Exhibit 99.1

CANADIAN NATURAL RESOURCES LIMITED

NOTICE OF THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, MAY 3, 2018

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "Meeting") of the Shareholders of Canadian Natural Resources Limited (the "Corporation") will be held at the Telus Convention Centre, 120 – 9th Avenue S.E. in the City of Calgary, in the Province of Alberta, Canada, on Thursday, May 3, 2018, at 1:00 o'clock in the afternoon (MDT) for the following purposes:

- 1.

- To receive the Annual Report of the Corporation to the Shareholders, the Consolidated Financial Statements, and the report of the Auditors, for the fiscal year ended December 31, 2017;

- 2.

- To elect Directors for the ensuing year;

- 3.

- To appoint Auditors for the ensuing year and to authorize the Audit Committee of the Corporation's Board of Directors to fix their remuneration;

- 4.

- To vote, on an advisory basis, on the Corporation's approach to executive compensation as described in the Information Circular accompanying this Notice of Meeting; and

- 5.

- To transact such other business as may properly be brought before the Meeting or any adjournments thereof.

ANY SHAREHOLDER OF RECORD AT THE CLOSE OF BUSINESS ON MARCH 14, 2018 WILL BE ENTITLED TO RECEIVE NOTICE OF, AND VOTE AT THE MEETING, PROVIDED THAT TO THE EXTENT SUCH A SHAREHOLDER TRANSFERS THE OWNERSHIP OF ANY OF HIS SHARES AFTER THE RECORD DATE AND THE TRANSFEREE OF THOSE SHARES PRODUCES A PROPERLY ENDORSED SHARE CERTIFICATE OR OTHERWISE ESTABLISHES THAT HE OWNS SUCH SHARES AND DEMANDS NOT LATER THAN 5 DAYS BEFORE THE MEETING THAT HIS NAME BE INCLUDED ON THE SHAREHOLDERS' LIST, SUCH TRANSFEREE IS ENTITLED TO VOTE SUCH SHARES AT THE MEETING. IF YOU CANNOT BE PRESENT IN PERSON, PLEASE SIGN AND RETURN THE ENCLOSED PROXY FORM IN THE ADDRESSED ENVELOPE PROVIDED. IN ORDER FOR YOUR PROXY FORM TO BE EFFECTIVE, IT MUST BE DULY COMPLETED AND MUST REACH THE OFFICE OF COMPUTERSHARE TRUST COMPANY OF CANADA, 8TH FLOOR, 100 UNIVERSITY AVENUE, TORONTO, ONTARIO, CANADA M5J 2Y1 AT LEAST 24 HOURS BEFORE THE MEETING TO BE HELD ON THURSDAY, MAY 3, 2018.

The specific details of the matters proposed to be put before the Meeting are set forth in the Information Circular of the Corporation, which accompanies this Notice. Copies of the Annual Report of the Corporation and Consolidated Financial Statements referred to herein are being sent under separate cover if you are a registered holder, or if, as a beneficial shareholder, you returned the financial statement request card sent with the 2017 proxy solicitation material.

DATED at Calgary, Alberta, this 14th day of March 2018

| BY ORDER OF THE BOARD OF DIRECTORS | ||

| ||

| PAUL M. MENDES Vice-President, Legal, General Counsel and Corporate Secretary |

CANADIAN NATURAL RESOURCES LIMITED

(the "CORPORATION")

INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL MEETING

OF SHAREHOLDERS

TO BE HELD ON THURSDAY, MAY 3, 2018 AT 1:00 P.M. (MDT)

AT THE TELUS CONVENTION CENTRE

120 – 9TH AVENUE S.E. CALGARY, ALBERTA

Contents of This Information Circular

Unless otherwise indicated, all dollar figures stated in this Circular represent Canadian dollars. On December 31, 2017, the reported Bank of Canada exchange rate for one Canadian dollar was U.S. $0.7971 and for one Pound Sterling was £0.5896. On December 31, 2017, the reported Bank of Canada exchange rate for one U.S. dollar was Canadian $1.2545 and for one pound sterling was Canadian $1.6961.

I. INFORMATION ON ITEMS TO BE ACTED UPON

This Information Circular (the "Circular") is furnished in connection withTHE SOLICITATION OF PROXIES BY THE MANAGEMENT OF CANADIAN NATURAL RESOURCES LIMITED (the "Corporation" or "Canadian Natural") for use at the 2018 Annual General Meeting of the Shareholders of the Corporation.

The solicitation of proxies will be primarily by mail, but may also be by telephone, electronic communication or oral communications by the directors, officers and regular employees of the Corporation, at no additional compensation. The costs of preparation and mailing of the Notice of Meeting, Instrument of Proxy and this Information Circular as well as any such solicitation referred to above will be paid by the Corporation.

Except as otherwise stated, the information contained herein is given as of March 14, 2018.

Where and When the Meeting Will Be Held

The 2018 Annual General Meeting of the Shareholders of the Corporation will be held at the Telus Convention Centre, 120 – 9th Avenue S.E. in the City of Calgary, in the Province of Alberta, Canada, on Thursday, May 3, 2018 at 1:00 o'clock in the afternoon (MDT) (the "Meeting") and at any adjournments thereof, for the purposes set forth in the accompanying Notice of Meeting.

Quorum for the Meeting

Holders of five percent of the outstanding common shares of the Corporation (the "Common Shares") entitled to vote, present at the Meeting in person or by proxy, will constitute a quorum for the Meeting.

Who Can Vote at the Meeting

Anyone who holds Common Shares as a registered shareholder or a beneficial shareholder on March 14, 2018 (the "Record Date") is entitled to receive notice of the Meeting and to vote at the Meeting to be held on May 3, 2018 or any adjournment of the Meeting (see Voting as a Registered Shareholder or Voting as a Beneficial Shareholder below). If you became a shareholder after the Record Date you may vote if you produce a properly endorsed share certificate or otherwise establish ownership of the Common Shares and not later than 5 days before the Meeting you request your name be included on the list of shareholders entitled to vote at the Meeting.

You as a shareholder have the right to designate a person or company (who need not be a shareholder of the Corporation) other than N. Murray Edwards and Steve W. Laut, the management designees, to attend and act for you at the Meeting. Such right may be exercised by inserting in the blank space provided on the proxy the name of the person or company to be designated and deleting therefrom the names of the management designees or by completing another proper instrument of proxy.

Voting as a Registered Shareholder

A registered shareholder is a shareholder who has a share certificate registered in their name. If you are a registered shareholder, you can attend the Meeting and vote in person, or, appoint someone to vote at the Meeting on your behalf in the manner described above.

1

Voting by proxy can be done in one of the following ways; 1) by mailing or personally delivering the completed form of proxy enclosed with this Information Circular to Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, Canada M5J 2Y1 at least 24 hours before the Meeting for which it is to be used; 2) by telephone by calling the toll free number specified in the form of proxy; or, 3) by internet by accessing the website address specified in the form of proxy.

Voting as Beneficial Shareholder

A non-registered shareholder (a beneficial shareholder) is a shareholder who has their shares held by an intermediary such as a broker, dealer, trustee or financial institution.

If you are a beneficial shareholder and you wish to have your shares voted at the Meeting, you must provide instructions to the intermediary who is holding your shares on how you want your shares voted at the Meeting. If you have provided instructions to your intermediary to receive information from the Corporation, you will receive from your intermediary a Voting Instruction Form. This form must be completed by you and returned to the intermediary in accordance with the instructions on the Voting Instruction Form. Alternatively, you can provide voting instruction by calling a toll free number or by internet by accessing the website address indicated on the Voting Instruction Form and following the instructions.

If you wish to vote in person at the Meeting, insert your name in the space provided on the Voting Instruction Form provided to you and sign and return it to the intermediary in accordance with the instructions provided. Do not otherwise complete the form, as you will be voting at the Meeting. When you arrive at the Meeting please register at the registration table.

In any case, DO NOT send the Voting Instruction Form to the transfer agent or the Corporation as it is not a legal proxy for voting your shares at the Meeting.

How Your Shares Will Be Voted

Your shares will be voted or withheld from voting on any ballot that may be called in accordance with the instructions you have provided on the properly completed proxy. If no voting instructions have been specified by you, the person you have appointed to vote on your behalf has discretion to vote as they see fit. If your proxy holder is one designated by us, and no voting instructions have been specified by you, your shares will be voted: (i) in favour of each of the persons nominated by management for election as directors; (ii) in favour of the appointment of PricewaterhouseCoopers LLP as auditor and the authorization of the Audit Committee of the Board of Directors to fix their remuneration; and, (iii) on the advisory vote, in favour of the Corporation's approach to executive compensation.

