Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month ended November 30, 2016

Commission File Number 0-28564

QIAGEN N.V.

Hulsterweg 82

5912 PL Venlo

The Netherlands

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ☐

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Table of Contents

QIAGEN N.V.

Form 6-K

Item | Page | |||

| 3 | ||||

| 4 | ||||

| 5 | ||||

2

Table of Contents

On November 15, 2016, QIAGEN N.V. held an Analyst & Investor Day in New York, New York. The presentations discussed that day are furnished herewith as Exhibit 99.1 through 99.9 and are incorporated by reference herein.

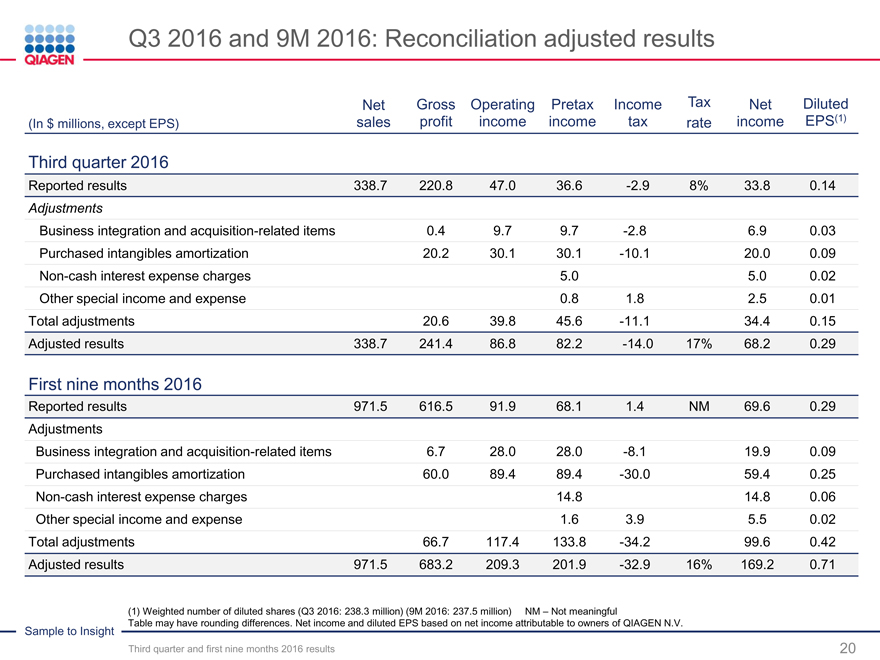

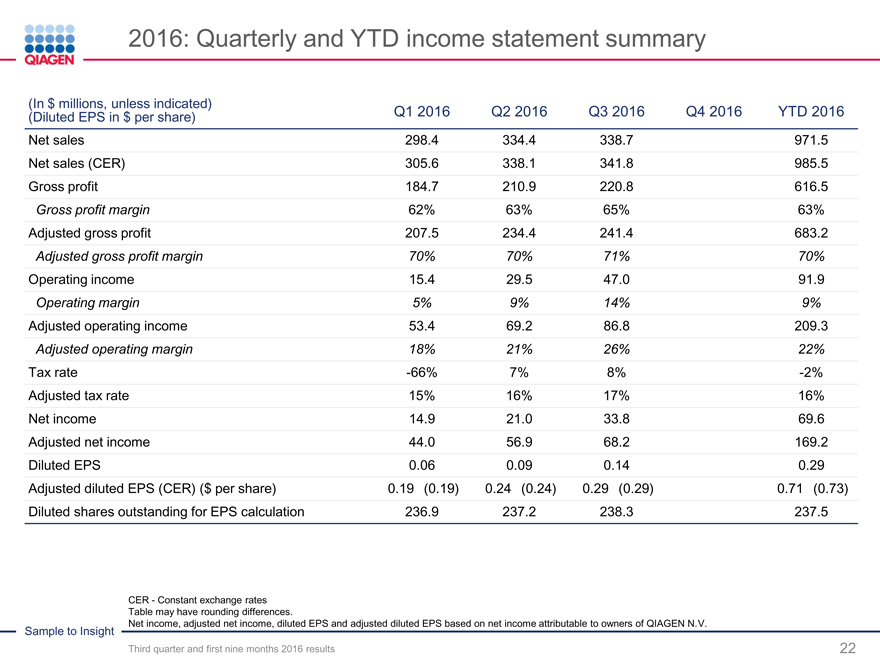

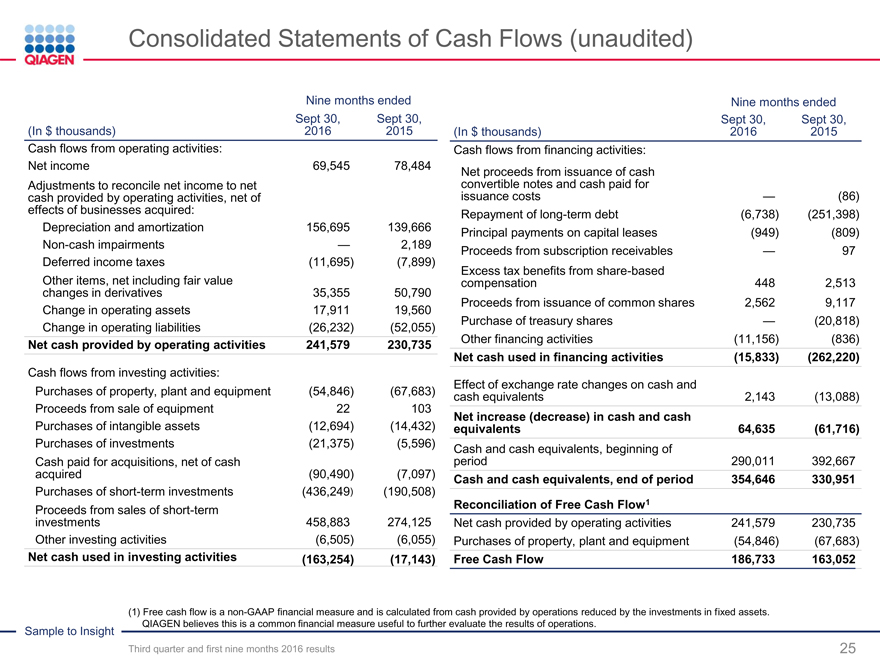

USE OF NON-GAAP FINANCIAL MEASURES

QIAGEN reports adjusted results, as well as results on a constant exchange rate basis, and other non-U.S. GAAP (generally accepted accounting principles) figures, to provide additional insight on performance. Adjusted results included in the Exhibits reflect adjusted operating expenses, adjusted earnings interest, taxes, depreciation and amortization (EBITDA), adjusted diluted earnings per share and free cash flow. Adjusted results are non-GAAP financial measures that we believe should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. We believe certain items should be excluded from adjusted results when they are outside of our ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the appendices provided in the Exhibits entitled “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. We do not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on our GAAP results.

FORWARD-LOOKING STATEMENTS

Exhibits 99.1 through 99.9 contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to our business, goals, strategy and financial and operational outlook. These “forward-looking statements” are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by forward-looking statements. These risks and uncertainties include, but are not limited to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for our products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting our products to integrated solutions and producing such products; our ability to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of our new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that we have filed with, or furnished to, the U.S. Securities and Exchange Commission. We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

3

Table of Contents

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

QIAGEN N.V.

| By: | /s/ Roland Sackers | |

| Roland Sackers | ||

| Chief Financial Officer | ||

| Date: | November 23, 2016 | |

4

Table of Contents

Exhibit No. | Exhibit | |

| 99.1 | Introduction 2016 Analyst & Investor Day | |

| 99.2 | Strategy Update | |

| 99.3 | Life Sciences | |

| 99.4 | Molecular Diagnostics | |

| 99.5 | Bioinformatics | |

| 99.6 | Commercial Operations | |

| 99.7 | Finance | |

| 99.8 | QuantiFeron-TB | |

| 99.9 | GeneReader NGS System | |

5

Table of Contents

Exhibit 99.1

|

QIAGEN

Welcome:

2016 Analyst & Investor Day

John Gilardi

Vice President, Corporate Communications and Investor Relations November 15, 2016

Sample to Insight

2016 Analyst & Investor Day

Table of Contents

|

QIAGEN

Disclaimer

Safe Harbor Statement: This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section

21E of the U.S. Securities Exchange Act of 1934, as amended. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our own expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited, to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of QIAGEN’s new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

Regulation G: QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight on performance. In this presentation, adjusted results include adjusted operating expenses, adjusted EBITDA, adjusted diluted EPS and free cash flow. Adjusted results are non-GAAP financial measures QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of its ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the Appendix provided in this presentation “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. QIAGEN does not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

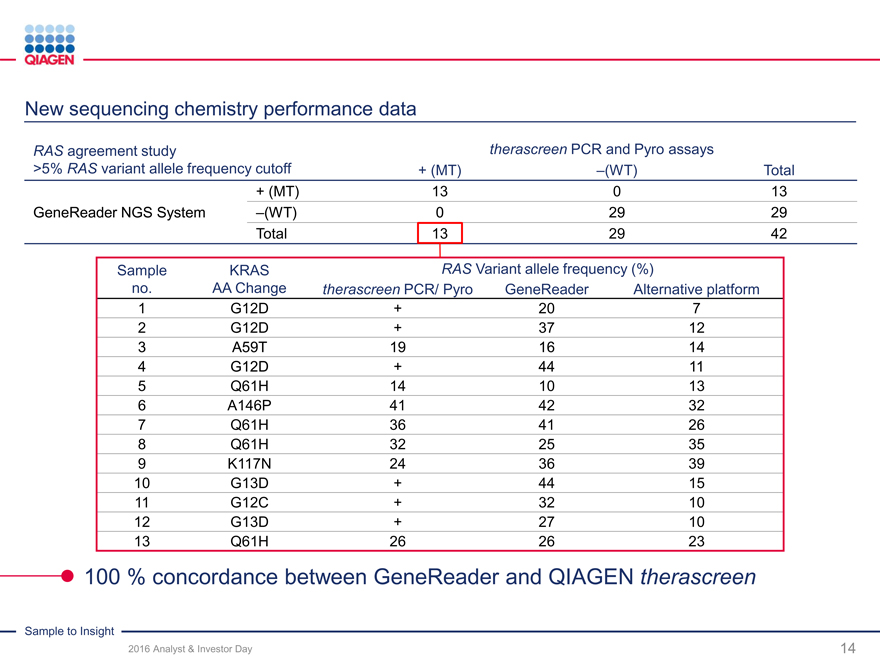

GeneReader NGS System: The QIAGEN GeneReader® NGS System is currently available for marketing and sales outside the United States. The QIAGEN GeneReader® NGS System with new sequencing chemistry will be made available in the United States starting in December 2016. The QIAGEN GeneReader® NGS System is intended for Research Use Only. This product is not intended for the diagnosis, prevention or treatment of a disease. QIAGEN Clinical Insight® is an evidence-based decision support software intended as an aid in the interpretation of variants observed in genomic sequencing data. The software evaluates genomic variants in the context of published biomedical literature, professional association guidelines, publicly available databases and annotations, drug labels and clinical-trials. Based on this evaluation, the software proposes a classification and bibliographic references to aid in the interpretation of observed variants. The software is not intended as a primary diagnostic tool by physicians or to be used as a substitute for professional healthcare advice. Each laboratory is responsible for ensuring compliance with applicable international, national and local clinical laboratory regulations and other accreditation requirements

Sample to Insight

2016 Analyst & Investor Day

Table of Contents

|

QIAGEN

10:30 – 10:40 Introduction John Gilardi

Vice President, Corporate Communications and Investor 10:40 – 11:10 Strategy update Peer M. Schatz Chief Executive Officer 11:10 – 11:25 Life Sciences Brad Crutchfield Senior Vice President, Life Sciences Business Area 11:25 – 11:40 Molecular Diagnostics Thierry Bernard Senior Vice President, Molecular Diagnostics Business Area 11:40 – 11:55 Bioinformatics Dr. Laura Furmanski Senior Vice President, Bioinformatics Business Area 11:55 – 12:05 Break 12:05 – 12:20 Commercial Operations Manuel O. Méndez Senior Vice President, Global Commercial Operations 12:20 – 12:40 Finance Roland Sackers Chief Financial Officer 12:40 – 13:00 Q&A session EC members 13:00 – 13:30 Lunch break with QIAGEN management 13:30 – 13:50 QuantiFERON-TB Dr. L. Masae Kawamura, M.D.

Senior Director, Medical & Scientific Affairs, TB Diagnostics, Molecular Diagnostics Business Area 13:50 – 14:00 Q&A session 14:00 – 14:20 GeneReader NGS System Jonathan Arnold Senior Director, Oncology Business Area Franchise, Molecular Diagnostics Business Area 14:20 – 14:30 Q&A session 14:30 – 14:35 Closing remarks Peer M. Schatz Chief Executive Officer 14:35 – 15:30 Post-event reception

Sample to Insight

2016 Analyst & Investor Day

Table of Contents

Exhibit 99.2

|

QIAGEN

Setting a new trajectory for growth and greater value creation

Peer M. Schatz

Chief Executive Officer

November 15, 2016

Sample to Insight

2016 Analyst & Investor Day 1

Table of Contents

|

QIAGEN

Disclaimer

Safe Harbor Statement: This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section

21E of the U.S. Securities Exchange Act of 1934, as amended. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our own expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited, to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of QIAGEN’s new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

Regulation G: QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight on performance. In this presentation, adjusted results include adjusted operating expenses, adjusted EBITDA, adjusted diluted EPS and free cash flow. Adjusted results are non-GAAP financial measures QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of its ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the Appendix provided in this presentation “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. QIAGEN does not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

GeneReader NGS System: The QIAGEN GeneReader® NGS System is currently available for marketing and sales outside the United States. The QIAGEN GeneReader® NGS System with new sequencing chemistry will be made available in the United States starting in December 2016. The QIAGEN GeneReader® NGS System is intended for Research Use Only. This product is not intended for the diagnosis, prevention or treatment of a disease. QIAGEN Clinical Insight® is an evidence-based decision support software intended as an aid in the interpretation of variants observed in genomic sequencing data. The software evaluates genomic variants in the context of published biomedical literature, professional association guidelines, publicly available databases and annotations, drug labels and clinical-trials. Based on this evaluation, the software proposes a classification and bibliographic references to aid in the interpretation of observed variants. The software is not intended as a primary diagnostic tool by physicians or to be used as a substitute for professional healthcare advice. Each laboratory is responsible for ensuring compliance with applicable international, national and local clinical laboratory regulations and other accreditation requirements

Sample to Insight

2016 Analyst & Investor Day 2

Table of Contents

|

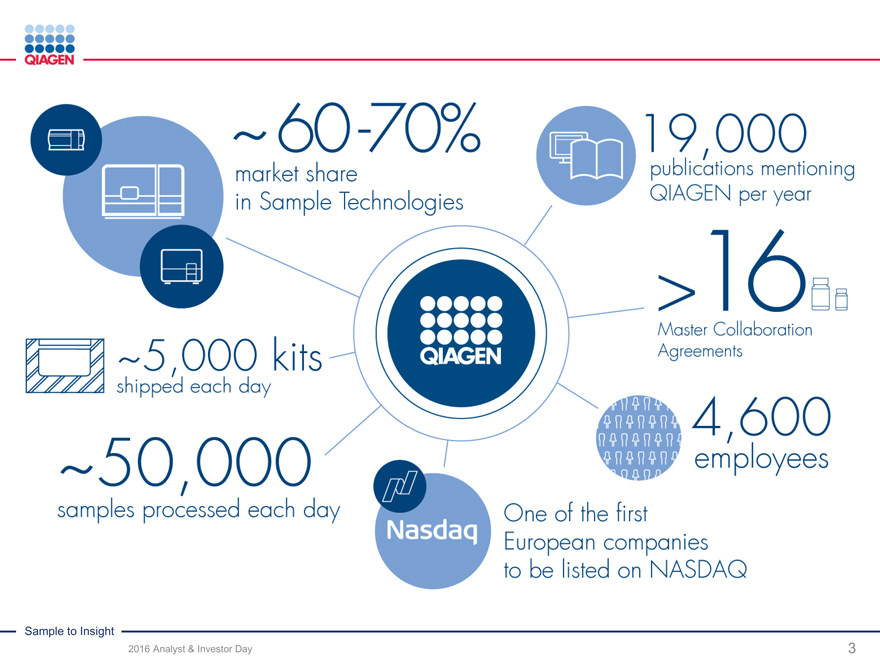

~60-70%

Market share in Sample Technologies

19,000

Publications mentioning QIAGEN per year

>16

Master Collaboration Agreements

~5,000 kits shipped each day

~50,000

Samples processed each day

Nasdaq

One of the first European companies to be listed on NASDAQ

4,600 employees

Sample to Insight

2016 Analyst & Investor Day 3

Table of Contents

|

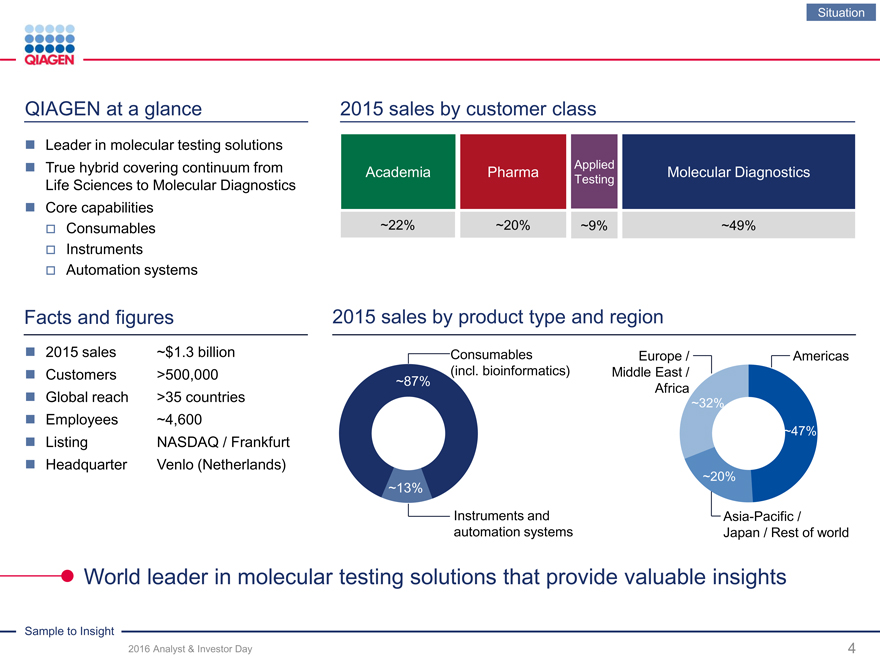

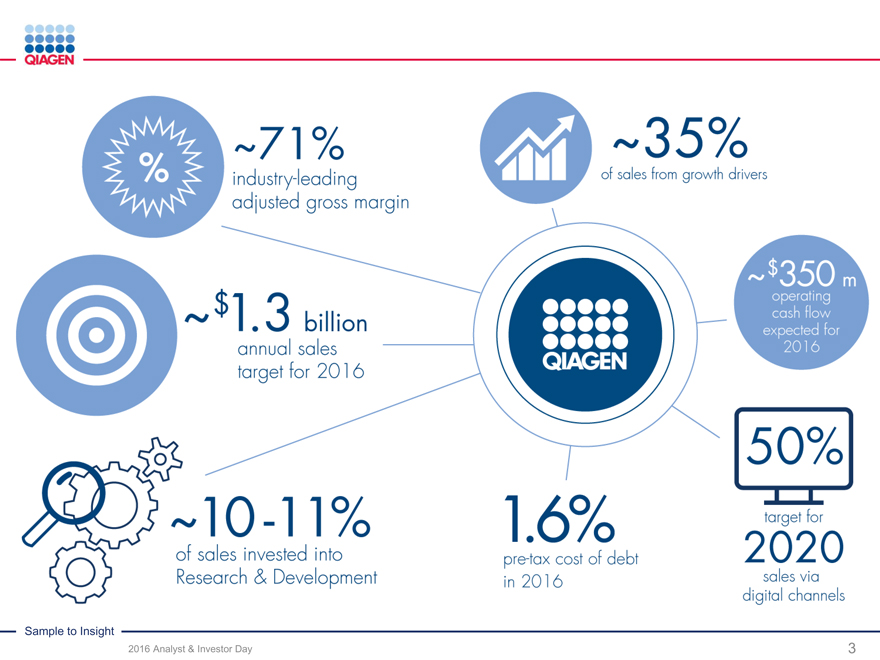

~$1.3 billion ConsumablesEurope /Americas

>500,000 (incl. bioinformatics)Middle East /

~87% Africa

>35 countries ~32%

~4,600

~47%

NASDAQ / Frankfurt

Venlo (Netherlands)

