UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Q

Filed by a party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Q

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material Pursuant to14a-12

Silver Dragon Resources Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Q

No fee required

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| | (1) | Title of each class of securities to which transaction applies: |

| | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

| Silver Dragon Resources Inc. |  |

| NASDAQ OTC: SDRG |

| |

| 5160 Yonge Street |

| Suite 803 |

| Toronto, Ontario |

| Canada, M2N 6L9 |

| |

| Telephone Facsimile |

| 416.223.8500 416.223.8507 |

| |

| |

August 23, 2008 Dear Shareholders: You are cordially invited to join us for our 2008 annual meeting of shareholders, which will be held on Tuesday September 23, 2008, at 10:30 a.m., EST, at the Novotel North York located at 3 Park Home Avenue, Toronto, Ontario, Canada M2N 6L3 in the Duncan Room on the second floor. Holders of record of our common stock as of August 15, 2008, are entitled to notice of and to vote at the 2008 annual meeting. The Notice of Annual Meeting of Shareholders and the proxy statement describe the business to be conducted at the meeting. We also will report at the meeting on matters of current interest to our shareholders. We hope you will be able to attend the meeting. However, even if you plan to attend in person, please vote your shares promptly to ensure that they are represented at the meeting. You may submit your proxy vote by telephone or internet as described in the following materials or by completing and signing the enclosed proxy card and returning it in the envelope provided. If you decide to attend the meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting. If your shares are held in the name of a broker, trust, bank or other nominee, you will need proof of ownership to be admitted to the meeting, as described under "How can I attend the meeting?" on page 4 of the proxy statement. We look forward to seeing you at the annual meeting. Sincerely, /s/ Alessandro M. Motta

Alessandro M. Motta, CISSP

Director, Investor Relations |

| |

|

| |

August 23, 2008 | |

| |

| |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

| |

Date and Time: | Tuesday September 23, 2008, at 10:30 a.m.EST |

| Novotel North York |

| 3 Park Home Avenue |

Place: | The Duncan Room (2nd Floor) |

| North York Ontario Canada, M2N 6L3 |

| Telephone 416-733-2929 |

| |

Items of Business: | The election of all five directors, each for a one-year term. The selection of SF Partnership, LLP as our independent auditor for the fiscal year ending December 31, 2008. Any other business that may properly be considered at the meeting or any adjournment of the meeting.

|

Record Date: | You may vote at the meeting if you were a shareholder of record at the close of business on August 15, 2008. |

| |

Voting by Proxy: | If you cannot attend the annual meeting in person, you may vote your shares by telephone or internet by no later than 11:59 p.m. Eastern time on September 22, 2008 (as directed on the enclosed proxy card), or by completing, signing and promptly returning the enclosed proxy card by mail. We encourage you to vote by telephone or internet in order to reduce our mailing and handling expenses. If you choose to submit your proxy by mail, we have enclosed an envelope for your use, which is prepaid if mailed in the United States. |

By Order of the Board of Directors

/s/ Marc M. Hazout

Marc M. Hazout

President and CEO

PROXY STATEMENT

TABLE OF CONTENTS

| | Page |

| | |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | 5 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 10 |

| | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 11 |

| | |

| PROPOSAL 1—ELECTION OF DIRECTORS | 11 |

Director nominees | |

Corporate governance | |

Executive compensation | |

Certain relationships and related transactions | |

Audit committee report and payment of fees to auditor | |

| | |

| PROPOSAL 2—RATIFICATION OF SELECTION OF AUDITOR | 18 |

-4-

PROXY STATEMENT

2008 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 23, 2008

The Board of Directors of Silver Dragon Resources Inc. is soliciting proxies for use at the annual meeting of shareholders to be held on September 23, 2008, and at any adjournment of the meeting. This proxy statement and the enclosed proxy card are first being mailed or given to shareholders on or about August 23, 2008.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the meeting?

At our annual meeting, shareholders will act upon the matters outlined in the Notice of Annual Meeting of Shareholders. These matters include the election of directors and ratification of the selection of our independent auditor. Also, management will report on our performance during the last fiscal year and, once the business of the annual meeting is concluded, respond to questions from shareholders.

Who is entitled to vote at the meeting?

The Board has set August 15, 2008 as the record date for the annual meeting. If you were a shareholder of record at the close of business on August 15, 2008, you are entitled to vote at the meeting.

As of the record date, 76,036,821 shares of our common stock were issued and outstanding and, therefore, eligible to vote at the meeting.

What are my voting rights?

Holders of our common stock are entitled to one vote per share. Therefore, a total of 76,036,821 votes are entitled to be cast at the meeting. There is no cumulative voting.

How many shares must be present to hold the meeting?

