NEWS RELEASE

![[exhibit1004.jpg]](https://capedge.com/proxy/6-K/0001016724-07-000002/logo.jpg)

TSX: CLG; AMEX: CLG

Suite 950 – 505 Burrard Street, Box 72, One Bentall Centre, Vancouver, B.C. Canada V7X 1M4

Tel: 604.608.2557 Fax: 604.608.2559 www.cumberlandresources.com

News Release 07-02

January 17, 2007

Cumberland Completes Cannu Gold Resource Estimate,

Plans for New Reserves and Continued Exploration in 2007 at Meadowbank Gold Project

CUMBERLAND RESOURCES LTD. (TSX: CLG; AMEX: CLG) is pleased to report that the 2006 drill program at the Company’s 100% owned Meadowbank gold project has been successful in readying gold resources for reserve definition at the Cannu zone, a potentially open pittable high-grade zone of mineralization discovered in 2005. Meadowbank is host to Canada’s largest undeveloped pure gold open pit reserves of 2.9 million ounces. The Meadowbank project, located 70 kilometres north of the hamlet of Baker Lake, Nunavut, is designed to produce an average of 330,000 ounces of gold per year over an eight year mine life.

The Cannu gold zone is located immediately north of the proposed Portage open pit, the largest of three proposed open pits at Meadowbank. Systematic infill and step-out drilling completed during 2006 has been incorporated in an updated Cannu resource estimate. Highlights of the updated Cannu mineral resource estimate (January 2007) include:

- Inferred mineral resources upgraded to the indicated resource category

- Indicated resource grade approximately 40% higher than Meadowbank reserve grade

- Near surface mineralization should contribute to future open pit expansion

- Majority of indicated resources expected to be converted into open pit reserves

- Potential for Cannu zone to be brought forward in mine plan

“We are very pleased with the quick progress made in discovering, defining and upgrading the gold resources at Cannu,” stated Kerry Curtis, President and CEO. “We will now focus on estimating a Cannu reserve in the first quarter of 2007 and incorporating Cannu into the Meadowbank mine plan. We are also planning an extensive 2007 drill program at the recently-discovered Goose South zone for continued resource and reserve growth at Meadowbank.”

2006 Drilling Improves Cannu Zone Resource

An updated resources estimate for the Cannu zone, incorporating mineralization intersected in the 2006 drill program, has been prepared by SRK Consulting (UK) Limited (“SRK”). The estimate is based on 123 intersections in 57 drill holes and, as with previously released Meadowbank resource estimates, utilizes three dimensional block models interpolated using inverse distance methods and the same cut-off grade. On this basis, SRK has derived the following Cannu resource estimate (January 2007):

Cannu Zone Mineral Resource (Jan. 2007)1

Category | Tonnes | Grade (g/t) | Ounces |

Indicated | 490,000 | 5.9 | 93,000 |

Inferred | 55,000 | 6.2 | 11,000 |

The Cannu zone was discovered in the fall of 2005 and an initial inferred mineral resource estimate was reported in early 2006. Since discovery, Cumberland has completed 76 drill holes totaling 9,340 metres in the Cannu zone. The zone has now been drilled along a strike length of 350 metres on 25 metres spaced sections, with spacing on section averaging 35 metres. The Company expects to convert the majority of the Cannu indicated mineral resources into open pit reserves in the first quarter of 2007.

