indicator of a deepening engagement with our customers and are a key driver of net operating interest income. |

| | • | | Daily average revenue trades (“DARTs”) are the predominant driver of commission revenue from our customers. |

| | • | | Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing. As a result, this metric is impacted by both the mix between our domestic and international businesses and the mix between active traders, mass affluent and main street customers. |

| | • | | End of period brokerage accounts is an indicator of the Company’s ability to attract and retain brokerage customers. |

Company Financial Metrics

| | • | | Corporate cash is an indicator of the liquidity at the parent company. It is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. |

| | • | | E*TRADE Bank excess risk-based capital is the excess capital that E*TRADE Bank has compared to the regulatory minimum well-capitalized threshold and is an indicator of E*TRADE Bank’s ability to absorb future loan losses. |

| | • | | Allowance for loan losses is an estimate of the losses inherent in our loan portfolio as of the balance sheet date and is typically equal to the expected charge-offs in our loan portfolio over the next twelve months. |

| | • | | Allowance for loan losses as a percentage of nonperforming loans is a general indicator of the adequacy of our allowance for loan losses. Changes in this ratio are also driven by changes in the mix of our loan portfolio. |

| | • | | Nonperforming loans receivable as a percentage of gross loans receivable is an indicator of the performance of our total loan portfolio. |

| | • | | Enterprise net interest spread is a broad indicator of our ability to generate net operating interest income. |

| | • | | Enterprise interest-earning assets, in conjunction with our enterprise net interest spread, are indicators of our ability to generate net operating interest income. |

Significant Events in the First Quarter of 2009

Strengthening Our Trading and Investing Customer Franchise

A key element of our strategy is to grow our trading and investing customer franchise. We believe we made significant progress in this area in the first quarter of 2009. Highlights from our progress are as follows:

| | • | | Opened 239,000 gross new accounts and produced 56,000 net new accounts; |

| | • | | Ended the quarter with a record 2.7 million brokerage accounts, with net new brokerage accounts during the quarter of 63,000; |

| | • | | Net new customer asset inflows of $3.5 billion; and |

| | • | | Total DARTs of 194,000, an 8% year-over-year increase, although a 10% decrease from the record levels of the prior quarter. |

5

Execution of Our Capital Plan

| | • | | E*TRADE Bank had excess risk-based capital (excess to the regulatory minimum well-capitalized threshold) of $444.2 million, a decrease of $270.5 million compared to December 31, 2008; and |

| | • | | We had corporate cash of $406.2 million, a decrease of $28.6 million compared to December 31, 2008. |

Enhancements to Our Trading and Investing Products and Services

| | • | | We introduced new tools that are designed to simplify the bond and fixed income mutual fund selection and investment process in order to help customers make more informed fixed income decisions; |

| | • | | We launched online chat services providing prospective customers with the opportunity to receive live online help when opening an account; and |

| | • | | We increased customer service phone support to 24 hours per day, seven days a week. |

Summary Financial Results

Income Statement Highlights for the Three Months Ended March 31, 2009 (dollars in millions, except per share amounts)

| | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | 2009 | | | 2008 | | | 2009 vs. 2008 | |

Net operating interest income | | $ | 278.7 | | | $ | 326.4 | | | (15 | )% |

Total net revenue | | $ | 497.3 | | | $ | 529.1 | | | (6 | )% |

Provision for loan losses | | $ | 454.0 | | | $ | 233.9 | | | 94 | % |

Commission revenue | | $ | 125.6 | | | $ | 122.3 | | | 3 | % |

Fees and service charges revenue | | $ | 46.7 | | | $ | 54.9 | | | (15 | )% |

Operating margin | | $ | (250.6 | ) | | $ | (59.1 | ) | | 324 | % |

Net loss | | $ | (232.7 | ) | | $ | (91.2 | ) | | 155 | % |

Diluted net loss per share | | $ | (0.41 | ) | | $ | (0.20 | ) | | 105 | % |

The continued deterioration in the residential real estate and credit markets, as well as the continued turmoil in the global financial markets, had a significant impact on our financial performance during the first quarter of 2009. The losses in our balance sheet management segment caused by this deterioration more than offset the continued strong underlying performance of our trading and investing segment, resulting in a net loss of $232.7 million for the three months ended March 31, 2009. We believe our trading and investing segment demonstrated its growth and earnings potential during the first quarter of 2009 as our customers fully participated in the highly volatile equity markets. Trading activity was strong during the quarter with DARTs increasing 8% when compared to the first quarter of 2008. In addition we opened 56,000 net new accounts and attracted $3.5 billion in net new customer assets. We believe these are indications that our trading and investing segment has not only stabilized, but is showing signs of robust and sustained growth.

Balance Sheet Highlights (dollars in billions)

| | | | | | | | | | | |

| | | March 31,

2009 | | | December 31,

2008 | | | Variance | |

| | | | 2009 vs. 2008 | |

Total assets | | $ | 49.4 | | | $ | 48.5 | | | 2 | % |

Total enterprise interest-earning assets | | $ | 46.0 | | | $ | 45.0 | | | 2 | % |

Loans, net and margin receivables as a percentage of enterprise

interest-earning assets | | | 58 | % | | | 63 | % | | (5 | )% |

Retail deposits and customer payables as a percentage of enterprise interest-bearing liabilities | | | 73 | % | | | 70 | % | | 3 | % |

6

The increase in total assets was attributable primarily to an increase of $1.4 billion in cash in connection with an increase in deposits. The decrease of $1.2 billion in loans, net was offset by the purchase of agency mortgage-backed securities, which led to an increase of $1.0 billion in available-for-sale mortgage-backed and investment securities. For the foreseeable future, we plan to allow our home equity loans to pay down, resulting in an overall decline in the balance of the loan portfolio. For the remainder of 2009, we also plan to allow total assets to decline in order to release additional regulatory capital which we are required to hold against these assets. As of March 31, 2009, our excess risk-based capital at E*TRADE Bank was $444.2 million

EARNINGS OVERVIEW

We incurred a net loss of $232.7 million for the three months ended March 31, 2009 compared to a net loss of $91.2 million in the same period in 2008. The net loss for the three months ended March 31, 2009 was due principally to our provision for loan losses of $454.0 million. The losses in our balance sheet management segment, which includes the provision for loan losses, more than offset the strong performance of our trading and investing segment, which generated net income of $122.2 million for the three months ended March 31, 2009.

We report corporate interest income and corporate interest expense separately from operating interest income and operating interest expense. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Our operating interest income and operating interest expense is generated from the operations of the Company. Our corporate debt, which is the primary source of our corporate interest expense, has been issued primarily in connection with the Citadel Investment and past acquisitions, such as Harrisdirect and BrownCo.

Similarly, we report gain (loss) on sales of investments, net separately from gain (loss) on loans and securities, net. We believe reporting these two items separately provides a clearer picture of the financial performance of our operations than would a presentation that combined these two items. Gain (loss) on loans and securities, net is the result of activities in our operations, namely our balance sheet management segment, including impairment on our available-for sale mortgage-backed and investment securities portfolio. Gain (loss) on sales of investments, net relates to historical equity investments of the Company at the corporate level and are not related to the ongoing business of our operating subsidiaries.

7

The following sections describe in detail the changes in key operating factors and other changes and events that have affected our consolidated net revenue, operating expense, other income (expense) and income tax benefit.

