2003 Annual Report

Cumberland Resources Ltd.

Cumberland Resources Ltd. is a mineral exploration and development company with interests in two advanced stage gold projects located in Nunavut, Canada. Cumberland is positioning itself to become a mid-tier North American gold producer by advancing development of the Meadowbank gold project towards production. The shares of Cumberland are traded on the Toronto Stock Exchange and the American Stock Exchange under the symbol CLG.

This document contains certain forward looking statements which involve known and unknown risks, delays and uncertainties not under the Company’s control which may cause actual results, performance or achievements of the Company to be materially different from the results, performance or expectations implied by these forward looking statements.

2003 Highlights

Meadowbank Gold Project Achievements

Accelerated all efforts to advance feasibility study

Completed an $11.2 million work program

Drilled 21,000 metres in an additional 230 holes

Increased Canada’s third largest undeveloped gold resource

Improved the definition and quality of the closely-spaced, near surface gold deposits

Identified new exploration targets

Advanced mine development permitting

Completed multi-disciplinary engineering studies for mine designs

Extended feasibility study in order to optimize preliminary capital cost estimates, mine configuration and throughput rate

Initiated a $4.7 million exploration program in early 2004

Corporate Activities

Raised $34 million through equity financings

Ended 2003 with $45.8 million in working capital and no debt

Commenced trading shares on the American Stock Exchange

Opened Baker Lake community office

Appointed Kerry Curtis as President and CEO; Michael Carroll as CFO

2004 Goals

Complete the Meadowbank feasibility study

Expand gold resources at Meadowbank

Complete environmental impact study and development permitting process at Meadowbank

Advancement, by the Operator, of the Meliadine West gold project

Message to Shareholders

In 2003, the Company accelerated all efforts at our 100% owned Meadowbank gold project located in Nunavut, Canada, with the goal of becoming a new mid-tier gold producer. We focused onimproving the fundamentals of the project and positioning ourselves to complete feasibility and develop the project:

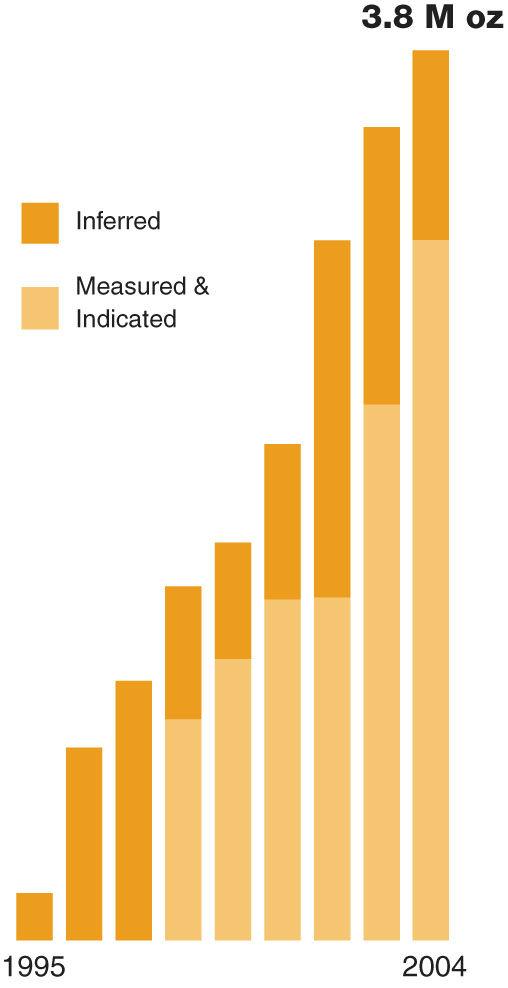

Resources continued to grow with substantial improvements in definition achieved in 2003. As a result over 230 new drill holes, we have now outlined the third largest, best defined undeveloped gold project in Canada and have prepared the resource for development. The growth of Meadowbank from the initial 200,000 ounces gold outlined in 1995 to the present estimates of 3.8 million ounces gold is a solid success story for our exploration group. Today, the same team is out to find more gold with a $4.7 million program designed to expand known deposits, explore new prospects and continue generative exploration across the large untested reaches of the project.

The environment surrounding the project received extensive study in 2003 as we completed the comprehensive environmental studies required for feasibility level designs and development permitting. As a result, we have the basis to design a modern mining facility while minimizing the potential impacts from development and operation. In January 2004, we successfully completed environmental screening and entered the full review process with the Nunavut Impact Review Board. The next stage of permitting requires us to submit an Environmental Impact Statement (EIS), which is being now being prepared.

