1 Corporate Update April 2017

2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act, as amended. Statements in this presentation that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things: Apricus’ ability to transition its ex-U.S. assets and rights related to Vitaros to Ferring; the timing and significance of the meeting with the FDA regarding device engineering and compliance; the timing of regulatory submission and approval of Vitaros in the United States, if any; Apricus’ plans for life-cycle development programs for Vitaros; Apricus’ development and partnering plans for RayVa; Apricus’ plans to reduce operating expenses and achieve profitability, including projected 2017 cost savings; and Apricus’ strategic objectives, including efforts to regain compliance with NASDAQ listing standards. Actual results could differ from those projected in any forward-looking statements due to a variety of reasons that are outside the control of Apricus, including, but not limited to: the risk that Apricus fails to provide the transition services as required by the transition services agreement with Ferring; competition in the erectile dysfunction market and other markets in which Apricus operates; Apricus’ ability to obtain FDA and other requisite governmental approval for Vitaros; Apricus’ ability to further develop Vitaros, such as delivery device improvements; Apricus' ability to carry out further clinical studies for Vitaros, if required, as well as the timing and success of the results of such studies; Apricus’ ability to achieve U.S. and EU Orphan Designation for RayVa; the failure to meet NASDAQ continued listing requirements which could result in Apricus’ common stock being delisted from the exchange; Apricus’ ability to retain and attract key personnel; Apricus’ ability to raise additional funding that it may need to continue to pursue its commercial and business development plans; Apricus’ ability to secure an ex-U.S. strategic partner for RayVa; and market conditions. These forward-looking statements are made as of the date of this presentation, and Apricus assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Readers are urged to read the risk factors set forth in Apricus’ most recent annual report on Form 10-K, subsequent quarterly reports filed on Form 10-Q, and other filings made with the Securities and Exchange Commission (SEC). Copies of these reports are available from the SEC’s website at www.sec.gov or without charge from Apricus. Forward-Looking Statements

3 Apricus has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. The registration statement has not yet become effective. Before you invest, you should carefully read the prospectus in the registration statement, together with the information incorporated by reference therein, for more information about Apricus and the offering. You may obtain those documents that are filed for free by visiting EDGAR on the SEC's website at www.sec.gov. Alternatively, you may obtain a copy of the prospectus by calling H.C. Wainwright at (212) 356-0500 or requesting a copy by email at placements@hcwco.com. Disclaimer

