UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07655

Driehaus Mutual Funds

(Exact name of registrant as specified in charter)

25 East Erie Street

Chicago, IL 60611

(Address of principal executive offices) (Zip code)

Janet L. McWilliams

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

(Name and address of agent for service)

Registrant's telephone number, including area code: 312-587-3800

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

(a) The Reports to Shareholders are attached herewith.

|  |  |

| Howard Schwab Lead Portfolio Manager | Chad Cleaver Portfolio Manager | Rich Thies Portfolio Manager |

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | 5 Years | 10 Years |

| Driehaus Emerging Markets Growth Fund Investor Class (DREGX) | (1.92)% | 16.11% | 13.31% | 8.04% |

| Driehaus Emerging Markets Growth Fund Institutional Class (DIEMX)1 | (1.69)% | 16.37% | 13.52% | 8.14% |

| MSCI Emerging Markets Index-N2 | (2.54)% | 10.94% | 9.88% | 5.49% |

| MSCI Emerging Markets Growth Index-N3 | (8.41)% | 14.60% | 12.55% | 7.52% |

| 1 | The returns for the periods prior to July 17, 2017 (institutional share class inception date) include the performance of the investor share class. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Growth Index-Net (MSCI Emerging Markets Growth Index-N) is a subset of the MSCI Emerging Markets Index and includes only the MSCI Emerging Markets Index stocks which are categorized as growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 97.93% | ||

| FAR EAST — 67.74% | ||

| China — 20.88% | ||

| BYD Co. Ltd. - H | 499,847 | $17,089,882 |

| Changzhou Xingyu Automotive Lighting Systems Co. Ltd. - A | 147,189 | 4,717,041 |

| China Mengniu Dairy Co. Ltd. * | 2,563,351 | 14,530,220 |

| China Merchants Bank Co. Ltd. - H | 5,004,917 | 38,864,480 |

| Contemporary Amperex Technology Co. Ltd. - A | 348,815 | 32,181,383 |

| East Money Information Co. Ltd. - A | 5,874,544 | 34,205,611 |

| JD.com, Inc. - ADR * | 488,531 | 34,231,367 |

| Li Ning Co. Ltd. | 1,619,705 | 17,728,879 |

| Meituan - B 1,* | 404,700 | 11,698,467 |

| NARI Technology Co. Ltd. - A | 3,574,525 | 22,451,024 |

| Proya Cosmetics Co. Ltd. - A | 692,765 | 22,642,704 |

| Shanghai MicroPort MedBot Group Co. Ltd. * | 252,000 | 1,892,210 |

| Shenzhou International Group Holdings Ltd. | 619,894 | 11,916,834 |

| Sungrow Power Supply Co. Ltd. - A | 440,026 | 10,066,259 |

| Sunny Optical Technology Group Co. Ltd. | 608,958 | 19,258,491 |

| Techtronic Industries Co. Ltd. | 1,956,169 | 38,934,977 |

| Tencent Holdings Ltd. | 1,541,845 | 90,325,140 |

| Wuxi Biologics Cayman, Inc. 1,* | 1,008,827 | 11,973,881 |

| Yum China Holdings, Inc. | 241,891 | 12,055,847 |

| Zhangzhou Pientzehuang Pharmaceutical Co. Ltd. - A | 571,857 | 39,223,844 |

| 485,988,541 | ||

| India — 17.74% | ||

| Apollo Hospitals Enterprise Ltd. | 494,947 | 33,380,582 |

| Bharti Airtel Ltd. * | 1,469,782 | 13,520,255 |

| Clean Science & Technology Ltd. * | 256,215 | 8,593,907 |

| Havells India Ltd. | 844,167 | 15,864,546 |

| HDFC Bank Ltd. - ADR 2 | 587,268 | 38,213,529 |

| Hindalco Industries Ltd. | 2,024,052 | 12,948,537 |

| Hindustan Unilever Ltd. | 230,345 | 7,313,432 |

| Housing Development Finance Corp. Ltd. | 1,171,273 | 40,753,515 |

| ICICI Bank Ltd. - SP ADR 2 | 3,527,360 | 69,806,454 |

| Infosys Ltd. - SP ADR 2 | 1,057,881 | 26,774,968 |

| Power Grid Corp. of India Ltd. | 7,341,571 | 20,187,045 |

| Reliance Industries Ltd. | 1,399,455 | 44,583,176 |

| Tata Consultancy Services Ltd. | 636,761 | 32,022,798 |

| Tata Motors Ltd. - ADR 2,* | 584,420 | 18,754,038 |

| Titan Co. Ltd. | 888,679 | 30,155,167 |

| 412,871,949 | ||

| Taiwan — 14.60% | ||

| Chailease Holding Co. Ltd. | 3,270,179 | 31,105,356 |

| Delta Electronics, Inc. | 1,217,293 | 12,078,207 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| MediaTek, Inc. | 803,000 | $34,456,351 |

| Merida Industry Co. Ltd. | 1,080,893 | 12,761,848 |

| Silergy Corp. | 145,463 | 26,328,267 |

| Taiwan Semiconductor Manufacturing Co. Ltd. - SP ADR 2 | 1,527,529 | 183,777,014 |

| TXC Corp. | 2,976,000 | 11,318,676 |

| Unimicron Technology Corp. | 1,979,484 | 16,473,209 |

| Win Semiconductors Corp. | 842,000 | 11,361,395 |

| 339,660,323 | ||

| South Korea — 8.55% | ||

| Ecopro BM Co. Ltd. | 14,513 | 6,097,573 |

| KB Financial Group, Inc. | 475,088 | 21,970,117 |

| Kia Corp. | 241,722 | 16,681,985 |

| Macquarie Korea Infrastructure Fund | 1,000,206 | 11,826,764 |

| Samsung Biologics Co. Ltd. 1,* | 12,239 | 9,293,154 |

| Samsung Electronics Co. Ltd. | 2,027,665 | 133,166,839 |

| 199,036,432 | ||

| Indonesia — 2.44% | ||

| Bank Central Asia Tbk PT | 80,702,800 | 41,331,999 |

| Bank Jago Tbk PT * | 13,808,555 | 15,488,330 |

| 56,820,329 | ||

| Thailand — 1.24% | ||

| Airports of Thailand PCL - NVDR * | 8,999,100 | 16,386,541 |

| The Siam Commercial Bank PCL - NVDR | 3,305,200 | 12,545,722 |

| 28,932,263 | ||

| Singapore — 0.97% | ||

| Sea Ltd. - ADR * | 100,676 | 22,522,228 |

| Australia — 0.59% | ||

| Lynas Rare Earths Ltd. * | 1,852,585 | 13,707,617 |

| Vietnam — 0.52% | ||

| Masan Group Corp. | 1,597,900 | 11,989,509 |

| Philippines — 0.21% | ||

| International Container Terminal Services, Inc. | 1,240,557 | 4,865,645 |

| Total FAR EAST (Cost $1,122,702,896) | 1,576,394,836 | |

| NORTH AMERICA — 13.95% | ||

| United States — 9.05% | ||

| Ball Corp. | 349,373 | 33,634,139 |

| EPAM System, Inc. * | 27,943 | 18,678,498 |

| Freeport-McMoRan, Inc. | 298,190 | 12,443,469 |

| Liberty Media Corp.-Liberty Formula One - C * | 360,546 | 22,800,929 |

| MELI Kaszek Pioneer Corp. - A * | 770,561 | 8,907,685 |

| Micron Technology, Inc. | 387,175 | 36,065,351 |

| NIKE, Inc. - B | 88,387 | 14,731,461 |

| NVIDIA Corp. | 92,790 | 27,290,467 |

| ROBLOX Corp. - A * | 213,521 | 22,026,827 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Schlumberger NV | 468,055 | $14,018,247 |

| 210,597,073 | ||

| Mexico — 3.01% | ||

| Cemex SAB de CV - SP ADR 2,* | 2,056,857 | 13,945,491 |

| Grupo Financiero Banorte SAB de CV - O | 6,027,430 | 39,201,624 |

| Wal-Mart de Mexico SAB de CV | 4,518,963 | 16,821,829 |

| 69,968,944 | ||

| Canada — 1.89% | ||

| Cameco Corp. 2 | 706,178 | 15,401,742 |

| Nutrien Ltd. 2 | 380,726 | 28,630,595 |

| 44,032,337 | ||

| Total NORTH AMERICA (Cost $284,334,204) | 324,598,354 | |

| EUROPE — 7.82% | ||

| Russia — 4.73% | ||

| LUKOIL PJSC - SP ADR 2 | 439,196 | 39,308,042 |

| Polyus PJSC 2 | 82,612 | 14,400,825 |

| Sberbank of Russia PJSC - SP ADR 2 | 1,596,824 | 25,629,025 |

| Yandex NV - A 2,* | 506,308 | 30,631,634 |

| 109,969,526 | ||

| Netherlands — 1.25% | ||

| ASML Holding NV | 14,334 | 11,532,821 |

| Heineken NV | 157,005 | 17,671,244 |

| 29,204,065 | ||

| France — 0.96% | ||

| L'Oreal SA | 46,852 | 22,240,531 |

| Germany — 0.53% | ||

| Infineon Technologies AG | 266,217 | 12,256,224 |

| Greece — 0.35% | ||

| OPAP SA | 578,534 | 8,213,502 |

| Total EUROPE (Cost $163,213,154) | 181,883,848 | |

| SOUTH AMERICA — 4.95% | ||

| Brazil — 3.19% | ||

| Banco BTG Pactual SA * | 6,096,457 | 22,898,826 |

| Petroleo Brasileiro SA - ADR 2 | 1,756,629 | 19,287,786 |

| Vale SA - SP ADR 2 | 2,290,975 | 32,119,470 |

| 74,306,082 | ||

| Uruguay — 0.91% | ||

| Globant SA * | 67,733 | 21,274,258 |

| Argentina — 0.85% | ||

| MercadoLibre, Inc. 2,* | 14,641 | 19,741,924 |

| Total SOUTH AMERICA (Cost $111,301,446) | 115,322,264 | |

| MIDDLE EAST — 1.93% | ||

| Saudi Arabia — 0.99% | ||

| Saudi Arabian Oil Co. 1 | 2,402,670 | 22,900,355 |

| Qatar — 0.55% | ||

| Qatar National Bank QPSC | 2,319,418 | 12,858,941 |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Israel — 0.39% | |||

| ICL Group Ltd. | 945,936 | $9,111,362 | |

| Total MIDDLE EAST (Cost $42,628,051) | 44,870,658 | ||

| AFRICA — 1.54% | |||

| South Africa — 1.54% | |||

| Capitec Bank Holdings Ltd. | 139,838 | 17,900,317 | |

| MTN Group Ltd. * | 1,676,774 | 17,963,106 | |

| 35,863,423 | |||

| Total AFRICA (Cost $30,927,554) | 35,863,423 | ||

| Total COMMON STOCKS (Cost $1,755,107,305) | 2,278,933,383 | ||

| SHORT TERM INVESTMENTS — 2.94% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 3 (Cost $68,460,869) | 68,460,869 | 68,460,869 | |

