Alon Blue Square Israel Ltd.

Monitoring reportו March 2015

Contacts:

Elad Seroussi, Senior Analyst

elads@midroog.co.il

Liat Kadish, CPA, Team Leader

liatk@midroog.co.il

Sigal Issachar, VP, Head of Corporate Finance

i.sigal@midroog.co.il

Alon Blue Square Israel Ltd.

| Issuer/Bond Rating | Baa1 | Credit review |

| Commercial Paper | P-2 | |

Midroog announces the downgrade of the issuer rating of Alon Blue Square Israel Ltd. (“Alon Square” or the "Company” or the "Group") and bond rating (Series C) from A3 to Baa1, and is placing the rating on neutral-negative credit watch. Midroog reaffirms the P-2 rating of the commercial paper (CP) the Company issued, which is also under watch.

In recent months the Company has been in the process of replacing senior management. A weak food market, as has been evident in recent months, together with the changes in management led, in our opinion, to a review of forecasts for 2015, as a result of which the Company made various provisions in its Annual Report for 2014. On this background, the Company ended the year with a net loss of approximately NIS 370 million. Approximately 40% of this loss is attributed to reduction of a deferred tax asset on transferred losses at companies where the loss for tax purposes is longer than three years, and the remainder is split between a goodwill decrease for Na'aman, reduction in investment in Kfar Hasha'asuim, and more. Note that most of the influence is not of cash flow character but books value only. On the other hand, these reductions (some of which are of a nonrecurring nature) eroded the Company's capital cushion by approximately 15%, and the total net loss eroded the Company's capital cushion by approximately 20%.

As of the date of this report, the Company had not yet renewed credit facilities with banks at the solo level, which are estimated at approximately NIS 200 million.

The rating downgrade is based on our assessment that the Company's credit risk has increased, with weaker than expected results for the fourth quarter of 2014, and our anticipation of weak results at Mega in the year to come. We are placing the rating under credit watch due to the persisting level of uncertainty in the business environment of Mega Retail, and all this on the backdrop of management changes. Our conclusions will be determined shortly, after we study the updated forecasts and financial debt derived from them.

Rating History

About the Company

Alon Square, a public company listed on the Tel Aviv and New York stock exchanges, is the largest retail company in Israel. The Company is about 72.7% owned by Alon Israel Oil Company Ltd., a private holding company engaged in the retail and energy industries in Israel and overseas, which is owned by Bielsol Investments Ltd., a private company jointly owned by Mr. David Weissman, the Biran family, and purchasing cooperative agencies belonging to kibbutzim. The Company operates today through four main subsidiaries: Mega Retail (100% holding), which concentrates the Group's food retail; BEE Retail (100%), which presently holds about 77.5% of Na'aman Ltd. and 35% of Kfar Hasha'ashuim; Dor Alon (78.4%), which is engaged in marketing and selling fuel in Israel; Blue Square Real Estate (63.7%), which owns real estate properties, most of which are currently leased for the Group's retail activity. The Company also owns a 49% stake in Diners Club Israel Ltd.

The chairman of the board of directors is Mr. Amit Ben Yitzhak.

Related Reports

Alon Blue Square Israel Ltd., Monitoring Report, March 2015

The Retail Sector - Rating Methodology, August 2010

Financial Ratios Adjustment Methodology, November 2010

Commercial papers - Methodology, March 2008

The reports are published on Midroog's website: www.midroog.co.il.

Date of the report: March 31, 2015

KEY FINANCIAL TERMS

| Interest | Net financing expenses from Income Statement |

| Cash Interest | Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows |

| Operating profit (EBIT) | Profit before tax, financing and onetime expenses/profits |

Operating profit before amortization (EBITA) | EBIT + amortization of intangible assets. |

| Operating profit before depreciation and amortization (EBITDA) | EBIT + depreciation + amortization of intangible assets. |

Operating profit before depreciation, amortization and rent/leasing (EBITDAR) | EBIT + depreciation + amortization of intangible assets + rent + operational leasing. |

| Assets | Company's total balance sheet assets. |

| Debt | Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing |

| Net debt | Debt - cash and cash equivalent – long-term investments |

| Capitalization (CAP) | Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet |

Capital investments Capital Expenditures (CAPEX) | Gross investments in equipment, machinery and intangible assets |

Funds From Operations (FFO)* | Cash flow from operations before changes in working capital and before changes in other asset and liabilities |

| Cash Flow from Current Operations (CFO)* | Cash flow from operating activity according to consolidated cash flow statements |

| Retained Cash Flow (RCF)* | Funds from operations (FFO) less dividend paid to shareholders |

Free Cash Flow (FCF)*

| Cash flow from operating activity (CFO) - CAPEX - dividends |

| * | It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity. |

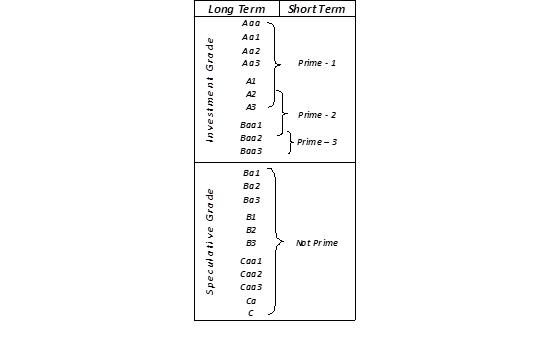

Obligations Rating Scale

| Investment grade | Aaa | Obligations rated Aaa are those that, in Midroog's judgment, are of the highest quality and involve minimal credit risk. |

