NEWS RELEASE

![[exhibit1004.jpg]](https://capedge.com/proxy/6-K/0001016724-06-000011/exhibit1004.jpg)

TSX: CLG; AMEX: CLG

Suite 950 – 505 Burrard Street, Box 72, One Bentall Centre, Vancouver, B.C. Canada V7X 1M4

Tel: 604.608.2557 Fax: 604.608.2559 www.cumberlandresources.com

News Release 06-08

April 13, 2006

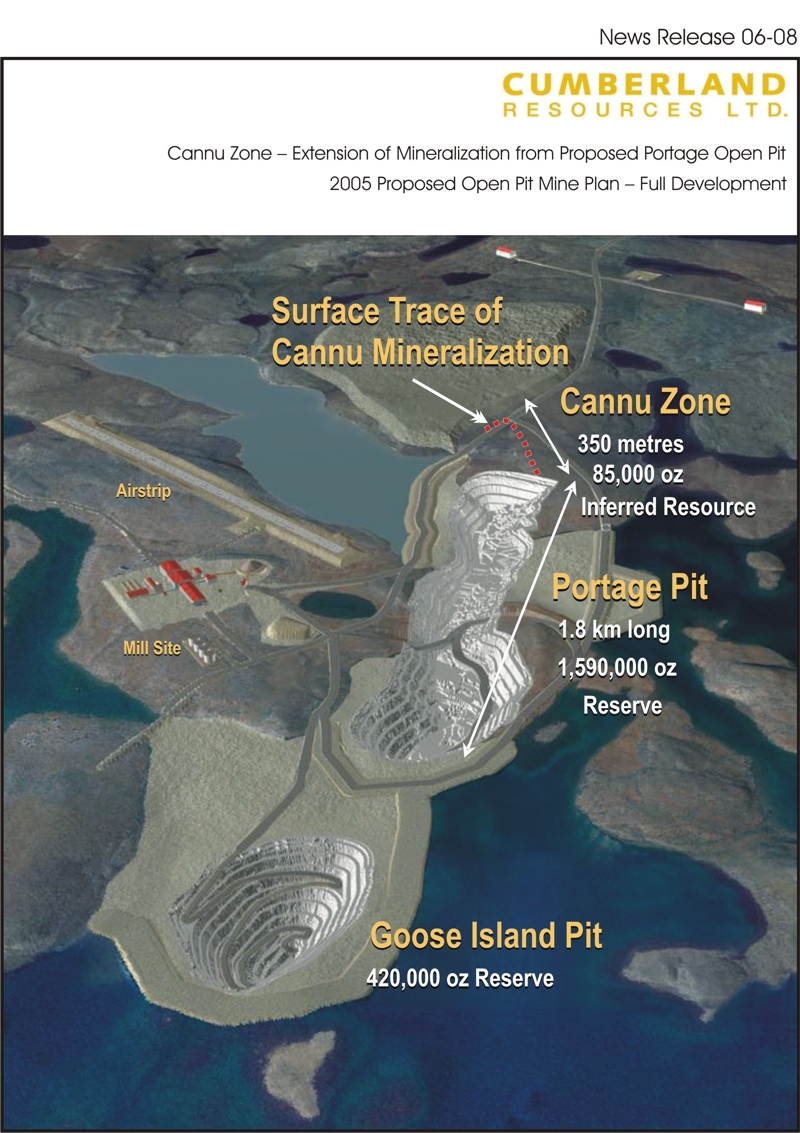

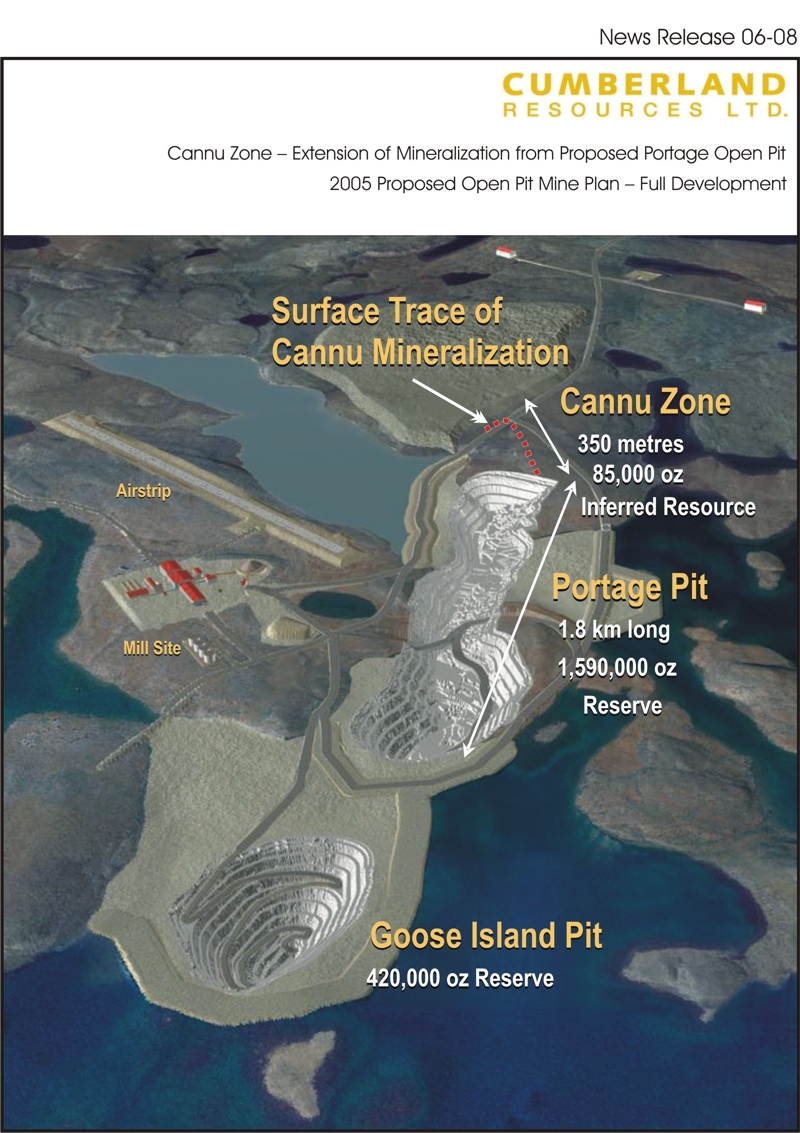

Cumberland Commences 2006 Drill Program at Meadowbank and Reports Initial Cannu Resource

CUMBERLAND RESOURCES LTD. (TSX: CLG; AMEX: CLG) is pleased to announce that two diamond drills are active and an initial inferred mineral resource has been completed at the recently discovered Cannu zone at the Company’s 100% owned Meadowbank gold project located in Nunavut, Canada. The two phased 2006 exploration program, including approximately 9,000 metres of diamond drilling, will focus on increasing gold resources and reserves at the Cannu zone and other targets along the 25 kilometre Meadowbank gold trend.

Cumberland is advancing the Meadowbank project towards the mid-tier level of gold production forecast at 330,000 ounces of gold per year over an 8.1 year mine life based on a feasibility study due diligence1 completed in December 2005. Final hearings in the permitting process were completed in March 2006 and operations from three, shallow open pits are planned to commence during the second half of 2008 provided all permits, licences and financing are received on a timely basis.

Cannu Zone Resource

The Cannu zone, a high grade, near surface zone of mineralization located just north of the proposed Portage open pit, was discovered in the fall of 2005. A total of 30 holes were completed in the 2005 drilling program (news release NR05-17). An initial resource estimate for the Cannu zone has been prepared by SRK Consulting (UK) Limited (“SRK”). The estimate is based on 64 intersections in 34 drill holes (including four pre-2005 holes) and, as with previously released Meadowbank resource estimates, utilizes three dimensional block models interpolated using inverse distance methods. On this basis, SRK has derived the following Cannu inferred mineral resource estimate:

Cannu Zone Mineral Resource (April 2005)2

Category | Tonnes | Au Grade (g/t) | Contained Ounces |

Inferred | 440,000 | 6.0 | 85,000 |

