One World Holdings, Inc.

418 Bridge Crest Boulevard

Houston, Texas 77082

February 13, 2012

Pamela A. Long

Division of Corporation Finance

United States Securities and Exchange Commission

100 F. Street NE

Washington, D.C. 20549

Re: One World Holdings, Inc.

Registration Statement on Form S-1

Filed November 10, 2011

File No. 333-177992

Dear Ms. Long,

On behalf of One World Holdings, Inc. (the “Company,” “we” and “us”), set forth below are the Company’s responses to the comments of the Staff of the Securities and Exchange Commission (the “Staff”) to the Company’s Registration Statement on Form S-1, filed November 10, 2011. The Staff’s comments were contained in the letter to the Company dated December 7, 2011.

General

| 1. | In response to the Staff’s Comment 1, we do not believe we are a “shell company” as defined in Rule 405 of the Securities Act of 1933. Rule 405 defines “shell company” as follows: |

The term shell company means a registrant, other than an asset-backed issuer as defined in Item 1101(b) of Regulation AB, that has:

1. No or nominal operations; and

2. Either:

| | ii. | Assets consisting solely of cash and cash equivalents; or |

| | iii. | Assets consisting of any amount of cash and cash equivalents and nominal other assets. |

Note: For purposes of this definition, the determination of a registrant's assets (including cash and cash equivalents) is based solely on the amount of assets that would be reflected on the registrant's balance sheet prepared in accordance with generally accepted accounting principles on the date of that determination.

We note that this is an “and” test, not an “or” test. Thus, if a company has more than no or nominal operations, it is not a shell company, regardless of whether it has more than no or nominal assets. We further note that the test is not based upon revenues but upon operations—an important distinction. A company that has more than nominal operations but has not generated revenues is not a shell company within this definition.

In footnote 172 of Release No. 33-8869, the Commission explicitly stated that a start-up company is not a shell company. In the footnote, the Commission addressed the definition of a shell company set forth in Rule 144(i)(1)(i)—which definition is identical to the definition set forth in Rule 405—stating:

Contrary to commenters’ concerns, Rule 144(i)(1)(i) is not intended to capture a “startup company,” or, in other words, a company with a limited operating history, in the definition of a reporting or non-reporting shell company, as we believe that such a company does not meet the condition of having “no or nominal operations.”

We believe we are a start-up company, in the development stage, and we have commenced real operations—well beyond no or nominal operations. We also believe it is likely we have more than no or nominal assets.

The Company has more than no or nominal operations

On July 21, 2011, we entered into and closed a Share Exchange Agreement with The One World Doll Project Inc, a Texas corporation ("OWDP"), and stockholders of OWDP, whereby OWDP became our wholly owned subsidiary. This transaction is described in more detail in the “Corporate History and Background” subsection of our Registration Statement. OWDP is currently our operating subsidiary and has had real operations since February 2011.

We currently have four compensated employees working out of our corporate offices located at 418 Bridge Crest Boulevard, Houston, Texas 77082. Operating activities conducted since February 2011 include, but are not limited to, the following:

| · | We have designed and developed the “Prettie Girls” doll line. The Prettie Girls doll line includes seven different multi-cultural doll designs—Sophia (two versions), Dahlia, Valencia, Kimani, Lena and Alexie (the seventh doll design was completed after our original Registration Statement was filed). All seven designs can be viewed on our website at www.oneworlddolls.com. Our Chief Product Development Officer, Stacey McBride-Irby, leads the design and development process. Ms. McBride-Irby has been a compensated employee of ours since July 2011 and was previously a compensated employee of OWDP since February 2011. This process also included the hiring of a 3D sculptor, a seamstress to create the fashion patterns, a face painter to create the color profile for the doll heads, a graphic designer to develop early packaging artwork and a production consultant to assist with the technical doll design elements. These individuals worked on this project at various times from March 2011 through December 2011. Some of them are still working on an as-needed-basis. |

| · | We have produced the first prototypes of all seven doll designs, which prototypes were fabricated in June and August 2011. Photographs of the prototypes are found on our website. In this process, we (through our third party manufacturer in China, Early Light Industrial Ltd.) also fabricated the molds and other tooling for future manufacturing of the dolls. As of the date of this correspondence, we have produced a total of 14 dolls for market testing and final development in preparation for manufacturing. |

| · | We have engaged Early Light to manufacture our initial inventory of dolls. During May 2011, our Chief Executive Officer, Corinda Joanne Melton, traveled to China where she (i) had meetings with Early Light representatives, (ii) toured Early Light’s production facility, (iii) solidified a production agreement, and (iv) met with a safety standards testing company. We are currently implementing our plan to manufacture and market our line of dolls in the United States. We have invested $70,000 in molds and tooling for the manufacturing process. |

| · | We have designed and developed a company and brand logo, which can be found on our Registration Statement under the subsection “The One World Doll Project.” We have also designed, developed and produced a prototype of packaging for our doll lines. |

| · | We have developed a marketing strategy and sales channels for our product. Our marketing strategies are set forth in detail within the “Description of Business” section of our Registration Statement, including but not limited to the subsections titled “Market Opportunity,” “Target Market,” “Business Strategy,” “Marketing Overview,” “Marketing Objectives,” “Marketing Strategies,” and “Early Pillars of Marketing Campaign.” In this process, we have also met with, negotiated and engaged celebrity spokespeople who have agreed to endorse our products when they are introduced to the market. These meetings took place from January 2011 through September 2011. |