In accordance with our bylaws, shares equal to at least one-third of the voting power of our outstanding shares of common stock as of the record date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Your shares are counted as present at the meeting if:

you are present and vote in person at the meeting; or

you have properly submitted a proxy by mail, telephone or internet.

How do I vote my shares?

If you are a shareholder of record as of the record date, you can give a proxy to be voted at the meeting in any of the following ways:

over the telephone by calling a toll-free number;

electronically, using the internet; or

by completing, signing and mailing the enclosed proxy card.

The telephone and internet voting procedures have been set up for your convenience. We encourage you to save corporate expense by submitting your vote by telephone or internet. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are a shareholder of record and you would like to submit your proxy by telephone or internet, please refer to the specific instructions provided on the enclosed proxy card. If you wish to submit your proxy by mail, please return your signed proxy card to us before the annual meeting.

-5-

If you hold your shares in "street name," you must vote your shares in the manner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares, and telephone and internet voting is also encouraged for shareholders who hold their shares in street name.

What is a proxy?

It is your designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. When you designate a proxy, you also may direct the proxy how to vote your shares. We refer to this as your "proxy vote." Two executive officers, Marc Hazout and Manuel Chan, have been designated as the proxies for our 2008 annual meeting of shareholders.

What is a proxy statement?

It is a document that we are required to give you, in accordance with regulations of the Securities and Exchange Commission, when we ask you to designate proxies to vote your shares of our common stock at a meeting of our shareholders. The proxy statement includes information regarding the matters to be acted upon at the meeting and certain other information required by regulations of the Securities and Exchange Commission.

What is the difference between a shareholder of record and a "street name" holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the shareholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in "street name." Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the voting instruction card provided by it.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit your proxy vote by telephone or internet, vote once for each proxy card you receive.

Can I vote my shares in person at the meeting?

If you are a shareholder of record, you may vote your shares in person at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting.

If you are a street name holder, you may vote your shares in person at the meeting only if you obtain a signed letter or other document from your broker, bank, trust or other nominee giving you the right to vote the shares at the meeting.

What vote is required for the election of directors or for a proposal to be approved?

Election of each director requires that the number of shares voted "FOR" a director nominee must exceed the number of votes cast "AGAINST" that nominee. The affirmative vote of a majority of the voting power of our common stock present and entitled to vote on the matter is required for the ratification of the selection of our independent auditor.

How are votes counted?

You may vote "FOR," "AGAINST" or "ABSTAIN" for each nominee for the Board of Directors and on the other proposals.

-6-

If you submit your proxy but abstain from voting on one or more matters, your shares will be counted as present at the meeting for the purpose of determining a quorum. Shares not present at the meeting and shares voting "ABSTAIN" have no effect on the election of directors. If you abstain from voting on the proposal ratifying the selection of our independent auditor or on the Board proposal, your abstention has the same effect as a vote against that proposal.

If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be "broker non-votes" and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote under the rules of the American Stock Exchange. Shares that constitute broker non-votes will be counted as present at the meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. Your broker or other nominee has discretionary authority to vote your shares on the election of directors and the ratification of SF Partnership, LLP. as our independent auditor, even if your broker or other nominee does not receive voting instructions from you. Your broker or other nominee may not vote on the Board proposal without instructions from you.

Who will count the vote?

Representatives of Broadridge Financial Solutions, our tabulation agent, will tabulate the votes and act as independent inspector of election.

How does the Board recommend that I vote?

You will vote on the following management proposals:

Election of five directors: Marc Hazout, Colin Sutherland, Manuel Chan, Glen MacMullin and Guoqiang Hao.

Ratification of the selection of SF Partnership, LLP. as our independent auditor for the fiscal year ending December 31, 2008.

The Board of Directors recommends that you vote FOR the election of each of the nominees to the Board of Directors and FOR the ratification of SF Partnership, LLP. as our independent auditor for the fiscal year ending December 31, 2008.

What if I do not specify how I want my shares voted?

If you submit a signed proxy card or submit your proxy by telephone or internet and do not specify how you want to vote your shares, we will vote your shares:

FOR the election of all of the nominees for director; and

FOR the ratification of the selection of SF Partnership, LLP. as our independent auditor for the fiscal year ending December 31, 2008.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting. If you are a shareholder of record, you may revoke your proxy and change your vote by submitting a later-dated proxy by telephone, internet or mail, or by voting in person at the meeting. Attending the meeting will not revoke your proxy unless you specifically request to revoke it. To request an additional proxy card, or if you have any questions about the annual meeting or how to vote or revoke your proxy, you should write to Corporate Secretary, Silver Dragon Resources Inc., 5160 Yonge Street, Suite 803; Toronto, Ontario, Canada, M2N 6L9or call (416) 223-8500.

Will my vote be kept confidential?