The proxy also confers discretionary authority upon the person you have named to vote on your behalf with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting, or at any adjournment thereof. Management of the Corporation does not know of any matters which may be presented at the Meeting, other than the matters set forth in the notice but if the other matters or amendments or variations do properly come before the Meeting, it is the intention of the persons named in the enclosed Form of Proxy to vote such proxy according to their best judgment.

Changing Your Vote

If you are a registered shareholder and change your mind on how you want your shares voted, or, you decide to attend the Meeting and vote in person, you can revoke your proxy by personally attending at the Meeting and voting your shares, or, depositing another form of proxy with a later date. You can also revoke your proxy by (a) providing written notice at the registered office of the Corporation or the office of Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, Canada

2

M5J 2Y1 at any time up to and including the last business day preceding the day of the Meeting or any adjournment; or, (b) depositing written notice with the Chair of such Meeting on the day of the Meeting prior to its commencement or adjournment.

The written notice revoking your proxy can be from you or your attorney, provided they have your written authorization. If the shares are owned by a corporation, the written notice must be from its authorized officer or attorney.

If you are a beneficial shareholder follow the instructions of your intermediary with respect to the procedures to be followed for voting as discussed above. Any votes that have been cast on your behalf prior to your revoking your proxy will remain and you will be bound by such vote.

You May Receive More than One Set of Voting Materials

You may receive more than one set of voting materials, including multiple copies of this Information Circular and multiple proxy or Voting Instruction Forms if you hold your shares in more than one brokerage account. You will receive a separate Voting Instruction Form for each brokerage account in which you hold shares. If you are a registered holder of record and you hold your shares in more than one name or variation of your name, you will receive more than one form of proxy. Please complete, sign and return each form of proxy and Voting Instruction Form you receive, or you may cast your vote by telephone or internet by following the instructions on each form of proxy or Voting Instruction Form.

How the Votes are Counted

As a shareholder you are entitled to one vote for each Common Share you hold as at March 14, 2018 on all matters proposed to come before the Meeting. Computershare Trust Company of Canada counts and tabulates the votes independently of the Corporation. Proxies are referred to the Corporation only when (i) it is clear a shareholder wants to communicate with management; (ii) the validity of the proxy is in question; or, (iii) it is required by law.

If You Have Other Questions

If you are a registered shareholder and have any questions regarding the Meeting or require any assistance in completing the form of proxy, contact the Corporation's transfer agent, Computershare Trust Company of Canada, 1-800-564-6253 in Canada or the United States or outside of Canada or the United States at 1-514-982-7555.

If you are a beneficial shareholder and have any questions regarding the Meeting or require any assistance in completing the Voting Instruction Form received from an intermediary, contact the intermediary from whom you received the Voting Instruction Form.

NUMBER OF VOTING SHARES OUTSTANDING AND PRINCIPAL HOLDERS THEREOF

The record date for determination of holders of Common Shares entitled to notice of and to vote at the Meeting isMarch 14, 2018, provided that, to the extent a shareholder transfers the ownership of any of his shares after the record date and the transferee of those shares produces a properly endorsed share certificate or otherwise establishes that they own such shares and requests not later than 5 days before the Meeting that their name be included on the shareholders' list, such transferee is entitled to vote such shares at the Meeting.

As at March 14, 2018 the Corporation has 1,225,901,803 voting securities outstanding as fully paid and non-assessable Common Shares without par value, each share carrying the right to one vote.

3

To the knowledge of the directors and officers of the Corporation, no person or company beneficially owns, or controls or directs, directly or indirectly, voting securities carrying 10% or more of the voting rights attached to all voting securities of the Corporation.

Shareholders will be addressing four items at the Meeting:

- (1)

- Receiving the Annual Report of the Corporation which includes the Consolidated Financial Statements and the report of the Auditors for the fiscal year ended December 31, 2017.

- (2)

- Electing the directors of the Corporation to serve until the next Annual General Meeting of shareholders.

- (3)

- Appointing the Auditors of the Corporation to serve until the next Annual General Meeting of shareholders and authorizing the Audit Committee of the Board of Directors to set the Auditors' remuneration.

- (4)

- Conducting an advisory vote on the Corporation's approach to executive compensation.

Shareholders will also consider other business that may properly be brought before the Meeting.

Copies of the Annual Report, including the Consolidated Financial Statements and the report of Auditors for the year ended December 31, 2017, will be sent under separate cover to all registered shareholders and to those beneficial shareholders who requested a copy of the Annual Report. The Annual Report is also available on the Corporation's website atwww.cnrl.com and on the System for Electronic Document Analysis and Retrieval ("SEDAR") atwww.sedar.com. As a shareholder, you will have an opportunity at the Meeting to address any questions you may have, to the Corporation's independent auditors, PricewaterhouseCoopers LLP, regarding their audit.

4

The affairs of the Corporation are managed by a board of directors (the "Board") who are elected annually at each Annual General Meeting of Shareholders. Directors are elected to hold office until the next Annual General Meeting, unless the Director resigns or the position becomes vacant for any reason prior to the next Annual General Meeting. The Articles of the Corporation allow for a minimum of 3 and a maximum of 15 directors. Shareholders will be asked to elect 11 directors at the Meeting of which 8 nominees out of 11 (73%) are independent. Mr. Tim S. McKay was appointed by the Board of Directors effective February 27, 2018. The remaining 10 nominees are currently Directors who were elected at the Annual General Meeting of Shareholders of the Corporation held on May 4, 2017.

The following table sets forth, among other information, the name of each of the persons proposed to be nominated for election as a director (the "Nominee"); the Nominee's principal occupation at present and within the preceding five (5) years; all positions and offices in the Corporation held by the Nominee, if applicable; other public company directorships held by the Nominee, if any; the date the Nominee was first elected, or appointed a director; the voting results of the Nominee at the previous Annual General Meeting, if applicable; the number and market value of the Common Shares and/or Deferred Share Units ("DSUs") of the Corporation that the Nominee has advised are beneficially owned or controlled or directed, directly or indirectly, by the Nominee as of March 14, 2018; whether each Nominee meets the mandatory share ownership level; the meeting attendance record of each Nominee, if applicable; whether each Nominee is independent or non-independent; and, in the case of Nominees who are members of management, the number of stock options and performance share units ("PSUs") held. Refer to page A–6 for additional information on the level of experience reflected on the Board.

Majority Voting Policy for Directors

In accordance with the Corporation's majority voting policy for directors, any nominee in an uncontested election who receives a greater number of shares withheld than shares voted in favour of their appointment must tender their resignation to the Board for consideration and to take effect upon acceptance of the resignation by the Board. The majority voting policy does not apply if there are contested director elections.

| Catherine M. Best, FCA, ICD.D (age 64) Calgary, Alberta Canada Director since November 2003 Independent | Ms. C.M. Best is a corporate director. Until May 2009, she served as Interim Chief Financial Officer of Alberta Health Services. Prior to that she was Executive Vice-President, Risk Management and Chief Financial Officer of Calgary Health Region from 2000. Prior to 2000, she was with Ernst & Young, a firm of chartered accountants where she served as a staff member and manager from 1980 to 1991, and was Corporate Audit Partner from 1991 to 2000. She holds a Bachelor of Interior Design degree from the University of Manitoba. Ms. C.M. Best is a Chartered Accountant, was awarded her FCA designation in 2005 and her ICD.D in 2009 and is a member of the Board of the Alberta Children's Hospital Foundation, the Calgary Foundation, The Wawanesa Mutual Insurance Company and the Calgary Stampede Foundation. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 96.57% Withheld: 3.43% | |||||||||

| Other Public Company Board Memberships | Superior Plus Corporation AltaGas Ltd. Badger Daylighting Ltd. | |||||||||

| Meeting Attendance | Securities held/market value of Common Shares | |||||||||

| Board of Directors Audit (Chair) Compensation | 6 of 6 5 of 5 7 of 7 | 100% | Common Shares 39,488/$1,530,160 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

