Business Process Outsourcing for Middle Market Enterprises

Patrick Dolan - CEO

Jim Cortens - President

Don Rutherford - CFO

Safe Harbor Statement

Certain statements in the following presentation relate to future results that are

forward looking statements as defined in the Private Securities Litigation Reform Act

of 1995. Actual results may differ materially from those projected as a result of

certain risks and uncertainties, including but not limited to those noted in our forms

and other filings with the SEC. This presentation includes historical and forward-

looking pro forma information. The Company assumes no responsibility to update

the information contained in this presentation.

forward looking statements as defined in the Private Securities Litigation Reform Act

of 1995. Actual results may differ materially from those projected as a result of

certain risks and uncertainties, including but not limited to those noted in our forms

and other filings with the SEC. This presentation includes historical and forward-

looking pro forma information. The Company assumes no responsibility to update

the information contained in this presentation.

This presentation and the information contained herein is the property of BPO

Management Services, Inc.

Management Services, Inc.

2

Non-GAAP Measures

The Company uses non-GAAP measures of (a) Earnings Before Interest Taxes Depreciation and Amortization ("EBITDA") and (b) Adjusted

EBITDA because it considers the information an important supplemental measure of the Company's performance and believes that these

measures are frequently used by security analysts, investors and other interested parties in the evaluation of companies with comparable

market capitalization. When either non-GAAP measure is presented in these slides, a reference is made to another slide which contains a

reconciliation to the most comparable GAAP financial measure.

EBITDA because it considers the information an important supplemental measure of the Company's performance and believes that these

measures are frequently used by security analysts, investors and other interested parties in the evaluation of companies with comparable

market capitalization. When either non-GAAP measure is presented in these slides, a reference is made to another slide which contains a

reconciliation to the most comparable GAAP financial measure.

(a) EBITDA represents net income before interest, taxes, depreciation and amortization. The Company presents EBITDA because it considers

such information an important supplemental measure of its performance and believes it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies with comparable market capitalization, many of which present EBITDA when reporting

their results. The Company also uses EBITDA to evaluate and price potential acquisition candidates.

such information an important supplemental measure of its performance and believes it is frequently used by securities analysts, investors and

other interested parties in the evaluation of companies with comparable market capitalization, many of which present EBITDA when reporting

their results. The Company also uses EBITDA to evaluate and price potential acquisition candidates.

EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company's results

as reported under GAAP. Some of these limitations are: (a) EBITDA does not reflect changes in, or cash requirements for, the Company's

working capital needs; (b) EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or

principal payments, on the Company's debts; and (c) although depreciation and amortization are non-cash charges, the assets being

depreciated and amortized may have to be replaced in the future, and EBITDA does not reflect any cash requirements for such capital

expenditures. Because of these limitations, EBITDA should not be considered as a principal indicator of the Company's performance. The

Company compensates for these limitations by relying primarily on the Company's GAAP results and using EBITDA only on a supplemental

basis.

as reported under GAAP. Some of these limitations are: (a) EBITDA does not reflect changes in, or cash requirements for, the Company's

working capital needs; (b) EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or

principal payments, on the Company's debts; and (c) although depreciation and amortization are non-cash charges, the assets being

depreciated and amortized may have to be replaced in the future, and EBITDA does not reflect any cash requirements for such capital

expenditures. Because of these limitations, EBITDA should not be considered as a principal indicator of the Company's performance. The

Company compensates for these limitations by relying primarily on the Company's GAAP results and using EBITDA only on a supplemental

basis.

(b) Adjusted EBITDA is defined as EBITDA plus all one time or non-recurring expenses associated with the acquisition of new businesses and

the resulting integration expenses. The Company presents Adjusted EBITDA because it considers such information to be an important

supplemental measure of the Company’s performance and believes it is frequently used by securities analysts, investors and other interested

parties in the evaluation of companies with comparable market capitalization.

the resulting integration expenses. The Company presents Adjusted EBITDA because it considers such information to be an important

supplemental measure of the Company’s performance and believes it is frequently used by securities analysts, investors and other interested

parties in the evaluation of companies with comparable market capitalization.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of the

Company’s results as reported under U.S. Generally Accepted Accounting Principles ("GAAP"). These limitations include that Adjusted

EBITDA excludes other significant cash disbursements, such as legal and accounting expenses, severance costs and other operating

expenses incurred by the Company during an acquisition and resulting follow-on integration period. Because of these limitations, Adjusted

EBITDA should not be considered as a principal indicator of the Company’s performance. The Company compensates for these limitations by

relying primarily on the Company’s GAAP results and using Adjusted EBITDA only on a supplemental basis.

