UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07657

Oppenheimer Developing Markets Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: August 31

Date of reporting period: 8/31/2015

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 8/31/15

| | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | MSCI Emerging Markets

Index |

| 1-Year | | -25.84% | | -30.10% | | -22.95% |

| 5-Year | | 1.13 | | -0.06 | | -0.92 |

| 10-Year | | 7.80 | | 7.16 | | 5.53 |

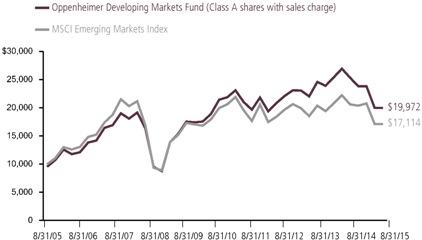

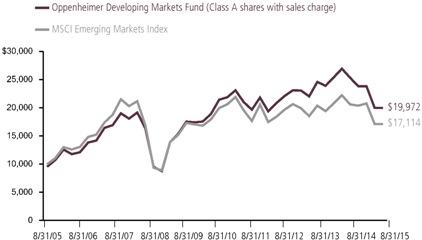

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual's investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

2 OPPENHEIMER DEVELOPING MARKETS FUND

Fund Performance Discussion

During a volatile time for emerging market equities the Fund’s Class A shares (without sales charge) returned -25.8% during the one-year reporting period ended August 31, 2015. On a relative basis, the Fund underperformed the MSCI Emerging Markets Index (the “Index”), which returned -22.9%. A large portion of the performance challenges for the Fund this year has been related to the overall market, which was negatively impacted by a slowdown in China, challenging economic environment in Brazil, the fall in commodity prices, global growth concerns and a potential increase in U.S. interest rates. Relative to the Index, the Fund’s underperformance during this reporting period stemmed primarily from stock selection in China, Brazil and Colombia, as well as non-benchmark holdings, including companies listed in the U.K. From the sector perspective, consumer staples and consumer discretionary holdings detracted most from the Fund’s performance during the reporting period.

The underperformance of the Fund during this one-year reporting period, while disappointing, should not detract from the Fund’s strong track record over the longer term. The Fund’s Class A shares (without sales charge) returned 1.1% and 7.8% for the five-year and ten-year periods ended August 31, 2015, respectively. During the same periods, the Index returned -0.9% and 5.5%, respectively.

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

3 OPPENHEIMER DEVELOPING MARKETS FUND

MARKET OVERVIEW

The reporting period was a difficult one for emerging markets. Market sentiment was negative throughout the reporting period, as investor concerns re-emerged regarding slow global growth and the potential for tighter liquidity if the U.S. normalizes interest rates. Currencies were a significant contributor to emerging markets equity losses in U.S. dollar terms. Currencies of resource exporters were particularly hard hit (Brazil real slid 38%, Russian ruble was down 42% and Colombian peso fell 37%) but few emerging markets currencies were spared. Indeed, despite the much touted ‘devaluation’ of the Chinese renminbi (the “RMB”) (-2%), it is notable that the RMB has been both among the strongest currencies on the planet both over the reporting period (down 4%) and over the past 5 years (up 7% in U.S. dollar terms). Although emerging markets equities rebounded briefly during the first quarter, they have slipped considerably since April given renewed concerns about global growth slippage, China’s macro deceleration and exceptional weakness in commodity prices and countries.

FUND REVIEW

India was an unconventional bastion of stability in the emerging market equity world, a result of significant improvements in the country’s balance of payments (big beneficiary of lower energy prices) and relative economic growth resilience. Top performing holdings for the Fund included three Indian holdings during the reporting period: Infosys Ltd., Dr. Reddy’s Laboratories

Ltd. and Zee Entertainment Enterprises Ltd. Infosys is a leading information technology service company that has demonstrated signs of significant improvements under new leadership and is a clear beneficiary of massive corporate technology shifts toward social, digital and cloud offerings. Dr. Reddy’s Laboratories is a global generics pharmaceutical company with a strong presence in the U.S., India, and Russia/Commonwealth of Independent States (CIS) markets. We believe the company is well positioned to continue to grow sales and earnings over the long-term due to its solid pipeline with a focus on complex injectables, biosimilars and proprietary products, as well as its global partnerships. Zee Entertainment is a leading media and entertainment company that produces content in Hindi and several other languages. Zee Entertainment is the most significant beneficiary of digitization of India’s television, which improves measurability of audiences and hence subscription monetization. Additionally, India has enormous potential for structural growth in advertising.

Top detractors from performance this reporting period included Petroleo Brasileiro SA, Glencore plc and Yandex NV. Petroleo Brasileiro — or “Petrobras” — is a Brazilian oil exploration and production company. Its share price has been very negatively affected by the fall in world oil prices and negative company specific news related to an alleged corruption scandal. We were initially optimistic about the enormous growth

4 OPPENHEIMER DEVELOPING MARKETS FUND

potential of the firm’s offshore reserve base and relative cost competitiveness of these resources. However, we exited the position following the significant decline in oil prices and increasing balance sheet strains associated with the company’s massive capital investment program. We were also disappointed, like most, with the unparalleled level of corporate governance and corruption allegations. Glencore is a natural resource company that was negatively impacted by declining commodity prices, which reduced the company’s profitability and put pressure on its balance sheet, sending the stock price down 58% during the period. Yandex is the leading Internet search engine in Russia. The company continues to show topline growth in local currency terms, but has suffered from the macroeconomic slowdown in Russia as well as the sharp depreciation of the Russian ruble during the reporting period.

STRATEGY & OUTLOOK

The downturn in emerging market equities (particularly in U.S. dollar terms), is a source of concern. While the macro climate is clearly adverse, markets seem structurally oversold. Heuristic thinking about China, the emerging markets and commodities lacks nuance, presenting medium term opportunities. Currently, “Three Cs”- China, Commodities and Credit – dominate the narrative. However, there are few signs of any widespread or pandemic macro crises in emerging markets. In our view, prices are attractive, particularly for U.S. dollar investors, and the structural opportunities are visibly exciting.

The emerging markets world is big and diverse. It accounts for nearly 90% of the world’s population and 40% of the world’s output, in nominal terms. The developing world will continue to contribute in a disproportionate fashion to global growth. In fact, China and India alone contribute nearly 30% of the world’s incremental growth. China is perhaps the most deeply misunderstood, where nuance matters most. China is an $11 trillion economy, which we believe can continue to grow 5-6% compounded over the next few years, which of course implies that it will be the largest single contributor (ahead of even the United States) to worldwide growth for many years. The developing world continues to produce profitable, innovative and growing companies. For these reasons, we believe to avoid the emerging markets would be to lose exposure to some of the fastest growing opportunities in the world.

For long-term investors, we believe it’s time to step back and ignore the noise. The Fund has struggled in the current environment and underperformed in the past 12 months. While this is disappointing, it does not change our strategy or investment philosophy. We maintain our focus on long-term investing. Nearly 50% of the Fund’s current holdings have been in the portfolio since Justin Leverenz became a portfolio manager more than eight years ago. We continue to invest in rare, extraordinary companies that have massive competitive advantages and interesting real options. These options generally manifest themselves over many

5 OPPENHEIMER DEVELOPING MARKETS FUND

years. Extraordinary companies often emerge from difficult periods with even greater competitive advantages. This is because great companies tend to have the cash flow and balance sheet flexibility to invest during tough times. We remain focused on big ideas and large disruptive opportunities. We believe this focus allows us to generate strong returns for investors over the long term, particularly when investors take the opportunity to invest at very compelling prices.

INVESTMENT TEAM UPDATE

Despite the turmoil in emerging markets equities, 2015 has been a particularly fruitful year for the emerging markets equity team at OppenheimerFunds. We have deliberately spent the year improving analytic processes, team collaboration, technology and operations. The team has improved analyst accountability and transparency of work flows, sharing of ideas and analyst priorities and promoted greater collaboration and coordination across the group. Justin Leverenz also promoted John Paul Lech as

head of research and co-portfolio manager of Oppenheimer Developing Markets Fund on September 9, 2015. John Paul will be responsible for building on these initiatives and improving research processes, collaboration and velocity. In addition, we added Jacqueline Zhang as an analyst on Developing Markets Fund on September 28, following an offer extended more than a year ago.

The team has also begun to optimize better collaboration between Oppenheimer Developing Markets Fund and the recently launched Oppenheimer Emerging Markets Innovators Fund. This has clearly resulted in a significant advantage for the new fund that invests in smaller and mid-cap emerging markets companies.

