Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 0-20971

EDGEWATER TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 71-0788538 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

20 Harvard Mill Square Wakefield, Massachusetts | 01880 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number including area code: (781) 246-3343

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of class)

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2007, there were 12,011,729 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes, but not conceding, that all executive officers and directors are “affiliates” of the Registrant) as of June 30, 2007 was approximately $89.5 million, computed based upon the closing price of $7.88 per share on June 30, 2007.

As of March 7, 2008, there were 13,337,100 shares of Common Stock of the Registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission no later than 120 days after the close of its fiscal year; provided that if such proxy statement is not filed with the Commission in such 120-day period, an amendment to this Form 10-K shall be filed no later than the end of the 120-day period.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Business,” “Risk Factors,” “Legal Proceedings,” “Market for Registrant’s Common Stock and Related Stockholder Matters” and “Management Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K (this “Form 10-K”) constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements made with respect to future earnings per share, future revenues, future Synapse services, future operating income, future cash flows, potential business combination transactions, competitive and strategic initiatives or revenues, potential stock repurchases and future liquidity needs. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, earnings per share or achievements to be materially different from any future results, levels of activity, growth, performance, earnings per share or achievements expressed or implied by such forward-looking statements. Such factors include, among other things, those listed under “Business – Factors Affecting Finances, Business Prospects and Stock Volatility” and elsewhere in this Form 10-K.

The forward-looking statements included in this Form 10-K and referred to elsewhere are related to future events or our strategies or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “future,” “forward,” “potential,” “estimate,” “encourage,” “opportunity,” “goal,” “objective,” “quality,” “growth,” “leader,” “could”, “expect,” “intend,” “plan,” “planned” “expand,” “focus,” “build,” “through,” “strategy,” “expiration,” “provide,” “offer,” “maximize,” “allow,” “allowed,” “represent,” “commitment,” “create,” “implement,” “result,” “seeking,” “increase,” “add,” “establish,” “pursue,” “feel,” “work,” “perform,” “make,” “continue,” “can,” “ongoing,” “include” or the negative of such terms or comparable terminology. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on our current plans or assessments which are believed to be reasonable as of the date of this Form 10-K. Factors that may cause actual results, goals, targets or objectives to differ materially from those contemplated, projected, forecasted, estimated, anticipated, planned or budgeted in such forward-looking statements include, among others, the following possibilities: (1) inability to execute upon growth objectives, including growth in entities acquired by our Company; (2) failure to obtain new customers or retain significant existing customers; (3) the loss of one or more key executives and/or employees; (4) changes in industry trends, such as a decline in the demand for Business Intelligence (“BI”) and Corporate Performance Management (“CPM”) solutions, custom development and system integration services and/or delays in industry-wide information technology (“IT”) spending, whether on a temporary or permanent basis and/or delays by customers in initiating new projects or existing project milestones; (5) adverse developments and volatility involving geopolitical or technology market conditions; (6) unanticipated events or the occurrence of fluctuations or variability in the matters identified under “Critical Accounting Policies;” (7) failure of our sales pipeline to be converted to billable work and recorded as revenue; (8) inability to recruit and retain professionals with the high level of information technology skills and experience needed to provide our services; (9) failure to expand outsourcing services to generate additional revenue; (10) any changes in ownership of the Company or otherwise that would result in a limitation of the net operating loss carryforward under applicable tax laws; and/or (11) the failure of the marketplace to embrace CPM or BI services. In evaluating these statements, you should specifically consider various factors described above as well as the risks outlined under Item IA. “Risk Factors.” These factors may cause our actual results to differ materially from those contemplated, projected, anticipated, planned or budgeted in any such forward-looking statements.

Although we believe that the expectations in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, growth, earnings per share or achievements. However, neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. We are under no duty to update any of the forward-looking statements after the date of this Form 10-K to conform such statements to actual results.

- 1 -

Table of Contents

Form 10-K

Annual Report

For the Year Ended December 31, 2007

TABLE OF CONTENTS

- 2 -

Table of Contents

AVAILABLE INFORMATION; BACKGROUND

Edgewater Technology, Inc. maintains executive offices located at 20 Harvard Mill Square, Wakefield, MA 01880-3209. Our telephone number is (781) 246-3343. Our stock is traded on the NASDAQ National Market under the symbol “EDGW.” Our Internet address iswww.edgewater.com. We make available, free of charge, on the Investor Relations section of our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Edgewater Technology, Attn: Investor Relations, 20 Harvard Mill Square, Wakefield, MA 01880-3209 or by emailingir@edgewater.com. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room in Washington, D.C., or the SEC’s Internet site atwww.sec.gov. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

In this Annual Report on Form 10-K, we use the terms “Edgewater Technology,” “Edgewater,” “we,” “our Company,” “the Company,” “our,” and “us” to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries. A listing of our wholly-owned subsidiaries as of December 31, 2007 is included as Exhibit 21.1 to this Annual Report on Form 10-K.

| ITEM 1. | BUSINESS |

Overview

Edgewater is a technology management consulting firm providing a synergistic blend of premium IT services primarily in the North American market. We work with our clients onsite providing services focused in three primary areas:

| • | envisioning and realizing strategic business solutions: |

| • | optimizing business processes to improve the delivery of products and services; |

| • | maximizing and unlocking the value of corporate data assets; and |

| • | providing program and project management. |

| • | implementing corporate performance management solutions: |

| • | providing dashboard and data cube design and build; |

| • | providing data warehouse and ETL tool strategies and implementations; and |

| • | combining all components into a comprehensive analytics solution. |

| • | leveraging line business with technology: |

| • | providing design, architectural, core data, and strategic build services; |

| • | melding advanced business analysis with workflow enhancement; and |

| • | evaluating and leveraging infrastructure services. |

Our primary target is the client who wants experienced, highly trained talent onsite for strategic, high return projects. Edgewater typically goes to market both vertically by industry and horizontally by product and technology specialty. Our strategic consulting, custom development and integration services offerings go to market by vertical industry and currently serve clients in the following industries: Specialized Financial Services (such as Student Lending, Distressed Debt, and Private Equity); Healthcare (Payor/Managed Care)/Life Sciences; Higher Education; Hospitality; Insurance; and various Emerging Markets. Our BI/CPM and Data Services offerings go to market horizontally and provide highly experienced teams of product specialists who span all industries.

Industry Dynamics and Opportunity

Industry Dynamics. In today’s complex business environment, organizations are seeking ways to optimize business processes and improve the delivery of information to customers, suppliers, employees, stockholders, partners and other constituents through the use of advanced IT systems and software products. While many organizations support their IT needs and initiatives internally, many are faced with the realization that they lack the resources or expertise to clearly identify where improvements can be made and implement them. Businesses are looking to build, integrate and implement change across their enterprise and finding the right industry, software product, and technical expertise to assist in this process is a critical decision.

