August 13, 2009

Joanna Lam

Ken Schuler

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-4628

| | Supplemental Response to August 5, 2009 Comment Letter |

Form 10-K for the Fiscal Year Ended December 31, 2008 (filed March 13, 2009)

Form 10-K/A for the Fiscal Year ended December 31, 2008 (filed April 2, 2009)

Form 10-Q for the Fiscal Quarter Ended March 31, 2009 (Filed May 8, 2009)

Dear Ms. Lam and Mr. Schuler:

We are in receipt of your above referenced letter relating to the Form 10-K and 10-K/A for the year ended December 31, 2008 and Form 10-Q for the Quarter ended March 31, 2009 for U.S. Energy Corp. Please find below the text of staff comments and our proposed responses. Our responses to the financial statement comments 1 through 4 were included in our Form 10-Q for the quarter ended June 30, 2009. Responses to the engineering comments also are set forth below.

Overview. If you find the responses to accounting comments satisfactory, we propose to include similar disclosures in periodic reports going forward. We submit that the changes in disclosure are not so substantial as to require amending the last 10-K and the first quarter 10-Q.

Regarding the engineering comments, our counsel, Steve Rounds, last week reached agreement with Mr. Schuler that at such time as the staff and U.S. Energy come to agreement on the proposed disclosures, they would be disclosed in the Form 10-K for the year ending December 31, 2009, and no amendment of the filed 10-K would be needed.

Form 10-K for the Fiscal Year Ended December 31, 2008

Financial Statements

Note B – Summary of Significant Accounting Policies, page 72

Mineral Properties, page 74

United States Securities and

Exchange Commission

August 14, 2009

Page 2

1. | Please expand your disclosure either under this heading or in the table above this heading to describe the properties and nature of costs included in your mineral properties balance for each period presented. |

Response at Page 12 of Form 10Q for the quarter ended June 30, 2009 under heading Mineral Properties and Item 2, Managements Discussion and Analysis, Critical Accounting Policies at page 26:

Mineral properties at June 30, 2009 and December 31, 2008 reflect capitalized costs associated with the Company’s Mount Emmons molybdenum property near Crested Butte, Colorado. The Company has entered into an agreement with Thompson Creek Metals Company USA (“TCM”) to develop this property. TCM may earn up to a 75% interest in the project for the investment of $400 million. The Company received the first of six annual payments in the amount of $1.0 million in January 2009. This payment was applied as a reduction of the Company’s investment in the Mount Emmons property. No impairment was therefore taken during either period on the Mount Emmons molybdenum property.

We believe the property contains high grade mineralized materials, sufficient for the project to be commercially viable in a volatile price environment. Activities are ongoing at this advanced exploration stage property, under the supervision of Thompson Creek Metals Company USA as Project Manager. TCM expended approximately $2.5 million in exploration efforts in 2008 and has a budget of $5.9 million for 2009 (these amounts include TCM’s scheduled option payments for 2008 and 2009).

| | Oil and Gas Properties, page 75 |

| 2. | We note you disclose that you use the full cost method of accounting for oil and gas properties. Please expand your disclosure to discuss in more details the limitation on your capitalized costs (i.e. the ceiling test). Refer to Rule 4-10(c)(4)(i)(B) and (C) of Regulation S-X for guidance. |

Response at Page 13 of Form 10-Q for the quarter ended June 30, 2009 under heading Oil and Gas Properties and Item 2, Management’s Discussion and Analysis, Critical Accounting Policies at page 26 and 27 of the Form 10-Q:

The Company uses the full cost method to account for its oil and natural gas operations. Accordingly, the costs to acquire, explore for and develop oil and natural gas properties are capitalized. Capitalized costs of oil and gas properties, net of accumulated Depreciation, Depletion and Amortization (“DD&A”) and related deferred taxes, are limited to the estimated future net cash flows from proved oil and gas reserves, discounted at 10%, plus the lower of cost or fair value of unproved properties, as adjusted for related income tax effects (the full cost ceiling). If capitalized costs exceed the full cost ceiling, the excess is charged to ceiling test write down of oil and gas properties in the quarter in which the excess occurs.

United States Securities and

Exchange Commission

August 14, 2009

Page 3

Full cost pool capitalized costs are amortized over the life of production of proven properties. Capitalized costs at June 30, 2009 and December 31, 2008 which were not included in the amortized cost pool were $3.2 million and $3.0 million, respectively. These costs consist of seismic costs that are being analyzed for potential drilling locations as well as land costs. It is anticipated that these costs will be added to the full cost amortization pool in the next two years as properties are evaluated, drilled or abandoned.