Revenue

The components of net revenue and the resulting variances are as follows (dollars in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | 2009 vs. 2008 | |

| | | 2009 | | | 2008 | | | Amount | | | % | |

Revenue: | | | | | | | | | | | | | | | |

Operating interest income | | $ | 486,637 | | | $ | 699,591 | | | $ | (212,954 | ) | | (30 | )% |

Operating interest expense | | | (207,975 | ) | | | (373,220 | ) | | | 165,245 | | | (44 | )% |

| | | | | | | | | | | | | | | |

Net operating interest income | | | 278,662 | | | | 326,371 | | | | (47,709 | ) | | (15 | )% |

| | | | | | | | | | | | | | | |

Commission | | | 125,626 | | | | 122,255 | | | | 3,371 | | | 3 | % |

Fees and service charges | | | 46,715 | | | | 54,941 | | | | (8,226 | ) | | (15 | )% |

Principal transactions | | | 17,642 | | | | 20,490 | | | | (2,848 | ) | | (14 | )% |

Gain (loss) on sales of loans and securities, net | | | 16,507 | | | | (8,567 | ) | | | 25,074 | | | * | |

Other revenue | | | 12,191 | | | | 13,604 | | | | (1,413 | ) | | (10 | )% |

| | | | | | | | | | | | | | | |

Total non-interest income | | | 218,681 | | | | 202,723 | | | | 15,958 | | | 8 | % |

| | | | | | | | | | | | | | | |

Total net revenue | | $ | 497,343 | | | $ | 529,094 | | | $ | (31,751 | ) | | (6 | )% |

| | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Total net revenue declined by 6% to $497.3 million for the three months ended March 31, 2009 compared to the same period in 2008. This decline was driven by a decrease in our net operating interest income, which decreased 15% to $278.7 million for the three months ended March 31, 2009 compared to the same period in 2008.

Net Operating Interest Income

Net operating interest income decreased 15% to $278.7 million for the three months ended March 31, 2009 compared to the same period in 2008. Net operating interest income is earned primarily through holding credit balances, which include margin, real estate and consumer loans, and by holding customer cash and deposits, which are a low cost source of funding. The decrease in net operating interest income was due primarily to the decrease in higher yielding enterprise interest-earning assets, specifically loans, net and margin receivables, partially offset by a decrease in the yields paid on our deposits.

8

The following table presents enterprise average balance sheet data and enterprise income and expense data for our operations, as well as the related net interest spread, yields and rates and has been prepared on the basis required by the SEC’s Industry Guide 3, “Statistical Disclosure by Bank Holding Companies” (dollars in thousands):

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2009 | | | 2008 | |

| | | Average

Balance | | Operating

Interest

Inc./Exp. | | Average

Yield/

Cost | | | Average

Balance | | Operating

Interest

Inc./Exp. | | Average

Yield/

Cost | |

Enterprise interest-earning assets: | | | | | | | | | | | | | | | | | | |

Loans, net(1) | | $ | 25,083,318 | | $ | 313,328 | | 5.00 | % | | $ | 29,925,013 | | $ | 451,574 | | 6.04 | % |

Margin receivables | | | 2,751,510 | | | 26,937 | | 3.97 | % | | | 6,683,969 | | | 90,937 | | 5.47 | % |

Available-for-sale mortgage-backed securities | | | 11,173,259 | | | 125,749 | | 4.50 | % | | | 9,281,381 | | | 110,072 | | 4.74 | % |

Available-for-sale investment securities | | | 126,307 | | | 2,034 | | 6.44 | % | | | 169,848 | | | 2,835 | | 6.67 | % |

Trading securities | | | 35,528 | | | 671 | | 7.56 | % | | | 572,817 | | | 10,708 | | 7.48 | % |

Cash and cash equivalents(2) | | | 4,937,608 | | | 5,736 | | 0.47 | % | | | 1,468,776 | | | 13,833 | | 3.79 | % |

Stock borrow and other | | | 588,748 | | | 8,101 | | 5.58 | % | | | 793,450 | | | 15,640 | | 7.93 | % |

| | | | | | | | | | | | | | | | | | |

Total enterprise interest-earning assets(3) | | | 44,696,278 | | | 482,556 | | 4.32 | % | | | 48,895,254 | | | 695,599 | | 5.70 | % |

| | | | | | | | | | | | | | | | | | |

Non-operating interest-earning assets(4) | | | 3,895,521 | | | | | | | | | 5,812,480 | | | | | | |

| | | | | | | | | | | | | | | | | | |

Total assets | | $ | 48,591,799 | | | | | | | | $ | 54,707,734 | | | | | | |

| | | | | | | | | | | | | | | | | | |

Enterprise interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

Retail deposits | | $ | 26,375,688 | | | 93,433 | | 1.44 | % | | $ | 25,383,594 | | | 171,535 | | 2.72 | % |

Brokered certificates of deposit | | | 293,714 | | | 3,581 | | 4.94 | % | | | 1,229,811 | | | 15,169 | | 4.96 | % |

Customer payables | | | 3,771,868 | | | 2,802 | | 0.30 | % | | | 4,348,906 | | | 9,910 | | 0.92 | % |

Repurchase agreements and other borrowings | | | 7,589,825 | | | 66,075 | | 3.48 | % | | | 7,980,130 | | | 94,934 | | 4.71 | % |

Federal Home Loan Bank (“FHLB”) advances | | | 3,683,600 | | | 41,204 | | 4.47 | % | | | 5,974,084 | | | 70,802 | | 4.69 | % |

Stock loan and other | | | 422,639 | | | 868 | | 0.83 | % | | | 1,679,887 | | | 10,640 | | 2.55 | % |

| | | | | | | | | | | | | | | | | | |

Total enterprise interest-bearing liabilities | | | 42,137,334 | | | 207,963 | | 1.98 | % | | | 46,596,412 | | | 372,990 | | 3.20 | % |

| | | | | | | | | | | | | | | | | | |

Non-operating interest-bearing liabilities(5) | | | 3,873,709 | | | | | | | | | 5,270,240 | | | | | | |

| | | | | | | | | | | | | | | | | | |

Total liabilities | | | 46,011,043 | | | | | | | | | 51,866,652 | | | | | | |

Total shareholders’ equity | | | 2,580,756 | | | | | | | | | 2,841,082 | | | | | | |

| | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 48,591,799 | | | | | | | | $ | 54,707,734 | | | | | | |

| | | | | | | | | | | | | | | | | | |

Excess of enterprise interest-earning assets over enterprise interest-bearing liabilities/Enterprise net interest income/Spread | | $ | 2,558,944 | | $ | 274,593 | | 2.34 | % | | $ | 2,298,842 | | $ | 322,609 | | 2.50 | % |

| | | | | | | | | | | | | | | | | | |

Enterprise net interest margin (net yield on enterprise interest-earning assets) | | | | | | | | 2.46 | % | | | | | | | | 2.64 | % |

Ratio of enterprise interest-earning assets to enterprise interest-bearing liabilities | | | | | | | | 106.07 | % | | | | | | | | 104.93 | % |

Return on average: | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | (1.92 | )% | | | | | | | | (0.67 | )% |

Total shareholders’ equity | | | | | | | | (36.06 | )% | | | | | | | | (12.84 | )% |

Average equity to average total assets | | | | | | | | 5.31 | % | | | | | | | | 5.19 | % |

Reconciliation from enterprise net interest income to net operating interest income (dollars in thousands):

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2009 | | | 2008 | |

Enterprise net interest income(6) | | $ | 274,593 | | | $ | 322,609 | |

Taxable equivalent interest adjustment | | | (714 | ) | | | (3,698 | ) |

Customer cash held by third parties and other(7) | | | 4,783 | | | | 7,460 | |

| | | | | | | | |

Net operating interest income | | $ | 278,662 | | | $ | 326,371 | |

| | | | | | | | |

(1) | | Nonaccrual loans are included in the respective average loan balances. Income on such nonaccrual loans is recognized on a cash basis. |

(2) | | Includes segregated cash balances. |

(3) | | Amount includes a taxable equivalent increase in operating interest income of $0.7 million and $3.7 million for the three months ended March 31, 2009 and 2008, respectively. |