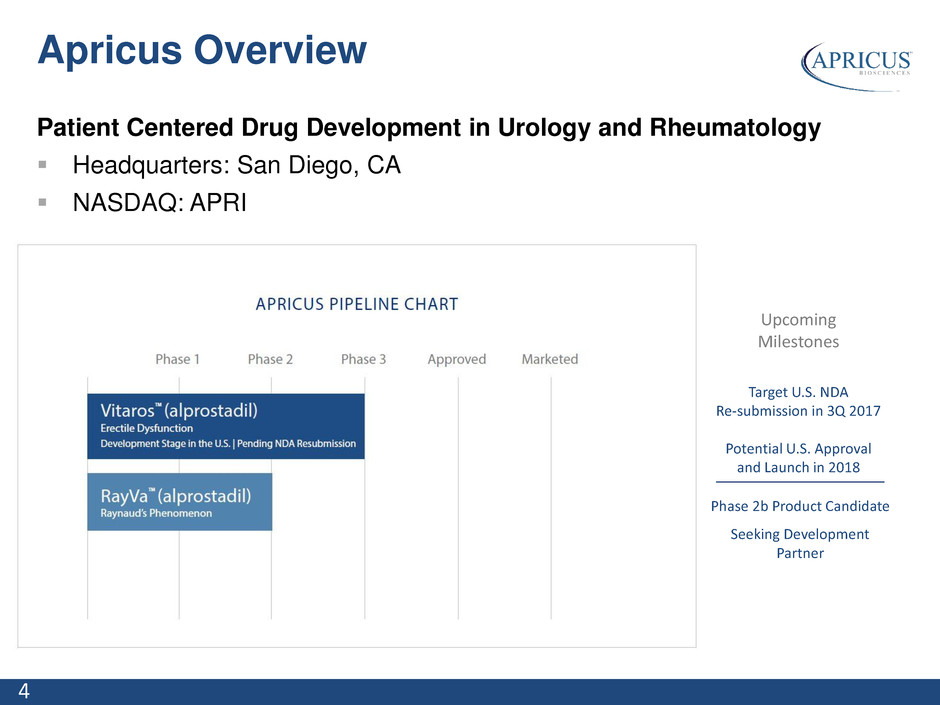

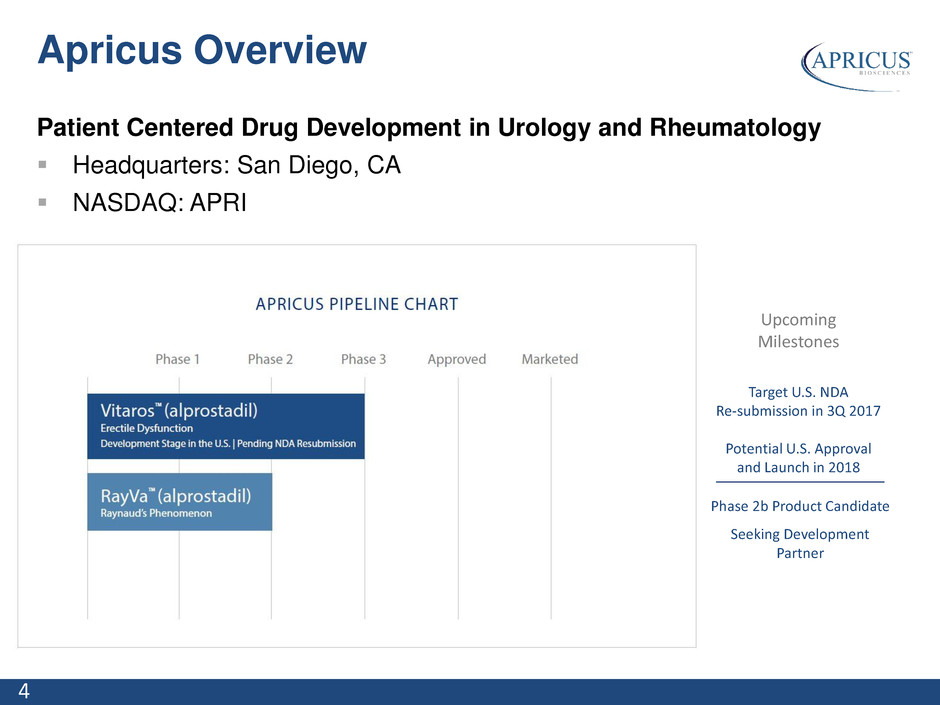

4 Patient Centered Drug Development in Urology and Rheumatology Headquarters: San Diego, CA NASDAQ: APRI Upcoming Milestones Target U.S. NDA Re-submission in 3Q 2017 Potential U.S. Approval and Launch in 2018 Phase 2b Product Candidate Seeking Development Partner Apricus Overview

5 Specialty pharmaceutical company focused on unmet need in urology and rheumatology Novel, capital efficient pipeline with multiple milestones expected in 2017-2018 Potential to partner RayVa Vitaros NDA re-submission targeted for 3Q 2017 Potential Vitaros NDA approval and U.S. Launch in 2018 Recent Developments Sold Vitaros ex-US rights and assets to Ferring in March 2017 Received an upfront payment of $11.5M Eligible to receive up to an additional $1.2M for inventory and transition assistance, subject to certain limitations Received FDA Guidance on Vitaros NDA re-submission in November 2016 Closed on a $3.7M equity offering in September 2016 Apricus Investment Highlights Primary Focus on Vitaros US NDA Re-Submission

6 Corporate Leadership Kleanthis G. Xanthopoulos, Ph.D. Chairman of the Board of Directors Rusty Ray Director Paul V. Maier Director Wendell Wierenga, Ph.D. Director Sandy Smith Director Board of Directors Executive Management Richard Pascoe Chief Executive Officer & Director Brian Dorsey, MSc. SVP, Chief Development Officer Neil Morton, MBA SVP, Chief Business Officer Mary Naggs, JD VP & General Counsel

