- USEG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

U.S. Energy (USEG) PRE 14APreliminary proxy

Filed: 25 Oct 19, 4:52pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | |

| Check the appropriate box: | |

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

|

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

U.S. ENERGY CORP.

675 Bering, Suite 100

Houston, TX 77057

Notice of Annual Meeting of Shareholders

[ ], 2019

Dear Shareholders:

We are pleased to provide you with notice of our 2019 Annual Meeting of Shareholders (the “Annual Meeting”), and we invite you to attend the meeting in person, if possible. The timing, location and summary of each of the proposals to be voted upon are as follows:

| Date: | December 10, 2019 | Time: | 8:00 AM CDT |

| Place: | 675 Bering, Suite 100 Houston, TX 77057 |

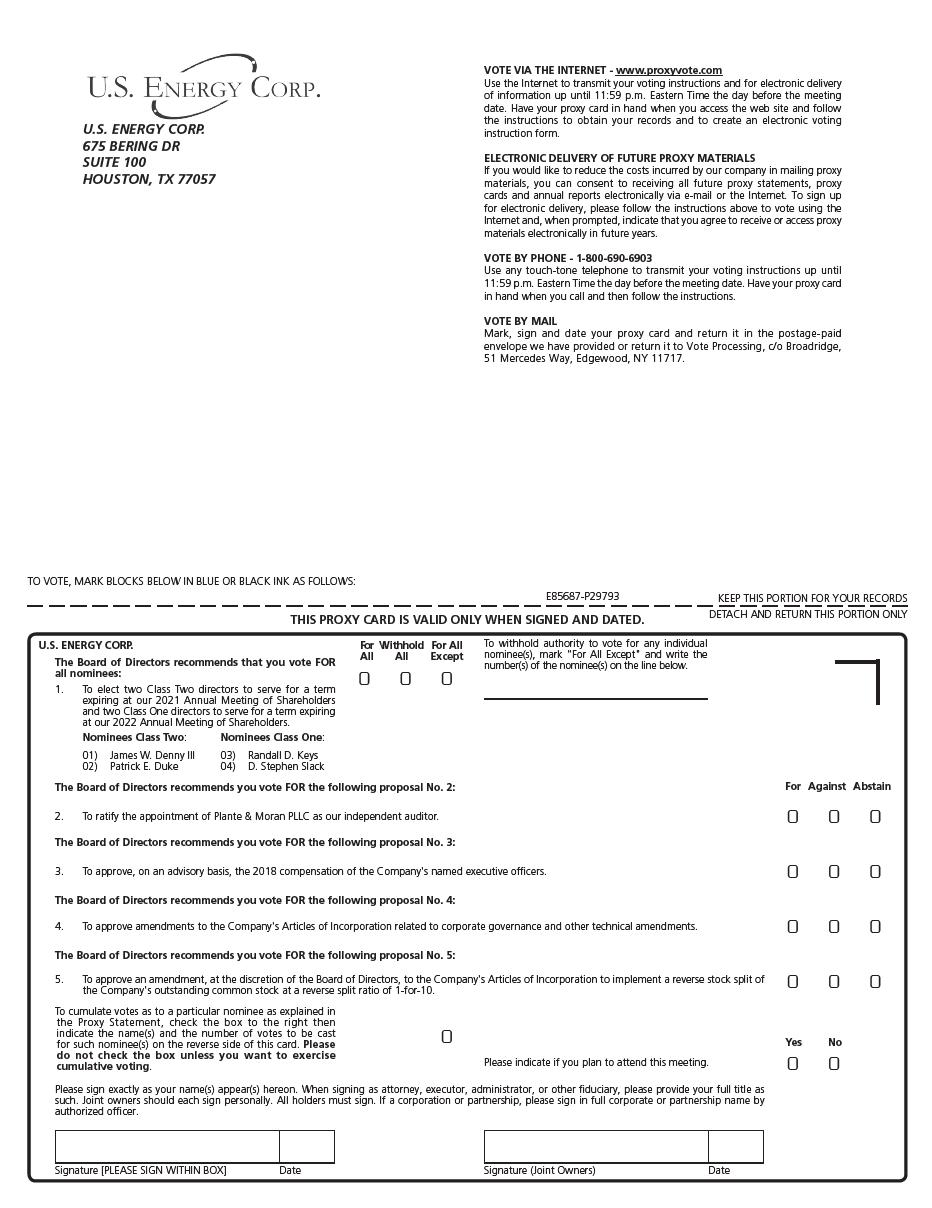

| Purposes: | 1. | To elect two nominees for Class Two directors identified in the accompanying Proxy Statement (James W. Denny III and Patrick E. Duke) to serve until the second succeeding annual meeting of shareholders (to be held in 2021) and until their successors have been duly elected or appointed and qualified, and to elect two nominees for Class One directors identified in the accompanying Proxy Statement (Randall D. Keys and D. Stephen Slack) to serve until the third succeeding annual meeting of shareholders (to be held in 2022) and until their successors have been duly elected or appointed and qualified; |

| 2. | To ratify the appointment of Plante & Moran PLLC as our independent auditor; | |

| 3. | To approve, on an advisory basis, the 2018 compensation of the Company’s named executive officers; | |

| 4. | To approve amendments to the Company’s Articles of Incorporation related to corporate governance and other technical amendments; | |

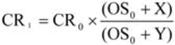

| 5. | To approve an amendment, at the discretion of the Board of Directors, to the Company’s Articles of Incorporation to implement a reverse stock split of the Company’s outstanding Common Stock at a reverse split ratio of 1-for-10; and | |

| 6. | To approve such other business as may arise that can properly be conducted at the Annual Meeting, or any adjournment or postponement thereof in accordance with the Bylaws of the Company. |

The formal Proxy Statement that follows this letter provides extensive background information about each of the proposals, along with the recommendations of our Board of Directors to vote in favor of each of the proposals.

Only shareholders of record at the close of business on October 14, 2019 are entitled to receive notice of and to vote at the Annual Meeting. A copy of our Annual Report for the fiscal year ended December 31, 2018 is available at www.usnrg.com. Please read this information carefully before voting your proxy.

The Securities and Exchange Commission (“SEC”) has adopted rules regarding how companies must provide proxy materials to their shareholders. These rules are often referred to as “notice and access,” under which a company may select either of the following options for making proxy materials available to its shareholders:

| ● | the full set delivery option; or | |

| ● | the notice only option. |

A company may use a single method for all of its shareholders, or use full set delivery for some while adopting the notice only option for others.

Under the full set delivery option, a company delivers all proxy materials to its shareholders by mail. In addition to delivery of proxy materials to shareholders, the company must post all proxy materials on a publicly-accessible website and provide information to shareholders about how to access the website.

In connection with the Annual Meeting, we have elected to use the full set delivery option. Accordingly, you should have received our proxy materials by mail. These proxy materials include the Notice of Annual Meeting of Shareholders, Proxy Statement, proxy card and Annual Report on Form 10-K. Additionally, these materials are available on our website www.usnrg.com.

Under the notice only option, which we have electedNOT to use for the Annual Meeting, a company must post all proxy materials on a publicly-accessible website. Instead of delivering proxy materials to its shareholders, the company instead delivers a “Notice of Internet Availability of Proxy Materials.” The notice includes, among other matters:

| ● | information regarding the date and time of the annual meeting of shareholders as well as the items to be considered at the meeting; | |

| ● | information regarding the website where the proxy materials are posted; and | |

| ● | various means by which a shareholder can request paper or e-mail copies of the proxy materials. |

If a shareholder requests paper copies of the proxy materials, these materials must be sent to the shareholder within three business days and by first class mail or other reasonably prompt means.

Although we have elected to use the full set delivery option in connection with the Annual Meeting, we have used in the past, and may choose to use again in the future, the notice only option. By reducing the amount of materials that a company needs to print and mail, the notice only option provides an opportunity for cost savings as well as conservation of paper products.

Whether or not you plan to attend the meeting, please take the time to vote:

| Ø | Via the internet – Go to the website shown on your proxy card; |

| Ø | Via telephone – Call the toll free number shown on your proxy card; or |

| Ø | Via mail – Complete, sign and date your proxy card and mail it in the postage paid envelope. |

If you were a shareholder of record at the close of business on October 14, 2019 you may attend and vote at the Annual Meeting. The names of shareholders of record entitled to vote at the Annual Meeting will be available for review at the Annual Meeting.

