Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 0-20971

EDGEWATER TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 71-0788538 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

20 Harvard Mill Square Wakefield, Massachusetts | 01880 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number including area code: (781) 246-3343

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of class)

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2009, there were 12,152,158 shares of Common Stock of the Registrant outstanding. The aggregate market value of the Common Stock of the Registrant held by non-affiliates (assuming for these purposes, but not conceding, that all executive officers and directors are “affiliates” of the Registrant) as of June 30, 2009 was approximately $30.1 million, computed based upon the closing price of $2.58 per share on June 30, 2009.

As of March 4, 2010, there were 12,208,808 shares of Common Stock of the Registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission no later than 120 days after the close of its fiscal year; provided that if such proxy statement is not filed with the Commission in such 120-day period, an amendment to this Form 10-K shall be filed no later than the end of the 120-day period.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Business,” “Risk Factors,” “Legal Proceedings,” “Market for Registrant’s Common Stock and Related Stockholder Matters” and “Management Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K (this “Form 10-K”) constitute forward-looking statements under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements made with respect to future revenues, future operating income, future earnings per share, future cash flows, potential business combination transactions, competitive and strategic initiatives or revenues, market opportunities, potential stock repurchases and future liquidity needs. These statements involve known and unknown risks, uncertainties and other factors that may cause results, levels of activity, growth, performance, earnings per share or achievements to be materially different from any future results, levels of activity, growth, performance, earnings per share or achievements expressed or implied by such forward-looking statements. Such factors include, among other things, those listed under “Business – Factors Affecting Finances, Business Prospects and Stock Volatility” and elsewhere in this Form 10-K.

The forward-looking statements included in this Form 10-K and referred to elsewhere are related to future events or our strategies or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “believe,” “anticipate,” “anticipated,” “expectation,” “continued,” “future,” “forward,” “potential,” “estimate,” “estimated,” “forecast,” “project,” “encourage,” “opportunity,” “goal,” “objective,” “could,” “expect,” “expected,” “intend,” “plan,” “planned,” or the negative of such terms or comparable terminology. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on our current plans or assessments which are believed to be reasonable as of the date of this Form 10-K. Factors that may cause actual results, goals, targets or objectives to differ materially from those contemplated, projected, forecasted, estimated, anticipated, planned or budgeted in such forward-looking statements include, among others, the following possibilities: (1) failure to obtain new customers or retain significant existing customers; (2) the loss of one or more key executives and/or employees; (3) changes in industry trends, such as a decline in the demand for Enterprise Resource Planning (“ERP”) and Enterprise Performance Management (“EPM”) solutions, custom development and system integration services and/or declines in industry-wide information technology (“IT”) spending, whether on a temporary or permanent basis and/or delays by customers in initiating new projects or existing project milestones; (4) inability to successfully integrate Fullscope, Inc. operations and realize the anticipated incremental revenues, synergies and other benefits from the Fullscope acquisition; (5) adverse developments and volatility involving geopolitical or technology market conditions; (6) unanticipated events or the occurrence of fluctuations or variability in the matters identified under “Critical Accounting Policies;” (7) delays in, or the failure of, our sales pipeline being converted to billable work and recorded as revenue; (8) inability to recruit and retain professionals with the high level of information technology skills and experience needed to provide our services; (9) failure to expand outsourcing services to generate additional revenue; (10) any changes in ownership of the Company or otherwise that would result in a limitation of the net operating loss carry forward under applicable tax laws; and/or (11) the failure of the marketplace to embrace specialty consulting services. In evaluating these statements, you should specifically consider various factors described above as well as the risks outlined under “Item IA Risk Factors.” These factors may cause our actual results to differ materially from those contemplated, projected, anticipated, planned or budgeted in any such forward-looking statements.

Although we believe that the expectations in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, growth, earnings per share or achievements. Neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. We are under no duty to update any of the forward-looking statements after the date of this Form 10-K to conform such statements to actual results.

1

Table of Contents

Form 10-K

Annual Report

For the Year Ended December 31, 2009

TABLE OF CONTENTS

2

Table of Contents

PART I

AVAILABLE INFORMATION; BACKGROUND

Edgewater Technology, Inc. maintains executive offices located at 20 Harvard Mill Square, Wakefield, MA 01880-3209. Our telephone number is (781) 246-3343. Our stock is traded on the NASDAQ Global Market under the symbol “EDGW.” Our Internet address iswww.edgewater.com. We make available, free of charge, on the Investor Relations section of our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Copies are also available, without charge, from Edgewater Technology, Inc. Attn: Investor Relations, 20 Harvard Mill Square, Wakefield, MA 01880-3209 or by emailingir@edgewater.com. Alternatively, reports filed with the SEC may be viewed or obtained at the SEC Public Reference Room in Washington, D.C., or the SEC’s Internet site atwww.sec.gov. We do not intend for information contained in our website to be part of this Annual Report on Form 10-K.

In this Annual Report on Form 10-K, we use the terms “Edgewater Technology,” “Edgewater,” “our Company,” “the Company,” “we,” “our,” and “us” to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries. A listing of our wholly-owned subsidiaries as of December 31, 2009 is included as Exhibit 21.1 to this Annual Report on Form 10-K (“Form 10-K”).

| ITEM 1. | BUSINESS |

Overview

Edgewater is a consulting firm that brings a synergistic blend of specialty services in the areas of business advisory, analytics, data management, and technology to our client base. We work onsite with our clients, providing services in the following primary areas:

| • | Business advisory services: |

| • | focus on facets within mergers & acquisitions for private equity, venture and office of the Chief Financial Officer (“CFO”): |

| • | process, operational, and technical due diligence |

| • | manage and implement programs to drive financial and operational efficiencies |

| • | drive strategic planning, organizational integration and change, and special projects aligned with an organization’s strategic goals and industry best practice |

| • | provide industry driven management consulting services centered around transformational change |

| • | Analytics services: |

| • | drive the implementation of best practices through key performance metrics and benchmarks |

| • | provide analytics driven dashboard visualization of financial and operational data |

| • | set foundation for predictive analytics |

| • | Enterprise information management services: |

| • | provide industry driven master data management and data governance best practices services |

| • | construct enterprise data architectures and roadmaps |

| • | provide for all forms of data conversion, transformation and quality strategies |

| • | provide for comprehensive data platforms for all analytics, business intelligence and enterprise application efforts |

| • | Enterprise application services: |

| • | facilitate business transformation with enterprise application platforms |

| • | design and implement enterprise performance management (“EPM”) solutions for the office of the CFO |

| • | design and implement advanced Customer Relationship Management (“CRM”) solutions |

| • | design and implement Enterprise Resource Planning (“ERP”) solutions and services |

| • | Technology services: |

| • | provide technology management services from application management through infrastructure services |

| • | provide technology architectures and roadmaps |

| • | provide specialized technical strategies and solutions |

| • | provide custom disaster recovery and business continuity design and implementation services |

3

Table of Contents

Our primary target is the client who wants experienced, highly-trained talent onsite for strategic, transformational projects providing a high rate of return. Edgewater typically goes to market both vertically by industry and horizontally by product and technology specialty. We provide horizontal services and capabilities packaged with vertical expertise to clients in industries including, but not limited to: CPG/Manufacturing; Discrete and Process Manufacturing; Energy/Utilities; Healthcare; Hospitality; Insurance; Retail; Travel/Entertainment; and various Emerging Markets. Our EPM and EIM offerings go to market horizontally and provide highly experienced teams of product specialists who span all industries.