- 3 -

Table of Contents

Companies typically turn to consulting firms, like Edgewater, to fill these internal project gaps for a number of different needs:

| • | For deep industry, product, data and technical expertise; |

| • | To provide premium consulting services in an accelerated timeframe; |

| • | To mitigate their business risk with focused onsite project teams; |

| • | To receive an outside objective perspective; and/or |

| • | To serve as an agent to plan, manage and implement change. |

We believe a structural change is taking place in the consulting industry. The change is two-fold: customer buying habits are becoming more complex and industry dynamics are evolving.

Customers with sufficient scale are looking for lower cost commodity programming services to reduce overall operational expenses and tend to look for offshore solutions. Offshore solutions are now mature, well understood and serve large scale Business Process Outsourcing and IT Service maintenance cheaply and efficiently. However, offshore solutions do not address all IT Service needs. Many companies are seeking premium consulting services to facilitate and expedite the management and implementation of smaller strategic projects, both product-based and custom vertically focused systems. Many companies are looking to local firms to build strategic components or systems that address a specialized business problem. Premium IT services, with its combination of business context and technology, usually proves to be the most effective solution in terms of project time and cost.

Industry Opportunity. Technology has become such an integral part of business that it requires skilled strategic management in its own right. Technology has become a key enabler to business change when the appropriate strategic steps, a meld of business process change and technology, are well laid out and thoughtfully executed. Technology management consulting firms deliver innovative strategic thinking and in-depth vertical industry expertise, along with the ability to implement business process transformation through the judicious use of the appropriate technologies. We have steadily enhanced our offerings to address the evolving need for premium IT services and plan to continue to grow our competencies in this arena.

Competitive Strengths

Edgewater offers premium IT services, IT with business context knowledge, designed to assist our clients in improving financial and operational performance across their enterprise. We develop business strategies and technology solutions that address their specific needs while providing them with increased competitive advantage. We feel that five core values differentiate us from the competition.

These values include the following:

| (1) | Delivery Excellence — Our history is built upon more than fifteen years of proven methodology and well-defined process, in addition to continually delivering business and technology solutions that work. Our delivery excellence is a derivative of a well-defined business plan, highly-skilled consultants, strong technical expertise and established implementation and support methodologies. Most importantly, we use an iterative business and technology approach, with an emphasis on quality assurance and project management, to achieve rapid and successful deployment of our solutions. Our delivery history has contributed to our ability to build long-term customer relationships. |

| (2) | Vertical Expertise — We combine vertical industry knowledge with a broad base of key strategic technologies to serve our customers’ needs and deliver tailored and innovative strategies and solutions. The primary vertical markets where we have developed core competencies include: Specialized Financial Services (such as Student Lending, Distressed Debt and Private Equity); Healthcare (Payor/Managed Care)/Life Sciences; Higher Education; Hospitality; Insurance; and various Emerging Markets. For the BI/CPM and Data Services space, Edgewater fields highly experienced teams of product specialists across all industries. |

| (3) | Technology Excellence — We deliver our services by blending proven strategic technologies and business practices to build scalable custom solutions providing a solid return on the investment. Our team of professionals has the business and technology expertise to offer comprehensive strategies and solutions. Our areas of expertise include: BI and CPM solutions in planning, budgeting and consolidation, business activity monitoring, predictive analytics, architectural services (assessment and builds), service-oriented architectures, Web analytics, advanced data and infrastructure services, transactional processing and legacy integration. |

| (4) | Client Focus — Edgewater is positioned to provide our customers with onsite services across North America. In addition, we stand ready to provide those exact individuals remotely from Edgewater’s North American offices should the need arise due to client requirements or project duration. Edgewater’s client-centric model is well positioned to serve the needs of the Global 2000 for tight, highly-trained product specialist project teams, as well as the middle market whose needs tend to span the full spectrum of our business/IT service offerings. |

- 4 -

Table of Contents

| (5) | Strong Operational Metrics — Since our inception in 1992, Edgewater’s original management team has built an organization that is defined by a record of operational excellence, tracking key performance indicators and well-defined operating metrics to manage our consulting resources, utilization and gross margin. |

Business Strategy

Our business strategy is to position our Company as the leading provider of premium IT services. We believe we can attain this strategic objective by delivering a range of blended solutions through a combination of business specific vertical offerings and advanced product technology horizontal offerings. This approach enables Edgewater to progress up the IT services pyramid and provides a measure of influence over the sourcing of integration and software builds. To attain our business strategy objective, we will maximize our ability to deliver the following capabilities:

| • | Envision and realize strategic business solutions. We plan to serve our clients by delivering industry-based process re-engineering services coupled with strategic technology management services. These strategic business solutions will assist clients to align their specific business goals with an enterprise-wide IT strategy. We initially conduct an overall IT assessment and business analysis. This involves a detailed evaluation of possible technology alternatives, including whether the solution should be a package solution, a customized solution or a combination of both. |

| • | Implement Corporate Performance Management solutions. The primary goal of the CPM solutions we develop is to improve financial performance and operating metrics across a client’s enterprise. We develop these solutions by leveraging a blend of BI technology and horizontal expertise in advanced CPM applications, such as Planning, Budgeting and Consolidation. Edgewater partners with industry CPM leaders, such as Oracle USA, Inc. (formerly Hyperion Solutions), IBM/Cognos Incorporated, SAP/OutlookSoft, Business Objects, Microsoft, and Informatica Corporation. With CPM, clients are able to improve their overall operational performance and productivity. A client’s ability to extract data and alert management of operational issues can enhance near real-time decision making – otherwise known as Business Activity Monitoring, a building block of CPM. |

| • | Optimize business processes to improve the delivery of products and services. We deliver solutions that integrate effectively into our client’s existing infrastructure while improving business operations that support the generation of revenue. We develop these solutions by conducting business process analysis. The analysis enables us to map business process with technology. |

| • | Provide program and project management. We have the ability to develop programs that manage multiple projects including those that are complex and could involve multiple local and global vendors. To build the best strategic, customized solutions, we take all facets of our client’s business into consideration and make recommendations that include an approach of integrating packaged and customized solutions together to form one cohesive solution. |

| • | Maximize and unlock the value of corporate data assets. Edgewater provides its clients with the necessary knowledge and experience to successfully integrate data from the most complex systems. With proven methodologies, we deliver data integration solutions, including data warehouses and data marts, enabling organizations to access, integrate, transform and deliver enterprise data from any source. |

| • | Infrastructure services. We offer a complete range of managed IT services that enable our middle-market clients to concentrate on their core business, while being assured their technical infrastructure will support them as they grow. We offer services including infrastructure assessment and remediation, technology consulting, IT due diligence, as well as managed solution care, which includes hosting solutions; remote monitoring and maintenance; network and operating systems maintenance; and application maintenance. These strategic services ensure that our clients’ technical infrastructure will properly support their short- and long-term business requirements, while aligning their business goals with their technical capabilities. |

| • | Access and leverage our blend of industry and technology expertise. Across all of our service offerings, we provide a combination of vertical business knowledge along with technology expertise in the areas of strategy, technology and program management. This approach enables us to deliver powerful business solutions for our clients. |

- 5 -

Table of Contents

Our Services

Edgewater offers a full spectrum of services and expertise to ensure the success of our engagement. Our premium IT services are consolidated into three major synergistic offerings: (1) Technical Consulting, (2) Corporate Performance Management (“CPM”), and (3) Business Consulting. The diagram that follows clearly illustrates these three offerings:

Edgewater has the proven expertise to plan, deliver and manage integration services that improve performance and maximize business results. We focus on deploying new systems and unlocking the value of the existing corporate data assets. This proven expertise enables us to bring complex technologies and systems together while minimizing risk, leveraging our clients’ technology investments and delivering tailored solutions.