Impairment of Oil and Gas Properties – Primarily due to the low market price for gas at March 31, 2009, the Company recorded a $1.1 million non-cash ceiling test write down of its oil and gas properties during the first quarter of 2009. At June 30, 2009, the Company computed the estimated future net cash flows from its proved oil and gas reserves, discounted at 10%, using quarter end prices of $3.70 per Mcf of gas and $69.82 per barrel of oil. Capitalized costs for oil and gas properties at June 30, 2009 do not exceed the ceiling test limit and no further impairment was recorded.

Wells in Progress - Wells in progress represent the costs associated with wells that have not reached total depth or been completed as of period end. They are classified as wells in progress and withheld from the depletion calculation and the ceiling test. The costs for these wells are then transferred to evaluated property when the wells reach total depth and are cased and the costs become subject to depletion and the ceiling test calculation in future periods.

Further, we did take an impairment to the oil and gas properties in second quarter 2009, as disclosed in the Form 10-Q. No impairment was necessary for the molybdenum property, as disclosed in MD&A in the Form 10-Q. We also refer you to Critical Accounting Policies – third paragraph under “Mineral Properties.”

| | Long-lived Assets, page 75 |

| 3. | We note your disclosure indicating that for both 2008 and 2007, there was no impairment on your long-lived assets including mineral and oil and gas properties. |

| | Please expand your disclosure under this heading and in the critical accounting policies section of your MD&A to discuss the assumptions used in reaching your no impairment conclusion, including your assumptions about the oil and gas and the molybdenum markets and your expectations of their pricing recoveries. |

| | Additionally, explain how you reached no impairment conclusion on your oil and gas properties under the full cost ceiling test given that as of December 31, 2008, your standardized measure of discounted future net cash flows relating to proved oil and gas reserves of $3.3 million as disclosed on page 88 is significantly less than your oil and gas properties capitalized cost balance of $7.9 million as disclosed on page 86. |

United States Securities and

Exchange Commission

August 14, 2009

Page 4

Response at Page 13 of Form 10Q for the quarter ended June 30, 2009 under heading Long Lived Assets and Item 2, Managements Discussion and Analysis, Critical Accounting Policies at page 27:

The Company evaluates its long-lived assets, which consist of commercial real estate, for impairment when events or changes in circumstances indicate that the related carrying amount may not be recoverable. Impairment calculations are based on market appraisals. If rental rates decrease or costs increase to levels that result in estimated future cash flows, on an undiscounted basis, that are less than the carrying amount of the related asset, an asset impairment is considered to exist. Changes in significant assumptions underlying future cash flow estimates may have a material effect on the Company's financial position and results of operations. At June 30, 2009 and December 31, 2008 and 2007, no impairment existed on the Company’s long lived assets as the appraised value at December 31, 2008 exceeded construction and carrying value and rental rates remained strong and costs within projected limits.

Please see our response to Comment 1 for discussion relating to mineral property impairment determination and our response to Comment 2 relating to the impairment of Oil & Gas properties.

Supplemental Financial Information on Oil and Natural Gas Exploration, Development and Production Activities

Capitalized Costs, page 86

| 4. | Please provide the disclosures required under Rule 4-10(c)(7)(ii) of Regulation S-X, including the description and current status of unproved properties for which costs are excluded from amortization, and the anticipated timing of including such costs in your amortization computation. |

See the response to Comment 1 above.

| 5. | We note that your website and some press releases refer to or use the terms “measured”, “indicated”, and “inferred”, resources. If you continue to make references on your web site or in press releases to measures other than proven and probable reserves, as defined by the SEC, please accompany such disclosure with the following cautionary language or provide a legal disclaimer tab or page: |

United States Securities and

Exchange Commission

August 14, 2009

Page 5

| | Cautionary Note to U.S. Investors – The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms on this website (or press release), such as “measured”, “indicated”, and “inferred” “resources”, which the SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 10-K which may be secured from us, or from our website at http://www.sec.gov/edgar.shtml. |

| | Please indicate the location of this disclaimer in your response |

Response: Concerning the Mount Emmons Project on the Company’s website, the reference to “resources” has been removed and replaced with the following language concerning mineralized material:

Historical records filed by predecessor owners of the Mount Emmons Project with the Bureau of Land Management in the 1990’s for the application of patented mineral claims, referenced identification of mineralized material of approximately 220 million tons of 0.366% molybdic disulfide (MoS2), with a high grade section of mineralized material containing approximately 23 million tons at a grade of 0.689% MoS2.