Company’s results as reported under U.S. Generally Accepted Accounting Principles ("GAAP"). These limitations include that Adjusted

EBITDA excludes other significant cash disbursements, such as legal and accounting expenses, severance costs and other operating

expenses incurred by the Company during an acquisition and resulting follow-on integration period. Because of these limitations, Adjusted

EBITDA should not be considered as a principal indicator of the Company’s performance. The Company compensates for these limitations by

relying primarily on the Company’s GAAP results and using Adjusted EBITDA only on a supplemental basis.

3

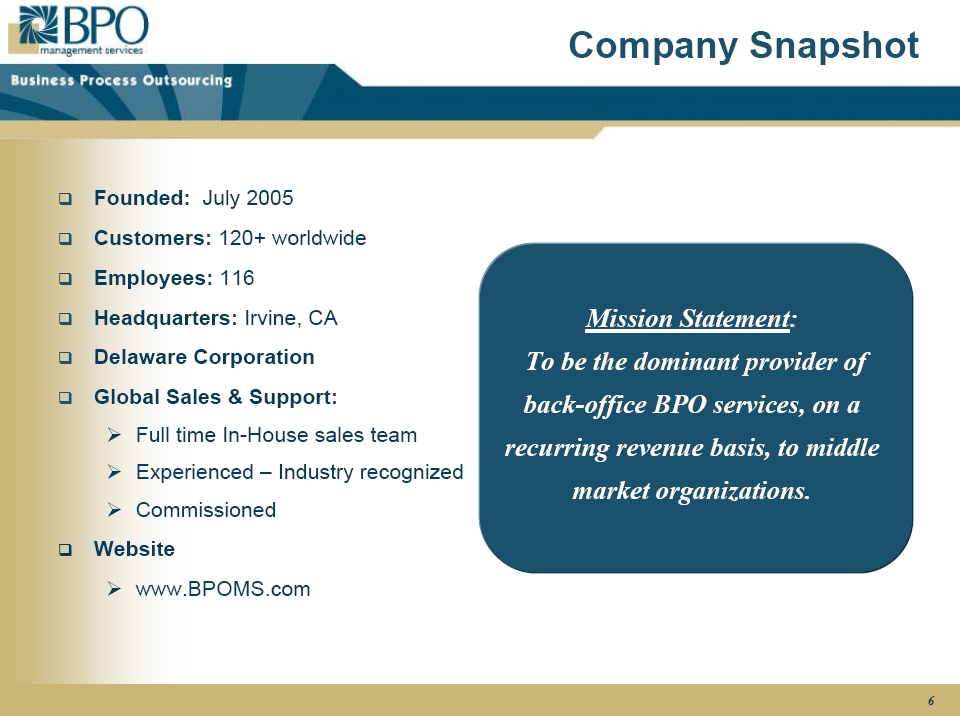

The Company

5

What We Do

Provide back-office business functions on an outsourced basis

Middle market cost per unit much higher than larger companies

BPOMS platform provides economies of scale and delivery capability similar to Global 2000

Significant cost savings passed along to BPOMS customers

Outsourced Services = Recurring Revenue

Primary business functions offered

Human Resources

Enterprise Content Management

Finance and Accounting

Information Technology

Services provided on standard BPOMS delivery platform

Global delivery capability

Software as a Service delivery ‘SaaS’

Leverage our data center infrastructure & IP

7

Who We Are

90

94

00

03

04

05

Future

Build SHL outsourcing

Grow SMS $6m - $120m

Sell SMS to Marconi - $130m

SMS buy back - $2m

SMS re-build

Sell SMS to IFOX - $40m

IFOX integration

Establish BPOMS

BPOMS build

History of Creating

Shareholder

Wealth

Wealth

Enhance Value with Focus on

Recurring Revenue Model

Acxiom acquisition

IFOX market cap increase $150m

SHL sold to MCI/EDS - $1b

Capital raise RLH

Capital raise - GIP

Capital raise - Roth

Acquire ADAPSYS

Strategix acquisition

Verizon buy

Successfully executed similar business model

06

Reverse Merger - NGRU

SMS 1

SMS 2

IFOX

BPOMS

SHL

8

Management Team

Patrick Dolan, Chairman and CEO

Co-Founder

Prior to co-founding BPOMS, Mr. Dolan served as president and chief operating officer of