Industry Dynamics and Opportunity

Industry Dynamics. In today’s complex business environment, organizations are seeking specialized advisory services to set financial and operational strategies. Many of the classic providers, such as the large management consulting firms, large accounting firms, and multinational integrators only provide these specialized services as part of a larger package of services which in many cases are too slow to deploy and not discreet enough to serve the customer’s specific needs. Edgewater’s advisory services are quickly deployable and focused especially in the mid-market and by specialized service customers such as private equity and venture capital.

Strategic, financial or operational analysis always leads to ways to optimize business processes and improve the delivery of information to customers, suppliers, employees, stockholders, partners and other constituents through the use of advanced IT systems and software products. While some organizations support their IT needs and initiatives internally, many lack the resources or expertise to clearly identify opportunities for improvements and then implement them. Businesses are looking to build, integrate and implement change across their enterprise and finding the right industry, software product, and technical expertise to assist in this process is a critical decision.

Companies typically turn to consulting firms, like Edgewater, to fill these internal project gaps for a number of different reasons:

| • | For deep industry, product, data and technical expertise; |

| • | To provide strategic consulting services in an accelerated timeframe; |

| • | To mitigate their business risk with focused onsite project teams; |

| • | To receive an outside objective perspective; |

| • | To provide EPM EIM-related services; |

| • | To provide product and services related to ERP and CRM; and/or |

| • | To serve as an agent to plan, manage and implement change. |

We believe a structural change is taking place in the consulting industry. The change is two-fold: customer buying habits are becoming more complex and industry dynamics are evolving.

Customers with sufficient scale are looking for lower cost commodity programming services to reduce overall operational expenses and tend to look for offshore solutions. Offshore solutions are now mature, well understood and serve large-scale Business Process Outsourcing and IT service maintenance cheaply and efficiently. However, offshore solutions do not address all IT service needs. Many companies are seeking strategic consulting services to facilitate and expedite the management and implementation of smaller strategic projects, both product-based and custom vertically-focused systems. Many companies are looking to local firms to build strategic components or systems that address a specialized business problem. Strategic IT services, with its combination of business context and technology, usually proves to be the most effective solution in terms of project time and cost.

Industry Opportunity. Focused advisory services provided independent of large customary providers and larger classic business consulting engagements are exactly what many customers are looking for in times of rapid change and uncertainty. Technology has become such an integral part of business that it requires skilled strategic management in its own right. Technology has become a key enabler to business change when the appropriate strategic steps, a meld of business process change and technology, are well laid out and thoughtfully executed. Technology management consulting firms deliver innovative strategic thinking and in-depth vertical industry expertise, along with the ability to implement business process transformation through the judicious use of appropriate technologies. We have steadily enhanced our offerings to address the evolving need for strategic advisory and IT services and plan to continue to grow our competencies in these arenas. Our goal is to provide a complete continuum of focused business services, encompassing all facets of business, through the enablement of technology.

Competitive Strengths

Edgewater offers strategic consulting services designed to assist our clients in improving financial and operational performance across their enterprise. We develop business strategies and technology solutions that address their specific needs while providing them with increased competitive advantage. We feel that five core values differentiate us from our competition.

4

Table of Contents

These values include the following:

| (1) | Delivery Excellence — Our history is built upon more than eighteen years of proven methodology and well-defined process, in addition to continually delivering business and technology solutions that work. Our delivery excellence is a derivative of a well-defined business plan, highly-skilled consultants, strong technical expertise and established implementation and support methodologies. Most importantly, we use an iterative business and technology approach, with an emphasis on quality assurance and project management, to achieve rapid and successful deployment of our solutions. Our delivery history has contributed to our ability to build long-term customer relationships. |

| (2) | Vertical Expertise — We combine vertical industry knowledge with a broad base of key strategic technologies to serve our customers’ needs and deliver tailored and innovative strategies and solutions. We have developed core competencies in primary vertical markets such as: CPG/Manufacturing; Discrete and Process Manufacturing, Energy/Utilities; Healthcare; Higher Education; Hospitality; Insurance; Retail; Travel/Entertainment; and various Emerging Markets. |

| (3) | Technology Excellence — We deliver our services by blending proven strategic technologies and business practices to build scalable solutions providing a solid return on the investment. Our team of professionals has the business and technology expertise to offer comprehensive strategies and solutions. Our areas of expertise include: business advisory services, EPM solutions in planning, budgeting and consolidation, Microsoft Dynamics solutions in the area of CRM and ERP, data analytics, Web analytics, advanced data and infrastructure services, and specialized IT services. |

| (4) | Client Focus — Edgewater is positioned to provide our customers with onsite services across North America. Edgewater’s client-centric model is well positioned to serve the needs of the Global 2000 for tight, highly-trained product specialist project teams, as well as the upper middle market whose needs tend to span the full spectrum of our business/IT service offerings. |

| (5) | Adherence to Operational Metrics — Since our inception in 1992, Edgewater’s original management team has built an organization that is defined by a record of operational excellence, tracking key performance indicators and well-defined operating metrics to manage our consulting resources, utilization and gross margin. |

Business Strategy

Our business strategy is to position our Company as the leading provider of business and technology transformational services. We believe we can attain this strategic objective by delivering a range of blended solutions through a combination of industry specific business consulting and advanced software product technology. Clients desire the personal attention provided by onsite industry, financial, and strategic expertise buttressed with the ability to speed idea implementation with cost-effective advanced software package solutions. Our ability to begin our services dialogue at the strategy level in business vernacular all the way through specific software product RFP response provides a spectrum of sales opportunities with varying degrees of channel control and cost. This spectrum of engagement entry opportunities provides, on balance, the highest probability of serving the upper mid-market through the Global 2000 with an appropriate set of services.