~20%

~13%

Instruments andAsia-Pacific /

automation systemsJapan / Rest of world

Situation

QIAGEN at a glance

2015 sales by customer class

Leader in molecular testing solutions

True hybrid covering continuum from Life Sciences to Molecular Diagnostics

Core capabilities

Consumables

Instruments

Automation systems

Facts and figures

Applied

Academia Pharma Molecular Diagnostics

Testing

~22% ~20% ~9%~49%

2015 sales by product type and region

2015 sales

Customers

Global reach

Employees

Listing

Headquarter

World leader in molecular testing solutions that provide valuable insights

Sample to Insight

2016 Analyst & Investor Day

4

Table of Contents

|

Situation

Customers want meaningful molecular insights

Faster Better More efficiently

Sample Technologies Assay Technologies

Bioinformatics Automation systems

VALUABLE

BIOLOGICAL SAMPLE TO INSIGHT SOLUTIONS MOLECULAR

SAMPLE INSIGHTS

Moving from tools and components to solutions that provide valuable insights

Sample to Insight

2016 Analyst & Investor Day 5

Table of Contents

|

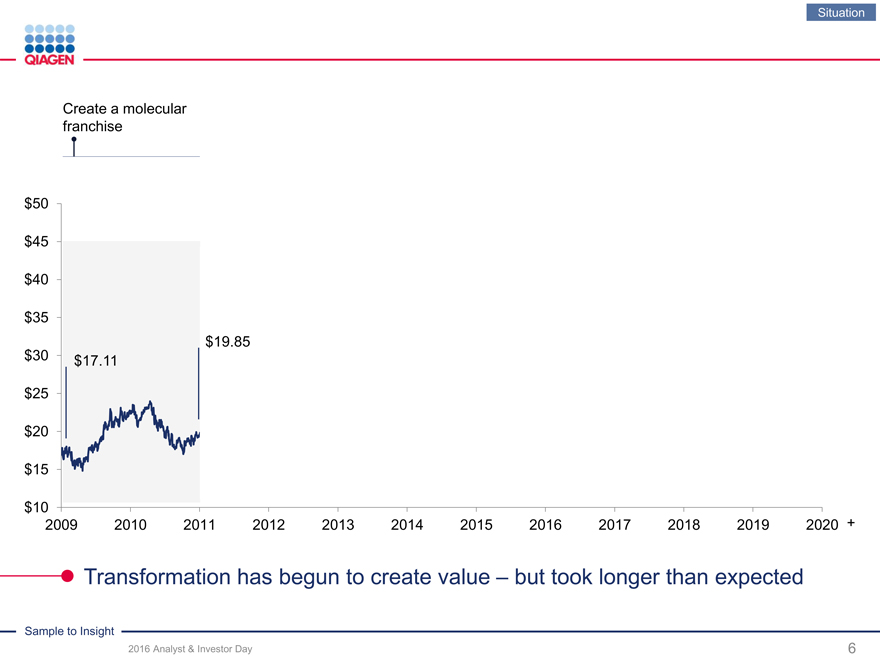

Situation

Create a molecular franchise

$50 $45 $40

$35

$19.85

$30 $17.11 $25

$20

$15

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 +

Transformation has begun to create value – but took longer than expected

Sample to Insight

2016 Analyst & Investor Day 6

Table of Contents

|

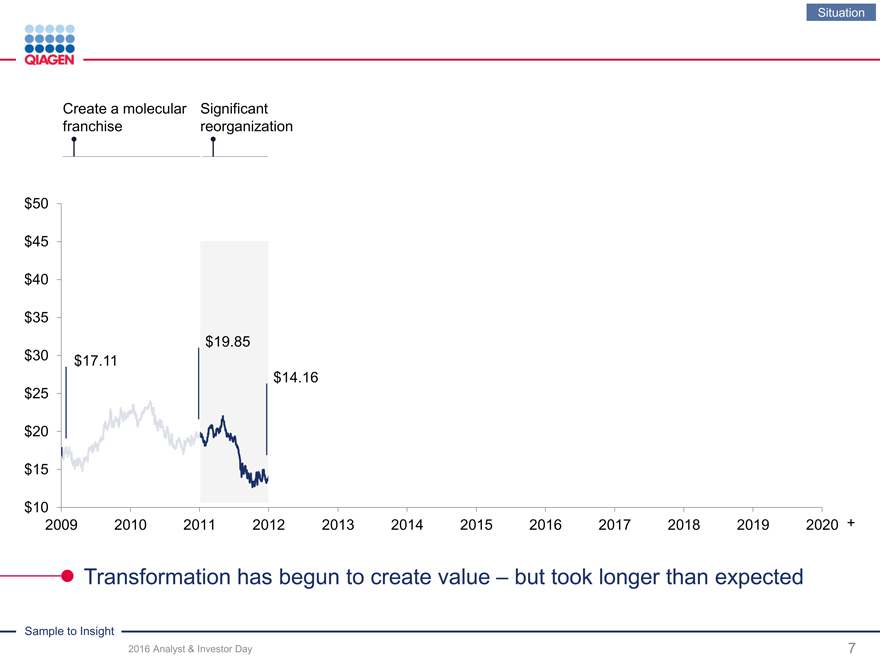

$50 $45 $40

$35

$19.85

$30 $17.11

$14.16 $25

$20

$15

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 +

Transformation has begun to create value – but took longer than expected

Sample to Insight

2016 Analyst & Investor Day 7

Situation

Create a molecular Significant

franchise reorganization

Table of Contents

|

$50 $45 $40

$23.37 $35

$19.85

$30 $17.11

$14.16 $25

$20

$15

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 +

Transformation has begun to create value – but took longer than expected

Sample to Insight

2016 Analyst & Investor Day 8

Situation

Create a molecular Significant Portfolio

franchise reorganization transformation

Table of Contents

|

$50

$45

$40 $27.51

$23.37 $35

$19.85

$30 $17.11

$14.16 $25

$20

$15

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 +

Transformation has begun to create value – but took longer than expected

Situation

Create a molecular Significant PortfolioCommercial

franchise reorganization transformationacceleration

Note: Latest share price as of November 11, 2016.

Sample to Insight

2016 Analyst & Investor Day 9

Table of Contents

|

$50

$45

$40 $27.51

$23.37 $35

$19.85

$30 $17.11

$14.16 $25

$20

$15

$10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 +

Transformation has begun to create value – but took longer than expected

Situation

Create a molecular Significant PortfolioCommercialSustain growth

franchise reorganization transformationaccelerationand deliver value

Note: Latest share price as of November 11, 2016.

Sample to Insight

2016 Analyst & Investor Day 10

Table of Contents

|

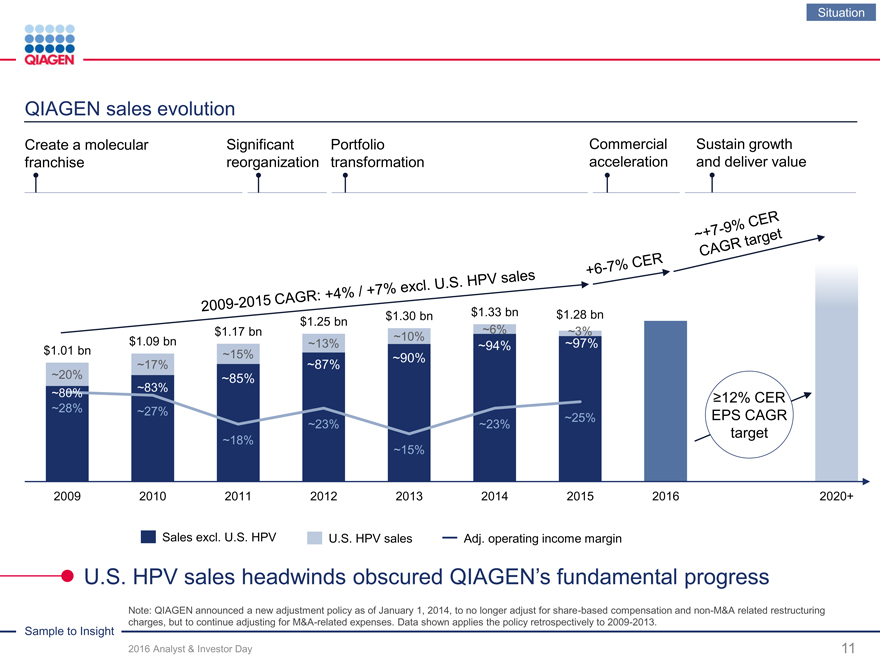

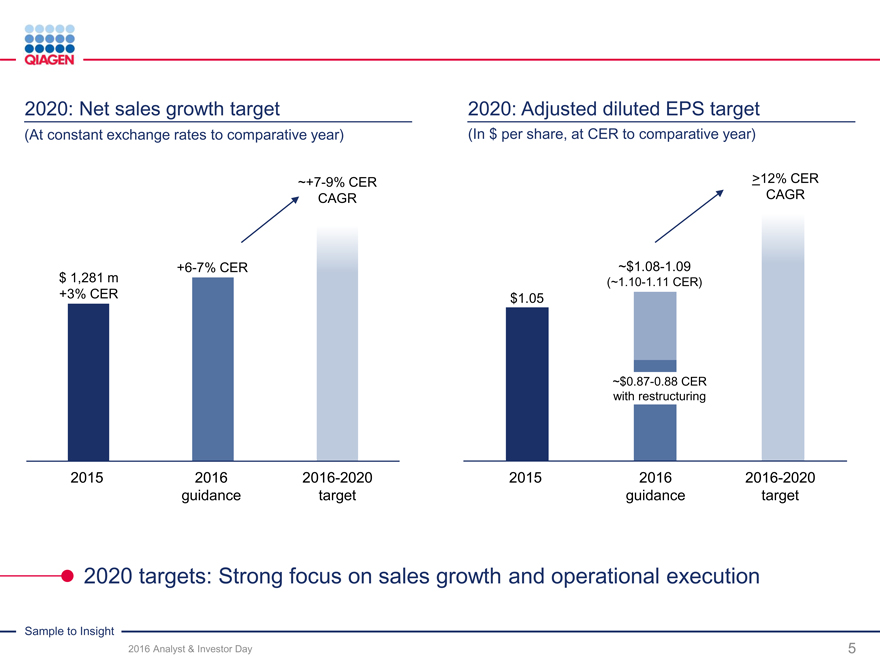

QIAGEN sales evolution

Create a molecular Significant PortfolioCommercialSustain growth

franchise reorganization transformationaccelerationand deliver value

$1.30 bn $1.33 bn $1.28 bn

$1.25 bn

$1.17 bn ~6% ~3%

$1.09 bn ~10%

~13% ~94% ~97%

$1.01 bn ~15%

~90%

~17% ~87%

~20% ~85% ~83%

~80% ?12% CER

~28% ~27%

~25% EPS CAGR

~23% ~23%

target

~18%

~15%

2009 2010 2011 2012 2013 2014 2015 2016 2020+

Sales excl. U.S. HPV U.S. HPV sales Adj. operating income margin

U.S. HPV sales headwinds obscured QIAGEN’s fundamental progress

Note: QIAGEN announced a new adjustment policy as of January 1, 2014, to no longer adjust for share-based compensation and non-M&A related restructuring Sample to Insight charges, but to continue adjusting for M&A-related expenses. Data shown applies the policy retrospectively to 2009-2013.

2016 Analyst & Investor Day 11

Situation

Table of Contents

|

Situation

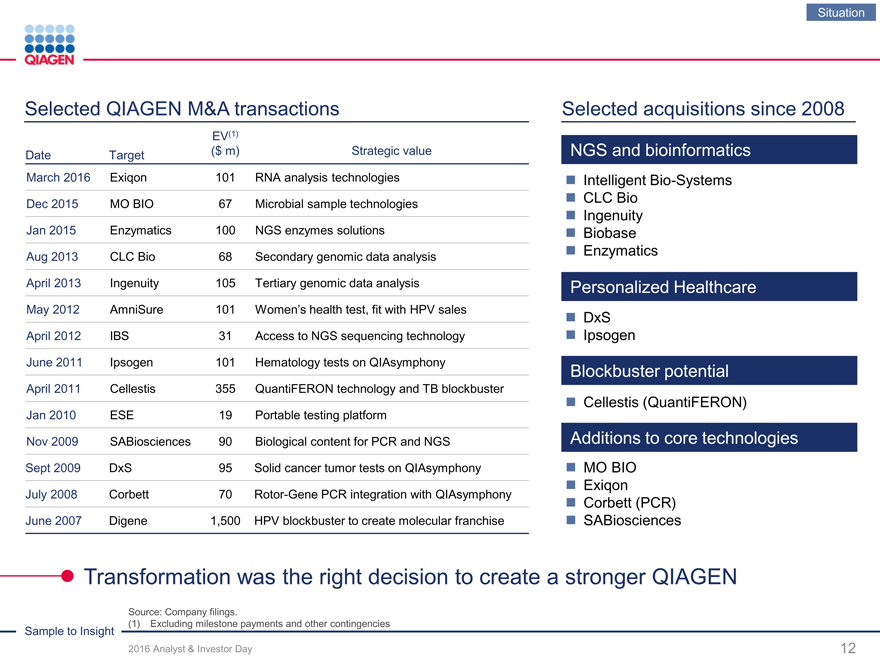

Selected QIAGEN M&A transactions Selected acquisitions since 2008

EV(1)

Date Target ($ m)Strategic valueNGS and bioinformatics

March 2016 Exiqon 101RNA analysis technologiesIntelligent Bio-Systems

Dec 2015 MO BIO 67Microbial sample technologiesCLC Bio

Ingenuity

Jan 2015 Enzymatics 100NGS enzymes solutionsBiobase

Aug 2013 CLC Bio 68Secondary genomic data analysisEnzymatics

April 2013 Ingenuity 105Tertiary genomic data analysisPersonalized Healthcare

May 2012 AmniSure 101Women’s health test, fit with HPV salesDxS

April 2012 IBS 31Access to NGS sequencing technologyIpsogen

June 2011 Ipsogen 101Hematology tests on QIAsymphonyBlockbuster potential

April 2011 Cellestis 355QuantiFERON technology and TB blockbuster

Cellestis (QuantiFERON)

Jan 2010 ESE 19Portable testing platform

Nov 2009 SABiosciences 90Biological content for PCR and NGSAdditions to core technologies

Sept 2009 DxS 95Solid cancer tumor tests on QIAsymphonyMO BIO

Exiqon

July 2008 Corbett 70Rotor-Gene PCR integration with QIAsymphonyCorbett (PCR)

June 2007 Digene 1,500HPV blockbuster to create molecular franchiseSABiosciences

Transformation was the right decision to create a stronger QIAGEN

Source: Company filings.

(1) Excluding milestone payments and other contingencies

Sample to Insight

2016 Analyst & Investor Day 12

Table of Contents

|

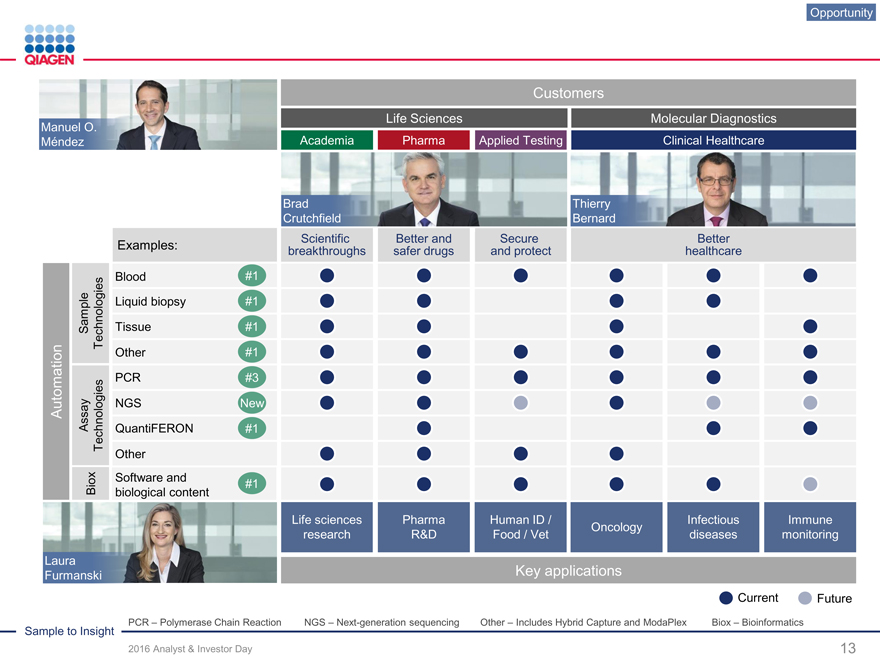

Brad Thierry Crutchfield Bernard

Scientific Better and Secure Better

Examples: breakthroughs safer drugs and protect healthcare

Blood #1 Liquid biopsy #1 Sample Technologies Tissue #1 Other #1

PCR #3 Automation Assay NGS New Technologies QuantiFERON #1 Other Software and Biox #1 biological content

Life sciences Pharma Human ID / Infectious Immune Oncology research R&D Food / Vet diseases monitoring

Laura

Furmanski Key applications

Current Future

PCR – Polymerase Chain Reaction NGS – Next-generation sequencing Other – Includes Hybrid Capture and ModaPlex Biox – Bioinformatics

Opportunity

Customers

Life Sciences Molecular Diagnostics

Manuel O.

Méndez Academia Pharma Applied Testing Clinical Healthcare

Sample to Insight

2016 Analyst & Investor Day 13

Table of Contents

|

Opportunity

AMP 2016: Early movers on new trends in Molecular Diagnostics

Sample to Insight

2016 Analyst & Investor Day 14

Table of Contents

|

Analyst & Investor Day:

November 2013

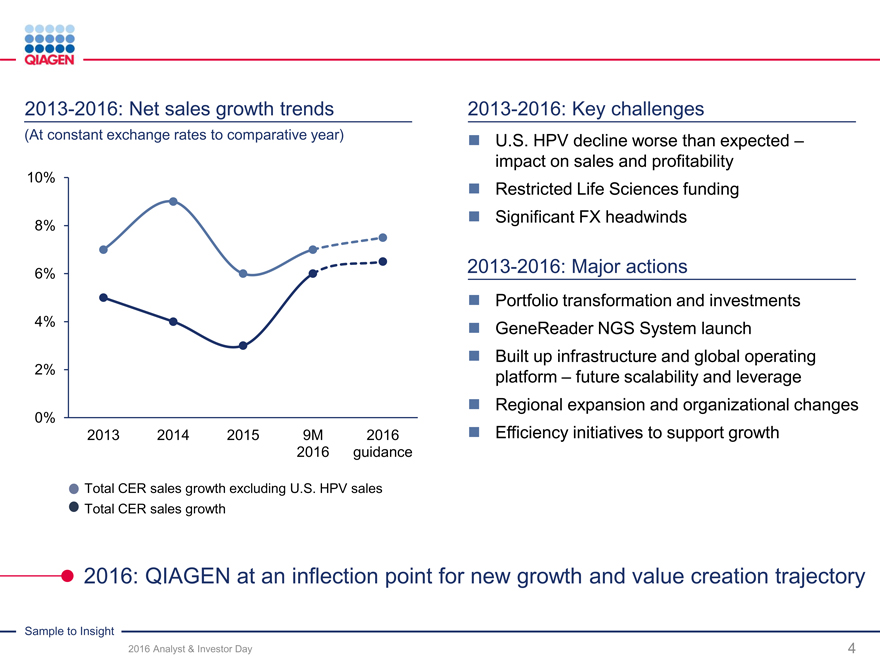

Sales Improving trends while addressing challenges

targets Reallocating resources to best opportunities

Growth Building momentum

drivers QIAsymphony

Personalized Healthcare (PHC)

