Malizia Spidi & Fisch, PC ATTORNEYS AT LAW |

1227 25th street, N.W. Suite 200 West Washington, D.C. 20037 (202) 434-4660 Facsimile: (202) 434-4661 | | 1900 South Atherton Street Suite 101 State College, PA 16801 (814) 272-3502 Facsimile: (814) 272-3514 |

John J. Spidi Spidi@malizialaw.com | | writer's direct dial number (202) 434-4670 |

VIA EDGAR

August 2, 2010

Kathryn McHale, Esq.

Attorney Advisor

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Sun Bancorp, Inc.

Form 10-K for Fiscal Year Ended December 31, 2009

Form 10-K/A for Fiscal Year Ended December 31, 2009

Form 8-K filed July 13, 2010

File No. 000-20957

Dear Ms. McHale:

On behalf of Sun Bancorp, Inc. (the “Company”), we hereby submit the following responses to the staff’s comment letter dated July 20, 2010, with respect to the above-referenced filings. For ease of reference, we have keyed our responses to the captions and paragraph numbering used in your comment letter.

Form 10-K for Fiscal Year Ended December 31, 2009

Notes to Financial Statements

4. Investment Securities, page 50 of the Annual Report

| 1. | We note your response to comment five in our letter dated May 27, 2010. For each of the quarterly periods since it was announced (i.e., June 2009) that the issuer of the trust preferred security would defer paying dividends, please address the following: |

| · | Provide us with a detailed description of the other-than-temporary impairment analysis performed on this security at each quarterly reporting period through June 2010. Please identify all of the evidence considered, explain the relative significance |

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 2

| | of each piece of evidence, and identify the primary evidence on which you relied to support your conclusion that no OTTI was necessary; |

| · | Tell us how management evaluated the financial condition of the issuer at each quarterly reporting period; |

| · | Tell us how management considered and evaluated the Regulatory Agreement entered into in June 2009 with both the applicable Federal and State regulatory agencies within the context of the quarterly OTTI analysis; |

| · | Provide us with the discounted cash flow analysis used to determine fair value at each quarterly period; and |

| · | Provide us with the assumptions and estimates used in the fair value measurements addressing the basis for, as well as any changes in and reasons for the changes in, the assumptions or estimates, which may have occurred during these periods. |

Response

1. Sun’s evaluation of whether an Other Than Temporary Impairment is to be taken on the noted single issuer trust preferred security generally follows the following steps:

| · | The paying status of the security is reviewed, including whether the issuer is in a contractually permitted deferral period or in actual default. The issuer of this security gave notice of its intent to defer dividends on August 18, 2009 and did defer its quarterly dividend due September 1, 2009 and all subsequent payments. The issuer is currently within their contractually permitted deferral period and not in default. |

