UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of November 2022

Commission File Number 001-38332

__________________________________

QIAGEN N.V.

(Translation of registrant’s name into English)

__________________________________

Hulsterweg 82

5912 PL Venlo

The Netherlands

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

QIAGEN N.V.

Form 6-K

TABLE OF CONTENTS

Item

Signatures

____________________________

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of Shareholders (the "Annual General Meeting") of QIAGEN N.V., a public limited liability company organized and existing under the laws of the Netherlands, with corporate seat in Venlo, the Netherlands (the "Company" or "QIAGEN") will be held on Thursday, June 23, 2022 at 10:00, local time, at Maaspoort, Oude Markt 30, 5911 HH Venlo, The Netherlands.

AGENDA

Undefined terms in this agenda shall have the meaning as set out in the explanatory notes to the agenda.

1.Opening;

2.Managing Board Report for the year ended December 31, 2021 (“Calendar Year 2021”);

3.Supervisory Board Report on the Company’s Annual Accounts (the “Annual Accounts”) for Calendar Year 2021;

4.Adoption of the Annual Accounts for Calendar Year 2021 (voting item);

5.Advisory Vote on the Remuneration Report 2021 (advisory voting item);

6.Reservation and dividend policy;

7.Discharge from liability of the Managing Directors for the performance of their duties during Calendar Year 2021 (voting item);

8.Discharge from liability of the Supervisory Directors for the performance of their duties during Calendar Year 2021 (voting item);

9.Appointment and reappointment of the following eight Supervisory Directors of the Company for a term running up to and including the day of the Annual General Meeting in 2023 (voting items):

(a)Dr. Metin Colpan;

(b)Mr. Thomas Ebeling;

(c)Dr. Toralf Haag;

(d)Prof. Dr. Ross L. Levine;

(e)Prof. Dr. Elaine Mardis;

(f)Dr. Eva Pisa;

(g)Mr. Lawrence A. Rosen; and

(h)Ms. Elizabeth E. Tallett

10.Reappointment of the following two Managing Directors of the Company for a term running up to and including the day of the Annual General Meeting in 2023 (voting items):

(a)Mr. Thierry Bernard; and

(b)Mr. Roland Sackers.

11.Reappointment of KPMG Accountants N.V. as auditors of the Company for the calendar year ending December 31, 2022 (voting item);

12.Authorization of the Supervisory Board, until December 23, 2023 to (voting items):

(a)issue a number of ordinary shares and financing preference shares and grant rights to subscribe for such shares, the aggregate par value of which shall be equal to the aggregate par value of fifty percent (50%) of shares issued and outstanding in the capital of the Company as at December 31, 2021 as included in the Annual Accounts for Calendar Year 2021;

(b)restrict or exclude the pre-emptive rights with respect to issuing ordinary shares or granting subscription rights, the aggregate par value of such shares or subscription rights shall be up to a maximum of ten percent (10%) of the aggregate par value of all shares issued and outstanding in the capital of the Company as at December 31, 2021;

13.Authorization of the Managing Board, until December 23, 2023, to acquire shares in the Company’s own share capital (voting item);

14.Discretionary rights for the Managing Board to implement a capital repayment by means of a synthetic share repurchase (voting item):

(a)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment to the Company's Articles of Association (Part I) to, amongst other things, increase the par value per ordinary share in the share capital of the Company (each a “QIAGEN Share”) by an amount to be determined by the Managing Board of the Company;

(b)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment of the Company's Articles of Association (Part II) to, amongst other things, consolidate the QIAGEN Shares at a consolidation ratio to be determined by the Managing Board, subject to the approval of the Supervisory Board (the reverse stock split);

(c)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment of the Company's Articles of Association (Part III) to decrease the par value per QIAGEN Share to an amount of EUR 0.01 and to repay to the shareholders an amount to be determined by the Managing Board, subject to the approval of the Supervisory Board, which amount will at maximum be USD 300 million in the aggregate; and

(d)Proposal to authorize each member of the Managing Board of the Company and each lawyer, (candidate) civil law notary and paralegal working at De Brauw Blackstone Westbroek N.V. to execute the three deeds of amendment of the Company's Articles of Association (Part I, II and III);

15.Cancellation of fractional QIAGEN Shares held by the Company (voting item);

16.Questions;

17.Closing.

Meeting documentation

Copies of the Annual Accounts for Calendar Year 2021, the reports of the Supervisory Board and the Managing Board, the Company's 2021 Remuneration Report, the explanatory notes to the agenda, including the list and biographies of binding nominees for (re-)appointment to the Supervisory Board and the Managing Board, a triptych containing an explanation to each of the proposed amendments to the Company's Articles of Association (Part I, II and III) as contemplated by Agenda Item 14 as well as documents reflecting the verbatim text of the amendments proposed under Agenda Item 14 can be obtained free of charge by shareholders and other persons entitled to attend the Annual General Meeting at the offices of the Company at Hulsterweg 82, 5912 PL Venlo, the Netherlands, and at the offices of American Stock Transfer and Trust Company, LLC ("AST") at 6201 15th Avenue, Brooklyn, New York 11219, United States of America, until the close of the Annual General Meeting.

Copies are also available on our website: https://corporate.qiagen.com/agm2022. In order to contribute to sustainability, we strongly encourage you to obtain your copies of the meeting documents electronically via our website.

Record Date

The record date for persons considered as entitled to participate and vote at the Annual General Meeting or by proxy, provided those persons are registered for the Annual General Meeting in accordance with the provisions set forth below, is close of business (05:00 p.m. New York time / 23:00 Frankfurt am Main time) on Thursday, May 26, 2022 (the "Record Date" and such persons 'record holders of shares').

Attendance

On or about May 27, 2022, a proxy statement together with an attendance form and form of proxy will be mailed to the record holders of shares as of the Record Date entitled to participate and vote at the Annual General Meeting. Record holders of shares wishing to exercise their rights in person are obliged to complete, sign and send the attendance form, such that the attendance form is received no later than 5 p.m. New York time (23:00 Frankfurt am Main time) on June 17, 2022 at the offices of AST, 6201 15th Avenue, Brooklyn, New York 11219, United States of America or by email at the following e-mail address: Admin7@Astfinancial.COM.

Proxy

Record holders of shares wishing to exercise their shareholder rights by proxy are obliged to complete, sign and send the proxy card, such that the proxy card is received no later than 5 p.m. New York time (23:00 Frankfurt am Main time) on June 20, 2022 at the offices of AST, 6201 15th Avenue, Brooklyn, New York 11219, United States of America or by email at the following e-mail address: Admin7@Astfinancial.COM.

The Company will send a card of admission to record holders of shares that have properly notified the Company of their intention to attend the Annual General Meeting.

Other matters

In case you have any queries with respect to the Annual General Meeting, please contact agm2022@qiagen.com.

The Annual General Meeting will be streamed live via video webcast on our website https://corporate.qiagen.com/agm2022. Shareholders will be able to follow the meeting in listen and view-only mode. It will not be possible to vote or address the meeting via the webcast.

Furthermore, you are advised to check our website (https://corporate.qiagen.com/agm2022) on a regular basis for updates on the Annual General Meeting. Considering the continuing circumstances regarding COVID-19 and, if, prior to the Annual General Meeting, stricter COVID-19 measures would become applicable, the Company may change the Annual General Meeting to a fully virtual meeting, provided that the Dutch Temporary Act Covid-19 Justice and Safety is still in force and allows so at that time.

Lastly, if you wish to attend the Annual General Meeting you are requested to do a COVID-19 self-test within the 24 hours prior to the meeting. If the test result is positive, you are requested to refrain from attending the Annual General Meeting in person. You are furthermore kindly encouraged to wear a face mask during your attendance of the Annual General Meeting.

The official language of the Annual General Meeting shall be the English language.

The Managing Board

Venlo, The Netherlands

May 11, 2022

Dear Shareholder:

You are cordially invited to attend the Annual General Meeting of Shareholders of QIAGEN N.V. (the “Company”) to be held on Thursday, June 23, 2022 at 10:00, local time, at Maaspoort, Oude Markt 30, 5911 HH Venlo, The Netherlands.1

We have attached a Notice of Annual General Meeting, including the Agenda and Explanatory Notes thereto, and enclosed an attendance form and proxy card for use in connection with the meeting.

We hope that you will be able to attend the Annual General Meeting. If you plan to do so, please complete and sign the enclosed attendance form and return it to American Stock Transfer and Trust Company, as specified thereon. We will then add your name to the admission list for the meeting and forward to you an entrance-ticket for the meeting. The signed attendance form must be received no later than 5 p.m. (New York time) on Friday, June 17, 2022 in order for you to attend the meeting.

The Annual General Meeting will also be streamed live via video webcast on our website https://corporate.qiagen.com/agm2022. Shareholders will be able to follow the meeting in listen and view-only mode. It will not be possible to vote or address the meeting via the webcast.

Whether or not you plan to attend the Annual General Meeting, it is important that your ordinary shares are represented. Therefore, please complete, sign, date and return the enclosed proxy card promptly in the enclosed envelope, which requires no postage if mailed in the United States. The completed proxy card must be received no later than 5:00 p.m. (New York time) on Monday, June 20, 2022 for your vote to count. Votes cast pursuant to a timely received proxy card shall be deemed votes cast in the meeting, and timely submitting your proxy will ensure your proper representation at the Annual General Meeting. If you physically attend the Annual General Meeting, you may vote in person if you wish, even if you have previously returned your proxy.

Sincerely,

/s/ Thierry Bernard /s/ Roland Sackers

THIERRY BERNARD ROLAND SACKERS

Managing Director Managing Director

Venlo, The Netherlands

May 11, 2022

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY CARD PROMPTLY.

________________________________

1 QIAGEN advises its shareholders to regularly check the Company's website (https://corporate.qiagen.com/agm2022) for updates on the Annual General Meeting. Considering the continuing circumstances regarding COVID-19 and, if, prior to the Annual General Meeting, stricter COVID-19 measures would become applicable, the Company may change the Annual General Meeting to a fully virtual meeting, provided that the Dutch Temporary Act Covid-19 Justice and Safety is still in force and allows so at that time.

