Exhibit 99.1

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum, 60972 Israel

___________________________

Dear Shareholder,

You are cordially invited to attend the Annual General Meeting of Shareholders (the “Meeting”) of Alon Blue Square Israel Ltd. (the “Company”) to be held at 10:30 a.m., Israel time, on June 15, 2015 at the Company's offices at Europark Yakum, France Building, Yakum, Israel. The purposes of the Meeting are (i) to receive and consider the Directors’ Report and Financial Statements of the Company for the fiscal years ended December 31, 2013 and December 31, 2014, (ii) to elect directors to the Company’s Board of Directors, and (iii) to re-appoint the independent auditors of the Company for the year 2014. The Company's Board of Directors recommends that you vote "FOR" the proposals, as specified on the enclosed form of proxy.

We look forward to greeting personally those shareholders who are able to be present at the Meeting. However, whether or not you plan to attend the Meeting, it is important that your shares be represented. Accordingly, you are kindly requested to complete, date, sign and mail the enclosed proxy in the envelope provided at your earliest convenience so that it will be received no later than two (2) business days prior to the Meeting. Shareholders may revoke their proxies at any time before the Meeting by providing written notice to the Company. Shareholders who attend the Meeting may revoke their proxies and vote their shares in person.

Shareholders registered in the Company's shareholders register in Israel and shareholders who hold shares through members of the Tel Aviv Stock Exchange may also vote through the enclosed proxy by completing, dating, signing and mailing the proxy to the Company's offices.Shareholders registered in the Company's shareholders register in Israel and shareholders who hold shares through members of the Tel Aviv Stock Exchange who vote their shares by proxy must also provide the Company with a copy of their identity card, passport or certification of incorporation, as the case may be. Shareholders who hold shares through members of the Tel Aviv Stock Exchange and intend to vote their shares either in person or by proxy must deliver the Company an ownership certificate confirming their ownership of the Company’s shares on the record date, which certificate must be approved by a recognized financial institution, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended.

Thank you for your continued cooperation.

| | Very Truly Yours, |

| | |

| | Amit Ben Itzhak |

| | Chairman of the Board of Directors |

Yakum, Israel

May 19, 2015

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum 60972 Israel

___________________________

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that the Annual General Meeting of Shareholders (the “Meeting”) of Alon Blue Square Israel Ltd. (the “Company”) will be held at 10:30 a.m., Israel time, on June 15, 2015 at the Company's offices at Europark Yakum, France Building, Yakum, Israel, in order to adopt the following resolutions or to consider the following items:

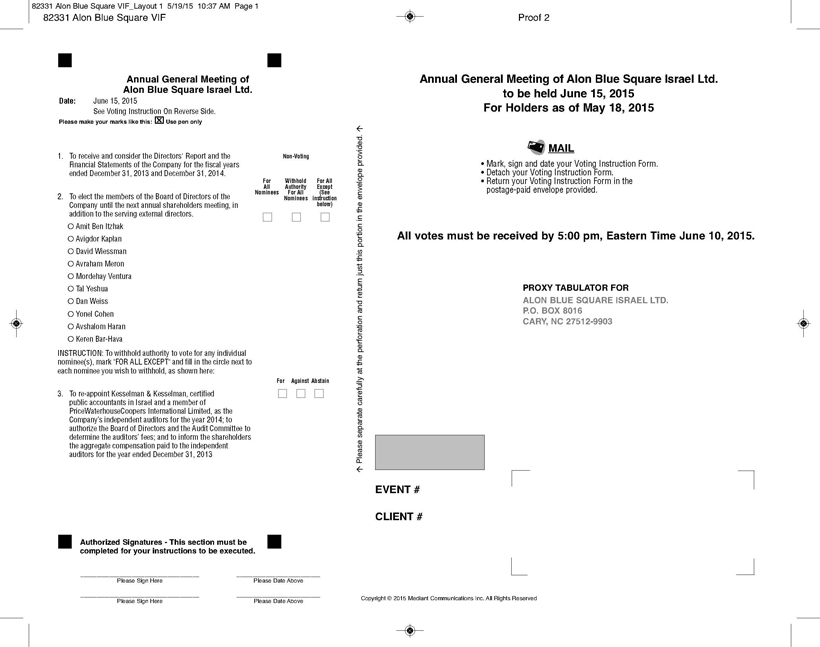

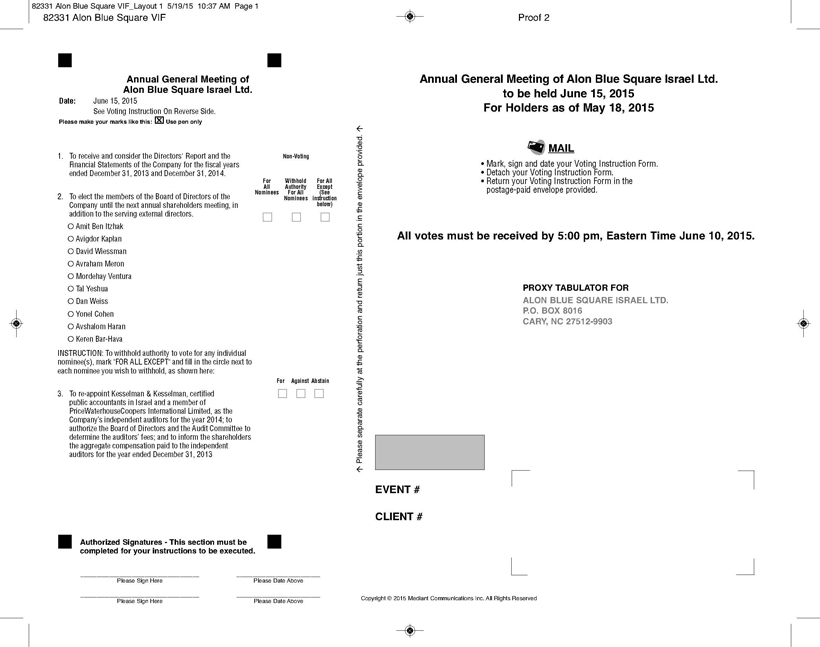

| 1. | To receive and consider the Directors' Report and the Financial Statements of the Company for the fiscal years ended December 31, 2013 and December 31, 2014; |

| 2. | To elect Amit Ben Itzhak, Avigdor Kaplan, David Wiessman, Avraham Meron, Mordehay Ventura, Tal Yeshua, Dan Weiss, Yonel Cohen, Avshalom Haran, and Keren Bar-Hava as members of the Board of Directors of the Company until the next annual shareholders meeting, in addition to the serving external directors of the Company; and |

| 3. | To re-appoint Kesselman & Kesselman, certified public accountants in Israel and a member of PriceWaterhouseCoopers International Limited, as the Company’s independent auditors for the year 2014; to authorize the Board of Directors and the Audit Committee to determine the auditors’ fees; and to inform the shareholders the aggregate compensation paid to the independent auditors for the year ended December 31, 2013. |

In addition, the shareholders may consider and act upon such other business as may properly come before the Meeting and any adjournment thereof.

Shareholders of record at the close of business onMay 18, 2015 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournment thereof. Shareholders who are unable to attend the Meeting in person are requested to complete, date and sign the enclosed proxy and return it in the pre-addressed envelope provided at your earliest convenience so that it will be received no later than two (2) business days prior to the Meeting. Shareholders may revoke their proxies at any time before the Meeting by providing written notice to the Company. Shareholders who attend the Meeting may revoke their proxies in writing and vote their shares in person.

Shareholders registered in the Company's shareholders register in Israel and shareholders who hold shares through members of the Tel Aviv Stock Exchange may also vote through the enclosed proxy by completing, dating, signing and mailing the proxy to the Company's offices. Shareholders registered in the Company's shareholders register in Israel and shareholders who hold shares through members of the Tel Aviv Stock Exchange who vote their shares by proxy must also provide the Company with a copy of their identity card, passport or certification of incorporation, as the case may be. Shareholders who hold shares through members of the Tel Aviv Stock Exchange and intend to vote their shares either in person or by proxy must deliver the Company an ownership certificate confirming their ownership of the Company’s shares on the Record Date, which certificate must be approved by a recognized financial institution, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended.

Shareholders are allowed to apply in writing, through the Company, to other shareholders of the Company in order to convince them with regard to their vote on items on the agenda of the Meeting (“Position Notice”). Position Notices may be sent to the Company's offices at the address above. Such Position Notices must be in the possession of the Company byMay 29, 2015.