Our services are loosely categorized into five distinct groups; business advisory, analytics, enterprise information management, enterprise application, and technology services. The spectrum begins with pure consulting and ends with pure information technology. Smaller organizations such as mid-market, subsidiaries of Global 2000, private equity, and venture capital will tend to start at the advisory and consulting level, while the Global 2000 tend to initially engage with enterprise application services. Following are the categories listed with sample services:

| • | Business advisory services |

| • | Monetize knowledge, new revenue streams from corporate data |

| • | Customer transformation, moving from business-to-business to business-to-customer or the reverse for new revenue opportunities |

| • | Business process rejuvenation with industry best practice and cross pollination |

| • | Specialized operational, due diligence, and technology management expertise to M&A, private equity, and venture capital |

| • | Strategic advice, costing, estimates to complete, failing or failed programs or project initiatives |

| • | Independent package selection and Request for Information or Proposal process design and implementation |

| • | Analytics services |

| • | Lead derivation of key financial and operational performance indicators and correlate their measurement, visualization, and action for a given organization |

| • | Advise on opportunities for the use of predictive techniques, external data and benchmarks to improve business performance measurement and forecasting |

5

Table of Contents

| • | Advise on the creation and adoption of analytics architectures, roadmaps, and supporting organizations |

| • | Advise, design, architecture, and roadmap analytics-based near real-time to real-time alerting strategies and implementations |

| • | Enterprise information management services |

| • | Provide for all things data related: master data management, data governance, logical and physical data base design, data warehouse strategies and design |

| • | Provide practical data architectures and roadmaps to support transactional systems, enterprise performance management, through advanced analytics |

| • | Provide all forms of data manipulation, transformation, and quality services |

| • | Enterprise application services |

| • | Effect business transformation through the use of packaged software solutions |

| • | Enterprise performance management with Oracle and SAP budgeting, planning and consolidation |

| • | Enterprise resource planning with Microsoft Dynamics AX, discrete manufacturing and a specialty of process-based manufacturing |

| • | Customer relationship management with Microsoft CRM |

| • | Industry specific platform and best practice solutions |

| • | Blended solutions; Microsoft CRM/XRM and custom |

| • | Technology services |

| • | Technical architecture and roadmaps |

| • | Technical evaluations and design |

| • | Custom component design and implementation |

| • | Web-centric solutions: internal, external and/or collaborative |

| • | Infrastructure optimization and redesign, disaster recovery, and business continuity specialized design and assistance |

Our consultants are expected to travel and to be onsite with the customer to provide the highest level of service and support in all of these endeavors. We work with varying degrees of customer project assistance and will incorporate customer resources for technology transfer or cost optimization purposes. Independent teams and proper project process and delineation provide conflict-free transition points between all key service offerings as well as independent entry points. Leads for all offerings are internally driven with assistance from the respective vendors for software product solutions.

6

Table of Contents

Our Services

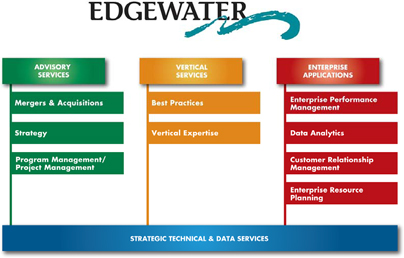

Edgewater offers a full spectrum of services and expertise to ensure the success of our engagement. Our consulting services are consolidated into three major synergistic offerings: (1) Advisory Services, (2) Vertical Services and (3) Enterprise Applications all based upon a foundation of Strategic Technical & Data Services. The diagram that follows clearly illustrates these offerings:

Edgewater has the proven expertise to plan, deliver and manage integration services that improve performance and maximize business results. We focus on deploying new systems and unlocking the value of the existing corporate assets. This proven expertise enables us to bring complex technologies and systems together while minimizing risk, leveraging our clients’ technology investments and delivering tailored solutions.

Customers; Significant Customers

Historically, we have derived a significant portion of our consulting services based-revenues (and overall revenues) from large technical consulting projects involving a limited number of customers. When we complete large technical consulting projects, we redeploy consulting professionals to new projects, even though these new projects, either individually or in the aggregate, may not be as large as the prior completed project. Our EPM engagements, in comparison, are smaller on a relative basis and do not typically entail commitments or project revenues comparable to large technical consulting projects.

Service revenue from our five largest customers, as a percentage of total service revenue, was 20.4%, 26.2% and 45.1% for the years ended December 31, 2009, 2008 and 2007, respectively. This trend has occurred for several reasons. Given the growth of our EPM service business and our efforts to expand and diversify our client base, particularly over the last three fiscal years, our reliance on (and the risks associated with) a limited number of significant customers has diminished. Also, during 2009, service revenue from several of our larger customers decreased significantly compared to prior years. See “Item 1A Risk Factors—Our success depends on a limited number of significant customers, and our results of operations and financial condition could be negatively affected by the loss of a major customer or significant project or the failure to collect a large account receivable.” During 2009, we recorded service revenue from 249 customers, of which 63 were new customers, as compared to recording service revenue from 308 customers in 2008, of which 81 were new customers.

Marketing, Sales and Strategic Alliances

Marketing. The primary goal of our marketing efforts is to generate sales opportunities by increasing Edgewater’s brand awareness, value proposition and overall domain expertise. Our marketing efforts continue to be closely aligned with the Company’s go-to-market strategy, while introducing specific offerings that address business and IT problems faced by our clients. We leverage the core competencies we have developed in delivering our services in key industries and horizontal offerings to increase the efficiency of our marketing efforts. Our marketing function utilizes comprehensive

7

Table of Contents

Internet marketing strategies that involve integrated activities including, but not limited to: webinars, highly-targeted email campaigns distributed to prospect and client lists developed with specific demographics and attributes and social media outlets to promote our Company’s capabilities and services (e.g. both company-driven and domain-specific blogs, social networking and video sharing websites). By leveraging closely coupled Internet marketing strategies to promote our services, we are able to reach a wider audience and communicate in a medium that has become more widely accepted and brings in quicker results from both a sales and marketing perspective. We also gather key statistics from our websites, blogs, email campaigns and other social media outlets to test, measure and trace our marketing initiatives. This enables us to ensure we are reaching the right target audience with concise and compelling offerings to promote our capabilities and warrant further action by our target audience. We also author white papers, byline and contribute to articles in trade publications, attend events and participate in targeted industry conferences and tradeshows.

Sales. Our sales approach is to combine traditional sales with our strength in industries and technology. Our traditional sales function is comprised of direct sales professionals and inside sales professionals. Both work closely with our practice directors to identify potential opportunities within each account. Using a consultative selling methodology, target prospects are identified and a pursuit plan is developed for each key account. When contact with a target is established, we utilize a blended sales model to demonstrate our expertise, combining consultative selling with traditional sales methods. Once the customer has engaged Edgewater, our sales professionals maintain their relationships with the customer by working collaboratively with the consulting professionals who are assigned to the customer.

Strategic Alliances. As part of our sales and marketing effort, we have established working relationships with a number of companies, including: Cognos, IBM, Informatica Corporation, ISO Insurance Technology Solutions, Google, Microsoft Corporation, Optical Image Technology, Oracle America, Inc. (“Oracle”), SAP, Sun Microsystems, UBMatrix, VMWare and Webtrends. These alliances generally entail sharing sales leads, joint marketing efforts, making joint customer presentations, negotiating discounts on license fees or other charges and conducting similar activities. Our arrangements with many of these companies are informal and are not subject to definitive written agreements. For those companies with whom we do have definitive written agreements, those agreements are either terminable at will by either party or are for terms of one year or less. We believe we have been successful in establishing alliances with a strong group of companies who are either industry leaders or well-regarded new entrants.