5

| N. Murray Edwards, O.C. (age 58) London, England Executive Chair Director since September 1988 Non-independent (Management) | Mr. N.M. Edwards is an investor and corporate director. Prior to December 2015, he was President, Edco Financial Holdings Ltd., a private management and consulting company. He has been a major contributor to the success and growth of the Corporation since becoming a Director and significant shareholder in 1988. Prior thereto, he was a partner of the law firm Burnet, Duckworth and Palmer in Calgary. He holds a Bachelor of Commerce degree (Great Distinction) from the University of Saskatchewan and a Bachelor of Laws degree (Honours) from the University of Toronto and is a recipient of the Order of Canada. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 98.27% Withheld: 1.73% | |||||||||

| Other Public Company Board Memberships | Ensign Energy Services Inc. Magellan Aerospace Corporation | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

| Board of Directors Reserves | 6 of 6 3 of 3 | 100% | Common Shares 21,273,494/$824,347,893 Stock Options 2,200,000 PSU 151,195/$5,858,806 | Required Ownership $2,268,000 | Exceeds Ownership Requirements | |||||

| Timothy W. Faithfull (age 73) London, England Director since November 2010 Independent | Mr. T.W. Faithfull is a corporate director. Until July 2003, when he retired, he was President and Chief Executive Officer of Shell Canada Limited. He joined the Royal Dutch Shell Group of companies in 1967 and throughout his 36 year international career with them he held ever increasing senior positions including Vice-President Crude Oil Shell International Trading and Shipping Company from 1993 to 1996 and Chairman and CEO Shell Companies in Singapore from 1996 to 1999, culminating in his appointment as President and Chief Executive Officer of Shell Canada Limited. Between 1999 and July 2003, he also served on the boards of the Calgary Health Trust and Epcor Centre for the Performing Arts and is Chairman of the Starehe Endowment Fund in the UK and a Council Member of the Canada-UK Colloquia. Mr. T.W. Faithfull holds Master of Arts from the University of Oxford (Keble College) (Philosophy, Politics and Economics) and is an alumnus of the London Business School (Senior Executive Program). He is a Distinguished Friend of the University of Oxford and of the London Business School. In the UK he is the Senior Independent Director of ICE Futures Europe, a non-public company that operates the financial, energy and commodities future exchange. As part of his ICE Futures Europe role, he serves on the Brent Oversight Committee of the ICE Brent Index, the regulated benchmark for Brent crude oil futures. He is a former director of AMEC plc, Canadian Pacific Railway, Enerflex Systems Income Fund and Shell Pension Trust Ltd. (private). | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 99.71% Withheld: 0.29% | |||||||||

| Other Public Company Board Memberships | TransAlta Corporation | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Audit Health, Safety, Asset Integrity and Environmental | 6 of 6 5 of 5 4 of 4 | 100% | Common Shares 9,000/$348,750 DSU 31,506/$1,220,858 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

6

| Christopher L. Fong (age 68) Calgary, Alberta Canada Director since November 2010 Independent | Mr. C.L. Fong is a corporate director. Until his retirement in May 2009, he was Global Head, Corporate Banking, Energy with RBC Capital Markets. Prior thereto, between 1974 and September 1980, Mr. C.L. Fong worked as a petroleum engineer and as corporate planning analyst in the oil and gas industry. He has served as Chair of EducationMatters, Calgary's Public Education Trust, as a governor of Honen's, an International Piano Competition, past Chair of UNICEF Canada and has served on the Petroleum Advisory Committee of the Alberta Securities Commission. Mr. C.L. Fong graduated from McGill University with a Bachelor of Chemical Engineering degree and has post graduate courses in Finance, Economics and Accounting from McGill University and the University of Calgary. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 99.89% Withheld: 0.11% | |||||||||

| Other Public Company Board Memberships | Computer Modelling Group Ltd. | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Health, Safety, Asset Integrity and Environmental Reserves | 6 of 6 4 of 4 3 of 3 | 100% | Common Shares 30,475/$1,180,906 DSU 1,000/$38,750 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

| Ambassador Gordon D. Giffin (age 68) Atlanta, Georgia U.S.A. Director since May 2002 and Lead Independent Director since May 2012 | Ambassador G.D. Giffin is a partner at Dentons US LLP, in their Washington, D.C. and Atlanta, Georgia offices, and was a Senior Partner with McKenna Long & Aldridge LLP, a law firm based in Washington, D.C. and Atlanta, Georgia from 2001 to 2015 when they merged with Dentons. Prior thereto, he was the United States Ambassador to Canada from 1997 to 2001 after a career spanning 20 years engaged in the private practice of business and regulatory law. He holds a Bachelor of Arts degree from Duke University and a J.D. from Emory University School of Law. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 98.04% Withheld: 1.96% | |||||||||

| Other Public Company Board Memberships | Canadian National Railway Company TransAlta Corporation | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Audit Nominating, Governance and Risk (Chair) | 6 of 6 5 of 5 3 of 3 | 100% | Common Shares 78,561/$3,044,239 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

7

| Wilfred A. Gobert (age 70) Calgary, Alberta Canada Director since November 2010 Independent | Mr. W.A. Gobert is an independent businessman. Until his retirement in 2006, he was Vice-Chair of Peters and Co. Limited, a position he held since 2002, and was a member of its Board of Directors and its Executive Committee. He joined Peters & Co. Limited in 1979 as Managing Director, Research and throughout his career at the firm his responsibilities included research analysis of integrated oil companies and oil and gas producers. Throughout the 1990s and early 2000s, he consistently ranked among the top ten rated analysts in the annual survey of oil industry analysts in Canada. Mr. W.A. Gobert received an MBA degree from McMaster University as well as Bachelor of Science (Honours) degree from the University of Windsor and holds a Chartered Financial Analyst (CFA) designation. He is Senior Fellow, Energy Studies, Centre for Energy Policy Studies with The Fraser Institute. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 97.85% Withheld: 2.15% | |||||||||

| Other Public Company Board Memberships | Gluskin Sheff & Associates Paramount Resources Ltd. | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Compensation Nominating, Governance and Risk Reserves | 6 of 6 7 of 7 3 of 3 3 of 3 | 100% | Common Shares 53,280/$2,064,600 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

| Steve W. Laut (age 60) Calgary, Alberta Canada Executive Vice Chairman Director since August 2006 Non-independent (Management) | Mr. S.W. Laut became Executive Vice-Chairman of the Corporation on March 1, 2018. Prior thereto, he joined the Corporation as Senior Exploitation Engineer in 1991 and was appointed to positions of increasing responsibility as Vice-President, Operations in 1996; Executive Vice-President, Operations in 2001; Chief Operating Officer in 2003; and, President in 2005. He has been instrumental in contributing to the Corporation's growth and success during his tenure. Mr. S.W. Laut holds a Bachelor of Science degree in Mechanical Engineering from the University of Calgary and is a member of the Association of Professional Engineers and Geoscientists of Alberta ("APEGA"). | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 99.33% Withheld: 0.67% | |||||||||

| Other Public Company Board Memberships | None | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Health, Safety, Asset Integrity and Environmental | 6 of 6 4 of 4 | 100% | Common Shares 2,357,486/$91,352,583 Stock Options 1,408,000 PSU 92,633/$3,589,529 | Required Ownership $2,268,000 | Exceeds Ownership Requirements | |||||

8

| Tim S. McKay (age 56) Calgary, Alberta Canada President Director since February 2018 Non-independent (Management) | Mr. T.S. McKay became President of the Corporation on March 1, 2018. Prior thereto, he joined the Corporation as Production Engineer in 1990 and was appointed to positions of increasing responsibility as Vice-President, Production in 1996, Senior Vice-President, Production in 2001, Senior Vice-President, Operations in 2002 and Chief Operating Officer since 2010. He has played a significant role in the Corporation's evolution throughout his tenure. Mr. T.S. McKay holds a Bachelor of Science in Petroleum Engineering from the University of Alberta. Mr. McKay is also a member of APEGA. | |||||||||

| Voting Results at 2017 Annual General Meeting | N/A | |||||||||

| Other Public Company Board Memberships | None | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

| N/A | N/A | Common Shares 1,157,853/$44,866,804 Stock Options 1,240,000 PSU 64,339/$2,493,136 | Required Ownership $1,944,000 | Exceeds Ownership Requirements | ||||||

| Honourable Frank J. McKenna, P.C., O.C., O.N.B., Q.C. (age 70) Cap Pelé, New Brunswick Canada Director since August 2006 Independent | Mr. F.J. McKenna has been the Deputy Chair of TD Bank Group since May 2006. Prior to this, he served as Canadian Ambassador to the United States from 2005 to 2006. From 1998 to 2005, he acted as Counsel to the Atlantic Canada law firm McInnes Cooper, while serving on numerous boards, and he was Premier of New Brunswick from 1987 to 1997. He holds a Bachelor of Arts degree from St. Francis Xavier University, a post-graduate degree in political science from Queen's University, and a Bachelor of Laws degree from the University of New Brunswick. He received the Order of Canada in 2008. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 97.51% Withheld: 2.49% | |||||||||

| Other Public Company Board Memberships | Brookfield Asset Management Inc. | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Compensation (Chair) Nominating, Governance and Risk | 6 of 6 7 of 7 3 of 3 | 100% | Common Shares 17,064/$661,230 DSU 38,461/$1,490,364 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