| · | We have designed and launched two commercial quality websites in preparation for our product launch. Our main website, www.oneworldolls.com, went online in December 2010, and the prototype Prettie Girls children’s site, www.prettiegirlsowp.com went online in March 2011. We also created obama2012dolls.com in connection with our “Obama 2012” line of collectors dolls, which went online in April 2011. |

| · | We are currently developing retail sales relationships with major store brands and completing the development of marketing and product materials. Since October 2011, we have had active negotiations with one major retailer and several small retailers. We are also currently receiving reseller applications from potential resellers of our product line. |

| · | Since the inception of OWDP, our management has actively been involved in financing procurement activities to raise capital needed to access the capital markets and prepare for manufacturing. |

| · | We have initiated pre-sales of the “Obama 2012 Prettie Girls” line of dolls, with a customer support system. We are currently actively pursuing pre-sales of the doll, and as of the date of this correspondence, we have received approximately 60 pre-sale orders. |

| · | We have developed and recorded the “Prettie Girls!” theme song. In this process, we contracted a songwriter and other creative staff to develop the song and a recording artist and producer to record the song. The initial version of the recording was finished on April 2011. We also produced an initial music video for the song, which was completed in July 2011, and we are currently producing a remake of this video, for which we are in the process of securing a cartoon producer and director. |

| · | We are actively developing a “Prettie Girls!” coloring book, Facebook pages for each doll, online video games, interactive websites and a “Prettie Girls!” cartoon in anticipation of the release of our dolls. |

The Commission has chosen to not define the word “nominal” as used in the definition of “shell company” in Rule 405—instead, stating in Release No. 33-8587 that the term “is not inappropriately vague or ambiguous.” Generally, “nominal” means existing or being something in name or form but not in reality, or being so small or trivial as to be a mere token. Based on the extent of operations described above in this correspondence and within our Registration Statement, there is no reasonable way to determine that we do not have more than nominal operations. Accordingly, we believe we are not a shell company.

The Company has more than no or nominal assets

Part 2 of the definition of shell company in Rule 405 states that a company is not a shell if it has “Either: i. No or nominal assets; ii.Assets consisting solely of cash and cash equivalents; or iii. Assets consisting of any amount of cash and cash equivalents and nominal other assets.”

As of the date of this correspondence, the Company has approximately $70,000 in non-cash assets. These assets consist of manufacturing equipment, including molds and tooling. While we do not contend that this constitutes an exorbitant amount of non-cash assets, we believe it is reasonable to deem this more than a nominal amount of non-cash assets. As described above, the word “nominal” as used in the definition of “shell company” in Rule 405 is not defined. These molds and tooling will be used to manufacture our dolls, and therefore represent a significant asset for our operations. These non-cash assets are more than “in name only” and beyond a “token” amount of assets. Accordingly, we have more than no or nominal assets.

For the reasons set forth in this response to the Staff’s Comment 1, we believe that we are not a shell company as defined in Rule 405. We have therefore (i) not made any revisions to the disclosure in Amendment No. 1 our Registration Statement indicating that we are a shell company, (ii) not revised our disclosure to indicate that the selling shareholders are underwriters and (iii) not fixed a price for shares offered during the duration of the offering. It should also be noted that in the Staff’s Comment 1, it incorrectly states that “the shares being registered for resale constitute 100% of the company’s shares not held by your directors or officers.” As of the date of filing of Amendment No. 1, we have 58,931,040 shares of common stock issued and outstanding, our directors and officers hold a total of 13,229,687 shares, and a total of 8,236,665 shares are being registered for resale (of which 1,250,000 shares are issuable upon conversion of a convertible debenture and are not currently issued and outstanding). Accordingly, the shares being registered for resale only constitute approximately 17.5% of the shares not held by our directors and officers.

| 2. | In response to the Staff’s Comment 2, we have included a draft of our legal opinion in Amendment No. 1 to our Registration Statement. Subsequently, we will amend our Registration Statement to include the final dated version of the legal opinion. |

| 3. | In response to the Staff’s Comment 3, we have included in Amendment No. 1 financial statements for the period ended September 30, 2011 and have updated the our disclosure throughout the Registration Statement accordingly. |

Calculation of Registration Fee

| 4. | In response to the Staff’s Comment 4, securities are to be offered by the selling stockholders at prices computed upon the basis of fluctuating market prices. Accordingly, for purposes of calculating the registration fee, the most applicable subparagraph of Rule 457 is subparagraph (c). Currently, however, we are not quoted on an exchange or over-the-counter, as we currently lack a public market for our common stock. A market maker has applied to have our stock quoted on the OTC Bulletin Board and the OTC Markets, which application is currently pending. Because we currently lack a public market for our common stock, we have chosen $0.04 per share only for purposes of calculating the registration fee. Although we believe this price is somewhat arbitrary, we have chosen it because we have certain convertible debentures outstanding that are convertible into shares of our common stock at the conversion price of $0.04 per share. These debentures, which we issued from August 2011 through October 2011, are described in more detail in the Registration Statement. We have added additional disclosure in Amendment No. 1 in footnote (1) to the table to reflect our methodology for calculating the registration fee. |