If you wish to attend the Annual Meeting and vote in person, but you hold your shares through a broker or other nominee (i.e., your shares are held in “street name”), contact your broker or nominee promptly to obtain a “legal proxy,” which you must bring to the meeting in order to vote in person at the meeting. Thank you for your support for the recommendations of our Board of Directors.

| By Order of the Board of Directors | |

| /s/ Ryan Smith | |

| Chief Financial Officer |

TABLE OF CONTENTS

| i |

U.S. ENERGY CORP.

675 Bering, Suite 100

Houston, TX 77057

PROXY STATEMENT

FOR 2019 ANNUAL MEETING OF SHAREHOLDERS

ON TUESDAY, DECEMBER 10, 2019

This proxy statement (“Proxy Statement”) is provided in connection with a solicitation of proxies by the Board of Directors (the “Board”) of U.S. Energy Corp. (“U.S. Energy”, the “Company”, “we”, “our”, or “us”) for the annual meeting of shareholders to be held on Tuesday, December 10, 2019, at 8:00 a.m., Central Time, at the Houston offices of U.S. Energy, 675 Bering, Suite 100, Houston, TX 77057 (the “Annual Meeting”), and at any adjournments of the meeting. On or about [ ], 2019, we are first mailing the proxy materials to shareholders.

Only holders of our common stock (“Common Stock”) and our Series A Convertible Preferred Stock at the close of business on the record date of October 14, 2019 are entitled to receive notice of the Annual Meeting, and only holders of our Common Stock at the close of business on the record date have the right to vote their shares at the Annual Meeting. As of October 21, 2019 there were 13,405,838 shares of our Common Stock issued and outstanding.

You may hold your shares “of record” or in “street name.” The difference between shareholders of record and street name holders is:

| ● | Shareholder of Record. If your shares are registered directly in your own name with our transfer agent, Computershare Trust Company, Inc., you are considered to be the holder of record of those shares, and you may vote directly via internet, by telephone, by mail or in person. | |

| ● | Street Name Shareholder. If your shares are held in a stock brokerage account or by a broker or other nominee, you are considered the “street name” holder and the beneficial owner of those shares, and you have the right to direct your broker or nominee how to vote. However, since you are not the shareholder of record, you may not vote those shares in person at the Annual Meeting unless you obtain a “legal proxy,” which you must bring to the Annual Meeting in order to vote in person at the meeting. |

A quorum for the Annual Meeting will exist if a majority of the voting power of the shareholders is present at the meeting, in person or represented by properly executed proxies delivered to us prior to the meeting. Shares of Common Stock present at the meeting that abstain/withhold from voting, or that are the subject of “broker non-votes,” will be counted as present for the purposes of determining a quorum.

New York Stock Exchange (“NYSE”) Rule 452 governs discretionary voting by brokers of shares held in street name when beneficial owners have not instructed how such shares should be voted. Because the rule governs all brokers that are members of the NYSE, it affects all public companies that have shares held in street name, not just companies listed on the NYSE. Under the rule, such brokers have discretionary authority to vote street name shares on “routine” items such as the ratification of the Company’s appointment of auditors, but not on other matters, including the election of directors. Of the matters to be presented at the Annual Meeting, Proposal 2 (ratification of auditors) will be considered a routine matter for purposes of the rule. Accordingly, if your broker does not receive instructions from you, your broker will not be able to vote your shares on any of the other matters, and a “broker non-vote” will occur with respect to those matters.

You are entitled to one vote for each share of U.S. Energy Common Stock you hold, except that for the election of directors you may cumulate your votes. Cumulative voting generally allows each holder of shares of Common Stock to multiply the number of shares owned by the number of directors nominated for election, and to distribute the resulting number of votes among nominees in any proportion that the holder chooses.

| 1 |

On Proposal 1, Election of Directors, nominees in a number equal to the seats to be filled on the Board who receive a plurality of votes cast will be elected as directors. If you withhold your shares from voting, your shares will not be counted for any director. Withheld votes and broker non-votes will have no effect on the election of directors.

Each of the other proposals, and any other matter which properly comes before the meeting in accordance with the Amended and Restated Bylaws of the Company (the “Bylaws”), will be approved or ratified, as the case may be, if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. Abstentions and broker non-votes are not considered votes cast, and they will have no effect on such proposals.

How Your Proxy Will Be Voted; Recommendation of the Board

The Board is soliciting a proxy to provide you with the opportunity to vote on all matters scheduled to come before the meeting (as stated in the Notice of Annual Meeting which accompanies this Proxy Statement), whether or not you attend in person.

The Board recommends you vote as follows on the five proposals stated in the Proxy Statement:

| ● | For each nominee in Proposal 1 – election of two nominees for Class Two directors (James W. Denny III and Patrick E. Duke) to serve until the second succeeding annual meeting of shareholders (to be held in 2021) and until their successors have been duly elected or appointed and qualified, and election of two nominees for Class One directors (Randall D. Keys and D. Stephen Slack) to serve until the third succeeding annual meeting of shareholders (to be held in 2022) and until their successors have been duly elected or appointed and qualified; | |

| ● | For Proposal 2 – the ratification of appointment of Plante & Moran PLLC as the independent auditor of the Company; | |

| ● | For Proposal 3 – to approve, on an advisory basis, the 2018 compensation of the Company’s Named Executive Officers; | |

| ● | For Proposal 4 – to approve amendments to the Company’s Articles of Incorporation related to corporate governance and other technical amendments; and | |

| ● | For Proposal 5 – to approve an amendment, at the discretion of the Board of Directors, to the Company’s Articles of Incorporation to implement a reverse stock split of the Company’s outstanding Common Stock at a reverse split ratio of 1-for-10. |

| 2 |

Your shares will be voted as you specify if you properly complete and return the appropriate form of proxy. If you make no specifications, your proxy will be voted in favor of each proposal listed above.

We do not expect any matters to be presented for action at the meeting other than the matters stated in the Notice of Annual Meeting accompanying this Proxy Statement. However, as permitted by Securities and Exchange Commission (“SEC”) Rule 14a-4(c), the proxy will confer discretionary authority with respect to any other matter that may properly come before the meeting. The persons named as proxies intend to vote in accordance with their judgment on any such matters.

If you are a shareholder of record and submit a proxy, you may revoke it later or submit a revised proxy at any time before it is voted. You also may attend the meeting in person and vote by ballot, which would cancel any proxy you previously submitted. If you are a street name shareholder and you vote by proxy, you may change your vote prior to the meeting by submitting new voting instructions to your broker or other nominee in accordance with that entity’s procedures.

We will pay all expenses of our solicitation of proxies for the Annual Meeting. In addition to solicitations by mail, arrangements have been made for brokers and other nominees to send proxy materials to beneficial owners, and we will reimburse those brokers and other nominees for their reasonable expenses. We have not hired a solicitation firm for the meeting. Our employees and directors may solicit proxies by telephone or other means, if necessary; they will not receive additional compensation for these services.

The SEC has adopted rules that permit companies and intermediaries (e.g. brokers) to satisfy the delivery requirements for proxy materials with respect to two or more shareholders sharing the same address by delivering a single set of proxy materials. This process, which is commonly referred to as “householding,” potentially results in extra convenience for shareholders, cost savings for companies and conservation of paper products. We have adopted this “householding” procedure.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate set of proxy materials, you may:

| ● | send a written request to U.S. Energy Corp., Attn: Ryan Smith, Chief Financial Officer, 675 Bering, Suite 100, Houston, TX 77057 or call (303) 993-3200, if you are a shareholder of record; or | |

| ● | notify your broker, if you hold your shares in street name. |

Upon receipt of your request, we will promptly deliver a separate set of proxy materials to you. You may also contact us as described above if you are receiving multiple copies of our proxy materials and would like to receive only one copy in the future.