7 VITAROS™ (alprostadil) First-in-class topical cream for erectile dysfunction

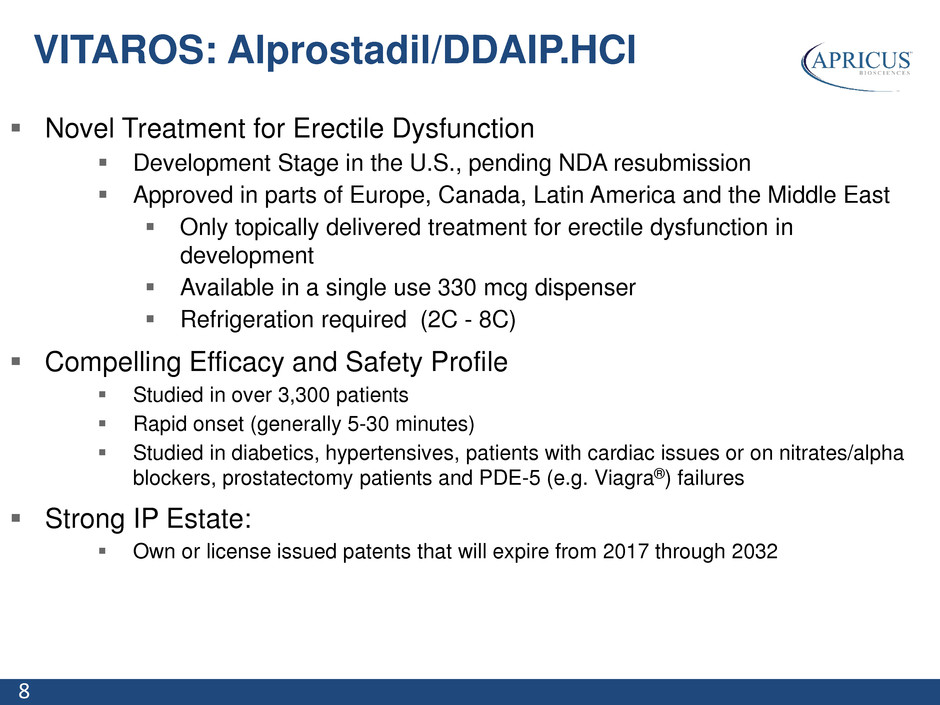

8 Novel Treatment for Erectile Dysfunction Development Stage in the U.S., pending NDA resubmission Approved in parts of Europe, Canada, Latin America and the Middle East Only topically delivered treatment for erectile dysfunction in development Available in a single use 330 mcg dispenser Refrigeration required (2C - 8C) Compelling Efficacy and Safety Profile Studied in over 3,300 patients Rapid onset (generally 5-30 minutes) Studied in diabetics, hypertensives, patients with cardiac issues or on nitrates/alpha blockers, prostatectomy patients and PDE-5 (e.g. Viagra®) failures Strong IP Estate: Own or license issued patents that will expire from 2017 through 2032 VITAROS: Alprostadil/DDAIP.HCl