Prospectus Cover Page

| 5. | In response to the Staff’s Comment 5, as described on the cover page, we currently lack a public market for our common stock and have no basis for estimating either the number of shares of our common stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold. Subsequent to the filing of our original Registration Statement, a market maker applied with FINRA to have our stock quoted on the OTC Bulletin Board and OTC Markets. This application is currently pending. |

Prospectus Summary, page 5

| 6. | In response to the Staff’s Comment 6, we have added disclosure in the Prospectus Summary in Amendment No. 1 on page 5. |

| 7. | In response to the Staff’s Comment 7, we have added disclosure in the Prospectus Summary in Amendment No. 1 on page 5. |

| 8. | In response to the Staff’s Comment 8, we have added disclosure in the Summary of the Offering in Amendment No. 1 on page 6. |

| 9. | In response to the Staff’s Comment 9, please note that all of the selling stockholders (except for Michael and Jacquelyn Emmers) received their shares through the Share Exchange Agreement described in the second paragraph of the Prospectus Summary and elsewhere in the Registration Statement. There are no rights attached to the resale shares such as registration rights. We have added disclosure in Amendment No. 1 on page 5 to the Prospectus Summary and the “Selling Stockholders” section on page 34. We previously filed a copy of the Share Exchange Agreement with the original Registration Statement. We have filed a copy of the 14% Convertible Debenture held by Michael and Jacquelyn Emmers as Exhibit 10.4 to Amendment No. 1. |

Risk Factors, page 6

Risks Related to the Company, the Industry and the Offering, page 6

We have limited capital and will need to raise additional capital in the future, page 6

| 10. | In response to the Staff’s Comment 10, we have revised this risk factor in Amendment No. 1 on page 6. |

We will depend on third-party manufacturers…, page 8

| 11. | In response to the Staff’s Comment 11, we have revised this risk factor in Amendment No. 1 on page 9. |

The shares of common stock offered herein have been arbitrarily valued, page 11

| 12. | In response to the Staff’s Comment 12, please see our response to the Staff’s Comment 1. Accordingly, we have not revised this risk factor in Amendment No. 1. |

Description of Business, page 13

General

| 13. | In response to the Staff’s Comment 13, under the subsection titled “Production and Manufacturing” in Amendment No. 1, we have revised and included additional disclosure in the second paragraph and added a fourth paragraph, which disclosure is found on page 20. |