Yes. We have procedures to ensure that, regardless of whether shareholders vote by mail, telephone, internet or in person, all proxies, ballots and voting tabulations that identify shareholders are kept permanently confidential, except as disclosure may be required by federal or state law or as expressly permitted by a shareholder. We also have the voting tabulations performed by an independent third party.

-7-

How can I attend the meeting?

You may be asked to present valid picture identification, such as a driver’s license or passport, before being admitted to the meeting. If you hold your shares in street name, you also will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from your broker or other nominee are examples of proof of ownership.

Please let us know whether you plan to attend the meeting by marking the attendance box on the proxy card or responding affirmatively when prompted during telephone or internet voting.

You may also send an e-mail to info@silverdragonresources.com with your first and last name and telephone number with your notice that you would like to attend the meeting.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks or other nominees for forwarding proxy materials to street name holders.

We are soliciting proxies primarily by mail. In addition, our directors, officers and regular employees may solicit proxies by telephone, facsimile or personally. These individuals will receive no additional compensation for their services other than their regular salaries.

What are the deadlines for submitting shareholder proposals for the 2008 annual meeting?

In order for a shareholder proposal to be considered for inclusion in our proxy statement for the 2009 annual meeting, the written proposal must be received at our principal executive offices at Silver Dragon Resources Inc., 5160 Yonge Street, Suite 803, Toronto, Ontario, Canada, M2N 6L9, Attention: Corporate Secretary, on or before July 20, 2009. The proposal must comply with Securities and Exchange Commission regulations regarding the inclusion of shareholder proposals in company-sponsored proxy materials.

Our bylaws provide that a shareholder may nominate a director for election at the annual meeting or may present from the floor a proposal that is not included in the proxy statement if proper written notice is received by the Corporate Secretary of Silver Dragon Resources Inc. at our principal executive offices in Toronto, Ontario, Canada, at least 120 days in advance of the anniversary of the date the proxy statement for the prior year’s annual meeting was released to shareholders. For the 2009 annual meeting, notices of director nominations and shareholder proposals to be made from the floor must be received on or before July 20, 2009. The notice must contain the specific information required by our bylaws. You may request a copy of our bylaws by contacting our Corporate Secretary, Silver Dragon Resources Inc., 5160 Yonge Street, Suite 803, Toronto, Ontario, Canada, M2N 6L9, telephone (416) 223-8500. Shareholder proposals and director nominations for which notice is received by us after July 20, 2009, may not be presented in any manner at the 2009 annual meeting.

How can I communicate with Silver Dragon’s Board of Directors?

You or any other interested party may communicate with our Board of Directors by sending a letter addressed to our Board of Directors, non-management directors, Chairman of the Board or specified individual directors to:

Silver Dragon Resources Inc.

5160 Yonge Street, Suite 803

Toronto, Ontario, Canada, M2N 6L9

Any such letters will be delivered to an independent director or a specified director if so addressed. Letters relating to accounting matters will also be delivered to our Chief Financial Officer or Corporate Controller for handling in accordance with the Board’s policy on investigation of complaints relating to accounting matters.

-8-

How can I elect to access proxy statements and annual reports electronically instead of receiving paper copies through the mail?

You can request electronic delivery if you are a shareholder of record or if you hold your shares in street name. In fact, we encourage you to request electronic delivery of these documents if you are comfortable with the electronic format because it saves us the expense of printing and mailing the materials to you and helps preserve environmental resources. You can choose this option by:

following the instructions provided on your proxy card or voter instruction form;

following the instructions provided when you vote over the internet; or

going to http://www.proxyvote.com and following the instructions provided.

If you choose to view future proxy statements and annual reports over the internet, you will receive an e-mail message next year containing a link to the internet website where you can access our proxy statement and annual report. The e-mail also will include instructions for voting over the internet. You may revoke this request at any time by following the instructions at http://www.proxyvote.com. Your election to view proxy materials online is permanent unless you revoke it later.

Do you have plans to implement the new rules that allow companies to direct their shareholders to an on-line copy of the proxy materials, rather than sending them paper copies?

As you may have heard, new rules now allow companies to choose to mail their shareholders a notice that their proxy materials can be accessed over the internet, instead of sending a paper copy of the proxy statement and annual report. Shareholders of companies who choose this delivery method can always request delivery of a paper copy of the proxy materials. We have decided not to adopt this new delivery method for this year’s annual meeting materials. We are considering carefully how to realize the cost savings opportunity and environmental benefits of avoiding the printing and mailing of these documents to shareholders who do not request paper copies, while still maintaining a meaningful and convenient proxy process for our shareholders.

-9-

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on September 23, 2008:

Our proxy statement and Annual Report are available at www.silverdragonresources.com

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Our executive officers and directors are encouraged to own our common stock to further align their interests with our shareholders’ interests.

