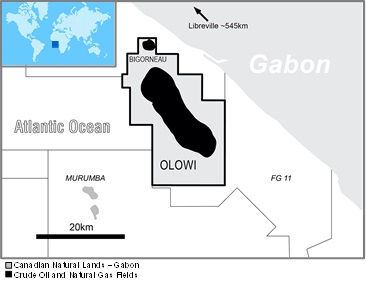

The Company has a permit comprising a 92% operating interest in the production sharing agreement for the block containing the Olowi Field. The field is located about 20 kilometers from the Gabonese coast and in 30 meters water depth. First crude oil production was achieved during the second quarter of 2009 at Platform C and during 2010 on Platform A and B. In mid 2011, production was temporarily suspended as a result of a failure in the mid-water arch. Production was reinstated in mid August 2011. During 2012 a second failure of the mid-water arch occurred. The mid-water arch was stabilized and production was reinstated in late Q1 2013.

equipment on the drilling rig. The rig safely left the well location and, as the available drilling window had ended, it was demobilized by the operator. The South African authorities have formally confirmed the well drilled satisfies the work obligation for the initial period of the Block 11B/12B Exploration Right. The operator is reviewing the course of action to re-enter the well, and has indicated drilling operations are unlikely to resume in the area before 2016.

Set forth below is a summary of the number of wells in which the Company has a working interest that were producing or mechanically capable of producing as of December 31, 2014.

Set forth below is a summary of the number of wells in which the Company has a working interest that were not producing or not mechanically capable of producing as of December 31, 2014.

Total success rate, excluding service and stratigraphic test wells, for 2014 is 98%.

2015 North America Activity

As a result of changes in commodity prices, the Company has reduced its targeted capital expenditures for 2015, primarily related to lower drilling activity and related facility capital. Additionally, the Company has deferred capital expenditures related to the Kirby North project. The Company maintains capital flexibility to quickly increase or decrease activity in the conventional operations depending on the economic and pricing environment. Capital expenditures for North America are targeted to be approximately $2 billion.

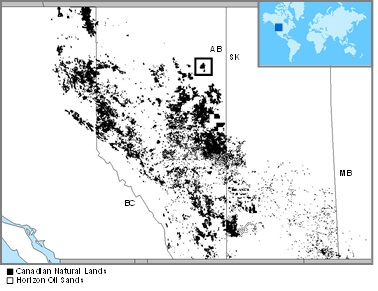

2015 Oil Sands Mining and Upgrading Activity

The Company continues to execute its disciplined strategy of staged expansion and work remains on track. The budgeted project capital expenditures reflect the Board of Directors approval of approximately $2.2 billion in targeted strategic expansion.

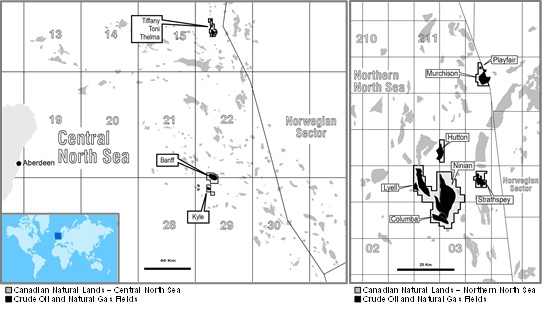

2015 North Sea Activity

As a result of changes in commodity prices, the Company has reduced its drilling activity and is currently targeting to drill one well in 2015 and has suspended all other development activities.

| 42 | Canadian Natural Resources Limited |

2015 Offshore Africa Activity

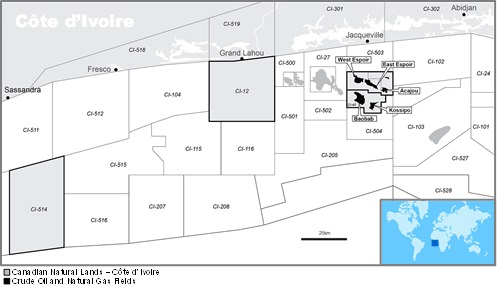

During 2015, the Company is currently targeting to commence drilling wells in the Espoir field, Baobab field and Block CI-514 in Côte d’Ivoire.

Production Estimates

The following table illustrates Canadian Natural’s estimated 2015 company gross daily proved and probable production reflected in the reserve reports as of December 31, 2014 using forecast prices and costs.

| | | Light and Medium Crude Oil (bbl/d) | | | Primary Heavy Crude Oil (bbl/d) | | | Pelican Lake Heavy Crude Oil (bbl/d) | | | Bitumen (Thermal Oil) (bbl/d) | | | Synthetic Crude Oil (bbl/d) | | | Natural Gas (MMcf/d) | | | Natural Gas Liquids (bbl/d) | | | Barrels of Oil Equivalent (BOE/d) | |

| PROVED | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | | 50,558 | | | | 149,844 | | | | 55,636 | | | | 132,392 | | | | 112,725 | | | | 1,546 | | | | 39,407 | | | | 798,229 | |

| North Sea | | | 29,795 | | | | - | | | | - | | | | - | | | | - | | | | 59 | | | | - | | | | 39,628 | |

| Offshore Africa | | | 14,600 | | | | - | | | | - | | | | - | | | | - | | | | 25 | | | | - | | | | 18,767 | |

| Total Proved | | | 94,953 | | | | 149,844 | | | | 55,636 | | | | 132,392 | | | | 112,725 | | | | 1,630 | | | | 39,407 | | | | 856,624 | |

| PROBABLE | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | | 3,461 | | | | 12,556 | | | | 1,259 | | | | 1,130 | | | | 5,575 | | | | 79 | | | | 2,215 | | | | 39,362 | |

| North Sea | | | 3,329 | | | | - | | | | - | | | | - | | | | - | | | | 4 | | | | - | | | | 3,996 | |

| Offshore Africa | | | 967 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 967 | |

| Total Probable | | | 7,757 | | | | 12,556 | | | | 1,259 | | | | 1,130 | | | | 5,575 | | | | 83 | | | | 2,215 | | | | 44,325 | |

| Canadian Natural Resources Limited | 43 |

Production History

| | 2014 |

| | | Q1 | | Q2 | | Q3 | | Q4 | | Year Ended |

| | | | | | | | | | | |

North America Production and Netbacks by Product Type (1) |

| | | | | | | | | | | |

| Light and Medium Crude Oil |

Average daily production (before royalties) (bbl/d) | | 46,909 | | 55,521 | | 54,377 | | 54,224 | | 52,782 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 94.09 | $ | 104.29 | $ | 96.77 | $ | 77.67 | $ | 93.21 |

| Transportation | | 2.68 | | 2.71 | | 2.59 | | 2.82 | | 2.70 |

| Royalties | | 20.97 | | 18.43 | | 19.63 | | 14.94 | | 18.39 |

| Production expenses | | 22.97 | | 22.01 | | 22.92 | | 21.13 | | 22.23 |

| Netback | $ | 47.47 | $ | 61.14 | $ | 51.63 | $ | 38.78 | $ | 49.89 |

| | | | | | | | | | | |

| Primary Heavy Crude Oil |

Average daily production (before royalties) (bbl/d) | | 142,174 | | 143,161 | | 143,400 | | 144,661 | | 143,356 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 77.78 | $ | 85.65 | $ | 79.70 | $ | 62.47 | $ | 76.29 |

| Transportation | | 2.79 | | 3.14 | | 2.63 | | 2.84 | | 2.84 |

| Royalties | | 12.86 | | 15.42 | | 12.95 | | 8.69 | | 12.44 |

| Production expenses | | 18.23 | | 17.61 | | 17.52 | | 17.11 | | 17.61 |

| Netback | $ | 43.90 | $ | 49.48 | $ | 46.60 | $ | 33.83 | $ | 43.40 |

| | | | | | | | | | | |

| Pelican Lake Heavy Crude Oil |

Average daily production (before royalties) (bbl/d) | | 48,048 | | 49,563 | | 51,911 | | 50,739 | | 50,078 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 79.94 | $ | 86.92 | $ | 81.52 | $ | 62.33 | $ | 77.58 |

| Transportation | | 3.45 | | 3.86 | | 3.48 | | 3.52 | | 3.58 |

| Royalties | | 20.23 | | 24.44 | | 17.31 | | 13.01 | | 18.66 |

| Production expenses | | 9.65 | | 8.92 | | 7.82 | | 7.82 | | 8.52 |

| Netback | $ | 46.61 | $ | 49.70 | $ | 52.91 | $ | 37.98 | $ | 46.82 |

| | | | | | | | | | | |

| Bitumen (Thermal Oil) |

Average daily production (before royalties) (bbl/d) | | 82,077 | | 114,414 | | 115,256 | | 118,973 | | 107,802 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 69.73 | $ | 79.39 | $ | 75.81 | $ | 58.64 | $ | 70.78 |