Customers; Significant Customers

We derive a significant portion of our revenues from large projects with a limited number of customers. In 2007, our five largest customers accounted for 45.1% of our service revenues. In 2006, our five largest customers accounted for 46.9% of our service revenues. In addition, The Synapse Group, Inc. (“Synapse”) is considered both a significant customer and a related party. For further details, see “Item 1A – Risk Factors – Our Reliance Upon Synapse” and “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Related-Party Transactions: Synapse.” During 2007, we recorded revenues from 73 new customers, excluding revenue generated from customers added through our current year acquisitions, as compared to 61 new customers in 2006.

- 6 -

Table of Contents

Marketing, Sales and Strategic Alliances

Marketing. The primary goal of all of our marketing efforts is to generate sales opportunities by increasing Edgewater’s brand awareness and value proposition. Our marketing efforts continued to be closely aligned with our go-to-market strategy, while introducing specific offerings that address business and IT challenges clients face within a particular vertical market. We have developed core competencies in delivering our services in key markets to increase the efficiency of our marketing efforts; we target specific areas of content on a monthly basis for each of our vertical practice areas. Marketing builds campaigns around each content area, which include: marketing collateral, webinars, sell sheets, tradeshow/conference participation, speaking engagements, direct mail and public relations activities.

Sales. Our sales approach is to combine traditional sales with our strength in verticals and technology. Our traditional sales function is comprised of direct sales professionals and inside sales professionals. Both work closely with our practice directors to identify potential opportunities within each account. Using a consultative selling methodology, target prospects are identified and a pursuit plan is developed for each key account. When contact with a target is established, we utilize a blended sales model to demonstrate our expertise, combining consultative selling with traditional sales methods, which typically consists of a business development manager, an industry consultant and a technology consultant. This team approach to selling allows Edgewater to demonstrate, from the initial contact point, its expertise in both the specific industry as well as technology. Once the customer has engaged Edgewater, our sales professionals maintain their relationships with the customer by working collaboratively with the consulting professionals who are assigned to the customer.

Strategic Alliances. As part of our sales and marketing effort, we have established working relationships with a number of companies, including: American Student Assistance, EMC/Document Sciences Corporation, IBM/Cognos, Informatica Corporation, ISO Insurance Technology Solutions, Microsoft, Optical Image Technology, Oracle USA, Inc. (formerly Hyperion Solutions), SAP/OutlookSoft and Sun Microsystems. These alliances generally entail sharing sales leads, joint marketing efforts, making joint customer presentations, negotiating discounts on license fees or other charges and conducting similar activities. Our arrangements with many of these companies are informal and are not subject to definitive written agreements. For those companies with whom we do have definitive written agreements, those agreements are either terminable at will by either party or are for terms of one year or less. We believe we have been successful in establishing alliances with a strong group of companies who are either industry leaders or well-regarded new entrants.

Professional Recruitment, Retention and Development

Our success depends in part upon our ability to recruit and retain business and technology professionals with the high level of skills and experience needed to provide our premium services. We believe that the combination of professional support, intellectual challenge, corporate culture and compensation we offer will continue to be attractive to these highly-skilled professionals. Our working environment also fosters collaboration, creativity and innovation. We believe that our employees are one of our most valuable assets.

Employees. As of December 31, 2007, Edgewater had 367 employees. Of these employees, 302 were billable consultants and 65 were management and administrative personnel, comprising sales, marketing, human resources, finance, accounting, internal information systems and administrative support. The average tenure of our employee base is approximately 4.2 years and the average “years of experience” is approximately 14 years. Our employees are not represented by a collective bargaining agreement. We believe that our employee relations are strong.

Culture. We believe that our business culture is critically important in hiring and retaining qualified professionals. Our ability to provide effective multidisciplinary teams is dependent upon our ability to develop and sustain a business culture that is common across all disciplines and vertical practices throughout our Company. Our employees are talented and energetic professionals that come from a multitude of professional backgrounds. Edgewater believes that this creates an exciting, diverse, and creative work environment for our employees.

Compensation. We have a competitive compensation program that has been structured to attract and retain highly-skilled professionals. Edgewater’s cash, bonus and equity compensation plans are tied to the achievement of the Company’s financial performance along with individual and team performance goals.

Recruiting. We believe that our long-term success will depend upon our ability to attract, retain and motivate highly-skilled employees. Our recruitment department has traditionally conducted its own direct recruiting efforts and coordinated informal and search firm referrals. We believe that our business model, which results in an intellectually stimulating work environment, provides greater opportunities for professional development and a dynamic corporate culture, which enhances our ability to attract and retain top professionals.

- 7 -

Table of Contents

Professional Development. We believe that providing our professionals with a wide variety of challenging projects, the opportunity to demonstrate ability and achieve professional advancement are keys to their retention. We work with our professionals to assist them with their professional development by offering internal and external learning opportunities. We encourage them to attain industry certifications which strengthen their expertise in both business and technology. In addition, we also believe that the working relationships they form on various project teams foster valuable formal and informal mentoring and knowledge sharing.

Competition

Our service offerings consist of a full spectrum of services and expertise to ensure the success of IT projects. Our competitors include IT solutions providers, in-house technical staff, software product companies with extended service organizations, international outsourcers of IT development, application and Web hosting firms and specialized providers of CPM/BAM/BI.

There is significant competition in the management and IT consulting services space. Mergers or consolidations in our market may create new, larger or better-capitalized competitors with enhanced abilities to attract and retain professionals. We also believe that the principle criteria considered by prospective clients when selecting a consulting firm include skills and capabilities of consultants, scope of services, service model approach, global presence, industry and technical expertise, reputation and quality of past work, perceived value and a results orientation.

The following is a representative list of competitors in the IT and management consulting services space:

| • | Technical Consulting/Systems integrators: Accenture, CMGI, EDS, IBM Global Services, Business and Decision Group, Caritor, Inc., LogicaCMG, Perficient, and Sapient; |

| • | Offshore software development firms: Aztec Software, Cognizant Technology Solutions, Infosys, Ventyx, Satyam, Tata, and Wipro; |

| • | Management/Business Consulting firms: Bain & Company, Booz-Allen & Hamilton, Boston Consulting Group, Diamond Management and Technology Consultants, Inc., and McKinsey & Company; |

| • | Corporate Performance Management (CPM) / Business Activity Monitoring (BAM) / Business Intelligence (BI) providers: The Hackett Group, Hitachi Consulting Corporation, and Hewlett-Packard; and |

| • | Computer hardware, software and service vendors: Hewlett-Packard, IBM, Oracle and SAP. |

Intellectual Property

We consider our intellectual property to be a valuable asset in a highly competitive industry. We also consider our intellectual property to be an important factor in building brand recognition for quality service and performance. Therefore, we have secured certain service marks for “Edgewater,” “Edgewater Technology,” “Edgewater Technology-Ranzal” and “Edgewater Strategy Services” among others. We believe we have secured all rights to trademarks and trade names related to our business.