QIAGEN N.V.

____________________________

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 23, 2022

____________________________

To The Shareholders:

Notice is hereby given that the Annual General Meeting of Shareholders (the “Annual General Meeting”) of QIAGEN N.V. (the “Company”), a public limited liability company organized and existing under the laws of The Netherlands, will be held on Thursday, June 23, 2022 at 10:00, local time, at Maaspoort, Oude Markt 30, 5911 HH Venlo, The Netherlands.

The Agenda of the Annual General Meeting of the Company, containing proposals of the Managing Board and the Supervisory Board of the Company, is as follows (undefined terms in this Agenda shall have the meaning as set out in the Explanatory Notes thereto):

1.Opening.

2.Managing Board Report for the year ended December 31, 2021 (“Calendar Year 2021”).

3.Supervisory Board Report on the Company’s Annual Accounts (the “Annual Accounts”) for Calendar Year 2021.

4.Adoption of the Annual Accounts for Calendar Year 2021 (voting item).

5.Advisory Vote on the Remuneration Report 2021 (advisory voting item).

6.Reservation and dividend policy.

7.Discharge from liability of the Managing Directors for the performance of their duties during Calendar Year 2021 (voting item).

8.Discharge from liability of the Supervisory Directors for the performance of their duties during Calendar Year 2021 (voting item).

9.Appointment and reappointment of the following eight Supervisory Directors of the Company for term running up to and including the day of the Annual General Meeting in 2023 (voting items):

(a)Dr. Metin Colpan;

(b)Mr. Thomas Ebeling;

(c)Dr. Toralf Haag;

(d)Prof. Dr. Ross L. Levine;

(e)Prof. Dr. Elaine Mardis;

(f)Dr. Eva Pisa;

(g)Mr. Lawrence A. Rosen; and

(h)Ms. Elizabeth E. Tallett.

10.Reappointment of the following two Managing Directors of the Company for a term running up to and including the day of the Annual General Meeting in 2023 (voting items):

(a)Mr. Thierry Bernard; and

(b)Mr. Roland Sackers.

11.Reappointment of KPMG Accountants N.V. as auditors of the Company for the calendar year ending December 31, 2022 (voting item).

12.Authorization of the Supervisory Board, until December 23, 2023 to (voting items):

(a)issue a number of ordinary shares and financing preference shares and grant rights to subscribe for such shares, the aggregate par value of which shall be equal to the aggregate par value of fifty percent (50%) of the shares issued and outstanding in the capital of the Company as at December 31, 2021 as included in the Annual Accounts for Calendar Year 2021; and

(b)restrict or exclude the pre-emptive rights with respect to issuing ordinary shares or granting subscription rights, the aggregate par value of such shares or subscription rights shall be up to a maximum of ten percent (10%) of the aggregate par value of all shares issued and outstanding in the capital of the Company as at December 31, 2021;

13.Authorization of the Managing Board, until December 23, 2023, to acquire shares in the Company’s own share capital (voting item).

14.Discretionary rights for the Managing Board to implement a capital repayment by means of a synthetic share repurchase (voting item):

(a)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment to the Company's Articles of Association (Part I) to, amongst other things, increase the par value per ordinary share in the share capital of the Company (each a “QIAGEN Share”) by an amount to be determined by the Managing Board of the Company;

(b)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment of the Company's Articles of Association (Part II) to, amongst other things, consolidate the QIAGEN Shares at a consolidation ratio to be determined by the Managing Board, subject to the approval of the Supervisory Board (the reverse stock split);

(c)Proposal to amend the Company's Articles of Association in accordance with the draft deed of amendment of the Company's Articles of Association (Part III) to decrease the par value per QIAGEN Share to an amount of EUR 0.01 and to repay to the shareholders an amount to be determined by the Managing Board, subject to the approval of the Supervisory Board, which amount will at maximum be USD 300 million in the aggregate; and

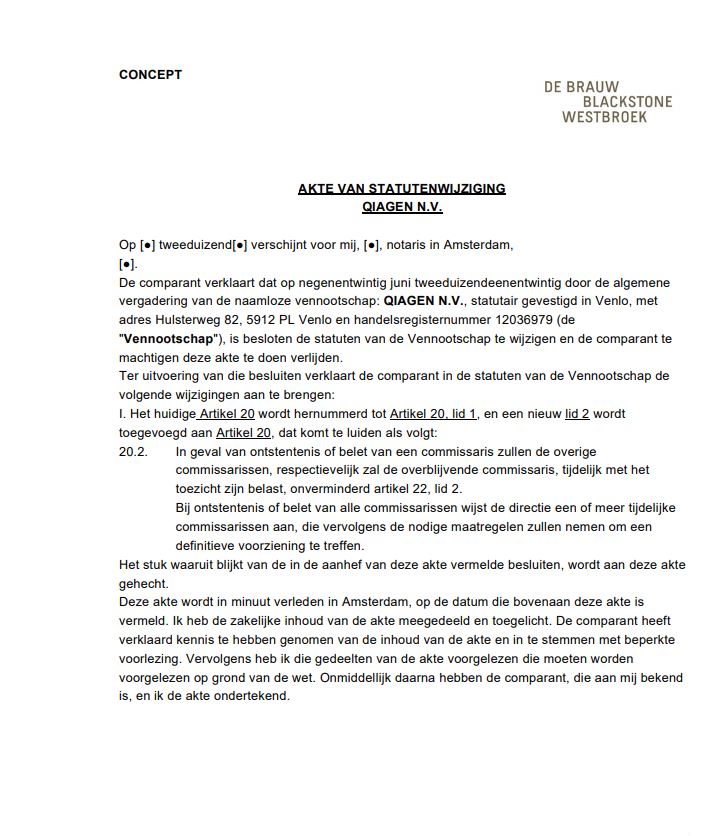

(d)Proposal to authorize each member of the Managing Board of the Company and each lawyer, (candidate) civil law notary and paralegal working at De Brauw Blackstone Westbroek N.V. to execute the three deeds of amendment of the Company's Articles of Association (Part I, II and III).

15.Cancellation of fractional QIAGEN Shares held by the Company (voting item).

16.Questions.

17.Closing.

Meeting documentation

Under the Articles of Association of the Company and Dutch law, copies of the Annual Accounts for Calendar Year 2021, the reports of the Supervisory Board and the Managing Board, the Company’s 2021 Remuneration Report, the list and biographies of binding nominees for (re-)appointment to the Supervisory Board and the Managing Board, a triptych containing an explanation to each of the proposed amendments to the Company's Articles of Association (Part I, II and III) as contemplated by Agenda Item 14 as well as documents reflecting the verbatim text of the amendments proposed under Agenda Item 14, the information sent to the record holders of QIAGEN Shares in connection with the Annual General Meeting and other documents relevant for the Annual General Meeting can be obtained free of charge by shareholders and other persons entitled to attend the Annual General Meeting at the offices of the Company at Hulsterweg 82, 5912 PL Venlo, The Netherlands, and at the offices of American Stock Transfer and Trust

Company, LLC at 6201 15th Avenue, Brooklyn, New York 11219, United States of America, until the close of the Annual General Meeting.

Copies are also available on our website: https://corporate.qiagen.com/agm2022. In order to contribute to sustainability, we strongly encourage you to obtain your copies of the meeting documents electronically via our website.

In an effort to reduce our cost of printing and mailing documents for the Annual General Meeting and to exhibit environmentally responsible conduct, we are not mailing paper copies of our 2021 Annual Report to our shareholders. The 2021 Annual Report, which provides additional information regarding our 2021 financial results, and copies of the Notice of Annual General Meeting, including the Agenda and Explanatory Notes thereto, and Annual Accounts for Calendar Year 2021, can be accessed on our website: https://corporate.qiagen.com/agm2022. Printed copies of the 2021 Annual Report can also be obtained free of charge by visiting our website: https://corporate.qiagen.com/investor-relations/ir-contacts/information-request-form/ or by contacting QIAGEN Sciences LLC, Attention: Executive Assistant to Chief Financial Officer, 19300 Germantown Rd, Germantown, MD 20874, United States of America, Phone number: +1 240 686 7774 until the close of the Annual General Meeting.

Record date

Close of business (5:00 p.m. New York time / 23:00 Frankfurt am Main time) on Thursday, May 26, 2022 is the record date (the “Record Date”) for the determination of the record holders of QIAGEN Shares entitled to attend and vote at the Annual General Meeting (in person or by proxy).

Attendance

All shareholders are cordially invited to attend the Annual General Meeting. If you plan to do so, please complete and sign the enclosed attendance form and return it as specified thereon. We will then add your name to the admission list for the meeting and forward to you an entrance-ticket for the Annual General Meeting.

