The Reserves Committee of the Board of Directors has reviewed the Corporation’s procedures for assembling and reporting other information associated with oil, gas and surface mineable oil sands activities and has reviewed that information with management. The Board of Directors has, on the recommendation of the Reserves Committee, approved:

Because the reserves data are based on judgments regarding future events, actual results will vary and the variations may be material. However, any variations should be consistent with the fact that reserves are categorized according to the probability of their recovery.

SIGNED: “STEVE W. LAUT”

Steve W. Laut

SIGNED: “DOUGLAS A. PROLL”

Douglas A. Proll

SIGNED: “DAVID A. TUER”

David A. Tuer

SIGNED: “JAMES S. PALMER”

James S. Palmer

The Audit Committee is appointed by the Board of Directors (the “Board”) to assist the Board in fulfilling its responsibility for the stewardship of the Corporation in overseeing the business and affairs of the Corporation. Although the Audit Committee has the powers and responsibilities set forth in this Charter, the role of the Audit Committee is oversight. The Audit Committee’s primary duties and responsibilities are to:

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as officers and employees of the Corporation. The Audit Committee has the authority to retain, at the Corporation’s expense, special legal, accounting or other consultants or experts it deems necessary in the performance of its duties. The Corporation shall at all times make adequate provisions for the payment of all fees and other compensation approved by the Audit Committee, to the Corporation’s independent auditors in connection with the issuance of its audit report, or to any consultants or experts employed by the Audit Committee.

71 | Canadian Natural Resources Limited |

Management’s Report

The accompanying consolidated financial statements and all other information contained elsewhere in this Annual Report are the responsibility of management. The consolidated financial statements have been prepared by management in accordance with the accounting policies described in the accompanying notes. Where necessary, management has made informed judgements and estimates in accounting for transactions that were not complete at the balance sheet date. In the opinion of management, the financial statements have been prepared in accordance with Canadian generally accepted accounting principles appropriate in the circumstances. The financial information presented elsewhere in the Annual Report has been reviewed to ensure consistency with that in the consolidated financial statements.

Management maintains appropriate systems of internal control. Policies and procedures are designed to give reasonable assurance that transactions are appropriately authorized and recorded, assets are safeguarded from loss or unauthorized use and financial records are properly maintained to provide reliable information for preparation of financial statements.

PricewaterhouseCoopers LLP, an independent firm of Chartered Accountants, has been engaged, as approved by a vote of the shareholders at the Company’s most recent Annual General Meeting, to audit and provide their independent audit opinions on the following:

| · | the Company’s consolidated financial statements as at December 31, 2009; and |

| · | the effectiveness of the Company’s internal control over financial reporting as at December 31, 2009. |

Their report is presented with the consolidated financial statements.

The Board of Directors (the “Board”) is responsible for ensuring that management fulfills its responsibilities for financial reporting and internal controls. The Board exercises this responsibility through the Audit Committee of the Board, which is comprised entirely of independent directors. The Audit Committee meets with management and the independent auditors to satisfy itself that management responsibilities are properly discharged and to review the consolidated financial statements before they are presented to the Board for approval. The consolidated financial statements have been approved by the Board on the recommendation of the Audit Committee.

| (signed) “Steve W. Laut” | (signed) “Douglas A. Proll” | (signed) “Randall S. Davis” |

Steve W. Laut President | Douglas A. Proll, CA Chief Financial Officer & Senior Vice-President, Finance | Randall S. Davis, CA Vice-President, Finance & Accounting |

Calgary, Alberta, Canada

March 3, 2010

Management’s Assessment of Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company as defined in Rules 13a–15(f) and 15(d)–15(f) under the United States Securities Exchange Act of 1934, as amended.

Management, including the Company’s President and the Company’s Chief Financial Officer and Senior Vice-President, Finance, performed an assessment of the Company’s internal control over financial reporting based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).

Based on the assessment, management has concluded that the Company’s internal control over financial reporting is effective as at December 31, 2009. Management recognizes that all internal control systems have inherent limitations. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

PricewaterhouseCoopers LLP, an independent firm of Chartered Accountants, has provided an opinion on the Company’s internal control over financial reporting as at December 31, 2009, as stated in their Auditors’ Report.

| (signed) “Steve W. Laut” | | (signed) “Douglas A. Proll” |

Steve W. Laut President | | Douglas A. Proll, CA Chief Financial Officer & Senior Vice-President, Finance |

Calgary, Alberta, Canada

March 3, 2010

Independent Auditors’ Report

To the Shareholders of Canadian Natural Resources Limited

We have completed integrated audits of Canadian Natural Resources Limited’s 2009, 2008 and 2007 consolidated financial statements and of its internal control over financial reporting as at December 31, 2009. Our opinions, based on our audits, are presented below.

Consolidated Financial statements

We have audited the accompanying consolidated balance sheets of Canadian Natural Resources Limited (the “Company”) as at December 31, 2009 and December 31, 2008, and the related consolidated statements of earnings, shareholders’ equity, comprehensive income and cash flows for each of the years in the three year period ended December 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits of the Company’s financial statements as at December 31, 2009 and for each of the years in the three year period then ended in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit of financial statements includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. A financial statement audit also includes assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as at December 31, 2009 and December 31, 2008 and the results of its operations and its cash flows for each of the years in the three year period ended December 31, 2009 in accordance with Canadian generally accepted accounting principles.

Internal control over financial reporting

We have also audited Canadian Natural Resources Limited’s internal control over financial reporting as at December 31, 2009, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. An audit of internal control over financial reporting includes obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we consider necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authori zations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as at December 31, 2009 based on criteria established in Internal Control — Integrated Framework issued by the COSO.

(signed) “PricewaterhouseCoopers LLP”

Chartered Accountants

March 3, 2010

Consolidated Balance Sheets

As at December 31 (millions of Canadian dollars) | | 2009 | | | 2008 | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

Cash and cash equivalents | | $ | 13 | | | $ | 27 | |

Accounts receivable | | | 1,148 | | | | 1,059 | |

Inventory, prepaids and other | | | 584 | | | | 455 | |

Future income tax (note 8) | | | 146 | | | | – | |

Current portion of other long-term assets (note 3) | | | – | | | | 1,851 | |

| | | | 1,891 | | | | 3,392 | |

Property, plant and equipment (note 4) | | | 39,115 | | | | 38,966 | |

Other long-term assets (note 3) | | | 18 | | | | 292 | |

| | | $ | 41,024 | | | $ | 42,650 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current liabilities | | | | | | | | |

Accounts payable | | $ | 240 | | | $ | 383 | |

Accrued liabilities | | | 1,522 | | | | 1,802 | |

Future income tax (note 8) | | | – | | | | 585 | |

Current portion of long-term debt (note 5) | | | – | | | | 420 | |

Current portion of other long-term liabilities (note 6) | | | 643 | | | | 230 | |

| | | | 2,405 | | | | 3,420 | |

Long-term debt (note 5) | | | 9,658 | | | | 12,596 | |

Other long-term liabilities (note 6) | | | 1,848 | | | | 1,124 | |

Future income tax (note 8) | | | 7,687 | | | | 7,136 | |

| | | | 21,598 | | | | 24,276 | |

| SHAREHOLDERS’ EQUITY | | | | | | | | |

Share capital (note 9) | | | 2,834 | | | | 2,768 | |

| Retained earnings | | | 16,696 | | | | 15,344 | |

Accumulated other comprehensive (loss) income (note 10) | | | (104 | ) | | | 262 | |

| | | | 19,426 | | | | 18,374 | |

| | | $ | 41,024 | | | $ | 42,650 | |

Commitments and contingencies (note 14)

Approved by the Board of Directors:

| (signed) "Catherine M. Best" | | (signed) " N. Murray Edwards" |

Catherine M. Best Chair of the Audit Committee and Director | | N. Murray Edwards Vice-Chairman of the Board of Directors and Director |

Consolidated Statements of Earnings

For the years ended December 31 (millions of Canadian dollars, except per common share amounts) | | 2009 | | | 2008 | | | 2007 | |

| Revenue | | $ | 11,078 | | | $ | 16,173 | | | $ | 12,543 | |

| Less: royalties | | | (936 | ) | | | (2,017 | ) | | | (1,391 | ) |

| Revenue, net of royalties | | | 10,142 | | | | 14,156 | | | | 11,152 | |

| Expenses | | | | | | | | | | | | |

| Production | | | 2,987 | | | | 2,451 | | | | 2,184 | |

| Transportation and blending | | | 1,218 | | | | 1,936 | | | | 1,570 | |

| Depletion, depreciation and amortization | | | 2,819 | | | | 2,683 | | | | 2,863 | |