9

| David A. Tuer (age 68) Calgary, Alberta Canada Director since May 2002 Independent | Mr. D.A. Tuer is Chairman of Optiom Inc., a private insurance company. Prior thereto, from 2010 to 2015, he was Vice-Chairman and Chief Executive Officer of Teine Energy Ltd., a private oil and gas exploration company. He served as Vice-Chairman and Chief Executive Officer of Marble Point Energy Ltd. the predecessor to Teine Energy Ltd., also a private oil and gas exploration company from 2008 until 2010. He was Chairman of the Calgary Health Region, a position he held from 2001 to 2008 when the Alberta government consolidated all of the provincial health regions under one authority, Alberta Health Services. Mr. D.A. Tuer also served as Executive Vice-Chairman, BA Energy Inc. from 2005 until 2008, when it was acquired by its parent company Value Creation Inc. through a Plan of Arrangement and which was engaged in the potential development, building and operations of a merchant heavy oil upgrader in Northern Alberta for the purpose of upgrading bitumen and heavy oil feedstock into high-quality crude oils. Prior thereto, he was President and Chief Executive Officer of PanCanadian Petroleum Inc. from 1994 to 2001 and President, Chief Executive Officer and a director of Hawker Resources Inc. from 2003 to 2005. Mr. D.A. Tuer holds a Bachelor of Science degree in Mechanical Engineering from the University of Calgary. He is Chairman of the board of directors of Altalink Management LLP, a private limited partnership. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 98.58% Withheld: 1.42% | |||||||||

| Other Public Company Board Memberships | None | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

| Board of Directors Audit Reserves (Chair) | 6 of 6 5 of 5 3 of 3 | 100% | Common Shares 79,508/$3,080,935 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

| Annette M. Verschuren, O.C. (age 61) Toronto, Ontario Canada Director since November 2014 Independent | Ms. A.M. Verschuren is the Chair and Chief Executive Officer of NRStor Inc., an energy storage project developer of energy storage technologies. She was President of The Home Depot Canada from 1996 to 2011. Prior to joining The Home Depot, she was President and co-owner of Michaels of Canada, a chain of arts and crafts stores. Previously, she was the Vice President, Corporate Development of Imasco Ltd. and Executive Vice President of Canada Development Investment Corporation. She currently serves as Chancellor of Cape Breton University and as a director of Liberty Mutual Insurance Group and is a board member of the CAMH Foundation, the Rideau Hall Foundation and the MARS Discovery District. Ms. A.M. Verschuren is an Officer of the Order of Canada and holds honorary doctorate degrees from six universities including St. Francis Xavier University, where she also earned a Bachelor of Business degree. | |||||||||

| Voting Results at 2017 Annual General Meeting | For: 97.63% Withheld: 2.37% | |||||||||

| Other Public Company Board Memberships | Air Canada Saputo Inc. | |||||||||

| Board/Committee Membership | Meeting Attendance | Securities held/market value of Common Shares | ||||||||

Board of Directors Compensation Health, Safety, Asset Integrity and Environmental | 6 of 6 7 of 7 4 of 4 | 100% | Common Shares 20,587/$797,746 DSU 1,000/$38,750 | Required Ownership $632,092 | Exceeds Ownership Requirements | |||||

10

We would like to acknowledge the contribution and service to the Corporation and to the Board of The Honourable Gary A. Filmon, who is not standing for re-election at the Meeting having reached the mandatory retirement age of 75. Mr. Filmon has served as a director since February, 2006 and as a member of both the Audit Committee and the Nominating, Governance and Risk Committee since that time. The depth of knowledge, experience and stewardship brought to the Board by Mr. Filmon and his ongoing dedication to the Corporation and its shareholders has contributed to the success of the Corporation.

Additional Disclosures Relating to Directors

Ambassador G.D. Giffin was a director of AbitibiBowater Inc. from October 29, 2007 until his resignation on January 22, 2009. In April 2009, AbitibiBowater Inc. and certain of its U.S. and Canadian subsidiaries filed voluntary petitions in the United States Bankruptcy Court for the District of Delaware for relief under the provisions of Chapter 11 and Chapter 15 of the United States Bankruptcy Code, as amended, and sought creditor protection under theCompanies' Creditors Arrangement Act (the "CCAA") with the Superior Court of Quebec in Canada.

Mandatory Share Ownership

The Board believes that in order to better align the interests of the directors and the executive officers with those of the Corporation's shareholders, share ownership by the directors and executive officers is desirable. Non-management directors are required to acquire and hold Common Shares and/or DSUs of the Corporation within five (5) years from the date of the director's appointment to the Board equal to a minimum aggregate market value of $632,092, being three times the annual retainer fee paid to directors in 2017. Management directors are required to hold Common Shares within three (3) years from the date of their appointment as an officer of the Corporation equal to a minimum aggregate market value of four times their annual salary. As the Executive Chair's annual salary is $1, his mandatory, required holdings in 2017 was the same as Mr. S.W. Laut's, at $2,268,000, being four times his annual salary.

Directors are required to confirm annually for the Corporation's Information Circular their Common Share and DSU ownership position which is reported in the table above for each director. Each director has also confirmed that such position is their beneficial and legal ownership position and that it has not been hedged against declines in the value of the Common Shares or otherwise sold.

Diversity Policy Statement

The Corporation believes in diversity and values the benefits that a diverse workforce can bring to the entire organization. Diversity promotes the inclusion of different perspectives and ideas, mitigates against group bias and ensures that the Corporation has the opportunity to benefit from all available talent and ideas. By creating an atmosphere where all people are welcomed, the Corporation is a place where everyone can grow and contribute to the success of the organization. The Corporation believes promotion of diversity is best served through careful consideration of all of the knowledge, experience, skills and backgrounds of each individual in light of the needs of the organization without focusing on a single diversity characteristic. The Corporation will continue to ensure that it is a representative employer, reflecting all the diversity evident in our society.

The Corporation also believes that it is in its best interests to have a Board of Directors whose members are diverse in background and experience and can bring a broad perspective to decision making for the good governance, guidance, direction and leadership of the Corporation. The Board of Directors supports diversity in all its forms and in sufficient numbers to bring a wide range of perspectives to its decision making processes. Director nominees are selected for their ability to exercise independent judgment, experience and expertise and their individual diversity of gender, background, experience and skills is always considered. The Board of Directors believes that a Board composition where 30% of its independent directors are women reflects appropriate gender diversity when the other factors relevant to

11

Board effectiveness are considered, and is committed to identifying and recruiting qualified female directors to satisfy that threshold. (See page A–10 for further discussion.)

The Corporation encourages the advancement of women and minorities within the organization and supports diversity as a means to stimulate creativity and innovation while promoting personal development. As part of the overall management succession plans of the Corporation and in following its mission statement todevelop people, all employees have the benefit of having access to continuing education and career development opportunities within the Corporation. Appointments by the Board of Directors to the executive level are determined on the merit, performance, management skills, expertise and experience of the individual that is relevant to the area of responsibility that they will be assuming.

With the exception of the fee paid to the Lead Independent Director, which is determined by the Compensation Committee and approved by the Board, the Nominating, Governance and Risk Committee reviews the fees paid to the directors to ensure the fees are reasonable and competitive. The Corporation pays compensation comprised of cash and Common Shares to its non-management directors in their capacity as directors. In 2013, the Nominating, Governance and Risk Committee reviewed the fees paid to directors and recommended to the Board that the fees be adjusted to remain comparable with fees paid by companies of similar size and complexity. The Board approved the recommended fee adjustment and the fees became effective May 3, 2013. In 2015, in recognition of the impact continued low commodity prices was having on the Corporation, the Board of Directors reduced the annual retainer fee by 10% from $50,000 to $45,000, which did not change in 2017.

| Annual Retainer Fees(1) | ||||

| Board Member | $ | 45,000 | ||

| 4,000 Common Shares | (2) | |||

| Committee Member | $ | 5,000 | ||

| Committee Chair | $ | 10,000 | ||

| Audit Committee Chair | $ | 25,000 | ||

| Compensation Committee Chair | $ | 15,000 | ||

| Lead Independent Director | $ | 25,000 | ||

| Per Meeting Fees | ||||

| Attended in person | $ | 1,500 | ||

| Attended by telephone unless meeting called by telephone | $ | 1,000 | ||

| Time and travel fee for a director whose principal residence is out of the Province of Alberta and attends meetings in person. | $ | 4,000 per round trip | ||

- (1)

- Retainer fees can be taken as DSUs which are redeemed for cash after the director leaves the Board. Messrs. T. W. Faithfull and F. J. McKenna are participants in the DSU plan. As of January 1, 2018, Mr. C.L. Fong and Ms. A.M. Verschuren became participants in the DSU Plan. Mr. G.A. Filmon ceased to be a participant in the DSU Plan effective January 1, 2017.

