AUTHORIZED SHARE INCREASE PROPOSAL

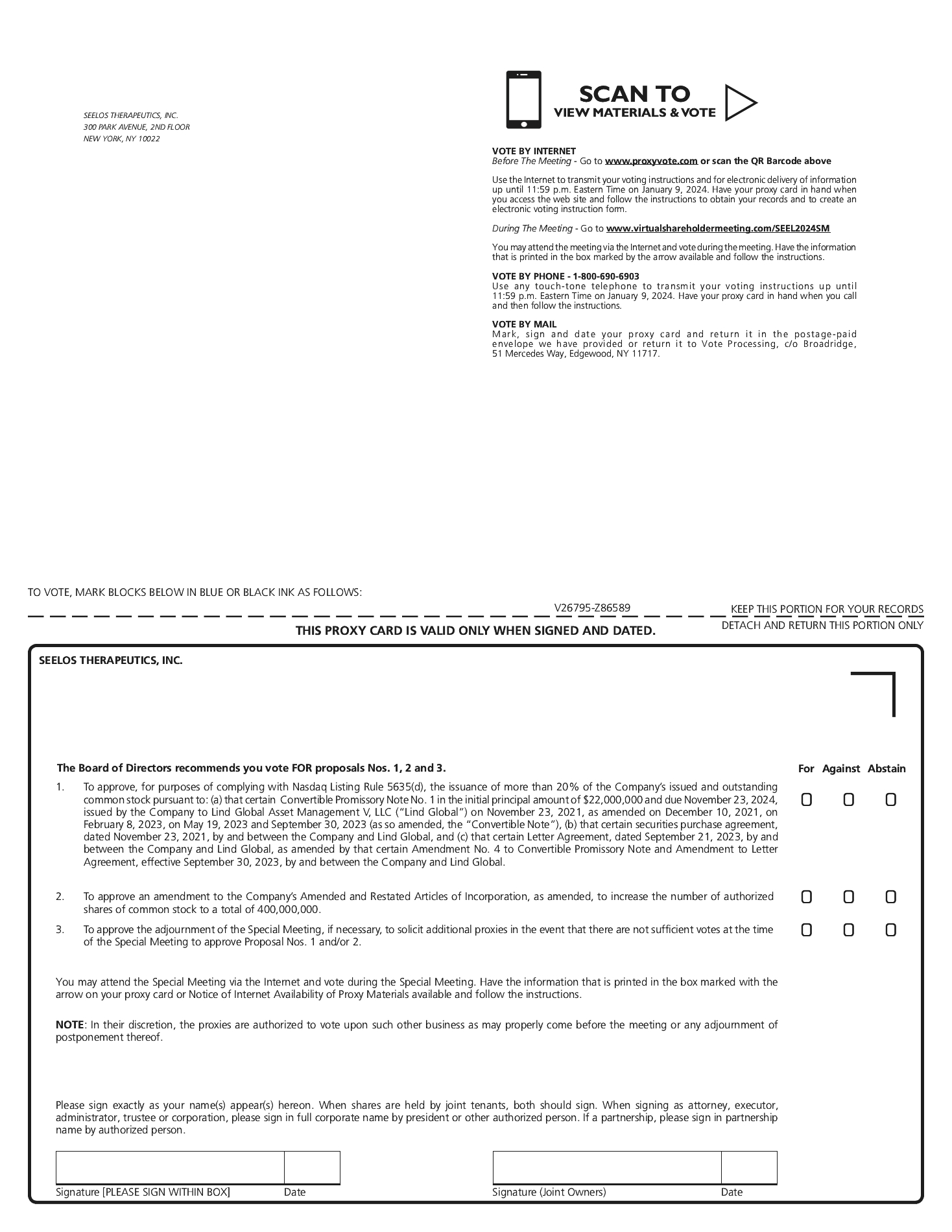

Our stockholders are being asked to approve an amendment to our Amended and Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase the number of authorized shares of Common Stock. On November 30, 2023, the Board approved a proposal to amend the Articles of Incorporation to increase the number of authorized shares of Common Stock from 16,000,000 shares to 400,000,000 (the “Share Increase”). On November 28, 2023, we effected the Reverse Stock Split under Nevada Revised Statutes (“NRS”) 78.207, which required a corresponding and proportional decrease in the number of authorized shares of Common Stock from 480,000,000 shares to 16,000,000 shares. As of the close of business on the Record Date, there were 9,794,594 shares of Common Stock issued and outstanding, and 6,176,468 shares of Common Stock were reserved for issuance under long-term equity incentive plans, the employee stock purchase plan, the Convertible Note and warrants to purchase Common Stock. Accordingly, of the total number of shares of Common Stock currently authorized under our Articles of Incorporation, 28,938 shares of Common Stock remain available for issuance or may be reserved for issuance.

Form of the Amendment

The proposed amendment (the “Amendment”) to our Articles of Incorporation would amend Paragraph A of Article FIFTH of our Articles of Incorporation to read in its entirety as follows:

“FIFTH: A. The total number of shares of all classes of stock which the Corporation shall have authority to issue is four hundred and ten million (410,000,000), consisting of four hundred million (400,000,000) shares of Common Stock, par value one-tenth of one cent ($0.001) per share (the “Common Stock”), and ten million (10,000,000) shares of preferred stock, par value one-tenth of one cent ($0.001) per share (the “Preferred Stock”).”

Background and Reasons for the Share Increase

Our Articles of Incorporation currently authorize the issuance of up to 16,000,000 shares of Common Stock and 10,000,000 shares of preferred stock. As of the close of business on the Record Date, there were 9,794,594 shares of Common Stock issued and outstanding, and 6,176,468 shares of Common Stock were reserved for issuance under long-term equity incentive plans, employee stock purchase plan, the Convertible Note and warrants to purchase Common Stock. Accordingly, of the total number of shares of Common Stock currently authorized under our Articles of Incorporation, 28,938 shares of Common Stock remain available for issuance or may be reserved for issuance.

If the Amendment is approved by our stockholders, upon its effectiveness we will have a total of 400,000,000 authorized shares of Common Stock, with 9,794,594 shares of Common Stock issued and outstanding (as of the Record Date), and 6,176,468 shares reserved for issuance under long-term equity incentive plans, the employee stock purchase plan, the Convertible Note and warrants to purchase Common Stock, leaving available 384,028,938 shares of Common Stock authorized and unissued and not reserved for any specific purpose.

The Board recommends that stockholders approve this Amendment. Under applicable Nevada law, the affirmative vote of the stockholders holding a majority of the outstanding shares of Common Stock is required for approval of the Amendment. Abstentions from voting on this proposal and Broker Non-Votes, if any, will have the same effect as a vote against this Proposal No. 2.

Purpose of the Amendment

The Board believes it is in the best interests of the Company and our stockholders to increase the number of authorized shares of Common Stock in order to give the Company greater flexibility in considering and planning for future general corporate needs, including, but not limited to, grants under equity compensation plans, forward or reverse stock splits, financings, potential strategic transactions, as well as other general corporate transactions. The Board believes that having available additional authorized shares of Common Stock will enable the Company to take timely advantage of market conditions and favorable financing and acquisition opportunities that become available to the Company by allowing the issuance of such shares without the expense and delay of holding another stockholder meeting.