Joint holders of shares should take note that, pursuant to the Articles of Association of the Company, the vote of the first of the joint holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other registered holder(s) of the shares. For this purpose, the first joint shareholder shall be the person whose name is entered first in the Company's Register of Shareholders.

| | By Order of the Board of Directors, |

| | |

| | |

| | Amit Ben Itzhak |

| | Chairman of the Board of Directors |

Yakum, Israel

May 19, 2015

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum 60972 Israel

___________________________

PROXY STATEMENT

For the Annual General Meeting of Shareholders

to be held on June 15, 2015

This Proxy Statement is furnished to the holders of Ordinary Shares, par value NIS 1.0 per share (the “Ordinary Shares”), and to holders of American Depository Shares (“ADSs”), evidenced by American Depositary Receipts (“ADRs”) issued by BNY Mellon (“BNY”), of Alon Blue Square Israel Ltd. (the “Company” or “Blue Square”) in connection with the solicitation by the Board of Directors of proxies for use at the Annual General Meeting of Shareholders (the “Meeting”), to be held on June 15, 2015 at 10:30 a.m. (Israel time) at the offices of the Company, at Europark Yakum, France Building, Yakum, Israel, or at any adjournments thereof.

It is proposed at the Meeting to adopt the following resolutions or to consider the following items:

| 1. | To receive and consider the Directors' Report and the Financial Statements of the Company for the fiscal years ended December 31, 2013 and December 31, 2014; |

| 2. | To elect Amit Ben Itzhak, Avigdor Kaplan, David Wiessman, Avraham Meron, Mordehay Ventura, Tal Yeshua, Dan Weiss, Yonel Cohen, Avshalom Haran, and Keren Bar-Hava as members of the Board of Directors of the Company until the next annual shareholders meeting, in addition to the serving external directors of the Company; and |

| 3. | To re-appoint Kesselman & Kesselman, certified public accountants in Israel and a member of PriceWaterhouseCoopers International Limited, as the Company’s independent auditors for the year 2014; to authorize the Board of Directors and the Audit Committee to determine the auditors’ fees; and to inform the shareholders the aggregate compensation paid to the independent auditors for the year ended December 31, 2013. |

The Company currently is unaware of any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated as proxies shall vote according to their own judgment on those matters.

A form of proxy for use at the Meeting and a return envelope for the proxy are enclosed. By appointing “proxies,” shareholders may vote at the Meeting whether or not they attend. If a properly executed proxy in the enclosed form is received by the Company at least two (2) business days prior to the Meeting, all of the shares represented by the proxy shall be voted as indicated on the form or, if no preference is noted, to the extent permitted by applicable law and stock exchange rules, shall be voted in favor of the matters described above, and in such manner as the holder of the proxy may determine with respect to any other business as may come before the Meeting or any adjournment thereof. Shareholders and ADR holders may revoke their proxies at any time before the deadline for receipt of proxies by filing with the Company (in the case of holders of Ordinary Shares) or with BNY (in the case of holders of ADRs), a written notice of revocation or duly executed proxy bearing a later date.

The Board of Directors of the Company is soliciting proxies for use at the Meeting. The Company expects to mail this Proxy Statement and the accompanying proxies to shareholders and ADR holders on or about May 19, 2015. In addition to solicitation of proxies by mail,certain officers, directors, employees and agents of the Company, none of whom shall receive additional compensation therefor, may solicit proxies by telephone, e-mail or other personal contact. The Company shall bear the cost of the solicitation of the proxies, including postage, printing and handling, and shall reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Ordinary Shares or ADRs. As a foreign private issuer, the Company is exempt from the rules under the Securities Exchange Act of 1934, as amended (the “1934 Act”), related to the furnishing and content of proxy statements. The circulation of this Proxy Statement should not be taken as an admission that the Company is subject to those proxy rules.

Only shareholders and ADR holders of record at the close of business on May 18, 2015 (the “Record Date”) shall be entitled to receive notice of and to vote at the Meeting. At the close of business on May 10, 2015, the Company had outstanding 66,161,860 Ordinary Shares (excluding 207,433 Ordinary Shares held by the Company as treasury shares), each of which is entitled to one vote for each of the matters to be presented at the Meeting. Two or more shareholders holding shares conferring in the aggregate at least 50% of the voting power of the Company, present in person or by proxy at the Meeting and entitled to vote thereat, shall constitute a quorum. If within half an hour from the time appointed for the Meeting a quorum is not present, the Meeting shall be adjourned to the same day in the next week, at the same time and place. At such reconvened meeting, any one shareholder present in person or by proxy, shall constitute a quorum regardless of the number of shares represented.