| Transportation | | 1.79 | | 3.02 | | 1.96 | | 1.39 | | 2.04 |

| Royalties | | 13.45 | | 15.68 | | 12.93 | | 8.84 | | 12.57 |

| Production expenses | | 15.88 | | 12.21 | | 11.24 | | 12.26 | | 12.61 |

| Netback | $ | 38.61 | $ | 48.48 | $ | 49.68 | $ | 36.15 | $ | 43.56 |

| | | | | | | | | | | |

| SCO |

Average daily production (before royalties) (bbl/d) (3) | | 113,095 | | 119,236 | | 82,012 | | 128,090 | | 110,571 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 107.82 | $ | 112.69 | $ | 103.91 | $ | 79.23 | $ | 100.27 |

| Transportation | | 1.96 | | 1.53 | | 2.28 | | 1.76 | | 1.85 |

Royalties (4) | | 5.06 | | 6.77 | | 7.17 | | 4.44 | | 5.77 |

Production expenses (5) | | 41.11 | | 36.61 | | 37.13 | | 34.34 | | 37.18 |

| Netback | $ | 59.69 | $ | 67.78 | $ | 57.33 | $ | 38.69 | $ | 55.47 |

| | | | | | | | | | | |

| Natural Gas |

Average daily production (before royalties) (MMcf/d) | | 1,147 | | 1,606 | | 1,644 | | 1,705 | | 1,527 |

| Netbacks ($/Mcf) | | | | | | | | | | |

Sales price (2) | $ | 5.56 | $ | 4.95 | $ | 4.43 | $ | 4.22 | $ | 4.72 |

| Transportation | | 0.30 | | 0.27 | | 0.27 | | 0.27 | | 0.27 |

| Royalties | | 0.60 | | 0.39 | | 0.30 | | 0.23 | | 0.36 |

| Production expenses | | 1.54 | | 1.48 | | 1.36 | | 1.34 | | 1.42 |

| Netback | $ | 3.12 | $ | 2.81 | $ | 2.50 | $ | 2.38 | $ | 2.67 |

| 44 | Canadian Natural Resources Limited |

Production History

| | 2014 |

| | | Q1 | | Q2 | | Q3 | | Q4 | | Year Ended |

| | | | | | | | | | | |

| Natural Gas Liquids |

Average daily production (before royalties) (bbl/d) | | 28,979 | | 37,495 | | 39,170 | | 41,379 | | 36,796 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 66.55 | $ | 58.79 | $ | 51.44 | $ | 42.10 | $ | 53.59 |

| Transportation | | 1.63 | | 1.27 | | 1.60 | | 1.53 | | 1.50 |

| Royalties | | 8.32 | | 12.65 | | 8.90 | | 5.46 | | 8.76 |

| Production expenses | | 8.29 | | 10.98 | | 10.37 | | 10.27 | | 10.09 |

| Netback | $ | 48.31 | $ | 33.89 | $ | 30.57 | $ | 24.84 | $ | 33.24 |

| | | | | | | | | | | |

North Sea Production and Netbacks by Product Type (1) |

| |

| Light and Medium Crude Oil |

Average daily production (before royalties) (bbl/d) | | 16,715 | | 12,615 | | 18,197 | | 21,927 | | 17,380 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | 121.38 | | 122.88 | $ | 113.08 | $ | 83.32 | $ | 106.63 |

| Transportation | | 1.35 | | 0.32 | | 0.49 | | 0.02 | | 0.48 |

| Royalties | | 0.38 | | 0.33 | | 0.84 | | 0.17 | | 0.33 |

| Production expenses | | 75.51 | | 79.21 | | 76.48 | | 68.64 | | 74.04 |

| Netback | $ | 44.14 | $ | 43.02 | $ | 35.27 | $ | 14.49 | $ | 31.78 |

| | | | | | | | | | | |

| Natural Gas |

Average daily production (before royalties) (MMcf/d) | | 7 | | 5 | | 7 | | 10 | | 7 |

| Netbacks ($/Mcf) | | | | | | | | | | |

Sales price (2) | $ | 6.05 | $ | 6.38 | $ | 6.93 | $ | 8.22 | $ | 7.07 |

| Transportation | | 0.22 | | 0.26 | | 0.29 | | 1.87 | | 0.82 |

| Royalties | | - | | - | | - | | - | | - |

| Production Expenses | | 5.83 | | 6.12 | | 19.21 | | 6.35 | | 9.10 |

| Netback | $ | 0.00 | $ | 0.00 | $ | (12.57) | $ | 0.00 | $ | (2.85) |

| | | | | | | | | | | |

Offshore Africa Production and Netbacks by Product Type (1) |

| |

| Light and Medium Crude Oil |

Average daily production (before royalties) (bbl/d) | | 10,791 | | 13,164 | | 13,684 | | 12,047 | | 12,429 |

| Netbacks ($/bbl) | | | | | | | | | | |

Sales price (2) | $ | - | $ | 119.47 | $ | 104.82 | $ | 68.90 | $ | 97.81 |

| Transportation | | - | | - | | - | | - | | - |

| Royalties | | - | | 3.92 | | 10.79 | | 4.83 | | 6.83 |

| Production expenses | | - | | 58.41 | | 27.20 | | 50.54 | | 43.97 |

| Netback | $ | - | $ | 57.14 | $ | 66.83 | $ | 13.53 | $ | 47.01 |

| �� | | | | | | | | | | |

| Natural Gas |

Average daily production (before royalties) (MMcf/d) | | 21 | | 23 | | 23 | | 18 | | 21 |

| Netbacks ($/Mcf) | | | | | | | | | | |

Sales price (2) | $ | 12.18 | $ | 12.25 | $ | 11.73 | $ | 11.73 | $ | 11.98 |

| Transportation | | 0.15 | | 0.15 | | 0.15 | | 0.15 | | 0.15 |

| Royalties | | 2.06 | | 1.89 | | 1.88 | | 0.99 | | 1.74 |

| Production expenses | | 3.64 | | 3.28 | | 2.68 | | 3.35 | | 3.22 |

| Netback | $ | 6.33 | $ | 6.93 | $ | 7.02 | $ | 7.24 | $ | 6.87 |

| (1) | Amounts expressed on a per unit basis are based on sales volumes. |

| (2) | Net of blending costs and excluding risk management activities. |

| (3) | The Company commenced production of diesel for internal use at Horizon. 2014 SCO production before royalties excludes 545 bbl/d of SCO consumed internally as diesel. |

| (4) | Calculated based on actual bitumen royalties expensed during the period; divided by the corresponding SCO sales volumes. |

| (5) | Adjusted cash production costs on a per unit basis are based on sales volumes excluding turnaround periods. |

| Canadian Natural Resources Limited | 45 |

| | | Year Ended December 31 | |

| (MM$, except per common share information) | | 2014 | | | 2013 | |

| | | | | | | |

| Product sales | | $ | 21,301 | | | $ | 17,945 | |

| Net earnings | | $ | 3,929 | | | $ | 2,270 | |

| Per common share | – basic | | $ | 3.60 | | | $ | 2.08 | |

| | – diluted | | $ | 3.58 | | | $ | 2.08 | |

Adjusted net earnings from operations (1) | | $ | 3,811 | | | $ | 2,435 | |

| Per common share | – basic | | $ | 3.49 | | | $ | 2.24 | |

| | – diluted | | $ | 3.47 | | | $ | 2.23 | |

Cash flow from operations (1) | | $ | 9,587 | | | $ | 7,477 | |

| Per common share | – basic | | $ | 8.78 | | | $ | 6.87 | |

| | – diluted | | $ | 8.74 | | | $ | 6.86 | |

| Dividends declared per common share | | $ | 0.90 | | | $ | 0.575 | |

| Total assets | | $ | 60,200 | | | $ | 51,754 | |

| Total long-term liabilities | | $ | 26,167 | | | $ | 20,748 | |

| Capital expenditures, net of dispositions | | $ | 11,744 | | | $ | 7,274 | |

| (1) | These non-GAAP measures are reconciled to net earnings as determined in accordance with IFRS in the “Net Earnings and Cash Flow from Operations” section of the Company’s MD&A which is incorporated by reference into this document. |

On January 17, 2001 the Board of Directors approved a dividend policy for the payment of regular quarterly dividends. Dividends have been paid on the first day of January, April, July and October of each year since April 2001. The dividend policy of the Company undergoes a periodic review by the Board of Directors and is subject to change at any time depending upon the earnings of the Company, its financial requirements and other factors existing at the time.

