![[exhibit1002.jpg]](https://capedge.com/proxy/SC 14D9/0001016724-07-000012/exhibit1002.jpg)

Agnico-Eagle Mines Limited

145 King Street East

Suite 500

Toronto, Ontario

M5C 2Y7

April 10, 2006

Attention:

Mr. Ebe Scherkus,

Dear Sirs:

Re:

Cumberland Resources Ltd. – Meadowbank Project, Nunavut

Further to our recent discussions, Agnico-Eagle Mines Limited (hereinafter with its wholly-owned subsidiaries referred to as “Agnico” or “you”), has expressed an interest in reviewing certain information that is in written or digital form (herein collectively referred to as the "Evaluation Material") relating to our Meadowbank and Meliadine Properties located in Kivilliq District, Nunavut (hereinafter the “Property”).

We are a publicly traded company with our shares listed on The Toronto Stock Exchange and the American Stock Exchange. Accordingly, there are numerous parties who have an interest in the manner in which you deal with the Evaluation Material provided to you by us.

You have represented to us that you are acting as principal in connection with your review of the Evaluation Material and not as agent or broker for any other person. In consideration of Cumberland Resources Ltd. (herein referred to as “Cumberland”, “us” or “we”) disclosing, or causing to be disclosed, the Evaluation Material to you and in consideration of our respective covenants, you and we hereby undertake and agree as follows.

1.

You hereby agree that any information concerning or relating to Cumberland or the Property furnished or to be furnished to you by or on behalf of Cumberland is confidential and proprietary to us and will not be duplicated, retained (except as set out herein) or distributed by you and will be used by you or your directors, officers, employees, representatives and agents (herein collectively referred to as “agents”) only for the purpose of considering a potential transaction between Agnico and Cumberland with respect to the Property and for no other purpose, which transaction may consist of a debt or equity financing or a corporate transaction such as the assignment to you of all or a part of our interests under the Meadowbank and Meliadine joint venture agreements, or a merger, arrangement or take over bid (the “Transaction”), and that such Evaluation Material will remain ou r property and will be kept confidential by you and your agents, provided, however, that:

a.

any such Evaluation Material may be disclosed to any of your agents who need to know such information for the purpose of evaluating any Transaction with Cumberland (it being understood that you shall inform any such agents of the confidential nature of the Evaluation Material and you shall cause them to undertake to be bound by the terms of this Agreement); and

b.

any disclosure of the Evaluation Material may be made to which Cumberland may specifically consent in writing from time to time.

2.

Also, you hereby acknowledge that you are aware (and that your agents who are apprised of this matter have been, or upon becoming so apprised will be, advised) of the restrictions imposed by the securities laws and other applicable domestic and foreign laws relating to the possession and use of material non-public information about a public company. You will be responsible for any unauthorized use or disclosure of the Evaluation Material by your agents and we will not be required to first assert claims against such persons as a condition of seeking or obtaining a remedy against you.

3.

In the event that no Transaction between our two companies is effected after the Evaluation Material is furnished to you, you agree that you shall upon a written request from Cumberland:

(a)

return to Cumberland the Evaluation Material received by you pursuant to this Agreement without retaining copies thereof, forthwith upon request by Cumberland, except that you shall be entitled to retain a summary of the Evaluation Material for your records for the purpose of identifying the Evaluation Material which was returned to Cumberland; and

(b)

destroy any and all analyses, compilations, studies or other documents prepared by you or on your behalf to the extent they contain or reflect the content of Evaluation Material, and provide a certificate to Cumberland, signed by a senior officer of Agnico, certifying that such material has been destroyed.

4.