We rely on a combination of trade secret, copyright and trademark laws to protect our proprietary rights. In particular, we require each of our employees to sign an invention and non-disclosure agreement, which provides that they must maintain the confidentiality of our intellectual property and that any intellectual property that they develop while employed by us is the property of Edgewater. We have developed detailed tools, processes and methodologies which are used in developing software code, scripts, libraries, data models, applications, business processes, frameworks and other technology used within our Company and in customer engagements. See also “Item 1A – Risk Factors.”

Potential Future Strategies, Transactions and Changes

Critical to our ability to create long-term stockholder value, the Company will continue to pursue internal growth initiatives and appropriate business combination transaction alternatives to achieve growth. From time to time, we have engaged and we may continue to engage in preliminary discussions with various persons regarding potential business combination transactions.

We believe that our current cash reserves and our anticipated cash flow from our operations will be, taken together, adequate for our working capital needs for at least the next twelve months. However, our actual experience may differ significantly from our expectation, particularly if we pursue growth through business combination transactions, which we presently believe will be advantageous to building long-term stockholder value. In addition, other future events may adversely or materially affect our business, expenses or prospects and could affect our available cash or the availability or cost of external financial resources.

- 8 -

Table of Contents

We may, in the future, purchase common stock in the open market, in private transactions or otherwise, pursuant to any future board approved repurchase programs. See “Item 5—Market for Registrants Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” included elsewhere in the Form 10-K. Any future purchases by us will depend on many factors, including:

| • | The market price of our common stock at that time; |

| • | Our business strategy; |

| • | Our business and financial position; and |

| • | General economic and market conditions. |

| ITEM 1A. | RISK FACTORS |

Risk Factors Affecting Finances, Business Prospects and Stock Volatility

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Edgewater Technology and its business because such factors could have a significant impact on our business, operating results and financial condition. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Our success depends on a limited number of significant customers, and our results of operations and financial condition could be negatively affected by the loss of a major customer or significant project or the failure to collect a large account receivable. We generate a significant portion of our service revenue from a limited number of customers. As a result, if we were to lose a major customer or large project, our service revenue could be materially and adversely affected. In 2007, our five largest customers accounted for 45.1% of our service revenue. In 2006, our five largest customers accounted for 46.9% of our service revenue. We perform varying amounts of work for specific customers from year-to-year. A major customer in one year may not use our services in another year. In addition, we may derive revenue from a major customer that constitutes a large portion of a particular quarter’s total revenue. If we lose any major customers or any of our customers cancel or significantly reduce a large project’s scope, including but not limited to Synapse, our results of operations and financial condition could be materially and adversely affected. Further, if we fail to collect a large accounts receivable balance, we could be subjected to a material adverse impact on financial results and a decrease in cash flow.

Our lack of long-term customer contracts reduces the predictability of our revenues because these contracts may be canceled on short notice and without penalty. Our customers generally retain us on a project-by-project basis, rather than under long-term contracts. As a result, a customer may not engage us for further services once a project is complete. If a significant customer, or a number of customers, terminate, significantly reduce, or modify their contracts with us, our results of operations would be materially and adversely affected. Consequently, future revenue should not be predicted or anticipated based on the number of customers we have or the number and size of our existing projects. If a customer were to postpone, modify, or cancel a project, including but not limited to changes in anticipated 2008 Synapse-related revenue, we would be required to shift our consultants to other projects to minimize the impact on our operating results. We cannot provide assurance that we will be successful in efficiently and effectively shifting our consultants to new projects in the event of project terminations, which could result in reduced service revenue and lower gross margins. If we experience unexpected changes or variability in our revenue, we could experience variations in our quarterly operating results and our actual results may differ materially from the amounts planned and our operating profitability may be reduced or eliminated.

If we fail to satisfy our customers’ expectations, our existing and continuing business could be adversely affected. Our sales and marketing strategy emphasizes our belief that we have highly referenceable accounts. Therefore, if we fail to satisfy the expectations of our customers, we could damage our reputation and our ability to retain existing customers and attract new customers. In addition, if we fail to deliver and perform on our engagements, we could be liable to our customers for breach of contract. Although most of our contracts limit the amount of any damages to the fees we receive, we could still incur substantial cost, negative publicity, and diversion of management resources to defend a claim, and as a result, our business results could suffer.

We may have lower margins, or lose money, on fixed-price contracts. As part of our strategy, we intend to continue to grow our business with time-and-materials contracts, fixed-price contracts, and fixed-fee contracts. In 2007, fixed-price contracts represented approximately 2.4% of our service revenue. We assume greater financial risk on fixed-price contracts than on time-and-materials or fixed-fee engagements, and we cannot assure you that we will be able to successfully price our larger fixed-price contracts. If we fail to accurately estimate the resources and time required for an engagement, fail to manage customer expectations effectively or fail to complete fixed-price engagements within planned budgets, on time and to our customers’ satisfaction, we could be exposed to cost overruns, potentially leading to lower gross profit margins, or even losses on these engagements.

Competition in the IT and management consulting services market is intense and, therefore, we may lose projects to, or face pricing pressure from, our competitors or prospective customers’ internal IT departments or international outsourcing firms. The market for IT and management consulting providers is highly competitive. In many cases, we compete for premium IT services work with in-house technical staff, software product companies with extended service organizations and other international IT and management consulting firms, including offshore outsourcing firms. In addition, there are many small, boutique technology management consulting firms who have developed services similar to those offered by us. We believe that

- 9 -

Table of Contents

competition will continue to be strong and may increase in the future, especially if our competitors continue to reduce their price for IT and management consulting services. Such pricing pressure could have a material impact on our revenues and margins and limit our ability to provide competitive services.

Our target market is rapidly evolving and is subject to continuous technological change. As a result, our competitors may be better positioned to address these developments or may react more favorably to these changes, which could have a material adverse effect on our business. We compete on the basis of a number of factors, many of which are beyond our control. Existing or future competitors may develop or offer IT and management consulting services that provide significant technological, creative, performance, price or other advantages over the services we offer.

See “Item 1 – Business – Competition” for a representative list of competitors in the IT and management consulting services space.

Some of our competitors have longer operating histories and significantly greater financial, technical, marketing and managerial resources than we do. There are relatively low barriers of entry into our business. We have no patented or other proprietary technology that would preclude or inhibit competitors from entering the IT services market. Therefore, we must rely on the skill of our personnel and the quality of our customer service. The costs to start an IT and management consulting services firm are low. We expect that we will continue to face additional competition from new entrants into the market in the future, offshore providers and larger integrators and we are subject to the risk that our employees may leave us and may start competing businesses. Any one or more of these factors could have a material impact on our business.