(4) | | Non-operating interest-earning assets consist of property and equipment, net, goodwill, other intangibles, net and other assets that do not generate operating interest income. Some of these assets generate corporate interest income. |

(5) | | Non-operating interest-bearing liabilities consist of corporate debt, accounts payable, accrued and other liabilities that do not generate operating interest expense. Some of these liabilities generate corporate interest expense. |

(6) | | Enterprise net interest income is taxable equivalent basis net operating interest income excluding corporate interest income and corporate interest expense and interest earned on customer cash held by third parties. Management believes this non-GAAP measure is useful to analysts and investors as it is a measure of the net operating interest income generated by our operations. |

(7) | | Includes interest earned on average customer assets of $2.8 billion and $3.3 billion for the three months ended March 31, 2009 and 2008, respectively, held by parties outside E*TRADE Financial, including third party money market funds and sweep deposit accounts at unaffiliated financial institutions. |

9

Average enterprise interest-earning assets decreased 9% to $44.7 billion for the three months ended March 31, 2009 compared to the same period in 2008, primarily the result of a decrease in our loans, net portfolio and our margin receivables, slightly offset by an increase in cash and equivalents and available-for-sale mortgage-backed securities. Average loans, net decreased 16% to $25.1 billion for the three months ended March 31, 2009 compared to the same period in 2008. For the foreseeable future, we plan to allow our home equity loans to pay down, resulting in an overall decline in the balance of the loan portfolio. For the remainder of 2009, we also plan to allow total assets to decline. Average margin receivables decreased 59% to $2.8 billion for the three months ended March 31, 2009 compared to the same period in 2008. We believe this decrease was due to customers deleveraging and reducing their risk exposure given the substantial volatility in the financial markets. These decreases were slightly offset by an increase in average cash and cash equivalents. Average cash and cash equivalents increased 236% to $4.9 billion for the three months ended March 31, 2009 compared to the same period in 2008. Average available-for-sale mortgage-backed securities increased 20% to $11.2 billion as a result of purchases of agency mortgage-backed securities during the three months ended March 31, 2009.

Average enterprise interest-bearing liabilities decreased 10% to $42.1 billion for the three months ended March 31, 2009 compared to the same period in 2008. The decrease in average enterprise interest-bearing liabilities was primarily due to a decrease in FHLB advances and stock loan and other. Average FHLB advances decreased 38% to $3.7 billion for the three months ended March 31, 2009 compared to the same period in 2008. Average stock loan and other decreased 75% to $0.4 billion for the three months ended March 31, 2009 compared to the same period in 2008. While our average deposits increased by $992.1 million during the quarter, we expect these balances to decrease over the remainder of 2009 as we focus on decreasing total assets.

Enterprise net interest spread decreased by 16 basis points to 2.34% for the three months ended March 31, 2009 compared to the same period in 2008. This decrease was driven in part by the decrease in loans, net and our margin receivables, both of which are among our higher yielding asset classes. During the three months ended March 31, 2009, we reduced the annual percentage yield paid on our Complete Savings Account by approximately 150 basis points. We believe the reduction in these yields will result in a modest increase to our net interest spread in future periods.

Commission

Commission revenue increased 3% to $125.6 million for the three months ended March 31, 2009, compared to the same period in 2008. The primary factors that affect our commission revenue are DARTs, average commission per trade and the number of trading days during the period. Average commission per trade is impacted by both trade types and the mix between our domestic and international businesses. Each business has a different pricing structure, unique to its customer base and local market practices and, as a result, a change in the relative number of executed trades in these businesses impacts average commission per trade. Each business also has different trade types (e.g. equities, options, fixed income, exchange-traded funds, contract for difference and mutual funds) that can have different commission rates. Accordingly, changes in the mix of trade types within either of these businesses may impact average commission per trade.

DARTs increased 8% to 194,482 for the three months ended March 31, 2009 compared to the same period in 2008. Our U.S. DART volume increased 10% for the three months ended March 31, 2009 compared to the same period in 2008, driven entirely by organic growth. Option-related DARTs as a percentage of our total U.S. DARTs represented 12% and 17% of U.S. trading volume for the periods ending March 31, 2009 and 2008, respectively.

Average commission per trade decreased 4% to $10.59 for the three months ended March 31, 2009 compared to the same period in 2008. The decrease was primarily a function of negative foreign currency exchange impact as a result of the strengthening U.S. dollar. The mix of customers was also a contributing factor.

10

Fees and Service Charges

Fees and service charges decreased 15% to $46.7 million for the three months ended March 31, 2009 compared to the same period in 2008. The decline was driven by a decrease in advisory management fees and collateralized debt obligation (“CDO”) management fee revenue. The decrease in advisory management fees was primarily due to our sale of RAA in the second quarter of 2008 and the decrease in CDO management fees was due to the sale of our collateral management agreements in the first quarter of 2008. A decline in foreign currency margin revenue, fixed income product revenue and mutual fund fees also contributed to the decrease in fees and service charges.

Principal Transactions

Principal transactions decreased 14% to $17.6 million for the three months ended March 31, 2009 compared to the same period in 2008. Our principal transactions revenue is influenced by overall trading volumes, the number of stocks for which we act as a market-maker, the trading volumes of those specific stocks and the performance of our proprietary trading activities. The decline in principal transactions revenue was driven by a 40% decrease in our average revenue capture per 1,000 equity shares traded to $0.339 for the three months ended March 31, 2009. This decrease was partially offset by an increase of 49% in the volume of our equity shares traded. Although overall equity shares traded increased 49%, the increased volume was primarily due to bulletin board trades, which earn lower revenue per trade than other market-making trades.

Gain (Loss) on Loans and Securities, Net

Gain (loss) on loans and securities, net was a gain of $16.5 million for the three months ended March 31, 2009, as shown in the following table (dollars in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2009 vs. 2008 | |

| | 2009 | | | 2008 | | | Amount | | | % | |

Loss on sales of loans, net | | $ | — | | | $ | (498 | ) | | $ | 498 | | | * | |

Gain on securities and other investments | | | 37,826 | | | | 13,263 | | | | 24,563 | | | 185 | % |

Loss on impairment | | | (18,801 | ) | | | (26,602 | ) | | | 7,801 | | | (29 | )% |

Gain (loss) on trading securities | | | (2,468 | ) | | | 3,621 | | | | (6,089 | ) | | * | |

Hedge ineffectiveness | | | (50 | ) | | | 1,649 | | | | (1,699 | ) | | * | |

| | | | | | | | | | | | | | | |

Gain (loss) on securities, net | | | 16,507 | | | | (8,069 | ) | | | 24,576 | | | * | |

| | | | | | | | | | | | | | | |

Gain (loss) on loans and securities, net | | $ | 16,507 | | | $ | (8,567 | ) | | $ | 25,074 | | | * | |

| | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

The increase in the total gain (loss) on loans and securities, net during the three months ended March 31, 2009 compared to the same period in 2008 was due primarily to the $37.8 million gain on securities and other investments, which was related to the sale of certain agency mortgage-backed securities. Offsetting this gain was $18.8 million of impairment recognized on certain securities in our collateralized mortgage obligation (“CMO”) portfolio during the three months ended March 31, 2009, which was a result of the deterioration in the expected credit performance of the underlying loans in the securities. Further declines in the performance of our CMO portfolio could result in additional impairment in future periods(1).