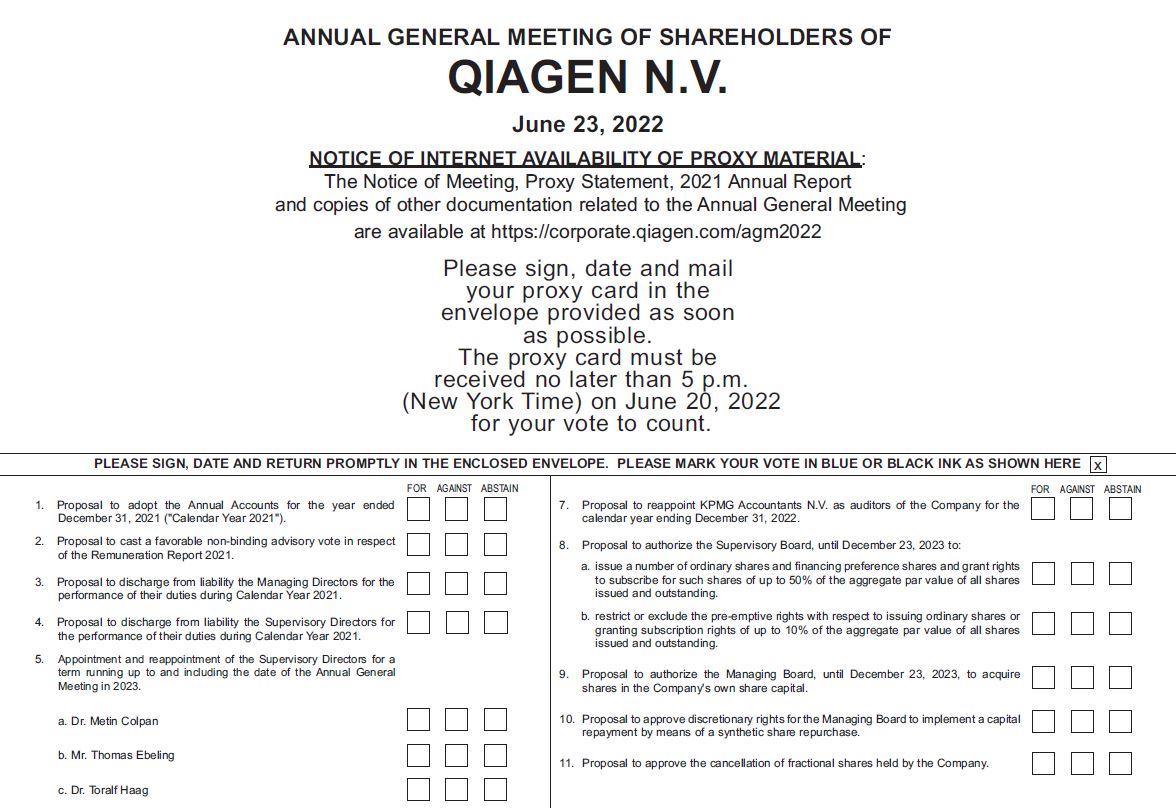

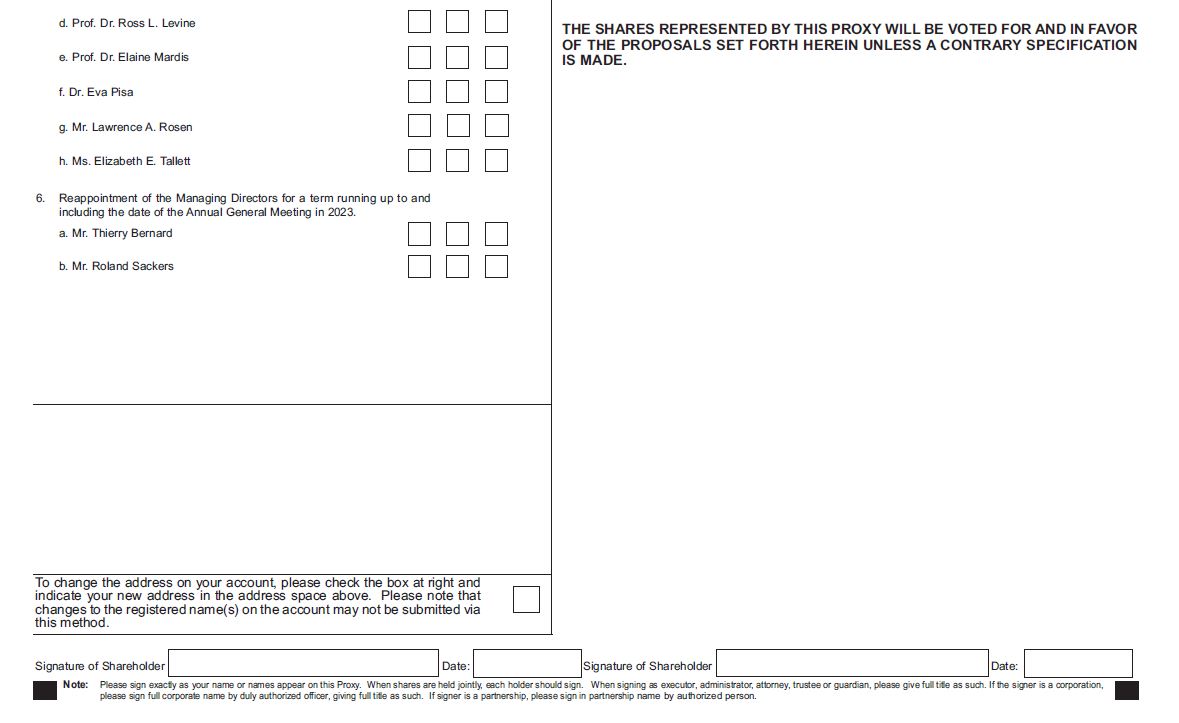

Voting

Whether you plan to attend the Annual General Meeting or not, you are requested to complete, sign, date and return the enclosed proxy card as soon as possible in accordance with the instructions on the card. A pre-addressed, postage prepaid return envelope is enclosed for your convenience. Completed proxy cards may also be submitted via email to Admin7@Astfinancial.com.

Other matters

In case you have any queries with respect to the Annual General Meeting, please contact agm2022@qiagen.com.

The Annual General Meeting will be streamed live via video webcast on our website https://corporate.qiagen.com/agm2022. Shareholders will be able to follow the meeting in listen and view-only mode. It will not be possible to vote or address the meeting via the webcast.

Furthermore, you are advised to check our website (https://corporate.qiagen.com/agm2022) on a regular basis for updates on the Annual General Meeting. Considering the continuing circumstances regarding COVID-19 and, if, prior to the Annual General Meeting, stricter COVID-19 measures would become applicable, the Company may change the Annual General Meeting to a fully virtual meeting, provided that the Dutch Temporary Act Covid-19 Justice and Safety is still in force and allows so at that time.

Lastly, if you wish to attend the Annual General Meeting you are requested to do a COVID-19 self-test within the 24 hours prior to the meeting. If the test result is positive, you are requested to refrain from attending the Annual General Meeting in person. You are furthermore kindly encouraged to wear a face mask during your attendance of the Annual General Meeting.

By Order of the Managing Board

/s/ Thierry Bernard /s/ Roland Sackers

THIERRY BERNARD ROLAND SACKERS

Managing Director Managing Director

May 11, 2022

Venlo, The Netherlands

QIAGEN N.V.

____________________________

ANNUAL GENERAL MEETING OF SHAREHOLDERS

____________________________

EXPLANATORY NOTES TO AGENDA

I. General

The enclosed proxy card and the accompanying Notice of Annual General Meeting of Shareholders and Agenda are being mailed to shareholders of QIAGEN N.V. (the “Company” or “QIAGEN”) in connection with the solicitation by the Company of proxies for use at the Annual General Meeting of Shareholders of the Company to be held on Thursday, June 23, 2022 at 10:00 local time, at Maaspoort, Oude Markt 30, 5911 HH Venlo, The Netherlands. These proxy solicitation materials will be mailed on or about May 27, 2022 to all shareholders of record as of Thursday, May 26, 2022, the record date for the Annual General Meeting.

Under the Articles of Association of the Company and Dutch law, copies of the Annual Accounts for Calendar Year 2021, the reports of the Company’s supervisory board (the “Supervisory Board”) and the Company’s managing board (the “Managing Board”), the Company’s 2021 Remuneration Report, the list and biographies of binding nominees for (re-)appointment to the Supervisory Board and the Managing Board, a triptych containing an explanation to each of the proposed amendments to the Company’s Articles of Association (Part I, II and III) as contemplated by Agenda Item 14 as well as documents reflecting the verbatim text of the amendments proposed under Agenda Item 14, the information sent to the record holders of QIAGEN Shares in connection with the Annual General Meeting and other documents relevant for the Annual General Meeting can be obtained free of charge by shareholders and other persons entitled to attend the Annual General Meeting at the offices of the Company at Hulsterweg 82, 5912 PL Venlo, The Netherlands, and at the offices of American Stock Transfer and Trust Company, LLC at 6201 15th Avenue, Brooklyn, New York 11219, United States of America, until the close of the Annual General Meeting. Copies are also available electronically on our website: https:// corporate.qiagen.com/agm2022. In order to contribute to sustainability, we strongly encourage you to obtain your copies of the meeting documents electronically via our website.

In an effort to support sustainable business practices and reduce printing and mailing costs, we are not mailing paper copies of the Company’s 2021 Annual Report (the “2021 Annual Report”) to our shareholders. The 2021 Annual Report, which provides additional information regarding our 2021 financial results, and copies of the Notice of Annual General Meeting, including the Agenda and Explanatory Notes, and Annual Accounts for 2021, can be accessed on our website: https://corporate.qiagen.com/agm2022. Printed copies of the 2021 Annual Report can also be obtained free of charge by visiting our website: https://corporate.qiagen.com/investor-relations/ir-contacts/information-request-form/ or by contacting QIAGEN Sciences LLC, Attention: Executive Assistant to Chief Financial Officer, 19300 Germantown Rd, Germantown, MD 20874, United States of America, Phone number: +1 240 686 7774 until the close of the Annual General Meeting.

The reasonable cost of soliciting proxies, including expenses in connection with preparing and mailing the proxy solicitation materials, will be borne by the Company. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of QIAGEN Shares for their expenses in forwarding proxy materials to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram, telex, electronic mail and personal solicitation by directors, officers or employees of the Company. No additional compensation will be paid for such solicitation.

The Company is not subject to the proxy solicitation rules contained in Regulation 14A promulgated under the United States Securities Exchange Act of 1934, as amended.

II. Voting and Solicitation

In order to attend, address and vote at the Annual General Meeting, or vote by proxy, the record holders of QIAGEN Shares are requested to advise the Company in writing in accordance with the procedure set forth in the

Notice of Annual General Meeting of Shareholders. Close of business (5:00 p.m. New York time / 23:00 Frankfurt am Main time) on Thursday, May 26, 2022 is the record date for the determination of the record holders of QIAGEN Shares entitled to participate in and vote at the Annual General Meeting or by proxy.

At May 3, 2022, there were 230,829,308.67 shares issued in the Company’s share capital (including 46.56 fractional QIAGEN Shares and 3,375,040.11 QIAGEN Shares held in treasury by the Company, which cannot be voted), which shares

were all QIAGEN Shares (i.e. ordinary shares); no preference shares or financing preference shares have been issued to date.