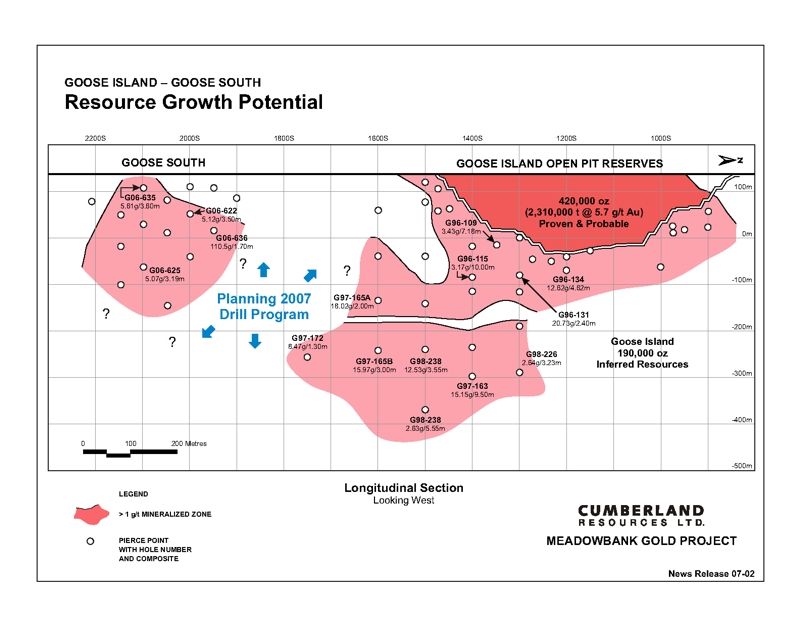

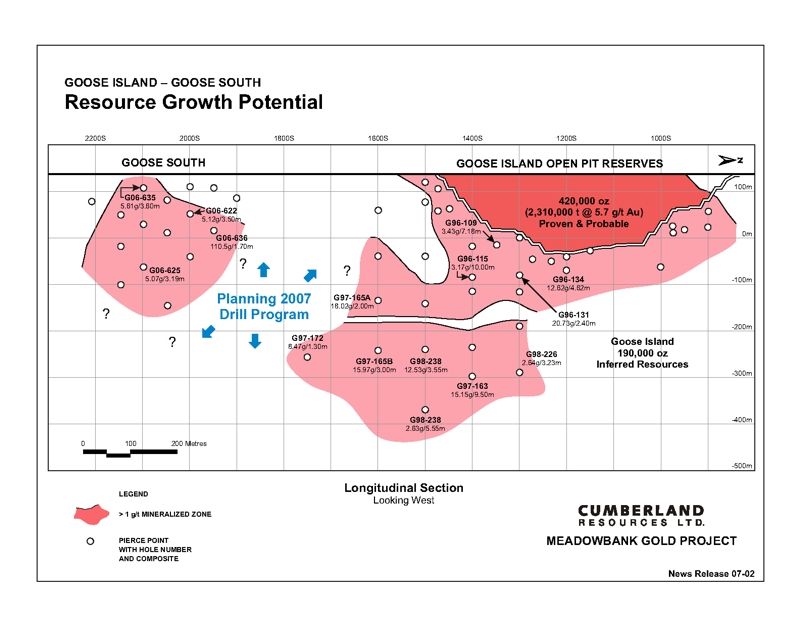

Discovery of Goose South Zone in 2006

The 2006 program was also successful in discovering a new zone of gold mineralization located approximately 400 metres south of the Goose Island deposit. Drill intersections at the Goose South zone yielded encouraging gold grades over narrow to moderate widths within a similar structural and stratigraphic setting as the Goose Island deposit. Approximately 2,270 metres of diamond drilling in 12 holes were completed at the Goose South zone during 2006. Cumberland is planning an extensive drill program in the spring of 2007 aimed at resource growth at the Goose South zone and Goose Island deposit (see mineralization and growth potential on attached longitudinal section).

Final 2006 Drilling at Cannu Zone

The Company completed approximately 5,940 metres of diamond drilling in 46 holes at the Cannu zone during 2006. The program has been successful in defining four distinct lenses of high grade mineralization (Keel, 305, Core and East lenses) within a shallow, bowl-shaped structure. Drill results have been incorporated into the above revised resource estimate and highlights from the final 2006 Cannu drilling include:

Selected Highlights from Cannu Zone Final 2006 Drill Holes2

Hole Number | Grade Au (g/t) | Width (m) | Depth (m below surface) | Lens |

NP06-657 | 2.95 | 10.50 | 31 | 305 |

NP06-659 | 6.01 | 7.12 | 7 | 305 |

NP06-660 | 8.41 | 2.14 | 17 | 305 |

NP06-667 | 5.94 | 3.07 | 54 | East |

NP06-668 | 2.49 | 7.40 | 46 | East |

Note: True thickness of intersections ranges from 80-100% of intersected widths.