Other Revenue

Other revenue decreased 10% to $12.2 million for the three months ended March 31, 2009 compared to the same period in 2008. The decrease in other revenue was due to a decline in the income from the cash surrender

| (1) | | In the second quarter of 2009, we will adopt Financial Accounting Standards Board (“FASB”) Staff Position (“FSP”) No. FAS 115-2 and FAS 124-2,Recognition and Presentation of Other-Than-Temporary Impairments(“FSP No. FAS 115-2 and FAS 124-2”), which amends the other-than-temporary impairment guidance in GAAP for debt securities. We expect the adoption of this standard to decrease the impact of impairments on our results of operations in future periods when compared to the impact we believe would have occurred without this new accounting standard. We are currently evaluating the impact of the adoption of FSP No. FAS 115-2 and FAS 124-2 to our financial condition, results of operations and cash flows. |

11

value of bank-owned life insurance, decreased fees earned in connection with distribution of shares during initial public offerings and lower software consulting fees from our Corporate Services business.

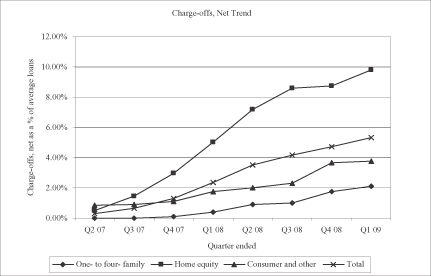

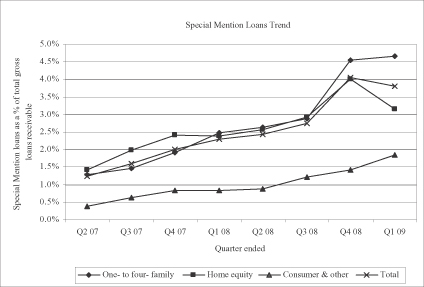

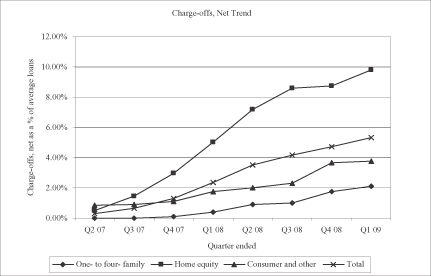

Provision for Loan Losses

Provision for loan losses increased $220.1 million to $454.0 million for the three months ended March 31, 2009 compared to the same period in 2008. The increase in the provision for loan losses was related primarily to deterioration in the performance of our one- to four-family and home equity loan portfolios. We believe the deterioration in both of these portfolios was caused by several factors, including: home price depreciation in key markets; growing inventories of unsold homes; rising foreclosure rates; significant contraction in the availability of credit; and a general decline in economic growth. In addition, the combined impact of home price depreciation and the reduction of available credit made it increasingly difficult for borrowers to refinance existing loans. We believe these factors will cause the provision for loan losses to continue at historically high levels in future periods.

Operating Expense

The components of operating expense and the resulting variances are as follows (dollars in thousands):

| | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | Variance | |

| | | | 2009 vs. 2008 | |

| | 2009 | | | 2008 | | Amount | | | % | |

Operating expense: | | | | | | | | | | | | | | |

Compensation and benefits | | $ | 84,172 | | | $ | 123,128 | | $ | (38,956 | ) | | (32 | )% |

Clearing and servicing | | | 42,671 | | | | 44,885 | | | (2,214 | ) | | (5 | )% |

Advertising and marketing development | | | 43,591 | | | | 57,448 | | | (13,857 | ) | | (24 | )% |

Communications | | | 21,561 | | | | 25,094 | | | (3,533 | ) | | (14 | )% |

Professional services | | | 19,630 | | | | 23,645 | | | (4,015 | ) | | (17 | )% |

Occupancy and equipment | | | 19,541 | | | | 20,498 | | | (957 | ) | | (5 | )% |

Depreciation and amortization | | | 20,274 | | | | 21,653 | | | (1,379 | ) | | (6 | )% |

Amortization of other intangibles | | | 7,436 | | | | 10,910 | | | (3,474 | ) | | (32 | )% |

Facility restructuring and other exit activities | | | (112 | ) | | | 10,566 | | | (10,678 | ) | | * | |

Other | | | 35,220 | | | | 16,506 | | | 18,714 | | | 113 | % |

| | | | | | | | | | | | | | |

Total operating expense | | $ | 293,984 | | | $ | 354,333 | | $ | (60,349 | ) | | (17 | )% |

| | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Operating expense decreased 17% to $294.0 million for the three months ended March 31, 2009 compared to the same period in 2008 and was driven primarily by decreases in compensation and benefits.

Compensation and Benefits

Compensation and benefits decreased 32% to $84.2 million for the three months ended March 31, 2009 compared to the same period in 2008. This decrease resulted primarily from lower salary expense due to a reduction in our employee base. The decrease was also due to increased severance compensation of $12.0 million during the first quarter of 2008.

Advertising and Market Development

Advertising and market development expense decreased 24% to $43.6 million for the three months ended March 31, 2009 compared to the same period in 2008. This decrease was due to higher expense in the first quarter of 2008 that was aimed at restoring customer confidence as well as an overall market decline in advertising rates in the first quarter of 2009.

12

Other

Other expense increased 113% to $35.2 million for the three months ended March 31, 2009 compared to the same period in 2008. The increase was due primarily to the $23.7 million gain on the sale of our corporate aircraft related assets which reduced operating expense during the three months ended March 31, 2008.

Other Income (Expense)

Other income (expense) increased from an expense of $90.5 million to an expense of $93.5 million for the three months ended March 31, 2009 compared to the same period in 2008, as shown in the following table (dollars in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | | 2009 vs. 2008 | |

| | 2009 | | | 2008 | | | Amount | | | % | |

Other income (expense): | | | | | | | | | | | | | | | |

Corporate interest income | | $ | 424 | | | $ | 2,426 | | | $ | (2,002 | ) | | (83 | )% |

Corporate interest expense | | | (87,315 | ) | | | (95,241 | ) | | | 7,926 | | | (8 | )% |

Gain (loss) on sales of investments, net | | | (433 | ) | | | 502 | | | | (935 | ) | | * | |

Loss on early extinguishment of debt | | | (2,999 | ) | | | (2,851 | ) | | | (148 | ) | | 5 | % |

Equity in income (loss) of investments and venture funds | | | (3,129 | ) | | | 4,699 | | | | (7,828 | ) | | * | |

| | | | | | | | | | | | | | | |

Total other income (expense) | | $ | (93,452 | ) | | $ | (90,465 | ) | | $ | (2,987 | ) | | 3 | % |

| | | | | | | | | | | | | | | |

| * | | Percentage not meaningful |

Total other income (expense) for the three months ended March 31, 2009 primarily consisted of corporate interest expense resulting from our corporate debt, which includes the springing lien notes and senior notes. Corporate interest expense decreased 8% to $87.3 million for the three months ended March 31, 2009, which was primarily due to the retirement of the $450 million in mandatory convertible notes during the fourth quarter of 2008.

The loss on early extinguishment of debt of $3.0 million for the three months ended March 31, 2009 was due to the early extinguishment of FHLB advances. The loss on early extinguishment of debt of $2.9 million for the three months ended March 31, 2008 was due to a loss of $10.8 million related to the early extinguishment of FHLB advances and a loss of $0.6 million on the prepayment of debt related to the sale of the corporate aircraft. These losses were partially offset by an $8.5 million gain recognized on the exchange of $25.0 million of our senior notes for 4.5 million shares of our common stock.

Income Tax Benefit

Income tax benefit was $111.4 million during the three months ended March 31, 2009 compared to $56.6 million for the same period in 2008. Our effective tax rates for the three months ended March 31, 2009 and 2008 were (32.4)% and (37.9)%, respectively.

