NEWS RELEASE

TSX: CLG; AMEX: CLG

Suite 950 – 505 Burrard Street, Box 72, One Bentall Centre, Vancouver, B.C. Canada V7X 1M4

Tel: 604.608.2557 Fax: 604.608.2559 www.cumberlandresources.com

News Release 05-08

July 11, 2005

Cumberland Reports Initial 2005 Drill Results and Commences Phase II Exploration Program at Meadowbank Gold Project

CUMBERLAND RESOURCES LTD. (TSX: CLG; AMEX: CLG) is pleased to report drill results from the Phase I 2005 drill program at the Company’s 100% owned Meadowbank gold project located 70 kilometres north of the Hamlet of Baker Lake, Nunavut. The 2005 program is focused on increasing gold reserves and resources at Meadowbank, which is host to Canada’s largest pure gold open pit reserves. The Phase I 2005 program has completed approximately 7,300 metres of diamond drilling in 47 holes at the Goose Island deposit, the Goose Island South target and the PDF deposit. Phase II of the 2005 Meadowbank exploration program is commencing with drilling scheduled to start in approximately three weeks. Initial drilling efforts will be focused on near surface mineralization intersected in 1998 drilling, located approximately 285 metres north of the proposed Portage open pit (1,534,000 ounces of gold reserves1). In addition, the Com pany will commence construction of an airstrip at Meadowbank to support ongoing exploration efforts.

Phase I drill results and drill hole location maps for the Goose Island deposit, Goose Island South target and the PDF deposit are attached to this release.

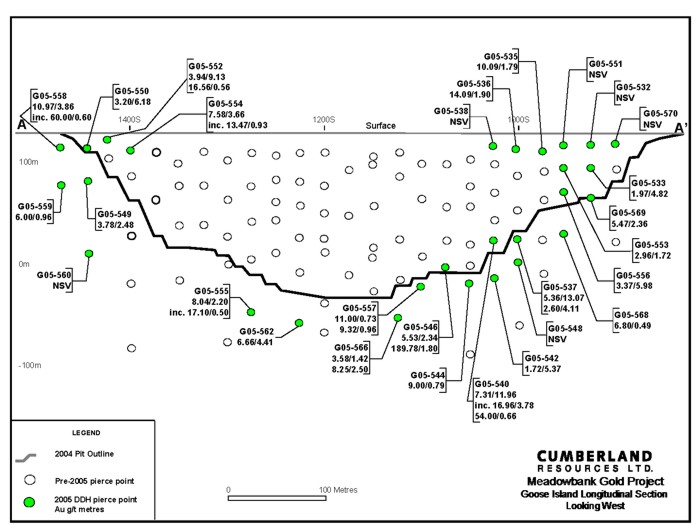

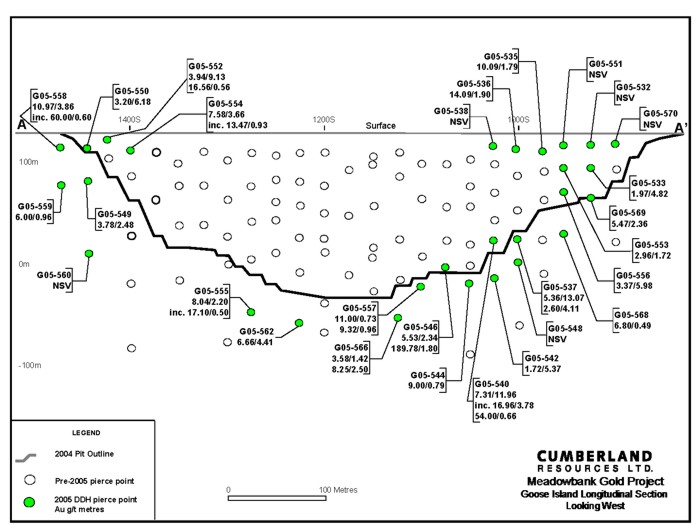

Goose Island Deposit – Definition and Depth Assessment Drilling

Drilling at the Goose Island deposit (368,000 ounces of gold reserves1) focused on further defining the near surface portions of the deposit along strike in both directions, assessing the high grade potential of the deposit below the current open pit design and improving the quality of the resources and reserves. The 2005 program included 28 drill holes to assess these targets. (See figure.)