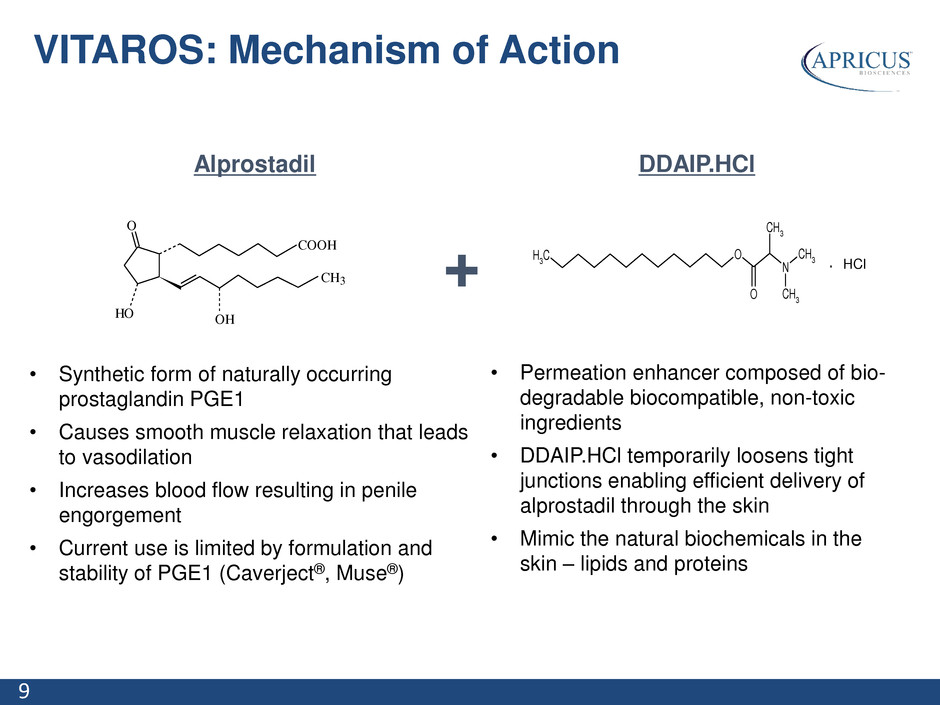

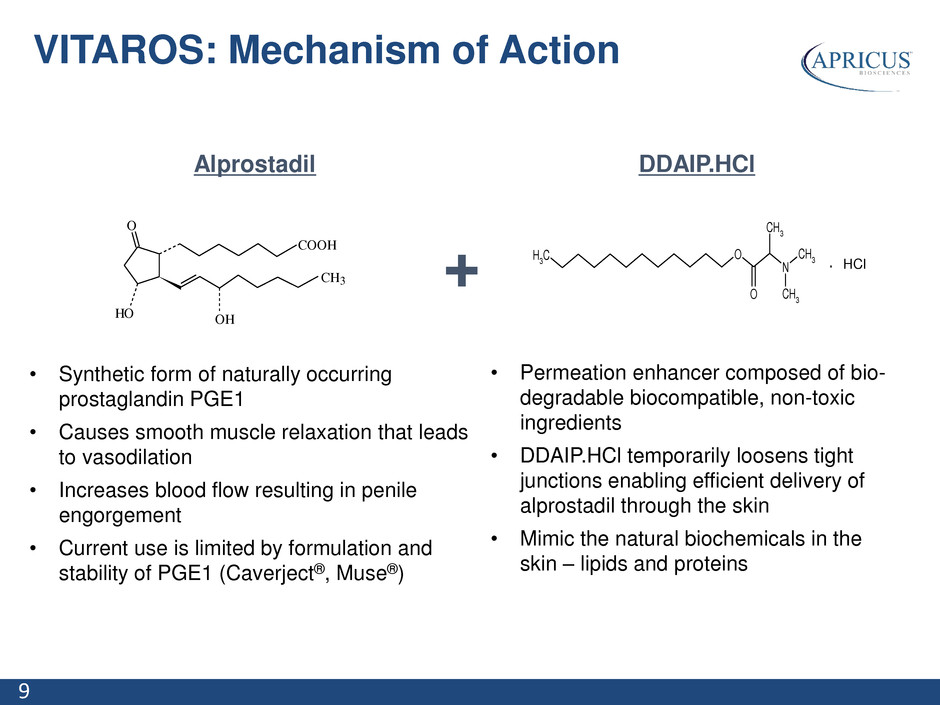

9 Alprostadil • Synthetic form of naturally occurring prostaglandin PGE1 • Causes smooth muscle relaxation that leads to vasodilation • Increases blood flow resulting in penile engorgement • Current use is limited by formulation and stability of PGE1 (Caverject®, Muse®) DDAIP.HCl • Permeation enhancer composed of bio- degradable biocompatible, non-toxic ingredients • DDAIP.HCl temporarily loosens tight junctions enabling efficient delivery of alprostadil through the skin • Mimic the natural biochemicals in the skin – lipids and proteins + O HO COOH CH3 OH O N CH 3 O CH 3 CH 3 CH 3 HCl. HCl VITAROS: Mechanism of Action

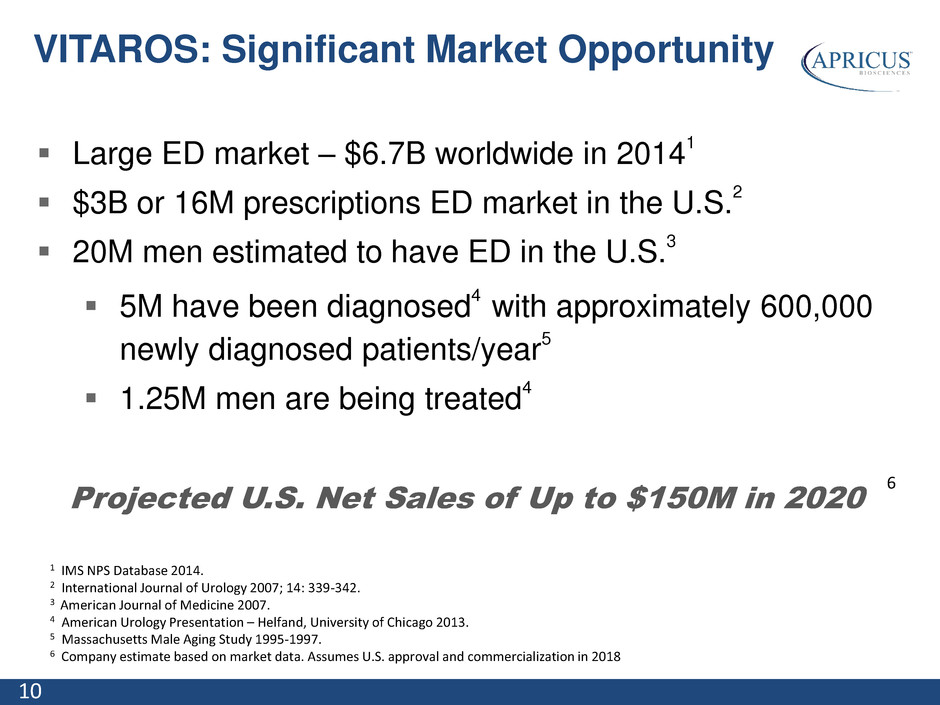

10 Large ED market – $6.7B worldwide in 20141 $3B or 16M prescriptions ED market in the U.S.2 20M men estimated to have ED in the U.S.3 5M have been diagnosed4 with approximately 600,000 newly diagnosed patients/year 5 1.25M men are being treated4 1 IMS NPS Database 2014. 2 International Journal of Urology 2007; 14: 339-342. 3 American Journal of Medicine 2007. 4 American Urology Presentation – Helfand, University of Chicago 2013. 5 Massachusetts Male Aging Study 1995-1997. 6 Company estimate based on market data. Assumes U.S. approval and commercialization in 2018 6 VITAROS: Significant Market Opportunity Projected U.S. Net Sales of Up to $150M in 2020

11 Vitaros™ is a non-PDE-5 treatment for patients who: Want a faster acting and on-demand treatment Patients who prefer a locally acting treatment instead of an oral treatment Are contraindicated due to medications or concurrent diseases (~18%1) Are healthy enough to take the PDE5 inhibitors but quit taking them because they are non-responders (~20%1,2) and Drop out after initial prescription (~31%3) or drop out after 3 years from start (~48%3) VITAROS: Addressing Unmet Need 1 D2 Market Research, June 2007. 2 J Sex Med 2012; 9: 2361–2369. 3 International Journal of Urology 2007; 14: 339-342.