13

We expect our 2009 tax expense to be based on a pro-forma tax rate in the range of 36% to 38% before taking into account $33.0 million of projected 2009 incremental tax expense, which is summarized in the following table (dollars in millions):

| | | |

| | | Projected

Year Ended

December 31, 2009

Tax Expense |

Incremental tax benefits | | | |

Tax exempt income | | $ | 3.8 |

Low income housing tax credits | | | 2.5 |

| | | |

Total tax benefits | | | 6.3 |

| | | |

Incremental tax expenses | | | |

Non-deductible officer’s compensation | | | 2.1 |

Tax rate differential of international operations | | | 4.1 |

Foreign valuation allowance | | | 4.3 |

Non-deductible portion of interest expense on springing lien notes | | | 28.8 |

| | | |

Total tax expense | | | 39.3 |

| | | |

Incremental tax items | | $ | 33.0 |

| | | |

A proportionate amount of these incremental tax items were included in the $111.4 million income tax benefit for the three months ended March 31, 2009.

During the three months ended March 31, 2009 we did not provide for a valuation allowance against our federal deferred tax assets. We are required to establish a valuation allowance for deferred tax assets and record a charge to income if we determine, based on available evidence at the time the determination is made, that it is more likely than not that some portion or all of the deferred tax assets will not be realized. If we did conclude that a valuation allowance was required, the resulting loss would have a material adverse effect on our results of operations, financial condition and our regulatory capital position at E*TRADE Bank.

We did not establish a valuation allowance against our federal deferred tax assets as of March 31, 2009 as we believe that it is more likely than not that all of these assets will be realized. Our evaluation focused on identifying significant, objective evidence that we will be able to realize our deferred tax assets in the future. We reviewed the estimated future taxable income for our trading and investing and balance sheet management segments separately and determined that our net operating losses in 2007 and 2008 were due solely to the credit losses in our balance sheet management segment. We believe these losses were caused by the crisis in the residential real estate and credit markets which significantly impacted our asset-backed securities and home equity loan portfolios in 2007 and continued to generate credit losses in 2008. We estimate that these credit losses will continue in future periods; however, we ceased the business activities which we believe are the root cause of these losses. Therefore, while we do expect credit losses to continue in future periods, we do expect these amounts to decline when compared to our credit losses in 2007 and 2008. Our trading and investing segment generated substantial book taxable income for each of the last six years and we estimate that it will continue to generate taxable income in future periods at a level sufficient to generate taxable income for the Company as a whole. We consider this to be significant, objective evidence that we will be able to realize our deferred tax assets in the future.

Our analysis of the need for a valuation allowance recognizes that we are in a cumulative book taxable loss position as of the three-year period ended December 31, 2008 and the three months ended March 31, 2009, which is considered significant, objective evidence that we may not be able to realize some portion of our deferred tax assets in the future. However, we believe we are able to rely on our forecasts of future taxable income and overcome the uncertainty created by the cumulative loss position.

14

The crisis in the residential real estate and credit markets has created significant volatility in our results of operations. This volatility is isolated almost entirely to our balance sheet management segment. Our forecasts for this segment include assumptions regarding our estimate of future expected credit losses, which we believe to be the most variable component of our forecasts of future taxable income. We believe this variability could create a book loss in our overall results for an individual reporting period while not significantly impacting our overall estimate of taxable income over the period in which we expect to realize our deferred tax assets. Conversely, we believe our trading and investing segment will continue to produce a stable stream of income which we believe we can reliably estimate in both individual reporting periods as well as over the period in which we estimate we will realize our deferred tax assets.

In evaluating the need for a valuation allowance, we estimated future taxable income based on management approved forecasts. This process required significant judgment by management about matters that are by nature uncertain. If future events differ significantly from our current forecasts, a valuation allowance may need to be established, which would have a material adverse effect on our results of operations, financial condition and our regulatory capital position at E*TRADE Bank. In addition, a significant portion of the net deferred tax asset relates to a $2.3 billion federal tax loss carryforward, the utilization of which may be further limited in the event of certain material changes in the ownership of the Company. We will continue to monitor and update our assumptions and forecasts of future taxable income and assess the need for a valuation allowance.

15

SEGMENT RESULTS REVIEW

Beginning in the first quarter of 2009, we revised our segment financial reporting to reflect the manner in which our chief operating decision maker had begun assessing the Company’s performance and making resource allocation decisions. As a result, we now report our operating results in two segments: 1) “Trading and Investing”, which includes the businesses that were formerly in the “Retail” segment and now includes our market-making business, and 2) “Balance Sheet Management”, which includes the businesses from the former “Institutional” segment, other than the market-making business. The Company’s segment financial information from prior periods has been reclassified in accordance with the new segment financial reporting.

Trading and Investing

The following table summarizes trading and investing financial and key metrics for the periods ended March 31, 2009 and 2008 (dollars in thousands, except for key metrics):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | 2009 vs. 2008 | |

| | | 2009 | | | 2008 | | | Amount | | | % | |

Trading and investing segment income: | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 161,675 | | | $ | 207,306 | | | $ | (45,631 | ) | | (22 | )% |

Commission | | | 125,626 | | | | 121,669 | | | | 3,957 | | | 3 | % |

Fees and service charges | | | 45,055 | | | | 50,877 | | | | (5,822 | ) | | (11 | )% |

Principal transactions | | | 17,642 | | | | 20,376 | | | | (2,734 | ) | | (13 | )% |

Loss on loans and securities, net | | | (22 | ) | | | (2 | ) | | | (20 | ) | | * | |

Other revenue | | | 8,894 | | | | 9,753 | | | | (859 | ) | | (9 | )% |

| | | | | | | | | | | | | | | |

Net segment revenue | | | 358,870 | | | | 409,979 | | | | (51,109 | ) | | (12 | )% |

Total segment expense | | | 236,720 | | | | 285,956 | | | | (49,236 | ) | | (17 | )% |

| | | | | | | | | | | | | | | |

Total trading and investing segment income | | $ | 122,150 | | | $ | 124,023 | | | $ | (1,873 | ) | | (2 | )% |

| | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | |

Customer assets (dollars in billions) | | $ | 110.4 | | | $ | 163.8 | | | $ | (53.4 | ) | | (33 | )% |

Net new customer assets (dollars in billions) | | $ | 3.5 | | | $ | 0.3 | | | $ | 3.2 | | | 1067 | % |

Customer cash and deposits (dollars in billions) | | $ | 34.4 | | | $ | 33.9 | | | $ | 0.5 | | | 1 | % |

DARTs | | | 194,482 | | | | 180,555 | | | | 13,927 | | | 8 | % |

Average commission per trade | | $ | 10.59 | | | $ | 11.05 | | | $ | (0.46 | ) | | (4 | )% |

End of period margin debt (dollars in billions) | | $ | 2.5 | | | $ | 6.5 | | | $ | (4.0 | ) | | (62 | )% |

End of period brokerage accounts | | | 2,660,584 | | | | 2,477,892 | | | | 182,692 | | | 7 | % |

| * | | Percentage not meaningful |

Our trading and investing segment generates revenue from brokerage and banking relationships with investors and from market-making activities. This segment generates six primary sources of revenue: net operating interest income; commission; fees and service charges; principal transactions; loss on loans and securities, net; and other revenue. Other revenue includes results from our stock plan administration products and services, as we ultimately service customers through these corporate relationships.

During the fourth quarter of 2007, we experienced a disruption in our customer base which caused a decline in the core drivers of our trading and investing segment, including: net new accounts, customer cash and deposits, DARTs, margin debt and customer assets. We believe this disruption was due to the uncertainty surrounding the Company in connection with the credit related losses in our balance sheet management segment. While we anticipate credit related losses will be at historically high levels in future periods, we believe our customer base stabilized and returned to modest growth during 2008. During the first quarter of 2009, our customer base continued to show positive growth trends, including adding approximately 56,000 net new

16

accounts and growth in net new customer assets of approximately $3.5 billion. We believe these are indications that our trading and investing segment has not only stabilized, but is showing signs of robust and sustained growth.