QuantiFERON-TB

Bioinformatics

Next-generation sequencing

Operating Further improve operating margin

efficiency Significant operational improvements

Capital More leverage with healthy financial position

structure Completed first $100 m buyback,

new program started

M&A Continue consistent M&A strategy

Reviewing our progress since 2013

Sample to Insight

2016 Analyst & Investor Day

Opportunity

15

Table of Contents

|

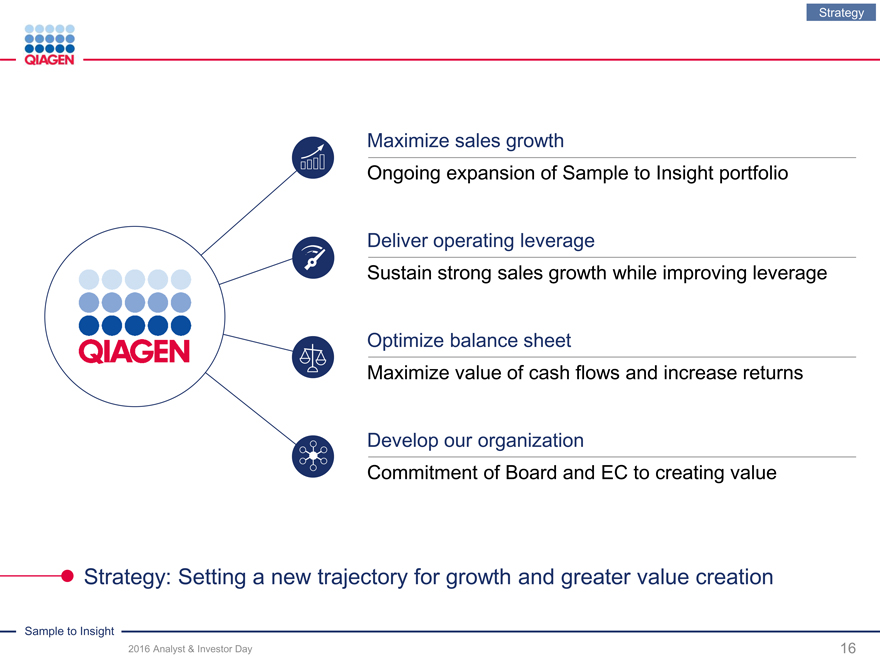

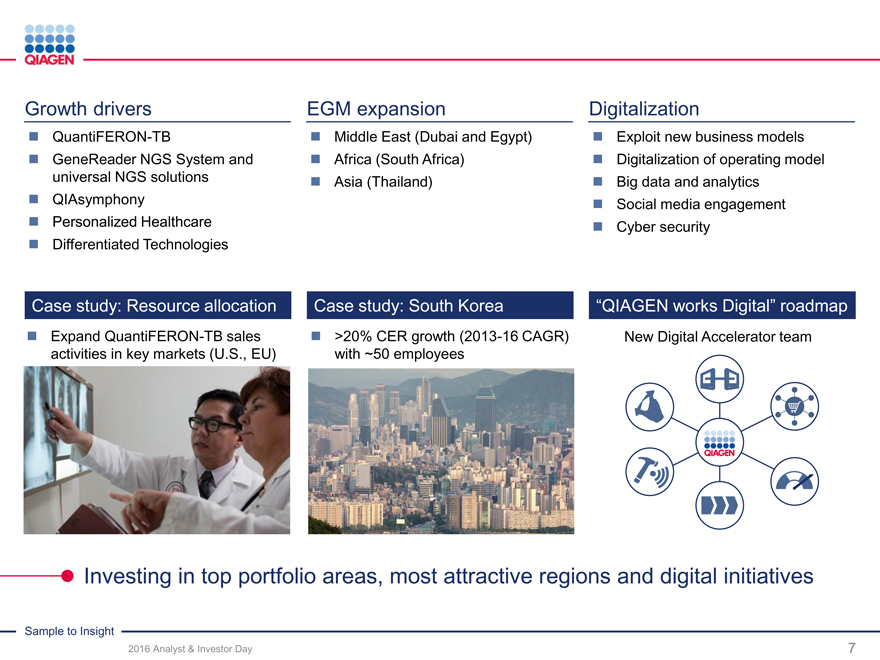

Strategy

Maximize sales growth

Ongoing expansion of Sample to Insight portfolio

Deliver operating leverage

Sustain strong sales growth while improving leverage

Optimize balance sheet

Maximize value of cash flows and increase returns

Develop our organization

Commitment of Board and EC to creating value

Strategy: Setting a new trajectory for growth and greater value creation

Sample to Insight

2016 Analyst & Investor Day 16

Table of Contents

|

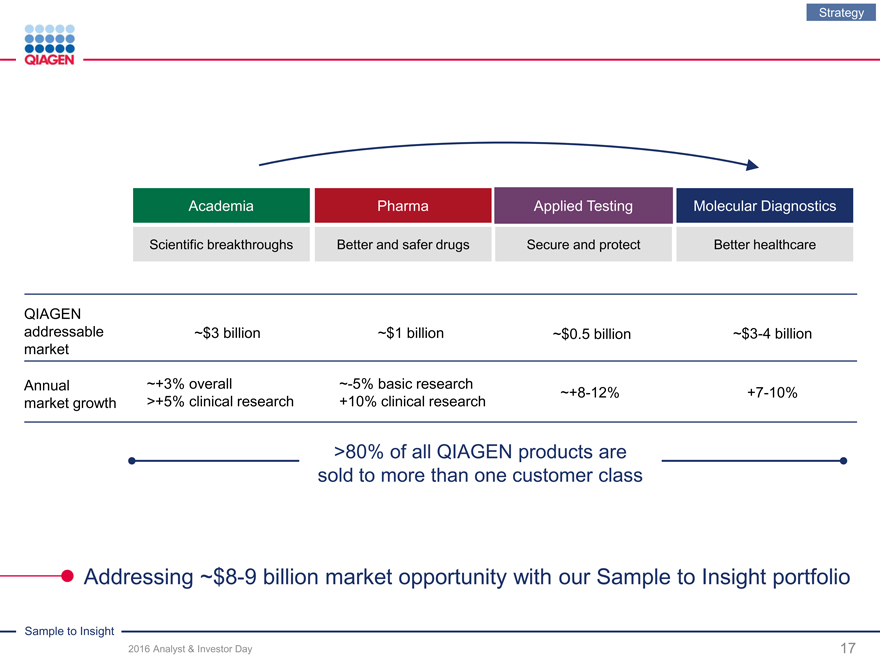

Strategy

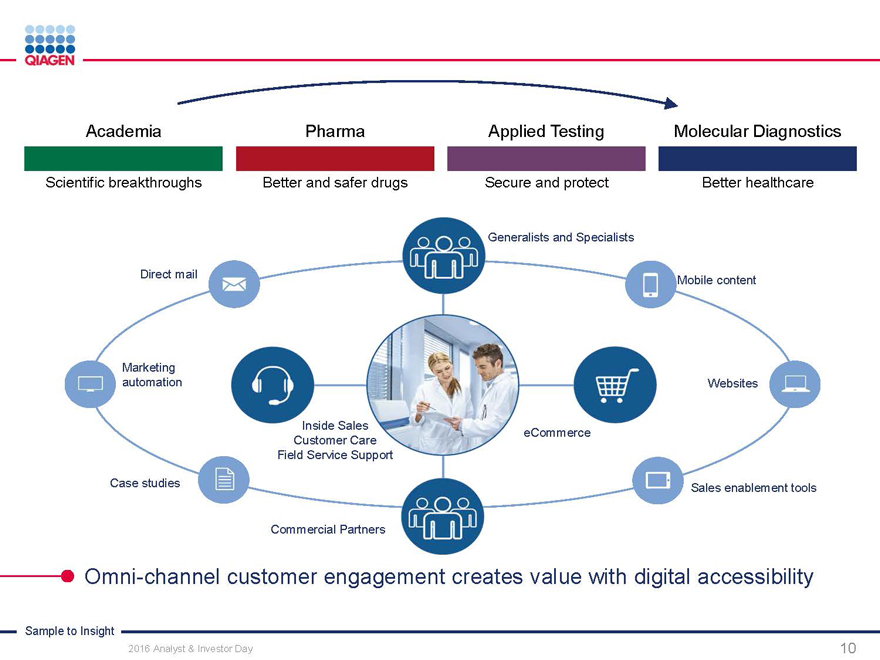

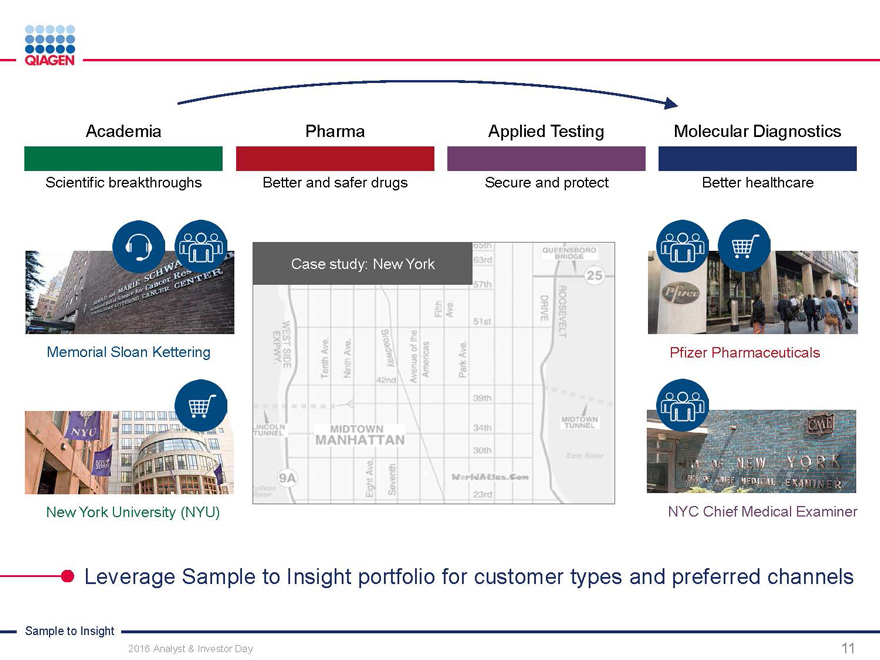

Academia Pharma Applied TestingMolecular Diagnostics

Scientific breakthroughs Better and safer drugs Secure and protectBetter healthcare

QIAGEN

addressable ~$3 billion ~$1 billion~$0.5 billion~$3-4 billion

market

Annual �� ~+3% overall ~-5% basic research~+8-12%+7-10%

market growth >+5% clinical research +10% clinical research

>80% of all QIAGENproducts are

sold to more than one customer class

Addressing ~$8-9 billion market opportunity with our Sample to Insight portfolio

Sample to Insight

2016 Analyst & Investor Day

17

Table of Contents

|

Strategy

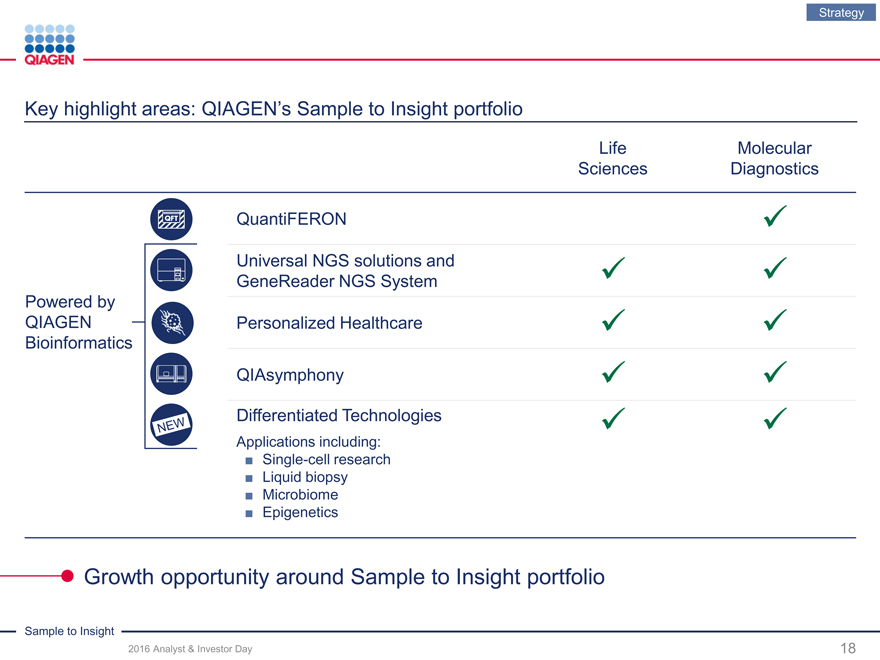

Key highlight areas: QIAGEN’s Sample to Insight portfolio

LifeMolecular

SciencesDiagnostics

QuantiFERON

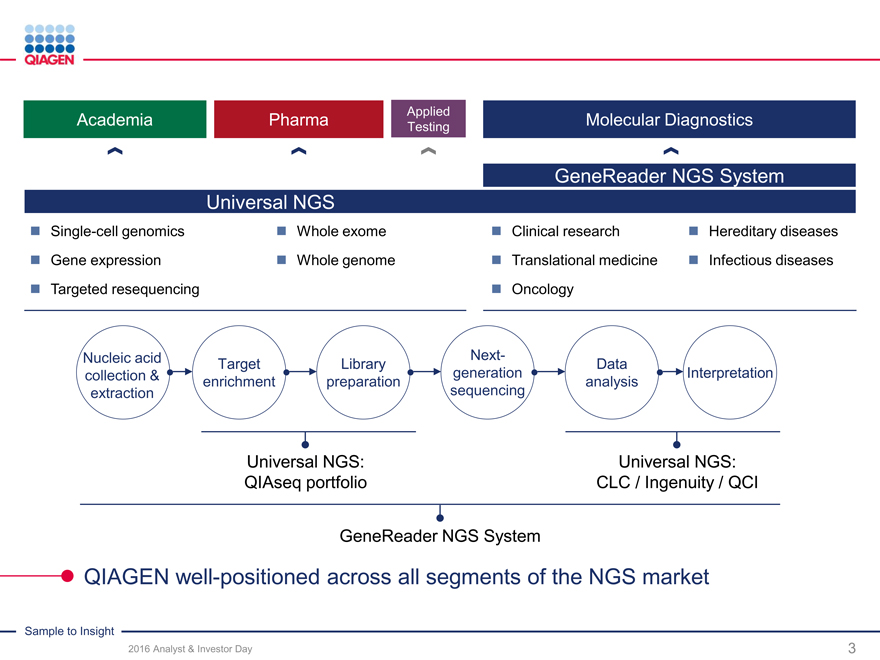

Universal NGS solutions and

GeneReader NGS System

Powered by

QIAGEN Personalized Healthcare

Bioinformatics

QIAsymphony

Differentiated Technologies

Applications including:

? Single-cell research

? Liquid biopsy

? Microbiome

? Epigenetics

Growth opportunity around Sample to Insight portfolio

Sample to Insight

2016 Analyst & Investor Day 18

Table of Contents

|

Strategy

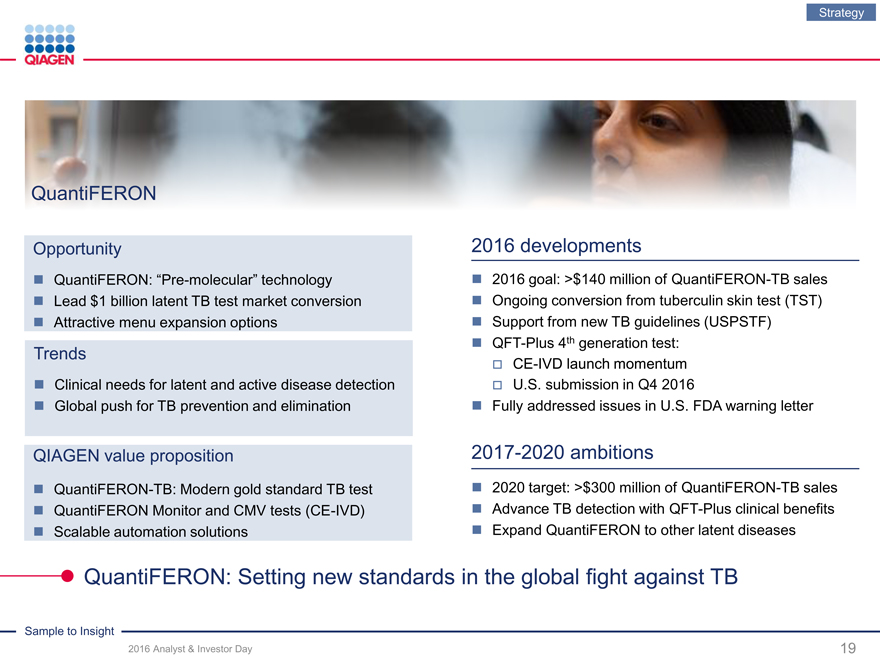

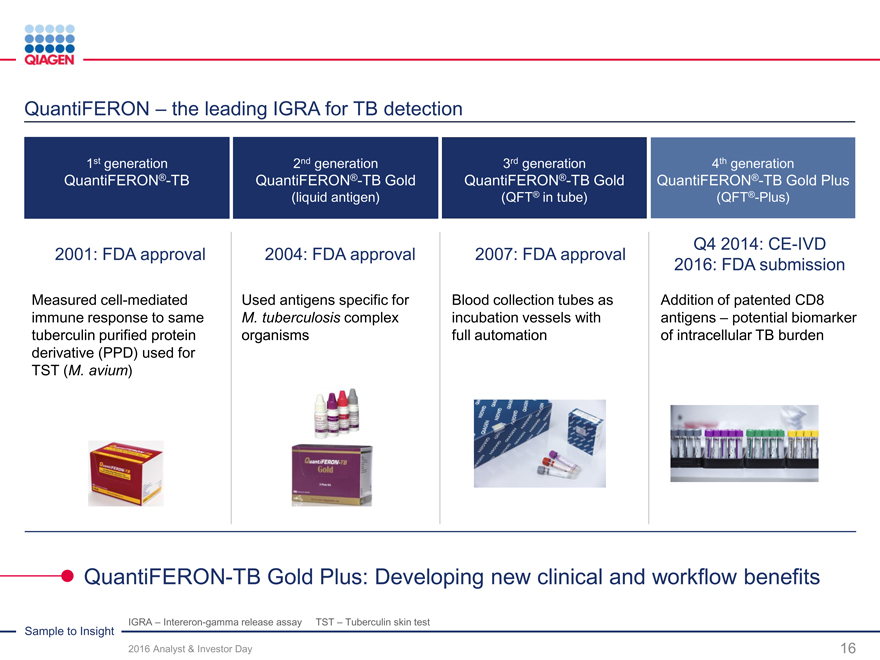

QuantiFERON

Opportunity

QuantiFERON: “Pre-molecular” technology

Lead $1 billion latent TB test market conversion

Attractive menu expansion options

Trends

Clinical needs for latent and active disease detection

Global push for TB prevention and elimination

2016 developments

2016 goal: >$140 million of QuantiFERON-TB sales

Ongoing conversion from tuberculin skin test (TST)

Support from new TB guidelines (USPSTF)

QFT-Plus 4th generation test:

CE-IVD launch momentum

U.S. submission in Q4 2016

Fully addressed issues in U.S. FDA warning letter

QIAGEN value proposition 2017-2020 ambitions

QuantiFERON-TB: Modern gold standard TB test 2020 target: >$300 million of QuantiFERON-TB sales

QuantiFERON Monitor and CMV tests (CE-IVD) Advance TB detection with QFT-Plus clinical benefits

Scalable automation solutions Expand QuantiFERON to other latent diseases

QuantiFERON: Setting new standards in the global fight against TB

Sample to Insight

2016 Analyst & Investor Day

19

Table of Contents

|

Strategy

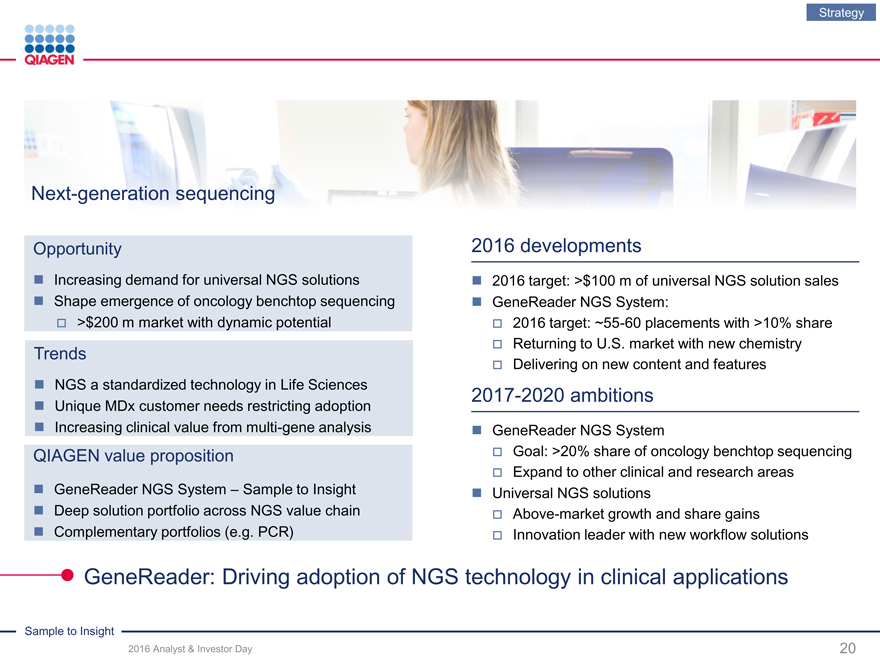

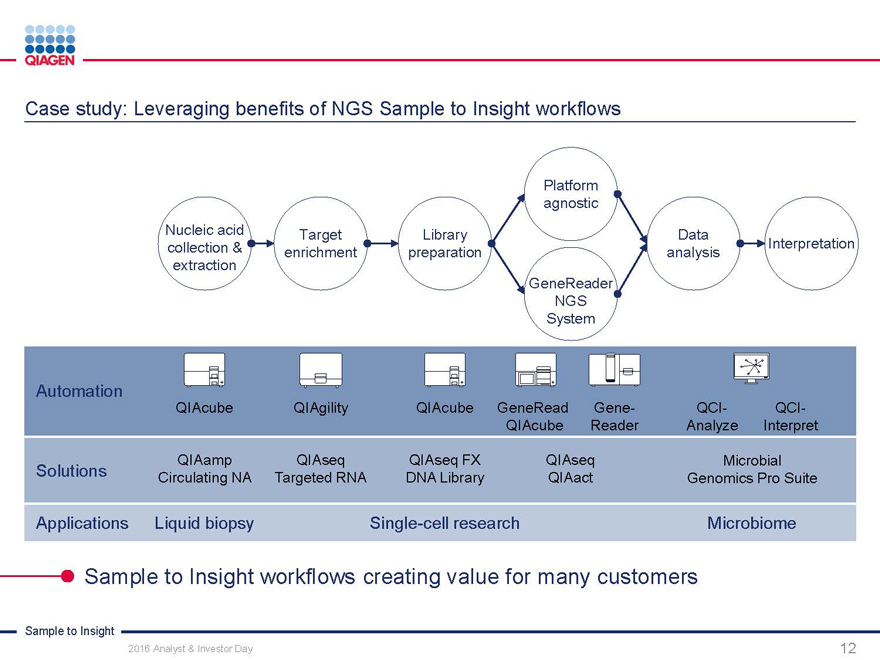

Next-generation sequencing

Opportunity

Increasing demand for universal NGS solutions

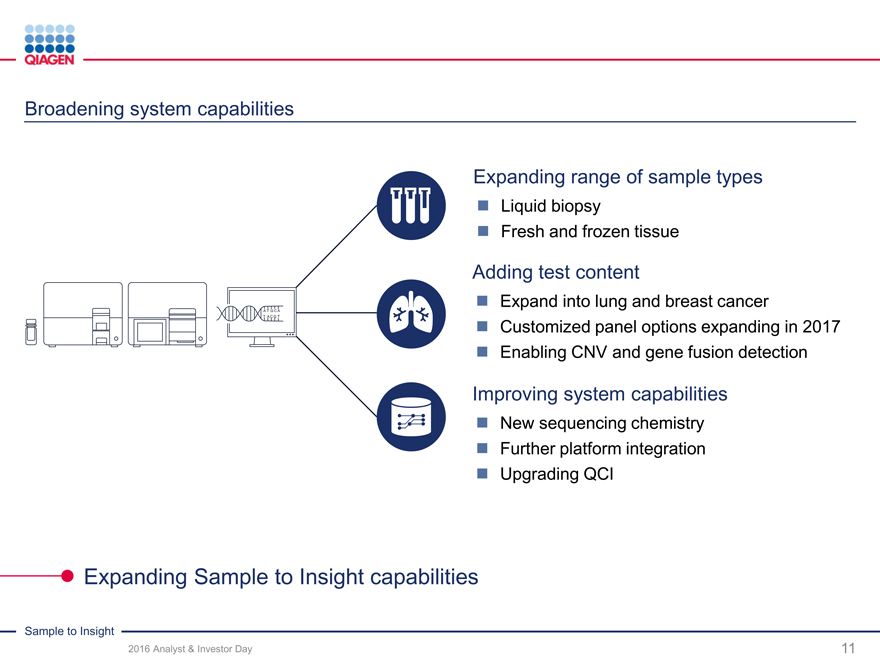

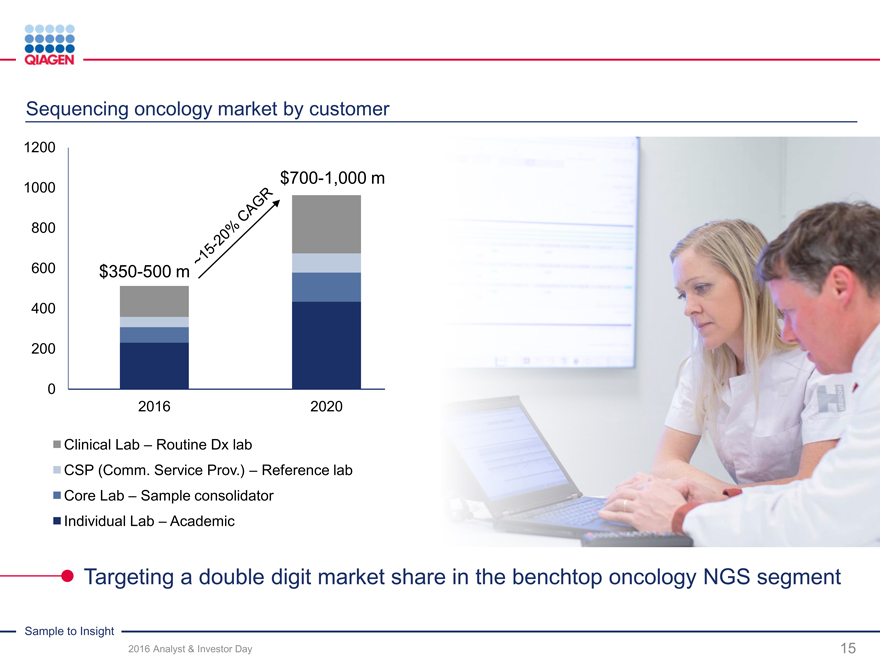

Shape emergence of oncology benchtop sequencing ? >$200 m market with dynamic potential