12 Apricus is responsible for all Vitaros development and regulatory efforts in the United States Allergan retains a one-time opt-in right upon FDA approval of an NDA to assume all future marketing and selling activities Apricus paid Allergan $1 million upfront and there is a future $1.5 million regulatory milestone payable to Allergan If Allergan elects to opt-in, Apricus may receive up to a total of $25 million in upfront and potential regulatory milestones, plus a double-digit royalty If Allergan elects to not opt-in, Apricus may commercialize Vitaros itself and will pay Allergan a double-digit royalty Allergan retains the right to launch a future AG under a profit share structure with Apricus Deal Leverages the Strengths of Both Parties VITAROS: Allergan U.S. Deal Summary

13 Summary of Deficiencies Non-Approvable/Complete Response Letter (CRL) received – July 21, 2008 No additional clinical studies required Approvability issues focused on: Possible risk with our permeation enhancer - DDAIP Safety risk to partner Acceptability of fill overage Plan of Action – Shift Benefit/Risk Profile Received FDA feedback on submission strategy in November 2016 in response to Type B Meeting request NDA re-submisson pathway confirmed FDA indicated that our responses to the non-clinical CRL issues will be address as part of the review of our complete response. Additional clinial analysis will be conducted per FDA input in an effort to strengthen clinical meaningfulness Complete drug device human factor test in 2Q 2017 Targeting NDA re-submission in 3Q 2017 Expected six month review VITAROS: U.S. Re-Submission Strategy

14 RAYVA™ (alprostadil) Potential first-in-class topical cream treatment for Raynaud’s Phenomenon Secondary to Scleroderma

