UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2016

ALON BLUE SQUARE ISRAEL LTD.

(translation of registrant’s name into English)

EuroparkYakum, France Building,

Yakum 60972 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F:

Form 20-F x Form 40-Fo

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ______

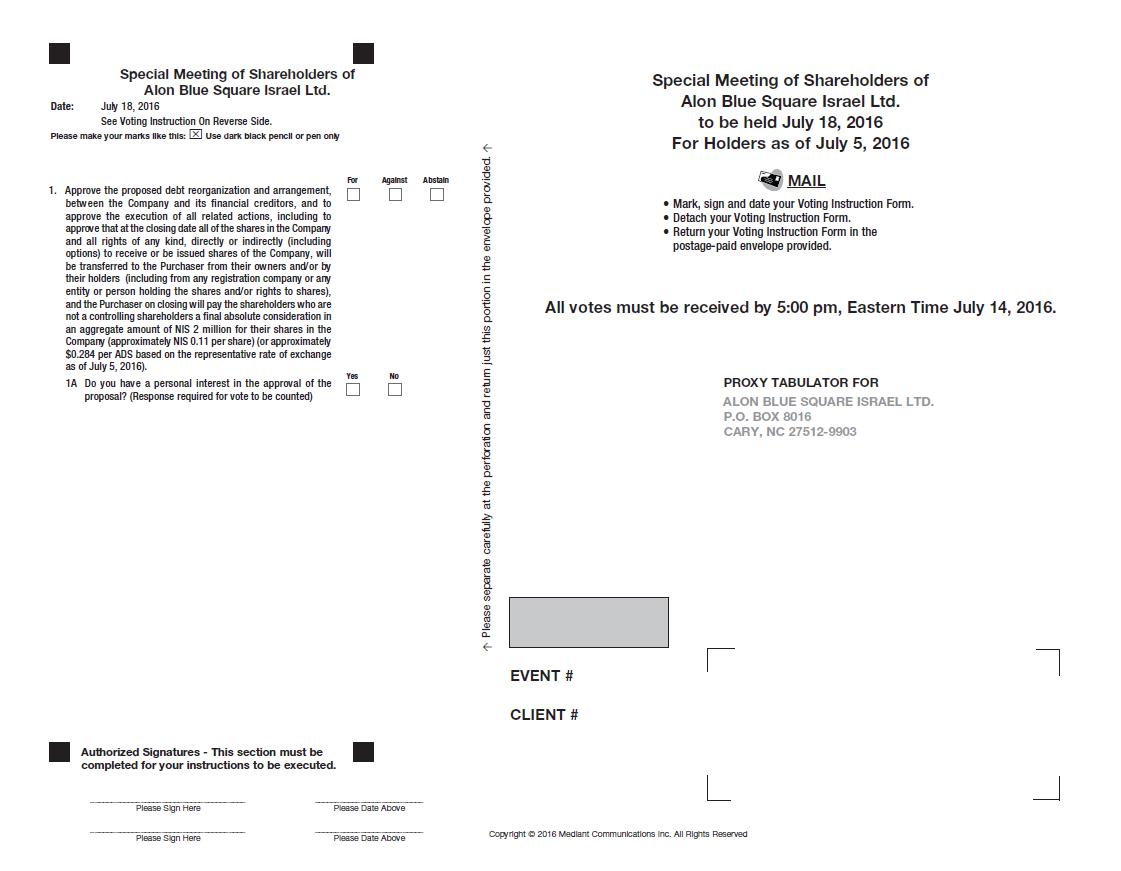

Attached hereto and incorporated herein by reference are a proxy statement and proxy card to be sent to shareholders in connection with the upcoming Special General Meeting of Shareholders.

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum 60972, Israel

Dear Shareholder,

You are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of Alon Blue Square Israel Ltd. (the “Company”) to be held at 17:00, Israel time, on July 18, 2016 at the offices of Agmon & Co. Rosenberg Hacohen & Co., 98 Yigal Alon Street, Tel-Aviv, Israel. The purpose of the Meeting is to approve the proposed debt reorganization and arrangement between the Company and its financial creditors, or Arrangement, under Section 350 of the Israeli Companies Law, 5759-1999, including to approve that all outstanding Ordinary Shares of the Company and all rights to receive or be issued Ordinary Shares of the Company (including options) held by their owners or holders (other than the Company's controlling shareholder) will be transferred to the purchaser for an aggregate consideration of NIS 2 million (approximately NIS 0.11 per Ordinary Share of the Company (or approximately $0.284 per ADS based on the representative rate of exchange as of July 5, 2016).

We look forward to greeting personally those shareholders who are able to be present at the Meeting. However, whether or not you plan to attend the Meeting, it is important that your shares be represented. Accordingly, ADS holders should return their proxies by the date set forth on the form of proxy. Shareholders may revoke their proxies at any time before the Meeting by providing written notice to the Company. Shareholders who attend the Meeting may revoke their proxies and vote their shares in person.

Thank you for your continued cooperation.

| | Very Truly Yours, |

| | |

| | Avigdor Kaplan |

| | Chairman of the Board of Directors |

Yakum, Israel

July 6, 2016

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum 60972, Israel

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of Alon Blue Square Israel Ltd. (the “Company”) will be held at 17:00, Israel time, on July 18, 2016 at the offices of Agmon & Co. Rosenberg Hacohen & Co., 98 Yigal Alon Street, Tel-Aviv, Israel in order to approve the following item:

| 1. | Approve the proposed debt reorganization and arrangement, between the Company and its financial creditors, and to approve the execution of all related actions, including to approve that at the closing date all of the shares in the Company and all rights of any kind, directly or indirectly (including options) to receive or be issued shares of the Company, will be transferred to the Purchaser from their owners and/or by their holders (including from any registration company or any entity or person holding the shares and/or rights to shares), and the Purchaser on closing will pay the shareholders who are not a controlling shareholders a final absolute consideration in an aggregate amount of NIS 2 million for their shares in the Company (approximately NIS 0.11 per share) (or approximately $0.284 per ADS based on the representative rate of exchange as of July 5, 2016)). |

The Company currently is unaware of any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated as proxies shall vote according to their own judgment on those matters.

Shareholders of record at the close of business on July 5, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. ADS holders should return their proxies by the date set forth on the form of proxy. Shareholders may revoke their proxies at any time before the Meeting by providing written notice to the Company. Shareholders who attend the Meeting may revoke their proxies in writing and vote their shares in person.

Shareholders are allowed to apply in writing, through the Company, to other shareholders of the Company in order to convince them with regard to their vote on items on the agenda of the Meeting (“Position Notice”). Position Notices may be sent to the Company's offices at the address above. Such Position Notices must be in the possession of the Company by July 10, 2016.

Joint holders of shares should take note that, pursuant to the Articles of Association of the Company, the vote of the first of the joint holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other registered holder(s) of the shares. For this purpose, the first joint shareholder shall be the person whose name is entered first in the Company's Register of Shareholders.

| | By Order of the Board of Directors, |

| | |

| | Avigdor Kaplan |

| | Chairman of the Board of Directors |

Yakum, Israel

July 6, 2016

ALON BLUE SQUARE ISRAEL LTD.

Europark Yakum, France Building,

Yakum 60972, Israel

PROXY STATEMENT

For the Special Meeting of Shareholders

to be held on July 18, 2016

This Proxy Statement is furnished to the holders of American Depository Shares (“ADSs”), evidenced by American Depositary Receipts (“ADRs”) issued by BNY Mellon (“BNY”), of Alon Blue Square Israel Ltd. (the “Company”) in connection with the solicitation by the Board of Directors (the “Board”) of proxies for use at the Special Meeting (the “Meeting”) of Ordinary Shares, par value NIS 1.0 per share (the “Ordinary Shares”), to be held on July 18, 2016 at 17:00 (Israel time) at the offices of Agmon & Co. Rosenberg Hacohen & Co., 98 Yigal Alon Street, Tel-Aviv, Israel.

It is proposed at the Meeting to approve the following item:

| 1. | Approve the proposed debt reorganization and arrangement, between the Company and its financial creditors, and to approve the execution of all related actions, including to approve that at the closing date all of the shares in the Company and all rights of any kind, directly or indirectly (including options) to receive or be issued shares of the Company, will be transferred to the Purchaser from their owners and/or by their holders (including from any registration company or any entity or person holding the shares and/or rights to shares), and the Purchaser on closing will pay the shareholders who are not a controlling shareholders a final absolute consideration in an aggregate amount of NIS 2 million for their shares in the Company (approximately NIS 0.11 per share) (or $0.284 per ADS based on the representative rate of exchange as of July 5, 2016)). |

The Company currently is unaware of any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated as proxies shall vote according to their own judgment on those matters.