Corporate History and Background, page 13

Business Concept, page 14

The One World Doll Project, page 14

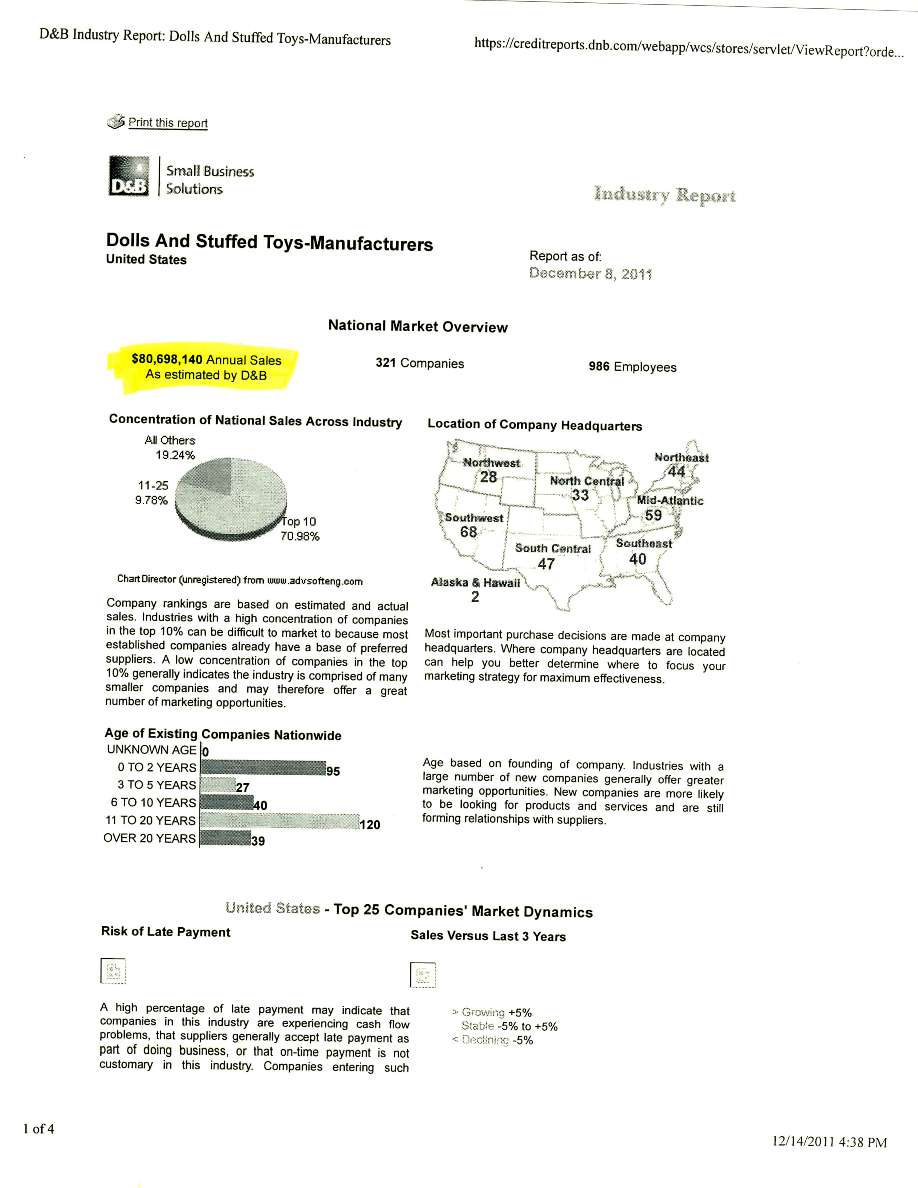

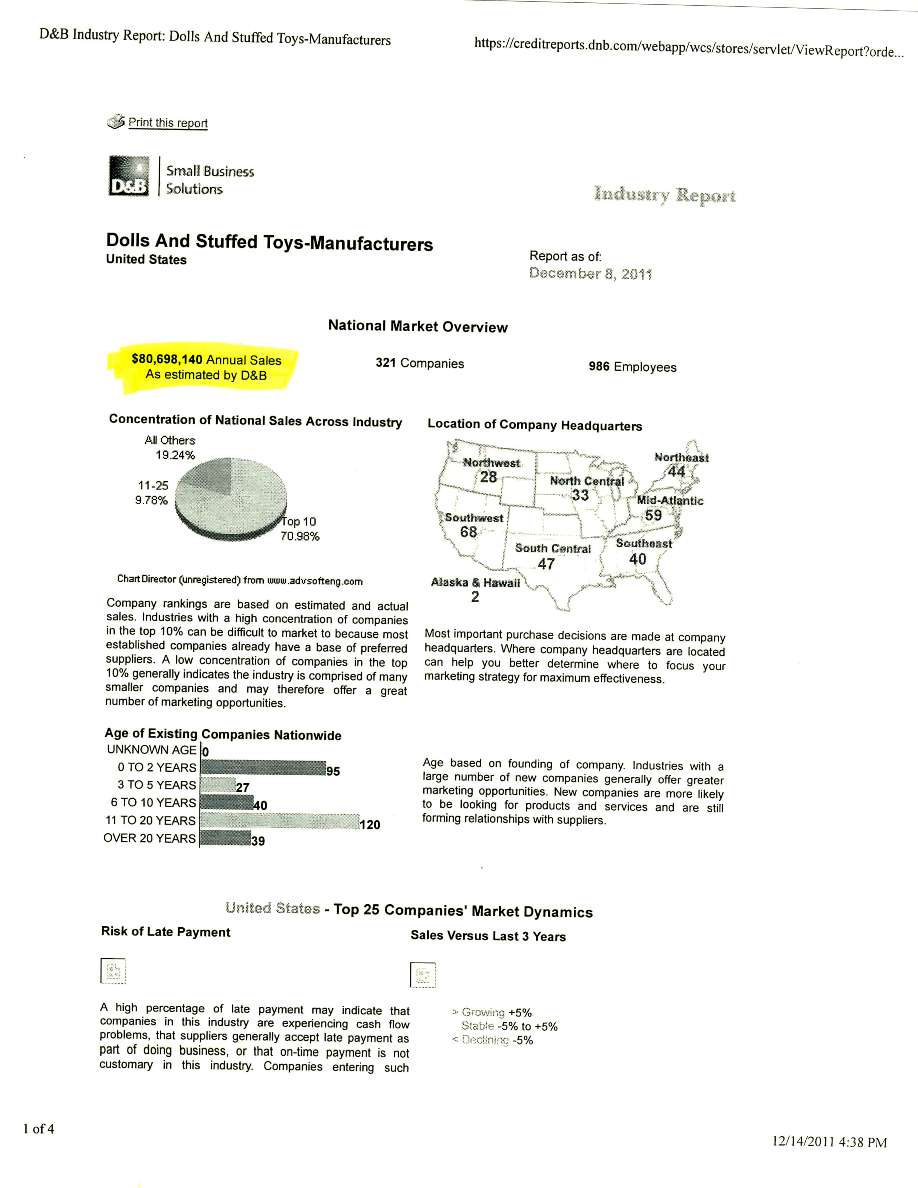

| 14. | In response to the Staff’s Comment 14, we have added a source citation in Amendment No. 1 in the paragraph (on page 14) you referenced in your Comment. Please note that we have changed the disclosure from “$20 billion a year market of dolls and stuffed toys” in the original Registration Statement to “$80 million a year market of dolls and stuffed toys manufacturing” in Amendment No. 1. The “$20 billion” number reflects sales in the overall doll and stuffed toy industry, as opposed to sales in the manufacturing subset of the dolls and stuffed toys industry ($80 million), and was inadvertently included in the original Registration Statement. |

We have also added a source citation in multiple other places within Amendment No. 1 for specific data disclosure, where appropriate.