Infocrossing Inc. [Nasdaq: IFOX], chairman and chief executive officer of Systems Management

Specialists (SMS) and spent the early years of his career with Affiliated Computer Services (ACS)

and SHL Systemhouse

Infocrossing Inc. [Nasdaq: IFOX], chairman and chief executive officer of Systems Management

Specialists (SMS) and spent the early years of his career with Affiliated Computer Services (ACS)

and SHL Systemhouse

25 years outsourcing industry experience

Jim Cortens, President and COO

Co-Founder

Prior to co-founding BPOMS, Mr. Cortens served as executive vice president of Infocrossing Inc.

[Nasdaq: IFOX], president and director of Systems Management Specialists (SMS), and spent the

early years of his career with SHL Systemhouse

[Nasdaq: IFOX], president and director of Systems Management Specialists (SMS), and spent the

early years of his career with SHL Systemhouse

25 years outsourcing industry experience

Don Rutherford– Chief Financial Officer

Over 35 years as chief financial officer and in other senior management capacities for companies in

the technology, resource, venture capital and life sciences sectors including General Automation,

USGT Resources, Grant Life Sciences, Aspeon, LifePoint, Wordplex, and VentureTek.

the technology, resource, venture capital and life sciences sectors including General Automation,

USGT Resources, Grant Life Sciences, Aspeon, LifePoint, Wordplex, and VentureTek.

CFO partner with Tatum LLC, the nation's fastest growing executive services and consulting firm.

9

The Middle Market Problem

Middle market enterprises have common problems

Significant expense - Non-core back office business functions create

significant pain and needless expense when not managed effectively and

efficiently

significant pain and needless expense when not managed effectively and

efficiently

Middle market lacks scale - Mid-market companies lack financial size

necessary to benefit from economies of scale and technology investments

necessary to benefit from economies of scale and technology investments

Middle market lacks expertise - Required domain expertise not resident in-

house

house

IT intensive - Back office services require enterprise applications and a robust

support function provided from a hardened data center – audit, regulatory and

compliance concerns

support function provided from a hardened data center – audit, regulatory and

compliance concerns

10

The BPOMS Solution

Passes on significant bottom-line savings

Economies of scale, workflow improvements and standardized technology deployment

yield direct cost savings of 20% - 45% to customers

yield direct cost savings of 20% - 45% to customers

On-demand model provides cost-effective mechanism to handle peak business volumes

Increases customer’s ability to focus resources on core business objectives

Provides back-office expertise

Improves customer’s back-office operations by taking advantage of BPOMS domain

expertise

expertise

Provides technology expertise

Common delivery platform leverages BPOMS technology expertise and provides faster

implementation and reduced risk

implementation and reduced risk

Is a “Trusted Advisor”

Initial consulting arrangement allows clients to ease into relationship and reduces

perceived risk profile

perceived risk profile

11

BPOMS Service Model

CFO

Web Services - SaaS – Applications

near/off-shore resources

Data Centers/Data Capture/Infrastructure

HRO

ECM

Domain Expertise

Application Support

Compute/Process Utility

Outsourcing = Cost Savings

Valuation Driver

Initial Access

ITO

Project management/Implementation

Workflow Optimization

FAO

Workflow/Solution design

Integration Skills

Comprehensive outsource of back-office functions

Substantially the

the same

across verticals

Requires specific

domain expertise

12

Our Customers

14

Global Footprint

15

Market Opportunity

16

Very Large Marketplace

North American

BPO Market Opportunity

including Fortune 500

($billions)

CAGR=15%

(Source: IDC, Everest Group)

Addressable Market is Huge

Thousands of mid-market companies in US

with total back-office spend >$1t

with total back-office spend >$1t

(Source: BPOMS est.)

