2004 Annual report

Cover: Satellite image of the Meadowbank regional study area covering approximately 10,000 sq. km.

Cumberland Resources Ltd. is a well financed mineral exploration and development company which is positioning itself to become a mid-tier North American gold producer. The company is advancing development of it's 100% owned Meadowbank Gold Project, host to Canada's largest pure gold open pit reserves. The shares of Cumberland are traded on the Toronto Stock Exchange and American Stock Exchange under the symbol CL G.

This document contains "forward-looking statements", including, but not limited to, statements regarding our expectations as to the market price of gold, strategic plans, future commercial production, production targets and timetables, mine operating costs, capital expenditures, work programs, exploration budgets and mineral reserve and resource estimates. Forward-looking statements express, as at the date of this report, our plans, estimates, forecasts, projections, expectations or beliefs as to future events or results. We caution that forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements. Factors that could cause results or events to differ materially from current expectations expressed or implied by the forward-looking statements include, but are no t limited to, factors associated with fluctuations in the market price of precious metals, mining industry risks and hazards, environmental risks and hazards, uncertainty as to calculation of mineral reserves and resources, requirement of additional financing, risks of delays in construction and other risks more fully described in our AIF filed with the Securities Commissions of the Provinces of British Columbia, Alberta, Ontario, Quebec and Nova Scotia and the Toronto Stock Exchange and in our 20F filed with the United States Securities and Exchange Commission (the "SEC").

2004 Highlights

Meadowbank Gold Project Achievements

- Completed a $9.0 million 2004 exploration and engineering program

- Improved resource size and definition by drilling 18,200 metres in 118 new drill holes

- Improved project economics by increasing planned open pit production, revising open pit scheduling and reducing capital costs

- Feasibility study results announced in early 2005

- Production profile High-grade open pit

- Production forecast 316,000 ounces per year

- Cash cost estimate US$224 per ounce

- Mine life forecast 8.3 years

- Capital costs estimate US$227 million

- Proven and probable gold reserves of 2.8 million ounces establish Meadowbank as Canada's largest pure gold open pit reserves

- Achieved a remarkable discovery cost of US$12 per reserve ounce of gold

- Expanded the PDF deposit

- Advanced development permitting process with submission of the Meadowbank Draft Environmental Impact Statement

- Ended 2004 with working capital of $37.0 million

- Received the 2005 Sustainable Development Award from the Nunavut Mining Symposium

2005 Goals

- Complete the draft review process for development permitting

- Submit the Final Environmental Impact Statement and move towards completion of development permitting in early 2006

- Complete a $3.5 million 2005 exploration program to increase reserves and extend mine life

- Further improve the economics of project by refining capital and operating costs

- Evaluate available project financing alternatives

Message to Shareholders

In 2004, Cumberland overcame global market challenges by focusing on a re-design of the mine model for our 100% owned Meadowbank gold project located in Nunavut, Canada. This change in strategy was due to global escalations in the cost of fuel, steel and other construction items which impacted the preliminary capital cost estimates for the project.

The new mine design benefits from the hard work and technical expertise of the Meadowbank Feasibility Review Committee which is comprised of our in-house mine engineering and construction management team and our independent metallurgical, geotechnical and engineering team. The team considered in detail more than 40 technical and cost aspects of the project, and significantly improved the project during a period when cost pressures were very challenging. The exploration division also weighed into the re-design effort by completing 18,200 metres of infill drilling leading to larger more robust open pit designs.

Our 2004 efforts resulted in significant changes to the project design and economics including increased annual production, changes to open pit scheduling, addition of a conventional access road and an overall reduction in capital costs.

Bankable Feasibility Study

The feasibility study, concluded in early 2005, provides us with a firm economic basis to advance development of the project. Today, Meadowbank stands as the largest Canadian gold project planned for mine development in the next several years.

- Production profile High-grade open pit

- Production forecast 316,000 ounces per year

- Cash cost estimate US$224 per ounce

- Mine life forecast 8.3 years

- Capital costs estimate US$227 million

- Rate of return (pre tax) 14.3%

(Assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.)

Moving Forward

In 2005, our efforts will focus on advancing the development permitting towards completion, further improving the economics of the project and assessing available project financing alternatives. We will also initiate a $3.5 million exploration program designed to explore for additional reserves and resources, and continue to evaluate further capital and operating cost reductions.

Advancing Meadowbank Towards Production

Provided all necessary permits and licenses are obtained in early 2006, allowing shipping of equipment and supplies, the project is currently scheduled to commence commercial production in mid-2008.

Exploration to Extend Mine Life

Cumberland has an excellent track record of discovering gold at Meadowbank and considerable opportunities exist to expand the known reserves and extend the operational life of the mine.

Meadowbank hosts 3.3 million ounces of measured and indicated resources and 0.5 million ounces of inferred resources. These resources now include 2.8 million ounces of proven and probable gold reserves - Canada's largest pure gold open pit gold reserves. The proven and probable reserves have been discovered at a remarkably low cost of approximately US$12 per reserve ounce of gold.

Our $3.5 million 2005 planned exploration program will focus on further additions to resources and reserves. The program will consist of drilling at and near existing deposits, including the PDF deposit which is not included in the scope of the current feasibility study, and grassroots exploration along the 25 kilometre Meadowbank gold trend.

Meadowbank will provide much needed long-term economic stimulus to Baker Lake and Nunavut

Socio- economic studies completed as a part of the Meadowbank overall impact assessment indicate 250 new jobs would be created during the operating mine. During the early operational life, an estimated 60 to 90 direct jobs will be created in the Kivalliq region of Nunavut, which had an estimated population of 7,500 people in 2001. Meadowbank operations are projected to improve the employment level in Baker Lake by over 20% and total expenditures on local wages, goods and services are estimated at approximately $300 million over the mine life and closure period.

In 2004, the gold sector continued to realize the effect of steadily increasing cost pressures. Canadian gold producers were also affected by the strength of our dollar which effectively neutralized much of the gain in US$ spot gold realized in the second half of the year. This combination of inflation and currency fluctuation continues to place formidable pressures on the gold industry and is forcing mine closures and reduced world production. While well financed, the exploration sector has not been discovering gold deposits at the feverish rate achieved in the 1980's and early 1990's. In fact, most of the Canadian gold mines found during this period are now nearing the end of commercial production. Ultimately, if cost pressures continue and production diminishes, gold prices will rise in tandem.

Cumberland is in a strong financial position to build on the successes achieved at Meadowbank in 2004 and early 2005. We ended 2004 with a very strong working capital position of $37.0 million and no debt. With a feasibility study forecasting gold production of 316,000 ounces per year with total cash costs estimated at US$224 per ounce over an 8.3 mine life, the Company remains focused and encouraged to advance Canada's largest pure gold open pit reserves towards production.

I would like to thank the Board, management and staff for their extraordinary efforts in 2004 and thank our shareholders for their outstanding support.

Kerry M. Curtis

Kerry M. CurtisPresident and Chief Executive Officer

April 14, 2005

2005 Open Pit Mine Plan

Meadowbank Gold Project

A Substantial Platform for Cumberland to Emerge as a Mid-Tier North American Gold Producer

Cumberland is focused on development of its 100% owned Meadowbank gold project located 70 kilometres north of the Hamlet of Baker Lake in the Kivalliq region of Nunavut, Canada.

High Grade, Low Cost Production Profile

Open pit gold production is forecast at 316,000 ounces per year with total cash costs estimated at US$224 per ounce over an 8.3 year mine life, based on a feasibility study completed in February 2005. The 2005 feasibility study incorporates significant improvements to the preliminary mine model as a result of a re-design completed in 2004 by Cumberland and the study manager, AMEC Americas Ltd.