2007 Meadowbank Resource Increases

With the addition of Cannu zone, mineralization has been defined over a continuous strike length of approximately 2.15 kilometres in the Portage area. The improved Cannu mineral resource has been included within the Portage deposit and has contributed to an approximate 6.5% increase in the indicated resource estimate at Portage. To date, approximately 142,000 metres of diamond drilling in 1,042 holes have been completed at Meadowbank. SRK has updated the Meadowbank resource estimate (January 2007) as follows:

Meadowbank Gold Project

2007 Mineral Resource (including Cannu Zone) (Jan. 2007)3

Deposit | Category | Tonnes | Grade (g/t) | Ounces |

Portage | Measured | 2,800,000 | 5.4 | 480,000 |

(including Cannu Zone) | Indicated | 9,000,000 | 5.1 | 1,460,000 |

| | Sub-Total | 11,800,000 | 5.1 | 1,940,000 |

| | Inferred | 700,000 | 4.7 | 100,000 |

Goose Island | Measured | - | - | - |

| | Indicated | 2,240,000 | 6.5 | 470,000 |

| | Sub-Total | 2,240,000 | 6.5 | 470,000 |

| | Inferred | 1,370,000 | 4.2 | 190,000 |

Vault | Measured | - | - | - |

| | Indicated | 8,610,000 | 3.9 | 1,080,000 |

| | Sub-Total | 8,610,000 | 3.9 | 1,080,000 |

| | Inferred | 870,000 | 5.4 | 150,000 |

PDF* | Inferred | 507,000 | 4.5 | 73,000 |

Total | Measured | 2,800,000 | 5.4 | 480,000 |

| | Indicated | 19,850,000 | 4.7 | 3,010,000 |

| | Sub-Total | 22,650,000 | 4.8 | 3,490,000 |

| | Inferred | 3,447,000 | 4.6 | 513,000 |

Note: Grade rounded to nearest 0.1 g/t. Numbers may not add due to rounding.

* The PDF inferred mineral resource estimate was prepared by Cumberland.

Development of Meadowbank

Cumberland is advancing the Meadowbank project toward open pit production based on a bankable feasibility study and subsequent bank due diligence4 completed in December 2005:

Meadowbank Gold Project Production Profile4 (Dec. 2005)

(Assuming long term US$400/oz. gold and US$0.75 per Cdn$1.00)

Mine Life | 8.1 years |

Average Annual Production Rate: Years 1 to 4 Life of Mine | 400,000 ounces 330,000 ounces |

Total Cash Cost per Oz.: Years 1 to 4 Life of Mine | US$175 US$201 |

Pre-production Capital Costs | US$235 million Cdn$313 million |

Meadowbank Gold Project

2005 Open Pit Mineral Reserve (Proven & Probable) (Fourth Quarter 2005)5

(Proven & probable mineral reserves are a subset of measured & indicated resources.)

Category | Ore (t) | Grade (g/t) | Ounces |

Proven | 3,020,000 | 4.8 | 470,000 |

Probable | 18,300,000 | 4.1 | 2,420,000 |

Proven & Probable | 21,320,000 | 4.2 | 2,890,000 |

Note: 95% mining recovery and contact dilution applied.

A production decision was made by the Board of Directors of Cumberland in September 2006 following a positive development recommendation by the Nunavut Impact Review Board (“NIRB”). The Company has since secured at least Cdn$254 million for its gold loan facility and has raised approximately Cdn$100 million in equity financing to be used for development of Meadowbank.