Asset retirement obligation accretion (note 6) | | | 90 | | | | 71 | | | | 70 | |

| Administration | | | 181 | | | | 180 | | | | 208 | |

Stock-based compensation expense (recovery) (note 6) | | | 355 | | | | (52 | ) | | | 193 | |

| Interest, net | | | 410 | | | | 128 | | | | 276 | |

Risk management activities (note 13) | | | 738 | | | | (1,230 | ) | | | 1,562 | |

| Foreign exchange (gain) loss | | | (631 | ) | | | 718 | | | | (471 | ) |

| | | | 8,167 | | | | 6,885 | | | | 8,455 | |

| Earnings before taxes | | | 1,975 | | | | 7,271 | | | | 2,697 | |

Taxes other than income tax (note 8) | | | 106 | | | | 178 | | | | 165 | |

Current income tax expense (note 8) | | | 388 | | | | 501 | | | | 380 | |

Future income tax (recovery) expense (note 8) | | | (99 | ) | | | 1,607 | | | | (456 | ) |

| Net earnings | | $ | 1,580 | | | $ | 4,985 | | | $ | 2,608 | |

Net earnings per common share (note 12) | | | | | | | | | | | | |

| Basic and diluted | | $ | 2.92 | | | $ | 9.22 | | | $ | 4.84 | |

Consolidated Statements of Shareholders’ Equity

For the years ended December 31 (millions of Canadian dollars) | | 2009 | | | 2008 | | | 2007 | |

Share capital (note 9) | | | | | | | | | |

| Balance – beginning of year | | $ | 2,768 | | | $ | 2,674 | | | $ | 2,562 | |

| Issued upon exercise of stock options | | | 24 | | | | 18 | | | | 21 | |

| Previously recognized liability on stock options exercised for common shares | | | 42 | | | | 76 | | | | 91 | |

| Balance – end of year | | | 2,834 | | | | 2,768 | | | | 2,674 | |

| Retained earnings | | | | | | | | | | | | |

| Balance – beginning of year, as originally reported | | | 15,344 | | | | 10,575 | | | | 8,141 | |

| Transition adjustment on adoption of financial instruments standards | | | – | | | | – | | | | 10 | |

| Balance – beginning of year, as restated | | | 15,344 | | | | 10,575 | | | | 8,151 | |

| Net earnings | | | 1,580 | | | | 4,985 | | | | 2,608 | |

Dividends on common shares (note 9) | | | (228 | ) | | | (216 | ) | | | (184 | ) |

| Balance – end of year | | | 16,696 | | | | 15,344 | | | | 10,575 | |

Accumulated other comprehensive (loss) income (note 10) | | | | | | | | | | | | |

| Balance – beginning of year, as originally reported | | | 262 | | | | 72 | | | | (13 | ) |

| Transition adjustment on adoption of financial instruments standards | | | – | | | | – | | | | 159 | |

| Balance – beginning of year, as restated | | | 262 | | | | 72 | | | | 146 | |

| Other comprehensive (loss) income, net of taxes | | | (366 | ) | | | 190 | | | | (74 | ) |

| Balance – end of year | | | (104 | ) | | | 262 | | | | 72 | |

| Shareholders’ equity | | $ | 19,426 | | | $ | 18,374 | | | $ | 13,321 | |

Consolidated Statements of Comprehensive Income

For the years ended December 31 (millions of Canadian dollars) | | 2009 | | | 2008 | | | 2007 | |

| Net earnings | | $ | 1,580 | | | $ | 4,985 | | | $ | 2,608 | |

| Net change in derivative financial instruments designated as cash flow hedges | | | | | | | | | | | | |

Unrealized (loss) income during the year, net of taxes of $5 million (2008 – $1 million, 2007 – $6 million) | | | (33 | ) | | | 30 | | | | 38 | |

Reclassification to net earnings, net of taxes of $1 million (2008 – $6 million, 2007 – $45 million) | | | (10 | ) | | | (12 | ) | | | (96 | ) |

| | | | (43 | ) | | | 18 | | | | (58 | ) |

| Foreign currency translation adjustment | | | | | | | | | | | | |

| Translation of net investment | | | (323 | ) | | | 172 | | | | (16 | ) |

| Other comprehensive (loss) income, net of taxes | | | (366 | ) | | | 190 | | | | (74 | ) |

| Comprehensive income | | $ | 1,214 | | | $ | 5,175 | | | $ | 2,534 | |

Consolidated Statements of Cash Flows

For the years ended December 31 (millions of Canadian dollars) | | 2009 | | | 2008 | | | 2007 | |

| Operating activities | | | | | | | | | |

| Net earnings | | $ | 1,580 | | | $ | 4,985 | | | $ | 2,608 | |

| Non-cash items | | | | | | | | | | | | |

Depletion, depreciation and amortization | | | 2,819 | | | | 2,683 | | | | 2,863 | |

Asset retirement obligation accretion | | | 90 | | | | 71 | | | | 70 | |

Stock-based compensation expense (recovery) | | | 355 | | | | (52 | ) | | | 193 | |

Unrealized risk management loss (gain) | | | 1,991 | | | | (3,090 | ) | | | 1,400 | |

Unrealized foreign exchange (gain) loss | | | (661 | ) | | | 832 | | | | (524 | ) |

Deferred petroleum revenue tax expense (recovery) | | | 15 | | | | (67 | ) | | | 44 | |

Future income tax (recovery) expense | | | (99 | ) | | | 1,607 | | | | (456 | ) |

| Other | | | 5 | | | | 25 | | | | 38 | |

| Abandonment expenditures | | | (48 | ) | | | (38 | ) | | | (71 | ) |

| Net change in non-cash working capital (note 15) | | | (235 | ) | | | (189 | ) | | | (346 | ) |

| | | | 5,812 | | | | 6,767 | | | | 5,819 | |

| Financing activities | | | | | | | | | | | | |

| Repayment of bank credit facilities, net | | | (2,021 | ) | | | (623 | ) | | | (1,925 | ) |

| Issue of medium-term notes | | | – | | | | – | | | | 273 | |

| Repayment of senior unsecured notes | | | (34 | ) | | | (31 | ) | | | (33 | ) |

| Issue of US dollar debt securities | | | – | | | | 1,215 | | | | 2,553 | |

| Issue of common shares on exercise of stock options | | | 24 | | | | 18 | | | | 21 | |

| Dividends on common shares | | | (225 | ) | | | (208 | ) | | | (178 | ) |

| Net change in non-cash working capital (note 15) | | | (12 | ) | | | 46 | | | | 8 | |

| | | | (2,268 | ) | | | 417 | | | | 719 | |

| Investing activities | | | | | | | | | | | | |

| Expenditures on property, plant and equipment | | | (2,985 | ) | | | (7,433 | ) | | | (6,464 | ) |

| Net proceeds on sale of property, plant and equipment | | | 36 | | | | 20 | | | | 110 | |

| Net expenditures on property, plant and equipment | | | (2,949 | ) | | | (7,413 | ) | | | (6,354 | ) |

| Net change in non-cash working capital (note 15) | | | (609 | ) | | | 235 | | | | (186 | ) |

| | | | (3,558 | ) | | | (7,178 | ) | | | (6,540 | ) |

| (Decrease) increase in cash and cash equivalents | | | (14 | ) | | | 6 | | | | (2 | ) |

| Cash and cash equivalents – beginning of year | | | 27 | | | | 21 | | | | 23 | |

| Cash and cash equivalents – end of year | | $ | 13 | | | $ | 27 | | | $ | 21 | |

Supplemental disclosure of cash flow information (note 15)

Notes to the Consolidated Financial Statements

(tabular amounts in millions of Canadian dollars, unless otherwise stated)