Highlights from the 2005 drill program at the Goose Island deposit include:

South limit definition:

Hole G05-552: 3.94 g/t over 9.13m at 12 m below surface

Hole G05-554: 7.58 g/t over 3.66 m at 21 m below surface

Hole G05-558: 10.97 g/t over 3.86 m at 28 m below surface

North limit definition:

Hole G05-535: 10.09 g/t over 1.79 m at 22 m below surface

Hole G05-536: 14.90 g/t over 1.90 m at 19 m below surface

Hole G05-556: 3.37 g/t over 5.98 m at 62 m below surface

Below pit:

Hole G05-537: 5.36 g/t over 13.07 metres at 98 metres below surface

Hole G05-540: 7.31 g/t over 11.96 m at 108 m below surface

Hole G05-546: 189.78 g/t over 1.80 m at 144 m below surface

Hole G05-555: 8.04 g/t over 2.20 m at 192 m below surface

Hole G05-566: 8.25 g/t over 2.50m at 180 m below surface

Drilling on the northern and southern flanks of the Goose Island deposit has returned intersections that are expected to improve the quality and size of the Goose Island resources and reserves.

Seven holes were drilled on the shallow southern flank of the deposit to follow up on high grade drill results from 2004. The 2005 holes returned strong grades (from 3.2 g/t up to 10.97 g/t) over better than expected widths (2.48 metres to 9.13 metres). These results are expected to improve the quality of the resources in this portion of the deposit and have extended the limits of the deposit approximately 50 metres to the south.

On the shallow northern flank of the deposit 11 holes were drilled. Six of these returned significant intersections, including four holes that have extended the deposit to the north by approximately 50 metres. The two other holes, at depths of 22 metres and 19 metres below surface, returned high grade values (10.09 g/t and 14.90 g/t) that are expected to improve resource and reserve quality.

Ten holes were drilled to assess the resource potential below the proposed Goose Island open pit, a majority of which yielded intersections with gold grades of greater than 5.00 g/t. Hole G05-546 returned the highest gold value grading 189.78 g/t over 1.8 metres. Several of these intersections which are below the current pit design indicate a resource with potential for future underground mining.