The core strategy and approach to investing in the developing world is unbending. We remain bottom up investors in extraordinary companies with long tailed, durable growth tailwinds and meaningful advantage.

| | |

| |

Justin Leverenz, CFA Portfolio Manager |

6 OPPENHEIMER DEVELOPING MARKETS FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

| Housing Development Finance Corp. Ltd. | | | 3.7 | % |

| Tencent Holdings Ltd. | | | 3.4 | |

| Magnit PJSC | | | 3.4 | |

| Infosys Ltd. | | | 3.0 | |

| Alibaba Group Holding Ltd., Sponsored ADR | | | 2.6 | |

| NOVATEK OAO, Sponsored GDR | | | 2.4 | |

| Baidu, Inc., Sponsored ADR | | | 2.2 | |

| JD.com, Inc., ADR | | | 2.0 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | | 1.9 | |

| Ctrip.com International Ltd., ADR | | | 1.7 | |

Portfolio holdings and allocations are subject to change. Percentages are as of August 31, 2015, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

TOP TEN GEOGRAPHICAL HOLDINGS

| | | | |

| China | | | 20.5 | % |

| India | | | 16.5 | |

| Hong Kong | | | 7.1 | |

| Brazil | | | 7.1 | |

| Russia | | | 6.9 | |

| Mexico | | | 6.7 | |

| United States | | | 6.2 | |

| France | | | 2.7 | |

| Philippines | | | 2.7 | |

| Colombia | | | 2.7 | |

Portfolio holdings and allocation are subject to change. Percentages are as of August 31, 2015, and are based on total market value of investments.

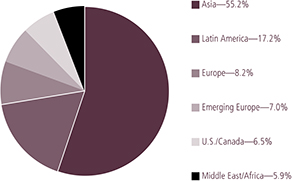

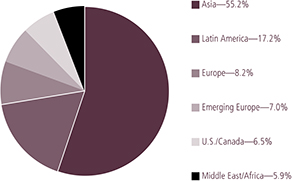

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of August 31, 2015, and are based on the total market value of investments.

7 OPPENHEIMER DEVELOPING MARKETS FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 8/31/15

| | | | | | | | | | | | | | | | |

| | | Inception Date | | | 1-Year | | | 5-Year | | | | | 10-Year |

| Class A (ODMAX) | | | 11/18/96 | | | | -25.84% | | | | 1.13% | | | | | 7.80% |

| Class B (ODVBX) | | | 11/18/96 | | | | -26.40% | | | | 0.31% | | | | | 7.30% |

| Class C (ODVCX) | | | 11/18/96 | | | | -26.39% | | | | 0.42% | | | | | 7.03% |

| Class I (ODVIX) | | | 12/29/11 | | | | -25.50% | | | | 2.01% * | | | | | N/A |

| Class R (ODVNX) | | | 3/1/01 | | | | -26.03% | | | | 0.81% | | | | | 7.42% |

| Class Y (ODVYX) | | | 9/7/05 | | | | -25.66% | | | | 1.44% | | | | | 7.80% * |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 8/31/15 |

| | | Inception Date | | | 1-Year | | | 5-Year | | | | | 10-Year |

| Class A (ODMAX) | | | 11/18/96 | | | | -30.10% | | | | -0.06% | | | | | 7.16% |

| Class B (ODVBX) | | | 11/18/96 | | | | -30.02% | | | | -0.08% | | | | | 7.30% |

| Class C (ODVCX) | | | 11/18/96 | | | | -27.11% | | | | 0.42% | | | | | 7.03% |

| Class I (ODVIX) | | | 12/29/11 | | | | -25.50% | | | | 2.01% * | | | | | N/A |

| Class R (ODVNX) | | | 3/1/01 | | | | -26.03% | | | | 0.81% | | | | | 7.42% |

| Class Y (ODVYX) | | | 9/7/05 | | | | -25.66% | | | | 1.44% | | | | | 7.80% * |

*Shows performance since inception

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. Prior to 7/1/14, Class R shares were named Class N shares. Beginning 7/1/14, new purchases of Class R shares will no longer be subject to a CDSC upon redemption (any CDSC will remain in effect for purchases prior to 7/1/14). There is no sales charge for Class I and Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion.

The Fund’s performance is compared to the performance of the MSCI Emerging Markets Index, which is designed to measure equity market performance of emerging markets. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees,

8 OPPENHEIMER DEVELOPING MARKETS FUND

expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund's performance, and does not predict or depict performance of the Fund. The Fund's performance reflects the effects of the Fund's business and operating expenses.

The Fund's investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund's investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

9 OPPENHEIMER DEVELOPING MARKETS FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended August 31, 2015.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended August 31, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10 OPPENHEIMER DEVELOPING MARKETS FUND

| | | | | | | | | | | | |

| | | Beginning | | | Ending | | | Expenses | |

| | | Account | | | Account | | | Paid During | |

| | | Value | | | Value | | | 6 Months Ended | |

| Actual | | March 1, 2015 | | | August 31, 2015 | | | August 31, 2015 | |

Class A | | $ | 1,000.00 | | | $ | 839.20 | | | $ | 6.09 | |

Class B | | | 1,000.00 | | | | 836.20 | | | | 9.59 | |

Class C | | | 1,000.00 | | | | 836.30 | | | | 9.59 | |

Class I | | | 1,000.00 | | | | 841.20 | | | | 4.09 | |

Class R | | | 1,000.00 | | | | 838.10 | | | | 7.26 | |

Class Y | | | 1,000.00 | | | | 840.30 | | | | 4.98 | |

| | | |

Hypothetical (5% return before expenses) | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,018.60 | | | | 6.69 | |

Class B | | | 1,000.00 | | | | 1,014.82 | | | | 10.52 | |

Class C | | | 1,000.00 | | | | 1,014.82 | | | | 10.52 | |

Class I | | | 1,000.00 | | | | 1,020.77 | | | | 4.49 | |

Class R | | | 1,000.00 | | | | 1,017.34 | | | | 7.96 | |

Class Y | | | 1,000.00 | | | | 1,019.81 | | | | 5.46 | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended August 31, 2015 are as follows:

| | | | |

| Class | | Expense Ratios | |

Class A | | | 1.31 | % |

Class B | | | 2.06 | |

Class C | | | 2.06 | |

Class I | | | 0.88 | |

Class R | | | 1.56 | |

Class Y | | | 1.07 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

11 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF INVESTMENTS August 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks—91.9% | |

| Consumer Discretionary—20.6% | |

| Automobiles—1.3% | |

Astra | | | | | | | | |

International Tbk | | | | | | | | |

PT | | | 948,316,800 | | | $ | 399,152,722 | |

| | | | | | | | | |

Diversified Consumer Services—2.3% | | | | | |

Estacio | | | | | | | | |

| Participacoes SA1 | | | 42,037,850 | | | | 144,544,411 | |

Kroton | | | | | | | | |

| Educacional SA1 | | | 115,616,536 | | | | 276,715,849 | |

New Oriental | | | | | | | | |

Education & | | | | | | | | |

Technology | | | | | | | | |

Group, Inc., | | | | | | | | |

Sponsored ADR1,2 | | | 14,908,372 | | | | 305,472,542 | |

| | | | | | | 726,732,802 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure—5.5% | | | | | |

China Lodging | | | | | | | | |

| Group Ltd., ADR2 | | | 1,136,568 | | | | 29,152,969 | |

Galaxy | | | | | | | | |

Entertainment | | | | | | | | |

| Group Ltd. | | | 49,937,000 | | | | 159,450,022 | |

| Genting Bhd1 | | | 219,961,100 | | | | 357,647,950 | |

Genting Malaysia | | | | | | | | |

| Bhd | | | 118,532,400 | | | | 111,470,099 | |

Genting | | | | | | | | |

| Singapore plc | | | 16,174,000 | | | | 8,771,625 | |

Homeinns Hotel | | | | | | | | |

| Group, ADR1,2 | | | 6,717,713 | | | | 178,691,166 | |

Jollibee Foods | | | | | | | | |

| Corp. | | | 46,318,793 | | | | 189,633,446 | |

Las Vegas Sands | | | | | | | | |

| Corp. | | | 6,437,550 | | | | 297,607,937 | |

Melco Crown | | | | | | | | |

Entertainment | | | | | | | | |

Ltd., ADR | | | 21,482,304 | | | | 378,518,197 | |

| | | | | | | 1,710,943,411 | |

| | | | | | | | | |

Household Durables—0.2% | | | | | |

Cyrela Brazil | | | | | | | | |

Realty SA | | | | | | | | |

Empreendimentos e Participacoes1 | | | 30,690,700 | | | | 71,085,404 | |

| | | | | | | | | |

Internet & Catalog Retail—4.3% | | | | | |

| B2W Cia Digital2 | | | 12,146,804 | | | | 52,249,360 | |

Ctrip.com | | | | | | | | |

International | | | | | | | | |

| Ltd., ADR1,2 | | | 7,900,702 | | | | 525,001,648 | |

JD.com, Inc., | | | | | | | | |

ADR2 | | | 24,066,134 | | | | 622,831,548 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Internet & Catalog Retail (Continued) | |