The following table sets forth certain information regarding the beneficial ownership of shares of our common stock as of August 15 by [:

our Named Executive Officers;

our directors;

all of our executive officers and directors as a group; and

each person who is known by us to beneficially own more than 5% of our issued and outstanding shares of common stock.

Unless otherwise indicated, the shareholders listed in the table below possess sole voting and investment power with respect to the shares shown. Our directors and executive officers do not have different voting rights from other shareholders.

| | Amount and | Percent of |

| | Nature of Beneficial | Common Stock |

| Name of Beneficial Owner | Ownership (Shares) | Outstanding |

| Marc Hazout(1) | 17,055,206 | 24.4% |

| Colin Sutherland | 500,000 | 0.7% |

| Manuel Chan | 200,000 | 0.2% |

| Glen MacMullin | 0 | 0% |

| Guoqiang Hao | 200,000 | 0.2% |

| All directors and executive officers as a group | 17,955,206 | 25.5% |

(1) Owned by Travellers International Inc., which is solely owned by Mr. Hazout. Mr. Hazout is the President and CEO of Travellers.

We have no knowledge of any other arrangements, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change of control of our company

-10-

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors to file initial reports of ownership and reports of changes in ownership of our securities with the Securities and Exchange Commission. Executive officers and directors are required to furnish us with copies of these reports. Based solely on a review of the Section 16(a) reports furnished to us with respect to fiscal year 2008 and written representations from the executive officers and directors, we believe that all Section 16(a) filing requirements applicable to our executive officers and directors during fiscal year 2007 were satisfied.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board is currently composed of five directors, Marc Hazout, Colin Sutherland, Manuel Chan, Glen MacMullin, Guoqiang Hao. The majority of the Board, made up of Mr. Hazout, Mr. Chan and Mr. Hao, are NOT independent as defined in National Instrument 58-101, Disclosure of Corporate Governance Practices and Multilateral Instrument 52-110, Audit Committees. Mr. Hazout and Mr. Chan are not independent based on their employment as executive officers of the Corporation and Mr. Hao is a Director of our partner company Huaguan Industrial Corp. (HIC) in China. The Board has one class of members elected to serve one-year terms. It is the intention of the Board to achieve Director Independence in 2009 as well as comply with requirement of establishing an Audit committee as per the 52-110 guidelines.

The election of each nominee requires that the number of votes cast "FOR" the nominee’s election exceed the votes cast "AGAINST" that nominee’s election.

The Board of Directors recommends a vote FOR election of the five nominated directors. Proxies will be voted FOR the election of the five nominees unless otherwise specified.

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our current directors and executive officers. The term for each director expires at our next annual general meeting or at such time as his or her successor is appointed and qualified.

| Name and Municipality of | | | | |

| Residence | | Position and Office Held | | Director/Officer Since |

| Marc Hazout | | Director, President and CEO | | June 1, 2002 |

| Manuel Chan | | Director and VP Operation for China | | August 29, 2007 |

| Colin Sutherland | | Director (and former CFO) | | August 15, 2007 |

| Glen MacMullin | | Director | | December 6, 2007 |

| Guoqiang Hao | | Director | | June 18, 2008 |

-11-

The following is a brief description of the business background of the Company’s directors and executive officers:

Marc M. Hazout, age 43, founded Silver Dragon Resources Inc. and currently serves as a Director, President and CEO.

Mr. Hazout brings over 10 years of experience in public markets, finance and business operations to Silver Dragon Resources Inc. Over the past several years Mr. Hazout has been involved in acquiring, restructuring and providing management services, as both a Director and an Officer, to several publicly traded companies. In 1998, Mr. Hazout founded and has been President and CEO of Travellers International Inc., a private investment banking firm headquartered in Toronto. Travellers has been involved in a multitude of successful capital market transactions, and over the past few years has focused on building relationships in China with the objective of participating in that country's tremendous growth opportunities.

Mr. Hazout attended York University in Toronto studying International Relations and Economics. He attended The Canadian Securities Institute, afterwhich, he traded Equities with a Securities firm in Toronto. Mr. Hazout speaks English, French, Hebrew and Arabic as well as some Spanish and Italian.

Mr. Chan, age 52, possesses more than 20 years of experience in the real estate sector and holds a Bachelor of Commerce Degree in Management Information Systems and Accounting from the University of British Columbia, Canada. Through his business dealings, Mr. Chan has established an extensive network of business and personal relationships throughout the Hong Kong and China Investment Community.

Mr. Chan is also a member of the Board of Directors of Sanhe Sino-Top Resources & Technologies Ltd., (``Sino-Top''), of which Silver Dragon owns a 90% equity interest. Sino-Top is a Chinese company which holds the exploration and mining rights to nine properties including the Erbahuo Silver Mine located in the Erbahuo Silver District in Northern China.