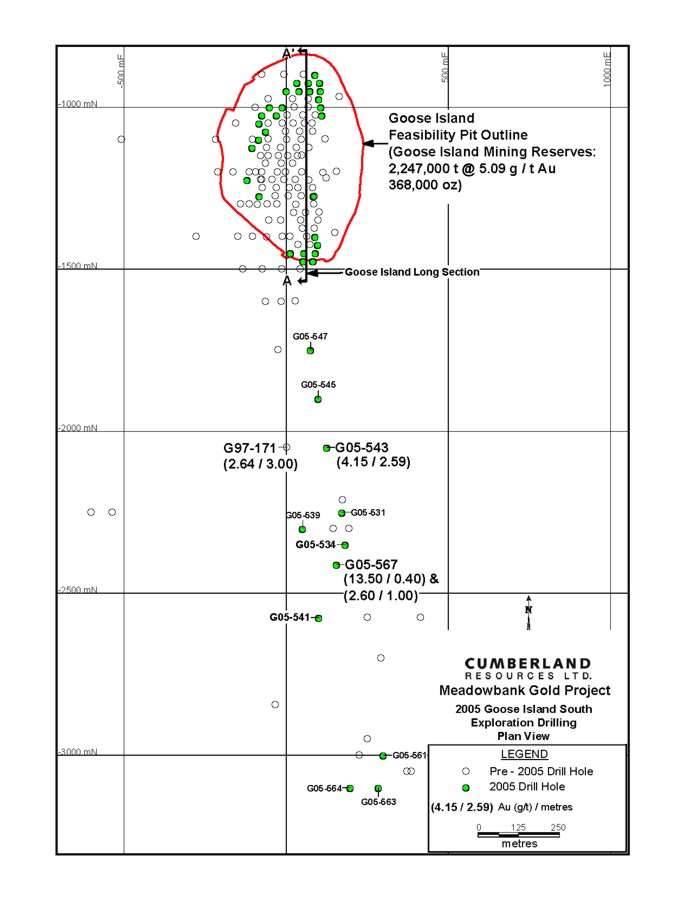

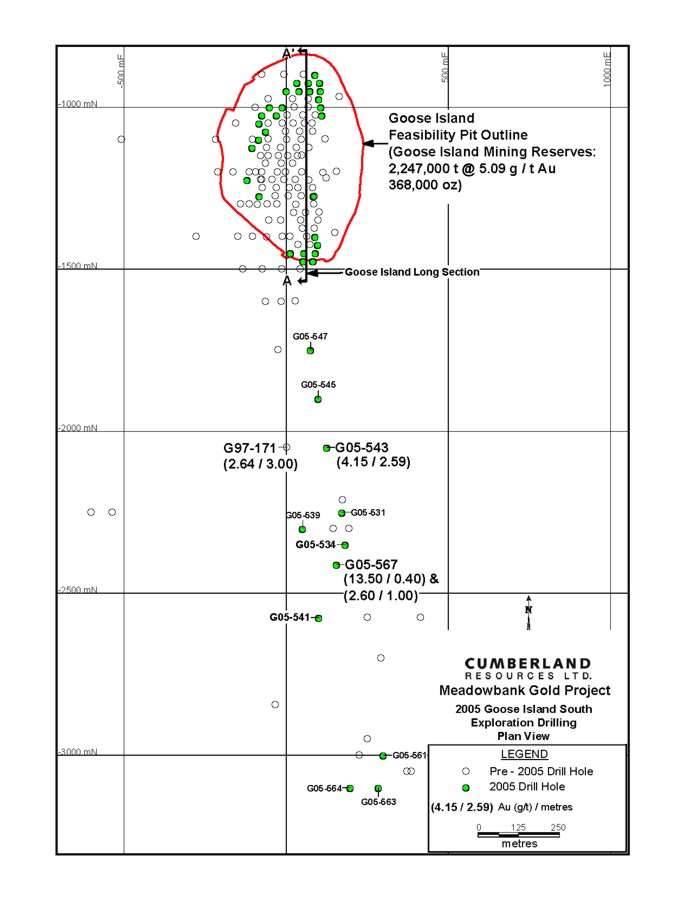

Goose Island South Target – Exploration Drilling

Drilling on the Goose Island South target was designed to follow up on mineralization intersected in wide spaced drilling completed in 1995 and 1997. The program covered approximately 1,400 metres of prospective iron formation, along which 11 holes were drilled in the 2005 program. (See figure.)

Highlights from the 2005 drill program at the Goose Island South target include:

Hole G05-543: 4.15 g/t over 2.59 m at 50 m below surface.

Hole G05-567: 13.50 g/t over 0.40 m at 90 m below surface, and

2.60 g/t over 1.00 m at 137 m below surface.

Drilling in 2005, 550 metres south of the Goose Island deposit, followed up on a deep intersection from 1997 (2.64 g/t over 3.00 metres at 277 metres below surface in hole G97-171). Hole G05-543 returned an encouraging 4.14 g/t over 2.59 metres at a shallow depth (50 metres below surface or 150 metres up dip from the intersection in G97-171). Potential exists for additional mineralization in the vicinity of this drill hole, as the nearest drilling is 150 metres along strike in both directions.

While narrow high grade results from drill hole G05-567 suggest that there is potential for high grade mineralization in this area, most other 2005 Goose South drill holes encountered narrow and low grade mineralized intercepts.