Meadowbank Gold Project 2005 Feasibility*

Open Pit Mineral Reserves

(Proven and Probable) |

2,768,000 ounces

|

Mine Throughput

a | 2.73 Mtpa

7,500 tpd |

Mine Life | 8.3 years |

Average Annual Production Rate

Years 1 to 4

Life of Mine |

376,000 ounces 316,000 ounces

|

Total Cash Cost per Oz.

Years 1 to 4

Life of Mine |

US$197

US$224

|

Payback Period | 4 years |

Pre-production Capital

a | Cdn$302 million

US$227 million |

*The feasibility study has been prepared in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101 ("NI 43-101"). The feasibility study assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

Canada's Largest Pure Gold Open Pit Reserves

The proven and probable open pit reserve estimate for the project is as follows:

Meadowbank Open Pit Gold Reserves

(Proven and Probable)*

Open Pit | Ore (t) | Au Grade (g/t) | Contained Ounces |

Portage | 11,180,000 | 4.27 | 1,534,000 |

Vault | 8,469,000 | 3.18 | 866,000 |

Goose | 2,247,000 | 5.09 | 368,000 |

Total | 21,896,000 | 3.93 | 2,768,000 |

*The reserves have been prepared in accordance with NI 43-101. Mr. Mark Pearson, P.Eng Principal Mining Engineer with AMEC Americas Ltd. is the independent Qualified Person responsible for preparation of stated reserves. Reserves are a subset of resources.

Increases in Mill Throughput and Annual Production

The new mine design has increased the preliminary mill throughput by 36% to 7,500 tonnes per day, resulting in a 28% increase in estimated gold production to 316,000 ounces per year over an 8.3 year mine life. This was achieved without a significant increase in capital cost or energy consumption for the process plant and is a result of additional metallurgical test work completed in 2004.

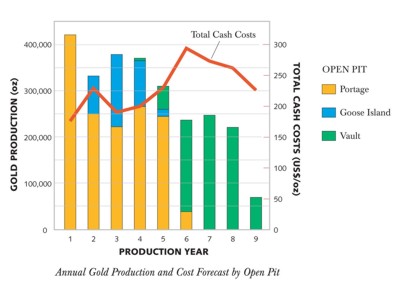

Changes to Open Pit Scheduling Achieve Peak Production in Early Years

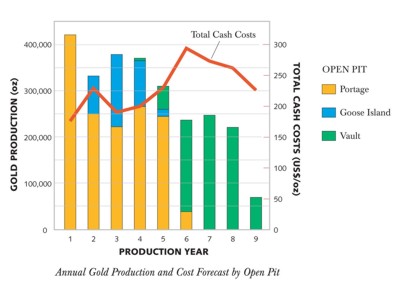

In the revised mine design, the high grade ores from the Portage and Goose Island open pits are scheduled to be mined in the first four to five years, allowing annual production to increase to an average 376,000 ounces over the first four years of production. Peak production is achieved in Year 1 with 421,000 ounces produced from the Portage pit.

Increased production in the early years of operation is a result of the 118 hole diamond drill program completed in 2004. Drill results from the Goose Island and Vault deposits improved the grade of the measured and indicated resources at the deposits, allowing the new, higher grade reserves from the Goose Island open pit to be moved forward (Year 2) in the mine schedule and improving the economics of the project.

Conventional Access Road Improves Economics

The new mine design also includes a proposed 102 kilometre long conventional access road to connect the project to the community of Baker Lake. Conventional road access will extend the access season, reduce on-site infrastructure requirements, improve efficiencies in construction scheduling and reduce overall operating costs.

Conventional Open Pit Mining

Three open pits are proposed at Meadowbank, the Portage, Goose Island and Vault pits. During Year 1 of operation, all of the ore material will come from the Portage pit (1,534,000 ounces of gold reserves). Selected waste material will be used to complete the construction of the Goose Island dykes with the remaining material hauled to a primary storage area.

With the completion of the Goose Island dyke, the high grade Goose Island pit (368,000 ounces of gold reserves) will commence production augmenting the ore flow from the Portage pit. These two pits will operate concurrently for a period of four years.

Production will commence at the Vault pit (866,000 ounces of reserves) in Year 4 as the Goose pit comes to a close. During the last two and half years of the project life, mining will be exclusively from the Vault pit.

Conventional Ore Processing

Mill processing will consist of primary gyratory crushing, grinding, gravity concentration, leaching and gold recovery in a carbon-in-pulp circuit. Extensive metallurgical testwork completed for the feasibility study indicates overall gold recovery will be 93.5% with approximately 40% typically recovered in the gravity circuit.

Advancing Meadowbank Towards Production

Permitting Process Moves Forward

In 2004, Cumberland advanced the permitting process from the project screening process to a "Part 5" Nunavut Impact Review Board (NIRB) full review.

The Company submitted a 34 volume Draft Environmental Impact Statement (DEIS) to NIRB. The DEIS report identifies the potential impacts the project will have on the local environment, socio-economic impacts, and the management and mitigation measures required to minimize the impacts of the project while maximizing the benefits.

The next stage of the permitting process requires Cumberland to file a Final Environmental Impact Statement to NIRB, after receiving guidelines from NIRB. NIRB would then make a development decision and provide it the Federal Minister. The Federal Minister would then make a development decision and issue a project certificate.

Proposed Engineering and Construction Schedule

The engineering and construction schedule for the project anticipates that all necessary NIRB approvals and licenses are obtained in early 2006 allowing shipping of equipment and supplies in the 2.5 month 2006 shipping season (mid-July to late September). Construction of the access road from Baker Lake to the Meadowbank site would commence in the fall of 2006. Upon completion of the access road a mine construction period of 18 months is required with production commencing in mid-2008.

Exploration to Expand Gold Reserves & Extend Mine Life

Historically, exploration has consistently returned additional resources, achieving a discovery cost of approximately US$12 per reserve ounce of gold. The 2005 exploration program will focus on the considerable opportunities that exist to expand the 2.8 million ounce reserve and further improve the economics of the project by extending the operational life of the mine.

The $3.5 million 2005 planned exploration program will consist of a two phased drill program (7,000 to 9,000 metres) at and near existing deposits and grassroots exploration along the 25 kilometre Meadowbank gold trend

Expansion of the Goose Island Deposit

Significant potential exists to expand the Goose Island deposit (368,000 ounces of open pit gold reserves) both along strike and in the down dip direction. The Phase I program will focus on expansion of high grade intersections yielded in the 2004 drill program.

South of the Goose Island Deposit

The Goose Island South target area is located approximately 300 metres south of the proposed Goose Island open pit. The target covers approximately 850 metres of prospective iron formation along strike from the Goose Island deposit. Phase I drilling will test stratigraphy where previous wide spaced drilling has intersected gold mineralization similar to the Goose Island deposit.

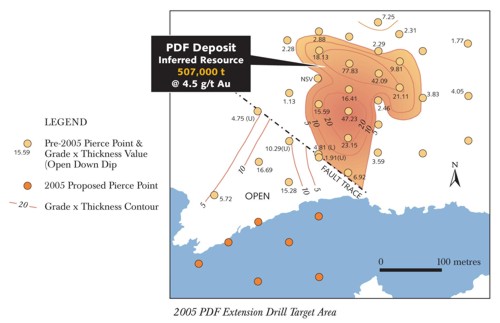

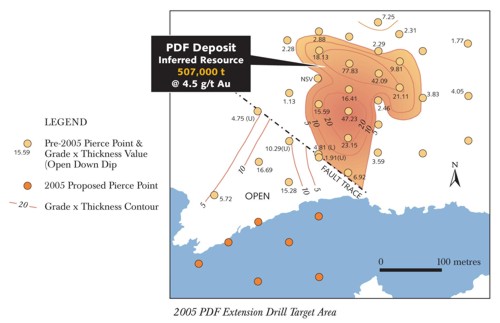

Expansion of the PDF Deposit

The PDF deposit, located 10 kilometres north of the Vault proposed pit, was expanded by drilling in late 2004. The deposit now hosts inferred gold resources of 73,000 ounces of gold in 507,000 tonnes grading 4.50 g/t gold, which are not included in the current mine plan. Wide spaced drilling in the Phase I program will focus on expansion potential of the deposit in the down dip direction and follow up on significant results from the 2004 program.