Mr. Hao, age 54, is currently head of Exploration Unit of North China Geological Exploration Bureau, a.k.a. Huaguan Industrial Corp.(HIC), a Chinese state-owned entity that operates in many diversified fields such as mining, engineering, manufacturing, chemical analysis and real estate. Mr. Hao has served with HIC for over 30 years, first as a geologist, then as a manager, and has witnessed its development from a geological exploration team to a conglomerate that boasts a staff of over 700 and over 10 subsidiaries. Under the leadership of Mr. Hao, HIC is also in the process of acquiring mining properties in northern Africa and central Asia.

Mr. Hao is also a member of the Board of the Directors of Sanhe Sino-Top Resources & Technologies Ltd., a joint venture between Silver Dragon and HIC. Having a dual capacity of corporate executive and government officer, Mr. Hao has extensive connections with China’s mining and industrial circles and the Chinese government.

Mr. Sutherland, age 37, is a chartered accountant with extensive management and financial market experience, and also serves as President and C.E.O. of Nayarit Gold Inc. He was the former Chief Financial Officer of Gammon Lake Resources Inc. (TSX: "GAM"; AMEX: "GRS") and of Mexgold Resources Inc. (TSXV: "MGR"). During his three year tenure at Gammon Lake, Mr. Sutherland was (i) instrumental in placing the Ocampo Mine (gold and silver -- Chihuahua State, Mexico) into production and (ii) responsible for completing Gammon Lake's successful merger with Mexgold Resources, both of which significantly contributed to Gammon Lake's market capitalization increasing from $300 million to more than $2 billion.

Mr. MacMullin, age 37, is currently a Vice President of Finance with Minto Group; an integrated real estate development, construction and management company. Prior to joining Minto Group in 2008, he was a Managing Director at Xavier Sussex, LLC; a private investment firm he co-founded in 2004. Previously, Mr. MacMullin was a Director and Chief Operating Officer with DB Advisors, LLC; a $6 billion hedge fund group based in New York and wholly owned by Deutsche Bank AG. He has also held several senior management positions with Deutsche Bank Offshore in the Cayman Islands, including Head of Investment Funds. He started his career in public accounting with Coopers & Lybrand in Ottawa, Canada and KPMG in the Cayman Islands. Mr. MacMullin received a Bachelor of Business Administration degree from Saint Francis Xavier University and is a member of the Canadian Institute of Chartered Accountants. He serves on the Board of Directors of Nayarit Gold Inc.

The Company confirms that no legal proceedings are required to be disclosed under Item 401(f) of regulation S-K.

-12-

CORPORATE GOVERNANCE

Our Board of Directors and management are dedicated to exemplary corporate governance. Good corporate governance is vital to the continued success of Silver Dragon Resources Inc. Our Board of Directors has adopted the Silver Dragon Resources Inc. Code of Business Conduct and Ethics to provide a corporate governance framework for our directors and management to effectively pursue Silver Dragon Resources Inc.’s objectives for the benefit of our shareholders. The Board annually reviews and updates these guidelines and the charters of the Board committees in response to evolving "best practices" and the results of annual Board and committee evaluations. Our Code of Business Conduct and Ethics can be found at www.silverdragonresources.com. by clicking on About Us and then Code of Ethics. Shareholders may request a free printed copy of our Code of Business Conduct and Ethics from our investor relations department by contacting them at info@silverdragonresources.com or by calling (416) 223-8500.

Director Independence

Our Board of Directors has determined that two of our directors have no material relationship with Silver Dragon Resources Inc. and are independent. Mr. Hazout is not independent because he is the Chief Executive Officer and President of Silver Dragon Resources Inc. Mr. Chan is not independent because he is the Vice President of Operations of Silver Dragon Resources Inc. Mr. Hao is not independent as he is a member of and sits on the Board of our partner company Huaguan Industrial Corp.(HIC) in China.

We plan to appoint two (2) additional members to the Board who are independent according to the definitions outlined in National Instrument 58-101 in 2009. We will also form our Audit, Governance and Compensation Committees which will be composed only of independent directors once the Board has achieved and issued a "Statement of Independence".

Our Board has adopted certain standards to assist it in assessing the independence of each of our directors. Absent other material relationships with Silver Dragon Resources Inc., a director of Silver Dragon Resources Inc. who otherwise meets the independence qualifications of the NASDAQ and Toronto Stock Exchange listing standards may be deemed "independent" by the Board of Directors after consideration of all of the relationships between Silver Dragon Resources Inc., or any of our subsidiaries, and the director, or any of his or her immediate family members (as defined in the American Stock Exchange listing standards), or any entity with which the director or any of his or her immediate family members is affiliated by reason of being a partner, officer or a significant shareholder thereof.

In assessing the independence of our directors, our full Board carefully considered all of the business relationships between Silver Dragon Resources Inc. and our directors or their affiliated companies. This review was based primarily on responses of the directors to questions regarding employment, business, familial, compensation and other relationships with Silver Dragon Resources Inc. and our management.