The Cannu zone gold mineralization represents a potential 350 metre northern extension to the reserves defined in the proposed Portage open pit (see attached Figure). Current Meadowbank reserves as estimated by SRK in December 2005 are:

Meadowbank Gold Project

Open Pit Mineral Reserve (Proven & Probable) (Fourth Quarter 2005)3

Open Pit | Ore (t) | Au Grade (g/t) | Contained Ounces |

Portage | 11,010,000 | 4.5 | 1,590,000 |

Vault | 8,010,000 | 3.4 | 870,000 |

Goose | 2,310,000 | 5.7 | 420,000 |

Total | | 4.2 | 2,890,000 |

Note: 95% mining recovery and contact dilution applied.

2006 Drilling Program

The 2006 exploration program at Cannu will include both infill and step-out drilling to define the extent of the mineralization and enable a reserve estimate. Mineralization at the Cannu zone is hosted in a shallow, bowl-shaped structure. Mineralization in the western portion of the structure represents a new target and is open for expansion. Additional drilling at Meadowbank in 2006 will focus on previously-defined mineralization south of the Goose Island deposit and drill testing of the Ukalik prospect north of the Vault deposit.

Meadowbank Project Advancing Towards Mid-Tier Gold Production

The Meadowbank project is host to Canada’s largest pure gold open pit reserves with gold reserves estimated at 2.9 million ounces3. Cumberland is advancing the Meadowbank project towards open pit production of 330,000 ounces of gold per year over an 8.1 year mine life with an estimated total cash cost of US$201 per ounce based on a feasibility study due diligence1 completed in December 2005. Peak production is achieved in Year 1 with 451,000 ounces produced at an estimated cash cost of US$155 per ounce. In March 2006, the Company announced that it had arranged a gold loan facility for up to 420,000 ounces of gold from Barclays Capital, Bayerische Hypo-und Vereinsbank and Société Générale. Such facility is subject to the satisfaction of certain conditions including, among other things, Cumberland securing all requisite regulatory permits and licences and completion of final loa n documentation. At a Cdn$600 per ounce spot gold price, the monetized value of the gold loan would be approximately Cdn$250 million. Final hearings in the permitting process were completed in March 2006 and operations from three, shallow open pits are planned to commence during the second half of 2008 provided all permits, licences and financing are received on a timely basis.