The affirmative vote of at least a majority of the votes of shareholders present and voting on the matter is required for shareholders to approve Items 2 and 3. On all matters considered at the Meeting, abstentions will be treated as neither a vote “for” nor “against” the Items considered at the Meeting, although they will be counted in determining whether a quorum is present.

Beneficial Ownership of Securities by Certain Beneficial Owners and Management

The following table sets forth certain information, as of May 10, 2015, concerning (i) the persons or entities known to the Company to beneficially own 5% or more of the Company’s outstanding Ordinary Shares; and (ii) the number of Ordinary Shares beneficially owned by directors and officers of the Company as a group. Our major shareholders do not have voting rights different from the voting rights of our other shareholders.

| Name | | Number of Ordinary

Shares Beneficially

Owned | | | Percentage of

Outstanding Ordinary

Shares(1) | |

| Alon Israel Oil Company Ltd.(2) | | | 47,957,264 | | | | 72.71 | % |

| | | | | | | | | |

| Alon Retail Ltd.(3) | | | 17,352,961 | | | | 26.3 | % |

| | | | | | | | | |

| Menorah Mivtachim Holdings Ltd.(4) | | | 5,585,221 | | | | 8.47 | % |

______________

| (1) | The percentage of outstanding ordinary shares is based on65,954,427 ordinary shares outstanding as of March 31, 2015 (excluding207,433ordinary shares held by Alon Blue Square as treasury shares). |

| (2) | Alon may be deemed to beneficially own all of the shares held directly and indirectly by Alon Retail Ltd. due to the ownership structure of Alon Retail described in footnote (3); accordingly, the number of shares listed as owned by Alon includes all the shares that are listed as owned by Alon Retail Ltd. |

| (3) | Alon Retail Ltd. is a wholly owned subsidiary of Nissan Alon Retail Holdings Ltd., which is a wholly owned subsidiary of the Nissan Dor Chains Ltd., which is a wholly owned subsidiary of Dor Food Chains Holdings Ltd., a wholly owned subsidiary of Alon. To the Company’s best knowledge, Alon is owned approximately48.21% (excluding shares held by Alon as treasury shares) by eight collective acquisition entities of kibbutzim in Israel and approximately51.79% (excluding shares held by Alon as treasury shares) are held by Bielsol Investments (1987) Ltd. To the Company’s best knowledge, the shareholders of Bielsol Investments (1987) Ltd. consist of Shibag Ltd. (whose shareholders are Advocate Shraga Biran, and Gara, Boaz and Iftah Biran, and which is controlled by Advocate Shraga Biran who holds all of the voting rights in Shibag Ltd. through a direct holding in85% of the shares that grant voting rights in Shibag Ltd. (“Voting Shares in Shibag”) and through a power of attorney relating to voting rights for the other15% of the Voting Rights in Shibag held by Mr. Boaz Biran), holding79.4% of the capital and voting rights of Bielsol Investments (and is the controlling shareholder of Bielsol Investments, and Advocate Shraga Biran is the controlling shareholder of Shibag Ltd.); D.B.W Investments Ltd. (a company owned and controlled by Mr. David Wiessman), holding19.8% of the capital and voting rights of Bielsol Investments; Shibago Ltd. (whose partners are Shibag Ltd. (75%) and a company owned and controlled by David Wiessman (25%)), holding0.8% of the capital and voting rights of Bielsol Investments. |

| (4) | The shares are held by subsidiaries of Menora Mivtachim Holdings Ltd. (“Menora Holdings”), as follows: Menora Mivtachim Insurance Ltd., Menora Mivtachim Pensions and Gemel Ltd., Shomera Insurance Company Ltd, and Menora Mivtachim Mutual Funds Ltd. To the Company’s best knowledge, Menora Holdings is an Israeli company, publicly traded (listed on the Tel Aviv stock exchange). Approximately 61.9% of Menora Holdings outstanding shares are held by Najaden Establishment and Palamas Establishment, foreign corporations, incorporated in Vaduz, Liechtenstein. These corporations are held in trust for the sole beneficiaries the heirs of the late Mr. Gurevitch, Ms. Tali Griffel and Ms. Niva Gurevitch. The remaining of the outstanding shares are held by the public. Menora Mivtachim Insurance Ltd., Menora Mivtachim Pensions and Gemel Ltd., Menora Mivtachim Finance Ltd. and Shomera Insurance Company Ltd. are wholly owned subsidiaries of Menora Holdings. Menora Mivtachim Mutual Funds Ltd. are wholly owned subsidiaries of Menora Mivtachim Finance Ltd. (which is wholly owned by Menora Holdings). Part of the shares reported are owned by Menora Holdings via Menora Mivtachim Insurance Ltd., Menora Mivtachim Pensions and Gemel Ltd., and Menora Mutual Funds Ltd. on behalf of members of the public (customers which the above-mentioned companies are investing on their behalf) through various financial instruments, such as, among others - provident funds, mutual funds, pension funds and insurance policies. Each of the above-mentioned companies makes independent voting and investment decisions. As of May 10, 2015, the ordinary shares beneficially held by Menora are held through the following: (i) Pension and Provident Funds – 4,221,063 ordinary shares; (ii) Insurance Policies – 1,364,158 ordinary shares. |