| TOTAL INVESTMENTS (Cost $1,823,568,174) | 100.87% | $2,347,394,252 | |

| Liabilities in Excess of Other Assets | (0.87)% | (20,290,209) | |

| Net Assets | 100.00% | $2,327,104,043 | |

| ADR | American Depositary Receipt |

| NVDR | Non-Voting Depositary Receipt |

| PCL | Public Company Limited |

| PJSC | Public Joint Stock Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $55,865,857, which represents 2% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 97.93% | |

| Short Term Investments | 2.94% | |

| Total Investments | 100.87% | |

| Liabilities In Excess of Other Assets | (0.87)% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Far East | 67.74% | |

| North America | 16.89% | |

| Europe | 7.82% | |

| South America | 4.95% | |

| Middle East | 1.93% | |

| Africa | 1.54% |

| Industry | Percent of Net Assets | |

| Auto Components | 0.20 | |

| Automobiles | 2.26 | |

| Banks | 14.34 | |

| Beverages | 0.76 | |

| Capital Markets | 2.96 | |

| Chemicals | 1.99 | |

| Construction Materials | 0.60 | |

| Containers & Packaging | 1.45 | |

| Diversified Financial Services | 1.34 | |

| Electric Utilities | 0.87 | |

| Electrical Equipment | 3.72 | |

| Electronic Equipment, Instruments & Components | 2.54 | |

| Energy Equipment & Services | 0.60 | |

| Entertainment | 2.90 | |

| Food & Staples Retailing | 0.72 | |

| Food Products | 1.15 | |

| Health Care Providers & Services | 1.51 | |

| Holding Companies - Diversified | 0.38 | |

| Hotels, Restaurants & Leisure | 0.87 | |

| Household Products | 0.31 |

| Industry | Percent of Net Assets | |

| Interactive Media & Services | 5.20 | |

| Internet & Direct Marketing Retail | 2.82 | |

| IT Services | 4.24 | |

| Leisure Products | 0.55 | |

| Life Sciences Tools & Services | 0.92 | |

| Machinery | 1.67 | |

| Metals & Mining | 3.69 | |

| Money Market Fund | 2.94 | |

| Oil, Gas & Consumable Fuels | 6.08 | |

| Personal Products | 1.93 | |

| Pharmaceuticals | 1.69 | |

| Semiconductors & Semiconductor Equipment | 14.74 | |

| Technology Hardware, Storage & Peripherals | 5.72 | |

| Textiles, Apparel & Luxury Goods | 3.20 | |

| Thrifts & Mortgage Finance | 1.75 | |

| Transportation Infrastructure | 0.91 | |

| Wireless Telecommunication Services | 1.35 | |

| Liabilities In Excess of Other Assets | (0.87) | |

| TOTAL | 100.00 |

|  |  |

| Chad Cleaver, CFA Lead Portfolio Manager | Howard Schwab Portfolio Manager | Rich Thies Portfolio Manager |

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | 5 Years | 10 Years |

| Driehaus Emerging Markets Small Cap Growth Fund (DRESX)1 | 15.93% | 27.45% | 15.97% | 9.98% |

| MSCI Emerging Markets Small Cap Index-N2 | 18.75% | 16.46% | 11.47% | 7.42% |

| MSCI Emerging Markets Small Cap Growth Index-N3 | 20.41% | 19.20% | 12.22% | 7.46% |

| 1 | The returns reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Net (MSCI Emerging Markets Small Cap Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Small Cap Growth Index-Net (MSCI Emerging Markets Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap growth stocks in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 92.60% | ||

| FAR EAST — 79.14% | ||

| India — 28.58% | ||

| 3M India Ltd. * | 1,594 | $543,819 |

| Amber Enterprises India Ltd. * | 25,657 | 1,144,589 |

| Apollo Hospitals Enterprise Ltd. | 11,963 | 806,818 |

| Ashok Leyland Ltd. | 427,161 | 703,644 |

| AU Small Finance Bank Ltd. 1,* | 68,911 | 960,861 |

| Birlasoft Ltd. | 246,660 | 1,807,419 |

| Burger King India Ltd. * | 258,841 | 492,885 |

| Clean Science & Technology Ltd. * | 40,915 | 1,372,362 |

| Dixon Technologies India Ltd. | 27,964 | 2,072,613 |

| Dr Lal PathLabs Ltd. 1 | 11,502 | 591,419 |

| Godrej Properties Ltd. * | 52,729 | 1,327,736 |

| ICICI Securities Ltd. 1 | 54,917 | 584,922 |

| IndiaMart InterMesh Ltd. 1 | 6,072 | 529,015 |

| Indian Energy Exchange Ltd. 1 | 239,206 | 813,490 |

| Indraprastha Gas Ltd. | 86,920 | 550,034 |

| JK Cement Ltd. | 19,041 | 870,612 |

| Jubilant Foodworks Ltd. | 12,934 | 624,832 |

| Max Healthcare Institute Ltd. * | 520,602 | 3,101,804 |

| MTAR Technologies Ltd. | 38,177 | 1,264,963 |

| Oberoi Realty Ltd. * | 44,365 | 514,339 |

| Prince Pipes & Fittings Ltd. | 85,129 | 801,753 |

| Radico Khaitan Ltd. | 155,682 | 2,588,883 |

| Relaxo Footwears Ltd. | 37,073 | 655,025 |

| Sobha Ltd. | 191,887 | 2,311,478 |

| Sona Blw Precision Forgings Ltd. 1,* | 165,136 | 1,651,790 |

| SRF Ltd. | 19,775 | 643,803 |

| Syngene International Ltd. 1,* | 77,911 | 649,716 |

| TVS Motor Co. Ltd. | 64,246 | 541,897 |

| Varun Beverages Ltd. | 112,418 | 1,343,378 |

| Vijaya Diagnostic Centre Private Ltd. * | 188,328 | 1,475,753 |

| 33,341,652 | ||

| China — 17.50% | ||

| Aluminum Corp. of China Ltd. - H * | 1,370,000 | 757,251 |

| Amoy Diagnostics Co. Ltd. - A | 49,263 | 583,657 |

| Asia - Potash International Investment Guangzhou Co. Ltd. - A * | 151,000 | 631,403 |

| Centre Testing International Group Co. Ltd. - A | 189,500 | 798,931 |

| Changzhou Xingyu Automotive Lighting Systems Co. Ltd. - A | 32,781 | 1,050,550 |

| China National Building Material Co. Ltd. - H | 496,000 | 608,109 |

| China Power International Development Ltd. | 1,528,000 | 1,028,785 |

| CIMC Enric Holdings Ltd. | 748,000 | 1,087,819 |

| Estun Automation Co. Ltd. - A | 272,478 | 1,109,433 |

| Gotion High-tech Co. Ltd. - A * | 90,400 | 726,933 |

| KWG Group Holdings Ltd. | 1,055,000 | 690,024 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Longshine Technology Group Co. Ltd. - A | 235,225 | $1,366,688 |

| Maanshan Iron & Steel Co. Ltd. - H | 2,936,000 | 1,076,872 |

| Man Wah Holdings Ltd. | 933,600 | 1,446,337 |

| Ming Yang Smart Energy Group Ltd. - A | 128,700 | 527,049 |

| Pacific Basin Shipping Ltd. | 3,389,000 | 1,243,024 |

| Proya Cosmetics Co. Ltd. - A | 43,700 | 1,428,314 |

| Shenzhen Envicool Technology Co. Ltd. - A | 111,000 | 712,151 |

| Wuhan DR Laser Technology Corp. Ltd. - A | 29,600 | 1,188,486 |

| Xinyi Energy Holdings Ltd. | 1,102,000 | 603,464 |

| Yantai Jereh Oilfield Services Group Co. Ltd. - A | 277,862 | 1,743,899 |

| 20,409,179 | ||

| Taiwan — 9.81% | ||

| Advanced Energy Solution Holding Co. Ltd. | 17,000 | 1,120,957 |

| ASPEED Technology, Inc. | 9,000 | 1,160,495 |

| Eclat Textile Co. Ltd. | 51,000 | 1,162,097 |

| Makalot Industrial Co. Ltd. | 126,000 | 1,123,832 |

| Parade Technologies Ltd. | 26,455 | 2,012,699 |

| Silergy Corp. | 8,000 | 1,447,970 |

| Sinbon Electronics Co. Ltd. | 172,000 | 1,761,908 |

| Voltronic Power Technology Corp. | 29,550 | 1,648,535 |

| 11,438,493 | ||

| Vietnam — 7.26% | ||

| Asia Commercial Bank JSC * | 495,675 | 802,889 |

| Dat Xanh Real Estate Services JSC * | 782,600 | 1,280,868 |

| FPT Corp. | 550,567 | 2,403,990 |

| Masan Group Corp. | 231,900 | 1,740,013 |

| Military Commercial Joint Stock Bank * | 918,157 | 1,199,244 |

| SSI Securities Corp. | 458,434 | 1,041,985 |

| 8,468,989 | ||

| South Korea — 7.22% | ||

| Chunbo Co. Ltd. | 4,842 | 1,416,736 |

| DB HiTek Co. Ltd. | 23,521 | 1,433,658 |

| Ecopro BM Co. Ltd. | 850 | 357,124 |

| F&F Co. Ltd. * | 1,863 | 1,479,095 |

| Iljin Materials Co. Ltd. | 13,212 | 1,495,932 |

| LEENO Industrial, Inc. | 9,681 | 1,612,205 |

| Mando Corp. * | 11,741 | 624,748 |

| 8,419,498 | ||

| Indonesia — 3.02% | ||

| Adi Sarana Armada Tbk PT * | 5,657,600 | 1,318,054 |

| Bank Jago Tbk PT * | 937,982 | 1,052,085 |

| Merdeka Copper Gold Tbk PT * | 4,226,600 | 1,156,976 |

| 3,527,115 | ||

| Kazakhstan — 2.33% | ||

| Kaspi.KZ JSC 1,2 | 14,830 | 1,761,507 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| NAC Kazatomprom JSC - GDR 2 | 26,005 | $955,684 |