A form of proxy for use at the Meeting and a return envelope for the proxy are enclosed. By appointing “proxies,” shareholders may vote at the Meeting whether or not they attend. If a properly executed proxy in the enclosed form is received by the Company by the date set forth on the form of proxy in the case of ADS holders, all of the shares represented by the proxy shall be voted as indicated on the form or, if no preference is noted, shall be voted in favor of the matters described above, and in such manner as the holder of the proxy may determine with respect to any other business as may come before the Meeting. ADR holders may revoke their proxies at any time before the deadline for receipt of proxies by filing with BNY, a written notice of revocation or duly executed proxy bearing a later date.

The Board is soliciting proxies for use at the Meeting. The Company expects to send this Proxy Statement and the accompanying proxies to ADR holders on or about July 8, 2016. In addition to solicitation of proxies by mail and by electronically,certain officers, directors, employees and agents of the Company, none of whom shall receive additional compensation therefor, may solicit proxies by telephone, e-mail or other personal contact. The Company shall bear the cost of the solicitation of the proxies, including printing and handling, and shall reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of ADRs. As a foreign private issuer, the Company is exempt from the rules under the Securities Exchange Act of 1934, as amended (the “1934 Act”), related to the furnishing and content of proxy statements. The circulation of this Proxy Statement should not be taken as an admission that the Company is subject to those proxy rules.

Only Shareholders and ADR holders of record at the close of business on July 5, 2016 (the “Record Date”) shall be entitled to receive notice of and to vote at the Meeting. At the close of business on July 3, 2016, the Company had outstanding 65,954,427 Ordinary Shares (excluding 207,433 Ordinary Shares held by the Company as treasury shares), each of which is entitled to one vote for each of the matters to be presented at the Meeting. Two or more shareholders holding shares conferring in the aggregate at least 50% of the voting power of the Company, present in person or by proxy at the Meeting and entitled to vote thereat, shall constitute a quorum.

The affirmative vote of the holders of seventy-five percent (75%) of the shares present, in person or by proxy, and voting at the Meeting (without taking abstentions into account) is required to approve the Arrangement, provided that such majority vote at the Meeting includes at least a majority of the total votes of shareholders, who do not have a personal interest in the approval of the proposal, participating in the voting at the Meeting in person or by proxy, vote in favor of the proposal without taking abstentions into account.

For this purpose, “personal interest” is defined under the Israeli Companies Law of 1999 (the “Companies Law”) as: (1) a shareholder’s personal interest in the approval of an act or a transaction of the Company, including (i) the personal interest of any of his or her relatives (which includes for these purposes foregoing shareholder's spouse, siblings, parents, grandparents, descendants, and spouse's descendants, siblings, and parents, and the spouse of any of the foregoing ); (ii) a personal interest of a corporation in which a shareholder or any of his/her aforementioned relatives serve as a director or the chief executive officer, owns at least 5% of its issued share capital or its voting rights or has the right to appoint a director or chief executive officer; and (iii) a personal interest of an individual voting via a power of attorney given by a third party (even if the empowering shareholder has no personal interest), and the vote of an attorney-in-fact shall be considered a personal interest vote if the empowering shareholder has a personal interest, and all with no regard as to whether the attorney-in-fact has voting discretion or not, but (2) excludes a personal interest arising solely from the fact of holding shares in the Company.

Abstentions will be treated as neither a vote “for” nor “against” the proposal considered at the Meeting, although they will be counted in determining whether a quorum is present.

Notwithstanding the above, the Company reserves its right to request the court to apply its authority in accordance with Section 350(m) of the Companies Law to approve the Arrangement without receipt of the affirmative vote of the Company's shareholders described above.

Beneficial Ownership of Securities by Certain Beneficial Owners and Management

The following table sets forth certain information, as of July 3, 2016, concerning (i) the persons or entities known to the Company to beneficially own 5% or more of the Company’s outstanding Ordinary Shares; and (ii) the number of Ordinary Shares beneficially owned by directors and officers of the Company as a group. Our major shareholders do not have voting rights different from the voting rights of our other shareholders.

| Name | | Number of Ordinary

Shares Beneficially

Owned | | | Percentage of

Outstanding Ordinary

Shares(1) | |

| Alon Israel Oil Company Ltd. ("Alon"). (2) | | | 47,957,264 | | | | 72.71 | % |

| | | | | | | | | |

| Alon Retail Ltd. (3) | | | 30,604,303 | | | | 46.40 | % |

| | | | | | | | | |

| Directors and Officers of the Company as a group(4) | | | 0 | (4) | | | 0 | % |

| (1) | The percentage of outstanding Ordinary Shares is based on 65,954,427 Ordinary Shares outstanding as of July 3, 2016 (excluding 207,433 Ordinary Shares held by the Company as treasury shares). |

| (2) | Alon may be deemed to beneficially own all of the shares held directly and indirectly by Alon Retail Ltd. due to the ownership structure of Alon Retail described in footnote (3); accordingly, the number of shares listed as owned by Alon includes all the shares that are listed as owned by Alon Retail Ltd. |

| (3) | Alon Retail Ltd. is a wholly owned subsidiary of Nissan Alon Retail Holdings Ltd., which is a wholly owned subsidiary of the Nissan Dor Chains Ltd., which is a wholly owned subsidiary of Dor Food Chains Holdings Ltd., a wholly owned subsidiary of Alon. To the Company’s best knowledge, Alon is owned approximately 48.21% (excluding shares held by Alon as treasury shares) by eight collective acquisition entities of kibbutzim in Israel and approximately 51.79% (excluding shares held by Alon as treasury shares) are held by Bielsol Investments (1987) Ltd. To the Company’s best knowledge, the shareholders of Bielsol Investments (1987) Ltd. consist of Shibag Ltd. (whose shareholders are Advocate Shraga Biran, and Gara, Boaz and Iftah Biran, and which is controlled by Advocate Shraga Biran who holds all of the voting rights in Shibag Ltd. through a direct holding in 85% of the shares that grant voting rights in Shibag Ltd. (“Voting Shares in Shibag”) and through a power of attorney relating to voting rights for the other 15% of the Voting Rights in Shibag held by Mr. Boaz Biran), holding 79.4% of the capital and voting rights of Bielsol Investments (and is the controlling shareholder of Bielsol Investments, and Advocate Shraga Biran is the controlling shareholder of Shibag Ltd.); D.B.W Investments Ltd. (a company owned and controlled by Mr. David Wiessman), holding 19.8% of the capital and voting rights of Bielsol Investments; Shibago Ltd. (whose partners are Shibag Ltd. (75%) and a company owned and controlled by David Wiessman (25%)), holding 0.8% of the capital and voting rights of Bielsol Investments. |

| (4) | Does not take into account Ordinary Shares that directors of the Company may be deemed to beneficially own by virtue of their interest in, or relationship with, Alon Israel Oil Company Ltd. or Alon Retail Ltd. |

ITEM 1 – APPROVE THE PROPOSED DEBT REORGANIZATION AND ARRANGEMENT, BETWEEN THE COMPANY AND ITS FINANCIAL CREDITORS, AND TO APPROVE THE EXECUTION OF ALL RELATED ACTIONS, INCLUDING TO APPROVE THAT AT THE CLOSING DATE ALL OF THE SHARES IN THE COMPANY AND ALL RIGHTS OF ANY KIND, DIRECTLY OR INDIRECTLY (INCLUDING OPTIONS) TO RECEIVE OR BE ISSUED SHARES OF THE COMPANY, WILL BE TRANSFERRED TO THE PURCHASER FROM THEIR OWNERS AND/OR BY THEIR HOLDERS (INCLUDING FROM ANY REGISTRATION COMPANY OR ANY ENTITY OR PERSON HOLDING THE SHARES AND/OR RIGHTS TO SHARES), AND THE PURCHASER ON CLOSING WILL PAY THE SHAREHOLDERS WHO ARE NOT A CONTROLLING SHAREHOLDERS A FINAL ABSOLUTE CONSIDERATION IN AN AGGREGATE AMOUNT OF NIS 2 MILLION FOR THEIR SHARES IN THE COMPANY (APPROXIMATELY NIS 0.11 PER SHARE) (OR $0.284 PER ADS BASED ON THE REPRESENTATIVE RATE OF EXCHANGE AS OF JULY 5, 2016).