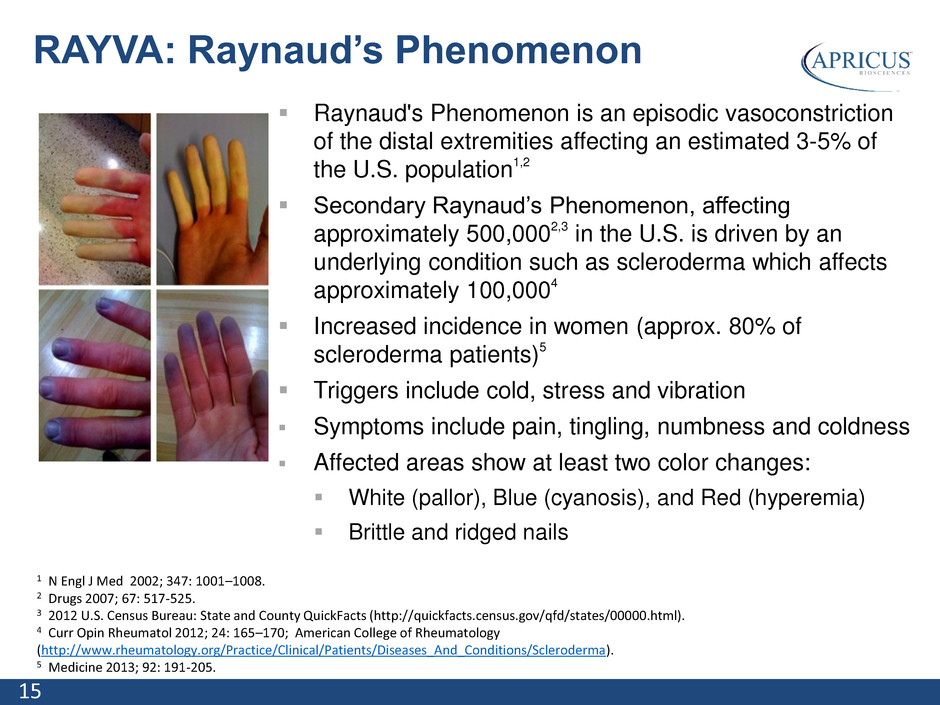

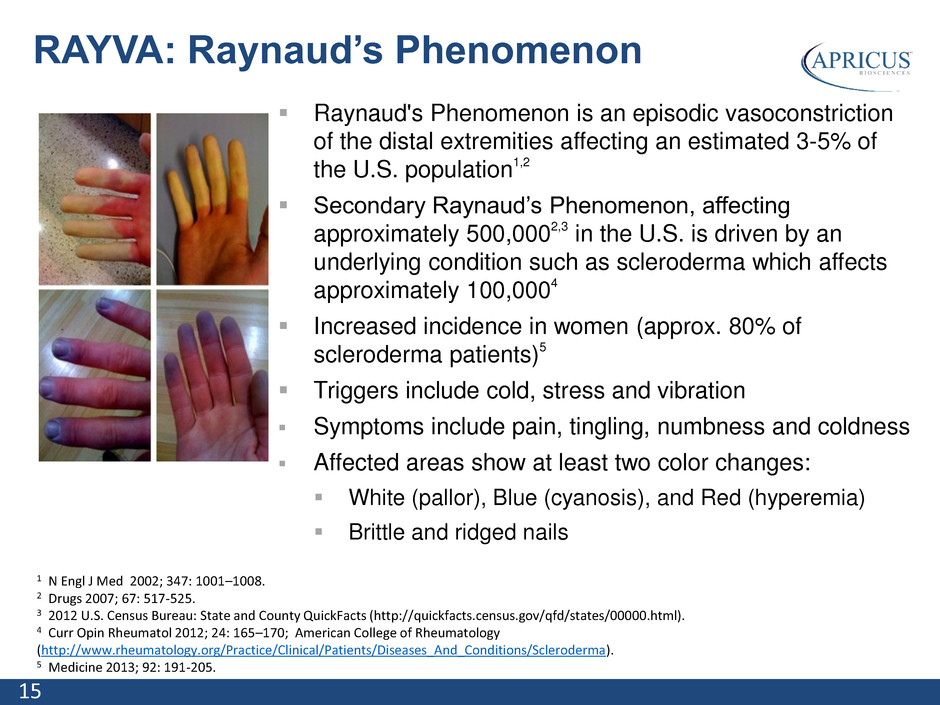

15 Raynaud's Phenomenon is an episodic vasoconstriction of the distal extremities affecting an estimated 3-5% of the U.S. population1,2 Secondary Raynaud’s Phenomenon, affecting approximately 500,0002,3 in the U.S. is driven by an underlying condition such as scleroderma which affects approximately 100,0004 Increased incidence in women (approx. 80% of scleroderma patients)5 Triggers include cold, stress and vibration Symptoms include pain, tingling, numbness and coldness Affected areas show at least two color changes: White (pallor), Blue (cyanosis), and Red (hyperemia) Brittle and ridged nails RAYVA: Raynaud’s Phenomenon 1 N Engl J Med 2002; 347: 1001–1008. 2 Drugs 2007; 67: 517-525. 3 2012 U.S. Census Bureau: State and County QuickFacts (http://quickfacts.census.gov/qfd/states/00000.html). 4 Curr Opin Rheumatol 2012; 24: 165–170; American College of Rheumatology (http://www.rheumatology.org/Practice/Clinical/Patients/Diseases_And_Conditions/Scleroderma). 5 Medicine 2013; 92: 191-205.

16 RayVa – Alprostadil/DDAIP.HCl Topical, on-demand route of administration Increased blood flow observed in preclinical models of Raynaud’s Phenomenon with RayVa, using a cold challenge test Attractive Commercial Opportunity Currently no approved Raynaud’s treatments in the U.S. Targeted call point – only 4,500 rheumatologists treating secondary Raynaud’s patients in U.S.1 Broad IP position with potential exclusivity to 2032 RAYVA: Treatment for Raynaud’s Phenomenon Secondary to Scleroderma (SSc) 1 American Medical Association 2011.