| 15. | In response to the Staff’s Comment 15, please note that in Amendment No. 1 we have removed the chart containing data sourced from The NPD Group. All market and industry data included in Amendment No. 1 represents information that is generally available to the public and was not prepared for us for a fee for use in the Registration Statement. We have not funded or been otherwise affiliated with any of the sources that we cite in Amendment No. 1. All of our sources are publicly available for no or a nominal fee. Included with this correspondence, we have provided you with copies of reports marked to highlight the information we used to support our disclosures in Amendment No. 1 relating to market and industry data. |

Target Market, page 17

| 16. | In response to the Staff’s Comment 16, we have revised our disclosure in Amendment No. 1 in the subsection “Target Market” on page 17. |

| 17. | In response to the Staff’s Comment 17, we have added disclosure in Amendment No. 1 within this section on page 17 that we currently do not have the financing to implement the strategies discussed. Although we do not have definitive plans to obtain such funds, after a market for our common stock develops, we plan to raise funds through a private offering of our common stock and/or notes payable to accredited investors. We have also added disclosure to this effect. |

Marketing Strategies, page 18

| 18. | In response to the Staff’s Comment 18, we have quantified the disclosure in the particular bullet point referenced in Amendment No. 1 on page 18. Please note that we have removed the disclosure regarding “heavy consumption from non-Black families” from this bullet point. |

Media Partnerships, Earned Media, Social Media, page 19

| 19. | In response to the Staff’s Comment 19, this blogging organization was identified by one of our strategic marketing and advertising partners. All discussions with the blogging organization have been conducted through this partner. We have expanded our disclosure in this section in Amendment No. 1 on page 19. |

Digital and Social Media, page 20

| 20. | In response to the Staff’s Comment 20, we have revised the disclosure in this paragraph in Amendment No. 1. The revised disclosure clarifies the issues you addressed in your Comment on page 20. |

Production and Manufacturing, page 20

| 21. | In response to the Staff’s Comment 21, under the subsection titled “Production and Manufacturing” beginning on page 20 of Amendment No. 1, we have revised and included additional disclosure in the second paragraph and added a fourth paragraph. As described we do not have an engagement agreement with our manufacturer. |

| 22. | In response to the Staff’s Comment 22, we have added additional disclosure to this subsection in Amendment No. 1 on page 20. |

Trademarks, Copyrights and Patents, page 21

| 23. | In response to the Staff’s Comment 23, we have not yet filed any registrations with any trademark offices in connection with any intellectual property we believe we own. When adequate funds are available, we intend to register certain trademarks we hold with the U.S. Patent and Trademark Office. Currently, we believe we hold certain common law trademark rights for certain trademarks including “Prettie Girls” and “The REAL Prettie Girls!” With respect to the heading, “The REAL Prettie Girls!”, you referenced in your Comment, the superscript “(tm)” was inadvertently used in lieu of the superscript “™”. We have corrected this typographical error in Amendment No. 1. Further, we have added the disclosure described above to the “Trademarks, Copyrights and Patents” subsection on page 21. |

Directors, Executive Officers, Promoters and Control Persons, page 22

| 24. | In response to the Staff’s Comment 24, we have included additional disclosure for each of the named directors within the specific director’s biographical information. |

Executive and Director Compensation, page 25

Current Levels of Executive Compensation and Employment Agreements, page 25

| 25. | In response to the Staff’s Comment 25, we have added additional disclosure to this subsection in Amendment No. 1 on page 25. |

Security Ownership of Certain Beneficial Owners and Management, page 26

| 26. | In response to the Staff’s Comment 26, upon effect of the Debt Cancellation Agreement on July 21, 2011, we believe Mr. James Percell held 3,635,750 shares of our common stock (including 15,400 shares beneficially held in street name). As disclosed in the subsection “Corporate History and Background,” we effected a 1 for 2.5 reverse stock split on July 26, 2011. After the reverse split, Mr. Percell held 1,454,300 shares of common stock, amounting to approximately 2.5% beneficial ownership of the 57,431,040 total shares we had outstanding in November 2011 (and approximately 2.5% beneficial ownership of the 58,931,040 shares we had outstanding as of February 6, 2012). Because Mr. Percell is not a current director or executive officer and is below the 5% threshold, as set forth in Item 403 or Regulation S-K, we did not include him in the beneficial ownership chart. |

| 27. | In response to the Staff’s Comment 27, Bradley Melton, the son of Ms. Corinda Joanne Melton, currently holds 3,179,405 shares of common stock, which is approximately 5.4% of our total outstanding common stock. As set forth in the chart, Ms. Melton beneficially owns 4,707,965 shares of common stock, representing 7.99% of the total shares outstanding. Ms. Melton’s shares do not include Bradley Melton’s shares. Bradley Melton is 31 years of age and does not live in the same household as Ms. Melton. Accordingly, we have determined that Ms. Melton in not a “beneficial owner” of any of Bradley Melton’s shares, pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, because she does not, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise have or share voting power which includes the power to vote, or to direct the voting of, such securities, and/or investment power which includes the power to dispose, or to direct the disposition of, such securities. |

| 28. | In response to the Staff’s Comment 28, we have reworded this footnote in Amendment No. 1 on page 26. We still maintain, however, that Trent Daniel does not have beneficial ownership of the shares held by his wife Sarah Marie Daniel. Based on an analysis of the facts and circumstances of this relationship, it was determined that Mr. Daniel does not directly or indirectly have or share voting and/or dispositive power over the shares held by Mrs. Daniel. We believe our analysis is consistent with the guidance set forth in the SEC’s Compliance and Disclosure Interpretations for Exchange Act Sections 13(d) and 13(g) and Regulation 13D-G Beneficial Ownership Reporting (See Question 105.05). |