Finance and Accounting Outsourcing

$15B in 2005 and growing rapidly

Enterprise Content Management

Projected to grow to $8B by 2007

Human Resource Outsourcing

Dramatic growth since early 2000

Information Technology Outsourcing

Large & mature market with a 6% CAGR

17

Market Opportunity

Tier 1 providers (IBM, EDS, Accenture, etc.) focused on Fortune 500

Tier 1 providers focused on large contract value

Tier 1 has low market penetration into middle market

Annual revenues of $100m to $3b

Customer contracts average $500K- $5M per year

Industry renewal rates of +95% results in long term relationship

Untapped mid-market opportunity entering ‘emerging rapid growth’ phase

Over 30,000 businesses in U.S. middle market

Greater cost savings/margin potential

BPO adoption by middle market companies is very low

Current marketplace of mid-market BPO providers is highly fragmented

Requires several service providers to meet needs

Unable to achieve scale economics

18

Growth Strategies

19

Significant Growth Opportunities

Increase penetration into current customer base

Leverage comprehensive back-office outsourcing platform

Expand middle market presence – accelerate organic growth

Become the ‘One Stop Shop” for busy management providing significant cost

savings compared to in-house spend – Tier 1 model

savings compared to in-house spend – Tier 1 model

Pursue strategic acquisitions

Acquire/consolidate selected niche players to add capability, geographic presence

and financial critical mass

and financial critical mass

Initial growth platform completed - Adapsys, Digica, Novus, NetGuru

Finalizing SPA’s for 2 strategic acquisitions

Cross sell comprehensive back-office solutions into acquired customer base

20

DocuCom - Outsourced ECM solution provider

Founded in 1996, formerly Bell + Howell, Canada

Provides document imaging/management services to large corporations

Serves entire Canadian marketplace – national recognition

200+ customers

Approximately 50% of revenue stream is through recurring service contracts

Vertical Market Strengths

Financial Services

Government

Expand existing service offering into larger marketplace in eastern Canada & U.S.

Significant up selling opportunity for existing document management solutions

Acquisition 1: DocuCom

21

HRMS - HR software solutions

Founded in 1983 – pioneer in HR information systems

HR software for middle market enterprises; Cornerstone for full HRO offering

100+ customers

National presence in most vertical markets

Approx. 50% of revenue is recurring maintenance & support

Cross selling opportunity for expanding HRO Services within existing

customer base

customer base

Acquisition 2: HRMS

22

Acquisition Profile

23

Financial Overview

24

Milestones to Date

$4.2 million founders investment

Completed Reverse Merger with netGuru to become publicly traded

Acquired companies in second half of 2005 and 2006 to create initial growth platform

ADAPSYS – Canadian based provider of document management solutions

BPOMS/CA – California based HRO company led by former Adecco executive

DIGICA – New Jersey based ITO provider

NOVUS – Canadian based provider of imaging and document management solutions

netGuru – California based provider of document management technology and IT

services

services

Hired new CFO to strengthen management team

Completing application to OTC Bulletin Board

Closing on 2 complementary BPO services companies

Strengthen product and services offerings

Expand current client base and enhance cross selling opportunities

25

Financial Projections

26

Investment Highlights

Significant market opportunity

Large emerging market - mid-market segment; Minimal penetration

HR and other back-office functions create significant pain point

Significant cost savings opportunity for outsourcing customers

BPOMS platform

Comprehensive, scalable, outsourced back-office solution (One Stop Shop)

Acquisition strategy provides:

Financial growth and earnings

Significant cross-selling opportunities

Additional back-office support capabilities

Strong management team - proven growth and acquisition strategy

Outsourced business services, technology deployment & rapid business growth

Acquisitions and business integration

27

Appendix

28

Agility Logistics Profile:

Global logistics company offering broad range of freight

management and customized logistics solutions backed by

a single, company wide IT system operating in over 100

countries

management and customized logistics solutions backed by

a single, company wide IT system operating in over 100

countries

Challenges:

Required provisioning and deployment of IT components to

support global expansion plans and 24*7 management of

critical logistic systems

support global expansion plans and 24*7 management of

critical logistic systems

BPOMS Solution:

24 X 7 network support center

Management of global AT&T back-bone network

24 x 7 management of over 90 servers

Procurement, configuration and deployment services for all

desktops and servers

desktops and servers

Full desktop support for over 1,100 users

Results:

24*7 support of global IT systems infrastructure that

reduced operating costs, improved system availability

levels and allows real-time visibility into all logistics support

systems worldwide.

reduced operating costs, improved system availability

levels and allows real-time visibility into all logistics support

systems worldwide.

Outsourced provisioning services provides rapid

deployment capability to support new office locations on an

on-demand basis.

deployment capability to support new office locations on an

on-demand basis.