As requested, any future news releases concerning the Mount Emmons Project will either use the term mineralized materials or if the term resources is used, the requested disclaimer will be included in the news release.

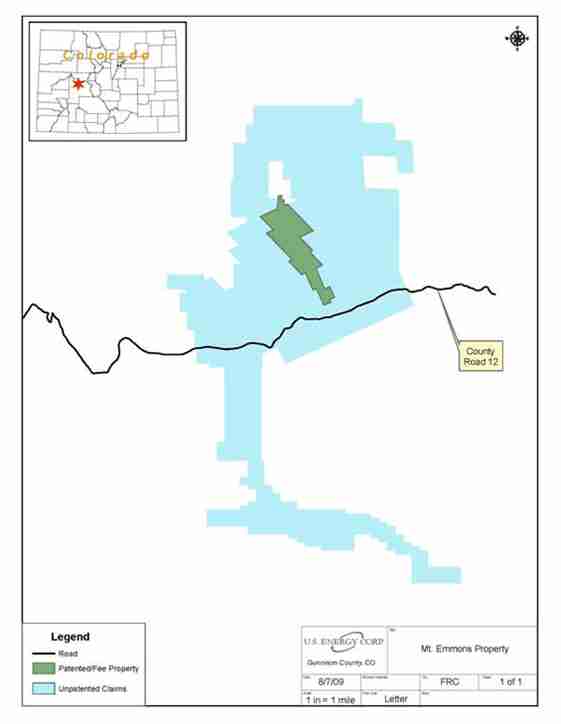

| 6. | We note your disclosure regarding your mineral claims and other real property for your Mt. Emmons project. Please disclose the total area and quantity of your patented, unpatented, and mill site claims. If you have other real properties or surface rights in the project area, please also include these properties in your property area tabulation. |

Response: As requested, please find the following property area tabulation for the Mount Emmons Project:

| | | Acres | | # of Claims |

| Patented / Fee | | 365 | | n/a | |

| Unpatented Claims | | 5,844 | | 662 | |

| Mill Site Claims | | 1,218 | | 244 | |

Fee Property(1) | | 160 | | n/a | |

| | | 7,587 | | 906 | |

United States Securities and

Exchange Commission

August 14, 2009

Page 6

| (1) | This property (fee ownership) is in the vicinity of the mining claims but presently is not considered by TCM and the Company to be part of the Mount Emmons Project. |

| 7. | Please disclose the information required under paragraph (b) of Industry Guide 7 for all your material properties listed under this heading. For any properties identified that are not material, please include a statement to that effect, clarifying your intentions. For each material property, include the following information: |

| · | The location and means of access to your property, including the modes of transportation utilized to and from the property. |

Response: The Mount Emmons Project is located in Gunnison County, Colorado. The property is accessed by vehicle traffic via Gunnison County Road 12.

| · | Any conditions that must be met in order to obtain or retain title to the property, whether you have surface and/or mineral rights. |

Response: The Company owns both surface and mineral rights at the Mount Emmons Project in fee pursuant to mineral patents issued by the United States of America. All fee property requires the payment of property taxes to Gunnison County. Unpatented mining and mill site claims require the payment of an annual maintenance fee of $125 per claim to the Bureau of Land Management, totaling payment for the 906 claims of $113,250 in 2008.

| · | A brief description of the rock formations and mineralization of existing or potential economic significance on the property. |

Response: The exploration work conducted in the late 1970’s by Amax, Inc. as discussed in the Patent Claim Application to the Bureau of Land Management dated December 23, 1992, defined the initial mineralized material at the Mount Emmons Project as follows.

Molybdenite is present in randomly distributed veinlets (i.e. stockwork veining) and in some larger veins that are up to two feet wide. This mineralized zone is found in metamorphosed sedimentary rocks and in Tertiary igneous complex which acted as the source of the mineralization.