Phase II Exploration Program

The Phase II program will consist of up to 2,000 metres of drilling, grassroots exploration on favourable structures north of the Vault deposit, and follow-up exploration on numerous recently defined prospects situated both near the proposed open pits and across the property.

Long Term Commitment to the Community

Cumberland expanded its commitment to the community of Baker Lake by opening a Meadowbank Community Relations office in early 2004 and appointing a local resident as the full time Community Liaison Officer. Through this office, Cumberland will provide a mining resource centre for the community and will continue to learn about issues of concern to the local community.

Since 1995, exploration activities at Meadowbank have contributed almost $10 million (approximately 25% of total project expenditures) to the economy of the Kivalliq region of Nunavut. The development of mining operations at Meadowbank promises to provide a much greater economic stimulus that will be felt across the entire territory.

Studies indicate approximately 350 direct jobs will be created through construction and 250 direct jobs through operations. During the early operational life of the mine, direct project wages paid to workers from Baker Lake and the rest of the Kivalliq region could exceed $3 million annually with 60 to 90 jobs. Total expenditures on local wages, goods and services are estimated at approximately $300 million over the mine life and closure period.

Meliadine Gold Projects

The Meliadine projects are located 20 kilometres north of Rankin Inlet, Nunavut. The area is divided into two projects - Meliadine West and Meliadine East.

Meliadine West Project

Cumberland holds a 22% interest (carried to production) in the Meliadine West project. Comaplex Minerals Corp. is the Operator of the project. Cumberland received an annual $500,000 option payment from the Operator in January 2005 in accordance with the joint venture agreement signed in 1995. Beginning in January 2006, such annual option payment to Cumberland will increase to $1,500,000.

Primary activities during 2004 included ongoing resource evaluation of the Main Tiriganiaq deposit and further exploration of deeper targets (West Tiriganiaq zone) in preparation for feasibility study. A surface drill program consisting of 21 holes in 9,297 metres was completed in 2004.

In March 2005, Comaplex reported a revised resource estimate for the Meliadine West project. Using a high grade, selective approach to resource estimation, Comaplex estimated 853,000 ounces of indicated resources and 171,000 ounces of inferred resources in the Tiriganiaq deposit. A deeper resource, at some 400 metres below surface in the West zone, is estimated to contain an inferred resource of 311,000 ounces.

Comaplex is planning a $5 to $7 million exploration program for the summer of 2005.

Meliadine East Project

Cumberland has a 50% joint venture interest with partner Comaplex Minerals Corp. on the Meliadine East project. Cumberland is operator of the project. No work was completed in 2004.

Gold Reserves

Meadowbank Gold Project1

(100% Interest)

Reserves are a subset of resources.

Open Pit | Reserve Category | Tonnes | Grade (g/t) | 100% Contained Ounces |

Portage | Proven & Probable | 11,180,000 | 4.27 | 1,534,000 |

Vault | Proven & Probable | 8,469,000 | 3.18 | 866,000 |

Goose Island | Proven & Probable | 2,247,000 | 5.09 | 368,000 |

Total | Proven & Probable | 21,896,000 | 3.93 | 2,768,000 |

Gold Resources+

Meadowbank Gold Project2

(100% Interest)

Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces |

Portage Area (1.5 g/t cutoff) | Measured & Indicated

Inferred | 12,298,000 528,000 | 4.7

4.3 | 1,865,000 73,000 |

Goose Island

(1.5 g/t cutoff) | Measured & Indicated Inferred | 2,541,000 1,740,000 | 5.5

4.5 | 449,000 252,000 |

Vault

(2.0 g/t cutoff) | Measured & Indicated Inferred | 8,507,000 1,223,000 | 3.7

3.8 | 1,012,000 149,000 |

Total | Measured & Indicated Inferred | 23,346,000 3,491,000 | 4.4

4.2 | 3,326,000 474,000 |

Meliadine West Gold Project3

(22% carried to production interest)

From Comaplex Minerals Corp., March 2005

Tiriganiaq Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces | Cumberland

Contained Ounces |

Main | Indicated

Inferred | 2,467,000 417,000 | 10.8

12.7 | 853,000 171,000 | 188,000

38,000 |

West | Inferred | 725,000 | 13.4 | 311,000 | 68,000 |

Meliadine East Gold Project4

(50% operating interest)

Deposit | Resource Category | Tonnes | Grade (g/t) | 100% Contained Ounces | Cumberland

Contained Ounces |

Discovery | Indicated | 1,841,000 | 6.7 | 397,000 | 198,000 |

Total | Indicated | 1,841,000 | 6.7 | 397,000 | 198,000 |

1Meadowbank Gold Reserves

Proven and probable gold reserves are a subset of measured and indicated gold resources. The open pit mining reserves consist of the inventory of diluted and recovered measured and indicated blocks within the final pit designs. Inferred tonnage, within the final pit design, is not included within the reserve and has been added to waste.

The Meadowbank reserves (first quarter 2005) have been prepared in accordance with NI 43-101. Mr. Mark Pearson, P.Eng Principal Mining Engineer with AMEC Americas Limited is the independent Qualified Person responsible for preparation of stated reserves.

2Meadowbank Gold Resources

The Meadowbank resource estimates (first quarter 2005) were prepared in conformance with the requirements set out in National Instrument 43-101 under the direction of Mr. Steven J. Blower, P.Geo., of AMEC Americas Limited, who is an independent qualified person as defined by NI 43-101.

3Meliadine West Gold Resources

The Meliadine West project resource estimate (March 2005) was completed by Strathcona Mineral Services Limited as a manual estimate cross-referenced on cross and longitudinal section, and on plan. The resource estimate was completed on the Tiriganiaq deposit (Main and West zones). The resource estimate does not include other deposits in the project.

Details about the procedures and methodology used in the Strathcona resource estimate are included in the National Instrument 43-101 technical report filed under Comaplex Minerals Corp. on the SEDAR website.

4Meliadine East Gold Resources

All Meliadine East resources estimated (1997) by MRDI Canada, a division of AMEC E&C Services Limited. Resource classification conforms to CIM Standards on Mineral Resources and Reserves (August 2000).

+Gold Resources

Cautionary Note to U.S. Investors - The SEC permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this document such as "mineral resources" and "inferred resources" that the SEC guidelines strictly prohibit us from including in our Form 20-F available from us at Suite 950 - 505 Burrard Street, Vancouver, B.C. V7X 1M4. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

Cautionary Note to U.S. Investors concerning estimates of Indicated Resources - This document uses the term "indicated" resources. We advise US Investors that while that term is recognized and required by Canadian regulations, the SEC does not recognize it. U.S. investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into mineral reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources : This document uses the term "inferred" resources. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. "Inferred Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

Cumberland Resources Ltd.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the year ended December 31, 2004

INTRODUCTION

This Management Discussion and Analysis (“MD&A”) provides a detailed analysis of the business of Cumberland Resources Ltd. (“Cumberland” or the “Company”) and compares its 2004 financial results to the previous two years. This MD&A should be read in conjunction with the Company’s audited financial statements for the year-ended December 31, 2004 (the “Financial Statements”). The Company’s reporting currency is the Canadian dollar and all amounts in this MD&A are expressed in Canadian dollars, unless otherwise noted. The Company reports its financial position, results of operations and cash-flows in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Differences between Canadian and United States generally accepted accounting principles that would affect the Company’s reported financial results are disclosed in Note 15 of the Financial Statements. This MD&A is made as of March 15, 2005.