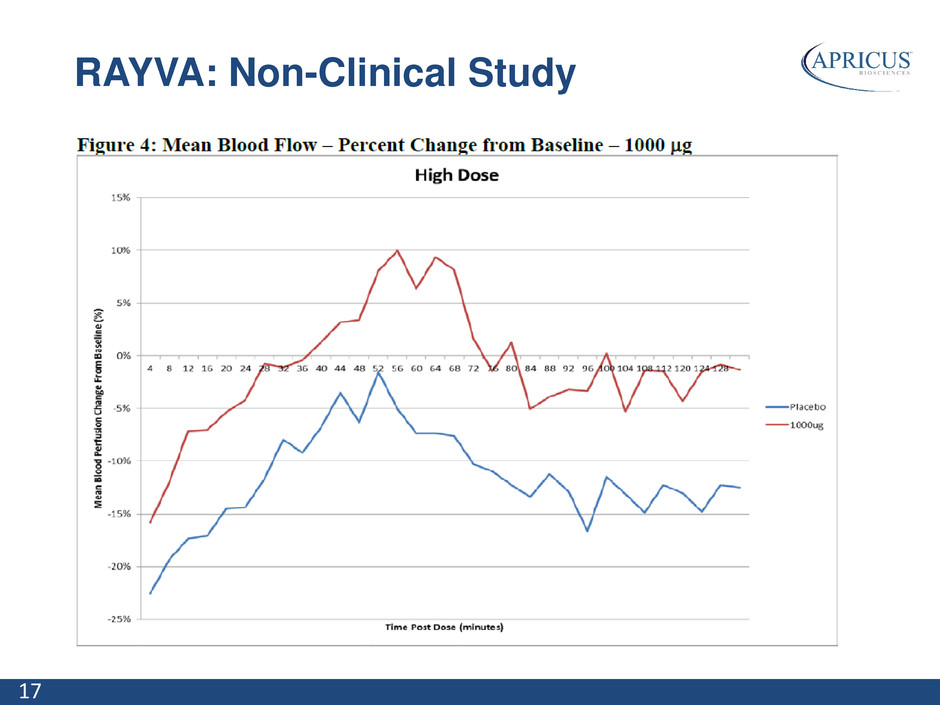

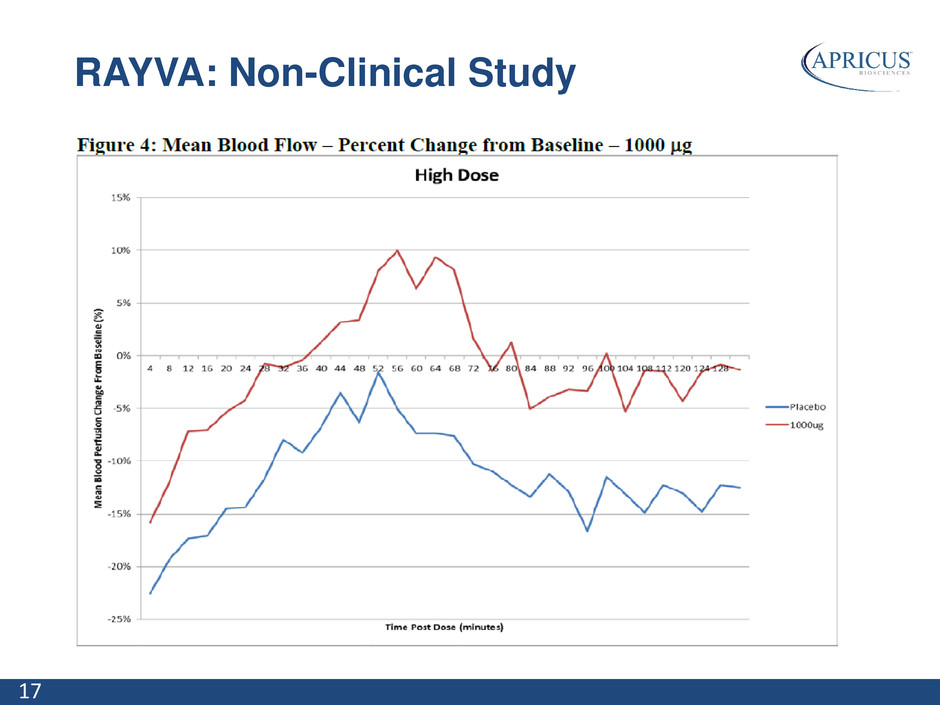

17 RAYVA: Non-Clinical Study

18 Study Design Randomized, double-blind, placebo-controlled, dose-ranging, crossover design; three dose levels (300, 1000 or 3000 μg) Objective assessments of hemodynamics (digital perfusion) and temperature change/recovery (by thermography) after cold challenge Safety and tolerability endpoints Study Results Well tolerated across all doses; no safety issues There were patients in each dose group with improvements in thermography, hemodynamics or both Additional analysis ongoing Did not include an assessment of symptomatic benefit RAYVA: Phase 2a Proof-of-Concept

19 Design Randomized, double-blind, placebo controlled Multi-Center (US and potentially ex-US sites) Assessment of symptomatic benefit in patients with Raynaud’s secondary to scleroderma in a “take home” setting Assessment of safety and tolerability Will likely include an open label extension Next steps Complete formulation development for at-home dosing Finalize Phase 2b study protocol Partner (global or regional) prior to initiating Phase 2b study Active partnering process with multiple parties underway Confirm endpoint(s) selection with FDA RAYVA: Phase 2b Proof-of-Concept