United States Securities and

Exchange Commission

August 14, 2009

Page 7

The sedimentary sequence in the Mount Emmons area spans from late Cretaceous to early Tertiary time. The oldest formation is the Mancos, a 4,000 foot sequence of shales with some interbedding limestone and siltstones. The Mancos Formation is not exposed on Mount Emmons, but may be seen in valley bottoms a few miles to the north, south, and east. All of the Mancos Formation encountered in the vicinity of the Mount Emmons mineralization has been strongly metamorphosed and attempts to correlate internal divisions of the unit have not been made. The overlying Mesaverde Formation, also of the late Cretaceous age, consists of a massive repetitive sequence of alternating sandstones, siltstones, shales and minor coals. Coal seams were not observed in any of the diamond drill holes, or in any of the underground drifts.

On Mount Emmons the Mesaverde Formation varies from 1100 to 1700 feet thick. The variability in thickness of the Mesaverde Formation is mainly due to post-depositional erosion. The Ohio Creek Formation, dominantly a coarse sandstone with local chert pebble conglomerate and well-defined shale to siltstone beds, overlies the Mesaverde Formation. The Ohio Creek Formation is of early Tertiary (Paleocene) age and remains fairly consistent at 400 feet thick on Mount Emmons. Capping Mount Emmons is the Wasatch Formation, also of early Tertiary (Paleocene to Eocene) age. On a more regional scale, within the Ruby Range the Wasatch Formation may reach 1700 feet in thickness. However, on Mount Emmons specifically, all but the basal 600 to 700 feet has been eroded. The Wasatch Formation is composed of alternating sequences of immature shales, siltstones, arkosic sandstones, and volcanic pebble conglomerates. The Mount Emmons stock has intruded the Mancos and Mesaverde sediments, strongly metamorphosing both formations to hornfels up to 1500 feet outward from the igneous body.

Sedimentary rocks on Mount Emmons generally dip 15 – 20 degrees to the southeast, south, and southwest as is consistent with the locations of the Oh-Be-Joyful anticline and Coal Creek syncline.

United States Securities and

Exchange Commission

August 14, 2009

Page 8

During crystallization of the Red Lady Complex, hydrothermal fluids collected near the top of the magma column. These fluids were released after a period of intense fracturing in the solid upper portions of the Red Lady Complex and the surrounding country rock. This release of fluids was responsible for the formation of the major part of the Mount Emmons molybdenum mineralized zone and the associated alteration zones. Hydrothermal alteration associated with the Mount Emmons stock occurs in several distinct overlapping zones. Altered rocks include sedimentary rocks of the Mancos, Mesaverde, Ohio Creek and Wasatch Formations, the rhyodacite porphyry sills, and rocks of the Mount Emmons stock.

| · | A description of any work completed on the property and its present condition. |

Response: There is an operating water treatment plant located at the Mount Emmons property, which was constructed in 1981 to treat mine discharge water from the historic lead and zinc Keystone Mine. There also are a number of existing mine adits located on the property. Historic work completed by Amax, Inc. in the 1970s and early 1980s included: 2,400 feet of new drift with 18 underground diamond drill stations to facilitate underground drilling consisting of 168 diamond drill holes for a total of 157,037 feet of core drilling. The majority of the drilling was concentrated within 3,000 feet north and south; 3,000 feet east and west and 2,000 vertical feet defining the area of mineralized material. A bulk sample was collected from this area and sent off site for metallurgical testing. Amax, Inc. also facilitated the completion of an Environmental Impact Statement (“EIS”) as required by NEPA for the Plan of Operations submitted to the United States Forest Service (“USFS”). The Amax, Inc. EIS is now outdated.

United States Securities and

Exchange Commission

August 14, 2009

Page 9

| · | The details as to modernization and physical condition of the plant and equipment, including subsurface improvements and equipment. |

Response: A certified water treatment plant operations contractor with four licensed and/or trained employees operate the heavy metals recovery plant (“water treatment plant”) on a continuous basis, treating the water discharge from the historic lead and zinc Keystone Mine. Several capital upgrades to the onsite facilities have taken place since the Company took ownership of the property in February 2006. The other facilities at the property include a core and office building, five ancillary pump houses and underground pipelines and utilities, which move water from five water storage ponds to the water treatment plant. Surface access is maintained to the four underground adits and the ancillary pump houses.

| · | A description of equipment, infrastructure, and other facilities. |

Response: Amax, Inc completed the construction of the water treatment plant in 1981 at a cost of approximately $15 million. The water treatment plant utilizes a standard lime PH adjustment to precipitate heavy metals from the Keystone Mine water. The mine water is then filtered and discharged in compliance with the approved NPDES Permit for the water treatment facility. The solids are dewatered and mixed with cement for proper disposal in accordance with state and federal law. Additional equipment used in the operation of the water treatment plant includes: a large front-end loader, forklifts, specialized snow removal equipment and pickup trucks. The Mount Emmons Project currently has a 24-hour, seven days a week security contract service to protect the property. Surface access continues to be maintained to the four adits.