Background to Proposed Arrangement

Following the continued deterioration in the financial strength of the Company's then subsidiary, Mega Retail Ltd., on January 17, 2016, Mega Retail applied to the District Court in Lod, Israel for a temporary stay of proceedings, following which trustees were appointed for the operation of Mega Retail.

In parallel, due to outstanding debt owed to holders of the Company's Series C Debentures, the principal of which was not paid in November 2015 as required, the holders of the Series C Debentures instructed the Series C Debenture trustee to put for immediate repayment the full balance of the Company's debt to the holders of the Series C Debentures. The Company entered into an undertaking agreement with the holders of its Series C Debentures who, following negotiations and deliberations, decided on the deferral of the payment date on account of the principal amounts of the Series C Debentures to July 25, 2016.

In addition, the Company has outstanding guarantees to lessors of real estate properties, suppliers, supplier credit insurers, employees, and claims made by Mega Retail’s trustees, which if materialized, may require the Company to make substantial payments of on account of these guarantees.

On May 8, 2016 the Company filed a motion with the District Court in Lod, Israel to convene meetings of its financial creditors and, for the sake of caution, a meeting of its shareholders for approval of a debt settlement, as amended based on the proposed Arrangement described more fully below. The Company filed a revised proposed Arrangement on May 25, 2016 and a further revision on June 19, 2016.

Summary of Proposed Arrangement

The Company announced on May 25, 2016 and a further on June 19, 2016 that it filed a revised motion with the District Court of Lod, Israel to convene meetings of its financial creditors (consisting of bank lenders and holders of its Series C Debentures), and Clal Insurance Company Ltd. and I.C.I.C. – The Israel Credit Insurance Company Ltd., the credit insurers) for the approval of a proposed debt reorganization and arrangement, or Arrangement, under Section 350 of the Israeli Companies Law, 5759-1999. An unofficial translation of the Arrangement is attached hereto asAnnex A.

Concurrently with the Arrangement, a company under control of Mr. Moti Ben Moshe would acquire from the Company's controlling shareholder, Alon Israel Oil Company Ltd., or Alon, (i) all of the outstanding shares of the Company held directly and indirectly by Alon (approximately 72.21% of the Company's shares), (ii) the rights and the obligations of Alon, to a bridge loan of NIS 110 million extended to the Company by Alon, (iii) the rights and the obligations of Alon Israel Oil Company Ltd. in another loan subordinated to financial debt of NIS 60 million extended to the Company by Alon, and (iv) rights to the brands "Alon" and "Alonit" (collectively, "Acquired Alon Assets") in consideration for the payment of NIS 115 million.

Following the filing of the Arrangement, Mr. Ben Moshe notified the Court that he will pay to shareholders, who are not a controlling shareholders, an aggregate amount of NIS 2 million for their shares in the Company (reflecting a price per ordinary share price of approximately NIS 0.11 (or approximately $0.284 per ADS based on the representative rate of exchange as of July 5, 2016)) at the closing date. Following closing of the Arrangement, Ben Moshe would be the sole shareholder of the Company, and effective upon closing, the Company will no longer be a publicly traded company and will thereafter be a private company.

The Company's Position Regarding the Value of Minority Shareholder Holdings

The creditors' arrangement submitted by the Company with the court as part of the amended motion to convene a creditor meeting submitted by the Company to court on June 25, 2016 (the "Amended Motion"), included conditions precedent to the completion of the arrangement under which, among other things, on the completion date of the arrangement, all the company's shares will be transferred to the Purchaser without consideration, or alternatively, all the Company’s shares will be deleted and canceled without consideration to its holders thereof (the “Inactivation of the Public Shares”). As part of the amended motion the Company expressed its position that there is a high likelihood that any alternative to the proposed arrangement would not leave in the hands of the shareholders any value taking into account the cash flow situation of the Company and the value of its assets in liquidation in relation to the value of its liabilities. The Company noted that in a preliminary discussion it held (through its audit committee, taking into account the existence of a personal interest of its controlling shareholder), in connection with the terms of the Inactivation of the Public Shares during the short time it had from when the investor asked to include this condition (less than two business days), the Company did not reached the conclusion at that stage that the controlling shareholder is not receiving any consideration for the ordinary share component in the Acquired Assets (as defined below) and that it will continue to review this issue and will present its conclusions in court after it will be clarified.

In furtherance of the above, the Company on June 5, 2016 submitted to the court the "Company's response to the Official Receiver’s position and the notification regarding the submission of an application for approval of a class action and regarding application for consolidation of the discussion, a notice regarding the approval of a compromise arrangement with Mega’s trustees and a request to schedule an urgent discussion regarding the Inactivation of the Public Shares issue". As part of its response, the Company related to the Inactivation of the Public Shares issue and the question regarding the existence of consideration to the controlling shareholder in respect of the ordinary share component under the Acquired Assets. The Company noted that the terms for inactivation of shares in accordance with the customary practice is that substantive equality between public shareholders and controlling shareholders will exist. In this context, and because the arrangement may be considered an extraordinary transaction in which controlling shareholder has a personal interest (taking into account future consideration controlling shareholder is receiving from Ben-Moshe in consideration for the Acquired Assets if the Arrangement were completed) the Company’s audit committee was required to examine the Arrangement, and in this context examined whether the value of the Acquired Assets included consideration for the Company ordinary shares held by the controlling shareholder (approximately 72.71%). The main points of the Company's position regarding this issue, as set out in its response mentioned above, are detailed below:

The Company mentioned that commencing November 2015 its financial reports includes a going concern note and that it possesses financial resources that enable the continuation of its operations for a very short period of only a few weeks. The Company also noted that in practice its ability to continue operating as a going concern business is only possible because its financial creditors are not accelerating for immediate repayment their financial debt (amounting to approximately NIS 929 million as of May 20, 2016, in addition to a credit insurers debt amounting to approximately NIS 87 million) out of expectation of the completion of the debt arrangement with Ben-Moshe, and the Company is now suffers from an actual lack of liquidity whose meaning is insolvency.

The Company also noted that under these circumstances there is a significant possibility that the Company will lose the ability to sell its assets at their real values, such that if the Company’s creditors decide to accelerate their debt for immediate repayment the Company will have only two alternatives - first, a procedure of insolvency (such as dissolution or stay of proceedings) or a quick sale of its assets (fire sale) under non-market conditions. The Company’s position is that both of these alternatives will lead to the sale of its assets at a value which are not optimal, which could hurt the Company's creditors’ ability to have their debt fully repaid (as opposed to the proposed debt arrangement submitted by the Company with the court).

According to the proposal provided to the controlling shareholder on February 15, 2016, the consideration of NIS 115 million to be paid to the controlling shareholder simultaneously with the implementation of the arrangement will be paid for the following acquired assets and related rights (the "Acquired Assets"): all rights to Company ordinary shares held by Alon Israel and Alon Retail (approximately 72.71%); all rights of Alon Israel in connection with the bridge loan of NIS 110 million, including the right to allocation of the Company's shares on its account (the “110 Loan”); all rights of Alon Israel in connection with the subordinated loan in the amount of NIS 60 million (the “60 Loan”). On June 19, 2016, Ben Moshe and Alon, the Company's controlling shareholder, notified the court of their agreement that the Acquired Assets to be acquired by Mr. Ben Moshe would include rights to the brands "Alon" and "Alonit", with the consideration to be paid to Alon to stay the same. Alon Israel’s creditors (the holders of series A debentures and Bank Hapoalim) have agreed to the above mentioned agreement. According to public reports of the Company's subsidiary, Dor Alon Ltd., Alon Israel receives, from Dor Alon, an annual sum of NIS 3 million for the use of such brands. The result is that the brands "Alon" and "Alonit" are included as part of the Acquired Assets.

The Company is aware of the claim of Ben Moshe that the consideration in an amount of NIS 115 million to the controlling shareholder is first and foremost for the acquisition of rights to the loans of NIS 170 million the controlling shareholder made to the Company. The controlling shareholder’s position, as noted to the Company, is that the bridge loan of NIS 110 million which it extended to the Company should be repaid to Alon Israel if there will be no share issuance on its account.