- (2)

- Shares are purchased on the Toronto Stock Exchange ("TSX").

There are no vesting or hold restrictions on the shares purchased as part of director's fees except to the extent required to be in compliance with the share ownership threshold for directors under the share ownership guidelines of the Corporation. Fees paid are inclusive of the time required preparing for Board or committee meetings.

The DSUs are included in the share ownership requirements for a Director.

12

The Compensation Committee, as one of its primary responsibilities, reviews and approves compensation to directors who provide ongoing day-to-day management services to the Corporation. No annual retainer, meeting fees or other form of director fees are paid to such directors. The compensation paid to Messrs. N.M. Edwards and S.W. Laut is reported in the Summary Compensation Table for Named Executive Officers on page 43. Fees paid to non-management directors for 2017 are reported in the table below.

Name | Fees Earned | Share Based Awards | Option Based Awards | Common Share Retainer(1)(2) | Pension Value | All Other Compensation(3) | Total | |||||||||||||||

C.M. Best | $ | 102,000 | $ | – | $ | – | $ | 165,697 | $ | – | $ | – | $ | 267,697 | ||||||||

T.W. Faithfull | 77,500 | – | – | 165,697 | – | 16,000 | 259,197 | |||||||||||||||

G.A. Filmon | 75,500 | – | – | 165,697 | – | 12,000 | 253,197 | |||||||||||||||

C.L. Fong | 79,500 | – | – | 165,697 | – | – | 245,197 | |||||||||||||||

G.D. Giffin | 106,000 | – | – | 165,697 | – | 16,000 | 287,697 | |||||||||||||||

W.A. Gobert | 87,500 | – | – | 165,697 | – | – | 253,197 | |||||||||||||||

F.J. McKenna | 89,000 | – | – | 165,697 | – | 16,000 | 270,697 | |||||||||||||||

D.A. Tuer | 80,000 | – | – | 165,697 | – | – | 245,697 | |||||||||||||||

A.M. Verschuren | $ | 80,000 | $ | – | $ | – | $ | 165,697 | $ | – | $ | 16,000 | $ | 261,697 | ||||||||

| ||||||||||||||||||||||

- (1)

- The amount shown represents the cost of Common Shares purchased on the TSX as the equity portion of the 2017 fees paid to directors.

- (2)

- Messrs. T.W. Faithfull and F.J. McKenna participate in the DSU Plan and receive the equivalent number of DSUs in lieu of shares for the equity portion of directors' fees which are given the same value as the Common Shares purchased for the other directors. As of January 1, 2018, Mr. C.L. Fong and Ms. A.M. Verschuren became participants in the DSU Plan. Mr. G.A. Filmon ceased to be a participant in the DSU Plan effective January 1, 2017.

- (3)

- The amount shown was paid to a director whose principal place of residence is outside the Province of Alberta and who attended meetings in person in 2017.

13

The Board of Directors of the Corporation, upon the recommendation of the Audit Committee of the Board of Directors, has selected the firm of PricewaterhouseCoopers LLP ("PwC") to be nominated at the Meeting for re-appointment as the Corporation's independent auditors for the ensuing year at remuneration to be fixed by the Audit Committee of the Board of Directors. Before PwC was recommended for appointment, the Audit Committee met with management and PwC to review and discuss the proposed fiscal year 2018 audit and non-audit services to be rendered, the relationship of PwC with the Audit Committee, and, the independence of PwC. The Corporation's independent auditor since its inception has been PwC. The Corporation has been advised by PwC that it is the policy of PwC to rotate the senior audit partner for the Corporation at least once every five years. The current senior audit partner for the Corporation has been the senior audit partner for the Corporation for one year.

The Audit Committee of the Board of Directors in 2017 approved specified audit and non-audit services to be performed by PwC. The services provided include: (i) the annual audit of the Corporation's consolidated financial statements and internal controls over financial reporting, reviews of the Corporation's quarterly unaudited consolidated financial statements, audits of certain of the Corporation's subsidiary companies' annual financial statements as well as other audit services provided in connection with statutory and regulatory filings; (ii) audit related services including pension assets, Crown Royalty Statements and in respect of the Athabasca Oil Sands Project ("AOSP") acquisition; (iii) tax services related to expatriate personal tax and compliance and other corporate tax return matters; and (iv) non-audit services related to expatriate visa application assistance and to accessing resource materials through PwC's accounting literature library. Fees accrued to PwC are shown in the table below.

Fees Accrued to Auditors PricewaterhouseCoopers LLP

Services | Fiscal 2017 | Fiscal 2016 | |||||

Audit | $ | 2,960,000 | $ | 2,512,000 | |||

Audit Related | 574,000 | 246,000 | |||||

Tax Related | 470,000 | 410,000 | |||||

Other | 52,000 | 62,000 | |||||

Total Accrued Fees | $ | 4,056,000 | $ | 3,230,000 | |||

| |||||||

Additional disclosure regarding the Audit Committee and its members is contained in the Corporation's Annual Information Form under "Audit Committee Information".

14

NON-BINDING ADVISORY VOTE ON APPROACH TO EXECUTIVE COMPENSATION

The Corporation is once again providing you with an opportunity to advise us of your view on its approach to executive compensation through a non-binding advisory vote ("Say On Pay"). Our compensation policies and procedures are centered on a pay-for-performance philosophy and aligned with the long term interests of our shareholders. With a pay mix heavily weighted towards at-risk incentive pay (short-term incentives comprised of annual cash incentive awards and long-term incentives comprised of stock options), our compensation program is designed to:

- •

- Reward the creation of long-term shareholder value.

- •

- Reflect short-, mid- and long-term corporate performance.

- •

- Maintain an appropriate balance between base salary and short-term and long-term incentive opportunities, with a distinct emphasis on compensation that is "at risk".

- •

- Be competitive, so as to attract and retain talented individuals.

- •

- Encourage share ownership by employees.

- •

- Align the pay-for-performance approach to executive compensation to the long-term interests of the shareholders.

In deciding how to vote on this proposal, the Compensation Committee encourages you to read the "Letter to Shareholders" from the Compensation Committee and the "Compensation Discussion and Analysis" sections beginning on page 16 for a detailed description of our executive compensation programs, the compensation decisions the Compensation Committee has made under these programs and the factors considered in making these decisions.

Although this is an advisory vote, and the results will not be binding on the Compensation Committee or the Board of Directors, the results of the vote will be taken into consideration by the Compensation Committee in determining its approach to executive compensation in the future. At the last Annual General Meeting on May 4, 2017, shareholders supported the Corporation's approach to executive compensation, with 95.4% of the votes cast in favour of the resolution.

The Board of Directors unanimously recommends that you vote in favour of the proposed resolution on the Corporation's approach to executive compensation. The persons designated in the enclosed Voting Instruction Form or Form of Proxy, unless instructed otherwise, intend to vote FOR the resolution.

Shareholders will be asked, at the Meeting, to approve the following resolution:

"BE IT RESOLVED, AS AN ORDINARY RESOLUTION OF THE SHAREHOLDERS OF THE CORPORATION, THAT:

1. On an advisory basis and not to diminish the role and responsibilities of the Board of Directors or that of the Compensation Committee, the shareholders accept the approach to executive compensation as described in the "Compensation Discussion and Analysis" section of the Information Circular dated March 14, 2018 and delivered in advance of the 2018 Annual General Meeting of Shareholders."

Management is not aware of any matters to come before the Meeting other than those set forth in the Notice of Meeting. If other matters properly come before the Meeting, it is the intention of the persons named in the form of proxy to vote the same in accordance with their best judgment in such matters.

15

II. INFORMATION RESPECTING EXECUTIVE COMPENSATION

LETTER TO SHAREHOLDERS FROM THE COMPENSATION COMMITTEE

Dear Fellow Shareholders:

The following Compensation Discussion and Analysis (the "CD&A") details the compensation paid to your company's executives in 2017. The discussion also gives you comprehensive information on your company's pay-for-performance, governance practices and performance culture – one of entrepreneurialism, with a focus on and maximizing shareholder value over the long-term.