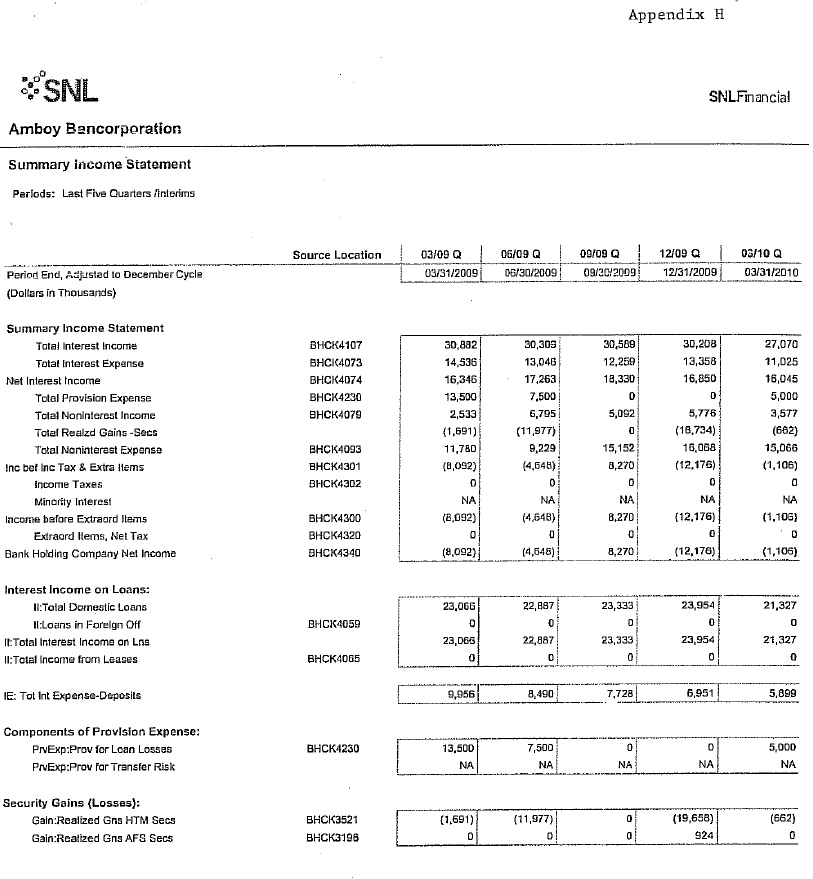

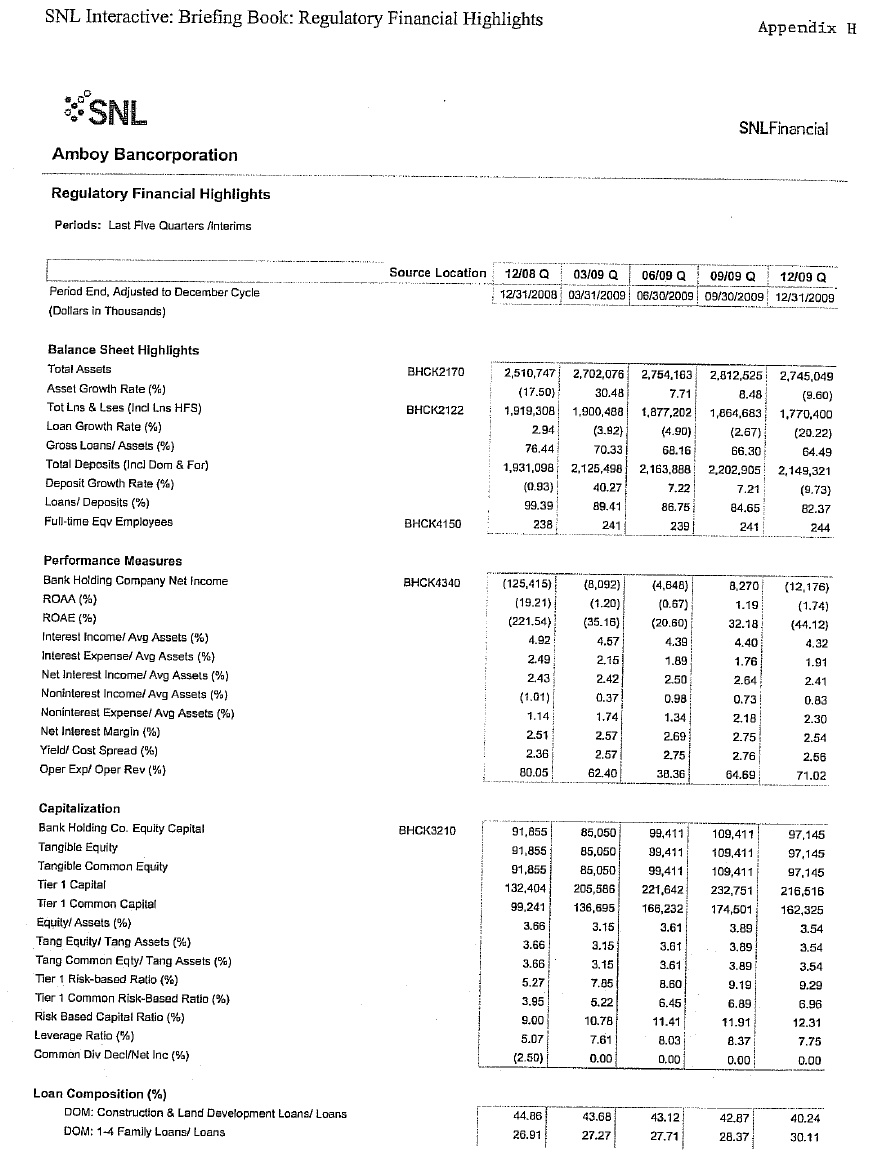

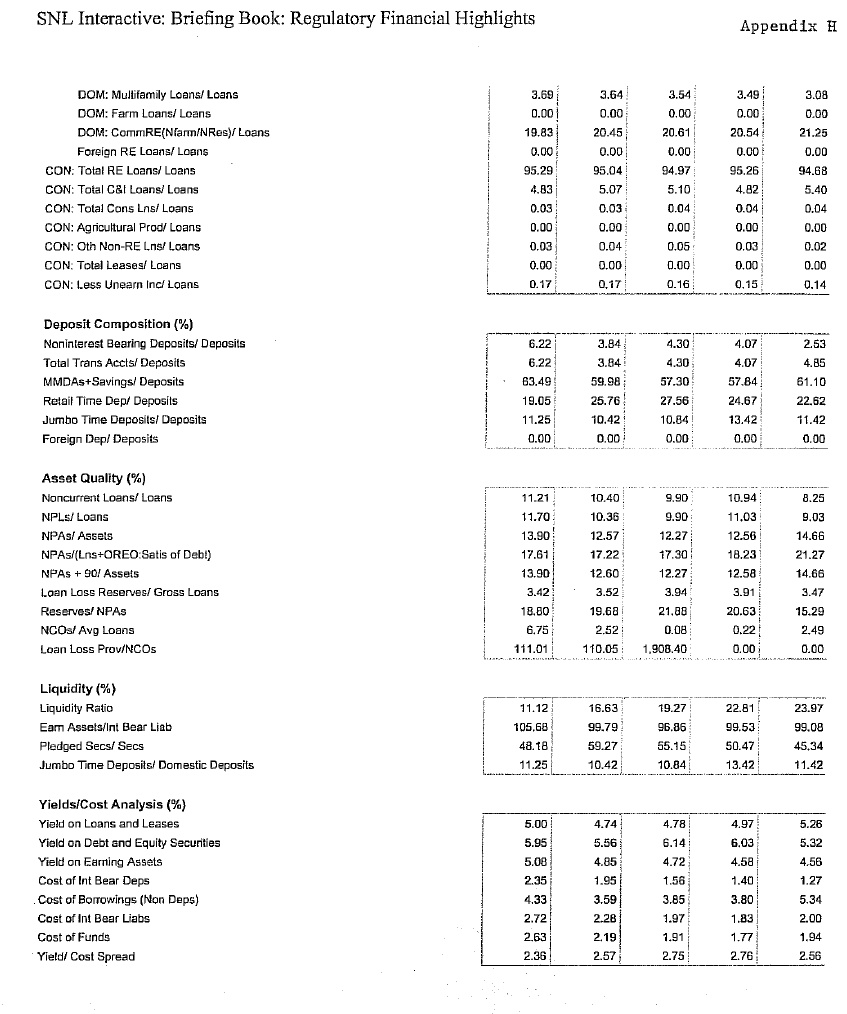

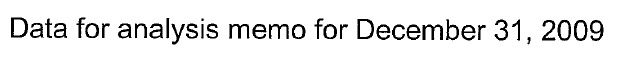

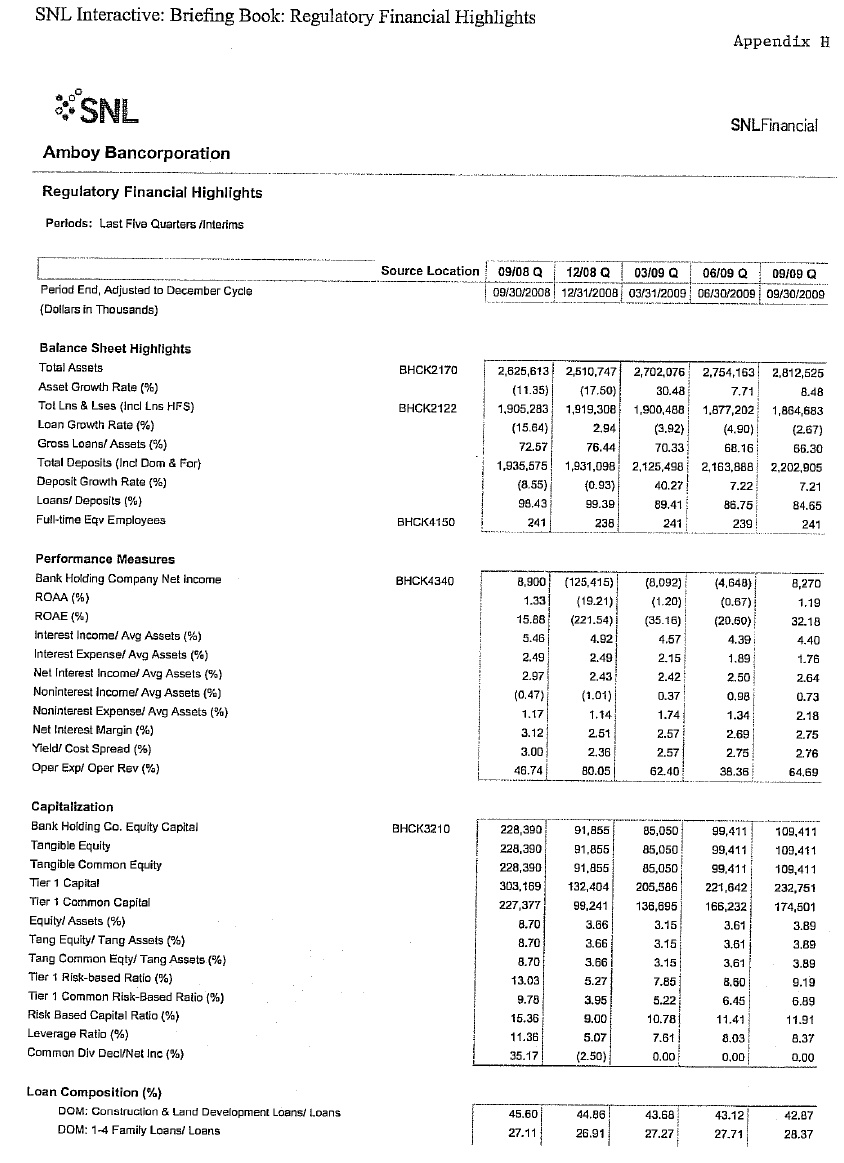

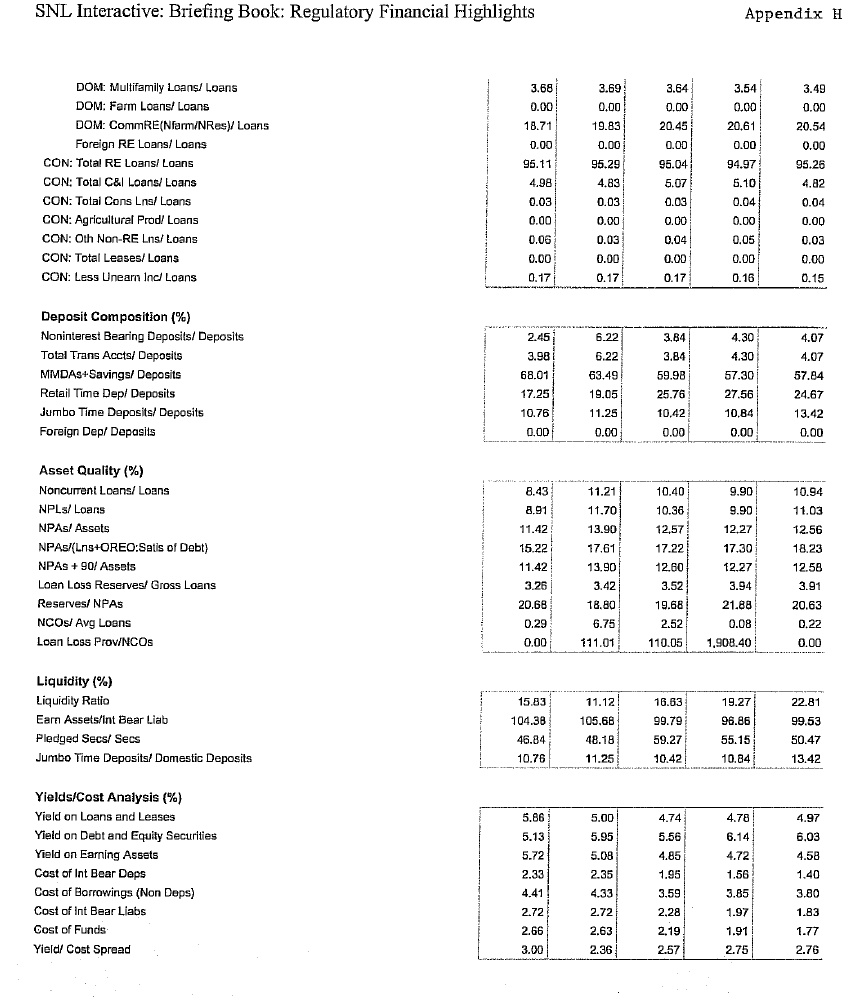

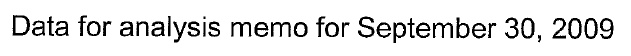

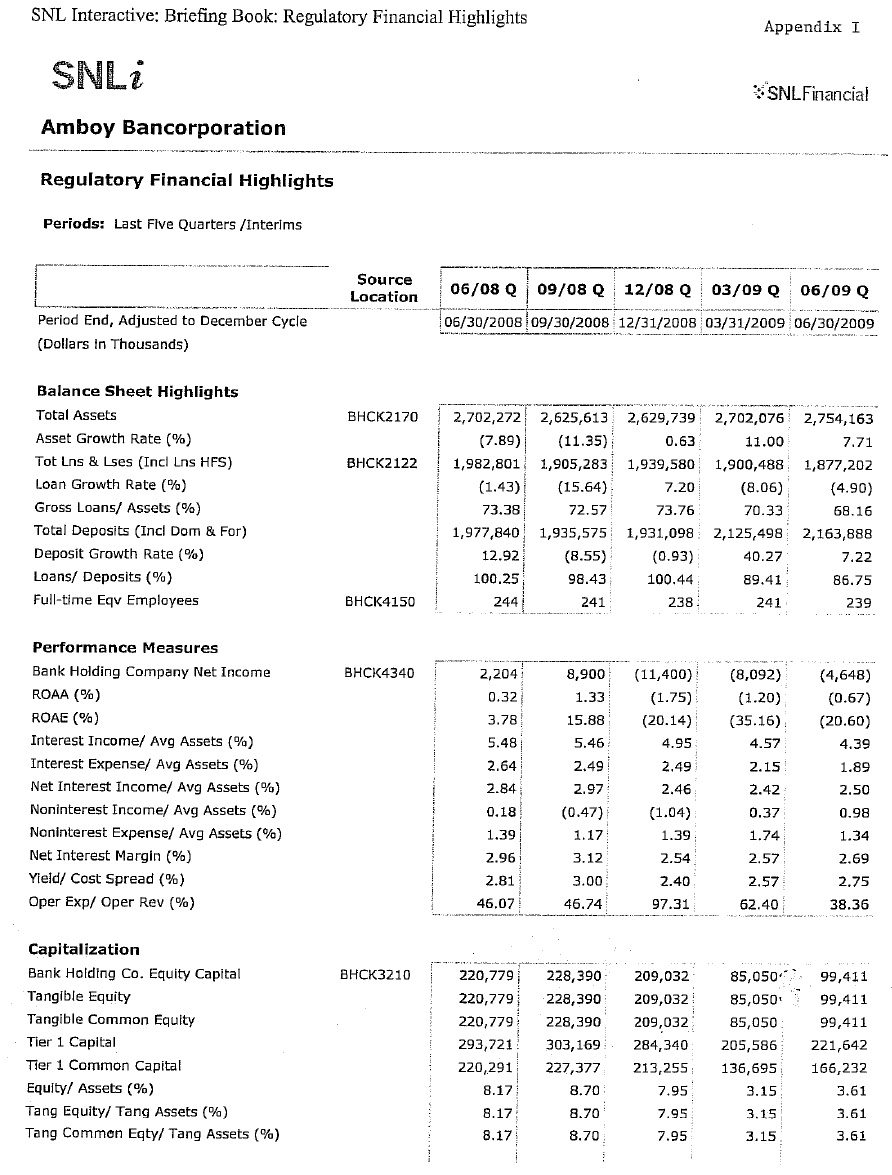

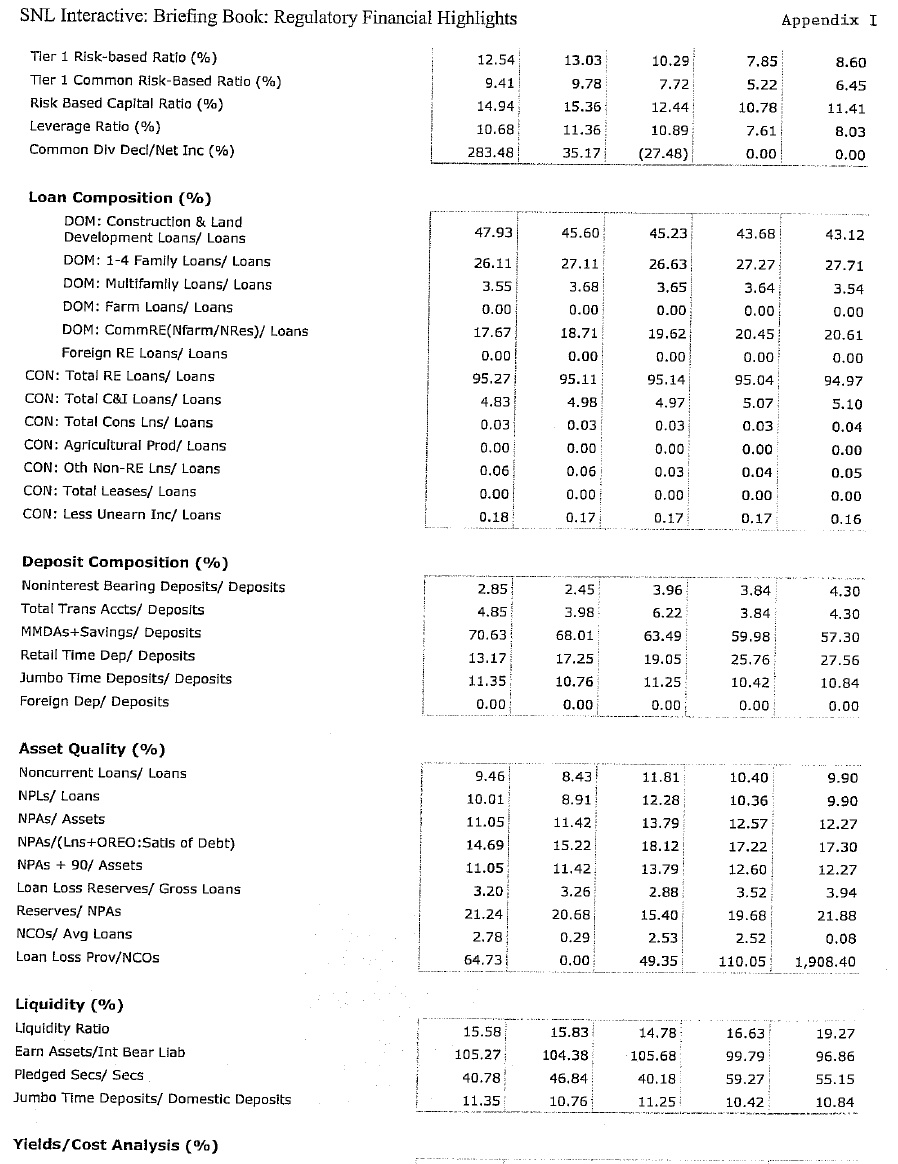

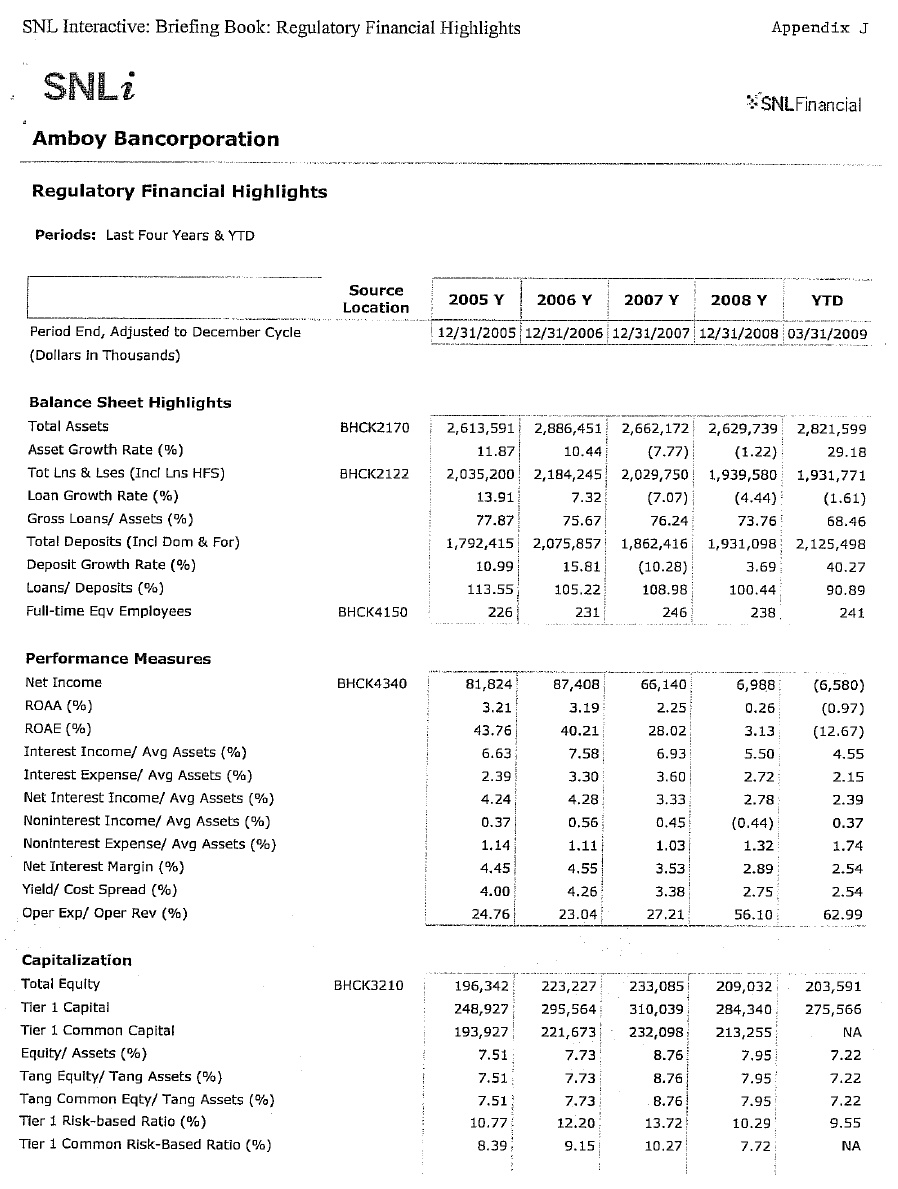

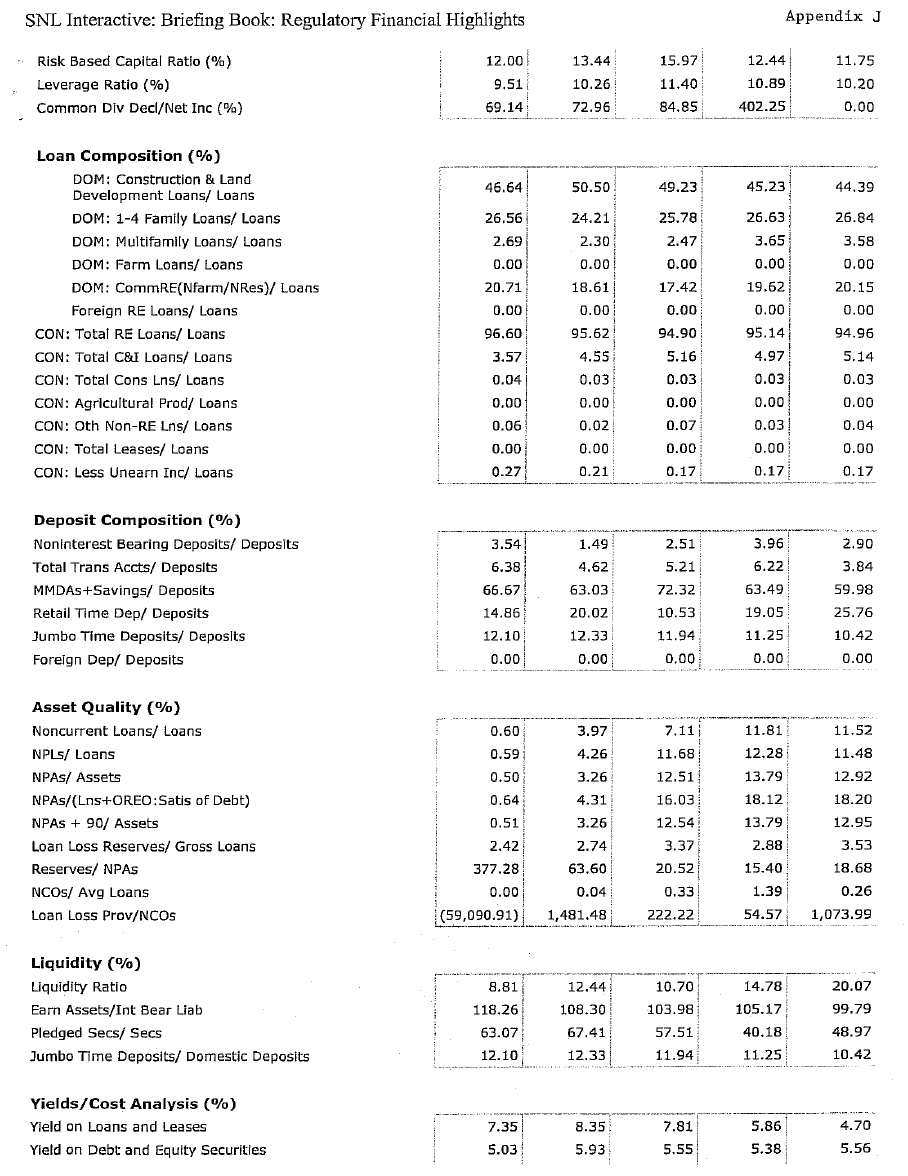

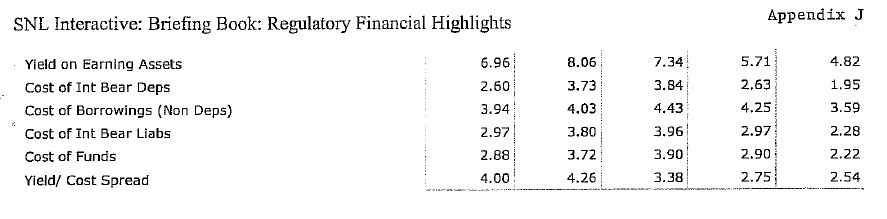

| · | The financial information on the issuer is reviewed quarterly. The source of this information is the regulatory filings available through SNL Financial. We utilize both SNL templated financial information as well as an in-house spreadsheet which uses downloaded information from the same source. As part of the financial review, we contact the Chief Financial Officer of the issuer to discuss updated trends. Included with this response are examples of both the templated financial information from SNL (Amboy data for analysis memos) and also the spreadsheet used to track the downloaded information (Trust Preferred Amboy – SNL). |