| 2,717,191 | ||

| Thailand — 1.44% | ||

| Chularat Hospital PCL - NVDR | 7,618,000 | 834,662 |

| Dohome PCL - NVDR | 1,209,400 | 842,056 |

| 1,676,718 | ||

| Australia — 1.08% | ||

| Lynas Rare Earths Ltd. * | 170,909 | 1,264,587 |

| Philippines — 0.90% | ||

| Wilcon Depot, Inc. | 1,756,300 | 1,050,491 |

| Total FAR EAST (Cost $71,679,339) | 92,313,913 | |

| SOUTH AMERICA — 6.28% | ||

| Brazil — 5.39% | ||

| Arezzo Industria e Comercio SA | 63,200 | 868,833 |

| Cia Brasileira de Aluminio * | 246,000 | 602,395 |

| Orizon Valorizacao de Residuos SA * | 282,700 | 1,362,950 |

| Petro Rio SA * | 484,300 | 1,793,394 |

| Vale SA | 33,503 | 466,811 |

| Vamos Locacao de Caminhoes Maquinas e Equipamentos SA | 557,200 | 1,189,530 |

| 6,283,913 | ||

| Uruguay — 0.89% | ||

| Globant SA * | 3,304 | 1,037,753 |

| Total SOUTH AMERICA (Cost $6,382,944) | 7,321,666 | |

| NORTH AMERICA — 5.38% | ||

| Canada — 2.95% | ||

| B2Gold Corp. | 423,690 | 1,668,031 |

| Ivanhoe Mines Ltd. - A * | 217,994 | 1,778,488 |

| 3,446,519 | ||

| Mexico — 2.01% | ||

| GCC SAB de CV | 126,400 | 970,741 |

| Grupo Traxion SAB de CV 1,* | 779,000 | 1,369,256 |

| 2,339,997 | ||

| United States — 0.42% | ||

| Fluence Energy, Inc. * | 13,677 | 486,354 |

| Total NORTH AMERICA (Cost $6,284,295) | 6,272,870 | |

| EUROPE — 1.80% | ||

| United Kingdom — 1.00% | ||

| Ceres Power Holdings PLC * | 86,682 | 1,169,178 |

| Poland — 0.80% | ||

| Dino Polska SA 1,* | 10,310 | 937,388 |

| Total EUROPE (Cost $1,477,241) | 2,106,566 | |

| Total COMMON STOCKS (Cost $85,823,819) | 108,015,015 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| PREFERRED STOCKS — 1.05% | |||

| SOUTH AMERICA — 1.05% | |||

| Brazil — 1.05% | |||

| Bradespar SA, 24.29% 3 | 273,100 | $1,218,610 | |

| Total SOUTH AMERICA (Cost $1,572,772) | 1,218,610 | ||

| Total PREFERRED STOCKS (Cost $1,572,772) | 1,218,610 | ||

| SHORT TERM INVESTMENTS — 5.99% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 4 (Cost $6,991,404) | 6,991,404 | 6,991,404 | |

| TOTAL INVESTMENTS (Cost $94,387,995) | 99.64% | $116,225,029 | |

| Other Assets In Excess of Liabilities | 0.36% | 419,352 | |

| Net Assets | 100.00% | $116,644,381 | |

| GDR | Global Depositary Receipt |

| JSC | Joint Stock Company |

| NVDR | Non-Voting Depositary Receipt |

| PCL | Public Company Limited |

| PLC | Public Limited Company |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $9,849,364, which represents 8% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| 4 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 92.60% | |

| Preferred Stocks | 1.05% | |

| Short Term Investments | 5.99% | |

| Total Investments | 99.64% | |

| Other Assets In Excess of Liabilities | 0.36% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Far East | 79.14% | |

| North America | 11.37% | |

| South America | 7.33% | |

| Europe | 1.80% |

| Industry | Percent of Net Assets | |

| Auto Components | 2.86 | |

| Automobiles | 0.46 | |

| Banks | 3.44 | |

| Beverages | 3.37 | |

| Biotechnology | 0.50 | |

| Building Products | 0.69 | |

| Capital Markets | 2.09 | |

| Chemicals | 2.94 | |

| Commercial Services & Supplies | 1.17 | |

| Construction Materials | 2.10 | |

| Consumer Finance | 1.51 | |

| Electrical Equipment | 5.17 | |

| Electronic Equipment, Instruments & Components | 3.81 | |

| Energy Equipment & Services | 1.50 | |

| Food & Staples Retailing | 0.80 | |

| Food Products | 2.03 | |

| Gas Utilities | 0.47 | |

| Health Care Providers & Services | 5.84 | |

| Hotels, Restaurants & Leisure | 0.96 | |

| Household Durables | 4.00 | |

| Independent Power and Renewable Electricity Producers | 1.40 |

| Industry | Percent of Net Assets | |

| Industrial Conglomerates | 0.47 | |

| IT Services | 2.95 | |

| Life Sciences Tools & Services | 0.56 | |

| Machinery | 4.17 | |

| Marine | 1.07 | |

| Metals & Mining | 8.56 | |

| Money Market Fund | 5.99 | |

| Oil, Gas & Consumable Fuels | 2.36 | |

| Personal Products | 1.23 | |

| Professional Services | 0.69 | |

| Real Estate Management & Development | 5.25 | |

| Road & Rail | 3.33 | |

| Semiconductors & Semiconductor Equipment | 6.58 | |

| Software | 2.72 | |

| Specialty Retail | 1.62 | |

| Textiles, Apparel & Luxury Goods | 4.53 | |

| Trading Companies & Distributors | 0.45 | |

| Other Assets In Excess of Liabilities | 0.36 | |

| TOTAL | 100.00 |

|  |

| Richard Thies Lead Portfolio Manager | Chad Cleaver Portfolio Manager |

|  |

| Howard Schwab Portfolio Manager | Jonathan Mershimer Assistant Portfolio Manager |

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | Since Inception (4/10/17 - 12/31/21) |

| Driehaus Emerging Markets Opportunities Fund (DMAGX)1 | (0.60)% | 16.32% | 11.24% |

| MSCI Emerging Markets Index-N2 | (2.54)% | 10.94% | 7.88% |

| MSCI EM/JP Morgan GBI Blended Index3 | (5.49)% | 6.65% | 4.95% |

| 1 | Prior to January 29, 2020, the Driehaus Emerging Markets Opportunities Fund was known as the Driehaus Multi-Asset Growth Economies Fund. The returns for the period reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The MSCI EM/JPMorgan Government Bond Index Blended Index is an equally weighted benchmark comprised of 50 percent by the Morgan Stanley Capital International Emerging Markets Index-Net (MSCI EM) and 50 percent by the JPMorgan Global Bond Index Emerging Markets Global Diversified (JPMorgan GBI). The MSCI EM is a market capitalization-weighted index designed to measure equity market performance in emerging markets and the JPMorgan GBI tracks debt instruments in the emerging markets. Source: Morgan Stanley Capital International Inc. and JPMorgan. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| SOVEREIGN BONDS — 16.21% | ||

| Brazil — 0.75% | ||

| Brazil Notas do Tesouro Nacional Serie F 10.00%, 1/1/31 1 | 2,500,000 | $430,843 |

| China — 4.75% | ||

| China Government Bond 3.20%, 3/16/24 1 | 1,200,000 | 191,420 |

| China Government Bond 3.54%, 8/16/28 1 | 2,500,000 | 410,750 |

| China Government Bond 2.68%, 5/21/30 1 | 7,000,000 | 1,082,309 |

| China Government Bond 3.27%, 11/19/30 1 | 6,500,000 | 1,055,047 |

| 2,739,526 | ||

| Dominican Republic — 0.53% | ||

| Dominican Republic International Bond 4.88%, 9/23/32 2 | 300,000 | 304,875 |

| Egypt — 1.66% | ||

| Egypt Government Bond 17.00%, 4/3/22 1 | 6,500,000 | 420,540 |

| Egypt Government International Bond 6.59%, 2/21/28 2 | 550,000 | 536,261 |

| 956,801 | ||

| Indonesia — 1.60% | ||

| Indonesia Treasury Bond 8.37%, 9/15/26 1 | 3,400,000,000 | 269,435 |

| Indonesia Treasury Bond 7.00%, 9/15/30 1 | 9,000,000,000 | 655,464 |

| 924,899 | ||

| Mexico — 2.38% | ||

| Banco Mercantil del Norte SA 6.63%, (U.S. Treasury Yield Curve Rate CMT 10Y + 503 basis points), 12/31/49 2,3 | 350,000 | 348,425 |

| Mexican Bonos 8.50%, 11/18/38 1 | 11,000,000 | 566,075 |

| Mexico Government International Bond 4.50%, 4/22/29 2 | 260,000 | 289,583 |

| Petroleos Mexicanos 6.70%, 2/16/32 2 | 169,000 | 170,690 |

| 1,374,773 | ||

| Nigeria — 0.51% | ||

| Nigeria Government International Bond 7.14%, 2/23/30 2 | 300,000 | 295,680 |

| Peru — 1.39% | ||

| Peruvian Government International Bond 6.95%, 8/12/31 1 | 3,000,000 | 805,360 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Qatar — 0.78% | ||

| Qatar Government International Bond 3.75%, 4/16/30 2 | 400,000 | $449,391 |

| Saudi Arabia — 0.71% | ||

| Saudi Government International Bond 2.75%, 2/3/32 2 | 400,000 | 412,508 |

| South Africa — 0.45% | ||

| Republic of South Africa Government Bond 8.50%, 1/31/37 1 | 4,900,000 | 259,943 |

| Ukraine — 0.70% | ||

| Ukraine Government International Bond 7.37%, 9/25/32 2 | 450,000 | 402,808 |

| Total SOVEREIGN BONDS (Cost $9,296,069) | 9,357,407 | |

| COMMON STOCKS — 78.65% | ||

| Argentina — 0.50% | ||

| MercadoLibre, Inc. 2,4,* | 214 | 288,558 |

| Australia — 0.93% | ||

| Lynas Rare Earths Ltd. * | 72,418 | 535,834 |

| Brazil — 0.91% | ||

| Vale SA - SP ADR 2,4 | 37,315 | 523,156 |

| Canada — 1.91% | ||

| Ivanhoe Mines Ltd. - A * | 74,200 | 605,355 |

| Nutrien Ltd. 2,4 | 6,578 | 494,666 |

| 1,100,021 | ||

| China — 14.93% | ||

| Alibaba Group Holding Ltd. * | 15,213 | 231,974 |

| BYD Co. Ltd. - H | 14,061 | 480,749 |

| China Merchants Bank Co. Ltd. - H | 83,259 | 646,528 |

| China Resources Beer Holdings Co. Ltd. | 75,810 | 620,768 |

| Contemporary Amperex Technology Co. Ltd. - A | 9,508 | 877,200 |

| East Money Information Co. Ltd. - A | 125,859 | 732,837 |

| Ganfeng Lithium Co. Ltd. - H 5 | 24,600 | 387,099 |

| JD Health International, Inc. 5,* | 172 | 1,355 |

| JD.com, Inc. - ADR 2,4,* | 4,247 | 297,587 |

| Li Ning Co. Ltd. | 49,684 | 543,828 |

| Meituan - B 5,* | 8,052 | 232,755 |

| Sungrow Power Supply Co. Ltd. - A | 13,470 | 308,147 |

| Techtronic Industries Co. Ltd. | 13,000 | 258,748 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Tencent Holdings Ltd. | 41,753 | $2,445,995 |