| Aa | Obligations rated Aa are those that, in Midroog's judgment, are of high quality and involve very low credit risk. |

| A | Obligations rated A are considered by Midroog to be in the upper-end of the middle rating, and involve low credit risk. |

| Baa | Obligations rated Baa are those that, in Midroog's judgment, involve moderate credit risk. They are considered medium grade obligations, and could have certain speculative characteristics. |

| Speculative Investment | Ba | Obligations rated Ba are those that, in Midroog's judgment, contain speculative elements, and involve a significant degree of credit risk. |

| B | Obligations rated B are those that, in Midroog's judgment, are speculative and involve a high credit risk. |

| Caa | Obligations rated Caa are those that, in Midroog's judgment, have weak standing and involve a very high credit risk. |

| Ca | Obligations rated Ca are very speculative investments, and are likely to be in, or very near to, a situation of insolvency, with some prospect of recovery of principal and interest. |

| C | Obligations rated C are assigned the lowest rating, and are generally in a situation of insolvency, with poor prospects of repayment of principal and interest. |

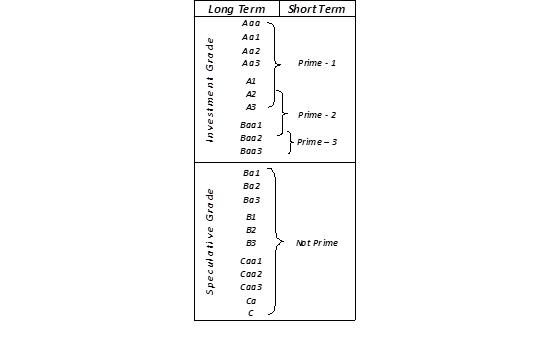

Midroog applies numerical modifiers 1, 2 and 3 in each of the rating categories from Aa to Caa. Modifier 1 indicates that the bond ranks in the higher end of the letter-rating category. Modifier 2 indicates that the bonds are in the middle of the letter-rating category; and modifier 3 indicates that the bonds are in the lower end of the letter-rating category.

Moody's short term ratings describe the ability of issuers to honor short-term financial obligations.Ratings may be assigned to issuers, individual issues and financial instruments.As a rule, short-term obligations are for a period of no more than 13 months, unless indicated otherwise.

| Symbol | Definition |

| Prime – 1 | Issuers (or supporting institutions) rated P-1 have a superior ability to repay short-term debt obligations. |

| Prime – 2 | Issuers (or supporting institutions) rated P-2 have a strong ability to repay short-term debt obligations. |

| Prime – 3 | Issuers (or supporting institutions) rated P-3 have an acceptable ability to repay their short-term debt obligations. |

| Not Prime (N-P) | Issuers rated N-P do not fall within any of the Prime rating categories. |

Short Term vs. Long Term Ratings

Report No.:CTR050315000M

Midroog Ltd., Millennium 17 Ha’Arba'a Street, Tel-Aviv 64739

Tel: 03-6844700, Fax: 03-6855002, www.midroog.co.il

© Copyright 2015, Midroog Ltd. (“Midroog”). All rights reserved.

This document (including the contents thereof) is the property of Midroog and is protected by copyright and other intellectual property laws. There is to be no copying, photocopying, reproduction, modification, distribution, or display of this document for any commercial purpose without the express written consent of Midroog.

All the information contained herein on which Midroog relied was submitted to it by sources it believes to be reliable and accurate. Midroog does not independently check the correctness, completeness, compliance, accuracy or reliability of the information (hereinafter: the "information") submitted to it, and it relies on the information submitted to it by the rated Company for assigning the rating.

The rating is subject to change as a result of changes in the information obtained or for any other reason, and therefore it is recommended to monitor its revision or modification on Midroog's website www.midroog.co.il. The ratings assigned by Midroog express a subjective opinion, and they do not constitute a recommendation to buy or not to buy bonds or other rated instruments. The ratings should not be referred as endorsements of the accuracy of any of the data or opinions, or attempts to independently assess or vouch for the financial condition of any company. The ratings should not be construed as an opinion on the attractiveness of their price or the return of bonds or other rated instruments. Midroog's ratings relate directly only to credit risks and not to any other risk, such as the risk that the market value of the rated debt will drop due to changes in interest rates or due to other factors impacting the capital market. Any other rating or opinion given by Midroog must be considered as an individual element in any investment decision made by the user of the Information contained in this document or by someone on his behalf. Accordingly, any user of the information contained in this document must conduct his own investment feasibility study on the Issuer, guarantor, debenture or other rated document that he intends to hold, buy or sell. Midroog's ratings are not designed to meet the investment needs of any particular investor. The investor should always seek the assistance of a professional for advice on investments, the law, or other professional matters. Midroog hereby declares that the Issuers of bonds or of other rated instruments or in connection with the issue thereof the rating is being assigned, have undertaken, even prior to performing the rating, to render Midroog a payment for valuation and rating services provided by Midroog.

Midroog is a 51% subsidiary of Moody’s. Nevertheless, Midroog's rating process is entirely independent of Moody's and Midroog has its own policies, procedures and independent rating committee; however, its methodologies are based on those of Moody’s.

For further information on the rating procedures of Midroog or of its rating committee, please refer to the relevant pages on Midroog's website.