Canadian Natural had a transformational year in 2017 with the completion of Horizon Phase 3 and the acquisition of a 70% direct and indirect interest in the AOSP and completing its targeted transition to a long life low decline asset base. The Corporation continued to execute on its strategy of balanced capital allocation through economic resource development, increased balance sheet strength, opportunistic acquisitions and increased returns to shareholders. The Compensation Committee (the "Committee") carefully considered the performance of the Company given the economic realities faced by the industry, the strong support (95%) of the Say On Pay vote cast by you in 2017, and the emerging trends in executive compensation in making their assessment of this year's executive compensation. In light of the enhancements adopted by the Corporation in 2016, the Committee also evaluated the overall compensation structure to ensure that executive compensation remains strongly aligned with your interests as shareholders.

We continue to pay for performance. Canadian Natural assessed corporate performance under four categories: 1) financial, 2) strategic, 3) operational, and 4) safety, asset integrity and environmental. Performance under each of these categories is assessed through testing specific metrics against a target performance range and/or a benchmark determined by prior period performance. In 2017, the Committee enhanced the benchmarks for safety, asset integrity and environmental to better reflect the size of the Corporation and its increasing production profile. The chosen metrics align with the Corporation's strategy, guidance provided to shareholders and overarching goal of continuous improvement and sustainable long-term value-creation for its shareholders.

With respect to compensation for the Named Executive Officers ("NEOs"), we:

- (i)

- maintained a structured approach in establishing total compensation to be awarded to NEOs;

- (ii)

- reviewed the performance metrics and the weightings assigned to each metric;

- (iii)

- reviewed year over year performance and 2017 performance relative to established targets;

- (iv)

- reviewed the one, three and five year total shareholder return ("TSR"); and

- (v)

- reviewed the peer group, the rationale for the choice of peers, peer pay practices and compensation levels and confirmed our position amongst those peers and considered other relevant factors.

The Committee also fulfilled its mandate including the review and approval of the executive succession plans as outlined on page 21.

2017 PERFORMANCE

We evaluated Canadian Natural's performance relative to our May 31, 2017 guidance. With the announcement of the AOSP transaction in early March, the impact of the transaction was a material change from the original 2017 issued budget and represented a more meaningful benchmark of the Corporation's performance going forward. Throughout 2017, commodity prices continued to be

16

challenged. The Corporation continued its focus on optimizing its operations to reduce its overall cost structure, targeting effective and efficient operations across all segments of its business. Overall in 2017, the Corporation accomplished strong operational execution, while maintaining a focus on improving its safety and environmental performance, resulting in strong financial results in relation to its established goals:

- •

- Financial: Canadian Natural met all of its financial targets for 2017, with improved funds flow from operations, a significantly improved debt to EBITDA metric and increased return metrics in higher ROE and ROACE. Debt to book capitalization results were achieved within the Corporation's 25 – 45% targeted range, even after incorporating the impacts of the AOSP acquisition.

- •

- Strategic: Canadian Natural continued to execute on its defined plan, with the ongoing transition to a long life low decline asset base. The Corporation successfully completed construction of the Horizon Phase 3 expansion and subsequently ramped up production on schedule and slightly ahead of its targeted production volumes for December 2017 of 240,000 bbl/d. In 2017, Canadian Natural further increased the robustness of its funds flow generation with the successful completion of the transformational AOSP acquisition. This acquisition brought immediate value, while bolstering the Corporation's light crude oil mix and further increasing the Corporation's long life low decline asset base. Later in the year, the Corporation added to its long life low decline assets with the acquisition of contiguous lands and operations at its world class Pelican Lake asset. Additionally, Canadian Natural was able to return significant value to shareholders through its 17th consecutive year of dividend increases.

- •

- Operations: In 2017, the Corporation achieved overall production of approximately 962 MBOE/d before royalties and operating costs of $15.87/BOE, both of which were well within previously issued guidance. The large increase in production over 2016 levels was driven by a full year of Phase 2B production from Horizon and 7 months of production from the newly acquired AOSP assets.

- •

- Safety, asset integrity and environmental: The Corporation performed very well on its overall safety, asset integrity and environmental performance in 2017. The Corporation outperformed on recordable injury frequency and performed on pipeline leaks, Greenhouse Gas ("GHG") emissions intensity and total lost time injury frequency.

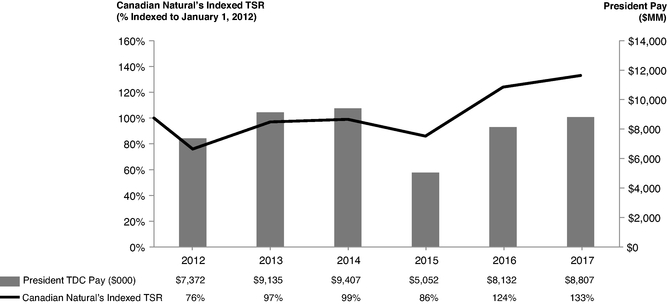

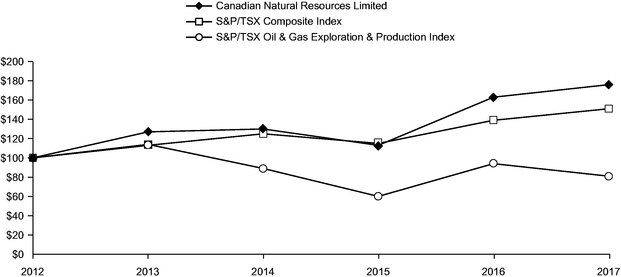

The Committee reviewed Canadian Natural's TSR performance: the absolute 1 year TSR was 8%, the 3 year TSR was 35% and the 5 year TSR was 76%. Additionally, the Committee reviewed the Corporation's reserves per share growth with Canadian Natural performing well against its peers at 40%, 62%, and 79% reserves per share growth for the 1 year, 3 year, and 5 year periods respectively. Considering commodity prices remained challenged in 2017, the relative TSR and reserves growth delivered by Canadian Natural demonstrates the robustness of the Corporation's assets, the strength of the management team and continued execution of its strategy.

Canadian Natural's 1 year performance as measured by TSR ranked well against its peers, outperforming 10 out of 12 of its peer group. Canadian Natural's 3 year TSR and 5 year TSR were at the 91st percentile relative to its peers. Finally, Canadian Natural outperformed the S&P/TSX Oil and Gas Exploration & Production Index for the 1 year, 3 year and 5 year TSR.

2017 Pay Decisions

As a result of the focus on cost control in the current commodity price environment, Canadian Natural did not increase base salaries again in 2017. In 2015, members of the Corporation's Management Committee took a 19% salary reduction and all other employees experienced salary reductions of up to

17

13%. In recognition of the economic situation facing the Corporation, the Board of Directors also reduced its annual retainer fee by 10% in 2015 and no change has been made since then.

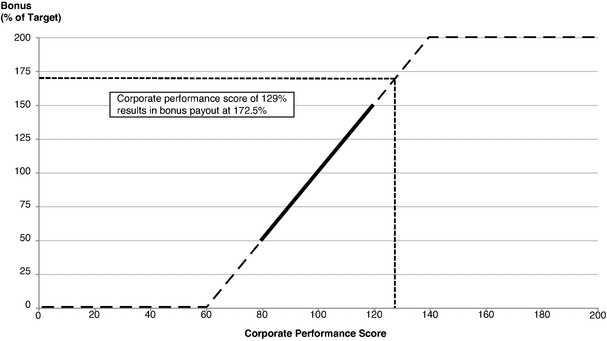

The Committee continually reviews and evaluates elements of the Corporation's compensation package to ensure that it remains competitive, while addressing any expressed concerns of stakeholders. The Committee also recognizes the contributions of executives and employees, notably for the strong operating and strategic performance of the Corporation in a difficult industry environment. The Committee maintained the integrity of the formulaic approach to incentive payments, while utilizing some discretion in recognizing the transformation undertaken by the Corporation in 2017. So, having considered the Corporation's results listed above, the Committee awarded a corporate performance score of 129%, which results in a bonus and PSU award of 172.5% of target. As a result, the Total Compensation for NEOs (excluding Messrs. L.G. Stevens and R.J.H. Doucet) increased on average 11.6%.

We are accountable for ensuring that the links between pay and our business goals are responsible, appropriate and strongly align with your interest as shareholders while mitigating compensation related risks to the Corporation. As always, we welcome comments and feedback from our shareholders.