Director Qualifications and Selection Process

Director Qualification Standards. Silver Dragon Resources Inc. will only consider as candidates for director individuals who possess the highest personal and professional ethics, integrity and values, and who are committed to representing the long-term interests of our shareholders. In evaluating candidates for nomination as a director of Silver Dragon Resources Inc., the Governance Committee will also consider other criteria, including current or recent experience as a chief executive officer of a public company or as a leader of another major complex organization; business and financial expertise; geography; experience as a director of a public company; gender and ethnic diversity on the Board; independence; and general criteria such as ethical standards, independent thought, practical wisdom and mature judgment. In addition, directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serving on the Board for an extended period of time. One or more of our directors must possess the education or experience required to qualify as an audit committee financial expert.

-13-

Majority Vote Standard for Election of Directors

Our Amended and Restated Bylaws provide that in uncontested elections a nominee for director will be elected to the Board if the number of votes cast "FOR" the nominee’s election exceeds the number of votes cast "AGAINST" that nominee’s election. The vote standard for directors in a contested election is a plurality of the votes cast at the meeting.

The by-laws provide that if an incumbent director fails to receive the required vote for re-election, our Governance Committee will act within 90 days after certification of the shareholder vote to determine a replacement for the incumbent director, and will submit a recommendation for prompt consideration by the Board. The Board expects the director whose status is under consideration to abstain from participating in any decision regarding that status. The Governance Committee and the Board may consider any factors they deem relevant in deciding whether to replace the incumbent director.

If each member of the Governance Committee fails to receive the required vote in favor of his or her election in the same election, then those independent directors who did receive the required vote will appoint a committee amongst themselves to consider the status of each director and recommend to the Board whether to replace them. However, if the only directors who did not receive the required vote in the same election constitute three or fewer directors, all directors may participate in the decision regarding whether to replace the directors.

Executive Sessions of the Board

Our non-employee directors meet in executive session at each regular meeting of the Board without the chief executive officer or any other member of management present, and the independent directors meet alone on an annual basis.

Director Policies

Policy Regarding Service on Other Boards. Our Board of Directors does not have a policy that restricts our directors from serving on the board of directors of other publicly traded companies unless the Board determines that such service will impair their service on the Silver Dragon Resources Board or could represent a conflict of interest.

Policy Regarding Attendance at Annual Meetings. We encourage, but do not require, our Board members to attend the annual meeting of shareholders.

LEGAL PROCEEDINGS

Neither we nor any of our property are currently subject to any material legal proceedings or other regulatory proceedings. We do not currently know of any legal proceedings against us involving our directors, executive officers, or shareholders of more than 5% of our voting stock.

EXECUTIVE COMPENSATION

This section contains a discussion of the material elements of compensation earned during 2007 by our "Named Executive Officers" listed in the summary compensation table below: Chief Executive Officer and President Marc M. Hazout; Chief Financial Officer Colin Sutherland; and VP Operations for China Manuel Chan. Effective May 31, 2008, Mr. Sutherland resigned as Chief Financial Officer of the Company.

-14-

Summary Compensation Table

The following table shows the cash and non-cash compensation for each of the last three fiscal years awarded to or earned by individuals who served as our chief executive officer or chief financial officer and each of our three other most highly compensated executive officers during the following fiscal years:

Executive & Director Compensation

| Name and Principal position(s) | Year Ended | Salary/Fees | Bonus ($) | Warrant/ | Restricted | Totals |

| December | ($) | | Option | Share | ($) |

| 31, | | | Awards | Issuances | |

| | | | (#) | (#) | |

| (a) | (b) | (c)(1) | (d)(2) | (f)(3) | (i)(4) | (j) |

| | | | | | | |

| Marc M. Hazout | 2006 | 288,000 | 0 | 0 | 2,000,000 | 288,000 |

| President & CEO | 2007 | 288,000 | 0 | 0 | 0 | 288,000 |

| | | | | | |

| Colin Sutherland(5) | 2006 | 0 | 0 | 0 | 0 | 0 |

| CFO, Director | 2007 | 24,000 | 0 | 500,000 | 500,000 | 24,000 |

| | | | | | | |

| Manuel Chan | 2006 | 0 | 0 | 1,000,000 | 0 | 0 |

| VP Operation for China | 2007 | 12,000 | 0 | 287,000 | 0 | 12,000 |

| | | | | | |

| Terry Christopher | 2006 | 0 | 0 | 0 | 0 | 0 |

| Director | 2007 | 0 | 0 | 500,000 | 0 | 0 |

| | | | | | | |

| Glen MacMullin | 2006 | 0 | 0 | 0 | 0 | 0 |

| Director | 2007 | 0 | 0 | 250,000 | 0 | 0 |

| | | | | | |

| Guoqiang Hao | 2006 | 0 | 0 | 0 | 0 | 0 |

| Director | 2007 | 0 | 0 | 500,000 | 200,000 | 0 |

(1)

Annual compensation that includes the dollar value of base salary (cash and non-cash).