1. ACCOUNTING POLICIES

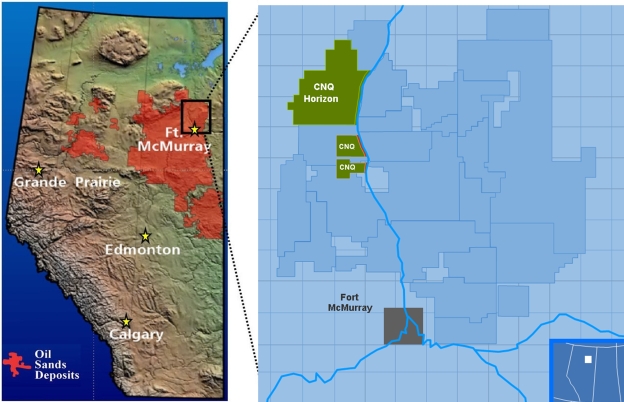

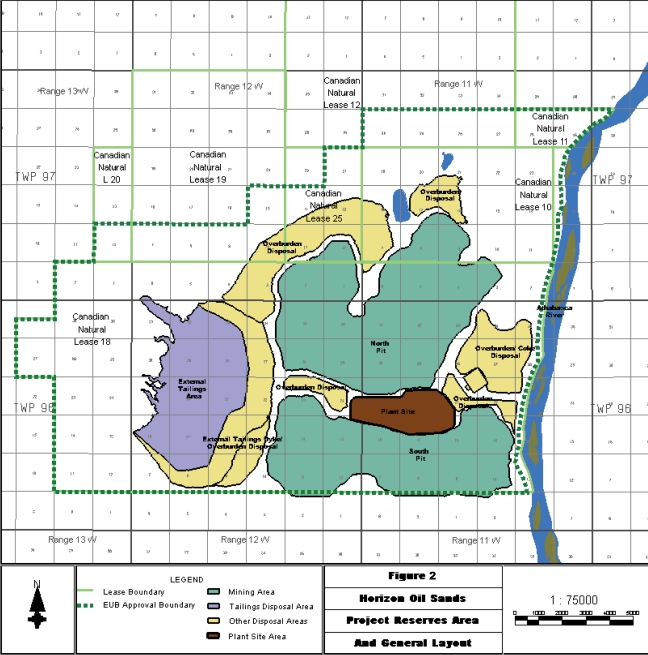

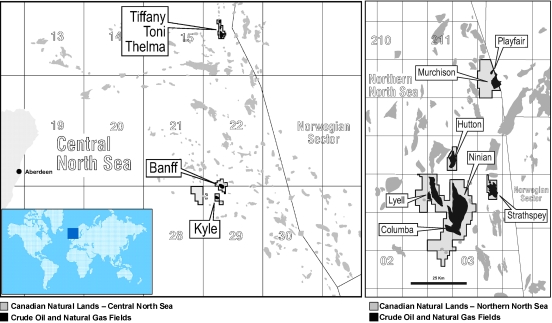

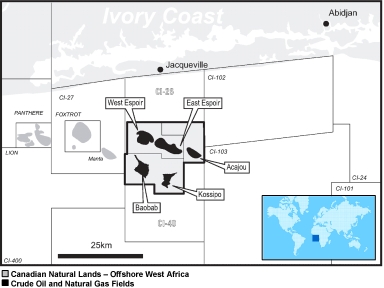

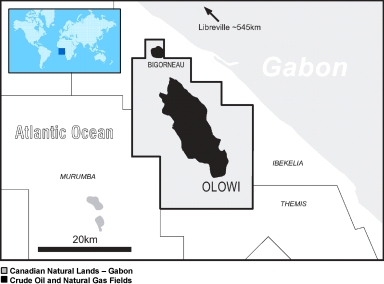

Canadian Natural Resources Limited (the “Company”) is a senior independent crude oil and natural gas exploration, development and production company head-quartered in Calgary, Alberta, Canada. The Company’s conventional crude oil and natural gas operations are focused in North America, largely in Western Canada; the United Kingdom (“UK”) portion of the North Sea; and Côte d’Ivoire and Gabon in Offshore West Africa.

Horizon oil sands properties (“Horizon”) produce synthetic crude oil through bitumen mining and upgrading operations. During 2009, Horizon Phase 1 assets were completed and available for their intended use. All Horizon related financial results are included in the “Oil Sands Mining and Upgrading” segment.

Also within Western Canada, the Company maintains certain midstream activities that include pipeline operations and an electricity co-generation system.

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”). A summary of differences between accounting principles in Canada and those generally accepted in the United States (“US GAAP”) is contained in note 17.

Significant accounting policies are summarized as follows:

(A) PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of the Company and all of its subsidiary companies and partnerships. A significant portion of the Company’s activities are conducted jointly with others and the consolidated financial statements reflect only the Company’s proportionate interest in such activities.

(B) MEASUREMENT UNCERTAINTY

Management has made estimates and assumptions regarding certain assets, liabilities, revenues and expenses in the preparation of the consolidated financial statements. Such estimates primarily relate to unsettled transactions and events as of the date of the consolidated financial statements. Accordingly, actual results may differ from estimated amounts.

Purchase price allocations, depletion, depreciation and amortization, and amounts used in impairment calculations are based on estimates of crude oil and natural gas reserves. The estimation of reserves involves the exercise of judgement. Forecasts are based on engineering data, estimated future prices, expected future rates of production and the timing of future capital expenditures, all of which are subject to many uncertainties and interpretations. The Company expects that, over time, its reserve estimates will be revised upward or downward based on updated information such as the results of future drilling, testing and production levels, and may be affected by changes in commodity prices. As a result, the impact of differences between actual and estimated oil and gas reserves amounts on the consolidated financial statements of future periods may be material.

The calculation of asset retirement obligations includes estimates of the future costs to settle the asset retirement obligation, the timing of the cash flows to settle the obligation, and the future inflation rates. The impact of differences between actual and estimated costs, timing and inflation on the consolidated financial statements of future periods may be material.

The calculation of income taxes requires judgement in applying tax laws and regulations, estimating the timing of temporary difference reversals, and estimating the realizability of future tax assets. These estimates impact current and future income tax assets and liabilities, and current and future income tax expense (recovery).

The measurement of petroleum revenue tax expense in the United Kingdom and the related provision in the consolidated financial statements are subject to uncertainty associated with future recoverability of crude oil and natural gas reserves, commodity prices and the timing of future events, which may result in material changes to deferred amounts.

The estimation of fair value for derivative financial instruments requires the use of assumptions. In determining these assumptions, the Company has relied primarily on external, readily observable market inputs including quoted commodity prices and volatility, interest rate yield curves, and foreign exchange rates. The resulting fair value estimates may not necessarily be indicative of the amounts that could be realized or settled in a current market transaction and these differences may be material.

(C) CASH AND CASH EQUIVALENTS

Cash comprises cash on hand and demand deposits. Other investments (term deposits and certificates of deposit) with an original term to maturity at purchase of three months or less are reported as cash equivalents on the balance sheet.

(D) INVENTORIES

Inventories are carried at the lower of cost and net realizable value. Cost consists of purchase costs, direct production costs, direct overhead and depletion, depreciation and amortization and is determined on a first-in, first-out basis. Inventories are primarily comprised of crude oil production held for sale.

(E) PROPERTY, PLANT AND EQUIPMENT

Conventional Crude Oil and Natural Gas

The Company follows the full cost method of accounting for its conventional crude oil and natural gas properties and equipment as prescribed by Accounting Guideline 16 (“AcG 16”) issued by the Canadian Institute of Chartered Accountants (“CICA”). Accordingly, all costs relating to the exploration for and development of conventional crude oil and natural gas reserves are capitalized and accumulated in country-by-country cost centres. Directly attributable administrative overhead incurred during the development of certain large capital projects is capitalized until the projects are available for their intended use. Proceeds on disposal of properties are ordinarily deducted from such costs without recognition of a gain or loss except where such dispositions result in a change in the depletion rate of the specific cost centre of 20% or more.

Oil Sands Mining and Upgrading

Horizon is comprised of both mining and upgrading operations and accordingly, capitalized costs are accounted for separately from the Company’s Canadian conventional crude oil and natural gas costs. Capitalized mining activity costs include property acquisition, construction and development costs. Construction and development costs are capitalized separately to each Phase of Horizon. The construction and development of a particular Phase of Horizon is considered complete once the Phase is available for its intended use. Costs related to major maintenance turnaround activities are capitalized and amortized on a straight-line basis over the period to the next scheduled major maintenance turnaround. During 2009, Horizon Phase 1 assets were completed and available for their intended use. Accordingly, capitalization of all associated Phase 1 de velopment costs, including capitalized interest and stock-based compensation, and all directly attributable Phase 1 administrative costs ceased and depletion, depreciation and amortization of these assets commenced.

Midstream and Other

The Company capitalizes all costs that expand the capacity or extend the useful life of the assets.

(F) OVERBURDEN REMOVAL COSTS

Overburden removal costs incurred during development of the Horizon mine are capitalized to property, plant and equipment. Overburden removal costs incurred during production of the Horizon mine are included in the cost of inventory, unless the overburden removal activity has resulted in a betterment of the mineral property, in which case the costs are capitalized to property, plant and equipment. Capitalized overburden removal costs are amortized over the life of the mining reserves that directly benefit from the overburden removal activity.

(G) CAPITALIZED INTEREST

The Company capitalizes construction period interest based on major qualifying costs incurred and the Company’s cost of borrowing. Interest capitalization on a particular project ceases once this project is available for its intended use.