However, the Company's position (as formulated preliminarily by the board of directors whose members include only the members of its audit committee and based on legal advice received) is that the bridge loan of NIS 110 million may not be repaid except by conversion into share capital, taking into account that it was a bridge loan until the rights issuance in which the controlling shareholder committed to exercise rights in an amount of NIS 110 million. Therefore, the Company's position (based on independent financial advice) is that the bridge loan, in essence, is not a loan but equity, and it should be considered as if it were converted into equity in a “theoretical” rights issuance. According to this position, the Acquired Assets including the 60 Loan and shares with a percentage ownership in the Company substantially higher rate than 72%. Accordingly, the ordinary share component in the Acquired Assets may be extracted by subtracting the fair value of the Acquired Assets components which are not ordinary shares (that is, the 60 Loan) from the total amount of the consideration for the Acquired Assets (NIS 115 million). Since the brands "Alon" and “Alonit” are included in the Acquired Assets, in order to extract the value of the ordinary shares component the value of those should also be subtracted from the NIS 115 million consideration.

In summary, the position of the Company is that there is a value (though not material) to the ordinary shares component in the Acquired Assets to be sold by the controlling shareholders to Ben-Moshe, and this value is less than 1% of the total debt subject to the debt arrangement (currently exceeding NIS one billion), if the Company's view that it is not required to repay the 110 Loan is accepted. In order to create equality between the controlling shareholder and shareholders from the public, the Company's position is that public shareholders should receive similar consideration in comparison to the consideration to be received by the controlling shareholder in respect of the ordinary share component in the Acquired Assets, in proportion to the extent of “theoretical” holdings by the public shareholders following an "theoretical dilution" (due to the conversion of the 110 Loan into share capital). The Company noted that due to the fact that the amount of consideration required to be paid, in its view, to the public shareholders, is not material in relation to the creditors arrangement, it would be unreasonable to allow the Inactivation of the Public Shares issue to withhold the completion of the debt arrangement, especially considering the fact that without the approval of the arrangement with Ben-Moshe, the value of the shareholders’ equity would likely be zero.

As part of the court hearing held on June 13, 2016 regarding the above mentioned issue, the Company submitted to the court calculations prepared by an independent economic consultant regarding the value of the Company's publicly-held shares based on the consideration payable (in the Company's view) to the controlling shareholder in connection with the ordinary shares component in the Acquired Assets, based on the Company's position that the NIS 110 million loan extended by the controlling shareholder to the Company is, in essence, not a loan, but rather equity, and should be viewed as if it were converted to capital in a “theoretical” rights offering (attached to this report asAnnex B.) The calculations provided were not intended to be a valuation of the Company. However, in accordance with the calculations, and in light of the fact that the brands "Alon" and "Alonit" are included as part of the Acquired Assets, the value of the publicly held shares derived from the consideration paid to the controlling shareholder are valued at approximately NIS 3.3 million. It should be noted that the for the purpose of calculation the Company did not conduct a valuation of the trademarks "Alon" and "Alonit", and the estimated allocation of the consideration for the trade marks in the Acquired Assets was based on public reports indicating that “Dor Alon”- a public company controlled by the Company - pays Alon Israel a total of NIS 3 million per year as reported to the Company commencing from March 2005 and according to the agreement submitted for the approval of the general meeting of public shareholders of Dor Alon every three years (as a transaction with a controlling shareholder). It is also noted that in accordance with financial advice received by the board of directors of the Company, the calculation assumed a multiple of 10 before tax and total value of NIS 30 million for the trademarks. The calculations prepared by an independent economic consultant submitted to the court by the Company are attached hereto asAnnex B.

It should be noted that prior to the hearing, a number of responses and notices were filed with the court on behalf of various parties in which the parties detailed, among other things, their position in connection with the issue of the value of the Company and the Inactivation of the Public Shares. In addition, on May 29, 2016 a motion to approve a class action was filed with the court on behalf of a shareholder of the Company, in which it argued, inter alia, that the condition precedent contained in the arrangement regarding the Inactivation of the Public Shares discriminates against the minority shareholders, in response to that motion, the Company filed a motion to dismiss the claim.

In the court hearing, Ben-Moshe suggested, ex gratia, and without prejudice to his claims, according to court recommendation and in order to reach a quick resolution, to pay the public shareholders a total sum of NIS 2 million. As stated above, after the hearing Ben-Moshe filed with the court an updated notice on its behalf, stating that this proposal still stands.

In the court hearing held on June 13, 2016 the Court discussed its authority to use its authority under Section 350(m) to approve the debt arrangement even if an approval of the shareholders meeting is not received. Note that in the decision of the court regarding the convening of meetings, the court appointed Prof. Amir Barnea to prepare and submit an opinion to the court and to the Company within 14 days of the court's decision (i.e., by July 11, 2016) in order to enable the Court to formulate its view in connection with the above mentioned authority, to the extent necessary. The opinion will examine the value of the Company prior to the arrangement, and regardless of that, the value of the consideration to be paid for the ordinary shares of the controlling shareholder as part of the arrangement. The Company will transfer copies of the opinion to all interested parties and publish it, to the extent there are no trade secrets, on its website and in an immediate report.

Description of the Arrangement

Below is a non-comprehensive description of the contemplated Arrangement. Please see the copy of the Arrangement attached hereto asAnnex A for the complete terms of the Arrangement.

The Closing of the Arrangement is contingent upon, among others, the following: (i) approval of the financial creditors (including credit insurers) at the creditors meeting, (ii) approval of the Israeli court following convening of the meeting described above, (iii) receipt of agreed upon third party approvals for effectuating a change of control in the Company, (iv) the transfer of the acquired assets free and clear of any liens, (v) transfer of all outstanding shares to Mr. Ben Moshe, (vi) approval of the Mega Retail settlement agreement and supplement to settlement agreement, and (vii) approval of the Company's shareholders of the Arrangement, or, alternatively, court approval that shareholder approval is not required. The deadline for satisfying the closing conditions is July 31, 2016, subject to extension. More information on closing conditions is set forth below.

There is no guarantee that Ben Moshe will reach a final agreement with the Company’s financial creditors and credit insurers or that all the closing conditions for the Arrangement will be satisfied.

As part of the Arrangement, Ben Moshe would commit to make cash infusions of up to NIS 900 million (approximately $233.5 million) into the Company.

Cash Infusions by Ben Moshe

In general, Ben Moshe would commit to make the following cash infusions into the Company:

| - | on the closing date, Ben Moshe would inject NIS 300 million (approximately $77.8 million) into the Company which are designated for partial payment of the debt to Company financial creditors and credit insurers and such additional amount agreed for the Company's immediate cash flow needs (collectively, the "First Injection"); |

| - | following the closing date, Ben Moshe would inject into the Company, within 12 months of closing of the Arrangement, an additional amount, that together with the First Injection, would reach NIS 600 million; |

| - | Ben Moshe would inject an additional (third) NIS 300 million into the Company during the third year following the closing; |

| - | Ben Moshe may make the cash injections into the Company in the form of subordinated convertible debt, capital notes or equity or as part of a private investment or as part of a rights offering or on account of participation in future rights offerings and/or exercise of rights or options exercisable into Company shares. To the extent paid by Ben Moshe (i) as part of a rights offering, the amounts will be paid on the terms in the rights offering and (ii) as part of a private offering, the amounts will be paid at a 10% discount to the market price at that time. Conversion of Ben Moshe's subordinated debt into Company shares would be made at a conversion rate of one ordinary share of the Company per NIS 0.136 of subordinated debt converted to shares; and |

| - | The balance of the financial debt following repayment at closing would be repaid as described below and would bear interest and linkage differentials as described in the Arrangement. The Arrangement contemplates the full repayment of the financial debt of the Company. |

Additional Principal Terms

The Arrangement would contain the following additional principal terms:

| - | at closing, a sum of NIS 30 million will be paid to the credit insurers (their remaining debt to be paid from the funds of Mega Retail's trustees), and a sum of NIS 270 million will be paid to the financial creditors; |

| | - | annual interest rate of 6% would accrue beginning from 50 days prior to the closing and be paid semi-annually to financial creditors beginning on the sixth month following closing (until full repayment of the debt); |

| | | |

| | - | each of the Company's financial creditors will have the optional right to demand early repayment of its debt, which will be effectuated after the elapse of 12 months from the closing date. With respect to the holders of the Series C Debentures, the right to the early repayment option is being clarified with the Tel Aviv Stock Exchange, and a notification in this regard will be published prior to the convening of creditor meetings. Insomuch as the early repayment option in not permitted, a mandatory early repayment will be applied solely to all the holders of the Series C Debentures;