| · | Sun’s management does consider the Regulatory Agreements as part of its evaluation of Amboy Bancorp. A discussion with Amboy’s CFO for the analysis memo for March 31, 2010, noted that Amboy believed they were in compliance with the Written Agreements with both Federal and State Regulatory Agencies. The primary consideration with the |

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 3

| | Written Agreements would be a long term inability to pay dividends, that is, periods extending beyond the 20 quarter deferral contractually permitted under the terms of the Trust Indenture. At this time Sun’s management expects Amboy will be able to meet the requirements of the Written Agreements and will return to paying status within the 20 quarter period deferral period. |

| · | The primary consideration in determining that no OTTI was necessary was our review of the financial information of Amboy. The capital position of Amoy Bancorp is a primary consideration in our decision regarding OTTI. Our three key ratios Risk Based Capital Ratio, Tier 1 to Risk Based Ratio and Leverage Ratio have all shown improvement since the since the signing of the Written Agreements. Earnings and in particular core earnings exclusive of securities related activities are the second most important factor. Though Amboy Bancorp has experienced net losses in four of the past five quarters, excluding realized securities losses, three of the five quarters would have shown positive net income. The third major consideration is credit quality and loan loss reserves. As noted in the memo exc erpts included below, though credit quality and non-performing loans remains a challenge for Amboy, levels of non-performing loans have begun to stabilize and Allowance for Loan Loss Reserves remain high and stable. After considering the relevant financial information, as well as payment status and regulatory actions, Sun’s management determines whether the issuer is likely resume paying dividends and catch up any accrued dividends during the contractually permitted 20 quarter deferral period, or whether the issuer is likely to default with no return of principal or dividends. To date management has made the determination that the issuer is likely to return to current paying status. |