Requirementsand Deadlines for Shareholders to Submit Proposals

The Annual Meeting was delayed from its previously anticipated schedule. We plan to return to our regular annual meeting schedule in 2020, including with respect to the deadlines for shareholder proposals and director nominations. We expect that our 2020 annual meeting of shareholders (the “2020 Annual Meeting”) will be held on or about July 5, 2020.

| 3 |

A shareholder may submit proposals for consideration at future shareholder meetings in accordance with SEC regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in Company-sponsored proxy materials. Based on the expected date of the 2020 Annual Meeting, and because the date of the 2020 Annual Meeting will be changed by more than 30 days from the date of the Annual Meeting, the date by which the Company must receive shareholder proposals to be considered for inclusion in the proxy materials for the 2020 Annual Meeting is February 5, 2020, which we believe is a reasonable time before we begin to print and send the proxy materials for the 2020 Annual Meeting. In addition, shareholder proposals must otherwise comply with the requirements of Rule 14a-8 promulgated under the Exchange Act and any other applicable laws and regulations. Such proposals should be addressed to U.S. Energy Corp., Attn: Ryan Smith, Chief Financial Officer, 675 Bering, Suite 100, Houston, TX 77057.

For a shareholder proposal to be considered at our next annual meeting that will not be included in our proxy statement for that meeting (including director nominations), written notice of the proposal must be delivered to the Company’s Secretary, in accordance with the Company’s Bylaws, at least 90 calendar days, but no earlier than 120 calendar days, before the date of such meeting.

Promptly upon receiving a written request from any shareholder, we will send to the shareholder without charge a copy of our Annual Report on Form 10-K for the year ended December 31, 2018, with exhibits, as filed with the SEC. Please address your request to Ryan Smith, Chief Financial Officer, at U.S. Energy Corp., 675 Bering, Suite 100, Houston, TX 77057.

No action is proposed at the Annual Meeting for which the laws of the State of Wyoming or our charter documents provide a right of our shareholders to dissent and obtain appraisal of or payment for such shareholders’ Common Stock.

Board of Directors, Audit, Compensation and Nominating Committees

We are committed to sound corporate governance principles. As evidence of this commitment, the Board has adopted charters for its committees and a Code of Ethics. These documents, along with the Company’s Restated Articles of Incorporation (as amended, the “Articles of Incorporation”) and Bylaws, provide the framework for our corporate governance. The charters of the Audit Committee, the Compensation Committee, and the Nominating Committee may be viewed at our website (www.usnrg.com), at the tab “About Us,” then go to “Corporate Governance.” The Code of Ethics also may be viewed at that location. If these documents are amended (or if the Code of Ethics is waived in a manner requiring disclosure under SEC rules), the amendments (and the occurrence of the waiver of the Code of Ethics) will be disclosed on the website as required by the SEC. Copies of each of these documents are available without charge to any person who requests them, by sending a request to U.S. Energy Corp., Attn: Ryan Smith, Chief Financial Officer, 675 Bering, Suite 100, Houston, TX 77057.

Board and Committee Independence

The Board is currently comprised of a majority of independent directors. Specifically, the Board has determined that Catherine J. Boggs, J. Weldon Chitwood and Javier F. Pico are independent under applicable Nasdaq rules. In addition, the Audit Committee, the Compensation Committee, and the Nominating Committee are each comprised solely of independent directors as required under the applicable requirements of Nasdaq and the SEC. The Board has also determined that director nominees James W. Denny III, Randall D. Keys and D. Stephen Slack are independent under applicable Nasdaq rules.

Historically under our Bylaws, the Chief Executive Officer has served as the Chairman of the Board, responsible for setting the agenda for and presiding over Board meetings. On August 5, 2019, the Board amended and restated our Bylaws to provide that the Chairman of the Board may not be the Chief Executive Officer and shall be appointed by the affirmative vote of at least a majority of the members of the Board, unless otherwise determined by the Board. We believe the separation of the Chairman and Chief Executive Officer roles to be a best practice as it relates to strong corporate governance.

| 4 |

The Board currently consists of five members and it has primary responsibility for directing management of the business. During 2018, the Board consisted of four members with one vacancy. The Board held six formal meetings during 2018, which were attended, in person or by telephone, by all four of the directors serving on the Board.

Attendance at Annual Meetings by Directors

Directors are encouraged, but not required, to attend annual meetings. At the Company’s last annual meeting held on September 11, 2018, three of the four directors were in attendance.

Communications from Shareholders to the Board

The independent directors have established a process for collecting and organizing communications from shareholders. Shareholders may send communications to the Board by addressing their communications to Ryan Smith, Chief Financial Officer, at 675 Bering, Suite 100, Houston, TX 77057. Pursuant to this process, the Chief Executive Officer then reviews the communications and determines which of the communications address matters of substance that should be considered by all directors, and sends those communications to all the directors for their consideration.

To provide effective direction and review of fiscal matters, the Board has established an Audit Committee. The Audit Committee has the responsibility of reviewing our financial statements, exercising general oversight of the integrity and reliability of our accounting and financial reporting practices, and monitoring the effectiveness of our internal control systems. The Audit Committee also retains our independent outside audit firm and recommends selection of the internal audit firm. It also exercises general oversight of the activities of our independent auditors, principal financial officer, principal accounting officer, accounting employees and related matters. The current Chairman of the Audit Committee is Javier F. Pico. The Board has determined that Mr. Pico is an “audit committee financial expert” as defined in Item 407(d) of SEC Regulation S-K. The other members of the Audit Committee are J. Weldon Chitwood, who has served since May 2017, and Catherine J. Boggs, who has served since June 2019. During 2018 and until his resignation in May 2019, John Hoffman was a member of the Audit Committee. All members of the Audit Committee are independent directors under applicable Nasdaq and SEC rules.

The Audit Committee met four times in 2018. All Audit Committee members attended each meeting in person or by telephone. The Committee reviewed our financial statements for each quarter in 2018 and the year as a whole and discussed the financial statements with management and our independent audit firm. Based on the foregoing, the Audit Committee recommended to the Board at the Audit Committee meeting held on September 12, 2019 that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2018. The Audit Committee also reviews and reassesses the adequacy of the Audit Committee Charter on an annual basis, and the Board approved amendments to the Audit Committee Charter on August 5, 2019.

We have a Compensation Committee, the current members of which are J. Weldon Chitwood and Javier F. Pico. These members are independent under applicable criteria established by Nasdaq. During 2018 and until his resignation in May 2019, John Hoffman was a member of the Compensation Committee. The Compensation Committee met formally on one occasion in 2018 and discussed compensation matters informally several times during the year. All Compensation Committee members attended all meetings of the Committee during 2018 either in person or by telephone.

The Compensation Committee reviews and recommends to the Board compensation packages for the executive officers of the Company. The Compensation Committee may delegate to a subcommittee or to our Chief Executive Officer or other officer such of its duties and responsibilities as the Compensation Committee deems to be in the best interests of the Company, provided such delegation is not prohibited by law or Nasdaq rule.

We have a Nominating Committee, the current members of which are J. Weldon Chitwood and Javier F. Pico. These members are independent directors under Nasdaq rules. During 2018 and until his resignation in May 2019, John Hoffman was a member of the Nominating Committee. The Nominating Committee is responsible for identifying and recommending to the Board nominees for election to the Board. This process involves consulting with our Chief Executive Officer to identify qualified candidates with expertise in one of our business areas, including financial, oil and natural gas, and investment banking expertise. Once identified, the Nominating Committee reviews the qualifications (including capability, availability to serve, conflicts of interest, and other relevant factors) of any identified potential director candidate and, where necessary, assists in interviewing such candidate. It recommends to the Board appropriate nominees for election to be included in the proxy statement for the annual shareholders meeting. The Nominating Committee did not hold any meetings during 2018.

The Nominating Committee (which is comprised solely of independent directors) considers and recommends to the Board individuals who may be suitable to be nominated to serve as directors. All director candidates recommended by a shareholder, or a director or officer, will be evaluated by the Nominating Committee in good faith. The Nominating Committee considers diversity in identifying nominees for director, but has not adopted a formal, written diversity policy. The charter of the Nominating Committee sets forth a procedure for shareholders to follow in recommending director candidates to the Committee. Pursuant to the charter, a nominating shareholder should provide a written request that the Committee consider a particular candidate at least 90 days prior to the meeting at which the candidate would be elected. The request must include specified information about the candidate, including a discussion of his or her background and experience, and related matters, and the candidate must have certain attributes and experience, in each case as described in the charter.

| 5 |

For the Annual Meeting, the Nominating Committee did not receive a request from any shareholder for consideration of a director nominee candidate.