| Zhangzhou Pientzehuang Pharmaceutical Co. Ltd. - A | 8,072 | 553,661 |

| 8,619,231 | ||

| Czech Republic — 1.14% | ||

| Komercni banka A/S | 15,335 | 655,662 |

| France — 1.14% | ||

| L'Oreal SA | 1,389 | 659,355 |

| India — 10.25% | ||

| Apollo Hospitals Enterprise Ltd. | 7,102 | 478,978 |

| Asian Paints Ltd. | 8,053 | 366,485 |

| Bharti Airtel Ltd. * | 28,289 | 260,225 |

| HDFC Bank Ltd. - ADR 2,4 | 11,908 | 774,854 |

| Housing Development Finance Corp. Ltd. | 10,109 | 351,735 |

| ICICI Bank Ltd. - SP ADR 2,4 | 53,768 | 1,064,069 |

| Power Grid Corp. of India Ltd. | 167,822 | 461,458 |

| Radico Khaitan Ltd. | 22,864 | 380,212 |

| Reliance Industries Ltd. | 24,096 | 767,639 |

| SBI Cards & Payment Services Ltd. * | 23,295 | 290,860 |

| Tech Mahindra Ltd. | 30,041 | 723,609 |

| 5,920,124 | ||

| Indonesia — 2.32% | ||

| Bank Central Asia Tbk PT | 1,745,245 | 893,828 |

| Bank Jago Tbk PT * | 398,378 | 446,840 |

| 1,340,668 | ||

| Japan — 1.00% | ||

| Tokyo Electron Ltd. | 1,000 | 575,573 |

| Kazakhstan — 2.04% | ||

| Kaspi.KZ JSC 2,5 | 6,419 | 762,449 |

| NAC Kazatomprom JSC - GDR 2 | 11,303 | 415,385 |

| 1,177,834 | ||

| Mexico — 1.58% | ||

| Cemex SAB de CV - SP ADR 2,4,* | 44,146 | 299,310 |

| Grupo Financiero Banorte SAB de CV - O | 94,271 | 613,126 |

| 912,436 | ||

| Netherlands — 1.22% | ||

| ASML Holding NV | 876 | 704,810 |

| Qatar — 0.64% | ||

| Qatar National Bank QPSC | 66,562 | 369,022 |

| Russia — 3.74% | ||

| LUKOIL PJSC - SP ADR 2 | 10,906 | 976,087 |

| Sberbank of Russia PJSC - SP ADR 2 | 28,523 | 457,794 |

| Yandex NV - A 2,4,* | 11,965 | 723,883 |

| 2,157,764 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| Saudi Arabia — 1.73% | ||

| Saudi Arabian Oil Co. 5 | 105,089 | $1,001,626 |

| Singapore — 0.92% | ||

| Sea Ltd. - ADR 2,4,* | 2,362 | 528,403 |

| South Africa — 0.78% | ||

| MTN Group Ltd. * | 42,189 | 451,966 |

| South Korea — 10.02% | ||

| Hankook Tire & Technology Co. Ltd. | 12,863 | 429,718 |

| Kakao Corp. | 4,554 | 430,045 |

| KB Financial Group, Inc. | 5,191 | 240,054 |

| Kia Corp. | 6,212 | 428,709 |

| LEENO Industrial, Inc. | 4,257 | 708,930 |

| Macquarie Korea Infrastructure Fund | 44,563 | 526,928 |

| Samsung Electronics Co. Ltd. | 40,096 | 2,633,304 |

| SK Innovation Co. Ltd. * | 1,926 | 385,645 |

| 5,783,333 | ||

| Taiwan — 12.65% | ||

| Chailease Holding Co. Ltd. | 67,000 | 637,292 |

| Delta Electronics, Inc. | 35,986 | 357,060 |

| Hon Hai Precision Industry Co. Ltd. | 121,103 | 454,153 |

| MediaTek, Inc. | 18,585 | 797,474 |

| Sinbon Electronics Co. Ltd. | 40,136 | 411,139 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 177,668 | 3,930,194 |

| Unimicron Technology Corp. | 50,311 | 418,687 |

| Win Semiconductors Corp. | 22,000 | 296,853 |

| 7,302,852 | ||

| United States — 7.07% | ||

| Fluence Energy, Inc. 4,* | 389 | 13,833 |

| Freeport-McMoRan, Inc. 4 | 9,712 | 405,282 |

| Freshworks, Inc. - A 4,* | 8,397 | 220,505 |

| Liberty Media Corp.-Liberty Formula One - C 4,* | 11,467 | 725,173 |

| MELI Kaszek Pioneer Corp. - A 4,* | 18,498 | 213,837 |

| NVIDIA Corp. 4 | 3,224 | 948,211 |

| ROBLOX Corp. - A 4,* | 6,782 | 699,631 |

| Samsonite International SA 5,* | 247,254 | 502,273 |

| Unity Software, Inc. 4,* | 2,480 | 354,615 |

| 4,083,360 | ||

| Uruguay — 1.23% | ||

| Globant SA 2,4,* | 2,256 | 708,587 |

| Total COMMON STOCKS (Cost $33,208,655) | 45,400,175 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| SHORT TERM INVESTMENTS — 4.57% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 6 (Cost $2,640,635) | 2,640,635 | $2,640,635 | |

| TOTAL INVESTMENTS (Cost $45,145,359) | 99.43% | $57,398,217 | |

| Other Assets in Excess of Liabilities | 0.57% | 329,349 | |

| Net Assets | 100.00% | $57,727,566 | |

| ADR | American Depositary Receipt |

| CMT | Constant Maturity |

| GDR | Global Depositary Receipt |

| JSC | Joint Stock Company |

| PJSC | Public Joint Stock Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Foreign security, principal amount shown in local currency. |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Variable rate security. Rates disclosed as of December 31, 2021. |

| 4 | All or a portion of this security is pledged as collateral for short sales or derivatives transaction. |

| 5 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $2,887,557, which represents 5% of Net Assets (see Note F in the Notes to Financial Statements). |

| 6 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Sovereign Bonds | 16.21% | |

| Common Stocks | 78.65% | |

| Short Term Investments | 4.57% | |

| Total Investments | 99.43% | |

| Other Assets In Excess of Liabilities | 0.57% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Far East | 61.41% | |

| North America | 18.04% | |

| Europe | 7.94% | |

| South America | 4.78% | |

| Middle East | 3.86% | |

| Africa | 3.40% |

| Industry | Percent of Net Assets | |

| Auto Components | 0.74 | |

| Automobiles | 1.57 | |

| Banks | 10.67 | |

| Beverages | 1.74 | |

| Capital Markets | 2.18 | |

| Chemicals | 1.50 | |

| Construction Materials | 0.52 | |

| Consumer Finance | 1.82 | |

| Diversified Financial Services | 1.10 | |

| Electric Utilities | 0.80 | |

| Electrical Equipment | 2.07 | |

| Electronic Equipment, Instruments & Components | 2.85 | |

| Entertainment | 3.39 | |

| Health Care Providers & Services | 0.83 | |

| Holding Companies - Diversified | 0.37 | |

| Interactive Media & Services | 6.25 | |

| Internet & Direct Marketing Retail | 1.82 |

| Industry | Percent of Net Assets | |

| IT Services | 2.48 | |

| Machinery | 0.45 | |

| Metals & Mining | 4.26 | |

| Money Market Fund | 4.57 | |

| Oil, Gas & Consumable Fuels | 6.14 | |

| Personal Products | 1.14 | |

| Pharmaceuticals | 0.96 | |

| Semiconductors & Semiconductor Equipment | 13.79 | |

| Software | 1.00 | |

| Sovereign Bonds | 16.21 | |

| Technology Hardware, Storage & Peripherals | 4.56 | |

| Textiles, Apparel & Luxury Goods | 1.81 | |

| Thrifts & Mortgage Finance | 0.61 | |

| Wireless Telecommunication Services | 1.23 | |

| Other Assets In Excess of Liabilities | 0.57 | |

| TOTAL | 100.00 |

|  |  |

| Daniel Burr Portfolio Manager | David Mouser Portfolio Manager | Ryan Carpenter Assistant Portfolio Manager |

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | 5 Years | 10 Years |

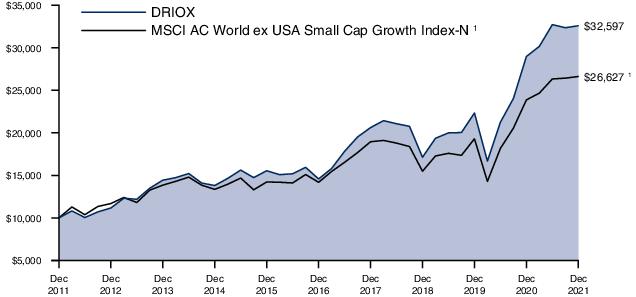

| Driehaus International Small Cap Growth Fund (DRIOX) | 12.49% | 23.92% | 17.46% | 12.54% |

| MSCI AC World ex USA Small Cap Growth Index-N1 | 11.53% | 19.79% | 13.43% | 10.29% |

| 1 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Net (MSCI AC World ex USA Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 98.21% | ||

| EUROPE — 70.05% | ||

| United Kingdom — 23.92% | ||

| 888 Holdings PLC | 588,501 | $2,397,663 |

| Abcam PLC * | 210,734 | 4,943,193 |

| Auto Trader Group PLC 1 | 346,408 | 3,469,716 |

| Bellway PLC | 73,918 | 3,337,725 |

| Conduit Holdings Ltd. | 386,582 | 2,263,091 |

| ConvaTec Group PLC 1 | 1,268,877 | 3,317,329 |

| Cranswick PLC | 45,033 | 2,256,533 |

| Electrocomponents PLC | 312,754 | 5,105,338 |

| Endava PLC - SP ADR 2,* | 28,588 | 4,800,497 |

| Ergomed PLC * | 86,900 | 1,764,353 |

| Fevertree Drinks PLC | 88,259 | 3,231,474 |

| Halfords Group PLC | 973,713 | 4,552,266 |

| IMI PLC | 104,748 | 2,461,330 |

| Marks & Spencer Group PLC * | 2,189,215 | 6,856,873 |

| OSB Group PLC | 726,752 | 5,454,590 |

| Oxford Nanopore Technologies PLC * | 219,430 | 2,073,126 |

| Pets at Home Group PLC | 272,802 | 1,717,018 |

| Serco Group PLC | 1,457,325 | 2,655,069 |

| Synthomer PLC | 739,997 | 4,002,486 |

| The Restaurant Group PLC * | 2,372,786 | 3,028,619 |

| Vesuvius PLC | 404,938 | 2,467,564 |

| Watches of Switzerland Group PLC 1,* | 220,751 | 4,242,925 |

| WH Smith PLC * | 88,054 | 1,763,945 |

| Yellow Cake PLC 1,* | 284,724 | 1,310,320 |

| 79,473,043 | ||

| Germany — 11.04% | ||

| Befesa SA 1 | 47,959 | 3,680,004 |

| GFT Technologies SE | 75,965 | 3,979,392 |

| Hornbach Holding AG & Co. KGaA | 44,592 | 6,696,789 |

| HUGO BOSS AG | 72,241 | 4,373,039 |

| Ibu-Tec Advanced Materials AG * | 27,154 | 1,390,497 |

| PVA TePla AG * | 100,833 | 4,790,375 |

| Sixt SE * | 14,206 | 2,506,115 |

| SUESS MicroTec SE * | 138,179 | 3,292,384 |

| TAG Immobilien AG | 71,732 | 2,003,638 |

| VERBIO Vereinigte BioEnergie AG | 58,376 | 3,973,573 |

| 36,685,806 | ||

| France — 6.41% | ||

| Coface SA * | 427,050 | 6,092,041 |

| IPSOS | 106,837 | 5,017,400 |

| Lectra | 19,563 | 935,444 |

| Maisons du Monde SA 1 | 74,281 | 1,721,823 |

| Virbac SA | 12,842 | 6,206,452 |

| Waga Energy SA * | 40,847 | 1,316,072 |

| 21,289,232 | ||

| Switzerland — 6.29% | ||

| Belimo Holding AG | 5,455 | 3,463,850 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Flughafen Zurich AG * | 16,708 | $3,000,488 |