This MD&A contains certain statements which may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 of the United States. Forward-looking statements include, but are not limited to, statements regarding completion of mine feasibility studies, mine development programs, mineral resource estimates and statements that describe the Company’s future plans, objectives or goals. Forward-looking statements involve various known and unknown risks and uncertainties, which may cause actual results, performance and achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. As a result, readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of their respective dates. Important factors that could cause actual results to diff er materially from the Company’s expectations include results of project feasibility studies and mine permitting activities, future gold prices, future prices of fuel, steel and other construction items, as well as other risk factors described in section 8 of this MD&A.

Additional information relating to Cumberland, including the Company’s Annual Information Form, is on SEDAR atwww.sedar.com.

Table of Contents

1.

Summary of Recent Activities and Business Outlook

2.

Business Overview

3.

Review of Financial Results

4.

Liquidity and Capital Resources

5.

Financial Outlook

6.

Foreign Currency, Interest Rate and Commodity Price Risk

7.

Disclosure of Outstanding Share Data

8.

Risk Factors

1. SUMMARY OF RECENT ACTIVITIES AND BUSINESS OUTLOOK

On February 24, 2005, Cumberland announced the results from the Feasibility Study (“Study”) on the Company’s 100% owned Meadowbank Gold Project located in Nunavut, Canada. Initiated in 2003, completion of the Study was extended in early 2004 due in part to global escalations in the cost of fuel, steel and other construction items which impacted the preliminary construction cost estimates for the project. The Study incorporates improvements to the Meadowbank mine model as a result of a re-design completed in 2004 by the Company and the study manager, AMEC Americas Ltd. (“AMEC”). The most significant improvements are from increased annual production and mill throughput, changes to open pit scheduling, and a proposed 102 km conventional access road to connect the project to the community of Baker Lake.

The Study results contemplate an open-pit gold mine and assume a gold price and exchange rate of US$400 per ounce and US$0.75 per Cdn $1.00 respectively and full equity financing. According to the Study, Meadowbank is projected to produce an average of more than 300,000 ounces of gold per year over an 8.3 year mine life. Additional financial projections reflected in the Study include:

Meadowbank Gold Project Feasibility*

Proven and Probable Mining Reserves (contained ounces) | 2.8 million |

Average Cash Production Cost (per Ounce) | US$224 |

Payback Period | 4.0 years |

Total Pre-production Capital | US$225 million |

Pre-tax Internal Rate of Return After-tax Internal Rate of Return | 14.3% 10.7% |

Pre-tax Net Present Value @ 0% After-Tax Net Present Value @ 0% | US$174 million US$115 million |

Conventional open pit mining methods will be used to exploit the reserves of the project. The proven and probable open pit reserve estimate for the three pits on the project is as follows:

Meadowbank Gold Project Open Pit Mining Reserves (Proven and Probable)**

Open Pit | Ore (t) | Au Grade (g/t) | Contained Ounces |

Portage | 11,180,000 | 4.27 | 1,534,000 |

Vault | 8,469,000 | 3.18 | 866,000 |

Goose | 2,247,000 | 5.09 | 368,000 |

Total | | 3.93 | 2,768,000 |

During 2004 the Company completed a two-phase exploration program at the Meadowbank property. An additional 118 drill holes were completed on the property between April and September, 2004, resulting in improved resource definition for feasibility level open pit designs. The second phase of the Company’s 2004 exploration program included testing for the potential expansion of the PDF deposit, additional exploration at the Phaser Lake target and initial exploration of the Jim Zone. The drilling of the PDF deposit was successful in extending mineralization and the deposit remains open at depth. A regional exploration program, including an airborne geophysical survey, was also completed in the northern area of the property with the objective of identifying new exploration targets.

In March 2005, the Company announced a planned $3.5 million exploration program at the Meadowbank property. Subject to the availability of third-party drillers, the Company has planned 7,000 to 9,000 meters of diamond drilling to commence in April. The two phased exploration program will focus on increasing gold reserves and resources and includes drilling targets at or near existing deposits and other grassroots exploration on the Meadowbank property.

The development of the Meadowbank Project is being reviewed under a NIRB Part 5 review as provided under Article 12 of the Nunavut Land Claims Agreement and existing Federal legislation. The Company has submitted a Draft Environmental Impact Study (“DEIS”) to the Nunavut Impact Review Board (“NIRB”). The report identifies the potential impacts the Meadowbank Project will have on the local environment, socio-economic impacts, and the management and mitigation measures required to minimize the impacts of the project while maximizing the benefits. The NIRB is presently reviewing the DEIS and following a period of review and initial hearings, Cumberland will prepare a final EIS document, which will include responses to matters raised through the NIRB review period. The Company anticipates it could move into the Final EIS stage in the fall of 2005. Final approvals and licenses are anticipated in early 20 06.

The engineering and construction schedule for the project assumes that all necessary NIRB approvals and licenses are obtained in early 2006 allowing shipping of equipment and supplies in the 2.5 month 2006 shipping season (mid-July to late September). Construction of the access road from Baker Lake to the Meadowbank site would commence in the fall of 2006. Upon completion of the access road a mine construction period of 18 months is required with production commencing in mid-2008

Cumberland also holds a 22% interest (carried to production) in the Meliadine West gold project located in Nunavut Territory. Comaplex Minerals Corp. is the Operator of the Meliadine West gold project. Primary activities during 2004 at Meliadine West included ongoing resource evaluation of the Main Tiriganiaq deposit and further exploration of deeper targets (West Tiriganiaq zone) in preparation for feasibility study. A surface drill program consisting of 21 holes in 9,297 metres was completed by the Operator in September, 2004. The Operator reported that results from the final drill holes in the West Tiriganiaq zone indicate potential for additional gold resources at depth and along strike of the Main Tiriganiaq deposit. The Operator further stated it intends to recalculate resources in the Main Tiriganiaq deposit and perform subsequent exploration with the goal of moving this deposit towards feasibility as quickly as possible.

During the second quarter, Kinross Gold Corporation reported that as of April 30, 2004, it had acquired (for investment purposes) a total of 4.8 million of the Company’s common shares, or 8.8% of the Company’s outstanding shares. Since such date, Kinross has reported increases in its share interest in the Company to approximately 7.9 million shares or 14.3% of the Company’s outstanding shares.

*Meadowbank Feasibility Study (First Quarter 2005) – The feasibility study incorporates improvements to the mine model as a result of a re-design completed in 2004 by the Company and the study manager, AMEC Americas Ltd. (“AMEC”). Construction scheduling and capital cost estimation has been prepared by Merit International Consultants Inc (“Merit”). Metallurgical and process test work was completed by SGS Lakefield Research Ltd. Process design was completed by International Metallurgical and Environmental Inc. and AMEC. Supporting geotechnical engineering, hydrogeological and geochemical studies were completed by Golder Associates Ltd. (“Golder”). The Study has been prepared in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101 (“NI 43-101”). Assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

**Meadowbank Gold Reserves (First Quarter 2005) - The open pit mining reserves have been prepared in accordance with NI 43-101. Mr. Mark Pearson, P.Eng Principal Mining Engineer with AMEC Americas Limited is the independent Qualified Person responsible for preparation of stated reserves.