Trading and investing segment income decreased 2% to $122.2 million for the three months ended March 31, 2009 compared to the same period in 2008. This was due primarily to a decrease in net operating interest income and fees and service charges. These were partially offset by a decrease in total segment expense.

Trading and investing net operating interest income decreased 22% to $161.7 million for the three months ended March 31, 2009 compared to the same period in 2008. This decrease was driven primarily by the decline in margin debt between the comparable periods.

Trading and investing commission revenue increased 3% to $125.6 million for the three months ended March 31, 2009 compared to the same period in 2008. The increase in commission revenue was primarily the result of an increase in DARTs of 8%, which was slightly offset by a decrease of 4% in the average commission per trade.

Trading and investing fees and service charges decreased 11% to $45.1 million for the three months ended March 31, 2009 compared to the same period in 2008. This decrease was primarily due to a decrease in advisory management fees due to the sale of Retirement Advisors of America in the second quarter of 2008.

Trading and investing principal transactions decreased 13% to $17.6 million for the three months ended March 31, 2009 compared to the same period in 2008. The decline in principal transactions revenue was driven by a 40% decrease in our average revenue capture per 1,000 equity shares traded to $0.339 for the three months ended March 31, 2009. This decrease was partially offset by an increase of 49% in our equity shares traded. Although overall equity shares traded increased 49%, the increased volume was primarily due to bulletin board trades, which earn lower revenue per trade than other market-making trades.

Trading and investing segment expense decreased 17% to $236.7 million for three months ended March 31, 2009 compared to the same period in 2008. This decrease related primarily to a decrease in compensation due to lower salary expense as a result of a reduction in our employee base.

As of March 31, 2009, we had approximately 2.7 million active brokerage accounts, 1.0 million stock plan accounts and 0.8 million active banking accounts. For the three months ended March 31, 2009 and 2008, our brokerage products contributed 65% and 64%, respectively, and our banking products, which includes sweep products, contributed 25% for both periods, of total trading and investing net revenue. All other products contributed less than 10% of total trading and investing net revenue for the three months ended March 31, 2009 and 2008.

17

Balance Sheet Management

The following table summarizes balance sheet management financial and key metrics for the periods ended March 31, 2009 and 2008 (dollars in thousands, except for key metrics):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, | | | Variance | |

| | | 2009 vs. 2008 | |

| | | 2009 | | | 2008 | | | Amount | | | % | |

Balance sheet management segment loss: | | | | | | | | | | | | | | | |

Net operating interest income | | $ | 116,987 | | | $ | 119,065 | | | $ | (2,078 | ) | | (2 | )% |

Commission | | | — | | | | 586 | | | | (586 | ) | | * | |

Fees and service charges | | | 1,660 | | | | 4,064 | | | | (2,404 | ) | | (59 | )% |

Principal transactions | | | — | | | | 114 | | | | (114 | ) | | * | |

Gain (loss) on loans and securities, net | | | 16,529 | | | | (8,565 | ) | | | 25,094 | | | * | |

Other revenue | | | 3,297 | | | | 3,867 | | | | (570 | ) | | (15 | )% |

| | | | | | | | | | | | | | | |

Net segment revenue | | | 138,473 | | | | 119,131 | | | | 19,342 | | | 16 | % |

Provision for loan losses | | | 453,963 | | | | 233,871 | | | | 220,092 | | | 94 | % |

Total segment expense | | | 57,264 | | | | 68,393 | | | | (11,129 | ) | | (16 | )% |

| | | | | | | | | | | | | | | |

Total balance sheet management segment loss | | $ | (372,754 | ) | | $ | (183,133 | ) | | $ | (189,621 | ) | | 104 | % |

| | | | | | | | | | | | | | | |

Key Metrics: | | | | | | | | | | | | | | | |

Nonperforming loans as a % of gross loans receivable | | | 5.36 | % | | | 2.02 | % | | | * | | | 3.34 | % |

Allowance for loan losses (dollars in millions) | | $ | 1,200.8 | | | $ | 565.9 | | | $ | 634.9 | | | 112 | % |

Allowance for loan losses as a % of nonperforming loans | | | 91.60 | % | | | 96.84 | % | | | * | | | (5.24 | )% |

| * | | Percentage not meaningful |

Our balance sheet management segment generates revenue from managing loans previously originated or purchased from third parties, and leveraging these loans and customer cash and deposit relationships to generate additional net operating interest income.

As a result of our exposure to the credit crisis in the residential real estate and credit markets, our balance sheet management segment incurred a loss of $372.8 million for the three months ended March 31, 2009. The loss was driven primarily by our provision for loan losses which was $454.0 million for the three months ended March 31, 2009.

Net operating interest income remained relatively flat at $117.0 million for the three months ended March 31, 2009 compared to the same period in 2008.

Gain (loss) on loans and securities, net increased to a gain of $16.5 million for the three months ended March 31, 2009 from a loss of $8.6 million for the same period in 2008. The increase was due primarily to a $37.8 million gain on securities and other investments, which was related to the sale of certain agency mortgage-backed securities in the first quarter of 2009. This gain was offset by $18.8 million of impairment recognized on certain securities in our CMO portfolio during the three months ended March 31, 2009, which was a result of the deterioration in the expected credit performance of the underlying loans in the securities. Further declines in the performance of our CMO portfolio could result in additional impairment in future periods(1).

Provision for loan losses increased $220.1 million to $454.0 million for the three months ended March 31, 2009 compared to the same period in 2008. The increase in the provision for loan losses was related primarily to

| (1) | | In the second quarter of 2009, we will adopt FSP No. FAS 115-2 and FAS 124-2 which amends the other-than-temporary impairment guidance in GAAP for debt securities. We expect the adoption of this standard to decrease the impact of impairments on our results of operations in future periods when compared to the impact we believe would have occurred without this new accounting standard. We are currently evaluating the impact of the adoption of FSP No. FAS 115-2 and FAS 124-2 to our financial condition, results of operations and cash flows. |

18

deterioration in the performance of our one- to four-family and home equity loan portfolios. We believe the deterioration in both of these portfolios was caused by several factors, including: home price depreciation in virtually all key markets; growing inventories of unsold homes; rising foreclosure rates; sustained contraction in the availability of credit; and a severe downturn in the economy. While we do believe the provision for loan losses will be at historically high levels in future periods, we do not expect those levels to be in excess of those incurred in 2008.

Total balance sheet management segment expense decreased 16% to $57.3 million for the three months ended March 31, 2009 compared to the same period in 2008 and was due primarily to lower salary expense due to a reduction in our employee base and a reduction in corporate overhead expenses, the majority of which are allocated to the balance sheet management segment.

BALANCE SHEET OVERVIEW

The following table sets forth the significant components of our consolidated balance sheet (dollars in thousands):

| | | | | | | | | | | | | |

| | | March 31,

2009 | | December 31,

2008 | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | | Amount | | | % | |

Assets: | | | | | | | | | | | | | |

Cash(1) | | $ | 6,392,541 | | $ | 4,995,447 | | $ | 1,397,094 | | | 28 | % |

Trading securities | | | 46,309 | | | 55,481 | | | (9,172 | ) | | (17 | )% |

Available-for-sale mortgage-backed and investment securities | | | 11,823,392 | | | 10,806,094 | | | 1,017,298 | | | 9 | % |

Margin receivables | | | 2,436,611 | | | 2,791,168 | | | (354,557 | ) | | (13 | )% |

Loans, net | | | 23,271,969 | | | 24,451,852 | | | (1,179,883 | ) | | (5 | )% |

Investment in FHLB stock | | | 183,863 | | | 200,892 | | | (17,029 | ) | | (8 | )% |