Trends

NGS a standardized technology in Life Sciences

Unique MDx customer needs restricting adoption

Increasing clinical value from multi-gene analysis

QIAGEN value proposition

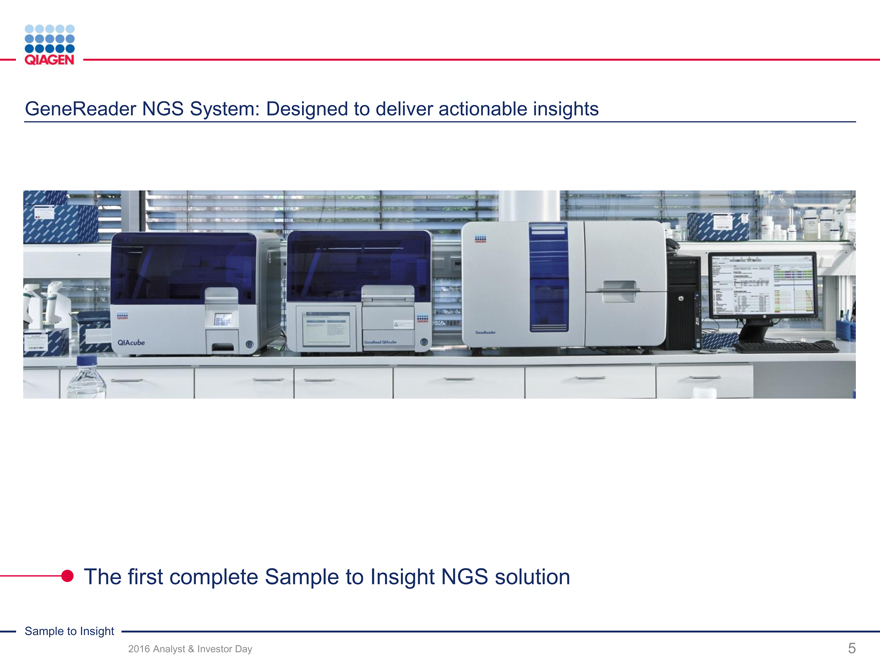

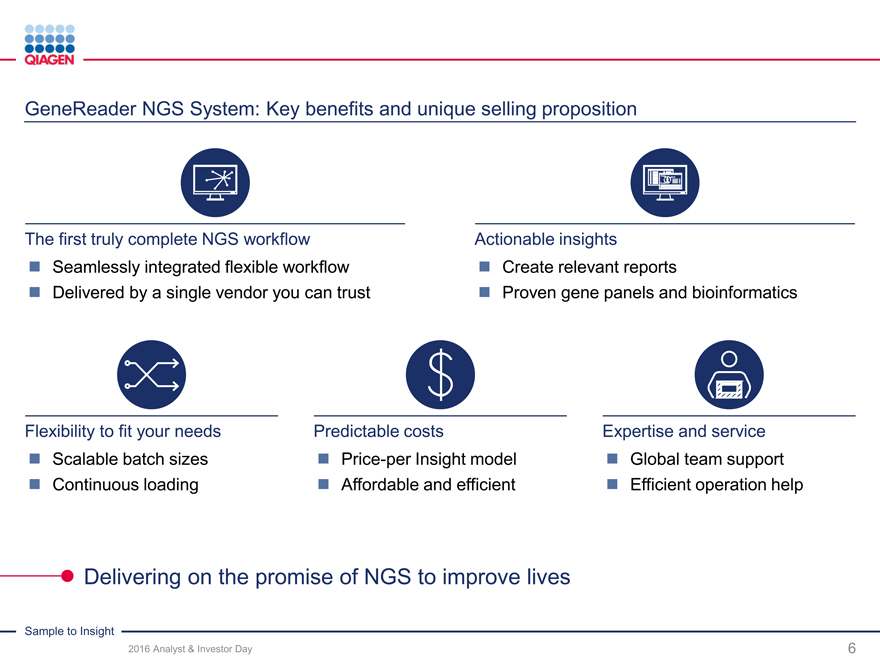

GeneReader NGS System – Sample to Insight

Deep solution portfolio across NGS value chain

Complementary portfolios (e.g. PCR)

2016 developments

2016 target: >$100 m of universal NGS solution sales

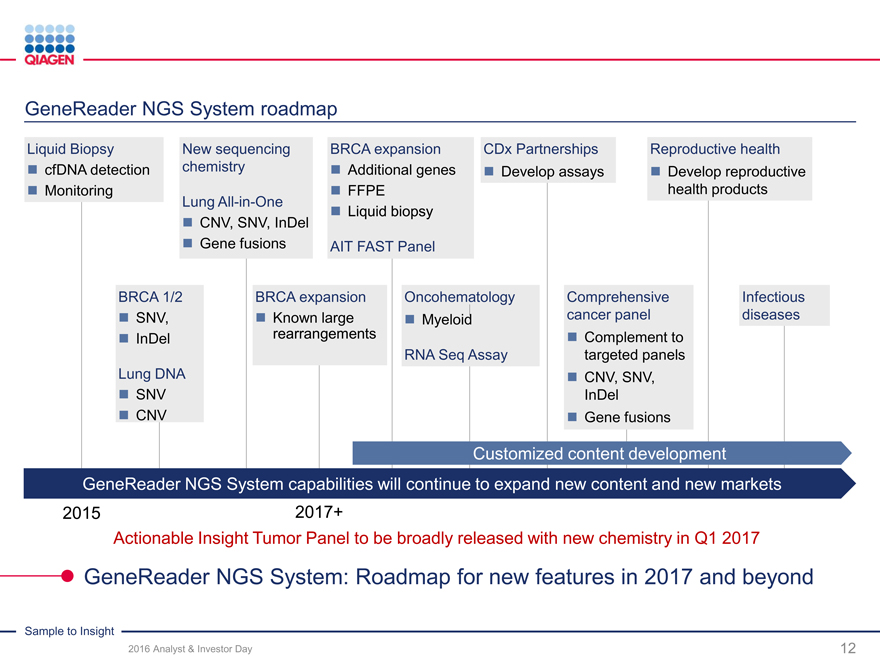

GeneReader NGS System:

2016 target: ~55-60 placements with >10% share

Returning to U.S. market with new chemistry

Delivering on new content and features

2017-2020 ambitions

GeneReader NGS System

Goal: >20% share of oncology benchtop sequencing

Expand to other clinical and research areas

Universal NGS solutions

Above-market growth and share gains

Innovation leader with new workflow solutions

GeneReader: Driving adoption of NGS technology in clinical applications

Sample to Insight

2016 Analyst & Investor Day

20

Table of Contents

|

Strategy

Personalized Healthcare

Opportunity 2016 developments

Precision medicine changing cancer treatment Milestone: >16 master collaboration agreements in 2016

Scientific advances: New tests and technologies Two new collaborations

Daiichi Sankyo – new extensive collaboration

Trends Confidential partner – immuno-oncology therapies

Expanded portfolio with GeneReader NGS System

Significant growth in molecular testing (PCR and NGS) Only supplier offering PCR and NGS technologies

Increasing acceptance of CDx value 2017-2020 ambitions

Varying regulatory conditions worldwide

QIAGEN value proposition Ambition to capture >50% of all CDx partnering deals

Expand CDx test portfolio to labs worldwide:

No. 1 worldwide in molecular companion diagnostics PCR

No. 1 in pharma co-development collaborations NGS

Proven track record of CE-IVD and FDA approvals Other molecular technologies

Personalized Healthcare: Expanding our leadership with NGS solutions

Sample to Insight

2016 Analyst & Investor Day

21

Table of Contents

|

Strategy

QIAsymphony

Opportunity 2016 developments

Medium-throughput testing: >$750 m market On track for >1,750 cumulative placements in 2016

Customer demand for robust automation systems Front-end use with GeneReader NGS System

? Modular components for different applications Workflow automation of QIAGEN liquid biopsy kits

Trends Major tender wins (viral load and transplantation)

Increasing test volumes requires more automation

Both IVD and laboratory-developed tests increasing 2017-2020 ambitions

2017 goal: >2,000 cumulative placements

QIAGEN value proposition Geographic strategy:

QIAsymphony: Highly flexible, proven automation Europe and rest of world: Broaden test menu

Largest IVD test menu in Europe U.S.: Address LDT and sample processing demand

Standard for sample processing for any application

QIAsymphony: Highly versatile automation solution providing solid growth

Sample to Insight

2016 Analyst & Investor Day 22

Table of Contents

|

Strategy

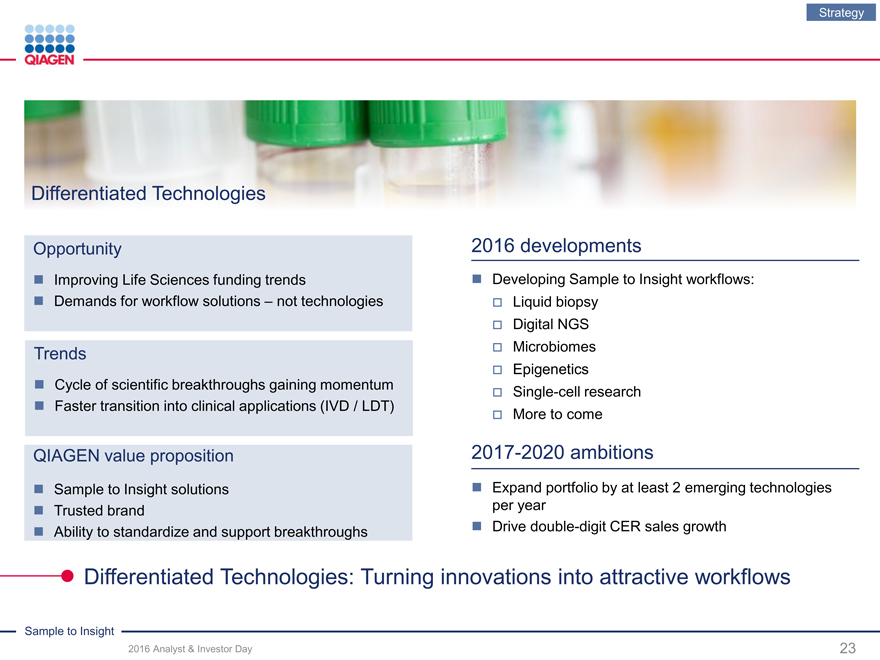

Differentiated Technologies

Opportunity

Improving Life Sciences funding trends

Demands for workflow solutions – not technologies

Trends

Cycle of scientific breakthroughs gaining momentum

Faster transition into clinical applications (IVD / LDT)

2016 developments

Developing Sample to Insight workflows:

Liquid biopsy

Digital NGS

Microbiomes

Epigenetics

Single-cell research

More to come

QIAGEN value proposition 2017-2020 ambitions

Sample to Insight solutions Expand portfolio by at least 2 emerging technologies

Trusted brand per year

Ability to standardize and support breakthroughs Drive double-digit CER sales growth

[Graphic Appears Here]

Differentiated Technologies: Turning innovations into attractive workflows

Sample to Insight

2016 Analyst & Investor Day

23

Table of Contents

|

Strategy

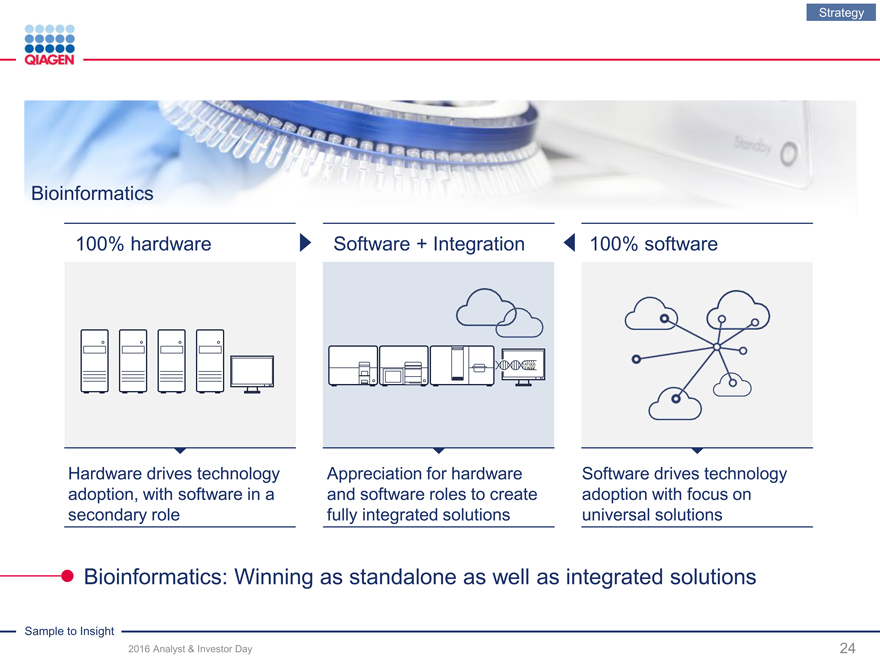

Bioinformatics

100% hardware Software + Integration 100% software

TACGT ATGCA

Hardware drives technology Appreciation for hardware Software drives technology adoption, with software in a and software roles to create adoption with focus on secondary role fully integrated solutions universal solutions

Bioinformatics: Winning as standalone as well as integrated solutions

Sample to Insight

2016 Analyst & Investor Day 24

Table of Contents

|

Strategy

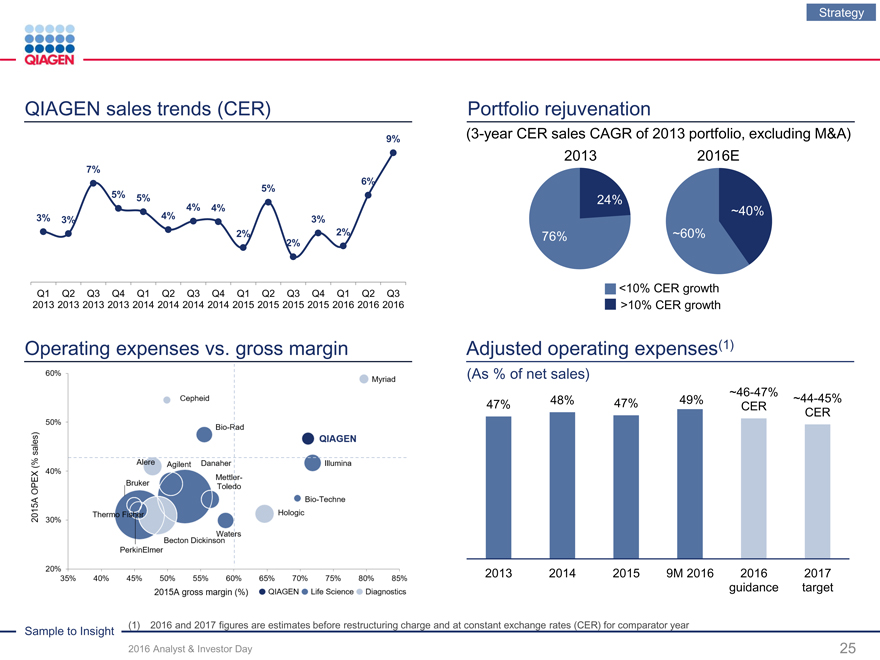

QIAGEN sales trends (CER)

9%

7%

6%

5%

5% 5%

4% 4%

3% 3% 4% 3%

2% 2%

2%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2013 2013 2013 2013 2014 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016

Operating expenses vs. gross margin

Portfolio rejuvenation

(3-year CER sales CAGR of 2013 portfolio, excluding M&A)

2013 2016E

24%

~40%

76% ~60%

<10% CER growth

>10% CER growth

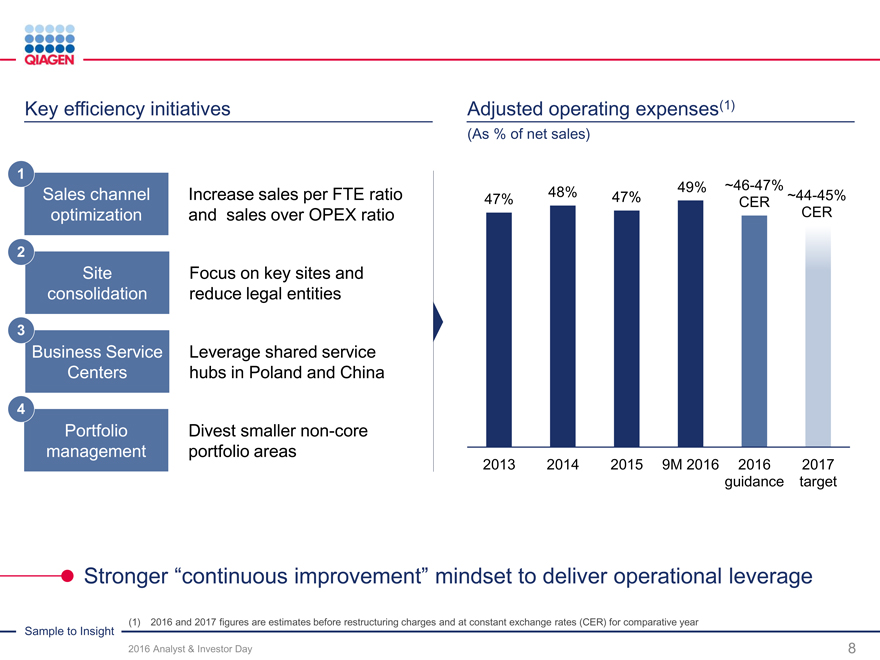

Adjusted operating expenses(1)

(As % of net sales)

48% ~46-47%

47% 47% 49%CER~44-45%

CER

2013 201420159M 201620162017

guidancetarget

Sample to Insight (1) 2016 and 2017 figures are estimates before restructuring charge and at constant exchange rates (CER) for comparator year

2016 Analyst & Investor Day 25

Table of Contents

|

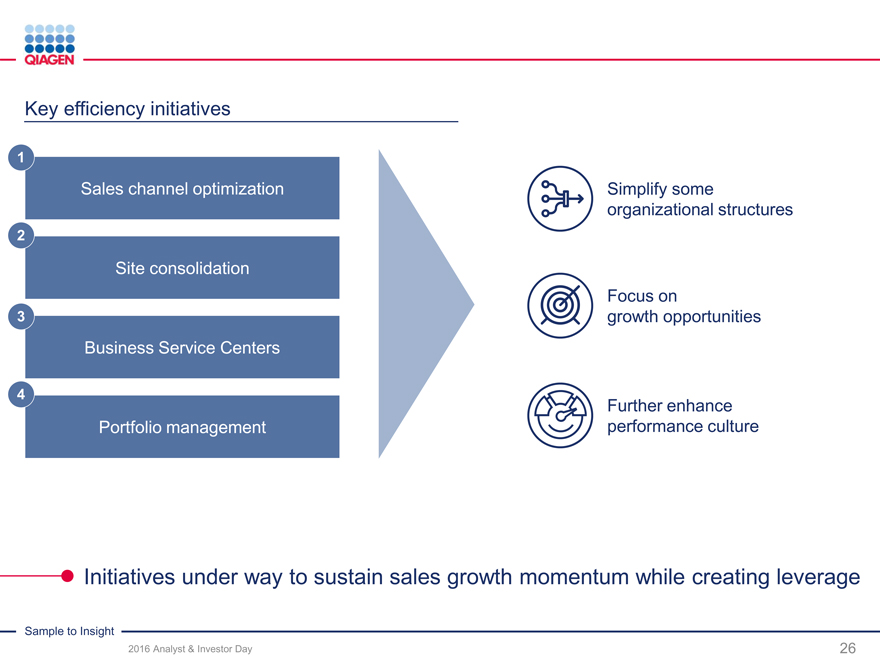

Key efficiency initiatives

1

Sales channel optimization Simplify some organizational structures

2

Site consolidation

Focus on

3 growth opportunities Business Service Centers

4

Further enhance Portfolio management performance culture

Initiatives under way to sustain sales growth momentum while creating leverage

Sample to Insight

2016 Analyst & Investor Day 26

Table of Contents

|

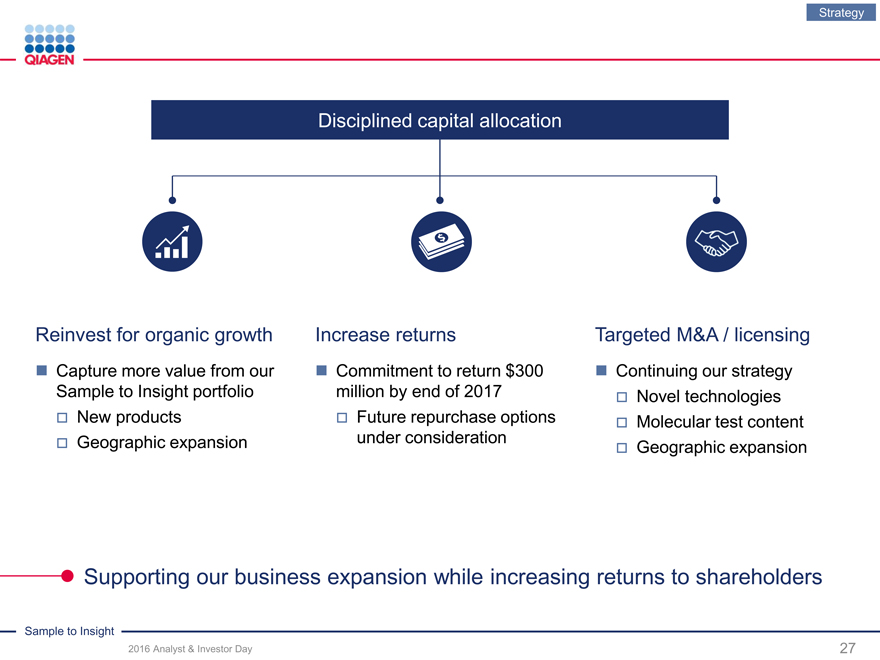

Strategy

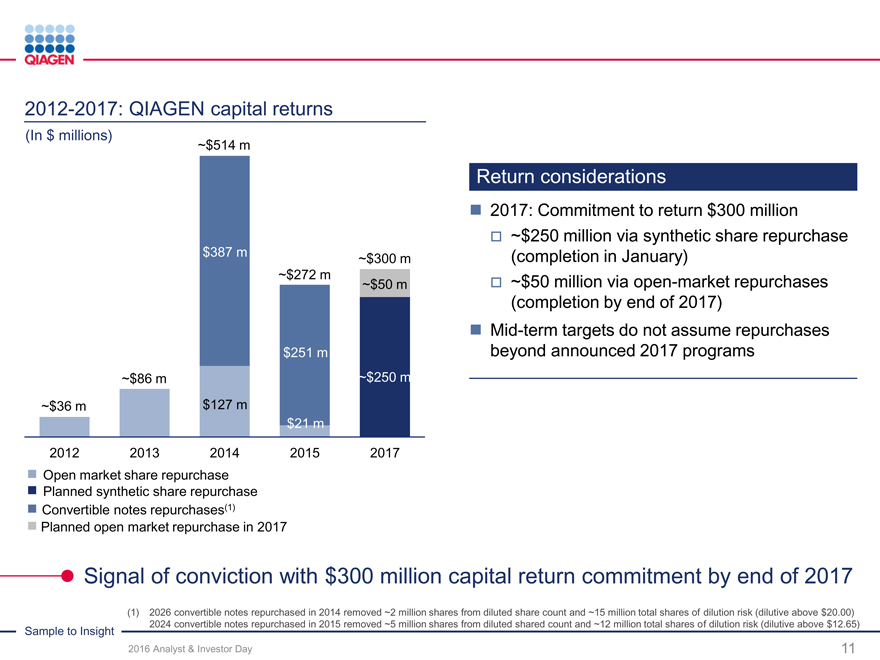

Disciplined capital allocation

Reinvest for organic growth Increase returns Targeted M&A / licensing

Capture more value from our Commitment to return $300Continuing our strategy

Sample to Insight portfolio million by end of 2017Novel technologies

New productsFuture repurchase optionsMolecular test content

Geographic expansionunder considerationGeographic expansion

Supporting our business expansion while increasing returns to shareholders

Sample to Insight

2016 Analyst & Investor Day

27

Table of Contents

|

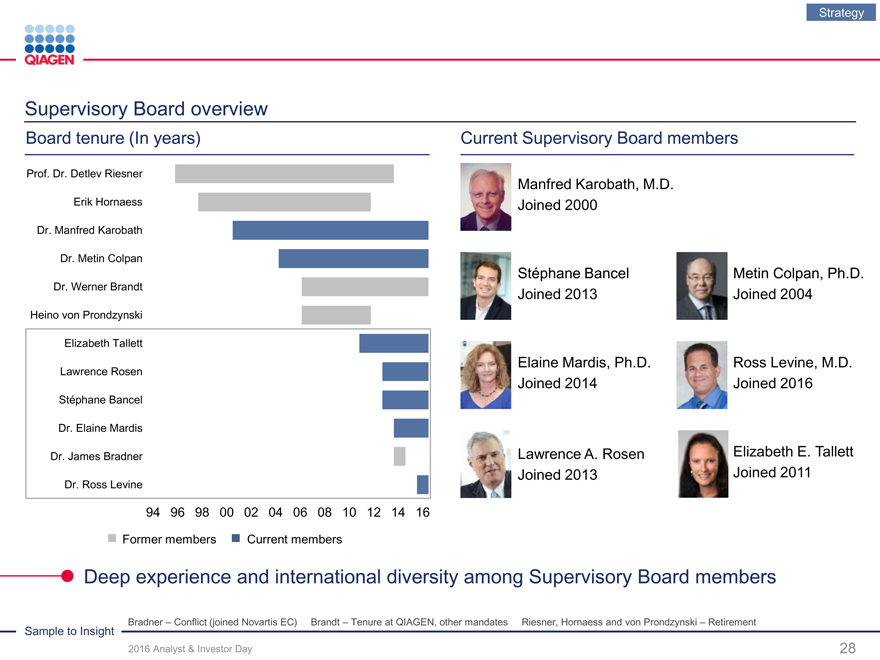

Strategy

Supervisory Board overview

Board tenure (In years) Current Supervisory Board members

Prof. Dr. Detlev Riesner

Manfred Karobath, M.D.