The following table shows the aggregate amount of the cash dividends declared per common share of the Company in each of its last three years ended December 31.

| | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | |

| Cash dividends declared per common share | | $ | 0.90 | | | $ | 0.575 | | | $ | 0.42 | |

In March 2015, the Company’s Board of Directors increased the quarterly cash dividend on common shares to $0.23 per common share effective with the April 1, 2015 payment.

Common Shares

The Company is authorized to issue an unlimited number of common shares, without nominal or par value. Holders of common shares are entitled to one vote per share at a meeting of shareholders of Canadian Natural, to receive such dividends as declared by the Board of Directors on the common shares and to receive pro-rata the remaining property and assets of the Company upon its dissolution or winding-up, subject to any rights having priority over the common shares.

Preferred Shares

The Company has no preferred shares outstanding. The Company is authorized to issue an unlimited number of Preferred Shares issuable in one or more series. The directors of the Company are authorized to fix, before the issue thereof, the number of shares in each series and to determine the designation, rights, privileges, restrictions and conditions attaching to the Preferred Shares of each series.

Credit Ratings

The following information relating to the Company's credit ratings is provided as it relates to the Company's financing costs, liquidity and operations. Specifically, credit ratings affect the Company's ability to obtain short-term and long-term financing

| 46 | Canadian Natural Resources Limited |

and the cost of such financing. A reduction in the current rating on the Company's debt by its rating agencies (particularly a reduction below investment grade ratings), or a negative change to the Company's ratings outlook could adversely affect the Company's cost of financing and its access to sources of liquidity and capital. In addition, changes to credit ratings may affect the Company's ability to, and the associated costs of, entering into ordinary course derivative or hedging transactions and entering into and maintaining ordinary course contracts with customers and suppliers on acceptable terms.

Credit ratings accorded to the Company’s debt securities are not recommendations to purchase, hold or sell the debt securities inasmuch as such ratings do not comment on the current market price or suitability for a particular investor. Any rating may not remain in effect for any given period of time or may be revised or withdrawn entirely by a rating agency in the future if in its judgment circumstances so warrant, and if any such rating is so revised or withdrawn, the Company is under no obligation to update this Annual Information Form.

| | Senior Unsecured Debt Securities | | Commercial Paper | | Outlook/Trend |

| Moody’s Investors Service, Inc. (“Moody’s”) | Baa1 | | | P-2 | | Stable |

Standard & Poor’s Rating Services (“S&P”) (1) | BBB+ | | | A-2 | | Stable |

| DBRS Limited (“DBRS”) | BBB (high) | | | - | | Stable |

| (1) | S&P assigns a rating outlook to Canadian Natural and not to individual long-term debt instruments. |

Credit ratings are intended to provide investors with an independent measure of credit quality of any issue of securities.

Moody’s credit ratings are on a long-term debt rating scale that ranges from Aaa to C, which represents the range from highest to lowest quality of such securities rated. A rating of Baa by Moody’s is within the fourth highest of nine categories and is assigned to obligations that are judged to be medium-grade and are subject to moderate credit risk. Such securities may possess certain speculative characteristics. Moody’s applies numerical modifiers 1, 2 and 3 to each generic rating classification from Aa through Caa in its corporate bond rating system. The modifier 1 indicates that the issue ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates that the issue ranks in the lower end of its generic rating category. A Moody’s rating outlook is an opinion regarding the likely rating direction over the medium term. Moody’s credit ratings on commercial paper are on a short-term debt rating scale that ranges from P-1 to NP, representing the range of such securities rated from highest to lowest quality. A rating of P-2 by Moody’s is the second highest of four categories and indicates a strong ability to repay short-term obligations.

S&P’s credit ratings are on a long-term debt rating scale that ranges from AAA to D, which represents the range from highest to lowest quality of such securities rated. According to the S&P rating system, debt securities rated BBB exhibit adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments on the debt securities. The ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. An S&P rating outlook assesses the potential direction of a long-term credit rating over the intermediate term. In determining a rating outlook, consideration is given to any changes in the economic and/or fundamental business conditions. S&P credit ratings on commercial paper are on a short-term debt rating scale that ranges from A-1 to D, representing the range of such securities rated from highest to lowest quality. A rating of A-2 by S&P is the second highest of seven categories and indicates that the obligor is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher rating categories, but the obligor’s capacity to meet its financial commitment on these obligations is satisfactory.

DBRS’ credit ratings are on a long-term debt rating scale that ranges from AAA to D, which represents the range from highest to lowest quality of such securities rated. According to the DBRS rating system, debt securities rated BBB are of adequate credit quality. The capacity for the payment of financial obligations is considered acceptable, though may be vulnerable to future events. All rating categories other than AAA and D also contain subcategories “(high)” and “(low)” which indicate the relative standing within such rating category. The rating trend is DBRS’ opinion regarding the outlook for the rating.

Canadian Natural has made payments to Moody’s, S&P and DBRS in connection with the assignment of ratings to our long-term and short-term debt and will make payments to Moody’s, S&P and DBRS in connection with the confirmation of such ratings for purposes of the offering of debt securities from time to time. Canadian Natural has made payments to an affiliate of Moody’s in the last 2 years for subscription to use its online credit analytical tools.

| Canadian Natural Resources Limited | 47 |

The Company’s common shares are listed and posted for trading on Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”) under the symbol CNQ. Set forth below is the trading activity of the Company’s common shares on the TSX in 2014.

| 2014 Monthly Historical Trading on TSX | |

| Month | | High | | | Low | | | Close | | | Volume Traded | |

| January | | $ | 37.00 | | | $ | 34.72 | | | $ | 36.52 | | | | 72,644,086 | |

| February | | $ | 41.70 | | | $ | 35.72 | | | $ | 40.52 | | | | 51,126,424 | |

| March | | $ | 42.49 | | | $ | 39.25 | | | $ | 42.37 | | | | 50,452,731 | |

| April | | $ | 45.59 | | | $ | 42.20 | | | $ | 44.66 | | | | 44,127,835 | |

| May | | $ | 45.22 | | | $ | 42.60 | | | $ | 44.13 | | | | 37,462,455 | |

| June | | $ | 49.22 | | | $ | 44.21 | | | $ | 49.03 | | | | 46,042,352 | |

| July | | $ | 49.57 | | | $ | 46.98 | | | $ | 47.53 | | | | 44,603,938 | |

| August | | $ | 47.53 | | | $ | 43.93 | | | $ | 47.39 | | | | 44,362,512 | |

| September | | $ | 47.42 | | | $ | 42.89 | | | $ | 43.51 | | | | 60,919,979 | |

| October | | $ | 43.75 | | | $ | 34.91 | | | $ | 39.33 | | | | 96,930,305 | |

| November | | $ | 43.10 | | | $ | 36.18 | | | $ | 37.96 | | | | 74,950,720 | |

| December | | $ | 40.10 | | | $ | 31.00 | | | $ | 35.92 | | | | 93,956,821 | |

During 2014, the Company purchased for cancellation 10,095,000 common shares under a Normal Course Issuer Bid at a weighted average purchase price of $44.85 per common share for a total cost of approximately $453 million.

| 48 | Canadian Natural Resources Limited |

The names, municipalities of residence, offices held with the Company and principal occupations of the Directors and Officers of the Company for the 5 preceding years, are set forth below. Further detail on the Directors and Named Executive Officers are found in the Company’s Information Circular dated March 18, 2015 incorporated herein by reference.

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Catherine M. Best, FCA, ICD.D Calgary, Alberta Canada | Director (1)(2) (age 61) | Corporate director. She has served continuously as a director of the Company since November 2003 and is currently serving on the board of directors of Superior Plus Corporation, Aston Hill Financial Inc. and AltaGas Ltd. She is also a member of the Board of the Alberta Children’s Hospital Foundation, The Calgary Foundation, The Wawanesa Mutual Insurance Company and serves as a volunteer member of the Audit Committee of the Calgary Stampede and of the Audit Committee of the University of Calgary. |

| | | |

N. Murray Edwards, O.C. Calgary/Banff, Alberta Canada | Chairman and Director (5) (age 55) | President, Edco Financial Holdings Ltd. (private management and consulting company). He has served continuously as a director of the Company since September 1988. Currently is Chairman and serving on the board of directors of Ensign Energy Services Inc. and Magellan Aerospace Corporation. |

| | | |

Timothy W. Faithfull London, United Kingdom | Director (1)(3) (age 70) | Corporate director. He has served continuously as a director of the Company since November 2010. He is Chairman of the Starehe Endowment Fund in the UK and a Council Member of the Canada – UK Colloquia and is currently serving on the board of directors of TransAlta Corporation, ICE Futures Europe, LIFFE Administration and Management and Shell Pension Trust Limited, a private pension trust. |

