Exhibit 99.1

Alon Blue Square Israel Ltd.

Monitoring Report | January 2016

Contacts:

Nir Israel, CPA, Analyst

niri@midroog.co.il

Liat Kadisch, CPA, Team Leader

liatk@midroog.co.il

Sigal Issachar, VP, Head of Corporate Finance

i.sigal@midroog.co.il

1

Alon Blue Square Israel Ltd.

| Series Rating | Caa1.il | Credit review |

Midroog announces the downgrade of the rating for Series C bonds issued by Alon Blue Square Israel Ltd. (“Alon Blue Square” or the "Company” or the "Group") from B3.il to Caa1.il and the reaffirmation of the rating on credit review, with uncertain implications.

Following are the bonds in circulation issued by the Company and rated by Midroog:

| | | | | | | | | | | Book Value of | | |

| | | | | Original | | | | | | Bond Balance | | |

| | | | | Date of | | Fixed Annual | | | | on Sept. 30, | | Remainder of Bond |

| Bond Series | | Security No. | | Issue | | Coupon | | Linkage | | 2015 (NIS M) | | Repayment Years |

| C | | 1121334 | | Oct. 2010 | | 2.50% | | CPI | | 385.0 | | 2016-2022 |

Since October 2015, the Company's rating has reflected default, as we define it, due to nonpayment principal and interest (Series C) on time. In the present rating, the expected loss to bondholders is reexamined, on the backdrop of the consolidation of a debt arrangement offer between the Company and its bondholders and additional creditors, and on the backdrop of the motion to stay proceedings that Mega Retail Ltd. ("Mega") filed with the court, which the court approved.

On November 2, 2015, the Company reported consolidating, with the banks and bondholders, principles of a plan to reschedule and restructure its debt. The company is conducting negotiations with the banks and the bondholders in order to reach a detailed and final agreement. Under the arrangement plan taking shape, the schedule to repay all financial creditors will be revised and equated, thus from 2017 to 2019, the Company will pay, on November 1 of each year, 2% of the principal. The outstanding principal (94%) will be paid on November 1, 2020. All the debts will bear annual interest of 5%. Also, while consolidating the detailed arrangement, an additional payment of 1% in 2020 in the event of upside will be discussed. The plan also states that any net income from selling the Company's assets (after consensual uses) will be used to repay early principal and interest pro rata among all its financial creditors. The Company shall also pledge all its holdings in Mega, Dor Alon and Alon Blue Square Real Estate in favor of banks and bondholders, pro rata to the extent of debt.

On January 17, 2016, Mega filed a motion with the court to suspend proceedings against it and to appoint trustees, on the backdrop of deterioration in its credit terms with suppliers, a slowing pace of supplies and inventory shortages at its branches, according to the grounds cited in the motion. On January 18, 2016, the court approved the motion to suspend proceedings against Mega for 30 days and to appoint trustees.

2

In our opinion, the deterioration in Mega's business and financial state and its entry into a process of suspending proceedings against it increase the probability that Mega will be liquidated, and that guarantees the Company provided to Mega's various creditors will be exercised, to a degree that increases the expected loss for the Company's bondholders to 5%-10%.

Starting January 14th 2016, the Company issued different reports on offers it received for its holdings in Blue Square Real Estate Ltd. ("Blue Square Real Estate", subsidiary, 53.9% interest) at a company value between ILS 1.65-1.7 billion, based on the various offers. The Company also reported that several bidders had begun due diligence on Blue Square Real Estate. We assess the probability that Blue Square Real Estate will be sold as high, though the value of the deal, its timing, and the structure of the sale remain uncertain.

Since the creditors' arrangement was reached for Mega in July 2015, the Company has infused approximately ILS 2451 million into Mega as part of the support it undertook to provide under the debt arrangement. On the other hand, the Company sold its holding in Diners for approximately ILS 97 million, and sold approximately 8% of total outstanding shares in Dor Alon to its parent company Alon Delek in a benefiting transaction for ILS 50 million.