| · | The current state of exploration of the property. |

The initial exploration of the Mount Emmons Project was conducted by Amax, Inc. in the late 1970’s. TCM, the Project Manager is currently preparing and evaluating engineering and environmental reports and studies to prepare a Plan of Operations, which the Company anticipates will be submitted to the USFS in 2010. The Company expects that the Plan of Operations will facilitate the development of an underground drilling program to further define the mineralized material. The Plan of Operations review will follow the NEPA process, requiring the collection of environmental baseline data and studies for the preparation of an EIS.

United States Securities and

Exchange Commission

August 14, 2009

Page 10

| · | The total costs incurred to date and all planned future costs. |

Amax, Inc. reportedly spent approximately $150 million in exploration and related activities on the Mount Emmons Project, which included construction of the water treatment plant. During 2007, Kobex Resources, the predecessor of TCM, spent approximately $10.5 million on the property. From August 2008 to December 31, 2008, TCM spent approximately $2.5 million on the Mount Emmons Project. The 2009 TCM budget for the Mount Emmons Project is $5.9 million. In addition, the Company’s annual operating cost for the water treatment plant is approximately $1.5 million. The total costs associated with future drilling and the development of the Mount Emmons Project has not yet been determined by TCM.

| · | The source of power and water that can be utilized at the property |

The Company is currently utilizing grid electric power to operate the water treatment plant and other facilities from the local electric utility serving Gunnison County. The Company has been granted conditional water rights from the State of Colorado for operation and development of the Mount Emmons Project. TCM, the Project Manager of the Mount Emmons Project is reviewing and evaluating potential future power and water needs, however no definitive development project plans have been finalized or approved at this time.

| · | If applicable, provide a clear statement that the property is without known reserves and the proposed program is exploratory in nature. |

Response: In the late 1970’s, Amax, Inc. through their exploration plan identified mineralized materials for the Mount Emmons Project. Additional drilling will need to be conducted to further delineate the depth, grades and volume of mineralized materials before we can determine if there are reserves present in the project (presently in the advanced exploration stage). The time table for completing drilling, and the permitting and construction of the mine and milling facilities, is dependent upon several factors, including State and Federal regulations and availability of capital which is driven by the market price for molybdenum.

United States Securities and

Exchange Commission

August 14, 2009

Page 11

You may refer to Industry Guide 7, paragraphs (b) (1) through (5), for specific guidance pertaining to the foregoing, available on our website at the following address:

www.sec.gov/about/forms/industryguides.pdf

| 8. | Please insert a small-scale map showing the location and access to each material property, as required by Instruction 3.B to Item 102 of Regulation S-K. Please note that the EDGAR program now accepts Adobe PDF files and digital maps, so please include these maps in any filings and amendments that are uploaded to EDGAR. It is relatively easy to include automatic links at the appropriate locations within the document to GIF or JPEG files, which will allow figures and diagrams to appear in the right location when the document is viewed on the Internet. For more information, please consult EDGAR manual, and if additional assistance is required, please call Filer Support at (202) 551-3600 for Post-Acceptance Filing Issues or (202) 551-8900 for Pre-Acceptance Filing Issues. Please include maps and drawings with the following features: |

| · | A legend or explanation showing, by means of pattern or symbol, every pattern or symbol used on the map or drawing. |

| · | A graphical bar scale; additional representations of scale such as “one inch equals one mile” may be utilized if the original scale of the map has not been altered. |

| · | An index map showing where the property is situated in relationship to the state, province, or other geographic area in which it is located. |

| · | A title of the map or drawing, and the date on which it was drawn. |

| · | In the event interpretive data is submitted in conjunction with any map, the identity of the geologist or engineer that prepared such data. |

Any drawing should be simple enough or of sufficiently large scale to clearly show all features on the drawing.