20 Financial Overview

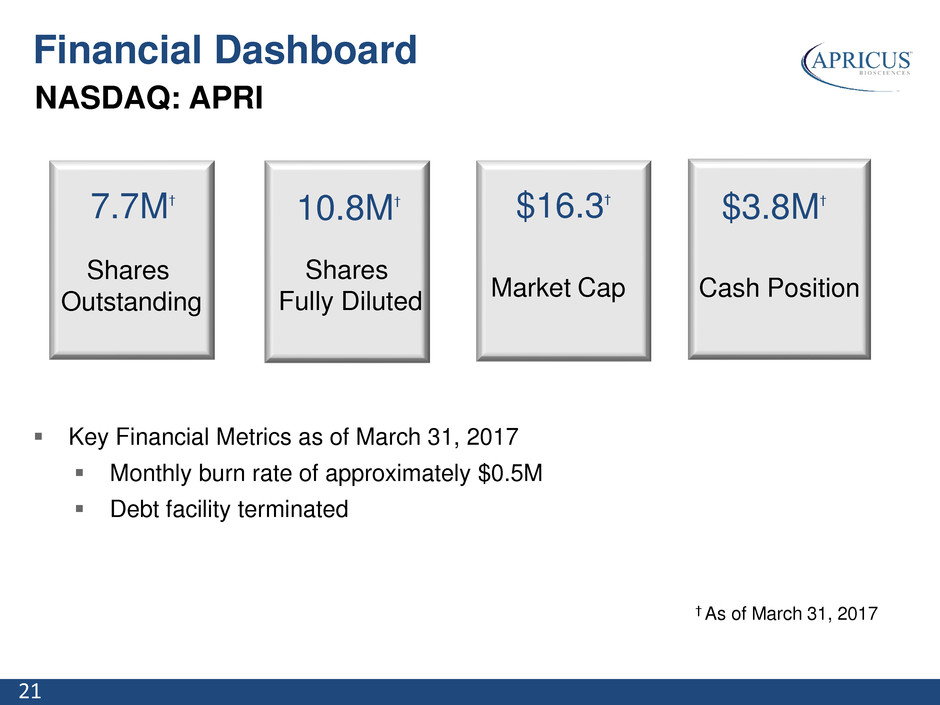

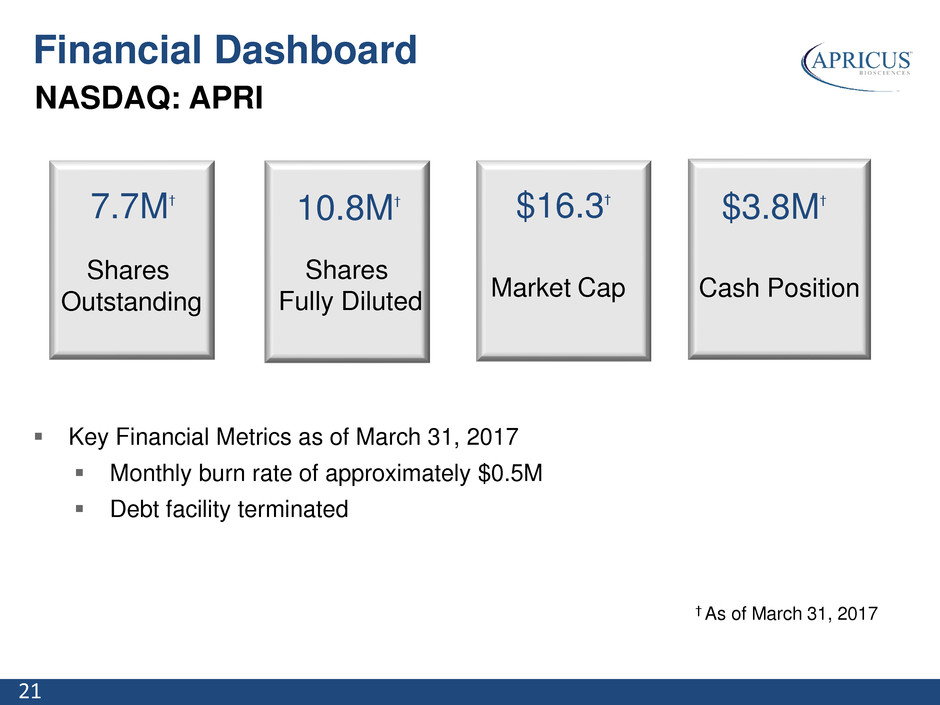

21 NASDAQ: APRI † As of March 31, 2017 7.7M† Shares Outstanding 10.8M† Shares Fully Diluted $16.3† Market Cap $3.8M† Cash Position Key Financial Metrics as of March 31, 2017 Monthly burn rate of approximately $0.5M Debt facility terminated Financial Dashboard

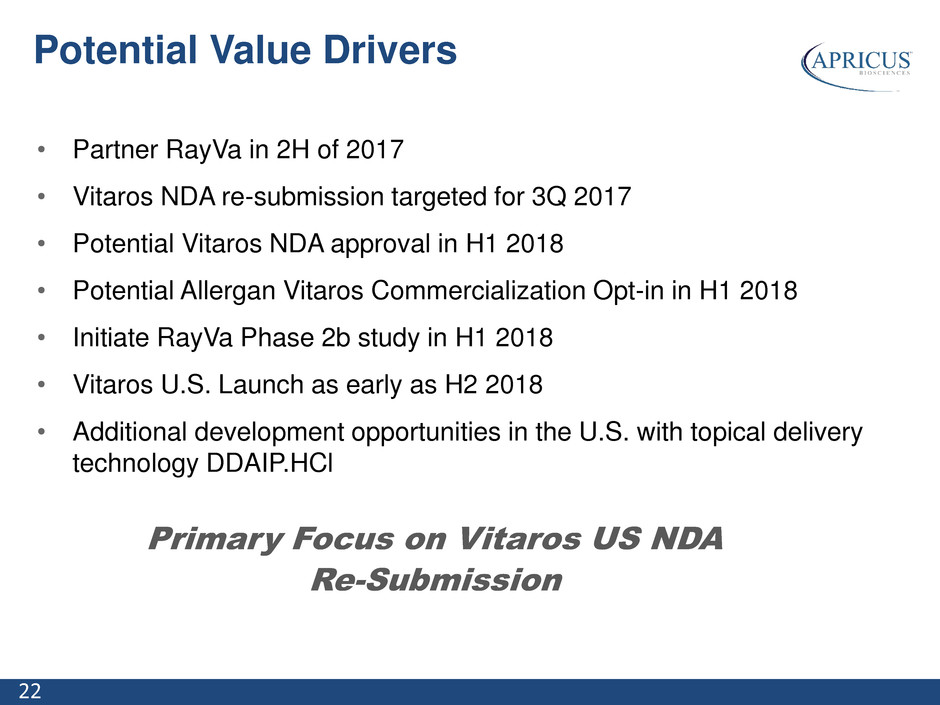

22 • Partner RayVa in 2H of 2017 • Vitaros NDA re-submission targeted for 3Q 2017 • Potential Vitaros NDA approval in H1 2018 • Potential Allergan Vitaros Commercialization Opt-in in H1 2018 • Initiate RayVa Phase 2b study in H1 2018 • Vitaros U.S. Launch as early as H2 2018 • Additional development opportunities in the U.S. with topical delivery technology DDAIP.HCl Potential Value Drivers Primary Focus on Vitaros US NDA Re-Submission

23 Corporate Update April 2017