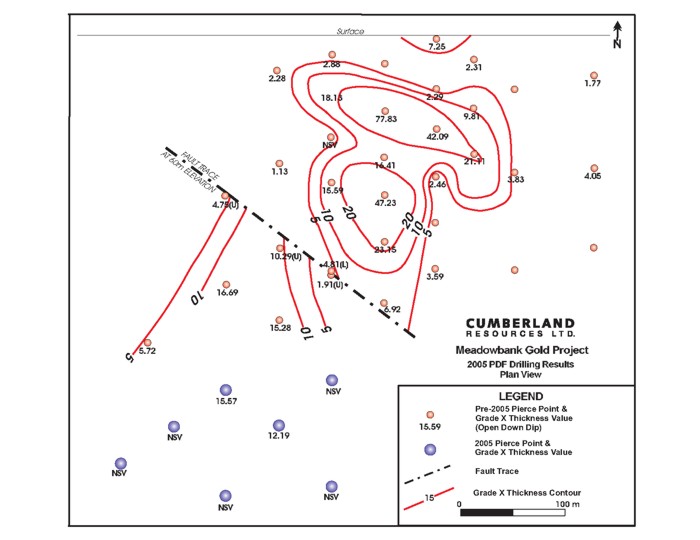

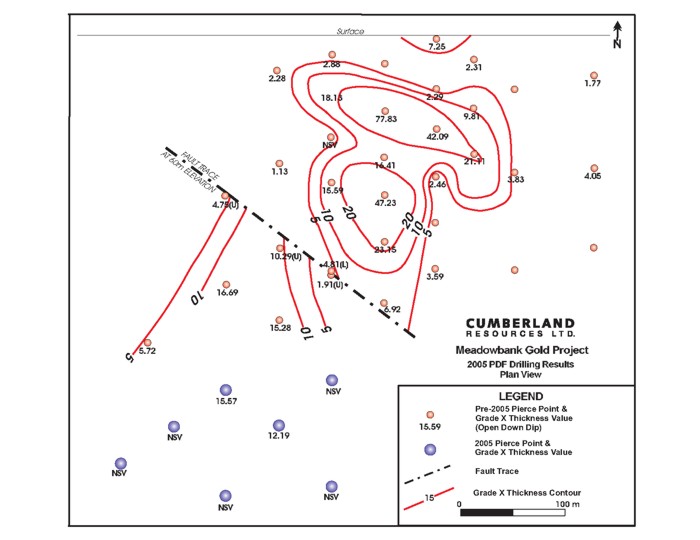

PDF Deposit – Depth Extension Drilling

Wide spaced drilling at the PDF deposit (73,000 ounces inferred resource2), located 15 kilometres north of the proposed Goose Island open pit, was designed to test the depth potential of the deposit as follow up to significant results from the 2004 program. Eight wide spaced holes were drilled in 2005 to test for depth extensions. (See figure.)

Highlights from the 2005 drill program at the PDF deposit include:

Hole PDF05-042: 1.92 g/t over 6.35 m at 164 m from surface.

Hole PDF05-043: 6.77 g/t over 2.30 m at 148 m from surface.

Holes PDF05-042 and PDF05-043 were successful in intersecting the PDF mineralized zone 100 metres down dip from 2004 intersections; however, a second series of 100 metre down dip step outs failed to return any significant values, effectively closing off the mineralized trend.

2005 Phase II Exploration Program

The 2005 Phase II exploration program is commencing with evaluation of a number of targets on the Meadowbank property through prospecting, till sampling and Induced Polarization geophysical surveys. In addition, Cumberland plans to carry out 2,000 metres of diamond drilling which will include follow up on shallow mineralization intersected in 1998 drilling, located 285 metres north of the proposed Portage open pit. Drill hole NP 98-305 intersected 4.41g/t over 6.65 metres from 4.70 metres to 11.35 metres down hole. Potential extensions of this mineralization to the north, south and at depth will be evaluated by the Phase II drill program.