The Executive Committee helps implement the Board’s overall directives as necessary. Members include C. Randel Lewis and Javier F. Pico. The Executive Committee does not regularly conduct formal meetings. The Executive Committee did not hold any meetings during 2018.

The Company has a Hedging Committee to review and approve the use of all swap agreements. The current members are C. Randel Lewis and J. Weldon Chitwood. The Hedging Committee did not formally meet in 2018 but discussed hedging matters informally several times during the year.

We face various risks in our business, including liquidity and operational risks. Liquidity risk is encountered in the context of balancing contractual commitments to spend capital and also is involved in our hedging commitments for oil and natural gas price protection. Any change in our hedging strategy will require the approval of the Board and the Hedging Committee.

General business operations are managed by our Chief Executive Officer, who reports to the Board. An annual budget is approved by the Board, with appropriate modifications as needed throughout the year by the Board. However, material budget variations are subject to prior approval by the Board, even if the category and fund allocation generally had been previously approved by the Board. In these situations, the Chairman will call a Board meeting to discuss specific terms, costs and variables, and associated risks, before committing the Company. We believe this process provides the Board with a continuing and key role in risk oversight.

We do not believe that our compensation programs encourage excessive risk taking. Risk mitigating factors of our compensation program and Board governance include:

| ● | A mix of short-term and long-term incentives designed to incentivize creation of long-term shareholder value; and | |

| ● | Caps on awards under our bonus programs, along with the use of targeted performance goals designed to emphasize metrics that lead to long-term shareholder value creation. |

Principal Holders of Voting Securities and Ownership by Officers and Directors

The following table sets forth certain information regarding the beneficial ownership of our Common Stock as of October 21, 2019 by (a) each shareholder who is known to us to own beneficially 5.0% or more of our outstanding Common Stock; (b) each of our directors and director nominees; (c) each of our executive officers, and (d) all directors and executive officers as a group. This information is based on SEC reports or as otherwise known by us. Except as otherwise indicated, and except for shares subject to forfeiture, all persons listed below have (i) sole voting power and investment power with respect to their shares of Common Stock, except to the extent that authority is shared by spouses under applicable law, and (ii) record and beneficial ownership with respect to their shares of Common Stock.

For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of Common Stock that such person has the right to acquire within 60 days of October 21, 2019. For purposes of computing the percentage of outstanding shares of our Common Stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days of October 21, 2019 is deemed to be outstanding but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Such options are assumed to be exercised for purposes of these calculations, even though such exercise prices are currently in excess of the closing price of our Common Stock of $0.48 per share as of October 21, 2019. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. Unless otherwise identified, the address of our directors, director nominees and officers is c/o 675 Bering, Suite 100, Houston, TX 77057.

| 6 |

| Title of Class | Name of Beneficial Owner | Position with Company | Beneficial Ownership | Percent of Class | ||||||||

| Directors, Director Nominees and Executive Officers | ||||||||||||

| Common | C. Randel Lewis | Custodian, Interim Chief Executive Officer, Director | — | * | ||||||||

| Common | Ryan L. Smith | Chief Financial Officer | 216,817 | (2) | 1.6 | % | ||||||

| Common | Catherine J. Boggs | Director | — | (3) | * | |||||||

| Common | J. Weldon Chitwood | Director | 20,000 | (3) | * | |||||||

| Common | Javier F. Pico | Director | 20,000 | (3) | * | |||||||

| Common | David A. Veltri | Director, Former Chairman and Chief Executive Officer | 273,665 | (1) | 2.0 | % | ||||||

| Common | Directors and executive officers as a group (6 people) | 530,482 | 3.9 | % | ||||||||

| Common | James W. Denny III | Director Nominee | — | * | ||||||||

| Common | Patrick E. Duke(6) | Director Nominee | 5,819,270 | (7) | 43.4 | % | ||||||

| Common | Randall D. Keys | Director Nominee | — | * | ||||||||

| Common | D. Stephen Slack | Director Nominee | — | * | ||||||||

| Shareholders in Excess of 5% | ||||||||||||

| Common | APEG Energy II, L.P.(6) | Shareholder | 5,819,270 | (4) | 43.4 | % | ||||||

| Series A Convertible Preferred | Mt. Emmons Mining Company 333 N. Central Avenue Phoenix, AZ 85004 | Series A Convertible Preferred | 793,349 | (5) | 5.6 | %** | ||||||

* Less than one percent

**Represents percent of outstanding Common Stock assuming full conversion of Series A Convertible Preferred shares into Common Stock. Mt. Emmons Mining Company owns 100% of outstanding Series A Convertible Preferred shares.

| (1) | Mr. Veltri’s beneficial ownership consists of (i) ownership of 256,998 shares of our Common Stock, and (ii) 16,667 shares underlying stock options that are presently exercisable. | |

| (2) | Mr. Smith owns 94,500 shares of our Common Stock, vested stock options to purchase 50,000 shares, which are presently exercisable, and stock options to purchase 50,000 shares that vest in November 2019. Mr. Smith’s beneficial ownership also includes 22,317 shares currently owned by the ESOP that Mr. Smith has dispositive power over as an ESOP Trustee. | |

| (3) | Independent directors were issued 20,000 options to purchase shares of our Common Stock on August 16, 2017 for their service on the board of directors. Ms. Boggs was not a director on August 16, 2017. | |

| (4) | APEG Energy II, L.P. beneficial ownership based on information disclosed in the Form 3 filed with the Securities and Exchange Commission on April 24, 2019. | |

| (5) | On February 11, 2016, Mt. Emmons Mining Company, a subsidiary of Freeport-McMoRan Inc., acquired 50,000 shares of our Series A Convertible Preferred Stock (“Series A Preferred Stock”) with an initial liquidation preference of $2,000,000 ($40.00 per share). The Series A Preferred Stock accrues dividends at a rate of 12.25% per annum and such dividends are not payable in cash but are accrued and compounded quarterly in arrears and added to the initial liquidation preference. As of December 31, 2018, the adjusted liquidation preference was approximately $2.9 million. In no event will the aggregate number of shares of Common Stock issued upon conversion be greater than 793,349 shares. The Series A Preferred Stock will generally not vote with the Company’s Common Stock on an as-converted basis on matters put before the Company’s shareholders. | |

| (6) | Address is 2808 Flintrock Trace Suite 373, Austin, Texas 78738. | |

| (7) | Mr. Duke may be deemed to indirectly beneficially own these shares, which are beneficially owned by APEG Energy II, L.P. Mr. Duke has shared voting power and shared investment power over these shares. |

| 7 |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board currently consists of five directors, Catherine J. Boggs, J. Weldon Chitwood, C. Randel Lewis, Javier F. Pico and David A. Veltri. However, during the year ended December 31, 2018 our Board consisted of only four directors, J. Weldon Chitwood, John Hoffman, Javier F. Pico and David A. Veltri, and we had one vacancy on the Board. The four-person Board ended up in deadlock on important votes. John Hoffman resigned as a director on May 22, 2019. On May 30, 2019, the Colorado Federal Court issued an order appointing Randel Lewis as our Custodian pursuant to the Wyoming Business Corporation Act, interim Chief Executive Officer and Chairman of the Board. The order noted that the primary purpose of having Mr. Lewis serve as Custodian was to allow for resolution of the aforementioned Board deadlock. Pursuant to the order, Mr. Lewis, as Custodian, was ordered to act in place of the Board to appoint one independent director to replace Mr. Hoffman. On June 13, 2019, Mr. Lewis appointed Catherine J. Boggs to serve as an independent director until the next annual meeting of our shareholders. Following the Annual Meeting, our directors are to vote on a new Chief Executive Officer to replace Mr. Lewis in that role, and Mr. Lewis will be discharged from serving as our Custodian, interim Chief Executive Officer and as a member of our Board. For more information regarding the Board deadlock and the appointment of Mr. Lewis as Custodian, see “Litigation – Litigation with Former Chief Executive Officer” below.