| · | The final component of the analysis is to perform two discounted cashflow analyses, one to evaluate for potential credit impairment, and the second to determine a fair value. The first analysis uses the original offering spread to determine if there is any anticipated credit impairment per ASC 325-40. The second analysis uses a discount rate the Company determines from a trading group of similar securities quoted on the New York Stock Exchange (“NYSE”) or over-the-counter markets based upon its review of market data points such as credit rating and maturity. An example of the information on the trading group is included as Trups Comparables 2010-06-30. The spread used for the fair value valuation of Amboy has been a composite of the sp reads on the Non-rated issues in the trading group. This discount cashflow and spread methodology was used from the fourth quarter 2008 until the second quarter of 2010 when Sun determined that one of the issuers in the Non-rated trading group is also in |

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 4

| | deferral. Consequently the spread used as of June 30, 2010 and going forward, so long as the circumstances are consistent, will be that of identified Non-rated deferring issuers. Copies of the discounted cashflow analysis for each quarterly period are included as Cashflows MM DD YYYY Credit and Cashflows MM DD YYYY Market. Since the first notice of deferral was issued on August 18, 2009 subsequent to the analysis for June 30, 2009, the cashflow analysis for June 30, 2009 was performed using the Bloomberg BC5 function which assumes no credit impairment. |

The following are excerpts from each of the quarterly evaluation memos related to Amboy Bancorp:

Excerpt analysis memo for June 30, 2009

Amboy Bancorp Capital Trust III

| Rate: | 3 month Libor + 1.75% |

Amboy Bancorp is a $2.7 billion Bank Holding company headquartered in Old Bridge NJ .

Amboy continues strong income performance in 2007, with a margin of 3.53, ROA of 2.25 and ROE of 28.02. Those ratios have been declining since 2004 and did slide further in QI 2008.

Capital is high with Tier 1 to Risk Based at 13.72 at year end 2007 and Equity to Assets at 8.76. However, this capital build was probably in anticipation of some credit deterioration as non-performing Loans to total loans reached 11.68% and non-performing assets to total assets increased to 12.51%.