Other assets(2) | | | 5,292,191 | | | 5,237,281 | | | 54,910 | | | 1 | % |

| | | | | | | | | | | | | |

Total assets | | $ | 49,446,876 | | $ | 48,538,215 | | $ | 908,661 | | | 2 | % |

| | | | | | | | | | | | | |

Liabilities and shareholders’ equity: | | | | | | | | | | | | | |

Deposits | | $ | 27,641,485 | | $ | 26,136,246 | | $ | 1,505,239 | | | 6 | % |

Wholesale borrowings(3) | | | 11,029,193 | | | 11,735,056 | | | (705,863 | ) | | (6 | )% |

Customer payables | | | 4,181,332 | | | 3,753,332 | | | 428,000 | | | 11 | % |

Corporate debt | | | 2,752,673 | | | 2,750,532 | | | 2,141 | | | 0 | % |

Accounts payable, accrued and other liabilities | | | 1,384,042 | | | 1,571,553 | | | (187,511 | ) | | (12 | )% |

| | | | | | | | | | | | | |

Total liabilities | | | 46,988,725 | | | 45,946,719 | | | 1,042,006 | | | 2 | % |

Shareholders’ equity | | | 2,458,151 | | | 2,591,496 | | | (133,345 | ) | | (5 | )% |

| | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 49,446,876 | | $ | 48,538,215 | | $ | 908,661 | | | 2 | % |

| | | | | | | | | | | | | |

(1) | | Includes balance sheet line items cash and equivalents and cash and investments required to be segregated under federal or other regulations. |

(2) | | Includes balance sheet line items property and equipment, net, goodwill, other intangibles, net and other assets. |

(3) | | Includes balance sheet line items securities sold under agreements to repurchase and other borrowings. |

The increase in total assets was attributable primarily to an increase of $1.4 billion in cash and $1.0 billion in available-for-sale mortgage-backed and investment securities, offset by a decrease of $1.2 billion in loans, net. The increase in available-for-sale mortgage-backed and investment securities was primarily due to a $1.0 billion increase in our mortgage-backed securities. The decrease in loans, net was due to our strategy of reducing balance sheet risk and halting our previous focus on growing the balance sheet. For the foreseeable future, we

19

plan to allow our home equity loans to pay down, resulting in an overall decline in the balance of the loan portfolio. For the remainder of 2009, we also plan to allow total assets to decline in order to release additional regulatory capital which we are required to hold against these assets.

The increase in total liabilities was attributable primarily to the increase in deposits which was partially offset by a decrease in wholesale borrowings. While our deposits increased by $1.5 billion during the quarter, we expect these balances to decrease over the remainder of 2009 as we focus on decreasing total assets. The decrease in wholesale borrowings was a result of paying down our FHLB advances and securities sold under agreements to repurchase in the first quarter of 2009.

Available-for-Sale Mortgage-Backed and Investment Securities

Available-for-sale securities are summarized as follows (dollars in thousands):

| | | | | | | | | | | | | |

| | | March 31,

2009 | | December 31,

2008 | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

Mortgage-backed securities: | | | | | | | | | | | | | |

Backed by U.S. Government sponsored and federal agencies | | $ | 11,163,736 | | $ | 10,110,813 | | $ | 1,052,923 | | | 10 | % |

CMOs and other | | | 561,822 | | | 602,376 | | | (40,554 | ) | | (7 | )% |

| | | | | | | | | | | | | |

Total mortgage-backed securities | | | 11,725,558 | | | 10,713,189 | | | 1,012,369 | | | 9 | % |

Investment securities | | | 97,834 | | | 92,905 | | | 4,929 | | | 5 | % |

| | | | | | | | | | | | | |

Total available-for-sale securities | | $ | 11,823,392 | | $ | 10,806,094 | | $ | 1,017,298 | | | 9 | % |

| | | | | | | | | | | | | |

Available-for-sale securities represented 24% and 22% of total assets at March 31, 2009 and December 31, 2008, respectively. Available-for-sale securities increased 9% to $11.8 billion at March 31, 2009 compared to December 31, 2008, due primarily to the purchase of agency mortgage-backed securities in the first quarter of 2009. All mortgage-backed securities backed by U.S. Government sponsored and federal agencies are AAA-rated.

Margin Receivables

The margin receivables balance is a component of the margin debt balance, which is reported as a key trading and investing metric of $2.5 billion and $2.8 billion at March 31, 2009 and December 31, 2008, respectively. The total margin debt balance is summarized as follows (dollars in thousands):

| | | | | | | | | | | | | |

| | | March 31,

2009 | | December 31,

2008 | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

Margin receivables | | $ | 2,436,611 | | $ | 2,791,168 | | $ | (354,557 | ) | | (13 | )% |

Margin held by third parties and other | | | 24,109 | | | 20,676 | | | 3,433 | | | 17 | % |

| | | | | | | | | | | | | |

Margin debt | | $ | 2,460,720 | | $ | 2,811,844 | | $ | (351,124 | ) | | (12 | )% |

| | | | | | | | | | | | | |

20

Loans, Net

Loans, net are summarized as follows (dollars in thousands):

| | | | | | | | | | | | | | | |

| | | March 31,

2009 | | | December 31,

2008 | | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

One- to four-family | | $ | 12,539,663 | | | $ | 12,979,844 | | | $ | (440,181 | ) | | (3 | )% |

Home equity | | | 9,533,008 | | | | 10,017,183 | | | | (484,175 | ) | | (5 | )% |

Consumer and other loans: | | | | | | | | | | | | | | | |

Recreational vehicle | | | 1,496,754 | | | | 1,570,116 | | | | (73,362 | ) | | (5 | )% |

Marine | | | 406,331 | | | | 424,595 | | | | (18,264 | ) | | (4 | )% |

Commercial | | | 188,934 | | | | 214,084 | | | | (25,150 | ) | | (12 | )% |

Other | | | 85,565 | | | | 89,875 | | | | (4,310 | ) | | (5 | )% |

Unamortized premiums, net | | | 222,522 | | | | 236,766 | | | | (14,244 | ) | | (6 | )% |

Allowance for loan losses | | | (1,200,808 | ) | | | (1,080,611 | ) | | | (120,197 | ) | | 11 | % |

| | | | | | | | | | | | | | | |

Total loans, net | | $ | 23,271,969 | | | $ | 24,451,852 | | | $ | (1,179,883 | ) | | (5 | )% |

| | | | | | | | | | | | | | | |

Loans, net decreased 5% to $23.3 billion at March 31, 2009 from $24.5 billion at December 31, 2008. This decline was due primarily to our strategy of reducing balance sheet risk and halting our previous focus on growing the balance sheet. We do not expect to grow our loan portfolio for the foreseeable future. In addition, we plan to allow our home equity loans to pay down, resulting in an overall decline in the balance of the loan portfolio.

We have a credit default swap (“CDS”) on $4.0 billion of our first-lien residential real estate loan portfolio through a synthetic securitization structure. As of March 31, 2009, the balance of the loans covered by the CDS was $2.7 billion. A CDS provides, for a fee, an assumption by a third party of a portion of the credit risk related to the underlying loans. The CDS provides protection for losses in excess of $4.0 million, but not to exceed approximately $30.3 million. In addition, our regulatory risk-weighted assets were reduced as a result of this transaction because we transferred a portion of our credit risk to an unaffiliated third party. We recognized $1.4 million in losses on the portion of the loans covered under the CDS during the three months ended March 31, 2009 and $3.0 million in losses since we entered the CDS. We have not yet realized any recoveries from the CDS as losses on the covered loans have not yet exceeded $4.0 million; however, the estimated recoveries from the CDS for the next twelve months were $27.3 million at March 31, 2009, which is reflected in the allowance for loan losses.