Qunar Cayman | | | | | | | | |

Islands Ltd., | | | | | | | | |

ADR1,2 | | | 4,232,159 | | | $ | 137,545,167 | |

| | | | | | | 1,337,627,723 | |

| | | | | | | | | |

Media—2.7% | | | | | |

Grupo Televisa | | | | | | | | |

SAB, Sponsored | | | | | | | | |

| ADR | | | 13,762,456 | | | | 420,580,655 | |

Zee | | | | | | | | |

Entertainment | | | | | | | | |

Enterprises Ltd.1 | | | 77,074,068 | | | | 444,577,952 | |

| | | | | | | 865,158,607 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods—4.3% | |

Cie Financiere | | | | | | | | |

| Richemont SA | | | 2,377,521 | | | | 176,997,440 | |

| Kering | | | 1,683,361 | | | | 287,240,907 | |

LVMH Moet | | | | | | | | |

Hennessy Louis | | | | | | | | |

| Vuitton SE | | | 2,212,409 | | | | 367,954,246 | |

Prada SpA | | | 126,303,810 | | | | 511,131,093 | |

| | | | | | | 1,343,323,686 | |

| | | | | | | | | |

| Consumer Staples—11.1% | | | | | |

Beverages—3.7% | | | | | |

Anadolu Efes | | | | | | | | |

Biracilik Ve Malt | | | | | | | | |

| Sanayii AS | | | 22,438,068 | | | | 167,188,818 | |

Fomento | | | | | | | | |

Economico | | | | | | | | |

Mexicano SAB de | | | | | | | | |

| CV | | | 39,672,290 | | | | 353,370,753 | |

Nigerian | | | | | | | | |

| Breweries plc | | | 227,681,258 | | | | 138,338,715 | |

| Pernod Ricard SA | | | 1,627,900 | | | | 170,564,300 | |

| SABMiller plc | | | 5,075,524 | | | | 235,641,117 | |

Tsingtao Brewery | | | | | | | | |

Co. Ltd., Cl. H | | | 20,744,000 | | | | 101,671,582 | |

| | | | | | | 1,166,775,285 | |

| | | | | | | | | |

Food & Staples Retailing—5.6% | | | | | |

Almacenes Exito | | | | | | | | |

| SA1 | | | 15,671,455 | | | | 86,088,854 | |

Almacenes Exito | | | | | | | | |

| SA, GDR1,3 | | | 11,250,373 | | | | 58,915,953 | |

BIM Birlesik | | | | | | | | |

| Magazalar AS | | | 9,494,158 | | | | 164,483,468 | |

Casino Guichard | | | | | | | | |

| Perrachon SA | | | 491,630 | | | | 31,001,827 | |

| CP ALL PCL | | | 141,909,100 | | | | 201,285,138 | |

Magnit PJSC1,2 | | | 5,689,221 | | | | 1,046,379,595 | |

12 OPPENHEIMER DEVELOPING MARKETS FUND

| | | | | | | | |

| | | Shares | | | Value | |

Food & Staples Retailing (Continued) | |

Sumber Alfaria | | | | | | | | |

| Trijaya Tbk PT | | | 1,399,700 | | | $ | 57,623 | |

Wal-Mart de | | | | | | | | |

Mexico SAB de | | | | | | | | |

CV | | | 60,721,653 | | | | 146,463,924 | |

| | | | | | | 1,734,676,382 | |

| | | | | | | | | |

Food Products—1.7% | |

Tingyi Cayman | | | | | | | | |

Islands Holding | | | | | | | | |

| Corp. | | | 199,610,000 | | | | 307,295,552 | |

Want Want | | | | | | | | |

China Holdings | | | | | | | | |

Ltd. | | | 274,506,000 | | | | 220,721,412 | |

| | | | | | | 528,016,964 | |

| | | | | | | | | |

Personal Products—0.1% | |

Natura | | | | | | | | |

| Cosmeticos SA | | | 6,366,700 | | | | 41,588,552 | |

| | | | | | | | | |

| Energy—3.1% | | | | | | | | |

Energy Equipment & Services—0.7% | |

China Oilfield | | | | | | | | |

Services Ltd., Cl. | | | | | | | | |

| H | | | 71,910,000 | | | | 76,704,974 | |

Tenaris SA, ADR | | | 5,317,141 | | | | 141,701,808 | |

| | | | | | | 218,406,782 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels—2.4% | |