After the first repayment upon closing, the remaining financial debt owed to the Company's financial creditors will be repaid in four annual payments, each equal to 15% of the principal debt amount, upon completion of 12 months, 24 months and 36 months, and the balance of the debt within 48 months after closing; |

| - | until full repayment of the outstanding debt to the financial creditors, the Company will be entitled to effectuate early repayment of the debt accrued until such time (in whole or in part). Additionally, the Company undertook that a sum of NIS 90 million will be designated for early debt repayment of the financial debt owed to the financial creditors which will occur within six months of the closing date. If an early debt repayment is effectuated in the first three years from the closing date beyond the payment designated for that year, includingthe early debt repayment within three months from the closing date, 2.5% of the paid amount will be added to the repayment amount (not applicable to the amount paid upon the closing or amounts paid according to new repayment schedule); |

| - | all other outstanding debts or liabilities of the Company will be paid by the Company in the ordinary course of business as determined by the Company at its sole discretion (other than debt owed to joint creditors as defined in the settlement agreement with Mega Retail's trustees which is to be paid from the funds of Mega Retail's trustees in accordance with the settlement agreement). The Arrangement does not apply to debts or liabilities incurred towards creditors not determined to be financial creditors and credit insurers under the Arrangement; |

| - | to secure full repayment under the Arrangement, at closing the Company would create a lien principally on the Company's unsecured shares in its subsidiaries Dor Alon Energy In Israel (1988) Ltd. and Blue Square Real Estate Ltd. for the benefit of the financial creditors and the credit insurers; |

| - | the financial creditors and credit insurers will be entitled to immediate repayment of their debt and to foreclose on the lien upon the occurrence of certain events, including among others: (i) delay in payment to them, (ii) a fundamental breach by the Company or Ben Moshe of their respective obligations, or (iii) dissolution proceedings; |

| - | upon the elapse of 12 months following full repayment of the debt of the financial creditors and credit insurers, the Company would be obligated to repay Ben Moshe the full amount of cash infusions paid to the Company in the form of debt that had not previously been converted to equity (subject to extension at the election of Ben Moshe); after repayment of the Company's financial debt, the debt to Ben Moshe will be linked and bear interest at 5%; and |

| - | Ben Moshe's obligation to make the cash infusions will end when the Company's obligations under the Arrangement terminate (including repayment of all financial debt). |

Mega Retail Settlement Agreement

The Company announced on June 20, 2016 that following the execution of a settlement agreement between the trustees of Mega Retail and a private company controlled by Mr. Moti Ben Moshe (as approved by the Company), and the execution of a supplement to such settlement agreement, the Company filed a revised proposed Arrangement with the District Court in Lod, Israel. The revised Arrangement included changes, based on the settlement agreement with Mega, including with regard to the identity of the creditors under the proposed Arrangement and the manner of payment to the credit insurance companies. The approval of the settlement agreement is subject to various conditions precedent that have not yet been satisfied.

Closing Conditions and Requested Orders from the Court

The Arrangement is subject to the satisfaction of the following closing conditions, among others:

| - | until June 27, 2016, the court would order the convening of creditor meetings to approve the Arrangement; |

| - | until July 21, 2016, the creditor meetings would approve the Arrangement; |

| - | until July 25, 2016, the court will approve the Arrangement (without conditions, unless approved explicitly in writing by the Company and Ben Moshe), and will grant the orders providing for the following: |

| - | until the date of closing, that no third party will have grounds for any demand or claim against the Company or any company under its control (including Blue Square Real Estate) or against any third party whatsoever based on the fact that control of the Company or any under company under its control has changed; |

| - | all requests for class actions against the Company will be dismissed, and commencing from closing date, no requests for class actions will be submitted against the Company with respect to the period prior to closing; |

| - | (A) all the outstanding shares of the Company, all direct or indirect rights of any kind (including options), to receive shares of the Company will be assigned to Ben Moshe from their respective holders, such that, among other things, as of the closing date, the Company will not be required to issue shares (or rights and options thereof) to any third party, including rights to suppliers of Mega Retail to convert their debt into shares of the Company pursuant to that certain Mega Retail plan of arrangement dated July 2015. Alternatively, a court order under which all the outstanding shares of the Company all direct or indirect rights of any kind (including options and rights to suppliers of Mega Retail as described above), to receive shares of the Company will be erased and nullified at the date of closing for no consideration such that such equity will not confer upon its holder any benefit or any right to consideration, (B) Ben Moshe would receive at the closing date, whether by manner of share issuance or share transfer 66,161,860 shares of the Company, which would entitle Ben Moshe to 100% of the Company's share capital on a fully diluted basis, fully paid, non-redeemable and free and clear of any debt, liens, options or third party claims, (C) the issuance of the shares under this Arrangement can be effectuated without the need for a prospectus and the restrictions of Israeli securities regulations will not apply, (D) the acquisition by Ben Moshe of the shares will be effectuated in accordance with Section 350 of the Companies Law and not pursuant to a tender offer, and (E) effective upon closing, the Company will no longer be a publicly traded company and will thereafter be a private company. |

| - | approval of the TASE to the change in the terms of the Company's Series C Debentures; |

| - | the Company and Ben Moshe will agree to the list of agreements and approvals needed in connection with the transfer of control in the Company and any company under its control to Ben Moshe and consummation of the Arrangement, including under commitments and agreements to which the Company and companies under its control (including Blue Square Real Estate) are parties, and for which their receipt will be a closing condition for the Arrangement ("Required Approvals); |

| - | Approval of the Arrangement by the Company's shareholders, or alternatively, that the Company request that the court apply its authority in accordance with Section 350(13) of the Companies Law to approve the Arrangement without receipt of the affirmative vote of the Company's shareholders as described herein; and |

| - | transfer of the acquired assets (as defined in the control acquisition agreement) to Ben Moshe free and clear of any third party rights. |

The last day for satisfaction of all conditions is July 31, 2016.

In the event not all the conditions are satisfied under the last day for satisfaction of the conditions as set forth above, each party will have the right to extend, at its sole discretion, the period to satisfy all conditions by no more than 14 days. In addition, insomuch as there is significant progress towards satisfaction of the closing conditions following the 14 day extension period, neither party will refuse, other than for reasonable grounds, an additional extension of up to 30 days for satisfaction of the closing conditions. In the event that court approval does not include the grant of an order for dismissal of third party claims regarding a change of control or class actions, or is not received on account of these orders, the creditors will be entitled to notify the Company and Ben Moshe that such conditions will no longer be contingencies for effectiveness of the Arrangement. Insomuch as the closing conditions are not satisfied by the final extended closing date, then the Arrangement will be null and void without any additional required action or notice, and all unless Ben Moshe notifies the Company (prior to the final extended closing date) in writing of its waiver of any conditions that were not satisfied and/or the parties to the Arrangement approve one or more extensions for the satisfaction of all or some of the conditions for such period of time as agreed upon between the parties.

In the event prior closing of the Arrangement and its effectiveness, the agreement to acquire control of the Company is nullified according to law or if the commitment of Ben-Moshe to acquire control of the Company under its agreement with Alon is nullified (under section 4 of Ben Moshe offer from February 15, 2016), then the Arrangement will be nullified without any additional required action or notice.

The Arrangement contemplates the complete and irrevocable waiver of all claims among the parties, including (i) the Company, directly or indirectly (e.g., through a derivative claim), its external advisors and legal counsel, (ii) the financial creditors and the credit insurers or anyone acting on their behalf, including holders of Series C Debentures, the trustee of the Series C Debentures, the banks, and (iii) members of the board of directors of the Company who served during 2015, provided they did not serve as officers in the Company (other than service as a director), members of the board of directors of the Company who served during 2016, and non-director officers of the Company who served from January 1, 2016 until the date of submission of the request to convene meetings for the Arrangement.

The Company will publish in an immediate report in Israel no later than seven days prior to the date of the initial meeting of the Company’s debentures holders (which is scheduled for July 13, 2016) the final version of the Arrangement, including appendices for which the amended application specified that will be attached to the arrangement prior to convening a meeting of creditors and additional appendices which required an update, as well as the additional information that the Israeli Securities Authority required the Company to complete.