Professional Recruitment, Retention and Development

Our success depends in part upon our ability to recruit and retain business and technology professionals with the high level of skills and experience needed to provide our specialty services. We believe that the combination of professional support, intellectual challenge, corporate culture and compensation we offer will continue to be attractive to these highly-skilled professionals. Our working environment also fosters collaboration, creativity and innovation. We believe that our employees are one of our most valuable assets.

Employees. As of December 31, 2009, Edgewater had 237 employees. Of these employees, 180 were billable consultants and 57 were management and administrative personnel, comprised of sales, marketing, human resources, finance, accounting, internal information systems and administrative support. The average tenure of our employee base is approximately 5.4 years and the average “years of experience” is approximately 20 years. Our employees are not represented by a collective bargaining agreement. We believe that our employee relations are strong.

Culture. We believe that our business culture is critically important in hiring and retaining qualified professionals. Our ability to provide effective multidisciplinary teams is dependent upon our ability to develop and sustain a business culture that is common across all disciplines and vertical practices throughout our Company. Our employees are talented and energetic professionals that come from a multitude of professional backgrounds. Edgewater believes that this creates an exciting, diverse and creative work environment for our employees.

Compensation. We have competitive compensation programs that have been structured to attract and retain highly-skilled professionals. Edgewater’s compensation programs include competitive base salaries, coupled with cash bonus and equity-based incentive opportunities. Compensation plans may be tied to the achievement of the Company’s financial performance or tied to individual and team performance goals.

Recruiting. We believe that our long-term success will depend upon our ability to attract, retain and motivate highly-skilled employees. Our recruitment department has traditionally conducted its own direct recruiting efforts and coordinated informal and search firm referrals. We believe that our business model, which results in an intellectually stimulating work environment, provides greater opportunities for professional development and a dynamic corporate culture, which enhances our ability to attract and retain top professionals.

Professional Development. We believe that providing our professionals with a wide variety of challenging projects, the opportunity to demonstrate ability and achieve professional advancement are keys to their retention. We work with our professionals to assist them with their professional development by offering internal and external learning opportunities. We encourage them to attain industry certifications which strengthen their expertise in both business and technology. In addition, we also believe that the working relationships they form on various project teams foster valuable formal and informal mentoring and knowledge sharing.

8

Table of Contents

Competition

We operate in a competitive and rapidly changing market. We also compete with a variety of organizations that offer services similar to those that we offer. Our clients often retain us on non-exclusive, project-by-project basis. We compete with a number of different types of businesses, including:

Traditional management and strategy consulting firms that focus on advising “C”-level executives on organization and corporate strategy. Many of the traditional strategic consulting firms have added services in information technology.

Systems integration and IT consulting firms that design and implement technology solutions, including software installation, for departments and enterprises. These firms have grown in size and scope of services, including the provision of offshore software development services.

Information technology product and service vendors that offer technical consulting to support their own products. Many of these firms have also developed various alliances with systems integration and IT consulting firms to augment their own capabilities.

There is significant competition in the management and IT consulting services space. Mergers or consolidations in our market may create new, larger or better-capitalized competitors with enhanced abilities to attract and retain professionals. The following is a representative list of competitors in the IT and management consulting services space:

| • | Technical Consulting/Systems integrators: Accenture, CMGI, EDS, eLoyalty Corporation, IBM Global Services, Business and Decision Group, Caritor, Inc., LogicaCMG, Perficient and Sapient; |

| • | Offshore software development firms: Aztec Software, Cognizant Technology Solutions, Infosys, Ventyx, Satyam, Tata and Wipro; |

| • | Management/Business Consulting firms: Bain & Company, Booz-Allen & Hamilton, Boston Consulting Group, Diamond Management and Technology Consultants, Inc. and McKinsey & Company; |

| • | Enterprise Performance Management / Business Activity Monitoring / Business Intelligence providers: The Hackett Group, Hitachi Consulting Corporation and Hewlett-Packard; and |

| • | Computer hardware, software and service vendors: Hewlett-Packard, IBM, Oracle, Microsoft and SAP. |

We believe that the principal criteria considered by prospective clients when selecting a consulting firm include skills and capabilities of consultants, scope of services, project methodology and approach, technical and industry expertise, reputation and quality of past work, perceived value and a commitment to delivering a solution that works as intended. Due to our ongoing dedication and attention to all of the above characteristics, Edgewater believes that it is well positioned against our competitors in our marketplace.

Intellectual Property

We consider our intellectual property to be a valuable asset in a highly competitive industry. We also consider our intellectual property to be an important factor in building brand recognition for quality service and performance. Therefore, we have secured certain service marks for “Edgewater,” “Edgewater Technology,” “Edgewater Strategy Services” and “Edgewater Technology-Ranzal,” among others. We believe we have secured all rights to trademarks and trade names related to our business.

We rely on a combination of trade secret, copyright and trademark laws to protect our proprietary rights. In particular, we require each of our employees to sign an invention and non-disclosure agreement, which provides that they must maintain the confidentiality of our intellectual property and that any intellectual property that they develop while employed by us is the property of Edgewater. We have developed detailed tools, processes and methodologies which are used in developing software code, scripts, libraries, data models, applications, business processes, frameworks and other technology used within our Company and in customer engagements. See also “Item 1A—Risk Factors” included elsewhere in this Form 10-K.

9

Table of Contents

Potential Future Strategies, Transactions and Changes

Critical to our ability to create long-term stockholder value, the Company will continue to pursue internal growth initiatives and appropriate business combination transaction alternatives to achieve growth in revenues and profitability. From time-to-time, we have engaged and we may continue to engage in preliminary discussions with various persons regarding potential business combination transactions.

We believe that our current cash reserves and our anticipated cash flow from our operations will be, taken together, adequate for our working capital needs for at least the next twelve months. However, our actual experience may differ significantly from our expectation, particularly if we pursue growth through business combination transactions, which we presently believe will be advantageous to building long-term stockholder value. In addition, other future events may adversely or materially affect our business, expenses or prospects and could affect our available cash or the availability or cost of external financial resources.

We may, in the future, purchase common stock in the open market, in private transactions or otherwise, pursuant to board approved repurchase programs. See “Item 5 – Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” included elsewhere in this Form10-K. Any future purchases by us will depend on many factors, including, but not limited to, the following:

| • | The market price of our common stock; |

| • | Our business strategy; |

| • | Our business and financial position; and |

| • | General economic and market conditions. |

| ITEM 1A. | RISK FACTORS |

Risk Factors Affecting Finances, Business Prospects and Stock Volatility

In addition to other information contained in this Form 10-K, the following risk factors should be carefully considered in evaluating Edgewater and its business because such factors could have a significant impact on our business, operating results and financial condition. These risk factors could cause actual results to materially differ from those projected in any forward-looking statements.

Our business could be adversely affected by material changes to our strategic relationship with Oracle America, Inc.Our EPM-related service offering derives a substantial portion of its revenues from a channel relationship with Oracle. This relationship involves Oracle assisted lead generation support with respect to the business intelligence services provided in connection with our EPM-related service offerings. This relationship is governed by an Oracle PartnerNetwork Agreement, which is subject to annual renewal and is scheduled to expire in September of 2010. A failure to renew this relationship, or a material modification or change in Oracle’s partner approach or its contract terms, for any reason, could have a material adverse impact on our results of operations.