This Agreement shall terminate or be inoperative as to particular portions of the Evaluation Material only if such information:

a.

becomes generally available to the public other than as a result of a disclosure by you or your agents; or

b.

is in the public realm at the time of the disclosure of such information by Cumberland to you or later becomes generally known, in either case other than as a result of disclosure in violation of the terms of this Agreement by you or your agents after the date hereof; or

c.

was developed by you independent of any disclosure by Cumberland or was available to you on a non-confidential basis prior to its disclosure by Cumberland; or

d.

becomes available to you on a non-confidential basis from a person other than Cumberland provided that you and (so far as you are aware after reasonable inquiry) that person are not in violation of a confidentiality obligation owed to Cumberland of which you have been made aware; or

e.

is required to be disclosed by law, provided you give us immediate notice of such requirement so that we can seek a protective order or other protection against disclosure, with respect to which you will use commercially reasonable efforts to assist us, providing always that nothing in this Agreement will prevent you from good faith compliance with your disclosure obligations under applicable securities law.

In any event, this Agreement shall terminate two years after the date of this Agreement.

5.

Cumberland shall not be deemed to make or have made any representation or warranty as to title to or ownership of the Property or to the accuracy or completeness of any Evaluation Material furnished hereunder and shall have no obligation to revise or update any Evaluation Material previously provided to you hereunder. However, Cumberland does not have in its possession or control any information not comprised in the Evaluation Material that qualifies, or materially affects the interpretation of, any part of the Evaluation Material. Our obligation to deliver the Evaluation Material to you shall be satisfied by delivery of Evaluation Material now in existence AS IS and in its current condition. You agree that neither Cumberland nor any agent of Cumberland shall have any liability to you or any of your Affiliates and agents resulting from the use, in accordance with the provisions hereof, of the Evaluation Material by you and your agents. Evaluation Material relating to our Property may be subject to confidentiality requirements imposed under agreements with third parties, and disclosure of the same to you may require a prior agreement from you agreeing to be bound to such third parties in accordance with such confidentiality requirements.

6.

In addition, except as required by applicable law or stock exchange listing agreements, you and we agree that, without the prior written consent of the other, neither you nor we nor our respective agents will disclose to any person either the fact that discussions or negotiations are taking place concerning a potential Transaction involving you and Cumberland or any of the terms, conditions or other facts with respect to any such possible transaction including the status thereof.

7.

You, for yourself, your successors and assigns, further agree that for a period of two years from the date of this Agreement, neither you nor any of your Affiliates or agents (regardless of whether such person or entity is an Affiliate or agent on the date hereof) will, without the prior approval of a majority of the directors of Cumberland who are independent of Agnico or any such Affiliate or agent:

a.

acquire, directly or indirectly, by purchase or otherwise, individually or jointly or in concert with any other person (as that expression is used in Part 13 of the British Columbia Securities Act), any voting securities or securities convertible into or exchangeable for voting securities, or direct or indirect rights or options to acquire any voting securities, of Cumberland representing more than 5% of the outstanding voting securities of Cumberland without our prior written consent;

b.

directly or indirectly, make, or in any way participate, in any solicitation of proxies to vote, or seek to advise or influence any other person with respect to the voting of any voting securities of Cumberland;

c.

form, join or in any way participate in a "group" within the meaning of the United States Securities Exchange Act of 1934, as amended, with respect to any voting securities of Cumberland;

d.

otherwise act alone or in concert with others to seek to control the management, board of directors or corporate policies of Cumberland;

e.

acquire or attempt to acquire, directly or indirectly, any interest in the area now comprising the Property, in any manner which is in competition with Cumberland or any affiliate of Cumberland; or

f.

acquire, directly or indirectly, by purchase or otherwise, individually or jointly or in concert with any other person any interest in any mineral properties located within the area described in Schedule “A” to this Agreement unless it occurs through an acquisition or combination with another company or entity that already holds mineral properties within the areas of influence.

8.