ITEM 1 – CONSIDERATION OF THE AUDITORS’ REPORT

AND FINANCIAL STATEMENTS

At the Meeting, the Directors' Report and the Financial Statements of the Company for the fiscal years ended December 31, 2013 and December 31, 2014 will be presented, reviewed and considered.

ITEM 2 – RE-ELECTION OF DIRECTORS

The Board of Directors has nominated the ten (10) persons named and described below to be elected as directors, in addition to the Company’s two external directors, David Alphandary and Uzi Baram, constituting the entire Board of Directors of the Company. All of the nominees currently serve as directors of the Company. The current shareholdings of Alon Israel Oil Company Ltd. and Alon Retail Ltd. empower it to elect all of the Company’s directors.

Messrs. Amit Ben Itzhak, Avigdor Kaplan, David Wiessman, Avraham Meron, Mordehay Ventura, Tal Yeshua, Dan Weiss, Yonel Cohen, Avshalom Haran, and Keren Bar-Hava have attested to the Board of Directors of the Company and the Company that they meet all the requirements in connection with the election of directors under the Israeli Companies Law, per the statement in the form attached hereto asAppendix A.

In April 2008, we agreed to pay to each director (including our external directors and expert external directors) other than the Chief Executive Officer, of the sum of NIS 97,500 per year and a meeting attendance fee of NIS 3,660, which amounts are equivalent to the amounts allowed to be paid to external directors of companies of comparable size under the second, third and fourth supplements to the Companies Regulations (Rules regarding Compensation and Expense Reimbursement of External Directors) 2000. These fees are adjusted from time to time based on changes to the Israeli Consumer Price Index in the same manner as the fees described in the Regulations are adjusted. The directors are also entitled to reimbursement of expenses incurred by them in connection with their service as directors.

Proxies (other than those directing the proxy holders not to vote for the listed nominees) will be voted for the election of each of the nominees to hold office until the next General Meeting and until his/her successor shall have duly taken office, or such earlier time as he or she shall resign or be removed from the Board of Directors of the Company pursuant to the terms of the Articles of Association of the Company. The Company is not aware of any reason why any of the nominees, if elected, should not be able to serve as a director.

The following information supplied with respect to each person nominated and recommended to be elected to the Board of Directors of the Company is based upon the records of the Company and information furnished to the Company by the nominees.

| Name | Age | Position |

| | | |

| Amit Ben Itzhak | 52 | Chairman of the Board of Directors and Director |

| Avigdor Kaplan | 75 | Chief Executive Officer and director |

| David Wiessman | 60 | Director |

| Avraham Meron | 75 | Director |

| Mordehay Ventura | 60 | Director |

| Mr. Tal Yeshua | 57 | Director |

| Dr. Dan Weiss | 52 | Director |

| Yonel Cohen | 55 | Director |

| Avshalom Haran | 57 | Director |

| Keren Bar-Hava | 41 | Director |

The nominees to serve on the Board of Directors of Blue Square are:

Amit Ben Itzhakhas served as our Chairman of the Board since December 2014. He currently serves as Acting Chairman of the Granot Corporation and as Chairman of Hamashbir Agriculture Ltd. ("Hamashbir"), an Israeli agricultural supply company. From 2008 -2013, Mr. Ben Itzhak served as Chief Executive Officer of Hamashbir. From 2005 – 2008, Mr. Ben Itzhak served as Chief Financial Officer of Tnuva Corporation, a leading food group in Israel, and from 2002 to 2005, Mr. Mr. Ben Itzhak served as Chief Executive Officer of Granot. Mr. Ben Itzhak was also Co – Founder, Chief Executive Officer, and Chairman of Zap Computing Ltd. from 2001 to 2005. Mr. Ben Itzhak has a B.A in Economics and Business Administration from the Ruppin Academic Center and an M.B.A (with honors) from the Hebrew University of Jerusalem.

