Exhibit 99.1

Alon Blue Square Israel Ltd.

Monitoring report July 2015

Contacts:

Avi Ben-Nun, Team Leader

avib@midroog.co.il

Sigal Issachar, VP, Head of Corporate Finance

i.sigal@midroog.co.il

Alon Blue Square Israel Ltd.

| Bond Rating | Baa3 | Credit review |

Midroog is downgrading the bond rating (Series C) of Alon Blue Square Israel Ltd. (“Blue Square” or the "Company” or the "Group") from Baa2 to Baa3, and is keeping the rating under review with negative implications.

Following is a breakdown of the bond series in circulation issued by the Company and rated by Midroog:

| Bond Series | Security No. | Original

Date of

Issue | Fixed Annual

Coupon | Linkage | Book Value of

Bond Balance

on March 31,

2015 (NIS M) | Remainder of Bond

Repayment Years |

| C | 1121334 | Oct. 2010 | 2.50% | CPI | 359.0 | 2015-2022 |

Key Rating Rationale

The downgrade is based on our assessment that the level of the Company's liquidity and financial flexibility have been impaired by negative developments in respect to its subsidiary (100%) Mega Retail Ltd. ("Mega"). On June 29, 2015, Mega petitioned the court for a creditors' arrangement designed to ease its cash flow situation and buy it time to rehabilitate its operations, based on a comprehensive recovery plan, which we believe further increases the level of the Blue Square's credit risk.

As we said in our last monitoring report, the Company gave Mega a "comfort letter" of up to NIS 240 million, designated, the Company says, to support Mega's working capital needs from time to time and financing its operation. Financing sources for this support were expected to arise from selling shares and possibly through a rights issue to Blue Square shareholders. In parallel, the Company declared embarkation on a sweeping recovery plan for Mega. At this point, in our opinion, Mega application for a creditors' arrangement and the uncertainty about the success of the arrangement create a significant threat to the Company's liquidity and financial flexibility, on the backdrop of the significant scope of guarantees, amounting to approximately NIS 470 million, which Blue Square extended to Mega's banks and credit insurance agencies. We also assess that the Company's financial flexibility has been damaged due to the state of its subsidiary, which will make it harder for the Company to refinance its liabilities and receive new credit facilities in the short run. However, the Company still has quite a bit of financial flexibility in the shape of liquid shares in its holdings, which are mostly unencumbered, and we believe the Company will tap this flexibility in the near term.

The present rating does not factor in Mega deteriorating to a state of liquidation (in contrast to a court-sponsored creditors' arrangement plan, which the Company is seeking), a situation which is not unreasonable, which however will become clear very soon (a creditors' assembly is scheduled for July 12, 2015). Still, in contrast to the past, when we assumed that the recovery plan and Alon Blue Square's intentions to provide support would improve Mega's status in the foreseeable future – now, given the threat to Mega's continued operations, we are stressing mainly the liquidity and financial flexibility available to Blue Square.

We assess the Company's liquidity in the four quarters to come as weak, also considering the erosion in the Company's financial flexibility, as said above. We estimate the Company's ongoing sources of financing for the next four quarters at approximately NIS 330 million, including its stand-alone balance of cash as of June 30, 2015, which we estimate at approximately NIS 80 million, ongoing dividends from subsidiaries estimated at approximately NIS 25 million, and the rights issue the Company reported in the totally amount of NIS 150 million, in which the share of the controlling shareholder would be approximately NIS 110 million. Another financing source should come from selling shares in Blue Square Real Estate – we project cash flow of approximately NIS 120 million from this source, reflecting a decrease in holdings to about 51% (as of this report, the Company owns 61.3%).taking into consideration sensitivity on the price of the stock. On the other hand, we estimate the extent of ongoing uses (stand-alone) in the next four quarters at approximately NIS 260-320 million, under the scenario that Mega continues to operate, and including ongoing repayment of debt obligations and interest amounting to approximately NIS 150 million, an infusion of NIS 100-150 million to Mega, and ongoing expenses amounting to about NIS 15 million. With these assumptions and without assuming any more asset divestiture, the cash balance is projected to be between small amount to zero after four quarters, against minimal uses of approximately NIS 120 million in the following year (without factoring in additional support of Mega).

We assess the Company's level of leverage as very high, in the range of 85%-100%, according to our different scenarios, based on the value of its holdings and stand-alone debt balance (approximately NIS 700 million as of June 30, 2015, according to the Company's figures[1]), while adding the sum of the guarantees to the Company's liabilities balance, on the assumption that Mega could, with some probability, deteriorate to the point of liquidation, which would put the guaranties threat as more material. We also note that according to the Company's information, the downgrade could constitute cause to call in certain obligations.

As said, the present downgrade does not assume that Mega will enter liquidation in the short run, a situation likely to become clearer quickly, and that event could lead to a more severe liquidity crunch and to significant rating downgrade. Leaving the rating on negative credit watch is designed to test developments regarding a creditors' arrangement at Mega (a creditors meeting has been set for July 12, 2015), and the ramifications it would have for Blue Square's liquidity and financial flexibility.