| | | |

Honourable Gary A. Filmon, P.C., O.C., O.M. Winnipeg, Manitoba Canada | Director (1)(4) (age 72) | Corporate director. He has served continuously as a director of the Company since February 2006 and is currently serving on the board of directors of MTS Allstream Inc., Arctic Glacier Income Trust, and Exchange Income Corporation. |

| | | |

Christopher L. Fong Calgary, Alberta Canada | Director (3)(5) (age 65) | Corporate director. Until his retirement in May 2009 he was Global Head, Corporate Banking, Energy with RBC Capital Markets. He has served continuously as a director of the Company since November 2010. He was appointed Advisor to the Alberta’s Department of Energy’s Competitive Review process in 2009. He is currently serving on the board of directors of Anderson Energy Inc., Computer Modelling Group Ltd. and sits on the Petroleum Advisory Committee of the Alberta Securities Commission. |

| | | |

Ambassador Gordon D. Giffin Atlanta, Georgia U.S.A | Director (1)(4) (age 65) | Senior Partner, McKenna Long & Aldridge LLP (law firm) since May 2001. He has served continuously as a director of the Company since May 2002. Currently serving on the board of directors of Canadian National Railway Company, Canadian Imperial Bank of Commerce, Element Financial Corporation, Just Energy Corp., and TransAlta Corporation. |

| Canadian Natural Resources Limited | 49 |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Wilfred A. Gobert Calgary, Alberta Canada | Director (2)(4)(5) (age 67) | Independent businessman. He has served continuously as a director since November 2010. He is currently serving on the board of directors of Gluskin Sheff & Associates, Trilogy Energy Corp., Manitok Energy Inc. and Mapan Energy Ltd. |

| | | |

Steve W. Laut Calgary, Alberta Canada | President and Director (3) (age 57) | Officer of the Company. He has served continuously as a director of the Company since August 2006. |

| | | |

Keith A.J. MacPhail Calgary, Alberta Canada | Director (3)(5) (age 58) | Executive Chairman of Bonavista Energy Corporation since November 2012 and prior thereto, Chairman and CEO of Bonavista since 1997. He is also Chairman of NuVista Energy Ltd. since July 2003. He has served continuously as a director of the Company since October 1993. He is currently serving on the board of directors of Bonavista Energy Corporation and NuVista Energy Ltd. |

| | | |

Honourable Frank J. McKenna, P.C., O.C., O.N.B., Q.C. Cap Pelé, New Brunswick Canada | Director (2)(4) (age 67) | Deputy Chair, TD Bank Group. He has served continuously as a director of the Company since August 2006. Currently serving on the board of directors of Brookfield Asset Management Inc. |

| | | |

Dr. Eldon R. Smith, O.C., M.D. Calgary, Alberta Canada | Director (2)(3) (age 75) | President of Eldon R. Smith & Associates Ltd., (a private health care consulting company) since 2001, and is Emeritus Professor of Medicine and Former Dean, Faculty of Medicine, University of Calgary. He has served continuously as a director of the Company since May 1997. Currently serving on the board of directors of Intellipharmaceutics International Inc., Resverlogix Corp., Zenith Epigenetics Corp and Aston Hill Financial Inc. |

| | | |

David A. Tuer Calgary, Alberta Canada | Director (1)(5) (age 65) | Vice-Chairman and Chief Executive Officer of Teine Energy Ltd. (private oil and gas exploration company) and served as Vice-Chairman and Chief Executive Officer of Marble Point Energy Ltd. the predecessor to Teine Energy Ltd. also a private oil and gas exploration company from 2008 to 2010. Prior thereto he was Chairman, Calgary Health Region from 2001 to 2008 and Executive Vice-Chairman BA Energy Inc. from 2005 to 2008 when it was acquired by its parent company Value Creation Inc. through a Plan of Arrangement. He has served continuously as a director of the Company since May 2002. |

| | | |

Annette M. Verschuren, O.C. Toronto, Ontario Canada | Director (age 58) | Ms. A. M. Verschuren is the Chair and Chief Executive Officer of NRStor Inc., an energy storage project developer of energy storage technologies. She was President of The Home Depot Canada from 1996 to 2011 where she oversaw the company's successful growth in Canada leading to its entry into China. Prior to joining The Home Depot, Ms. Verschuren was President and co-owner of Michaels of Canada, a chain of arts and crafts stores. She currently serves as Chancellor of Cape Breton University and as a director of Liberty Mutual Insurance Group and a board member of numerous non-profit organizations. Currently serving on the board of directors of Air Canada and Saputo Inc. |

| | | |

| 50 | Canadian Natural Resources Limited |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Troy J.P. Anderson Calgary, Alberta Canada | Vice-President, West Conventional Operations (age 36) | Officer of the Company since January 2015; prior thereto UK1 Production Manager from March 2009 to July 2011, Production Manager from July 2011 to October 2013 and most recently Northern Operations Manager from October 2013 to January 2015. |

| | | |

Jeffrey J. Bergeson Calgary, Alberta Canada | Vice-President, Exploitation West (age 58) | Officer of the Company. |

| | | |

Corey B. Bieber Calgary, Alberta Canada | Chief Financial Officer and Senior Vice-President, Finance (age 51) | Officer of the Company. |

| | | |

Bryan C. Bradley Calgary, Alberta Canada | Vice-President, Marketing (age 49) | Officer of the Company since November 2011; prior thereto Manager Crude Oil Marketing from November 2006 to November 2011. |

| | | |

Trevor J. Cassidy Calgary, Alberta Canada | Vice-President, Production Central (age 41) | Officer of the Company since August 2014; prior thereto Production Manager from April 2005 to August 2014. |

| | | |

Mark Chalmers Calgary, Alberta Canada | Vice-President, Exploration Central (age 55) | Officer of the Company since January 2015; prior thereto Exploration Manager, British Columbia North from December 2006 to September 2010 and most recently Exploration Manager, Northern Plains from September 2010 to January 2015. |

| | | |

William R. Clapperton Calgary, Alberta Canada | Vice-President, Regulatory, Stakeholder and Environmental Affairs (age 52) | Officer of the Company. |

| | | |

James F. Corson Calgary, Alberta Canada | Vice-President, Human Resources (age 64) | Officer of the Company. |

| | | |

Réal M. Cusson Calgary, Alberta Canada | Senior Vice-President, Marketing (age 64) | Officer of the Company. |

| | | |

Réal J. H. Doucet Calgary, Alberta Canada | Senior Vice-President, Horizon Projects (age 62) | Officer of the Company. |

| | | |

Darren M. Fichter Calgary, Alberta Canada | Senior Vice-President, Exploitation (age 44) | Officer of the Company since January 2012; prior thereto Manager, Heavy Oil South April 2004 to June 2009 and most recently Vice-President, Exploitation of CNR International (U.K.) Limited, a wholly owned subsidiary of the Company, from June 2009 to January 2012. |

| Canadian Natural Resources Limited | 51 |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Allan E. Frankiw Calgary, Alberta Canada | Vice-President, Production, East (age 58) | Officer of the Company. |

| | | |

Jay E. Froc Calgary, Alberta Canada | Vice-President, Infrastructure, Logistics and Project Controls (age 49) | Officer of the Company since June 2013. Most recently held various positions with Suncor Energy Inc. since 2006. |

| | | |

Dean W. Halewich Calgary, Alberta Canada | Vice-President, Facilities and Pipelines (age 47) | Officer of the Company since September 2011; prior thereto Manager, Facilities Engineering from February 2002 to May 2011 and most recently Manager, Thermal Projects from May 2011 to September 2011. |

| | | |

Jon Halford Calgary, Alberta Canada | Vice-President, Commercial Operations (age 41) | Officer of the Company since January 2015; prior thereto Manager, Materials and Contracts from June 2010 to November 2010 and most recently Director, Supply Management – Major Projects. |

| | | |

Murray G. Harris Calgary, Alberta Canada | Vice-President, Financial Controller and Horizon Accounting (age 51) | Officer of the Company since March 2012; prior thereto Financial Controller from June 2005 to March 2012. |

| | | |

David B. Holt Calgary, Alberta Canada | Vice-President, Production, West (age 49) | Officer of the Company since September 2011; prior thereto Production Manager, Heavy Oil North from January 2003 to September 2011. |

| | | |

John A. Howard Calgary, Alberta Canada | Vice-President, Thermal Production Primrose (age 56) | Officer of the Company since September 2011; prior thereto Project Manager, Bitumen Upgrading from May 2006 to May 2007; Manager, Deep Basin Production from May 2007 to October 2009 and most recently Manager, SAGD Production from October 2009 to September 2011. |

| | | |

Gerard Iannattone Calgary, Alberta Canada | Vice-President, Thermal Exploitation Athabasca (age 55) | Officer of the Company since March 2014; prior thereto Exploitation Manager, N. E. British Columbia from November 2006 to March 2014. |