NOVATEK OAO, | | | | | | | | |

| Sponsored GDR | | | 7,951,184 | | | | 755,488,721 | |

| | | | | | | | | |

| Financials—23.0% | |

Commercial Banks—6.6% | |

Bancolombia SA, | | | | | | | | |

| Sponsored ADR | | | 3,412,671 | | | | 117,737,149 | |

Commercial | | | | | | | | |

International | | | | | | | | |

| Bank Egypt SAE | | | 28,529,090 | | | | 180,391,600 | |

Grupo Aval | | | | | | | | |

Acciones y | | | | | | | | |

| Valores SA, ADR | | | 34,430,533 | | | | 265,115,104 | |

Grupo Financiero | | | | | | | | |

Banorte SAB de | | | | | | | | |

| CV, Cl. O | | | 100,394,089 | | | | 480,586,509 | |

Grupo Financiero | | | | | | | | |

Inbursa SAB de | | | | | | | | |

| CV, Cl. O | | | 145,629,981 | | | | 307,598,691 | |

Guaranty Trust | | | | | | | | |

| Bank plc | | | 813,506,865 | | | | 93,557,658 | |

ICICI Bank Ltd., | | | | | | | | |

Sponsored ADR | | | 49,163,030 | | | | 428,701,622 | |

| | | | | | | | |

| | | Shares | | | Value | |

Commercial Banks (Continued) | |

Kotak Mahindra | | | | | | | | |

| Bank Ltd. | | | 9,445,368 | | | $ | 92,220,114 | |

Zenith Bank plc | | | 1,278,261,810 | | | | 97,484,416 | |

| | | | | | | 2,063,392,863 | |

| | | | | | | | | |

Diversified Financial Services—3.6% | |

BM&FBovespa | | | | | | | | |

SA-Bolsa de | | | | | | | | |

Valores | | | | | | | | |

Mercadorias e | | | | | | | | |

| Futuros1 | | | 111,087,648 | | | | 330,201,383 | |

Grupo de | | | | | | | | |

Inversiones | | | | | | | | |

| Suramericana SA | | | 17,689,539 | | | | 204,426,349 | |

Haci Omer | | | | | | | | |

Sabanci Holding | | | | | | | | |

| AS | | | 87,171,296 | | | | 260,203,728 | |

Hong Kong | | | | | | | | |

Exchanges & | | | | | | | | |

Clearing Ltd. | | | 14,043,325 | | | | 328,822,413 | |

| | | | | | | 1,123,653,873 | |

| | | | | | | | | |

Insurance—5.9% | |

| AIA Group Ltd. | | | 94,044,200 | | | | 517,455,711 | |

China Life | | | | | | | | |

Insurance Co. | | | | | | | | |

| Ltd., Cl. H | | | 77,141,000 | | | | 263,525,204 | |

China Pacific | | | | | | | | |

Insurance Group | | | | | | | | |

| Co. Ltd., Cl. H | | | 72,735,000 | | | | 263,974,212 | |

| Old Mutual plc | | | 140,736,241 | | | | 420,869,144 | |

People’s | | | | | | | | |

Insurance Co. | | | | | | | | |

Group of China | | | | | | | | |

| Ltd. (The), Cl. H | | | 155,464,000 | | | | 73,588,480 | |

PICC Property & | | | | | | | | |

Casualty Co. | | | | | | | | |

| Ltd., Cl. H | | | 89,874,000 | | | | 169,787,068 | |

Sul America SA1 | | | 27,427,333 | | | | 132,347,574 | |

| | | | | | | 1,841,547,393 | |

| | | | | | | | | |

Real Estate Management & Development—3.2% | |

Global Logistic | | | | | | | | |

| Properties Ltd. | | | 81,100,000 | | | | 127,616,932 | |

Hang Lung | | | | | | | | |

| Group Ltd. | | | 39,349,750 | | | | 151,908,308 | |

Hang Lung | | | | | | | | |

| Properties Ltd. | | | 156,912,881 | | | | 354,222,166 | |

SM Prime | | | | | | | | |

Holdings, Inc. | | | 732,394,672 | | | | 303,135,272 | |

13 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF INVESTMENTS Continued

| | | | | | | | |

| | | Shares | | | Value | |

Real Estate Management & Development | |

| (Continued) | | | | | | | | |

SOHO China Ltd. | | | 182,160,000 | | | $ | 77,862,767 | |

| | | | | | | 1,014,745,445 | |

| | | | | | | | | |

Thrifts & Mortgage Finance—3.7% | |

Housing | | | | | | | | |

Development | | | | | | | | |

Finance Corp. | | | | | | | | |

Ltd. | | | 64,824,142 | | | | 1,152,741,500 | |

| | | | | | | | | |

| Health Care—6.0% | | | | | |

Health Care Providers & Services—2.3% | |

Apollo Hospitals | | | | | | | | |

| Enterprise Ltd.1 | | | 12,086,295 | | | | 242,176,073 | |

Diagnosticos da | | | | | | | | |

| America SA1 | | | 27,003,700 | | | | 72,299,761 | |

Sinopharm Group | | | | | | | | |

Co. Ltd., Cl. H1 | | | 111,316,000 | | | | 421,386,800 | |

| | | | | | | 735,862,634 | |

| | | | | | | | | |

Life Sciences Tools & Services—0.4% | |

Divi’s | | | | | | | | |

| Laboratories Ltd. | | | 772,105 | | | | 27,622,935 | |

WuXi | | | | | | | | |

PharmaTech | | | | | | | | |

Cayman, Inc., | | | | | | | | |

ADR2 | | | 2,327,133 | | | | 98,344,640 | |

| | | | | | | 125,967,575 | |

| | | | | | | | | |

Pharmaceuticals—3.3% | |

| Cipla Ltd. | | | 15,432,241 | | | | 158,308,592 | |

Dr. Reddy’s | | | | | | | | |

| Laboratories Ltd. | | | 7,255,073 | | | | 470,318,884 | |

Glenmark | | | | | | | | |

Pharmaceuticals | | | | | | | | |

| Ltd.2 | | | 6,882,421 | | | | 117,218,575 | |

| Lupin Ltd. | | | 2,486,892 | | | | 71,390,593 | |

Sun | | | | | | | | |

Pharmaceutical | | | | | | | | |

Industries Ltd. | | | 15,105,114 | | | | 200,805,370 | |

| | | | | | | 1,018,042,014 | |

| | | | | | | | | |

| Industrials—5.6% | | | | | | | | |

Aerospace & Defense—1.1% | |

Embraer SA, | | | | | | | | |

Sponsored ADR1 | | | 13,662,162 | | | | 345,379,455 | |

| | | | | | | | | |

Construction & Engineering—0.1% | |

Larsen & Toubro | | | | | | | | |

Ltd.2 | | | 1,458,706 | | | | 35,116,023 | |

| | | | | | | | | |

Industrial Conglomerates—2.2% | |

Jardine Strategic | | | | | | | | |

Holdings Ltd. | | | 11,800,443 | | | | 336,273,071 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Industrial Conglomerates (Continued) | |

SM Investments | | | | | | | | |

Corp. | | | 18,506,926 | | | $ | 345,264,117 | |

| | | | | | | 681,537,188 | |

| | | | | | | | | |

Transportation Infrastructure—2.2% | |

Airports of | | | | | | | | |

| Thailand PCL | | | 9,942,700 | | | | 76,373,709 | |

| DP World Ltd. | | | 21,344,136 | | | | 475,785,743 | |

Grupo | | | | | | | | |

Aeroportuario del | | | | | | | | |

Sureste SAB de | | | | | | | | |

CV, Cl. B | | | 8,530,765 | | | | 124,328,008 | |

| | | | | | | 676,487,460 | |

| | | | | | | | | |

| Information Technology—17.4% | |

Internet Software & Services—10.6% | |

Alibaba Group | | | | | | | | |

Holding Ltd., | | | | | | | | |

| Sponsored ADR2 | | | 12,455,200 | | | | 823,537,824 | |

Baidu, Inc., | | | | | | | | |

| Sponsored ADR2 | | | 4,548,144 | | | | 669,714,204 | |

MercadoLibre, | | | | | | | | |

| Inc.1 | | | 2,669,702 | | | | 293,800,705 | |

| NAVER Corp. | | | 754,371 | | | | 314,740,570 | |

Tencent Holdings | | | | | | | | |

| Ltd. | | | 61,756,110 | | | | 1,049,697,290 | |

Yandex NV, Cl. | | | | | | | | |

A2 | | | 12,219,201 | | | | 149,074,252 | |

| | | | | | | 3,300,564,845 | |

| | | | | | | | | |

IT Services—4.3% | |

| Infosys Ltd. | | | 55,953,979 | | | | 932,106,105 | |

Tata Consultancy | | | | | | | | |

Services Ltd. | | | 10,977,181 | | | | 424,639,945 | |

| | | | | | | 1,356,746,050 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment— 2.5% | |

| MediaTek, Inc. | | | 24,378,000 | | | | 188,055,448 | |

Taiwan | | | | | | | | |

Semiconductor | | | | | | | | |

Manufacturing | | | | | | | | |

Co. Ltd. | | | 150,995,429 | | | | 592,606,209 | |

| | | | | | | 780,661,657 | |

| | | | | | | | | |

| Materials—3.3% | | | | | | | | |

Chemicals—0.2% | |

Asian Paints Ltd. | | | 4,610,800 | | | | 58,631,742 | |

| | | | | | | | | |

Construction Materials—1.7% | |

Ambuja Cements | | | | | | | | |

Ltd. | | | 39,518,628 | | | | 122,887,086 | |

14 OPPENHEIMER DEVELOPING MARKETS FUND

| | | | | | | | | | |

| | | Shares | | | Value | | | |

| Construction Materials (Continued) | | | |

Indocement | | | | | | | | | | |

Tunggal Prakarsa | | | | | | | | | | |

| Tbk PT | | | 102,713,200 | | | $ | 143,520,294 | | | |

Semen Indonesia | | | | | | | | | | |

| Persero Tbk PT | | | 159,847,300 | | | | 105,272,170 | | | |

Ultratech Cement | | | | | | | | | | |

Ltd. | | | 3,881,542 | | | | 167,984,923 | | | |

| | | | | | | 539,664,473 | | | |

| | | | | | | | | | | |

Metals & Mining—1.4% | | | |

| Alrosa PAO2 | | | 211,056,317 | | | | 205,081,735 | | | |

First Quantum | | | | | | | | | | |

| Minerals Ltd. | | | 13,412,004 | | | | 69,934,894 | | | |

Glencore plc | | | 73,873,319 | | | | 167,146,698 | | | |

| | | | | | | 442,163,327 | | | |

| | | | | | | | | | | |

| Telecommunication Services—1.8% | | | |

Wireless Telecommunication Services—1.8% | | | |

America Movil | | | | | | | | | | |

SAB de CV, Cl. L, | | | | | | | | | | |

| ADR | | | 14,034,449 | | | | 256,830,417 | | | |

MTN Group Ltd. | | | 23,083,043 | | | | 308,427,104 | | | |

| | | | | | | 565,257,521 | | | |

Total Common Stocks | | | | | | | |

(Cost $28,037,239,058) | | | | 28,757,140,079 | | | |

| | | | | | | | | | | |

| Preferred Stocks—2.8% | | | |

Banco | | | | | | | | | | |

Davivienda SA, | | | | | | | | | | |

| Preference | | | 12,909,328 | | | | 100,752,432 | | | |

Cia Brasileira de | | | | | | | | | | |

Distribuicao, | | | | | | | | | | |

Preference | | | 17,379,600 | | | | 304,304,137 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| Preferred Stocks (Continued) | |