Shareholders are entitled to one vote for each whole QIAGEN Share held.

Each of the proposals to (re-)appoint members to the Supervisory Board and the Managing Board set forth under Agenda Items 9 and 10 will be adopted irrespective of the number of votes cast in favor, unless such proposal is overruled by at least two-thirds of the votes cast being votes against the proposal, provided such votes also represent more than fifty percent (50%) of the issued share capital of the Company as of the record date of the Annual General Meeting.

The proposals (i) to authorize the Supervisory Board to restrict or exclude the pre-emptive rights with respect to issuing shares or granting subscription rights set forth under Agenda Item 12.b, (ii) to decrease the par value of the QIAGEN Shares through an amendment of the Articles of Association in connection with the discretionary repayment of capital by means of a synthetic share repurchase set forth under Agenda Item 14.c, and (iii) to cancel fractional QIAGEN Shares the Company holds in its own share capital set forth under Agenda Item 15, shall be validly adopted if adopted by at least two-thirds of the votes cast at the Annual General Meeting if less than fifty percent (50%) of the Company’s issued share capital is represented at the Annual General Meeting. If fifty percent (50%) or more of the Company’s issued share capital is represented at the Annual General Meeting, the proposals set forth under Agenda Items 12.b, 14 (being one combined voting item, comprising Agenda Item 14.c referred to above) and 15 shall be validly adopted if adopted by a simple majority of the votes cast at the Annual General Meeting.

All other proposals presented to the shareholders at the Annual General Meeting shall be validly adopted if adopted by a simple majority of the votes cast at the Annual General Meeting. No majority requirement applies to the non-binding advisory vote referred to under Agenda Item 5.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivery to the Company of a written notice of revocation or a duly executed proxy bearing a later date. Any shareholder who has executed a proxy but is present at the Annual General meeting, and who wishes to vote in person, may do so by revoking his or her proxy as described in the preceding sentence. Mere attendance at the Annual General Meeting will not serve to revoke a proxy. QIAGEN Shares represented by valid proxies received in time for use at the Annual General Meeting and not revoked prior to the Annual General Meeting, will be voted at the Annual General Meeting.

III. Explanatory Notes to Agenda Items

Explanatory Note to Item 2—Managing Board Report for Calendar Year 2021

At the Annual General Meeting, the Managing Board will conduct a presentation on the performance of the Company during Calendar Year 2021.

Explanatory Note to Item 3—Supervisory Board Report on the Company’s Annual Accounts for Calendar Year 2021

At the Annual General Meeting, the Supervisory Board will conduct a presentation of its report on the Company’s Annual Accounts for Calendar Year 2021.

Explanatory Note to Item 4—Adoption of the Annual Accounts for the Calendar Year 2021

The shareholders of the Company are being asked to adopt the Annual Accounts for Calendar Year 2021. The Annual Report and the Annual Accounts have been prepared by the Managing Board and approved by the Supervisory Board.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

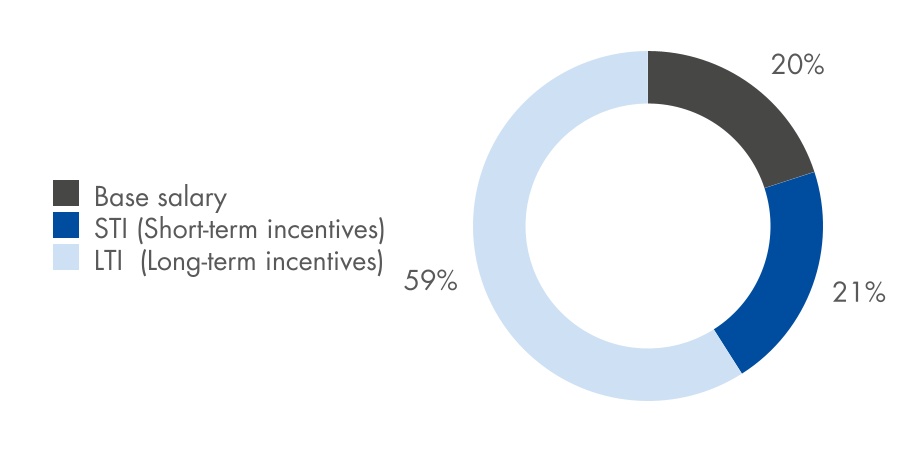

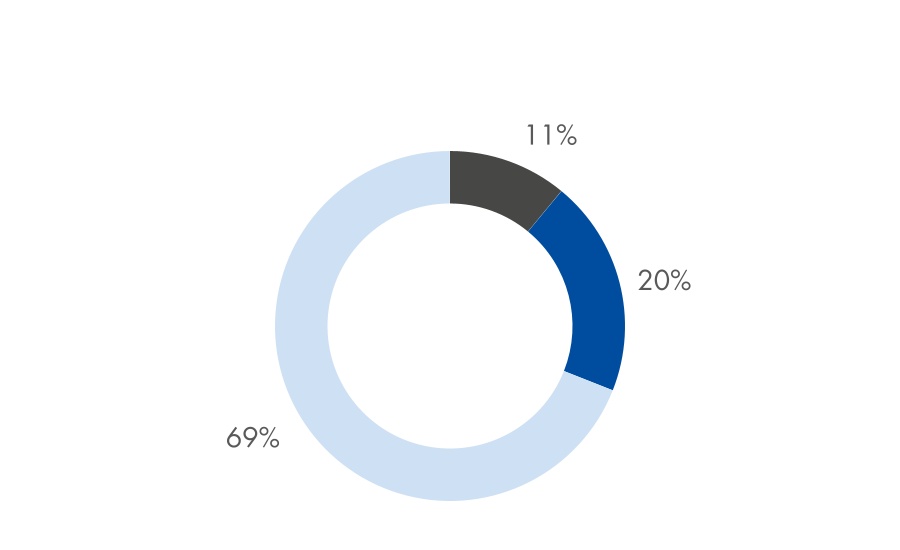

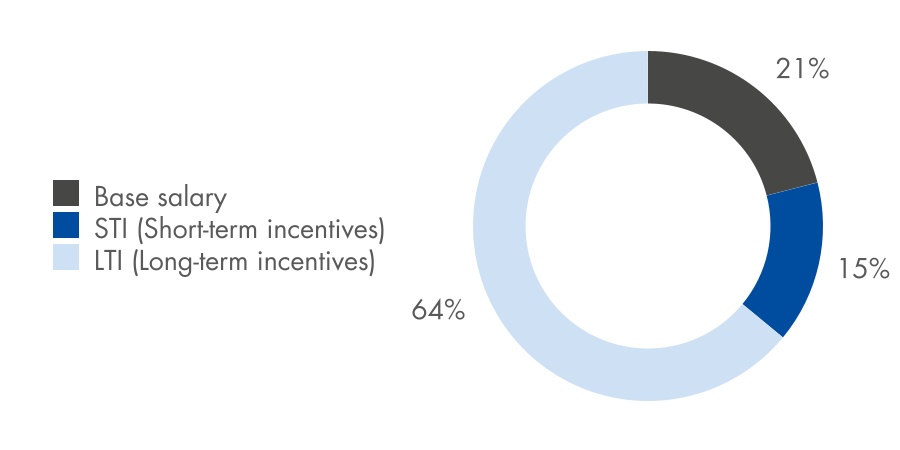

Explanatory Note to Item 5— Advisory Vote on the Remuneration Report 2021.

At the Annual General Meeting, the Company’s Compensation & Human Resources Committee will conduct a presentation on the implementation of the Remuneration Policies for the Managing Board and Supervisory Board during Calendar Year 2021. Following the presentation, it will be proposed to cast a favorable, non-binding, advisory vote in respect of the Remuneration Report 2021.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A NON-BINDING ADVISORY VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 6—Reservation and Dividend Policy

The Company’s reservation and dividend policy is to retain the profits by way of reserve. Consequently, the Company will not pay a dividend to the shareholders out of the Calendar Year 2021 profits. This policy benefits our shareholders by increasing share value, and the Company believes that this policy is aligned with shareholders’ taxation preferences.

As further set out under Agenda Item 14, the Company is proposing to the Annual General Meeting to grant the Managing Board the discretionary power to, subject to the approval of the Supervisory Board, return capital to the shareholders of the Company by means of a Synthetic Share Repurchase.

Explanatory Note to Item 7—Discharge from Liability of the Managing Directors

Under Dutch law, the adoption of the Annual Accounts does not automatically discharge the members of the Managing Board and the Supervisory Board from liability for the performance of their duties during Calendar Year 2021. The grant of such discharge from liability is typical for Dutch companies, and its approval is commonly included on the agenda for annual general meetings.