| Montana Aerospace AG 1,* | 78,302 | 2,904,978 |

| PolyPeptide Group AG 1,* | 18,225 | 2,729,302 |

| Siegfried Holding AG * | 1,823 | 1,773,354 |

| Tecan Group AG | 8,521 | 5,175,367 |

| Ypsomed Holding AG | 9,157 | 1,869,123 |

| 20,916,462 | ||

| Denmark — 5.17% | ||

| ISS A/S * | 189,373 | 3,590,660 |

| Matas A/S | 218,214 | 4,159,130 |

| Netcompany Group A/S 1 | 38,690 | 4,148,358 |

| Ossur HF * | 450,158 | 2,915,116 |

| Royal Unibrew A/S | 21,149 | 2,378,900 |

| 17,192,164 | ||

| Netherlands — 3.02% | ||

| Accell Group NV * | 63,905 | 3,492,280 |

| Corbion NV | 49,039 | 2,313,633 |

| OCI NV * | 161,830 | 4,241,284 |

| 10,047,197 | ||

| Sweden — 2.79% | ||

| Elekta AB - B | 271,379 | 3,431,187 |

| Hexatronic Group AB | 72,912 | 4,040,296 |

| Kindred Group PLC | 153,049 | 1,813,266 |

| 9,284,749 | ||

| Italy — 2.23% | ||

| FinecoBank Banca Fineco SpA | 96,244 | 1,685,477 |

| Intercos SpA * | 160,273 | 2,565,540 |

| Seco SpA * | 311,405 | 3,172,620 |

| 7,423,637 | ||

| Austria — 2.02% | ||

| BAWAG Group AG 1 | 109,649 | 6,724,919 |

| Ireland — 1.86% | ||

| Glanbia PLC | 260,591 | 3,699,635 |

| James Hardie Industries PLC | 61,577 | 2,477,459 |

| 6,177,094 | ||

| Finland — 1.79% | ||

| Metso Outotec OYJ | 432,477 | 4,592,972 |

| Tokmanni Group Corp. | 60,219 | 1,348,093 |

| 5,941,065 | ||

| Belgium — 1.66% | ||

| Bekaert SA | 36,749 | 1,637,568 |

| Lotus Bakeries NV | 609 | 3,875,807 |

| 5,513,375 | ||

| Spain — 1.45% | ||

| Indra Sistemas SA * | 444,417 | 4,800,631 |

| Norway — 0.40% | ||

| SmartCraft ASA * | 569,124 | 1,325,794 |

| Total EUROPE (Cost $190,891,906) | 232,795,168 | |

| FAR EAST — 13.58% | ||

| Japan — 10.80% | ||

| Asics Corp. | 202,600 | 4,491,540 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Azbil Corp. | 92,800 | $4,232,476 |

| Capcom Co. Ltd. | 48,000 | 1,130,465 |

| en Japan, Inc. | 43,100 | 1,218,026 |

| Fujitec Co. Ltd. | 78,850 | 1,728,175 |

| Koito Manufacturing Co. Ltd. | 55,600 | 2,944,801 |

| MINEBEA MITSUMI, Inc. | 85,454 | 2,428,059 |

| Nichias Corp. | 71,230 | 1,718,998 |

| Pola Orbis Holdings, Inc. | 75,500 | 1,258,268 |

| Riken Keiki Co. Ltd. | 40,600 | 2,073,537 |

| Shibaura Machine Co. Ltd. | 121,200 | 3,966,207 |

| Takeuchi Manufacturing Co. Ltd. | 151,000 | 3,582,196 |

| Tokai Carbon Co. Ltd. | 181,400 | 1,906,782 |

| Yokogawa Electric Corp. | 177,500 | 3,203,773 |

| 35,883,303 | ||

| Taiwan — 1.23% | ||

| Giant Manufacturing Co. Ltd. | 328,589 | 4,089,615 |

| Australia — 1.02% | ||

| NEXTDC Ltd. * | 364,002 | 3,387,171 |

| South Korea — 0.53% | ||

| ST Pharm Co. Ltd. * | 15,165 | 1,773,393 |

| Total FAR EAST (Cost $40,039,849) | 45,133,482 | |

| NORTH AMERICA — 12.62% | ||

| Canada — 12.18% | ||

| Altus Group Ltd. | 91,455 | 5,131,081 |

| Boardwalk REIT | 74,774 | 3,241,123 |

| Cameco Corp. | 69,000 | 1,504,423 |

| Converge Technology Solutions Corp. * | 551,888 | 4,742,498 |

| Docebo, Inc. * | 51,066 | 3,426,200 |

| Intertape Polymer Group, Inc. | 120,525 | 2,507,781 |

| K92 Mining, Inc. * | 396,854 | 2,255,726 |

| Kinaxis, Inc. * | 42,811 | 6,001,561 |

| Parkland Corp. | 76,023 | 2,089,663 |

| Pason Systems, Inc. | 200,100 | 1,825,490 |

| TELUS International CDA, Inc. 2,* | 144,410 | 4,774,195 |

| Tidewater Renewables Ltd. * | 84,414 | 982,311 |

| Xenon Pharmaceuticals, Inc. 2,* | 63,629 | 1,987,770 |

| 40,469,822 | ||

| Mexico — 0.44% | ||

| GCC SAB de CV | 190,986 | 1,466,755 |

| Total NORTH AMERICA (Cost $39,138,284) | 41,936,577 | |

| SOUTH AMERICA — 1.96% | ||

| Brazil — 1.96% | ||

| Cyrela Brazil Realty SA Empreendimentos e Participacoes | 499,400 | 1,408,654 |

| Embraer SA * | 724,800 | 3,237,270 |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Iochpe Maxion SA | 680,925 | $1,869,071 | |

| 6,514,995 | |||

| Total SOUTH AMERICA (Cost $6,880,535) | 6,514,995 | ||

| Total COMMON STOCKS (Cost $276,950,574) | 326,380,222 | ||

| SHORT TERM INVESTMENTS — 1.63% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 3 (Cost $5,404,309) | 5,404,309 | 5,404,309 | |

| TOTAL INVESTMENTS (Cost $282,354,883) | 99.84% | $331,784,531 | |

| Other Assets In Excess of Liabilities | 0.16% | 527,608 | |

| Net Assets | 100.00% | $332,312,139 | |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $34,249,674, which represents 10% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 98.21% | |

| Short Term Investments | 1.63% | |

| Total Investments | 99.84% | |

| Other Assets In Excess of Liabilities | 0.16% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Europe | 70.05% | |

| North America | 14.25% | |

| Far East | 13.58% | |

| South America | 1.96% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 1.86 | |

| Auto Components | 0.89 | |

| Banks | 2.53 | |

| Beverages | 1.68 | |

| Biotechnology | 2.09 | |

| Building Products | 1.56 | |

| Chemicals | 4.17 | |

| Commercial Services & Supplies | 2.99 | |

| Construction Materials | 1.19 | |

| Containers & Packaging | 0.75 | |

| Electrical Equipment | 1.22 | |

| Electronic Equipment, Instruments & Components | 2.86 | |

| Energy Equipment & Services | 0.55 | |

| Entertainment | 0.34 | |

| Food Products | 2.96 | |

| Health Care Equipment & Supplies | 3.47 | |

| Hotels, Restaurants & Leisure | 2.17 | |

| Household Durables | 1.43 | |

| Insurance | 2.51 | |

| Interactive Media & Services | 1.04 | |

| IT Services | 7.99 | |

| Leisure Products | 2.28 | |

| Life Sciences Tools & Services | 4.59 |

| Industry | Percent of Net Assets | |

| Machinery | 6.94 | |

| Media | 1.51 | |

| Metals & Mining | 1.17 | |

| Money Market Fund | 1.63 | |

| Multiline Retail | 2.47 | |

| Oil, Gas & Consumable Fuels | 2.58 | |

| Personal Products | 1.15 | |

| Pharmaceuticals | 1.87 | |

| Professional Services | 0.37 | |

| Real Estate Investment Trusts (REITs) | 3.11 | |

| Road & Rail | 0.75 | |

| Semiconductors & Semiconductor Equipment | 2.43 | |

| Software | 4.77 | |

| Specialty Retail | 7.48 | |

| Technology Hardware, Storage & Peripherals | 0.95 | |

| Textiles, Apparel & Luxury Goods | 2.67 | |

| Thrifts & Mortgage Finance | 1.64 | |

| Trading Companies & Distributors | 1.93 | |

| Transportation Infrastructure | 1.30 | |

| Other Assets In Excess of Liabilities | 0.16 | |

| TOTAL | 100.00 |

|  | |

| Jeff James Lead Portfolio Manager | Michael Buck Portfolio Manager | |

| ||

| Prakash Vijayan Assistant Portfolio Manager |

| Fund Only | Including Predecessor Limited Partnership | |||||

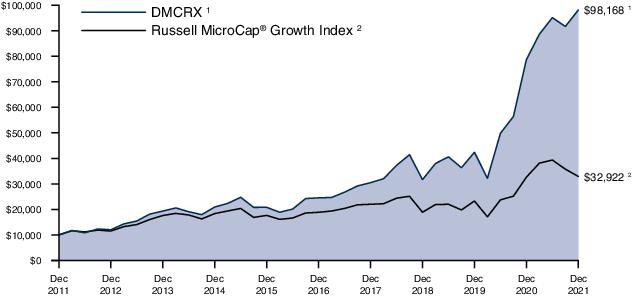

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | 5 Years | Since Inception (11/18/13 - 12/31/21) | 10 Years | |

| Driehaus Micro Cap Growth Fund (DMCRX)1 | 24.73% | 45.80% | 31.97% | 23.22% | 25.66% | |

| Russell Microcap® Growth Index2 | 0.88% | 20.36% | 11.78% | 8.93% | 12.65% | |

| 1 | The Driehaus Micro Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Micro Cap Fund, L.P. (the “Predecessor Limited Partnership”), one of the Fund’s predecessors, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on July 1, 1996, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets together with the assets of the Driehaus Institutional Micro Cap Fund, L.P. on November 18, 2013. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for periods prior to November 18, 2016, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Russell Microcap® Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes those Russell Microcap companies that are considered more growth oriented relative to the overall market as defined by FTSE Russell's leading style methodology. The Russell Microcap® Growth Index is constructed to provide a comprehensive and unbiased barometer for the microcap growth segment of the market. Data is calculated with net dividend reinvestment. Source: FTSE Russell. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 100.03% | ||