The Federal Minister of Indian Affairs and Northern Development accepted the positive NIRB recommendation in November 2006 and the NIRB issued a Project Certificate to Cumberland in December 2006. With receipt of the Project Certificate, Cumberland has commenced the processing of all ancillary permits required for construction. The Company has staged the necessary equipment and supplies at Baker Lake for the construction of a four season access road to Meadowbank and has retained Nuna Logistics Limited as contractor for road construction. Subject to the timely receipt of all ancillary permits and requisite financing, production is expected to commence in late 2008 or early 2009.

Cumberland is a well financed mineral development and exploration company which is positioning itself to become a mid-tier gold producer by developing its 100% owned Meadowbank gold project to production. The shares of Cumberland are traded on the Toronto Stock Exchange and American Stock Exchange under the symbol CLG.

CUMBERLAND RESOURCES LTD.

”Kerry M. Curtis, B.Sc., P.Geo.”

President and CEO

For further information contact: Kerry Curtis, President and CEO or Joyce Musial, Manager, Investor Relations

1Cannu Resource (January 2007) - The inferred mineral resource estimate was prepared in conformance with the requirements set out in NI 43-101 under the direction of Dr. Mike Armitage, Managing Director of SRK Consulting (UK) Limited, who is an independent Qualified Person as defined by NI 43-101. The Cannu zone resources are not included in the feasibility study of the Meadowbank project.

2Qualified Person – Roger March, P.Geo., is Senior Project Geologist for Cumberland Resources Ltd. and is the designated Qualified Person, as defined by NI 43-101, for the Meadowbank project. Mr. March has supervised drill hole planning, implementation and quality control/quality assurance programs at the Meadowbank project since 2002. Drill core analysis is performed on split core with standard fire assay procedures and AA finish. QA/QC programs employ random insertion of four internal standards, field duplicates and blank samples. Gravimetric analysis is performed on any sample yielding greater than 1 g/t gold in fire assay. Primary assaying is performed by IPL Laboratories, of Vancouver. ACME Analytical Laboratories of Vancouver provides external reference assaying.

32007 Meadowbank Gold Resources (January 2007)

Portage and Cannu Zone (January 2007), Goose Island (Fourth Quarter 2005) and Vault (Fourth Quarter 2005) Resources - The resource estimates were prepared in conformance with the requirements set out in NI 43-101 under the direction of Dr. Mike Armitage , Managing Director of SRK Consulting (UK) Limited, who is an independent Qualified Person as defined by NI 43-101. The Cannu zone resources are not included in the feasibility study of the Meadowbank project.

PDF Resources (August 2000) – The PDF inferred mineral resource estimate was prepared by Cumberland in accordance with standards outlined in National Instrument 43-101 and CIM Standards on Mineral Resources and Reserves (August 2000). James McCrea, P.Geo., Manager, Mineral Resources for Cumberland, is the Qualified Person under NI 43-101. PDF deposit resources are not included in the feasibility study of the Meadowbank project.

4Meadowbank Feasibility Study Due Diligence (December 2005) – As a requirement of bank financing, bank-appointed independent engineers SRK Consulting (UK) (“SRK”) completed a due diligence audit of the Meadowbank feasibility study completed in early 2005 by AMEC Americas Ltd. (“AMEC”). The results from the feasibility study by AMEC are summarized in a Technical Report, dated March 31, 2005, prepared by AMEC in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Construction scheduling and capital cost estimation has been prepared by Merit International Consultants Inc. (“Merit”). Metallurgical and process test work was completed by SGS Lakefield Research Ltd. Process design was completed by International Metallurgical and Environmental Inc. and AMEC. Supporting geotechnical engineering, hydrogeologica l and geochemical studies were completed by Golder Associates Ltd. (“Golder”). Both the SRK and AMEC assumptions include a long term gold price of US$400/oz. and an exchange rate of US$0.75 per Cdn$1.00.

52005 Meadowbank Gold Reserves (Fourth Quarter 2005) - The open pit mineral reserves have been prepared in accordance with NI 43-101. Dr. Mike Armitage, Managing Director of SRK Consulting (UK) Limited is the independent Qualified Person responsible for preparation of stated reserves.