(H) LEASES

Leases that transfer substantially all of the benefits and risks of ownership to the Company are accounted for as capital leases and are recorded as property, plant and equipment with an offsetting liability. All other leases are accounted for as operating leases whereby lease costs are expensed as incurred. Contractual arrangements that meet the definition of a lease are accounted for as capital leases or operating leases as appropriate.

(I) DEPLETION, DEPRECIATION, AMORTIZATION AND IMPAIRMENT

Conventional Crude Oil and Natural Gas

Substantially all costs related to each country-by-country cost centre are depleted on the unit-of-production method based on the estimated proved reserves of that country. Volumes of net production and net reserves before royalties are converted to equivalent units on the basis of estimated relative energy content. In determining its depletion base, the Company includes estimated future costs to be incurred in developing proved reserves and excludes the cost of unproved properties and major development projects. Costs for major development projects, as identified by management, are not subject to depletion until the projects are available for their intended use. Unproved properties and major development projects are assessed periodically to determine whether impairment has occurred. When proved reserves are assigned or the value of an unproved property or major development project is considered to be impaired, the cost of the property or the amount of the impairment is added to costs subject to depletion. Processing and production facilities are depreciated on a straight-line basis over their estimated lives.

The Company reviews the carrying amount of its conventional crude oil and natural gas properties (“the properties”) relative to their recoverable amount (“the ceiling test”) for each cost centre at each annual balance sheet date, or more frequently if circumstances or events indicate impairment may have occurred. The recoverable amount is calculated as the undiscounted cash flow from the properties using proved reserves and expected future prices and costs. If the carrying amount of the properties exceeds their recoverable amount, an impairment loss is recognized in depletion and depreciation expense equal to the amount by which the carrying amount of the properties exceeds their fair value. Fair value is calculated as the cash flow from those properties using proved and probable reserves and expected future prices and co sts, discounted at a risk-free interest rate.

Oil Sands Mining and Upgrading

Mine-related costs and costs of the upgrader and related infrastructure located on the Horizon site are amortized on the unit-of-production method based on the estimated proved reserves of Horizon or productive capacity, respectively. Moveable mine-related equipment is depreciated on a straight-line basis over its estimated useful life.

The Company reviews the carrying amount of Horizon relative to its recoverable amount if circumstances or events indicate impairment may have occurred. The recoverable amount is calculated as the undiscounted cash flow from Horizon assets using proved and probable reserves and expected future prices and costs. If the carrying amount exceeds the recoverable amount, an impairment loss is recognized in depletion equal to the amount by which the carrying amount of the assets exceeds fair value. Fair value is calculated as the discounted cash flow from Horizon using proved and probable reserves and expected future prices and costs.

Midstream and Other

Midstream assets are depreciated on a straight-line basis over their estimated lives. The Company reviews the recoverability of the carrying amount of the midstream assets when events or circumstances indicate that the carrying amount might not be recoverable. If the carrying amount of the midstream assets exceeds their recoverable amount, an impairment loss equal to the amount by which the carrying amount of the midstream assets exceeds their fair value is recognized in depreciation. Other capital assets are amortized on a declining balance basis.

(J) ASSET RETIREMENT OBLIGATIONS

The Company provides for future asset retirement obligations on its resource properties, facilities, production platforms, gathering systems, and oil sands mining operations and tailings ponds based on current legislation and industry operating practices. The fair values of asset retirement obligations related to property, plant and equipment are recognized as a liability in the period in which they are incurred. Retirement costs equal to the fair value of the asset retirement obligations are capitalized as part of the cost of the associated property, plant and equipment and are amortized to expense through depletion and depreciation over the lives of the respective assets. The fair value of an asset retirement obligation is estimated by discounting the expected future cash flows to settle the asset retirement obligation at the Company’s a verage credit-adjusted risk-free interest rate. In subsequent periods, the asset retirement obligation is adjusted for the passage of time and for changes in the amount or timing of the underlying future cash flows. Actual expenditures are charged against the accumulated asset retirement obligation as incurred.

The Company’s Horizon upgrader and related infrastructure and its midstream pipelines have an indeterminate life and therefore the fair values of the related asset retirement obligations cannot be reasonably determined. The asset retirement obligations for these assets will be recorded in the year in which the lives of the assets are determinable.

(K) FOREIGN CURRENCY TRANSLATION

Foreign operations that are self-sustaining are translated using the current rate method. Under this method, assets and liabilities are translated to Canadian dollars from their functional currency using the exchange rate in effect at the consolidated balance sheet date. Revenues and expenses are translated to Canadian dollars at the monthly average exchange rates. Gains or losses on translation are included in accumulated other comprehensive income (loss) in shareholders’ equity in the consolidated balance sheets.

Foreign operations that are integrated are translated using the temporal method. For foreign currency balances and integrated subsidiaries, monetary assets and liabilities are translated to Canadian dollars at the exchange rate in effect at the consolidated balance sheet date. Non-monetary assets and liabilities are translated at the exchange rate in effect when the assets were acquired or obligations incurred. Revenues and expenses are translated to Canadian dollars at the monthly average exchange rates. Provisions for depletion, depreciation and amortization are translated at the same rate as the related assets. Gains or losses on translation of integrated foreign operations and foreign currency balances are included in the consolidated statements of earnings.

(L) REVENUE RECOGNITION AND COSTS OF GOODS SOLD

Revenue from the production of crude oil and natural gas is recognized when title passes to the customer, delivery has taken place and collection is reasonably assured. The Company assesses customer creditworthiness, both before entering into contracts and throughout the revenue recognition process.

Revenue as reported represents the Company’s share and is presented before royalty payments to governments and other mineral interest owners. Revenue, net of royalties represents the Company’s share after royalty payments to governments and other mineral interest owners.

Related costs of goods sold are comprised of production; transportation and blending; and depletion, depreciation and amortization expenses. These amounts have been separately presented in the consolidated statements of earnings.

(M) PRODUCTION SHARING CONTRACTS

Production generated from Offshore West Africa is currently shared under the terms of various Production Sharing Contracts (“PSCs”). Revenues are divided into cost recovery oil and profit oil. Cost recovery oil allows the Company to recover its capital and production costs and the costs carried by the Company on behalf of the respective Government State Oil Companies (the “Governments”). Profit oil is allocated to the joint venture partners in accordance with their respective equity interests, after a portion has been allocated to the Governments. The Governments’ share of profit oil attributable to the Company’s equity interest is allocated to royalty expense and current income tax expense in accordance with the terms of the PSCs.

(N) PETROLEUM REVENUE TAX

The Company accounts for the UK petroleum revenue tax (“PRT”) over the life of the field. The total future liability or recovery of PRT is estimated using proved and probable reserves and anticipated future sales prices and costs. The estimated future PRT is then apportioned to accounting periods on the basis of total estimated future operating income. Changes in the estimated total future PRT are accounted for prospectively.

(O) INCOME TAX

The Company follows the liability method of accounting for income taxes. Under this method, future income tax assets and liabilities are recognized based on the estimated tax effects of temporary differences in the carrying value of assets and liabilities in the consolidated financial statements and their respective tax bases, using income tax rates substantively enacted or enacted as of the consolidated balance sheet date. The effect of a change in income tax rates on the future income tax assets and liabilities is recognized in net earnings in the period of the change.

Taxable income arising from the conventional crude oil and natural gas business in Canada is primarily generated through partnerships, with the related income taxes payable in subsequent periods. Accordingly, North America current and future income taxes have been provided on the basis of this corporate structure.

(P) STOCK-BASED COMPENSATION PLANS

The Company accounts for stock-based compensation using the intrinsic value method as the Company’s Stock Option Plan (the “Option Plan”) provides current employees with the right to elect to receive common shares or a direct cash payment in exchange for options surrendered. A liability for potential cash settlements under the Option Plan is accrued over the vesting period of the stock options based on the difference between the exercise price of the stock options and the market price of the Company’s common shares, after consideration of an estimated forfeiture rate. This liability is revalued at each reporting date to reflect changes in the market price of the Company’s common shares and actual forfeitures, with the net change recognized in net earnings, or capitalized during the construction period in the case of Horizon. When stock options are surrendered for cash, the cash settlement paid reduces the outstanding liability. When stock options are exercised for common shares under the Option Plan, consideration paid by employees and any previously recognized liability associated with the stock options are recorded as share capital.

The Company has an employee stock savings plan and a stock bonus plan. Contributions to the employee stock savings plan are recorded as compensation expense at the time of the contribution. Contributions to the stock bonus plan are recognized as compensation expense over the related vesting period.