Forward Looking Statements, page 28

| 29. | In response to the Staff’s Comment 29, we have deleted from this section all reference to Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 28

Results of Operations, page 30

| 30. | In response to the Staff’s Comment 30, we have added an additional paragraph of disclosure within the subsection on page 31. |

| 31. | In response to the Staff’s Comment 31, the amount of $1.6 million we disclosed within the original Registration Statement’s “Results of Operations” subsection in regards to our “extensive media marketing and advertising campaign” is incorrect. We actually plan to spend an additional $300,000 on the media marketing and advertising campaign. This disclosure has been revised within the "Liquidity and Capital Resources" subsection on page 33 and is now consistent with our disclosure in the “Summary of the Offering” section, as amended, that states “our capital requirements for the next 12 months will be approximately $1.5 million, including $300,000 for capital expenditures, and manufacturing costs and $1.2 million for inventory, marketing, public relations, and general and administrative costs.” |

Liabilities and Commitments, page 31

Events Subsequent to June 30, 2011, page 32

| 32. | In response to the Staff’s Comment 32, we did not issue any of the convertible debentures you referenced to related parties. We have filed these debentures as exhibits to Amendment No. 1. |

Liquidity and Capital Resources, page 32

| 33. | In response to the Staff’s Comment 33, we have revised the disclosure in the “Liquidity and Capital Resources” subsection on page 32. |

Plan of Operations and Related Risks, page 33

| 34. | In response to the Staff’s Comment 34, we have revised the disclosure in the “Plan of Operations and Related Risks” subsection on page 33. |

Product Launch and Implementation, page 34

| 35. | In response to the Staff’s Comment 35, we have revised the disclosure in the “Product Launch and Implementation” subsection on page 34. |

Costs, page 35

| 36. | In response to the Staff’s Comment 36, we have revised the disclosure in the “Costs” subsection on page 35. |

Transactions with Related Persons, Promoters and Certain Control Persons, page 37

| 37. | In response to the Staff’s Comment 37, we have expanded the disclosure in this section in Amendment No. 1 on page 38. We have also filed Mr. Daniel’s consulting agreement with Amendment No. 1. |

Selling Stockholders, page 38

| 38. | In response to the Staff’s Comment 38, in Amendment No. 1, we have revised the registration fee table and the footnote thereto. |

| 39. | In response to the Staff’s Comment 39, we have included footnote disclosure on page 40 to identify the person(s) with voting or investment control over the shares owned by M Green Inc., Advanced Eye Films and Brown Shade Inc. |

Market for Common Equity and Related Stockholder Matters, page 41

| 40. | In response to the Staff’s Comment 40, all warrants were fully exercised at the date of our Form S-1. The warrants referred to on page F-5 and F-11 of the original Registration Statement were exercised subsequent to December 31, 2010 and accordingly no warrants remain outstanding. |

| 41. | In response to the Staff’s Comment 41, please note that 1,250,000 shares of common stock that are issuable upon conversion of a convertible debenture were inadvertently included in part of the calculation described in this subsection. Additionally, subsequent to the filing of the original Registration Statement, our total number of issued and outstanding shares of common stock increased by 1,500,000 shares. Accordingly, Amendment No. 1 reflects that 47,966,924 shares of common stock constitute restricted securities. The Staff’s calculation that we have concluded that 3,977,451 shares of common stock are unrestricted, however, remains correct. As described in the Registration Statement, on July 21, 2011, we (One World Holdings, Inc., which was formerly named Environmental Safeguards, Inc.) entered into and closed a Share Exchange Agreement (the “Exchange Agreement”) with The One World Doll Project Inc ("OWDP") and the persons owning 100% of the outstanding capital stock of OWDP. Immediately prior to closing the Exchange Agreement, we had 13,563,976 pre-split shares of common stock issued and outstanding (on July 26, 2011, we effected a 1 for 2.5 reverse stock split). Of these pre-split shares, 3,620,350 shares were and are held of record by James Percell, a former executive officer and director, which shares we have deemed restricted securities. We believe the remaining 9,943,626 pre-split shares (3,977,451 post-split shares) are unrestricted securities. We believe all of these shares were issued before we became a shell company and were held for at least the applicable holding period under Rule 144. Additionally, 3,106,694 of the 3,977,451 shares are currently held in “street name” by brokerage firms. |

June 30, 2011 Financial Statements

(2) Summary of Significant Accounting Policies, page F-7

| 42. | In response to the Staff’s Comment 42, in the financial statements for the period ended September 30, 2011, we have included disclosure that describes the nature of the manufacturing equipment, the consideration that was provided to acquire the equipment, the nature of the directly related trade debt and where the debt is reflected in our financial statements. |