The entry into effectiveness of the Arrangement is dependent upon fulfillment of all precedent conditions set forth in Section 13 to the Arrangement.

Shareholders are being asked to approve the Purchaser proposal, pursuant to which the Purchaser will pay to shareholders, who are not a controlling shareholders, an aggregate amount of NIS 2 million for their shares in the Company (reflecting a price per ordinary share price of approximately NIS 0.11) at the closing date (or $$0.284 per ADS based on the representative rate of exchange as of July 5, 2016).

Required Vote

The affirmative vote of the holders of seventy-five percent (75%) of the shares present, in person or by proxy, and voting at the Meeting (without taking abstentions into account) is required to approve the Arrangement, provided that such majority vote at the Meeting includes at least a majority of the total votes of shareholders, who do not have a personal interest in the approval of the proposal, participating in the voting at the Meeting in person or by proxy, vote in favor of the proposal without taking abstentions into account.

Notwithstanding the above, the Company reserves its right to request that the court apply its authority in accordance with Section 350(m) of the Companies Law to approve the Arrangement without receipt of the affirmative vote of the Company's shareholders as described above.

It is proposed that at the Meeting, the following Resolution be adopted:

“RESOLVED,to approve the proposed debt reorganization and arrangement, between the Company and its financial creditors, and to approve the execution of all related actions, including to approve that at the closing date all of the shares in the Company and all rights of any kind, directly or indirectly (including options) to receive or be issued shares of the Company, will be transferred to the Purchaser from their owners and/or by their holders (including from any registration company or any entity or person holding the shares and/or rights to shares), and the Purchaser on closing will pay the shareholders who are not a controlling shareholders a final absolute consideration in an aggregate amount of NIS 2 million for their shares in the Company (approximately NIS 0.11 per share) (or approximately $0.284 per ADS based on the representative rate of exchange as of July 5, 2016)).”

OTHER BUSINESS

Other than as set forth above, as of the mailing of this Proxy Statement, management knows of no business to be transacted at the Meeting, but, if any other matters are properly presented at the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

By Order of the Board of Directors

| Avigdor Kaplan | |

| Chairman of the Board of Directors | |

Dated: July 6, 2016

Annex A

[unofficial translation from Hebrew]

Alon Blue Square Israel Ltd.

Arrangement

That was made and signed in Tel-Aviv on _________ ___, 2016

| Whereas | the company (as defined below) has debts to the financial creditors (as defined below); |

| And whereas | the company contacted the financial creditors with a request to reach a debt arrangement with them with regard to its debts; |

Wherefore it has been declared, stipulated and agreed between the parties as follows:

| 1.1 | The preamble to this arrangement and its annexes constitute an integral part hereof. |

| 1.2 | The titles of the sections in this arrangement are for the sake of the convenience of reading only and they should not be used for the interpretation of this arrangement. |

In this arrangement, the following terms (that appear in Hebrew alphabetical order) shall have the meaning that appears alongside them, unless expressly stated otherwise (the definitions were made for the sake of convenience only, and no consent or admission or waiver of any party should be derived from them, including with regard to rights or claims, including those of any parties including third parties):

| 2.1 | ‘The bonds’ – series C bonds in a total amount of NIS 360,565,696 nominal value (security no. 1121334). |

| 2.2 | ‘Alon Cellular’ – Alon Cellular Ltd., private company 51-449389-9. |

| 2.3 | ‘Bondholders’ meeting’ – a meeting of the bondholders. |

| 2.4 | ‘Stock exchange’ – the Tel-Aviv Stock Exchange Ltd. |

| 2.5 | ‘The controlling owners’ – Alon Israel Oil Company Ltd., public company 52-004169-0 and/or Alon Retail Ltd., private company 51-338738-1 (as applicable). |

| 2.6 | ‘Related entity’ – with regard to any person or entity, any other person or entity that controls it, that is controlled by it, or that is controlled by whoever controls it or a corporation controlled by any of the aforesaid, all of which whether directly or indirectly. |

| 2.7 | ‘Dor Alon’ – Dor Alon Energy in Israel (1988) Ltd., public company 52-004387-8. |

| 2.8 | ‘The banks’– FIBI, Bank HaPoalim, Bank Discount, Bank Leumi and Bank Mizrahi, each as defined below: |

| 2.8.1 | ‘FIBI’– the First International Banks of Israel Ltd. |

| 2.8.2 | ‘Bank HaPoalim’ – Bank HaPoalim Ltd. |

| 2.8.3 | ‘Bank Discount’– Israel Discount Bank Ltd. |

| 2.8.4 | ‘Bank Leumi’ – Bank Leumi LeIsrael B.M. |

| 2.8.5 | ‘Bank Mizrahi’ – Bank Mizrahi-Tefahot Ltd. |

| 2.9 | ‘The arrangement’or‘this arrangement’ – this debt arrangement (with its annexes), which regulates the payment of all of the comprehensive bank debt, the payment of all of the debt to credit insurers and the payment of all of the debt to the bondholders, starting from the completion date. |

| 2.10 | ‘The required consent’ – consent that will be given at a meeting of the financial creditors (or in a signed document in lieu of a meeting) with a majority of 75% of the balance of the comprehensive debt as of the relevant date (the trustee of the bondholders will vote at the aforesaid meeting on behalf of the bondholders by virtue of the company’s debt to them, pursuant to the decision of the bondholders that will be adopted in accordance with the provisions of the amended trust deed at a preliminary meeting of the bondholders which will be convened before the aforesaid creditors’ meeting). |

| 2.11 | ‘The company’ – Alon Blue Square Israel Ltd., public company 52-004284-7. |

| 2.12 | ‘The comprehensive bank debt’ – at any given time: the combined amount of the debt to each bank to all of the banks jointly as of that time. |

| 2.13 | ‘The comprehensive debt’ – at any given time: the comprehensive bank debt at that time and the debt to the bondholders at that time together with the debt to credit insurers as of that date. |

| 2.14 | ‘The principal of the financial debt’ – the debt to the bondholders and the banks (including the debt to Bank Mizrahi that is not for the joint debt) as of July 1, 2015 (‘the base date’), and with regard to Bank Mizrahi for the joint debt (only) – the balance of the debt in the joint account as of January 17, 2016 (‘the base debt’ with regard to Bank Mizrahi), including interest and/or linkage differentials, commissions and expenses that have accrued as of the base date insofar as these have not been paid thereafter, all of which as stated in Annexes 1A and 1B of this arrangement in the ‘Principal of the debt’ column, as well as debts to credit insurers (as defined below). |

| 2.15 | ‘The debt to each bank as of the publication date’ – the debt to each bank as of the publication date, which includes the principal of the financial debt together with interest and linkage differentials that have accrued from the base date pursuant to the Interest Terms Annex (Annex 3) and have not yet been paid as of the publication date. |

| 2.16 | ‘The debt to the bondholders as of the publication date’ – the debt to the bondholders as of the publication date, which includes the principal of the financial debt together with interest and linkage differentials that have accrued from the base date pursuant to the Interest Terms Annex (Annex 3) and have not yet been paid as of the publication date. |

| 2.17 | ‘The debt to each bank’ – the debt to the bank as it stood as of the base date (as stated in section 5.1 below and as stated in Annex 1A under the column ‘principal of the debt’), together with interest and/or indexation differentials according to the terms of the Interest Annex (as this term is defined below) for the period until the completion date, and from the completion date onwards together with interest and indexation differentials in accordance with this arrangement, and at any given date – plus any payment due to the bank from the company pursuant to this arrangement as of that date, after deduction of any amount that was paid to the bank after the base date, and with regard to Bank HaPoalim – starting from the completion date – with the addition also of the debt to Bank HaPoalim for the Bee Group less any amount insofar as it will be paid to Bank HaPoalim for that debt. To avoid doubt, the aforesaid relates solely to the debt regulated pursuant to the terms of this arrangement. |

| 2.18 | ‘The debt to the bondholders’ – the debt to the bondholders as it stood as of the base date (as stated in section 5.2.1 below and as stated in Annex 1B under the column ‘principal of the debt’), together with interest and indexation differentials according to the terms of the Interest Annex (as this term is defined below) for the period until the completion date, and from the completion date onwards together with interest and indexation differentials in accordance with this arrangement, and at any given date – plus any payment due to the bondholders pursuant to this arrangement as of that date, after deduction of any amount that was paid after the base date. |