Erik Hornaess Joined 2000

Dr. Manfred Karobath

Dr. Metin Colpan

Stéphane Bancel Metin Colpan, Ph.D.

Dr. Werner Brandt Joined 2013 Joined 2004

Heino von Prondzynski

Elizabeth Tallett

Lawrence Rosen

Stéphane Bancel

Dr. Elaine Mardis

Dr. James Bradner

Dr. Ross Levine

94 96 98 00 02 04 06 08 10 121416

Former members Current members

Elaine Mardis, Ph.D. Ross Levine, M.D.

Joined 2014 Joined 2016

Lawrence A. Rosen Elizabeth E. Tallett

Joined 2013 Joined 2011

Deep experience and international diversity among Supervisory Board members

Sample to Insight Bradner – Conflict (joined Novartis EC) Brandt – Tenure at QIAGEN, other mandates Riesner, Hornaess and von Prondzynski – Retirement

2016 Analyst & Investor Day 28

Table of Contents

|

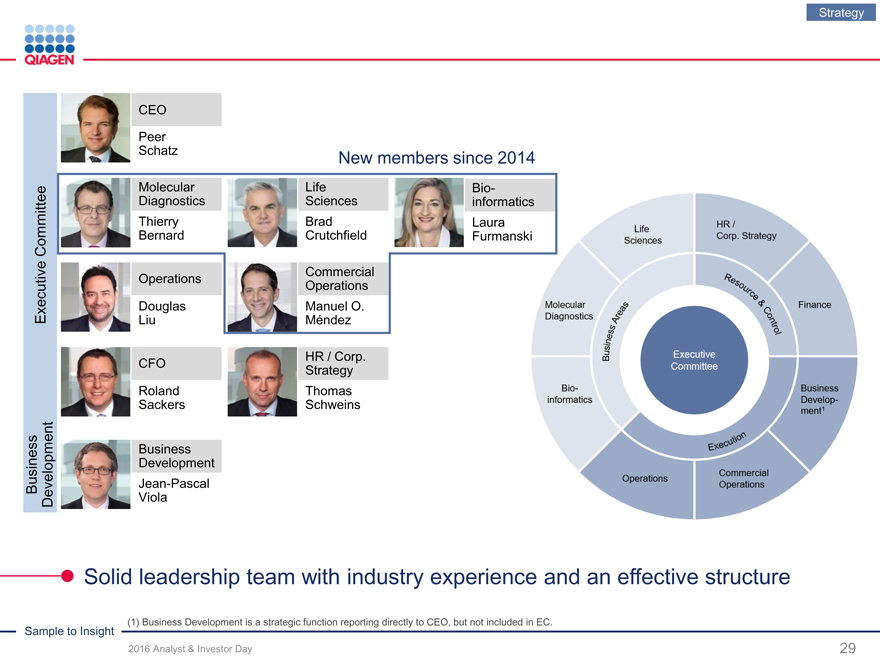

Strategy

CEO

Peer

Schatz

New members since 2014

Molecular LifeBio-

Diagnostics Sciencesinformatics

Thierry BradLaura

Committee Bernard CrutchfieldFurmanski

Commercial

Operations

Operations

Executive DouglasManuel O.

LiuMéndez

HR / Corp.

CFO

Strategy

RolandThomas

SackersSchweins

Business

Development

Jean-Pascal

Business Development

Viola

Solid leadership team with industry experience and an effectivestructure

(1) Business Development is a strategic function reporting directly to CEO, but not included in EC.

Sample to Insight

2016 Analyst & Investor Day29

Table of Contents

|

Strategy

Committed employees worldwide helping customers to gain valuable insights

Sample to Insight

2016 Analyst & Investor Day 30

Table of Contents

|

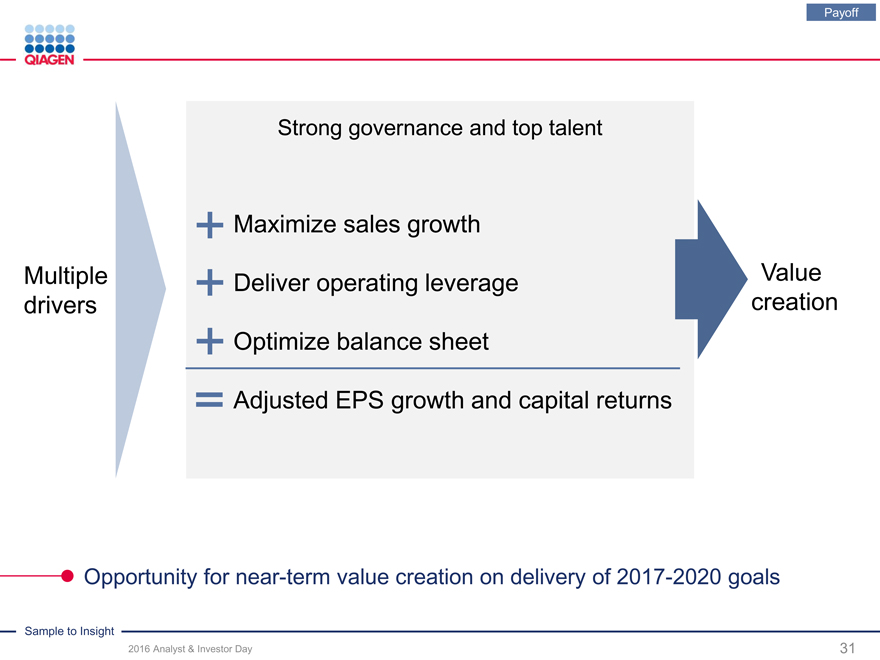

Payoff

Strong governance and top talent

Maximize sales growth

Multiple Deliver operating leverage Value drivers creation Optimize balance sheet

Adjusted EPS growth and capital returns

Opportunity for near-term value creation on delivery of 2017-2020 goals

Sample to Insight

2016 Analyst & Investor Day 31

Table of Contents

|

Summary

Reaccelerating performance after transformation Sustainable sales growth and leverage trajectory Emerging as a stronger, focused, differentiated leader Committed to higher returns and greater value creation

Sample to Insight

2016 Analyst & Investor Day 32

Table of Contents

Exhibit 99.3

|

Life Sciences:

Innovator at the leading edge of research

Brad Crutchfield

Senior Vice President, Head of Life Sciences Business Areas November 15, 2016

Sample to Insight

2016 Analyst & Investor Day 1

Table of Contents

|

Disclaimer

Safe Harbor Statement: This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section

21E of the U.S. Securities Exchange Act of 1934, as amended. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our own expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited, to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of QIAGEN’s new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

Regulation G: QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight on performance. In this presentation, adjusted results include adjusted operating expenses, adjusted EBITDA, adjusted diluted EPS and free cash flow. Adjusted results are non-GAAP financial measures QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of its ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the Appendix provided in this presentation “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. QIAGEN does not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

GeneReader NGS System: The QIAGEN GeneReader® NGS System is currently available for marketing and sales outside the United States. The QIAGEN GeneReader® NGS System with new sequencing chemistry will be made available in the United States starting in December 2016. The QIAGEN GeneReader® NGS System is intended for Research Use Only. This product is not intended for the diagnosis, prevention or treatment of a disease. QIAGEN Clinical Insight® is an evidence-based decision support software intended as an aid in the interpretation of variants observed in genomic sequencing data. The software evaluates genomic variants in the context of published biomedical literature, professional association guidelines, publicly available databases and annotations, drug labels and clinical-trials. Based on this evaluation, the software proposes a classification and bibliographic references to aid in the interpretation of observed variants. The software is not intended as a primary diagnostic tool by physicians or to be used as a substitute for professional healthcare advice. Each laboratory is responsible for ensuring compliance with applicable international, national and local clinical laboratory regulations and other accreditation requirements

Sample to Insight

2016 Analyst & Investor Day

2

Table of Contents

|

Sample to Insight

2016 Analyst & Investor Day 3

Table of Contents

|

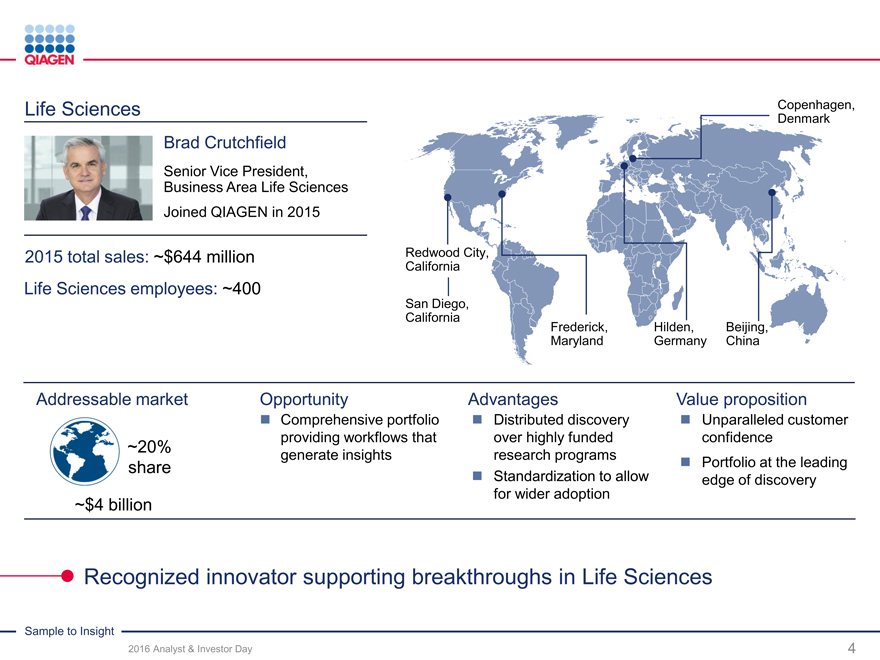

Life Sciences Copenhagen,

Denmark

Brad Crutchfield

Senior Vice President,

Business Area Life Sciences

Joined QIAGEN in 2015

2015 total sales: ~$644 million Redwood City,

California

Life Sciences employees: ~400

San Diego,

California

Frederick,Hilden,Beijing,

MarylandGermanyChina

Addressable market Opportunity AdvantagesValue proposition

Comprehensive portfolio Distributed discovery Unparalleled customer

providing workflows thatover highly fundedconfidence

~20% generate insightsresearch programs

share Portfolio at the leading

Standardization to allowedge of discovery

for wider adoption

~$4 billion

Recognized innovator supporting breakthroughs in Life Sciences

Sample to Insight

2016 Analyst & Investor Day

4

Table of Contents

|

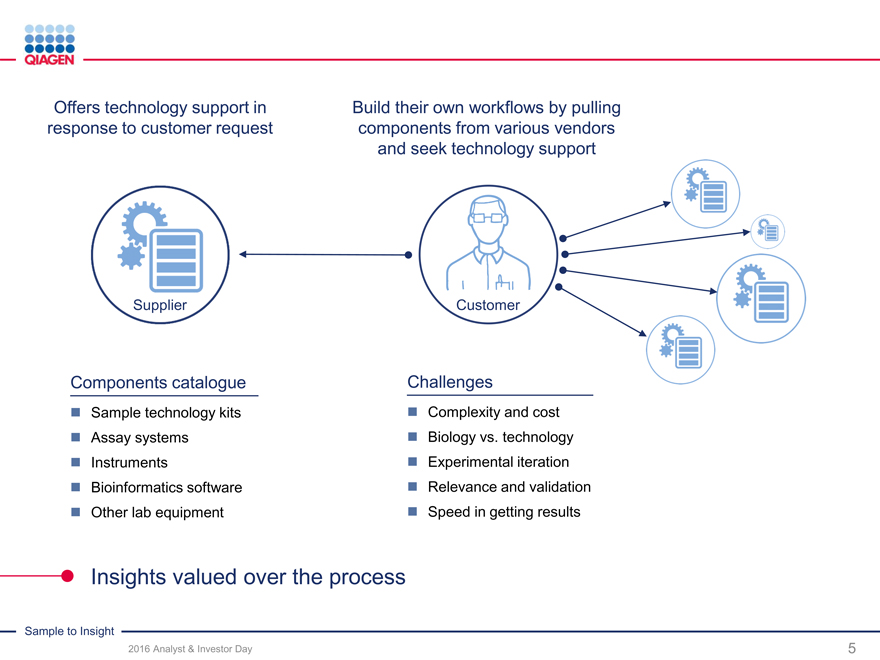

Offers technology support in Build their own workflows by pulling

response to customer request components from various vendors

and seek technology support

Supplier Customer

Components catalogue Challenges

Sample technology kits Complexity and cost

Assay systems Biology vs. technology

Instruments Experimental iteration

Bioinformatics software Relevance and validation

Other lab equipment Speed in getting results

Insights valued over the process

Sample to Insight

2016 Analyst & Investor Day

5

Table of Contents

|

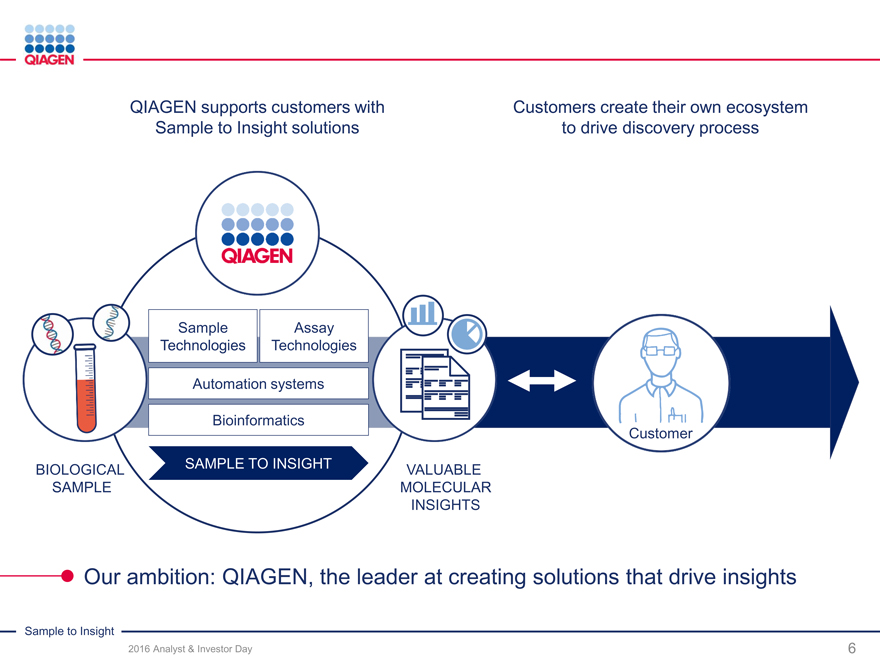

QIAGEN supports customers with Customers create their own ecosystem

Sample to Insight solutions to drive discovery process

Sample Assay

Technologies Technologies

Automation systems

Bioinformatics

Customer

BIOLOGICAL SAMPLE TO INSIGHT VALUABLE

SAMPLE MOLECULAR

INSIGHTS

Our ambition: QIAGEN, the leader at creating solutions that drive insights

Sample to Insight

2016 Analyst & Investor Day

6

Table of Contents

|

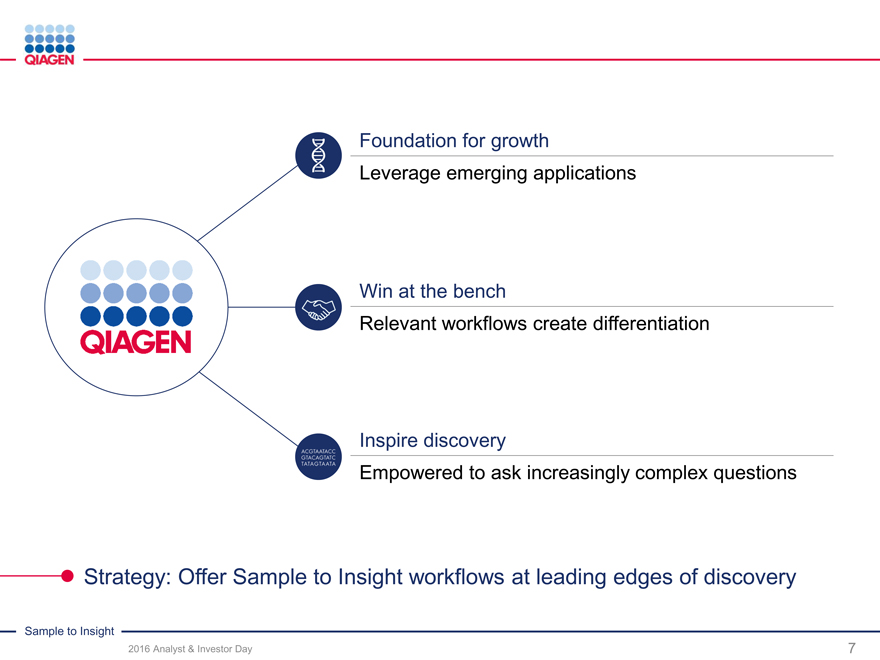

Foundation for growth

Leverage emerging applications

Win at the bench

Relevant workflows create differentiation

Inspire discovery

Empowered to ask increasingly complex questions

Strategy: Offer SampletoInsight workflows at leading edges of discovery

Sample to Insight

2016 Analyst & Investor Day

7

Table of Contents

|

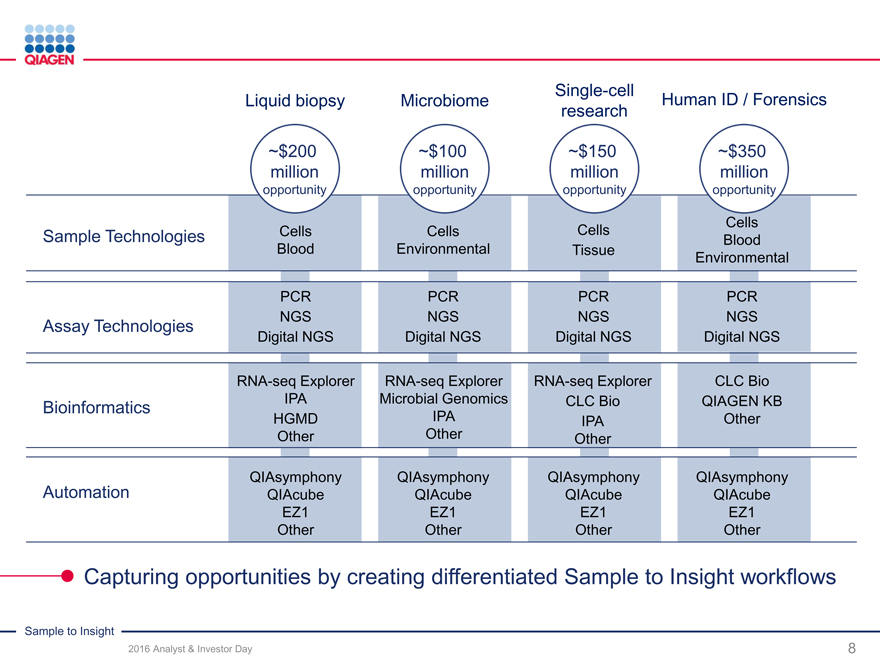

Single-cell

Liquid biopsy MicrobiomeHuman ID / Forensics

research

~$200 ~$100~$150~$350

million millionmillionmillion

opportunity opportunityopportunityopportunity

Cells

Sample Technologies Cells CellsCellsBlood

Blood EnvironmentalTissueEnvironmental

PCR PCRPCRPCR

Assay Technologies NGS NGSNGSNGS

Digital NGS Digital NGSDigital NGSDigital NGS

RNA-seq Explorer RNA-seq ExplorerRNA-seq ExplorerCLC Bio

Bioinformatics IPA Microbial GenomicsCLC BioQIAGEN KB

HGMD IPAIPAOther

Other OtherOther

QIAsymphony QIAsymphonyQIAsymphonyQIAsymphony

Automation QIAcube QIAcubeQIAcubeQIAcube

EZ1 EZ1EZ1EZ1

Other OtherOtherOther

Capturing opportunities by creating differentiated Sample to Insight workflows

Sample to Insight

2016 Analyst & Investor Day

8

Table of Contents

|

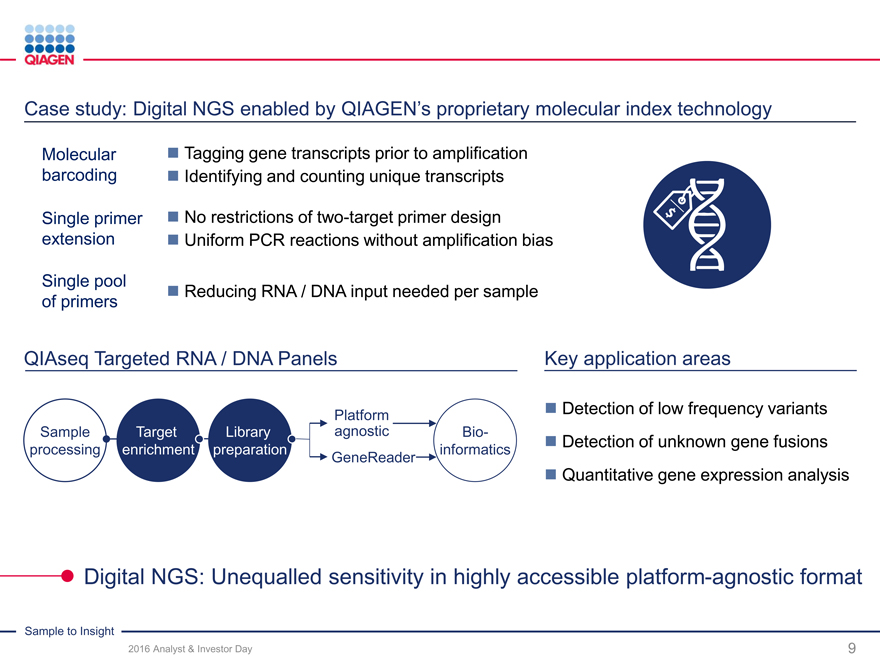

Case study: Digital NGS enabled by QIAGEN’s proprietary molecular index technology