Communitysupportfrom the Hamlet of Baker Lake will continue to play an integral role in the success of Meadowbank. In 2003, we established a community office in Baker Lake to provide a mining resource centre for the community and continue to learn about issues of concern to Baker Lake residents. Back in 1995, we committed to maximize the benefits of our activities to the local community through employment opportunities, training, business development and support for a wide variety of local enterprises. Today, we are fortunate to have a locally based, skilled exploration workforce and a community that is informed and supportive of development.

Engineeringstudies were accelerated throughout 2003. We achieved improved forecasted gold recoveries and simplified our planned ore processing techniques. Larger preliminary open pit designs also introduced the potential for extended mine life and higher rates of throughput. In late 2003 and into 2004 the engineering team assembled over 50 different studies, ranging from geotechnical and environmental analysis to archeology and traditional knowledge, to commence the mine design process.

Our financial strength also improved in 2003. We welcomed Michael L. Carroll, C.P.A., as Chief Financial Officer of Cumberland in mid 2003. Mike has quickly established himself as a key member of our executive team, bringing more than 20 years of financial management experience in the mining sector, mst recently as Vice President and Treasurer of Homestake Mining Company. With the successes achieved at Meadowbank in 2003, coupled with a strong gold market and a $34 million equity placement, Cumberland ended the year in a solid financial position with $45.8 million in working capital and no debt.

After several years of inactivity, we were please to see drilling efforts re-commenced at the Meliadine West gold project in Nunavut. Plans for 2004 programs, including additional drilling, are currently being finalized by the Operator.

In March 2004, the Company announced that the Meadowbank feasibility study would not be completed by the end of the first quarter of 2004 as originally planned and that due to seasonal constraints in shipping such delay would result in a one year setback to the planned development of the project. In addition, the Company announced an increase in its preliminary capital cost estimates for the Meadowbank project due to higher than anticipated costs for almost all items required for construction.

A management committee, chaired by Co-Chairman Walter Segsworth, has commenced a thorough review of all aspects of the preliminary estimate of capital costs and work is progressing on a wide range of mine configurations and alternative throughput variations with a view to finding the most economically attractive parameters for developing a mine at Meadowbank. The large open pit resources at Meadowbank provide us with additional flexibility and a wide range of production alternatives.

Our experience tells us that Meadowbank, like most mining projects, requires continued hard work to realize the best alternatives for making it a successful mining operation. Across 2003, we assembled a team of geologists, engineers and financial specialists with the goal of realizing gold production for our Company. While the delay is disappointing, the fundamentals haven’t changed. A combination of a solid financial position, one of Canada’s largest and best defined gold resources and a skilled team of professionals will guide us through the challenges ahead to production.

I would like to thank the Board, management and staff for their extraordinary efforts and determination through 2003 and into 2004.

/s/ Kerry M. Curtis

Kerry M. Curtis

President and Chief Executive Officer

Meadowbank Gold Project

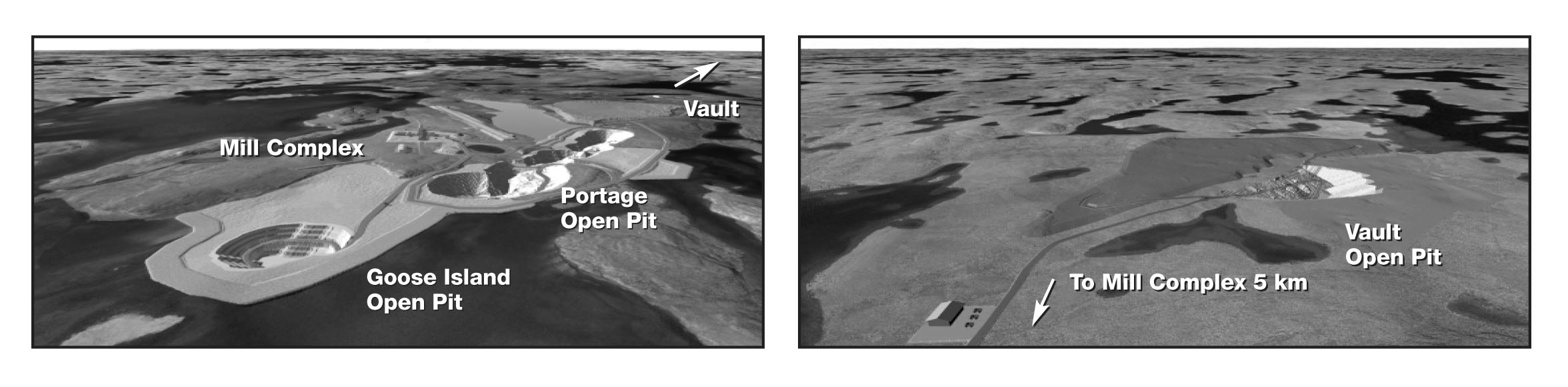

Cumberland’s most significant asset is the 100% owned Meadowbank gold project located 70 kilometres north of the Hamlet of Baker Lake, in the Kivalliq region of Nunavut.