(2)

Dollar value of bonuses (cash and non-cash) are eligible to all employees. Bonus plans are submitted and approved by the Board annually.

(3)

The amounts shown in this column represent stock options and warrants awarded under our the agreement between The Company and person. This column reflects the number of warrants or options awarded and disclosed in our audited 2007 financial statements. The options awarded to Colin Sutherland were exercisable on the day of grant (August 16, 2007) and there are no conditions on the options other than the fact that they expire on August 16, 2012 and they may have to be forfeited upon termination of contract.

(4)

Restricted share issuances consists of all share issuances of the Company stock to the respective officer.

(5)

Effective May 31, 2008, Colin Sutherland resigned as Chief Financial Officer of the Company.

Our executive officers do not receive any material incremental benefits that are not otherwise available to all of our employees.

On November 15, 2005, the Company entered into an Employment Agreement with Marc Hazout. The Employment Agreement provides that Mr. Hazout shall be employed by the Company for a term of five years, and is entitled to a base salary of $288,000 per year. Mr. Hazout is also entitled to a commission on sales generated by him consistent with the Company's commission policy for all sales personnel. Further, he is entitled to 8 weeks paid holiday and 14 personal days, sick leave, medical and group insurance, participation in pension or profit sharing plans of the Company, and a car allowance of up to $3,000 per month. In the event of a termination of the Employment Agreement without cause by the Company, he will be entitled to severance equal to 100% of his remaining base salary under the Employment Agreement, plus an amount equal to 75% of the base salary plus full medical coverage for 12 months following the termination date.

The Employment Agreement contains provisions prohibiting him from competing with the Company or soliciting customers or employees from the Company for a period of one year following the termination of his employment.

-15-

Manuel Chan, Vice President of Operations for China, signed a one-year consulting agreement on August, 29, 2007, which provides for an annual compensation of $36,000. Mr. Chan is entitled to receive incentive stock options as determined by the Company’s board of directors and benefits as are or may become available to other employees. The consulting agreement may be terminated by the Company without notice or pay in lieu thereof for legal cause, or on giving 1 month’s written notice, or on paying the equivalent termination pay in lieu of notice for any reason.

Colin Sutherland, Chief Financial Officer, signed a consulting agreement commencing August 15, 2007, which provides for an annual salary of $72,000. Mr. Sutherland was issued 500,000 common shares as part of a signing bonus, and was awarded options to acquire 500,000 common shares at a per share price of $0.945. Mr. Sutherland is entitled to participate in any benefit plan which the Corporation may participate from time to time. The agreement may be terminated by the Company during the first year of the term on giving him 4 weeks’ written notice and after the first year of the term on giving 8 weeks’ written notice and after the first two years of the term on giving 12 weeks’ written notice, or on paying the equivalent termination pay in lieu of notice. Upon termination for any reason, any stock options which have not vested will be forfeited.

Long Term Incentive Plan (LTIP) Awards

The Corporation does not have any long-term incentive plans pursuant to which cash or non-cash compensation intended to serve as an incentive for performance (whereby performance is measured by reference to financial performance or the price of the Corporation’s securities) was paid or distributed to any Named Executive Officers during the financial year ended December 31, 2007.

Option and Stock Appreciation Rights (SARs)

The Corporation currently does not have in place a stock option plan (the "Stock Option Plan") for the purpose of attracting and motivating directors, officers, employees and consultants of the Corporation. As of the record date of August 15, 2008, the Corporation has 4,354,878 options issued and outstanding.

Defined Benefit or Actuarial Plan

The Corporation does not have a defined benefit or actuarial plan.

-16-

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review of Related Person Transactions

Silver Dragon Resources Inc. has written procedures for reviewing transactions between Silver Dragon Resources Inc. and its directors and executive officers, their immediate family members and entities with which they have a position or relationship. These procedures are intended to determine whether any such related person transaction impairs the independence of a director or presents a conflict of interest on the part of a director or executive officer

Transactions with Management and Others

The table below describes transactions with Management and related parties as of December 31, 2007.

| | December 31, 2007 |

| Unpaid Remuneration | $ | 36,000 |

| Loans payable | $ | 435,625 |

| Balance | $ | 471,625 |

Certain Business Relationships

No material business relationships exist between the Company and directors, or family or affiliates of directors as at December 31, 2007.

Indebtedness of Management

Throughout the fiscal year and at fiscal year end, management was not indebted to the Company or any of its subsidiaries.