Molecular Tagging gene transcripts prior to amplification

barcoding Identifying and counting unique transcripts

Single primer No restrictions of two-target primer design

extension Uniform PCR reactions without amplification bias

Single pool Reducing RNA / DNA input needed per sample

of primers

QIAseq Targeted RNA / DNA Panels Key application areas

Platform

Sample Target LibraryagnosticBio-

processing enrichment preparationinformatics

GeneReader

Detection of low frequency variants

Detection of unknown gene fusions

Quantitative gene expression analysis

Digital NGS: Unequalled sensitivity in highly accessible platform-agnostic format

Sample to Insight

2016 Analyst & Investor Day

9

Table of Contents

|

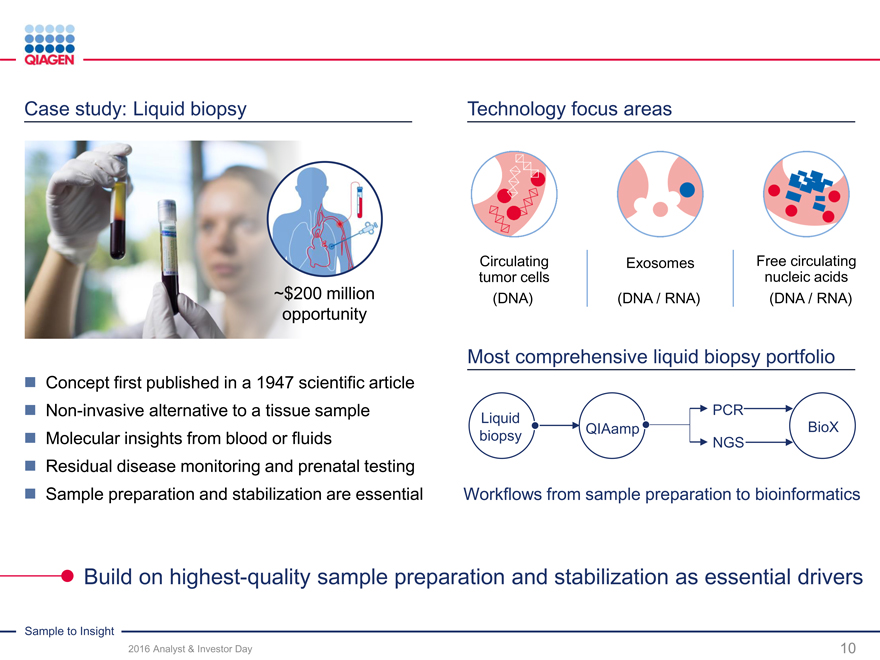

Case study: Liquid biopsy Technology focus areas

CirculatingExosomesFree circulating

tumor cellsnucleic acids

~$200 million (DNA)(DNA / RNA)(DNA / RNA)

opportunity

Most comprehensive liquid biopsy portfolio

Concept first published in a 1947 scientific article

Non-invasive alternative to a tissue sample PCR

LiquidQIAampBioX

Molecular insights from blood or fluids biopsyNGS

Residual disease monitoring and prenatal testing

Sample preparation and stabilization are essential Workflows from sample preparation to bioinformatics

Build on highest-quality sample preparation and stabilization as essential drivers

Sample to Insight

2016 Analyst & Investor Day 10

Table of Contents

|

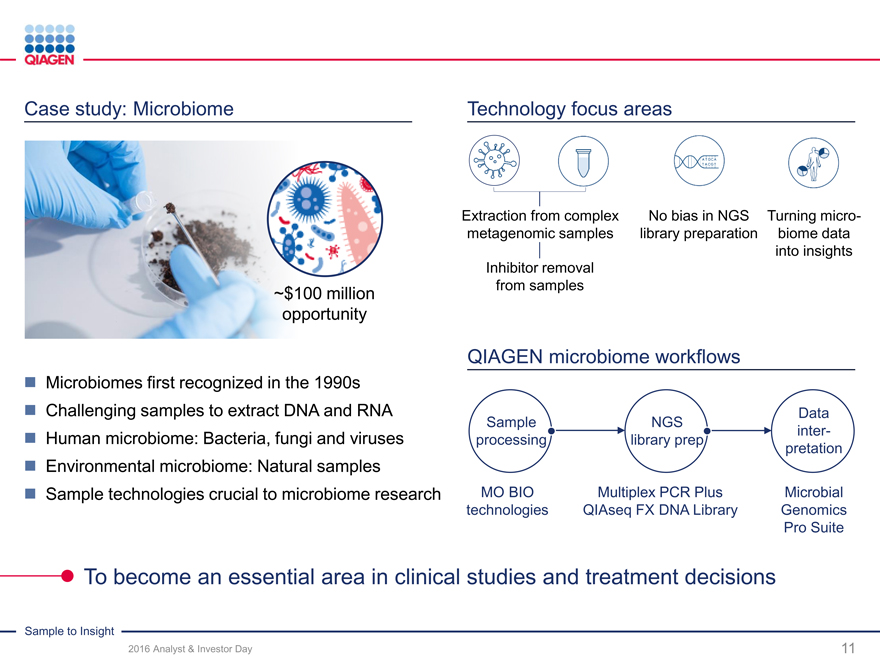

Case study: Microbiome

~$100 million opportunity

Technology focus areas

Microbiomes first recognized in the 1990s

Challenging samples to extract DNA and RNA

Human microbiome: Bacteria, fungi and viruses

Environmental microbiome: Natural samples

Sample technologies crucial to microbiome research

Extraction from complex No bias in NGS Turning micro-

metagenomic samples library preparation biome data

into insights

Inhibitor removal

from samples

QIAGEN microbiome workflows

Data

Sample NGSinter-

processing library preppretation

MO BIO Multiplex PCR Plus Microbial

technologies QIAseq FX DNA Library Genomics

Pro Suite

To become an essential area in clinical studies and treatment decisions

Sample to Insight

2016 Analyst & Investor Day

11

Table of Contents

|

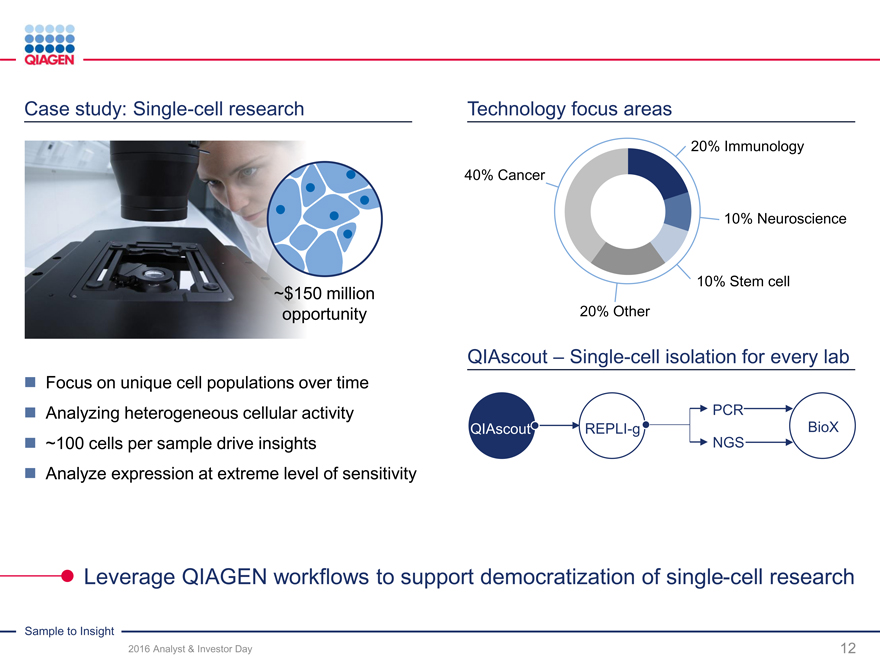

Case study: Single-cell research Technology focus areas

20% Immunology

40% Cancer

10% Neuroscience

10% Stem cell

~$150 million

opportunity 20% Other

QIAscout – Single-cell isolation for every lab

Focus on unique cell populations over time

Analyzing heterogeneous cellular activity PCR

QIAscoutREPLI-gBioX

~100 cells per sample drive insights NGS

Analyze expression at extreme level of sensitivity

Leverage QIAGEN workflows to support democratization of single-cell research

Sample to Insight

2016 Analyst & Investor Day 12

Table of Contents

|

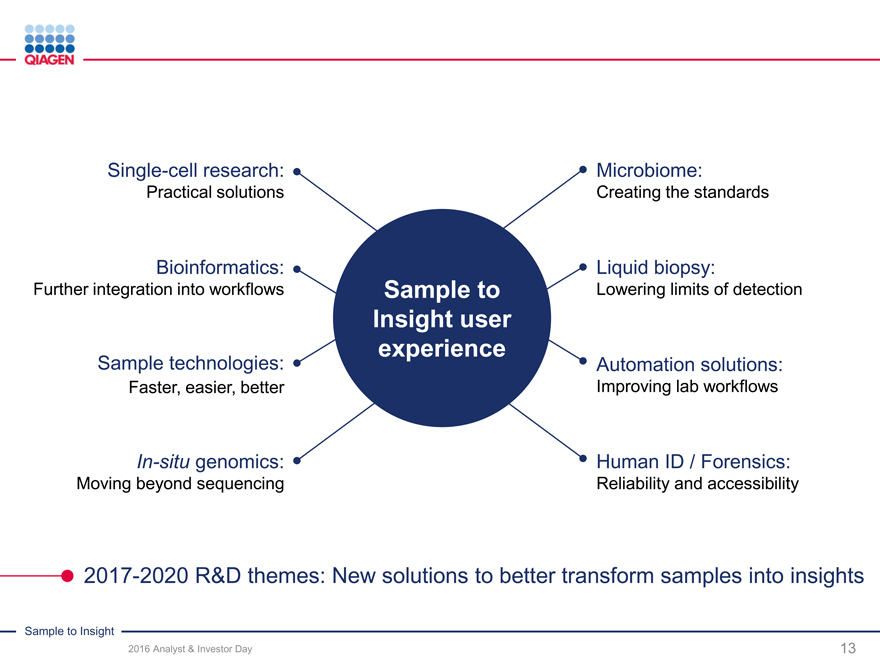

Single-cell research: Microbiome:

Practical solutions Creating the standards

Bioinformatics: Liquid biopsy:

Further integration into workflows Sample to Lowering limits of detection

Insight user

experience

Sample technologies: Automation solutions:

Faster, easier, better Improving lab workflows

In-situ genomics: Human ID / Forensics:

Moving beyond sequencing Reliability and accessibility

2017-2020 R&D themes: New solutions to better transform samples into insights

Sample to Insight

2016 Analyst & Investor Day

13

Table of Contents

|

A trusted innovator in Life Science Research Unique position to deliver solutions Differentiation with the best user experience Transforming samples into valuable insights

Sample to Insight

2016 Analyst & Investor Day 14

Table of Contents

Exhibit 99.4

|

Molecular Diagnostics:

Addressing urgent healthcare issues with innovative solutions

Thierry Bernard

Senior Vice President, Head of Molecular Diagnostics Business Area November 15, 2016

Sample to Insight

2016 Analyst & Investor Day 1

Disclaimer

Table of Contents

|

Safe Harbor Statement: This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section

21E of the U.S. Securities Exchange Act of 1934, as amended. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our own expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited, to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of QIAGEN’s new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

Regulation G: QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight on performance. In this presentation, adjusted results include adjusted operating expenses, adjusted EBITDA, adjusted diluted EPS and free cash flow. Adjusted results are non-GAAP financial measures QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of its ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the Appendix provided in this presentation “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. QIAGEN does not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

GeneReader NGS System: The QIAGEN GeneReader® NGS System is currently available for marketing and sales outside the United States. The QIAGEN GeneReader® NGS System with new sequencing chemistry will be made available in the United States starting in December 2016. The QIAGEN GeneReader® NGS System is intended for Research Use Only. This product is not intended for the diagnosis, prevention or treatment of a disease. QIAGEN Clinical Insight® is an evidence-based decision support software intended as an aid in the interpretation of variants observed in genomic sequencing data. The software evaluates genomic variants in the context of published biomedical literature, professional association guidelines, publicly available databases and annotations, drug labels and clinical-trials. Based on this evaluation, the software proposes a classification and bibliographic references to aid in the interpretation of observed variants. The software is not intended as a primary diagnostic tool by physicians or to be used as a substitute for professional healthcare advice. Each laboratory is responsible for ensuring compliance with applicable international, national and local clinical laboratory regulations and other accreditation requirements

Sample to Insight

2016 Analyst & Investor Day

2

Table of Contents

|

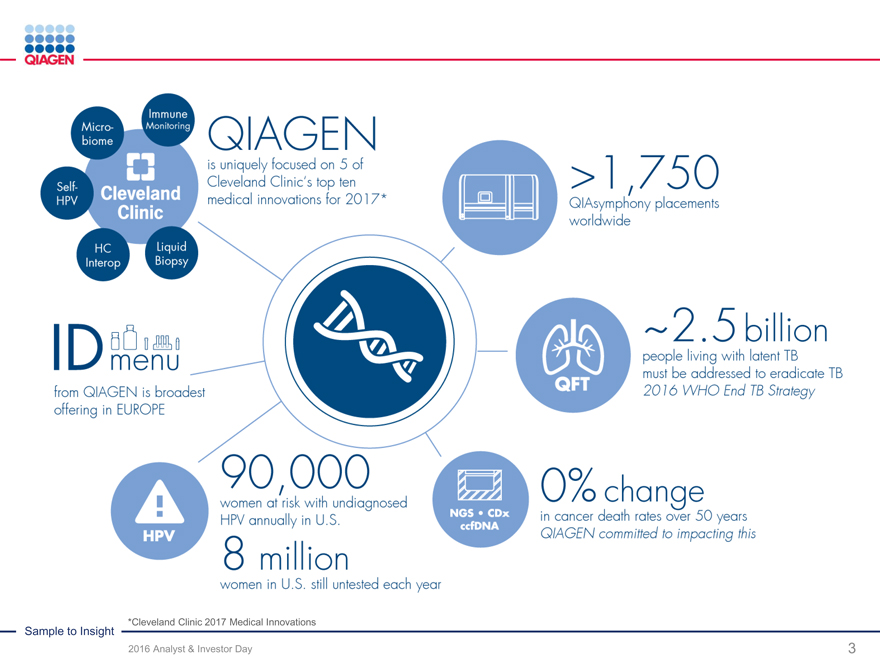

Sample to Insight *Cleveland Clinic 2017 Medical Innovations

2016 Analyst & Investor Day 3

Table of Contents

|

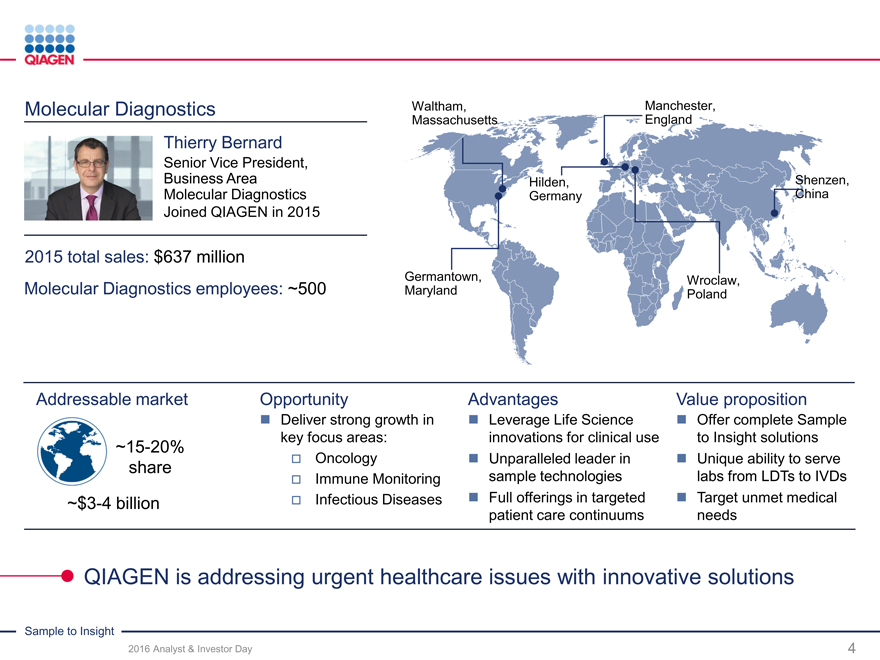

Molecular Diagnostics Waltham, Manchester,

Massachusetts England

Thierry Bernard

Senior Vice President,

Business Area Hilden,Shenzen,

Molecular Diagnostics GermanyChina

Joined QIAGEN in 2015

2015 total sales: $637 million

Germantown, Wroclaw,

Molecular Diagnostics employees: ~500 Maryland Poland

Addressable market Opportunity AdvantagesValue proposition

Deliver strong growth in Leverage Life Science Offer complete Sample

~15-20% key focus areas: innovations for clinical useto Insight solutions

share Oncology Unparalleled leader in Unique ability to serve

Immune Monitoringsample technologieslabs from LDTs to IVDs

~$3-4 billion Infectious Diseases Full offerings in targeted Target unmet medical

patient care continuumsneeds

QIAGEN is addressing urgent healthcare issues with innovative solutions

Sample to Insight

2016 Analyst & Investor Day

4

Table of Contents

|

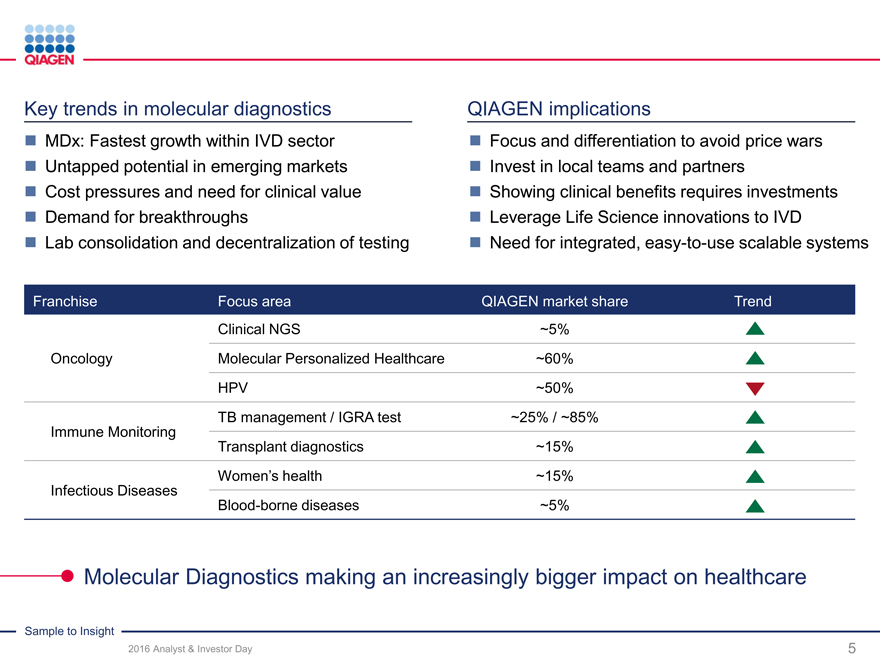

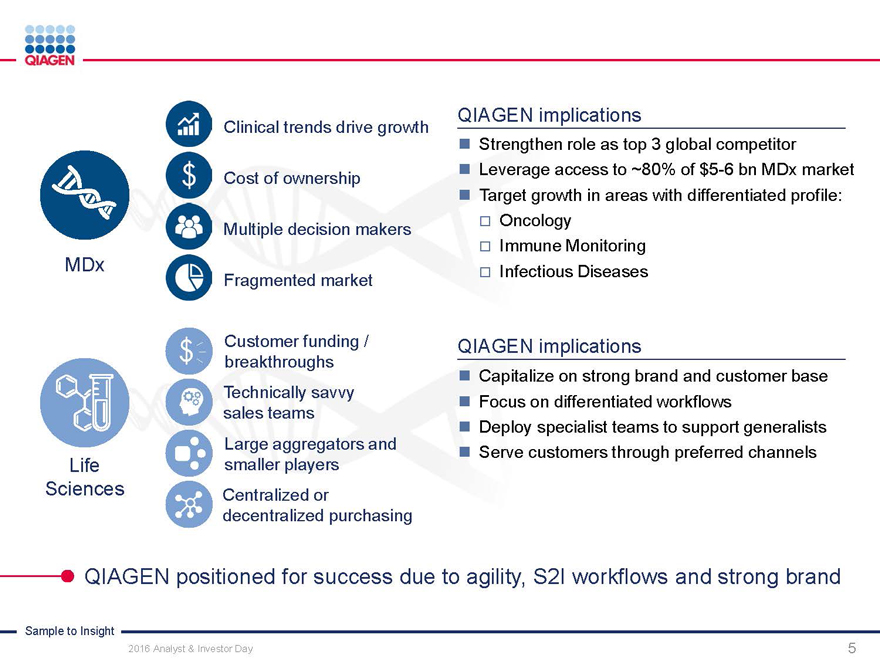

Key trends in molecular diagnostics

MDx: Fastest growth within IVD sector

Untapped potential in emerging markets

Cost pressures and need for clinical value

Demand for breakthroughs

Lab consolidation and decentralization of testing

QIAGEN implications

Focus and differentiation to avoid price wars

Invest in local teams and partners

Showing clinical benefits requires investments

Leverage Life Science innovations to IVD

Need for integrated, easy-to-use scalable systems

Franchise Focus area QIAGEN market shareTrend

Clinical NGS ~5%

Oncology Molecular Personalized Healthcare ~60%

HPV ~50%

TB management / IGRA test ~25% / ~85%

Immune Monitoring

Transplant diagnostics ~15%

Women’s health ~15%

Infectious Diseases

Blood-borne diseases ~5%

Molecular Diagnostics making an increasingly bigger impact on healthcare

Sample to Insight

2016 Analyst & Investor Day

5

Table of Contents

|

Covering the most attractive Molecular Diagnostics segments

QIAGEN’s differentiated offering addressing urgent healthcare needs:

Immune Monitoring

Oncology

Infectious Diseases

Complete Sample to Insight solutions: Scalable workflows using different technologies

Our ambition: A QIAGEN Sample to Insight solution in every MDx lab worldwide

Sample to Insight

2016 Analyst & Investor Day

6

Table of Contents

|

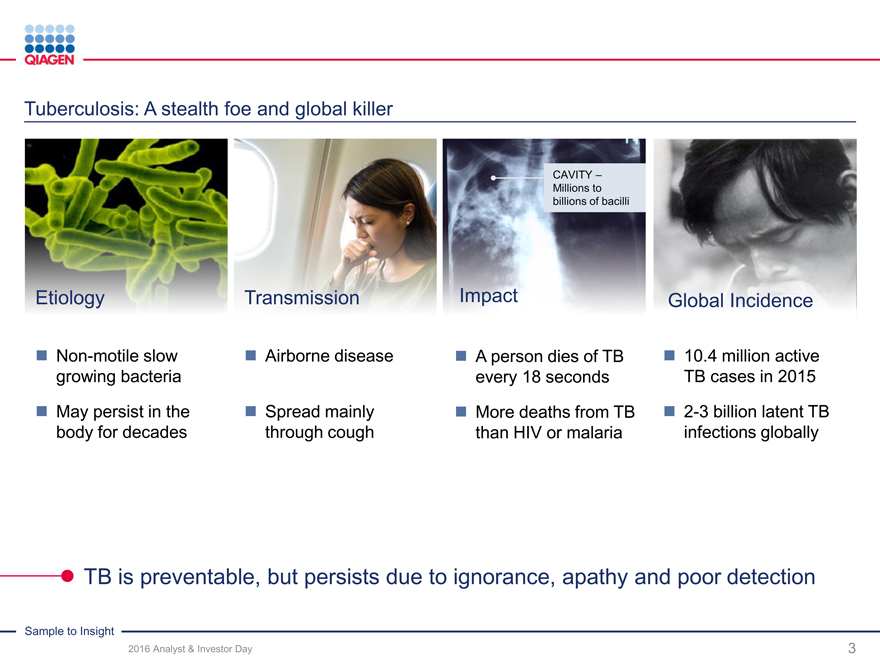

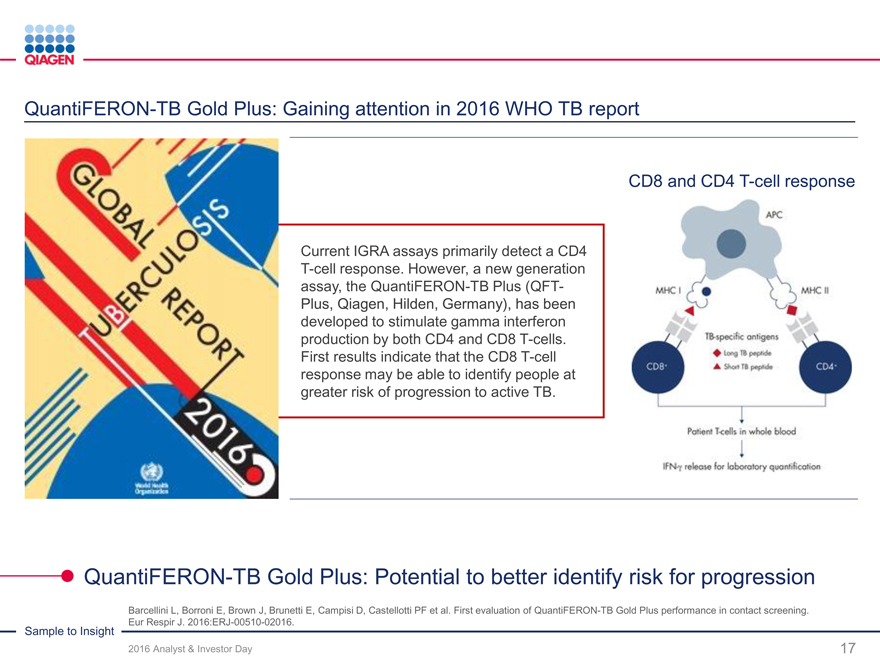

Immune Monitoring: Expand QuantiFERON benefits 2020 sales target: >$300 million from QuantiFERON-TB

Oncology: Accelerate lead in Personalized Healthcare Expanding offering from PCR to NGS with GeneReader

Infectious Diseases: Maximize portfolio strengths

QIAsymphony as flagship automation solution

Deliver innovations

Enhance our focused market leadership positions

Strategy: Strengthen our top 3 leadership position with differentiated portfolios

Sample to Insight

2016 Analyst & Investor Day

7

Table of Contents

|

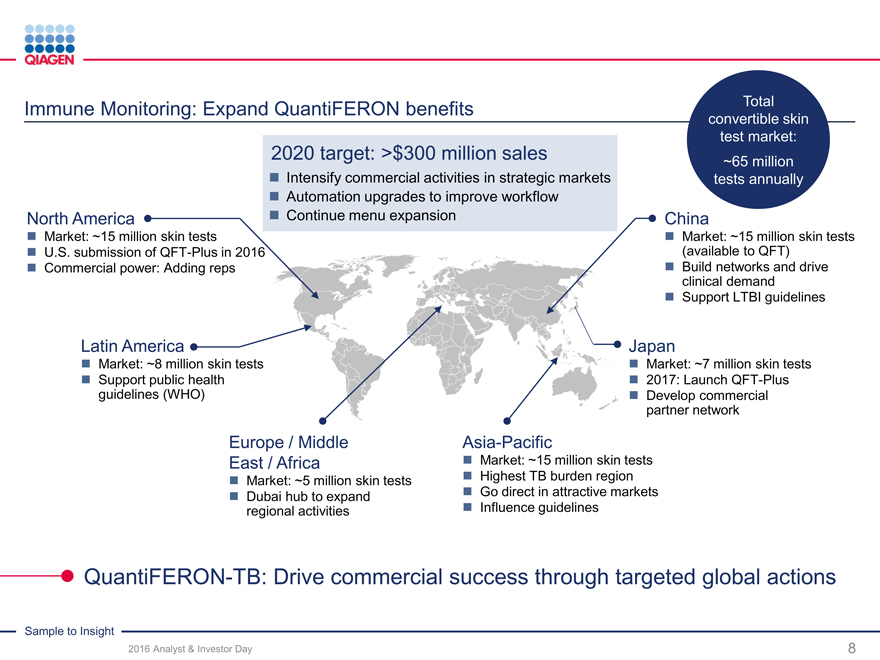

Immune Monitoring: Expand QuantiFERON benefits Total

convertible skin

test market:

2020 target: >$300 million sales ~65 million

Intensify commercial activities in strategic marketstests annually

Automation upgrades to improve workflow

North America Continue menu expansionChina

Market: ~15 million skin tests Market: ~15 million skin tests

U.S. submission of QFT-Plus in 2016 (available to QFT)

Commercial power: Adding reps Build networks and drive

clinical demand

Support LTBI guidelines

Latin America Japan

Market: ~8 million skin tests Market: ~7 million skin tests

Support public health 2017: Launch QFT-Plus

guidelines (WHO) Develop commercial

partner network

Europe / Middle Asia-Pacific

East / Africa Market: ~15 million skin tests

Market: ~5 million skin tests Highest TB burden region

Dubai hub to expand Go direct in attractive markets

regional activities Influence guidelines

QuantiFERON-TB: Drive commercial success through targeted global actions

Sample to Insight

2016 Analyst & Investor Day

8

Table of Contents

|

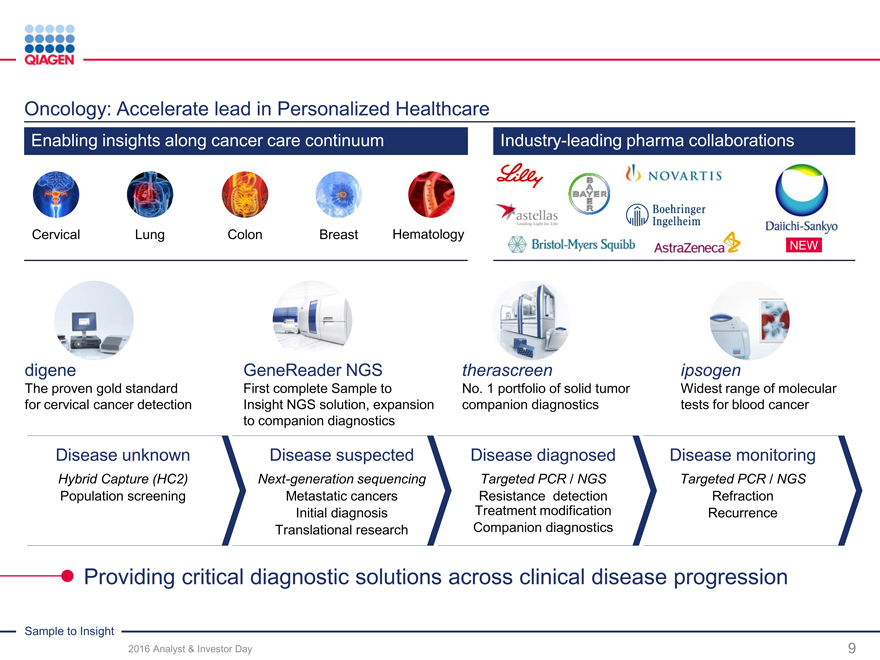

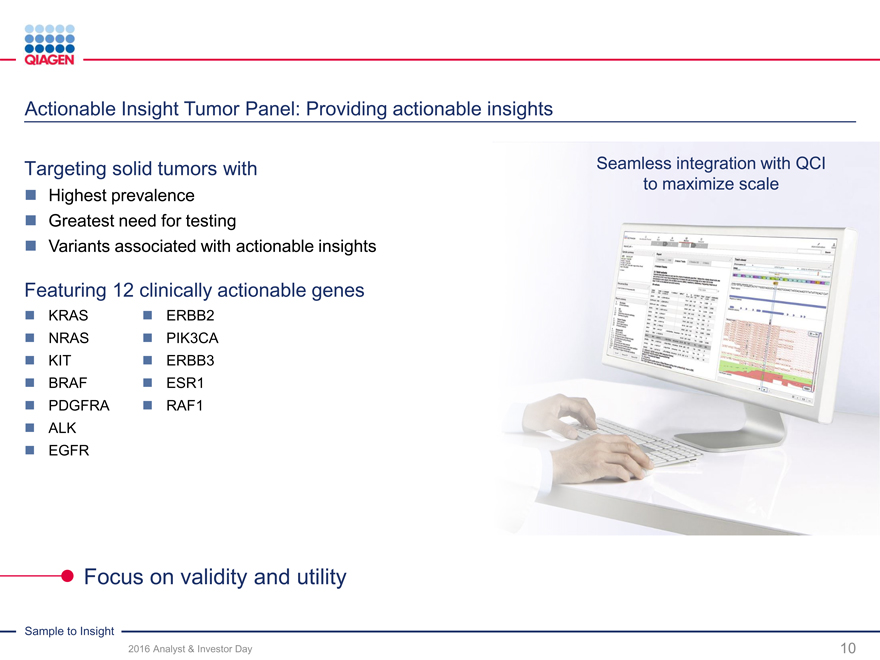

Oncology: Accelerate lead in Personalized Healthcare

Enabling insights along cancer care continuum Industry-leading pharma collaborations

Cervical Lung ColonBreastHematology

NEW

digene GeneReader NGS therascreenipsogen

The proven gold standard First complete Sample to No. 1 portfolio of solid tumorWidest range of molecular

for cervical cancer detection Insight NGS solution, expansion companion diagnosticstests for blood cancer

to companion diagnostics

Disease unknown Disease suspected Disease diagnosedDisease monitoring

Hybrid Capture (HC2) Next-generation sequencing Targeted PCR / NGSTargeted PCR / NGS

Population screening Metastatic cancers Resistance detectionRefraction

Initial diagnosis Treatment modificationRecurrence

Translational research Companion diagnostics

Providing critical diagnostic solutions across clinical disease progression

Sample to Insight

2016 Analyst & Investor Day 9

Table of Contents

|

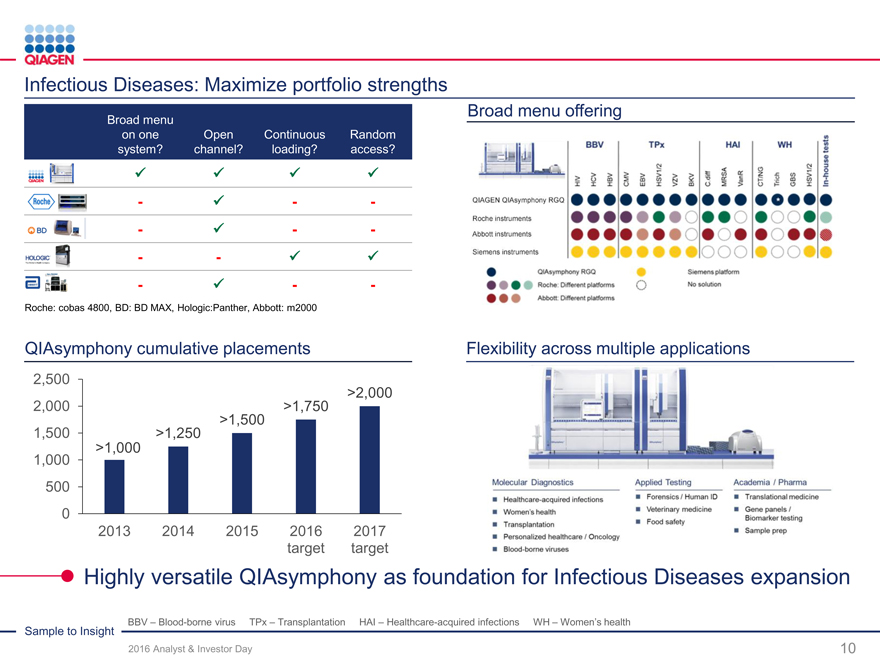

Infectious Diseases: Maximize portfolio strengths

Broad menu Broad menu offering

on one OpenContinuousRandom

system? channel? loading?access?

??

- ?--

- ?--

- -??

- ?--

Roche: cobas 4800, BD: BD MAX, Hologic:Panther, Abbott: m2000

QIAsymphony cumulative placements Flexibility across multiple applications

2,500

>2,000

2,000 >1,750

>1,500

1,500 >1,250

>1,000

1,000

500

0

2013 2014 201520162017

targettarget

Highly versatile QIAsymphony as foundation for Infectious Diseasesexpansion

BBV – Blood-borne virus TPx – Transplantation HAI – Healthcare-acquired infections WH – Women’s health

Sample to Insight

2016 Analyst & Investor Day 10

Table of Contents

|

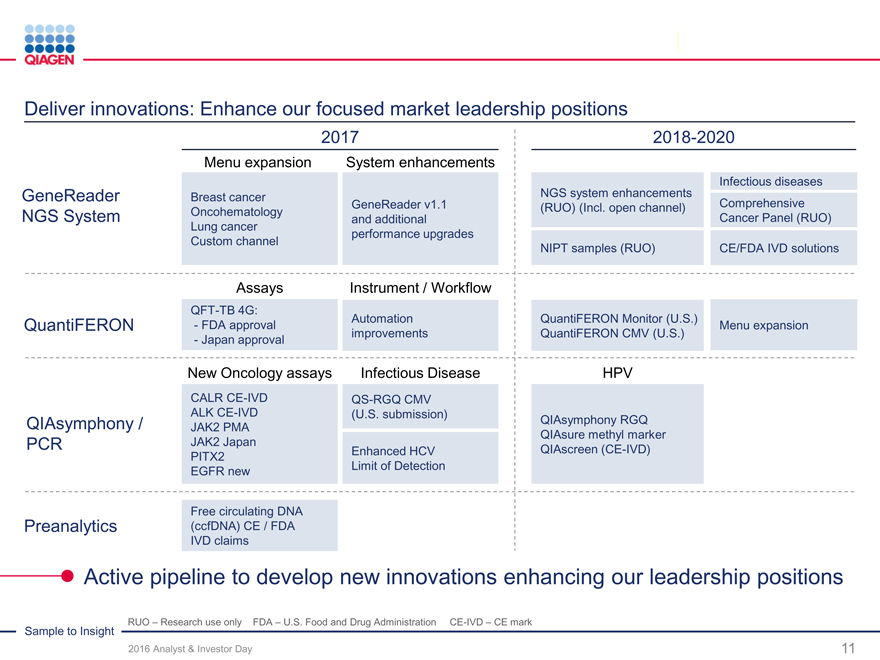

Deliver innovations: Enhance our focused market leadership positions

2017 2018-2020

Menu expansion System enhancements

Infectious diseases

GeneReader Breast cancer NGS system enhancements

GeneReader v1.1(RUO) (Incl. open channel)Comprehensive

NGS System Oncohematology and additionalCancer Panel (RUO)

Lung cancer performance upgrades

Custom channel NIPT samples (RUO)CE/FDA IVD solutions

Assays Instrument / Workflow

QFT-TB 4G:

QuantiFERON - FDA approval AutomationQuantiFERON Monitor (U.S.)Menu expansion

- Japan approval improvementsQuantiFERON CMV (U.S.)

New Oncology assays Infectious DiseaseHPV

CALR CE-IVD QS-RGQ CMV

ALK CE-IVD (U.S. submission)

QIAsymphony / JAK2 PMA QIAsymphony RGQ

QIAsure methyl marker

PCR JAK2 Japan Enhanced HCVQIAscreen (CE-IVD)

PITX2

EGFR new Limit of Detection

Free circulating DNA

Preanalytics (ccfDNA) CE / FDA

IVD claims

Active pipeline to develop new innovations enhancing our leadership positions

Sample to Insight RUO – Research use only FDA – U.S. Food and Drug Administration CE-IVD – CE mark

2016 Analyst & Investor Day 11

Table of Contents

|

Unique portfolio of solutions from LDT to IVD tests Focus on significant unmet needs with differentiation Offering complete, scalable solutions across continuum Delivering to labs a one-stop shop for molecular solutions

Sample to Insight

2016 Analyst & Investor Day 12

Table of Contents

Exhibit 99.5

|

Bioinformatics:

Partner of choice for insights from complex genomic data

Dr. Laura Furmanski, Ph.D.

Senior Vice President, Head of Bioinformatics Business Area November 15, 2016

Sample to Insight

2016 Analyst & Investor Day 1

Table of Contents

|

Disclaimer

Safe Harbor Statement: This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be forward looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our own expectations and projections. Some of the factors that could cause actual results to differ include, but are not limited, to the following: general industry conditions and competition; risks associated with managing growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, and the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including factors such as general economic conditions, the level and timing of customers’ funding, budgets and other factors); our ability to obtain regulatory approval of our products; technological advances of our competitors and related legal disputes; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitor products; market acceptance of QIAGEN’s new products and the integration of acquired technologies and businesses. For further information, please refer to “Risk Factors” section of reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC). We undertake no obligation, and do not intend, to update these forward-looking statements as a result of new information or future events or developments unless and to the extent required by law.