The shareholders of the Company are being asked to discharge the members of the Managing Board from liability for the performance of their duties during Calendar Year 2021, as described in the 2021 Annual Report and the 2021 Annual Accounts or as otherwise disclosed to the General Meeting of Shareholders.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 8—Discharge from Liability of the Supervisory Directors

The shareholders of the Company are being asked to discharge the members of the Supervisory Board from liability for the performance of their duties during Calendar Year 2021, as described in the 2021 Annual Report and the 2021 Annual Accounts or as otherwise disclosed to the General Meeting of Shareholders.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

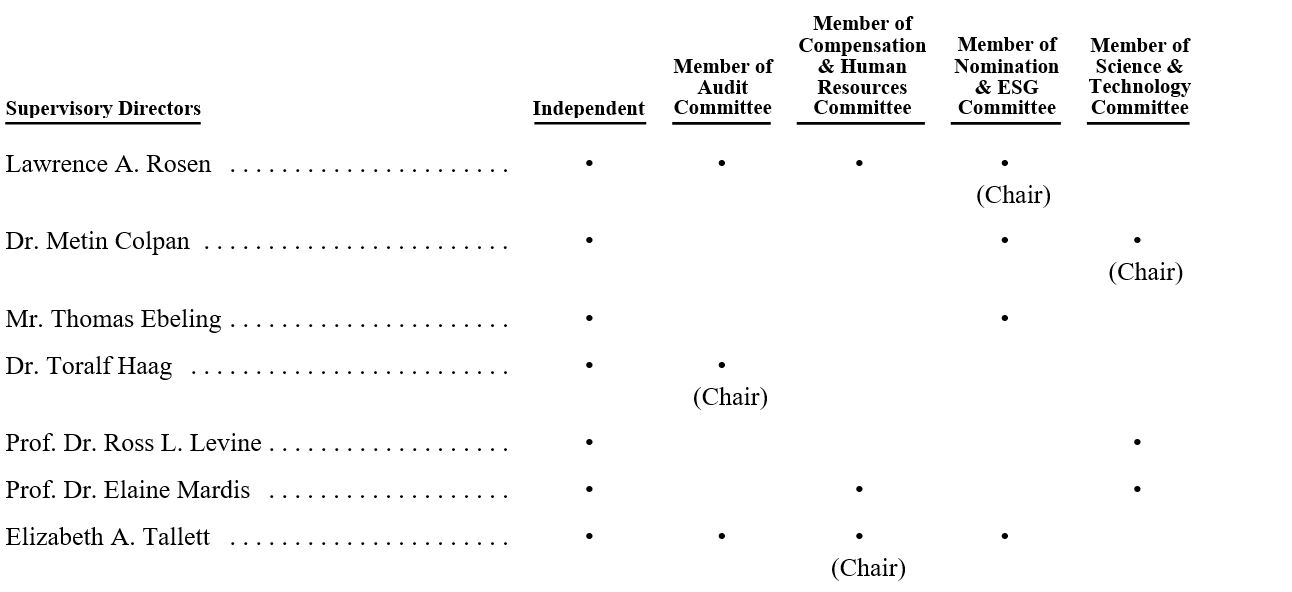

Explanatory Note to Items 9 and 10 —Reappointment of the Supervisory Directors and the Reappointment of the Managing Directors

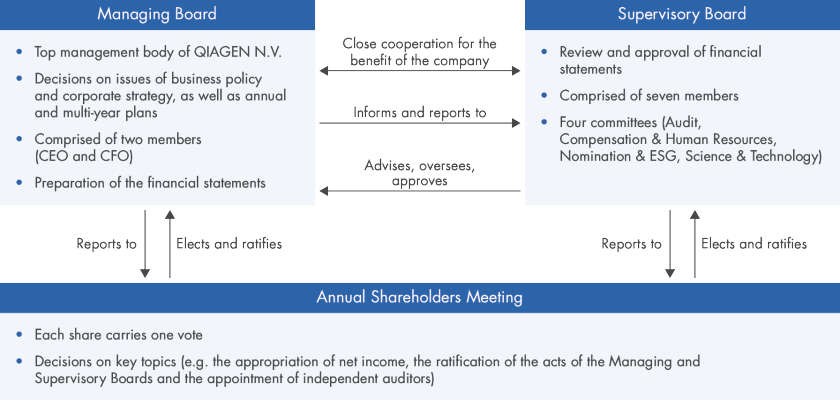

The Supervisory Board and the Managing Board acting together at a joint meeting (the “Joint Meeting”) resolved to make a binding nomination for the reappointment of the seven current members of the Supervisory Board and the appointment of one new member to the Supervisory Board (the “Supervisory Directors”). Furthermore, the Joint Meeting resolved to make a binding nomination for the reappointment of the two current members of the Managing Board.

The Supervisory Board consists of such number of members, with a minimum of three members, as the Joint Meeting may determine. The Supervisory Board presently consists of seven members. The Joint Meeting has set the number of members of the Supervisory Board at eight as of the Annual General Meeting. The Supervisory Directors are appointed by a vote of the shareholders of the Company at the Annual General Meeting, subject to the authority of the Supervisory Board to appoint up to one-third of its members if vacancies occur during a calendar year. The Managing Board has one or more members, as determined by the Supervisory Board. The Managing Board presently consists of two members. The members of the Managing Board (the “Managing Directors”) are appointed by a vote of the shareholders of the Company at the Annual General Meeting.

The Supervisory Board and the Managing Board at the Joint Meeting may make a binding nomination to fill each vacancy on the Supervisory Board and Managing Board. At the Annual General Meeting, the shareholders may overrule the binding nature of a nomination by resolution adopted with a majority of at least two-thirds of the votes cast, provided such majority also represents more than half the issued share capital of the Company as of the date of the Annual General Meeting. Our shareholders vote for each nominee for (re-)appointment to our Supervisory Board and Managing Board as a separate voting item.

It is proposed to reappoint the current members of the Supervisory Board and to appoint Dr. Eva Pisa as new Supervisory Board member as per the below, for a period beginning on the date following the date of the Annual General Meeting, until and including the date of the Annual General Meeting held in the following calendar year. It is furthermore proposed to reappoint the persons nominated for appointment to the Managing Board as per the below for a period beginning on the date following the date of the Annual General Meeting, until and including the date of the Annual General Meeting held in the following calendar year.

By unanimous written consent, the Joint Meeting resolved to make a binding nomination for eight members of the Supervisory Board and two members of the Managing Board. The eight binding nominees for election to the Supervisory Board positions are as follows:

•Nomination for position no. 1: Dr. Metin Colpan;

•Nomination for position no. 2: Mr. Thomas Ebeling;

•Nomination for position no. 3: Dr. Toralf Haag;

•Nomination for position no. 4: Prof. Dr. Ross L. Levine;

•Nomination for position no. 5: Prof. Dr. Elaine Mardis;

•Nomination for position no. 6: Dr. Eva Pisa;

•Nomination for position no. 7: Mr. Lawrence A. Rosen; and

•Nomination for position no. 8: Ms. Elizabeth E. Tallett.

The Supervisory Board believes that these nominees meet the criteria for Supervisory Board positions, as approved by the Supervisory Board and set forth on the Company’s website, and that they will continue to deliver significant contributions in view of their broad international, financial and management experience, integrity and ethics. This applies in particular for Dr. Metin Colpan, Prof. Dr. Elaine Mardis, Mr. Lawrence A. Rosen and Ms. Elizabeth E. Tallett, who have served on the Supervisory Board for eight years or more. The Dutch Corporate Governance Code states that reasons should be given for a reappointment after an eight-year period. The Supervisory Board believes that the in-depth knowledge of the Company represented by Dr. Colpan, Prof. Dr. Mardis, Mr. Rosen and Ms. Tallett is very valuable for QIAGEN and beneficially supplements the diverse and mixed profile of the Supervisory Board. The experience and qualifications of each nominee to the Supervisory Board are described below.

The binding nominations for the two Managing Board positions are as follows:

•Nomination for position no. 1: Mr. Thierry Bernard; and

•Nomination for position no. 2: Mr. Roland Sackers.

The following is a brief summary of the background of each of the Supervisory Director and Managing Director nominees. References to “QIAGEN” and the “Company” in relation to periods prior to April 29, 1996 mean QIAGEN GmbH and its consolidated subsidiaries.

Dr. Metin Colpan, 67, is a co-founder of QIAGEN and was the Chief Executive Officer and a Managing Director from 1985 to 2003. Dr. Colpan has been a member of the Supervisory Board since 2004 and has served as Chair of the Science & Technology Committee since 2014. He has been a member of the Nomination & ESG Committee since 2015. Dr. Colpan obtained his Ph.D. and M.S. in Organic Chemistry and Chemical Engineering from the Darmstadt Institute of Technology in 1983. Prior to founding QIAGEN, Dr. Colpan was an Assistant Investigator at the Institute for Biophysics at the University of Düsseldorf. Dr. Colpan has extensive experience in sample technologies, and in particular in the separation and purification of nucleic acids, and has many patents in the field. Dr. Colpan also serves as a Supervisory Board member of CGR GmbH in Mettmann, Germany, and Heilpflanzenwohl AG in Baar, Germany.

Mr. Thomas Ebeling, 63, joined the Supervisory Board and the Nomination & ESG Committee in 2021. Mr. Ebeling has been an advisor in recent years to various businesses after having served as the CEO of the publicly listed German media group ProSiebenSat.1 Media from 2009 to 2018. Prior to that, he worked for the global healthcare company Novartis from 1997 to 2008, including roles as CEO of Novartis Pharmaceuticals and also as CEO of Novartis Consumer Health. Since beginning his career in 1987, Mr. Ebeling held various positions in marketing and sales in the consumer goods industry before joining Novartis. He previously served on the Supervisory Boards of Bayer AG in Germany and Lonza AG in Switzerland. Mr. Ebeling has a degree in psychology from the University of Hamburg.

Dr. Toralf Haag, 56, joined the Supervisory Board and the Audit Committee in 2021. He has served since October 2018 as Chairman of the Corporate Board of Management of Voith GmbH & Co. KGaA in Germany, a global technology company with more than EUR 4 billion in annual sales and over 19,000 employees. Before joining Voith in October 2016 as Chief Financial Officer, Dr. Haag served for more than 11 years as CFO and Member of the Executive Committee of Lonza Group AG. He began his career in 1994 as the personal assistant to the CEO of Thyssen Handelsunion AG after earning a degree in Business Administration from the University of Augsburg and a Ph.D. at the University of Kiel.

Prof. Dr. Ross L. Levine, 50, joined the Supervisory Board and its Science & Technology Committee in 2016. He is a physician-scientist focused on researching and treating blood and bone marrow cancers as the Laurence Joseph Dineen Chair in Leukemia Research, the Chief of Molecular Cancer Medicine, and an Attending Physician at Memorial Sloan Kettering Cancer Center, as well as Professor of Medicine at Weill Cornell Medical College. He leads a research lab investigating genetics and targeted therapies in myeloid malignancies and is interested in application of next-generation sequencing technology in the practice of medicine in hematologic cancers. He trained in internal medicine at Massachusetts General Hospital and in hematology-oncology at the Dana-Farber Cancer Institute, earning board certification in these specialties. He received his M.D. from the Johns Hopkins University School of Medicine and his A.B. degree from Harvard College.