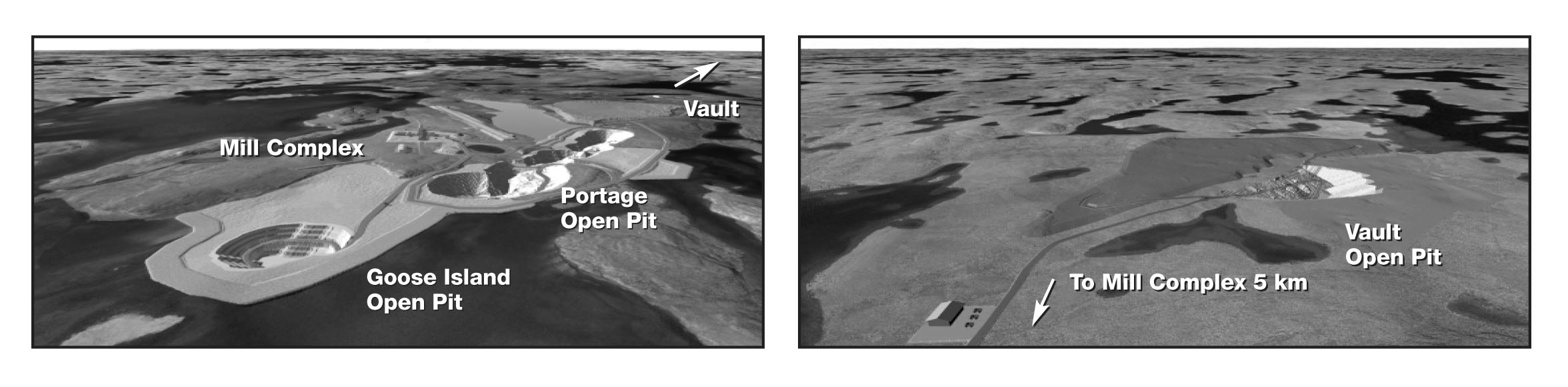

In 2003, Cumberland continued to evaluate the feasibility of developing an open pit gold mine with a forecast production rate of approximately 250,000 ounces per year for over eight years. The Company completed an $11.2 million work program focused on improving annual gold production and extending the mine life. Throughout the year significant advancements were made in resource definition, discovery of new exploration targets and in multi-disciplinary studies required for feasibility designs and development permitting. Completion of the feasibility study was delayed in early 2004 due to higher than expected preliminary construction cost estimates. Initiatives to optimize capital costs and gold production in order to complete the feasibility study at Meadowbank are underway.