At this time there is no concern about Amboy’s ability to continue servicing this debt, though we need to closely monitor the Company’s progress.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 5

Excerpt analysis memo for September 30, 2009

Amboy Bancorp Capital Trust III

| Rate: | 3 month Libor + 1.75% |

Amboy’s balance sheet grew in QII 2009 despite second consecutive quarter of de-leveraging of the loan portfolio. Loans to Assets declined to 68.16% from 70.33 in QI 2009 and Loans to Deposits declined to 86.75% from 89.41%. Credit quality remains a challenge, though there has been slow steady improvement from the peak in QIV 2008. Non-performing Assets register 12.27% of Total Assets down from the QIV 2009 peak of 13.79% and Non-performing Assets + 90 days delinquent are12.27% of Total Assets versus 13.79%. Reserves are being rebuilt, currently standing at 21.88% of Non-Performing Assets compared to 15.40% in QIV 2008.

Through a combination of de-leveraging of the loan portfolio, omission of dividends and a recent capital raise, Amboy’s capital ratios have uniformly increased. Tier 1 to Risk Based Ratio increased to 6.45% versus the prior quarter of 5.22%. Equity to Assets increased to 3.6% from the prior quarter’s 3.15% and the Risk Based Capital Ratio increased to 11.41% from 10.78%.

On 7/6/09 Amboy Bancorp and Amboy Bank entered into written agreements with both the Federal Reserve Bank of New York and the New Jersey Department of Banking. The agreement is wide ranging including requirements for improvements in areas of Board oversight, management, credit administration, capital, liquidity as well as other areas. The Bancorp is required to petition Federal Reserve prior to paying any dividends on common, preferred or trust preferred issues. The request to make the 9/1/09 dividend payment was not granted and Amboy has notified its trustees that it is invoking the contractually permitted deferral of up to 20 quarters of dividends on its Trust Preferred issues.

Given the modestly improved financial condition of the Company and the recent capital raise of $48 million, we anticipate Amboy will return to paying status. The terms of the Trust indenture require that once a deferring entity returns to paying status, all past due dividends plus interest on those dividends must be paid to debt holders. Unless there is anticipation of a total default from which 0% will be recovered, Sun as a holder of this instrument should be made whole for all missed payments. Factoring this “catch up” provision into the cashflows would indicate no credit impairment should be recognized.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 6

Conclusion

Principal and Interest Current: Dividend was deferred by Regulatory requirement

ASC 325-40

Based current information, we anticipate a return to paying status after the contractually permitted deferral period. Cash flow analysis would indicate Sun will be made whole on any past due payments of interest consequently, we judge this issue not to be impaired according to Accounting Guidance ASC 325-40.

ASC 320-10

Per the requirements of ASC 320-10, Sun does not have the intent nor does it anticipate that it will be required to sell the security prior to anticipate recovery.

Management has reviewed its investment securities at 9/30/09 and has determined that the unrealized losses are temporary.

Excerpt analysis memo for December 31, 2009

Amboy Bancorp Capital Trust III

| Rate: | 3 month Libor + 1.75% |

Amboy’s balance sheet grew slightly in QIII 2009 despite third consecutive quarter of de-leveraging of the loan portfolio. Loans to Assets declined to 66.30% from 68.16% in QII 2009 and Loans to Deposits declined to 84.65% from 86.75%. Credit quality remains a challenge, though there has been a gradual improvement from the peak in QIV 2008. Non-performing Assets register 12.56% of Total Assets down from the QIV 2009 peak of 13.90% , but higher than the 12.27% in QII. Non-performing Assets + 90 days delinquent are 12.58% of Total Assets versus 12.27% at the end of QII 2009. Reserves are slightly lower than QII, currently standing at 20.63% of Non-Performing Assets.

Amboy’s capital ratios continue to improve. Tier 1 to Risk Based Ratio increased to 9.19% versus the prior quarter of 8.60%. Equity to Assets increased to 3.89% from the prior quarter’s 3.61% and the Risk Based Capital Ratio increased to 11.91% from 11.41%

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 7

Amboy recorded a Net Income of $8.2 million generating an ROAA of 1.19% and an ROAE of 32.18%

Given the stabilizing condition of the Company we anticipate Amboy will return to paying status. The terms of the Trust indenture require that once a deferring entity returns to paying status, all past due dividends plus interest on those dividends must be paid to debt holders. Unless there is anticipation of a total default from which 0% will be recovered, Sun as a holder of this instrument should be made whole for all missed payments. Factoring this “catch up” provision into the cash flows would indicate no credit impairment should be recognized.

Conclusion

Principal and Interest Current: Dividend was deferred by Regulatory requirement

ASC 325-40

Based current information, we anticipate a return to paying status after the contractually permitted deferral period. Cash flow analysis would indicate Sun will be made whole on any past due payments of interest. Consequently, we judge this issue not to be impaired according to Accounting Guidance ASC 325-40.

ASC 320-10

Per the requirements of ASC 320-10, Sun does not have the intent nor does it anticipate that it will be required to sell the security prior to anticipate recovery.

Management has reviewed its investment securities at 12/31/09 and has determined that the unrealized losses are temporary.

Excerpt analysis memo for March 31, 2010

Amboy Bancorp Capital Trust III

| Rate: | 3 month Libor + 1.75% |

Amboy decreased its balance sheet at an annualized rate of 9.60% in QIV 2009. The main driver was a continued de-leveraging of the loan portfolio, decreasing $94 million or an annualized 20.22%. Loans to Assets declined to 64.49% from 66.30% in QIII 2009 and Loans to Deposits declined to 82.37% from 84.65%.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 8

Credit quality remains a challenge. Non Current Loans to Total Loans declined to 8.25% and Non Performing Loans to Total Loans dropped to 9.03%. . However at least a portion of the Non Performing Loans were transferred into Other Real Estate Owned which increased to 14.66% of Total Assets.

Amboy’s capital ratios continue to improve. Tier 1 to Risk Based Ratio increased to 9.29% versus the prior quarter of 9.19%. t he Risk Based Capital Ratio increased to 13.21% from 11.91% and Tier 1 Common to Risk Based increased to 6.96% from 6.89%.