(Q) FINANCIAL INSTRUMENTS

The Company classifies its financial instruments into one of the following categories: held-for-trading financial assets and financial liabilities; held-to-maturity investments; loans and receivables; available-for-sale financial assets; and other financial liabilities. All financial instruments are required to be measured at fair value on initial recognition. Measurement in subsequent periods is dependent on the classification of the respective financial instrument.

Held-for-trading financial instruments are subsequently measured at fair value with changes in fair value recognized in net earnings. Available-for-sale financial assets are subsequently measured at fair value with changes in fair value recognized in other comprehensive income, net of tax. All other categories of financial instruments are measured at amortized cost using the effective interest method.

Cash and cash equivalents are classified as held-for-trading and are measured at fair value. Accounts receivable are classified as loans and receivables. Accounts payable, accrued liabilities, certain other long-term liabilities, and long-term debt are classified as other financial liabilities. Although the Company does not intend to trade its derivative financial instruments, risk management assets and liabilities are classified as held-for-trading for accounting purposes.

Financial assets and liabilities are categorized using a three-level hierarchy that reflects the significance of the inputs used in making fair value measurements for these assets and liabilities. The fair values of financial assets and liabilities included in Level 1 are determined by reference to quoted prices in active markets for identical assets and liabilities. Fair values of financial assets and liabilities in Level 2 are based on inputs other than Level 1 quoted prices that are observable for the asset or liability either directly (as prices) or indirectly (derived from prices). The fair values of Level 3 financial assets and liabilities are not based on observable market data. The disclosure of the fair value hierarchy excludes financial assets and liabilities where book value approximates fair value due to the liquid nature of the asse t or liability.

Transaction costs that are directly attributable to the acquisition or issue of a financial asset or liability and original issue discounts on long-term debt have been included in the carrying value of the related financial asset or liability and are amortized to consolidated net earnings over the life of the financial instrument using the effective interest method.

(R) RISK MANAGEMENT ACTIVITIES

The Company uses derivative financial instruments to manage its commodity price, foreign currency and interest rate exposures. These financial instruments are entered into solely for hedging purposes and are not used for speculative purposes. All derivative financial instruments are recognized on the consolidated balance sheet at estimated fair value at each balance sheet date. The estimated fair value of derivative financial instruments is determined based on appropriate internal valuation methodologies and/or third party indications. Fair values determined using valuation models require the use of assumptions concerning the amount and timing of future cash flows and discount rates.

The Company documents all derivative financial instruments that are formally designated as hedging transactions at the inception of the hedging relationship, in accordance with the Company’s risk management policies. The effectiveness of the hedging relationship is evaluated, both at inception of the hedge and on an ongoing basis.

The Company periodically enters into commodity price contracts to manage anticipated sales of crude oil and natural gas production in order to protect cash flow for capital expenditure programs. The effective portion of changes in the fair value of derivative commodity price contracts formally designated as cash flow hedges is initially recognized in other comprehensive income and is reclassified to risk management activities in consolidated net earnings in the same period or periods in which the commodity is sold. The ineffective portion of changes in the fair value of these designated contracts is immediately recognized in risk management activities in consolidated net earnings. All changes in the fair value of non-designated crude oil and natural gas commodity price contracts are recognized in risk management activities in consolidated net ea rnings.

The Company enters into interest rate swap contracts to manage its fixed to floating interest rate mix on certain of its long-term debt. The interest rate swap contracts require the periodic exchange of payments without the exchange of the notional principal amounts on which the payments are based. Changes in the fair value of interest rate swap contracts designated as fair value hedges and corresponding changes in the fair value of the hedged long-term debt are included in interest expense in consolidated net earnings. Changes in the fair value of non-designated interest rate swap contracts are included in risk management activities in consolidated net earnings.

Cross currency swap contracts are periodically used to manage currency exposure on US dollar denominated long-term debt. The cross currency swap contracts require the periodic exchange of payments with the exchange at maturity of notional principal amounts on which the payments are based. Changes in the fair value of the foreign exchange component of cross currency swap contracts designated as cash flow hedges are included in foreign exchange in consolidated net earnings. The effective portion of changes in the fair value of the interest rate component of cross currency swap contracts designated as cash flow hedges is initially included in other comprehensive income and is reclassified to interest expense when realized, with the ineffective portion recognized in risk management activities in consolidated net earnings. Changes in the fair value o f non-designated cross currency swap contracts are included in risk management activities in consolidated net earnings.

Realized gains or losses on the termination of financial instruments that have been designated as cash flow hedges are deferred under accumulated other comprehensive income on the consolidated balance sheets and amortized into consolidated net earnings in the period in which the underlying hedged item is recognized. In the event a designated hedged item is sold, extinguished or matures prior to the termination of the related derivative instrument, any unrealized derivative gain or loss is recognized immediately in consolidated net earnings. Realized gains or losses on the termination of financial instruments that have not been designated as hedges are recognized in consolidated net earnings immediately.

Upon termination of an interest rate swap designated as a fair value hedge, the interest rate swap is de-recognized on the balance sheet and the related long-term debt hedged is no longer revalued for changes in fair value. The fair value adjustment on the long-term debt at the date of termination of the interest rate swap is amortized to interest expense over the remaining term of the debt.

Foreign currency forward contracts are periodically used to manage foreign currency cash management requirements. The foreign currency forward contracts involve the purchase or sale of an agreed upon amount of US dollars at a specified future date at forward exchange rates. Changes in the fair value of foreign currency forward contracts designated as cash flow hedges are initially recorded in other comprehensive income and are reclassified to foreign exchange loss (gain) when realized. Changes in the fair value of foreign currency forward contracts not included as hedges are included in risk management activities in consolidated net earnings.

Embedded derivatives are derivatives that are included in a non-derivative host contract. Embedded derivatives are recorded at fair value separately from the host contract when their economic characteristics and risks are not clearly and closely related to the host contract.

(S) COMPREHENSIVE INCOME

Comprehensive income is comprised of the Company’s net earnings and other comprehensive income. Other comprehensive income includes the effective portion of changes in the fair value of derivative financial instruments designated as cash flow hedges and foreign currency translation gains and losses on the net investment in self-sustaining foreign operations. Other comprehensive income is shown net of related income taxes.

(T) PER COMMON SHARE AMOUNTS

The Company uses the treasury stock method to determine the dilutive effect of stock options and other dilutive instruments. This method assumes that proceeds received from the exercise of in-the-money stock options not accounted for as a liability are used to purchase common shares at the average market price during the year. The Company’s Option Plan described in note 9 results in a liability and expense for all outstanding stock options. As such, the potential common shares associated with the stock options are not included in the calculation of diluted earnings per share. The dilutive effect of other convertible securities is calculated by applying the “if-converted” method, which assumes that the securities are converted at the beginning of the period and that income items are adjusted to net earnings.

(U) RECENTLY ISSUED ACCOUNTING STANDARDS UNDER CANADIAN GAAP

The following standards will be effective for the Company’s year beginning on January 1, 2011:

Business Combinations, Consolidated Financial Statements and Non-Controlling Interests

| ● | Section 1582 – “Business Combinations”, 1601 – “Consolidated Financial Statements”, and 1602 – “Non-Controlling Interests” replace Section 1581 – “Business Combinations”, and 1600 – “Consolidated Financial Statements”. The new standards are the Canadian equivalent of IFRS 3 “Business Combinations” and IAS 27 “Consolidated and Separate Financial Statements”. Section 1582 is effective for business combinations for acquisition dates on or after January 1, 2011. Earlier adoption is permitted, provided all three new standards are adopted simultaneously. Section 1582 requires equity instruments issued as part of the purchase consideration to be measured at fair value at the acquisition date, rather than the date when the acquisition was agreed to and announced. In addition, most acquisition costs are expensed as incurred, instead of being included in the purchase consideration. The new standard also requires non-controlling interests to be measured at fair value instead of carrying amounts. Section 1602 provides guidance on the treatment of non-controlling interests after acquisition. Section 1601 carries forward existing guidance on the preparation of consolidated financial statements, other than non-controlling interests. There is no impact on the Company’s results of operations or financial position at this time. |

(V) INTERNATIONAL FINANCIAL REPORTING STANDARDS

In February 2008, the CICA’s Accounting Standards Board confirmed that Canadian publicly accountable entities will be required to adopt International Financial Reporting Standards (“IFRS”) as promulgated by the International Accounting Standards Board in place of Canadian GAAP effective January 1, 2011. The Company has assessed which accounting policies will be affected by the change to IFRS and continues to assess the potential impact of these changes on its financial position and results of operations.

(W) COMPARATIVE FIGURES

Certain prior year figures have been reclassified to conform to the presentation adopted in 2009.