Deposits

Deposits are summarized as follows (dollars in thousands):

| | | | | | | | | | | | | |

| | | March 31,

2009 | | December 31,

2008 | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

Money market and savings accounts | | $ | 14,257,747 | | $ | 12,692,729 | | $ | 1,565,018 | | | 12 | % |

Sweep deposit accounts | | | 10,243,981 | | | 9,650,431 | | | 593,550 | | | 6 | % |

Certificates of deposit | | | 2,033,182 | | | 2,363,385 | | | (330,203 | ) | | (14 | )% |

Checking accounts | | | 862,177 | | | 991,477 | | | (129,300 | ) | | (13 | )% |

Brokered certificates of deposit | | | 244,398 | | | 438,224 | | | (193,826 | ) | | (44 | )% |

| | | | | | | | | | | | | |

Total deposits | | $ | 27,641,485 | | $ | 26,136,246 | | $ | 1,505,239 | | | 6 | % |

| | | | | | | | | | | | | |

21

Deposits represented 59% and 57% of total liabilities at March 31, 2009 and December 31, 2008, respectively. Deposits generally provide us the benefit of lower interest costs, compared with wholesale funding alternatives. While our deposits increased by $1.5 billion during the quarter, we expect these balances to decrease over the remainder of 2009 as we focus on decreasing total assets. At March 31, 2009, 95% of our customer deposits were covered by FDIC insurance.

The deposits balance is a component of the total customer cash and deposits balance reported as a customer activity metric of $34.4 billion and $32.3 billion at March 31, 2009 and December 31, 2008, respectively. The total customer cash and deposits balance is summarized as follows (dollars in thousands):

| | | | | | | | | | | | | | | |

| | | March 31,

2009 | | | December 31,

2008 | | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

Deposits | | $ | 27,641,485 | | | $ | 26,136,246 | | | $ | 1,505,239 | | | 6 | % |

Less: brokered certificates of deposit | | | (244,398 | ) | | | (438,224 | ) | | | 193,826 | | | 44 | % |

| | | | | | | | | | | | | | | |

Retail deposits | | | 27,397,087 | | | | 25,698,022 | | | | 1,699,065 | | | 7 | % |

Customer payables | | | 4,181,332 | | | | 3,753,332 | | | | 428,000 | | | 11 | % |

Customer cash balances held by third parties and other | | | 2,775,407 | | | | 2,805,101 | | | | (29,694 | ) | | (1 | )% |

| | | | | | | | | | | | | | | |

Total customer cash and deposits | | $ | 34,353,826 | | | $ | 32,256,455 | | | $ | 2,097,371 | | | 7 | % |

| | | | | | | | | | | | | | | |

Wholesale Borrowings

Wholesale borrowings, which consist of securities sold under agreements to repurchase and other borrowings are summarized as follows (dollars in thousands):

| | | | | | | | | | | | | |

| | | March 31,

2009 | | December 31,

2008 | | Variance | |

| | | | 2009 vs. 2008 | |

| | | | Amount | | | % | |

Securities sold under agreements to repurchase | | $ | 6,946,160 | | $ | 7,381,279 | | $ | (435,119 | ) | | (6 | )% |

| | | | | | | | | | | | | |

FHLB advances | | $ | 3,503,600 | | $ | 3,903,600 | | $ | (400,000 | ) | | (10 | )% |

Subordinated debentures | | | 427,349 | | | 427,328 | | | 21 | | | 0 | % |

Other(1) | | | 152,084 | | | 22,849 | | | 129,235 | | | 566 | % |

| | | | | | | | | | | | | |

Total other borrowings | | $ | 4,083,033 | | $ | 4,353,777 | | $ | (270,744 | ) | | (6 | )% |

| | | | | | | | | | | | | |

Total wholesale borrowings | | $ | 11,029,193 | | $ | 11,735,056 | | $ | (705,863 | ) | | (6 | )% |

| | | | | | | | | | | | | |

(1) | | Includes approximately $101 million payable to Lehman Brothers related to terminated derivatives transactions. Refer to Note 6—Accounting for Derivative Financial Instruments and Hedging Activities in Item 1. Consolidated Financial Statements for more information. |

Wholesale borrowings represented 23% and 26% of total liabilities at March 31, 2009 and December 31, 2008, respectively. The decrease in wholesale borrowings of $0.7 billion during for the three months ended March 31, 2009 was due primarily to a decrease in securities sold under agreements to repurchase and FHLB advances. Securities sold under agreements to repurchase coupled with FHLB advances are the primary wholesale funding sources of the Bank. As a result, we expect these balances to fluctuate over time as our deposits and our interest-earning assets fluctuate.

22

Corporate Debt

Corporate debt by type is shown as follows (dollars in thousands):

| | | | | | | | | | | | | |

| | | Face Value | | Discount | | | Fair Value

Adjustment | | Net |

March 31, 2009 | | | | | | | | | | | | | |

Senior notes: | | | | | | | | | | | | | |

8% Notes, due 2011 | | $ | 435,515 | | $ | (1,601 | ) | | $ | 12,484 | | $ | 446,398 |

7 3/8% Notes, due 2013 | | | 414,665 | | | (4,118 | ) | | | 30,834 | | | 441,381 |

7 7/8% Notes, due 2015 | | | 243,177 | | | (1,997 | ) | | | 12,693 | | | 253,873 |

| | | | | | | | | | | | | |

Total senior notes | | | 1,093,357 | | | (7,716 | ) | | | 56,011 | | | 1,141,652 |

Springing lien notes 12 1/2%, due 2017 | | | 2,057,000 | | | (455,101 | ) | | | 9,122 | | | 1,611,021 |

| | | | | | | | | | | | | |

Total corporate debt | | $ | 3,150,357 | | $ | (462,817 | ) | | $ | 65,133 | | $ | 2,752,673 |

| | | | | | | | | | | | | |

| | | | |

| | | Face Value | | Discount | | | Fair Value

Adjustment | | Net |

December 31, 2008 | | | | | | | | | | | | | |

Senior notes: | | | | | | | | | | | | | |

8% Notes, due 2011 | | $ | 435,515 | | $ | (1,763 | ) | | $ | 13,855 | | $ | 447,607 |

7 3/8% Notes, due 2013 | | | 414,665 | | | (4,334 | ) | | | 32,435 | | | 442,766 |

7 7/8% Notes, due 2015 | | | 243,177 | | | (2,071 | ) | | | 13,183 | | | 254,289 |

| | | | | | | | | | | | | |

Total senior notes | | | 1,093,357 | | | (8,168 | ) | | | 59,473 | | | 1,144,662 |

Springing lien notes 12 1/2%, due 2017 | | | 2,057,000 | | | (460,515 | ) | | | 9,385 | | | 1,605,870 |

| | | | | | | | | | | | | |

Total corporate debt | | $ | 3,150,357 | | $ | (468,683 | ) | | $ | 68,858 | | $ | 2,750,532 |

| | | | | | | | | | | | | |

LIQUIDITY AND CAPITAL RESOURCES

We have established liquidity and capital policies. The objectives of these policies are to support the successful execution of our business strategies while ensuring ongoing and sufficient liquidity through the business cycle. These policies are especially important during periods of stress in the financial markets, which have been ongoing since the fourth quarter of 2007 and will likely continue for some time. During the fourth quarter of 2007, we experienced a disruption in our customer base, which caused a significant decline in customer deposits. We believe this disruption was due to the uncertainty in connection with the credit related losses in our balance sheet management segment. Deposits are the primary source of liquidity for E*TRADE Bank, so this sudden and rapid decline created a substantial amount of liquidity risk. We followed our existing liquidity policies and contingency plans and successfully met our liquidity needs during this extraordinary period. We believe that our ability to meet liquidity needs during that time validates the effectiveness of our liquidity policies and contingency plans. While the liquidity risk associated with our customer deposits remains at increased levels, we believe the current level of risk is substantially lower than it was during the fourth quarter of 2007.