Lojas Americanas | | | | | | | | |

| SA, Preference1 | | | 98,405,500 | | | $ | 442,284,105 | |

Zee | | | | | | | | |

Entertainment | | | | | | | | |

Enterprises Ltd., | | | | | | | | |

6% Cum. Non- | | | | | | | | |

Cv.1 | | | 1,895,913,054 | | | | 25,383,417 | |

Total Preferred Stocks | | | | | | | | |

(Cost $1,090,712,183) | | | | | | | 872,724,091 | |

| | |

| | | Units | | | | |

| Rights, Warrants and Certificates—0.0% | |

Genting Bhd | | | | | | | | |

Wts., Strike Price | | | | | | | | |

7.96MYR, Exp. | | | | | | | | |

12/18/181,2 (Cost | | | | | | | | |

$22,944,872) | | | 36,522,500 | | | | 5,174,021 | |

| | |

| | | Shares | | | | |

| Investment Companies—5.3% | |

OFI Global China | | | | | | | | |

Fund, LLC, China | | | | | | | | |

| A Series1,2 | | | 20,020,250 | | | | 225,428,015 | |

Oppenheimer | | | | | | | | |

Institutional | | | | | | | | |

Money Market | | | | | | | | |

Fund, Cl. E, | | | | | | | | |

0.17%1,4 | | | 1,432,448,652 | | | | 1,432,448,652 | |

Total Investment Companies | | | | | |

| (Cost $1,632,680,299) | | | | | | | 1,657,876,667 | |

Total Investments, at Value | | | | | | | | |

| (Cost $30,783,576,412) | | | 100.0% | | | | 31,292,914,858 | |

Net Other Assets | | | | | | | | |

(Liabilities) | | | (0.0) | | | | (2,021,916) | |

| | | | |

Net Assets | | | 100.0% | | | $ | 31,290,892,942 | |

| | | | |

Footnotes to Statement of Investments

Strike price reported in U.S. Dollars, except for those denoted in the following currency:

MYR Malaysian Ringgit

1. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares/Units

August 29,

2014a | | | Gross Additions | | | Gross

Reductions | | | Shares/Units

August 31, 2015 | |

Almacenes Exito SA | | | 12,282,111 | | | | 3,389,344 | | | | — | | | | 15,671,455 | |

Almacenes Exito SA, GDR | | | 11,250,373 | | | | — | | | | — | | | | 11,250,373 | |

Apollo Hospitals Enterprise Ltd. | | | 11,678,894 | | | | 407,401 | | | | — | | | | 12,086,295 | |

B2W Cia Digitalb | | | 13,741,532 | | | | 2,361,300 | | | | 3,956,028 | | | | 12,146,804 | |

15 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF INVESTMENTS Continued

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | | | | | |

| | | Shares/Units

August 29, 2014a | | | Gross Additions | | | Gross Reductions | | | Shares/Units

August 31, 2015 | |

| BM&FBovespa SA-Bolsa de Valores Mercadorias e Futuros (formerly BM&FBovespa SA) | | | 144,771,198 | | | | 6,087,600 | | | | 39,771,150 | | | | 111,087,648 | |

| China Oilfield Services Ltd., Cl. Hb | | | 78,612,000 | | | | 30,652,000 | | | | 37,354,000 | | | | 71,910,000 | |

| Cia Brasileira de Distribuicao, Preferenceb | | | — | | | | 17,379,600 | | | | — | | | | 17,379,600 | |

| Ctrip.com International Ltd., ADR | | | 3,431,175 | | | | 7,900,702 | | | | 3,431,175 | | | | 7,900,702 | |

| Cyrela Brazil Realty SA Empreendimentos e Participacoes | | | 34,568,300 | | | | — | | | | 3,877,600 | | | | 30,690,700 | |

| Diagnosticos da America SA | | | 27,003,700 | | | | — | | | | — | | | | 27,003,700 | |

| Embraer SA, ADR | | | 9,592,082 | | | | 4,070,080 | | | | — | | | | 13,662,162 | |

| Estacio Participacoes SA | | | 33,258,250 | | | | 19,421,700 | | | | 10,642,100 | | | | 42,037,850 | |

| Genel Energy PLC | | | 13,112,988 | | | | 1,624,464 | | | | 14,737,452 | | | | — | |

| Genting Bhd | | | 157,365,600 | | | | 62,595,500 | | | | — | | | | 219,961,100 | |

| Genting Bhd Wts. | | | 36,522,500 | | | | — | | | | — | | | | 36,522,500 | |

| Homeinns Hotel Group, ADR | | | 6,468,725 | | | | 248,988 | | | | — | | | | 6,717,713 | |

| Kroton Educacional SA | | | 15,322,067 | | | | 123,039,124c | | | | 22,744,655 | | | | 115,616,536 | |

| Lojas Americanas SA, Preference | | | 93,094,600 | | | | 5,310,900 | | | | — | | | | 98,405,500 | |

| Magnit OJSC | | | 4,081,317 | | | | 1,657,394 | | | | 49,490 | | | | 5,689,221 | |

| MercadoLibre, Inc. | | | 4,728,681 | | | | — | | | | 2,058,979 | | | | 2,669,702 | |

| Mindray Medical INTL LTD | | | 5,767,314 | | | | — | | | | 5,767,314 | | | | — | |

| Natura Cosmeticos SA/ BRLb | | | 23,391,700 | | | | 2,545,800 | | | | 19,570,800 | | | | 6,366,700 | |

| New Oriental Education & Technology Group, Inc., Sponsored ADR | | | 17,676,762 | | | | 873,097 | | | | 3,641,487 | | | | 14,908,372 | |

| OFI Global China Fund, LLC, China A Series | | | — | | | | 20,020,250 | | | | — | | | | 20,020,250 | |

| Oppenheimer Institutional Money Market Fund, Cl. E | | | 2,678,303,651 | | | | 5,589,849,663 | | | | 6,835,704,662 | | | | 1,432,448,652 | |

| Qunar Cayman Islands Ltd., ADR | | | — | | | | 7,607,416 | | | | 3,375,257 | | | | 4,232,159 | |

| Shandong Weigao Group Medical Polymer Co. Ltd., Cl. H | | | 174,240,000 | | | | — | | | | 174,240,000 | | | | — | |

| Sinopharm Group Co. Ltd., Cl. H | | | 93,383,600 | | | | 30,598,800 | | | | 12,666,400 | | | | 111,316,000 | |

| Soho China LTDb | | | 279,218,500 | | | | — | | | | 97,058,500 | | | | 182,160,000 | |

| Sul America SA | | | 27,659,033 | | | | — | | | | 231,700 | | | | 27,427,333 | |

| Tullow Oil plc | | | 46,902,566 | | | | 9,952,412c | | | | 56,854,978 | | | | — | |

| Zee Entertainment Enterprises Ltd. | | | 82,290,959 | | | | 8,357,493 | | | | 13,574,384 | | | | 77,074,068 | |

| Zee Entertainment Enterprises Ltd., 6% Cum. Non-Cv. | | | 1,895,913,054 | | | | — | | | | — | | | | 1,895,913,054 | |

| | | | | | | | | | | | | | |

| | | | | Value | | | Income | | | Realized Gain

(Loss) | |

Almacenes Exito SA | | | | $ | 86,088,854 | | | $ | 3,248,877 | | | $ | — | |

Almacenes Exito SA, GDR | | | | | 58,915,953 | | | | 2,393,056 | | | | — | |

Apollo Hospitals Enterprise Ltd. | | | | | 242,176,073 | | | | 1,085,624 | | | | — | |

B2W Cia Digitalb | | | | | — d | | | | — | | | | (21,127,489) | |

BM&F Bovespa SA-Bolsa de Valores Mercadorias e Futuros (formerly BM&FBovespa SA) | | | | | 330,201,383 | | | | 16,690,987 | | | | (119,825,373) | |

China Oilfield Services Ltd., Cl. Hb | | | | | — d | | | | 5,076,419 | | | | (14,395,565) | |

Cia Brasileira de Distribuicao, Preferenceb | | | | | — d | | | | 3,830,158 | | | | — | |

Ctrip.com International Ltd., ADR | | | | | 525,001,648 | | | | — | | | | 90,081,481 | |