Submitted by the members of the Compensation Committee:

Frank J. McKenna (Chair)

Catherine M. Best

Wilfred A. Gobert

Annette M. Verschuren

18

COMPENSATION DISCUSSION AND ANALYSIS

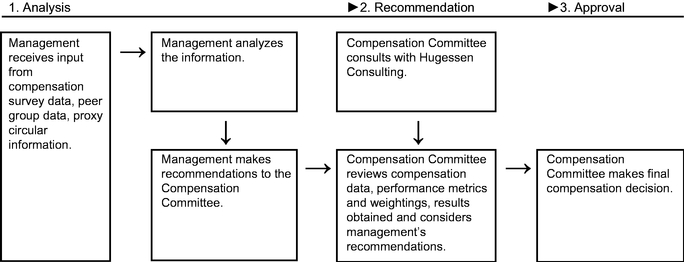

Board of Directors Oversight and Compensation Governance

To oversee the Corporation's compensation practices, the Board of Directors (the "Board") established a Compensation Committee (the "Committee") comprised solely of independent directors.

The Directors who were members of the Committee during 2017 are: Catherine M. Best, Wilfred A. Gobert, Frank J. McKenna (Chair), and Annette M. Verschuren, all of whom are independent and knowledgeable with respect to executive compensation. Collectively, the members of the Committee have expertise in, among other areas, finance, auditing, law and business management. They possess extensive experience in executive compensation acquired through their careers as business executives, directors of other companies and specifically as members of compensation committees, acquiring an in-depth understanding of executive compensation from a diverse array of industries which provided exposure to and experience with varied approaches to executive compensation.

Compensation Committee Mandate

With respect to compensation, the Committee reviews and approves the Corporation's compensation philosophy and programs for executive officers, including the Corporation's Named Executive Officers, and employees of the Corporation. The Committee sets the compensation paid to each of the Corporation's executive officers; the overall compensation paid by the Corporation to its employees; the granting of stock options to executive officers and employees; and, approves the compensation paid to the Executive Chair, the Executive Vice-Chair and the President. The Committee's role includes ensuring there is (i) a well-defined link between executive compensation and performance, and (ii) rigor in setting corporate goals and assessing performance.

Risk Considerations

Corporate Risk – The Board has overall responsibility for risk oversight with a focus on the most significant risks facing the Corporation, including strategic, operational, cyber and reputational risks. The Board's risk oversight process builds upon management's risk assessment and mitigation processes, which include reviews of long-term strategic and operational planning; executive development and evaluation; code of conduct compliance, regulatory compliance; safety and environmental compliance; financial reporting and controllership; and information technology and security. Management is responsible for the identification of key business risks, providing for appropriate management of these risks and enforcement through policies and procedures. The Nominating, Governance and Risk Committee assists the Board by reviewing significant enterprise risk exposure not delegated to other Board committees and those steps management has taken to monitor, control and report such exposures.

Compensation Risk – The Committee assists the Board in monitoring the risks associated with the Corporation's compensation program and practices. The Committee, in reviewing and before approving the Corporation's compensation program, considered such risks. Compensation practices do not vary between business units or executives, except for the level and mix of pay that is commensurate with the responsibilities of the position. The compensation program of the Corporation consists of (i) a fixed annual base salary; (ii) a cash bonus, with capped payout, based on the overall performance of the Corporation in meeting specific goals set by the Corporation and the Board (iii) a Performance Share Unit ("PSU") plan with a capped award level that vests annually over a 3 year period provided however that, for members of the Corporation's Management Committee, for grants made after 2016, PSUs vest 3 years from the grant date; and, (iv) common share stock options which have five year vesting provisions with the first 20% not vesting until the first anniversary of the grant date and the final 20% having only one month to be exercised before expiry following vesting on the 5th anniversary of grant date. The Committee concluded that the Corporation's compensation policies do not create an environment where an

19

executive or any individual is encouraged to take excessive risk, but does encourage and reward prudent business judgment and appropriate risk taking over the short and long term without creating risk that is reasonably likely to have a material adverse impact on the Corporation.

Stock Ownership Guidelines and Common Shares Held by Named Executive Officers – The Board adopted Common Share ownership guidelines for officers of the Corporation. The guidelines require Common Share ownership proportionate to the individual's compensation and position which are:

| The Executive Chair, Executive Vice-Chairman, the President and any Chief Operating Officer | 4 times base salary | |

| Senior Vice-President | 2 times base salary | |

| All other Officers | 1 times base salary | |

Under the guidelines, the individual has 3 years from date of hire or appointment as an officer to acquire and hold the required level of Common Share ownership. Common Share ownership includes Common Shares of the Corporation purchased and held within the Corporation's stock savings plan and any other personal holdings of the individual. As of the date of this Information Circular, each officer meets or exceeds the share ownership requirement of the Corporation.

Officers are required to confirm annually their Common Share ownership position and that such position is their beneficial and legal ownership position and has not been hedged or otherwise sold. The following table sets forth as of March 14, 2018, the beneficial ownership and market value of the Common Shares held directly and indirectly by the NEOs:

Name | Number of Common Shares Held | Market Value of Common Shares Held(1) | Share Ownership Requirements (multiple of base salary) | Value of Share Ownership Requirements To Be Met | Meets Share Ownership Requirements | |||||||||||

N. Murray Edwards | 21,273,494 | $ | 824,347,893 | 4 times | $ | 2,268,000 | (2) | Exceeds | ||||||||

Steve W. Laut(3) | 2,357,486 | $ | 91,352,583 | 4 times | $ | 2,268,000 | Exceeds | |||||||||

Tim S. McKay(3) | 1,157,853 | $ | 44,866,804 | 4 times | $ | 1,944,000 | Exceeds | |||||||||

Scott G. Stauth(3) | 155,275 | $ | 6,016,906 | 4 times | $ | 1,560,000 | Exceeds | |||||||||

Darren M. Fichter(3) | 49,513 | $ | 1,918,629 | 4 times | $ | 1,400,000 | Exceeds | |||||||||

Corey B. Bieber | 154,385 | $ | 5,982,419 | 2 times | $ | 700,000 | Exceeds | |||||||||

| ||||||||||||||||

- (1)

- The closing price of the Common Shares on the TSX on March 14, 2018 was $38.75.

- (2)

- As Mr. N.M. Edwards' annual salary is $1, his mandatory, required holdings in 2017 was the same as Mr. S.W. Laut's, being four times his annual salary.

- (3)

- Mr. S.W. Laut became Executive Vice-Chairman of the Corporation effective March 1, 2018 at which time Mr. T.S. McKay became President of the Corporation. Effective January 1, 2018, Mr. S.G.Stauth became Chief Operating Officer, Oil Sands and Mr. D.M. Fichter became Chief Operating Officer, Exploration and Production. In 2017, Mr. Laut was President of the Corporation; Mr. McKay was Chief Operating Officer of the Corporation; Mr. Stauth was Executive Vice-President, Canadian Field Operations; and, Mr. Fichter was Executive Vice-President, Canadian Conventional.

Clawback Policy – The Corporation's clawback policy provides the Committee with the authority to seek re-imbursement of all or any portion of performance based compensation (cash bonus, PSUs and stock options) from any NEO who in the Committee's determination is responsible for a material misrepresentation or misconduct resulting in a restatement of the financial results of the Corporation and was improperly paid such performance based compensation in the year for which the financial misstatement occurred.

20

Anti-Hedging Policy – The Corporation's anti-hedging policy prohibits directors and officers of the Corporation from purchasing any financial instrument that is designed to hedge or offset any decrease in the market value of the Common Shares, including options, prepaid variable forward contracts, equity swaps, collars and exchange funds. The policy does not prohibit pledging securities as collateral for loans, nor does it prohibit holding the Corporation's securities in broker margin accounts.

Independent Advice – The Committee has engaged the independent consulting firm Hugessen Consulting Inc. ("Hugessen") since 2013. Hugessen's mandate is to support the Committee, developing principles related to disclosure and shareholder engagement, and to advise the Committee on the structure of the Corporation's executive compensation and management's compensation recommendations. In carrying out their mandate, Hugessen has had direct access to the Chair of the Committee, the other Committee members and with management, as required. The Corporation paid for Committee consulting services provided as indicated in the table below.

| 2017 | 2016 | ||||||

Executive Compensation Related Fees | $ | 24,783 | $ | 28,407 | |||

All Other Fees | – | – | |||||

Total Fees | $ | 24,783 | $ | 28,407 | |||

| |||||||

Succession Planning – The Corporation does not have a chief executive officer but has a Management Committee comprised of seventeen members of the management group including the Executive Chair, Executive Vice-Chairman, the President, the Chief Operating Officers and the Chief Financial Officer and Senior Vice-President, Finance. The Management Committee structure is an effective leadership and accountability driven organizational structure and has kept pace with the expansion and increased complexity of operations. This management structure (1) limits the ability of any one individual to unduly influence the direction of the Corporation as consensus of other members of the Management Committee must be achieved; (2) enables the continuation of the strong leadership of the Corporation should a member of the management team leave the Corporation; and (3) enhances management development in learning key decision making strategy, skills and leadership and secures management succession.