Our business could be adversely affected by material changes to our strategic relationship with Microsoft Corporation.As a result of our December 31, 2009 acquisition of Fullscope, Inc. (“Fullscope”), we will derive a substantial portion of our future ERP-related product and service revenues from a channel relationship with Microsoft Corporation. This relationship involves Microsoft-assisted lead generation support with respect to the ERP-related services provided by Fullscope. This relationship is governed by a Microsoft Partner Agreement, which is subject to annual renewal. A failure to renew this relationship, or a material modification or change in Microsoft’s partner approach or its contract terms, for any reason, could have a material adverse impact on our results of operations.

Our results can be subject to variability as work is completed for a limited number of significant customers, and our results of operations and financial condition could be negatively affected by the loss of a major customer or significant project or the failure to collect a large account receivable. We have in the past derived, and may in the future derive, a significant portion of our service revenue from a limited number of customers. From year-to-year, revenue from one or more of our customers may exceed 10% of our total service revenue. Although reliance on significant customers has diminished over the last three fiscal years (see “Item 1 – Customers—Significant Customers”), the loss of a major customer or large project could materially and adversely affect our results of operations. In this regard, two technical consulting customers that accounted for $8.9 million of our 2008 service revenues ceased using our services in the first quarter of 2009, which had a material impact upon our 2009 service revenues. This loss of service revenue may continue to cause variability in operating results and period-to-period comparisons, until we are able to replace these customers with other projects and customers. However, given the current adverse economic landscape, corporate budgetary restrictions and reduced external IT services spending trends, it may take us longer than we desire to raise revenues at or above 2009 levels and no assurance can be given that we can be successful in this regard. In 2009, one customer accounted for more than 5% of our service revenues and our top five customers represented only 20.4% of our 2009 service revenues. Nonetheless, the future receipt of significant commitments from new or existing clients could create future risks such as those described above concerning customer concentration.

10

Table of Contents

We perform varying amounts of work for specific customers from year-to-year. A major customer in one year may not use our services in another year. In addition, we may derive revenue from a major customer that constitutes a large portion of a particular quarter’s total revenue. If we lose any major customers or any of our customers cancel or significantly reduce a large project’s scope, our results of operations and financial condition could be materially and adversely affected. Further, if we fail to collect a large accounts receivable balance, we could be subjected to a material adverse impact on financial results and a decrease in cash flow.

Our business could be adversely affected by a significant or prolonged economic downturn.Our results of operations are affected by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. A decline in the level of business activity of our clients has had and could continue to have a material adverse effect on our revenue and profit margin. Future economic conditions could cause some clients to reduce or defer their expenditures for consulting services. We have implemented and will continue to implement cost-savings initiatives to manage our expenses as a percentage of revenue. However, current and future cost-management initiatives may not be sufficient to avoid reductions in our margins if the economic environment should weaken for a prolonged period.

Our lack of long-term customer contracts reduces the predictability of our revenues because these contracts may be canceled on short notice and without penalty. Our customers generally retain us on a project-by-project basis, rather than under long-term contracts. As a result, a customer may not engage us for further services once a project is complete. If a significant customer, or a number of customers, terminate, significantly reduce, or modify their contracts with us, our results of operations would be materially and adversely affected. Consequently, future revenue should not be predicted or anticipated based on the number of customers we have or the number and size of our existing projects. If a customer were to postpone, modify or cancel a project, we would be required to shift our consultants to other projects to minimize the impact on our operating results. We cannot provide assurance that we will be successful in efficiently and effectively shifting our consultants to new projects in the event of project terminations, which could result in reduced service revenue and lower gross margins. If we experience unexpected changes or variability in our revenue, we could experience variations in our quarterly operating results and our actual results may differ materially from the amounts planned and our operating profitability may be reduced or eliminated.

We have significant fixed operating costs, which may be difficult to adjust in response to unanticipated fluctuations in revenue.A high percentage of our operating expenses, particularly salary expense, rent, depreciation expense and amortization of intangible assets, are fixed in advance of any particular quarter. As a result, an unanticipated decrease in the number or average size of, or unanticipated delay in the scheduling for, our projects may cause significant variations in operating results in any particular quarter and could have a material adverse effect on operations for that quarter. An unanticipated termination or decrease in size or scope of a significant project, a client’s decision not to proceed with a project we anticipated or the completion during the quarter of several significant client projects could require us to maintain underutilized employees and could have a material adverse effect on our business, financial condition and results of operations.

If we fail to satisfy our customers’ expectations, our existing and continuing business could be adversely affected. Our sales and marketing strategy emphasizes our belief that we have highly referenceable accounts. Therefore, if we fail to satisfy the expectations of our customers, we could damage our reputation and our ability to retain existing customers and attract new customers. In addition, if we fail to deliver and perform on our engagements, we could be liable to our customers for breach of contract. Although most of our contracts limit the amount of any damages to the fees we receive, we could still incur substantial cost, negative publicity and diversion of management resources to defend a claim, and as a result, our business results could suffer.

We may have lower margins, or lose money, on fixed-price contracts. As part of our strategy, we intend to continue to grow our business with time-and-materials contracts, fixed-price contracts and fixed-fee contracts. In 2009, fixed-price contracts represented approximately 4.7% of our total service revenue. We assume greater financial risk on fixed-price contracts than on time-and-materials or fixed-fee engagements, and we cannot assure you that we will be able to successfully price our larger fixed-price contracts. If we fail to accurately estimate the resources and time required for an engagement, fail to manage customer expectations effectively or fail to complete fixed-price engagements within planned budgets, on time and to our customers’ satisfaction, we could be exposed to cost overruns, potentially leading to lower gross profit margins or even losses on these engagements.

Competition in the IT and management consulting services market is intense and, therefore, we may lose projects to, or face pricing pressure from, our competitors or prospective customers’ internal IT departments or international outsourcing firms. The market for IT and management consulting providers is highly competitive. In many cases, we compete for specialty IT services work with in-house technical staff, software product companies with extended service organizations and other international IT and management consulting firms, including offshore outsourcing firms. In addition, there are many small, boutique technology management consulting firms who have developed services similar to those offered by us. We believe that competition will continue to be strong and may increase in the future, especially if our competitors continue to reduce their price for IT and management consulting services. Such pricing pressure could have a material impact on our revenues and margins and limit our ability to provide competitive services.

11

Table of Contents

Our target market is rapidly evolving and is subject to continuous technological change. As a result, our competitors may be better positioned to address these developments or may react more favorably to these changes, which could have a material adverse effect on our business. We compete on the basis of a number of factors, many of which are beyond our control. Existing or future competitors may develop or offer IT and management consulting services that provide significant technological, creative, performance, price or other advantages over the services we offer.

See “Item 1 – Business—Competition” included elsewhere in this Form 10-K for a representative list of competitors in the IT and management consulting services space.