Response: The following map will be added the 2009 10-K Annual Report for the Mount Emmons Project:

United States Securities and

Exchange Commission

August 14, 2009

Page 12

United States Securities and

Exchange Commission

August 14, 2009

Page 13

| 9. | In the description of each exploration property, please provide a clear statement that the property is without known reserves and the proposed program is exploratory in nature to comply with the guidance in paragraph (b)(4)(i) of Industry Guide 7. |

Response: Please see our response (10th bullet) to Comment 7.

| 10. | On a related point, it appears you should also expand your disclosure concerning the exploration plans for the properties to address the following points. |

| · | Disclose a brief geological justification for each of the exploration projects written in non-technical language. |

| · | Give a breakdown of the exploration timetable and budget, including estimated amounts that will be required for each exploration activity, such as geophysics, geochemistry, surface sampling, drilling, etc. for each prospect. |

| · | If there is a phased program planned, briefly outline all phases. |

| · | If there are no current detailed plans to conduct exploration on the property, disclose this prominently. |

| · | Disclose how the exploration program will be funded. |

| · | Identify who will be conducting any proposed exploration work, and discuss what their qualifications are. |

Response: As noted above, the initial exploration of the Mount Emmons Project was conducted by Amax, Inc. in the late 1970’s. TCM, the Project Manager is currently preparing and evaluating numerous engineering and environmental reports and studies to prepare a Plan of Operations, which the Company anticipates will be submitted to the USFS in 2010. The Company expects that the Plan of Operations will facilitate the development of an underground drilling program to further define the mineralized material. The Company anticipates that any drilling program for the Mount Emmons Project will be developed during 2010 and that if approved, the program will be funded and managed by TCM. However, there are no current detailed plans to conduct exploration on the property.

United States Securities and

Exchange Commission

August 14, 2009

Page 14

| 11. | We recommend that a brief description of the QA/QC protocols be provided to inform readers regarding sample preparation, controls, custody, assay precision and accuracy, covering those activities associated with your exploration program. |

Response: As noted above, TCM, the Project Manager for the Mount Emmons Project is reviewing and evaluating potential future drilling activities, but no such activities have yet been finalized or approved.

| | Mount Emmons Molybdenum Property, page 36 |

| | Mount Emmons Molybdenum Property and Thompson Creek Metals Company, USA, page 42 |

| 12. | We note your disclosure of mineral resources and minable reserves on the pages noted above. The provisions in Industry Guide 7 generally preclude the use of any terms other than proven or probable reserves for disclosure in SEC documents. However, we would not object if you wish to disclose quantity estimates for mineralized material that has been delineated by appropriate drilling and/or underground sampling to establish continuity sufficient to support an estimate of tonnage and an average grade of the selected metals. |

| | Under SEC standards, until a comprehensive evaluation that includes appropriate estimates of unit costs, grades, recoveries, and other factors indicates the project is both economically and legally feasible, such a deposit would not qualify as a reserve. |

| | Mineralized material may only be reported as an in-place tonnage and grade, and should not be disclosed as units of product, such as ounces of gold or pounds of copper. |

| | Please note that mineralized material does not include: 1) material reported as reserves, and 2) volumes and grades estimated by using geologic inference, which are sometimes classed as inferred or possible by some evaluators. |

| · | Please remove the terms such as resources, mineral resources, geological resources, minable reserves, and the associated estimates of tonnage and grade, which do not conform to the guidance outline above. |

| · | If the quantities associated with the above terms meet the requirements of mineralized material, disclose the estimates as mineralized material. |

| · | Please do not disclose estimates based on geologic inference, such as inferred or possible resources. |

United States Securities and

Exchange Commission

August 14, 2009

Page 15

Response: As requested, in the future when the Company discusses the Mount Emmons Project, the Company will not use the terms resources, mineral resources, geological resources, minable reserves, and their associated reserve tonnages. The Company will instead report the tonnage and grade of mineralized materials as follows:

Historical records filed by predecessor owners of the Mount Emmons Project with the Bureau of Land Management in the 1990’s for the application of patented mineral claims, referenced identification of mineralized material of approximately 220 million tons of 0.366% molybdic disulfide (MoS2), with a high grade section of mineralized material containing approximately 23 million tons at a grade of 0.689% MoS2.

Closing Comments:

Response: Management of the Company acknowledges that:

| · | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities law as of the United States. |

We appreciate your review and comments. In the event that further disclosure is required, please send further comments to me at FAX (307) 857-3050 with a copy to our SEC counsel, Steve Rounds at FAX (303) 377-0231. Should you wish to discuss the proposed disclosures set forth above, prior to issuing further comments, please call Mr. Rounds at (303) 377-6997.

Sincerely,

Robert Scott Lorimer,

CFO/V.P. Finance