Agility Logistics

“BPOMS gives us the resources we need to meet

the ongoing needs of our current customers, as

well as providing us with a flexible platform to

support growth for future customers. We wanted

to work with a single organization on a global

basis.”

basis.”

– Bill Flynn, President & CEO, Agility Logistics

29

Canadian Tire Profile:

Canada ’s most-shopped general merchandise retailer, operates more

than 1,100 stores, gas bars and car washes in a national inter-related

network of businesses engaged in retail, financial services and

petroleum. Over 50,000 employees work in the enterprise’s retail,

financial services, and petroleum businesses.

than 1,100 stores, gas bars and car washes in a national inter-related

network of businesses engaged in retail, financial services and

petroleum. Over 50,000 employees work in the enterprise’s retail,

financial services, and petroleum businesses.

Challenges:

Canadian Tire Financial Services (CTFS)whichmanages

approximately 4 million Canadian Tire MasterCard accounts and

markets related financial products and services required an automated

scan/capture and data retrieval system to support their in-store credit

card application and approval process.

approximately 4 million Canadian Tire MasterCard accounts and

markets related financial products and services required an automated

scan/capture and data retrieval system to support their in-store credit

card application and approval process.

BPOMS Solution:

Designed and implemented a document management system to scan

and process all in-store credit card applications and other banking

documents (Loan applications, Know Your Customer, Pre-authorized

Payments, etc.)

and process all in-store credit card applications and other banking

documents (Loan applications, Know Your Customer, Pre-authorized

Payments, etc.)

Management and support for this system on a 24*7 basis.

Results:

Faster approval of credit card and loan applications at a lower unit cost

Improved accuracy of data captured

Ability to retrieve and analyze captured data from digitized credit card

applications – target promotion/sales campaigns

applications – target promotion/sales campaigns

Improved turnaround and customer service

Ability to deal with high business volumes during holiday seasons

without having to staff to meet peak demand period

without having to staff to meet peak demand period

Canadian Tire

“BPOMS implemented a document management

system which resulted in faster-turn around of

credit card applications and more accurate data

capture allowing CTFS to cross-market other

financial services yielding additional revenue

opportunities and an enhanced customer service

experience. In addition, their 24*7 scalable support

model reduces our need to add staff during the

business-critical holiday season.”

system which resulted in faster-turn around of

credit card applications and more accurate data

capture allowing CTFS to cross-market other

financial services yielding additional revenue

opportunities and an enhanced customer service

experience. In addition, their 24*7 scalable support

model reduces our need to add staff during the

business-critical holiday season.”

– Mr. Todd LaFontaine Manager, Web Enabled

Business Solutions

Business Solutions

30

Deutsche Post-DHL

Deutsche Post Profile :

Deutsche Post AG (LSE: DPO)is a German postal, logistics and

courier company headquartered in Bonn. Comprising of Deutsche

Post and DHL, Deutsche Post World Net (DPWN) employs half a

million people in 220 countries and territories,and generates revenue

of over €50 billion annually.

courier company headquartered in Bonn. Comprising of Deutsche

Post and DHL, Deutsche Post World Net (DPWN) employs half a

million people in 220 countries and territories,and generates revenue

of over €50 billion annually.

Challenges:

DP recognized that to maintain high service levels and to efficiently

process shipments from customers, it needed superior document

review, management, and approval workflow.

process shipments from customers, it needed superior document

review, management, and approval workflow.

DP’s priority was to increase the efficiency of the administrative, HR,

invoice and AR processing so the accounting staff could access, view,

collaborate and resolve all customer queries on the spot from their

desktop without having to make follow up calls

invoice and AR processing so the accounting staff could access, view,

collaborate and resolve all customer queries on the spot from their

desktop without having to make follow up calls

BPOMS eReview Solution:

Integrated into the DP electronic Document processing architecture,

eReview allowed quick access to the pertinent documents for viewing,

annotation and stamping depending on business rules and privileges

eReview allowed quick access to the pertinent documents for viewing,

annotation and stamping depending on business rules and privileges

Results:

Manual handling of the paperwork in the approval process has been

eliminated

eliminated

Authorized users can retrieve and stamp an image or a document

from a global data warehouse directly from their desktop

from a global data warehouse directly from their desktop

Online document workflow, review and collaboration resulted in faster

response time and reduced operating expense

response time and reduced operating expense

“Because of the type of organization we are, the

amount of paperwork we generate is phenomenal:

from customs clearance documents to invoices,

proofs of delivery and airway bills. The paperwork

just multiplies and multiplies.”

amount of paperwork we generate is phenomenal:

from customs clearance documents to invoices,

proofs of delivery and airway bills. The paperwork

just multiplies and multiplies.”