2. BUSINESS OVERVIEW

The Company is in the business of developing, exploring and acquiring mineral properties, with an emphasis on gold, and is in the process of exploring and developing properties located in the Nunavut Territory in Northern Canada.

The Company is focused on the development of its 100% owned Meadowbank property, and has recently completed a feasibility study on such property. The Company’s development plans at Meadowbank will depend on the Company’s ability to secure all requisite financing and mine permitting on a timely basis.

During 2004, the Company completed a $9.0 million work program at its 100% owned Meadowbank Gold Project, located in Nunavut, Canada. The work program included a diamond drilling program to increase the open pit potential of the project in support of the ongoing feasibility study, as well as further exploration of the PDF deposit and other targets, and multi-disciplinary studies related to engineering and environmental components required for feasibility studies and mine development permitting.

The Company is the operator for its 50% joint venture interest in the Meliadine East exploration property, which is also located in Nunavut Territory in Northern Canada. The Company’s share of exploration costs incurred in 2004 was $0.1 million.

The Company also has a 22% carried to production interest in the Meliadine West joint venture, and is receiving annual option payments from the joint venture partner of $500,000 per year (increasing to $1,500,000 per year in 2006) in accordance with an option agreement signed in 1995. The Company’s share of exploration costs is being funded through a contingent non-recourse loan and is only repayable by the Company if commercial production is achieved and will be repaid only out of production cash flow.

Other than the annual option receipts from the operator of the Meliadine West joint venture, the Company currently has no other sources of operating revenue. The Company has working capital of $37.0 million at December 31, 2004 and will require substantial additional financing to complete development of Meadowbank.

3. REVIEW OF FINANCIAL RESULTS

a) Selected Annual Information

The Company’s results of operations for the years ended December 31 are summarized below:

| | 2004 | 2003 | 2002 |

| | $ | $ | $ |

| | | | |

Option receipts | 500,000 | 500,000 | 500,000 |

Interest and other income | 2,499,211 | 1,056,077 | 138,254 |

Exploration and development costs | (9,040,483) | (11,518,663) | (7,993,736) |

General and administrative and other expenses | (2,590,258) | (1,990,241) | (1,341,615) |

Stock based compensation expense | (1,900,013) | (1,481,612) | - |

| | | | |

Loss for the period | (10,531,543) | (13,434,439) | (8,697,097) |

| | | | |

Net loss per share, basic and fully diluted | ($0.19) | ($0.30) | ($0.26) |

| | | | |

Total assets | 51,519,283 | 59,302,768 | 28,252,472 |

Total long-term liabilities | 640,847 | 889,696 | 270,275 |

Shareholders’ equity | 49,986,909 | 57,082,453 | 27,249,652 |

Dividends | n/a | n/a | n/a |

This financial information has been reported in accordance with Canadian GAAP, and is denominated in Canadian Dollars, the Company’s reporting currency. A reconciliation of the Company’s results of operations and financial position to US GAAP is provided in Note 15 of the Financial Statements.

b) Critical Accounting Policies and Estimates

The Company’s significant accounting policies are disclosed in Note 2 of the Financial Statements. The following is a discussion of the critical accounting policies and estimates which management believes are important for an understanding of the Company’s financial results:

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities at the date of the financial statements and revenues and expenses for the period reported. By their nature, these estimates are subject to measurement uncertainty and the effect on the financial statements of changes in such estimates in future periods could be significant. Actual results will likely differ from those estimates.

Exploration and development of mineral property interests

Exploration costs are expensed as incurred. Development costs are expensed until it has been established that a mineral deposit is commercially mineable and a production decision has been made by the Company to formulate a mining plan and develop a mine, at which point the costs subsequently incurred to develop the mine on the property are capitalized until mining operations commence.

As at December 31, 2004 the Company had not yet completed a positive economic analysis on any of its mineral properties and therefore all development costs were expensed in 2004.

The Company capitalizes the cost of acquiring mineral property interests, including undeveloped mineral property interests, until the viability of the mineral interest is determined. Capitalized acquisition costs are expensed if it is determined that the mineral property has no future economic value. Exploration stage mineral interests represent interests in properties that are believed to potentially contain (i) other mineralized material such as measured, indicated or inferred resources with insufficient drill hole spacing to qualify as proven and probable mineral reserves and (ii) other mine-related or greenfield exploration potential that are not an immediate part of measured or indicated resources. The Company’s mineral rights are generally enforceable regardless of whether proven and probably reserves have been established. The Corporation has the ability and intent to renew mineral rights where the existing term is not sufficien t to recover undeveloped mineral interests.

Capitalized amounts (including capitalized development costs) are also written down if future cash flows, including potential sales proceeds, related to the mineral property are estimated to be less than the property’s total carrying value. Management of the Company reviews the carrying value of each mineral property periodically, and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Reductions in the carrying value of a property would be recorded to the extent that the total carrying value of the mineral property exceeds its estimated fair value.

Site closure costs

Accrued site closure costs relate to the Company’s legal obligation to remove exploration equipment and other assets from it’s mineral property sites in Nunavut and to perform other site reclamation work. Although the ultimate amount of future site restoration costs to be incurred for existing exploration interests is uncertain, the Company has estimated the fair value of this liability to be $443,759 at December 31, 2004 based on the expected payments of $1,081,404 to be made primarily in 2017, discounted at interest rates of 8.5% or 10.0% per annum.

Accounting for stock-based compensation

The Company accounts for stock option awards granted to employees and directors under the fair value based method. The fair value of the stock options at the date of grant is calculated using a Black-Scholes option pricing model and then amortized over the vesting period, with the offsetting credit to contributed surplus. If the stock options are exercised, the proceeds are credited to share capital. Prior to 2003 the Company had elected to recognize no stock compensation expense for grants to employees and directors where the stock option awards had no cash settlement features and the exercise price was equal to the stock price on the date of grant.

c)Results of Operations

2004 compared to 2003

The Company incurred a net loss of $10.5 million for the year-ended December 31, 2004, compared to a net loss of $13.4 million for the year-ended December 31, 2003. The reduction in net loss during 2004 is primarily attributable to a $2.5 million reduction in exploration and development costs and a $1.5 million increase in the gain on investments in public companies, which were partially offset by increases in stock-based compensation expense and general and administrative and other expenses.

The Company had no operating revenues in either 2004 or 2003, as it had not commenced mining operations. In both 2004 and 2003, the Company received the annual $500,000 option payment from the operator of the Meliadine West joint venture in accordance with an option agreement signed in 1995.

The most significant component of the Company’s net loss for both 2004 and 2003 was exploration and development costs related to Meadowbank. During the years ending December 31, 2004 and December 31, 2003, the Company incurred exploration and development costs of $9.0 million and $11.2 million respectively on the Meadowbank project. The $2.2 million reduction in 2004 is primarily attributable to the additional costs associated with the timely completion of the 2003 programs, including helicopter related costs, which resulted in higher exploration costs in 2003. Consulting engineering costs related to completion of the Meadowbank feasibility study were also lower in 2004 than in the prior year.

The $9.0 million of costs incurred at Meadowbank during 2004, included (i) a $5.8 million field program, comprising two phases of drilling totaling approximately 18,200 meters designed to increase the open pit potential of the project in support of the ongoing feasibility study, and to further explore the PDF deposit and other targets, (ii) $1.4 million of costs related to the feasibility studies which commenced in early 2003 and (iii) $1.7 million in environmental permitting related costs.

The costs associated with the Company’s 22% carried interest in Meliadine West are being financed by way of a contingent non-recourse loan from the property operator which will only be repayable by the Company if commercial production is achieved and will be repaid only out of production cash flow. In 2004, the joint venture completed a $3.8 million exploration program on this property.