Meadowbank Gold Project Production Profile1 (Dec. 2005)

Open Pit Mineral Reserve (Proven & Probable) | 2,890,000 ounces3 |

Metallurgical Recovery | 93.2% |

Mine Throughput | 2.73 Mtpa |

Mine Life | 8.1 years |

Average Annual Production Rate Years 1 to 4 Life of Mine |

400,000 ounces 330,000 ounces |

Total Cash Cost per Oz. Years 1 to 4 Life of Mine |

US$175 US$201 |

Pre-production Capital Costs | US$235 million Cdn$313 million |

Assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

Cumberland is a well financed mineral development and exploration company. The Company has completed a bankable feasibility study on the Meadowbank gold project (100% interest) in Nunavut and is advancing the project towards production. The Company also holds a 22% carried to production interest in the Meliadine West gold project and a 50% interest in the Meliadine East gold project, both located in Nunavut. The shares of Cumberland are traded on the Toronto Stock Exchange and the American Stock Exchange under the symbol CLG.

CUMBERLAND RESOURCES LTD.

”Kerry M. Curtis, B.Sc., P.Geo.”

President and CEO

For further information contact: Kerry Curtis, President and CEO or Joyce Musial, Manager, Investor Relations

1Meadowbank Feasibility Study Due Diligence (December 2005) – As a requirement of bank financing, bank-appointed independent engineers SRK Consulting (UK) (“SRK”) completed a due diligence audit of the Meadowbank feasibility study completed in early 2005 by AMEC Americas Ltd. (“AMEC”). The results from the feasibility study by AMEC are summarized in a Technical Report, dated March 31, 2005, prepared by AMEC in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Construction scheduling and capital cost estimation has been prepared by Merit International Consultants Inc. (“Merit”). Metallurgical and process test work was completed by SGS Lakefield Research Ltd. Process design was completed by International Metallurgical and Environmental Inc. and AMEC. Supporting geotechnical engineering, hydrogeologica l and geochemical studies were completed by Golder Associates Ltd. (“Golder”). Both the SRK and AMEC assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

2Cannu Resource (April 2006) - The inferred mineral resource estimate was prepared in conformance with the requirements set out in NI 43-101 under the direction of Dr. Mike Armitage, Managing Director of SRK Consulting (UK) Limited, who is an independent Qualified Person as defined by NI 43-101.

3Meadowbank Gold Reserves (Fourth Quarter 2005) - The open pit mineral reserves have been prepared in accordance with NI 43-101. Dr. Mike Armitage, Managing Director of SRK Consulting (UK) Limited is the independent Qualified Person responsible for preparation of stated reserves.

Forward Looking Statements and Risks -This News Release contains “forward-looking statements”, including, but not limited to, statements regarding our expectations as to the market price of gold, strategic plans, future commercial production, production targets and timetables, mine operating costs, capital expenditures, work programs, exploration budgets and mineral reserve and resource estimates. Forward-looking statements express, as at the date of this report, our plans, estimates, forecasts, projections, expectations or beliefs as to future events or results. We caution that forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements. Factors that could cause results or events to differ materially from current expecta tions expressed or implied by the forward-looking statements include, but are not limited to, factors associated with fluctuations in the market price of precious metals, mining industry risks and hazards, environmental risks and hazards, uncertainty as to calculation of mineral reserves and resources, requirement of additional financing, risks of delays in construction and other risks more fully described in our AIF filed with the Securities Commissions of the Provinces of British Columbia, Alberta, Ontario, Quebec and Nova Scotia and the Toronto Stock Exchange and in our 20F filed with the United States Securities and Exchange Commission (the “SEC”).

Cautionary Note to U.S. Investors -The SEC permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this news release such as “measured”, “indicated” and “inferred” “resources” that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 20-F, which is available from us at Suite 950 – 505 Burrard Street, Vancouver, B.C. V7X 1M4. You can also obtain this form from the SEC’s website at: http://sec.gov/edgar.shtml.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources – This news release uses the term “inferred resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

Cautionary Note to U.S. Investors concerning estimates of Proven and Probable Reserves - The estimates of mineral reserves described in this News Release have been prepared in accordance with Canadian National Instrument 43-101. The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Guide 7. Accordingly, the Company’s disclosure of mineral reserves in this News Release may not be comparable to information from U.S. companies subject to the SEC’s reporting and disclosure requirements.

![[exhibit1004.jpg]](https://capedge.com/proxy/6-K/0001016724-06-000011/exhibit1004.jpg)