Because we rely on highly-trained and experienced personnel to design and build complex systems for our customers, an inability to retain existing employees and attract new qualified employees would impair our ability to provide our services to existing and new customers.Our future success depends in large part on our ability to attract new qualified employees and retain existing highly-trained and experienced technical consultants, project management consultants, business analysts and sales and marketing professionals of various experience levels. If we fail to attract new employees or retain our existing employees, we may be unable to complete existing projects or bid for new projects of similar size, which could adversely affect our revenues. While attracting and retaining experienced employees is critical to our business and growth strategy, maintaining our current employee base may also be particularly difficult. Even if we are able to grow and expand our employee base, the additional resources required to attract new employees and retain existing employees may adversely affect our operating margins.

We depend on our key personnel, and the loss of their services may adversely affect our business. We believe that our success depends on the continued employment of the senior management team and other key personnel. This dependence is particularly important to our business because personal relationships are a critical element in obtaining and maintaining customer engagements. If one or more members of the senior management team or other key personnel were unable or unwilling to continue in their present positions, our business could be seriously harmed. Furthermore, other companies seeking to develop in-house business capabilities may hire away some of our key personnel.

Past or future business combination transactions or other strategic alternatives could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our business. We realized recent growth, in part, through acquisitions, and we anticipate that a portion of our future growth may be accomplished through one or more business combination transactions or other strategic alternatives. The ultimate success of any such transactions will depend upon, among other things, our ability to integrate acquired personnel, operations, products and technologies into our organization effectively, to retain and motivate key personnel of acquired businesses and to retain customers of acquired businesses. We cannot assure you that we will be successful in this regard or that we will be able to identify suitable opportunities, successfully grow acquired businesses, integrate acquired personnel and operations successfully or utilize our cash or equity securities as acquisition currency on acceptable terms to complete any such business combination transactions. These difficulties could disrupt our ongoing business, distract our management and employees, increase our expenses and materially and adversely affect our results of operations. Any such transactions would involve certain other risks, including the reduction of cash and/or working capital, the assumption of additional liabilities, potentially dilutive issuances of equity securities and diversion of management’s attention from operating activities.

Volatility of our stock price could result in expensive class action litigation. If our common stock suffers from volatility like the securities of other technology and consulting companies, we could be subject to securities class action litigation similar to that which has been brought against other companies following periods of volatility in the market price of their common stock. The process of defending against these types of claims, regardless of their merit, is costly and often creates a considerable distraction to senior management. Any future litigation could result in substantial additional costs and could divert our resources and senior management’s attention. This could harm our productivity and profitability and potentially adversely affect our stock price.

We may not be able to protect our intellectual property rights or we may infringe upon the intellectual property rights of others, which could adversely affect our business. Our future success will depend, in part, upon our intellectual property rights and our ability to protect these rights. We do not have any patents or patent applications pending. Existing trade secret and copyright laws afford us only limited protection. Third parties may attempt to disclose, obtain or use our solutions or technologies. This is particularly true in foreign countries where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States. Others may independently develop and obtain patents or copyrights for

- 10 -

Table of Contents

technologies that are similar or superior to our technologies. If that happens, we may need to license these technologies and we may not be able to obtain licenses on reasonable terms, if at all. If we are unsuccessful in any future intellectual property litigation, we may be forced to do one or more of the following:

| • | Cease selling or using technology or services that incorporate the challenged intellectual property; |

| • | Obtain a license, which may not be available on reasonable terms or at all, to use the relevant technology; |

| • | Configure services to avoid infringement; and |

| • | Refund license fees or other payments that we have previously received. |

Generally, we develop software applications for specific customer engagements. Issues relating to ownership of and rights to use software applications and frameworks can be complicated. Also, we may have to pay economic damages in these disputes, which could adversely affect our results of operations and financial condition.

Fluctuations in our quarterly revenues and operating results may lead to reduced prices for our stock. Our quarterly revenues and operating results can sometimes be volatile. We believe comparisons of prior period operating results cannot be relied upon as indicators of future performance. If our revenues or our operating results in any future period fall below the expectations of securities analysts and investors, the market price of our securities would likely decline.

Factors that may cause our quarterly results to fluctuate in the future include the following:

| • | Variability in market demand for IT and management consulting services; |

| • | Length of the sales cycle associated with our service offerings; |

| • | Unanticipated variations in the size, budget, number or progress toward completion of our engagements; |

| • | Unanticipated termination of a major engagement, a customer’s decision not to proceed with an engagement we anticipated or the completion or delay during a quarter of several major customer engagements; |

| • | Efficiency with which we utilize our employees, or utilization, including our ability to transition employees from completed engagements to new engagements; |

| • | Our ability to manage our operating costs, a large portion of which are fixed in advance of any particular quarter; |

| • | Changes in pricing policies by us or our competitors; |

| • | Seasonality and cyclicality, including the effects of lower utilization rates during periods with disproportionately high holiday and vacation usage experience; |

| • | Timing and cost of new office expansions; |

| • | The timing of customer year-end periods and the impact of spending relative to such year-end periods; |

| • | Our ability to manage future growth; and |

| • | Costs of attracting, retaining and training skilled personnel. |

Some of these factors are within our control, while others are outside of our control.

Anti-takeover provisions in our charter documents, our stockholder rights plan and/or Delaware law could prevent or delay a change in control of our Company. Our Board of Directors can issue preferred stock in one or more series without stockholder action. The existence of this “blank-check” preferred stock provision could render more difficult or discourage an attempt to obtain control by means of a tender offer, merger, proxy contest or otherwise. In addition, our Company has a stockholder rights plan, commonly referred to as a “poison pill,” that may discourage an attempt to obtain control by means of a tender offer, merger, proxy contest or otherwise. If a person acquires 20% or more of our outstanding shares of common stock, except for certain institutional stockholders, who may acquire up to 25% of our outstanding shares of common stock, then rights under this plan would be triggered, which would significantly dilute the voting rights of any such acquiring person. Certain provisions of the Delaware General Corporation Law may also discourage someone from acquiring or merging with us.

If clients view offshore development as a viable alternative to our service offerings, our pricing, revenue, margins and profitability may be negatively affected. A trend has developed where international IT service firms have been founded in countries such as India and China, which have well-educated and technically-trained workforces available at wage rates that are substantially lower than U.S. wage rates. While traditionally we have not competed with offshore development, presently this form of software development is experiencing rapid and increasing acceptance in the market. To counteract this trend, we are focusing towards premium service offerings, including design and strategy consulting engagements, which are more difficult for offshore development firms to replicate. If we are unable to continually evolve our service offerings or the rate of acceptance of offshore development advances even faster than we expect, then our pricing and revenue could be adversely affected.