| | | |

Peter J. Janson Calgary, Alberta Canada | Senior Vice-President, Horizon Operations (age 57) | Officer of the Company. |

| | | |

Terry J. Jocksch Calgary, Alberta Canada | Senior Vice-President, Thermal (age 47) | Officer of the Company. |

| | | |

| 52 | Canadian Natural Resources Limited |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Pamela A. Jones Calgary, Alberta Canada | Vice-President, Safety and Asset Integrity (age 52) | Officer of the Company since May 2011; prior thereto Project Integration Manager from July 2007 to January 2011 and most recently Manager, Special Projects Assets from January 2011 to May 2011. |

| | | |

Philip A. Keele Calgary, Alberta Canada | Vice-President, Mining (age 55) | Officer of the Company. |

| | | |

Kevin B. Kowbel Calgary, Alberta Canada | Vice-President, Drilling and Completions (age 44) | Officer of the Company since January 2012; prior thereto Drilling Manager from April 2006 to January 2012. |

| | | |

Trevor D. Krause Calgary, Alberta Canada | Vice-President, Exploration, East (age 43) | Officer of the Company since January 2015; prior thereto Exploration Manager, N. E. Alberta from April 2007 to July 2011 and most recently Exploration Manager, Heavy Oil South from July 2011 to January 2015. |

| | | |

Dan H. Krentz Calgary, Alberta Canada | Vice-President, Exploration, West (age 56) | Officer of the Company since March 2014; prior thereto Exploration Manager, Foothills from November 2006 to April 2011 and most recently Exploration Manager, Deep Basin from April 2011 to March 2014. |

| | | |

Ronald K. Laing Calgary, Alberta Canada | Senior Vice-President, Corporate Development and Land (age 45) | Officer of the Company. |

| | | |

Bruce E. McGrath Calgary, Alberta Canada | Corporate Secretary (age 65) | Officer of the Company. |

| | | |

Tim S. McKay Calgary, Alberta Canada | Chief Operating Officer (age 53) | Officer of the Company. |

| | | |

Casey D. McWhan Calgary, Alberta Canada | Vice-President, Bitumen Production (age 52) | Officer of the Company since November 2011; prior thereto President, Modec du Brasil from January 2006 to September 2008; Senior Vice-President, Prosafe Production from September 2008 to January 2010 and most recently Continuous Process Improvement Lead with the Company from April 2010 to November 2011. |

| | | |

Paul M. Mendes Calgary, Alberta Canada | Vice-President, Legal and General Counsel (age 49) | Officer of the Company. |

| | | |

Leon Miura Calgary, Alberta Canada | Vice-President, Horizon Downstream Projects (age 60) | Officer of the Company. |

| | | |

| Canadian Natural Resources Limited | 53 |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Stephen J. Olson Calgary, Alberta Canada | Vice-President, Finance, E&P Accounting (age 57) | Officer of the Company since March 2014; prior thereto Controller, Operations and Expenditure Accounting from March 2009 to March 2014. |

| | | |

S. John Parr Calgary, Alberta Canada | Vice-President, Thermal Projects (age 54) | Officer of the Company. |

| | | |

David A. Payne Calgary, Alberta Canada | Vice-President, Exploitation, Central (age 53) | Officer of the Company. |

| | | |

William R. Peterson Calgary, Alberta Canada | Senior Vice-President, Production and Development Operations (age 48) | Officer of the Company. |

| | | |

Douglas A. Proll Calgary, Alberta Canada | Executive Vice-President (age 64) | Officer of the Company. |

| | | |

David W. Reed Calgary, Alberta Canada | Vice-President, Horizon Upgrading and Utilities (age 65) | Officer of the Company since August 2012; prior thereto Vice-President Tesoro Corporation from May 2007 to November 2011. |

| | | |

Andrew Richardson Calgary, Alberta Canada | Vice-President, Thermal Production Athabasca (age 47) | Officer of the Company since March 2014; prior thereto Manager Production Engineering, Long Lake with Nexen Inc. from August 2006 to January 2012, Manager CSS Production with the Company from January 2012 to November 12, 2012 and most recently Manager, Wolf Lake and Production Development from December 2012 to March 2014. |

| | | |

Joy P. Romero Calgary, Alberta Canada | Vice-President, Technology Development (age 58) | Officer of the Company. |

| | | |

Sheldon L. Schroeder Fort McMurray, Alberta Canada | Vice-President, Horizon Upstream Projects (age 47) | Officer of the Company. |

| | | |

Kara Slemko Calgary, Alberta Canada | Vice-President, Supply Management (age 45) | Officer of the Company since January 2015; prior thereto Director Operations with Canadian National Railway from February 2003 to February 2011, Management Consultant with Ernst & Young LLP from March 2011 to September 2012 and most recently Director, Supply Management, Operations with the Corporation from September 2012 to January 2015. |

| | | |

| 54 | Canadian Natural Resources Limited |

| Name | Position Presently Held | Principal Occupation During Past 5 Years |

| | | |

Kendall W. Stagg Calgary, Alberta Canada | Senior Vice-President, Exploration (age 53) | Officer of the Company. |

| | | |

Scott G. Stauth Calgary, Alberta Canada | Senior Vice-President, North American Operations (age 49) | Officer of the Company. |

| | | |

Lyle G. Stevens Calgary, Alberta Canada | Executive Vice-President, Canadian Conventional (age 60) | Officer of the Company. |

| | | |

Stephen C. Suche Calgary, Alberta Canada | Vice-President, Information and Corporate Services (age 55) | Officer of the Company. |

| | | |

Domenic Torriero Calgary, Alberta Canada | Vice-President, Thermal Exploration (age 50) | Officer of the Company. |

| | | |

Gregory A. Ulrich Calgary, Alberta Canada | Vice-President, Thermal And East Conventional Field Operations (age 52) | Officer of the Company since March 2014; prior thereto Field Operations Manager from November 2006 to March 2014. |

| | | |

Betty Yee Calgary, Alberta Canada | Vice-President, Land (age 50) | Officer of the Company since June 2013. Most recently was Manager of Acquisition and Divestments of the Company since 2003. |

| | | |

Daryl G. Youck Calgary, Alberta Canada | Vice-President, Thermal Exploitation Primrose (age 46) | Officer of the Company. |

| | | |

Robin S. Zabek Calgary, Alberta Canada | Vice-President, Exploitation East (age 43) | Officer of the Company since March 2014; prior thereto Manager Exploitation from September 2006 to March 2014. |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Health, Safety, and Environmental Committee. |

| (4) | Member of the Nominating, Governance and Risk Committee. |

| (5) | Member of the Reserves Committee. |

All directors stand for election at each Annual General Meeting of Canadian Natural shareholders. All of the current directors, other than Annette M. Verschuren who was appointed to the Board in November 2014, were elected to the Board at the last Annual General Meeting of Shareholders held on May 8, 2014.

As at December 31, 2014, the directors and executive officers of the Company, as a group, beneficially owned or controlled or directed, directly or indirectly, in the aggregate, approximately 3% of the total outstanding common shares (approximately 4% after the exercise of options held by them pursuant to the Company’s stock option plan).

There are potential conflicts of interest to which the directors and officers of the Company may become subject in connection with the operations of the Company. Some of the directors and officers have been and will continue to be engaged in the

| Canadian Natural Resources Limited | 55 |

identification and evaluation of businesses and assets with a view to potential acquisition of interests on their own behalf and on behalf of other corporations. Situations may arise where the directors and officers will be in direct competition with the Company. Conflicts, if any, will be subject to the procedures and remedies under the Business Corporations Act (Alberta).

From time to time, Canadian Natural is the subject of litigation arising out of the Company’s normal course of operations. Damages claimed under such litigation may be material and the outcome of such litigation may materially impact the Company’s financial condition or results of operations. While the Company assesses the merits of each lawsuit and defends itself accordingly, the Company may be required to incur significant expenses or devote significant resources to defend itself against such litigation. The claims that have been made to date are not currently expected to have a material impact on the Company’s financial position.

No director, executive officer or principal shareholder of Canadian Natural, or associate or affiliate of those persons, has any material interest, direct or indirect, in any transaction within the last three years that has materially affected or is reasonably expected to materially affect the Company.

The Company’s transfer agent and registrar for its common shares is Computershare Trust Company of Canada in the cities of Calgary and Toronto and Computershare Investor Services LLC in the city of New York. The registers for transfers of the Company’s common shares are maintained by Computershare Trust Company of Canada.

Other than contracts entered into in the ordinary course of business, the Company has not entered into any material contracts in the most recently completed financial year nor has it entered into any material contracts before the most recently completed financial year and which are still in effect.