Our Articles of Incorporation provide for the division of our Board into three classes as equal in number as the total number of members of the Board provided in our Bylaws permit. Our Bylaws limit service of the independent directors to two three-year terms. If recommended by the Chairman of the Board and approved by the Board, an independent director may serve one additional three-year term.

The Board seats currently held by Mr. Veltri, our former Chief Executive Officer, President and Chairman, and Mr. Chitwood expire in 2019 and are up for election at the Annual Meeting. Neither Mr. Veltri nor Mr. Chitwood will stand for re-election. Additionally, Mr. Lewis, our court-appointed Custodian and interim Chief Executive Officer and Chairman of the Board, and Ms. Boggs, the independent director appointed by Mr. Lewis pursuant to a court order, will only serve through the Annual Meeting and will not stand for re-election. We will have a total of four Board seats up for election at the Annual Meeting. The Board has nominated James W. Denny III and Patrick E. Duke to fill the Class Two director seats that will expire in 2021 and Randall D. Keys and D. Stephen Slack to fill the Class One director seats that will expire in 2022. Mr. Pico currently holds the sole Class Three board seat, which expires in 2020, and therefore Mr. Pico’s seat is not up for election at the Annual Meeting. Each of James W. Denny III, Patrick E. Duke, Randall D. Keys and D. Stephen Slack was recommended for nomination by the Nominating Committee and confirmed for nomination by the Board.

Our executive officers, unless otherwise subject to an employment agreement, are selected by the Board at the annual directors’ meeting that follows each annual shareholders’ meeting, to serve until the officer’s successor has been duly elected and qualified, or until earlier death, retirement, resignation or removal. Following the Annual Meeting, our Board will appoint a new Chief Executive Officer to replace Randel Lewis, our court-appointed Custodian and interim Chief Executive Officer and Chairman. Please see biographical information for our sole executive officer below, under the heading“Business Experience of Current Directors and Officers and Director Nominees.”

APEG Energy II, L.P. (“APEG II”) and its general partner, APEG Energy II, GP (together with APEG II, “APEG”) are involved in litigation with the Company and our former Chief Executive Officer, David Veltri, as described below. APEG II holds approximately 43% of our outstanding Common Stock and was our secured lender prior to the maturity on July 30, 2019 of a credit facility the Company had with APEG II. The costs associated with the ongoing litigation have been a significant use of our existing cash. While we have historically funded all litigation costs out of operating cash flow, continued excessive legal fees associated with litigation could impair our liquidity profile and ability to fund significant drilling obligations.

| 8 |

APEG II Litigation

On February 14, 2019, our Board received a letter from APEG II, our largest shareholder and, at that time, our secured lender under the credit facility, urging the Company to work with APEG II and other shareholders to establish a seven-person, independent board of directors, establish a corporate business plan and reduce our corporate general and administrative expenses.

On February 25, 2019, APEG II provided an access termination notice to our bank under our collateral documents, and the bank confirmed to the Company that access to our collateral accounts was terminated. On February 26, 2019, APEG II provided account disposition instructions to our operating subsidiary’s bank instructing the bank to deliver to APEG II all of the funds held in the collateral accounts, which totaled $1,794,294. The funds were wired by the bank to APEG II on March 1, 2019.

On March 1, 2019, David Veltri, our former Chief Executive Officer and President, filed a lawsuit against APEG II in the Company’s name (the “Texas Litigation”) by filing an Original Petition and Application for Temporary Restraining Order, Temporary Injunction, Permanent Injunction, and Appointment of Receiver, Case No. 2019-15528 (the “Action”), in the District Court of Harris County Texas, 190th Judicial District (the “State Court”), naming APEG II and its general partner as defendants. The State Court granted the motion for a temporary restraining order (“TRO”) and ordered APEG to return immediately the $1,794,294 in cash previously wired to APEG II.

On March 4, 2019, APEG II filed a Notice of Removal and an Emergency Motion to Stay or Modify State Court Temporary Restraining Order in the United States District Court for the Sothern District of Texas, Houston Division, Case No. 4:19-cv-00754 (the “Texas Federal Court”), in order to remove the Texas Litigation from the State Court to the Federal District Court and to stay or modify the TRO. Following a hearing on March 4, 2019, the Texas Federal Court vacated the TRO. On March 7, 2019, at the continued hearing on emergency motions, the Court ordered APEG to return our funds, less the outstanding balance due to APEG II under the credit facility of $936,620, and we received back $857,674.

On February 25, 2019, the Board held a meeting at which it voted to terminate for cause Mr. Veltri from his position as Chief Executive Officer and President as a result of using Company funds in excess of, and inconsistent with, certain authority granted by the Board and other reasons. Mr. Veltri, along with John Hoffman, a member of the Board, called into question whether or not such action was properly taken at the Board meeting. On March 8, 2019, our Audit Committee, as an official committee of the Board, represented by independent counsel retained by the Audit Committee, intervened by filing in the Texas Litigation an Emergency Motion of the Official Audit Committee of the Board of U.S. Energy Requesting Company Protections Necessary for Releasing Funds Pending Internal Investigation (the “AC Motion”). The AC Motion requested that the Texas Federal Court order that all of the Company’s funds, financial, and monetary matters be placed under the control of our Chief Financial Officer and that control of these functions be removed from our Chief Executive Officer, who the Audit Committee believed had been properly terminated by the Board on February 25, 2019.

On March 12, 2019, the Texas Federal Court granted the AC Motion and issued an additional Management Order, ordering that any disbursement made by us must be approved in writing by the Audit Committee in advance. Additionally, the Management Order stated that our Chief Financial Officer must be appointed as the sole signatory on all of our bank accounts.

Litigation with Former Chief Executive Officer

In connection with the above described litigation with APEG II, APEG II then initiated a second lawsuit on March 18, 2019 as a shareholder derivative action in Colorado against Mr. Veltri, our former Chief Executive Officer, Chairman of the Board, and President, as a result of his refusal to recognize the Board’s decision to terminate him for cause (the “Colorado Litigation”). The Company was named as a nominal defendant in the Colorado Litigation, Civil Action No. 1:19-cv-00801 before the United States District Court for the District of Colorado (the “Colorado Federal Court”), filed on March 18, 2019.

| 9 |

The APEG II complaint in the Colorado Litigation alleged that Mr. Veltri’s employment was terminated by the Board of Directors and sought an injunction and temporary restraining order against Mr. Veltri to prevent him from continuing to act as Chief Executive Officer, President and Chairman, which he claimed he was entitled to continue doing. Mr. Veltri currently remains a member of the Board but will not stand for re-election.

Meanwhile, APEG II asserted claims against the Company directly in the Texas Litigation, while in roughly the same period, counsel for Mr. Veltri withdrew from the Texas Litigation, leaving the Company without counsel with respect to the claims asserted in the Company’s name and the APEG II claims asserted against the Company in the Texas Litigation. The Texas Federal Court ordered the Audit Committee to identify counsel to represent or act in the name of the Company in the Texas Litigation on or by April 30, 2019. On that date, the Audit Committee took over the control of the defense of the Company, prosecution of its claims against APEG II, and filed third-party claims on our behalf against Mr. Veltri and John Hoffman, asserting that Mr. Veltri was responsible for any damages that APEG II claims, including attorneys’ fees, and that Mr. Veltri and Mr. Hoffman should be removed from the Board of Directors in accordance with the laws of the State of Wyoming. On May 22, 2019, the Company and APEG II entered into a settlement agreement with Mr. Hoffman pursuant to which Mr. Hoffman agreed to resign from the Board of Directors and committees thereof, and we agreed to pay up to $50,000 of Mr. Hoffman’s legal fees incurred with respect to the Texas Litigation. Further, we released Mr. Hoffman from any claims related to the Texas Litigation, APEG II released the Company from any claims that may have been caused by Mr. Hoffman, and Mr. Hoffman released the Company and two of our current directors from any and all claims Mr. Hoffman may have.

In the Colorado Litigation, the Colorado Federal Court entered an order on May 16, 2019 (the “Order”) granting interim preliminary injunctive relief to APEG II against Mr. Veltri, holding that Mr. Veltri, without authorization, continued to hold himself out to be and continued to act as our President and Chief Executive Officer. Pursuant to the Order, Mr. Veltri was preliminarily enjoined from acting as, or holding himself out to be, our President and/or Chief Executive Officer. Ryan Smith, our Chief Financial Officer, was appointed temporary Custodian of the Company with the charge to act as our interim Chief Executive Officer.