2. CHANGES IN ACCOUNTING POLICIES

During 2009, the Company adopted the following new accounting standards issued by the CICA:

Goodwill and Intangible Assets

| ● | Effective January 1, 2009 Section 3064 – “Goodwill and Intangible Assets” replaced Section 3062 – “Goodwill and Other Intangible Assets” and Section 3450 – “Research and Development Costs”. In addition, EIC-27 – “Revenue and Expenditures during the Pre-Operating Period” was withdrawn. The new standard addresses when an internally generated intangible asset meets the definition of an asset. The adoption of this standard, which was adopted retroactively, did not have an impact on the Company’s results of operations or financial position. |

Credit Risk and the Fair Value of Financial Assets and Liabilities

| ● | On January 20, 2009 the Emerging Issues Committee (“EIC”) issued a new abstract EIC–173 “Credit Risk and the Fair Value of Financial Assets and Financial Liabilities”. This abstract concludes that an entity’s own credit risk and the credit risk of the counterparty should be taken into account when determining the fair value of financial assets and financial liabilities, including derivative financial instruments. This abstract applies to all financial assets and liabilities measured at fair value in interim and annual financial statements for periods ending on or after January 20, 2009. The adoption of this abstract did not have a material impact on the Company’s results of operations or financial position. |

The Company also adopted the following amendments to accounting standards issued by the CICA:

Financial Instruments

| ● | Effective July 1, 2009 Section 3855 – “Financial Instruments – Recognition and Measurement” was amended to add guidance on the assessment of embedded derivatives upon reclassification of a financial asset from the held-for-trading category. This amendment did not have any impact on the Company’s results of operations or financial position. |

Financial Instruments – Disclosures

| · | Effective October 1, 2009 Section 3862 – “Financial Instruments – Disclosures” was amended to include additional disclosure requirements for fair value measurements of financial instruments and to enhance liquidity risk disclosure requirements. The amendment requires the classification and disclosure of fair value measurements using a three-level hierarchy that reflects the significance of the inputs used in making the fair value measurements. This amendment affected disclosure only and did not impact the Company’s accounting for financial instruments (note 13). |

3. OTHER LONG-TERM ASSETS

| | | 2009 | | | 2008 | |

Risk management (note 13) | | $ | – | | | $ | 2,119 | |

| Other | | | 18 | | | | 24 | |

| | | | 18 | | | | 2,143 | |

| Less: current portion | | | – | | | | 1,851 | |

| | | $ | 18 | | | $ | 292 | |

4. PROPERTY, PLANT AND EQUIPMENT

| | | Cost | | | 2009 Accumulated depletion and depreciation | | | Net | | | Cost | | | 2008 Accumulated depletion and depreciation | | | Net | |

| Conventional crude oil and natural gas | | | | | | | | | | | | | | | | | | |

| North America | | $ | 38,259 | | | $ | 16,425 | | | $ | 21,834 | | | $ | 36,532 | | | $ | 14,381 | | | $ | 22,151 | |

| North Sea | | | 3,879 | | | | 2,067 | | | | 1,812 | | | | 4,167 | | | | 2,119 | | | | 2,048 | |

| Offshore West Africa | | | 2,861 | | | | 978 | | | | 1,883 | | | | 2,671 | | | | 777 | | | | 1,894 | |

| Other | | | 42 | | | | 14 | | | | 28 | | | | 40 | | | | 14 | | | | 26 | |

| Oil Sands Mining and Upgrading | | | 13,481 | | | | 186 | | | | 13,295 | | | | 12,573 | | | | – | | | | 12,573 | |

| Midstream | | | 284 | | | | 81 | | | | 203 | | | | 278 | | | | 72 | | | | 206 | |

| Head office | | | 200 | | | | 140 | | | | 60 | | | | 190 | | | | 122 | | | | 68 | |

| | | $ | 59,006 | | | $ | 19,891 | | | $ | 39,115 | | | $ | 56,451 | | | $ | 17,485 | | | $ | 38,966 | |

During the year ended December 31, 2009, the Company capitalized directly attributable administrative costs of $41 million (2008 – $55 million, 2007 – $47 million) in the North Sea and Offshore West Africa, related to exploration and development and $79 million (2008 – $404 million, 2007 – $312 million) in North America, related to Oil Sands Mining and Upgrading.

During the year ended December 31, 2009, the Company capitalized $106 million (2008 – $481 million, 2007 – $356 million) in construction period interest costs related to Oil Sands Mining and Upgrading.

Included in property, plant and equipment are unproved land and major development projects that are not currently subject to depletion or depreciation:

| | | 2009 | | | 2008 | |

| Conventional crude oil and natural gas | | | | | | |

| North America | | $ | 2,102 | | | $ | 2,271 | |

| North Sea | | | 4 | | | | 12 | |

| Offshore West Africa | | | 666 | | | | 595 | |

| Other | | | 28 | | | | 26 | |

| Oil Sands Mining and Upgrading | | | 752 | | | | 12,573 | |

| | | $ | 3,552 | | | $ | 15,477 | |

The Company has used the following estimated benchmark future prices (“escalated pricing”) in its full cost ceiling tests for conventional crude oil and natural gas activities prepared in accordance with Canadian GAAP, as at December 31, 2009:

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | Average annual increase thereafter | |

| Crude oil and NGLs | | | | | | | | | | | | | | | | | | |

| North America | | | | | | | | | | | | | | | | | | |

| WTI at Cushing (US$/bbl) | | $ | 79.17 | | | $ | 84.46 | | | $ | 86.89 | | | $ | 90.20 | | | $ | 92.01 | | | | 2 | % |

| Western Canada Select (C$/bbl) | | $ | 74.14 | | | $ | 78.29 | | | $ | 76.86 | | | $ | 78.87 | | | $ | 79.49 | | | | 2 | % |

| Edmonton Par (C$/bbl) | | $ | 84.25 | | | $ | 89.99 | | | $ | 92.61 | | | $ | 96.19 | | | $ | 98.13 | | | | 2 | % |

| North Sea and Offshore West Africa | | | | | | | | | | | | | | | | | | | | | | | | |

| North Sea Brent (US$/bbl) | | $ | 77.92 | | | $ | 83.19 | | | $ | 85.59 | | | $ | 88.88 | | | $ | 90.65 | | | | 2 | % |

| Natural gas | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | | | | | | | | | | | | | | | | | | | | | | | |

| Henry Hub Louisiana (US$/mmbtu) | | $ | 5.70 | | | $ | 6.48 | | | $ | 6.70 | | | $ | 7.43 | | | $ | 8.12 | | | | 2 | % |

| AECO (C$/mmbtu) | | $ | 5.36 | | | $ | 6.21 | | | $ | 6.44 | | | $ | 7.23 | | | $ | 7.98 | | | | 2 | % |

| Huntingdon/Sumas (C$/mmbtu) | | $ | 5.61 | | | $ | 6.46 | | | $ | 6.69 | | | $ | 7.48 | | | $ | 8.23 | | | | 2 | % |

Offshore West Africa property, plant and equipment has been reduced by $115 million to reflect the impact of a ceiling test impairment charge as at December 31, 2009. The impairment charge has been included in depletion, depreciation and amortization expenses.

5. LONG-TERM DEBT

| | | 2009 | | | 2008 | |

| Canadian dollar denominated debt | | | | | | |

| Bank credit facilities | | | | | | |

| Bankers’ acceptances | | $ | 1,897 | | | $ | 4,073 | |

| Medium-term notes | | | | | | | | |

| 5.50% unsecured debentures due December 17, 2010 | | | 400 | | | | 400 | |

| 4.50% unsecured debentures due January 23, 2013 | | | 400 | | | | 400 | |

| 4.95% unsecured debentures due June 1, 2015 | | | 400 | | | | 400 | |

| | | | 3,097 | | | | 5,273 | |

| US dollar denominated debt | | | | | | | | |

| Senior unsecured notes | | | | | | | | |

| Adjustable rate due May 27, 2009 (2009 – US$nil, 2008 – US$31 million) | | | – | | | | 38 | |

| US dollar debt securities | | | | | | | | |

6.70% due July 15, 2011 (2009 and 2008 – US$400 million) | | | 419 | | | | 490 | |

5.45% due October 1, 2012 (2009 and 2008 – US$350 million) | | | 366 | | | | 429 | |

5.15% due February 1, 2013 (2009 and 2008 – US$400 million) | | | 419 | | | | 490 | |

4.90% due December 1, 2014 (2009 and 2008 – US$350 million) | | | 366 | | | | 429 | |

6.00% due August 15, 2016 (2009 and 2008 – US$250 million) | | | 262 | | | | 306 | |

5.70% due May 15, 2017 (2009 and 2008 – US$1,100 million) | | | 1,151 | | | | 1,346 | |