Regulation G: QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight on performance. In this presentation, adjusted results include adjusted operating expenses, adjusted EBITDA, adjusted diluted EPS and free cash flow. Adjusted results are non-GAAP financial measures QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP, but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of its ongoing core operations, vary significantly from period to period, or affect the comparability of results with its competitors and its own prior periods. Please see the Appendix provided in this presentation “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of historical non-GAAP measures to comparable GAAP measures and the definitions of terms used in the presentation. QIAGEN does not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

GeneReader NGS System: The QIAGEN GeneReader® NGS System is currently available for marketing and sales outside the United States. The QIAGEN GeneReader® NGS System with new sequencing chemistry will be made available in the United States starting in December 2016. The QIAGEN GeneReader® NGS System is intended for Research Use Only. This product is not intended for the diagnosis, prevention or treatment of a disease. QIAGEN Clinical Insight® is an evidence-based decision support software intended as an aid in the interpretation of variants observed in genomic sequencing data. The software evaluates genomic variants in the context of published biomedical literature, professional association guidelines, publicly available databases and annotations, drug labels and clinical-trials. Based on this evaluation, the software proposes a classification and bibliographic references to aid in the interpretation of observed variants. The software is not intended as a primary diagnostic tool by physicians or to be used as a substitute for professional healthcare advice. Each laboratory is responsible for ensuring compliance with applicable international, national and local clinical laboratory regulations and other accreditation requirements

Sample to Insight

2016 Analyst & Investor Day

2

Table of Contents

|

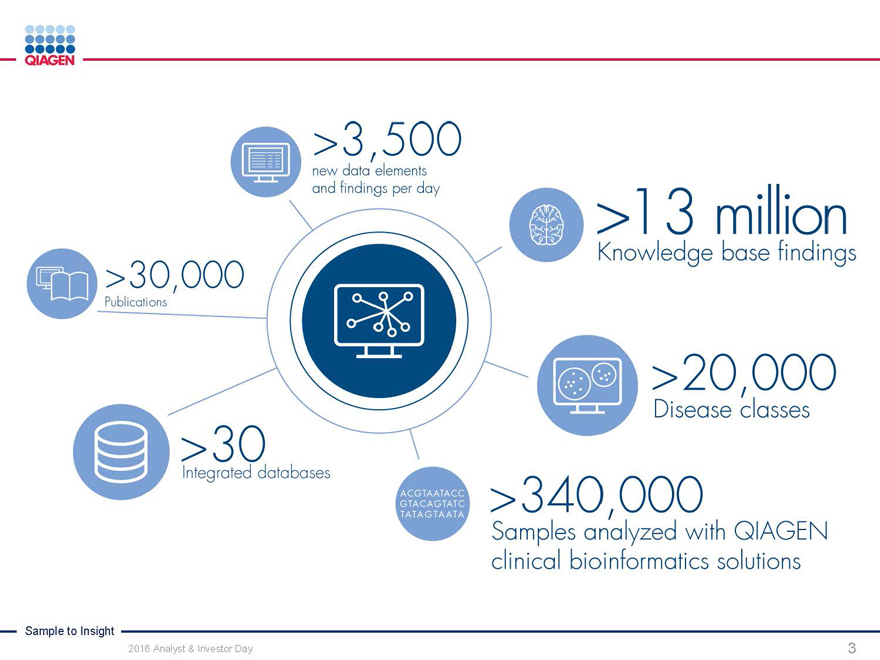

Sample to Insight

2016 Analyst & Investor Day 3

Table of Contents

|

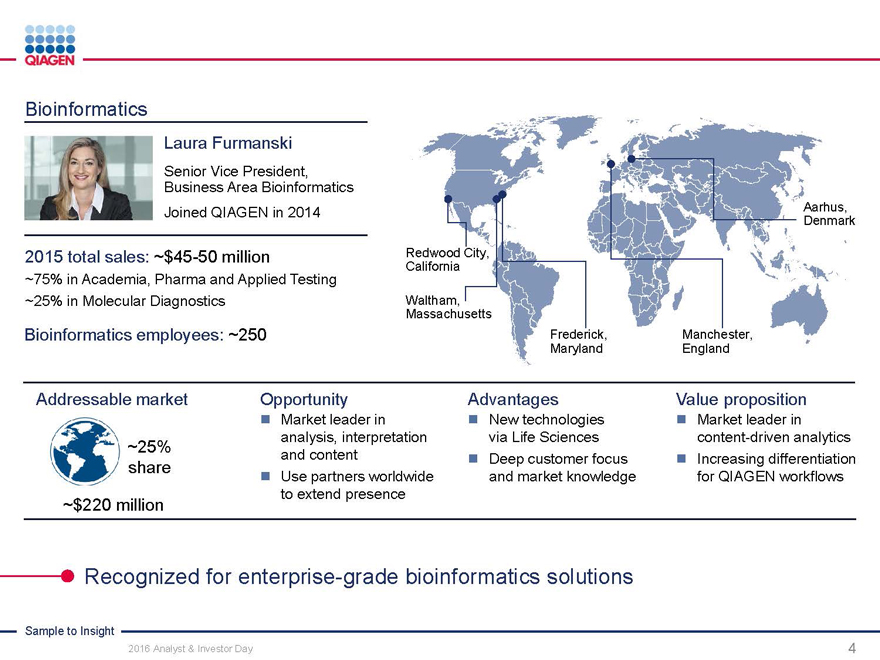

Bioinformatics

Laura Furmanski

Senior Vice President, Business Area Bioinformatics Joined QIAGEN in 2014

2015 total sales: ~$45-50 million Redwood City,

California

~75% in Academia, Pharma and Applied Testing

~25% in Molecular Diagnostics Waltham,

Massachusetts

Aarhus, Denmark

Bioinformatics employees: ~250 Frederick,Manchester,

MarylandEngland

Addressable market Opportunity AdvantagesValue proposition

Market leader in New technologies Market leader in

analysis, interpretationvia Life Sciencescontent-driven analytics

~25% and content Deep customer focus Increasing differentiation

share Use partners worldwideand market knowledgefor QIAGEN workflows

~$220 million to extend presence

Recognized for enterprise-grade bioinformatics solutions

Sample to Insight

2016 Analyst & Investor Day 4

Table of Contents

|

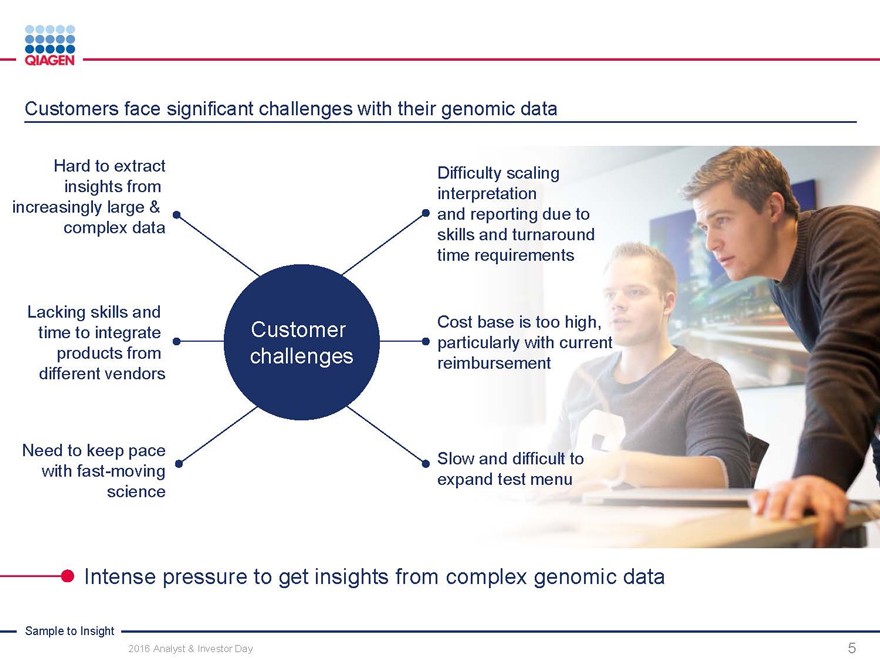

Customers face significant challenges with their genomic data

Hard to extract Difficulty scaling

insights from interpretation

increasingly large & and reporting due to

complex data skills and turnaround

time requirements

Lacking skills and

time to integrate Customer Cost base is too high,

particularly with current

products from challenges reimbursement

different vendors

Need to keep pace Slow and difficult to

with fast-moving expand test menu

science

Intense pressure to get insights from complex genomic data

Sample to Insight

2016 Analyst & Investor Day

5

Table of Contents

|

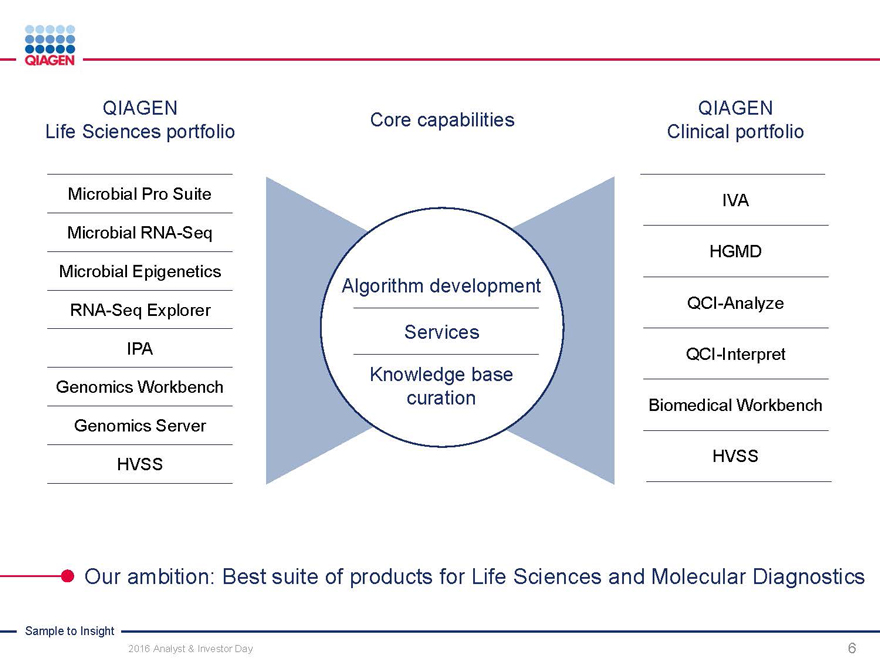

QIAGEN QIAGEN

Core capabilities

Life Sciences portfolio Clinical portfolio

Microbial Pro Suite IVA

Microbial RNA-Seq

HGMD

Microbial Epigenetics

Algorithm development

RNA-Seq Explorer QCI-Analyze

Services

IPA QCI-Interpret

Knowledge base

Genomics Workbench curation Biomedical Workbench

Genomics Server

HVSS HVSS

Our ambition: Best suite of products for Life Sciences and Molecular Diagnostics

Sample to Insight

2016 Analyst & Investor Day 6

Table of Contents

|

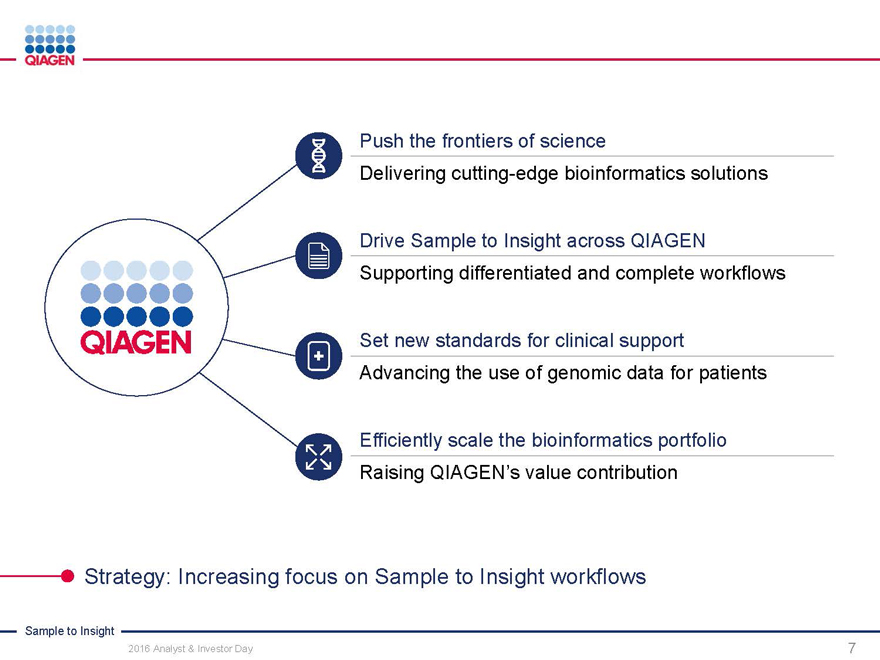

Push the frontiers of science

Delivering cutting-edge bioinformatics solutions

Drive Sample to Insight across QIAGEN Supporting differentiated and complete workflows

Set new standards for clinical support

Advancing the use of genomic data for patients

Efficiently scale the bioinformatics portfolio Raising QIAGEN’s value contribution

Strategy: Increasing focus on Sample to Insight workflows

Sample to Insight

2016 Analyst & Investor Day

7

Table of Contents

|

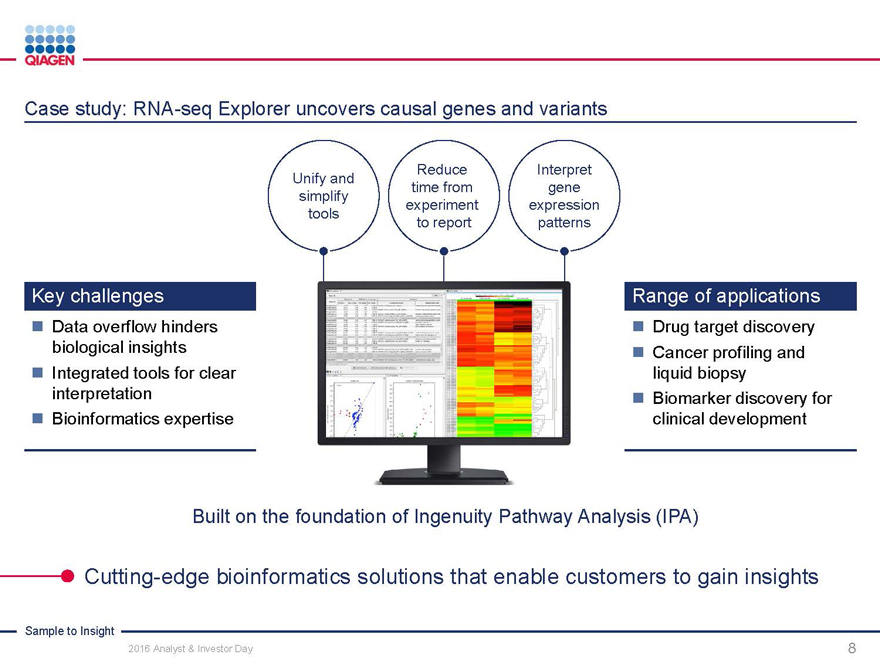

Case study: RNA-seq Explorer uncovers causal genes and variants

Unify and Reduce Interpret

simplify time from gene

experiment expression

tools to report patterns

Key challenges Range of applications

Data overflow hinders Drug target discovery

biological insights Cancer profiling and

Integrated tools for clear liquid biopsy

interpretation Biomarker discovery for

Bioinformatics expertise clinical development

Built on the foundation of Ingenuity Pathway Analysis (IPA)

Cutting-edge bioinformatics solutions that enable customers to gain insights

Sample to Insight

2016 Analyst & Investor Day

8

Table of Contents

|

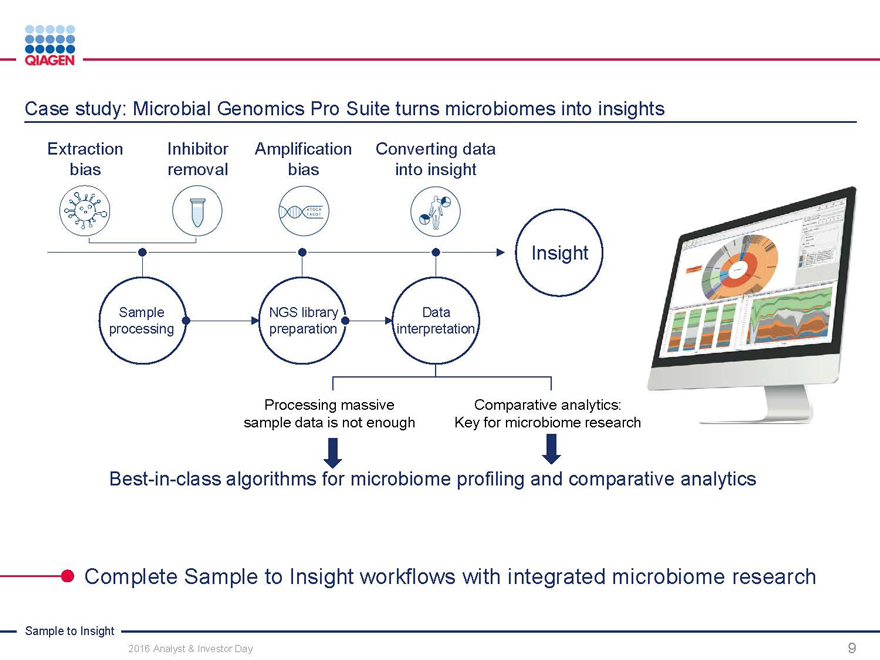

Case study: Microbial Genomics Pro Suite turns microbiomes into insights

Extraction Inhibitor AmplificationConverting data

bias removal biasinto insight

Insight

Sample NGS library Data processing preparation interpretation

Processing massive Comparative analytics: sample data is not enough Key for microbiome research

Best-in-class algorithms for microbiome profiling and comparative analytics

Complete Sample to Insight workflows with integrated microbiome research

Sample to Insight

2016 Analyst & Investor Day 9

Table of Contents

|

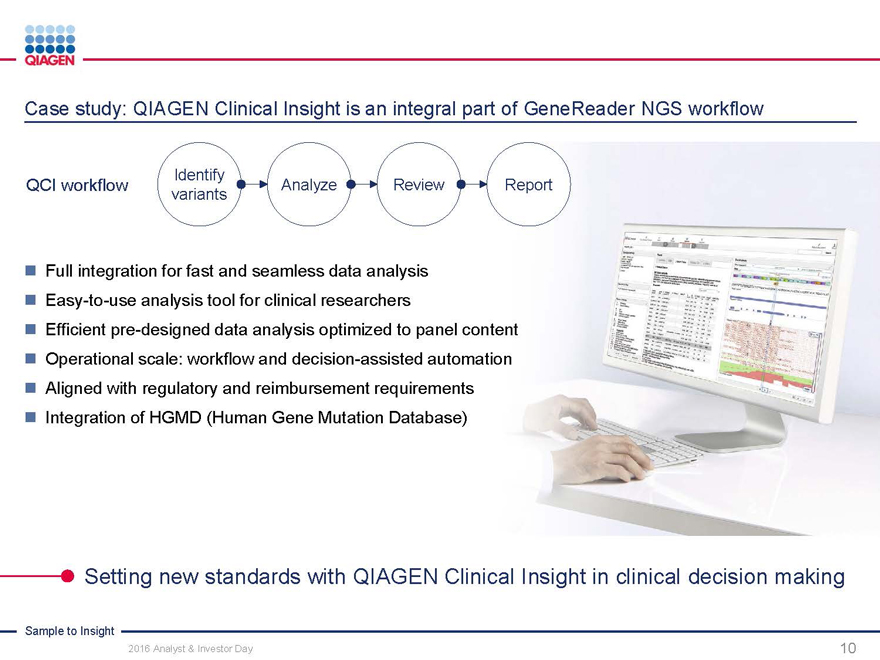

Case study: QIAGEN Clinical Insight is an integral part of GeneReader NGS workflow

Identify

QCI workflow AnalyzeReviewReport

variants

Full integration for fast and seamless data analysis

Easy-to-use analysis tool for clinical researchers

Efficient pre-designed data analysis optimized to panel content

Operational scale: workflow and decision-assisted automation

Aligned with regulatory and reimbursement requirements

Integration of HGMD (Human Gene Mutation Database)

Setting new standards with QIAGEN Clinical Insight in clinical decision making

Sample to Insight

2016 Analyst & Investor Day

10

Table of Contents

|

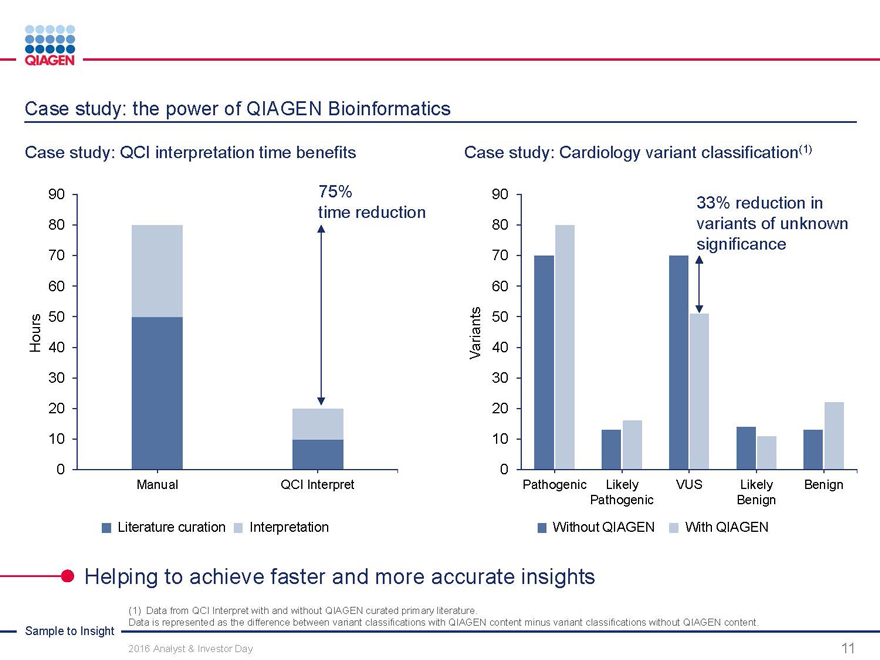

Case study: the power of QIAGEN Bioinformatics

Case study: QCI interpretation time benefits Case study: Cardiology variant classification(1)

90 75%90

time reduction33% reduction in

80 80variants of unknown

70 70significance

60 60

50 50

Hours 40 Variants40

30 30

20 20

10 10

0 0

Manual QCI InterpretPathogenic LikelyVUSLikelyBenign

PathogenicBenign

Literature curation InterpretationWithout QIAGENWith QIAGEN

Helping to achieve faster and more accurate insights

Sample to Insight

(1) Data from QCI Interpret with and without QIAGEN curated primary literature.

Data is represented as the difference between variant classifications with QIAGEN content minus variant classifications without QIAGEN content.

2016 Analyst & Investor Day

11

Table of Contents

|

“We truly are a Sample to Insight laboratory. As a result, we are bringing greater understanding to a wide range of important medical issues, particularly in cancer.”

Dr. Lars Joensen

Head of NGS Core Unit, Center for Genomic Medicine Rigshospitalet, Copenhagen

“Analysis is a bottleneck and it is not going to get easier in the future. The only solution is to analyze the data quicker and QIAGEN allows us to do this – faster and better.”

Indresh Singh

Senior Bioinformatics Engineer, JCVI

“Assembling allele frequency information in a comprehensive fashion over many different populations is a critical element of genome interpretation, and making it available as a public resource is the right way to do it.”

Dr. Eric Schadt

Director of the Icahn Institute for Genomics and Multiscale Biology at Mount Sinai

40,000 active users across the QIAGEN bioinformatics product offering

Sample to Insight

2016 Analyst & Investor Day

12

Table of Contents

|

Market leader in analysis, interpretation and content Portfolio with strong commercial traction Solving challenges of complex genomic data Focusing on delivering Sample to Insight solutions

Sample to Insight

2016 Analyst & Investor Day 13

Table of Contents

Exhibit 99.6

|

Commercial Operations:

Engaging customers with our Sample to Insight portfolio

Manuel O. Méndez

Senior Vice President, Head of Global Commercial Operations November 15, 2016

Sample to Insight

2016 Analyst & Investor Day 1

Disclaimer

Table of Contents

|