Some of our competitors have longer operating histories and significantly greater financial, technical, marketing and managerial resources than we do. There are relatively low barriers of entry into our business. We have no patented or other proprietary technology that would preclude or inhibit competitors from entering the IT services market. Therefore, we must rely on the skill of our personnel and the quality of our customer service. The costs to start an IT and management consulting services firm are low. We expect that we will continue to face additional competition from new entrants into the market in the future, offshore providers and larger integrators and we are subject to the risk that our employees may leave us and may start competing businesses. Any one or more of these factors could have a material impact on our business.

If clients view offshore development as a viable alternative to our service offerings, our pricing, revenue, margins and profitability may be negatively affected. In recent years, international IT service firms have been founded in countries such as India and China, which have well-educated and technically-trained workforces available at wage rates that are substantially lower than U.S. wage rates. While traditionally we have not competed with offshore development, the offshore model has matured and offers an alternative choice when companies evaluate their IT consulting needs. To counteract the alternative of going offshore for IT consulting services, we are focusing on specialty service offerings, including design and strategy consulting engagements, which are more difficult for offshore development firms to replicate. If we are unable to continually evolve our service offerings or the rate of acceptance of offshore development advances beyond current levels, then our pricing and revenue could be adversely affected.

Because we rely on highly-trained and experienced personnel to design and build complex systems for our customers, an inability to retain existing employees and attract new qualified employees would impair our ability to provide our services to existing and new customers.Our future success depends in large part on our ability to attract new qualified employees and retain existing highly-trained and experienced technical consultants, project management consultants, business analysts and sales and marketing professionals of various experience levels. If we fail to attract new employees or retain our existing employees, we may be unable to complete existing projects or bid for new projects of similar size, which could adversely affect our revenues. While attracting and retaining experienced employees is critical to our business and growth strategy, maintaining our current employee base may also be particularly difficult. Even if we are able to grow and expand our employee base, the additional resources required to attract new employees and retain existing employees may adversely affect our operating margins.

We depend on our key personnel, and the loss of their services may adversely affect our business. We believe that our success depends on the continued employment of the senior management team and other key personnel. This dependence is particularly important to our business because personal relationships are a critical element in obtaining and maintaining customer engagements. If one or more members of the senior management team or other key personnel were unable or unwilling to continue in their present positions, our business could be seriously harmed. Furthermore, other companies seeking to develop in-house business capabilities may hire away some of our key personnel.

Past or future business combination transactions or other strategic alternatives could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our business. We have, in the past, realized growth, in part, through acquisitions, including our recent acquisition of Fullscope, Inc., and we anticipate that a portion of our future growth may be accomplished through one or more business combination transactions or other strategic alternatives. The ultimate success of any such transactions, including the Fullscope acquisition, will depend upon, among other things, our ability to integrate acquired personnel, operations, products and technologies into our organization effectively, to retain and motivate key personnel of acquired businesses and to retain customers of acquired businesses. We cannot assure you that we will be successful in this regard or that we will be able to identify suitable opportunities, successfully grow acquired businesses, integrate acquired personnel and operations successfully or utilize our cash or equity securities as acquisition currency on acceptable terms to complete any such business combination transactions. These difficulties could disrupt our ongoing business, distract our management and employees, increase our expenses and materially and adversely affect our results of operations. Any such transactions would involve certain other risks, including the reduction of cash and/or working capital, the assumption of additional liabilities, potentially dilutive issuances of equity securities and diversion of management’s attention from operating activities.

We may not be able to protect our intellectual property rights or we may infringe upon the intellectual property rights of others, which could adversely affect our business. Our future success will depend, in part, upon our intellectual property rights and our ability to protect these rights. We do not have any patents or patent applications pending. Existing trade secret and copyright laws afford us only limited protection. Third parties may attempt to disclose, obtain or use our solutions or technologies. This is particularly true in foreign countries where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States. Others may independently develop and obtain patents or copyrights for

12

Table of Contents

technologies that are similar or superior to our technologies. If that happens, we may need to license these technologies and we may not be able to obtain licenses on reasonable terms, if at all. If we are unsuccessful in any future intellectual property litigation, we may be forced to do one or more of the following:

| • | Cease selling or using technology or services that incorporate the challenged intellectual property; |

| • | Obtain a license, which may not be available on reasonable terms or at all, to use the relevant technology; |

| • | Configure services to avoid infringement; and |

| • | Refund license fees or other payments that we have previously received. |

Generally, we develop software applications for specific customer engagements. Issues relating to ownership of and rights to use software applications and frameworks can be complicated. Also, we may have to pay economic damages in these disputes, which could adversely affect our results of operations and financial condition.

Fluctuations in our quarterly revenues and operating results may lead to increased volatility of our stock. Our quarterly revenues and operating results can sometimes be volatile. We believe comparisons of prior period operating results cannot be relied upon as indicators of future performance. If our revenues or our operating results in any future period fall below the expectations of securities analysts and investors, the market price of our securities would likely decline.

Factors that may cause our quarterly results to fluctuate in the future include the following:

| • | Variability in market demand for IT and management consulting services; |

| • | General economic or stock market conditions unrelated to our operating performance; |

| • | Length of the sales cycle associated with our service offerings; |

| • | Unanticipated variations in the size, budget, number or progress toward completion of our engagements; |

| • | Unanticipated termination of a major engagement, a customer’s decision not to proceed with an engagement we anticipated or the completion or delay during a quarter of several major customer engagements; |

| • | Efficiency with which we utilize our employees, or utilization, including our ability to transition employees from completed engagements to new engagements; |

| • | Our ability to manage our operating costs, a large portion of which are fixed in advance of any particular quarter; |

| • | Changes in pricing policies by us or our competitors; |

| • | Seasonality and cyclicality, including the effects of lower utilization rates during periods with disproportionately high holiday and vacation usage experience; |

| • | The timing of customer year-end periods and the impact of spending relative to such year-end periods; |

| • | Our ability to manage future growth; and |

| • | Costs of attracting, retaining and training skilled personnel. |

Some of these factors are within our control, while others are outside of our control.

Volatility of our stock price could result in expensive class action litigation. If our common stock suffers from volatility like the securities of other technology and consulting companies, we could be subject to securities class action litigation similar to that which has been brought against other companies following periods of volatility in the market price of their common stock. The process of defending against these types of claims, regardless of their merit, is costly and often creates a considerable distraction to senior management. Any future litigation could result in substantial additional costs and could divert our resources and senior management’s attention. This could harm our productivity and profitability and potentially adversely affect our stock price.

Anti-takeover provisions in our charter documents, our stockholder rights plan and/or Delaware law could prevent or delay a change in control of our Company.Our Board of Directors can issue preferred stock in one or more series without stockholder action. The existence of this “blank-check” preferred stock provision could render more difficult or discourage an attempt to obtain control by means of a tender offer, merger, proxy contest or otherwise. In addition, our Company has a stockholder rights plan, commonly referred to as a “poison pill,” that may discourage an attempt to obtain control by means of a tender offer, merger, proxy contest or otherwise. If a person acquires 20% or more of our outstanding shares of common stock, except for certain institutional stockholders, who may acquire up to 25% of our outstanding shares of common stock, then rights under this plan would be triggered, which would significantly dilute the voting rights of any such acquiring person. Certain provisions of the Delaware General Corporation Law may also discourage someone from acquiring or merging with us.