The Corporation has developed a strong culture of promoting from within. As part of succession planning, management at least annually reviews each executive position and evaluates the qualification and experience needed to succeed in the position. Each member of the corporate Management Committee evaluates their direct reports and from that evaluation identifies up to 3 possible candidates for succession. Through the evaluation, the strengths of each candidate and required areas of development are identified and a development plan created to ensure the candidate will be ready to succeed the incumbent. The approximate length of time required before the candidate is ready to assume the role is also a factor in the evaluation. Senior management presents a recommendation of the executive succession plans, including the detailed succession planning logs completed by management, to the Compensation Committee for its review, consideration and approval.

21

Retirement – The Corporation has implemented a matrix on what constitutes "Normal Retirement Age" to better reflect work force demographics. In the event an individual retires from their employment with the Corporation, the following matrix would be applied to the vested and unvested portions of any grants made to the individual in respect of the Corporation's Performance Share Unit Plan and Stock Savings Plan.

| Age at Retirement | Entitlement | |

| <60 years old | Only entitled to vested amounts; no incremental entitlement to unvested amounts | |

|

| |

|

| |

|

| |

| ||

In order to receive the post-retirement entitlements described above, an individual would be subject to a non-compete agreement that would remain in place until after the final vesting of any entitlements under the above matrix.

Peer Group

Compensation levels of the NEOs are compared to similar positions within comparable Canadian peer companies, while a US peer group is used as a secondary point of reference. The Canadian peer group of companies is chosen from energy industry companies that are of similar size as the Corporation (including comparable oil and gas exploration and production companies), have comparably complex operations, and operate in similar geographical regions. The U.S. peer group of companies is chosen from exploration and production companies that are of similar size as the Corporation, and have comparably complex operations (including operations in geographical regions similar to those in which the Corporation operates). In reviewing the primary peer group in 2017, the Committee determined the peers to be an acceptable comparative group for Canadian Natural. In reviewing the US based secondary "reference" peer group of companies, the Committee determined the peer group to also be appropriate. In our view, the following companies operate in the same or related industries and are comparable in size and scope of operations to the Corporation, and therefore were deemed reasonable peers to benchmark executive compensation:

22

| FY 2017 Net Revenue (C$B) | Total Enterprise Value (C$B) Dec. 31, 2017 | Production FY 2017 (MBOE/d) | ||||||||

Canadian Natural Resources Limited | $ | 17 | $ | 77 | 962 | |||||

Primary Group (production before royalties) | ||||||||||

Cenovus Energy Inc. | $ | 18 | $ | 23 | 470 | |||||

Crescent Point Energy Corp. | 3 | 9 | 176 | |||||||

Enbridge Inc. | 44 | 167 | N/A | |||||||

Encana Corporation(1) | 6 | 21 | 313 | |||||||

Husky Energy Inc. | 19 | 22 | 323 | |||||||

Suncor Energy Inc. | 32 | 89 | 685 | |||||||

TransCanada Corp. | 13 | 102 | N/A | |||||||

Average of Primary Group | $ | 19 | $ | 62 | 394 | |||||

Secondary Reference Group (production after royalties) | ||||||||||

Anadarko Petroleum Corporation | $ | 15 | $ | 53 | 672 | |||||

Apache Corp. | 8 | 30 | 403 | |||||||

Devon Energy Corporation | 18 | 43 | 543 | |||||||

EOG Resources, Inc. | 15 | 85 | 609 | |||||||

Marathon Oil Corporation | 6 | 24 | 377 | |||||||

Average of Secondary Group | $ | 12 | $ | 47 | 521 | |||||

| ||||||||||

- (1)

- Production reported after royalties.

Note: Source for information above is Bloomberg and public company reports. Amounts in Canadian dollars; translated at average 2017 and year end rates where required.

Compensation Philosophy

Compensation at Canadian Natural is structured to attract, retain and motivate employees and officers, and to encourage a focus on improving corporate performance and an accountability to shareholders. Compensation is comprised of base salary and short-term and longer term performance-conditioned incentive payments. It has worked for our shareholders over the years, and remains aligned with our shareholders' interests:

- •

- Total compensation targeted at the median of similar Canadian oil and gas companies (US peer company pay data is used as a reference only) with base salaries and bonuses that are below the 25th percentile. As Canadian Natural targets a median pay position, but provides low base salaries, the proportion of Canadian Natural's variable pay and pay at risk is high relative to peers.

- •

- Short term incentive metrics are tied to the annual budget and related guidance announced each year.

- •

- A significant proportion of Canadian Natural's compensation is provided through a PSU plan with the grant size based on the prior year's performance.

- •

- The Corporation does not have a pension plan for its NEOs. It has a share savings plan through which the Common Shares are purchased – our culture of share ownership is demonstrated by the high participation rate in the plan (approximately 98% employee participation).

- •

- Canadian Natural does not provide employment agreements to its NEOs and therefore they do not benefit from pre-determined compensation awards in the event of a change of control and/or

23

- •

- Executive compensation risk is mitigated by linking the short term incentive plan ("STIP") and PSUs to the Corporation's annual guidance, performance metrics, the Committee's use of judgment, the NEO's alignment to shareholders through share ownership that is reinforced by ownership guidelines, claw-back and anti-hedging policies as well as succession planning. NEO compensation is further linked to corporate performance by having PSU grants vest using a weighted 3 year average of relative reserves growth per share (1/3) and relative total shareholder return (2/3), both measured against identified industry peers.

loss of position. Commencing in 2016, vesting provisions for equity based compensation granted to the Corporation's Management Committee contain a "double trigger" whereby, in the event of a change in control, an individual must also be terminated without cause as a result of the change of control or within 24 months thereof, in order for such compensation to vest.

Having reviewed market practice, Canadian Natural has refined its approach to target compensation at the median of the larger exploration and production companies based in Canada. While Canadian Natural reviews US compensation levels, the information is provided to the Committee for reference purposes only and has not been considered in the development of executive pay levels.

The Committee believes this target pay level, mix and use of peer group comparisons is appropriate to ensure that overall compensation levels remain competitive to attract and retain quality employees while also ensuring that overall compensation levels do not become excessive. The Committee continually reviews all components of the Corporation's compensation program. The purpose of the review is to ensure the Corporation's compensation program is competitive, reasonable, fair to all of its employees, and overall, in the best interests of the Corporation and its shareholders.

Executive Compensation Pay Structure

Named Executive Officers for 2017

The Corporation does not have a chief executive officer but has a corporate Management Committee which, in 2017, included two members who were also directors of the Corporation, the Executive Chair and the President. Directors who serve on the corporate Management Committee do not receive fees related to serving as a director of the Corporation. Accordingly, the Corporation has determined that its NEOs should include the two members of the corporate Management Committee who, in 2017, were directors, in addition to the Chief Financial Officer and the next three highest paid members of the corporate Management Committee. This includes Mr. T.S. McKay, who became a director on February 27, 2018.

Mr. N.M. Edwards, Executive Chair, is a director and a member of the corporate Management Committee and a significant shareholder of the Corporation. He is paid an annual cash salary of $1 (one dollar) by the Corporation and does not participate in the Corporation's stock savings plan. However, he is compensated relative to other Named Executive Officers with compensation comprised of bonus, PSUs and options to acquire share ownership.

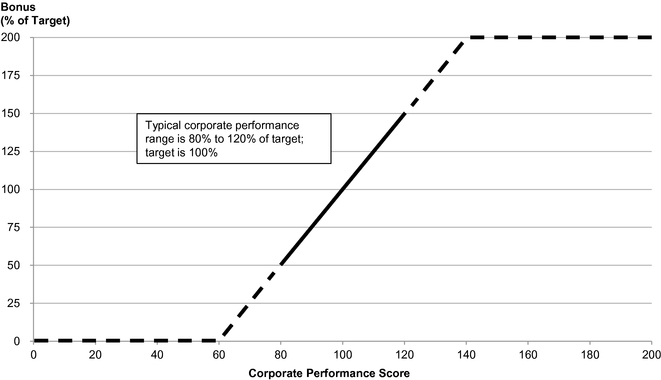

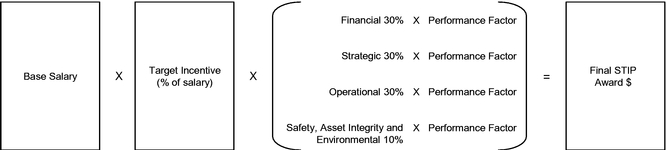

Components of Compensation

1. Base Salary