Resources – Increased Size and Improved Quality

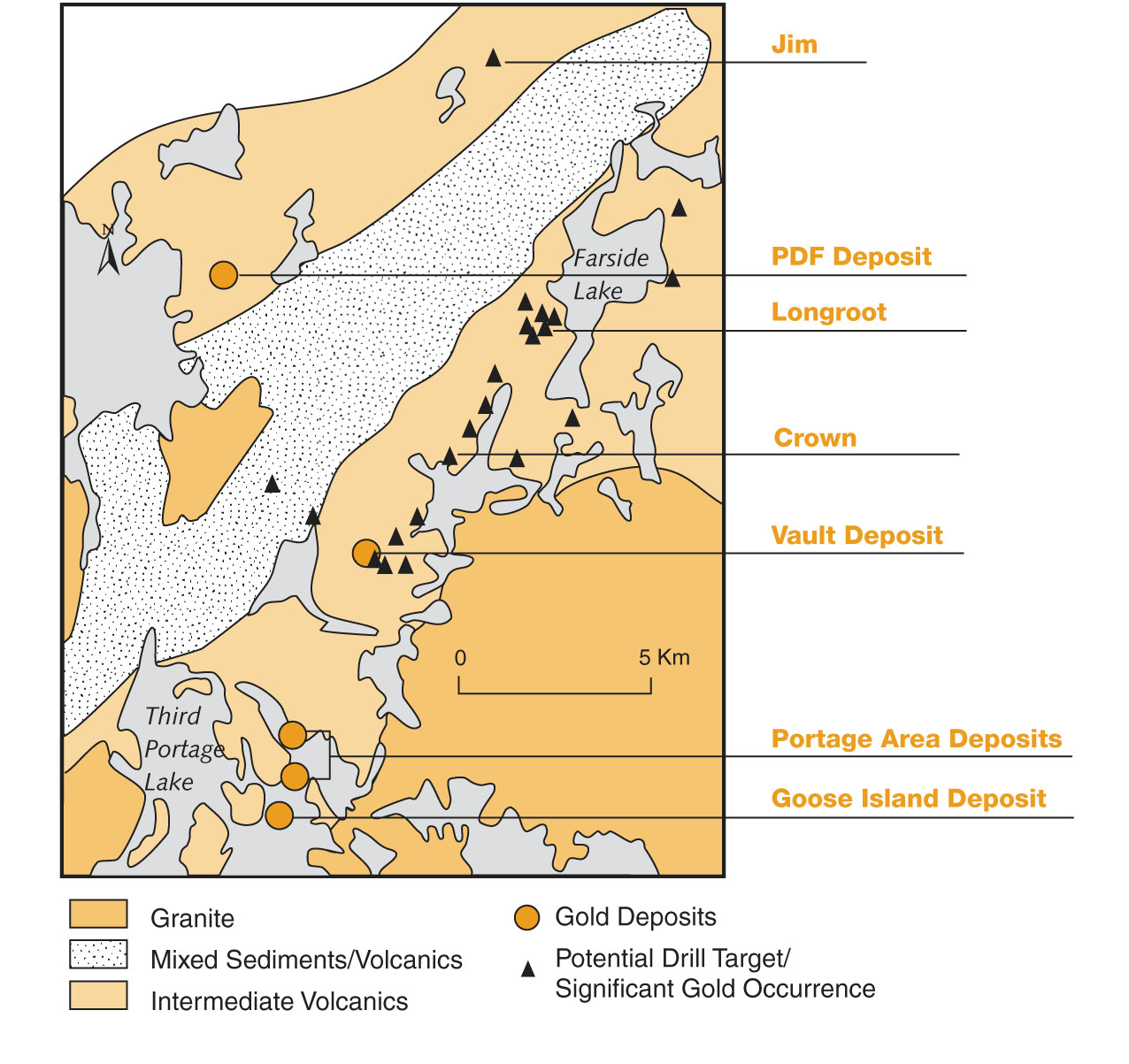

Meadowbank is host to the third largest undeveloped gold resource in Canada. Cumberland has discovered six closely-spaced, near surface gold deposits and continues to explore along a 25 kilometre long gold trend.

Growing Gold Resources

(ounces of gold)

Gold resources increased 20% from first quarter 2003

Current gold resources (first quarter 2004) are estimated at 3.0 million ounces of measured and indicated resources and 0.8 million ounces of inferred resources.

Diamond drilling improved deposit definition

•

230 diamond drill holes in 21,000 metres

•

Measured and indicated resources increased 50% from first quarter 2003

•

Improved resource definition at Portage area deposits and Vault deposit

Overburden drilling outlined additional exploration targets

•

381 short holes in 1,500 metres

•

Numerous exploration targets detected north of Vault deposit

Engineering

Advancements were made in all multi-disciplinary studies required for feasibility level designs and mine development permitting at Meadowbank.

Improved open pit mine plans

•

Preliminary open pit designs expanded

•

Underground mining plans potentially deferred or eliminated

Simplified mill processing designs

•

Mill processing plant simplified to conventional ore processing designs

•

Projected mill throughput increased to 5,500 tonnes per day

•

Improved recoveries indicated by metallurgical testing

Proven water containment technique

•

Dyke placement in shallow lakes

•

Utilization of waste rock

Geotechnical and geochemical studies

•

Competent, low-permeable rock

•

Shallow overburden

•

Subaerial waste storage

Studies undertaken to optimize preliminary capital cost estimates, mine configuration and throughput rate

In March 2004, the Company announced that the Meadowbank feasibility study would not be completed by the end of the first quarter of 2004 as originally planned and that due to seasonal constraints in shipping such delay would result in a one year setback to the planned development of the project. In addition, the Company announced an increase in its preliminary capital cost estimates for the Meadowbank project due to higher than anticipated costs for almost all items required for construction.

A management committee, chaired by Co-Chairman Walter Segsworth, has commenced a thorough review of all aspects of the preliminary estimate of capital costs and work is progressing on a wide range of mine configurations and alternative throughput variations with a view to finding the most economically attractive parameters for developing a mine at Meadowbank. The large open pit resources at Meadowbank provide us with additional flexibility and a wide range of production alternatives.