2005 Airstrip Construction

Construction of an airstrip with capacity to handle light fixed wing aircraft will commence towards the end of July. The airstrip construction will be managed by Tercon Construction Ltd. and is designed to improve access to the property in support of ongoing exploration programs.

Meadowbank Gold Project

Cumberland is advancing Meadowbank towards open pit production of 315,000 ounces of gold per year over an 8.3 year mine life with an estimated total cash cost of US$224 per ounce. A feasibility study3 was completed by AMEC Americas Ltd. in February 2005, SG Corporate & Investment Banking was appointed Financial Adviser in June 2005 in connection with potential debt financing, and development permitting is progressing. Operations from three, shallow open pits are planned to commence in mid-2008, provided final permits and licenses are obtained in early 2006.

Meadowbank Gold Project Production Profile3

Open Pit Mineral Reserves (Proven and Probable) | 2,768,000 ounces1 |

Mine Throughput | 2.73 Mtpa |

Mine Life | 8.3 years |

Average Annual Production Rate Years 1 to 4 Life of Mine |

375,000 ounces 315,000 ounces |

Total Cash Cost per Oz. Years 1 to 4 Life of Mine |

US$199 US$224 |

Cumberland is a well financed mineral exploration and development company. The Company completed a feasibility study on the Meadowbank gold project (100% interest) in Nunavut and is advancing the project towards production. The Company also holds a 22% carried to production interest in the Meliadine West gold project and a 50% interest in the Meliadine East gold project, both located in Nunavut. The shares of Cumberland are traded on the Toronto Stock Exchange and the American Stock Exchange under the symbol CLG.

CUMBERLAND RESOURCES LTD.

”Kerry M. Curtis, B.Sc., Geo.”

President and CEO

For further information contact: Kerry Curtis, President and CEO or Joyce Musial, Manager, Investor Relations

Qualified Person - Gordon I. Davidson, P.Geol., is Exploration Manager, Canada, for Cumberland Resources Ltd. and is the designated Q.P. for the Meadowbank Project. Mr. Davidson has supervised drill hole planning, implementation and quality control/quality assurance programs at the Meadowbank Project since 1996. Drill core analysis is performed on split core with standard fire assay procedures and AA finish. QA/QC programs employ random insertion of four internal standards, field duplicates and blank samples. Gravimetric analysis is performed on any sample yielding greater than 1 g/t gold in fire assay. Primary assaying is performed by IPL Laboratories, of Vancouver. ACME Analytical Laboratories of Vancouver provides external reference assaying.

Forward Looking Statements and Risks -This News Release contains “forward-looking statements”, including, but not limited to, statements regarding our expectations as to the market price of gold, strategic plans, future commercial production, production targets and timetables, mine operating costs, capital expenditures, work programs, exploration budgets and mineral reserve and resource estimates. Forward-looking statements express, as at the date of this report, our plans, estimates, forecasts, projections, expectations or beliefs as to future events or results. We caution that forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements. Factors that could cause results or events to differ materially from current expecta tions expressed or implied by the forward-looking statements include, but are not limited to, factors associated with fluctuations in the market price of precious metals, mining industry risks and hazards, environmental risks and hazards, uncertainty as to calculation of mineral reserves and resources, requirement of additional financing, risks of delays in construction and other risks more fully described in our AIF filed with the Securities Commissions of the Provinces of British Columbia, Alberta, Ontario, Quebec and Nova Scotia and the Toronto Stock Exchange and in our 20F filed with the United States Securities and Exchange Commission (the “SEC”).

Cautionary Note to U.S. Investors - The SEC permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this news release such as “mineral resources” and “inferred resources” that the SEC guidelines strictly prohibit us from including in our Form 40-F available from us at Suite 950 – 505 Burrard Street, Vancouver, B.C. V7X 1M4. You can also obtain this form from the SEC by calling 1-800-SEC-0330.