We may not generate enough income in future periods to maintain the current net carrying value of our deferred tax asset.We have a deferred tax asset of approximately $21.1 million, net of an applicable valuation allowance, as of December 31, 2009. If we are unable to generate enough income in future periods, the valuation allowance relating to our deferred tax asset may have to be revised upward, which would reduce the carrying value of this asset on our consolidated balance sheet under generally accepted accounting principles. An increase in the valuation allowance and a related reduction in the carrying value of this asset would increase our provision for income taxes, thereby reducing net income or increasing net loss, and could reduce our total assets (depending on the amount of any such change or changes). An increase in the valuation allowance could otherwise have a material adverse effect on our results of operations and/or our stockholders’ equity and financial position.

13

Table of Contents

We may be required to record additional impairment charges against the carrying value of our goodwill and other intangible assets in future quarters.As of December 31, 2009, we had recorded goodwill and intangible assets with a net book value of $15.6 million related to prior acquisitions. We test for impairment at least annually and whenever evidence of impairment exists. We have in the past recorded impairment charges against the carrying value of our goodwill and intangible assets. The carrying value of our goodwill and intangible asset values are measured using a variety of factors, including values of comparable companies, overall stock market and economic data and our own projections of future financial performance. We may be required in the future to record additional impairment charges that could have a material adverse effect on our reported results.

Our operating results could be adversely affected by fluctuations in the value of the U.S. dollar against foreign currencies.As a result of the our acquisition of Fullscope, a portion of our future revenues and operating expenses will be denominated in currencies other than the U.S. dollar. As result, Fullscope’s revenues and operating expenses are affected by fluctuating foreign currency exchange rates. An increase in the U.S. dollar relative to other currencies in which we have revenues will cause our revenues to be lower than with a stable exchange rate. Changes in exchange rates between other foreign currencies and the U.S. dollar can affect the recorded levels of our assets, liabilities and expenses relating to our operations. The primary foreign currencies in which we have exchange rate fluctuation exposure are the Canadian dollar and the Euro. Exchange rates between these currencies and U.S. dollars have fluctuated significantly in recent years, particularly as the current global financial crisis has unfolded, and may continue to do so in the future. We cannot predict the impact of future exchange rate fluctuations on our operating results.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We lease 66,027 square feet of office space for our principal executive offices currently located at 20 Harvard Mill Square, Wakefield, Massachusetts 01880-3209. We also have office facilities in Alabama, Georgia, New Hampshire, New York and Montreal.

Our corporate and satellite offices are all leased properties. We do not own any real estate. Our existing properties satisfy our current operating needs, however we will seek additional space in the event our existing properties are unable to meet our operating requirements in the future.

| ITEM 3. | LEGAL PROCEEDINGS |

We are sometimes a party to litigation incidental to our business. We maintain insurance in amounts, with coverages and deductibles that we believe are reasonable. As of the date of the filing of this Form 10-K, our Company is not a party to any existing material litigation matters.

| ITEM 4. | RESERVED |

14

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Price Information

Our common stock, which has a par value of $0.01 per share, trades on the NASDAQ Global Market under the symbol “EDGW.” On March 4, 2010, there were approximately 1,766 holders of record of our common stock and 12.2 million shares of our common stock were outstanding. The number of record holders indicated above does not reflect persons or entities that hold their shares of stock in nominee or “street” name through various bankers or brokerage firms. Based on our Company’s solicitations of proxies in April 2009, we estimate that there are approximately 8,000 holders of our Company’s common stock.

The following table sets forth the range of high and low trading prices for our common stock as reported by the NASDAQ Global Market for each quarter in 2008 and 2009 and the first quarter of 2010 through March 4, 2010.

| High | Low | |||||

FISCAL 2008: | ||||||

First Quarter | $ | 7.40 | $ | 5.16 | ||

Second Quarter | 5.97 | 4.85 | ||||

Third Quarter | 5.04 | 4.37 | ||||

Fourth Quarter | 4.83 | 1.90 | ||||

FISCAL 2009: | ||||||

First Quarter | $ | 3.17 | $ | 2.29 | ||

Second Quarter | 2.90 | 2.08 | ||||

Third Quarter | 3.34 | 2.16 | ||||

Fourth Quarter | 3.16 | 2.48 | ||||

FISCAL 2010: | ||||||

First Quarter | $ | 3.23 | $ | 2.76 | ||

(through March 4, 2010) | ||||||

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

In December 2007, our Board of Directors (the “Board”) authorized a stock repurchase program for up to $5.0 million of common stock on the open market or through privately negotiated transactions from time-to-time through December 31, 2008 (the “Stock Repurchase Program”). In September 2008, the Board authorized both an increase to and an extension of the Stock Repurchase Program. The Board increased the maximum dollar value of shares to be purchased under the Stock Repurchase Program by $3.5 million, to a total of $8.5 million and extended the period during which purchases could be made from December 31, 2008 to September 24, 2009 (the “Repurchase Period”). On September 23, 2009, the Board authorized an extension of the Repurchase Period from September 24, 2009 to September 23, 2010, while maintaining the Stock Repurchase Program’s cumulative maximum dollar repurchase limitation.

The timing and amount of the purchases will be based upon market conditions, securities law considerations and other factors. The Stock Repurchase Program does not obligate the Company to acquire a specific number of shares in any period and may be modified, suspended, extended or discontinued at any time, without prior notice.

The Company has repurchased a total of 1,548,449 shares of common stock since the inception of the Stock Repurchase Program at an aggregate purchase price of $5.7 million. See also “Item 1 – Business—Potential Future Strategies, Transactions and Changes” included elsewhere herein.

15

Table of Contents

Performance Graph

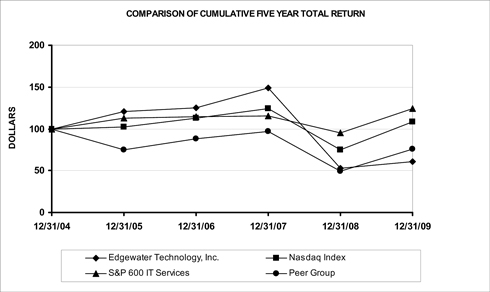

The following chart compares the cumulative total stockholder return and total return analysis, respectively, of our common stock with the cumulative total return on the NASDAQ Composite US Index, the SP600 IT Services Index and the common stock of six companies in the technology consulting industry for the five-year period beginning on December 31, 2004 (the closing sale price of our common stock on this date was $4.90) and ending on December 31, 2009 (the last trading date for our common stock in the 2009 fiscal year), assuming a $100 investment in each and assuming the reinvestment of dividends. We did not pay any dividends during the period. Refer to the footnotes below the graph for a listing of the companies included in our peer group.