Meadowbank Preliminary Mine Designs

Environment and Development Permitting

Cumberland submitted a Project Description Report, summarizing the potential impacts of development at Meadowbank, to the Nunavut Impact Review Board (NIRB) in April 2003. In early 2004, the Department of Indian Affairs and Northern Development (DIAND) approved a recommendation made by NIRB for the Meadowbank project to enter the formal project review process for mine development. The permitting process will now advance from the project screening process to a “Part 5” NIRB review within the context of the Nunavut Land Claims Agreement. The next stage of the permitting process requires Cumberland to submit an Environmental Impact Statement (EIS) to NIRB.

A Prolific Greenstone Belt

Geology Plan with Deposits and Targets

Exploration

2004 exploration focuses on continued resource growth

A $4.7 million exploration program is underway, which includes two phases of diamond drilling totaling approximately 12,000 metres. The program focuses on the expansion of existing gold deposits, new exploration targets and continued grassroots exploration within the 25 kilometre long gold trend at Meadowbank.

2004 Exploration Targets

Goose Island Deposit Expansion

A series of drill holes will test the extension of the Goose Island deposit at depth. In1997 and 1998, high grade intersections were yielded well below the current preliminary open pit designs.

Vault Deposit – Northeast Expansion

The shallow northeast margin of the Vault deposit will be drilled for expansion potential. This area of the deposit returned near surface, high grade intersections in wide-spaced 2002 drilling, including:

Hole 02-52:

8.23 g/t over 2.45 m at 100 m below surface

Hole 02-56:

12.74 g/t over 3.65 m at 60 m below surface

Vault Deposit – Expansion to the South

Overburden drill programs in 2002 detected anomalous gold in rock and soils located 400 metres south of the known margin of the Vault deposit. Subsequent drilling in 2003 yielded shallow intersections and similar geology to that seen at Vault. Drill hole VLT03-135 intersected 2.84 g/t over 3.10 m at 13 metres below surface.