Avigdor Kaplan has served as a member of the board of directors of the Company since February of 2015 and as CEO of the Company since March 29, 2015. Mr. Kaplan has also served as CEO of Alon Israel Oil Company Ltd. since January 2015. From June 2013 to June 2014, he served as the Director General of Hadassah Medical Organization. From June 2008 to May 2013, Mr. Kaplan served as the Chairman of the Board of Clal Insurance Group, and from May 1997 to May 2008, he served as CEO of the Clal Insurance Group. Mr. Kaplan holds a B.A. in Economics and Statistics from The Hebrew University, a Diploma in Business Administration from The Hebrew University, an M.sc in Industrial Engineering from Technion, and a PhD in Health Sciences from Ben Gurion University.

David Wiessman has served as our director since 2003. Mr. Wiessman served as our Executive Chairman of the Board of Directors from November 2005 until January 2013, and served as our Chief Executive Officer and Chief Operating Decision Maker until mid-March 2015. Mr. Wiessman serves as a director in Mega Retail, Alon Israel Oil Company Ltd., Dor Alon Energy in Israel (1988) Ltd., and BSRE. In addition, Mr. Wiessman is currently the Chief Executive Officer of Bielsol Investments (1987) Ltd., Executive Chairman of Alon U.S.A. Energy, Inc. and Alon USA Partners GP, LLC. In addition, Mr. Wiessman also serves as a director in other companies not affiliated with Alon Israel Oil Company Ltd., or with Alon USA Inc.

Avraham Meron has served as our director and member of the audit committee since August 20, 2007. Mr. Meron is currently an independent advisor and is an external director in Africa Israel Properties Ltd., a director in Discount Mortgage Bank Ltd., a member of the investments committee in Clal Finance group, and a director in A.I. America Israel Investments Ltd. For a period of 13 years, until October 2005, Mr. Meron served as senior vice president-finance of Africa Israel Investments Ltd. Mr. Meron also served as a director of Africa Israel’s subsidiaries, including Alon Oil Company group, the controlling shareholder of Alon Blue Square. Mr. Meron is a CPA and holds a degree in Accounting from the Hebrew University of Jerusalem.

Mordehay Ventura has served as our director since March 22, 2012. Mr. Ventura has served as Chief Executive Officer of the Mishkey Hadarom Aguda Haklait Shitufit Ltd. (Mishkey Hadarom) since 2004, and currently serves as a director in Oil Holdings (Founded by the Kibbutzim Organizations) Ltd., Alon Israel Oil Company Ltd., Dor Alon Energy in Israel (1988) Ltd., Dor Alon Retail Sites Management Ltd., Gan Smuel Mazon Ltd., Ganir (1992) Ltd., Hadarey Nitzanim Aguda Haklait Shitufit Ltd., Sivey Hadarom (S.D.) Ltd., Hanegev Aguda Haklait Shitufit Transport Company Ltd., Megadley Drom Yehuda Aguda Haklait Shitufit Ltd., Shkedey Drom Yehuda Aguda Haklait Shitufit Ltd., Zeitey Drom Yehuda Aguda Haklait Shitufit Ltd., Hazera (1939) Ltd., Megadley Zraim Ltd., the Egg and Poultry Board, Amal Darom Aguda Haklait Shitufit Ltd., Marbek Services and assets (2002) Ltd., Mishkey Dan Partnership, Dana Finance Services Ltd., Amber Machon Letaarovet Aguda Haklait Shitufit Merkazit Ltd., Alon USA Partners LP and Tnuva Holdings. Mr. Ventura holds a B.A. degree in Economics and Business Administration from the Rupin Academic Center in the Hefer Valley in Israel.

Tal Yeshua has served as our director since February 11, 2015. He has served as the Chairman of Mishkey Emek Hayarden & Zemach Mifalim, a concern of various kibbutzim, since last year, and since 2007 has been an owner and Chairman of Travelers Hotels Ltd., a chain organizing accommodations for travelers. Mr. Yeshua also serves as a director of Alon Israel Oil Company Ltd. From 2007 to 2014, Mr. Yeshua served as Chairman of Amiad Water Systems, a global producer of filtration systems traded on AIM, the international market of the London Stock Exchange for smaller growing companies, and from 2002 and to 2010, Mr. Yeshua served as Chairman of Termokir Ltd., a factory owned by Kibbutz Horshim in the dry mixtures business for the building industry. From 2006 to 2008, Mr. Yeshua served as Chairman of Asiv Textile Industries Ltd., owned by Kibbutz Afek in the knit fabrics business for the garment and home textile industries. Mr. Yeshua has an Executive MBA from Tel Aviv University, a B.A. in Society and Management from the Open University and a B.A in Practical Computer Engineering from Ruppin College.