The current rating reflects an expected loss of around 5%-10% for bondholders, based on the following key assumptions:

| - | The value of the Company's tradable holdings was assessed as follows: The value of the holding in Dor Alon (63.13%) was estimated, according to different scenarios made by us, in the range of ILS 290-320 million based on the market value of the held shares around the time of this report (about ILS 320 million) and on sensitivity scenarios reflecting a value about 8% lower, mainly due to the nature of the sale and the existence of several fuel retail companies also presently for sale; the value of the Blue Square Real Estate interest (53.92%) was assessed in the range of ILS 900-950 million, based on concrete bids that the Company recently reported, which reflect a value about 18% higher than the market value around the time of this report. The value of Naaman-Verdinon was assessed by market value around the time of this report. |

1 As published by Mega on January 17, 2016 in its motion with the court to suspend proceedings against it

3

| - | Mega's value – We ascribe high weight to the scenario of Mega defaulting, and therefore include the Company's guarantees on Mega's behalf, including guarantees to the branches' renters, to credit assurance suppliers, to workers, to suppliers, and the outstanding infusion liabilities to Mega under Mega's creditors' arrangement. Based on the data figures published by the Company, we estimate these guarantees to be in the range of ILS 230-250 million in total. We note that based on Mega's current financial and legal status, we believe there is a great deal of uncertainty regarding the value of its assets, the various alternatives for their sale, and regarding future developments for Mega on the business and legal fronts. In light of this, our base scenario does not assume recovery of debt from Mega and/or capital for Blue Square at this stage. Our base scenario also assumes that no additional debts will be assigned to the Company regarding Mega beyond its existing liabilities and guarantees. |

| - | The Company's outstanding liabilities totaling ILS 1.05 billion, based on September 2015 figures and adjustments for the date of the report based on figures received from the Company. The outstanding liabilities include the Company's direct debts and debt guarantees2 for Mega. |

Based on the various scenarios, we assume the Company has negative NAV of around ILS 60-85 million.

We are reaffirming the credit watch with uncertain implications and shall continue to monitor developments at the Company and the need to revise the estimated loss.

Factors that could improve the rating:

· Selling assets for higher prices than we project

· A higher than estimated recovery rate of the debt assumed by the Company on behalf of Mega

Factors that could lower the rating:

· An increase in expected loss for bondholders

· Banks calling in liabilities

2 Debts of Mega and Teva Eden Market to the banks that the Company guaranteed or that were joint to Mega and the Company.

4

Alon Blue Square is a public company listed on the Tel Aviv and New York stock exchanges. The Company operates through four main subsidiaries: Mega Retail (100% holding), which concentrates the retail food business; BEE Retail (100%), which presently holds about 77.5% of Na'aman Ltd. and 35% of Kfar Hasha'ashuim; Dor Alon (63.13%), which is engaged in marketing and selling fuel in Israel; Blue Square Real Estate (53.92%), which owns real estate properties, most of which are currently leased for the retail activity. The Company is about 72.7% owned by Alon Israel Oil Company Ltd., a private holding company, which is owned by Bielsol Investments Ltd. (a private company jointly owned by Shraga Biran and David Weissman), and purchasing cooperative agencies belonging to kibbutzim. The chairman of the board of directors is Mr. Avigdor Kaplan and the CEO is Mr. Israel Yaniv.

Alon Blue Square Israel Ltd., Monitoring Report, October 2015

Alon Blue Square Israel Ltd., Monitoring Report, July 2015

Alon Blue Square Israel Ltd., Monitoring Report, May 2015

Alon Blue Square Israel Ltd., Rating Action, March 2015

Alon Blue Square Israel Ltd., Monitoring Report, March 2015

Midroog Rating Scales and Definitions – August 2015

The reports are published on Midroog's website:www.midroog.co.il.