1The above debt amount includes, in additional to the company's bonds and banks, also loans of subsidiaries guaranteed by the company (expect for Mega) in the sum of NIS 30 million as well as current debt balance to blue square real estate in the amount of NIS 50 million.

Rating Outlook

Factors that may improve the rating

| · | A significant capital injection into the Company that would significantly reduce its leverage and/or reduced exposure to Mega by selling its operations, or parts of them |

Factors that may lower the rating

| · | Mega entering into state of liquidation, in that way or another, in the short run |

| · | Further erosion in liquidity, including calling in financial obligations |

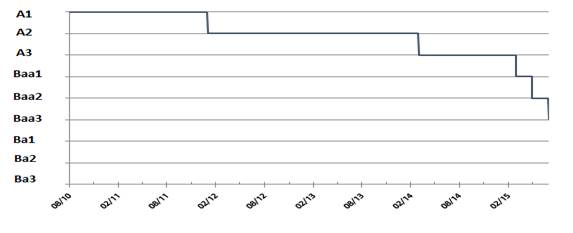

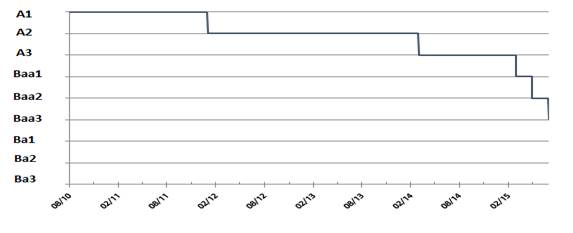

Rating History

About the Company

Alon Square is a public company listed on the Tel Aviv and New York stock exchanges. The Company is about 72.7% owned by Alon Israel Oil Company Ltd. a private holding company engaged in the retail and energy industries in Israel and overseas, which is owned by Bielsol Investments Ltd. (a private company controlled by Mr. Shraga Birran and held also by Mr. David Weissman) and purchasing cooperative agencies belonging to kibbutzim. The Company operates through four main subsidiaries: Mega Retail (100% holding), which concentrates the Group's retail food business; BEE Retail (100%), which presently holds mainly about 77.5% of Na'aman Ltd. and 35% of Kfar Hasha'ashuim; Dor Alon (71.17%), which is engaged in marketing and selling fuel in Israel; Blue Square Real Estate (61.19%), which owns real estate properties, most of which are currently leased for the Group's retail activity. The Company also has a 36.75% stake in Diners Club Israel Ltd. Mr. Amit Ben Yitzhak is the chairman of the board of directors and Mr. Avigdor Kaplan is the CEO.

Related Reports

Alon Blue Square Israel Ltd., Monitoring Report, May 2015

Alon Blue Square Israel Ltd., Monitoring Report, March 2015

The Retail Sector - Rating Methodology, August 2010

Financial Ratios Adjustment Methodology, November 2010

The reports are published on Midroog's website:www.midroog.co.il.

Date of the report: July 7, 2015

KEY FINANCIAL TERMS

| Interest | | Net financing expenses from Income Statement |

| | | |

| Cash Interest | | Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows |

| | | |

| Operating profit (EBIT) | | Profit before tax, financing and onetime expenses/profits |

| | | |

Operating profit before amortization (EBITA) | | EBIT + amortization of intangible assets. |

| | | |

Operating profit before depreciation

and amortization (EBITDA) | | EBIT + depreciation + amortization of intangible assets. |

| | | |

Operating profit before depreciation,

amortization and rent/leasing (EBITDAR) | | EBIT + depreciation + amortization of intangible assets + rent + operational leasing. |

| | | |

| Assets | | Company's total balance sheet assets. |

| | | |

| Debt | | Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing |

| | | |

| Net debt | | Debt - cash and cash equivalent – long-term investments |

| | | |

| Capitalization (CAP) | | Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet |

| | | |

Capital investments Capital Expenditures (CAPEX) | | Gross investments in equipment, machinery and intangible assets |

| | | |

Funds From Operations (FFO)* | | Cash flow from operations before changes in working capital and before changes in other asset and liabilities |

| | | |

| Cash Flow from Current Operations (CFO)* | | Cash flow from operating activity according to consolidated cash flow statements |

| | | |

| Retained Cash Flow (RCF)* | | Funds from operations (FFO) less dividend paid to shareholders |

| | | |

| Free Cash Flow (FCF)* | | Cash flow from operating activity (CFO) - CAPEX - dividends |