-17-

PROPOSAL 2—RATIFICATION OF SELECTION OF AUDITOR

SF Partnership, LLP. began serving as our independent auditor in January, 2006. The Board has selected SF Partnership, LLP to serve as our independent auditor for the fiscal year ending December 31, 2008. While we are not required to do so, Silver Dragon Resources Inc. is submitting the selection of SF Partnership, LLP. to serve as our independent auditor for the fiscal year ending December 31, 2008, for ratification in order to ascertain the views of our shareholders on this appointment. If the selection is not ratified, the Board will reconsider its selection. Representatives of SF Partnership, LLP are not expected to be present at the annual meeting.

Recommendation of the Board

The Board of Directors recommends that you vote FOR ratification of the selection of SF Partnership, LLP. as the independent auditor of Silver Dragon Resources Inc. and our subsidiaries for the fiscal year ending December31, 2008. Proxies will be voted FOR ratifying this selection unless otherwise specified.

ANNUAL REPORT TO SHAREHOLDERS AND FORM 10-K

Our Annual Report to Shareholders, including financial statements for the fiscal year ended December 31, 2007, accompanies this proxy statement. The Annual Report to Shareholders is also available on our website at www.silverdragonresources.com. Copies of our Annual Report on Form 10-K, which is on file with the SEC, are available to any shareholder who submits a request in writing to Silver Dragon Resources Inc. Copies of any exhibits to the Form 10-K are also available upon written request and payment of a fee covering our reasonable expenses in furnishing the exhibits.

"HOUSEHOLDING" OF PROXY MATERIALS

The Securities and Exchange Commission has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement or annual report, as applicable, addressed to those shareholders. This process, which is commonly referred to as "householding," potentially provides extra convenience for shareholders and cost savings for companies. Although we do not household for our registered shareholders, some brokers household Silver Dragon Resources Inc. proxy materials and annual reports, delivering a single proxy statement and annual report to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement or annual report, or if you are receiving multiple copies of either document and wish to receive only one, please notify your broker. We will deliver promptly upon written or oral request a separate copy of our annual report and/or proxy statement to a shareholder at a shared address to which a single copy of either document was delivered. For copies of either or both documents, shareholders should write to Silver Dragon Resources Inc., 5160 Yonge Street, Suite 803; Toronto, Ontario, Canada, M2N 6L9, or call (416) 223-8500.

OTHER MATTERS

We do not know of any other matters that may be presented for consideration at the annual meeting. If any other business does properly come before the annual meeting, the persons named as proxies on the enclosed proxy card will vote as they deem in the best interests of Silver Dragon Resources Inc.

Marc Hazout

President & CEO

Dated: August 23, 2008

-18-

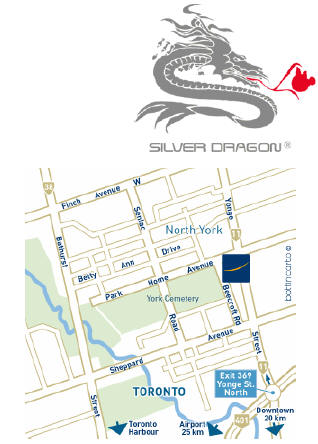

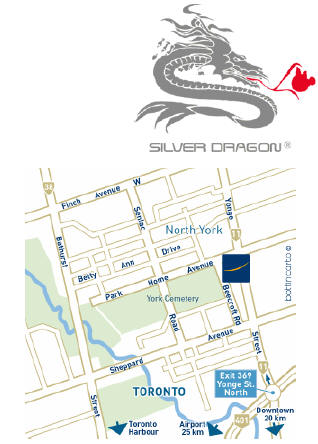

LOCATION OF SILVER DRAGON RESOURCES INC. ANNUAL MEETING OF SHAREHOLDERS

Tuesday, September 23, 2008 at 10:30 a.m. EST

Novotel North York

The Duncan Room (2nd Floor)

3 Park Home Avenue

Toronto, Ontario, Canada M2N 6L3

Telephone: 416-733-3403

Directions

From Pearson International Airport, follow Hwy 401 east, exit for Yonge Street North, follow Yonge Street past 6 traffic lights then turn left onto Park Home Ave. The hotel is on the left. From Eastern Ontario, Ottawa or Quebec, follow Hwy 401 to Toronto West, exit for Yonge Street to Park Home Ave. From Niagara Falls, Buffalo, Rochester and the US Border, follow the QEW (Queen Elizabeth Way), to Toronto East to Hwy 427 and head north to Hwy 401 east, follow the same directions as from the airport.

Airport : PEARSON INTL AIRPORT

Railway Station : VIA/UNION STATION

| Underground Station : Line | Station |

| YONGE | NORTH YORK CENTER |

Beneficial owners of common stock held in street name by a broker or bank will need proof of ownership to be admitted to the meeting. A recent brokerage statement or a letter from your broker or bank are examples of proof of ownership.

-19-