5.90% due February 1, 2018 (2009 and 2008 – US$400 million) | | | 419 | | | | 490 | |

7.20% due January 15, 2032 (2009 and 2008 – US$400 million) | | | 419 | | | | 490 | |

6.45% due June 30, 2033 (2009 and 2008 – US$350 million) | | | 366 | | | | 429 | |

5.85% due February 1, 2035 (2009 and 2008 – US$350 million) | | | 366 | | | | 429 | |

6.50% due February 15, 2037 (2009 and 2008 – US$450 million) | | | 471 | | | | 551 | |

6.25% due March 15, 2038 (2009 and 2008 – US$1,100 million) | | | 1,151 | | | | 1,346 | |

6.75% due February 1, 2039 (2009 and 2008 – US$400 million) | | | 419 | | | | 490 | |

Less – original issue discount on senior unsecured notes and US dollar debt securities (1) | | | (22 | ) | | | (23 | ) |

| | | | 6,572 | | | | 7,730 | |

Fair value impact of interest rate swaps on US dollar debt securities (2) | | | 38 | | | | 68 | |

| | | | 6,610 | | | | 7,798 | |

| Long-term debt before transaction costs | | | 9,707 | | | | 13,071 | |

Less: transaction costs (1) (3) | | | (49 | ) | | | (55 | ) |

| | | | 9,658 | | | | 13,016 | |

| Less: current portion | | | – | | | | 420 | |

| | | $ | 9,658 | | | $ | 12,596 | |

| (1) | The Company has included unamortized original issue discounts and directly attributable transaction costs in the carrying value of the outstanding debt. |

| (2) | The carrying value of US$350 million of 5.45% notes due October 2012 and US$350 million of 4.90% notes due December 2014 have been adjusted by $38 million (2008 – $68 million) to reflect the fair value impact of hedge accounting. |

| (3) | Transaction costs primarily represent underwriting commissions charged as a percentage of the related debt offerings, as well as legal, rating agency and other professional fees. |

Bank Credit Facilities

As at December 31, 2009, the Company had in place unsecured bank credit facilities of $3,955 million, comprised of:

| · | a $200 million demand credit facility; |

| · | a revolving syndicated credit facility of $2,230 million maturing June 2012; |

| · | a revolving syndicated credit facility of $1,500 million maturing June 2012; and |

| · | a £15 million demand credit facility related to the Company’s North Sea operations. |

The revolving syndicated credit facilities are extendible annually for one year periods at the mutual agreement of the Company and the lenders. If the facilities are not extended, the full amount of the outstanding principal would be repayable on the maturity date. Borrowings under these facilities can be made by way of Canadian dollar and US dollar bankers’ acceptances, and LIBOR, US base rate and Canadian prime loans.

During 2009, the Company repaid the remaining $2,350 million outstanding on the non-revolving syndicated credit facility related to the acquisition of Anadarko Canada Corporation (“ACC”) and cancelled the facility. In March 2007, $1,500 million was repaid.

During 2009, the Company renegotiated its demand credit facility, increasing it to $200 million.

The Company’s weighted average interest rate on bank credit facilities outstanding as at December 31, 2009, was 0.8% (2008 – 2.2%).

In addition to the outstanding debt, letters of credit and financial guarantees aggregating $358 million, including $300 million related to Horizon, were outstanding at December 31, 2009.

Medium-Term Notes

During 2009, the Company filed a base shelf prospectus that allows for the issue of up to $3,000 million of medium-term notes in Canada until November 2011. If issued, these securities will bear interest as determined at the date of issuance.

Senior Unsecured Notes

During 2009, the remaining US$31 million of senior unsecured notes bearing interest at 6.54% was repaid.

US Dollar Debt Securities

During 2009, the Company filed a base shelf prospectus that allows for the issue of up to US$3,000 million of debt securities in the United States until November 2011. If issued, these securities will bear interest as determined at the date of issuance.

In January 2008, the Company issued US$1,200 million of unsecured notes under a previous US base shelf prospectus, comprised of US$400 million of 5.15% unsecured notes due February 2013, US$400 million of 5.90% unsecured notes due February 2018, and US$400 million of 6.75% unsecured notes due February 2039. Proceeds from the securities issued were used to repay bankers’ acceptances under the Company’s bank credit facilities.

During 2008, US$8 million of US dollar debt securities was repaid.

During 2008, the Company terminated the interest rate swaps that had been designated as a fair value hedge of US$350 million of 5.45% unsecured notes due October 2012. Accordingly, the Company ceased revaluing the related debt for subsequent changes in fair value from the date of termination of the interest rate swaps. The fair value adjustment of $20 million at the date of termination is being amortized to interest expense over the remaining term of the debt, with $14 million remaining at December 31, 2009.

Required Debt Repayments

Required debt repayments are as follows:

| Year | | Repayment | |

| 2010 | | $ | 400 | |

| 2011 | | $ | 419 | |

| 2012 | | $ | 366 | |

| 2013 | | $ | 819 | |

| 2014 | | $ | 366 | |

| Thereafter | | $ | 5,424 | |

No debt repayments are reflected in the above table for $1,897 million of revolving bank credit facilities due to the extendable nature of the facilities. Should the bank credit facilities not be extended by mutual agreement of the Company and the lenders, the amounts outstanding under these facilities would be due in 2012.

6. OTHER LONG-TERM LIABILITIES

| | | 2009 | | | 2008 | |

| Asset retirement obligations | | $ | 1,610 | | | $ | 1,064 | |

| Stock-based compensation | | | 392 | | | | 171 | |

Risk management (note 13) | | | 309 | | | | - | |

| Other | | | 180 | | | | 119 | |

| | | | 2,491 | | | | 1,354 | |

| Less: current portion | | | 643 | | | | 230 | |

| | | $ | 1,848 | | | $ | 1,124 | |

Asset Retirement Obligations

At December 31, 2009, the Company’s total estimated undiscounted costs to settle its asset retirement obligations were approximately $6,606 million (2008 – $4,474 million; 2007 – $4,426 million). Payments to settle these asset retirement obligations will occur on an ongoing basis over a period of approximately 60 years and have been discounted using a weighted average credit-adjusted risk-free interest rate of 6.9% (2008 – 6.7%; 2007 – 6.6%). A reconciliation of the discounted asset retirement obligations is as follows:

| | | 2009 | | | 2008 | | | 2007 | |

| Balance – beginning of year | | $ | 1,064 | | | $ | 1,074 | | | $ | 1,166 | |

Liabilities incurred (1) | | | 299 | | | | 18 | | | | 21 | |

| Liabilities acquired | | | – | | | | 3 | | | | – | |

| Liabilities disposed | | | – | | | | – | | | | (65 | ) |

| Liabilities settled | | | (48 | ) | | | (38 | ) | | | (71 | ) |

| Asset retirement obligation accretion | | | 90 | | | | 71 | | | | 70 | |

| Revision of estimates | | | 276 | | | | (156 | ) | | | 35 | |

| Foreign exchange | | | (71 | ) | | | 92 | | | | (82 | ) |

| Balance – end of year | | $ | 1,610 | | | $ | 1,064 | | | $ | 1,074 | |

| (1) | During 2009, the Company recognized additional asset retirement obligations related to Horizon and Gabon, Offshore West Africa. |

Stock-Based Compensation

The Company recognizes a liability for potential cash settlements under its Option Plan. The current portion represents the maximum amount of the liability payable within the next twelve–month period if all vested options are surrendered for cash settlement.

| | | 2009 | | | 2008 | | | 2007 | |

| Balance – beginning of year | | $ | 171 | | | $ | 529 | | | $ | 744 | |

| Stock-based compensation expense (recovery) | | | 355 | | | | (52 | ) | | | 193 | |

| Cash payment for options surrendered | | | (94 | ) | | | (207 | ) | | | (375 | ) |

| Transferred to common shares | | | (42 | ) | | | (76 | ) | | | (91 | ) |

| Capitalized (recovery) to Oil Sands Mining and Upgrading | | | 2 | | | | (23 | ) | | | 58 | |

| Balance – end of year | | | 392 | | | | 171 | | | | 529 | |

| Less: current portion | | | 365 | | | | 159 | | | | 390 | |

| | | $ | 27 | | | $ | 12 | | | $ | 139 | |

7. EMPLOYEE FUTURE BENEFITS

In connection with the acquisition of ACC, the Company assumed obligations to provide defined contribution pension benefits to certain ACC employees continuing their employment with the Company, and defined benefit pension and other post-retirement benefits to former ACC employees, under registered and unregistered pension plans.