| 2.19 | ‘The debt to credit insurers’ – the guaranteed debt to the credit insurers as such term is defined in the supplement to the settlement agreement with Mega Retail Ltd.'s trustees (as this term is defined in section 5.7 below), which shall stand at the maximum amount of NIS 86,875,109. Without derogating from the provisions of the supplement to the settlement, it is clarified, to avoid doubt, that any other debt of Mega to the credit insurers shall not constitute ‘the debts to the credit insurers,’ the company is not liable for it and in any case this arrangement is not intended to regulate it. |

| 2.20 | ‘Mega’s guaranteed debt’ – a joint debt of the company and Mega (as this term is defined below) and Mega’s guaranteed debt (as this term is defined below), jointly. |

| 2.21 | ‘The internal ratio’ – with regard to the banks: the internal ratio between the debts to the banksinter seas they stand on a given date, i.e., the amount of the debt to each bank as of a given date for the comprehensive bank debt as it is as of a given date. With regard to the credit insurers: the internal ratio between the credit insurersinter se as they are as of a given date. |

| 2.22 | ‘The new index’ – the index known on the date of making the indexation calculation within the framework of this arrangement. |

| 2.23 | ‘The publication debt’ – March 31, 2016. |

| 2.24 | ‘credit insurers’ –Clal Credit Insurance Ltd. and B"ASASACH the Israel Company for Credit Insurance Ltd., as the credit insurers of Mega Retail Ltd.'s suppliers. |

| 2.25 | ‘The financial creditors’ – Each of the banks (each bank for the debt to that bank) and the bondholders (for the debt to the bondholders) and each of the credit insurers (for the debts to the credit insurers, as defined above). |

| 2.26 | ‘The agreement for the acquisition of control’ – the buyer’s offer of February 15, 2016, including all of the addenda to it (including the consents between the buyer and the controlling owner that were set out in the notice filed on June 19, 2016, with the court) and the acceptance notice of the controlling owners of February 28, 2016, which are attached as Annex 13. |

| 2.27 | ‘Indexation’ or ‘linked to the index’ – multiplying the amount that needs to be linked to the index by the new index and dividing the result by the base index. However, if the new index will be lower than the base index, then for the purpose of this calculation the new index will be equal to the base index. |

| 2.28 | ‘The buyer’ – C.A.A. Extra Holdings Ltd., private company 515068849 (hereinafter:‘C.A.A.’), which is controlled by Mr. Moti Ben-Moshe and wholly owned by him; or any other company that was incorporated in Israel and is controlled by Mr. Moti Ben-Moshe, provided that the percentage of his holdings in the other company shall not be less on the completion date than 51% (hereinafter:‘the other company’) of which C.A.A. will give notice in writing to the company, the banks and the trustee of the bonds, until the completion date, that it is the buyer. From the date of C.A.A.’s notice and the signature of the other company instead of the buyer at the bottom of this arrangement with regard to taking on all of C.A.A.’s undertakings, the other company shall replace C.A.A. for all intents and purposes as the buyer, andinter alia the other company shall sign as aforesaid at the end of this arrangement as the buyer instead of C.A.A., which will be released as of the date of its aforesaid notice and the signature of the other company instead of the buyer at the bottom of this arrangement with regard to taking on all of C.A.A.’s undertakings from any undertaking in connection with this arrangement. |

| 2.29 | ‘Extra’ – ExtraHolding GMBH. |

| 2.30 | ‘The debt to Bank HaPoalim for the Bee Group’ – the debt to Bank HaPoalim stated in Annex 8, which has become (or will become) the debt of the company upon completion of the merger of Bee Group Ltd. into the company, shall be regarded as a part of the debt to Bank HaPoalim that is regulated in this arrangement and shall be paid pursuant to the terms of the comprehensive debt pursuant to this arrangement, apart from for the purpose of the collateral (as stated in section 10 below). |

| 2.31 | ‘The Companies Law’ – the Companies Law, 5759-1999, and the regulations pursuant thereto, from time to time. |

| 2.32 | ‘The Securities Law’ – the Securities Law, 5728-1968, and the regulations pursuant thereto, from time to time. |

| 2.33 | ‘Trading day’ – a day on which there is trading on the stock exchange. |

| 2.34 | ‘Business day’ – Sundays through Fridays, with the exception of days on which the branches of the banks in Israel are closed to the general public. |

| 2.35 | ‘The debt-collateral ratio’ – the ratio between the comprehensive debt on a certain date (not including the debt to Bank HaPoalim for the Bee Group that will be deducted from the comprehensive debt for the purposes of calculating the debt-collateral ratio), as the numerator, and the value of the ‘charged assets’ (as they are defined in section 10.1 below) that will be equal to the average of the closing prices of the shares that constitute the charged assets on the stock exchange in the thirty trading days that preceded that date (and insofar as one of the aforesaid ‘charged assets’ will stop being traded on the Stock Exchange, the value of that charged asset in accordance with an outside appraisal of an outside entity with expertise and goodwill, where the date on which it was made will be within the period of twelve months prior to the relevant date), as the denominator. It is clarified that any asset that is not included within the framework of the ‘charged assets’ (as defined in section 10.1 below) shall not constitute a part of the charged assets and shall not be regarded as a part of their value. In any case where money has been charged pursuant to the provisions of section 10.6 below, then for the purpose of examining the debt-collateral ratio, that money (the ‘net receipts’ as defined in section 10.6 below) shall be regarded as if it had paid off a part of the comprehensive debt (i.e., the amount of the charged money as aforesaid shall be deducted from the amount of the numerator, and for the avoidance of doubt, charged assets that were sold pursuant to section 10.6 below shall not be included in the denominator). |

| 2.36 | ‘Thepro rata amount’ – as of a given date – the ratio between the comprehensive bank debt, on the one hand, and the debt to the bondholders and the debt to credit insurers, on the other, out of the comprehensive debt as of that given date. It is clarified that thepro rataratio shall not be affected by payments that will be made to a creditor pursuant to this arrangement on account of an interest debt, which shall also be madepro rataon each relevant date (with the exception of a payment on account of a debt for linkage differentials and interest for the period prior to the completion date, which will be paid on the completion date as stated in section 6.1 below, and payment on the optional redemption date as stated in section 6.5.1 below), but only for payments on account of the principal of the debt. |

| 2.37 | ‘Index’ – the Consumer Price Index including fruits and vegetables, which is published by the Central Bureau of Statistics or any other official entity or institution that will replace it. |

| 2.38 | ‘The base index’ – the index that was published on November 15, 2015 (i.e., the index for October 2015), which is 99.6 points. |

| 2.39 | ‘Mega’ – Mega Retail Ltd. (in a suspension of proceedings), private company 51-003618-7. |

| 2.40 | ‘The completion date’ – as this term is defined in section 13.3 below. |

| 2.41 | ‘The bondholders’ – the following bondholders: (a) someone in whose favor bonds are registered with a stockbroker, and those bonds are included among the bonds that are registered in the Register of Bondholders in the name of a registration company; or (b) someone in whose favor bonds are registered in the Register of Bondholders. |

| 2.42 | ‘The completion documents’ – all of the documents that will be signed and/or delivered on the completion date, as stated in section 13.3 below, and which will constitute an integral part of this arrangement. |

| 2.43 | ‘Register of Bondholders’ – the Register of Bondholders maintained pursuant to the provisions of sections 35H2 and 35H3 of the Securities Law. |

| 2.44 | ‘Trustee of the bondholders’ – Hermetic Trust (1975) Ltd., which acts as trustee for the bondholders. |

| 2.45 | ‘Eden’ – Eden Health Teva Market Ltd. (in liquidation), private company 51-333020-9. |

| 2.46 | ‘Alon Cellular guarantee’– the guarantees attached hereto as Annex 7. |

| 2.47 | ‘The existing bank guarantees’ – bank guarantees of the banks in favor of the company, which are attached below as Annex 6. |

| 2.48 | ‘Bee Group’ – Bee Group Retail Ltd., private company 51-188490-0. |

| 2.49 | ‘Family member,’ ‘interested party,’ ‘distribution,’ ‘control’ – as these terms are defined in the Companies Law. |