Forward Looking Statements -This News Release contains “forward looking information” within the meaning of the Ontario Securities Act or “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 of the United States, including statements concerning our plans at the Meadowbank Gold Project and other mineral properties, which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with our expectations, metal recoveries, accidents, equipment breakdowns, title matters and surface access, labour disputes or other unanticipated difficulties with or interruptions in production, the potential for delays in exploration or development activities or the completion of new or updated feasibility studies, the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations (including gold, fuel, steel and construction items), currency fluctuations, failure to obtain adequate financing on a timely basis and other risks and uncertainties, including those described in the Annual Information Form filed with the Securities Commissions of the Provinces of British Columbia, Ontario, Que bec and Nova Scotia in our 40F filed with the United States Securities and Exchange Commission (the “SEC”) and with the Toronto Stock Exchange. Forward-looking information is in addition based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long term price of gold, that we will receive required permits and access to surface rights, that we can access financing, appropriate equipment and sufficient labour and that the political environment within Nunavut and Canada will continue to support the development of environmentally safe mining projects so that we will be able to commence the development of the Meadowbank Gold Project within the established timetable. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-look ing statements. The words “anticipate”, “believe”, “estimate” and “expect” and similar expressions, as they relate to us or our management, are intended to identify forward looking statements relating to the business and affairs of the Company. Except as required under applicable securities legislation, we undertake no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise.

Cautionary Note to U.S. Investors -The SEC permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this news release such as “measured”, “indicated” and “inferred” “resources” that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 40-F, which is available from us at Suite 950 – 505 Burrard Street, Vancouver, B.C., V7X 1M4. You can also obtain this form from the SEC’s website at: http://sec.gov/edgar.shtml.

Cautionary Note to U.S. Investors concerning estimates of Proven and Probable Reserves - The estimates of mineral reserves described in this News Release have been prepared in accordance with Canadian National Instrument 43-101. The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Guide 7. Accordingly, the Company’s disclosure of mineral reserves in this news release may not be comparable to information from U.S. companies subject to the SEC’s reporting and disclosure requirements.

Cautionary Note to U.S. Investors concerning estimates of Indicated Resources – This news release uses the term “indicated” resources. We advise US Investors that while that term is recognized and required by Canadian regulations, the SEC does not recognize it.U.S. investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into mineral reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources – This news release uses the term “inferred” resources. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

FINAL 2006 DIAMOND DRILLING: Cannu Composites* |

HOLE - ID | LOCATION | FROM | TO | GRADE | WIDTH |

| | Northing | Easting | (m) | (m) | Au (g/t) | (m) |

NP06-656 | 1525N | -665E | 57.00 | 60.00 | 2.75 | 3.00 |

| | | | 85.00 | 91.35 | 2.05 | 6.35 |

| | | | 118.00 | 120.30 | 2.08 | 2.30 |

NP06-657 | 1525N | -639E | 34.00 | 44.50 | 2.95 | 10.50 |

NP06-659 | 1625N | -641E | 6.88 | 14.00 | 6.01 | 7.12 |

| | | inc. | 7.92 | 9.75 | 17.63 | 1.83 |

| | | | 42.00 | 46.00 | 4.95 | 4.00 |

NP06-660 | 1500N | -600E | 16.60 | 19.20 | 3.80 | 2.60 |

| | | | 21.45 | 23.59 | 8.41 | 2.14 |

NP06-664 | 1522N | -610E | 17.45 | 19.36 | 4.29 | 1.91 |

| | | | 57.70 | 59.48 | 4.04 | 1.78 |

NP06-665 | 1600N | -598E | 17.85 | 20.25 | 6.00 | 2.40 |

NP06-667 | 1400N | -514E | 62.20 | 65.27 | 5.94 | 3.07 |

NP06-668 | 1400N | -487E | 50.82 | 58.22 | 2.49 | 7.40 |

NP06-669 | 1500N | -500E | 3.46 | 5.80 | 2.41 | 2.34 |

* True thickness of intersections ranges from 80-100% of intersected widths.