The Company’s auditors, PricewaterhouseCoopers LLP, have prepared an independent auditors’ report dated March 4, 2015 in respect of the Company’s consolidated balance sheets as at December 31, 2014 and December 31, 2013, the consolidated statements of earnings, comprehensive income, changes in equity and cash flows for each of the three years in the period ended December 31, 2014 and the Company’s internal control over financial reporting as at December 31, 2014. PricewaterhouseCoopers LLP has advised that they are independent with respect to the Company within the meaning of the Rules of Professional Conduct of the Institute of Chartered Accountants of Alberta and the rules of the SEC.

Based on information provided by the relevant persons or companies, there are beneficial interests, direct or indirect, in less than 1% of the Company’s securities or property or securities or property of our associates or affiliates held by Sproule Associates Limited, Sproule International Limited or GLJ Petroleum Consultants Ltd., or any partners, employees or consultants of such independent reserves evaluators who participated in and who were in a position to directly influence the preparation of the relevant report, or any such person who, at the time of the preparation of the report was in a position to directly influence the outcome of the preparation of the report.

Audit Committee Members

The Audit Committee of the Board of Directors of the Company is comprised of Ms. C. M. Best, Chair, Messrs. G. A. Filmon, T.W. Faithfull, G. D. Giffin and D. A. Tuer each of whom is independent and financially literate as those terms are defined under Canadian securities regulations, National Instrument 52-110 and the NYSE listing standards as they pertain to audit committees of listed issuers. All of the members of the Corporation’s Audit Committee are financially literate. The education and experience of each member of the Audit Committee relevant to their responsibilities as an Audit Committee member is described below.

Ms. C. M. Best is a chartered accountant with over 20 years experience as a staff member and partner of an international public accounting firm. During her tenure she was responsible for direct oversight and supervision of a large staff of auditors conducting audits of the financial reporting of significant publicly traded entities, many of which were oil and gas companies. This oversight and supervision required Ms. C. M. Best to maintain a current understanding of generally accepted accounting

| 56 | Canadian Natural Resources Limited |

principles, and be able to assess their application in each of her clients. It also required an understanding of internal controls and financial reporting processes and procedures. Ms. C. M. Best who is chair of the Audit Committee qualifies as an “audit committee financial expert” under the rules issued by the SEC pursuant to the requirements of the Sarbanes Oxley Act of 2002.

Mr. T. W. Faithfull holds a Master of Arts degree from the University of Oxford (Philosophy, Politics and Economics), and is an alumnus of the London Business School. As Chief Executive Officer of Shell Canada Limited and in his other capacities during his 36 years with the Royal Dutch/Shell group of companies, together with his experience as an audit committee member of other publicly traded companies, he has acquired significant financial experience and exposure to complex accounting and financial issues and an understanding of audit committee functions.

Honourable G. A. Filmon holds both a Bachelor of Science degree and a Master of Science degree in Civil Engineering. He was Premier of the Province of Manitoba for several years and during that time chaired the Treasury Board for a period of five years. He was President of Success Commercial College for 11 years and is currently a business management consultant. Mr. G. A. Filmon is a director of other public companies and is an active member of other audit committees.

Ambassador G. D. Giffin’s education and experience relevant to the performance of his responsibilities as an audit committee member is derived from a law practice of over thirty years involving complex accounting and audit-related issues associated with complicated commercial transactions and disputes. He has developed extensive practical experience and an understanding of internal controls and procedures for financial reporting from his service on audit committees for several publicly traded issuers and continues pursuit of extensive professional reading and study on related subjects.

Mr. D. A. Tuer's education and experience relevant to the performance of his responsibilities as an audit committee member is derived from professional training and a business career as a chief executive officer in a large publicly traded company which provided experience in analyzing and evaluating financial statements and supervising persons engaged in the preparation, analysis and evaluation of financial statements of publicly traded companies. He has gained an understanding of internal controls and procedures for financial reporting through oversight of those functions, and the understanding of audit committee functions through his years of chief executive involvement.

Auditor Service Fees

The Audit Committee of the Board of Directors in 2014 approved specified audit and non-audit services to be performed by PricewaterhouseCoopers LLP (“PwC”). The services provided include: (i) the annual audit of the Company's consolidated financial statements and internal controls over financial reporting, reviews of the Company's quarterly unaudited consolidated financial statements, audits of certain of the Company's subsidiary companies' annual financial statements as well as other audit services provided in connection with statutory and regulatory filings; (ii) audit related services including pension assets and Crown Royalty Statements; (iii) tax services related to expatriate personal tax and compliance and other corporate tax return matters; and (iv) non-audit services related to expatriate visa application assistance and to accessing resource materials through PwC’s accounting literature library. Fees accrued to PwC are shown in the table below.

| Auditor service (000’s) | | 2014 | | | 2013 | |

| Audit fees | | $ | 3,047 | | | $ | 3,032 | |

| Audit related fees | | | 259 | | | | 212 | |

| Tax fees | | | 523 | | | | 478 | |

| All other fees | | | 87 | | | | 73 | |

| | | $ | 3,916 | | | $ | 3,795 | |

The Charter of the Audit Committee of the Company is attached as Schedule “C” to this Annual Information Form.

| Canadian Natural Resources Limited | 57 |

Additional information relating to the Company can be found on the SEDAR website at www.sedar.com and on EDGAR at www.sec.gov.

Additional information including Directors' and Executive Officers' remuneration and indebtedness, Director nominees standing for re-election, principal holders of the Company's securities, options to purchase the Company's securities and interest of insiders in material transactions is contained in the Company's Notice of Annual General Meeting and Information Circular dated March 18, 2015 in connection with the Annual and General Meeting of Shareholders of Canadian Natural to be held on May 7, 2015 which information is incorporated herein by reference. Additional financial information and discussion of the affairs of the Company and the business environment in which the Company operates is provided in the Company's Management’s Discussion and Analysis, comparative Consolidated Financial Statements and Supplementary Oil & Gas Information for the most recently completed fiscal year ended December 31, 2014 found on pages 20 to 55, 56 to 91 and 92 to 99 respectively, of the 2014 Annual Report to the Shareholders, which information is incorporated herein by reference.

For additional copies of this Annual Information Form, please contact:

Corporate Secretary of the Corporation at:

2100, 855 - 2nd Street S.W.

Calgary, Alberta T2P 4J8

| 58 | Canadian Natural Resources Limited |

FORM 51-101F2

REPORT ON RESERVES DATA BY

INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR

Report on Reserves Data

To the Board of Directors of Canadian Natural Resources Limited (the “Corporation”):

| 1. | We have evaluated and reviewed the Corporation’s reserves data as at December 31, 2014. The reserves data are estimates of proved reserves and probable reserves and related future net revenue as at December 31, 2014, estimated using forecast prices and costs. |

| 2. | The reserves data are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on the reserves data based on our evaluation and review. |

| | We carried out our evaluation and review in accordance with standards set out in the Canadian Oil and Gas Evaluation Handbook (the “COGE Handbook”) prepared jointly by the Society of Petroleum Evaluation Engineers (Calgary Chapter) and the Canadian Institute of Mining, Metallurgy & Petroleum (Petroleum Society). |

| 3. | Those standards require that we plan and perform an evaluation and review to obtain reasonable assurance as to whether the reserves data are free of material misstatement. An evaluation and review also includes assessing whether the reserves data are in accordance with principles and definitions presented in the COGE Handbook. |

| 4. | The following table sets forth the estimated future net revenue (before deduction of income taxes) attributed to proved plus probable reserves, estimated using forecast prices and costs and calculated using a discount rate of 10 percent, included in the reserves data of the Corporation evaluated and reviewed by us for the year ended December 31, 2014 and identifies the respective portions thereof that we have evaluated and reviewed and reported on to the Corporation’s management and board of directors: |

Independent Qualified Reserves | Description and | Location of Reserves | | Net Present Value of Future Net Revenue (Before Income Taxes, 10% Discount Rate) ($ millions) | |

Evaluator or Auditor | Preparation Date of Evaluation/Review Report | (Country or Foreign Geographic Area) | | Audited | | | Evaluated | | | Reviewed | | | Total | |

Sproule

Associates Limited | Sproule evaluated the P&NG Reserves February 2, 2015 | Canada and USA | | $ | 0 | | | $ | 50,067 | | | $ | 524 | | | $ | 50,591 | |

Sproule

International Limited | Sproule evaluated the P&NG Reserves February 2, 2015 | United Kingdom and Offshore Africa | | $ | 0 | | | $ | 10,255 | | | $ | 0 | | | $ | 10,255 | |