Prof. Dr. Elaine Mardis, 59, joined the Supervisory Board in 2014. She is also a member of the Science & Technology Committee and the Compensation & Human Resources Committee. Dr. Mardis is the Co-Executive Director of the Institute for Genomic Medicine at Nationwide Children’s Hospital in Columbus, OH and is Professor of Pediatrics at the Ohio State University College of Medicine. Dr. Mardis has research interests in the application of genomic technologies to improve our understanding of human disease, and toward improving the precision of medical diagnosis, prognosis and treatment. Dr. Mardis is the former Robert E. and Louise F. Dunn Distinguished Professor of Medicine at Washington University School of Medicine in St. Louis, MO, where she was on the faculty for 22 years. As Co-Director of the McDonnell Genome Institute, she devised methods and automation that contributed to the Human Genome Project and has since played key roles in the 1000 Genomes Project, The Cancer Genome Atlas, and the Pediatric Cancer Genome Project. Prior to joining the Washington University faculty, she was a senior research scientist at BioRad Laboratories in Hercules, California. Dr. Mardis currently serves as a member of the Board of Directors of Singular Genomics Systems, Inc., a publicly listed company in the U.S. Additionally, she is an elected member of the U.S. National Academy of Medicine. She is also a past President of the American Association for Cancer Research, and has scientific advisory roles at PACT Pharma, LLC and Scorpion Therapeutics, LLC. She received her Bachelor of Science degree in Zoology in 1984, and her Ph.D. in Chemistry and Biochemistry in 1989, both from the University of Oklahoma.

Dr. Eva Pisa, 67, is expected to join the Supervisory Board following the 2022 Annual General Meeting. She was the CEO of a Swedish molecular diagnostic start-up from 2001-2007 that was acquired by Cepheid (now part of Danaher) and specialized in infectious diseases affecting immune-compromised patients. She then worked for Roche Diagnostics International from 2007-2020, where she held positions of increasing responsibility. During her tenure, the Roche cobas 6800 / 8800 System was developed and launched. Dr. Pisa most recently served as Senior Vice President at Roche Centralized and POC Solutions from April 2016 to February 2020, where she was responsible for Clinical Chemistry, Endocrinology and Custom Biotech (B2B business). She continues to support and consult with diagnostic and life science companies. Dr. Pisa holds a Ph.D. from the Karolinska Institute in Sweden and an MBA from Heriot-Watt University in Scotland.

Mr. Lawrence A. Rosen, 64, joined the Supervisory Board in 2013 and has served as Chair of the Supervisory Board since 2020. He is also a member of the Audit Committee and the Compensation & Human Resources Committee and Chair of the Nomination & ESG Committee. As a member of the Board of Management and Chief Financial Officer of Deutsche Post DHL from 2009 to 2016, he was responsible for controlling, corporate accounting and reporting, investor relations, corporate finance, corporate internal audit and security, taxes, as well as the group’s global business services. Prior to this role, Mr. Rosen served as Chief Financial Officer of Fresenius Medical Care AG & Co. KGaA in Germany from 2003 to 2009 and earlier served as Senior Vice President and Treasurer for Aventis SA in Strasbourg, France. From 1984 to 2000, he held various positions of increasing responsibility at the Aventis predecessor companies Hoechst AG and American Hoechst/ Hoechst Celanese, Inc. He currently serves on the Supervisory Boards of Deutsch Post DHL Group and Lanxess AG, both publicly listed companies in Germany. Mr. Rosen holds a bachelor’s degree in economics from the State University of New York and an M.B.A. from the University of Michigan.

Ms. Elizabeth E. Tallett, 73, joined the Supervisory Board in 2011, and also became a member of the Audit Committee and the Compensation & Human Resources Committee. She has also served as Chair of the Compensation & Human Resources Committee since 2016, and joined the Nomination & ESG Committee, in that same year. Ms. Tallett was a Principal of Hunter Partners, LLC, a management company for early to mid-stage pharmaceutical, biotechnology and medical device companies, from 2002 until February 2015. Ms. Tallett continues to consult with early stage health care companies. Her senior management experience includes President and CEO of Transcell Technologies Inc., President of Centocor Pharmaceuticals, member of the Parke-Davis Executive Committee, and Director of Worldwide Strategic Planning for Warner-Lambert Company. Ms. Tallett is also a member of the Board of Directors of Anthem, Inc. (where she is currently Chair) and Moderna, Inc., both publicly listed companies in the U.S., and previously served on the Board of Directors of Meredith Corporation and Principal Financial Group, Inc. Ms. Tallett was a founding board member of the Biotechnology Council of New Jersey and is Chair of the Trustees of Solebury School in Pennsylvania. Ms. Tallett graduated from Nottingham University, England with dual bachelor’s degrees with honors in mathematics and economics.

Thierry Bernard, 58, joined QIAGEN in 2015 to lead our growing presence in Molecular Diagnostics, the application of Sample to Insight solutions for molecular testing in human healthcare. He was named Chief Executive Officer in March 2020, after having previously served in this role on an interim basis. Mr. Bernard previously worked at bioMérieux SA, where he served in roles of increasing responsibility for 15 years, most recently as Corporate Vice President, Global Commercial Operations, Investor Relations and the Greater China Region. Prior to joining bioMérieux, he served in management roles in multiple international environments. Mr. Bernard was appointed in 2020 as a member of the Board of Directors of T2 BioSystems, Inc., a publicly listed company in the U.S. Mr. Bernard has earned degrees from Sciences Po (Paris), Harvard Business School, London School of Economics, and the College of Europe and is a member of French Foreign Trade Advisors.

Roland Sackers, 53, joined QIAGEN in 1999 as Vice President Finance and has been Chief Financial Officer since 2004. In 2006, Mr. Sackers became a member of the Managing Board. Between 1995 and 1999, he served as an auditor with Arthur Andersen Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft. Mr. Sackers earned his Diplom-Kaufmann from University of Münster, Germany. Mr. Sackers was appointed in 2021 as Vice Chair of the Supervisory Board of Evotec SE, a publicly listed company in Germany and has been a member and Chair of the Audit Committee since 2019. He is also a board member of the industry association BIO Deutschland in Germany.

Share Ownership

The following table sets forth certain information as of January 31, 2022 concerning the ownership of QIAGEN shares by each current member of the Supervisory Board being proposed for (re-)appointment. In preparing the following table, the Company has relied on information furnished by such persons.

| Name and Country of Residence | Number of Shares Beneficially Owned(1)(2) | ||||

| Dr. Metin Colpan, Germany | 407,783 | ||||

| Mr. Thomas Ebeling, Switzerland | — | ||||

| Dr. Toralf Haag, Germany | 700 | ||||

| Prof. Dr. Ross L. Levine, United States of America | 4,129 | ||||

| Prof. Dr. Elaine Mardis, United States of America | — | ||||

| Dr. Eva Pisa, Switzerland | — | ||||

| Mr. Lawrence A. Rosen, United States of America | — | ||||

| Ms. Elizabeth E. Tallett, United States of America | 34,089 | ||||

___________

(1) The number of QIAGEN Shares outstanding as of January 31, 2022 was 227,073,511. The persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them and have the same voting rights as other shareholders with respect to QIAGEN Shares.

(2) Does not include Common Shares subject to options or awards held by such persons as at January 31, 2022.

The Dutch Authority of Financial Markets (“AFM”) maintains a public database of notifications regarding shareholdings and voting rights of directors on its website. This database includes all notifications made by the current members of the Supervisory Board regarding their holdings of QIAGEN Shares and related voting rights. The database can be accessed through an Internet link on our website: www.qiagen.com.

THE SUPERVISORY BOARD AND THE MANAGING BOARD ACTING TOGETHER AT THE JOINT MEETING UNANIMOUSLY RECOMMEND THE (RE-)APPOINTMENT OF EACH PROPOSED NOMINEE TO THE SUPERVISORY BOARD AND THE APPOINTMENT OR REAPPOINTMENT OF EACH PROPOSED NOMINEE TO THE MANAGING BOARD. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 11—Reappointment of Auditor

The Supervisory Board approved a resolution to propose to the shareholders of the Company at the Annual General Meeting, and hereby does so propose, the reappointment of KPMG Accountants N.V. to audit the financial statements of the Company for the calendar year ending December 31, 2022. KPMG Accountants N.V. audited the Company’s financial statements for Calendar Year 2021.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 12—Extension of Certain Powers of the Supervisory Board

At our Annual General Meeting on June 29, 2021, the Supervisory Board was designated, for a period of eighteen (18) months, to:

a)issue a number of ordinary shares and financing preference shares and grant rights to subscribe for such shares, the aggregate par value of which shall be equal to the aggregate par value of fifty percent (50%) of shares issued and outstanding in the capital of the Company as at December 31, 2020 as included in the Annual Accounts for Calendar Year 2020; and

b)restrict or exclude the pre-emptive rights with respect to issuing ordinary shares or granting subscription rights for such shares, the aggregate par value of such shares or subscription rights shall be up to a maximum of ten percent (10%) of the aggregate par value of all shares issued and outstanding in the capital of the Company as at December 31, 2020.

The Managing Board and the Supervisory Board consider it in the best interest of the Company and its shareholders for the Supervisory Board to be able to react in a timely manner when certain opportunities arise that require issuance of our shares. For example, in the past, this designation has been used in relation to the issuance of convertible bonds because of the short window of opportunity for completing such transactions to maximize shareholder value.

Therefore, the Managing Board and the Supervisory Board believe it would be in the best interests of the Company and its shareholders to grant to the Supervisory Board the authority to issue QIAGEN Shares or financing preference shares, or to grant rights to subscribe for such shares, when such occasions occur, and to exclude the pre-emptive rights in situations where it is imperative to be able to act quickly, without having to obtain shareholder approval at an extraordinary general meeting of shareholders, which could take valuable time and may create disrupting market speculations. In addition, the authority to issue QIAGEN Shares may also be applied to meet the Company’s obligations under options, RSUs and PSUs awarded in accordance with applicable employee participation plans or the Company’s remuneration policies.