(4) Long-term Debt, page F-11

| 43. | In response to the Staff’s Comment 43, the warrants exercised were the warrants that were issued to originate debt and valued at $8,824 in the statement of stockholders deficit for the six months ended June 30, 2011 and $17,648 in the statement of stockholders deficit for the period from inception, October 1, 2010, to December 31, 2010. These warrants were detachable and were issued at an exercise price of $0.0327 per share. The Company, as an incentive to exercise, reduced the exercise price to $0.02617 per share. The financial statements for the period ended September 30, 2011 eliminate the $22,500 warrant expense because the warrant exercise was a negotiated cash price for the Company to prompt the warrant holders to invest. |

December 31, 2010 Financial Statements

(9) Subsequent Events, page F-34

| 44. | In response to the Staff’s Comment 44, we have added disclosure on page F-32 to reconcile the "shares issued for cash" and the "shares issued for services to consultants, management and directors and employees", as shown on page F-32 to the amounts shown on page F-5. The differences all relate to issuances in July 2011. |

Signatures

| 45. | In response to the Staff’s Comment 45, Corinda Joanne Melton currently serves as principal accounting officer, in addition to serving as Chief Executive Officer and principal financial officer. We have revised the signature page in Amendment No. 1 to reflect this. |

Exhibits

Exhibit 2.1 Share Exchange Agreement

| 46. | In response to the Staff’s Comment 46, we have included a complete copy of the agreement including the stockholders’ signature pages with Amendment No. 1. |

The Company acknowledges that:

| · | should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| · | the action of the Commission or the Staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| · | the Company may not assert Staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you should need clarification or any additional information in connection with your inquiries, please contact me. Thank you for your help in this matter.

Very truly yours,

/s/ Corinda Joanne Melton

Corinda Joanne Melton,

President

Cc: Era Anagnosti

Division of Corporation Finance

U.S. Securities & Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| POP 1 Child population: Number of children (in millions) ages 0–17 in the United States by age, 1950–2010 and projected 2030 – 2050 | | | | | |

| Number (in millions) | 1950 | 1951 | 1952 | 1953 | 1954 | 1955 | 1956 | 1957 | 1958 | 1959 | 1960 | 1961 | 1962 | 1963 | 1964 | 1965 | 1966 | 1967 | 1968 | 1969 |

| All Children | 47.3 | 48.8 | 50.5 | 52.1 | 53.9 | 55.7 | 57.5 | 59.5 | 61.3 | 63.1 | 64.5 | 65.8 | 67.1 | 68.4 | 69.7 | 69.7 | 69.9 | 69.9 | 69.9 | 69.8 |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | 19.1 | 20.0 | 21.0 | 21.1 | 21.5 | 22.0 | 22.6 | 23.2 | 23.7 | 24.1 | 24.3 | 24.5 | 24.6 | 24.5 | 24.3 | 23.9 | 23.4 | 22.6 | 21.9 | 21.3 |

| Ages 6–11 | 15.3 | 15.8 | 16.2 | 17.5 | 18.4 | 18.9 | 19.6 | 20.4 | 21.4 | 21.4 | 21.8 | 22.3 | 22.8 | 23.4 | 23.8 | 24.2 | 24.4 | 24.7 | 24.8 | 24.7 |

| Ages 12–17 | 12.9 | 13.1 | 13.3 | 13.6 | 14.0 | 14.8 | 15.4 | 15.9 | 16.3 | 17.6 | 18.4 | 19.0 | 19.7 | 20.6 | 21.6 | 21.6 | 22.1 | 22.6 | 23.2 | 23.7 |

| | | | | | | | | | | | | | | | | | | | | |

| Number (in millions) | 1970 | 1971 | 1972 | 1973 | 1974 | 1975 | 1976 | 1977 | 1978 | 1979 | 1980 | 1981 | 1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 |

| All Children | 69.8 | 69.8 | 69.4 | 68.8 | 68.0 | 67.2 | 66.3 | 65.5 | 64.8 | 64.1 | 63.7 | 63.2 | 62.8 | 62.6 | 62.5 | 62.6 | 62.9 | 63.1 | 63.2 | 63.5 |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | 20.9 | 20.8 | 20.6 | 20.2 | 19.9 | 19.7 | 19.3 | 18.9 | 18.9 | 19.2 | 19.6 | 20.0 | 20.5 | 20.8 | 21.1 | 21.4 | 21.5 | 21.7 | 21.8 | 22.1 |

| Ages 6–11 | 24.6 | 24.3 | 23.9 | 23.2 | 22.6 | 22.1 | 21.7 | 21.5 | 21.3 | 21.0 | 20.8 | 20.4 | 19.9 | 19.5 | 19.4 | 19.6 | 20.0 | 20.4 | 20.9 | 21.3 |

| Ages 12–17 | 24.3 | 24.7 | 25.0 | 25.3 | 25.5 | 25.4 | 25.3 | 25.0 | 24.6 | 23.9 | 23.3 | 22.8 | 22.4 | 22.2 | 22.0 | 21.6 | 21.3 | 21.0 | 20.5 | 20.1 |