On May 30, 2019, and following briefing by the parties to the Colorado Litigation, the Colorado Federal Court issued a subsequent order (the “Second Order”) appointing C. Randel Lewis as Custodian of the Company pursuant to the Wyoming Business Corporation Act and to take over for Mr. Smith in acting as our interim Chief Executive Officer and to serve on the Board of Directors as Chairman. As noted in the Second Order, two of our Board members had moved in the Board meeting on February 25, 2019 to terminate Mr. Veltri as President and Chief Executive Officer for cause by a vote of two to one. However, there was a dispute among the Board members as to whether the Board meeting was properly called and whether Mr. Veltri should have been allowed to vote on his own termination. The outcome of the vote on Mr. Veltri’s termination was in dispute as Mr. Veltri contended that he should have voted on his termination, and had he voted, Mr. Veltri would have voted against his own termination, thus creating a board deadlock preventing his termination. Specifically, Mr. Veltri contended the Board, which consisted of four members at that time, remained deadlocked on the issue, which prompted APEG II to file the above-mentioned suit against Mr. Veltri to have him removed as President and Chief Executive Officer. The Second Order noted that the primary purpose of having Mr. Lewis serve as Custodian was to resolve the aforementioned Board deadlock. Pursuant to the Second Order, Mr. Lewis, as Custodian, was ordered to act in place of the Board to appoint one independent director to replace Mr. Hoffman. On June 13, 2019, Mr. Lewis appointed Catherine J. Boggs to serve as an independent director until the next annual meeting of our shareholders. Following the Annual Meeting, the Board is to vote on a new Chief Executive Officer to replace Mr. Lewis in that role, and Mr. Lewis will be discharged from serving as the Company’s Custodian, interim Chief Executive Officer and as a member of the Board.

Following the issuance of the Second Order, the Audit Committee, which had been continuing its investigation into Mr. Veltri’s actions while he served as President and Chief Executive Officer, engaged an independent accounting firm to conduct a forensic accounting of our books and records in an effort to determine whether certain of Mr. Veltri’s actions regarding his use of Company funds was appropriate and authorized. See “Audit Committee Investigation” below. Following the completion of such investigation, the Audit Committee met on June 21, 2019 and voted unanimously to recommend to the Board to reaffirm its termination of Mr. Veltri for cause by ratifying its prior actions at the Board meeting on February 25, 2019. The Board, which following the issuance of the Second Order was reconstituted with all five members as required by our Bylaws and the Second Order, met on August 5, 2019 and received a report from the Audit Committee. Following such report, the Board approved and ratified the termination of Mr. Veltri as President and Chief Executive Officer for cause.

| 10 |

Both the Texas Litigation and the Colorado Litigation remain pending. On September 18, 2019, APEG II filed a motion for voluntary dismissal with the Colorado Federal Court seeking to dismiss the Colorado Litigation, to discharge Randel Lewis as Custodian and interim Chief Executive Officer and a director, and reimbursement of its expenses and attorneys’ fees that it incurred in connection with the Colorado Litigation. In its motion for dismissal, APEG II stated that its claims (i) to request a declaratory judgment that Mr. Veltri was validly terminated as Chief Executive Officer and President of the Company by the Board on February 25, 2019 and (ii) to request an injunction enjoining Mr. Veltri from acting as the Chief Executive Officer and President of the Company have both been addressed and are now moot. On October 16, 2019, Mr. Veltri filed his response to the motion for dismissal. In his response, Mr. Veltri argued that APEG II’s motion for dismissal should be denied by the Federal Court because (i) the Company should continue to operate under the guidance of the independent Custodian pending the outcome of a trial on the merits of the action, (ii) until the Custodian provides the Company with all of the relief set forth in the Second Order, the claims in the Colorado Litigation are not moot and the action should not be dismissed, (iii) the other Company shareholders’ interests will otherwise be negatively impacted if the Custodian is prematurely dismissed as the Company would be left without a Chief Executive Officer to run the Company’s business, the Board would again become a four-member Board subject to deadlock, and there would be no one to ensure the Annual Meeting occurs, and (iv) APEG II should not be entitled to any attorneys’ fees. As of October 22, 2019, the Colorado Federal Court had not yet ruled on APEG II’s motion for dismissal or Mr. Veltri’s response.

Audit Committee Investigation

Following the termination of our former Chief Executive Officer, President and Chairman of the Board on February 25, 2019, the Company’s independent auditors, Plante & Moran PLLC, informed the Audit Committee that the auditors had found at least one instance of irregularities in the submission and payment of expense reports with respect to the former Chief Executive Officer. Our Audit Committee engaged independent legal counsel, which engaged an independent accounting firm to conduct a forensic accounting investigation of our expense reporting system in relation to issues raised by our independent auditors regarding potential financial improprieties related to expense reports, including examining expense reports and third-party expenditures made by or through the former Chief Executive Officer or his staff. The investigation was expanded into a forensic investigation of the integrity of our computer-based record keeping after Mr. Veltri and Mr. Hoffman managed to reset the security codes to give them complete control of our books and records temporarily and exclude our other officers and directors from accessing those records during that period, which further raised concerns with respect to material weaknesses in our internal control over financial reporting. The scope of the forensic accounting and investigation covered the period from January 1, 2017 through March 31, 2019. The Audit Committee has taken certain steps in response to the forensic accounting investigation.

The forensic accounting investigation was completed on June 13, 2019 and resulted in the finding of a number of irregularities and reimbursements for personal expenses or expenses that were unrelated to furthering the Company’s business. An expense report was submitted in October 2018 that included $1,537 for the registration of a vehicle owned by an affiliated entity of Mr. Hoffman, as well as insurance premiums for the vehicle totaling $813. Mr. Hoffman repaid the Company in full for such amounts in connection with his resignation and settlement agreement with the Company in May 2019. It is possible that these payments by the Company on behalf of Mr. Hoffman could be deemed to be in violation of Section 402 of the Sarbanes-Oxley Act of 2002. However, we have not made a determination as of the date hereof if such payments resulted in a violation of that provision. If, however, it is determined these payments violated the prohibitions of Section 402, we could be subject to investigation and/or litigation that could involve significant time and costs and may not be resolved favorably. We are unable to predict the extent of its ultimate liability with respect to these payments. The costs and other effects of any future litigation, government investigations, legal and administrative cases and proceedings, settlements, judgments and investigations, claims and changes in this matter could have a material adverse effect on our financial condition and operating results.

In addition, the investigation found that our former Chief Executive Officer and President, David Veltri, had expense reports that consistently lacked detailed receipts and descriptions of the business purpose of each expense. The expense reimbursements did not go through a review process or require Board approval or approval from any other employee, as we did not have in place any expense report policy or other process for pre-approving expenses prior to incurring such expense. Mr. Veltri was the sole signatory on our bank accounts and effectively had sole authority to approve his own expense reports when he provided reimbursement checks to himself and controlled all funds of the Company.

| 11 |

The forensic accounting investigation and our internal investigation also identified numerous expense items on Mr. Veltri’s expense reports that appeared to be personal in nature, or lacked adequate documentation showing that such expense was for legitimate business purposes. These expense items totaled at least $81,014, of which $32,194 was incurred during the year ended December 31, 2017, $34,203 was incurred during the year ended December 31, 2018 and $14,617 was incurred during 2019 prior to Mr. Veltri’s termination. We have reclassified the entire $81,014 reimbursed to Mr. Veltri as additional compensation and taxable income. In addition, we have accrued payroll taxes payable on the additional compensation, however, we have not accrued penalties and interest that may be assessed because the amount of such penalties and interest cannot be reasonably determined.