| 2.50 | ‘Blue Square Real Estate’– Blue Square Real Estate Ltd., 51-376585-9. |

| 2.51 | ‘The original trust deed’ – the trust deed that was signed between the company and the trustee of the bondholders on November 8, 2010 (and which pursuant to the provisions of this arrangement will be replaced on the completion date by the amended trust deed). |

| 2.52 | ‘The amended trust deed’ – the amended trust deed (which is attached hereto as Annex 4 of this arrangement), which will be signed between the company and the trustee of the bondholders and which will come into effect on the completion date and replace and be instead of the original trust deed. |

| 3. | Annexes of the arrangement (the annexes of the arrangement that were not attached to the arrangement on the date of filing it with the court together with the revised motion for convening a creditors’ meeting shall be attached to the arrangement with the wording that will be approved by the parties, before the date of convening the creditors’ meeting for approval of the arrangement. The annexes of the arrangement which are attached to the arrangement along with the revised motion for convening a creditor's meeting will be updated, if necessary, in proximity to the date of the creditors' meeting): |

| 3.1 | Annex 1A – details of the debt to each bank as of the publication date, which includes the principal of the financial debt, the comprehensive bank debt and the internal debt, all of which as of the publication date (attached). |

| 3.2 | Annex 1B – details of the debt to the bondholders as of the publication date (attached). |

| 3.3 | Annex 2 – Settlement Agreement with Mega Retail's trustees and the supplement to the Settlement Agreement with Mega Retail's trustees (attached). |

| 3.4 | Annex 3 – Interest Terms Annex (attached). |

| 3.5 | Annex 4 – the amended trust deed (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.6 | Annex 5 – a list of the bank accounts for payment pursuant to this arrangement to each of the financial creditors (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.7 | Annex 6 – the existing bank guarantees (attached). |

| 3.8 | Annex 7 – the Alon Cellular guarantee (attached). |

| 3.3 | Annex 8 – details of the debt to Bank HaPoalim for the Bee Group (attached). |

| 3.10 | Annex 9 – a letter of reduction (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.11 | Annex 10 – a letter of undertaking from Extra to the company (attached). |

| 3.12 | Annex 11 – debts to the controlling owners (and their controlling owners) (attached). |

| 3.13 | Annex 12 – notice of exercising an optional early redemption (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.14 | Annex 13 – agreement for the acquisition of control (attached). |

| 3.15 | Annex 14 – the new bank loan agreements (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.16 | Annex 15 – the charge documents (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.17 | Annex 16 – approval of an officer for the release clause (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.18 | Annex 17 – the Articles of the company, amended pursuant to the provisions of 13.2.1.3 (c) (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.19 | Annex 18 – specific assets that will be charged in favor of the Bank HaPoalim debt for the Bee Group (will be attached before the date of convening the creditors’ meeting for approval of the arrangement). |

| 3.20 | Annex 19 – details of the sections of the buyer’s undertakings (attached). |

| 3.21 | Annex 20 – The guarantee of Doctor Baby Marketing and Distribution 888 Ltd. (in dissolution) covering the debts of the Bee Group toward Bank Hapoalim (to be attached prior to the date of convening the meeting of creditors for approval of the arrangement). |

| 3.21 | Annex 21 – Consent of Company counsel attached to the motion to convene a meeting of creditors (to be attached prior to the date of convening the meeting of creditors for approval of the arrangement). |

| 4. | General – nature of the arrangement |

| 4.1 | The purpose of this arrangement is the regulate the comprehensive debt. |

| 4.2 | Starting from the completion date, the payment and terms of the comprehensive debt will be solely in accordance with and subject to the provisions of this arrangement only. |

| 5.1 | The comprehensive bank debt and the debt to each bank |

| 5.1.1 | The debt to each bank as of the publication date (including any credit / loan / service / according to its terms) is only as stated inAnnex 1A, which includes a split between debts for principal and debts for interest, and is classified within the framework of the annex as follows: |

| 5.1.1.1 | Debt for an account that belongs only to the company (hereinafter:‘non-joint direct debt’); |

| 5.1.1.2 | Debt in a joint account of the company together with Mega (hereinafter:‘joint debt of the company and Mega’); |

| 5.1.1.3 | Debt of the company to a bank for a guarantee of the company in favor of the bank for Mega’s debt to the bank, including Mega’s debt that derives from guarantees that Mega gave to Eden (hereinafter:‘Mega’s guaranteed debt’); |

| 5.1.1.4 | Debt of the company to a bank for the company’s guarantee in favor of the bank for Eden’s debt to the bank (hereinafter:‘Eden’s guaranteed debt’); |

| 5.1.1.5 | The company’s debt to Bank HaPoalim for the Bee Group. |

| 5.1.2 | The comprehensive bank debt as of the date of publication doesnot include the following: |

| 5.1.2.1 | Debts for instruments of the company that were assigned to any of the banks by third parties (insofar as there are any). It is clarified that such debts are and will have the status of ordinary debt (they will not be secured by the charged assets and they will not be included in the debt to any bank, and consequently they will not change the internal ratio and/or thepro rataratio, for all intents and purposes); the company confirms that the amount of the company’s checks that were drawn by it and have not yet been paid as of May 1, 2016, does not exceed a sum of NIS 1 million. It is clarified that the company’s approval with regard to the aforesaid amount of NIS 1 million shall not constitute a representation or consent on the part of any of the banks; |

| 5.1.2.2 | Debt (insofar as there will be any) relating to the existing bank guarantees. The maximum debt that may arise, if any, for these guarantees is a sum that does not exceed NIS 1 million; |

| 5.1.2.3 | Debt (insofar as there will be any) with regard to a guarantee of Alon Cellular (which adopted a voluntary liquidation resolution on December 30, 2015). The maximum debt that may arise, if any, for this guarantee is a sum of NIS 2 million, linked to the index. |

| 5.1.3 | Each of the banks confirms absolutely, finally and irrevocably (with regard to itself only) what is stated in this section above and the balance of the company’s debt to it as of the publication date, as stated in Annex 1A (and with regard to Bank Hapoalim, also as stated in Annex 8), and also that the component of interest included in the aforesaid balance of the debt was accrued in accordance with the provisions of Annex 3 of this arrangement, which sets out the interest terms for the debt in the period from the base date to the completion date (hereinbefore and hereinafter:‘the Interest Terms Annex’), and that as of the completion date the company has no additional debt to it beyond what is stated in section 5.1 above, with the exception of linkage differentials and/or interest that will accrue on the debt to each bank as of the publication date for the period from the publication date to the completion date, pursuant to the provisions of the Interest Terms Annex. Each of the banks also confirms with respect to itself that apart from the debts stated above in this section 5.1, and subject to performance of all of the operations on the completion date that are a condition for the arrangement coming into effect, it (or anyone acting on its behalf directly or indirectly) neither has nor will have, and it waives in favor of the company, all contentions, claims, objections or challenges for the period up to the completion date for and/or with regard to the amount and terms of the debt (without derogating from what is stated in section 14 below). Nothing in the aforesaid shall derogate from the company’s undertakings pursuant to this arrangement, including with regard to the payment of the debt pursuant to this arrangement. |

| 5.1.4 | The bank confirms absolutely, finally and irrevocably in favor of each of the banks and/or an entity connected to the banks and/or any of the organs, officers and employees of the banks and/or anyone acting on their behalf what is stated in this section 5.1 above and the balances of the company’s debts to the banks as of the publication date, as stated in Annex 1A. The debts stated in Annex 1A were examined by the company and were found to be correct, and subject to the performance of all of the operations on the completion date that are a condition for the arrangement coming into effect, the company (or anyone acting on its behalf directly or indirectly) neither has nor will have, and it waives in favor of each of the banks, all contentions, claims, objections or challenges for and/or with regard to the amount of the debts stated in Annex 1A and the terms thereof (without derogating from what is stated in Annex 14 below). |

| 5.1.5 | The company recognizes the validity and force of all of the external documents (as defined below), and all of its undertakings to the banks pursuant to those documents and it (or anyone acting on its behalf) neither has nor will have any contention and/or claim and/or demand with regard to the aforesaid documents, including a contention of a discrepancy and/or a lack of validity and/or prescription and/or mistake and/or misrepresentation and/or any other claim, and that these documents will continue to remain fully valid. However, notwithstanding the aforesaid, from the completion date the external documents will apply subject to and pursuant to the provisions of section 17 below. |

| 5.2 | The debt to the bondholders |