Notwithstanding the authorization of the Supervisory Board to issue shares as described herein, as a matter of Dutch law (Section 2:107a of the Dutch Civil Code), we must seek the approval of the general meeting of shareholder for resolutions of the Managing Board in respect of any transaction concerning a material change to the identity or the character of the Company or its business.

It is proposed to renew the current authorizations of the Supervisory Board to issue QIAGEN Shares and financing preference shares and to grant rights to subscribe for such shares as well as to restrict or exclude pre-emptive rights in connection therewith, with the same limits as the current authorizations, for a period of 18 months from the date of the Annual General Meeting (i.e., until December 23, 2023).

Designation of the Supervisory Board, for a period of 18 months from the date of the Annual General Meeting, as the body authorized to issue a number of ordinary shares and financing preference shares and grant rights to subscribe for such shares, up to a maximum of fifty percent (50%) of the Company’s issued and outstanding share capital as at December 31, 2021 (Agenda Item 12.a)

It is proposed to designate the Supervisory Board, for a period of 18 months from the date of the Annual General Meeting (i.e., until December 23, 2023), as the body authorized to issue a number of QIAGEN Shares and financing preference shares in the capital of the Company and grant rights to subscribe for such shares, the aggregate par value of which shall be equal to the aggregate par value of fifty percent (50%) of shares issued and outstanding in the capital of the Company as at December 31, 2021 as included in the Annual Accounts for Calendar Year 2021. The designation granted by the general meeting of shareholders held on June 29, 2021, will expire on adoption of this proposed resolution.

Designation of the Supervisory Board, for a period of 18 months from the date of the Annual General Meeting, as the body authorized to restrict or exclude the pre-emptive rights with respect to issuing QIAGEN Shares or granting subscription rights for such shares, up to a maximum of ten percent (10%) of the Company’s issued and outstanding share capital as at December 31, 2021 (Agenda Item 12.b)

In connection with the authorization of the Supervisory Board to issue shares and grant rights to subscribe for shares, it is proposed to also designate the Supervisory Board, for a period of 18 months from the date of the Annual General Meeting (i.e.,

until December 23, 2023), as the body authorized to restrict or exclude the pre-emptive rights with respect to issuing QIAGEN Shares or granting subscription rights for such shares, the aggregate par value of such shares or subscription rights shall be up to a maximum of ten percent (10%) of the aggregate par value of all shares issued and outstanding in the capital of the Company as at December 31, 2021 as included in the Annual Accounts for Calendar Year 2021. The designation granted by the general meeting of shareholders held on June 29, 2021, will expire on adoption of this proposed resolution.

According to Dutch law and the Company’s Articles of Association, the proposal set forth under Agenda Item 12.a may be adopted by an affirmative vote of a simple majority of the votes cast at the Annual General Meeting. The proposal set forth under Agenda Item 12.b requires the affirmative vote of two-thirds of the votes cast at the Annual General Meeting if less than fifty percent (50%) of the Company’s issued share capital is represented at the Annual General Meeting. If fifty percent (50%) or more of the Company’s issued share capital is represented at the Annual General Meeting, the proposal set forth under Agenda Item 12.b shall be validly adopted if adopted by a simple majority of the votes cast at the Annual General Meeting.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR EACH OF THESE ITEMS. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 13—Extension of Certain Powers of the Managing Board

Pursuant to Article 6 of the Company’s Articles of Association, the Managing Board shall have the power to cause the Company to acquire for consideration shares in the Company’s own share capital, if and in so far as the Managing Board has been authorized by the General Meeting of Shareholders for this purpose. The grant of such power to the Managing Board is typical for Dutch companies, and its approval is commonly included by such companies on the agenda for annual general meetings.

On June 29, 2021, the Managing Board was authorized by the General Meeting of Shareholders to, subject to the approval of the Supervisory Board and to the provisions of the Company’s Articles of Association and Section 2:98 of the Dutch Civil Code, cause the Company to acquire for consideration shares in the Company’s own share capital, up to a maximum of ten percent (10%) of the Company’s issued share capital on the date of acquisition and provided that the Company or any subsidiary of the Company shall not hold more than ten percent (10%) of the Company’s issued share capital at any time. Such acquisition may occur (i) with respect to QIAGEN Shares, at a price between EUR 0.01 and one hundred ten percent (110%) of the higher of the average closing price of the QIAGEN Shares on the New York Stock Exchange or, as applicable, the Frankfurt Stock Exchange, for the five trading days prior to the day of purchase or (ii) with respect to preference and financing preference shares, at a price between EUR 0.01 and three times the issuance price. This authorization is valid up to and including December 29, 2022.

The power to repurchase shares provides the Managing Board, subject to the approval of the Supervisory Board, with flexibility to repurchase shares for general corporate purposes and allows the Managing Board to return capital to the Company’s shareholders by repurchasing shares. In addition to being a means to return value to shareholders, repurchases of shares in the Company’s own share capital could be used by the Managing Board to streamline the Company’s investor base, demonstrate a commitment to the Company’s business and confidence in the long-term growth of the Company, provide increased liquidity for investors and cover obligations under the Company’s share-based compensation plans.

It is therefore proposed to renew this authorization and authorize the Managing Board, for a period of 18 months from the date of the Annual General Meeting (i.e., until December 23, 2023) and subject to the approval of the Supervisory Board and to the provisions of the Company’s Articles of Association and Section 2:98 of the Dutch Civil Code, to cause the Company to acquire, on a stock exchange or otherwise, for consideration shares in the Company’s own share capital, up to a maximum of ten percent (10%) of the Company’s issued share capital on the date of acquisition and provided that the Company or any subsidiary of the Company shall not hold more than ten percent (10%) of the Company’s issued share capital at any time. Such acquisition may occur (i) with respect to QIAGEN Shares, between EUR 0.01 and one hundred ten percent (110%) of the higher of the average closing price of the QIAGEN Shares on the New York Stock Exchange or, as applicable, the Frankfurt Stock Exchange, for the five trading days prior to the day of purchase or, (ii) with respect to preference and financing preference shares, between EUR 0.01 and three times the issuance price. The authorization granted by the general meeting of shareholders held on June 29, 2021, will expire on adoption of this proposed resolution.

THE SUPERVISORY BOARD AND THE MANAGING BOARD UNANIMOUSLY RECOMMEND A VOTE FOR THIS ITEM. COMPLETED PROXY CARDS WILL BE VOTED IN FAVOR THEREOF UNLESS INSTRUCTIONS ARE OTHERWISE PROVIDED.

Explanatory Note to Item 14—Discretionary rights for the Managing Board to implement a Capital Repayment by means of a Synthetic Share Repurchase

General introduction and key principles

Synthetic Share Repurchase

It is proposed, at the discretion of the Managing Board within the boundaries set forth below, and subject to the approval of the Supervisory Board, to adjust the Company’s capital structure and to repay capital to the Company’s shareholders via a synthetic share repurchase. The key consequences of this synthetic share repurchase, if implemented, will be as follows:

(i)an amount to be determined by the Managing Board, subject to the approval of the Supervisory Board, which amount will at maximum be USD 300 million, will be paid to the holders of QIAGEN Shares as a capital repayment; and

(ii)the number of outstanding QIAGEN Shares will at least be decreased by a number of QIAGEN Shares approximately equal to the number of QIAGEN Shares that could, theoretically, have been repurchased by the Company for the aggregate amount repaid to the holders of QIAGEN Shares (the amount repaid on each outstanding QIAGEN Share, the “Repayment Amount”, the aggregate amount to be repaid to a certain shareholder, the “Shareholder Repayment Amount”, and the aggregate of all Shareholder Repayment Amounts, the “Aggregate Repayment Amount”).

The Company conducted such a Synthetic Share Repurchase in 2016 / 2017, and this program received virtually unanimous shareholder approval at the Extraordinary General Meeting of Shareholders specifically organized for the purpose of resolving upon the program. To retain flexibility as to the implementation of the currently proposed synthetic share repurchase, as well as to reduce the implementation timelines and costs, the resolutions now proposed include a grant of certain discretionary powers (as further described below) to the Managing Board. The adoption by the Company’s shareholders of the resolutions proposed under Agenda Item 14 would, if implemented, reduce the implementation time for such a program from about five (5) months to approximately two and a half (2.5) months (including a mandatory two-month creditor opposition period), and in particular eliminate the need for an Extraordinary General Meeting of Shareholders.

Implementation Steps

If implemented, the synthetic share repurchase will take place in three steps that involve three subsequent amendments to the Company’s Articles of Association, which are all proposed by the Supervisory Board in accordance with article 43.2 of the Company’s Articles of Association:

(i)Step I: firstly, the par value of each QIAGEN Share will be increased by an amount to be determined by the Managing Board, subject to the approval of the Supervisory Board in accordance with the procedure described below (amendment Part I);

(ii)Step II: secondly, the QIAGEN Shares will be consolidated on the basis of a ratio to be determined by the Managing Board, subject to the approval of the Supervisory Board, which share consolidation will decrease the number of issued and outstanding QIAGEN Shares, such that the number of outstanding QIAGEN Shares will be reduced by a number approximately equal to the number of QIAGEN Shares that could, theoretically, have been repurchased by the Aggregate Repayment Amount (amendment Part II); and

(iii)Step III: thirdly, the par value of the QIAGEN Shares will be decreased to EUR 0.01 (the current par value of the QIAGEN Shares) (amendment Part III) and on each outstanding QIAGEN Share the Repayment Amount will be paid, which Repayment Amount will not exceed the amount by which the par value of the QIAGEN Shares will be reduced pursuant to this Step III.

A further explanation to these proposed subsequent amendments to the Company’s Articles of Association (Part I, II and III) and the overall mechanics of the proposed synthetic share repurchase are reflected below. The proposed steps including the related amendments to the Company’s Articles of Association under this Agenda Item 14 are put to a vote as one combined voting item.