The report also indicated that Mr. Veltri used the Company’s vendors for his own personal benefit. Mr. Veltri bypassed our accounts payable process by paying third-party vendors personally through expense reports and then approved his own expense reports, which limited the visibility of the payments and review by our accounting personnel. Mr. Veltri personally obtained reimbursements for several charges incurred by a consultant hired by the Company, which consultant potentially had a conflict of interest with the Company. The reimbursements totaled $2,710, and such reimbursements were highly unusual since the consultant included its expenses directly on its own invoices. The independent accounting firm conducting the forensic accounting investigation called into question other payments made to the consultant because of the vagueness of the work descriptions and project details provided by the consultant, and the independent accounting firm questioned Mr. Veltri’s judgment and the legitimacy of the services provided by the consultant for which we paid a total of $38,774. The forensic investigation revealed that Mr. Veltri may have made personal loans to the owners of the consulting firm, which indicates that a conflict of interest existed between Mr. Veltri’s personal interests and the Company’s best interests.

Mr. Veltri also incurred $47,156 in third-party professional fees in connection with a potential transaction with a company controlled by a former Board member, which transaction and related expenses in evaluating the potential transaction were not approved by the Board. The professional fees when incurred were treated as unevaluated prospect cost and included in unproved oil and gas properties. At December 31, 2018, the total amount of the fees was impaired and transferred to the full cost pool.

Mr. Veltri also entered into an agreement to acquire some oil and natural gas properties for which the Board authorized $250,000, which amount was fully refundable, subject to the funds being held in escrow pending the closing of the acquisition. Mr. Veltri wired the funds directly into the seller’s account, rather than escrowing such funds, and also paid the seller an additional amount of $124,328, which amount was not authorized by the Board, as well as $40,578 for professional services. The transaction never closed. We are currently seeking a refund of such funds from the seller, who made a partial payment of $50,000 in September 2019. While we are pursuing collection of the deposit, we have established an allowance for the remaining $324,328 due from the seller due to the uncertainty of collection of the deposit.

Business Experience of Current Directors and Officers and Director Nominees

Set forth below is certain biographical information for each director and executive officer as of the date of this filing. The Nominating Committee selects director nominees based on their skills, achievements, and experience, and believes that each nominee should have experience in positions of responsibility and leadership and an understanding of our oil and natural gas exploration and production business. Our overall objective is to identify a group of directors that can best contribute to our long-term success. All of the directors and the nominees discussed below are seasoned leaders who collectively bring to the Board a vast array of oil and natural gas industry, public company and private company and other business experience, all at the senior executive officer level, and who meet our director qualification standards. Among other attributes, the members of our Board possess a wide breadth of varied skills, experience and leadership in the natural resources and energy industries, finance and accounting, risk management, operations management, strategic planning, business development, regulatory and government affairs, corporate governance, human resources and compensation, and public policy—qualities that led the Nominating Committee and the Board to conclude that these individuals should serve as our directors at this time, in light of our business and structure, overall industry environment, and our long-term strategy. The specific experiences, qualifications, attributes, and skills of each director and nominee are briefly described below. In addition, the directors and nominees represent diverse backgrounds, skill sets, and viewpoints, with a blend of historical and fresh perspectives, and have a demonstrated ability to work collaboratively with candid discussion.

| 12 |

Catherine J. Boggs(65) - Independent Director.Ms. Boggs was appointed to the Board by our court-appointed Custodian and interim Chief Executive Officer on June 13, 2019. Ms. Boggs will serve on our Board until the Annual Meeting. Ms. Boggs was appointed to the Board of Directors of Hecla Mining Company, a publicly traded company, in January 2017 and continues to serve on this board. Ms. Boggs served as General Counsel at Resource Capital Funds from January 2011 until her retirement in February 2019. Prior to that, she served as Senior Vice President, Corporate Development at Barrick Gold Corporation from January 2009 to December 2010 and Vice President from July 2005 to 2008. Ms. Boggs was also an international partner at the law firm of Baker & McKenzie from July 2001 to July 2005. She has 37 years of experience as a mining and natural resources lawyer with experience in domestic and international mining projects.

J. Weldon Chitwood(54) - Independent Director. Mr. Chitwood was appointed to the Board on May 8, 2017 and will continue to serve as a director until the Annual Meeting. Mr. Chitwood served as President, Director, and Regional Vice President of Shaw Industries Subsidiaries, Spectra Flooring and Carpets International in Seattle, San Francisco and London from 1988 to 2005. Since that time he has served in various executive and board of director roles for Brand Partners from 2003 to 2004, Beaulieu Group from 2005 to 2013, Mohawk Industries from 2014 to 2016, Vice President, Real Estate Operations for Angelus Private Equity Group from 2016 to 2018, and is currently Regional Vice President with Happy Feet International. With the exception of Angelus Private Equity Group, the parent organization of APEG Energy II, L.P., which is an affiliate of the Company, none of the entities with which Mr. Chitwood has been employed is a parent, subsidiary, or affiliate of the Company. The Board has concluded that Mr. Chitwood’s experience qualifies him for service as an independent director and as a member of the Compensation, Audit, Hedging and Nominating Committees.

James W. Denny III (72) – Independent Director Nominee (Class Two). Mr. Denny possesses more than 45 years of industry related experience. Mr. Denny previously served as Executive Vice President of Operations for Lilis Energy during 2018 and 2019. Mr. Denny served as Vice President at Siltstone from 2016 to 2018 and as Magnum Hunter Resource Corporation’s Executive Vice President of Operations and as President of the Appalachian Division from 2007 to 2016. Mr. Denny also served as President and Chief Executive Officer of Gulf Energy Management Company, a wholly-owned subsidiary of Harken Energy Corporation from 2002 to 2007. In his capacity as President and Chief Executive Officer of Gulf Energy Management, Mr. Denny was responsible for all facets of Gulf Energy Management’s North American operations. He is a registered professional engineer in the state of Louisiana and is a certified earth scientist. He is also a member of various industry associations, including the American Petroleum Institute, the National Society of Professional Engineers, the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers. He is a graduate of the University of Louisiana-Lafayette with a Bachelor of Science in Petroleum Engineering. The Board has concluded that Mr. Denny’s experience qualifies him for service as an independent director and as a member of the Audit, Compensation and Nominating Committees.

Patrick E. Duke (54) –Director Nominee (Class Two). Mr. Duke is the managing partner of The Angelus Group, which he co-founded in 2014, and also is the founder, president, and managing director of Duke Capital, which has been operating for approximately 17 years, and was president of Lone Star Builders. Before that, as CEO of Ameracall and National Wireless, Mr. Duke revolutionized the marketing of wireless services for Southwestern Bell, Century, Cellunet, and Bell South. As their largest agent, he delivered more than 10,000 customers per month. He also has extensive experience in negotiating public-switched telephone (PSTN) agreements. As an investment banker for Sun Technologies, Mr. Duke was responsible for developing and managing market targeted acquisitions totaling more than $200 million in various technology sectors. Mr. Duke’s professional experience includes high levels of success in multiple industries: energy, real estate, investing, and technology. To date, Mr. Duke has been involved in predominantly onshore oil and gas transactions exceeding a total of $150 million. In addition, he co-founded an oil and gas exploration company that was eventually sold to Placid Oil Company, which is owned by the Hunt Family in Dallas, Texas. As president of Lone Star Building and Remodeling, Mr. Duke used his Certified Real Estate Appraiser background to value, purchase, refurbish, and sell over $300 million in value-added real estate properties in Texas, particularly in and around strategic locations in Austin, Houston, and Dallas.

| 13 |

Randall D. Keys (60) – IndependentDirector Nominee (Class One). Mr. Keys served as Chief Executive Officer of Evolution Petroleum Corporation, a NYSE-listed exploration and production company, prior to his retirement in 2018. He joined Evolution in 2014 as Chief Financial Officer. Mr. Keys has over 35 years of experience in the oil and gas industry, including positions as Chief Financial Officer of public energy companies. He earned a B.B.A. in Accounting from the University of Texas at Austin and began his career with the accounting firm of KPMG. The Board has concluded that Mr. Keys’ broad experience in the energy industry qualifies him for service as an independent director. Further, his experience as a financial officer in public energy companies, experience with SEC reporting requirements and his education and prior certification as a CPA qualifies him to serve as an Audit Committee Financial Expert.