Date of the report: January 27, 2016

5

| KEY FINANCIAL TERMS | | |

| | | |

| Interest | | Net financing expenses from Income Statement |

| | | |

| Cash Interest | | Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows |

| | | |

| Operating profit (EBIT) | | Profit before tax, financing and onetime expenses/profits |

| | | |

| Operating profit before amortization (EBITA) | | EBIT + amortization of intangible assets. |

| | | |

| Operating profit before depreciation and amortization (EBITDA) | | EBIT + depreciation + amortization of intangible assets. |

| | | |

| Operating profit before depreciation, amortization and rent/leasing (EBITDAR) | | EBIT + depreciation + amortization of intangible assets + rent + operational leasing. |

| | | |

| Assets | | Company's total balance sheet assets. |

| | | |

| Debt | | Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing |

| | | |

| Net debt | | Debt - cash and cash equivalent – long-term investments |

| | | |

| Capitalization (CAP) | | Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet |

| | | |

| Capital investments | | Gross investments in equipment, machinery and intangible assets |

| Capital Expenditures (CAPEX) | | |

| | | |

| Funds From Operations (FFO)* | | Cash flow from operations before changes in working capital and before changes in other asset and liabilities |

| | | |

| Cash Flow from Current Operations (CFO)* | | Cash flow from operating activity according to consolidated cash flow statements |

| | | |

| Retained Cash Flow (RCF)* | | Funds from operations (FFO) less dividend paid to shareholders |

| | | |

| Free Cash Flow (FCF)* | | Cash flow from operating activity (CFO) - CAPEX - dividends |

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

6

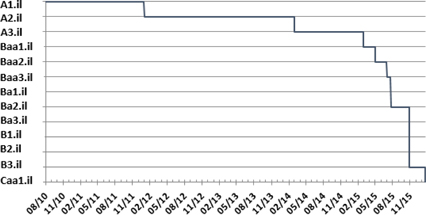

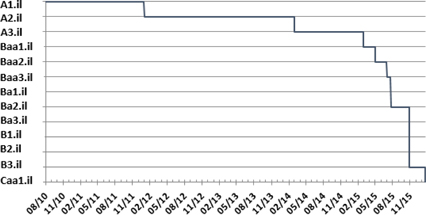

Obligations Rating Scale

Local Long-Term Rating Scale

| Aaa.il | Issuers or issues rated Aaa.il are those that, in Midroog judgment, have highest creditworthiness relative to other local issuers. |

| | |

| Aa.il | Issuers or issues rated Aa.il are those that, in Midroog judgment, have very strong creditworthiness relative to other local issuers. |

| | |

| A.il | Issuers or issues rated A.il are those that, in Midroog judgment, have relatively high creditworthiness relative to other local issuers. |

| | |

| Baa.il | Issuers or issues rated Baa.il are those that, in Midroog judgment, have relatively moderate credit risk relative to other local issuers, and could involve certain speculative characteristics. |

| | |

| Ba.il | Issuers or issues rated Ba.il are those that, in Midroog judgment, have relatively weak creditworthiness relative to other local issuers, and involve speculative characteristics. |

| | |

| B.il | Issuers or issues rated B.il are those that, in Midroog judgment, have relatively very weak creditworthiness relative to other local issuers, and involve significant speculative characteristics. |

| | |

| Caa.il | Issuers or issues rated Caa.il are those that, in Midroog judgment, have extremely weak creditworthiness relative to other local issuers, and involve very significant speculative characteristics. |

| | |

| Ca.il | Issuers or issues rated Ca.il are those that, in Midroog judgment, have extremely weak creditworthiness and very near default, with some prospect of recovery of principal and interest. |

| | |

| C.il | Issuers or issues rated C are those that, in Midroog judgment, have the weakest creditworthiness and are usually in a situation of default, with little prospect of recovery of principal and interest. |

Note: Midroog appends numeric modifiers 1, 2, and 3 to each rating category from Aa.il to Caa.il. The modifier '1' indicates that the obligation ranks in the higher end of its rating category, which is denoted by letters. The modifier '2' indicates that it ranks in the middle of its rating category and the modifier '3' indicates that the obligation ranks in the lower end of that category, denoted by letters.