Amboy recorded a Net loss of $12.2 million primarily a result of realized securities losses of $18.7 million.

A follow-up conversation with Mary Riccardi, CFO noted the following items

| · | The Bank is in full compliance with terms of the Written Agreement with both Federal and State regulators. |

| · | Pre-OTTI and Pre-Provision earnings, are hitting plan |

| · | The move from loans to Other Real Estate Owned was strategic, in order to gain control of the properties collateralizing non-performing loans. |

| · | The Bank is having some success liquidating OREO with a number of properties currently under contract and expected to settle in the next several months. |

| · | The Company is in the process of publishing its annual reports for 2008 and 2009 (they are structured as a closely held Subchapter S Corporation) and any additional capital raise will have to wait until this process is complete |

We believe the situation at Amboy continues to stabilize, consequently we anticipate Amboy will return to paying status. The terms of the Trust indenture require that once a deferring entity returns to paying status, all past due dividends plus interest on those dividends must be paid to debt holders. Unless there is anticipation of a total default from which 0% will be recovered, Sun as a holder of this instrument should be made whole for all missed payments. Factoring this “catch up” provision into the cash flows would indicate no credit impairment should be recognized.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 9

Conclusion

Principal and Interest Current: Dividend was deferred by Regulatory requirement

ASC 325-40

Based current information, we anticipate a return to paying status after the contractually permitted deferral period. Cash flow analysis would indicate Sun will be made whole on any past due payments of interest. Consequently, we judge this issue not to be impaired according to Accounting Guidance ASC 325-40.

ASC 320-10

Per the requirements of ASC 320-10, Sun does not have the intent nor does it anticipate that it will be required to sell the security prior to anticipate recovery.

Management has reviewed its investment securities at 03/31/10 and has determined that the unrealized losses are temporary.

Excerpt analysis memo for June 30, 2010

Amboy Bancorp Capital Trust III

| Rate: | 3 month Libor + 1.75% |

Amboy decreased its balance sheet at an annualized rate of 17.25% in QI 2010. The main driver was a continued de-leveraging of the loan portfolio, decreasing $45.8 million or an annualized 10.35%.

Credit quality remains a challenge though credit trends in QI 2010 were generally steady to improving. Non Current Loans to Total Loans declined to 7.96% from 8.25% in the prior quarter and from 10.94% at year end 2009. Non Performing Loans to Total Loans dropped to 7.94% from 9.03% the prior quarter. Both Non Performing Loans to Loans + OREO and Reserves to Non Performing Loans showed modest improvement in the quarter.

Amboy’s capital ratios are steady to improving. Tier 1 to Risk Based Ratio increased to 9.57% versus the prior quarter of 9.29%. The Risk Based Capital Ratio increased to 12.43% from 12.31% in the prior quarter and 11.91% at year end 2009. Tier 1 Common to Risk Based increased to 7.17% from 6.96%.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 10

Amboy recorded a Pre-tax and Pre-Provision income of $3.9 million and a net loss of $1.1 million as a result of additional loan loss provision of $5 million and securities losses of $662,000.

We believe the situation at Amboy continues to stabilize, consequently we anticipate Amboy will return to paying status. The terms of the Trust indenture require that once a deferring entity returns to paying status, all past due dividends plus interest on those dividends must be paid to debt holders. Unless there is anticipation of a total default from which 0% will be recovered, Sun as a holder of this instrument should be made whole for all missed payments. Factoring this “catch up” provision into the cash flows would indicate no credit impairment should be recognized.

Conclusion

Principal and Interest Current: Dividend was deferred by Regulatory requirement

ASC 325-40

Based current information, we anticipate a return to paying status after the contractually permitted deferral period. Cashflow analysis would indicate Sun will be made whole on any past due payments of interest. Consequently, we judge this issue not to be impaired according to Accounting Guidance ASC 325-40.

ASC 320-10

Per the requirements of ASC 320-10, Sun does not have the intent nor does it anticipate that it will be required to sell the security prior to anticipate recovery.

Management has reviewed its investment securities at 6/30/10 and has determined that the unrealized losses are temporary.

Form 10-K/A Filed April 30, 2010

Item 11. Executive Compensation

Summary of Pay Components, page 15

| 2. | We note your response to comment 10 in our letter dated May 27, 2010. We also note the disclosure in your document that “[t]here is no formulaic approach between the market data reviewed each year, year-to-year changes in the market data, and the compensation decisions made by the Compensation Committee.” However, benchmarking generally entails using compensation data about other companies as a reference point on which – either wholly or in part – to base, justify or provide a |

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 11

| | framework for a compensation decision. Thus, although you may not utilize a formulaic approach, to the extent you use compensation data about other companies as a reference point on which to base, justify or provide a framework for a compensation decision, the peer group companies should be disclosed. Refer to Item 402(b)(2)(xiv) of Regulation S-K and Regulation S-K Compliance & Disclosure Interpretation 118.05. To the extent you believe your disclosure might incorrectly lead shareholders to believe that there is a defined process of analysis or discipline in the committee’s review of such information that does not exist, please revise the disclosure so that it is not misleading to investors. |

Response

2. In future filings that include Compensation Discussion and Analysis, the Company will include a list of peer group companies that are utilized by the Compensation Committee in reviewing the compensation of its named executive officers.

Form 8-K Filed July 13, 2010

| 3. | It appears that certain exhibits were omitted from the securities purchase agreements filed as exhibits to the Form 8-K. Please amend the form 8-K to file the agreements in their entirety. |

| 3. | The Company will file an amendment to the Form 8-K to include the missing exhibits to the securities purchase agreements. |

We hereby acknowledge that (i) the Company is responsible for the adequacy and accuracy of the disclosure in the filing; (ii) staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. The staff’s other closing comments have been duly noted.

MALIZIA SPIDI & FISCH, PC

Kathryn McHale, Esq.

Attorney Advisor

August 2, 2010

Page 12

If you have any additional comments or questions, please direct such inquiries to the undersigned of this office. Thank you for your prompt attention to this matter.

Sincerely,

/s/ John J. Spidi

John J. Spidi

cc: Mr. Thomas X. Geisel, President and CEO