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

Obligations Rating Scale

| Investment | Aaa | Obligations rated Aaa are those that, in Midroog's judgment, are of the highest quality and involve minimal credit risk. |

| grade | Aa | Obligations rated Aa are those that, in Midroog's judgment, are of high quality and involve very low credit risk. |

| | A | Obligations rated A are considered by Midroog to be in the upper-end of the middle rating, and involve low credit risk. |

| | Baa | Obligations rated Baa are those that, in Midroog's judgment, involve moderate credit risk. They are considered medium grade obligations, and could have certain speculative characteristics. |

| Speculative | Ba | Obligations rated Ba are those that, in Midroog's judgment, contain speculative elements, and involve a significant degree of credit risk. |

| Investment | B | Obligations rated B are those that, in Midroog's judgment, are speculative and involve a high credit risk. |

| | Caa | Obligations rated Caa are those that, in Midroog's judgment, have weak standing and involve a very high credit risk. |

| | Ca | Obligations rated Ca are very speculative investments, and are likely to be in, or very near to, a situation of insolvency, with some prospect of recovery of principal and interest. |

| | C | Obligations rated C are assigned the lowest rating, and are generally in a situation of insolvency, with poor prospects of repayment of principal and interest. |

Midroog applies numerical modifiers 1, 2 and 3 in each of the rating categories from Aa to Caa. Modifier 1 indicates that the bond ranks in the higher end of the letter-rating category. Modifier 2 indicates that the bonds are in the middle of the letter-rating category; and modifier 3 indicates that the bonds are in the lower end of the letter-rating category.

Copyright © All rights reserved to Midroog Ltd. (“Midroog”).

This document, including this paragraph, is copyrighted by Midroog, and is protected by copyright and by intellectual property law. This document may not be copied, scanned or photocopied, amended, distributed, duplicated, or displayed for any purpose whatsoever, commercial or otherwise, without advance written consent from Midroog.

Caveat regarding the limitations of a rating and the risks of relying on a rating

Ratings and/or publications by Midroog are subjective opinions about future relative credit risks of entities relative to their credit obligations, debts and/or debt-like financial instruments that apply on the date of their publication. Midroog's publications may contain assessments based on quantitative models of credit risks, as well as related opinions that served it in the rating process. Ratings and publications by Midroog do not constitute a statement about the accuracy of the facts at the time of the publication or in the past. Midroog makes use of rating scales to issue relative prognoses of credit risks and/or entities risks and/or the risks of a financial asset according to definitions detailed in the scale itself. The choice of a symbol to reflect credit risk reflects solely a relative assessment of that risk. Midroog defines credit risk as the risk that an entity may fail to meet its contractual financial obligations on schedule and estimated financial loss given default. Midroog's ratings do not address any other risk, such as risks relating to liquidity, market value, changes in interest rates, fluctuation in prices or any other element that influences the capital market. The ratings and/or publications issued by Midroog do not constitute a recommendation to buy, hold, and/or sell bonds and/or other financial instruments and/or make any other investment and/or forgo any of these actions. Nor do the ratings and/or publications issued by Midroog constitute investment advice or financial advice, nor do they address the appropriateness of any given investment for any specific investor, or constitute a recommendation for investment of any type whatsoever relying on the rating. Midroog issues ratings on the assumption that anybody making use of the information therein and of the ratings will exercise due caution and conduct the appropriate tests required himself and/or through authorized professionals, in order to personally assess the merit of any investment in a financial asset that he is thinking of buying, holding or selling. Every investor should obtain professional advice in respect to his investments, to the applicable law, and/or to any other professional issue. Any rating or other opinion that Midroog issues should be considered as just one component in any investment decision by the user of information contained in this document or by anybody on his behalf, and accordingly, any user of information contained in Midroog ratings and/or publications and/or in this document must study and reach an assessment of the merit of investment on his behalf regarding any issuer, guarantor, bond or other financial instrument he intends to hold, buy or sell. "Investor" – an investor in a financial asset that has been rated, or in a financial asset of a rated corporation. All the information contained in Midroog ratings and/or publications, and on which it relied (hereinafter: "the Information") was delivered to Midroog by sources that it considers credible,inter alia the rated entity. Midroog is not responsible for the accuracy of the Information and presents it as provided by the sources. Midroog exercises all reasonable means, to the best of its understanding, to assure that the Information is of quality and of adequate extent and that it originates from sources Midroog considers to be credible, including when relying on information received from independent third parties, if and when appropriate. However, Midroog does not carry out audits and cannot therefore verify or certify the Information. Midroog, its directors, its officers, its employees and/or anybody on its behalf involved in the rating shall not be held responsible under law, unless their responsibility towards a specific person and/or entity is explicitly determined under law, for any damage and/or loss, financial or other, direct, indirect, special, consequential, associated or related, incurred in any way or in connection with the Information or a rating or a rating process, including not issuing a rating, including if they were advised in advance of the possibility of damage or a loss as said above, including but not confined to (a) any loss of profit in present or future, including the loss of other investments opportunities; (b) any loss or damage caused consequential to holding, acquisition and/or selling of a financial instrument, whether it is a subject of a rating issued by Midroog or not; (c) any loss or damage caused consequential to the relevant financial asset, that was caused,inter alia and not exclusively, as a result of or in respect to negligence (except for fraud, a malicious action or an action for which the law does not permit exemption from responsibility) by directors, officers, employees and/or anybody acting on Midroog's behalf, whether by action or omission.