Additionally, a (hyb) modifier is added to all ratings of hybrid securities issued by banks and insurers. By their terms, hybrid securities allow for the omission of scheduled dividends, interest, or principal payments, which could potentially result in impairment if such an omission occurs. Hybrid securities may also be subject to contractually allowable write-downs of principal. A long-term rating with a (hyb) modifier reflects the relative credit risk associated with that obligation.

7

Long-Term Credit Ratings for Defaulted or Impaired Securities

When a debt instrument becomes impaired or defaults, or is very likely to become impaired or to default, the rating will reflect our expectations for recovery of principal and interest, as well as the uncertainty around that expectation, as summarized in the table below. Given the usual high level of uncertainty around recovery rate expectations, the table uses approximate expected recovery rates and is intended to present rough guidance rather than a rigid map.

| Expected recovery rate | | | | |

| (Midroog definitions based on | | | | |

| Moody's definitions)3 | | Structured finance rating | | Fundamental rating |

| | | | | |

| 99% to 100% | | B1.il(sf)* | | B1.il* |

| | | | | |

| 97%-99% | | B2.il(sf)* | | B2.il* |

| | | | | |

| 95%-97% | | B3.il(sf)* | | B3.il* |

| | | | | |

| 90%-95% | | Caa1.il(sf) | | Caa1.il |

| | | | | |

| 80%-90% | | Caa2.il(sf) | | Caa2.il |

| | | | | |

| 65%-80% | | Caa3.il(sf) | | Caa3.il |

| | | | | |

| 35%-65% | | Ca.il(sf) | | Ca.il |

| | | | | |

| Less than 35% | | C.il(sf) | | C.il |

* For instruments in the B.il group, the uncertainty around expected recovery rates should be low. For example, if the probability that the recovery rate be less than 90% is not negligible (for instance, over 10%), it would generally be rated lower than the B.il group.

Also, under unusual circumstances, the above table may not apply, for example, a security in default where the default is likely to be fully cured over the short-term but remain very risky over a longer horizon might be rated much lower than suggested by this table. Another example could be very low-risk ratings that experience temporary default events, which might be rated much higher than B1.il4. Under relatively rare circumstances, structured finance transactions may incur a one-time, small principal write-down (considerably less than 1%) that is not expected to recur (e.g., additional administrative costs that constitute a loss for investors).

| 3 | The table is based on Moody's definitions. Change in Moody's definitions may lead to change in Midroog's definitions. |

4 Payments missed for operational or technical reasons may not be classified as default events. Also, in structured finance transactions, interest and/or principal payments may be delayed beyond the relevant grace period due to a temporary delay in recovery or an operational problem. In such cases, Midroog may consider the potential increase in expected loss should interest not be paid on the delayed payment and may rate the security higher than B1.

8

Copyright © All rights reserved to Midroog Ltd. (“Midroog”).

This document, including this paragraph, is copyrighted by Midroog, and is protected by copyright and by intellectual property law. This document may not be copied, scanned or photocopied, amended, distributed, duplicated, or displayed for any purpose whatsoever, commercial or otherwise, without advance written consent from Midroog.

Caveat regarding the limitations of a rating and the risks of relying on a rating

Ratings and/or publications by Midroog are subjective opinions about future relative credit risks of entities relative to their credit obligations, debts and/or debt-like financial instruments that apply on the date of their publication. Midroog's publications may contain assessments based on quantitative models of credit risks, as well as related opinions that served it in the rating process. Ratings and publications by Midroog do not constitute a statement about the accuracy of the facts at the time of the publication or in the past. Midroog makes use of rating scales to issue relative prognoses of credit risks and/or entities risks and/or the risks of a financial asset according to definitions detailed in the scale itself. The choice of a symbol to reflect credit risk reflects solely a relative assessment of that risk. Midroog defines credit risk as the risk that an entity may fail to meet its contractual financial obligations on schedule and estimated financial loss given default. Midroog's ratings do not address any other risk, such as risks relating to liquidity, market value, changes in interest rates, fluctuation in prices or any other element that influences the capital market.