Cautionary Note to U.S. Investors concerning estimates of Indicated Resources – This news release uses the term “indicated” resources. We advise US Investors that while that term is recognized and required by Canadian regulations, the SEC does not recognize it.U.S. investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into mineral reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources – This news release uses the term “inferred” resources. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

1 Meadowbank Gold Reserves (First Quarter 2005) - The open pit mining reserves have been prepared in accordance with NI 43-101. Mr. Mark Pearson, P.Eng, Principal Mining Engineer with AMEC Americas Limited is the independent Qualified Person responsible for preparation of stated reserves.

2 PDF Deposit Resource Parameters (Fourth Quarter 2004) - PDF resource estimates were prepared by Cumberland in accordance with standards outlined in National Instrument 43-101 and CIM Standards on Mineral Resources and Reserves (August 2000). James McCrea, P.Geo., is the Qualified Person under NI 43-101. PDF deposit resources are not included in the feasibility study of the Meadowbank project.

3 Meadowbank Feasibility Study (First Quarter 2005) – The feasibility study incorporates improvements to the mine model as a result of a re-design completed in 2004 by the Company and the study manager, AMEC Americas Ltd. (“AMEC”). The results from the Study are summarized in a Technical Report, dated March 31, 2005, prepared by AMEC in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Construction scheduling and capital cost estimation has been prepared by Merit International Consultants Inc. (“Merit”). Metallurgical and process test work was completed by SGS Lakefield Research Ltd. Process design was completed by International Metallurgical and Environmental Inc. and AMEC. Supporting geotechnical engineering, hydrogeological and geochemical studies were completed by Golder Associates Ltd. (“Golder” ). The Study has been prepared in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101 (“NI 43-101”). Assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