GLJ Petroleum Consultants Ltd. | GLJ evaluated the oil sands mining properties February 2, 2015 | Canada | | $ | 0 | | | $ | 33,126 | | | $ | 0 | | | $ | 33,126 | |

| Totals | | | | $ | 0 | | | $ | 93,448 | | | $ | 524 | | | $ | 93,972 | |

| 5. | In our opinion, the reserves data respectively evaluated by us have, in all material respects, been determined and are in accordance with the COGE Handbook, consistently applied. We express no opinion on the reserves data that we reviewed but did not audit or evaluate. |

| Canadian Natural Resources Limited | 59 |

| 6. | We have no responsibility to update our reports referred to in paragraph 4 for events and circumstances occurring after their respective preparation dates. |

| 7. | Because the reserves data are based on judgements regarding future events, actual results will vary and the variations may be material. |

Executed as to our report(s) referred to above:

Sproule Associates Limited Calgary, Alberta, Canada, March 4, 2015 Original Signed By SIGNED “HARRY J. HELWERDA” | | Sproule International Limited Calgary, Alberta, Canada, March 4, 2015 Original Signed By SIGNED “HARRY J. HELWERDA” | |

Harry J. Helwerda, P.Eng., FEC, FGC (Hon.) President and Director | | Harry J. Helwerda, P.Eng., FEC, FGC (Hon.) President and Director | |

| | | | |

SIGNED “NORA T. STEWART” | | Original Signed By SIGNED “SCOTT W. PENNELL” | |

Nora T. Stewart, P.Eng. Senior Vice-President, Canada and Partner | | Scott W. Pennell, P.Eng. Vice-President, Engineering, International and Director | |

| | | | |

SIGNED “CAMERON P. SIX” | | | |

Cameron P. Six, P.Eng. Senior Vice-President, Unconventional and Director | | | |

GLJ Petroleum Consultants Ltd. Calgary, Alberta, Canada, March 4, 2015 Original Signed By SIGNED “TIM R. FREEBORN” | | | |

Tim R. Freeborn, P.Eng. Vice-President Mineable Oil Sands and Shales | | | |

| 60 | Canadian Natural Resources Limited |

FORM 51-101F3

REPORT OF

MANAGEMENT AND DIRECTORS

ON OIL AND GAS DISCLOSURE

Report of Management and Directors on Reserves Data and Other Information

Management of Canadian Natural Resources Limited (the “Corporation”) is responsible for the preparation and disclosure of information with respect to the Corporation’s oil and gas activities in accordance with securities regulatory requirements. This information includes reserves data, which are estimates of proved reserves and probable reserves and related future net revenue as at December 31, 2014, estimated using forecast prices and costs.

Independent qualified reserves evaluators have evaluated and reviewed the Corporation’s reserves data. The report of the independent qualified reserves evaluators will be filed with securities regulatory authorities concurrently with this report.

The Reserves Committee of the Board of Directors of the Corporation has:

| (a) | reviewed the Corporation’s procedures for providing information to the independent qualified reserves evaluators; |

| (b) | met with each of the independent qualified reserves evaluators to determine whether any restrictions affected the ability of the independent qualified reserves evaluators to report without reservation; and |

| (c) | reviewed the reserves data with management and the independent qualified reserves evaluators. |

The Reserves Committee of the Board of Directors has reviewed the Corporation’s procedures for assembling and reporting other information associated with oil and gas activities and has reviewed that information with management. The Board of Directors has, on the recommendation of the Reserves Committee, approved:

| (a) | the content and filing with securities regulatory authorities of Form 51-101F1 containing reserves data and other oil and gas information; |

| (b) | the filing of Form 51-101F2 which is the report of the independent qualified reserves evaluators on the reserves data; and |

| (c) | the content and filing of this report. |

| Canadian Natural Resources Limited | 61 |

Because the reserves data are based on judgments regarding future events, actual results will vary and the variations may

be material.

Original Signed By SIGNED “STEVE W. LAUT” | | | |

Steve W. Laut President | | | |

| | | | |

| | | |

Chief Financial Officer and Senior Vice President, Finance | | | |

| | | | |

| | | |

David A. Tuer Independent Director and Chair of the Reserves Committee | | | |

| | | | |

Original Signed By

SIGNED “CHRISTOPHER L. FONG” | | | |

Christopher L. Fong Independent Director and Member of the Reserves Committee | | | |

Dated this 4th day of March, 2015 | | | |

| 62 | Canadian Natural Resources Limited |

CANADIAN NATURAL RESOURCES LIMITED

(the “Corporation”)

Charter of the Audit Committee of the Board of Directors

| | The Audit Committee is appointed by the Board of Directors (the “Board”) to assist the Board in fulfilling its responsibility for the stewardship of the Corporation in overseeing the business and affairs of the Corporation. Although the Audit Committee has the powers and responsibilities set forth in this Charter, the role of the Audit Committee is oversight. The Audit Committee’s primary duties and responsibilities are to: |

| 1. | ensure that the Corporation’s management implemented an effective system of internal controls over financial reporting; |

| 2. | monitor and oversee the integrity of the Corporation’s financial statements, financial reporting processes and systems of internal controls regarding financial, accounting and compliance with regulatory and statutory requirements as they relate to financial statements, taxation matters and disclosure of material facts; |

| 3. | select and recommend for appointment by the shareholders, the Corporation’s independent auditors, pre-approve all audit and non-audit services to be provided to the Corporation by the Corporation’s independent auditors consistent with all applicable laws, and establish the fees and other compensation to be paid to the independent auditors; |

| 4. | monitor the independence, qualifications and performance of the Corporation’s independent auditors and oversee the audit and review of the Corporation’s financial statements; |

| 5. | monitor the performance of the internal audit function; |

| 6. | establish procedures for the receipt, retention, response to and treatment of complaints, including confidential, anonymous submissions by the Corporation’s employees, regarding accounting, internal controls or auditing matters; and, |

| 7. | provide an avenue of communication among the independent auditors, management, the internal auditing function and the Board. |

| II | Audit Committee Composition, Procedures and Organization |

| 1. | The Audit Committee shall consist of at least three (3) directors as determined by the Board, each of whom shall be independent, non-executive directors, free from any relationship that would interfere with the exercise of his or her independent judgment. Audit Committee members shall meet the independence and experience requirements of the regulatory bodies to which the Corporation is subject to. All members of the Audit Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements at the time of their appointment to the Audit Committee. At least one member of the Audit Committee shall have accounting or related financial management expertise and qualify as a “financial expert” or similar designation in accordance with the requirements of the regulatory bodies to which the Corporation may be subject to. |

| 2. | The Board at its organizational meeting held in conjunction with each annual general meeting of the shareholders shall appoint the members of the Audit Committee for the ensuing year. The Board may at any time remove or replace any member of the Audit Committee and may fill any vacancy in the Audit Committee. |

| 3. | The Board shall appoint a member of the Audit Committee as chair of the Audit Committee. If an Audit Committee Chair is not designated by the Board, or is not present at a meeting of the Audit Committee, the members of the Audit Committee may designate a chair by majority vote of the Audit Committee membership. |

| Canadian Natural Resources Limited | 63 |

| 4. | The Secretary or the Assistant Secretary of the Corporation shall be secretary of the Audit Committee unless the Audit Committee appoints a secretary of the Audit Committee. |

| 5. | The quorum for meetings shall be one half (or where one half of the members of the Audit Committee is not a whole number, the whole number which is closest to and less than one half) of the members of the Audit Committee subject to a minimum of two members of the Audit Committee present in person or by telephone or other telecommunications device that permits all persons participating in the meeting to speak and to hear each other. |

| 6. | Meetings of the Audit Committee shall be conducted as follows: |

| (a) | the Audit Committee shall meet at least four (4) times annually at such times and at such locations as may be requested by the Chair of the Audit Committee; |

| (b) | the Audit Committee shall meet privately in executive sessions at each meeting with management, the manager of internal auditing, the independent auditors, and as a committee to discuss any matters that the Audit Committee or each of these groups believe should be discussed. |

| 7. | The independent auditors and internal auditors shall have a direct line of communication to the Audit Committee through its chair and may bypass management if deemed necessary. Any employee may bring before the Audit Committee directly and may bypass management if deemed necessary any matter involving questionable, illegal or improper financial practices or transactions. |

| III | Audit Committee Duties and Responsibilities |

| 1. | The overall duties and responsibilities of the Audit Committee shall be as follows: |

| a. | to assist the Board in the discharge of its responsibilities relating to the Corporation’s accounting principles, reporting practices and internal controls and its approval of the Corporation’s annual and quarterly consolidated financial statements; |

| b. | to establish and maintain a direct line of communication with the Corporation’s internal auditors and independent auditors and assess their performance; |

| c. | to ensure that the management of the Corporation has implemented and is maintaining an effective system of internal controls over financial reporting; |

| d. | to report regularly to the Board on the fulfillment of its duties and responsibilities; and, |