General and administrative and other expenses increased from $2.0 million in 2003 to $2.6 million in 2004. This increase primarily relates to the higher level of activity and required management staff in 2004 as well as higher corporate insurance costs.

Stock-based compensation expense increased from $1.5 million in 2003 to $1.9 million in 2004. The stock-based compensation expense is a non-cash item based on the estimated fair value of stock options vesting during the year. The total number of stock options granted in 2004 was comparable to 2003 and the average fair value of stock options granted in 2004 was lower than in the prior year, however, a significant portion of the 2003 option grants did not vest until 2004 resulting in a higher recorded expense in the current year. The Company adopted the fair value based method of accounting for stock options on a prospective basis from January 1, 2003 (see 3(b) above, Critical Accounting Policies and Estimates).

Interest and other income increased from $1.0 million in 2003 to $2.5 million in 2004 due to the increased gains realized from sales of the Company’s investment in Eurozinc Mining. During the year ended December 31, 2004 the Company sold 2,920,000 Eurozinc shares for a gain of $1.6 million compared to 266,666 shares sold in 2003 for a gain of $0.04 million.

2003 compared to 2002

The Company incurred a net loss of $13.4 million for the year-ended December 31, 2003, compared to a net loss of $8.7 million for the year-ended December 31, 2002. The net loss increased during 2003 due to increases in project development costs at Meadowbank, increased general and administrative costs and increased stock-based compensation expense, partially offset by increased interest income.

The Company had no operating revenues in either 2003 or 2002, as it had not commenced mining operations. In both 2003 and 2002, the Company received an annual $500,000 option payment from the operator of the Meliadine West joint venture in accordance with the option agreement signed in 1995.

The most significant component of the Company’s net loss for both 2003 and 2002 was exploration and development costs on the Meadowbank project. During the years ending December 31, 2003 and December 31, 2002, the Company incurred exploration and development costs of $11.2 million and $7.9 million respectively on Meadowbank. The $3.3 million increase in exploration and development costs at Meadowbank primarily relates to increased costs for project level feasibility studies and mine development permitting requirements.

The $11.2 million of costs incurred at Meadowbank during 2003, included (i) a $7.5 million field program, comprising two phases of infill drilling totaling approximately 21,000 meters designed to complete feasibility requirements as well as substantial environmental and field exploration programs, (ii) $1.9 million of costs related to the feasibility studies which commenced in early 2003 and (iii) $1.8 million in environmental permitting related costs.

In 2003, the Meliadine West joint venture completed a $2.1 million exploration program on this property. The Company’s share of these costs was financed by the contingent non-recourse loan and would only be repayable if commercial production is achieved and will be repaid only out of production cash flow.

The substantial increase in general and administrative expenses for 2003 reflects the increased level of activity and required management staff in 2003 and the greater emphasis placed on public relations, including investor relations activities and financing activities.

The stock-based compensation expense of $1,481,612 is a non-cash item based on the estimated fair value of stock options granted and vested in 2003. The fair value of stock options granted is calculated based on a Black-Scholes Option Pricing Model. The Company adopted the fair value based method of accounting for stock options on a prospective basis from January 1, 2003 (see 3(b) above, Critical Accounting Policies and Estimates). However, had compensation cost for stock-based compensation been recorded under the fair value based method in 2002, the Company’s net loss would have increased by $983,400 for the year-ended December 31, 2002.

Interest and other income increased substantially in 2003 primarily due to the significantly higher balances of cash and short-term investments resulting from approximately $43.7 million of additional funds that were raised during 2003 through a private placement and exercises of warrants and stock options. In addition, interest and other income in 2002 also included a one-time charge of $0.3 million for the write-down of the Company’s investment in Eurozinc Mining.

d) Summary of Quarterly Results

The table below sets out the quarterly results, expressed in thousands of Canadian dollars, for the past eight quarters:

| | 2004 | | 2003 |

| | Fourth | Third | Second | First | | Fourth | Third | Second | First |

| | | | | | | | | | |

Option receipts | - | - | - | 500,000 | | - | - | - | 500,000 |

Other income | 354,885 | 303,512 | 732,859 | 1,107,954 | | 340,527 | 402,024 | 151,357 | 162,169 |

| | | | | | | | | | |

Exploration and development costs | (939,069) | (2,125,327) | (3,937,040) | (2,039,047) | | (1,470,427) | (3,319,283) | (4,845,004) | (1,883,949) |

Stock-based compensation | (194,272) | (1,276,206) | (204,845) | (224,690) | | (810,562) | (125,600) | (211,850) | (333,600) |

Other expenses | (557,591) | (554,831) | (760,328) | (717,507) | | (576,326) | (652,359) | (487,024) | (274,532) |

| | | | | | | | | | |

Net loss | (1,336,047) | (3,652,852) | (4,169,354) | (1,373,290) | | (2,516,788) | (3,695,218) | (5,392,521) | (1,829,912) |

Net loss per share | (0.02) | (0.07) | (0.08) | (0.03) | | (0.05) | (0.08) | (0.14) | (0.05) |

The majority of exploration costs are incurred in the second and third quarters of the fiscal year due to the seasonal weather conditions in Nunavut Territory. Option receipts are received from the operator of the Meliadine West joint venture in the first quarter.

4. LIQUIDITY AND CAPITAL RESOURCES

The Company’s principal source of liquidity at December 31, 2004 is cash and cash equivalents and short-term investments of $37.1 million (2003 - $46.4 million). The majority of this amount is invested in highly liquid Canadian dollar denominated investments in investment grade debt and banker’s acceptances, with maturities through March 7, 2005. The counter-parties include corporations and financial institutions.

The Company’s principal sources of cash during the 2004 were proceeds from the sale of shares in Eurozinc Mining ($1.7 million), the issuance of common shares from the exercise of stock options and warrants ($1.5 million) and option receipts from the operator of the Meliadine West joint venture ($0.5 million).

The Company used $10.4 million in operating activities, primarily for exploration and development costs on the Company’s 100% owned Meadowbank property. The Company also had capital expenditures of $1.2 million during the year, primarily related to equipment required for mine construction.

At December 31, 2004 the Company had working capital of $37.0 million as compared to $45.8 million at December 31, 2003. The following is a summary of the Company’s outstanding contractual obligations and commitments as at December 31, 2004:

| | Payments due by period |

| | | | | | |

| | | Less than | 1 to 3 | 4 to 5 | After |

| | Total | 1 year | years | years | 5 years |

| | | | | | |

Capital lease obligations | 609,968 | 404,973 | 204,995 | | |

| | | | | | |

Operating lease obligations | 470,556 | 221,556 | 249,000 | | |

| | | | | | |

Contingent payments(1) | 1,200,000 | | 1,200,000 | | |

| | | | | | |

Site closure costs(2) | 1,081,404 | | | | 1,081,404 |

| | | | | | |

Total contractual obligations | 3,361,928 | 626,529 | 1,653,995 | - | 1,081,404 |

(1) The Company has three employment contracts in place that provide for the payment of specific bonus amounts should certain financial and operating milestones with respect to the Meadowbank Project be attained in the future.

(2) The Company has estimated future costs of $1,081,404 to be incurred primarily in 2017 related to the Company’s legal obligation to remove exploration equipment and other assets from its mineral property sites in Nunavut and to perform other site reclamation work.

The Company has committed to use certain third party mobile equipment between 2005 and 2007. Whereas the ultimate commitment amount will depend on usage, the maximum commitment amount is approximately $4 million.