– Derek Monahen, IS Director

31

BBK Worldwide Profile:

A leader in clinical trial patient recruitment for the Pharmaceutical,

Medical Device, Biotech, and Public Health Industries.

Medical Device, Biotech, and Public Health Industries.

Challenges:

Create an e-business suite of tools for patient recruitment that

maximizes the clinical trial study’s enrollment potential, enrollment

projection modeling, effective site selection, accurate measurement of

site performance, gauging the pace of patient recruitment, CRO

assessment, control clinical trial costs

maximizes the clinical trial study’s enrollment potential, enrollment

projection modeling, effective site selection, accurate measurement of

site performance, gauging the pace of patient recruitment, CRO

assessment, control clinical trial costs

BPOMS Solution:

Created a web-based product that offers Study Forecaster, Site

Selection, Patient Generator for effective recruitment outreach, track

and manage regulatory approvals and study materials, protocol

compliance, foster collaboration amongst the study community

Selection, Patient Generator for effective recruitment outreach, track

and manage regulatory approvals and study materials, protocol

compliance, foster collaboration amongst the study community

Provide ongoing maintenance support, new feature development,

integration, documentation, and training using on-shore, near-shore

and off-shore resources.

integration, documentation, and training using on-shore, near-shore

and off-shore resources.

Results:

BPOMS is the exclusive technology partner of BBK and provides other

e-business integration and management services to support this

important initiative

e-business integration and management services to support this

important initiative

BPOMS on-demand support model allows BBK to scale their support

effort to match changing market/product development demands

effort to match changing market/product development demands

BBK Worldwide

“TrialCentralNet 4.0 was developed by BBK in

concert with BPOMS. The goal was to combine a

highly advanced study enrollment data capture and

analysis system with online study communication

and study community-building functions. The

challenge was to make it as efficient as possible

using the most advanced technology”

concert with BPOMS. The goal was to combine a

highly advanced study enrollment data capture and

analysis system with online study communication

and study community-building functions. The

challenge was to make it as efficient as possible

using the most advanced technology”

– A recent BBK Healthcare Press Release

32

Cap Table

33

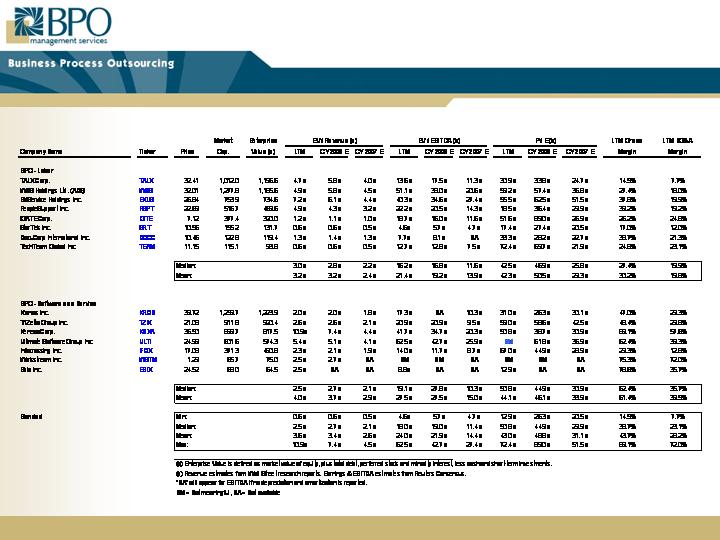

Comparable Company Analysis

34

Major Financial Assumptions

Close DocuCom and HRMS transactions by 3/31/07 according to agreed

upon terms

upon terms

Complete financing package required to close acquisitions and fund

future growth activities under terms agreeable to Company

future growth activities under terms agreeable to Company

Achieve organic growth rate of 5% per quarter across all business lines

generating gross margins consistent with existing Company

performance

generating gross margins consistent with existing Company

performance

Successful integration of acquisitions and new business according to

Company plans

Company plans

Business/financial performance of individual Company operating units

will be consistent with recent history

will be consistent with recent history

Continued favorable conditions in economy and North American BPO

marketplace

marketplace

35

Adjusted EBITDA Reconciliation

36

Adjusted EBITDA Reconciliation

37