| e. | to review annually the Audit Committee Charter and recommend any changes to the Nominating, Governance and Risk Committee for approval by the Board. |

| 2. | The duties and responsibilities of the Audit Committee as they relate to the independent auditors shall be as follows: |

| a. | to select and recommend to the Board of Directors for appointment by the shareholders, the Corporation’s independent auditors, review the independence and monitor the performance of the independent auditors and approve any discharge of auditors when circumstances warrant; |

| b. | to approve the fees and other significant compensation to be paid to the independent auditors, scope and timing of the audit and other related services rendered by the independent auditors; |

| c. | to review and discuss with management and the independent auditors prior to the annual audit the independent auditor’s annual audit plan, including scope, staffing, locations and reliance upon management and internal audit department and oversee the audit of the Corporation’s financial statements; |

| d. | to pre-approve all proposed non-audit services to be provided by the independent auditors except those non-audit services prohibited by legislation; |

| e. | on an annual basis, obtain and review a report by the independent auditors describing (i) the independent auditor’s internal quality control procedures; (ii) any material issues raised by the most recent quality-control |

| 64 | Canadian Natural Resources Limited |

| | review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm; and, (iii) any steps taken to address any such issues arising from the review, inquiry or investigation, and, receive a written statement from the independent auditors outlining all significant relationships they have with the Corporation that could impair the auditor’s independence. The Corporation’s independent auditors may not be engaged to perform prohibited activities under the Sarbanes-Oxley Act of 2002 or the rules of the Public Company Accounting Oversight Board or other regulatory bodies, which the Corporation is governed by; |

| f. | to review and discuss with the independent auditors, upon completion of their audit and prior to the filing or releasing annual financial statements: |

| | (i) | contents of their report, including : |

| (a) | all critical accounting policies and practices used; |

| (b) | all alternative treatments of financial information within GAAP that have been discussed with management, ramifications of the use of such treatments and the treatment preferred by the independent auditor; |

| (c) | other material written communications between the independent auditor and management; |

| | (ii) | scope and quality of the audit work performed; |

| | (iii) | adequacy of the Corporation’s financial and auditing personnel; |

| | (iv) | cooperation received from the Corporation’s personnel during the audit; |

| | (v) | internal resources used; |

| | (vi) | significant transactions outside of the normal business of the Corporation; |

| | (vii) | significant proposed adjustments and recommendations for improving internal accounting controls, accounting principles or management systems; |

| | (viii) | the non-audit services provided by the independent auditors; and, |

| | (ix) | consider the independent auditor’s judgments about the quality and appropriateness of the Corporation’s accounting principles and critical accounting estimates as applied in its financial reporting. |

| g. | to review and approve a report to shareholders as required, to be included in the Corporation’s Information Circular and Proxy Statement, disclosing any non-audit services approved by the Audit Committee. |

| h. | to review and approve the Corporation’s hiring policies regarding partners, employees and former partners and employees of the present and former independent auditor of the Corporation. |

| 3. | The duties and responsibilities of the Audit Committee as they relate to the internal auditors shall be as follows: |

| a. | to review the budget, internal audit function with respect to the organization structure, staffing, effectiveness and qualifications of the Corporation’s internal audit department; |

| b. | to review the internal audit plan; and |

| c. | to review significant internal audit findings and recommendations together with management’s response and follow-up thereto. |

| 4. | The duties and responsibilities of the Audit Committee as they relate to the internal control procedures of the Corporation shall be as follows: |

| a. | to review the appropriateness and effectiveness of the Corporation’s policies and business practices which impact on the financial integrity of the Corporation, including those relating to internal auditing, insurance, accounting, information services and systems and financial controls, management reporting (including financial reporting) and risk management; |

| b. | to review any unresolved issues between management and the independent auditors that could affect the financial reporting or internal controls of the Corporation; and |

| c. | to periodically review the extent to which recommendations made by the internal audit staff or by the independent auditors have been implemented. |

| Canadian Natural Resources Limited | 65 |

| 5. | Other duties and responsibilities of the Audit Committee shall be as follows: |

| a. | to review and discuss with management, the internal audit group and the independent auditors, the Corporation’s unaudited quarterly consolidated financial statements and related Management Discussion & Analysis including the impact of unusual items and changes in accounting principles and estimates, the earnings press releases before disclosure to the public and report to the Board with respect thereto; |

| b. | to review and discuss with management, the internal audit group and the independent auditors, the Corporation’s audited annual consolidated financial statements and related Management Discussion & Analysis including the impact of unusual items and changes in accounting principles and estimates, the earnings press releases before disclosure to the public and report to the Board with respect thereto; |

| c. | to ensure adequate procedures are in place for the review of the Corporation’s public disclosure of financial information extracted or derived from the Corporation’s financial statements, other than the quarterly and annual earnings press releases, and periodically assess the adequacy of those procedures; |

| d. | to review management’s report on the appropriateness of the policies and procedures used in the preparation of the Corporation’s consolidated financial statements and other required disclosure documents and consider recommendations for any material change to such policies; |

| e. | to review with management, the independent auditors and if necessary with legal counsel, any litigation, claim or other contingency, including tax assessments that could have a material affect upon the financial position or operating results of the Corporation and the manner in which such matters have been disclosed in the consolidated financial statements; |

| f. | to establish procedures for: |

| | (i) | the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters; and |

| | (ii) | the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters. |

| g. | to co-ordinate meetings with the Reserves Committee of the Corporation, the Corporation’s senior engineering management, independent evaluating engineers and auditors as required and consider such further inquiries as are necessary to approve the consolidated financial statements; |

| h. | to develop a calendar of activities to be undertaken by the Audit Committee for each ensuing year and to submit the calendar in the appropriate format to the Board following each annual general meeting of shareholders; |

| i. | to perform any other activities consistent with this Charter, the Corporation’s By-laws and governing law, as the Audit Committee or the Board deems necessary or appropriate; and, |

| j. | to maintain minutes of meetings and to report on a regular basis to the Board on significant results of the foregoing activities. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as officers and employees of the Corporation. The Audit Committee has the authority to retain, at the Corporation’s expense, special legal, accounting or other consultants or experts it deems necessary in the performance of its duties. The Corporation shall at all times make adequate provisions for the payment of all fees and other compensation approved by the Audit Committee, to the Corporation’s independent auditors in connection with the issuance of its audit report, or to any consultants or experts employed by the Audit Committee.

| 66 | Canadian Natural Resources Limited |

The accompanying consolidated financial statements and all other information contained elsewhere in this Annual Report are the responsibility of management. The consolidated financial statements have been prepared by management in accordance with the accounting policies described in the accompanying notes. Where necessary, management has made informed judgements and estimates in accounting for transactions that were not complete at the balance sheet date. In the opinion of management, the financial statements have been prepared in accordance with International Financial Reporting Standards appropriate in the circumstances. The financial information presented elsewhere in the Annual Report has been reviewed to ensure consistency with that in the consolidated financial statements.

Management maintains appropriate systems of internal control. Policies and procedures are designed to give reasonable assurance that transactions are appropriately authorized and recorded, assets are safeguarded from loss or unauthorized use and financial records are properly maintained to provide reliable information for preparation of financial statements.

PricewaterhouseCoopers LLP, an independent firm of Chartered Accountants, has been engaged, as approved by a vote of the shareholders at the Company’s most recent Annual General Meeting, to audit and provide their independent audit opinions on the following:

| · | the Company’s consolidated financial statements as at and for the year ended December 31, 2014; and |

| · | the effectiveness of the Company’s internal control over financial reporting as at December 31, 2014. |

Their report is presented with the consolidated financial statements.

The Board of Directors (the “Board”) is responsible for ensuring that management fulfills its responsibilities for financial reporting and internal controls. The Board exercises this responsibility through the Audit Committee of the Board, which is comprised entirely of independent directors. The Audit Committee meets with management and the independent auditors to satisfy itself that management responsibilities are properly discharged and to review the consolidated financial statements before they are presented to the Board for approval. The consolidated financial statements have been approved by the Board on the recommendation of the Audit Committee.

| (signed) “Steve W. Laut” | | (signed) “Corey B. Bieber” | | (signed) “Murray G. Harris” | |

| Steve W. Laut President | | Corey B. Bieber, CA Chief Financial Officer and Senior Vice-President, Finance | | Murray G. Harris, CAVice-President, Financial Controller and Horizon Accounting | |

Calgary, Alberta, Canada

March 4, 2015

Management’s Assessment of Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company as defined in Rules 13a–15(f) and 15d–15(f) under the United States Securities Exchange Act of 1934, as amended.

Management, including the Company’s President and the Company’s Chief Financial Officer and Senior Vice-President, Finance, performed an assessment of the Company’s internal control over financial reporting based on the criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).