16 OPPENHEIMER DEVELOPING MARKETS FUND

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | |

| | | Value | | | Income | | | Realized Gain

(Loss) | |

| Cyrela Brazil Realty SA Empreendimentos e Participacoes | | $ | 71,085,404 | | | $ | 4,889,825 | | | $ | (14,910,211) | |

| Diagnosticos da America SA | | | 72,299,761 | | | | 571,553 | | | | — | |

| Embraer SA, Sponsored ADR | | | 345,379,455 | | | | 4,612,543 | | | | — | |

| Estacio Participacoes SA | | | 144,544,411 | | | | 4,797,581 | | | | 49,879,378 | |

| Genel Energy plc | | | — | | | | — | | | | (104,547,456) | |

| Genting Bhd | | | 357,647,950 | | | | 2,255,538 | | | | — | |

| Genting Bhd Wts. | | | 5,174,021 | | | | — | | | | — | |

| Homeinns Hotel Group, ADR | | | 178,691,166 | | | | — | | | | — | |

| Kroton Educacional SA | | | 276,715,849 | | | | 2,731,397 | | | | 79,793,904 | |

| Lojas Americanas SA, Preference | | | 442,284,105 | | | | 3,127,572 | | | | — | |

| Magnit PJSC | | | 1,046,379,595 | | | | 28,112,659 | | | | (2,683,255) | |

| MercadoLibre, Inc. | | | 293,800,705 | | | | 1,831,207 | | | | 78,183,057 | |

| Mindray Medical International Ltd., ADR | | | — | | | | — | | | | (29,902,737) | |

| Natura Cosmeticos SAb | | | — d | | | | 8,101,621 | | | | (115,885,646) | |

| New Oriental Education & Technology Group, Inc., Sponsored ADR | | | 305,472,542 | | | | — | | | | (4,783,408) | |

| OFI Global China Fund, LLC, China A Series | | | 225,428,015 | | | | — | | | | — | |

| Oppenheimer Institutional Money Market Fund, Cl. E | | | 1,432,448,652 | | | | 2,154,617 | | | | — | |

| Qunar Cayman Islands Ltd., ADR | | | 137,545,167 | | | | — | | | | 25,845,602 | |

| Shandong Weigao Group Medical Polymer Co. Ltd., Cl. H | | | — | | | | 595,621 | | | | (20,511,313) | |

| Sinopharm Group Co. Ltd., Cl. H | | | 421,386,800 | | | | 4,673,670 | | | | 5,400,317 | |

| SOHO China LTD b | | | — d | | | | 9,316,067 | | | | (13,936,598) | |

| Sul America SA | | | 132,347,574 | | | | 4,428,653 | | | | (915,742) | |

| Tullow Oil plc | | | — | | | | — | | | | (592,877,403) | |

| Zee Entertainment Enterprises Ltd. | | | 444,577,952 | | | | 2,733,123 | | | | 37,658,923 | |

| Zee Entertainment Enterprises Ltd., 6% Cum. Non-Cv. | | | 25,383,417 | | | | 1,815,574 | | | | — | |

| | | | |

Total | | $ | 7,600,976,452 | | | $ | 119,073,942 | | | $ | (689,459,534) | |

| | | | |

a. August 29, 2014 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

b. No longer an affiliate at period end.

c. All or a portion are the result of a corporate action.

d. The security is no longer an affiliate; therefore, the value has been excluded from this table.

2. Non-income producing security.

3. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $58,915,953 or 0.19% of the Fund’s net assets at period end.

4. Rate shown is the 7-day yield at period.

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| | | | | | | | |

| Geographic Holdings (Unaudited) | | Value | | | Percent | |

China | | $ | 6,416,507,051 | | | | 20.5% | |

India | | | 5,172,831,451 | | | | 16.5 | |

Hong Kong | | | 2,226,649,888 | | | | 7.1 | |

Brazil | | | 2,212,999,991 | | | | 7.1 | |

Russia | | | 2,156,024,303 | | | | 6.9 | |

17 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF INVESTMENTS Continued

| | | | | | | | |

| Geographic Holdings (Unaudited) (Continued) | | Value | | | Percent | |

Mexico | | $ | 2,089,758,956 | | | | 6.7% | |

United States | | | 1,955,484,603 | | | | 6.2 | |

France | | | 856,761,279 | | | | 2.7 | |

Philippines | | | 838,032,835 | | | | 2.7 | |

Colombia | | | 833,035,843 | | | | 2.7 | |

Taiwan | | | 780,661,657 | | | | 2.5 | |

United Kingdom | | | 656,510,260 | | | | 2.1 | |

Indonesia | | | 648,002,808 | | | | 2.1 | |

Turkey | | | 591,876,013 | | | | 1.9 | |

Italy | | | 511,131,093 | | | | 1.6 | |

United Arab Emirates | | | 475,785,743 | | | | 1.5 | |

Malaysia | | | 474,292,069 | | | | 1.5 | |

Switzerland | | | 344,144,138 | | | | 1.1 | |

Nigeria | | | 329,380,789 | | | | 1.1 | |

South Korea | | | 314,740,570 | | | | 1.0 | |

South Africa | | | 308,427,104 | | | | 1.0 | |

Argentina | | | 293,800,705 | | | | 0.9 | |

Thailand | | | 277,658,848 | | | | 0.9 | |

Egypt | | | 180,391,600 | | | | 0.6 | |

Luxembourg | | | 141,701,808 | | | | 0.5 | |

Singapore | | | 136,388,558 | | | | 0.4 | |

Canada | | | 69,934,895 | | | | 0.2 | |

| | | | |

Total | | $ | 31,292,914,858 | | | | 100.0% | |

| | | | |

See accompanying Notes to Financial Statements.

18 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF ASSETS AND LIABILITIES August 31, 2015

| | |

| Assets | | |

Investments, at value—see accompanying statement of investments: | | |

Unaffiliated companies (cost $22,817,947,747) | | $ 23,691,938,406 |

Affiliated companies (cost $7,965,628,665) | | 7,600,976,452 |

| | |

| | | 31,292,914,858 |

| Cash | | 65,538,524 |

| Cash—foreign currencies (cost $42,174,228) | | 41,149,723 |

Receivables and other assets: | | |

Investments sold | | 71,865,026 |

Shares of beneficial interest sold | | 47,822,545 |

Dividends | | 35,473,333 |

Other | | 1,360,255 |

| | |

Total assets | | 31,556,124,264 |

| Liabilities | | |

Payables and other liabilities: | | |

Shares of beneficial interest redeemed | | 133,849,125 |

Investments purchased | | 102,185,164 |

Foreign capital gains tax | | 19,904,845 |

Distribution and service plan fees | | 2,239,790 |

Trustees’ compensation | | 1,743,716 |

Shareholder communications | | 70,620 |

Other | | 5,238,062 |

| | |

Total liabilities | | 265,231,322 |

Net Assets | | $ 31,290,892,942 |

| | |

| | |

| Composition of Net Assets | | |

| Paid-in capital | | $ 32,549,682,906 |

| Accumulated net investment income | | 133,799,779 |

| Accumulated net realized loss on investments and foreign currency transactions | | (1,880,491,781) |

| Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | 487,902,038 |

| | |

Net Assets | | $ 31,290,892,942 |

| | |

19 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF ASSETS AND LIABILITIES Continued

| | | | | | |

| Net Asset Value Per Share | | | | | | |

Class A Shares: | | | | | | |

| Net asset value and redemption price per share (based on net assets of $7,679,025,667 and 255,418,892 shares of beneficial interest outstanding) | | | | $ | 30.06 | |

| | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | | | $ | 31.89 | |

| | |

Class B Shares: | | | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $83,559,016 and 2,877,045 shares of beneficial interest outstanding) | | | | $ | 29.04 | |

| | |

Class C Shares: | | | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $1,311,171,376 and 46,252,190 shares of beneficial interest outstanding) | | | | $ | 28.35 | |

| | |

Class I Shares: | | | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $6,201,063,724 and 208,319,948 shares of beneficial interest outstanding) | | | | $ | 29.77 | |

| | |

Class R Shares: | | | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $657,581,374 and 22,765,642 shares of beneficial interest outstanding) | | | | $ | 28.88 | |

| | |

Class Y Shares: | | | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $15,358,491,785 and 516,683,047 shares of beneficial interest outstanding) | | | | $ | 29.73 | |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF OPERATIONS For the Year Ended August 31, 2015

| | | | |

| Investment Income | |

Dividends: | | | | |

Unaffiliated companies (net of foreign withholding taxes of $59,592,567) | | $ | 583,516,135 | |