We may be required to record additional goodwill impairment charges in future quarters.As of December 31, 2007, we had recorded goodwill and related intangible assets with a net book value of $53.7 million related to prior acquisitions. We test for impairment at least annually and whenever evidence of impairment exists. We performed our annual goodwill impairment test as of December 2, 2007 and 2006 and determined that the goodwill and related intangible assets were not impaired. We have in the past recorded impairments to our goodwill, however. As goodwill values are measured using a variety of factors, including values of comparable companies and using overall stock market and economic data, in addition to our own future financial performance, we may be required in the future to record additional impairment charges that could have a material adverse effect on our reported results.

- 11 -

Table of Contents

We may not generate enough income in future periods to maintain the current net carrying value of our deferred tax asset.We have a deferred tax asset of approximately $22.3 million, net of an applicable valuation allowance, as of December 31, 2007. If we are unable to generate enough income in future periods, the valuation allowance relating to our deferred tax asset may have to be revised upward, which would reduce the carrying value of this asset on our balance sheet under generally accepted accounting principles. An increase in the valuation allowance and a related reduction in the carrying value of this asset would increase our provision for income taxes, thereby reducing net income or increasing net loss, and could reduce our total assets (depending on the amount of any such change or changes). An increase in the valuation allowance could otherwise have a material adverse effect on our results of operations and/or our stockholders’ equity and financial position.

The recent credit market turmoil may impact our sales to our financial services customers.Recently, many financial services institutions have been forced to record massive write-offs on their financial statements to reflect the reduced value of their portfolios of sub-prime mortgage loans and/or securities derived from these loans. Additionally, financial institutions that are in the business of mortgage lending have seen a dramatic reduction in the number of loan transactions. All of this turmoil could impact the ability and willingness of our financial services customers to make investments in technology, which may delay or reduce the amount of purchases of our software and professional services by these customers.

Material changes to our strategic relationship with Oracle USA, Inc. (“Oracle”) (formerly known as Hyperion Solutions Corporation).The Ranzal business derives a substantial portion of its revenues from a channel relationship with Oracle. This relationship involves Oracle assisted lead generation support with respect to the business intelligence services provided by Ranzal. This relationship is governed by an Oracle PartnerNetwork Agreement, which is subject to annual renewal and is scheduled to expire in September of 2008. A failure to renew this relationship, or a material modification or change in Oracle’s partner approach or its contract terms, for any reason, could have a material adverse impact on our results of operations.

Our reliance upon Synapse.Synapse, as more fully described in “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Related-Party Transactions: Synapse,” is considered both a significant customer and a related party. Service revenue from Synapse amounted to $7.0 million, or 11.0% of our total service revenues, and $8.7 million, or 15.5% of total service revenue, for 2007 and 2006, respectively. The Company provides services to Synapse related to infrastructure support, custom software development and systems integration. Services are provided on both a fixed-fee and time and materials basis. Our contracts with Synapse, including all terms and conditions, are consistent with those we have with our other customers and are negotiated on an arm’s-length basis. Our existing one-year services contract with Synapse, which was entered into in January of 2007, automatically extended through June 30, 2008, as per the terms of the contract on January 1, 2008. Based on the automatic six-month renewal and the amount of services being currently performed, it is anticipated that we will provide ongoing services to Synapse throughout 2008 and such services are expected to generate approximately $3.5 million in revenue during 2008. The Company anticipates that it will enter into a new one-year services contract with Synapse during the first quarter of 2008. There is no guarantee that the Company will be able to successfully negotiate a new contract with Synapse at the end of the current contract period.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We lease 63,611 square feet of office space for our principal executive offices currently located at 20 Harvard Mill Square, Wakefield, Massachusetts 01880-3209. An amendment to the lease for our corporate headquarters was executed and made effective on May 4, 2006 (the “2006 Lease Amendment”). The 2006 Lease Amendment extended the lease term related to our original corporate headquarters for a three-year period, until December 31, 2016.

We also have office facilities in Arkansas, California, Colorado, New Hampshire and New York. Our corporate and satellite offices are all leased properties. We do not own any real estate. Our existing properties satisfy our current operating needs, however we will seek additional space in the event our existing properties are unable to meet our operating requirements in the future.

| ITEM 3. | LEGAL PROCEEDINGS |

We are sometimes a party to litigation incidental to our business. We maintain insurance in amounts, with coverages and deductibles that we believe are reasonable. As of the date of the filing of this Form 10-K, our Company is not a party to any existing material litigation matters.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2007.

- 12 -

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Price Information

Our common stock, which has a par value of $0.01 per share, trades on the NASDAQ National Market under the symbol “EDGW.” On March 7, 2008, there were approximately 1,821 holders of record of our common stock and 13,337,100 million shares of our common stock were outstanding. The number of record holders indicated above does not reflect persons or entities that hold their shares of stock in nominee or “street” name through various bankers or brokerage firms. Based on our Company’s solicitations of proxies in April 2007, we estimate that there are approximately 8,000 holders of our Company’s common stock.

The following table sets forth the range of high and low trading prices for our common stock as reported by the NASDAQ National Market for each quarter in 2006 and 2007 and the first quarter of 2008 through March 7, 2008.

| High | Low | |||||

FISCAL 2006: | ||||||

First Quarter | $ | 6.89 | $ | 5.58 | ||

Second Quarter | 7.82 | 6.32 | ||||

Third Quarter | 6.94 | 5.25 | ||||

Fourth Quarter | 6.99 | 5.63 | ||||

FISCAL 2007: | ||||||

First Quarter | $ | 8.97 | $ | 5.81 | ||

Second Quarter | 10.00 | 6.62 | ||||

Third Quarter | 9.45 | 7.00 | ||||

Fourth Quarter | 9.45 | 6.03 | ||||

FISCAL 2008: | ||||||

First Quarter | $ | 7.47 | $ | 5.21 | ||

(through March 7, 2008) | ||||||

Recent Sales of Unregistered Securities

As further described in “Item 8 – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note 4” included elsewhere herein, the Company, in December 2007, issued 876,038 shares of its Common Stock to Vertical Pitch, LLC pursuant to the provisions of an Asset Purchase Agreement. The issuance of the foregoing shares of Common Stock was exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended. In each case, there was no general solicitation or advertising, the number of recipients of such unregistered shares was limited and such recipients are accredited and/or sophisticated.

Issuer Purchases of Equity Securities

In December 2007, our Board of Directors authorized a stock repurchase program for up to $5.0 million of common stock on the open market or through privately negotiated transactions from time-to-time through December 31, 2008 (the “Stock Repurchase Program”). The timing and amount of purchases will be based upon market conditions, securities law considerations and other factors. The Stock Repurchase Program does not obligate the Company to acquire a specific number of shares in any period and may be modified, suspended, extended or discontinued at any time, without prior notice. The Company did not repurchase any shares of its outstanding common stock during the year ended December 31, 2007. See also “Item 1 – Business – Potential Future Strategies, Transactions and Changes” included elsewhere herein.