2005 SPRING DIAMOND DRILLING: Goose Island Composites |

HOLE - ID | LOCATION | FROM | TO | GRADE | WIDTH |

| | Northing | Easting | (m) | (m) | Au (g/t) | (m) |

G05-532 | 925S | 103E | | | NSV | |

G05-533 | 925S | 69E | 44.76 | 49.58 | 1.97 | 4.82 |

G05-535 | 975S | 100E | 25.72 | 27.51 | 10.09 | 1.79 |

G05-536 | 1000S | 106E | 21.30 | 23.20 | 14.09 | 1.90 |

G05-537 | 1000S | 12W | 111.72 | 124.79 | 5.36 | 13.07 |

| | | | 138.59 | 142.70 | 2.60 | 4.11 |

G05-538 | 1025S | 111E | | | NSV | |

G05-540 | 1025S | 30W | 125.02 | 136.98 | 7.31 | 11.96 |

| | | incl | 125.78 | 129.56 | 16.96 | 3.78 |

| | | and | 128.10 | 128.76 | 54.00 | 0.66 |

G05-542 | 1025S | 75W | 168.86 | 174.23 | 1.72 | 5.37 |

G05-544 | 1050S | 84W | 184.31 | 185.10 | 9.00 | 0.79 |

G05-546 | 1075S | 62W | 150.12 | 152.46 | 5.53 | 2.34 |

| | | | 174.39 | 176.19 | 189.78 | 1.80 |

G05-548 | 1000S | 50W | | | NSV | |

G05-549 | 1450S | 55E | 65.93 | 68.41 | 3.78 | 2.48 |

G05-550 | 1450S | 90E | 21.60 | 27.78 | 3.20 | 6.18 |

G05-551 | 950S | 105E | | | NSV | |

G05-552 | 1425S | 96E | 9.90 | 19.03 | 3.94 | 9.13 |

| | | | 22.75 | 23.31 | 16.56 | 0.56 |

G05-553 | 950S | 74E | 45.33 | 47.05 | 2.96 | 1.72 |

G05-554 | 1400S | 88E | 24.21 | 27.87 | 7.58 | 3.66 |

| | | incl | 24.21 | 25.14 | 13.47 | 0.93 |

| | | and | 25.74 | 26.04 | 34.80 | 0.30 |

G05-555 | 1275S | 83W | 233.90 | 236.10 | 8.04 | 2.20 |

| | | incl | 233.90 | 234.40 | 17.10 | 0.50 |

G05-556 | 950S | 40E | 71.20 | 77.18 | 3.37 | 5.98 |

G05-557 | 1100S | 87W | 170.27 | 172.00 | 11.00 | 0.73 |

| | | | 224.15 | 225.11 | 9.32 | 0.96 |

G05-558 | 1475S | 82E | 32.00 | 35.86 | 10.97 | 3.86 |

| | | incl | 35.26 | 35.86 | 60.00 | 0.60 |

G05-559 | 1475S | 52E | 73.54 | 74.50 | 6.00 | 0.96 |

G05-560 | 1450S | 13E | | | NSV | |

G05-562 | 1225S | 120W | 266.54 | 270.95 | 6.66 | 4.41 |

G05-566 | 1125S | 105W | 197.40 | 198.82 | 3.58 | 1.42 |

| | | | 211.50 | 214.00 | 8.25 | 2.50 |

| | | incl. | 211.50 | 212.45 | 18.77 | 0.95 |

G05-568 | 950S | 0E | 128.71 | 129.20 | 6.80 | 0.49 |

G05-569 | 925S | 34E | 80.79 | 83.15 | 5.47 | 2.36 |

G05-570 | 900S | 88E | | | NSV | |

2005 SPRING DIAMOND DRILLING: Goose Island South Composites |

HOLE - ID | LOCATION | FROM | TO | GRADE | WIDTH |

| | Northing | Easting | (m) | (m) | Au (g/t) | (m) |

G05-531 | 2250S | 170E | 99.70 | 100.05 | 1.48 | 0.35 |

G05-534B | 2350S | 182E | 124.63 | 125.05 | 1.60 | 0.42 |

G05-539 | 2300S | 50E | | | NSV | |

G05-541 | 2575S | 100E | | | NSV | |

G05-543 | 2050S | 125E | 56.71 | 59.30 | 4.15 | 2.59 |

| | | | 61.70 | 62.28 | 1.28 | 0.58 |

G05-545 | 1900S | 100E | 54.42 | 55.41 | 2.10 | 0.99 |

G05-547 | 1750S | 75E | 85.23 | 86.00 | 4.26 | 0.77 |

G05-561 | 3000S | 300E | | | NSV | |

G05-563 | 3100S | 285E | 20.75 | 21.75 | 1.10 | 1.00 |

| | | | 120.80 | 121.22 | 1.70 | 0.42 |

G05-564 | 3100S | 200E | 116.85 | 117.40 | 1.00 | 0.55 |

G05-567 | 2412S | 155E | 109.00 | 109.64 | 1.14 | 0.64 |

| | | | 111.60 | 112.00 | 13.50 | 0.40 |

| | | | 139.72 | 140.27 | 1.20 | 0.55 |

| | | | 167.00 | 168.00 | 2.60 | 1.00 |

2005 SPRING DIAMOND DRILLING: PDF Composites |

HOLE - ID | LOCATION | FROM | TO | GRADE | WIDTH |

| | Easting | Northing | (m) | (m) | Au (g/t) | (m) |

PDF05-040 | 1950E | 4675N | | | NSV | |

PDF05-041 | 1950E | 4575N | | | NSV | |

PDF05-042 | 1800E | 4600N | 163.15 | 169.50 | 1.92 | 6.35 |

| | | Incl | 163.15 | 163.65 | 13.00 | 0.50 |

PDF05-043 | 1850E | 4643N | 144.85 | 145.35 | 1.60 | 0.50 |

| | | | 148.45 | 150.75 | 6.77 | 2.30 |

| | | incl | 149.25 | 149.80 | 10.80 | 0.55 |

PDF05-046 | | | | | NSV | |

PDF05-047 | | | | | NSV | |

PDF05-048 | | | 145.31 | 145.85 | 1.14 | 0.54 |

PDF05-049 | | | | | NSV | |