| | | | | | | | | | | | | | | | | | | | | |

| Number (in millions) | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| All Children | 64.2 | 65.3 | 66.5 | 67.6 | 68.6 | 69.5 | 70.2 | 70.1 | 71.4 | 71.9 | 72.4 | 72.7 | 73.0 | 73.3 | 73.5 | 73.7 | 74.0 | 74.3 | 74.4 | 74.5 |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | 22.5 | 22.9 | 23.3 | 23.5 | 23.7 | 23.7 | 23.5 | 23.3 | 23.2 | 23.1 | 23.2 | 23.4 | 23.5 | 23.8 | 24.1 | 24.4 | 24.7 | 25.0 | 25.3 | 25.5 |

| Ages 6–11 | 21.6 | 22.0 | 22.2 | 22.5 | 22.7 | 23.0 | 23.6 | 24.0 | 24.5 | 24.8 | 25.0 | 24.9 | 24.6 | 24.3 | 24.0 | 23.8 | 23.8 | 23.9 | 24.1 | 24.3 |

| Ages 12–17 | 20.1 | 20.4 | 21.0 | 21.6 | 22.2 | 22.7 | 23.1 | 23.5 | 23.8 | 24.0 | 24.2 | 24.5 | 24.9 | 25.2 | 25.4 | 25.5 | 25.5 | 25.4 | 25.1 | 24.8 |

| | | | | | | | | | | | | | | | | | | | | |

| Number (in millions) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| All Children | 74.2 | 75.6 | 76.1 | 76.7 | 77.4 | 78.1 | 78.9 | 79.6 | 80.4 | 81.0 | 81.7 | 82.3 | 83.0 | 83.6 | 84.2 | 84.9 | 85.5 | 86.1 | 86.7 | 87.2 |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | // | 25.5 | 25.7 | 26.0 | 26.2 | 26.4 | 26.7 | 26.9 | 27.1 | 27.2 | 27.4 | 27.6 | 27.7 | 27.9 | 28.0 | 28.2 | 28.3 | 28.5 | 28.6 | 28.8 |

| Ages 6–11 | // | 25.0 | 25.0 | 25.2 | 25.4 | 25.7 | 26.0 | 26.3 | 26.6 | 26.8 | 27.1 | 27.3 | 27.6 | 27.8 | 28.1 | 28.4 | 28.6 | 28.9 | 29.2 | 29.4 |

| Ages 12–17 | // | 25.1 | 25.4 | 25.6 | 25.8 | 26.0 | 26.2 | 26.5 | 26.7 | 27.0 | 27.2 | 27.5 | 27.7 | 27.9 | 28.1 | 28.3 | 28.5 | 28.7 | 28.9 | 29.0 |

| | | | | | | | | | | | | | | | | | | | | |

| Number (in millions) | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 | 2047 | 2048 | 2049 |

| All Children | 87.8 | 88.4 | 89.0 | 89.5 | 90.1 | 90.7 | 91.3 | 92.0 | 92.6 | 93.3 | 94.0 | 94.7 | 95.4 | 96.2 | 96.9 | 97.7 | 98.4 | 99.2 | 100.0 | 100.8 |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | 29.0 | 29.2 | 29.4 | 29.6 | 29.8 | 30.0 | 30.3 | 30.5 | 30.8 | 31.0 | 31.3 | 31.6 | 31.8 | 32.1 | 32.3 | 32.6 | 32.8 | 33.1 | 33.3 | 33.5 |

| Ages 6–11 | 29.6 | 29.9 | 30.1 | 30.3 | 30.5 | 30.6 | 30.8 | 31.0 | 31.2 | 31.4 | 31.6 | 31.8 | 32.0 | 32.2 | 32.4 | 32.7 | 32.9 | 33.2 | 33.5 | 33.8 |

| Ages 12–17 | 29.2 | 29.4 | 29.5 | 29.7 | 29.9 | 30.0 | 30.2 | 30.4 | 30.6 | 30.9 | 31.1 | 31.4 | 31.6 | 31.9 | 32.1 | 32.4 | 32.7 | 33.0 | 33.2 | 33.5 |

| | | | | | | | | | | | | | | | | | | | | |

| Number (in millions) | 2050 | | | | | | | | | | | | | | | | | | | |

| All Children | 101.6 | | | | | | | | | | | | | | | | | | | |

| Age | | | | | | | | | | | | | | | | | | | | |

| Ages 0–5 | 33.8 | | | | | | | | | | | | | | | | | | | |

| Ages 6–11 | 34.0 | | | | | | | | | | | | | | | | | | | |

| Ages 12–17 | 33.8 | | | | | | | | | | | | | | | | | | | |

| // Not available at publication time. | | | | | | | | | | | | | | | | | | |

| NOTE: Population projections are based on the Census 2000 counts. | | | | | | | | | | | | | |

SOURCE: U.S. Census Bureau, Current Population Reports, Estimates of the population of the United States by single years of age, color, and sex: 1900 to 1959 (Series P-25, No. 311); Estimates of the population of the United States, by age, sex, and race: April 1, 1960, to July 1, 1973 (Series P-25, No. 519); Preliminary estimates of the population of the United States by age, sex, and race: 1970 to 1981 (Series P-25, No. 917); and intercensal estimates for 1980–1989 and 1990–1999. The data for 2000 to 2009 are based on the population estimates released for July 1, 2009. Data for 2010 are from the 2010 decennial census. The data for 2030 and 2050 are derived from the national population projections released in August 2008. |

| | | | | | | | | | | | | | | | | | | | | |