| Affiliated companies (net of foreign withholding taxes of $6,958,827) | | | 119,073,942 | |

| Portfolio lending fees | | | 5,294,149 | |

Interest | | | 1,173 | |

Total investment income | | | 707,885,399 | |

| Expenses | |

| Management fees | | | 304,590,732 | |

Distribution and service plan fees: | | | | |

Class A | | | 25,470,510 | |

Class B | | | 1,205,184 | |

Class C | | | 17,808,974 | |

| Class R | | | 4,150,728 | |

Transfer and shareholder servicing agent fees: | | | | |

Class A | | | 22,631,710 | |

Class B | | | 265,444 | |

Class C | | | 3,920,899 | |

Class I | | | 2,082,912 | |

Class R | | | 1,828,311 | |

| Class Y | | | 42,964,213 | |

Shareholder communications: | | | | |

Class A | | | 92,331 | |

Class B | | | 3,243 | |

Class C | | | 18,395 | |

Class I | | | 10,465 | |

Class R | | | 3,411 | |

| Class Y | | | 145,344 | |

| Custodian fees and expenses | | | 22,107,013 | |

| Trustees’ compensation | | | 607,242 | |

| Borrowing fees | | | 64,888 | |

Other | | | 5,386,348 | |

Total expenses | | | 455,358,297 | |

Less reduction to custodian expenses | | | (23,996 | ) |

Less waivers and reimbursements of expenses | | | (1,904,584 | ) |

Net expenses | | | 453,429,717 | |

Net Investment Income | | | 254,455,682 | |

21 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENT OF OPERATIONS Continued

| | | | |

| Realized and Unrealized Loss | | | | |

Net realized loss on: | | | | |

Investments from: | | | | |

Unaffiliated companies (net of foreign capital gains tax of $3,939,297) | | $ | (1,143,195,728) | |

Affiliated companies | | | (689,459,534) | |

Foreign currency transactions | | | (15,225,091) | |

| | | | |

| Net realized loss | | | (1,847,880,353) | |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (7,727,764,088) | |

Translation of assets and liabilities denominated in foreign currencies | | | (2,043,271,849) | |

| | | | |

Net change in unrealized appreciation/depreciation | | | (9,771,035,937) | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (11,364,460,608) | |

| | | | |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER DEVELOPING MARKETS FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | Year Ended August 31, 2015 | | | | | Year Ended

August 29, 20141 | |

| Operations | | | | | | | | | | |

| Net investment income | | $ | 254,455,682 | | | | | $ | 203,081,835 | |

| Net realized gain (loss) | | | (1,847,880,353) | | | | | | 1,306,596,312 | |

Net change in unrealized appreciation/depreciation | | | (9,771,035,937) | | | | | | 6,336,848,672 | |

| | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (11,364,460,608) | | | | | | 7,846,526,819 | |

| Dividends and/or Distributions to Shareholders | | | | | | | | | | |

Dividends from net investment income: | | | | | | | | | | |

Class A | | | (29,843,512) | | | | | | (13,234,494) | |

Class B | | | — | | | | | | — | |

Class C | | | — | | | | | | — | |

Class I | | | (55,106,788) | | | | | | (16,436,167) | |

Class R2 | | | (922,751) | | | | | | — | |

Class Y | | | (122,099,117) | | | | | | (80,830,331) | |

| | | | |

| | | | (207,972,168) | | | | | | (110,500,992) | |

Distributions from net realized gain: | | | | | | | | | | |

Class A | | | (174,988,969) | | | | | | (65,134,075) | |

Class B | | | (2,155,550) | | | | | | (799,843) | |

Class C | | | (32,263,186) | | | | | | (11,300,209) | |

Class I | | | (110,292,826) | | | | | | (13,834,591) | |

Class R2 | | | (14,384,024) | | | | | | (4,593,518) | |

Class Y | | | (326,400,898) | | | | | | (88,605,506) | |

| | | | |

| | | (660,485,453) | | | | | | (184,267,742) | |

| Beneficial Interest Transactions | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | | | |

Class A | | | (1,756,774,548) | | | | | | (2,316,362,156) | |

Class B | | | (33,207,152) | | | | | | (31,217,391) | |

Class C | | | (323,504,660) | | | | | | (330,154,289) | |

Class I | | | 960,273,360 | | | | | | 4,315,820,141 | |

Class R2 | | | (57,695,825) | | | | | | (61,633,667) | |

Class Y | | | (76,996,040) | | | | | | 2,101,612,738 | |

| | | | | | | | | | |

| | | (1,287,904,865) | | | | | | 3,678,065,376 | |

| Net Assets | | | | | | | | | | |

| Total increase (decrease) | | | (13,520,823,094) | | | | | | 11,229,823,461 | |

Beginning of period | | | 44,811,716,036 | | | | | | 33,581,892,575 | |

| | | | | | | | | | |

End of period (including accumulated net investment income of $133,799,779 and $109,957,866, respectively) | | $ | 31,290,892,942 | | | | | $ | 44,811,716,036 | |

| | | | |

1. August 29, 2014 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Effective July 1, 2014, Class N shares were renamed Class R. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

23 OPPENHEIMER DEVELOPING MARKETS FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year Ended

August 31, 2015 | | | Year Ended

August 29, 2014 1 | | | Year Ended

August 30, 2013 1 | | | Year Ended

August 31, 2012 | | | Year Ended

August 31, 2011 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 41.30 | | | $ | 33.94 | | | $ | 32.25 | | | $ | 33.15 | | | $ | 29.83 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.17 | | | | 0.14 | | | | 0.09 | | | | 0.19 | | | | 0.683 | |

Net realized and unrealized gain (loss) | | | (10.71) | | | | 7.44 | | | | 1.74 | | | | (0.53) | | | | 2.69 | |

| Total from investment operations | | | (10.54) | | | | 7.58 | | | | 1.83 | | | | (0.34) | | | | 3.37 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.10) | | | | (0.04) | | | | (0.14) | | | | (0.56) | | | | (0.05) | |

Distributions from net realized gain | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (0.70) | | | | (0.22) | | | | (0.14) | | | | (0.56) | | | | (0.05) | |

Net asset value, end of period | | $ | 30.06 | | | $ | 41.30 | | | $ | 33.94 | | | $ | 32.25 | | | $ | 33.15 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value4 | | | (25.84)% | | | | 22.38% | | | | 5.67% | | | | (0.89)% | | | | 11.28% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 7,679,026 | | | $ | 12,573,313 | | | $ | 12,371,560 | | | $ | 10,784,891 | | | $ | 10,802,874 | |

| Average net assets (in thousands) | | $ | 10,303,699 | | | $ | 13,256,077 | | | $ | 12,394,351 | | | $ | 10,327,349 | | | $ | 11,015,700 | |

Ratios to average net assets:5 | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.47% | | | | 0.36% | | | | 0.27% | | | | 0.61% | | | | 1.94% | 3 |

Expenses excluding interest and fees from borrowings | | | 1.31% | | | | 1.32% | | | | 1.36% | | | | 1.36% | | | | 1.30% | |

Interest and fees from borrowings | | | 0.00% | 6 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Total expenses7 | | | 1.31% | | | | 1.32% | | | | 1.36% | | | | 1.36% | | | | 1.30% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.30% | | | | 1.31% | | | | 1.35% | | | | 1.36% | | | | 1.30% | |

Portfolio turnover rate | | | 36% | | | | 26% | | | | 29% | | | | 20% | | | | 34% | |

24 OPPENHEIMER DEVELOPING MARKETS FUND

1. August 29, 2014 and August 30, 2013 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Net investment income per share and the net investment income ratio includes $0.47 and 1.35%, respectively, resulting from a special dividend from E-Mart Co. Ltd. in June 2011.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2015 | | 1.31% | | | | |

| | Year Ended August 29, 2014 | | 1.33% | | | | |

| | Year Ended August 30, 2013 | | 1.37% | | | | |

| | Year Ended August 31, 2012 | | 1.36% | | | | |

| | Year Ended August 31, 2011 | | 1.30% | | | | |

See accompanying Notes to Financial Statements.