- 13 -

Table of Contents

Performance Graph

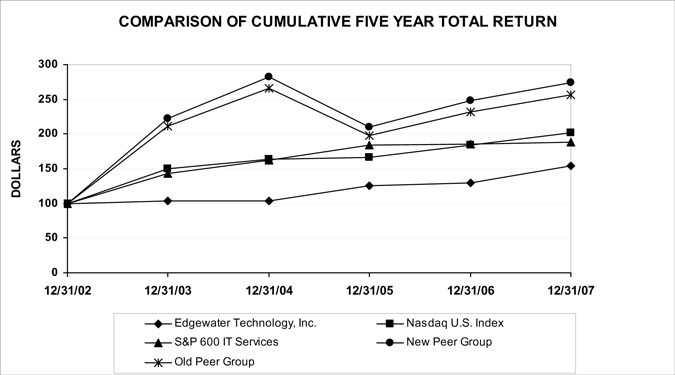

The following charts compare the cumulative total stockholder return and total return analysis, respectively, of our common stock with the cumulative total return on the NASDAQ Composite US Index, the SP600 IT Services Index and the common stock of seven companies in the technology consulting industry for the five-year period beginning on December 31, 2002 (the closing sale price of our common stock on this date was $4.75) and ending on December 31, 2007 (the last trading date for our common stock in the 2007 fiscal year), assuming a $100 investment in each and assuming the reinvestment of dividends. We did not pay any dividends during the period. Refer to the footnotes below the graph for a description of the companies included in our peer group.

Company Name / Index | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | ||||||

Edgewater Technology, Inc. | 100 | 104.24 | 103.81 | 125.00 | 129.45 | 154.66 | ||||||

Nasdaq U.S. Index | 100 | 150.36 | 163.00 | 166.58 | 183.68 | 201.91 | ||||||

S&P 600 IT Services | 100 | 143.83 | 162.95 | 184.27 | 186.07 | 188.17 | ||||||

New Peer Group1 | 100 | 221.87 | 282.51 | 210.49 | 247.98 | 274.09 | ||||||

Old Peer Group2 | 100 | 211.19 | 265.79 | 198.04 | 232.17 | 256.61 |

| (1) | Our self-selected peer group for 2007 consists of the following companies: The Hackett Group (formerly Answerthink, Inc.); Ciber, Inc.; Diamond Management & Technology Consultants, Inc. (“Diamond”); eLoyalty Corporation; Perficient, Inc.; and Sapient Corporation. |

| (2) | Our self-selected peer group for 2006 consisted of the following companies: Answerthink, Inc.; Ciber, Inc.; Diamond; eLoyalty; Inforte Corporation (“Inforte”); Perficient, Inc.; and Sapient Corporation. |

During 2007, we elected to change the composition of our self-selected peer group companies to eliminate, from the 2006 peer group presentation, Inforte based upon its 2007 acquisition by Business and Decision Group, an international consulting and systems integration company. As a result of the acquisition, Inforte is no longer comparable to our business model. We feel that the companies included in our 2007 peer group are comparable to our Company as they provide similar IT consulting services and expertise to their clients.

- 14 -

Table of Contents

Other Stockholder Matters

We have not paid dividends in the past and intend to retain any earnings to finance the expansion and operations of our business. We do not anticipate paying any cash dividends with regard to cash generated through our normal operations in the foreseeable future. The trading price of our common stock is subject to wide fluctuations in response to quarterly variations in operating results, announcements of acquisitions, performance by our competitors, and other market events or factors. In addition, the stock market has, from time to time, experienced price and volume fluctuations, which have particularly affected the market price of many professional service companies and which often have been unrelated to the operating performance of these companies. These broad market fluctuations may adversely affect the market price of our common stock.

| ITEM 6. | SELECTED FINANCIAL DATA |

The 2007, 2006, 2005, 2004, and 2003 selected consolidated financial data presented below has been derived from our audited consolidated financial statements and have been prepared in accordance with United States generally accepted accounting principles. The financial data presented is not directly comparable between periods as a result of the adoption of Statement of Accounting Standards No. 123R (as amended) on January 1, 2006. We believe that this information should be read in conjunction with our audited consolidated financial statements and accompanying notes and “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Form10-K.

| Year Ended December 31, | ||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||

| (In Thousands, Except per Share Data) | ||||||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||||

Total revenue | $ | 68,490 | $ | 60,083 | $ | 43,126 | $ | 25,322 | $ | 25,054 | ||||||||

Cost of revenue | 40,392 | 35,582 | 25,126 | 15,659 | 13,540 | |||||||||||||

Gross profit | 28,098 | 24,501 | 18,000 | 9,663 | 11,514 | |||||||||||||

Operating expenses: | ||||||||||||||||||

Selling, general and administrative | 21,335 | 18,721 | 15,883 | 10,154 | 10,080 | |||||||||||||

Depreciation and amortization | 2,448 | 1,755 | 1,046 | 896 | 948 | |||||||||||||

Total operating expenses | 23,783 | 20,476 | 16,929 | 11,050 | 11,028 | |||||||||||||

Operating income (loss) | 4,315 | 4,025 | 1,071 | (1,387 | ) | 486 | ||||||||||||

Interest income, net | 1,599 | 1,283 | 1,054 | 556 | 455 | |||||||||||||

Income (loss) before taxes, and discontinued operations | 5,914 | 5,308 | 2,125 | (831 | ) | 941 | ||||||||||||

Tax provision (benefit) | (2,896 | ) | 2,105 | 850 | — | (1,053 | ) | |||||||||||

Income (loss) from continuing operations before discontinued operations | 8,810 | 3,203 | 1,275 | (831 | ) | 1,994 | ||||||||||||

Discontinued operations: | ||||||||||||||||||

Income (loss) from discontinued divisions, net of applicable taxes | — | — | 325 | 236 | (1,020 | ) | ||||||||||||

Net income (loss) | $ | 8,810 | $ | 3,203 | $ | 1,600 | $ | (595 | ) | $ | 974 | |||||||

Basic income (loss) per share: | ||||||||||||||||||

Continuing operations | $ | 0.75 | $ | 0.29 | $ | 0.13 | $ | (0.07 | ) | $ | 0.18 | |||||||

Discontinued operations | — | — | 0.03 | 0.02 | (0.09 | ) | ||||||||||||

Net income (loss) | $ | 0.75 | $ | 0.29 | $ | 0.16 | $ | (0.05 | ) | $ | 0.09 | |||||||

Weighted average shares, basic | 11,793 | 10,980 | 10,241 | 11,283 | 11,381 | |||||||||||||

Diluted income (loss) per share: | ||||||||||||||||||

Continuing operations | $ | 0.66 | $ | 0.27 | $ | 0.12 | $ | (0.07 | ) | $ | 0.17 | |||||||

Discontinued operations | — | — | 0.03 | 0.02 | (0.09 | ) | ||||||||||||

Net income (loss) | $ | 0.66 | $ | 0.27 | $ | 0.15 | $ | (0.05 | ) | $ | 0.08 | |||||||

Weighted average shares, diluted | 13,358 | 11,956 | 10,653 | 11,283 | 11,694 | |||||||||||||