C. Randel Lewis(60) – Custodian/Interim Chief Executive Officer/Director.Mr. Lewis was appointed to the Board as chairman on May 30, 2019 per court order. Mr. Lewis will serve as a director, interim Chief Executive Officer and court-appointed Custodian through the Annual Meeting. Mr. Lewis has extensive experience in developing and managing successful business solutions in highly contested environments. He serves regularly as a court-appointed receiver, liquidating trustee, turnaround advisor, expert witness and mediator in distressed business situations. Mr. Lewis is a fellow of the College of Law Practice Management and a founding fellow of the Redwood Think Tank (an invitation-only management forum assembled to study and formulate solutions to significant professional service firm management issues). He is a regular contributor to the professional education programs of the Turnaround Management Association and the Urban Land Institute. He is a member of the National Association of Corporate Directors and the Society of Corporate Governance Professionals. He was a co-instructor of mediation and negotiation at the Stanford Law School and is a guest lecturer on Receivership and Creditors’ Rights issues.

Javier F. Pico(60) - Independent Director (Class Three). Mr. Pico was appointed to the Board on May 8, 2017 and elected by the shareholders on July 17, 2017. Mr. Pico has practiced law for 27 years and has been the Managing Partner of Javier F. Pico, P.C. Law Offices in Boston, Massachusetts since 1992 where he practices business, real estate and immigration law. He received his Juris Doctor from the Boston University School of Law and is licensed to practice law in New York and Massachusetts. The Board has concluded that Mr. Pico’s experience qualifies him for service as an independent director and as a member of the Audit, Compensation and Nominating Committees.

D. Stephen Slack (70) – IndependentDirector Nominee (Class One). Mr. Slack is the former President and Chief Executive Officer of South Bay Resources, L.L.C., a privately held oil and gas exploration and production company, and of its subsidiary South Bay Resources Canada, Inc. Prior to founding South Bay in 2001, Mr. Slack served as Senior Vice President and Chief Financial Officer of Pogo Producing Company, Inc. (formerly NYSE: PPP), an independent oil and gas producer, from 1988 to 1998, and as a director from 1990 to 1998. From March 2003 to August 2010, Mr. Slack served as a director of The Cornell Companies, Inc. (formerly NYSE: CRN). During his tenure, Mr. Slack served as chair of the Audit Committee, the Committee’s designated financial expert and as a member of the Compensation Committee. Mr. Slack received his bachelor’s degree from the University of Southern California and his Master of Business Administration (M.B.A.) from Columbia University.The Board has concluded that Mr. Slack’s experience qualifies him for service as an independent director and as a member of the Audit, Compensation and Nominating Committees.

Ryan L. Smith(36) – Chief Financial Officer. Mr. Smith has served as our Chief Financial Officer since May 2017 and consulted for us from January 2017 to May 2017. Prior to this position, Mr. Smith served as the Chief Financial Officer of Emerald Oil Inc. from September 2014 to January 2017 and its Vice President of Capital Markets and Strategy from July 2013 to September 2014. Prior to joining Emerald Oil, Mr. Smith was a Vice President in the Investment Banking Group of Canaccord Genuity and focused solely on the energy sector. Mr. Smith joined Canaccord Genuity in 2008 and was responsible for the execution of public and private financing engagements along with mergers and acquisitions advisory services. Prior to joining Canaccord Genuity, Mr. Smith was an Analyst in the Energy Group of Wells Fargo, working solely with upstream and midstream oil and gas companies. Mr. Smith holds a Bachelor of Business Administration degree in Finance from Texas A&M University.

David A. Veltri(61) – Director.Mr. Veltri served as the Company’s President and Chief Executive Officer from September 2015 until his termination in February 2019, and he previously served as the Company’s President and Chief Operating Officer beginning in December 2014. Since December 2015, Mr. Veltri has served as a director of the Company and will continue to serve as a director until the Annual Meeting. Mr. Veltri served as Chief Operating Officer of Emerald Oil, Inc. from November 2012 until December 2014. Mr. Veltri served as an independent petroleum engineering consultant from October 2011 through November 2012. From August 2008 through September 2011, Mr. Veltri served as Vice President/General Manager of Baytex Energy USA Ltd., where he managed business unit operations, capital drilling programs, lease maintenance and producing properties in the Williston Basin in North Dakota. From September 2006 to July 2008, Mr. Veltri was Production Manager at El Paso Exploration and Production Company, where he managed producing oil and natural gas properties located in northern New Mexico. Mr. Veltri received a Bachelor of Science in Mining and Engineering from West Virginia University.

| 14 |

Delinquent Section 16(a) Reports

Under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), directors, executive officers, and persons beneficially holding more than 10% of our Common Stock must report their initial ownership of our Common Stock and any changes in that ownership in reports that must be filed with the SEC and us. The SEC has designated specific deadlines for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due.

Based solely on a review of reports furnished to us and written representations from the filing persons, all directors, executive officers, and 10% owners timely filed all reports regarding transactions in our securities required to be filed in 2018 under Section 16(a) of the Exchange Act, other than (i) APEG Energy II, L.P., which did not timely file its Form 3, (ii) David A. Veltri did not timely file one Form 4, and (iii) Ryan Smith did not timely file one Form 4.

The Board recommends you vote “FOR” each director nominee contained in Proposal 1. For the reasons provided in this Proxy Statement, we are asking shareholders to vote “FOR” the following resolution:

“RESOLVED, that the shareholders approve the election of (i) James W. Denny III and Patrick E. Duke as Class Two directors of the Company to serve until the second succeeding annual meeting of shareholders to be held in 2021 and until their successors have been duly elected or appointed and qualified, and (ii) Randall D. Keys and D. Stephen Slack as Class One directors of the Company to serve until the third succeeding annual meeting of shareholders to be held in 2022 and until their successors have been duly elected or appointed and qualified.”

| 15 |

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Board seeks shareholder ratification of the Audit Committee’s engagement and appointment of Plante & Moran PLLC (“Plante Moran”), certified public accountants, to act as the independent registered public accounting firm for our financial statements for the year ending December 31, 2019. The Audit Committee has not determined what action, if any, would be taken should the appointment of Plante Moran not be ratified at the meeting. A representative from Plante Moran will be present at the Annual Meeting in person or by telephone to respond to appropriate questions and will be provided the opportunity to make a statement at the meeting.

Principal Accounting Fees and Services

The Audit Committee approves the terms of engagement before we engage the audit firm for audit and non-audit services, except as to engagements for services outside the scope of the original terms, in which instances the services are provided pursuant to pre-approval policies and procedures established by the Audit Committee. These pre-approval policies and procedures are detailed as to the category of service and the Audit Committee is kept informed of each service provided. These policies and procedures, and the work performed pursuant thereto, do not include any delegation to management of the Audit Committee’s responsibilities under the Exchange Act.

Plante Moran, the Company’s independent registered accounting firm for the fiscal year ended December 31, 2018, charged the following fees related to our 2018 financial statements through September 10, 2019, all of which were approved by the Audit Committee:

| Audit fees | $ | 380,483 | ||

| Audit-related fees(1) | $ | 19,141 | ||

| Tax fees(2) | $ | 2,900 | ||

| All other fees | $ | - |

(1) Audit-related fees represent fees associated with the review of a potential acquisition transaction and additional work related to governance issues.

(2) Tax fees represent fees associated with filing extensions for the Company’s 2018 income tax returns.

On May 31, 2018, our audit committee engaged EKS&H, LLP (“EKS&H”), which, in October 2018, merged with Plante Moran and took the name Plante & Moran PLLC, to serve as our independent registered public accounting firm.

Moss Adams LLP (“Moss Adams”) audited our financial statements for the year ended December 31, 2017. Hein & Associates LLP (“Hein”), which audited our financial statements for the year ended December 31, 2016, combined with Moss Adams in November 2017. On April 30, 2018, our Audit Committee Chairman and Chief Financial Officer received notice that Moss Adams declined to stand for re-election as our independent registered public accounting firm. Moss Adams charged the following fees related to our 2017 and 2018 financial statements, all of which were approved by the Audit Committee:

| 2017 | 2018 | |||||||

| Audit fees | $ | 99,750 | $ | 25,000 | ||||

| Audit-related fees | - | - | ||||||

| Tax fees | - | - | ||||||

| All other fees | - | - | ||||||

Relationship with Independent Accountants

The audit report of Moss Adams on the Company’s financial statements for the year ended December 31, 2017 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope or accounting principles.