Paragraph 7 of this Agreement shall not apply to prevent you from announcing your intention to make, making, proceeding with and concluding an offer by means of a formal take over bid circular in compliance with applicable Canadian securities laws to acquire all of the outstanding shares of Cumberland in any of the following circumstances without obtaining the approval of Cumberland directors specified therein:

(a)

not less than 20 days following the making, by a third party at arms’ length from, and not acting in concert with, Agnico or any of Agnico’s affiliates, of an unsolicited take over bid in compliance with applicable Canadian securities laws for shares of Cumberland, which, if successfully completed, would result in the third party holding all of the outstanding shares of Cumberland, unless within such 20 day period the directors of Cumberland determine that the third party bid is not bona fide or the directors of Cumberland recommend that Cumberland’s shareholders reject the bid;

(b)

at any time following the public announcement by Cumberland of Cumberland’s execution of an agreement with respect to an amalgamation, arrangement, merger, take over bid or other similar business combination with an arm’s length third party which, if successfully completed, will result in shareholders of Cumberland receiving consideration for their shares in the form of cash or securities of an arm’s length third party, provided that, notwithstanding this paragraph 8(b), Agnico and Agnico’s affiliates shall not announce, make, proceed with or conclude any such offer without the prior approval of Cumberland’s directors in any case where securities to be received by the Cumberland shareholders pursuant to any such business combination will constitute in aggregate 50% or more of the number of such securities to be issued and outstanding immediately following the successf ul completion of such business combination or bid.

9.

In no circumstances shall any announcement by or on behalf of Agnico or any Agnico affiliate of any intention or willingness to make an offer as contemplated in paragraph 8 of this Agreement be made, directly or indirectly, at any time prior to the times set forth in paragraph 8 of this Agreement and, if any such announcement is made, the provisions of paragraph 8 shall cease to apply.

10.

You acknowledge that Cumberland would not have an adequate remedy at law for money damages in the event that this Agreement was not performed in accordance with its terms and therefore agree that Cumberland shall be entitled to specific enforcement of the terms hereof in addition to any other remedy to which it may be entitled, at law or in equity.

11.

If you desire to visit any area comprising the Property you will notify us in writing and we will use reasonable efforts to arrange a site visit in the company of our representatives. Any information obtained by you as a result of such visit will be deemed part of the Evaluation Material. You will bear your own costs and expenses in connection with any site visit and will indemnify and save us harmless from any loss, liability, cost, damage, injury or expense arising out of any injury to any of your representatives or property as a result of such a site visit.

12.

It is further understood and agreed that no failure or delay by Cumberland in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise thereof preclude any other right, power or privilege hereunder.

13.

The term "person" as used herein shall be interpreted very broadly and shall include without limitation any corporation, company, partnership or individual. The term "affiliate" shall have the meaning set forth in the Business Corporations Act (British Columbia). The term control shall have the meaning set forth in the Securities Act (Ontario).

14.

This Agreement shall be governed and construed in accordance with the laws of the Province of British Columbia and any proceeding relating to or arising as a consequence of this Agreement will be commenced or maintained only in the Courts of British Columbia to which Courts each party hereby irrevocably attorns.

15.

This Agreement is in addition to, and not in substitution for or in derogation of, Cumberland's rights at law or in equity arising in any way in connection with the disclosure of the Evaluation Material by Cumberland to you under this Agreement in connection with the potential Transaction.

16.

If any covenant or provision herein is determined to be void or unenforceable in whole or in part it shall be deemed to be severable and it shall not affect or impair the enforceability or validity of any other covenant or provision of this Agreement or any part thereof.

17.

No waiver of any particular requirement hereunder shall be construed as a general waiver of this Agreement and any failure or delay by Cumberland in enforcing its rights with respect to any particular breach of this Agreement shall not limit or affect the rights of Cumberland to enforce such rights with respect to any other breach of this Agreement.

18.

Agnico hereby represents and warrants to us that the person executing this Agreement on your behalf has the authority to act for and to bind you to this Agreement and this Agreement shall be binding on you and your successors and assigns.

19.

Cumberland hereby represents and warrants to you that the person executing this Agreement on Cumberland’s behalf has the authority to act for and to bind Cumberland to this Agreement and this Agreement shall be binding on Cumberland and its successors and assigns.

20.

If you are in agreement with the foregoing, please sign and return one copy of this letter which will then constitute our agreement with respect to the subject matter hereof as of the date first written above.