| HEALTH CARE — 28.03% | ||

| Biotechnology — 16.76% | ||

| Apellis Pharmaceuticals, Inc. * | 34,548 | $1,633,429 |

| Applied Therapeutics, Inc. * | 60,081 | 537,725 |

| Avid Bioservices, Inc. * | 148,889 | 4,344,581 |

| Bicycle Therapeutics PLC - ADR 1,* | 30,729 | 1,870,474 |

| Biomea Fusion, Inc. * | 54,546 | 406,368 |

| C4 Therapeutics, Inc. * | 47,401 | 1,526,312 |

| Celldex Therapeutics, Inc. * | 67,745 | 2,617,667 |

| Centessa Pharmaceuticals PLC - ADR 1,* | 66,215 | 745,581 |

| Crinetics Pharmaceuticals, Inc. * | 196,370 | 5,578,872 |

| Cytokinetics, Inc. * | 137,772 | 6,279,648 |

| Day One Biopharmaceuticals, Inc. * | 54,040 | 910,574 |

| Dynavax Technologies Corp. * | 63,541 | 894,022 |

| Elevation Oncology, Inc. * | 40,276 | 242,462 |

| Imago Biosciences, Inc. * | 47,547 | 1,127,339 |

| Intellia Therapeutics, Inc. * | 10,471 | 1,238,091 |

| IVERIC bio, Inc. * | 113,163 | 1,892,085 |

| Kymera Therapeutics, Inc. * | 29,146 | 1,850,480 |

| Merus NV 1,* | 95,587 | 3,039,667 |

| Morphic Holding, Inc. * | 28,281 | 1,339,954 |

| Natera, Inc. * | 18,382 | 1,716,695 |

| Nuvalent, Inc. - A * | 80,784 | 1,538,127 |

| ProQR Therapeutics NV 1,* | 223,726 | 1,792,045 |

| Relay Therapeutics, Inc. * | 152,821 | 4,693,133 |

| SpringWorks Therapeutics, Inc. * | 69,781 | 4,325,026 |

| VectivBio Holding AG 1,* | 56,642 | 278,112 |

| Xenon Pharmaceuticals, Inc. 1,* | 152,947 | 4,778,064 |

| 57,196,533 | ||

| Health Care Technology — 3.07% | ||

| EQRx, Inc. * | 172,879 | 1,179,035 |

| Inspire Medical Systems, Inc. * | 9,480 | 2,180,969 |

| OptimizeRx Corp. * | 57,014 | 3,541,139 |

| Phreesia, Inc. * | 46,968 | 1,956,687 |

| Sophia Genetics SA 1,* | 38,646 | 544,908 |

| Vocera Communications, Inc. * | 16,652 | 1,079,716 |

| 10,482,454 | ||

| Health Care Providers & Services — 2.66% | ||

| AirSculpt Technologies, Inc. * | 178,141 | 3,062,244 |

| Cross Country Healthcare, Inc. * | 168,035 | 4,664,652 |

| RadNet, Inc. * | 44,773 | 1,348,115 |

| 9,075,011 | ||

| Health Care Equipment & Supplies — 2.43% | ||

| Alphatec Holdings, Inc. * | 152,295 | 1,740,732 |

| CryoPort, Inc. * | 49,483 | 2,927,909 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| SeaSpine Holdings Corp. * | 117,514 | $1,600,541 |

| SI-BONE, Inc. * | 59,156 | 1,313,855 |

| Treace Medical Concepts, Inc. * | 39,105 | 728,917 |

| 8,311,954 | ||

| Life Sciences Tools & Services — 1.77% | ||

| Codexis, Inc. * | 125,657 | 3,929,294 |

| Inotiv, Inc. * | 50,228 | 2,113,092 |

| 6,042,386 | ||

| Pharmaceuticals — 1.34% | ||

| DICE Therapeutics, Inc. * | 80,299 | 2,032,367 |

| EyePoint Pharmaceuticals, Inc. * | 67,845 | 830,423 |

| Ventyx Biosciences, Inc. * | 85,801 | 1,704,008 |

| 4,566,798 | ||

| Total HEALTH CARE (Cost $72,097,557) | 95,675,136 | |

| INFORMATION TECHNOLOGY — 22.87% | ||

| Semiconductors & Semiconductor Equipment — 10.56% | ||

| Axcelis Technologies, Inc. * | 81,397 | 6,068,960 |

| Camtek Ltd. 1,* | 92,640 | 4,265,146 |

| Impinj, Inc. * | 89,420 | 7,931,554 |

| Silicon Motion Technology Corp. - ADR 1 | 35,353 | 3,359,596 |

| SiTime Corp. * | 17,410 | 5,093,121 |

| SMART Global Holdings, Inc. 1,* | 70,579 | 5,010,403 |

| Ultra Clean Holdings, Inc. * | 75,017 | 4,302,975 |

| 36,031,755 | ||

| Communications Equipment — 5.41% | ||

| Aviat Networks, Inc. * | 57,899 | 1,857,400 |

| Calix, Inc. * | 110,888 | 8,867,714 |

| Cambium Networks Corp. 1,* | 43,183 | 1,106,780 |

| Clearfield, Inc. * | 47,195 | 3,984,202 |

| Extreme Networks, Inc. * | 62,901 | 987,546 |

| Sierra Wireless, Inc. 1,* | 93,631 | 1,649,778 |

| 18,453,420 | ||

| IT Services — 4.41% | ||

| Backblaze, Inc. * | 52,218 | 881,962 |

| Endava PLC - SP ADR 1,* | 29,997 | 5,037,096 |

| Grid Dynamics Holdings, Inc. * | 240,837 | 9,144,581 |

| 15,063,639 | ||

| Software — 2.49% | ||

| ChannelAdvisor Corp. * | 187,621 | 4,630,486 |

| Docebo, Inc. 1,* | 57,307 | 3,860,200 |

| 8,490,686 | ||

| Total INFORMATION TECHNOLOGY (Cost $40,534,141) | 78,039,500 | |

| Shares, Principal Amount, or Number of Contracts | Value | |

| CONSUMER DISCRETIONARY — 19.11% | ||

| Hotels, Restaurants & Leisure — 6.58% | ||

| Everi Holdings, Inc. * | 215,656 | $4,604,256 |

| Full House Resorts, Inc. * | 221,184 | 2,678,538 |

| Golden Entertainment, Inc. * | 46,203 | 2,334,637 |

| Kura Sushi USA, Inc. - A * | 36,364 | 2,939,666 |

| Lindblad Expeditions Holdings, Inc. * | 81,516 | 1,271,650 |

| NEOGAMES SA 1,* | 19,100 | 530,598 |

| Playa Hotels & Resorts NV 1,* | 315,075 | 2,514,298 |

| Portillo's, Inc. - A * | 73,892 | 2,773,906 |

| Xponential Fitness, Inc. - A * | 137,779 | 2,816,203 |

| 22,463,752 | ||

| Specialty Retail — 3.69% | ||

| Arhaus, Inc. * | 155,676 | 2,062,707 |

| Boot Barn Holdings, Inc. * | 63,953 | 7,869,417 |

| Brilliant Earth Group, Inc. - A * | 146,793 | 2,651,081 |

| 12,583,205 | ||

| Household Durables — 3.23% | ||

| Green Brick Partners, Inc. * | 70,619 | 2,141,874 |

| Skyline Champion Corp. * | 74,923 | 5,917,419 |

| The Lovesac Co. * | 44,567 | 2,953,009 |

| 11,012,302 | ||

| Internet & Direct Marketing Retail — 2.48% | ||

| Liquidity Services, Inc. * | 87,983 | 1,942,665 |

| PubMatic, Inc. - A * | 79,201 | 2,696,794 |

| RumbleON, Inc. - B * | 43,343 | 1,799,601 |

| Xometry, Inc. - A * | 39,371 | 2,017,764 |

| 8,456,824 | ||

| Diversified Consumer Services — 1.32% | ||

| European Wax Center, Inc. - A * | 148,210 | 4,498,173 |

| Leisure Products — 0.99% | ||

| Solo Brands, Inc. - A * | 124,460 | 1,945,310 |

| Vista Outdoor, Inc. * | 31,547 | 1,453,370 |

| 3,398,680 | ||

| Textiles, Apparel & Luxury Goods — 0.53% | ||

| Movado Group, Inc. | 42,930 | 1,795,762 |

| Auto Components — 0.29% | ||

| XPEL, Inc. * | 14,703 | 1,003,921 |

| Total CONSUMER DISCRETIONARY (Cost $44,996,011) | 65,212,619 | |

| INDUSTRIALS — 9.39% | ||

| Machinery — 2.44% | ||

| Chart Industries, Inc. * | 10,305 | 1,643,545 |

| Energy Recovery, Inc. * | 108,260 | 2,326,507 |

| The Shyft Group, Inc. | 88,409 | 4,343,534 |

| 8,313,586 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| Commercial Services & Supplies — 2.01% | ||

| Li-Cycle Holdings Corp. 1,* | 157,710 | $1,570,792 |

| Montrose Environmental Group, Inc. * | 68,537 | 4,832,544 |

| Performant Financial Corp. * | 195,086 | 470,157 |

| 6,873,493 | ||

| Trading Companies & Distributors — 1.76% | ||

| BlueLinx Holdings, Inc. * | 25,434 | 2,435,560 |

| H&E Equipment Services, Inc. | 42,465 | 1,879,926 |

| Karat Packaging, Inc. * | 82,853 | 1,674,459 |

| 5,989,945 | ||

| Air Freight & Logistics — 1.36% | ||

| Air Transport Services Group, Inc. * | 34,308 | 1,007,969 |

| Forward Air Corp. | 30,124 | 3,647,715 |

| 4,655,684 | ||

| Construction & Engineering — 0.83% | ||

| NV5 Global, Inc. * | 20,604 | 2,845,824 |

| Electrical Equipment — 0.77% | ||

| Vicor Corp. * | 20,697 | 2,628,105 |

| Professional Services — 0.22% | ||

| HireRight Holdings Corp. * | 46,496 | 743,936 |

| Total INDUSTRIALS (Cost $20,373,599) | 32,050,573 | |

| FINANCIALS — 7.72% | ||

| Banks — 5.35% | ||

| Customers Bancorp, Inc. * | 42,797 | 2,797,640 |

| Live Oak Bancshares, Inc. | 55,517 | 4,846,079 |

| Metropolitan Bank Holding Corp. * | 36,450 | 3,883,018 |

| Silvergate Capital Corp. - A * | 14,583 | 2,161,201 |

| Triumph Bancorp, Inc. * | 38,473 | 4,581,365 |

| 18,269,303 | ||

| Thrifts & Mortgage Finance — 0.98% | ||

| Meta Financial Group, Inc. | 55,936 | 3,337,142 |

| Insurance — 0.87% | ||

| BRP Group, Inc. - A * | 82,082 | 2,963,981 |

| Capital Markets — 0.52% | ||

| Cowen, Inc. - A | 48,924 | 1,766,156 |

| Total FINANCIALS (Cost $11,839,076) | 26,336,582 | |

| CONSUMER STAPLES — 5.98% | ||

| Beverages — 2.94% | ||

| Celsius Holdings, Inc. * | 71,570 | 5,336,975 |

| MGP Ingredients, Inc. | 21,455 | 1,823,460 |

| The Duckhorn Portfolio, Inc. * | 124,121 | 2,896,984 |

| 10,057,419 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| Personal Products — 1.66% | ||