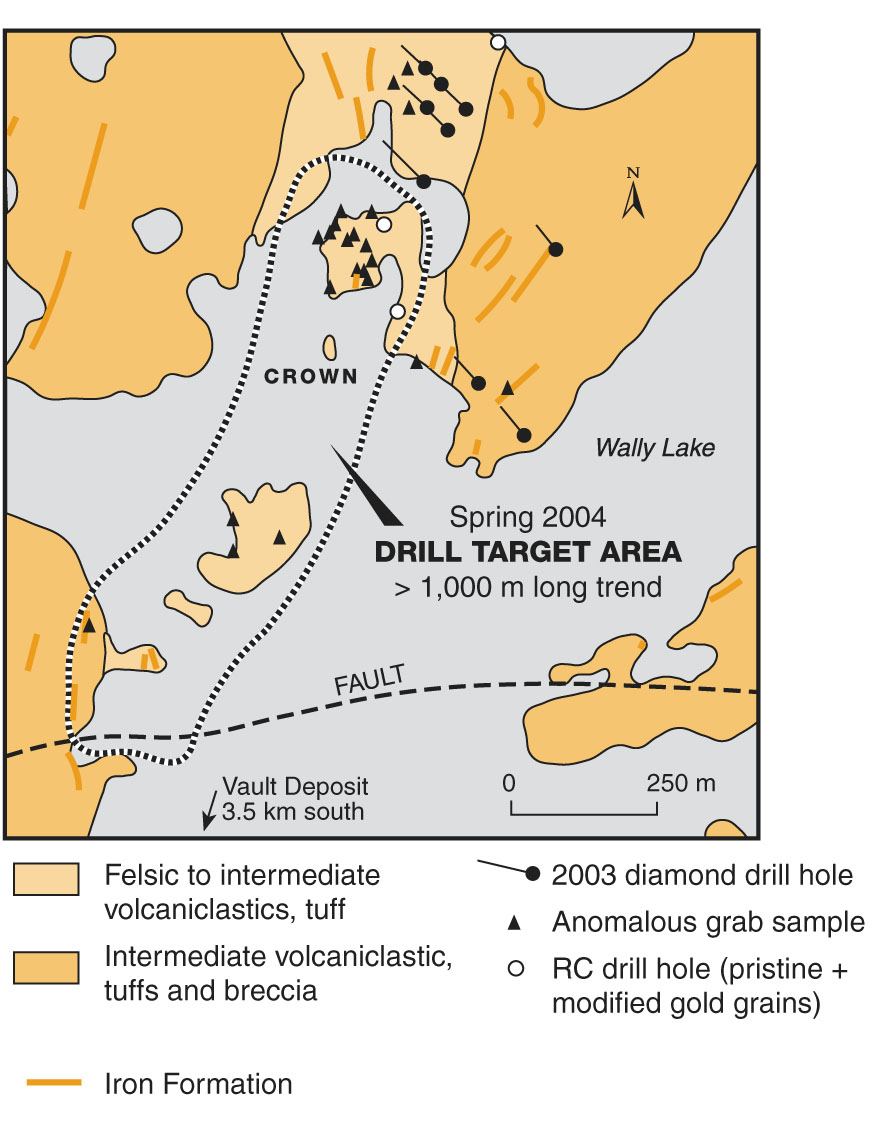

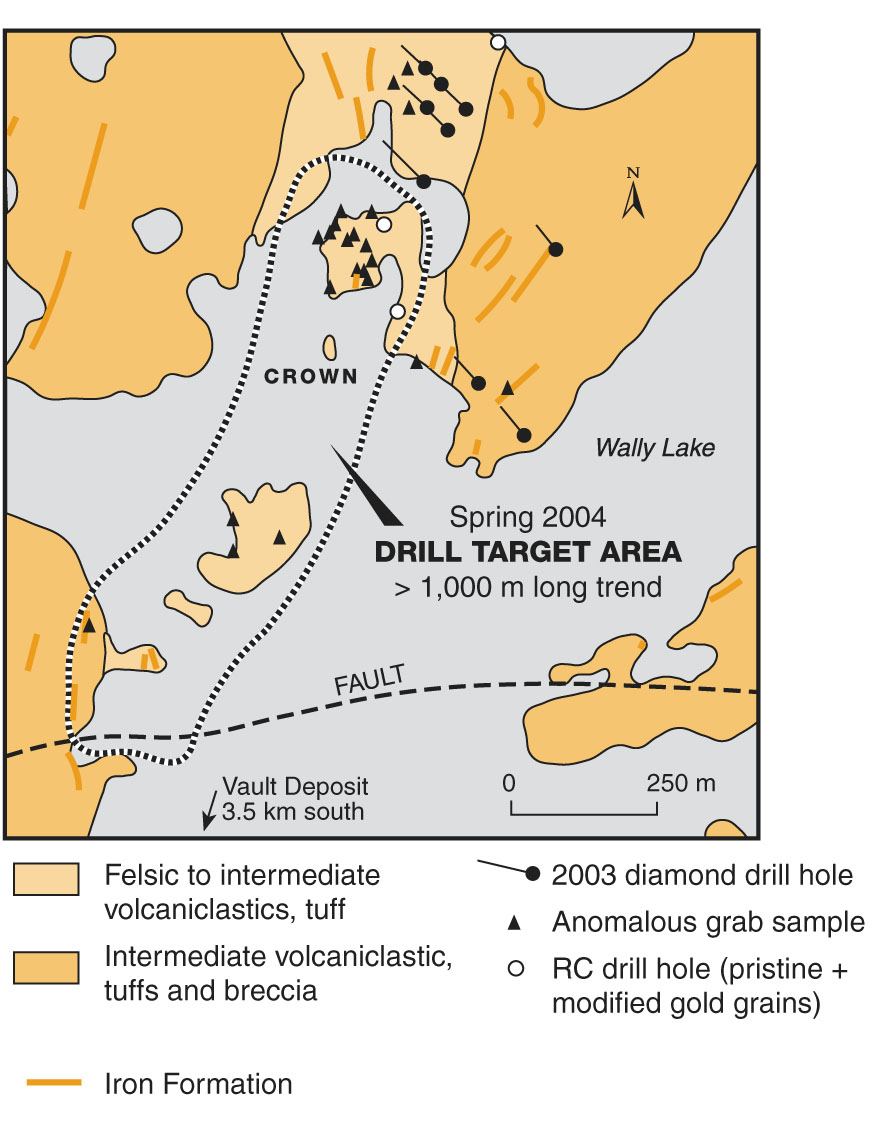

Crown Area

The Crown area, identified in 2003, is a prospective target located 3.5 kilometres north of the Vault deposit. Mineralization occurs in both outcrop and float, and is similar to that seen at the Vault deposit. Eleven grab samples taken from two islands in Wally Lake assayed between 1.33 g/t and 13.45 g/t.

Other Targets along Regional Gold Trend

The Phase II drill program will focus on additional targets along the regional gold trend including the potential expansion of the PDF deposit and exploration of the Jim zone and Longroot area.