25 OPPENHEIMER DEVELOPING MARKETS FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | |

| Class B | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

2014 1 | | | Year Ended

August 30,

2013 1 | | | Year Ended

August 31,

2012 | | | Year Ended

August 31, 2011 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 40.11 | | | $ | 33.19 | | | $ | 31.68 | | | $ | 32.48 | | | $ | 29.43 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | (0.11) | | | | (0.16) | | | | (0.22) | | | | (0.09) | | | | 0.343 | |

Net realized and unrealized gain (loss) | | | (10.36) | | | | 7.26 | | | | 1.73 | | | | (0.49) | | | | 2.71 | |

| Total from investment operations | | | (10.47) | | | | 7.10 | | | | 1.51 | | | | (0.58) | | | | 3.05 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.22) | | | | 0.00 | |

Distributions from net realized gain | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | (0.22) | | | | 0.00 | |

Net asset value, end of period | | $ | 29.04 | | | $ | 40.11 | | | $ | 33.19 | | | $ | 31.68 | | | $ | 32.48 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value4 | | | (26.40)% | | | | 21.44% | | | | 4.77% | | | | (1.73)% | | | | 10.36% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 83,559 | | | $ | 153,828 | | | $ | 155,638 | | | $ | 179,874 | | | $ | 228,170 | |

| Average net assets (in thousands) | | $ | 120,812 | | | $ | 156,760 | | | $ | 177,608 | | | $ | 189,982 | | | $ | 259,240 | |

Ratios to average net assets:5 | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.30)% | | | | (0.43)% | | | | (0.64)% | | | | (0.28)% | | | | 0.98% | 3 |

Expenses excluding interest and fees from borrowings | | | 2.06% | | | | 2.09% | | | | 2.23% | | | | 2.24% | | | | 2.14% | |

Interest and fees from borrowings | | | 0.00% | 6 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Total expenses7 | | | 2.06% | | | | 2.09% | | | | 2.23% | | | | 2.24% | | | | 2.14% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 2.05% | | | | 2.08% | | | | 2.22% | | | | 2.22% | | | | 2.14% | |

Portfolio turnover rate | | | 36% | | | | 26% | | | | 29% | | | | 20% | | | | 34% | |

1. August 29, 2014 and August 30, 2013 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Net investment income per share and the net investment income ratio includes $0.46 and 1.35%, respectively, resulting from a special dividend from E-Mart Co. Ltd. in June 2011.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2015 | | 2.06% | | | | |

| | Year Ended August 29, 2014 | | 2.10% | | | | |

| | Year Ended August 30, 2013 | | 2.24% | | | | |

| | Year Ended August 31, 2012 | | 2.24% | | | | |

| | Year Ended August 31, 2011 | | 2.14% | | | | |

See accompanying Notes to Financial Statements.

26 OPPENHEIMER DEVELOPING MARKETS FUND

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

2014 1 | | | Year Ended

August 30,

2013 1 | | | Year Ended

August 31,

2012 | | | Year Ended

August 31, 2011 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 39.17 | | | $ | 32.40 | | | $ | 30.87 | | | $ | 31.74 | | | $ | 28.72 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | (0.10) | | | | (0.13) | | | | (0.15) | | | | (0.02) | | | | 0.433 | |

Net realized and unrealized gain (loss) | | | (10.12) | | | | 7.08 | | | | 1.68 | | | | (0.51) | | | | 2.59 | |

| Total from investment operations | | | (10.22) | | | | 6.95 | | | | 1.53 | | | | (0.53) | | | | 3.02 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.34) | | | | 0.00 | |

Distributions from net realized gain | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | (0.34) | | | | 0.00 | |

Net asset value, end of period | | $ | 28.35 | | | $ | 39.17 | | | $ | 32.40 | | | $ | 30.87 | | | $ | 31.74 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value4 | | | (26.39)% | | | | 21.50% | | | | 4.96% | | | | (1.57)% | | | | 10.52% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 1,311,171 | | | $ | 2,190,364 | | | $ | 2,112,136 | | | $ | 2,024,406 | | | $ | 2,060,954 | |

| Average net assets (in thousands) | | $ | 1,785,113 | | | $ | 2,180,118 | | | $ | 2,231,136 | | | $ | 1,974,630 | | | $ | 2,014,543 | |

Ratios to average net assets:5 | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.29)% | | | | (0.37)% | | | | (0.44)% | | | | (0.08)% | | | | 1.30% | 3 |

Expenses excluding interest and fees from borrowings | | | 2.06% | | | | 2.04% | | | | 2.06% | | | | 2.05% | | | | 2.01% | |

Interest and fees from borrowings | | | 0.00% | 6 | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Total expenses7 | | | 2.06% | | | | 2.04% | | | | 2.06% | | | | 2.05% | | | | 2.01% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 2.05% | | | | 2.03% | | | | 2.05% | | | | 2.05% | | | | 2.01% | |

Portfolio turnover rate | | | 36% | | | | 26% | | | | 29% | | | | 20% | | | | 34% | |

1. August 29, 2014 and August 30, 2013 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Net investment income per share and the net investment income ratio includes $0.45 and 1.35%, respectively, resulting from a special dividend from E-Mart Co. Ltd. in June 2011.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2015 | | 2.06% | | | | |

| | Year Ended August 29, 2014 | | 2.05% | | | | |

| | Year Ended August 30, 2013 | | 2.07% | | | | |

| | Year Ended August 31, 2012 | | 2.05% | | | | |

| | Year Ended August 31, 2011 | | 2.01% | | | | |

See accompanying Notes to Financial Statements.

27 OPPENHEIMER DEVELOPING MARKETS FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | |

| Class I | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

2014 1 | | | Year Ended

August 30,

2013 1 | | | Period Ended August 31, 20122 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 40.94 | | | $ | 33.65 | | | $ | 31.97 | | | $ | 28.91 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income3 | | | 0.34 | | | | 0.33 | | | | 0.30 | | | | 0.30 | |

Net realized and unrealized gain (loss) | | | (10.61) | | | | 7.35 | | | | 1.68 | | | | 2.76 | |

| Total from investment operations | | | (10.27) | | | | 7.68 | | | | 1.98 | | | | 3.06 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.30) | | | | (0.21) | | | | (0.30) | | | | 0.00 | |

Distributions from net realized gain | | | (0.60) | | | | (0.18) | | | | 0.00 | | | | 0.00 | |

| Total dividends and/or distributions to shareholders | | | (0.90) | | | | (0.39) | | | | (0.30) | | | | 0.00 | |

Net asset value, end of period | | $ | 29.77 | | | $ | 40.94 | | | $ | 33.65 | | | $ | 31.97 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total Return, at Net Asset Value4 | | | (25.50)% | | | | 22.95% | | | | 6.19% | | | | 10.58% | |

| | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 6,201,064 | | | $ | 7,445,448 | | | $ | 2,353,100 | | | $ | 597,537 | |

| Average net assets (in thousands) | | $ | 6,961,648 | | | $ | 3,901,775 | | | $ | 1,440,608 | | | $ | 156,814 | |

Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

Net investment income | | | 0.95% | | | | 0.87% | | | | 0.87% | | | | 1.46% | |

Expenses excluding interest and fees from borrowings | | | 0.87% | | | | 0.86% | | | | 0.88% | | | | 0.88% | |

Interest and fees from borrowings | | | 0.00% | 6 | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Total expenses7 | | | 0.87% | | | | 0.86% | | | | 0.88% | | | | 0.88% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.86% | | | | 0.85% | | | | 0.87% | | | | 0.88% | |

Portfolio turnover rate | | | 36% | | | | 26% | | | | 29% | | | | 20% | |

1. August 29, 2014 and August 30, 2013 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. For the period from December 29, 2011 (inception of offering) to August 31, 2012.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

| | Year Ended August 31, 2015 | | 0.87% | | | | |

| | Year Ended August 29, 2014 | | 0.87% | | | | |

| | Year Ended August 30, 2013 | | 0.89% | | | | |

| | Period Ended August 31, 2012 | | 0.88% | | | | |

See accompanying Notes to Financial Statements.

28 OPPENHEIMER DEVELOPING MARKETS FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Class R | | Year Ended

August 31,

2015 | | | Year Ended

August 29,

2014 1 | | | Year Ended

August 30,

2013 1 | | | Year Ended

August 31,

2012 | | | Year Ended

August 31,

2011 | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 39.74 | | | $ | 32.72 | | | $ | 31.11 | | | $ | 32.00 | | | $ | 28.87 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | 0.08 | | | | 0.04 | | | | (0.03) | | | | 0.09 | | | | 0.553 | |

Net realized and unrealized gain (loss) | | | (10.30) | | | | 7.16 | | | | 1.69 | | | | (0.52) | | | | 2.58 | |