| The Beauty Health Co. * | 197,966 | $4,782,859 |

| Thorne HealthTech, Inc. * | 141,045 | 875,889 |

| 5,658,748 | ||

| Food Products — 1.38% | ||

| Sovos Brands, Inc. * | 192,850 | 2,902,393 |

| The Real Good Food Co., Inc. * | 101,295 | 634,107 |

| The Vita Coco Co., Inc. * | 104,455 | 1,166,762 |

| 4,703,262 | ||

| Total CONSUMER STAPLES (Cost $13,548,191) | 20,419,429 | |

| ENERGY — 4.98% | ||

| Oil, Gas & Consumable Fuels — 3.25% | ||

| Civitas Resources, Inc. | 39,092 | 1,914,335 |

| Energy Fuels, Inc. 1,* | 282,902 | 2,158,542 |

| Green Plains, Inc. * | 118,745 | 4,127,576 |

| Matador Resources Co. | 54,034 | 1,994,935 |

| Ranger Oil Corp. - A * | 33,370 | 898,321 |

| 11,093,709 | ||

| Energy Equipment & Services — 1.73% | ||

| Aspen Aerogels, Inc. * | 118,712 | 5,910,671 |

| Total ENERGY (Cost $9,961,032) | 17,004,380 | |

| COMMUNICATION SERVICES — 1.08% | ||

| Media — 1.04% | ||

| Perion Network Ltd. 1,* | 147,931 | 3,557,741 |

| Entertainment — 0.04% | ||

| Motorsport Games, Inc. - A * | 34,681 | 117,915 |

| Total COMMUNICATION SERVICES (Cost $2,775,230) | 3,675,656 | |

| MATERIALS — 0.87% | ||

| Containers & Packaging — 0.87% | ||

| Ranpak Holdings Corp. * | 78,968 | 2,967,617 |

| Total MATERIALS (Cost $1,664,740) | 2,967,617 | |

| Total COMMON STOCKS (Cost $217,789,577) | 341,381,492 | |

| WARRANTS — 0.01% | ||

| EQRx, Inc., Exp 12/31/2028, Strike $11.50 * | 34,575 | 35,958 |

| Total WARRANTS (Cost $0) | 35,958 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| SHORT TERM INVESTMENTS — 0.23% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 2 (Cost $762,764) | 762,764 | $762,764 | |

| TOTAL INVESTMENTS (Cost $218,552,341) | 100.27% | $342,180,214 | |

| Liabilities In Excess of Other Assets | (0.27)% | (910,963) | |

| Net Assets | 100.00% | $341,269,251 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 100.03% | |

| Warrants | 0.01% | |

| Short Term Investments | 0.23% | |

| Total Investments | 100.27% | |

| Liabilities In Excess of Other Assets | (0.27)% | |

| Net Assets | 100.00% |

| Industry | Percent of Net Assets | |

| Air Freight & Logistics | 1.36 | |

| Auto Components | 0.29 | |

| Banks | 5.35 | |

| Beverages | 2.94 | |

| Biotechnology | 16.76 | |

| Capital Markets | 0.52 | |

| Commercial Services & Supplies | 2.01 | |

| Communications Equipment | 5.41 | |

| Construction & Engineering | 0.83 | |

| Containers & Packaging | 0.87 | |

| Diversified Consumer Services | 1.32 | |

| Electrical Equipment | 0.77 | |

| Energy Equipment & Services | 1.73 | |

| Entertainment | 0.04 | |

| Food Products | 1.38 | |

| Health Care Equipment & Supplies | 2.43 | |

| Health Care Providers & Services | 2.66 | |

| Health Care Technology | 3.08 | |

| Hotels, Restaurants & Leisure | 6.58 | |

| Household Durables | 3.23 | |

| Insurance | 0.87 |

| Industry | Percent of Net Assets | |

| Internet & Direct Marketing Retail | 2.48 | |

| IT Services | 4.41 | |

| Leisure Products | 0.99 | |

| Life Sciences Tools & Services | 1.77 | |

| Machinery | 2.44 | |

| Media | 1.04 | |

| Money Market Fund | 0.23 | |

| Oil, Gas & Consumable Fuels | 3.25 | |

| Personal Products | 1.66 | |

| Pharmaceuticals | 1.34 | |

| Professional Services | 0.22 | |

| Semiconductors & Semiconductor Equipment | 10.56 | |

| Software | 2.49 | |

| Specialty Retail | 3.69 | |

| Textiles, Apparel & Luxury Goods | 0.53 | |

| Thrifts & Mortgage Finance | 0.98 | |

| Trading Companies & Distributors | 1.76 | |

| Liabilities In Excess of Other Assets | (0.27) | |

| TOTAL | 100.00 |

|  | |

| Jeff James Lead Portfolio Manager | Michael Buck Portfolio Manager | |

| ||

| Prakash Vijayan Assistant Portfolio Manager |

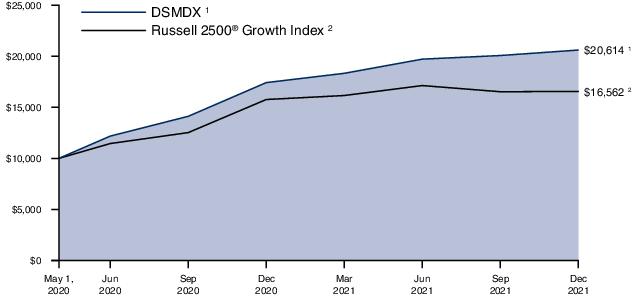

| Fund Only | Including Predecessor Limited Partnership | |||||

| Average Annual Total Returns as of 12/31/21 | 1 Year | 3 Years | Since Inception (8/21/17 - 12/31/21) | 5 Years | 10 Years | |

| Driehaus Small Cap Growth Fund Investor Class (DVSMX)1 | 21.12% | 40.64% | 32.34% | 30.30% | 22.34% | |

| Driehaus Small Cap Growth Fund Institutional Class (DNSMX)1 | 21.44% | 41.07% | 32.72% | 30.62% | 22.49% | |

| Russell 2000® Growth Index2 | 2.83% | 21.17% | 15.17% | 14.53% | 14.14% | |

| 1 | The Driehaus Small Cap Growth Fund (“the Fund”) performance shown above includes the performance of the Driehaus Institutional Small Cap, L.P. (the “Predecessor Partnership”), one of the Fund’s predecessors, for the periods before the Fund’s registration statement became effective. The Predecessor Partnership was managed by the same investment team with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Partnership’s assets together with the assets of the Driehaus Institutional Small Cap Recovery Fund, L.P., Driehaus Small Cap Recovery Fund, L.P. and Driehaus Small Cap Investors, L.P. (together, the “Limited Partnerships”) on August 21, 2017. The investment portfolios of the Limited Partnerships were identical and therefore had similar performance. The performance of the Predecessor Partnership is shown here because it has been in operation the longest. The Predecessor Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Partnership’s performance has not been restated to reflect estimated expenses applicable to each class of shares of the Fund. The returns reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Russell 2000® Growth Index measures the performance of the small cap growth segment of the US Equity universe. It includes those Russell 2000® companies with higher price-value ratio and higher forecasted growth values. The Russell 2000® Index is constructed to provide a comprehensive and unbiased barometer for the small cap growth segment of the market. Data is calculated with net dividend reinvestment. Source: FTSE Russell. |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 99.30% | ||

| INFORMATION TECHNOLOGY — 24.23% | ||

| Semiconductors & Semiconductor Equipment — 14.13% | ||

| Ambarella, Inc. * | 83,510 | $16,943,344 |

| Axcelis Technologies, Inc. * | 143,019 | 10,663,497 |

| Impinj, Inc. * | 62,476 | 5,541,621 |

| Lattice Semiconductor Corp. * | 136,391 | 10,510,290 |

| MaxLinear, Inc. * | 144,095 | 10,863,322 |

| Silicon Motion Technology Corp. - ADR 1 | 70,236 | 6,674,527 |

| SiTime Corp. * | 37,538 | 10,981,366 |

| Synaptics, Inc. * | 21,502 | 6,225,044 |

| Ultra Clean Holdings, Inc. * | 134,060 | 7,689,682 |

| 86,092,693 | ||

| Software — 4.32% | ||

| ChannelAdvisor Corp. * | 172,750 | 4,263,470 |

| CyberArk Software Ltd. 1,* | 17,908 | 3,103,098 |

| Docebo, Inc. 1,* | 98,357 | 6,625,328 |

| Monday.com Ltd. 1,* | 15,783 | 4,872,528 |

| Zscaler, Inc. * | 23,216 | 7,459,997 |

| 26,324,421 | ||

| IT Services — 3.59% | ||

| DigitalOcean Holdings, Inc. * | 33,017 | 2,652,256 |

| Endava PLC - SP ADR 1,* | 64,479 | 10,827,314 |

| Grid Dynamics Holdings, Inc. * | 221,221 | 8,399,761 |

| 21,879,331 | ||

| Communications Equipment — 2.19% | ||

| Calix, Inc. * | 166,833 | 13,341,635 |

| Total INFORMATION TECHNOLOGY (Cost $92,758,780) | 147,638,080 | |

| HEALTH CARE — 20.49% | ||

| Biotechnology — 12.15% | ||

| Beam Therapeutics, Inc. * | 26,576 | 2,117,841 |

| Biohaven Pharmaceutical Holding Co. Ltd. * | 23,216 | 3,199,397 |

| Blueprint Medicines Corp. * | 47,405 | 5,077,550 |

| Centessa Pharmaceuticals PLC - ADR * | 120,758 | 1,359,735 |

| Crinetics Pharmaceuticals, Inc. * | 193,737 | 5,504,068 |

| Cytokinetics, Inc. * | 225,162 | 10,262,884 |

| Halozyme Therapeutics, Inc. * | 83,342 | 3,351,182 |

| Intellia Therapeutics, Inc. * | 23,955 | 2,832,439 |

| Invitae Corp. * | 108,439 | 1,655,863 |

| Kymera Therapeutics, Inc. * | 49,689 | 3,154,755 |

| Merus NV 1,* | 78,117 | 2,484,121 |

| Mirati Therapeutics, Inc. * | 25,584 | 3,752,917 |

| Morphic Holding, Inc. * | 54,444 | 2,579,557 |

| Natera, Inc. * | 33,260 | 3,106,151 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Nuvalent, Inc. - A * | 117,622 | $2,239,523 |