Company Name / Index | 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | ||||||

Edgewater Technology, Inc. | 100 | 120.41 | 124.69 | 148.98 | 52.86 | 60.61 | ||||||

Nasdaq Index | 100 | 102.20 | 112.68 | 124.56 | 74.70 | 108.56 | ||||||

S&P 600 IT Services | 100 | 113.09 | 114.19 | 115.48 | 95.49 | 124.55 | ||||||

Peer Group | 100 | 74.51 | 87.78 | 97.02 | 49.49 | 75.41 |

Our self-selected peer group consists of the following companies: The Hackett Group, Ciber, Inc., Diamond Management & Technology Consultants, Inc., eLoyalty Corporation, Perficient, Inc. and Sapient Corporation.

Other Stockholder Matters

We have not paid dividends in the past and intend to retain any earnings to finance the expansion and operations of our business. We do not anticipate paying any cash dividends with regard to cash generated through our normal operations in the foreseeable future. The trading price of our common stock is subject to wide fluctuations in response to quarterly variations in operating results, announcements of acquisitions, performance by our competitors and other market events or factors. In addition, the stock market has, from time-to-time, experienced price and volume fluctuations, which have particularly affected the market price of many professional service companies and which often have been unrelated to the operating performance of these companies. These broad market fluctuations may adversely affect the market price of our common stock.

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The 2009, 2008, 2007, 2006 and 2005 selected consolidated financial data presented below has been derived from our audited consolidated financial statements and have been prepared in accordance with United States generally accepted accounting principles. We believe that this information should be read in conjunction with our audited consolidated financial statements and accompanying notes and “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report on Form10-K.

| Year Ended December 31, | ||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||

| (In Thousands, Except per Share Data) | ||||||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||||

Total revenue | $ | 50,085 | $ | 73,743 | $ | 68,490 | $ | 60,083 | $ | 43,126 | ||||||||

Cost of revenue | 33,987 | 44,955 | 40,392 | 35,582 | 25,126 | |||||||||||||

Gross profit | 16,098 | 28,788 | 28,098 | 24,501 | 18,000 | |||||||||||||

Operating expenses: | ||||||||||||||||||

Selling, general and administrative | 18,412 | 23,232 | 21,335 | 18,721 | 15,883 | |||||||||||||

Depreciation and amortization | 2,694 | 3,771 | 2,448 | 1,755 | 1,046 | |||||||||||||

Impairment of goodwill and other intangible assets (1) | — | 48,594 | — | — | — | |||||||||||||

Total operating expenses | 21,106 | 75,597 | 23,783 | 20,476 | 16,929 | |||||||||||||

Operating (loss) income | (5,008 | ) | (46,809 | ) | 4,315 | 4,025 | 1,071 | |||||||||||

Other income, net | 122 | 503 | 1,599 | 1,283 | 1,054 | |||||||||||||

(Loss) income before taxes, and discontinued operations | (4,886 | ) | (46,306 | ) | 5,914 | 5,308 | 2,125 | |||||||||||

Tax (benefit) provision | (1,047 | ) | 712 | (2,896 | ) | 2,105 | 850 | |||||||||||

(Loss) income from continuing operations before discontinued operations | (3,839 | ) | (47,018 | ) | 8,810 | 3,203 | 1,275 | |||||||||||

Discontinued operations: | ||||||||||||||||||

Income from discontinued divisions, net of applicable taxes | — | — | — | — | 325 | |||||||||||||

Net (loss) income | $ | (3,839 | ) | $ | (47,018 | ) | $ | 8,810 | $ | 3,203 | $ | 1,600 | ||||||

Basic (loss) income per share: | ||||||||||||||||||

Continuing operations | $ | (0.32 | ) | $ | (3.66 | ) | $ | 0.75 | $ | 0.29 | $ | 0.13 | ||||||

Discontinued operations | — | — | — | — | 0.03 | |||||||||||||

Net (loss) income | $ | (0.32 | ) | $ | (3.66 | ) | $ | 0.75 | $ | 0.29 | $ | 0.16 | ||||||

Weighted average shares, basic | 12,067 | 12,861 | 11,793 | 10,980 | 10,241 | |||||||||||||

Diluted (loss) income per share: | ||||||||||||||||||

Continuing operations | $ | (0.32 | ) | $ | (3.66 | ) | $ | 0.66 | $ | 0.27 | $ | 0.12 | ||||||

Discontinued operations | — | — | — | — | 0.03 | |||||||||||||

Net (loss) income | $ | (0.32 | ) | $ | (3.66 | ) | $ | 0.66 | $ | 0.27 | $ | 0.15 | ||||||

Weighted average shares, diluted | 12,067 | 12,861 | 13,358 | 11,956 | 10,653 | |||||||||||||

| (1) | During 2008, the Company recorded $48.6 million of impairment charges related to the carrying values of its goodwill and certain other intangible assets. Additional details can be found in the Company’s previously filed reports with the SEC. |

17

Table of Contents

| As of December 31, | |||||||||||||||

| 2009 (2) | 2008 | 2007 | 2006 | 2005 | |||||||||||

| (In Thousands) | |||||||||||||||

Consolidated Balance Sheet Data: | |||||||||||||||

Cash, cash equivalent and marketable securities | $ | 12,661 | $ | 24,566 | $ | 22,775 | $ | 33,141 | $ | 33,381 | |||||

Accounts receivable, net | 18,043 | 11,683 | 15,146 | 10,883 | 9,858 | ||||||||||

Goodwill and intangibles, net | 15,582 | 3,592 | 53,715 | 29,163 | 17,076 | ||||||||||

Deferred tax asset, net | 21,108 | 22,393 | 22,255 | 18,549 | 21,491 | ||||||||||

Other assets | 5,737 | 4,836 | 6,335 | 3,884 | 2,783 | ||||||||||

Total assets | $ | 73,131 | $ | 67,070 | $ | 120,226 | $ | 95,620 | $ | 84,589 | |||||

Total liabilities | $ | 18,015 | $ | 9,112 | $ | 12,700 | $ | 9,370 | $ | 6,504 | |||||

Stockholders’ equity | 55,116 | 57,958 | 107,526 | 86,250 | 78,085 | ||||||||||

Total liabilities and stockholders’ equity | $ | 73,131 | $ | 67,070 | $ | 120,226 | $ | 95,620 | $ | 84,589 | |||||

Outstanding shares of common stock | 12,132 | 12,162 | 13,297 | 11,522 | 10,683 | ||||||||||

| (2) | Edgewater’s December 31, 2009 balance sheet amounts reflect initial fair value assessments related to the assets acquired, liabilities assumed, allocation to identifiable intangible assets, recognition of deferred taxes and the allocation to goodwill associated with our acquisition of Fullscope, Inc. See “Item 8 – Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 4 – Business Combinations” included elsewhere herein. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following summary together with the more detailed business information and consolidated financial statements and related notes that appear elsewhere in this annual report and in the documents that we incorporate by reference into this annual report. This annual report may contain certain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. This information involves risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in “Item 1A—Risk Factors” and under “Special Note Regarding Forward-Looking Statements.”

Overview