The ratings and/or publications issued by Midroog do not constitute a recommendation to buy, hold, and/or sell bonds and/or other financial instruments and/or make any other investment and/or forgo any of these actions. Nor do the ratings and/or publications issued by Midroog constitute investment advice or financial advice, nor do they address the appropriateness of any given investment for any specific investor, or constitute a recommendation for investment of any type whatsoever relying on the rating. Midroog issues ratings on the assumption that anybody making use of the information therein and of the ratings will exercise due caution and conduct the appropriate tests required himself and/or through authorized professionals, in order to personally assess the merit of any investment in a financial asset that he is thinking of buying, holding or selling. Every investor should obtain professional advice in respect to his investments, to the applicable law, and/or to any other professional issue. Any rating or other opinion that Midroog issues should be considered as just one component in any investment decision by the user of information contained in this document or by anybody on his behalf, and accordingly, any user of information contained in Midroog ratings and/or publications and/or in this document must study and reach an assessment of the merit of investment on his behalf regarding any issuer, guarantor, bond or other financial instrument he intends to hold, buy or sell. "Investor" – an investor in a financial asset that has been rated, or in a financial asset of a rated corporation.

All the information contained in Midroog ratings and/or publications, and on which it relied (hereinafter: "the Information") was delivered to Midroog by sources that it considers credible,inter alia the rated entity. Midroog is not responsible for the accuracy of the Information and presents it as provided by the sources. Midroog exercises all reasonable means, to the best of its understanding, to assure that the Information is of quality and of adequate extent and that it originates from sources Midroog considers to be credible, including when relying on information received from independent third parties, if and when appropriate. However, Midroog does not carry out audits and cannot therefore verify or certify the Information.

9

Midroog, its directors, its officers, its employees and/or anybody on its behalf involved in the rating shall not be held responsible under law, unless their responsibility towards a specific person and/or entity is explicitly determined under law, for any damage and/or loss, financial or other, direct, indirect, special, consequential, associated or related, incurred in any way or in connection with the Information or a rating or a rating process, including not issuing a rating, including if they were advised in advance of the possibility of damage or a loss as said above, including but not confined to (a) any loss of profit in present or future, including the loss of other investments opportunities; (b) any loss or damage caused consequential to holding, acquisition and/or selling of a financial instrument, whether it is a subject of a rating issued by Midroog or not; (c) any loss or damage caused consequential to the relevant financial asset, that was caused,inter alia and not exclusively, as a result of or in respect to negligence (except for fraud, a malicious action or an action for which the law does not permit exemption from responsibility) by directors, officers, employees and/or anybody acting on Midroog's behalf, whether by action or omission.

Midroog hereby declares that most of the issuers of financial assets that it rates, or entities for whose issue a rating was conducted, undertook to pay Midroog for the rating prior to the rating process. Midroog maintains policy and procedures in respect to the independence of the rating and the rating processes.

Midroog is a subsidiary of Moody's (hereinafter: Moody's), which owns 51% of Midroog's shares. However, Midroog's rating processes are independent and separate from Moody's and are not subject to approval by Moody's. Midroog has its own policies and procedures and its rating committee is independent in its discretion and decisions.

A rating issued by Midroog reflects Midroog’s opinion on the date it had been issued, and it can change as a result of the information it was based on, and/or as a result of receiving new information and/or any other reason. Updates and/or changes of ratings are presented in Midroog’s website:www.midroog.co.il, where additional information on Midroog’s Policies and Procedures and/or the operation of its rating committee can be found.

10