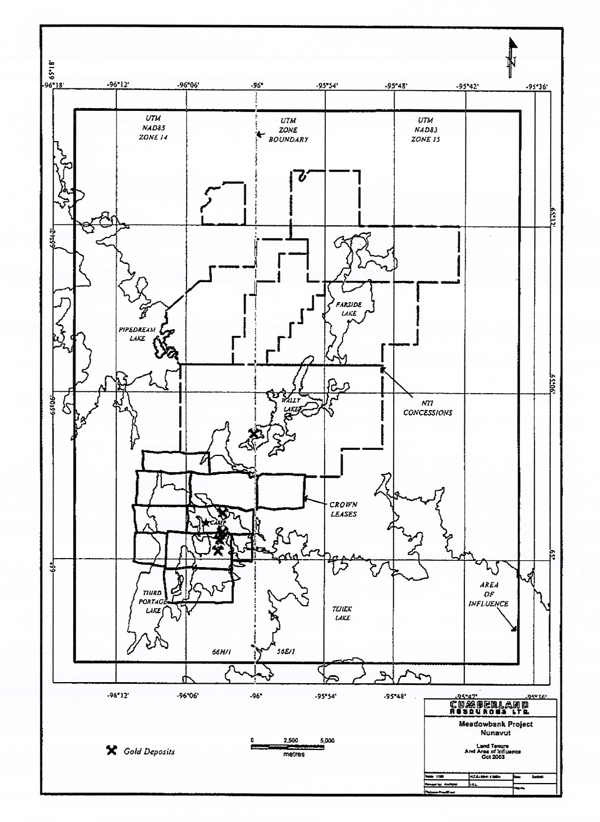

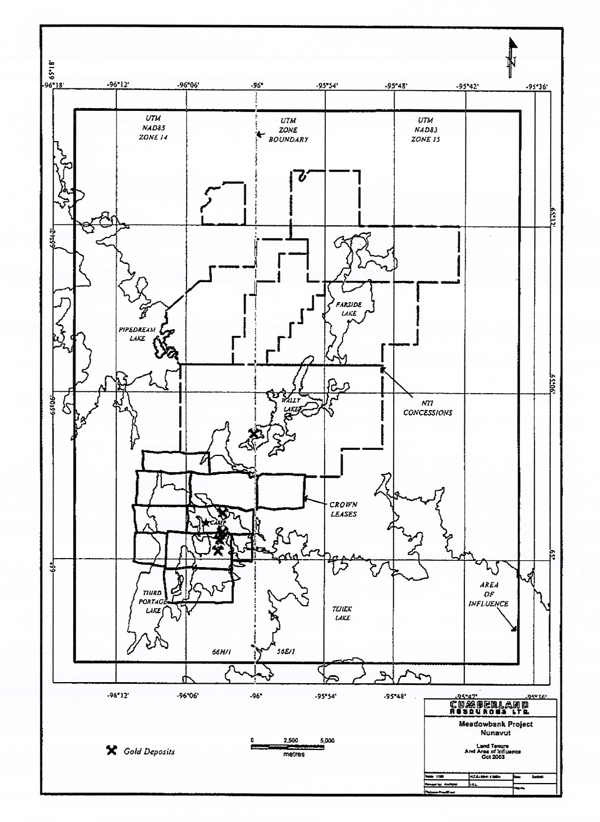

SCHEDULE A

Meadowbank Area of Influence Co-ordinates

Corner | dd-mm-ss(Long) | dd-mm-ss(Lat) | UTM NAD83 ZONE15 | UTM NAD83 ZONE14 |

NE | 95-37-17.74W | 65-16-9.09N | 377,647.5E | 7,240,999.1N | ----- | ----- |

SE | 95-37-20.989W | 64-56-17.4N | 376,073.5E | 7,204,125.9N | ----- | ----- |

NW | 96-15-13.5W | 65-16-18.74N | ----- | ----- | 627,934.6E | 7,241,225.8N |

SW | 96-15-31.5W | 64-56-16.53N | ----- | ----- | 629,536.4E | 7,204,344.4N |

![[exhibit1002.jpg]](https://capedge.com/proxy/SC 14D9/0001016724-07-000012/exhibit1002.jpg)