Discretionary Powers

After a favorable vote by the Annual General Meeting in respect of this Agenda Item 14, the Managing Board shall have the full discretionary power not to, or, subject to the approval of the Supervisory Board, to implement the synthetic share repurchase. Furthermore, if the synthetic share repurchase were to be implemented, the Managing Board, with the approval of the Supervisory Board, will have the full discretionary power to determine when the synthetic share repurchase will be implemented and what the record date and the payment date(s) of the Shareholder Repayment Amount to shareholders will be, provided that the proposed amendments to the Company’s Articles of Association cannot be effected after 18 months from the date of the Annual General Meeting (i.e., until December 23, 2023).

Furthermore, the Managing Board shall have full discretionary power, subject to the approval of the Supervisory Board, to only implement Step I and III, but not Step II. For example, if the Repayment Amount will be relatively limited and the reduction of the number of QIAGEN Shares pursuant to the consolidation will be limited accordingly. Where the context so requires, references to the synthetic share repurchase should be read to include a reference to the implementation of only Step I and Step III.

The powers of the Managing Board set out in the two preceding paragraphs are jointly referred to as the “Discretionary Powers”. As a result of these Discretionary Powers, a favorable vote by the Annual General Meeting in respect of Agenda Item 14 will not by any means guarantee the actual implementation of a synthetic share repurchase, and therefore, a favorable outcome should expressly not be understood by shareholders as a final and unconditional decision to execute the program. A favorable vote only enables the Managing Board to implement the synthetic share repurchase in a more efficient and economical manner, if and when the Managing Board, using the Discretionary Powers, and with the approval of the Supervisory Board, decides to execute the program. It is emphasized that the Discretionary Powers also leave room to the Managing Board to decide not to implement the synthetic share repurchase at all, for reasons that the Managing Board deems in the best interests of the Company and its affiliated enterprise, taking into account the interests of the Company’s stakeholders, including its shareholders.

Procedure of the synthetic share repurchase

First amendment of the Company’s Articles of Association (Part I) — increase of par value

To make it possible to pay the Repayment Amount to the holders of QIAGEN Shares as a repayment of share capital, the par value of the QIAGEN Shares must be increased. The increase of the par value will take place prior to the share consolidation, if Step II is implemented, and will be such that prior to the decrease of the par value and repayment of share capital as provided for in Step III, the nominal value of the QIAGEN Shares at least equals the Repayment Amount plus EUR 0.01.

This increase of the par value of the QIAGEN Shares will be achieved through an amendment to the Company’s Articles of Association (Part I), as referred to under Agenda Item 14.a.

The increase in par value will be charged to the Company’s share premium reserve. Note that, if Step II is implemented, due to rounding, a second increase of the par value per consolidated QIAGEN Share may take place pursuant to amendment Part II as further described below.

Second amendment of the Company’s Articles of Association (Part II) — share consolidation (reverse stock split)

Secondly it is proposed to consolidate the QIAGEN Shares (including all fractional QIAGEN Shares in issue) in accordance with a consolidation ratio, which will be determined on the basis of the formula below. This consolidation of QIAGEN Shares, or reverse stock split, will be implemented by means of a second amendment of the Company’s Articles of Association (Part II), which amendment is proposed under Agenda Item 14.b.

Under Dutch law the par value per QIAGEN Share must be a multiple of EUR 0.01, therefore if the par value of the QIAGEN Shares after implementation of amendment Part I, divided by the consolidation ratio, would not result in a euro amount that is a multiple of EUR 0.01, the par value of the consolidated QIAGEN Shares will be rounded upwards. This potential subsequent increase of the par value of the QIAGEN shares will again be charged to the Company’s share premium reserve. The par value after amendment Part I will be set at such level that, taking into account such potential increase pursuant to amendment Part II, after amendment Part II the par value of the QIAGEN Shares will be at the level that is required to make the capital repayment as envisaged in the context of amendment Part III.

Third amendment of the Company’s Articles of Association (Part III) — decrease par value and repayment of share capital

Finally, it is proposed to decrease the par value of each (consolidated) QIAGEN Share back to EUR 0.01. This requires a third amendment to the Company’s Articles of Association (Part III), which is proposed under Agenda Item 14.c. In connection with this capital decrease, the Shareholder Repayment Amount will be paid to the holders of QIAGEN Shares and fractional QIAGEN Shares, whereby (i) the Repayment Amount will always be an amount having no more than two decimal places and be determined by the Managing Board, subject to the approval of the Supervisory Board, and (ii) to the extent that a Shareholder Repayment Amount would, as a result of entitlement to payment on fractional QIAGEN Shares, have more than two decimal places, the relevant Shareholder Repayment Amount will be rounded upwards to the nearest amount with two decimal places.

Calculation of the consolidation ratio

The consolidation ratio (“Y”) will be determined by the Managing Board as follows:

A = the total market value of the outstanding QIAGEN Shares in euro calculated on the basis of a market price per QIAGEN Share on a date to be determined by the Managing Board and based on the market price of a QIAGEN Share, which can be a volume weighted average market price on a stock-exchange as determined by the Managing Board and converted into euro if applicable in accordance with an exchange ratio determined by the Managing Board.

B = the intended Aggregate Repayment Amount (subject to rounding).

Y = a fraction as close as possible to Q, provided that Y shall have a denominator not exceeding 25.

| A-B | = | Q | ||||||||||||

| A | ||||||||||||||

Calculation example

Example2

The calculations below provide an example of the procedure. No rights can be derived from this example. The actual values, if and when the synthetic share repurchase would be implemented, will be determined by the Managing Board on the basis of the formulas reflected above.

Total number of outstanding QIAGEN Shares: 200 million

Market price per QIAGEN Share: EUR 40.00

Total market value of QIAGEN Shares: EUR 8 billion

Par value per QIAGEN Share EUR 0.01

Intended Aggregate Repayment Amount EUR 100 million (subject to rounding)

The intended Aggregate Repayment Amount to the holders of QIAGEN Shares in this example amounts to EUR 100 million. This equals one point twenty-five percent (1.25%) of the total market value of the outstanding QIAGEN Shares in this example. Therefore, the total number of issued QIAGEN Shares should be decreased by approximately one point twenty-five percent (1.25%) by means of the reverse stock split to ensure that the market value of an outstanding QIAGEN Share will stay approximately the same. Or, in other words, approximately one point twenty-five percent (1.25%) of the outstanding QIAGEN Shares could theoretically have been repurchased by the Company, if the amount of EUR 100 million was used for a share repurchase against a price per QIAGEN Share of EUR 40.00, the market value of a QIAGEN Share in this example.

____________________

2 Note that these numbers have been included for illustrative purposes only. They should not be considered to give any guidance of the intended amount of the Repayment Amount or the past, current or future value of the QIAGEN Shares.

As can be seen in the formula below, this reduction can be achieved by using a consolidation ratio of 25 pre-split QIAGEN Shares to 24 post-split QIAGEN shares:

| A (EUR 8 billion) -B (EUR 100 million) | = | Q | ≈ | 24 | ||||||||||||||||

| A (EUR 8 bilion) | 25 | |||||||||||||||||||

As set out above under ‘calculation of the consolidation ratio’, the consolidation ratio Y, shall be a fraction as close as possible to Q with a denominator not exceeding 25. In this example, Y therefore equals 24/25. Accordingly, the 200 million outstanding QIAGEN Shares shall be consolidated into 192 million shares, representing a four percent (4%) reduction (note that this percentage deviates from the one point twenty-five percent (1.25%) mentioned earlier, because Y’s denominator cannot exceed 25).

Since the Repayment Amount will be paid on the consolidated QIAGEN Shares, the intended Aggregate Repayment Amount must be divided by 192 million shares. This results in a payment per QIAGEN Share of EUR 0.52083, which will be rounded upwards to EUR 0.53. This rounded amount is the actual Repayment Amount.

As set out above, the par value of the QIAGEN Shares will be increased to such level that prior to the capital reduction as contemplated by Part III, the par value of each QIAGEN Share at least equals the Repayment Amount plus EUR 0.01 in this case EUR 0.54. To arrive at a par value of EUR 0.54 per consolidated QIAGEN Share, taking into account a 24/25 consolidation ratio, the par value pre-consolidation should be EUR 0.5184 (EUR 0.5184 times 25 divided by 24 equals EUR 0.54). In Part I the amount will be rounded such that it allows for the par value to increase to such value after Part II that at least equals the Repayment Amount plus EUR 0.01. In this calculation example each QIAGEN Share shall therefore have a par value of EUR 0.51 after implementation of amendment Part I.

Pursuant to the share consolidation each 25 QIAGEN Shares (aggregate par value 0.51 times 25, equals EUR 12.75) will be consolidated into 24 QIAGEN Shares. This would result in a par value of EUR 0.531325 (EUR 12.75 dividend by 24), which will be rounded upwards as set out above to EUR 0.54. Subsequently, amendment Part III will be implemented pursuant to which the par value will again be reduced to EUR 0.01, and EUR 0.53 will be repaid on each outstanding QIAGEN Share and in pro rata entitlements on each outstanding fractional QIAGEN Share. For QIAGEN Shares or fractional QIAGEN Shares held in treasury, the relevant amount will again be added to the Company’s reserves.

Timeline and implementation process

If the Managing Board resolves to implement the synthetic share repurchase, it will timely announce the intention to implement this program, the relevant Ex Distribution Date, Record Date and Payment Date(s) to the holders of QIAGEN Shares. Note that, in addition to the exercise of the Discretionary Powers by the Managing Board and the required approvals of the Supervisory Board, the implementation of the synthetic share repurchase will be subject to the observance of a statutory creditor opposition procedure, which involves a two-months creditor opposition period and the Company having sufficient reserves to charge the increase of the par value to at the time of the implementation of the synthetic share repurchase.

Shareholders’ interests

Beneficial Shareholders

For persons holding their QIAGEN Shares through the Depository Trust Company, subject to contractual arrangements, the shareholding of beneficial shareholders will be rounded down. As a result, shareholders entitled to fractional QIAGEN Shares in accordance with the consolidation ratio will receive cash from their relevant bank or intermediary.

Registered Shareholders

Shareholdings registered in the Company’s shareholders register will be consolidated into QIAGEN Shares with the new par value in accordance with the consolidation ratio based on the formula described above. Any registered holding of QIAGEN