Dan Weiss has served as our director since August 2014. Mr. Weiss has been a faculty member of the Recanati Business School at the Tel Aviv University, since 2003. Mr. Weiss also serves as a director in Alon Israel Oil Company Ltd and Mega Retail. Mr. Weiss is a certified CPA, holds a B.Sc.I.E in Industrial Engineering and Management from the Technion – Israel Institute of Technology, an MBA from the Tel Aviv University, and a PhD in Managerial Economics from the Tel Aviv University.

Yonel Cohen has served as our director since August 2014. Mr. Cohen is the chairman of the Board of Directors of Bielsol Investments (1987) Ltd., which is the largest shareholder of Alon Israel Oil Company Ltd. Mr. Cohen serves as a director in various companies within the Alon Israel group, including Alon Israel Oil Company Ltd., and Alon Natural Gas Explorations Ltd. Mr. Cohen also serves as the Chairman of the Board of Directors of Golden House Ltd., a company traded on the Tel Aviv Stock Exchange, Tamir Fishman Investment House and as a director in several other private companies. Mr. Cohen has served as the Chief Executive Officer of Migdal Group from 2008 to 2013, which is the largest insurance group in Israel. Mr. Cohen holds a bachelor of Sciences in Mathematics and Computer Sciences from the Tel Aviv University.

Avshalom Haran has served as the CEO of Mishkei Hakibutzim, which concentrates the purchasing power of the kibbutz movement in Israel via a number of independent companies owned by the group since 2012, and from 2006 to 2012, he served as CEO of Meser, which competes with the Israel Postal Company in the distribution of business mail. From 2006 to 2009, Mr. Haran served as Chairman of Kibbutz Be'eri and from 2003 to 2006, he served as CEO of Kibbutz Be'eri. Mr. Haran has a B.A. in Agriculture Economy from the Hebrew University and an Executive MBA from the Tel Aviv University.

Keren Bar-Hava has served as the head of the accounting department at the Hebrew University of Jerusalem since 2012. Since 2010, Ms. Bar-Hava has held several positions with the Israel Securities Authority, including, member of its Board of Governors, chairperson of its finance committee, and member of its audit committee, secondary market committee, stock exchange committee, penalty matters committee, and tender committee. From 2006 to 2009 she served as an external director, chairperson of the audit committee, and member of investment committee of Halman-Aldubi Investment House. From 2007-2008, she served as an external director and chairperson of the audit committee of Edri El Israel Assets Ltd., a real estate company. Prior to that, from 1996-2003 she served as the CFO of a privately held company. Ms Bar-Hava is a CPA (Isr.) and holds a B.A in economics and accounting and an M.A in economics from Tel-Aviv University, and a PhD in business administration from Tel-Aviv University.

It is proposed that at the Meeting, the following Resolution be adopted:

“RESOLVED, that Amit Ben Itzhak, Avigdor Kaplan, David Wiessman, Avraham Meron, Mordehay Ventura, Tal Yeshua, Dan Weiss, Yonel Cohen, Avshalom Haran, and Keren Bar-Hava be, and hereby is, each elected to hold office as a director of the Company until the close of the next annual general meeting.”

The affirmative vote of the holders of a majority of the Ordinary Shares represented at the Meeting in person or by proxy and voting thereon is required to adopt this resolution.

The Board of Directors recommends a vote FOR the nominees to the Board of Directors.

ITEM 3 – RE-APPOINTMENT OF AUDITORS

Kesselman & Kesselman, certified public accountants in Israel and a member of PriceWaterhouseCoopers International Limited, has been nominated by the Board of Directors of the Company for re-appointment as the auditors of the Company for the year ending December 31, 2014. Kesselman & Kesselman are the Company’s current auditors and have no relationship with the Company or with any affiliate of the Company, except as auditors.

It is proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that Kesselman & Kesselman be, and hereby is, appointed as the auditors of the Company for the year 2014, and that the Audit Committee and the Board of Directors of the Company be, and hereby is, authorized to determine the compensation of the said auditors.”