Crown - - New Surface Exploration Target Goose Island Deposit - Potential Underground Expansion

Surface Plan Longitudinal Section

Community

Community commitment began in 1995

Cumberland started extensive consultation with the local community when the Company began exploration at Meadowbank in 1995. Since then, Cumberland has spent approximately $7 million (over 20% of total Meadowbank expenditures) supporting local employment and services in Baker Lake and the Kivalliq region, including about $2 million expended in 2003. During the 2003 field season, Cumberland was one of the largest private employers in Baker Lake, employing 36 individuals from the local and surrounding communities.

Sensitive to the needs of the local community

In January 2004, Cumberland opened a Baker Lake community office, with local resident Michael Haqpi appointed as the Community Liaison Officer. Through the development of this office, the Company will provide a mining resource centre for the community and continue to learn about issues of concern to the local community.

Nunavut is supportive of responsible development

Nunavut Territory is the first province or territory in Canada to fully settle First Nations land claims and the Government of Nunavut fully supports the responsible development of its mineral resources.

Meliadine Projects

The Meliadine projects cover more than 70 kilometres of the highly prospective Meliadine gold trend located 20 kiilometres north of Rankin Inlet, Nunavut. The Meliadine project is divided into two projects – Meliadine West and Meliadine East.

Meliadine West Project

Cumberland holds a 22% (carried to production) interest in the Meliadine West project. In October 2003, Comaplex Minerals Corp. announced it had closed a transaction whereby it had acquired WMC Resources Ltd.’s wholly-owned Canadian subsidiary, WMC International Ltd. (WMCIL). Comaplex, directly and indirectly through WMCIL, now holds, subject to its obligations to Cumberland, the right to perfect a 78% interest in Meliadine West by financing 100% of the property to commercial production.

A $2.1 million 2003 work program, including 5,400 metres in 19 drill holes, was completed and fully funded by WMCIL on the Meliadine West property. In the first quarter of 2004, Comaplex announced details of the 2004 exploration plans are being finalized.

Meliadine East Project

A $625,000 2003 work program, shared on a 50/50 joint venture basis with partner Comaplex Minerals Corp., was completed at the Meliadine East project. The 2003 drilling intersected numerous kimberlite bodies, however, analysis of drill core returned insignificant diamond contents. No work is planned in 2004.

Gold Resources

Meadowbank Gold Project (100% interest)*

Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces | Cumberland Contained Ounces |

Portage Area (1.5 g/t cutoff) | Measured & Indicated Inferred | 11,818,000 774,000 | 4.6 4.3 | 1,742,000 107,000 | |

| | | | | | |

Vault (2.0 g/t cutoff) | Measured & Indicated Inferred | 7,944,000 2,513,000 | 3.6 3.8 | 919,000 307,000 | |

| | | | | | |

Goose Island (1.5 g/t cutoff) | Measured & Indicated Inferred | 1,924,000 2,069,000 | 4.8 4.8 | 297,000 319,000 | |

| | | | | | |

PDF** (2.0 g/t cutof) | Inferred | 344,000 | 5.2 | 58,000 | |

| | | | | | |

Total | Measured & Indicated Inferred | 21,685,000 5,700,000 | 4.3 4.3 | 2,998,000 788,000 | 2,998,000 788,000 |

Meliadine West Gold Project (22% carried to production interest)***

Resources were estimated by WMC International Ltd. in October 2000.

Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces | Cumberland Contained Ounces |

Tiriganiaq | Indicated Inferred | 5,212,000 7,136,000 | 7.7 6.1 | 1,290,000 1,400,000 | |

Tiriganiaq West | Inferred | 700,000 | 6.7 | 151,000 | |

F-Zone | Inferred | 4,100,000 | 5.0 | 659,000 | |

Pump Zone | Inferred | 1,400,000 | 6.9 | 311,000 | |

Wolf Main | Inferred | 2,500,000 | 6.0 | 482,000 | |

Wolf North | Inferred | 1,100,000 | 5.7 | 202,000 | |

| | | | | | |

Total | Indicated Inferred | 5,212,000 16,936,000 | 7.7 6.1 | 1,290,000 3,204,000 | 284,000 705,000 |

Meliadine East Gold Project (50% operating interest)****

Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces | Cumberland Contained Ounces |

Discovery | Indicated | 1,841,000 | 6.7 | 397,000 | |

| | | | | | |

Total | Indicated | 1,841,000 | 6.7 | 397,000 | 198,000 |

Cautionary Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates include inferred mineral resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred resources will be converted to measured and indicated categories through further drilling, or into mineral reserves once economic considerations are applied. The standards employed in estimating the mineral resources differ significantly from the requirements of the United States Securities and Exchange Commission and the resource information reported by United States companies. The term “resources” does not equate to “reserve” and normally may not be included in documents filed with the Securities and Exchange Commission. “Resources” are sometimes referred to as “mineralization” or “mineral deposits”.