| Relay Therapeutics, Inc. * | 284,016 | 8,722,131 |

| SpringWorks Therapeutics, Inc. * | 132,544 | 8,215,077 |

| Xenon Pharmaceuticals, Inc. 1,* | 141,970 | 4,435,143 |

| 74,050,334 | ||

| Life Sciences Tools & Services — 2.82% | ||

| Codexis, Inc. * | 75,562 | 2,362,824 |

| Medpace Holdings, Inc. * | 49,399 | 10,751,198 |

| Repligen Corp. * | 15,436 | 4,088,070 |

| 17,202,092 | ||

| Health Care Equipment & Supplies — 1.79% | ||

| AtriCure, Inc. * | 44,007 | 3,059,807 |

| Inmode Ltd. 1,* | 40,777 | 2,878,041 |

| Shockwave Medical, Inc. * | 27,868 | 4,969,700 |

| 10,907,548 | ||

| Health Care Providers & Services — 1.71% | ||

| AMN Healthcare Services, Inc. * | 84,886 | 10,384,105 |

| Health Care Technology — 1.48% | ||

| Inspire Medical Systems, Inc. * | 28,682 | 6,598,581 |

| OptimizeRx Corp. * | 38,512 | 2,391,980 |

| 8,990,561 | ||

| Pharmaceuticals — 0.54% | ||

| DICE Therapeutics, Inc. * | 130,512 | 3,303,259 |

| Total HEALTH CARE (Cost $102,814,045) | 124,837,899 | |

| INDUSTRIALS — 18.83% | ||

| Machinery — 4.09% | ||

| Chart Industries, Inc. * | 17,683 | 2,820,261 |

| Evoqua Water Technologies Corp. * | 143,253 | 6,697,078 |

| Kornit Digital Ltd. 1,* | 61,165 | 9,312,371 |

| The Shyft Group, Inc. | 123,960 | 6,090,155 |

| 24,919,865 | ||

| Electrical Equipment — 3.81% | ||

| Atkore, Inc. * | 58,657 | 6,522,072 |

| Fluence Energy, Inc. * | 101,793 | 3,619,759 |

| Generac Holdings, Inc. * | 7,133 | 2,510,245 |

| Vicor Corp. * | 83,361 | 10,585,180 |

| 23,237,256 | ||

| Professional Services — 2.75% | ||

| Exponent, Inc. | 51,346 | 5,993,618 |

| KBR, Inc. | 132,506 | 6,309,936 |

| Korn Ferry | 58,338 | 4,417,937 |

| 16,721,491 | ||

| Construction & Engineering — 1.92% | ||

| Ameresco, Inc. - A * | 53,358 | 4,345,476 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| WillScot Mobile Mini Holdings Corp. * | 180,604 | $7,375,867 |

| 11,721,343 | ||

| Trading Companies & Distributors — 1.72% | ||

| Core & Main, Inc. - A * | 206,515 | 6,265,665 |

| Herc Holdings, Inc. | 26,866 | 4,205,872 |

| 10,471,537 | ||

| Commercial Services & Supplies — 1.48% | ||

| Montrose Environmental Group, Inc. * | 56,373 | 3,974,860 |

| Tetra Tech, Inc. | 29,750 | 5,051,550 |

| 9,026,410 | ||

| Road & Rail — 1.43% | ||

| Saia, Inc. * | 25,855 | 8,713,911 |

| Building Products — 0.63% | ||

| Armstrong World Industries, Inc. | 33,054 | 3,838,231 |

| Aerospace & Defense — 0.61% | ||

| Axon Enterprise, Inc. * | 23,655 | 3,713,835 |

| Air Freight & Logistics — 0.39% | ||

| Forward Air Corp. | 19,509 | 2,362,345 |

| Total INDUSTRIALS (Cost $86,115,848) | 114,726,224 | |

| CONSUMER DISCRETIONARY — 15.28% | ||

| Household Durables — 4.13% | ||

| Century Communities, Inc. | 88,004 | 7,197,847 |

| Installed Building Products, Inc. | 47,180 | 6,591,990 |

| Skyline Champion Corp. * | 143,683 | 11,348,083 |

| 25,137,920 | ||

| Hotels, Restaurants & Leisure — 3.32% | ||

| Dutch Bros, Inc. - A * | 59,986 | 3,053,887 |

| Everi Holdings, Inc. * | 114,028 | 2,434,498 |

| Krispy Kreme, Inc. | 181,745 | 3,438,615 |

| Papa John's International, Inc. | 36,695 | 4,897,682 |

| SeaWorld Entertainment, Inc. * | 98,816 | 6,409,206 |

| 20,233,888 | ||

| Specialty Retail — 2.42% | ||

| Boot Barn Holdings, Inc. * | 97,636 | 12,014,110 |

| National Vision Holdings, Inc. * | 56,934 | 2,732,262 |

| 14,746,372 | ||

| Leisure Products — 2.11% | ||

| Callaway Golf Co. * | 84,877 | 2,329,025 |

| Hayward Holdings, Inc. * | 245,186 | 6,431,229 |

| Latham Group, Inc. * | 163,978 | 4,104,369 |

| 12,864,623 | ||

| Auto Components — 1.44% | ||

| Fox Factory Holding Corp. * | 21,016 | 3,574,821 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Gentherm, Inc. * | 60,080 | $5,220,952 |

| 8,795,773 | ||

| Textiles, Apparel & Luxury Goods — 1.26% | ||

| Crocs, Inc. * | 59,930 | 7,684,225 |

| Internet & Direct Marketing Retail — 0.60% | ||

| Revolve Group, Inc. * | 65,472 | 3,669,051 |

| Total CONSUMER DISCRETIONARY (Cost $74,741,750) | 93,131,852 | |

| FINANCIALS — 7.91% | ||

| Banks — 5.05% | ||

| Customers Bancorp, Inc. * | 76,705 | 5,014,206 |

| Live Oak Bancshares, Inc. | 88,968 | 7,766,017 |

| Silvergate Capital Corp. - A * | 36,349 | 5,386,922 |

| The Bancorp, Inc. * | 103,047 | 2,608,120 |

| Triumph Bancorp, Inc. * | 83,969 | 9,999,028 |

| 30,774,293 | ||

| Insurance — 1.49% | ||

| BRP Group, Inc. - A * | 95,352 | 3,443,161 |

| Kinsale Capital Group, Inc. | 23,649 | 5,625,860 |

| 9,069,021 | ||

| Capital Markets — 1.37% | ||

| CI Financial Corp. 1 | 224,086 | 4,683,397 |

| StepStone Group, Inc. - A | 88,977 | 3,698,774 |

| 8,382,171 | ||

| Total FINANCIALS (Cost $40,144,951) | 48,225,485 | |

| CONSUMER STAPLES — 3.94% | ||

| Beverages — 2.81% | ||

| Celsius Holdings, Inc. * | 147,241 | 10,979,761 |

| The Duckhorn Portfolio, Inc. * | 264,357 | 6,170,093 |

| 17,149,854 | ||

| Personal Products — 1.13% | ||

| The Beauty Health Co. * | 284,156 | 6,865,209 |

| Total CONSUMER STAPLES (Cost $19,521,553) | 24,015,063 | |

| ENERGY — 3.59% | ||

| Oil, Gas & Consumable Fuels — 2.78% | ||

| Cameco Corp. 1 | 200,898 | 4,381,585 |

| Green Plains, Inc. * | 75,104 | 2,610,615 |

| Magnolia Oil & Gas Corp. - A | 302,682 | 5,711,609 |

| Matador Resources Co. | 114,018 | 4,209,545 |

| 16,913,354 | ||

| Energy Equipment & Services — 0.81% | ||

| Aspen Aerogels, Inc. * | 99,106 | 4,934,488 |

| Total ENERGY (Cost $19,311,436) | 21,847,842 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| MATERIALS — 3.44% | |||

| Metals & Mining — 1.44% | |||

| MP Materials Corp. * | 192,408 | $8,739,171 | |

| Chemicals — 1.06% | |||

| Livent Corp. * | 265,715 | 6,478,132 | |

| Construction Materials — 0.94% | |||

| Summit Materials, Inc. - A * | 142,944 | 5,737,772 | |

| Total MATERIALS (Cost $16,964,527) | 20,955,075 | ||

| COMMUNICATION SERVICES — 1.59% | |||

| Interactive Media & Services — 1.59% | |||

| Cargurus, Inc. * | 118,708 | 3,993,337 | |

| ZipRecruiter, Inc. - A * | 227,905 | 5,683,951 | |

| 9,677,288 | |||

| Total COMMUNICATION SERVICES (Cost $10,536,924) | 9,677,288 | ||

| Total COMMON STOCKS (Cost $462,909,814) | 605,054,808 | ||

| SHORT TERM INVESTMENTS — 0.64% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 0.01% 2 (Cost $3,893,758) | 3,893,758 | 3,893,758 | |

| TOTAL INVESTMENTS (Cost $466,803,572) | 99.94% | $608,948,566 | |

| Other Assets In Excess of Liabilities | 0.06% | 363,075 | |

| Net Assets | 100.00% | $609,311,641 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | 7 day current yield as of December 31, 2021 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 99.30% | |

| Short Term Investments | 0.64% | |

| Total Investments | 99.94% | |

| Other Assets In Excess of Liabilities | 0.06% | |

| Net Assets | 100.00% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 0.61 | |

| Air Freight & Logistics | 0.39 | |

| Auto Components | 1.44 | |

| Banks | 5.05 | |

| Beverages | 2.81 | |

| Biotechnology | 12.15 | |

| Building Products | 0.63 | |

| Capital Markets | 1.37 | |

| Chemicals | 1.06 | |

| Commercial Services & Supplies | 1.48 | |

| Communications Equipment | 2.19 | |

| Construction & Engineering | 1.92 | |

| Construction Materials | 0.94 | |

| Electrical Equipment | 3.81 | |

| Energy Equipment & Services | 0.81 | |

| Health Care Equipment & Supplies | 1.79 | |

| Health Care Providers & Services | 1.71 | |

| Health Care Technology | 1.48 | |

| Hotels, Restaurants & Leisure | 3.32 | |

| Household Durables | 4.13 | |

| Insurance | 1.49 |

| Industry | Percent of Net Assets | |

| Interactive Media & Services | 1.59 | |

| Internet & Direct Marketing Retail | 0.60 | |

| IT Services | 3.59 | |

| Leisure Products | 2.11 | |

| Life Sciences Tools & Services | 2.82 | |

| Machinery | 4.09 | |

| Metals & Mining | 1.44 | |

| Money Market Fund | 0.64 | |

| Oil, Gas & Consumable Fuels | 2.78 | |

| Personal Products | 1.13 | |

| Pharmaceuticals | 0.54 | |

| Professional Services | 2.75 | |

| Road & Rail | 1.43 | |

| Semiconductors & Semiconductor Equipment | 14.13 | |

| Software | 4.32 | |

| Specialty Retail | 2.42 | |

| Textiles, Apparel & Luxury Goods | 1.26 | |