The Company also has a contingent loan balance which totals $15,121,045 as December 31, 2004 [2003 - $13,726,265]. This loan will be repaid only if commercial production at Meliadine West is achieved and will be paid only out of production cash flow (as defined in the joint venture agreement).

5. FINANCIAL OUTLOOK

The outlook for the Company continues to be heavily weighted to the successful permitting, development and exploitation of the Meadowbank Gold Project. Assuming that all required permits are received and a final production decision is made by the Company with respect to Meadowbank, substantial long-term financing would be required to develop and construct the property. Currently, the Company anticipates that such financing would be derived from a combination of debt and equity financing.

The ultimate success of Meadowbank will be dependent on, among other factors, the U.S. dollar price of gold as well as the U.S. dollar currency exchange rate relative to the Canadian dollar. In addition, if the Company were able to partially finance the development of Meadowbank with long-term debt financing, the Company’s future profitability would likely be sensitive to market interest rates.

During 2005, the Company plans to incur approximately $3.5 million in exploration costs at Meadowbank, subject to the availability of third-party drillers. An additional $3.1 million is budgeted for feasibility and engineering costs, environmental permitting and other Meadowbank development activities. The Company’s 2005 budgeted expenditures for general and administrative costs are $1.4 million. In addition, the Company expects to incur approximately $1.0 million on other corporate expenses (consisting of insurance, public relations, investor relations and stock exchange listing costs).

During 2005, the Company’s share of exploration costs on its joint venture interest in Meliadine West will once again be fully financed via the Company’s contingent non-recourse loan arrangement with the operator of the Meliadine West joint venture.

As of December 31, 2004, the Company held approximately 1.5 million shares of Eurozinc Mining Corporation (Eurozinc) with a market value of $1.0 million, based on the quoted share trading price at year-end. This amount may not be reflective of what the Company would realize on liquidation of its investment.

6. FOREIGN CURRENCY, INTEREST RATE AND COMMODITY PRICE RISK

The Company has not commenced mining operations and accordingly, has no gold operating revenues. However, future fluctuations in the price of gold could impact the Company’s ability to secure future financing on the Company’s existing mineral property interests. Fluctuations in the price of commodities required for the construction and operation of a gold mine, including fuel and steel, could also impact the economics of the project and the Company’s ability to secure future financing.

At December 31, 2004 the Company does not have significant foreign currency assets or liabilities and does not incur significant expenses in foreign currencies. Consequently, the Company is not currently subject to significant foreign exchange risk.

Other than the capital lease obligations, the Company has no interest bearing long-term liabilities. However, the rate of return on the Company’s portfolio of short-term investments and cash equivalents is subject to change based on movements in market interest rates.

The Company does not currently engage in any hedging or derivative transactions to manage these risks.

7. DISCLOSURE OF OUTSTANDING SHARE DATA

The following is a summary of changes in outstanding shares and stock options since December 31, 2004:

| | Stock options outstanding | Common shares outstanding | Share capital $ |

Balance, December 31, 2004 | 3,268,628 | 54,973,941 | 112,404,856 |

Stock options exercised | - | - | - |

Balance, March 15, 2005 | 3,268,628 | 54,973,941 | 112,404,856 |

8. RISK FACTORS

Speculative Nature of Mineral Exploration and Uncertainty of Development Projects

Mineral exploration is highly speculative in nature, involves many risks and is frequently not productive. There can be no assurance that our exploration efforts will be successful. Success in identifying and increasing mineralized material and converting such mineralized material to resources and reserves is the result of a number of factors, including the quality of a company’s management, its level of geological and technical expertise, the quality of land available for exploration and other factors. Once mineral resources are discovered, it may take many years until production is possible, if at all, during which time the economic feasibility of production may change. Substantial expenditures are required to establish mineral resources and proven and probable reserves through drilling, to determine the optimal metallurgical process to extract metals from the ore and to construct mining and processing faciliti es and related access, transportation, power and fuel infrastructures, particularly in environmentally sensitive remote locations, such as the areas of Nunavut where our properties are located. As a result of these uncertainties, no assurance can be given that our exploration programs will result in commercial mining operations.

Development projects have no operating history upon which to base estimates of future cash operating costs. Particularly for development projects, estimates of mineral resources and proven and probable reserves and cash operating costs are, to a large extent, based upon the interpretation of geological data obtained from drill holes and other sampling techniques, feasibility studies which derive estimates of cash operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of gold, estimated operating costs, anticipated climatic conditions and other factors. As a result, it is possible that actual cash operating costs and economic returns will differ significantly from those estimated for a project prior to production. It is not unusual in new mining operations to experience unexpected problems during the start-up phase, and delays often can occur in the commencement of production. If we should ultimately be successful in achieving commercial production at Meadowbank, our project operations, including mining, transportation of materials and shipping, may be adversely affected by severe climatic conditions, due to the remote northern location of such project.

Operations Risks

The business of exploratory searches for minerals and the business of mining is subject to a number of risks and hazards including environmental hazards, industrial accidents, labour disputes, encountering unusual or unexpected geologic formations or other geological or grade problems, unanticipated changes in metallurgical characteristics and recovery, encountering unanticipated ground or water conditions, cave-ins, pit wall failures, flooding, rock bursts, periodic interruptions due to inclement or hazardous weather conditions, and other acts of God or unfavourable operating conditions and bullion losses. Such risks could result in damage to, or destruction of mineral properties or processing facilities, personal injury or death, loss of key employees, environmental damage, delays in mining, monetary losses and possible legal liability. Our properties are located at high latitudes and, as a result, conducting exploration, const ruction or mining operations may be hampered by severe weather conditions.

Risks of Non-Availability of Insurance

Where considered practical to do so, we maintain insurance against risks in the operation of our business in amounts, which we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage. There can be no assurance that such insurance will continue to be available, will be available at economically acceptable premiums or will be adequate to cover any resulting liability. In some cases, coverage is not available or considered too expensive relative to the perceived risks. We may become subject to liability for cave-ins, pollution or other hazards against which we cannot insure or against which we may elect not to insure because of high premium costs or other reasons. The payment of such liabilities would reduce the funds available for exploration and mining activities

Financing Risks and Dilution

Although we currently have sufficient financial resources to undertake our presently planned exploration and development program at Meadowbank, further exploration on, and development of, our mineral properties in Nunavut will require additional capital. In addition, a positive production decision on our Meadowbank project would require significant additional capital for project engineering and construction. Accordingly, the continuing exploration and development of our projects depends upon our ability to obtain equity and debt financing on reasonable terms. There is no assurance the Company will be successful in obtaining the required financing. If we are unable to acquire additional capital we will be forced to curtail exploration and development activities and general administrative spending and may seek to joint venture or farm-out some of our properties. In addition to the need to complete additional equity financings in or der to advance our exploration and development projects, there are a number of outstanding securities and agreements pursuant to which our common shares may be issued in the future. This would result in further dilution to our shareholders.

Mineral Reserves and Resources

Our published mineral reserves and resources are estimated only and no assurance can be given that probable reserves or inferred, indicated and measured resources will be moved to higher confidence levels or that any particular level of recovery of minerals will in fact be realized or that identified mineral resources will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. In addition, the grade of mineral resources ultimately mined may differ from that indicated by drilling results and such differences could be material. While the Company’s reserves and resources are estimated by independent and experienced third parties, material changes in mineral reserves and resources, grades, stripping ratios, recovery rates, capital or operating costs (including fuel costs) and declines in the market price of gold may affect the economic viability of projects. It cannot be assumed that mineral resources will ever be upgraded to reserves.

Limited Operating History: Losses

We have limited experience in the development of mines and in the construction of facilities required to bring mines into production. We have relied and may continue to rely upon external consultants and others for expertise in these areas. We may determine that it is not commercially feasible or it is impractical to commence commercial production on our projects or, if commenced, to continue commercial operations. We have no experience in mining or processing of metals.