* Resource estimates (Q1/2004) were prepared in conformance with the requirements set out in National Instrument 43-101 by AMEC independent qualified persons as defined by NI 43-101. All resource estimates (except for the PDF deposit which is not included in the current feasibility study) have been prepared by AMEC independent qualified persons as defined by NI 43-101 under the direction of Steve Blower, P.Geo.

** PDF resource parameters: Resource estimates are based on 24 NQ diamond drill holes and a total of 1024 samples. Samples were assayed at IPL labs in Vancouver, British Columbia utilizing fire assay with AA finish and fire assay with gravimetric finish on all assays yielding greater than 1 gram per tonne. QA/QC programs employ random insertion of four internal standards, field duplicates and blank samples. Acme Labs of Vancouver provides external reference assaying. Resource analysis is based on 3 dimensional solid models generated from geological and assay data. Interpolation is based on compositing at 0.75 meter down-hole lengths. Inverse distance to the 2nd power with a minimum of 2 and a maximum of 12 composites to is required to interpolate grade into a block. Composites were capped at 20g/t. A 2.0 g/t cut-off grade is applied. James McCrea, P.Geo., Manager, Mineral Resources, is the Qual ified Person under National Instrument 43-101. Resource classification conforms to CIM Standards on Mineral Resources and Reserves (August 2000).

***Resources were estimated by WMC International Ltd. in October 2000. Resource classification conforms to CIM Standards on Mineral Resources and Reserves (August 2000).

****Resources were estimated by MRDI Canada, a division of AMEC, in 1997. Resource classification conforms to CIM Standards on Mineral Resources and Reserves (August 2000).

Corporate Data

Corporate Office

Suite 950, One Bentall Centre

505 Burrard Street, Box 72

Vancouver, British Columbia

Canada V7X 1M4

Tel 604-608-2557

Fax 604-608-2559

E-mailinfo@cumberlandresources.com

Websitewww.cumberlandresources.com

Baker Lake Office

QDC – 15

Baker Lake, Nunavut

Tel 867-793-4610

Fax 867-793-4611

Mailing Address:

General Delivery

Baker Lake, Nunavut X0C 0A0

Exchange Listing

Toronto Stock Exchange (TSX:CLG)

American Stock Exchange (AMEX:CLG)

Number of Shares

(at December 31, 2003)

Issued

54,222,744

Fully Diluted

62,546,419

Authorized

100,000,000

Legal Counsel

Gowling, Lafleur and Henderson, LLP

Vancouver, British Columbia

Registrar and Transfer Agent

Computershare Trust Company of Canada

Vancouver, British Columbia

Tel: 1-800-564-6253

E-mail: service@computershare.com

Auditors

Ernst & Young LLP

Vancouver, British Columbia

Directors

John A. GreigA,Cx - Chairman

Walter T. SegsworthB,C - Co-Chairman

Kerry M. Curtis - President and Chief Executive Officer

Abraham I. AronowiczA,C

Richard M. ColterjohnAx

Glen D. Dickson

J. Michael KenyonBx

William E. McCrindle

Jonathan A. RubensteinA,B

A Member of Audit Committee

B Member of Corporate Governance Committee

C Member of Compensation Committee

x Denotes Committee Chairman

Senior Officers

Kerry M. Curtis, P.Geo. - President and Chief Executive Officer

Michael L. Carroll, C.P.A. - Chief Financial Officer and Corporate Secretary

Brad G. Thiele, P.Eng. - Vice President, Meadowbank Project Development

Managers

Gordon I. Davidson, P.Geol. - Project Manager, Exploration

Craig Goodings, M.Sc. - Manager, Environmental and Regulatory Affairs

Betty Goyette – Office Manager

Roger B. March, P.Geo. - Senior Project Geologist

James A. McCrea, P.Geo. - Manager, Resource Evaluation

Stuart D. McDonald, C.A. – Corporate Controller and Principal Accounting Officer

Joyce L. Musial, B.Sc. (Hons) - Manager, Investor Relations

Investor Relations Contact

Joyce Musial, Manager, Investor Relations

Tel 604-608-2557

Fax 604-608-2559

Annual and Special General Meeting

The Annual and Special General Meeting will be held on Thursday, June 10, 2004 at 2:00 p.m. (local time) in the Stanley Room, Hyatt Regency Hotel, 655 Burrard Street, Vancouver, British Columbia.