The affirmative vote of the holders of a majority of the Ordinary Shares represented at the General Meeting in person or by proxy and voting thereon is required to adopt this resolution.

The Board of Directors and the Audit Committee recommend a vote FOR approval of the proposed resolution.

OTHER BUSINESS

Other than as set forth above, as of the mailing of this Proxy Statement, management knows of no business to be transacted at the Meeting, but, if any other matters are properly presented at the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

By Order of the Board of Directors

Amit Ben Itzhak

Chairman of the Board of Directors

Dated: May 19, 2015

Appendix A - Form of Statement of a Candidate to Serve as a Director

The undersigned, ____________________, hereby declares to Alon Holdings Blue Square – Israel Ltd. (the “Company”), effective as of ____________________________, as follows:

I am making this statement as required under Section 224B of the Israeli Companies Law, 5759-1999 (the “Israeli Companies Law”). Such provision requires that I make the statements set forth below prior to, and as a condition to, the submission of my election as a director of the Company to the approval of the Company's shareholders.

I possess the necessary qualifications and skills and have the ability to dedicate the appropriate time for the purpose of performing my service as a director in the Company, taking into account, among other things, the Company's special needs and its size.

My qualifications were presented to the Company. In addition, attached hereto is my resume, which includes a description of my academic degrees, as well as previous experience relevant for the evaluation of my suitability to serve as a director.

I am not restricted from serving as a director of the Company under any items set forth in Sections 2261, 226A2 or 2273 of the Israeli Companies Law, which include, among other things, restrictions relating to on the appointment of a minor, a person who is legally incompetent, a person who was declared bankrupt, a person who has prior convictions or anyone whom the administrative enforcement committee of the Israel Securities Law 5728-1968 (the “Israel Securities Law”) prohibits from serving as a director.

I am aware that this statement shall be presented at the Annual General Meeting of Shareholders of the Company in which my election shall be considered, and that pursuant to Section 241 of the Israeli Companies Law it shall be kept in the Company’s registered office and shall be available for review by any person.

Should a concern arise that I will be aware of and/or that will be brought to my attention, pursuant to which I will no longer fulfill one or more of the requirements and/or the declarations set forth above, I shall notify the Company immediately, in accordance with Section 227A of the Israeli Companies Law.

IN WITNESS WHEREOF, the undersigned have signed this statement as of the date set forth above.

| Name: _________________ | | Signature: __________________ |

1As of the date hereof, Section 226 of the Israeli Companies Law generally provides that a candidate shall not be appointed as a director of a public company (i) if the person was convicted of an offensenot listed below but the court determined that due to its nature, severity or circumstances, he/she is not fit to serve as a director of a public company for a period that the court determined which shall not exceed five years from judgment or (ii) if he/she has been convicted of one or more offences specified below, unless five years have elapsed from the date the convicting judgment was granted or if the court has ruled, at the time of the conviction or thereafter, that he/she is not prevented from serving as a director of a public company:

(1) offences under Sections 290-297 (bribery), 392 (theft by an officer), 415 (obtaining a benefit by fraud), 418-420 (forgery), 422-428 (fraudulent solicitation, false registration in the records of a legal entity, manager and employee offences in respect of a legal entity, concealment of information and misleading publication by a senior officer of a legal entity, fraud and breach of trust in a legal entity, fraudulent concealment, blackmail using force, blackmail using threats) of the Israel Penal Law 5737-1997; and offences under sections 52C, 52D (use of inside information), 53(a) (offering shares to the public other than by way of a prospectus, publication of a misleading detail in the prospectus or in the legal opinion attached thereto, failure to comply with the duty to submit immediate and period reports) and 54 (fraud in securities) of the Israel Securities Law;

(2) conviction by a court outside of the State of Israel of an offence of bribery, fraud, offences of directors/managers in a corporate body or exploiting inside information.

2 As of the date hereof, Section 226A of the Israeli Companies Law provides that if the administrative enforcement committee of the Israel Securities Authority has imposed on a person enforcement measures that prohibited him/her from holding office as director of a public company, that person shall not be appointed as a director of a public company in which he/she is prohibited to serve as a director according to this measure.

3 As of the date hereof, Section 227 of the Israeli Companies Law provides that a candidate shall not be appointed as a director of a company if he/she is a minor, legally incompetent, was declared bankrupt and not discharged, and with respect to a corporate body – in case of its voluntary dissolution or if a court order for its dissolution was granted.