- 15 -

Table of Contents

| As of December 31, | |||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||

| (In Thousands) | |||||||||||||||

Consolidated Balance Sheet Data: | |||||||||||||||

Cash equivalents, marketable securities and accrued interest | $ | 22,823 | $ | 33,241 | $ | 33,763 | $ | 33,908 | $ | 44,259 | |||||

Accounts receivable, net | 15,146 | 10,883 | 9,858 | 5,272 | 3,532 | ||||||||||

Goodwill and intangibles | 53,715 | 29,163 | 17,076 | 16,628 | 13,135 | ||||||||||

Deferred tax asset | 22,255 | 18,549 | 21,491 | 22,213 | 22,175 | ||||||||||

Other assets | 6,287 | 3,784 | 2,401 | 3,681 | 3,430 | ||||||||||

Total assets | $ | 120,226 | $ | 95,620 | $ | 84,589 | $ | 81,702 | $ | 86,531 | |||||

Total liabilities | $ | 12,700 | $ | 9,370 | $ | 6,504 | $ | 5,106 | $ | 5,647 | |||||

Stockholders’ equity | 107,526 | 86,250 | 78,085 | 76,596 | 80,884 | ||||||||||

Total liabilities and stockholders’ equity | $ | 120,226 | $ | 95,620 | $ | 84,589 | $ | 81,702 | $ | 86,531 | |||||

Outstanding shares of common stock | 13,297 | 11,522 | 10,683 | 10,549 | 11,366 | ||||||||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following summary together with the more detailed business information and consolidated financial statements and related notes that appear elsewhere in this annual report and in the documents that we incorporate by reference into this annual report. This annual report may contain certain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. This information involves risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in “Item 1A – Risk Factors” and under “Special Note Regarding Forward-Looking Statements.”

Overview

Edgewater Technology, Inc. is an innovative technology management consulting firm serving both middle-market companies and divisions of Global 2000 companies throughout the United States and Canada. We provide a unique blend of premium IT services in business consulting, Corporate Performance Management consulting and technology consulting. Our solutions provide customer benefits by integrating, automating and extending business processes, optimizing technology infrastructure and providing software applications that enable companies to monitor their financial and operational performance. During the fiscal year ended December 31, 2007, we generated revenues, including software revenue and reimbursement of out-of-pocket expenses, of approximately $68.5 million from a total of 265 clients. Headquartered in Wakefield, Massachusetts, as of December 31, 2007, our Company employed approximately 302 technical consulting professionals and 367 total professionals.

Service Revenue

Our service revenue is derived from professional services in providing premium IT services consulting. Specifically, we provide strategy and other business consulting services to develop, implement, integrate, automate and extend business processes, technology infrastructure and corporate performance management software applications for our clients. Most of our projects, approximately 95.0%, are performed on a time and materials basis and a smaller amount of revenue is derived from projects performed on either a fixed-price or fixed-fee basis. Fixed-priced engagements represented approximately 2.4% of our service revenue for the year ended December 31, 2007. Fixed-fee engagements represented approximately 2.6% of our service revenue for the year ended December 31, 2007. For time and material projects, revenue is recognized and billed as services are performed. For fixed-price projects, revenue is generally recognized using the proportionate performance method. Provisions for estimated profits or losses on uncompleted projects are made on a contract-by-contract basis and are recognized in the period in which such profits or losses are determined. On many projects, we are reimbursed for out-of-pocket expenses such as airfare, lodging and meals. These reimbursements are included as a component of revenue and cost of revenue. The aggregate amount of reimbursed expenses will fluctuate depending on the location of our customers, the total number of our projects that require travel, and whether our arrangements with our clients provide for the reimbursement of travel and other project-related expenses.

- 16 -

Table of Contents

Operating Expenses

The largest portion of our operating expenses consists of cash and non-cash compensation and benefits associated with our project consulting personnel and related expenses. Non-cash compensation includes stock compensation expense arising from restricted stock and option grants to employees. Project personnel expenses also consist of payroll costs and related benefits associated with our professional staff. Other related expenses include travel, subcontracting costs, third-party vendor payments and non-billable expenses associated with the delivery of services to our clients. We consider the relationship between project personnel expenses and revenue to be an important measure of our operating performance. The relationship between project personnel expenses and revenue is driven largely by the chargeability of our consultant base, the prices we charge our clients and the non-billable costs associated with securing new client engagements and developing new service offerings. The remainder of our recurring operating expenses is comprised of expenses associated with the development of our business and the support of our client-serving professionals, such as professional development and recruiting, marketing and sales, and management and administrative support. Professional development and recruiting expenses consist primarily of recruiting and training content development and delivery costs. Marketing and sales expenses consist primarily of the costs associated with the development and maintenance of our marketing materials and programs. Management and administrative support expenses consist primarily of the costs associated with operations including finance, information systems, human resources, facilities (including the rent of office space), and other administrative support for project personnel.

We regularly review our fees for services, professional compensation and overhead costs to ensure that our services and compensation are competitive within the industry, and that our overhead costs are balanced with our revenue levels. In addition, we monitor the progress of client projects with client senior management. We manage the activities of our professionals by closely monitoring engagement schedules and staffing requirements. However, a rapid decline in the demand for the professional services that we provide could result in lower utilization of our professionals than we planned. In addition, because most of our client engagements are terminable by our clients without penalty, an unanticipated termination of a client project could require us to maintain underutilized employees. While professional staff levels must be adjusted to reflect active engagements, we must also maintain a sufficient number of consulting professionals to oversee existing client engagements and to participate in sales activities to secure new client assignments.

Company Performance Measurement Systems and Metrics

The Company’s management monitors and assesses its operating performance by evaluating key metrics and indicators on an ongoing basis. For example, we regularly review performance information related to annualized revenue per billable consultant, periodic consultant utilization rates, gross profit margins, average bill rates and billable employee headcount. Edgewater Technology has also developed internal Corporate Performance Management systems which aid us in measuring our operating performance and consultant utilization rates. The matching of sales opportunities to available skill sets in our consultant base is one of our greatest challenges and therefore, we monitor consultant utilization closely. These metrics, along with other operating and financial performance metrics, are used in evaluating management’s overall performance. These metrics and indicators are discussed in more detail under “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results for the Year Ended December 31, 2007 Compared to Results for the Year Ended December 31, 2006.”

Plans for Growth and Acquisitions

Our goal is to continue to build one of the leading independent technology management consulting firms in North America by growing our client base, leveraging our industry expertise to enhance our service offerings and continue to make disciplined strategic acquisitions. Previous acquisitions have further expanded our geographical footprint, increased our vertical expertise and have provided more scale to our organization. We believe the United States and Canada represent an attractive market to grow our revenues through a combination of organic growth and acquisitions.

Consistent with our strategy of growth, we consummated three acquisitions during 2007 and one during 2006. The acquisitions are more fully described in “Item 8 – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note 4” included elsewhere herein.

- 17 -

Table of Contents

Critical Accounting Policies