We have experienced, on a consolidated basis, losses in all years of operations. As at December 31, 2004, our deficit on a consolidated basis totalled $65.7 million. All of our activities have been of an exploration nature. There can be no assurance that we will generate profits in the future.

Share Price Volatility

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration stage companies, have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. In particular, the per share price of our common shares fluctuated from a high of $5.25 to a low of $1.72 within our two most recent fiscal years, being 2004 and 2003. Share price fluctuations are likely to continue in the future.

Gold Price Volatility

The market price of gold is volatile and cannot be controlled. If the price of gold should drop significantly, the economic prospects of the projects in which we have an interest could be significantly reduced or rendered uneconomic. There is no assurance that, even if commercial quantities of gold are discovered, a profitable market may exist for the sale of gold. Factors beyond our control could affect the marketability of any gold discovered or produced. Gold prices have fluctuated widely, particularly in recent years. The marketability of gold is also affected by numerous other factors beyond our control, including government regulations relating to royalties and allowable production, the effect of which cannot be accurately predicted.

Factors tending to affect the price of gold include:

•

- the relative strength of the U.S. dollar against other currencies;

•

- government sale or lending of gold bullion, and perceptions of their future intentions;

•

- government monetary and fiscal policies:

•

- expectations of the future rate of global monetary inflation and interest rates;

•

- general economic conditions and the perception of risk in capital markets;

•

- political conditions including the threat of terrorism or war and restrictions on holding of gold;

•

- speculative trading;

•

- investment demand for gold;

•

- supply of gold from production, disinvestments and scrap recycling.

Currency Fluctuations

Currency fluctuations may affect the operating revenue that the Company realizes in the future. Gold is sold throughout the world based principally on the U.S. dollar price, but most of the Company’s capital costs and expenses are expected to be incurred in Canadian dollars. The appreciation of the Canadian dollar against the U.S. dollar could result in a decrease in the Company’s future operating revenue in Canadian dollar terms. Conversely, a depreciation of the Canadian dollar against the U.S. dollar could result in an increase in the Company’s future operating revenue in Canadian dollar terms.

Impact of Price increases on Construction Items

The amount of capital costs associated with the development of a mining property is adversely impacted by escalations in the price of items related to construction, including steel, fuel, concrete and other construction consumables. Such price escalations are caused by numerous factors beyond the Company’s control.

Title Matters

Some of the mining claims in which we have an interest have not been surveyed and, accordingly, the precise location of the boundaries of the claims and ownership of mineral rights on specific tracts of land comprising the claims may be in doubt. Such claims have not been converted to lease and tenure, and are, accordingly, subject to annual compliance with assessment work requirements. Other parties may dispute our title to mining properties. All of the claims on the Meadowbank property have been surveyed and converted to leases. While we have diligently investigated title to all mineral claims and, to the best of our knowledge, title to all properties is in good standing, this should not be construed as a guarantee of title. The properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects.

Competition for Mineral Land

There is aggressive competition within the mining industry for the discovery and acquisition of properties considered having commercial potential. We compete with other mining companies, many of which have greater financial resources than us, for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel.

Key Executives

We are dependent on the services of key executives, including our President and Chief Executive Officer, our Chief Financial Officer and a small number of highly skilled and experienced executives and personnel. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees may adversely affect our business and future operations.

Environmental and Other Regulatory Requirements

At present, none of our properties are at the development stage. However, when a property is identified as having economic potential, government approvals, permits and licences will be required. These approvals, permits and licences will include water licenses, land use permits, fuel storage permits, mine construction and mining operations licences, which include mine waste and tailings disposal sites. Delays in obtaining or any failure to secure such approvals, permits and licences could materially adversely affect our financial performance. Existing and possible future environmental legislation, regulations and actions could cause additional expense, capital expenditures, restrictions and delays in our activities, the extent of which cannot be predicted. Before production can commence on any properties we must obtain regulatory approval and there is no assurance that such approvals will be obtained. Under the current regulation s, approval to develop a mining operation at the Meadowbank gold project requires a thorough environmental review process conducted by the NIRB with final approvals by the Federal Government. Although the Company believes its exploration activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner, which could limit or curtail production or development.

Conflicts of Interest

Certain of our directors and officers serve as directors or officers of other natural resource companies or have significant shareholdings in natural resource companies and, to the extent that such other companies may participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. Under the laws of the Province of British Columbia, our directors are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not we will participate in a particular program and the interest therein to be acquired by it, our directors will primarily consider the degree of risk to whi ch we may be exposed and our financial position at that time.

Management's Responsibility for Financial Reporting

The financial statements and the information contained in the annual report are the responsibility of the Board of Directors and management. The financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles and reconciled to United States generally accepted accounting principles as set out in note 15.

The Audit Committee of the Board of Directors is composed of four Directors and meets periodically with management and the independent auditors to review the scope and results of the annual audit and to review the financial statements and related financial reporting matters prior to submitting the financial statements to the Board for approval.

The Company has developed and maintains a system of control to provide reasonable assurance that financial information is accurate and reliable.

The financial statements have been audited by Ernst & Young LLP, Chartered Accountants, who were appointed by the shareholders. The auditors’ report outlines the scope of their examination and their opinion on the financial statements.

![[fs001.jpg]](https://capedge.com/proxy/6-K/0001016724-05-000022/fs001.jpg) | |

Michael L. Carroll

Chief Financial Officer | Kerry M. Curtis

President and Chief Executive Officer |

Vancouver, Canada

March 10, 2005

AUDITORS’ REPORT

To the Shareholders of

Cumberland Resources Ltd.

We have audited the balance sheets ofCumberland Resources Ltd. as at December 31, 2004 and 2003 and the statements of loss and deficit and cash flows for each of the years in the three year period ended December 31, 2004. These financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these financial statements present fairly, in all material respects, the financial position of the company as at December 31, 2004 and 2003 and the results of its operations and its cash flows for each of the years in the three year period ended December 31, 2004 in accordance with Canadian generally accepted accounting principles.

| | ![[fs003.jpg]](https://capedge.com/proxy/6-K/0001016724-05-000022/fs003.jpg) |

Vancouver, Canada

March 10, 2005 | Chartered Accountants |

Cumberland Resources Ltd.

BALANCE SHEETS

(Canadian dollars)

As at December 31

| | 2004 | 2003 |

| | $ | $ |

| | | |

ASSETS | | |

Current | | |

Cash and cash equivalents[note 3] | 10,063,509 | 24,270,017 |

Short term investments[note 3] | 27,062,928 | 22,142,993 |

Accrued interest receivable | 216,499 | 433,086 |

Accounts receivable | 109,317 | 188,702 |

Due from joint venturer | 65,899 | 9,906 |

Prepaid expenses | 384,541 | 67,873 |

Total current assets | 37,902,693 | 47,112,577 |

Mineral property interests[note 4] | 8,246,083 | 8,246,083 |

Capital assets, net[note 6] | 4,676,302 | 3,679,703 |

Reclamation deposit[note 11(b)] | 605,000 | - |

Investments in public companies[note 13] | 89,205 | 264,405 |

| | 51,519,283 | 59,302,768 |

| | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | |

Current | | |

Accounts payable and accrued liabilities | 532,949 | 1,001,510 |

Current portion of capital leases[note 7] | 358,578 | 329,109 |

Total current liabilities | 891,527 | 1,330,619 |

Accrued site closure costs[note 8] | 443,759 | 340,000 |

Capital leases[note 7] | 197,088 | 549,696 |