The estimated future cost of providing defined benefit pension and other post-retirement benefits to former ACC employees is actuarially determined using management’s best estimates of demographic and financial assumptions. The discount rate of 5.5% (2008 – 7.0%) used to determine accrued benefit obligations is based on a year-end market rate of interest for high-quality debt instruments with cash flows that match the timing and amount of expected benefit payments. Company contributions to the defined contribution plan are expensed as incurred.

The benefit obligation under the registered pension plan at December 31, 2009 was $29 million (2008 – $27 million). As required by government regulations, the Company has set aside funds with an independent trustee to meet these benefit obligations. As at December 31, 2009, these plan assets had a fair value of $32 million (2008 – $34 million). The unregistered pension plan and other post-retirement benefits are unfunded and have a benefit obligation of $10 million at December 31, 2009 (2008 – $9 million).

8. TAXES

Taxes Other Than Income Tax

| | | 2009 | | | 2008 | | | 2007 | |

| Current PRT expense | | $ | 70 | | | $ | 210 | | | $ | 97 | |

| Deferred PRT expense (recovery) | | | 15 | | | | (67 | ) | | | 44 | |

| Provincial capital taxes and surcharges | | | 21 | | | | 35 | | | | 24 | |

| | | $ | 106 | | | $ | 178 | | | $ | 165 | |

Income Tax

The provision for income tax is as follows:

| | | 2009 | | | 2008 | | | 2007 | |

| Current income tax – North America | | $ | 28 | | | $ | 33 | | | $ | 96 | |

| Current income tax – North Sea | | | 278 | | | | 340 | | | | 210 | |

| Current income tax – Offshore West Africa | | | 82 | | | | 128 | | | | 74 | |

| Current income tax expense | | | 388 | | | | 501 | | | | 380 | |

| Future income tax (recovery) expense | | | (99 | ) | | | 1,607 | | | | (456 | ) |

| Income tax expense (recovery) | | $ | 289 | | | $ | 2,108 | | | $ | (76 | ) |

The provision for income tax is different from the amount computed by applying the combined statutory Canadian federal and provincial income tax rates to earnings before taxes. The reasons for the difference are as follows:

| | | 2009 | | | 2008 | | | 2007 | |

| Canadian statutory income tax rate | | | 29.1 | % | | | 29.8 | % | | | 32.5 | % |

| Income tax provision at statutory rate | | $ | 576 | | | $ | 2,166 | | | $ | 877 | |

| Effect on income taxes of: | | | | | | | | | | | | |

| Deductible UK petroleum revenue tax | | | (43 | ) | | | (72 | ) | | | (71 | ) |

| Foreign and domestic tax rate differentials | | | (127 | ) | | | (5 | ) | | | (25 | ) |

| North America income tax rate and other legislative changes | | | (19 | ) | | | (19 | ) | | | (864 | ) |

| Côte d’Ivoire income tax rate changes | | | – | | | | (22 | ) | | | – | |

| Non-taxable portion of foreign exchange (gain) loss | | | (92 | ) | | | 127 | | | | (96 | ) |

| Stock options exercised in shares | | | 27 | | | | 6 | | | | 63 | |

| Other | | | (33 | ) | | | (73 | ) | | | 40 | |

| Income tax expense (recovery) | | $ | 289 | | | $ | 2,108 | | | $ | (76 | ) |

The following table summarizes the temporary differences that give rise to the net future income tax asset and liability:

| | | 2009 | | | 2008 | |

| Future income tax liabilities | | | | | | |

| Property, plant and equipment | | $ | 6,992 | | | $ | 6,303 | |

| Timing of partnership items | | | 1,127 | | | | 1,276 | |

| Unrealized foreign exchange gain on long-term debt | | | 152 | | | | 13 | |

| Unrealized risk management activities | | | – | | | | 651 | |

| Other | | | 31 | | | | – | |

| Future income tax assets | | | | | | | | |

| Asset retirement obligations | | | (499 | ) | | | (372 | ) |

| Loss carryforwards for income tax | | | (84 | ) | | | (62 | ) |

| Stock-based compensation | | | (83 | ) | | | (38 | ) |

| Unrealized risk management activities | | | (69 | ) | | | – | |

| Other | | | – | | | | (7 | ) |

| Deferred petroleum revenue tax | | | (26 | ) | | | (43 | ) |

| Net future income tax liability | | | 7,541 | | | | 7,721 | |

| Less: current portion of future income tax (asset) liability | | | (146 | ) | | | 585 | |

| Future income tax liability | | $ | 7,687 | | | $ | 7,136 | |

During 2009, substantively enacted or enacted income tax rate changes resulted in a reduction of future income tax liabilities of $19 million in British Columbia.

During 2008, substantively enacted or enacted income tax rate changes resulted in a reduction of future income tax liabilities of approximately $19 million in British Columbia and approximately $22 million in Côte d’Ivoire.

During 2007, substantively enacted or enacted income tax rate and other legislative changes resulted in a reduction of future income tax liabilities of approximately $864 million in North America.

As a result of enacted income tax rate changes in 2007, the Canadian Federal corporate income tax rate is being reduced from 21% in 2007 to 15% in 2012.

The Company is subject to income tax reassessments arising in the normal course. The Company does not believe that any liabilities ultimately arising from these reassessments will be material.

9. SHARE CAPITAL

Authorized

200,000 Class 1 preferred shares with a stated value of $10.00 each.

Unlimited number of common shares without par value.

Issued

| | | 2009 | | | 2008 | |

| Common shares | | Number of shares (thousands) | | | Amount | | | Number of shares (thousands) | | | Amount | |

| Balance – beginning of year | | | 540,991 | | | $ | 2,768 | | | | 539,729 | | | $ | 2,674 | |

| Issued upon exercise of stock options | | | 1,336 | | | | 24 | | | | 1,262 | | | | 18 | |

| Previously recognized liability on stock options exercised for common shares | | | - | | | | 42 | | | | - | | | | 76 | |

| Balance – end of year | | | 542,327 | | | $ | 2,834 | | | | 540,991 | | | $ | 2,768 | |

Dividend Policy

The Company has paid regular quarterly dividends in January, April, July and October of each year since 2001. The dividend policy undergoes a periodic review by the Board of Directors and is subject to change.

On March 3, 2010, the Board of Directors set the Company’s regular quarterly dividend at $0.15 per common share (2009 – $0.105 per common share, 2008 – $0.10 per common share).

Normal Course Issuer Bid

On March 3, 2010 the Board of Directors approved a resolution to file with the Toronto Stock Exchange a notice of intention to purchase by way of normal course issuer bid up to 2.5% of the Company’s issued and outstanding common shares. Subject to acceptance by the Toronto Stock Exchange of the Notice of Intention, the purchases would be made through the facilities of the Toronto Stock Exchange and the New York Stock Exchange.

Share split

On March 3, 2010, the Company’s Board of Directors approved a resolution to subdivide the Company’s common shares on a two for one basis, subject to shareholder approval. The proposal will be voted on at the Company’s Annual and Special Meeting of Shareholders to be held on May 6, 2010.

Stock Options

The Company’s Option Plan provides for the granting of stock options to employees. Stock options granted under the Option Plan have terms ranging from five to six years to expiry and vest over a five-year period. The exercise price of each stock option granted is determined at the closing market price of the common shares on the Toronto Stock Exchange on the day prior to the grant. Each stock option granted provides the holder the choice to purchase one common share of the Company at the stated exercise price or receive a cash payment equal to the difference between the stated exercise price and the market price of the Company’s common shares on the date of surrender of the option.

The following table summarizes information relating to stock options outstanding at December 31, 2009 and 2008:

| | | 2009 | | | 2008 | |

| | | Stock options (thousands) | | | Weighted average exercise price | | | Stock options (thousands) | | | Weighted average exercise price | |

| | | | | | | | | | | | | |

| Outstanding – beginning of year | | | 30,962 | | | $ | 51.94 | | | | 30,659 | | | $ | 47.23 | |

| Granted | | | 6,736 | | | $ | 67.91 | | | | 7,705 | | | $ | 53.38 | |

| Surrendered for cash settlement | | | (2,833 | ) | | $ | 27.31 | | | | (3,702 | ) | | $ | 25.60 | |

| Exercised for common shares | | | (1,336 | ) | | $ | 17.99 | | | | (1,262 | ) | | $ | 14.61 | |

| Forfeited | | | (1,423 | ) | | $ | 59.55 | | | | (2,438 | ) | | $ | 56.56 | |

| Outstanding – end of year | | | 32,106 | | | $ | 58.54 | | | | 30,962 | | | $ | 51.94 | |

| Exercisable – end of year | | | 10,969 | | | $ | 53.90 | | | | 8,809 | | | $ | 44.58 | |